Second Quarter 2022 Financial Results Presentation July 27, 2022 Exhibit 99.3

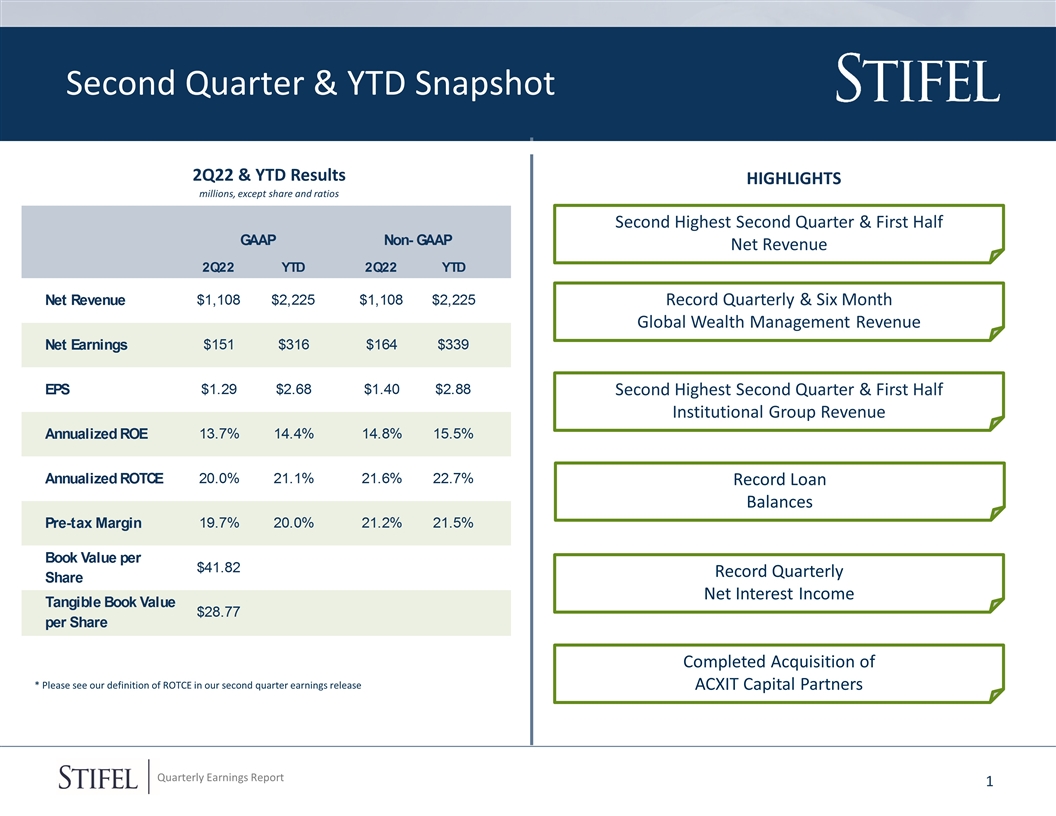

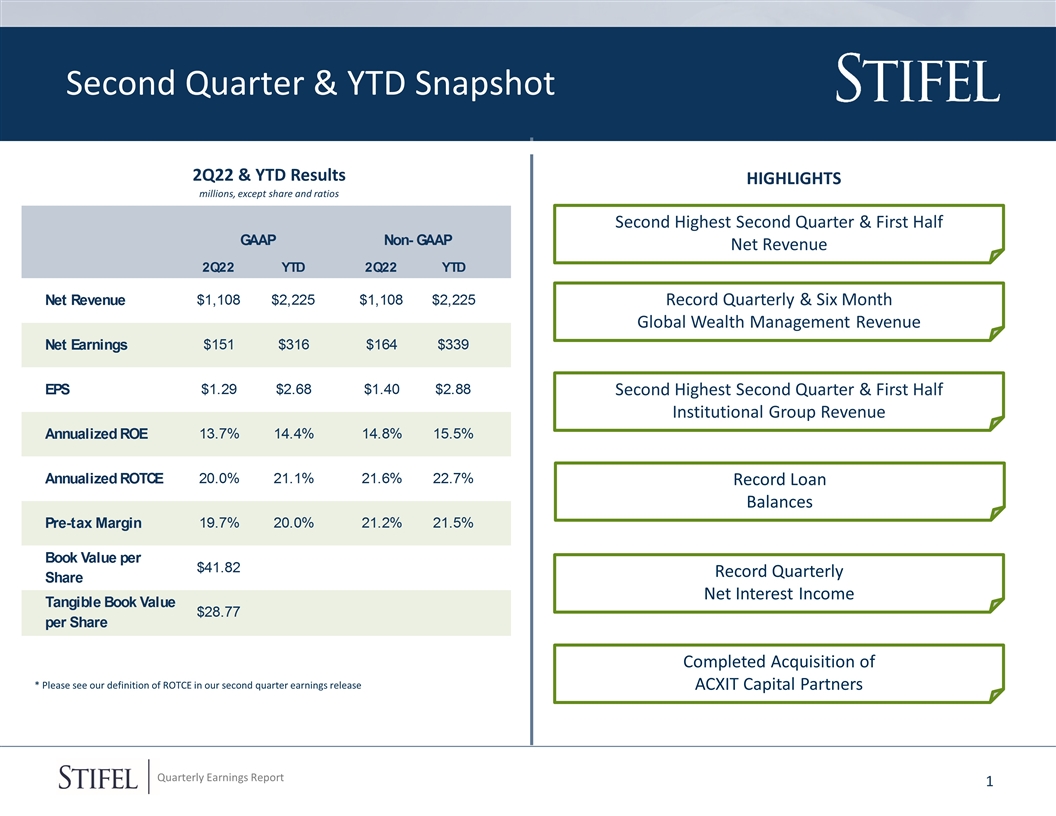

Second Highest Second Quarter & First Half Net Revenue Second Quarter & YTD Snapshot HIGHLIGHTS Record Loan Balances Record Quarterly & Six Month Global Wealth Management Revenue Second Highest Second Quarter & First Half Institutional Group Revenue Completed Acquisition of ACXIT Capital Partners Record Quarterly Net Interest Income * Please see our definition of ROTCE in our second quarter earnings release 2Q22 & YTD Results millions, except share and ratios

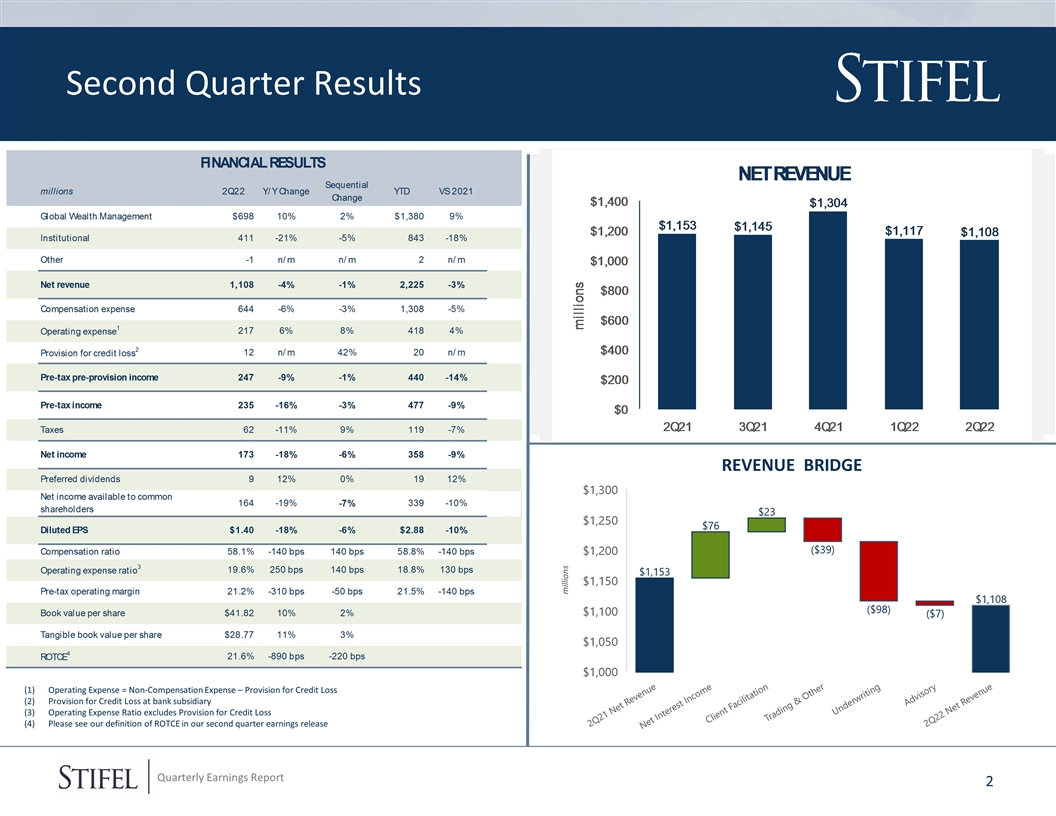

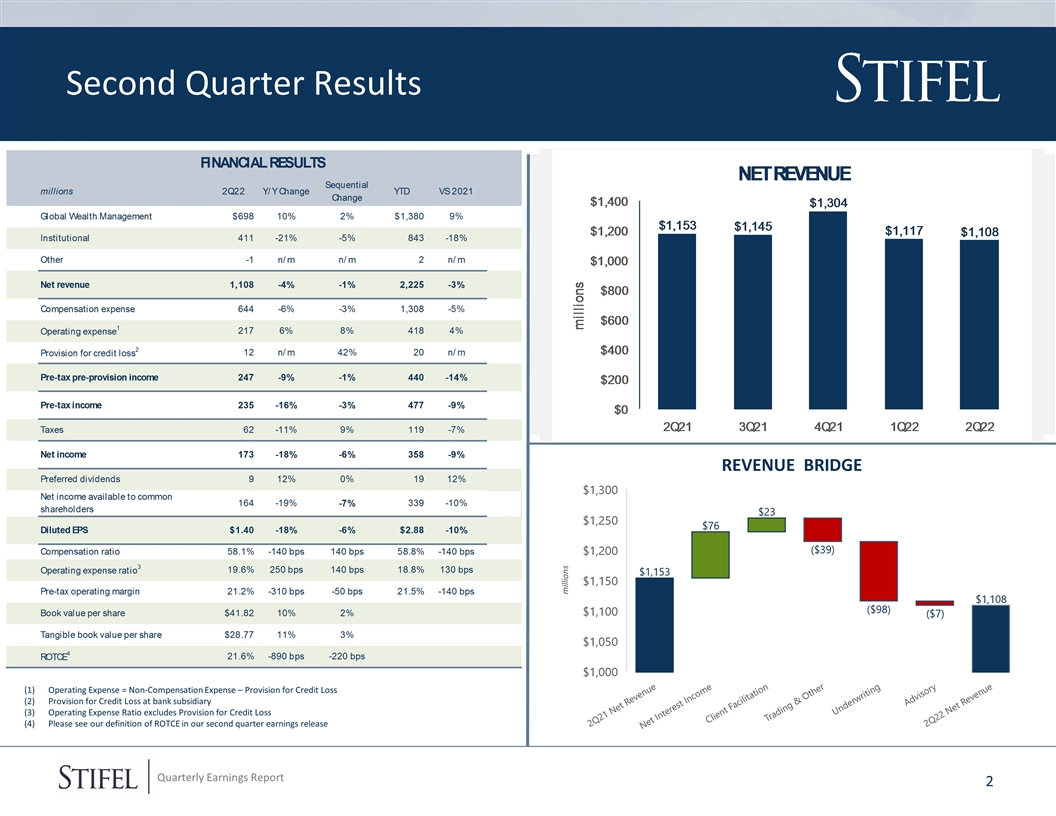

Second Quarter Results Operating Expense = Non-Compensation Expense – Provision for Credit Loss Provision for Credit Loss at bank subsidiary Operating Expense Ratio excludes Provision for Credit Loss Please see our definition of ROTCE in our second quarter earnings release

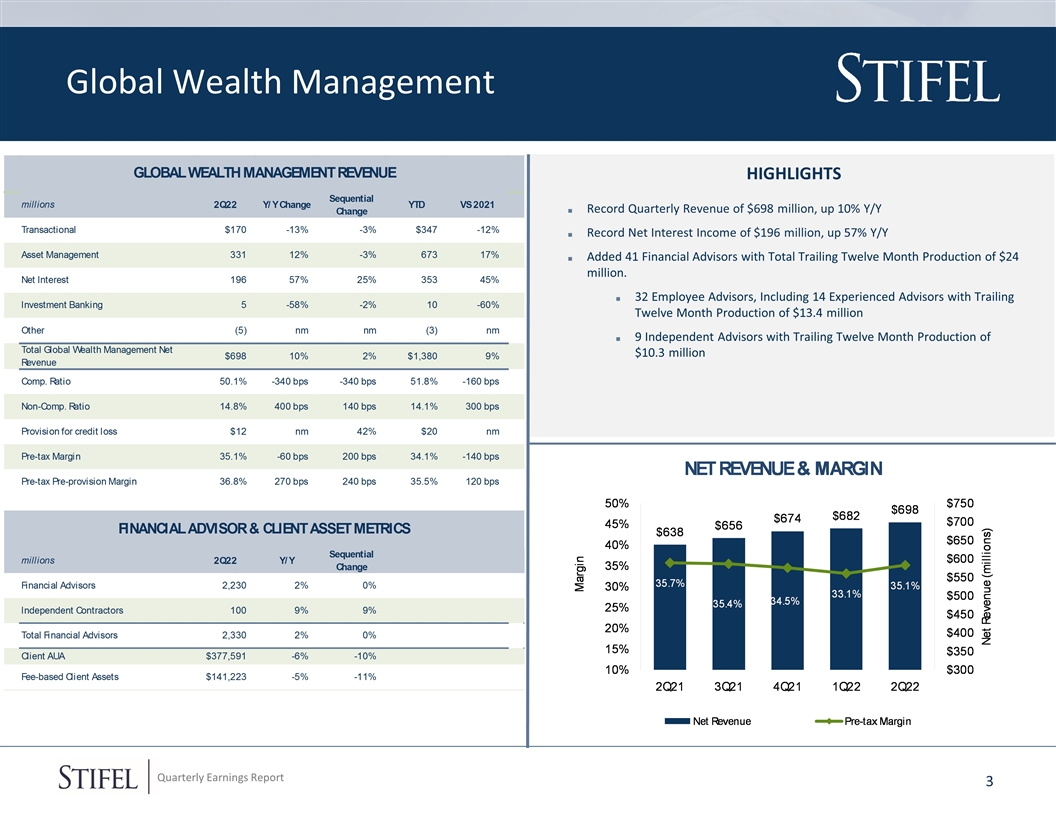

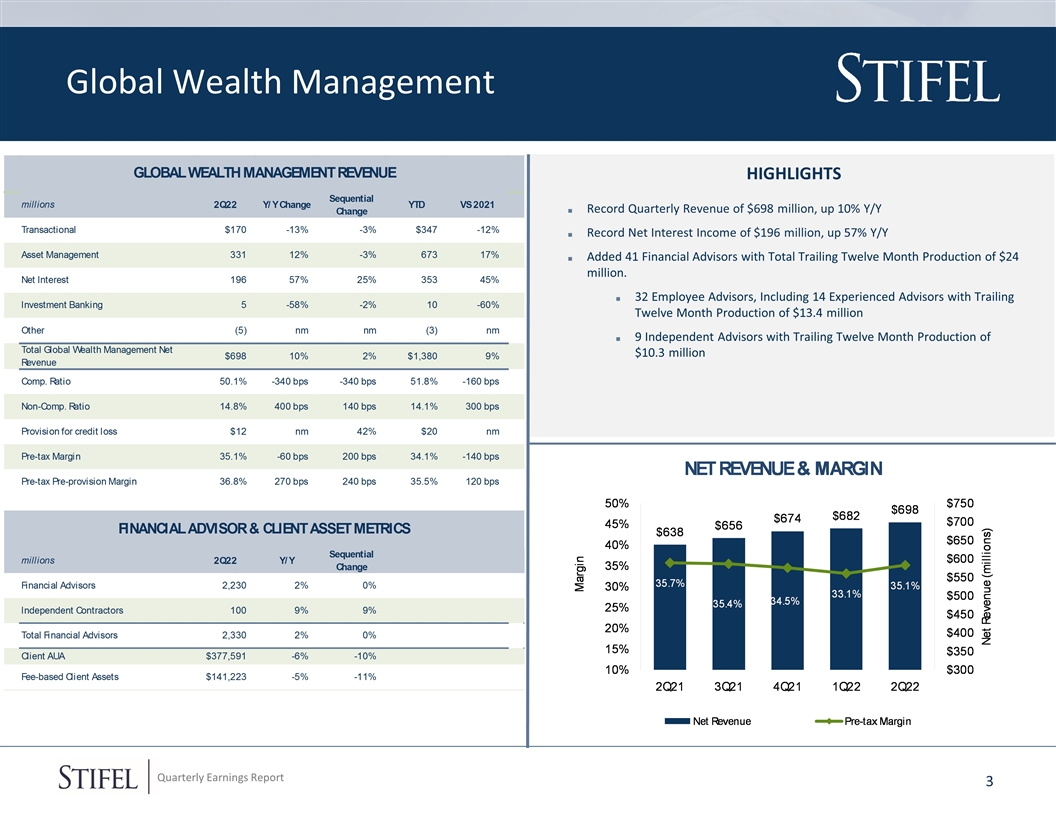

HIGHLIGHTS Record Quarterly Revenue of $698 million, up 10% Y/Y Record Net Interest Income of $196 million, up 57% Y/Y Added 41 Financial Advisors with Total Trailing Twelve Month Production of $24 million. 32 Employee Advisors, Including 14 Experienced Advisors with Trailing Twelve Month Production of $13.4 million 9 Independent Advisors with Trailing Twelve Month Production of $10.3 million Global Wealth Management

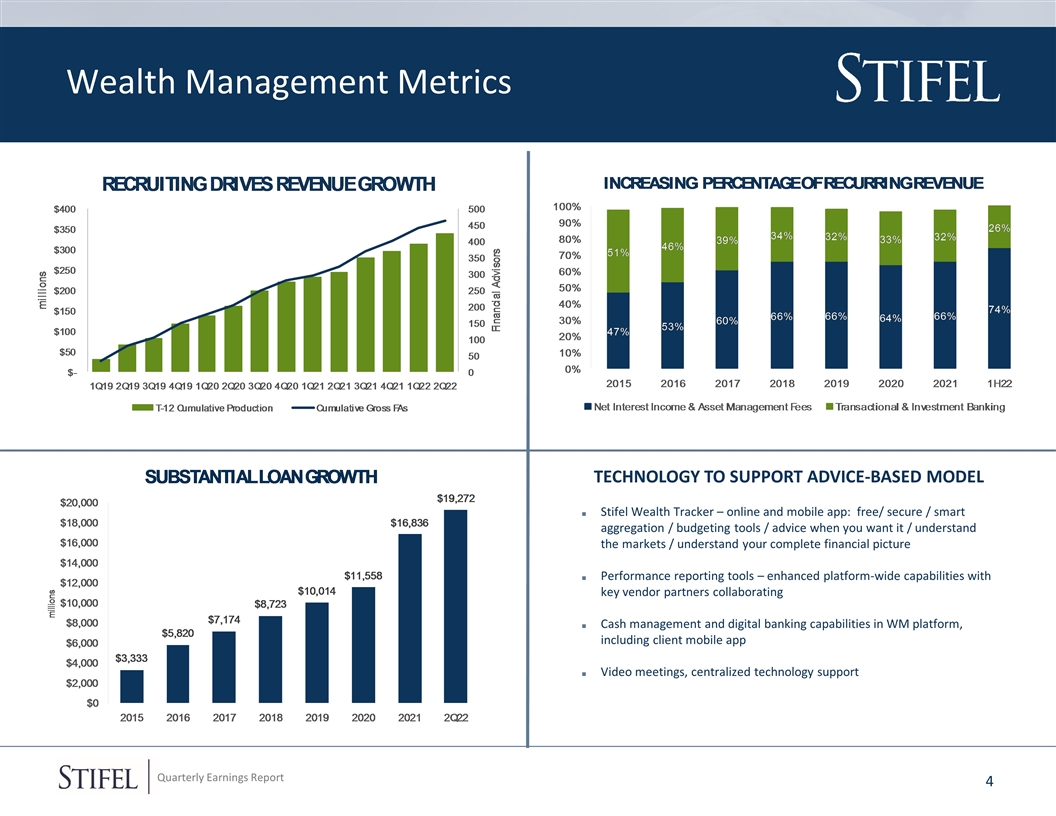

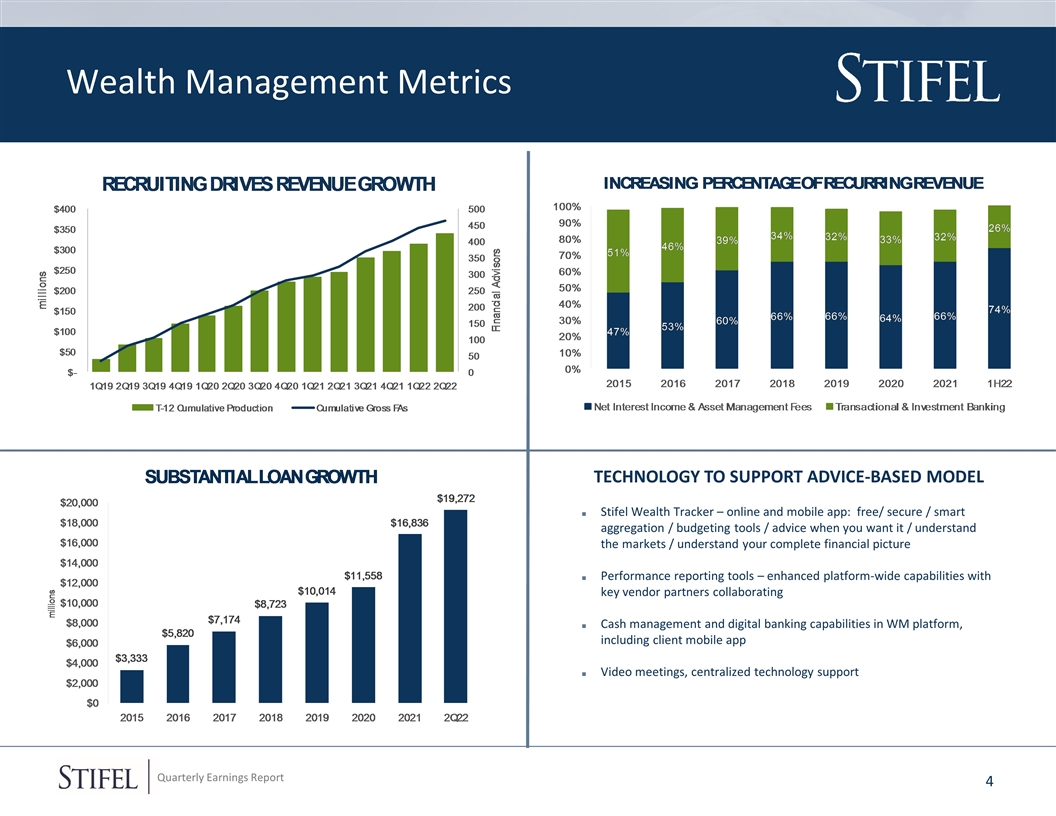

Wealth Management Metrics Technology to support advice-based model Stifel Wealth Tracker – online and mobile app: free/ secure / smart aggregation / budgeting tools / advice when you want it / understand the markets / understand your complete financial picture Performance reporting tools – enhanced platform-wide capabilities with key vendor partners collaborating Cash management and digital banking capabilities in WM platform, including client mobile app Video meetings, centralized technology support

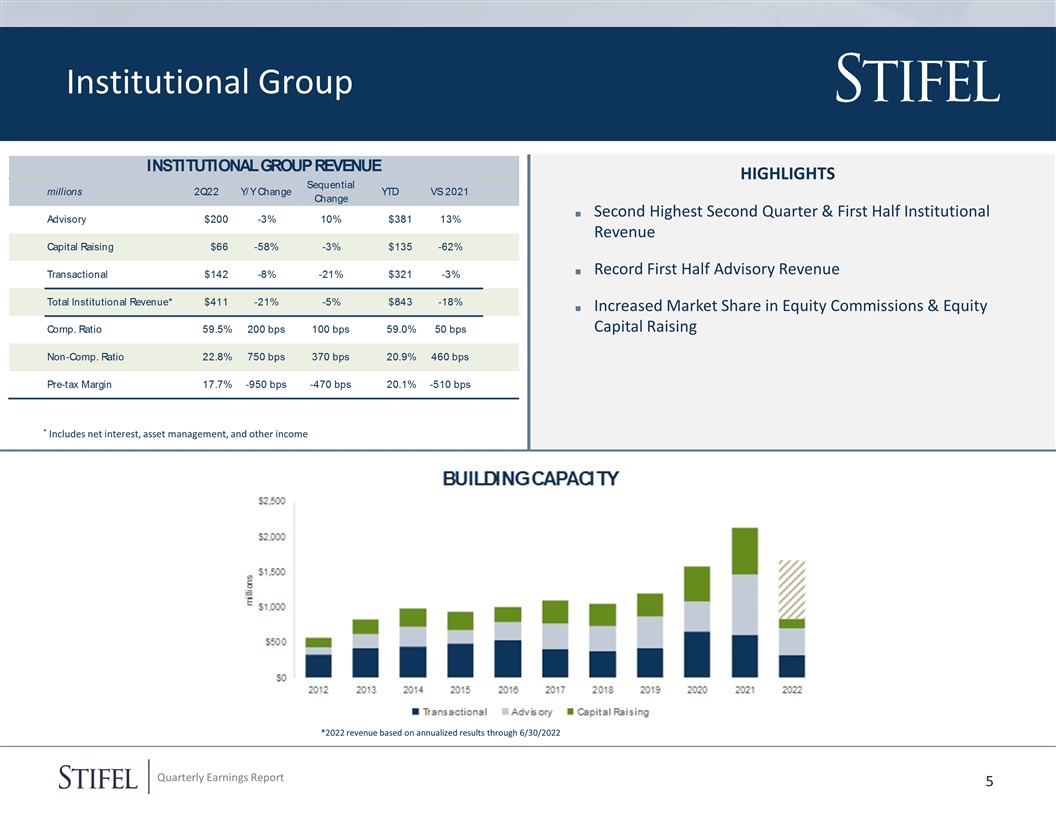

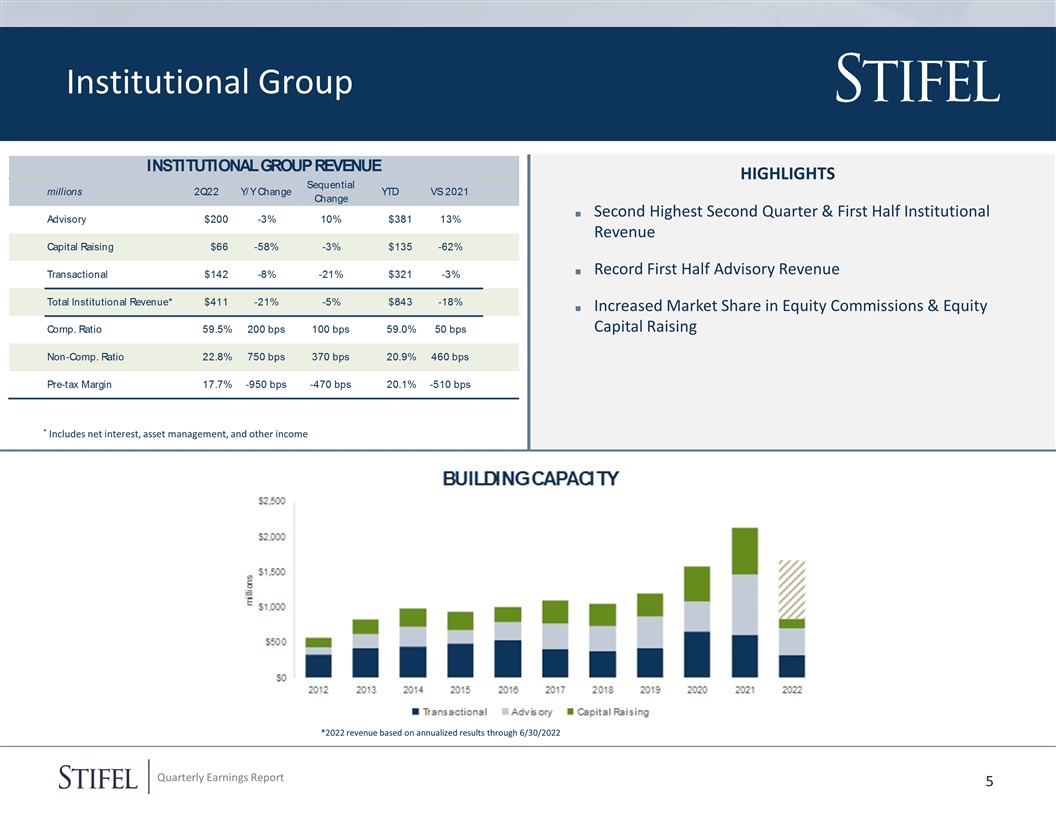

Institutional Group * Includes net interest, asset management, and other income HIGHLIGHTS Second Highest Second Quarter & First Half Institutional Revenue Record First Half Advisory Revenue Increased Market Share in Equity Commissions & Equity Capital Raising * 2021 revenue based on annualized results through 9/30/2021 *2022 revenue based on annualized results through 6/30/2022

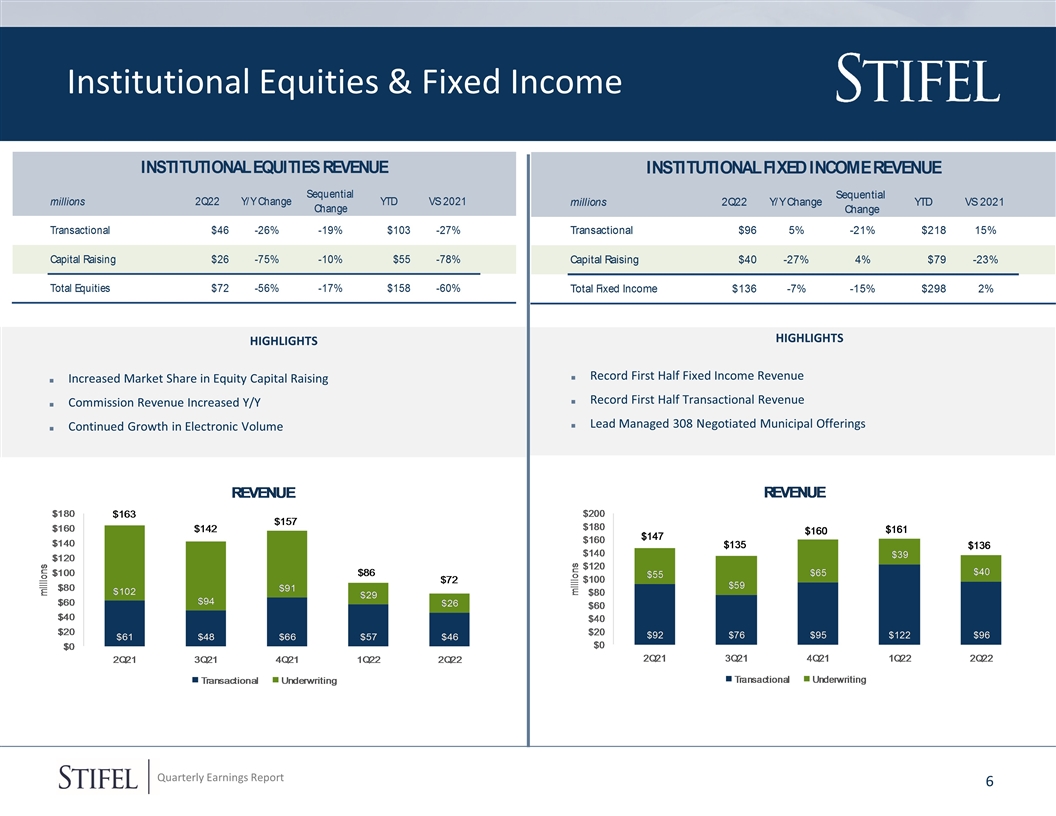

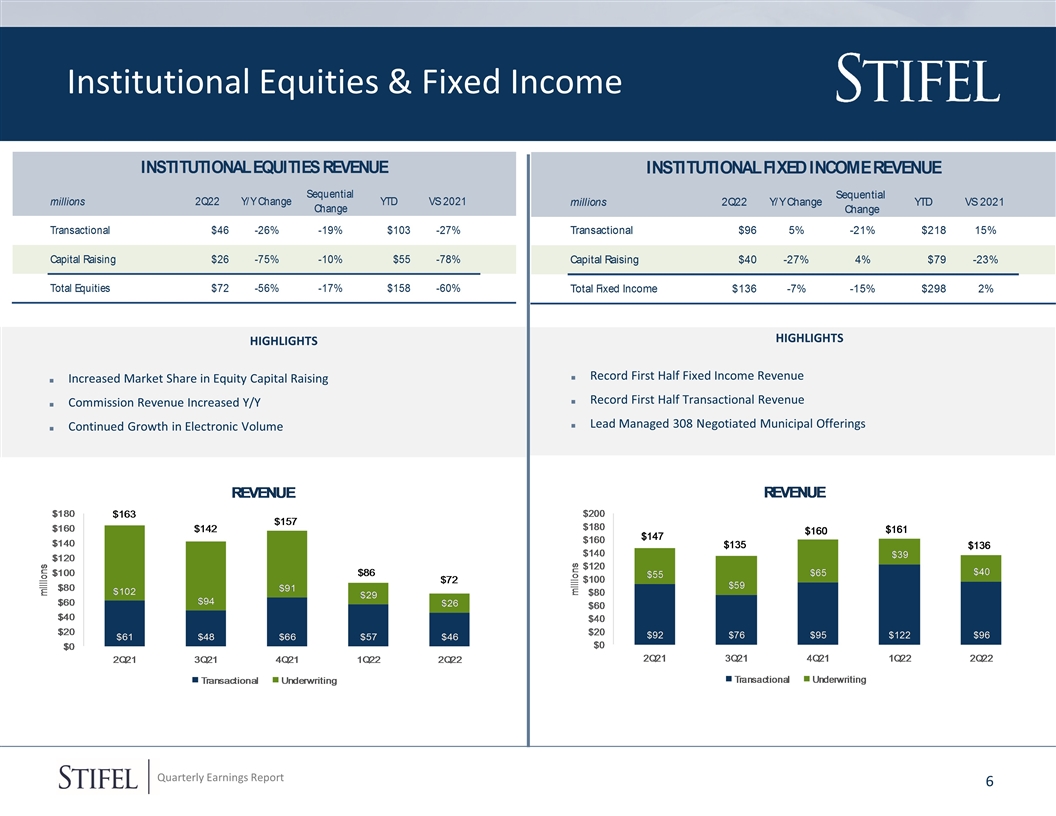

highlights Record First Half Fixed Income Revenue Record First Half Transactional Revenue Lead Managed 308 Negotiated Municipal Offerings Institutional Equities & Fixed Income highlights Increased Market Share in Equity Capital Raising Commission Revenue Increased Y/Y Continued Growth in Electronic Volume Bar chart header numbers are a graphic

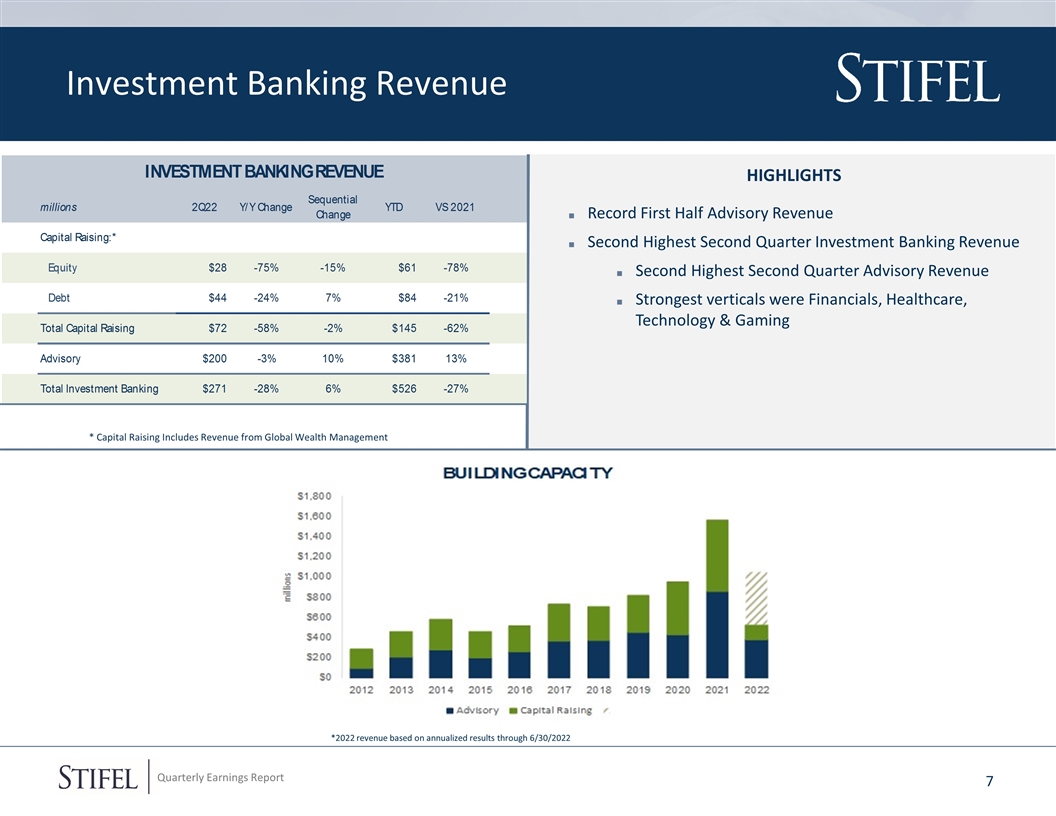

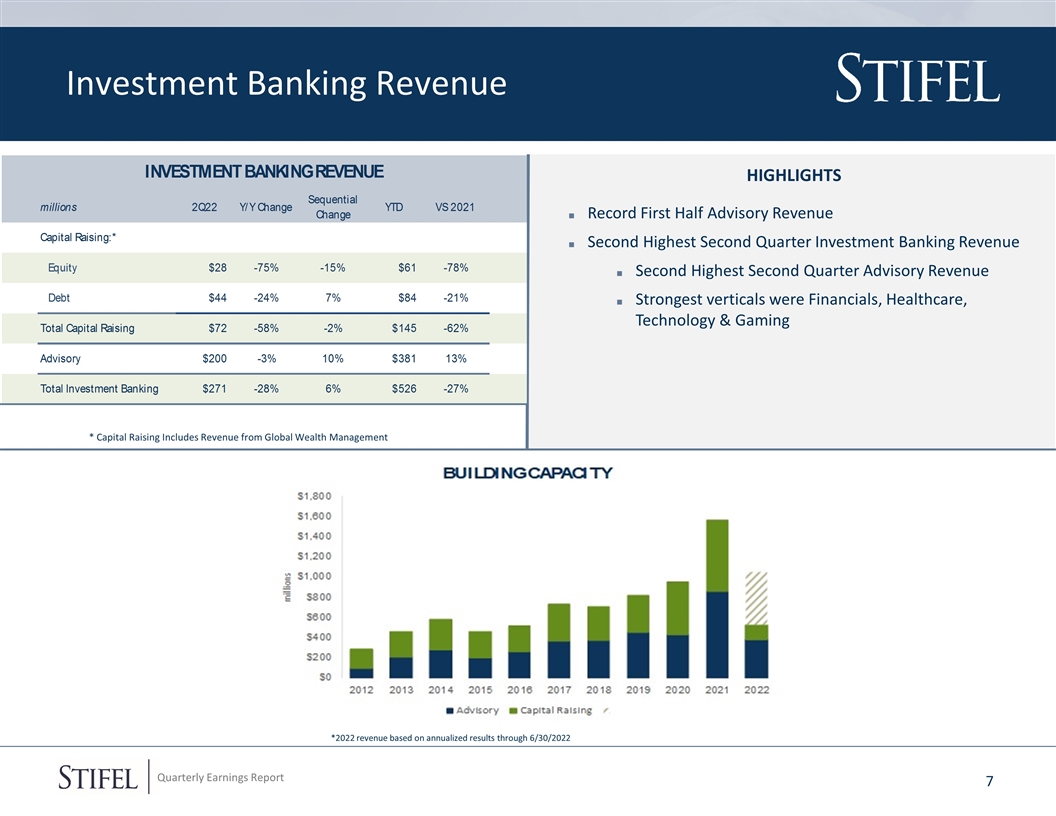

Investment Banking Revenue Highlights Record First Half Advisory Revenue Second Highest Second Quarter Investment Banking Revenue Second Highest Second Quarter Advisory Revenue Strongest verticals were Financials, Healthcare, Technology & Gaming Bar chart header numbers are a graphic * Capital Raising Includes Revenue from Global Wealth Management *2022 revenue based on annualized results through 6/30/2022

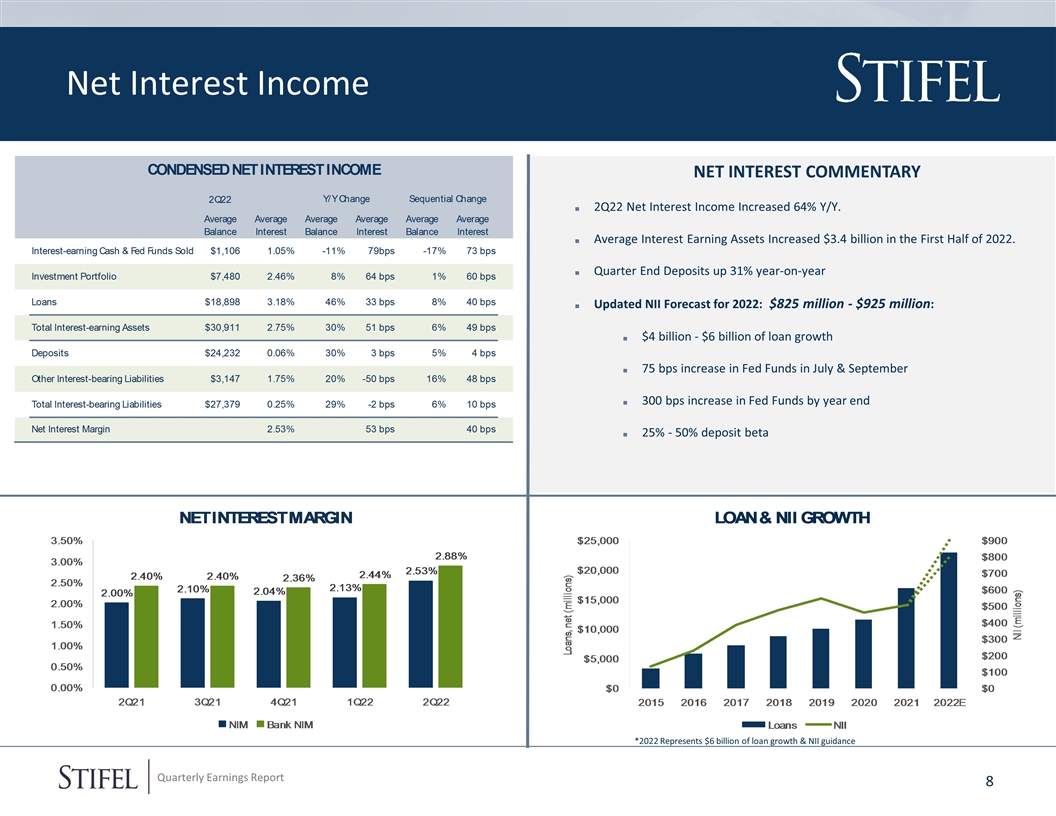

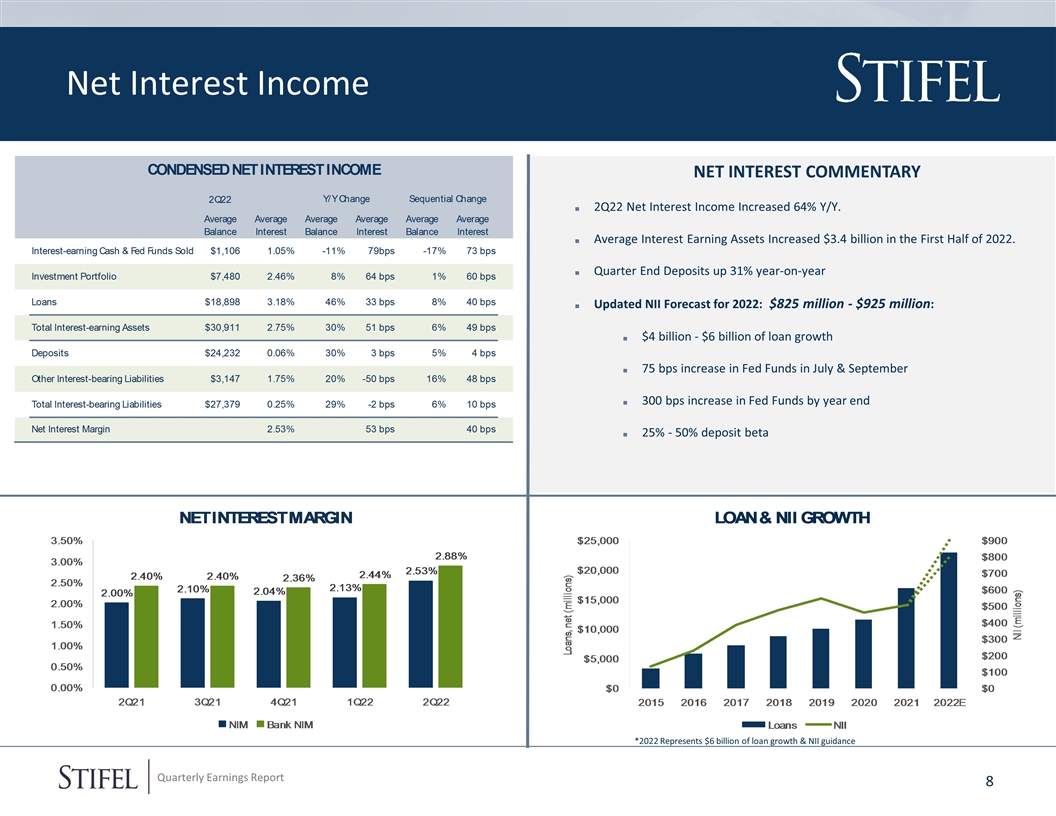

Net Interest Income Net Interest commentary 2Q22 Net Interest Income Increased 64% Y/Y. Average Interest Earning Assets Increased $3.4 billion in the First Half of 2022. Quarter End Deposits up 31% year-on-year Updated NII Forecast for 2022: $825 million - $925 million: $4 billion - $6 billion of loan growth 75 bps increase in Fed Funds in July & September 300 bps increase in Fed Funds by year end 25% - 50% deposit beta *2022 Represents $6 billion of loan growth & NII guidance

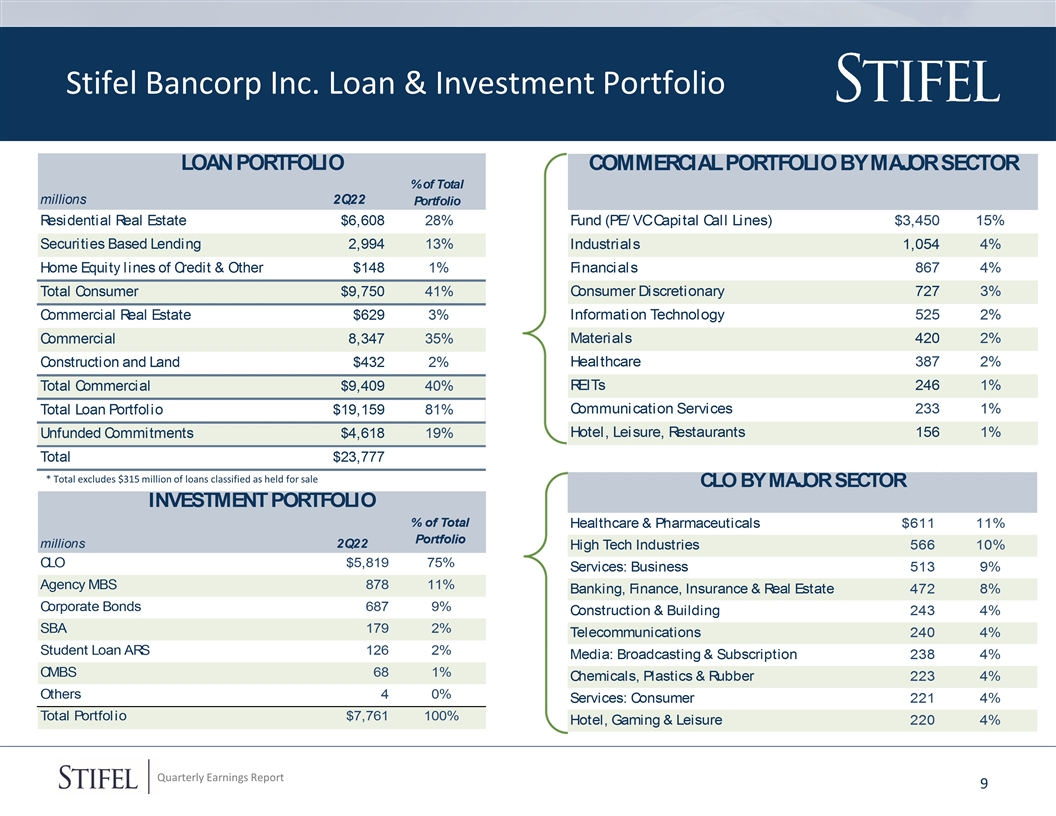

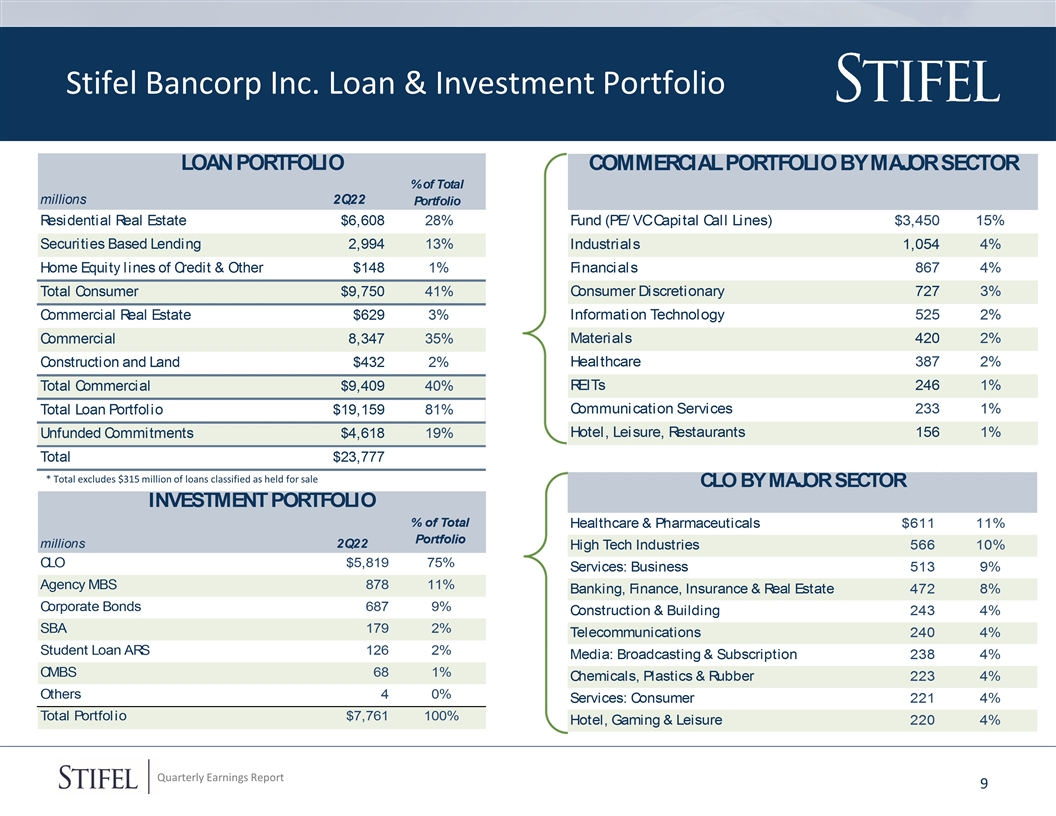

Stifel Bancorp Inc. Loan & Investment Portfolio * Total excludes $315 million of loans classified as held for sale

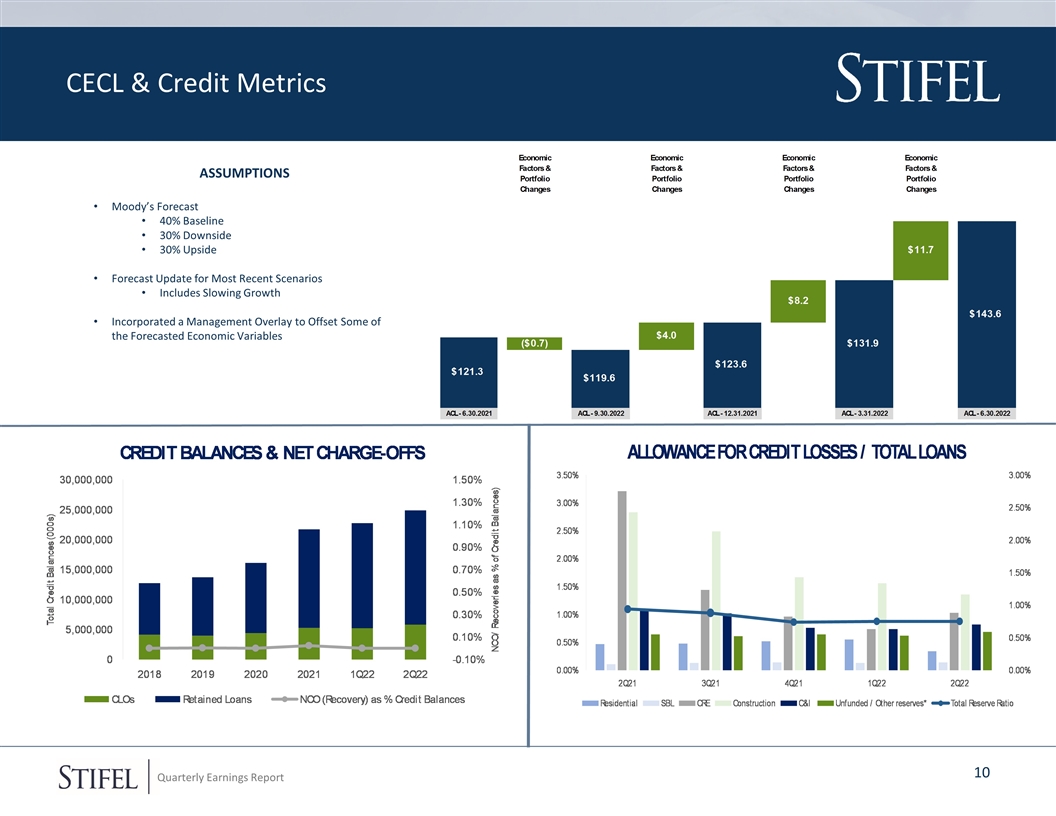

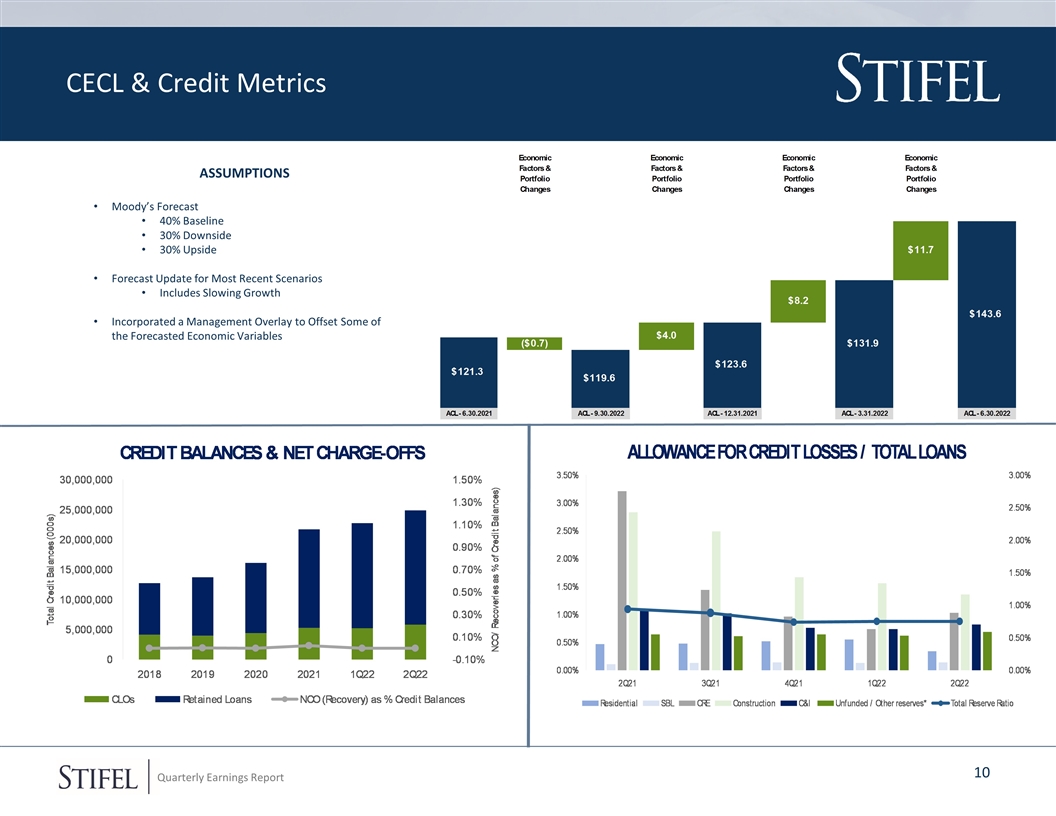

CECL & Credit Metrics ASSUMPTIONS Moody’s Forecast 40% Baseline 30% Downside 30% Upside Forecast Update for Most Recent Scenarios Includes Slowing Growth Incorporated a Management Overlay to Offset Some of the Forecasted Economic Variables

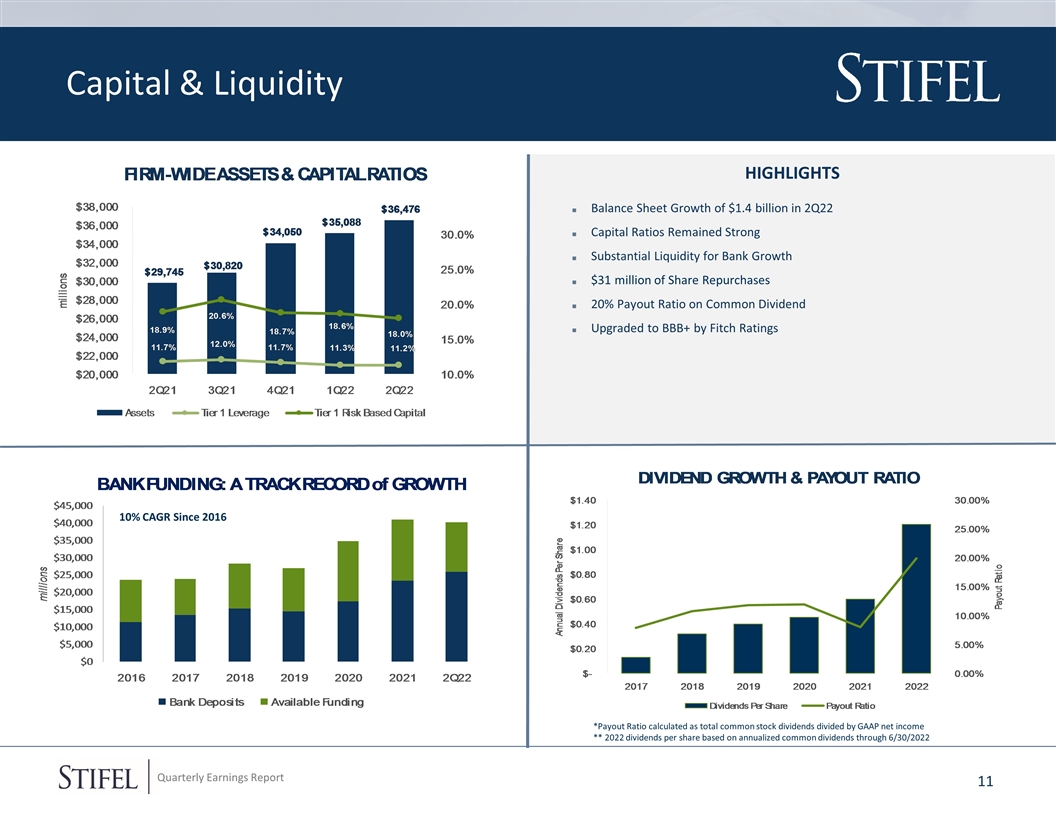

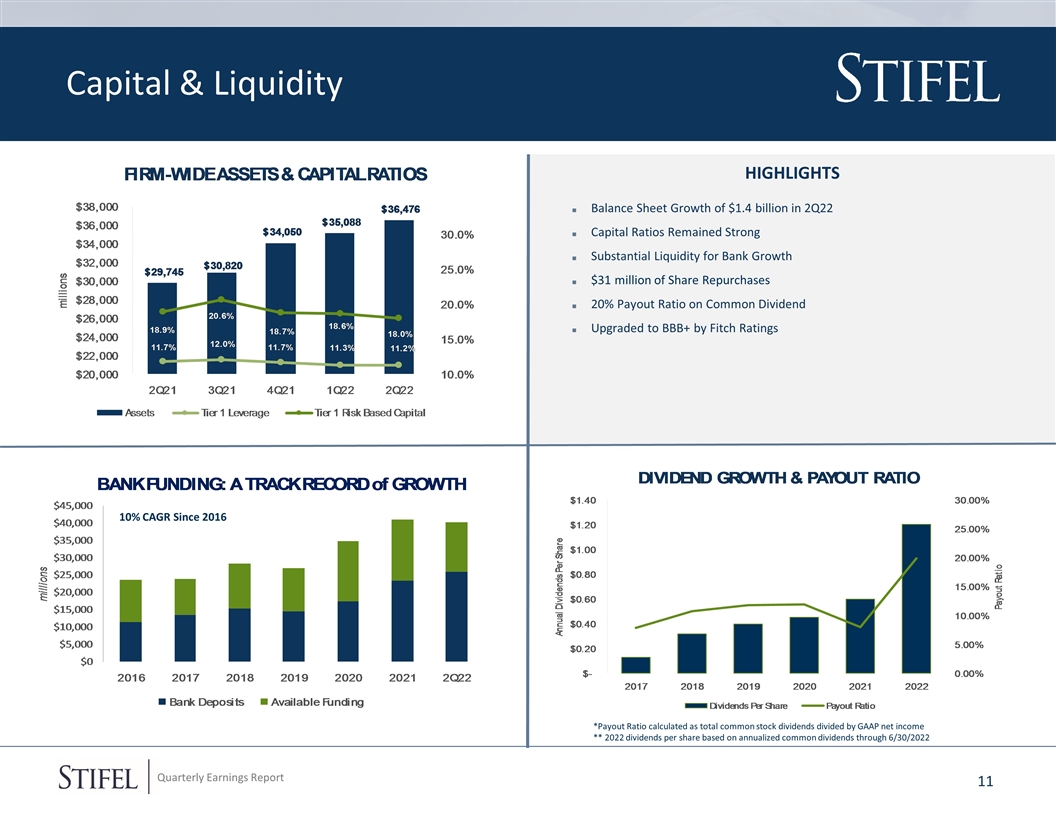

Capital & Liquidity HIGHLIGHTS Balance Sheet Growth of $1.4 billion in 2Q22 Capital Ratios Remained Strong Substantial Liquidity for Bank Growth $31 million of Share Repurchases 20% Payout Ratio on Common Dividend Upgraded to BBB+ by Fitch Ratings *Payout Ratio calculated as total common stock dividends divided by GAAP net income ** 2022 dividends per share based on annualized common dividends through 6/30/2022 10% CAGR Since 2016

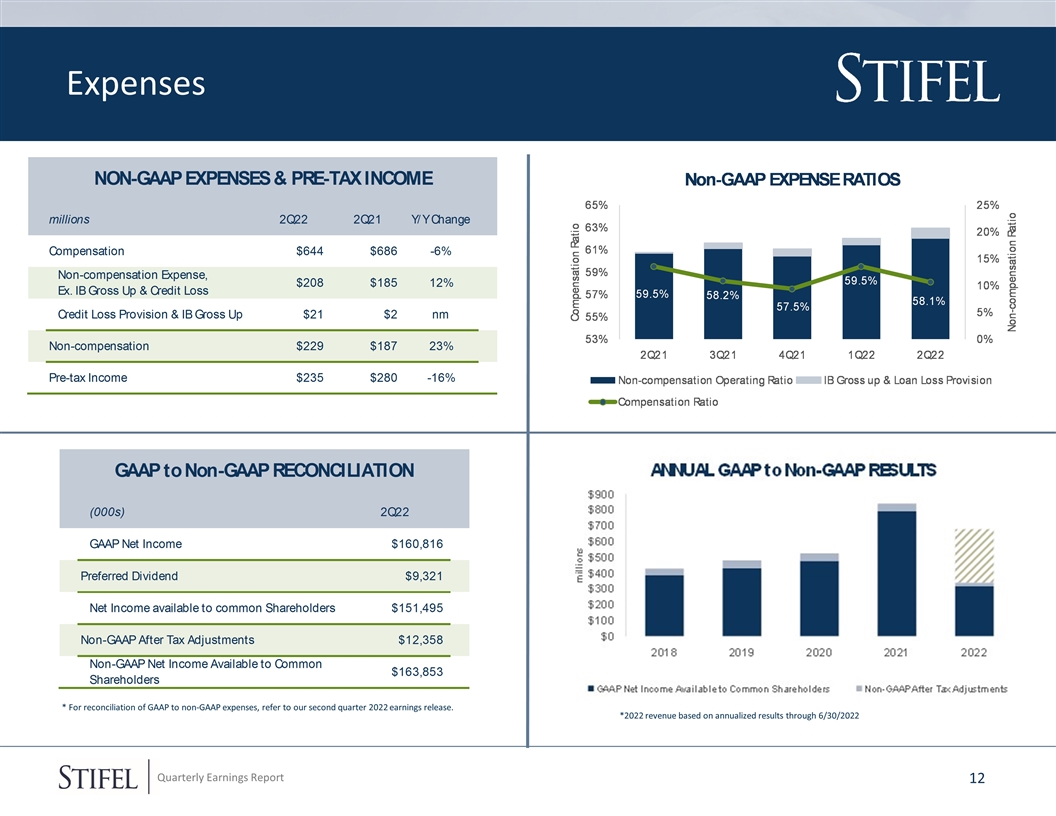

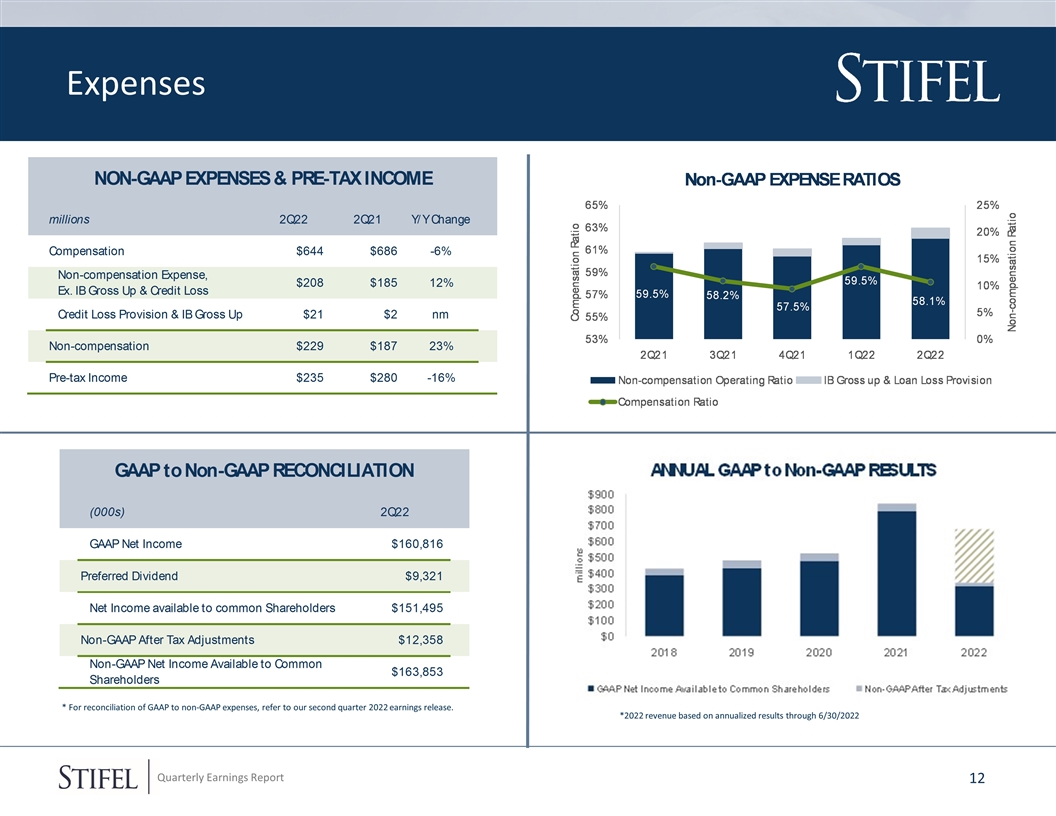

Expenses * For reconciliation of GAAP to non-GAAP expenses, refer to our second quarter 2022 earnings release. Bar chart header numbers are a graphic *2022 revenue based on annualized results through 6/30/2022

Concluding Remarks

Second Quarter 2022 Financial Results Presentation July 27, 2022

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. All statements not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. For information about the risks and important factors that could affect the Company’s future results, financial condition and liquidity, see “Risk Factors” in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. Forward-looking statements speak only as to the date they are made. The Company disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Use of Non-GAAP Financial Measures The Company prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S. GAAP). The Company may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. The Securities and Exchange Commission defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude, or include, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by the Company are provided as additional information to analysts, investors and other stakeholders in order to provide them with greater transparency about, or an alternative method for assessing the Company’s financial condition or operating results. These measures are not in accordance with, or a substitute for U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever the Company refers to a non-GAAP financial measure, it will also define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure it references and such comparable U.S. GAAP financial measure.