2nd Quarter 2016 Financial Results Presentation August 2, 2016

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. In particular, these statements may refer to our goals, intentions, and expectations, our business plans and growth strategies, our ability to integrate and manage our acquired businesses, estimates of our risks and future costs and benefits, and forecasted demographic and economic trends relating to our industry. You should not place undue reliance on any forward-looking statements, which speak only as of the date they were made. We will not update these forward-looking statements, even though our situation may change in the future, unless we are obligated to do so under federal securities laws. Actual results may differ materially and reported results should not be considered as an indication of future performance. Factors that could cause actual results to differ are included in the Company’s annual and quarterly reports and from time to time in other reports filed by the Company with the Securities and Exchange Commission and include, among other things, changes in general economic and business conditions, actions of competitors, regulatory and legal actions, changes in legislation, and technology changes. Use of Non-GAAP Financial Measures The Company utilized non-GAAP calculations of presented net revenues, compensation and benefits, non-compensation operating expenses, income from continuing operations before income taxes, provision for income taxes, net income from continuing operations, net income, compensation and non-compensation operating expense ratios, pre-tax margin and diluted earnings per share as an additional measure to aid in understanding and analyzing the Company’s financial results for the three months ended March 31, 2016. Specifically, the Company believes that the non-GAAP measures provide useful information by excluding certain items that may not be indicative of the Company’s core operating results and business outlook. The Company believes that these non-GAAP measures will allow for a better evaluation of the operating performance of the business and facilitate a meaningful comparison of the Company’s results in the current period to those in prior periods and future periods. Reference to these non-GAAP measures should not be considered as a substitute for results that are presented in a manner consistent with GAAP. These non-GAAP measures are provided to enhance investors' overall understanding of the Company’s financial performance.

2nd Quarter Highlights 2nd Quarter Highlights: Record total net revenue of $652 mil. up 5% sequentially & 9% Y/Y Record total Global Wealth Management net revenue of $386 mil. up 2% sequentially & 12% Y/Y Record total Stifel Bank & Trust net revenue of $56 mil. up 5% sequentially & 36% Y/Y Total assets on balance sheet of $15.2 bil. up 7% sequentially & 50% Y/Y Total Institutional net revenue of $261 mil., up 8% sequentially & 1% Y/Y Total Advisory net revenue of $67 mil., up 41% sequentially & 5% Y/Y Non-GAAP EPS of $0.69 up 21% sequentially but down 3% Y/Y; GAAP EPS of $0.13 Completed acquisition of ISM Sale of Legacy Sterne Agee Clearing and Independent Broker Businesses Continued Optimization of Balance Sheet

Revenue & Segment Results

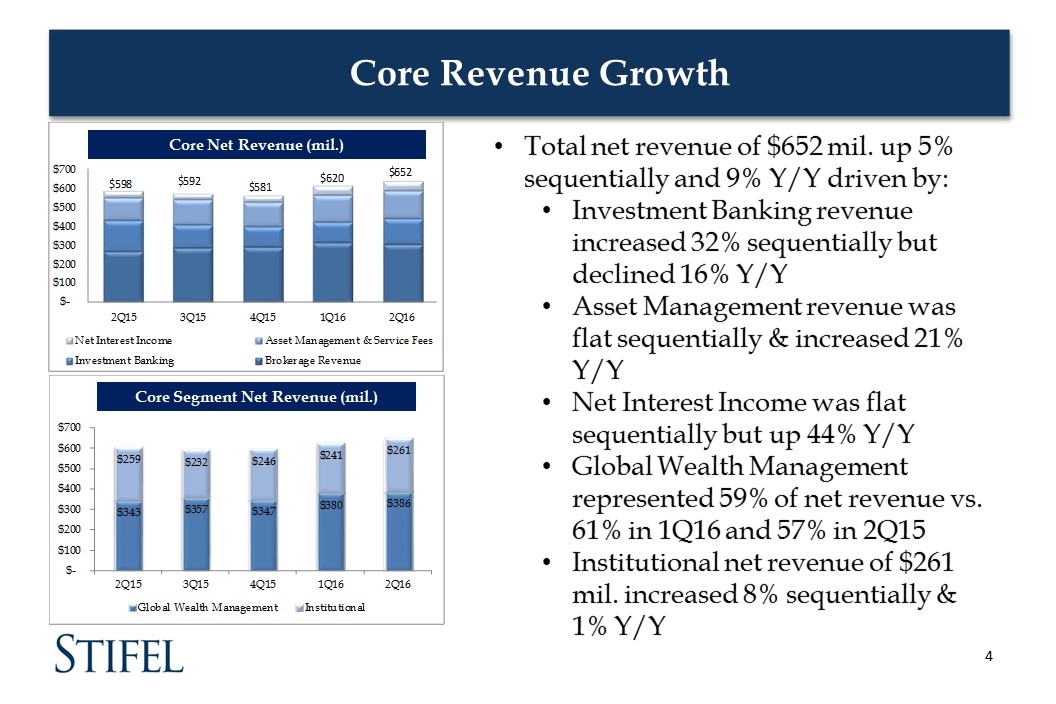

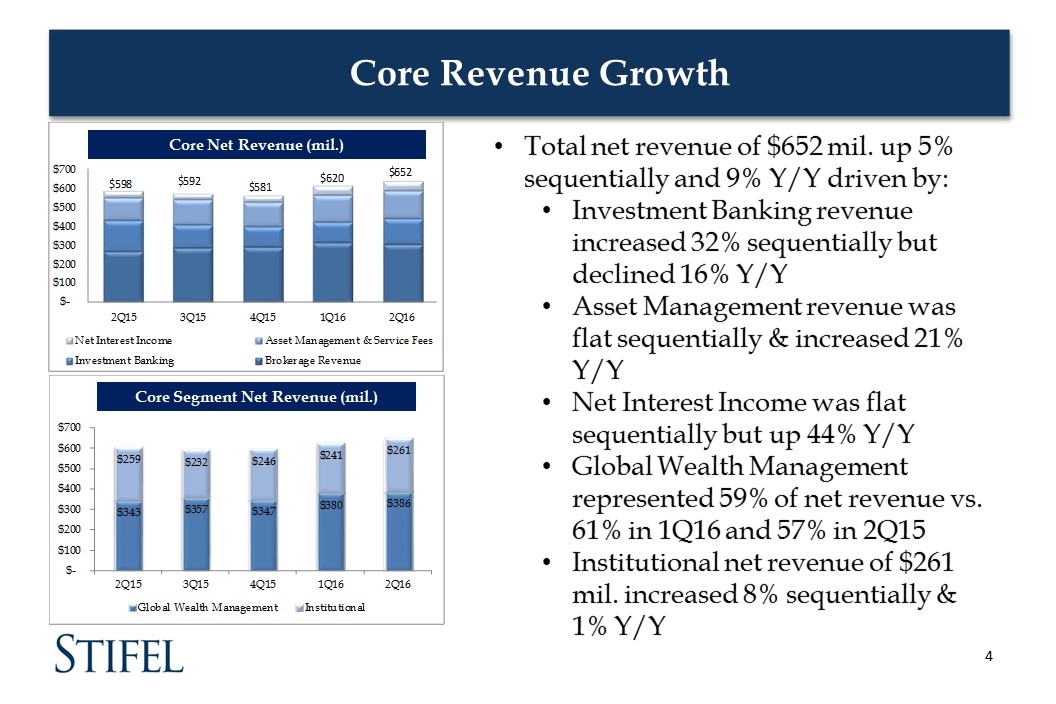

Core Revenue Growth Core Net Revenue (mil.) Core Segment Net Revenue (mil.) Total net revenue of $652 mil. up 5% sequentially and 9% Y/Y driven by: Investment Banking revenue increased 32% sequentially but declined 16% Y/Y Asset Management revenue was flat sequentially & increased 21% Y/Y Net Interest Income was flat sequentially but up 44% Y/Y Global Wealth Management represented 59% of net revenue vs. 61% in 1Q16 and 57% in 2Q15 Institutional net revenue of $261 mil. increased 8% sequentially & 1% Y/Y

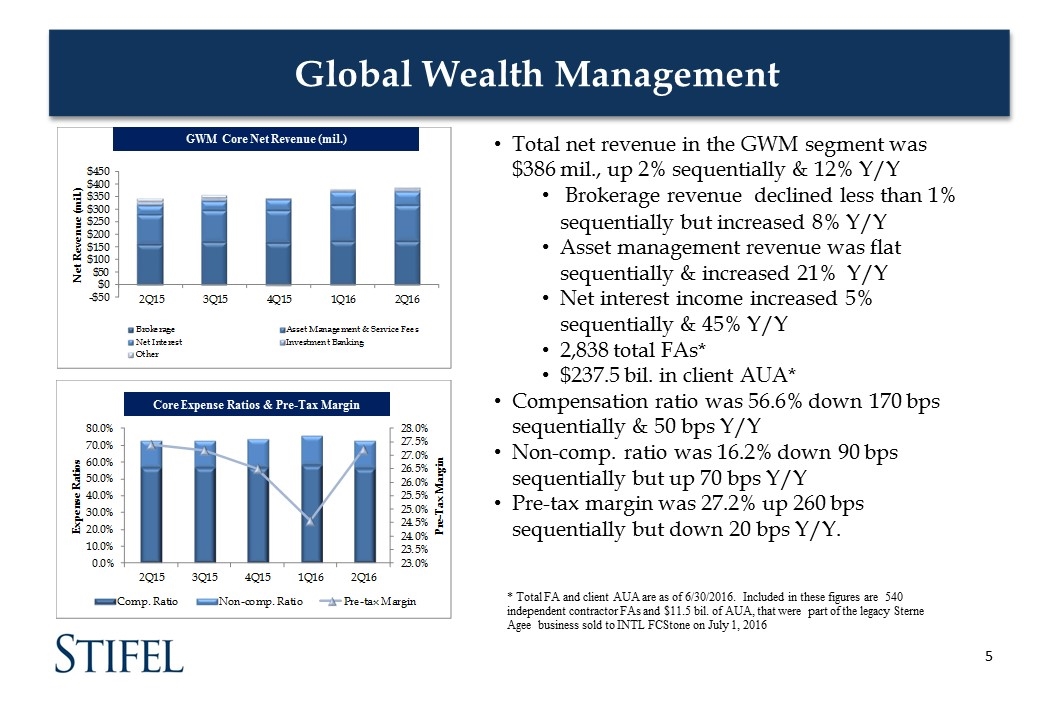

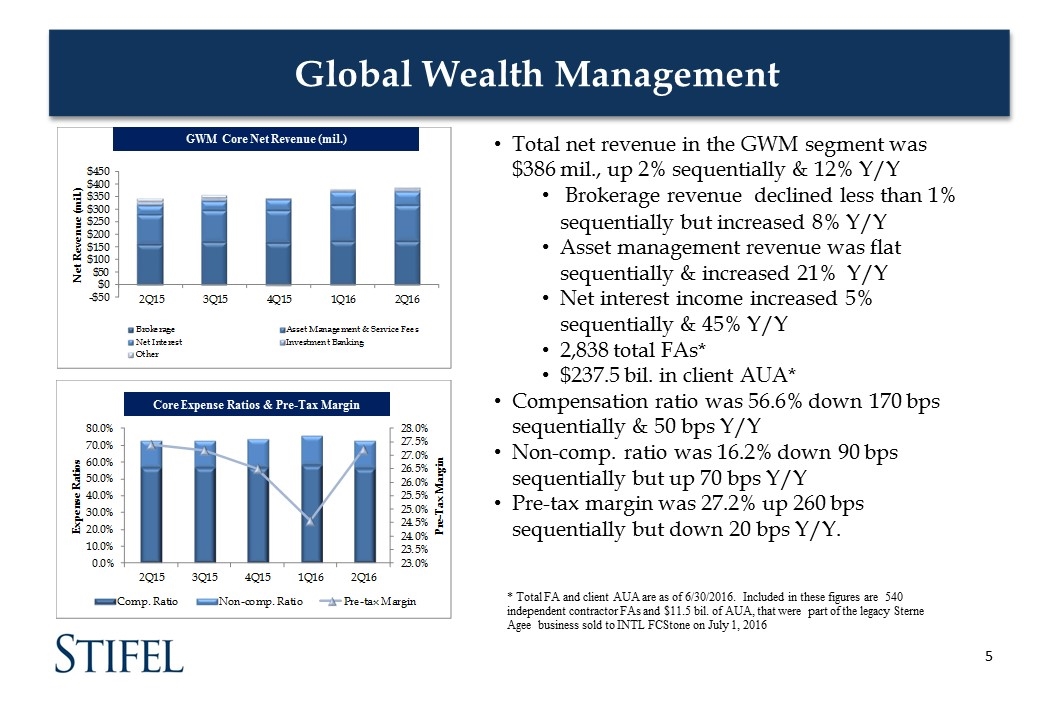

Global Wealth Management GWM Core Net Revenue (mil.) Core Expense Ratios & Pre-Tax Margin Total net revenue in the GWM segment was $386 mil., up 2% sequentially & 12% Y/Y Brokerage revenue declined less than 1% sequentially but increased 8% Y/Y Asset management revenue was flat sequentially & increased 21% Y/Y Net interest income increased 5% sequentially & 45% Y/Y 2,838 total FAs* $237.5 bil. in client AUA* Compensation ratio was 56.6% down 170 bps sequentially & 50 bps Y/Y Non-comp. ratio was 16.2% down 90 bps sequentially but up 70 bps Y/Y Pre-tax margin was 27.2% up 260 bps sequentially but down 20 bps Y/Y. * Total FA and client AUA are as of 6/30/2016. Included in these figures are 540 independent contractor FAs and $11.5 bil. of AUA, that were part of the legacy Sterne Agee business sold to INTL FCStone on July 1, 2016

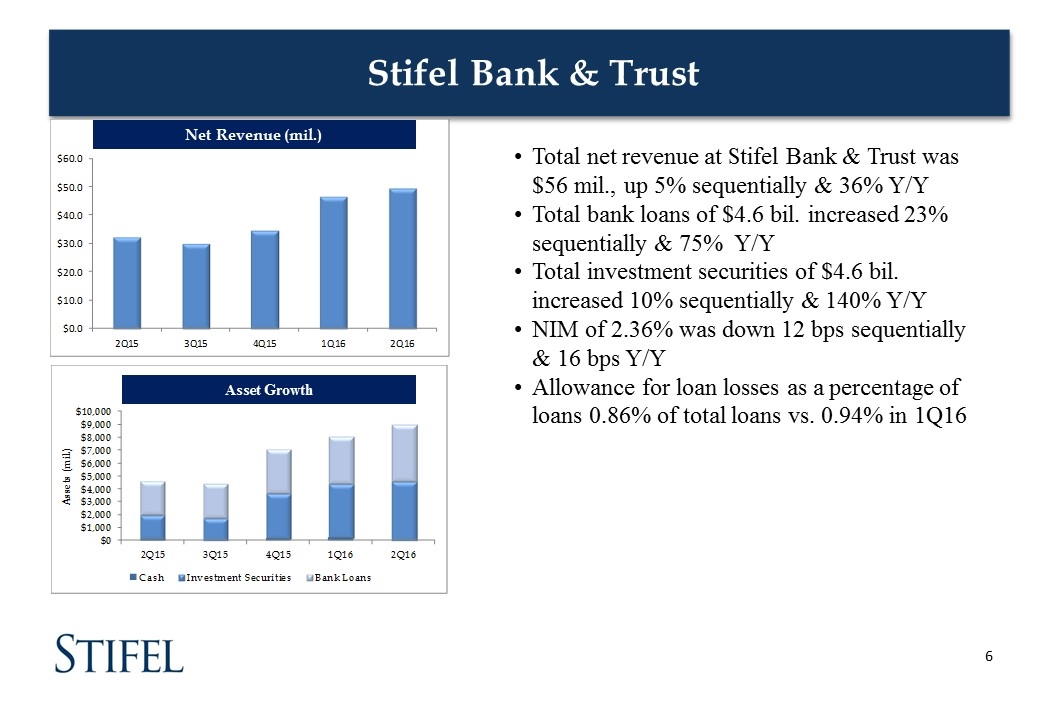

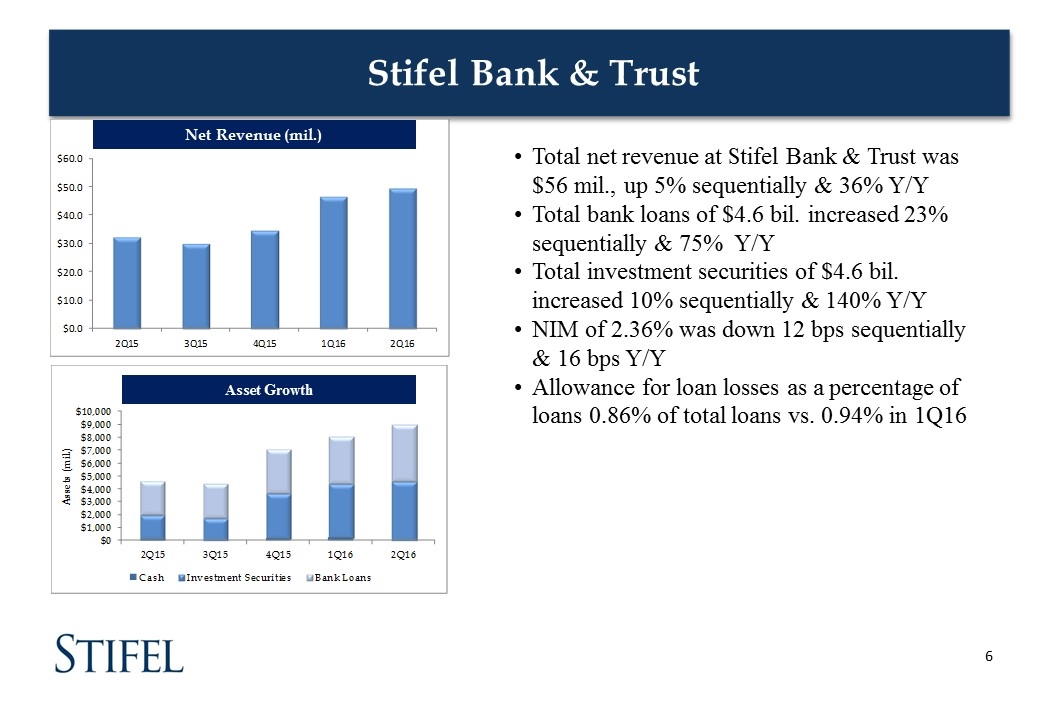

Stifel Bank & Trust Net Revenue (mil.) Asset Growth Total net revenue at Stifel Bank & Trust was $56 mil., up 5% sequentially & 36% Y/Y Total bank loans of $4.6 bil. increased 23% sequentially & 75% Y/Y Total investment securities of $4.6 bil. increased 10% sequentially & 140% Y/Y NIM of 2.36% was down 12 bps sequentially & 16 bps Y/Y Allowance for loan losses as a percentage of loans 0.86% of total loans vs. 0.94% in 1Q16

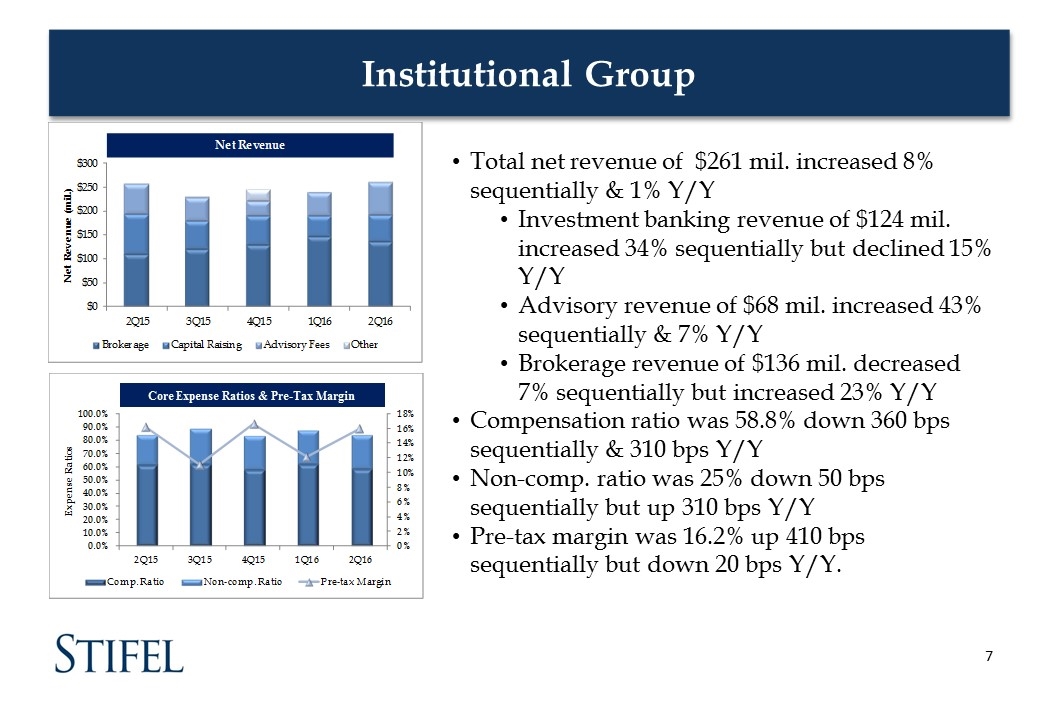

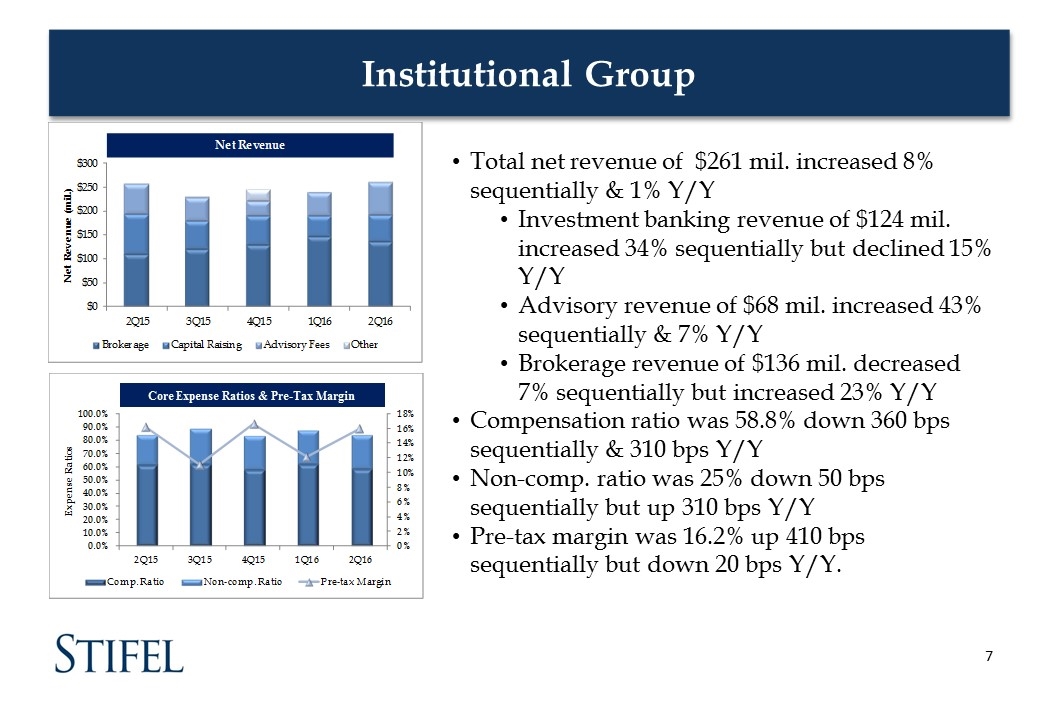

Institutional Group Core Expense Ratios & Pre-Tax Margin Total net revenue of $261 mil. increased 8% sequentially & 1% Y/Y Investment banking revenue of $124 mil. increased 34% sequentially but declined 15% Y/Y Advisory revenue of $68 mil. increased 43% sequentially & 7% Y/Y Brokerage revenue of $136 mil. decreased 7% sequentially but increased 23% Y/Y Compensation ratio was 58.8% down 360 bps sequentially & 310 bps Y/Y Non-comp. ratio was 25% down 50 bps sequentially but up 310 bps Y/Y Pre-tax margin was 16.2% up 410 bps sequentially but down 20 bps Y/Y.

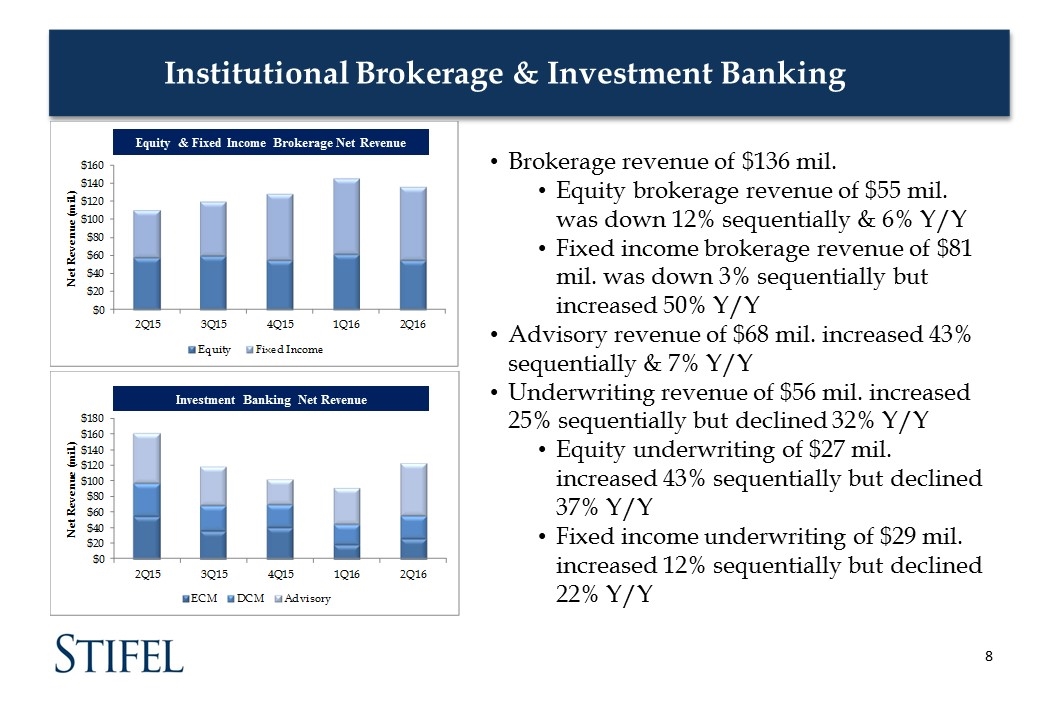

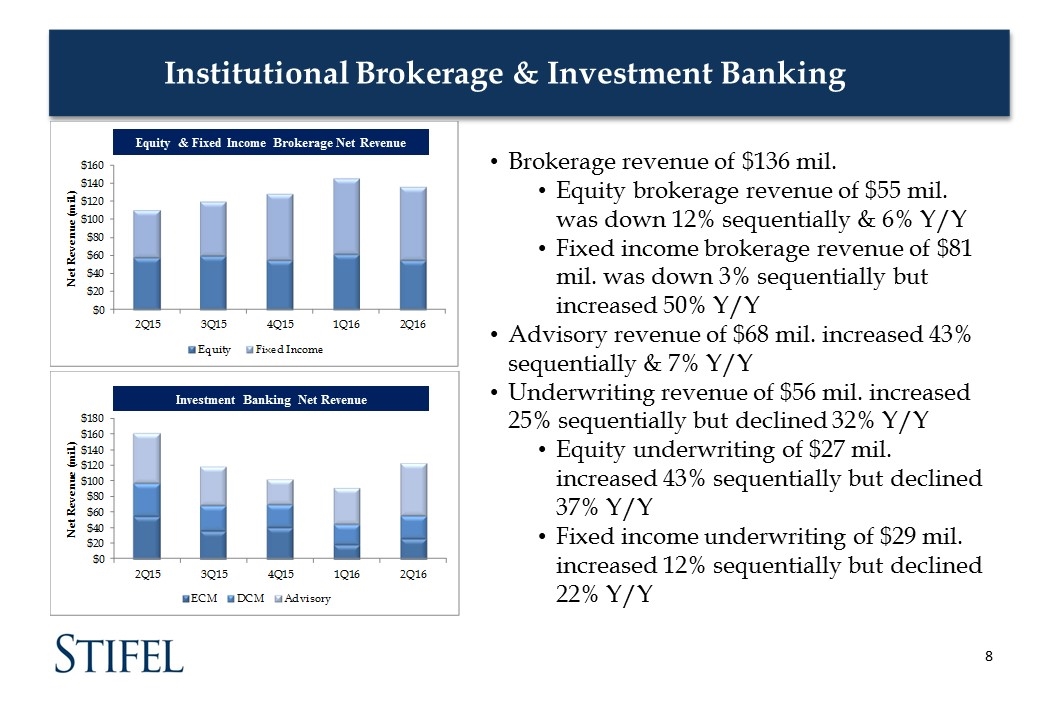

Institutional Brokerage & Investment Banking Equity & Fixed Income Brokerage Net Revenue Investment Banking Net Revenue Brokerage revenue of $136 mil. Equity brokerage revenue of $55 mil. was down 12% sequentially & 6% Y/Y Fixed income brokerage revenue of $81 mil. was down 3% sequentially but increased 50% Y/Y Advisory revenue of $68 mil. increased 43% sequentially & 7% Y/Y Underwriting revenue of $56 mil. increased 25% sequentially but declined 32% Y/Y Equity underwriting of $27 mil. increased 43% sequentially but declined 37% Y/Y Fixed income underwriting of $29 mil. increased 12% sequentially but declined 22% Y/Y

Expense & Balance Sheet

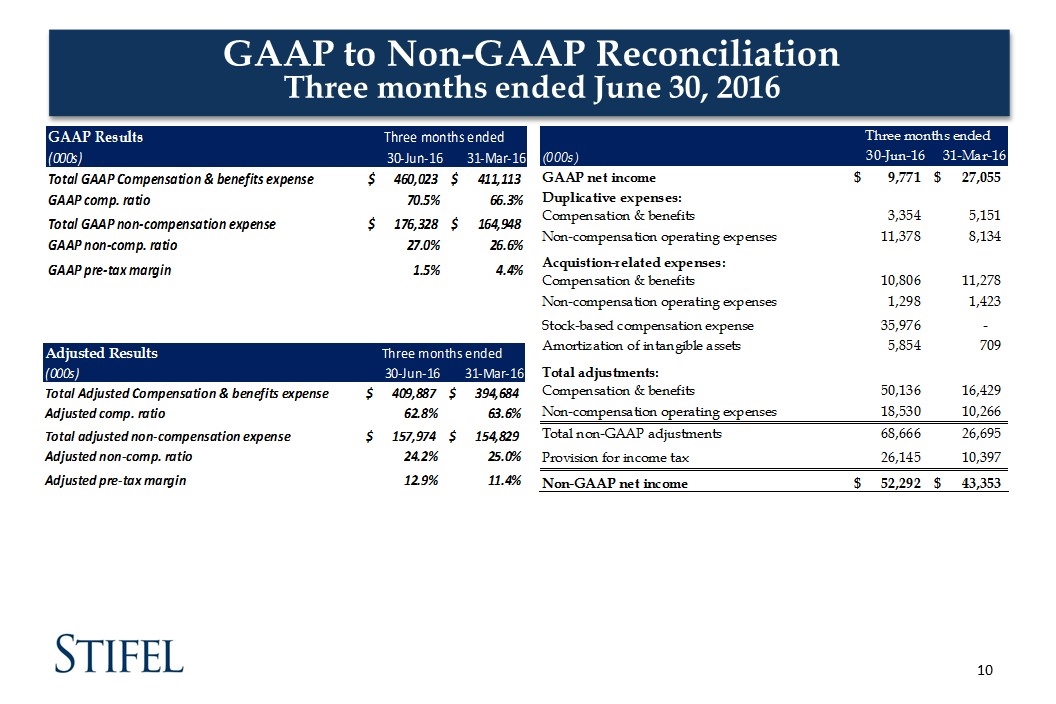

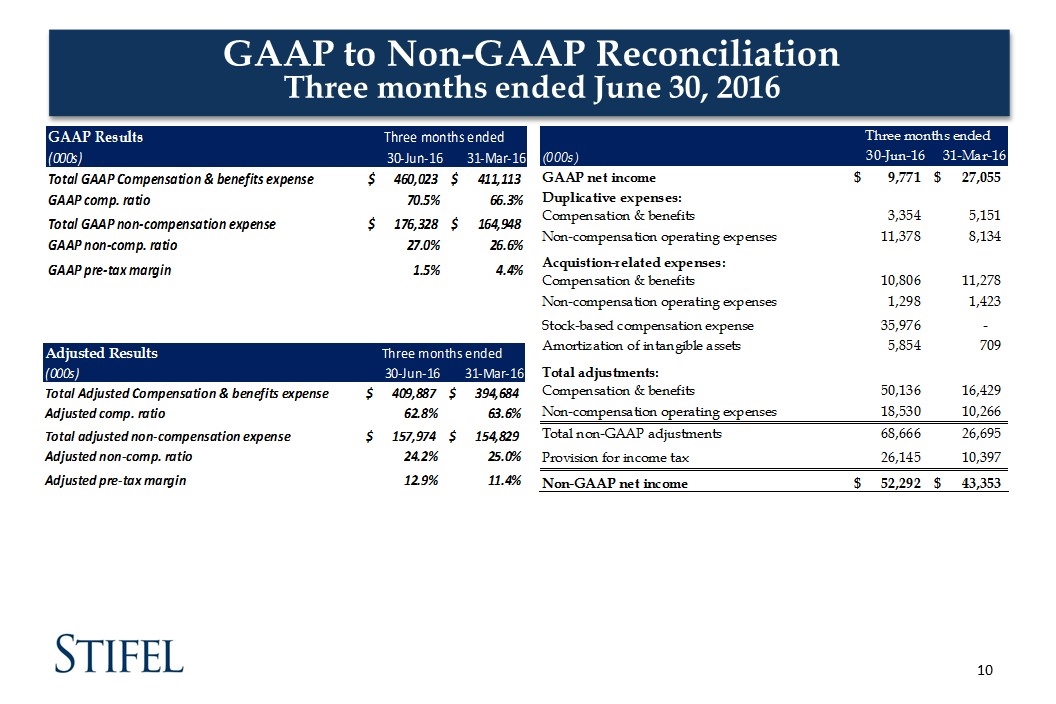

GAAP to Non-GAAP Reconciliation Three months ended June 30, 2016

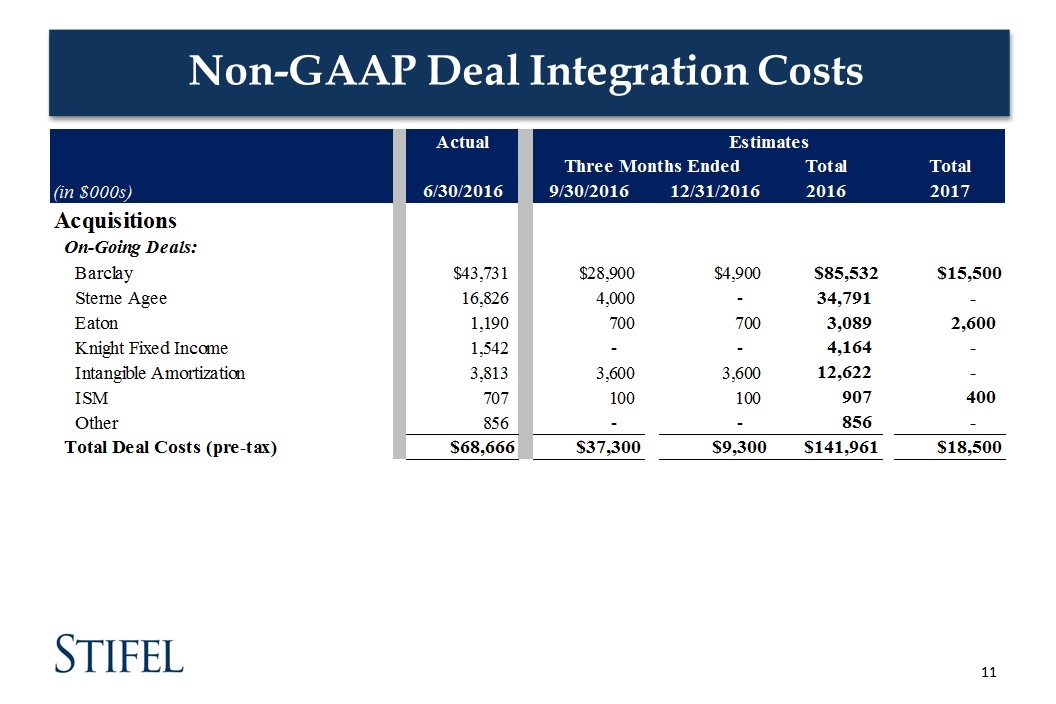

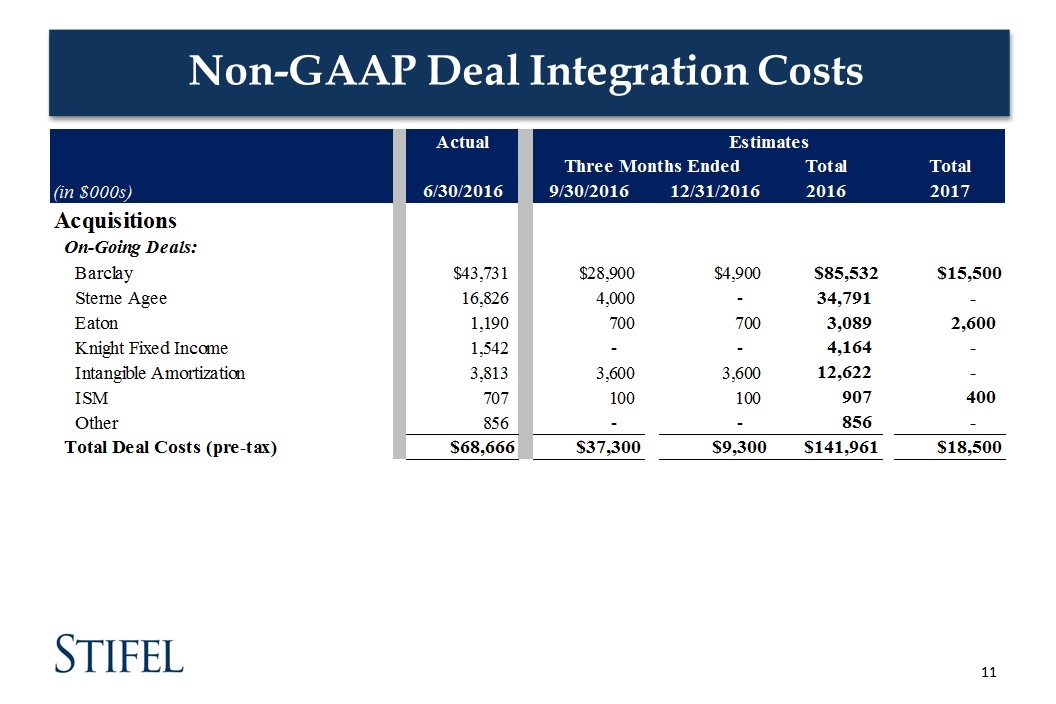

Non-GAAP Deal Integration Costs

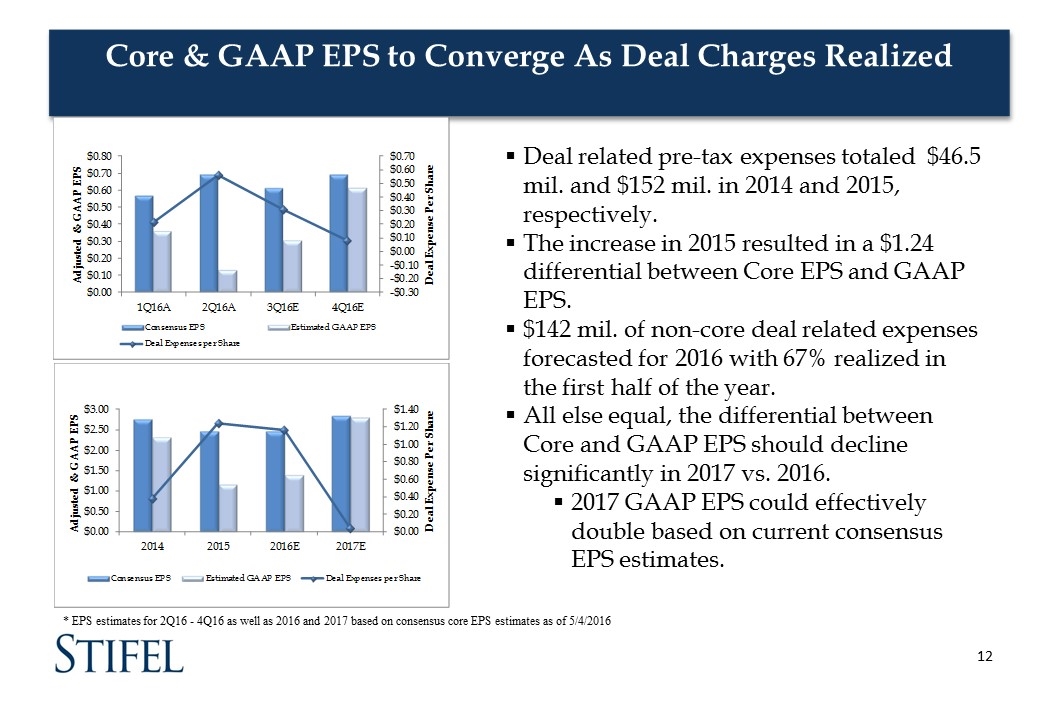

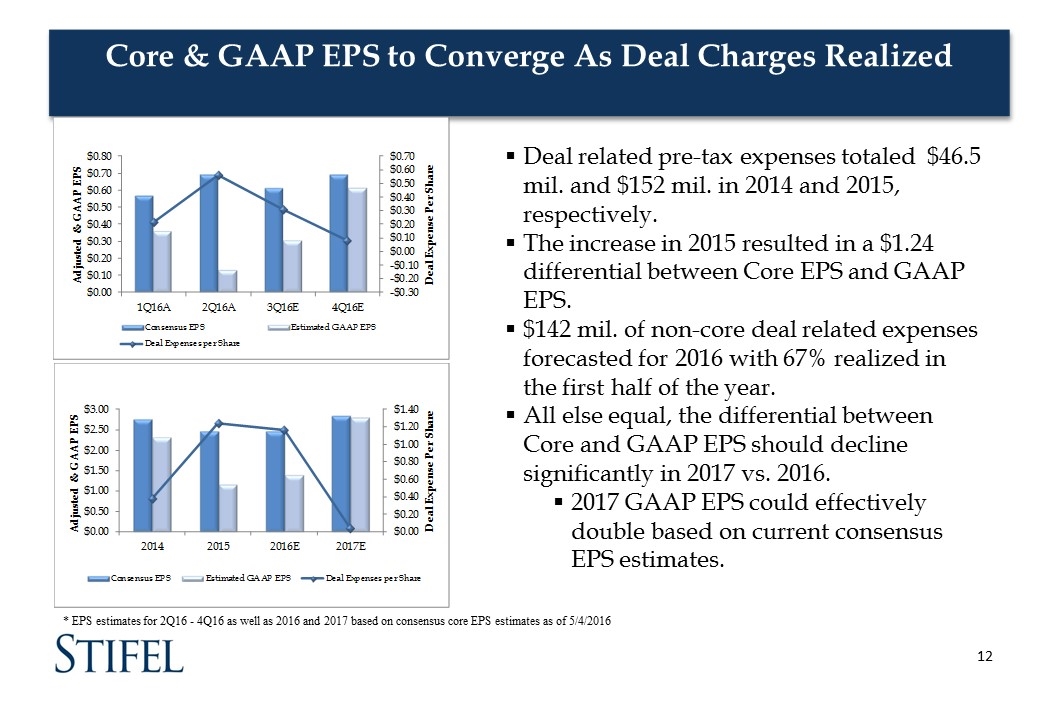

Core & GAAP EPS to Converge As Deal Charges Realized Deal related pre-tax expenses totaled $46.5 mil. and $152 mil. in 2014 and 2015, respectively. The increase in 2015 resulted in a $1.24 differential between Core EPS and GAAP EPS. $142 mil. of non-core deal related expenses forecasted for 2016 with 67% realized in the first half of the year. All else equal, the differential between Core and GAAP EPS should decline significantly in 2017 vs. 2016. 2017 GAAP EPS could effectively double based on current consensus EPS estimates. * EPS estimates for 2Q16 - 4Q16 as well as 2016 and 2017 based on consensus core EPS estimates as of 5/4/2016

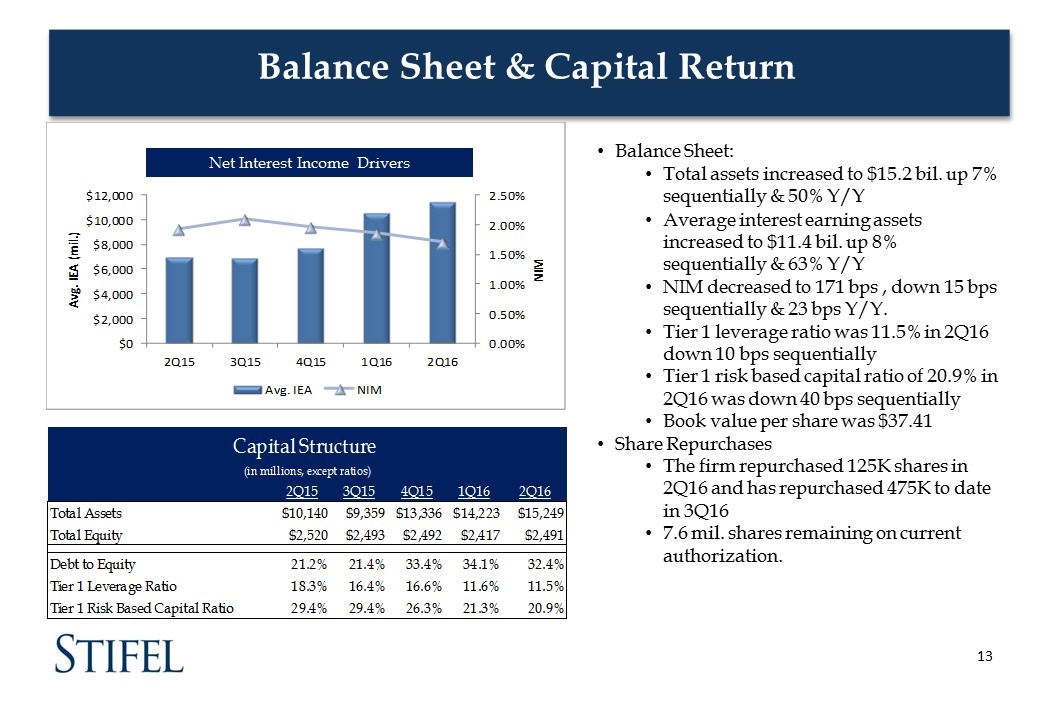

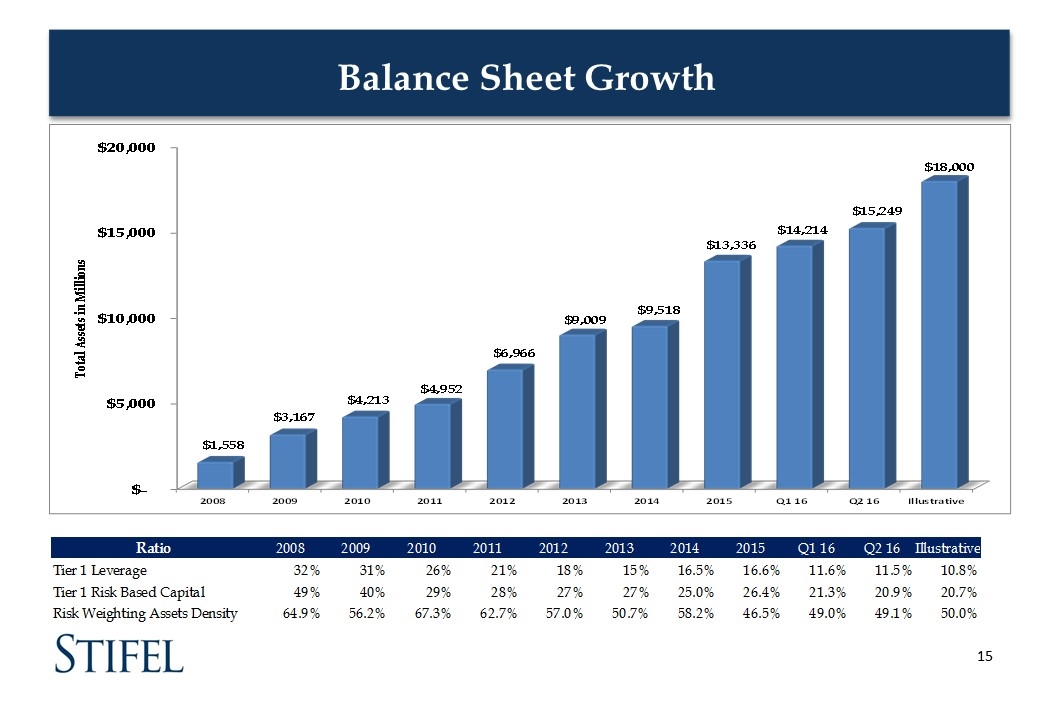

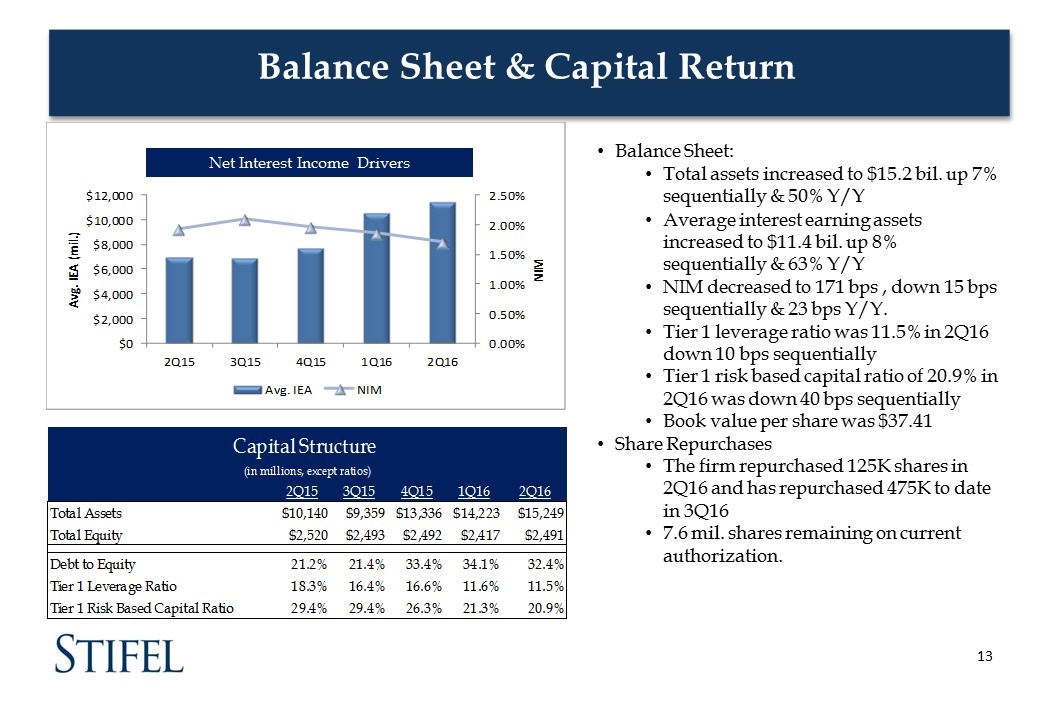

Balance Sheet & Capital Return Net Interest Income Drivers Balance Sheet: Total assets increased to $15.2 bil. up 7% sequentially & 50% Y/Y Average interest earning assets increased to $11.4 bil. up 8% sequentially & 63% Y/Y NIM decreased to 171 bps , down 15 bps sequentially & 23 bps Y/Y. Tier 1 leverage ratio was 11.5% in 2Q16 down 10 bps sequentially Tier 1 risk based capital ratio of 20.9% in 2Q16 was down 40 bps sequentially Book value per share was $37.41 Share Repurchases The firm repurchased 125K shares in 2Q16 and has repurchased 475K to date in 3Q16 7.6 mil. shares remaining on current authorization.

Outlook & Key Drivers

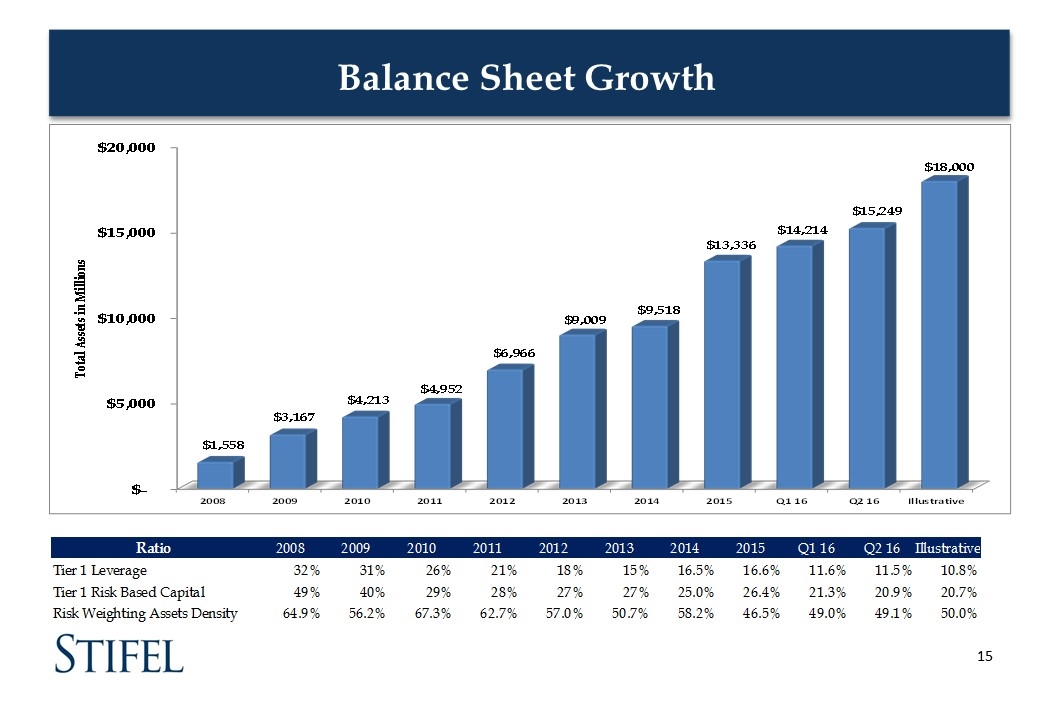

Balance Sheet Growth

Subsequent Events & Industry Issues Continued focus on balance sheet optimization: Closed the sale of legacy Sterne Agee correspondent clearing and independent contractor brokerage business for approximately $50 mil. Issued $150 mil. of 6.25% non-cumulative Preferred Shares Issued $200 mil. of 4.25% senior debt Called $150 mil. of 5.375% senior debt Repurchased 600K shares of Stifel common stock since the end of the first quarter, 7.6 mil. shares remaining on existing authorization. Industry Issues: DOL Brexit

Q&A