Investor Presentation Wells Fargo Securities Asset Managers, Brokers & Exchange Forum March 21, 2017 Exhibit 99.1

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. In particular, these statements may refer to our goals, intentions, and expectations, our business plans and growth strategies, our ability to integrate and manage our acquired businesses, estimates of our risks and future costs and benefits, and forecasted demographic and economic trends relating to our industry. You should not place undue reliance on any forward-looking statements, which speak only as of the date they were made. We will not update these forward-looking statements, even though our situation may change in the future, unless we are obligated to do so under federal securities laws. Actual results may differ materially and reported results should not be considered as an indication of future performance. Factors that could cause actual results to differ are included in the Company’s annual and quarterly reports and from time to time in other reports filed by the Company with the Securities and Exchange Commission and include, among other things, changes in general economic and business conditions, actions of competitors, regulatory and legal actions, changes in legislation, and technology changes. Use of Non-GAAP Financial Measures The Company utilized certain non-GAAP calculations as additional measures to aid in understanding and analyzing the Company’s financial results for the three months and 12 months ended December 31, 2016. Specifically, the Company believes that the non-GAAP measures provide useful information by excluding certain items that may not be indicative of the Company’s core operating results and business outlook. The Company believes that these non-GAAP measures will allow for a better evaluation of the operating performance of the business and facilitate a meaningful comparison of the Company’s results in the current period to those in prior and future periods. Reference to these non-GAAP measures should not be considered as a substitute for results that are presented in a manner consistent with GAAP. These non-GAAP measures are provided to enhance investors' overall understanding of the Company’s current financial performance. The non-GAAP financial information should be considered in addition to, not as a substitute for or as being superior to, operating income, cash flows, or other measures of financial performance prepared in accordance with GAAP. These non-GAAP measures primarily exclude expenses which management believes are, in some instances, non-recurring and not representative of ongoing business. Management has not included costs which they believe are duplicative in the analysis below, which is a change from prior periods. A limitation of utilizing these non-GAAP measures is that the GAAP accounting effects of these charges do, in fact, reflect the underlying financial results of the Company’s business and these effects should not be ignored in evaluating and analyzing its financial results. Therefore, the Company believes that GAAP measures and the same respective non-GAAP measures of the Company’s financial performance should be considered together.

Our Strategy

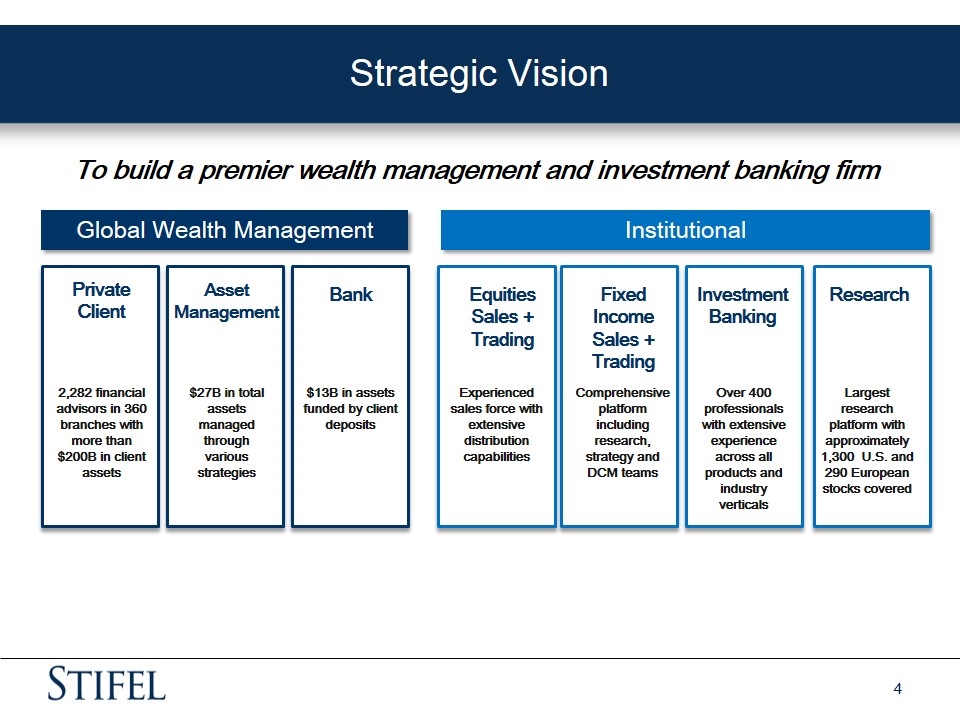

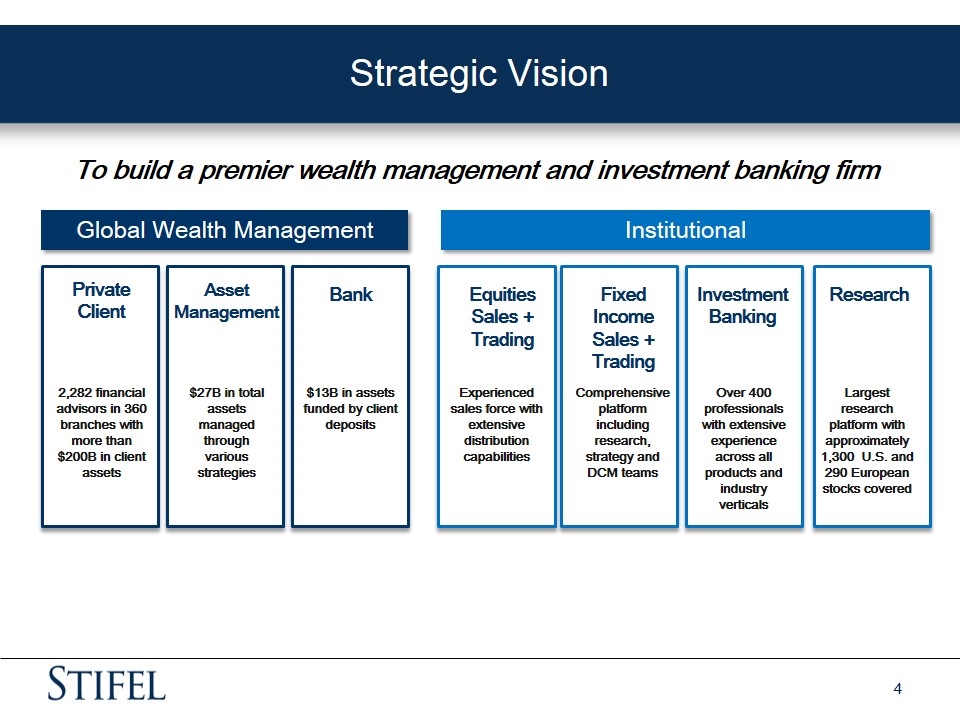

Strategic Vision To build a premier wealth management and investment banking firm Global Wealth Management Institutional Private Client 2,282 financial advisors in 360 branches with more than $200B in client assets Asset Management $27B in total assets managed through various strategies Bank $13B in assets funded by client deposits Equities Sales + Trading Fixed Income Sales + Trading Investment Banking Research Experienced sales force with extensive distribution capabilities Comprehensive platform including research, strategy and DCM teams Over 400 professionals with extensive experience across all products and industry verticals Largest research platform with approximately 1,300 U.S. and 290 European stocks covered

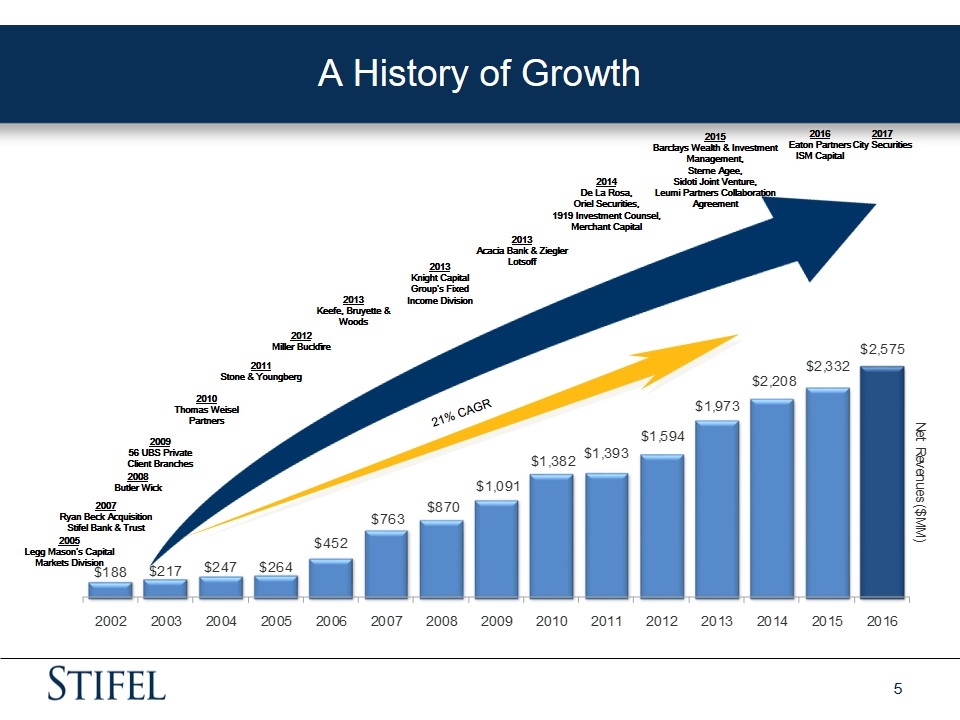

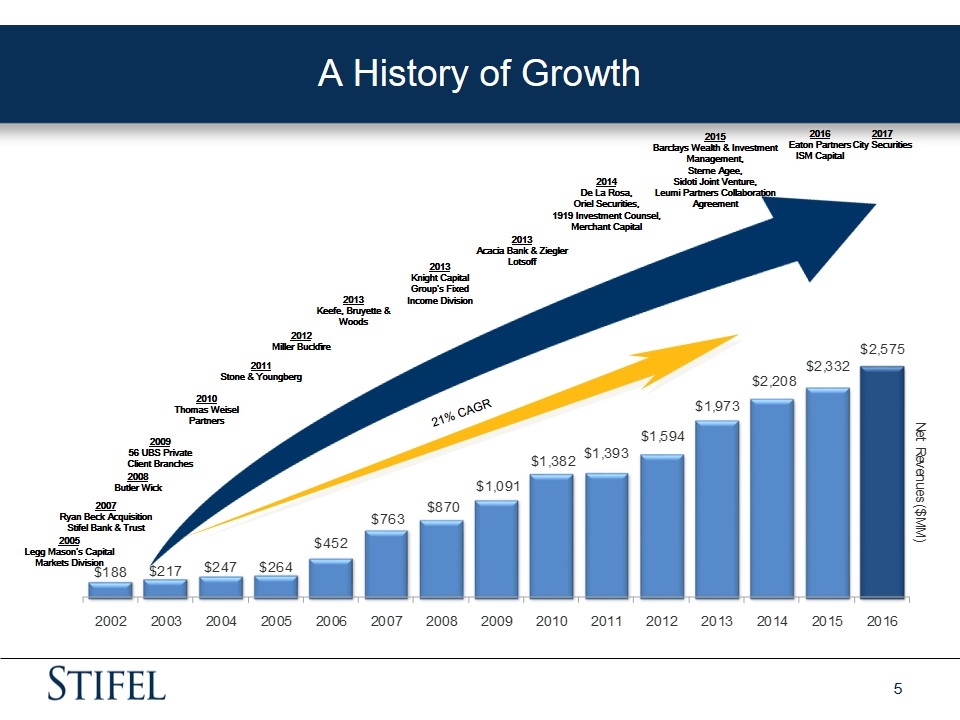

A History of Growth 2005 Legg Mason’s Capital Markets Division 2008 Butler Wick 2009 56 UBS Private Client Branches 2010 Thomas Weisel Partners 2007 Ryan Beck Acquisition Stifel Bank & Trust 2011 Stone & Youngberg 2012 Miller Buckfire 2013 Knight Capital Group’s Fixed Income Division 2014 De La Rosa, Oriel Securities, 1919 Investment Counsel, Merchant Capital 2013 Keefe, Bruyette & Woods 2013 Acacia Bank & Ziegler Lotsoff 2015 Barclays Wealth & Investment Management, Sterne Agee, Sidoti Joint Venture, Leumi Partners Collaboration Agreement 2016 Eaton Partners ISM Capital 21% CAGR 2017 City Securities

Driving Shareholder Value Through Deal Integration & Balance Sheet Growth

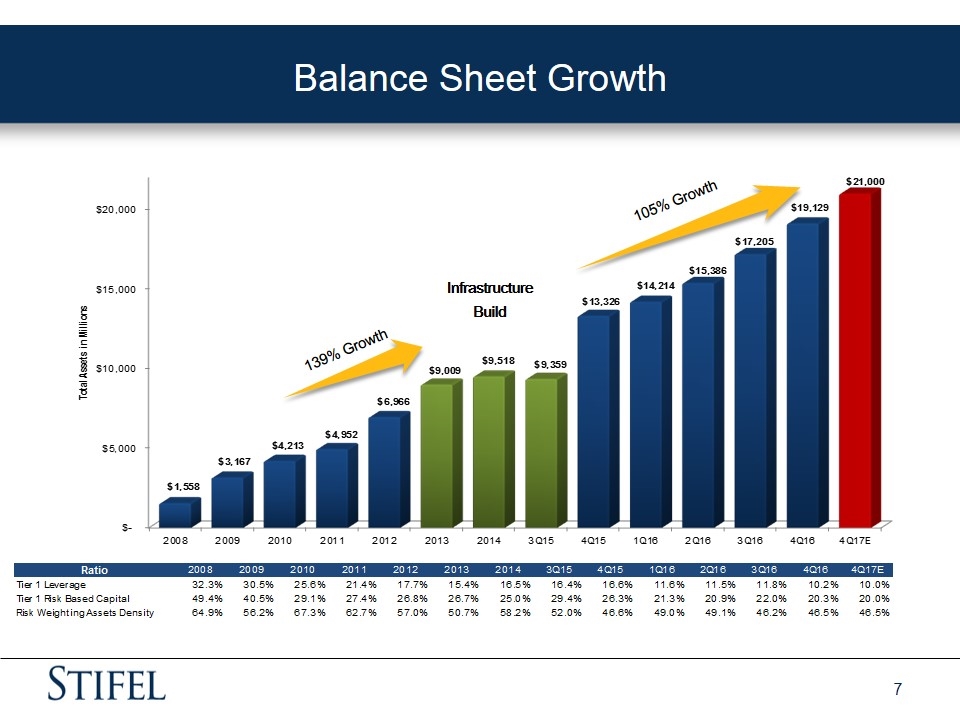

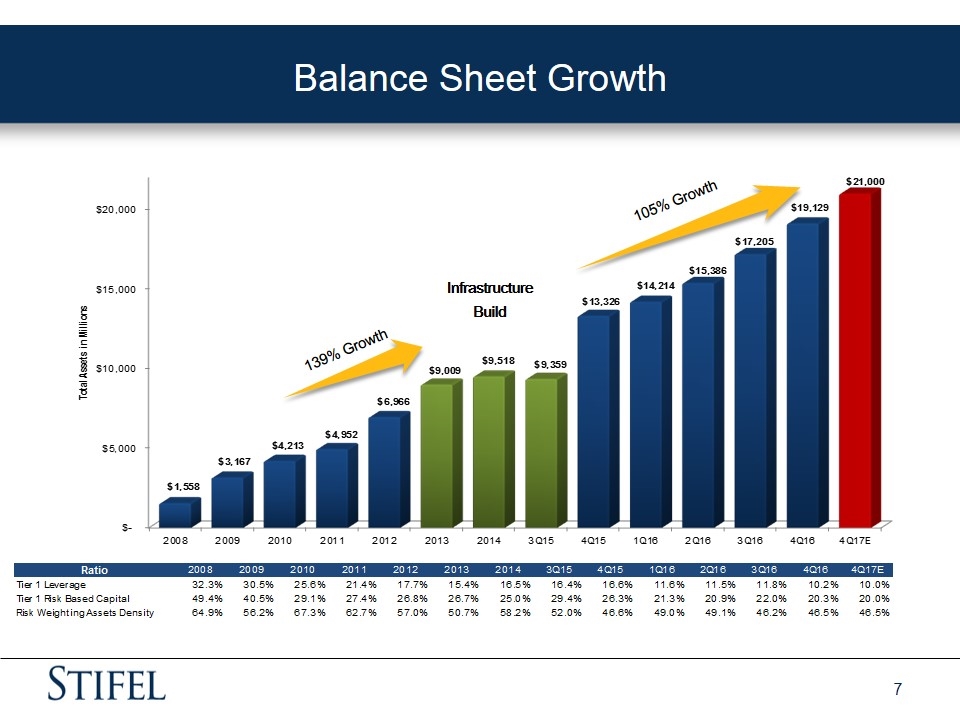

139% Growth 105% Growth Infrastructure Build Balance Sheet Growth

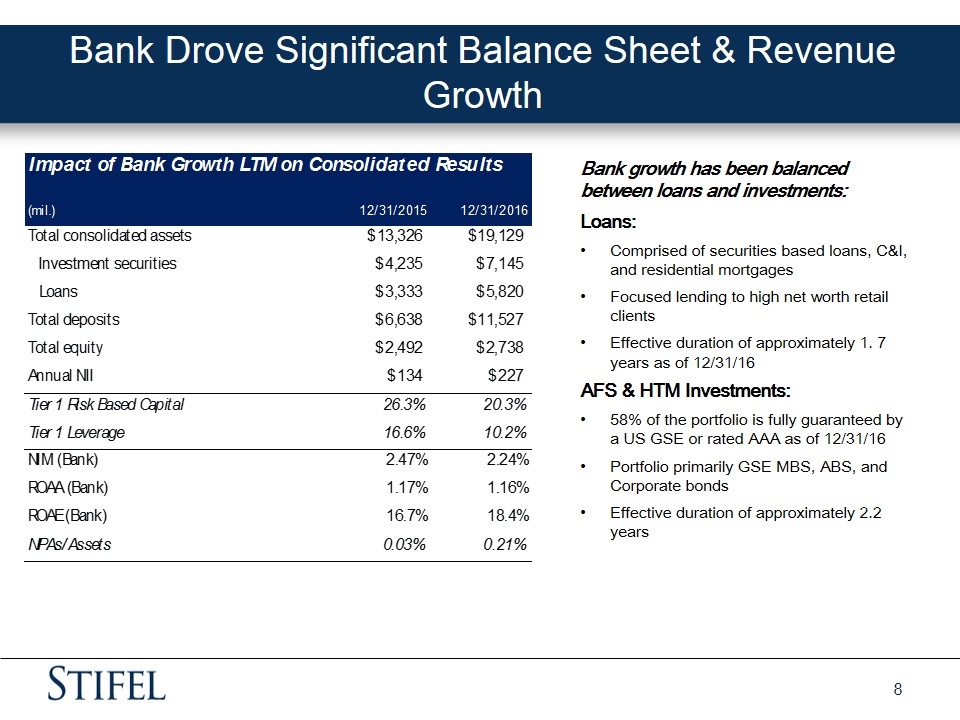

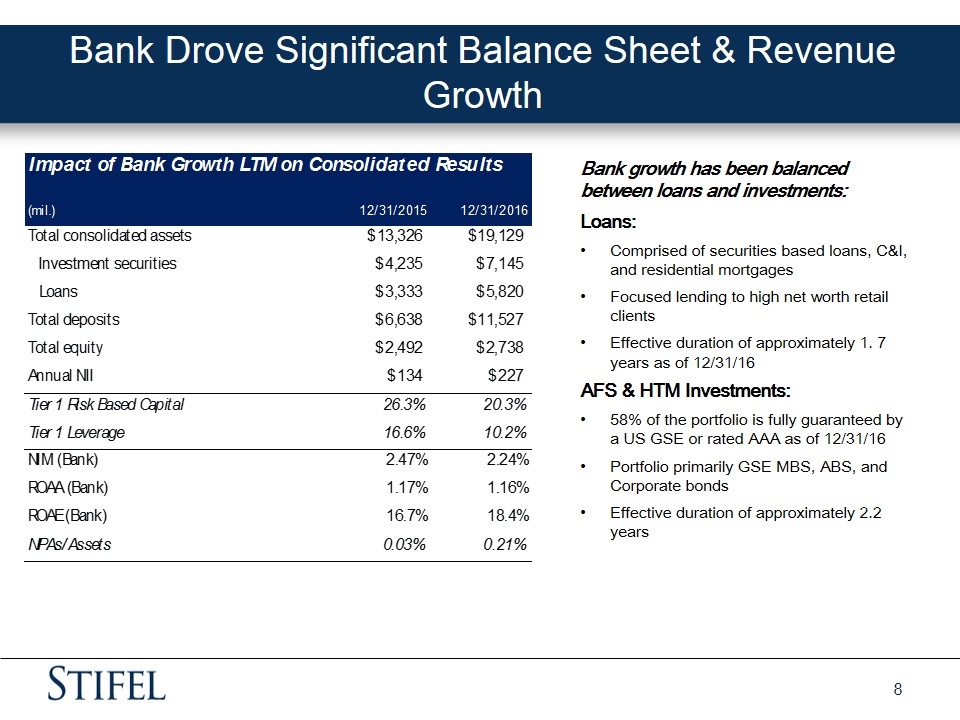

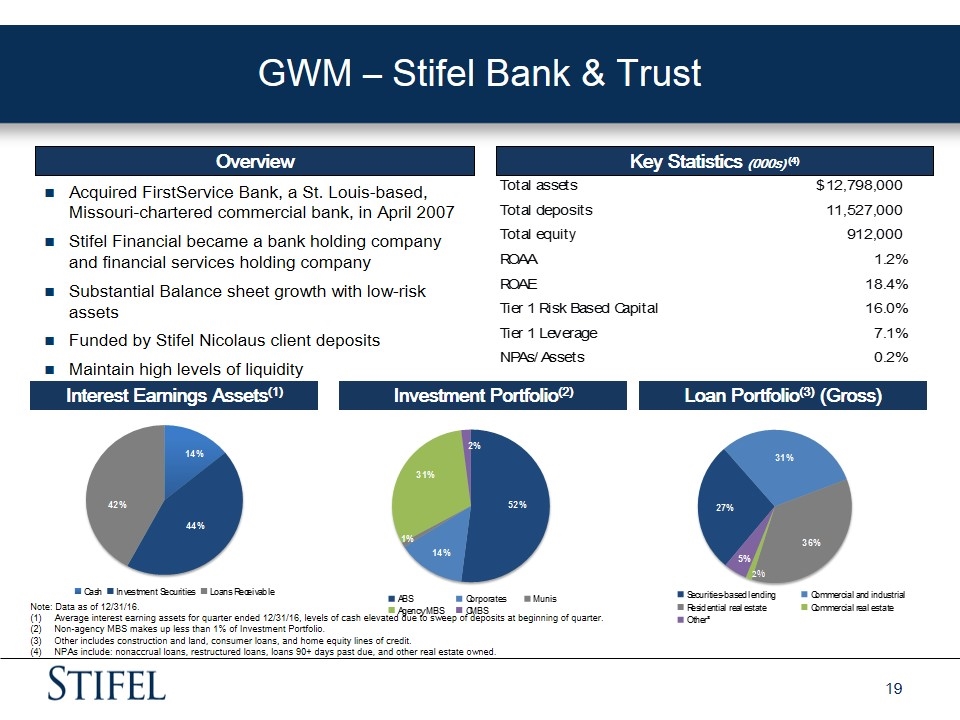

Bank Drove Significant Balance Sheet & Revenue Growth Bank growth has been balanced between loans and investments: Loans: Comprised of securities based loans, C&I, and residential mortgages Focused lending to high net worth retail clients Effective duration of approximately 1. 7 years as of 12/31/16 AFS & HTM Investments: 58% of the portfolio is fully guaranteed by a US GSE or rated AAA as of 12/31/16 Portfolio primarily GSE MBS, ABS, and Corporate bonds Effective duration of approximately 2.2 years

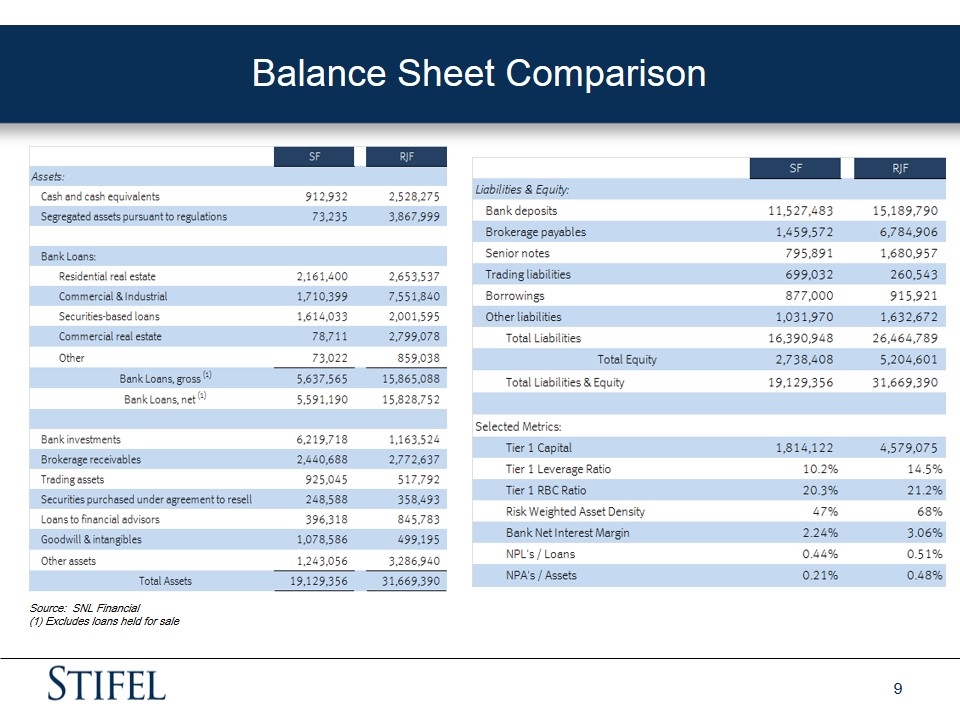

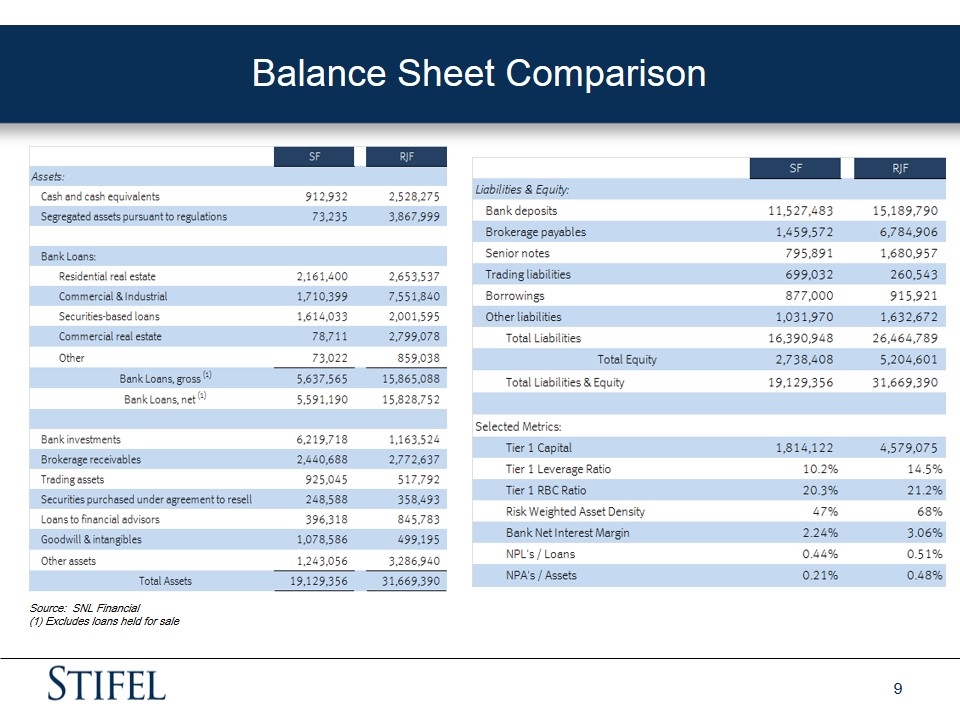

Balance Sheet Comparison Source: SNL Financial (1) Excludes loans held for sale

Stifel Overview

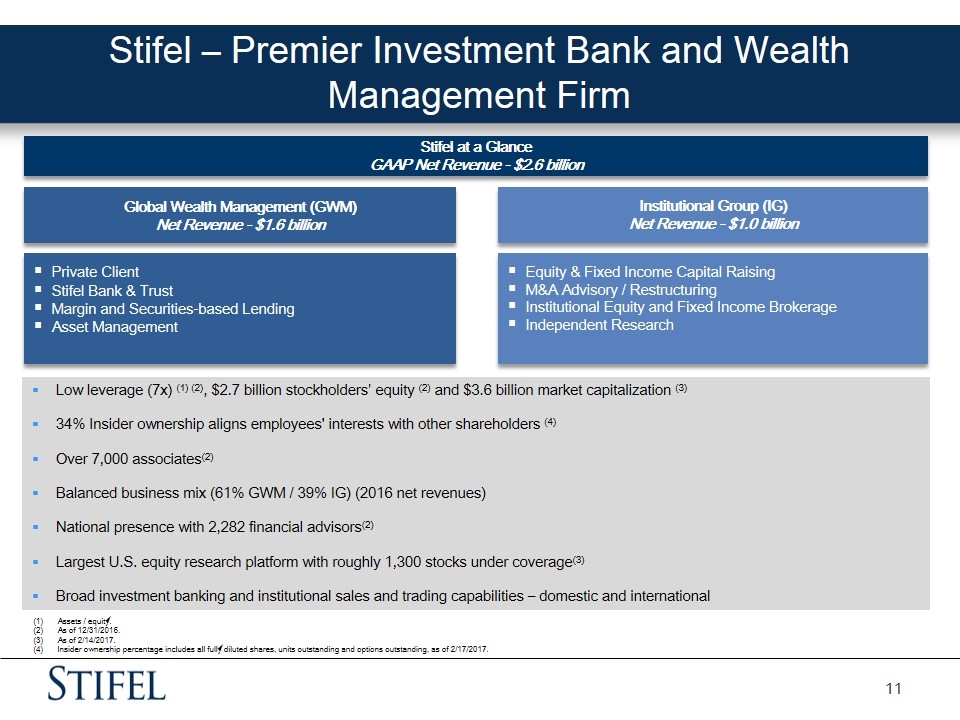

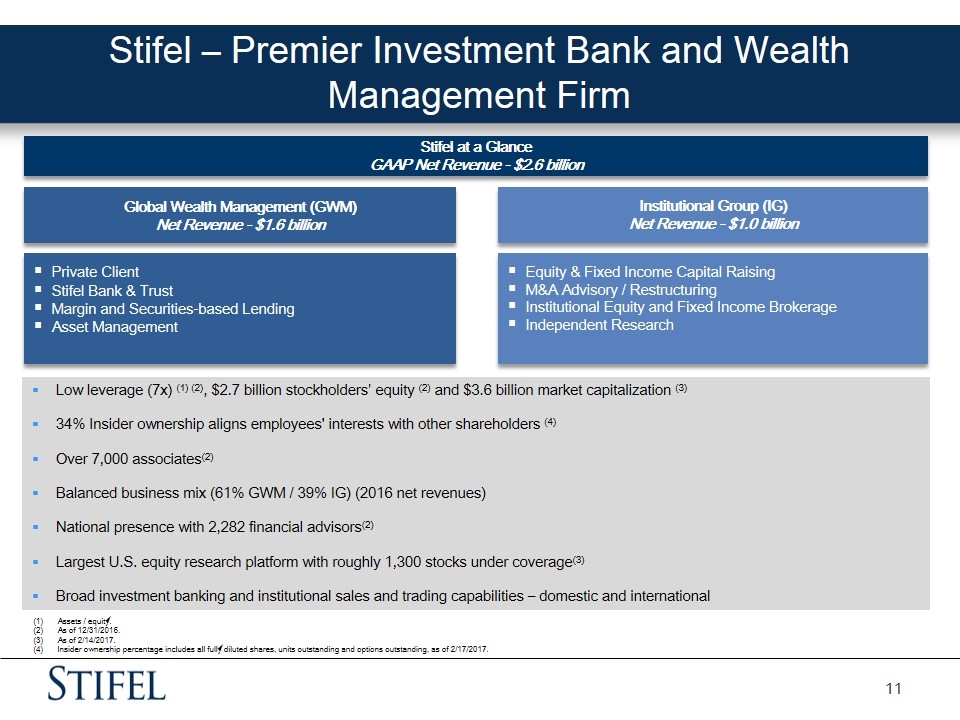

Stifel – Premier Investment Bank and Wealth Management Firm Stifel at a Glance GAAP Net Revenue - $2.6 billion Global Wealth Management (GWM) Net Revenue - $1.6 billion Institutional Group (IG) Net Revenue - $1.0 billion Private Client Stifel Bank & Trust Margin and Securities-based Lending Asset Management Equity & Fixed Income Capital Raising M&A Advisory / Restructuring Institutional Equity and Fixed Income Brokerage Independent Research Low leverage (7x) (1) (2), $2.7 billion stockholders’ equity (2) and $3.6 billion market capitalization (3) 34% Insider ownership aligns employees' interests with other shareholders (4) Over 7,000 associates(2) Balanced business mix (61% GWM / 39% IG) (2016 net revenues) National presence with 2,282 financial advisors(2) Largest U.S. equity research platform with roughly 1,300 stocks under coverage(3) Broad investment banking and institutional sales and trading capabilities – domestic and international Assets / equity. As of 12/31/2016. As of 2/14/2017. Insider ownership percentage includes all fully diluted shares, units outstanding and options outstanding, as of 2/17/2017.

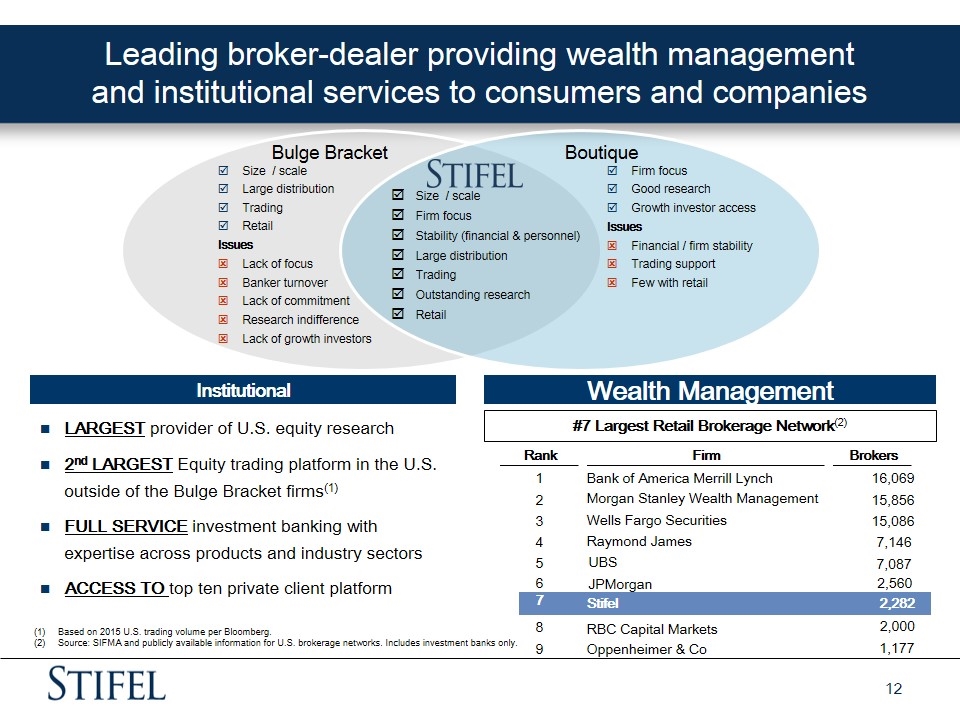

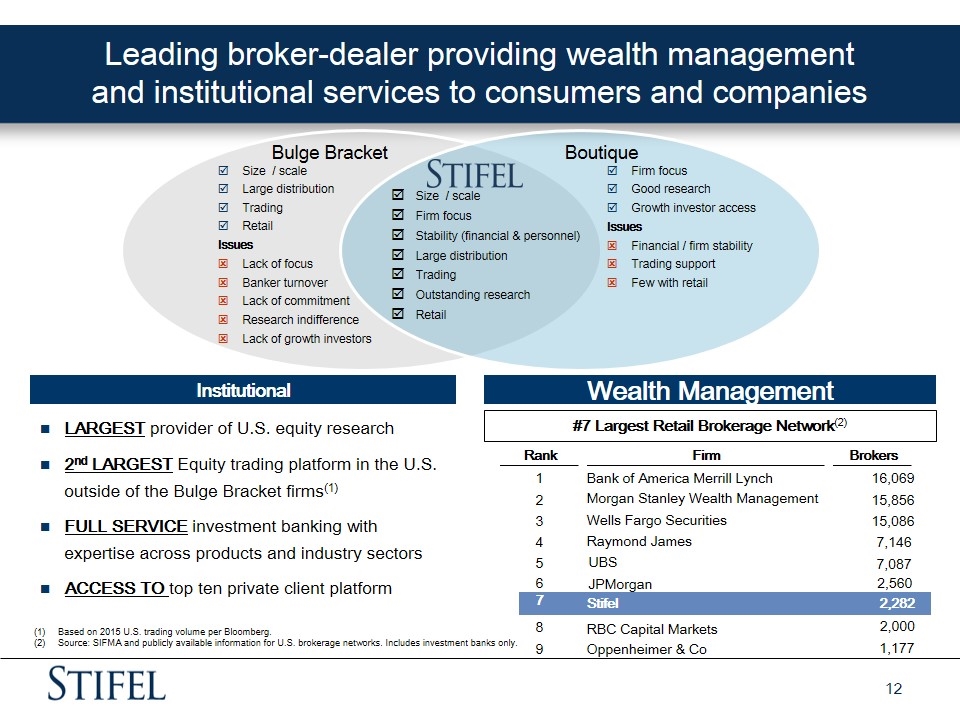

Leading broker-dealer providing wealth management and institutional services to consumers and companies Bulge Bracket Boutique Size / scale Large distribution Trading Retail Issues Lack of focus Banker turnover Lack of commitment Research indifference Lack of growth investors Firm focus Good research Growth investor access Issues Financial / firm stability Trading support Few with retail Size / scale Firm focus Stability (financial & personnel) Large distribution Trading Outstanding research Retail Institutional Wealth Management LARGEST provider of U.S. equity research 2nd LARGEST Equity trading platform in the U.S. outside of the Bulge Bracket firms(1) FULL SERVICE investment banking with expertise across products and industry sectors ACCESS TO top ten private client platform #7 Largest Retail Brokerage Network(2) Rank Firm Brokers 1 16,069 2 Bank of America Merrill Lynch 15,856 3 Wells Fargo Securities 15,086 4 UBS 7,087 5 Raymond James 7,146 6 Stifel 2,282 7 RBC Capital Markets 2,000 8 Oppenheimer & Co 1,177 9 JPMorgan 2,560 Morgan Stanley Wealth Management Based on 2015 U.S. trading volume per Bloomberg. Source: SIFMA and publicly available information for U.S. brokerage networks. Includes investment banks only.

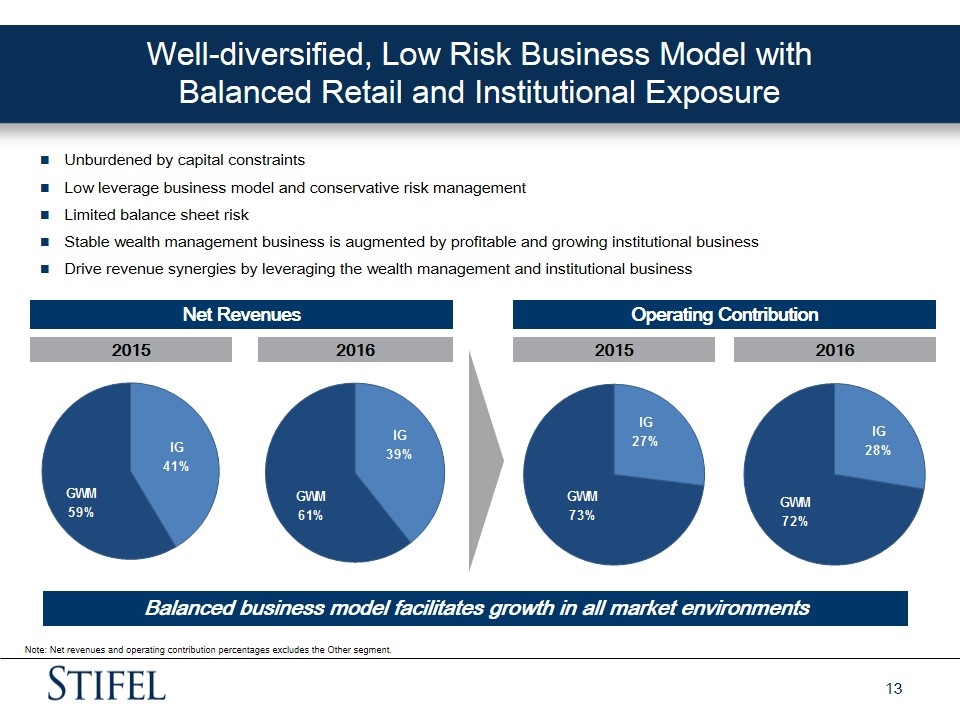

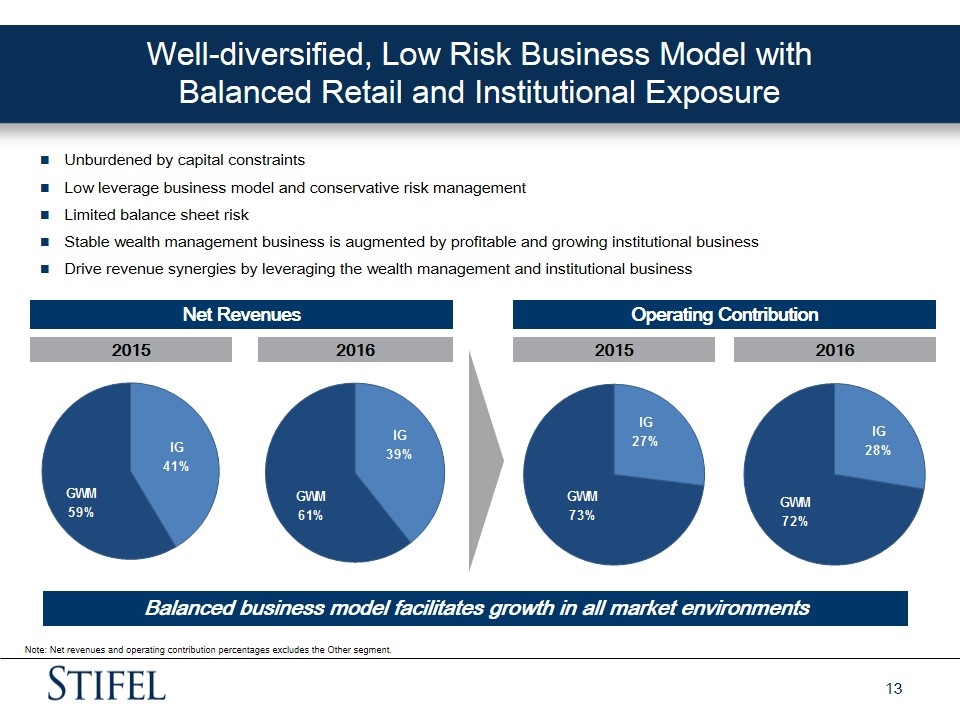

Well-diversified, Low Risk Business Model with Balanced Retail and Institutional Exposure Unburdened by capital constraints Low leverage business model and conservative risk management Limited balance sheet risk Stable wealth management business is augmented by profitable and growing institutional business Drive revenue synergies by leveraging the wealth management and institutional business Net Revenues 2015 2016 Operating Contribution 2015 2016 Balanced business model facilitates growth in all market environments Note: Net revenues and operating contribution percentages excludes the Other segment.

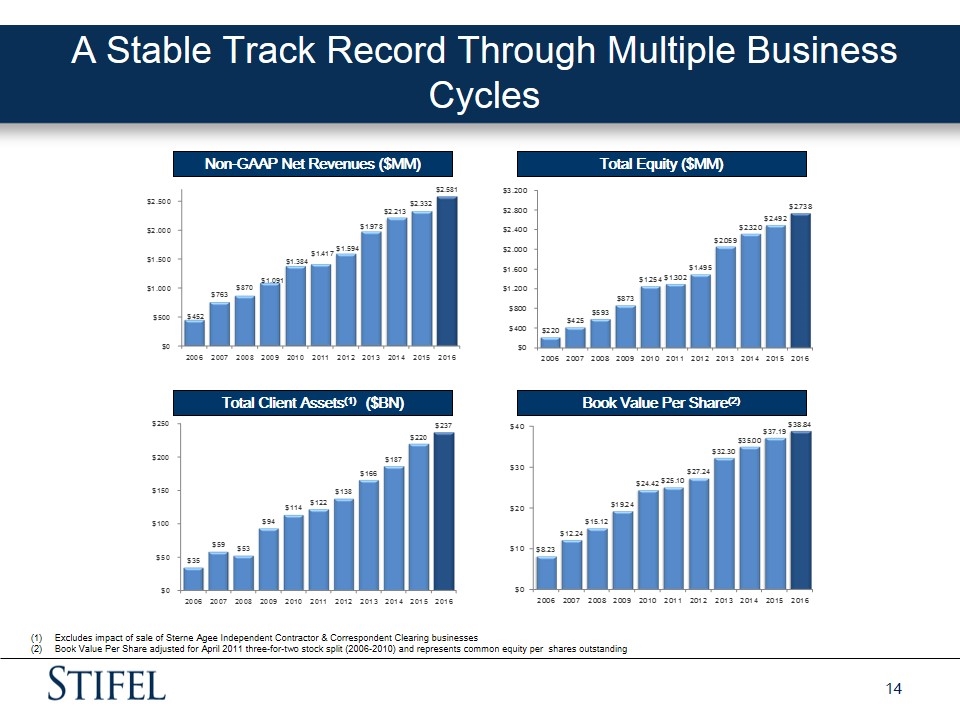

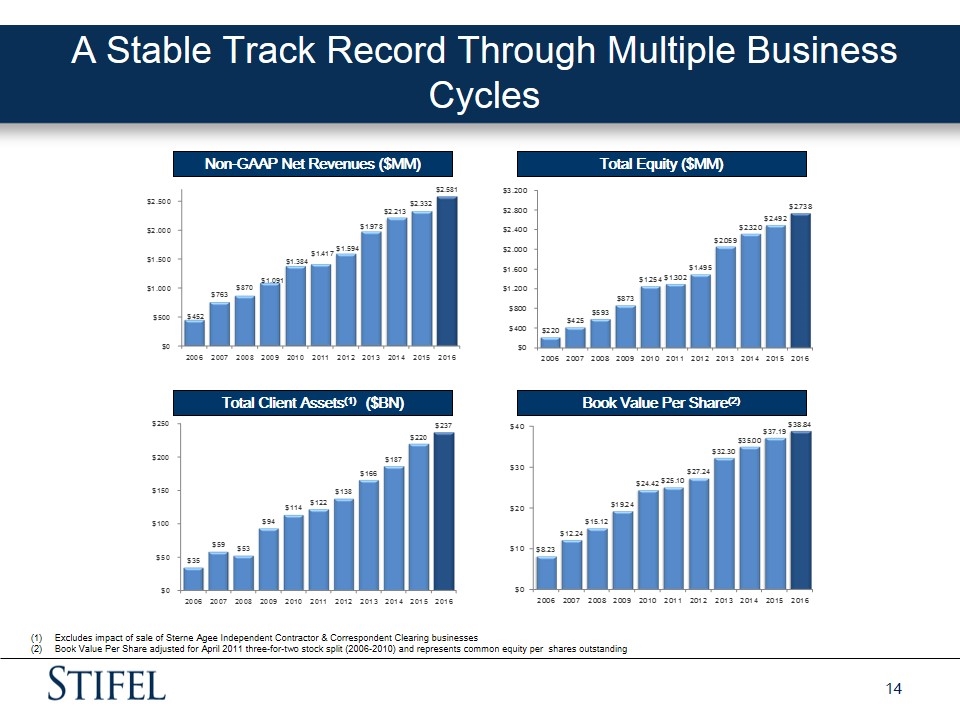

A Stable Track Record Through Multiple Business Cycles Non-GAAP Net Revenues ($MM) Total Equity ($MM) Total Client Assets(1) ($BN) Book Value Per Share(2) Excludes impact of sale of Sterne Agee Independent Contractor & Correspondent Clearing businesses Book Value Per Share adjusted for April 2011 three-for-two stock split (2006-2010) and represents common equity per shares outstanding

Global Wealth Management

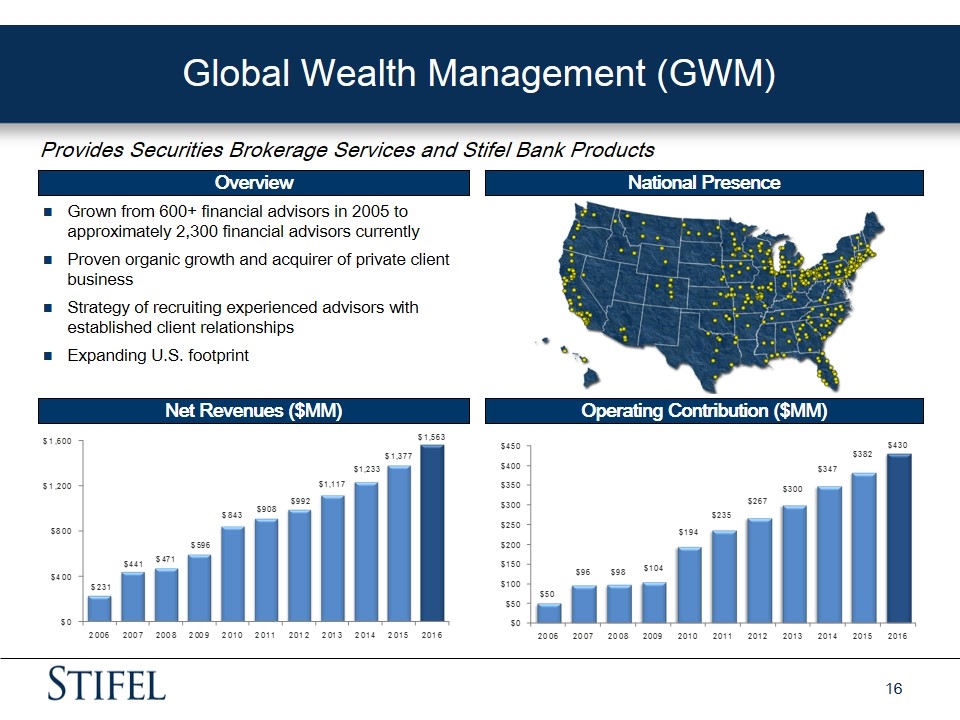

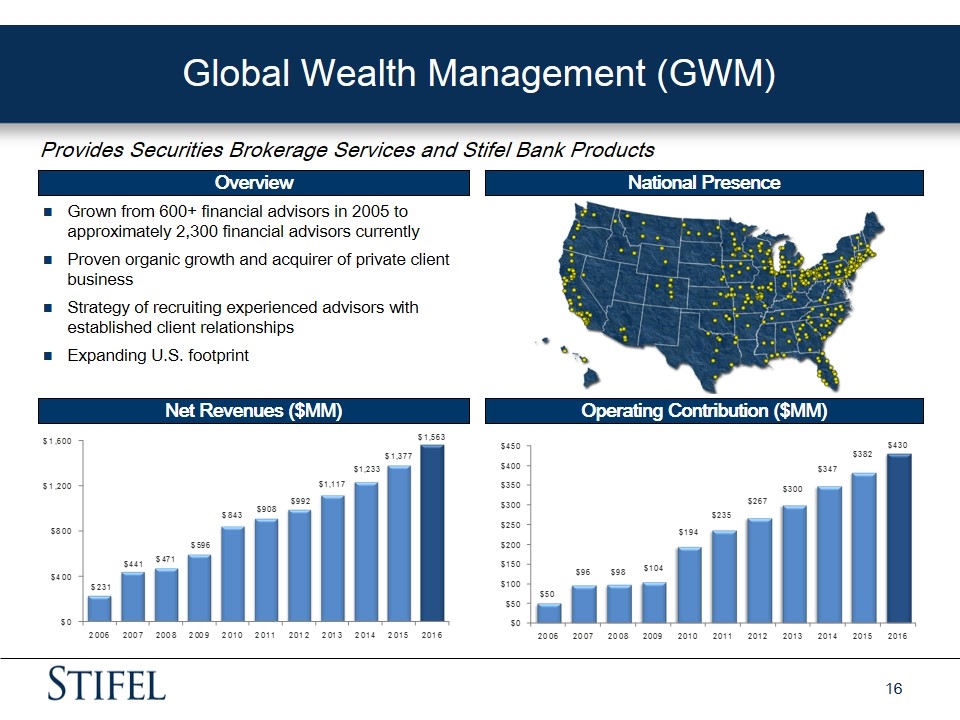

Global Wealth Management (GWM) Provides Securities Brokerage Services and Stifel Bank Products Overview National Presence Grown from 600+ financial advisors in 2005 to approximately 2,300 financial advisors currently Proven organic growth and acquirer of private client business Strategy of recruiting experienced advisors with established client relationships Expanding U.S. footprint Net Revenues ($MM) Operating Contribution ($MM)

Building Scale and Capabilities into a $1.6B Revenue Segment Private Client Asset Management Bank 56 UBS Branches Private Client – 350 financial advisors and support Revenue production has exceeded expectations October 2009 Private Client – 75 financial advisors Public Finance December 2008 Private Client – 400 financial advisors Capital Markets February 2007 Asset Management Over $4 billion in assets November 2013 Customized investment advisory and trust services November 2014 ~100 advisors managing over $20B in AUM December 2015 ~130 advisors managing ~ $10B in AUM June 2015 Bank holding company Grown assets from ~ $100M to $7.3B April 2007 One-branch community bank; 95% of loan portfolio sold in 3Q15 October 2013

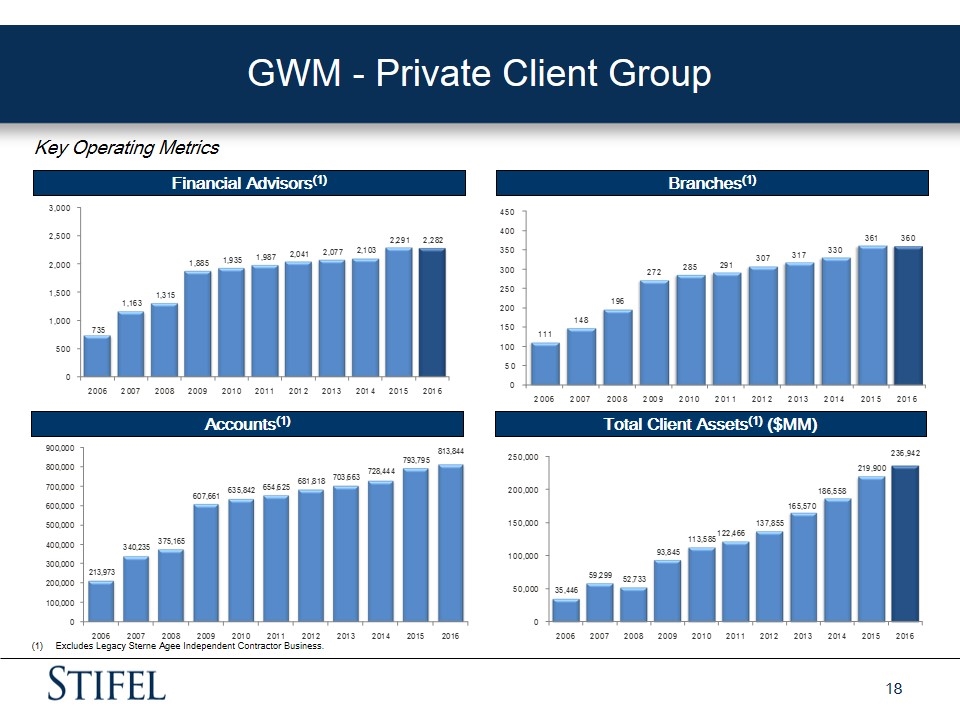

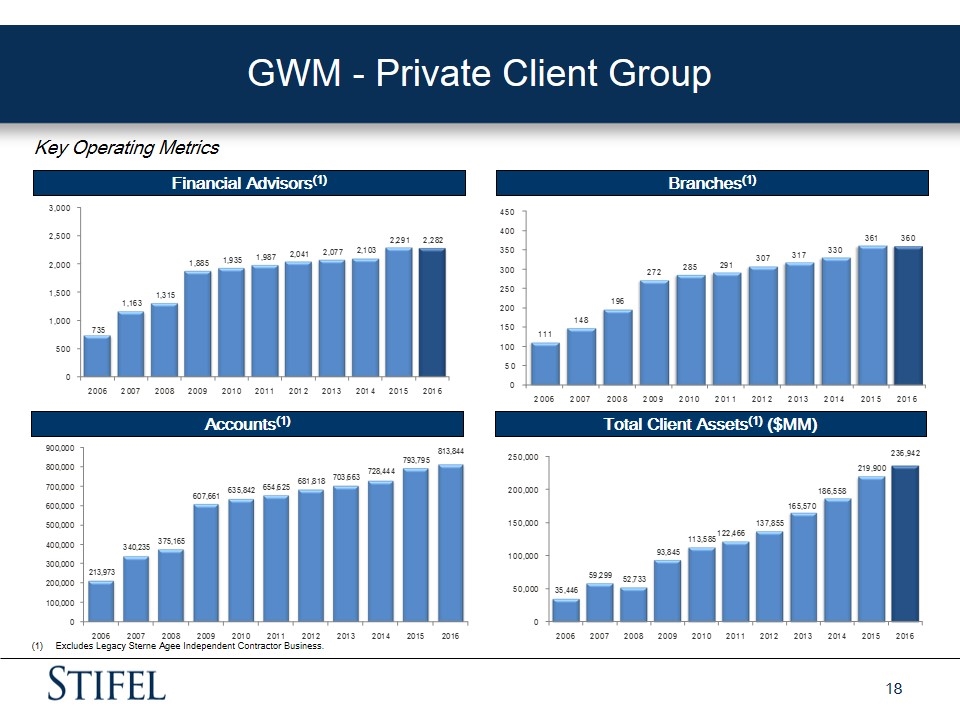

GWM - Private Client Group Key Operating Metrics Accounts(1) Financial Advisors(1) Total Client Assets(1) ($MM) Branches(1) Excludes Legacy Sterne Agee Independent Contractor Business.

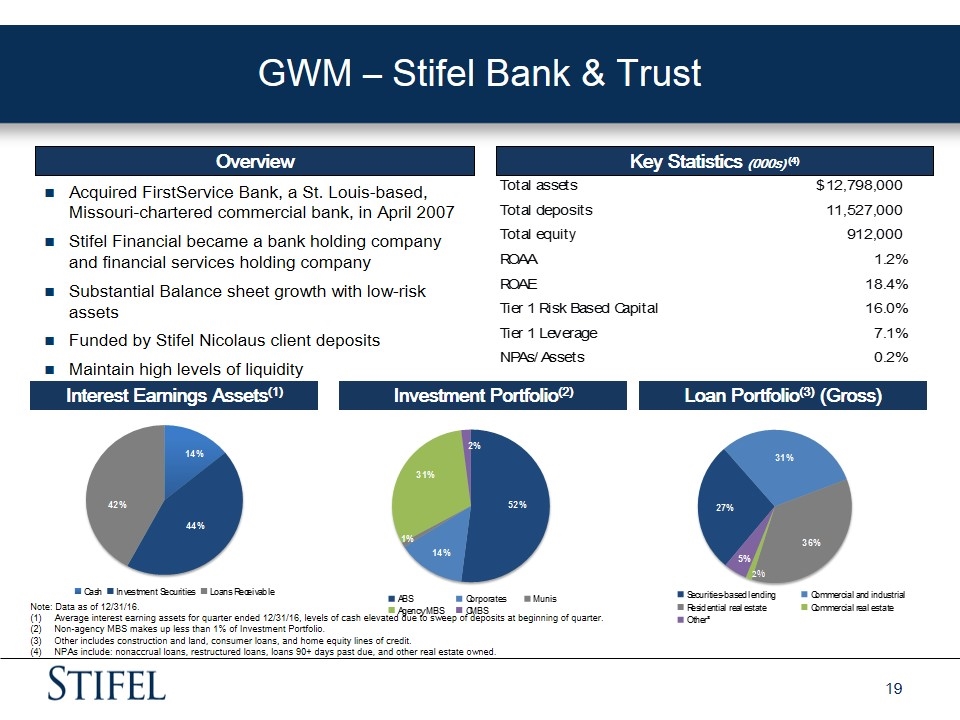

GWM – Stifel Bank & Trust Acquired FirstService Bank, a St. Louis-based, Missouri-chartered commercial bank, in April 2007 Stifel Financial became a bank holding company and financial services holding company Substantial Balance sheet growth with low-risk assets Funded by Stifel Nicolaus client deposits Maintain high levels of liquidity Overview Key Statistics (000s) (4) Investment Portfolio(2) Loan Portfolio(3) (Gross) Interest Earnings Assets(1) Note: Data as of 12/31/16. Average interest earning assets for quarter ended 12/31/16, levels of cash elevated due to sweep of deposits at beginning of quarter. Non-agency MBS makes up less than 1% of Investment Portfolio. Other includes construction and land, consumer loans, and home equity lines of credit. NPAs include: nonaccrual loans, restructured loans, loans 90+ days past due, and other real estate owned.

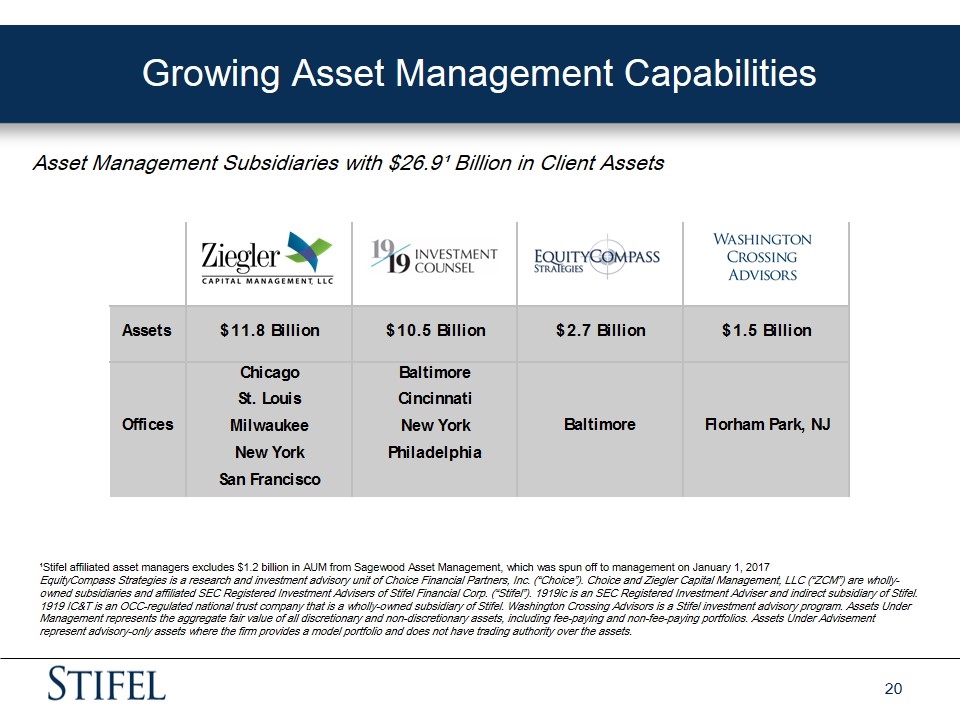

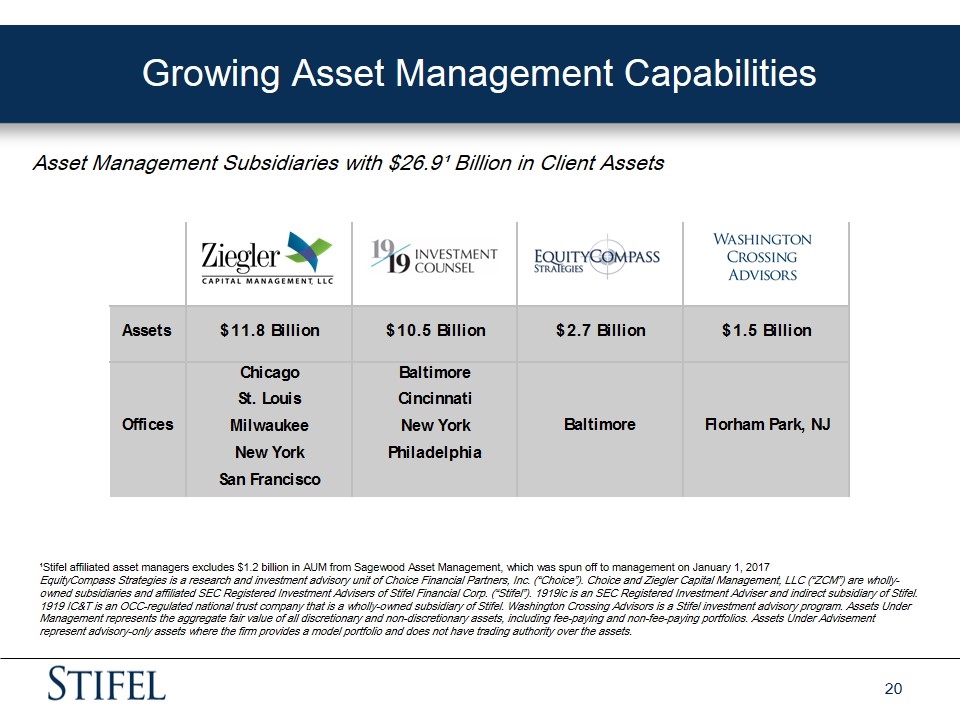

Growing Asset Management Capabilities Asset Management Subsidiaries with $26.9¹ Billion in Client Assets ¹Stifel affiliated asset managers excludes $1.2 billion in AUM from Sagewood Asset Management, which was spun off to management on January 1, 2017 EquityCompass Strategies is a research and investment advisory unit of Choice Financial Partners, Inc. (“Choice”). Choice and Ziegler Capital Management, LLC (“ZCM”) are wholly-owned subsidiaries and affiliated SEC Registered Investment Advisers of Stifel Financial Corp. (“Stifel”). 1919ic is an SEC Registered Investment Adviser and indirect subsidiary of Stifel. 1919 IC&T is an OCC-regulated national trust company that is a wholly-owned subsidiary of Stifel. Washington Crossing Advisors is a Stifel investment advisory program. Assets Under Management represents the aggregate fair value of all discretionary and non-discretionary assets, including fee-paying and non-fee-paying portfolios. Assets Under Advisement represent advisory-only assets where the firm provides a model portfolio and does not have trading authority over the assets. Assets $11.8 Billion $10.5 Billion $2.7 Billion $1.5 Billion Offices Chicago Baltimore Baltimore Florham Park, NJ St. Louis Cincinnati Milwaukee New York New York Philadelphia San Francisco

Institutional Group

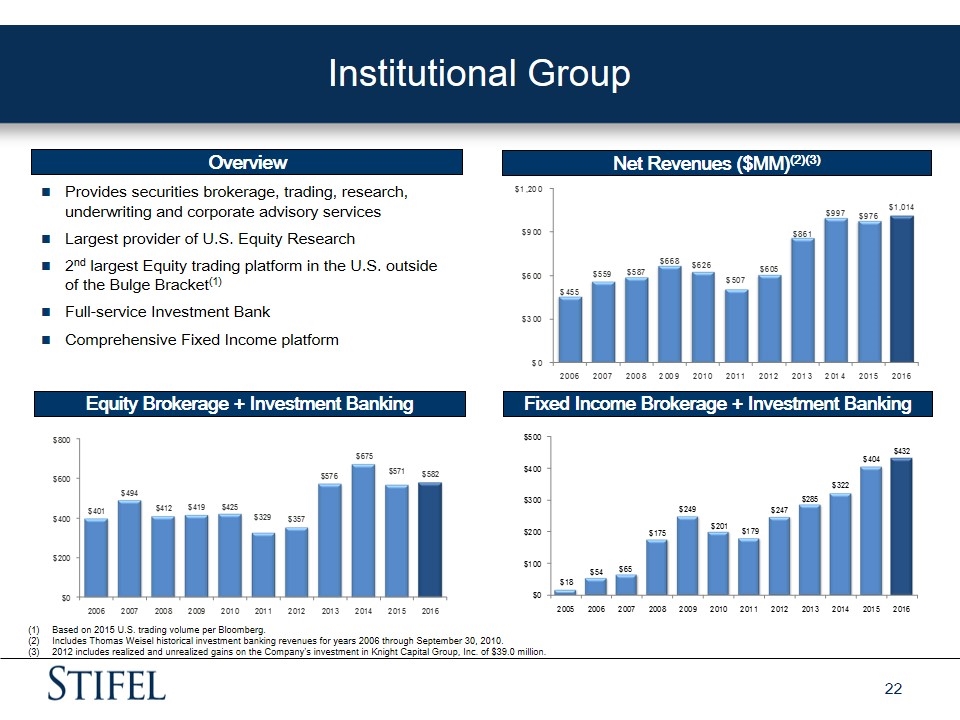

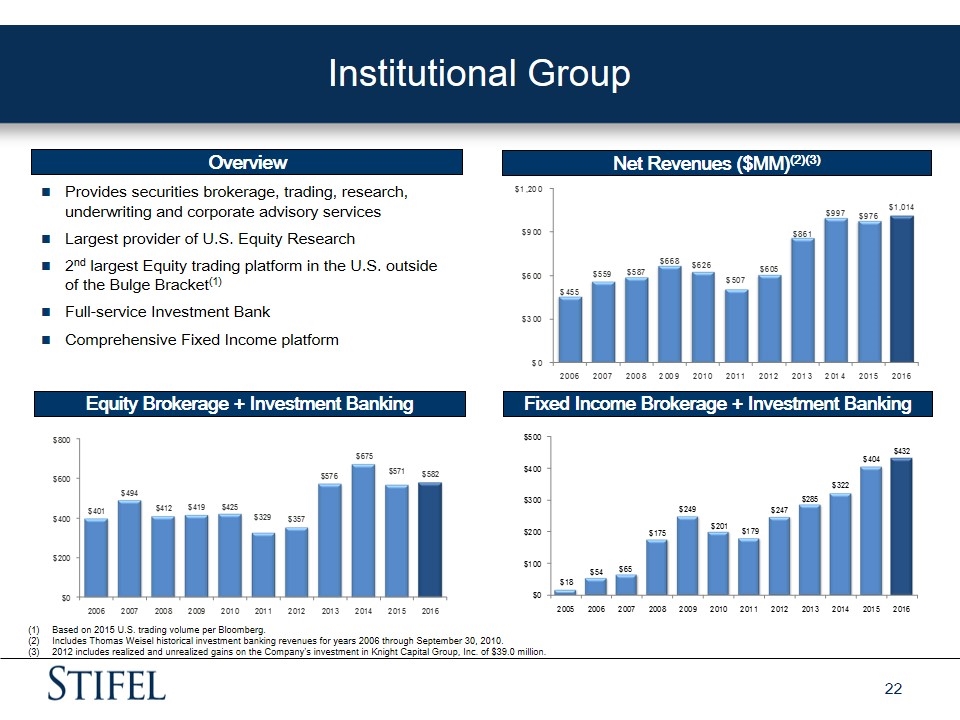

Institutional Group Net Revenues ($MM)(2)(3) Fixed Income Brokerage + Investment Banking Overview Equity Brokerage + Investment Banking Provides securities brokerage, trading, research, underwriting and corporate advisory services Largest provider of U.S. Equity Research 2nd largest Equity trading platform in the U.S. outside of the Bulge Bracket(1) Full-service Investment Bank Comprehensive Fixed Income platform Based on 2015 U.S. trading volume per Bloomberg. Includes Thomas Weisel historical investment banking revenues for years 2006 through September 30, 2010. 2012 includes realized and unrealized gains on the Company’s investment in Knight Capital Group, Inc. of $39.0 million.

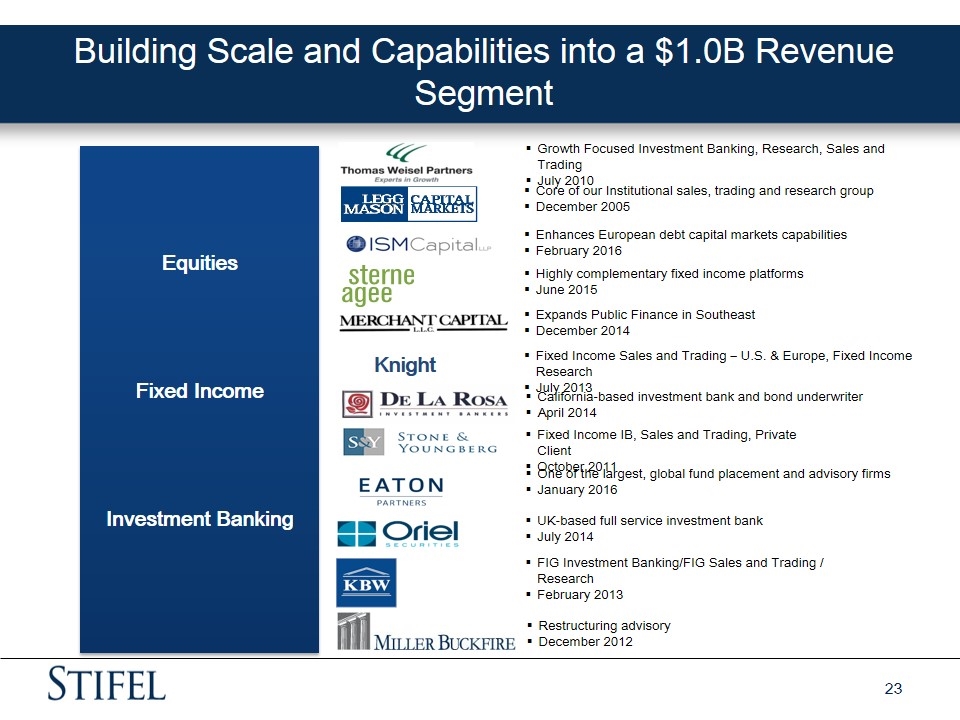

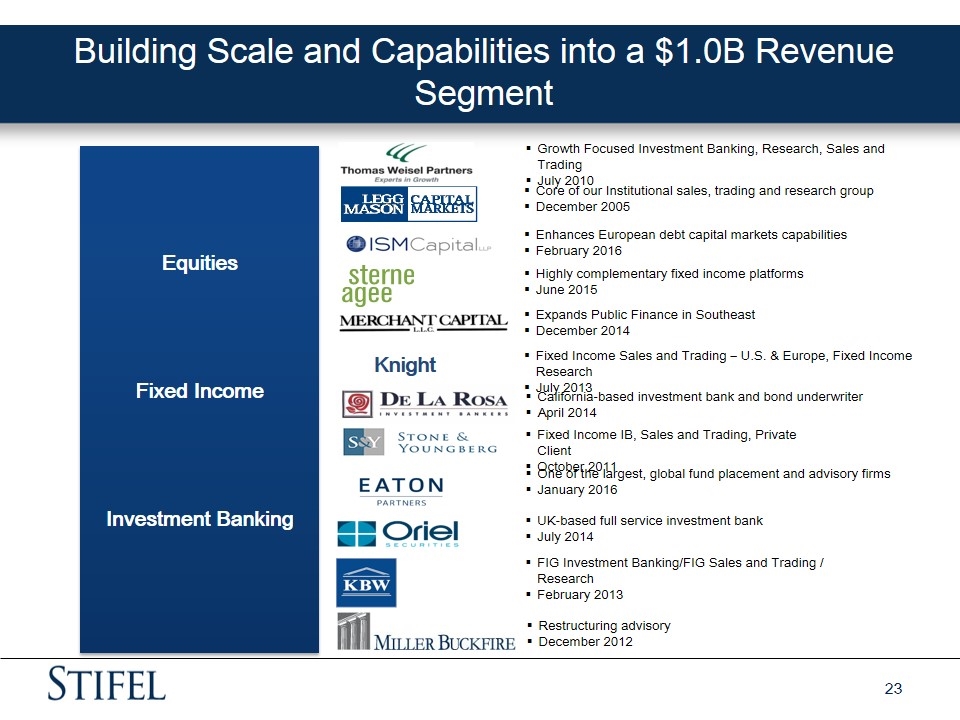

Equities Fixed Income Investment Banking Building Scale and Capabilities into a $1.0B Revenue Segment Growth Focused Investment Banking, Research, Sales and Trading July 2010 Core of our Institutional sales, trading and research group December 2005 Knight Fixed Income IB, Sales and Trading, Private Client October 2011 Fixed Income Sales and Trading – U.S. & Europe, Fixed Income Research July 2013 California-based investment bank and bond underwriter April 2014 Expands Public Finance in Southeast December 2014 Highly complementary fixed income platforms June 2015 Enhances European debt capital markets capabilities February 2016 FIG Investment Banking/FIG Sales and Trading / Research February 2013 Restructuring advisory December 2012 UK-based full service investment bank July 2014 One of the largest, global fund placement and advisory firms January 2016

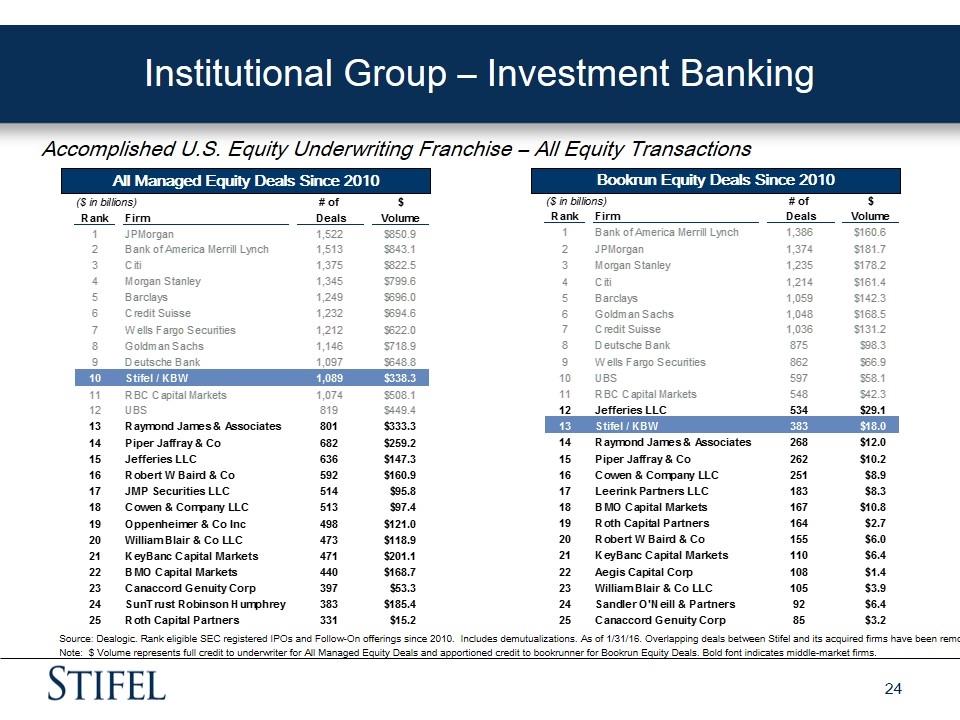

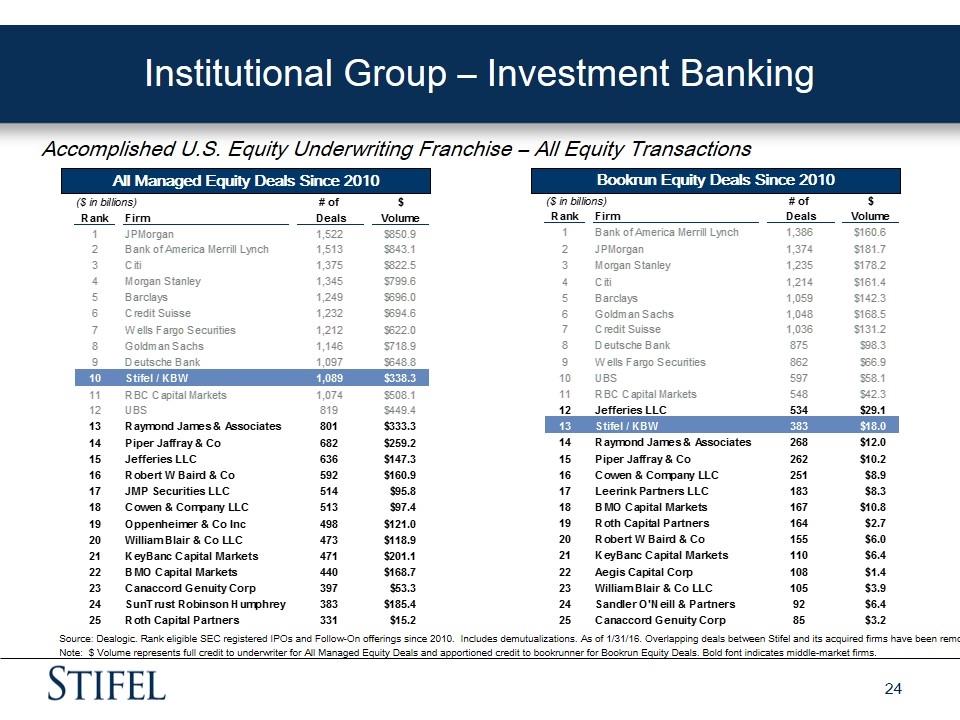

Institutional Group – Investment Banking Accomplished U.S. Equity Underwriting Franchise – All Equity Transactions Bookrun Equity Deals Since 2010 All Managed Equity Deals Since 2010 Source: Dealogic. Rank eligible SEC registered IPOs and Follow-On offerings since 2010. Includes demutualizations. As of 1/31/16. Overlapping deals between Stifel and its acquired firms have been removed. Note: $ Volume represents full credit to underwriter for All Managed Equity Deals and apportioned credit to bookrunner for Bookrun Equity Deals. Bold font indicates middle-market firms. All Managed Equity Deals Since 2010 Lead / Cos ($ in billions) # of $ Rank Firm Deals Volume 1 JPMorgan 1,522 $,850,929.16 2 Bank of America Merrill Lynch 1,513 $,843,080.58 3 Citi 1,375 $,822,477.16 4 Morgan Stanley 1,345 $,799,572.55 5 Barclays 1,249 $,695,955.45 6 Credit Suisse 1,232 $,694,612.65 7 Wells Fargo Securities 1,212 $,621,957.54 8 Goldman Sachs 1,146 $,718,894.31 9 Deutsche Bank 1,097 $,648,834.88 10 Stifel / KBW 1,089 $,338,291.43 11 RBC Capital Markets 1,074 $,508,085 12 UBS 819 $,449,427.73 13 Raymond James & Associates 801 $,333,275.98 14 Piper Jaffray & Co 682 $,259,214.63 15 Jefferies LLC 636 $,147,281.53 16 Robert W Baird & Co 592 $,160,881.51999999999 17 JMP Securities LLC 514 $95,782.69 18 Cowen & Company LLC 513 $97,426.79 19 Oppenheimer & Co Inc 498 $,120,983.67 20 William Blair & Co LLC 473 $,118,912.41 21 KeyBanc Capital Markets 471 $,201,103.74 22 BMO Capital Markets 440 $,168,716.7 23 Canaccord Genuity Corp 397 $53,337.9 24 SunTrust Robinson Humphrey 383 $,185,427.88 25 Roth Capital Partners 331 $15,230.19 Bookrun Equity Deals Since 2010 Books ($ in billions) # of $ Rank Firm Deals Volume 1 Bank of America Merrill Lynch 1,386 $,160,642.69 2 JPMorgan 1,374 $,181,671.99 3 Morgan Stanley 1,235 $,178,217.69 4 Citi 1,214 $,161,410.32 5 Barclays 1,059 $,142,259.60999999999 6 Goldman Sachs 1,048 $,168,487.85 7 Credit Suisse 1,036 $,131,217.81 8 Deutsche Bank 875 $98,324.55 9 Wells Fargo Securities 862 $66,875.89 10 UBS 597 $58,067.94 11 RBC Capital Markets 548 $42,295.5 12 Jefferies LLC 534 $29,071.93 13 Stifel / KBW 383 $17,977.75 14 Raymond James & Associates 268 $12,011.91 15 Piper Jaffray & Co 262 $10,208.42 16 Cowen & Company LLC 251 $8,870.5499999999993 17 Leerink Partners LLC 183 $8,251.77 18 BMO Capital Markets 167 $10,782.59 19 Roth Capital Partners 164 $2,726.55 20 Robert W Baird & Co 155 $6,016.9 21 KeyBanc Capital Markets 110 $6,443.96 22 Aegis Capital Corp 108 $1,377.3 23 William Blair & Co LLC 105 $3,859.2 24 Sandler O'Neill & Partners 92 $6,444.95 25 Canaccord Genuity Corp 85 $3,223.8

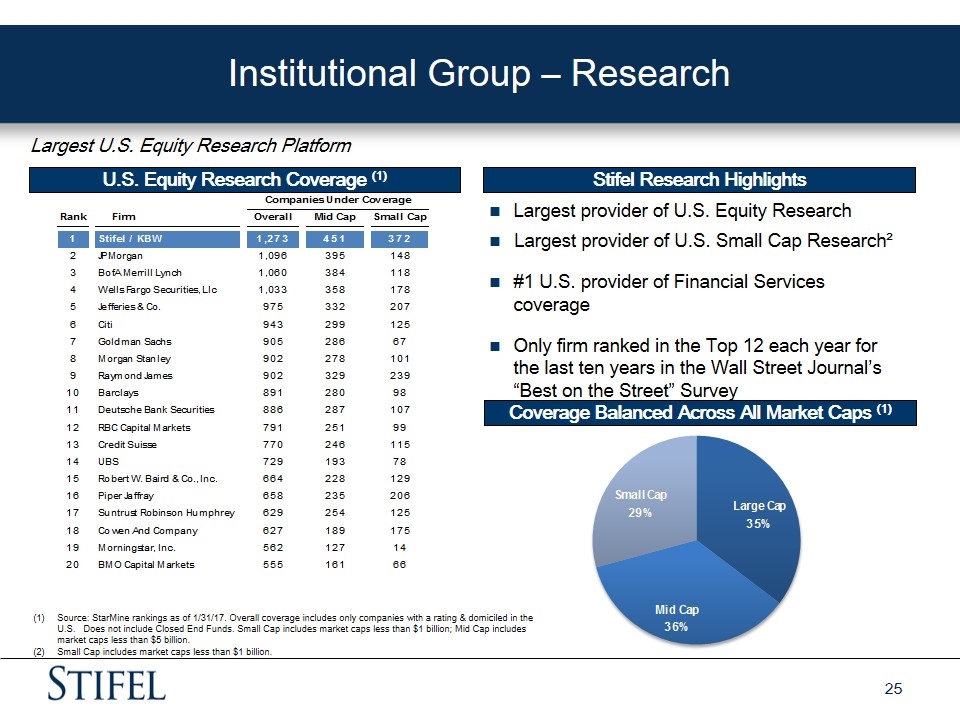

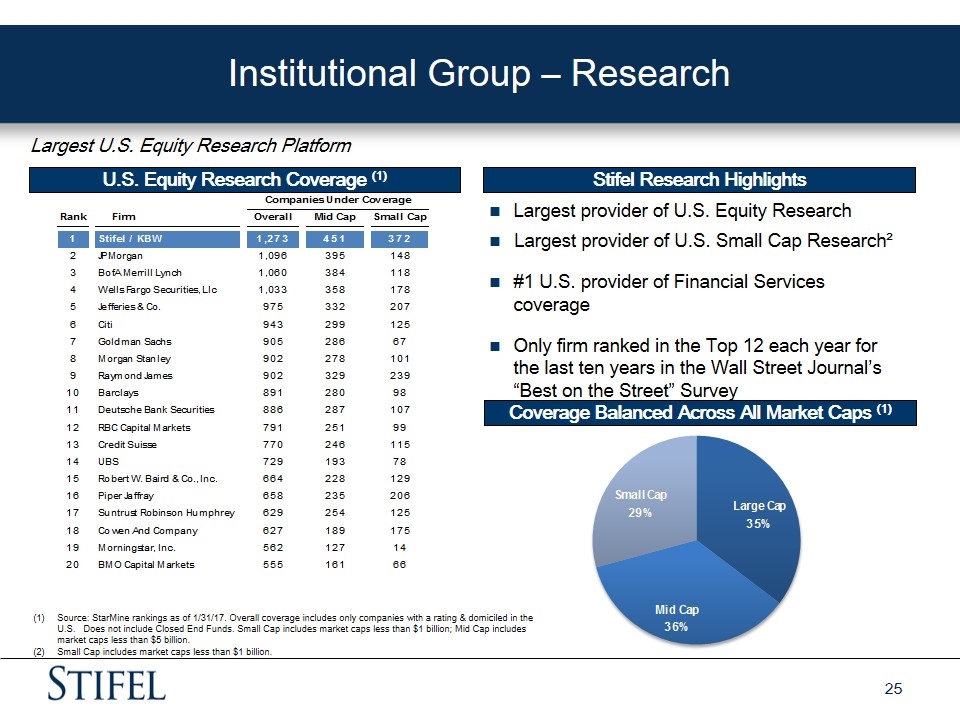

Institutional Group – Research Largest U.S. Equity Research Platform U.S. Equity Research Coverage (1) Coverage Balanced Across All Market Caps (1) Stifel Research Highlights Largest provider of U.S. Equity Research Largest provider of U.S. Small Cap Research² #1 U.S. provider of Financial Services coverage Only firm ranked in the Top 12 each year for the last ten years in the Wall Street Journal’s “Best on the Street” Survey Source: StarMine rankings as of 1/31/17. Overall coverage includes only companies with a rating & domiciled in the U.S. Does not include Closed End Funds. Small Cap includes market caps less than $1 billion; Mid Cap includes market caps less than $5 billion. Small Cap includes market caps less than $1 billion.

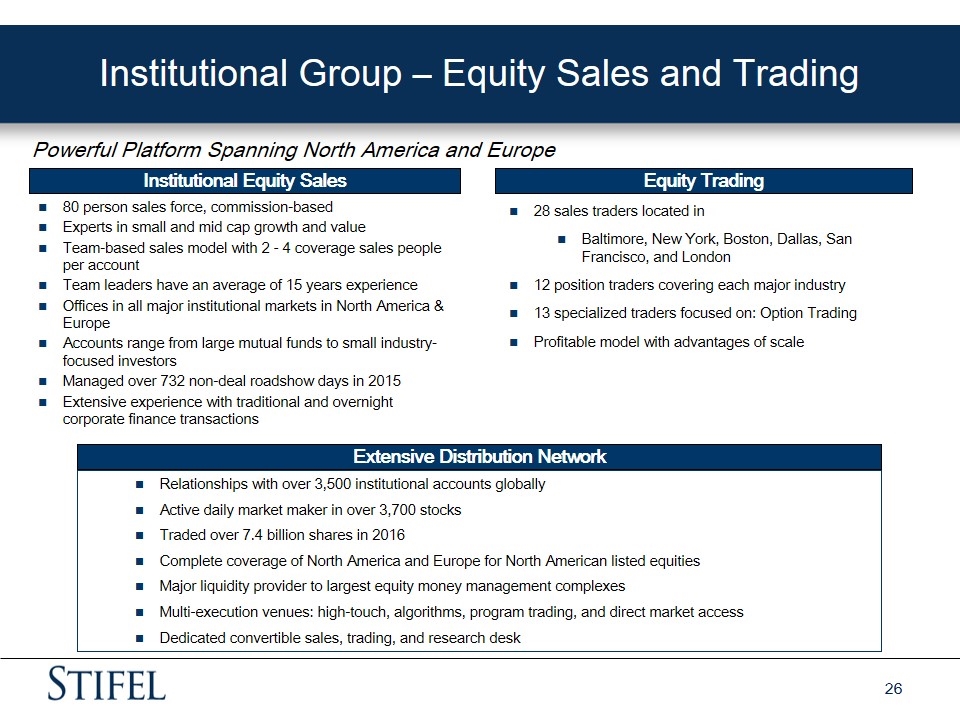

Institutional Group – Equity Sales and Trading Powerful Platform Spanning North America and Europe Institutional Equity Sales Equity Trading Extensive Distribution Network Relationships with over 3,500 institutional accounts globally Active daily market maker in over 3,700 stocks Traded over 7.4 billion shares in 2016 Complete coverage of North America and Europe for North American listed equities Major liquidity provider to largest equity money management complexes Multi-execution venues: high-touch, algorithms, program trading, and direct market access Dedicated convertible sales, trading, and research desk 28 sales traders located in Baltimore, New York, Boston, Dallas, San Francisco, and London 12 position traders covering each major industry 13 specialized traders focused on: Option Trading Profitable model with advantages of scale 80 person sales force, commission-based Experts in small and mid cap growth and value Team-based sales model with 2 - 4 coverage sales people per account Team leaders have an average of 15 years experience Offices in all major institutional markets in North America & Europe Accounts range from large mutual funds to small industry-focused investors Managed over 732 non-deal roadshow days in 2015 Extensive experience with traditional and overnight corporate finance transactions

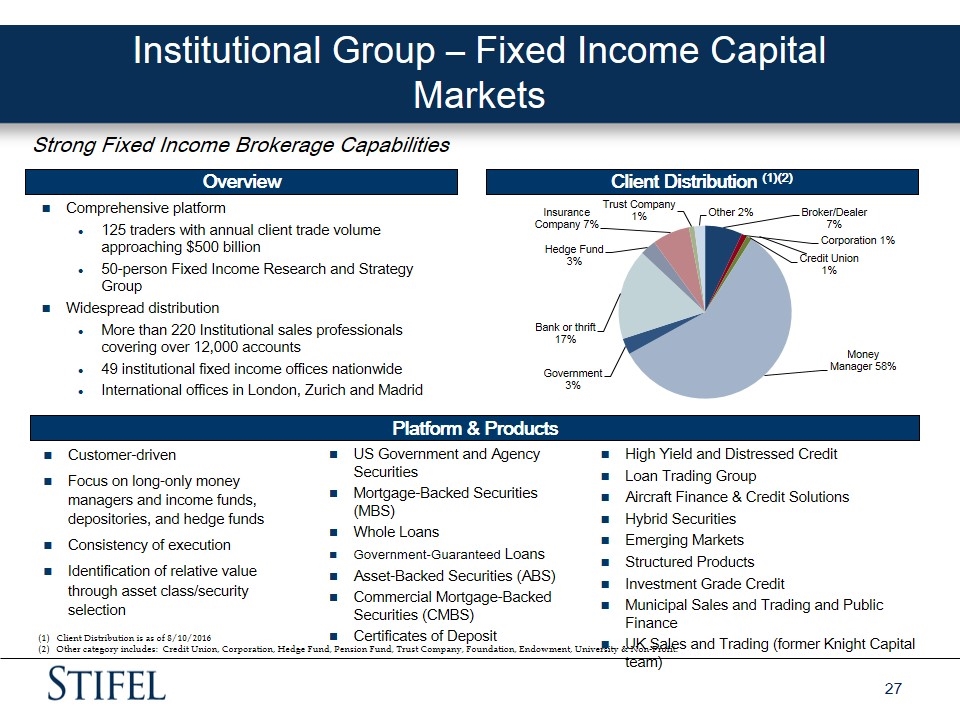

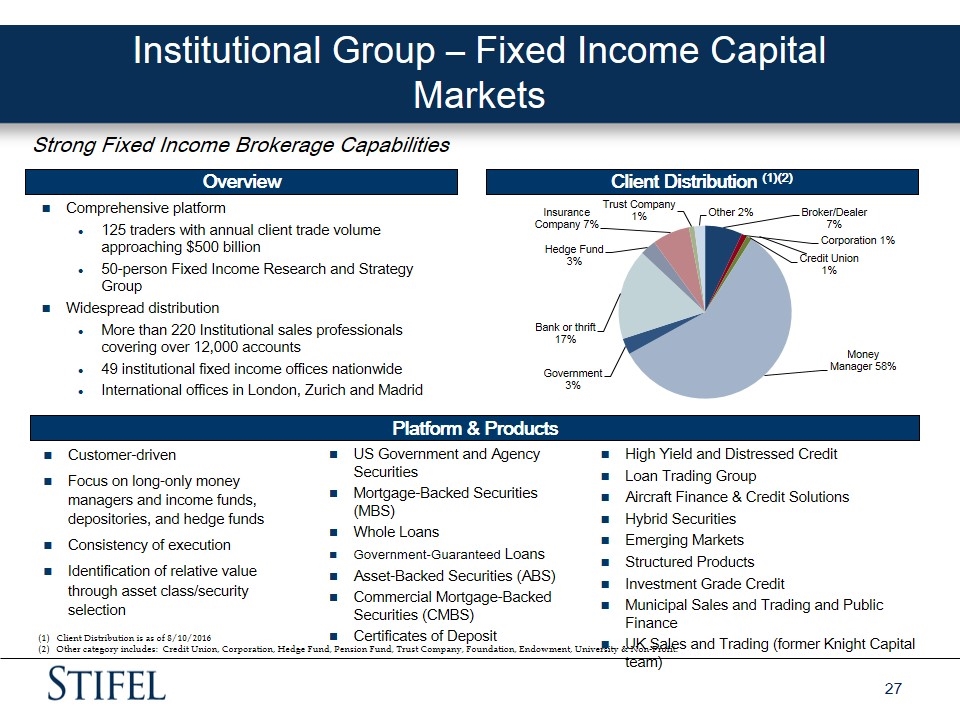

Institutional Group – Fixed Income Capital Markets Strong Fixed Income Brokerage Capabilities Overview Client Distribution (1)(2) Platform & Products Comprehensive platform 125 traders with annual client trade volume approaching $500 billion 50-person Fixed Income Research and Strategy Group Widespread distribution More than 220 Institutional sales professionals covering over 12,000 accounts 49 institutional fixed income offices nationwide International offices in London, Zurich and Madrid Customer-driven Focus on long-only money managers and income funds, depositories, and hedge funds Consistency of execution Identification of relative value through asset class/security selection US Government and Agency Securities Mortgage-Backed Securities (MBS) Whole Loans Government-Guaranteed Loans Asset-Backed Securities (ABS) Commercial Mortgage-Backed Securities (CMBS) Certificates of Deposit High Yield and Distressed Credit Loan Trading Group Aircraft Finance & Credit Solutions Hybrid Securities Emerging Markets Structured Products Investment Grade Credit Municipal Sales and Trading and Public Finance UK Sales and Trading (former Knight Capital team) Client Distribution is as of 8/10/2016 Other category includes: Credit Union, Corporation, Hedge Fund, Pension Fund, Trust Company, Foundation, Endowment, University & Non-Profit.

Institutional Group – Public Finance Overview Stifel has ranked in the top ten nationally for senior managed negotiated underwritings for the past five years, and Stifel has ranked #1 nationally for senior managed K-12 negotiated underwritings for 2016. Stifel’s Public Finance Group ranked #1 in municipal negotiated issues in 2016 Total of 26 Public Finance offices Nearly 150 Public Finance professionals Specialty sectors: Education Local Government/Municipal Healthcare Public-Private Partnerships/Development Housing Source: Thomson Reuters: SDC (True Economics to Book) Ranked by number of transactions.

Financial Information

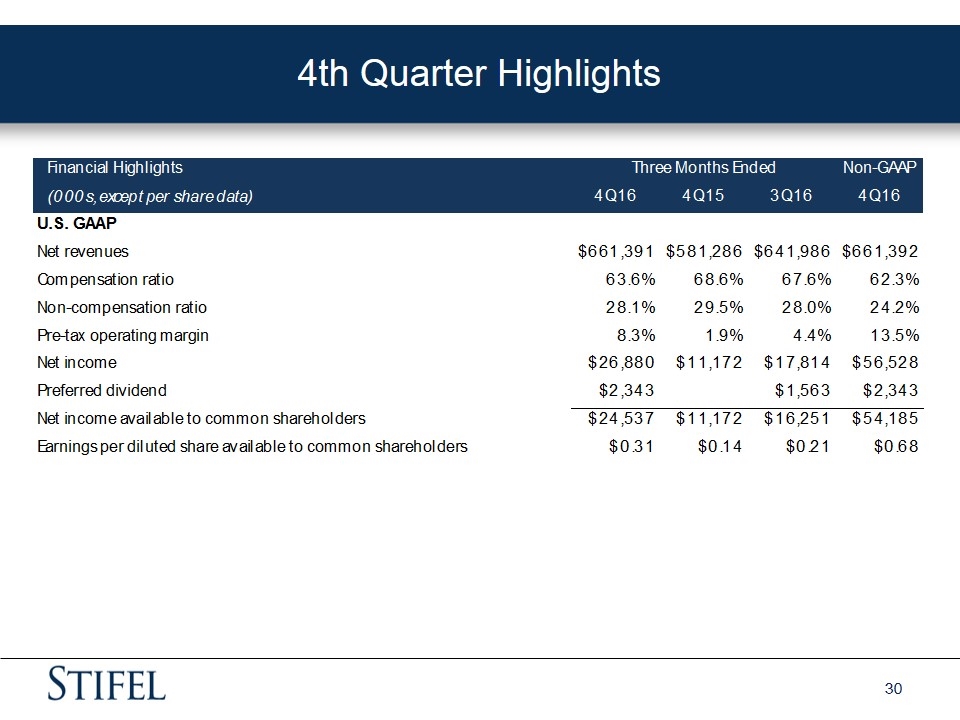

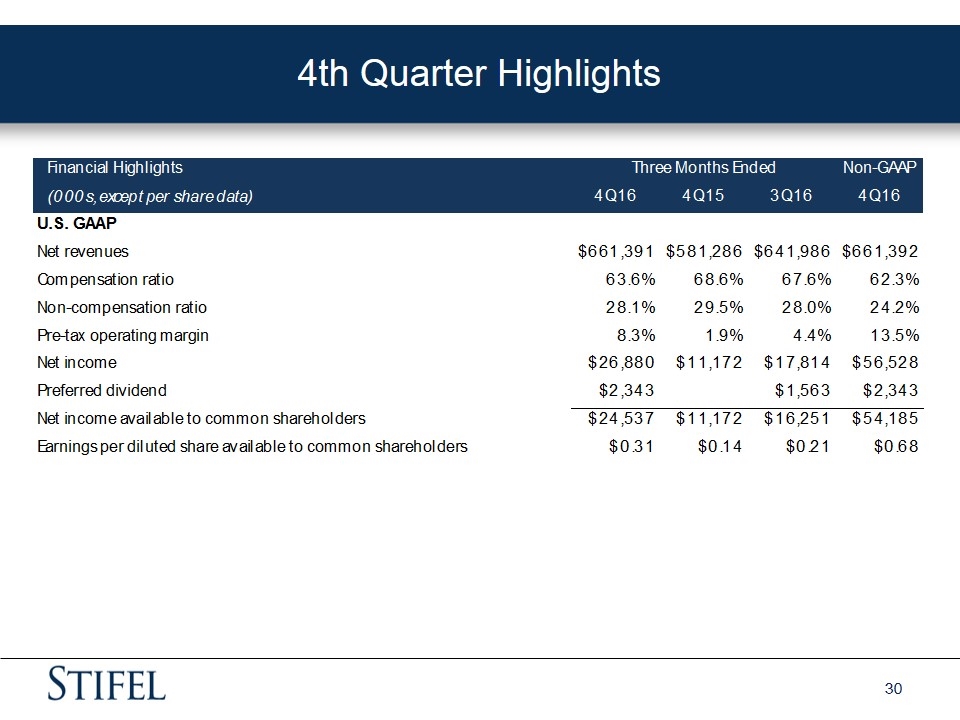

4th Quarter Highlights

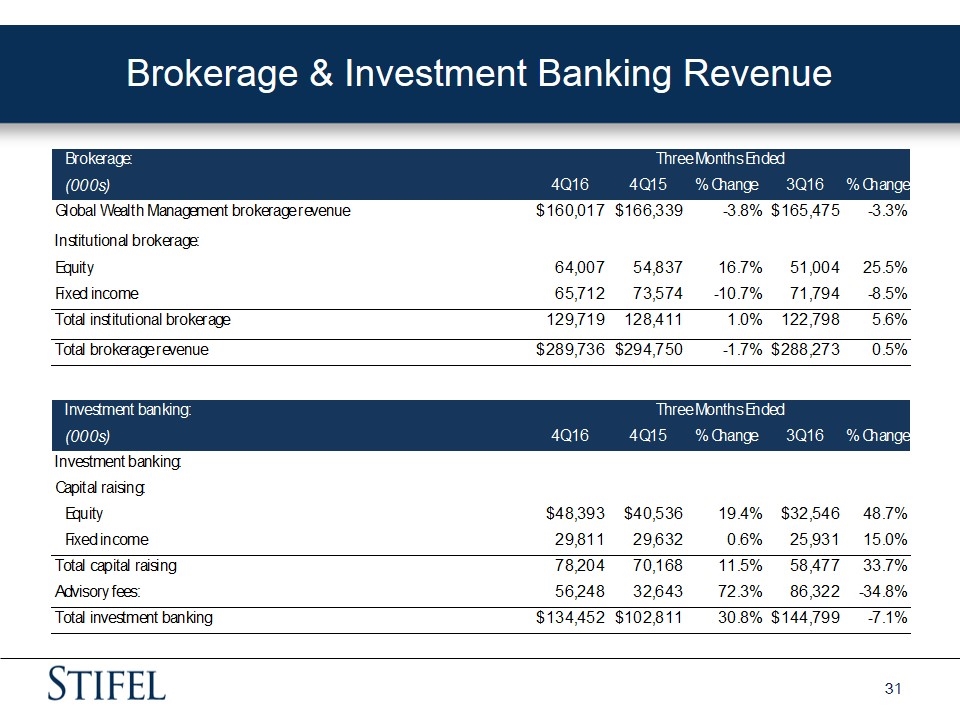

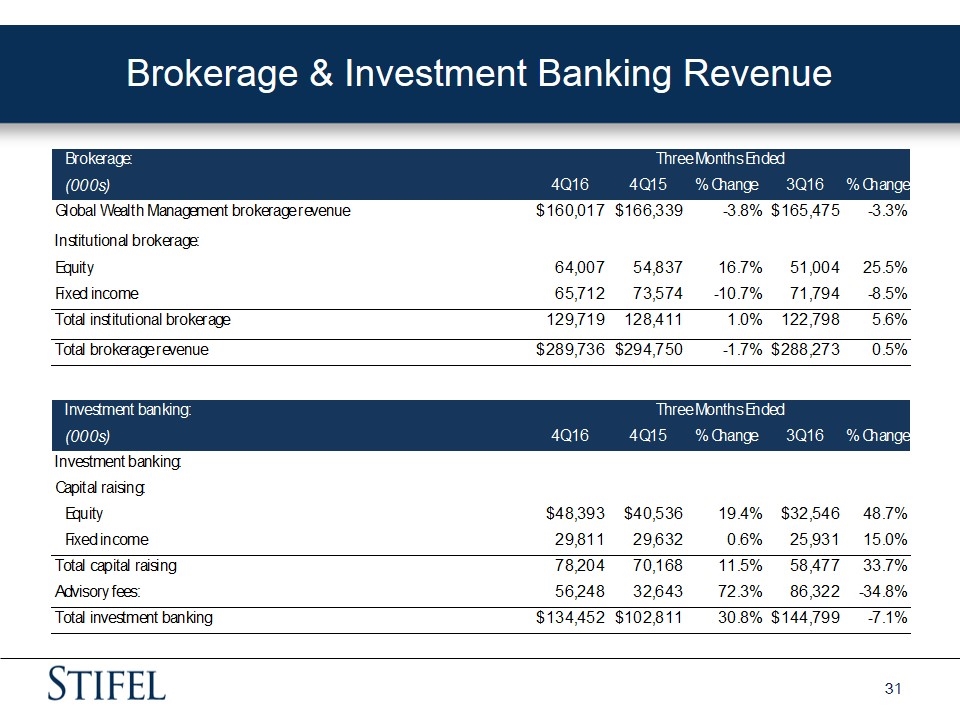

Brokerage & Investment Banking Revenue

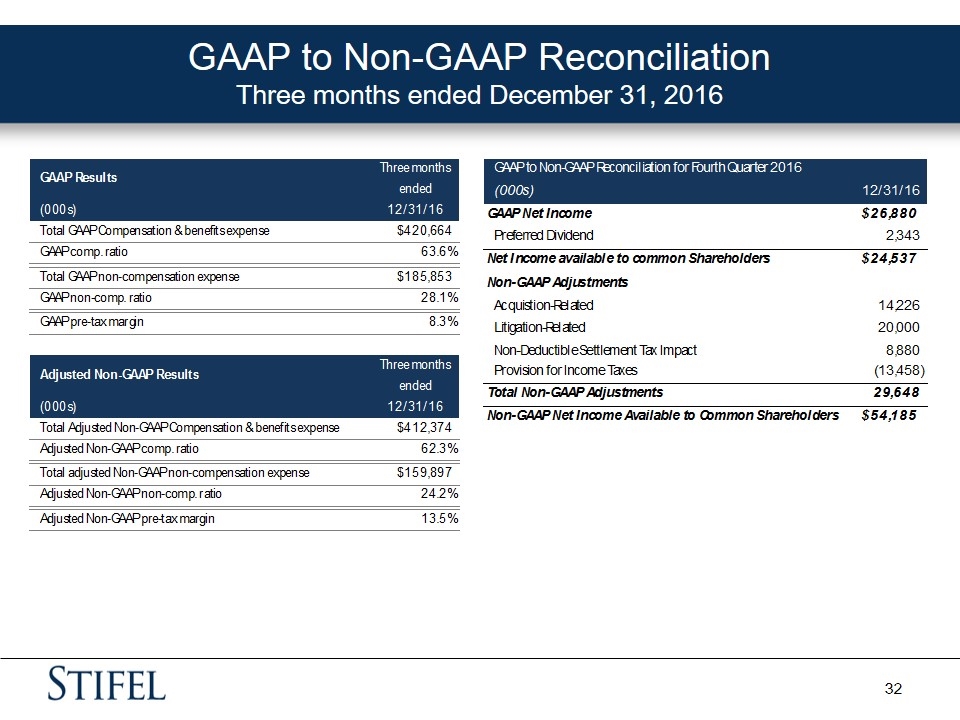

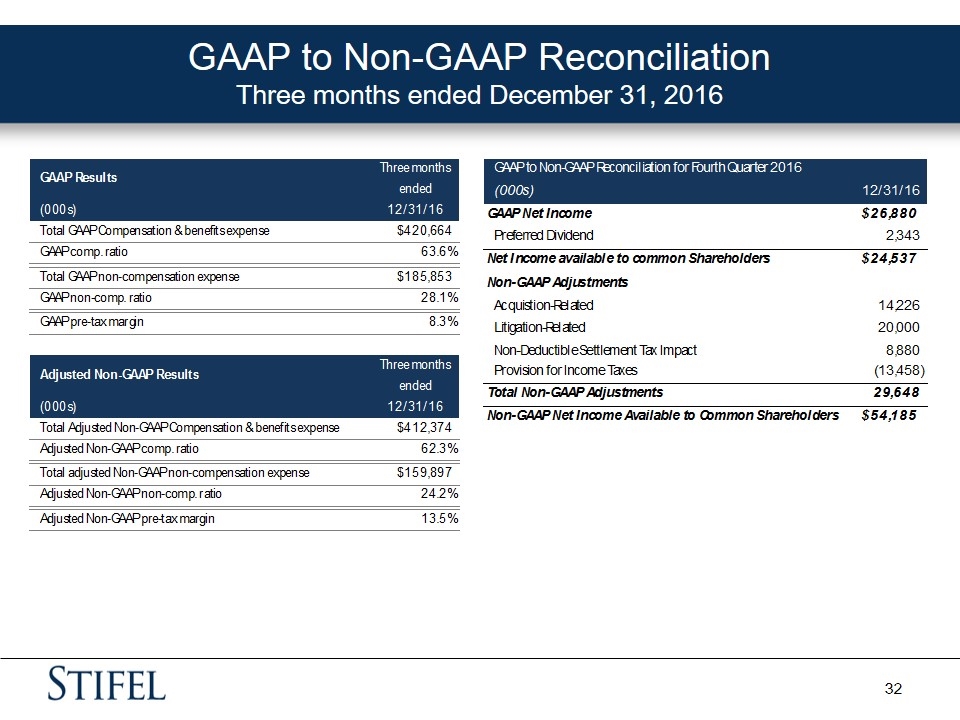

GAAP to Non-GAAP Reconciliation Three months ended December 31, 2016

Balance Sheet & Net Interest Margin Net Interest Income Drivers: Total assets increased to $19.1 bil. up 11% sequentially & 44% Y/Y Average interest earning assets increased to $15.6 bil. up 27% sequentially & 111% Y/Y NIM increased to 191 bps , up 10 bps sequentially but down 5 bps Y/Y. NIM at Stifel Bank of 225 bps decreased 15bps sequentially & 20 bps Y/Y NIM at Stifel Bank in December was 252 bps Firm-wide NII of $74.7 mil. increased 35% sequentially and 106% Y/Y. Book value per share was $38.84

Segment Results

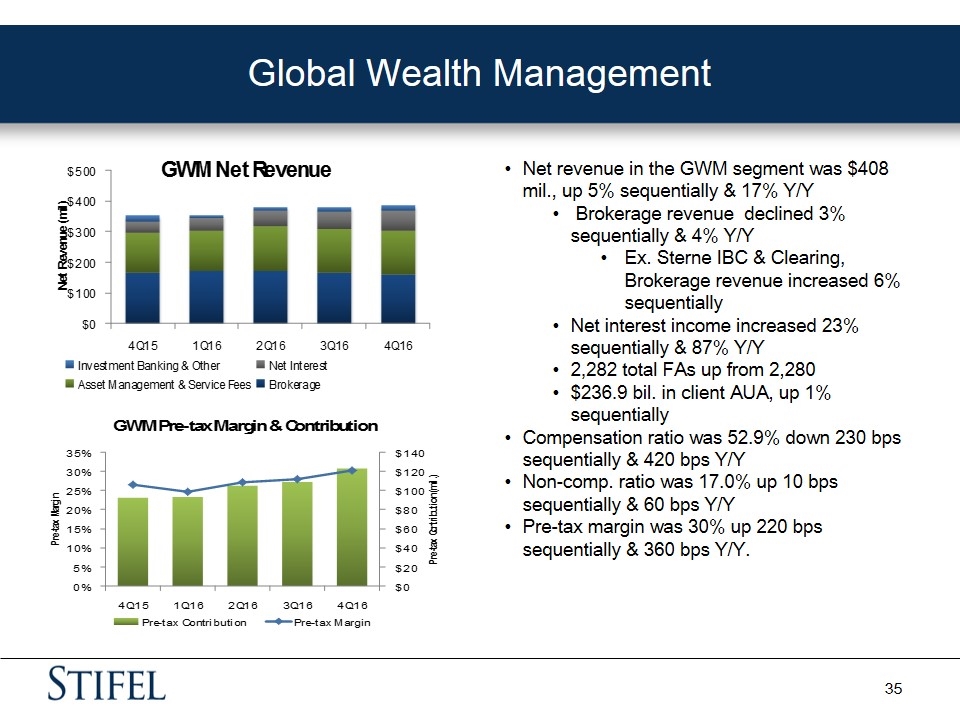

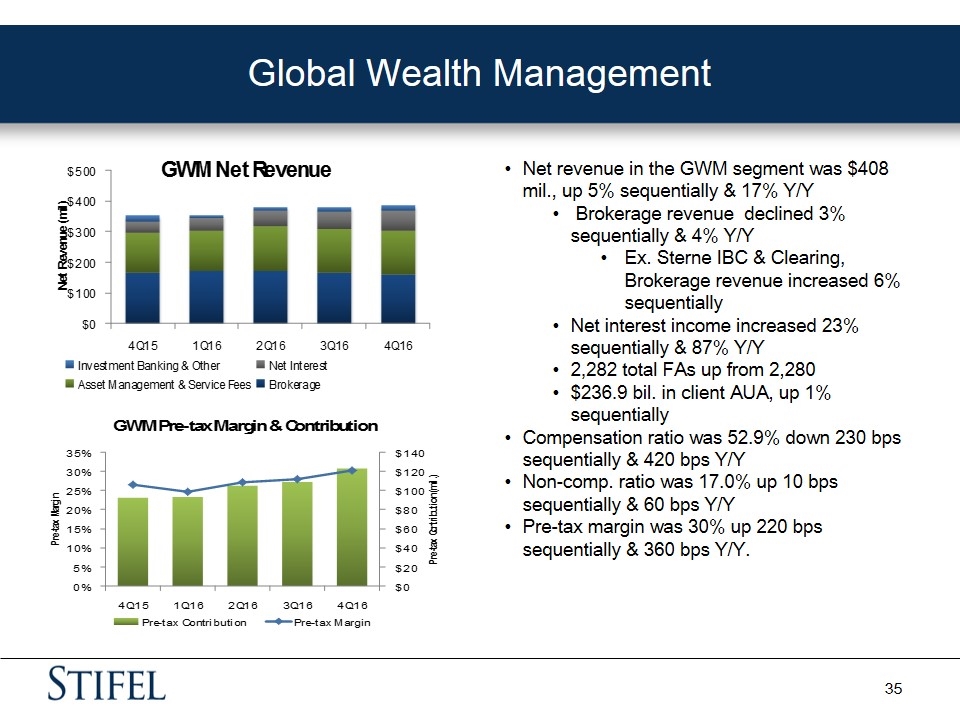

Global Wealth Management Net revenue in the GWM segment was $408 mil., up 5% sequentially & 17% Y/Y Brokerage revenue declined 3% sequentially & 4% Y/Y Ex. Sterne IBC & Clearing, Brokerage revenue increased 6% sequentially Net interest income increased 23% sequentially & 87% Y/Y 2,282 total FAs up from 2,280 $236.9 bil. in client AUA, up 1% sequentially Compensation ratio was 52.9% down 230 bps sequentially & 420 bps Y/Y Non-comp. ratio was 17.0% up 10 bps sequentially & 60 bps Y/Y Pre-tax margin was 30% up 220 bps sequentially & 360 bps Y/Y.

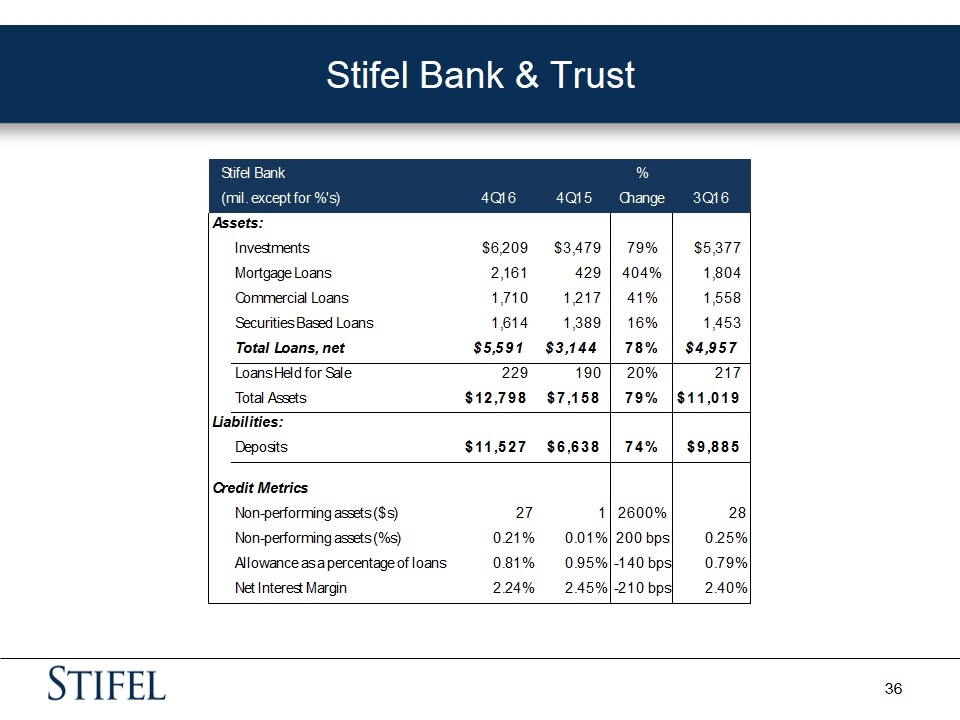

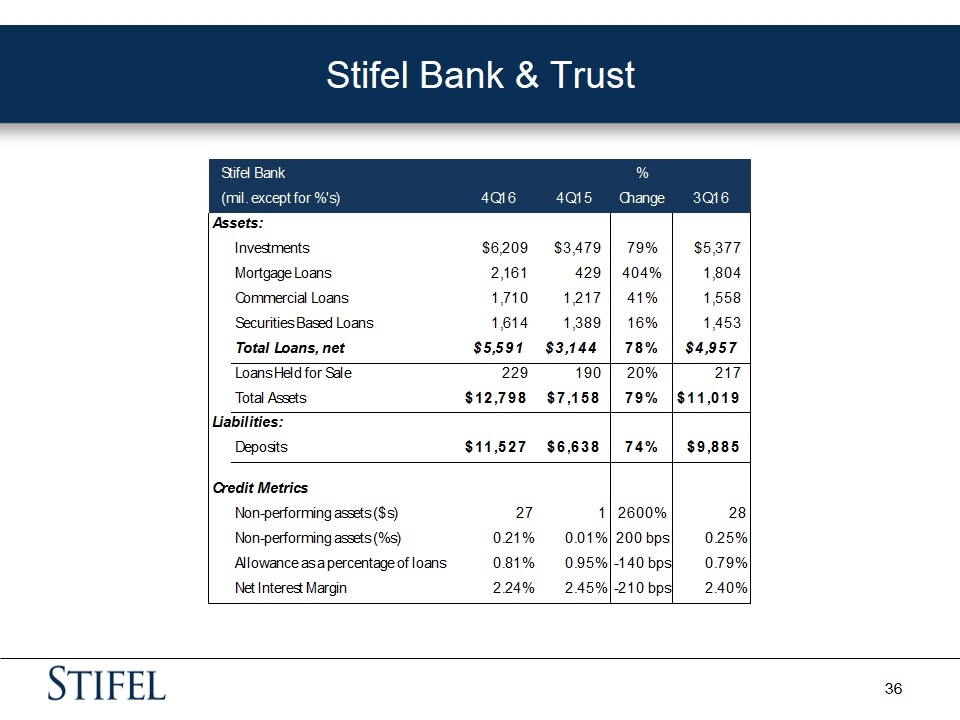

Stifel Bank & Trust

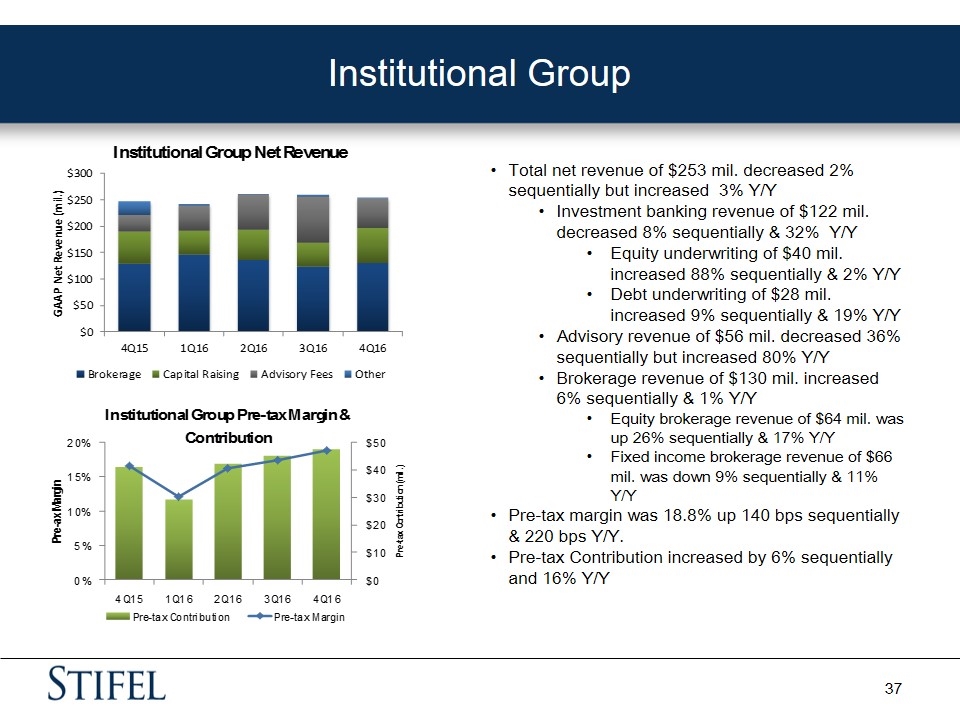

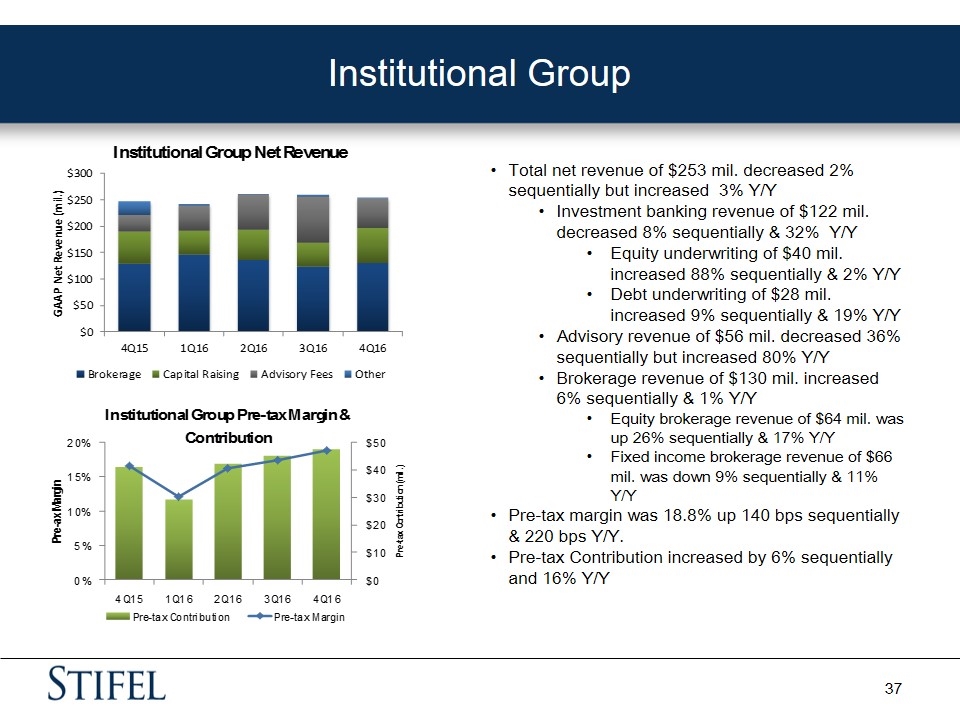

Institutional Group Total net revenue of $253 mil. decreased 2% sequentially but increased 3% Y/Y Investment banking revenue of $122 mil. decreased 8% sequentially & 32% Y/Y Equity underwriting of $40 mil. increased 88% sequentially & 2% Y/Y Debt underwriting of $28 mil. increased 9% sequentially & 19% Y/Y Advisory revenue of $56 mil. decreased 36% sequentially but increased 80% Y/Y Brokerage revenue of $130 mil. increased 6% sequentially & 1% Y/Y Equity brokerage revenue of $64 mil. was up 26% sequentially & 17% Y/Y Fixed income brokerage revenue of $66 mil. was down 9% sequentially & 11% Y/Y Pre-tax margin was 18.8% up 140 bps sequentially & 220 bps Y/Y. Pre-tax Contribution increased by 6% sequentially and 16% Y/Y