UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03785

Fidelity Advisor Series I

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | December 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Advisor® Mid Cap II Fund Fidelity Advisor® Mid Cap II Fund Class Z : FZAMX |

| | | |

This annual shareholder report contains information about Fidelity Advisor® Mid Cap II Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 63 | 0.58% | |

What affected the Fund's performance this period?

•U.S. equities gained in 2024, driven by a sturdy economy, the Federal Reserve's long-anticipated pivot to cutting interest rates and the potential for artificial intelligence to drive transformative change.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P MidCap 400 Index for the year, led by the consumer discretionary sector. Stock picks in consumer staples and financials also boosted the fund's relative performance.

•The top individual relative contributor was our non-benchmark stake in Vertiv Holdings (+142%). This period we decreased our stake in the stock. An overweight in Deckers Outdoor (+81%) helped as well. We decreased our position in 2024. A non-benchmark holding in Howmet Aerospace gained 112% and further bolstered the fund's result. The stock was not held at period end.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in information technology. Also hurting our result was security selection in energy and utilities. Lastly, the fund's position in cash also detracted.

•Not owning Texas Pacific Land, a benchmark component that gained 117%, was the largest individual relative detractor. A stake in Super Micro Computer (+276%) also hurt. The stock was not held at period end. Another notable relative detractor was our position in Emcor (+111%), an investment we established this period.

•Notable changes in positioning include higher allocations to the health care and financials sectors.

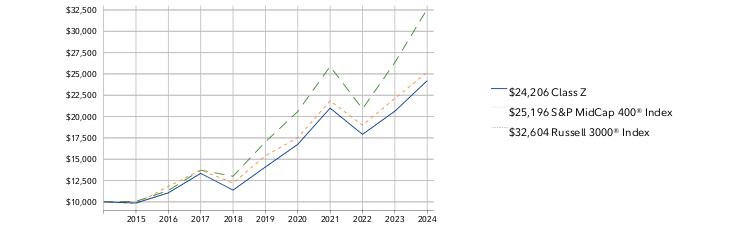

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000.

Class Z | $10,000 | $9,862 | $11,052 | $13,341 | $11,375 | $14,086 | $16,741 | $20,989 | $17,909 | $20,627 | $24,206 |

S&P MidCap 400® Index | $10,000 | $9,782 | $11,811 | $13,730 | $12,208 | $15,407 | $17,511 | $21,847 | $18,993 | $22,115 | $25,196 |

Russell 3000® Index | $10,000 | $10,048 | $11,327 | $13,721 | $13,002 | $17,035 | $20,593 | $25,877 | $20,907 | $26,334 | $32,604 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class Z | 17.35% | 11.44% | 9.24% |

| S&P MidCap 400® Index | 13.93% | 10.34% | 9.68% |

| Russell 3000® Index | 23.81% | 13.86% | 12.55% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,551,980,039 | |

| Number of Holdings | 180 | |

| Total Advisory Fee | $9,939,485 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.1 | |

| Industrials | 18.0 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 11.7 | |

| Information Technology | 9.8 | |

| Real Estate | 6.5 | |

| Energy | 6.0 | |

| Materials | 5.2 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.4 | |

| Communication Services | 1.8 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| United States | 91.1 |

| Canada | 2.2 |

| Israel | 1.6 |

| United Kingdom | 1.6 |

| Belgium | 0.9 |

| Puerto Rico | 0.8 |

| Brazil | 0.4 |

| Italy | 0.4 |

| France | 0.3 |

| Others | 0.7 |

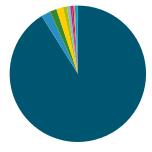

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 91.1 |

| | Canada - 2.2 |

| | Israel - 1.6 |

| | United Kingdom - 1.6 |

| | Belgium - 0.9 |

| | Puerto Rico - 0.8 |

| | Brazil - 0.4 |

| | Italy - 0.4 |

| | France - 0.3 |

| | Others - 0.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Foods Holding Corp | 1.5 | |

| Reinsurance Group of America Inc | 1.4 | |

| East West Bancorp Inc | 1.4 | |

| ITT Inc | 1.3 | |

| Williams-Sonoma Inc | 1.3 | |

| Wintrust Financial Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| Primerica Inc | 1.2 | |

| AptarGroup Inc | 1.2 | |

| Wix.com Ltd | 1.2 | |

| | 13.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914263.100 2538-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Advisor® Mid Cap II Fund Fidelity Advisor® Mid Cap II Fund Class C : FIICX |

| | | |

This annual shareholder report contains information about Fidelity Advisor® Mid Cap II Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 185 | 1.71% | |

What affected the Fund's performance this period?

•U.S. equities gained in 2024, driven by a sturdy economy, the Federal Reserve's long-anticipated pivot to cutting interest rates and the potential for artificial intelligence to drive transformative change.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P MidCap 400 Index for the year, led by the consumer discretionary sector. Stock picks in consumer staples and financials also boosted the fund's relative performance.

•The top individual relative contributor was our non-benchmark stake in Vertiv Holdings (+142%). This period we decreased our stake in the stock. An overweight in Deckers Outdoor (+81%) helped as well. We decreased our position in 2024. A non-benchmark holding in Howmet Aerospace gained 112% and further bolstered the fund's result. The stock was not held at period end.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in information technology. Also hurting our result was security selection in energy and utilities. Lastly, the fund's position in cash also detracted.

•Not owning Texas Pacific Land, a benchmark component that gained 117%, was the largest individual relative detractor. A stake in Super Micro Computer (+276%) also hurt. The stock was not held at period end. Another notable relative detractor was our position in Emcor (+111%), an investment we established this period.

•Notable changes in positioning include higher allocations to the health care and financials sectors.

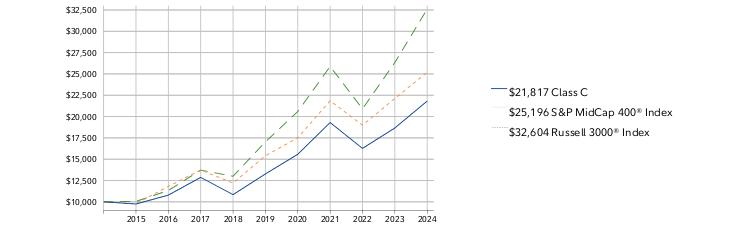

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $9,743 | $10,789 | $12,867 | $10,844 | $13,272 | $15,576 | $19,300 | $16,268 | $18,660 | $21,817 |

S&P MidCap 400® Index | $10,000 | $9,782 | $11,811 | $13,730 | $12,208 | $15,407 | $17,511 | $21,847 | $18,993 | $22,115 | $25,196 |

Russell 3000® Index | $10,000 | $10,048 | $11,327 | $13,721 | $13,002 | $17,035 | $20,593 | $25,877 | $20,907 | $26,334 | $32,604 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class C (incl. contingent deferred sales charge) | 15.08% | 10.11% | 8.11% |

| Class C | 16.08% | 10.11% | 8.11% |

| S&P MidCap 400® Index | 13.93% | 10.34% | 9.68% |

| Russell 3000® Index | 23.81% | 13.86% | 12.55% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,551,980,039 | |

| Number of Holdings | 180 | |

| Total Advisory Fee | $9,939,485 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.1 | |

| Industrials | 18.0 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 11.7 | |

| Information Technology | 9.8 | |

| Real Estate | 6.5 | |

| Energy | 6.0 | |

| Materials | 5.2 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.4 | |

| Communication Services | 1.8 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| United States | 91.1 |

| Canada | 2.2 |

| Israel | 1.6 |

| United Kingdom | 1.6 |

| Belgium | 0.9 |

| Puerto Rico | 0.8 |

| Brazil | 0.4 |

| Italy | 0.4 |

| France | 0.3 |

| Others | 0.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 91.1 |

| | Canada - 2.2 |

| | Israel - 1.6 |

| | United Kingdom - 1.6 |

| | Belgium - 0.9 |

| | Puerto Rico - 0.8 |

| | Brazil - 0.4 |

| | Italy - 0.4 |

| | France - 0.3 |

| | Others - 0.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Foods Holding Corp | 1.5 | |

| Reinsurance Group of America Inc | 1.4 | |

| East West Bancorp Inc | 1.4 | |

| ITT Inc | 1.3 | |

| Williams-Sonoma Inc | 1.3 | |

| Wintrust Financial Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| Primerica Inc | 1.2 | |

| AptarGroup Inc | 1.2 | |

| Wix.com Ltd | 1.2 | |

| | 13.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year. The variations in class fees are primarily the result of the following changes:- Management fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914260.100 1361-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Advisor® Mid Cap II Fund Fidelity Advisor® Mid Cap II Fund Class A : FIIAX |

| | | |

This annual shareholder report contains information about Fidelity Advisor® Mid Cap II Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 105 | 0.96% | |

What affected the Fund's performance this period?

•U.S. equities gained in 2024, driven by a sturdy economy, the Federal Reserve's long-anticipated pivot to cutting interest rates and the potential for artificial intelligence to drive transformative change.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P MidCap 400 Index for the year, led by the consumer discretionary sector. Stock picks in consumer staples and financials also boosted the fund's relative performance.

•The top individual relative contributor was our non-benchmark stake in Vertiv Holdings (+142%). This period we decreased our stake in the stock. An overweight in Deckers Outdoor (+81%) helped as well. We decreased our position in 2024. A non-benchmark holding in Howmet Aerospace gained 112% and further bolstered the fund's result. The stock was not held at period end.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in information technology. Also hurting our result was security selection in energy and utilities. Lastly, the fund's position in cash also detracted.

•Not owning Texas Pacific Land, a benchmark component that gained 117%, was the largest individual relative detractor. A stake in Super Micro Computer (+276%) also hurt. The stock was not held at period end. Another notable relative detractor was our position in Emcor (+111%), an investment we established this period.

•Notable changes in positioning include higher allocations to the health care and financials sectors.

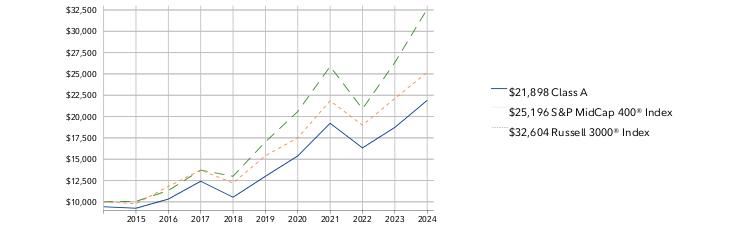

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,425 | $9,251 | $10,324 | $12,414 | $10,540 | $12,997 | $15,381 | $19,214 | $16,328 | $18,729 | $21,898 |

S&P MidCap 400® Index | $10,000 | $9,782 | $11,811 | $13,730 | $12,208 | $15,407 | $17,511 | $21,847 | $18,993 | $22,115 | $25,196 |

Russell 3000® Index | $10,000 | $10,048 | $11,327 | $13,721 | $13,002 | $17,035 | $20,593 | $25,877 | $20,907 | $26,334 | $32,604 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class A (incl. 5.75% sales charge) | 10.20% | 9.69% | 8.15% |

| Class A (without 5.75% sales charge) | 16.92% | 11.00% | 8.80% |

| S&P MidCap 400® Index | 13.93% | 10.34% | 9.68% |

| Russell 3000® Index | 23.81% | 13.86% | 12.55% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,551,980,039 | |

| Number of Holdings | 180 | |

| Total Advisory Fee | $9,939,485 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.1 | |

| Industrials | 18.0 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 11.7 | |

| Information Technology | 9.8 | |

| Real Estate | 6.5 | |

| Energy | 6.0 | |

| Materials | 5.2 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.4 | |

| Communication Services | 1.8 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| United States | 91.1 |

| Canada | 2.2 |

| Israel | 1.6 |

| United Kingdom | 1.6 |

| Belgium | 0.9 |

| Puerto Rico | 0.8 |

| Brazil | 0.4 |

| Italy | 0.4 |

| France | 0.3 |

| Others | 0.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 91.1 |

| | Canada - 2.2 |

| | Israel - 1.6 |

| | United Kingdom - 1.6 |

| | Belgium - 0.9 |

| | Puerto Rico - 0.8 |

| | Brazil - 0.4 |

| | Italy - 0.4 |

| | France - 0.3 |

| | Others - 0.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Foods Holding Corp | 1.5 | |

| Reinsurance Group of America Inc | 1.4 | |

| East West Bancorp Inc | 1.4 | |

| ITT Inc | 1.3 | |

| Williams-Sonoma Inc | 1.3 | |

| Wintrust Financial Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| Primerica Inc | 1.2 | |

| AptarGroup Inc | 1.2 | |

| Wix.com Ltd | 1.2 | |

| | 13.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914259.100 1359-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Advisor® Mid Cap II Fund Fidelity Advisor® Mid Cap II Fund Class M : FITIX |

| | | |

This annual shareholder report contains information about Fidelity Advisor® Mid Cap II Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 131 | 1.21% | |

What affected the Fund's performance this period?

•U.S. equities gained in 2024, driven by a sturdy economy, the Federal Reserve's long-anticipated pivot to cutting interest rates and the potential for artificial intelligence to drive transformative change.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P MidCap 400 Index for the year, led by the consumer discretionary sector. Stock picks in consumer staples and financials also boosted the fund's relative performance.

•The top individual relative contributor was our non-benchmark stake in Vertiv Holdings (+142%). This period we decreased our stake in the stock. An overweight in Deckers Outdoor (+81%) helped as well. We decreased our position in 2024. A non-benchmark holding in Howmet Aerospace gained 112% and further bolstered the fund's result. The stock was not held at period end.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in information technology. Also hurting our result was security selection in energy and utilities. Lastly, the fund's position in cash also detracted.

•Not owning Texas Pacific Land, a benchmark component that gained 117%, was the largest individual relative detractor. A stake in Super Micro Computer (+276%) also hurt. The stock was not held at period end. Another notable relative detractor was our position in Emcor (+111%), an investment we established this period.

•Notable changes in positioning include higher allocations to the health care and financials sectors.

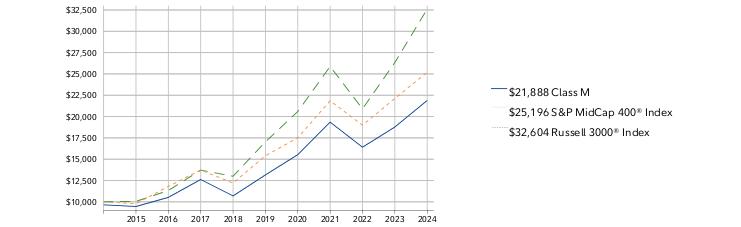

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,650 | $9,453 | $10,523 | $12,618 | $10,693 | $13,155 | $15,530 | $19,347 | $16,408 | $18,773 | $21,888 |

S&P MidCap 400® Index | $10,000 | $9,782 | $11,811 | $13,730 | $12,208 | $15,407 | $17,511 | $21,847 | $18,993 | $22,115 | $25,196 |

Russell 3000® Index | $10,000 | $10,048 | $11,327 | $13,721 | $13,002 | $17,035 | $20,593 | $25,877 | $20,907 | $26,334 | $32,604 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class M (incl. 3.50% sales charge) | 12.51% | 9.93% | 8.15% |

| Class M (without 3.50% sales charge) | 16.59% | 10.72% | 8.53% |

| S&P MidCap 400® Index | 13.93% | 10.34% | 9.68% |

| Russell 3000® Index | 23.81% | 13.86% | 12.55% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,551,980,039 | |

| Number of Holdings | 180 | |

| Total Advisory Fee | $9,939,485 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.1 | |

| Industrials | 18.0 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 11.7 | |

| Information Technology | 9.8 | |

| Real Estate | 6.5 | |

| Energy | 6.0 | |

| Materials | 5.2 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.4 | |

| Communication Services | 1.8 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| United States | 91.1 |

| Canada | 2.2 |

| Israel | 1.6 |

| United Kingdom | 1.6 |

| Belgium | 0.9 |

| Puerto Rico | 0.8 |

| Brazil | 0.4 |

| Italy | 0.4 |

| France | 0.3 |

| Others | 0.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 91.1 |

| | Canada - 2.2 |

| | Israel - 1.6 |

| | United Kingdom - 1.6 |

| | Belgium - 0.9 |

| | Puerto Rico - 0.8 |

| | Brazil - 0.4 |

| | Italy - 0.4 |

| | France - 0.3 |

| | Others - 0.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Foods Holding Corp | 1.5 | |

| Reinsurance Group of America Inc | 1.4 | |

| East West Bancorp Inc | 1.4 | |

| ITT Inc | 1.3 | |

| Williams-Sonoma Inc | 1.3 | |

| Wintrust Financial Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| Primerica Inc | 1.2 | |

| AptarGroup Inc | 1.2 | |

| Wix.com Ltd | 1.2 | |

| | 13.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914261.100 1362-TSRA-0325 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF DECEMBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity Advisor® Mid Cap II Fund Fidelity Advisor® Mid Cap II Fund Class I : FIIMX |

| | | |

This annual shareholder report contains information about Fidelity Advisor® Mid Cap II Fund for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 77 | 0.71% | |

What affected the Fund's performance this period?

•U.S. equities gained in 2024, driven by a sturdy economy, the Federal Reserve's long-anticipated pivot to cutting interest rates and the potential for artificial intelligence to drive transformative change.

•Against this backdrop, security selection was the primary contributor to the fund's performance versus the S&P MidCap 400 Index for the year, led by the consumer discretionary sector. Stock picks in consumer staples and financials also boosted the fund's relative performance.

•The top individual relative contributor was our non-benchmark stake in Vertiv Holdings (+142%). This period we decreased our stake in the stock. An overweight in Deckers Outdoor (+81%) helped as well. We decreased our position in 2024. A non-benchmark holding in Howmet Aerospace gained 112% and further bolstered the fund's result. The stock was not held at period end.

•In contrast, the biggest detractor from performance versus the benchmark was stock picking in information technology. Also hurting our result was security selection in energy and utilities. Lastly, the fund's position in cash also detracted.

•Not owning Texas Pacific Land, a benchmark component that gained 117%, was the largest individual relative detractor. A stake in Super Micro Computer (+276%) also hurt. The stock was not held at period end. Another notable relative detractor was our position in Emcor (+111%), an investment we established this period.

•Notable changes in positioning include higher allocations to the health care and financials sectors.

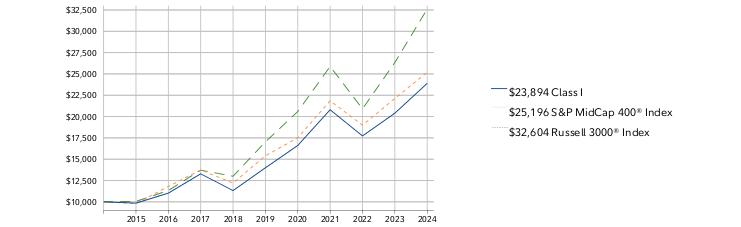

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

December 31, 2014 through December 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $9,848 | $11,020 | $13,285 | $11,319 | $13,995 | $16,609 | $20,801 | $17,728 | $20,392 | $23,894 |

S&P MidCap 400® Index | $10,000 | $9,782 | $11,811 | $13,730 | $12,208 | $15,407 | $17,511 | $21,847 | $18,993 | $22,115 | $25,196 |

Russell 3000® Index | $10,000 | $10,048 | $11,327 | $13,721 | $13,002 | $17,035 | $20,593 | $25,877 | $20,907 | $26,334 | $32,604 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class I | 17.17% | 11.29% | 9.10% |

| S&P MidCap 400® Index | 13.93% | 10.34% | 9.68% |

| Russell 3000® Index | 23.81% | 13.86% | 12.55% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of December 31, 2024)

KEY FACTS | | |

| Fund Size | $1,551,980,039 | |

| Number of Holdings | 180 | |

| Total Advisory Fee | $9,939,485 | |

| Portfolio Turnover | 52% | |

What did the Fund invest in?

(as of December 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 20.1 | |

| Industrials | 18.0 | |

| Consumer Discretionary | 12.3 | |

| Health Care | 11.7 | |

| Information Technology | 9.8 | |

| Real Estate | 6.5 | |

| Energy | 6.0 | |

| Materials | 5.2 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.4 | |

| Communication Services | 1.8 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| | Common Stocks - 99.7 |

| | Short-Term Investments and Net Other Assets (Liabilities) - 0.3 |

| |

| United States | 91.1 |

| Canada | 2.2 |

| Israel | 1.6 |

| United Kingdom | 1.6 |

| Belgium | 0.9 |

| Puerto Rico | 0.8 |

| Brazil | 0.4 |

| Italy | 0.4 |

| France | 0.3 |

| Others | 0.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| | United States - 91.1 |

| | Canada - 2.2 |

| | Israel - 1.6 |

| | United Kingdom - 1.6 |

| | Belgium - 0.9 |

| | Puerto Rico - 0.8 |

| | Brazil - 0.4 |

| | Italy - 0.4 |

| | France - 0.3 |

| | Others - 0.7 |

| |

TOP HOLDINGS(% of Fund's net assets) | | |

| US Foods Holding Corp | 1.5 | |

| Reinsurance Group of America Inc | 1.4 | |

| East West Bancorp Inc | 1.4 | |

| ITT Inc | 1.3 | |

| Williams-Sonoma Inc | 1.3 | |

| Wintrust Financial Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| Primerica Inc | 1.2 | |

| AptarGroup Inc | 1.2 | |

| Wix.com Ltd | 1.2 | |

| | 13.0 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2025 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914262.100 1363-TSRA-0325 |

Item 2.

Code of Ethics

As of the end of the period, December 31, 2024, Fidelity Advisor Series I (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity Advisor Mid Cap II Fund (the “Fund”):

Services Billed by Deloitte Entities

December 31, 2024 FeesA

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity Advisor Mid Cap II Fund | $39,200 | $- | $7,800 | $900 |

| | | | |

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Fidelity Advisor Mid Cap II Fund | $39,300 | $- | $8,200 | $1,000 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by Deloitte Entities that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by Deloitte Entities

| | |

| December 31, 2024A | December 31, 2023A |

Audit-Related Fees | $125,000 | $75,000 |

Tax Fees | $- | $- |

All Other Fees | $2,929,500 | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by Deloitte Entities for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

| | |

Billed By | December 31, 2024A | December 31, 2023A |

Deloitte Entities | $3,357,700 | $5,366,300 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by Deloitte Entities to Fund Service Providers to be compatible with maintaining the independence of Deloitte Entities in its(their) audit of the Fund(s), taking into account representations from Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Fidelity Advisor® Mid Cap II Fund

Annual Report

December 31, 2024

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2025 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies (Annual Report)

Fidelity Advisor® Mid Cap II Fund

Schedule of Investments December 31, 2024

Showing Percentage of Net Assets

| Common Stocks - 99.7% |

| | | Shares | Value ($) |

| BELGIUM - 0.9% | | | |

| Health Care - 0.9% | | | |

| Pharmaceuticals - 0.9% | | | |

| UCB SA | | 69,100 | 13,757,145 |

| BRAZIL - 0.4% | | | |

| Materials - 0.4% | | | |

| Metals & Mining - 0.4% | | | |

| Wheaton Precious Metals Corp | | 116,600 | 6,563,085 |

| CANADA - 2.2% | | | |

| Consumer Discretionary - 0.4% | | | |

| Specialty Retail - 0.4% | | | |

| Aritzia Inc Subordinate Voting Shares (a) | | 167,300 | 6,219,703 |

| Energy - 0.2% | | | |

| Oil, Gas & Consumable Fuels - 0.2% | | | |

| MEG Energy Corp | | 205,800 | 3,378,817 |

| Financials - 0.5% | | | |

| Capital Markets - 0.5% | | | |

| TMX Group Ltd | | 237,500 | 7,316,081 |

| Industrials - 0.9% | | | |

| Commercial Services & Supplies - 0.9% | | | |

| RB Global Inc (United States) | | 150,700 | 13,594,647 |

| Materials - 0.2% | | | |

| Metals & Mining - 0.2% | | | |

| Teck Resources Ltd Class B (United States) | | 79,100 | 3,205,922 |

| TOTAL CANADA | | | 33,715,170 |

| FRANCE - 0.3% | | | |

| Health Care - 0.3% | | | |

| Life Sciences Tools & Services - 0.3% | | | |

| Sartorius Stedim Biotech | | 25,100 | 4,906,169 |

| GERMANY - 0.2% | | | |

| Health Care - 0.2% | | | |

| Biotechnology - 0.2% | | | |

| BioNTech SE ADR (a) | | 27,300 | 3,110,835 |

| ISRAEL - 1.6% | | | |

| Information Technology - 1.6% | | | |

| IT Services - 1.2% | | | |

| Wix.com Ltd (a) | | 85,100 | 18,258,205 |

| Semiconductors & Semiconductor Equipment - 0.4% | | | |

| Nova Ltd (a) | | 33,800 | 6,656,910 |

| TOTAL ISRAEL | | | 24,915,115 |

| ITALY - 0.4% | | | |

| Industrials - 0.4% | | | |

| Electrical Equipment - 0.4% | | | |

| Prysmian SpA | | 95,900 | 6,125,182 |

| JAPAN - 0.3% | | | |

| Information Technology - 0.3% | | | |

| Semiconductors & Semiconductor Equipment - 0.3% | | | |

| Allegro MicroSystems Inc (a) | | 211,907 | 4,632,287 |

| NETHERLANDS - 0.2% | | | |

| Health Care - 0.2% | | | |

| Biotechnology - 0.2% | | | |

| Argenx SE ADR (a) | | 4,500 | 2,767,499 |

| PUERTO RICO - 0.8% | | | |

| Financials - 0.8% | | | |

| Banks - 0.8% | | | |

| Popular Inc | | 136,300 | 12,820,378 |

| UNITED KINGDOM - 1.6% | | | |

| Energy - 1.0% | | | |

| Energy Equipment & Services - 1.0% | | | |

| TechnipFMC PLC | | 513,000 | 14,846,220 |

| Financials - 0.2% | | | |

| Insurance - 0.2% | | | |

| Fidelis Insurance Holdings Ltd | | 227,600 | 4,126,388 |

| Information Technology - 0.4% | | | |

| Software - 0.4% | | | |

| Sage Group PLC/The | | 359,000 | 5,721,271 |

| TOTAL UNITED KINGDOM | | | 24,693,879 |

| UNITED STATES - 90.8% | | | |

| Communication Services - 1.8% | | | |

| Entertainment - 1.6% | | | |

| Liberty Media Corp-Liberty Formula One Class C (a) | | 83,400 | 7,727,844 |

| Live Nation Entertainment Inc (a) | | 97,200 | 12,587,400 |

| TKO Group Holdings Inc Class A (a) | | 33,400 | 4,746,474 |

| | | | 25,061,718 |

| Interactive Media & Services - 0.2% | | | |

| Pinterest Inc Class A (a) | | 122,500 | 3,552,500 |

TOTAL COMMUNICATION SERVICES | | | 28,614,218 |

| | | | |

| Consumer Discretionary - 11.9% | | | |

| Diversified Consumer Services - 3.1% | | | |

| Duolingo Inc Class A (a) | | 45,900 | 14,882,157 |

| Grand Canyon Education Inc (a) | | 95,700 | 15,675,660 |

| Service Corp International/US | | 218,800 | 17,464,616 |

| | | | 48,022,433 |

| Hotels, Restaurants & Leisure - 3.6% | | | |

| Aramark | | 349,700 | 13,047,307 |

| Churchill Downs Inc | | 89,316 | 11,927,259 |

| Dutch Bros Inc Class A (a) | | 137,800 | 7,217,964 |

| Light & Wonder Inc Class A (a) | | 128,200 | 11,073,916 |

| Red Rock Resorts Inc Class A | | 77,900 | 3,602,096 |

| Texas Roadhouse Inc | | 48,100 | 8,678,683 |

| | | | 55,547,225 |

| Household Durables - 1.5% | | | |

| Cavco Industries Inc (a) | | 12,600 | 5,622,498 |

| NVR Inc (a) | | 815 | 6,665,804 |

| Taylor Morrison Home Corp (a) | | 114,200 | 6,990,182 |

| Toll Brothers Inc | | 35,500 | 4,471,225 |

| | | | 23,749,709 |

| Specialty Retail - 2.5% | | | |

| Dick's Sporting Goods Inc | | 78,600 | 17,986,824 |

| Williams-Sonoma Inc | | 111,000 | 20,554,980 |

| | | | 38,541,804 |

| Textiles, Apparel & Luxury Goods - 1.2% | | | |

| Deckers Outdoor Corp (a) | | 62,750 | 12,743,898 |

| PVH Corp | | 61,600 | 6,514,199 |

| | | | 19,258,097 |

TOTAL CONSUMER DISCRETIONARY | | | 185,119,268 |

| | | | |

| Consumer Staples - 4.9% | | | |

| Consumer Staples Distribution & Retail - 4.5% | | | |

| Albertsons Cos Inc | | 226,700 | 4,452,388 |

| BJ's Wholesale Club Holdings Inc (a) | | 190,100 | 16,985,435 |

| Performance Food Group Co (a) | | 226,800 | 19,175,940 |

| Sprouts Farmers Market Inc (a) | | 54,900 | 6,976,143 |

| US Foods Holding Corp (a) | | 329,100 | 22,201,086 |

| | | | 69,790,992 |

| Food Products - 0.4% | | | |

| Simply Good Foods Co/The (a) | | 109,800 | 4,280,004 |

| Westrock Coffee Co (a)(b) | | 422,034 | 2,709,458 |

| | | | 6,989,462 |

TOTAL CONSUMER STAPLES | | | 76,780,454 |

| | | | |

| Energy - 4.8% | | | |

| Energy Equipment & Services - 1.9% | | | |

| Baker Hughes Co Class A | | 207,300 | 8,503,446 |

| Kodiak Gas Services Inc | | 139,500 | 5,695,785 |

| Valaris Ltd (a) | | 127,707 | 5,649,758 |

| Weatherford International PLC | | 128,200 | 9,182,966 |

| | | | 29,031,955 |

| Oil, Gas & Consumable Fuels - 2.9% | | | |

| Antero Resources Corp (a) | | 442,100 | 15,495,605 |

| Ovintiv Inc | | 223,500 | 9,051,750 |

| Permian Resources Corp Class A | | 906,800 | 13,039,784 |

| Range Resources Corp | | 208,297 | 7,494,526 |

| | | | 45,081,665 |

TOTAL ENERGY | | | 74,113,620 |

| | | | |

| Financials - 18.6% | | | |

| Banks - 7.3% | | | |

| Bancorp Inc/The (a) | | 230,200 | 12,115,426 |

| BOK Financial Corp | | 71,200 | 7,579,240 |

| Cadence Bank | | 231,400 | 7,971,730 |

| East West Bancorp Inc | | 214,188 | 20,510,643 |

| First Citizens BancShares Inc/NC Class A | | 6,000 | 12,678,120 |

| First Interstate BancSystem Inc Class A | | 119,500 | 3,880,165 |

| Huntington Bancshares Inc/OH | | 226,600 | 3,686,782 |

| KeyCorp | | 865,400 | 14,832,956 |

| Pinnacle Financial Partners Inc | | 73,800 | 8,441,982 |

| Wintrust Financial Corp | | 158,400 | 19,754,064 |

| | | | 111,451,108 |

| Capital Markets - 3.8% | | | |

| Blue Owl Capital Inc Class A | | 577,300 | 13,427,998 |

| Houlihan Lokey Inc Class A | | 61,700 | 10,714,822 |

| Northern Trust Corp | | 87,200 | 8,938,000 |

| Raymond James Financial Inc | | 88,286 | 13,713,464 |

| Stifel Financial Corp | | 120,600 | 12,793,248 |

| | | | 59,587,532 |

| Financial Services - 2.0% | | | |

| Essent Group Ltd | | 219,929 | 11,972,935 |

| PennyMac Financial Services Inc | | 62,600 | 6,393,964 |

| Toast Inc Class A (a) | | 339,900 | 12,389,355 |

| | | | 30,756,254 |

| Insurance - 5.5% | | | |

| American Financial Group Inc/OH | | 87,200 | 11,940,296 |

| Arch Capital Group Ltd | | 77,100 | 7,120,185 |

| First American Financial Corp | | 158,300 | 9,884,252 |

| Hartford Financial Services Group Inc/The | | 58,000 | 6,345,200 |

| Old Republic International Corp | | 177,100 | 6,409,249 |

| Primerica Inc | | 70,058 | 19,015,142 |

| Reinsurance Group of America Inc | | 101,591 | 21,702,886 |

| Selective Insurance Group Inc | | 34,600 | 3,235,792 |

| | | | 85,653,002 |

TOTAL FINANCIALS | | | 287,447,896 |

| | | | |

| Health Care - 10.1% | | | |

| Biotechnology - 2.1% | | | |

| Arcellx Inc (a) | | 38,500 | 2,952,565 |

| Arrowhead Pharmaceuticals Inc (a) | | 133,715 | 2,513,842 |

| Avidity Biosciences Inc (a) | | 67,800 | 1,971,624 |

| Blueprint Medicines Corp (a) | | 37,800 | 3,296,916 |

| Centessa Pharmaceuticals PLC ADR (a) | | 117,400 | 1,966,450 |

| Crinetics Pharmaceuticals Inc (a) | | 41,300 | 2,111,669 |

| Exact Sciences Corp (a) | | 110,000 | 6,180,900 |

| Krystal Biotech Inc (a) | | 10,453 | 1,637,567 |

| SpringWorks Therapeutics Inc (a) | | 23,000 | 830,990 |

| United Therapeutics Corp (a) | | 24,600 | 8,679,864 |

| | | | 32,142,387 |

| Health Care Equipment & Supplies - 2.8% | | | |

| Cooper Cos Inc/The (a) | | 62,756 | 5,769,159 |

| Glaukos Corp (a) | | 27,500 | 4,123,350 |

| Insulet Corp (a) | | 19,700 | 5,143,079 |

| Integer Holdings Corp (a)(b) | | 50,400 | 6,679,008 |

| Lantheus Holdings Inc (a) | | 19,800 | 1,771,308 |

| Masimo Corp (a) | | 81,635 | 13,494,266 |

| TransMedics Group Inc (a)(b) | | 96,700 | 6,029,245 |

| | | | 43,009,415 |

| Health Care Providers & Services - 3.2% | | | |

| Astrana Health Inc (a) | | 67,041 | 2,113,802 |

| BrightSpring Health Services Inc (a) | | 363,900 | 6,197,217 |

| Encompass Health Corp | | 171,000 | 15,791,850 |

| Molina Healthcare Inc (a) | | 26,700 | 7,771,035 |

| Tenet Healthcare Corp (a) | | 97,425 | 12,297,958 |

| Universal Health Services Inc Class B | | 30,400 | 5,454,368 |

| | | | 49,626,230 |

| Life Sciences Tools & Services - 1.5% | | | |

| 10X Genomics Inc Class A (a) | | 37,600 | 539,936 |

| Avantor Inc (a) | | 542,500 | 11,430,475 |

| Bruker Corp | | 120,900 | 7,087,158 |

| Repligen Corp (a) | | 26,900 | 3,871,986 |

| | | | 22,929,555 |

| Pharmaceuticals - 0.5% | | | |

| Elanco Animal Health Inc (a) | | 745,400 | 9,026,794 |

TOTAL HEALTH CARE | | | 156,734,381 |

| | | | |

| Industrials - 16.7% | | | |

| Aerospace & Defense - 0.5% | | | |

| Axon Enterprise Inc (a) | | 13,500 | 8,023,320 |

| Air Freight & Logistics - 0.3% | | | |

| GXO Logistics Inc (a) | | 102,466 | 4,457,271 |

| Building Products - 1.1% | | | |

| AZEK Co Inc/The Class A (a) | | 282,900 | 13,429,263 |

| Simpson Manufacturing Co Inc | | 25,200 | 4,178,916 |

| | | | 17,608,179 |

| Commercial Services & Supplies - 1.3% | | | |

| ACV Auctions Inc Class A (a) | | 453,900 | 9,804,240 |

| CECO Environmental Corp (a)(b) | | 164,100 | 4,960,743 |

| Clean Harbors Inc (a) | | 26,000 | 5,983,640 |

| | | | 20,748,623 |

| Construction & Engineering - 2.0% | | | |

| Comfort Systems USA Inc | | 29,900 | 12,679,394 |

| EMCOR Group Inc | | 27,800 | 12,618,420 |

| Quanta Services Inc | | 17,600 | 5,562,480 |

| | | | 30,860,294 |

| Electrical Equipment - 2.0% | | | |

| Acuity Brands Inc | | 28,600 | 8,354,918 |

| AMETEK Inc | | 57,600 | 10,382,976 |

| nVent Electric PLC | | 92,000 | 6,270,720 |

| Vertiv Holdings Co Class A | | 50,900 | 5,782,749 |

| | | | 30,791,363 |

| Ground Transportation - 1.8% | | | |

| JB Hunt Transport Services Inc | | 34,649 | 5,913,198 |

| Saia Inc (a) | | 25,900 | 11,803,407 |

| XPO Inc (a) | | 74,000 | 9,705,100 |

| | | | 27,421,705 |

| Machinery - 5.1% | | | |

| Allison Transmission Holdings Inc | | 42,500 | 4,592,550 |

| Chart Industries Inc (a) | | 77,400 | 14,771,016 |

| Crane Co | | 108,900 | 16,525,575 |

| Ingersoll Rand Inc | | 111,000 | 10,041,060 |

| ITT Inc | | 144,259 | 20,611,726 |

| Westinghouse Air Brake Technologies Corp | | 62,100 | 11,773,539 |

| | | | 78,315,466 |

| Passenger Airlines - 0.3% | | | |

| Alaska Air Group Inc (a)(b) | | 64,800 | 4,195,800 |

| Professional Services - 1.3% | | | |

| Dayforce Inc (a)(b) | | 123,900 | 9,000,096 |

| Maximus Inc | | 28,800 | 2,149,920 |

| TransUnion | | 93,600 | 8,677,656 |

| | | | 19,827,672 |

| Trading Companies & Distributors - 1.0% | | | |

| DNOW Inc (a) | | 301,674 | 3,924,779 |

| Watsco Inc | | 26,000 | 12,321,140 |

| | | | 16,245,919 |

TOTAL INDUSTRIALS | | | 258,495,612 |

| | | | |

| Information Technology - 7.5% | | | |

| Communications Equipment - 0.7% | | | |

| Digi International Inc (a) | | 338,400 | 10,229,832 |

| Electronic Equipment, Instruments & Components - 3.1% | | | |

| Belden Inc | | 91,500 | 10,303,815 |

| Coherent Corp (a) | | 162,200 | 15,365,206 |

| Flex Ltd (a) | | 313,100 | 12,019,909 |

| Jabil Inc | | 40,474 | 5,824,209 |

| OSI Systems Inc (a) | | 31,316 | 5,243,237 |

| | | | 48,756,376 |

| Semiconductors & Semiconductor Equipment - 2.5% | | | |

| First Solar Inc (a) | | 32,900 | 5,798,296 |

| MKS Instruments Inc | | 137,200 | 14,322,308 |

| Semtech Corp (a) | | 79,800 | 4,935,630 |

| Teradyne Inc | | 82,000 | 10,325,440 |

| Universal Display Corp | | 21,700 | 3,172,540 |

| | | | 38,554,214 |

| Software - 1.0% | | | |

| Appfolio Inc Class A (a) | | 5,100 | 1,258,272 |

| Informatica Inc Class A (a) | | 154,200 | 3,998,406 |

| Manhattan Associates Inc (a) | | 18,200 | 4,918,368 |

| Monday.com Ltd (a) | | 20,500 | 4,826,520 |

| | | | 15,001,566 |

| Technology Hardware, Storage & Peripherals - 0.2% | | | |

| Western Digital Corp (a) | | 72,400 | 4,317,212 |

TOTAL INFORMATION TECHNOLOGY | | | 116,859,200 |

| | | | |

| Materials - 4.6% | | | |

| Chemicals - 1.8% | | | |

| Axalta Coating Systems Ltd (a) | | 410,800 | 14,057,576 |

| Element Solutions Inc | | 565,500 | 14,380,665 |

| | | | 28,438,241 |

| Construction Materials - 0.5% | | | |

| Martin Marietta Materials Inc | | 14,600 | 7,540,900 |

| Containers & Packaging - 2.3% | | | |

| AptarGroup Inc | | 119,600 | 18,789,160 |

| Avery Dennison Corp | | 44,000 | 8,233,720 |

| International Paper Co | | 163,700 | 8,810,334 |

| | | | 35,833,214 |

TOTAL MATERIALS | | | 71,812,355 |

| | | | |

| Real Estate - 6.5% | | | |

| Health Care REITs - 1.2% | | | |

| Omega Healthcare Investors Inc | | 161,100 | 6,097,635 |

| Ventas Inc | | 222,200 | 13,085,358 |

| | | | 19,182,993 |

| Industrial REITs - 1.3% | | | |

| EastGroup Properties Inc | | 75,800 | 12,165,142 |

| Terreno Realty Corp | | 138,000 | 8,161,320 |

| | | | 20,326,462 |

| Real Estate Management & Development - 0.4% | | | |

| Jones Lang LaSalle Inc (a) | | 25,800 | 6,531,012 |

| Residential REITs - 0.7% | | | |

| Invitation Homes Inc | | 208,700 | 6,672,139 |

| Sun Communities Inc | | 32,000 | 3,935,040 |

| | | | 10,607,179 |

| Retail REITs - 1.5% | | | |

| Acadia Realty Trust | | 454,700 | 10,985,552 |

| Agree Realty Corp | | 108,600 | 7,650,870 |

| Macerich Co/The | | 223,500 | 4,452,120 |

| | | | 23,088,542 |

| Specialized REITs - 1.4% | | | |

| Four Corners Property Trust Inc | | 312,500 | 8,481,250 |

| Lamar Advertising Co Class A | | 105,600 | 12,855,744 |

| | | | 21,336,994 |

TOTAL REAL ESTATE | | | 101,073,182 |

| | | | |

| Utilities - 3.4% | | | |

| Electric Utilities - 0.7% | | | |

| PG&E Corp | | 525,000 | 10,594,500 |

| Gas Utilities - 0.2% | | | |

| Southwest Gas Holdings Inc | | 54,400 | 3,846,624 |

| Independent Power and Renewable Electricity Producers - 1.3% | | | |

| AES Corp/The | | 541,900 | 6,974,253 |

| Vistra Corp | | 90,000 | 12,408,300 |

| | | | 19,382,553 |

| Multi-Utilities - 0.6% | | | |

| CenterPoint Energy Inc | | 141,500 | 4,489,795 |

| NorthWestern Corp | | 102,400 | 5,474,304 |

| | | | 9,964,099 |

| Water Utilities - 0.6% | | | |

| Essential Utilities Inc | | 237,900 | 8,640,528 |

TOTAL UTILITIES | | | 52,428,304 |

| | | | |

| TOTAL UNITED STATES | | | 1,409,478,490 |

| TOTAL COMMON STOCKS (Cost $1,161,903,053) | | | 1,547,485,234 |

| | | | |

| Money Market Funds - 1.7% |

| | | Yield (%) | Shares | Value ($) |

| Fidelity Cash Central Fund (c) | | 4.36 | 5,336,351 | 5,337,418 |

| Fidelity Securities Lending Cash Central Fund (c)(d) | | 4.35 | 21,100,290 | 21,102,400 |

| TOTAL MONEY MARKET FUNDS (Cost $26,439,818) | | | | 26,439,818 |

| | | | | |

| TOTAL INVESTMENT IN SECURITIES - 101.4% (Cost $1,188,342,871) | 1,573,925,052 |

NET OTHER ASSETS (LIABILITIES) - (1.4)% | (21,945,013) |

| NET ASSETS - 100.0% | 1,551,980,039 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | Shares, end of period | % ownership, end of period |

| Fidelity Cash Central Fund | 10,232,493 | 365,701,320 | 370,596,039 | 1,078,359 | (355) | (1) | 5,337,418 | 5,336,351 | 0.0% |

| Fidelity Securities Lending Cash Central Fund | 42,433,562 | 277,233,862 | 298,565,024 | 343,965 | - | - | 21,102,400 | 21,100,290 | 0.1% |

| Total | 52,666,055 | 642,935,182 | 669,161,063 | 1,422,324 | (355) | (1) | 26,439,818 | 26,436,641 | |

| | | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of December 31, 2024, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Common Stocks | | | | |

Communication Services | 28,614,218 | 28,614,218 | - | - |

Consumer Discretionary | 191,338,971 | 191,338,971 | - | - |

Consumer Staples | 76,780,454 | 76,780,454 | - | - |

Energy | 92,338,657 | 92,338,657 | - | - |

Financials | 311,710,743 | 311,710,743 | - | - |

Health Care | 181,276,029 | 181,276,029 | - | - |

Industrials | 278,215,441 | 278,215,441 | - | - |

Information Technology | 152,127,873 | 152,127,873 | - | - |

Materials | 81,581,362 | 81,581,362 | - | - |

Real Estate | 101,073,182 | 101,073,182 | - | - |

Utilities | 52,428,304 | 52,428,304 | - | - |

|

| Money Market Funds | 26,439,818 | 26,439,818 | - | - |

| Total Investments in Securities: | 1,573,925,052 | 1,573,925,052 | - | - |

Financial Statements

| Statement of Assets and Liabilities |

As of December 31, 2024 |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $20,991,838) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $1,161,903,053) | $ | 1,547,485,234 | | |

Fidelity Central Funds (cost $26,439,818) | | 26,439,818 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $1,188,342,871) | | | $ | 1,573,925,052 |

| Foreign currency held at value (cost $26,837) | | | | 26,305 |

| Receivable for investments sold | | | | 45,761 |

| Receivable for fund shares sold | | | | 531,381 |

| Dividends receivable | | | | 1,023,518 |

| Distributions receivable from Fidelity Central Funds | | | | 48,927 |

| Prepaid expenses | | | | 1,336 |

| Other receivables | | | | 26,579 |

Total assets | | | | 1,575,628,859 |

| Liabilities | | | | |

| Payable to custodian bank | $ | 87 | | |

| Payable for investments purchased | | 149,224 | | |

| Payable for fund shares redeemed | | 1,103,413 | | |

| Accrued management fee | | 916,584 | | |

| Distribution and service plan fees payable | | 326,931 | | |

| Other payables and accrued expenses | | 50,181 | | |

| Collateral on securities loaned | | 21,102,400 | | |

| Total liabilities | | | | 23,648,820 |

| Net Assets | | | $ | 1,551,980,039 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 1,104,067,311 |

| Total accumulated earnings (loss) | | | | 447,912,728 |

| Net Assets | | | $ | 1,551,980,039 |

| | | | | |

| Net Asset Value and Maximum Offering Price | | | | |

| Class A : | | | | |

Net Asset Value and redemption price per share ($764,953,253 ÷ 33,045,168 shares)(a) | | | $ | 23.15 |

| Maximum offering price per share (100/94.25 of $23.15) | | | $ | 24.56 |

| Class M : | | | | |

Net Asset Value and redemption price per share ($297,934,182 ÷ 13,450,022 shares)(a) | | | $ | 22.15 |

| Maximum offering price per share (100/96.50 of $22.15) | | | $ | 22.95 |

| Class C : | | | | |

Net Asset Value and offering price per share ($37,225,338 ÷ 2,025,554 shares)(a) | | | $ | 18.38 |

| Class I : | | | | |

Net Asset Value, offering price and redemption price per share ($360,932,816 ÷ 14,826,853 shares) | | | $ | 24.34 |

| Class Z : | | | | |

Net Asset Value, offering price and redemption price per share ($90,934,450 ÷ 3,740,841 shares) | | | $ | 24.31 |

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| Statement of Operations |

| Year ended December 31, 2024 |

| Investment Income | | | | |

| Dividends | | | $ | 16,071,649 |

| Income from Fidelity Central Funds (including $343,965 from security lending) | | | | 1,422,324 |

| Total income | | | | 17,493,973 |

| Expenses | | | | |

| Management fee | $ | 10,002,231 | | |

| Transfer agent fees | | 412,402 | | |

| Distribution and service plan fees | | 3,739,963 | | |

| Accounting fees | | 65,359 | | |

| Custodian fees and expenses | | 25,021 | | |

| Independent trustees' fees and expenses | | 6,470 | | |

| Registration fees | | 98,243 | | |

| Audit fees | | 71,656 | | |

| Legal | | 11,267 | | |

| Miscellaneous | | 38,530 | | |

| Total expenses before reductions | | 14,471,142 | | |

| Expense reductions | | (64,924) | | |

| Total expenses after reductions | | | | 14,406,218 |

| Net Investment income (loss) | | | | 3,087,755 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | 157,531,142 | | |

| Redemptions in-kind | | 89,755,821 | | |

| Fidelity Central Funds | | (355) | | |

| Foreign currency transactions | | (37,420) | | |

| Total net realized gain (loss) | | | | 247,249,188 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers | | (19,203,845) | | |

| Fidelity Central Funds | | (1) | | |

| Assets and liabilities in foreign currencies | | (6,660) | | |

| Total change in net unrealized appreciation (depreciation) | | | | (19,210,506) |

| Net gain (loss) | | | | 228,038,682 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 231,126,437 |

| Statement of Changes in Net Assets |

| |

| | Year ended December 31, 2024 | | Year ended December 31, 2023 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 3,087,755 | $ | 2,839,155 |

| Net realized gain (loss) | | 247,249,188 | | 65,642,240 |

| Change in net unrealized appreciation (depreciation) | | (19,210,506) | | 117,750,989 |

| Net increase (decrease) in net assets resulting from operations | | 231,126,437 | | 186,232,384 |

| Distributions to shareholders | | (103,421,668) | | (36,429,267) |

| | | | | |

| Share transactions - net increase (decrease) | | 19,479,270 | | (75,406,965) |

| Total increase (decrease) in net assets | | 147,184,039 | | 74,396,152 |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,404,796,000 | | 1,330,399,848 |

| End of period | $ | 1,551,980,039 | $ | 1,404,796,000 |

| | | | | |

| | | | | |

Financial Highlights

Fidelity Advisor® Mid Cap II Fund Class A |

| |

| Years ended December 31, | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 21.21 | $ | 18.98 | $ | 23.56 | $ | 22.59 | $ | 19.31 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | .04 | | .04 | | .04 | | .03 | | .01 |

| Net realized and unrealized gain (loss) | | 3.49 | | 2.74 | | (3.54) | | 5.40 | | 3.52 |

| Total from investment operations | | 3.53 | | 2.78 | | (3.50) | | 5.43 | | 3.53 |

| Distributions from net investment income | | (.05) | | (.04) | | (.02) | | (.01) | | (.03) |

| Distributions from net realized gain | | (1.55) | | (.51) | | (1.06) | | (4.46) | | (.22) |

| Total distributions | | (1.59) C | | (.55) | | (1.08) | | (4.46) C | | (.25) |

| Net asset value, end of period | $ | 23.15 | $ | 21.21 | $ | 18.98 | $ | 23.56 | $ | 22.59 |

Total Return D,E | | | | 14.70% | | (15.02)% | | 24.92% | | 18.34% |

Ratios to Average Net Assets B,F,G | | | | | | | | | | |

| Expenses before reductions | | .97% | | 1.01% | | 1.01% | | 1.00% | | 1.05% |

| Expenses net of fee waivers, if any | | | | 1.00% | | 1.01% | | 1.00% | | 1.05% |

| Expenses net of all reductions | | .96% | | 1.00% | | 1.01% | | 1.00% | | 1.04% |

| Net investment income (loss) | | .19% | | .19% | | .17% | | .11% | | .06% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 764,953 | $ | 698,537 | $ | 651,156 | $ | 828,601 | $ | 674,103 |

Portfolio turnover rate H | | | | 47% | | 34% | | 42% | | 43% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal distributions per share do not sum due to rounding.

DTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

ETotal returns do not include the effect of the sales charges.

FFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

GExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

HAmount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs), derivatives or securities that mature within one year from acquisition.

IPortfolio turnover rate excludes securities received or delivered in-kind.

Fidelity Advisor® Mid Cap II Fund Class M |

| |

| Years ended December 31, | | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

Selected Per-Share Data | | | | | | | | | | |

| Net asset value, beginning of period | $ | 20.37 | $ | 18.26 | $ | 22.74 | $ | 21.94 | $ | 18.78 |

| Income from Investment Operations | | | | | | | | | | |

Net investment income (loss) A,B | | (.01) | | (.01) | | (.01) | | (.03) | | (.03) |

| Net realized and unrealized gain (loss) | | 3.34 | | 2.63 | | (3.41) | | 5.23 | | 3.41 |

| Total from investment operations | | 3.33 | | 2.62 | | (3.42) | | 5.20 | | 3.38 |

| Distributions from net realized gain | | (1.55) | | (.51) | | (1.06) | | (4.40) | | (.22) |

| Total distributions | | (1.55) | | (.51) | | (1.06) | | (4.40) | | (.22) |

| Net asset value, end of period | $ | 22.15 | $ | 20.37 | $ | 18.26 | $ | 22.74 | $ | 21.94 |

Total Return C,D | | | | 14.42% | | (15.19)% | | 24.58% | | 18.05% |

Ratios to Average Net Assets B,E,F | | | | | | | | | | |

| Expenses before reductions | | 1.22% | | 1.25% | | 1.25% | | 1.25% | | 1.28% |

| Expenses net of fee waivers, if any | | | | 1.25% | | 1.25% | | 1.25% | | 1.28% |

| Expenses net of all reductions | | 1.21% | | 1.25% | | 1.25% | | 1.25% | | 1.28% |

| Net investment income (loss) | | (.06)% | | (.06)% | | (.07)% | | (.13)% | | (.17)% |

| Supplemental Data | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 297,934 | $ | 276,480 | $ | 268,867 | $ | 347,492 | $ | 308,136 |

Portfolio turnover rate G | | | | 47% | | 34% | | 42% | | 43% |

ACalculated based on average shares outstanding during the period.

BNet investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

CTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

DTotal returns do not include the effect of the sales charges.

EFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.