Exhibit 99.1

Investor Presentation August 2019 Franklin Financial Services Corporation F&M TRUST

Forward Looking Statements Certain statements appearing herein which are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements refer to a future period or periods, reflecting management’s current views as to likely future developments, and use words “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” or similar terms. Because forward-looking statements involve certain risks, uncertainties and other factors over which Franklin Financial Services Corporation has no direct control, actual results could differ materially from those contemplated in such statements. These factors include (but are not limited to) the following: general economic conditions, changes in interest rates, changes in the Corporation’s cost of funds, changes in government monetary policy, changes in government regulation and taxation of financial institutions, changes in the rate of inflation, changes in technology, the intensification of competition within the Corporation’s market area, and other similar factors. We caution readers not to place undue reliance on these forward-looking statements. They only reflect management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in other documents the Corporation files from time to time with the SEC, including the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and any Current Reports on Form 8-K. 2

Overview of Franklin Financial •F&M Trust founded in 1906 •Franklin Financial formed in 1983 •Headquartered in Chambersburg, PA •22 offices throughout Cumberland, Franklin, Fulton and Huntingdon Counties, PA •Total assets of the Company were $1.3 billion as of June 30, 2019 •As of June 30, 2019 Franklin Financial reported $888.7 million in brokerage and trust assets under management 3

The Foundation for Success: Our Beliefs Mission Statement Delivering the right financial solutions … from people you know and trust. Vision Statement We are committed to remaining independent by growing our bank to meet the increasing needs of our customers, communities and shareholders. We will be the financial services leader in the markets we serve. Core Values We, the employees, officers and directors, are committed to the core values of integrity, teamwork, excellence, accountability, and a concern for our customers and the communities we serve. 4

Why Franklin Financial? •A market share leader in core deposit, loan and asset management segments in economically strong and growing markets •Deep management team with extensive banking industry experience mixed with local market knowledge •Consistently strong core operating fundamentals with a diverse revenue mix •Strong capital position, sound risk management and neutral to slightly asset sensitive balance sheet •Commitment to enhancing value for our key stakeholder groups 5

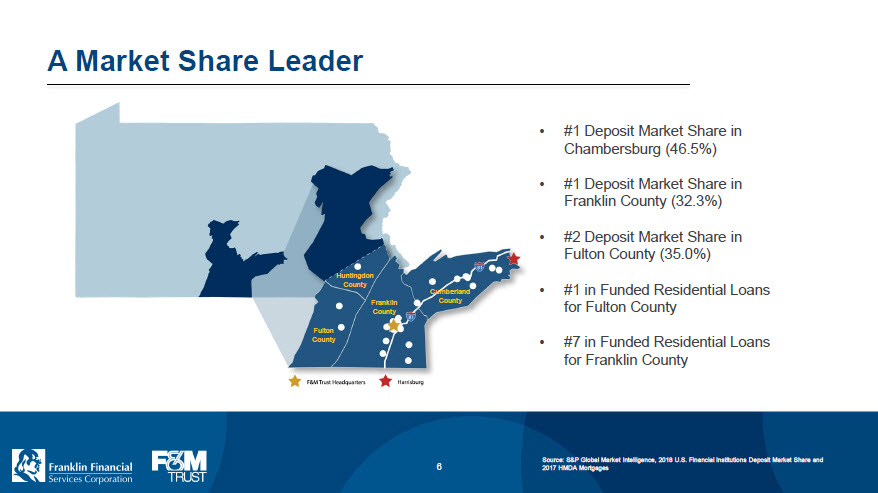

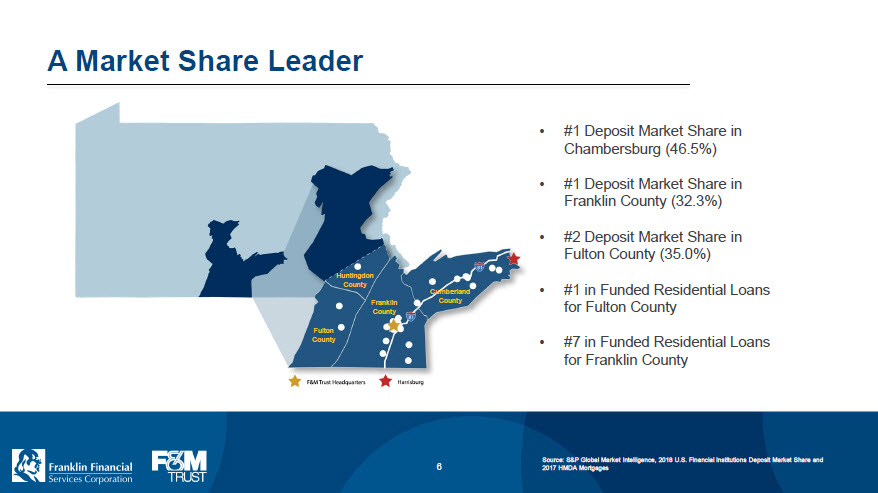

A Market Share Leader •#1 Deposit Market Share in Chambersburg (46.5%) •#1 Deposit Market Share in Franklin County (32.3%) •#2 Deposit Market Share in Fulton County (35.0%) •#1 in Funded Residential Loans for Fulton County •#7 in Funded Residential Loans for Franklin County Fulton County Franklin County Cumberland County Huntingdon County F&M Trust Headquarters Harrisburg Source: S&P Global Market Intelligence, 2018 U.S. Financial Institutions Deposit Market Share and 2017 HMDA Mortgages 6

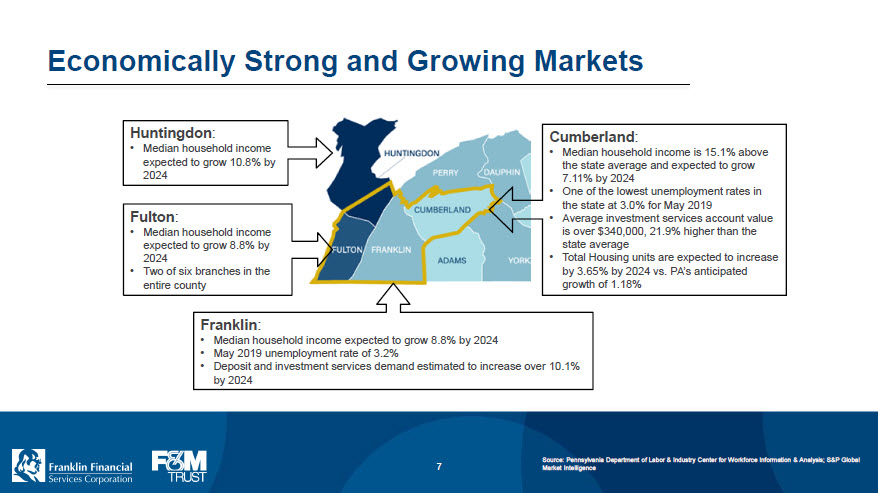

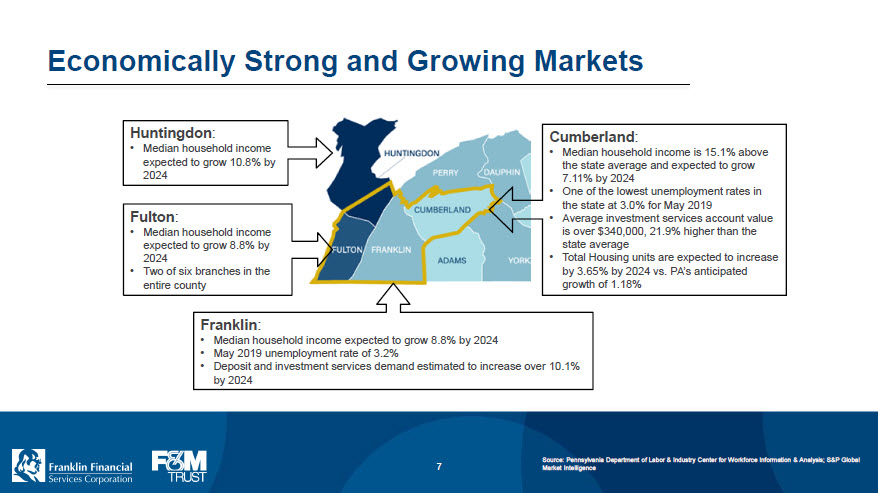

Economically Strong and Growing Markets Huntingdon: •Median household income expected to grow 10.8% by 2024 Fulton: •Median household income expected to grow 8.8% by 2024 •Two of six branches in the entire county Franklin: •Median household income expected to grow 8.8% by 2024 •May 2019 unemployment rate of 3.2% •Deposit and investment services demand estimated to increase over 10.1% by 2024 Cumberland: •Median household income is 15.1% above the state average and expected to grow 7.11% by 2024 •One of the lowest unemployment rates in the state at 3.0% for May 2019 •Average investment services account value is over $340,000, 21.9% higher than the state average •Total Housing units are expected to increase by 3.65% by 2024 vs. PA’s anticipated growth of 1.18% HUNTINGTON PERRY DAUPHIN CUMBERLAND FULTON FRANKLIN ADAMS YORK Source: Pennsylvania Department of Labor & Industry Center for Workforce Information & Analysis; S&P Global Market Intelligence 7

A Deep and Cohesive Management Team Timothy G. Henry President & CEO Mark R. Hollar CFO & Treasurer Lorie Heckman Risk Management Steven D. Butz Commercial Services Susan L. Rosenberg Investment & Trust Services Patricia A. Hanks Retail Services Ronald L. Cekovich Information & Operations Karen K. Carmack Human Resources Matthew D. Weaver Marketing & Communications 8

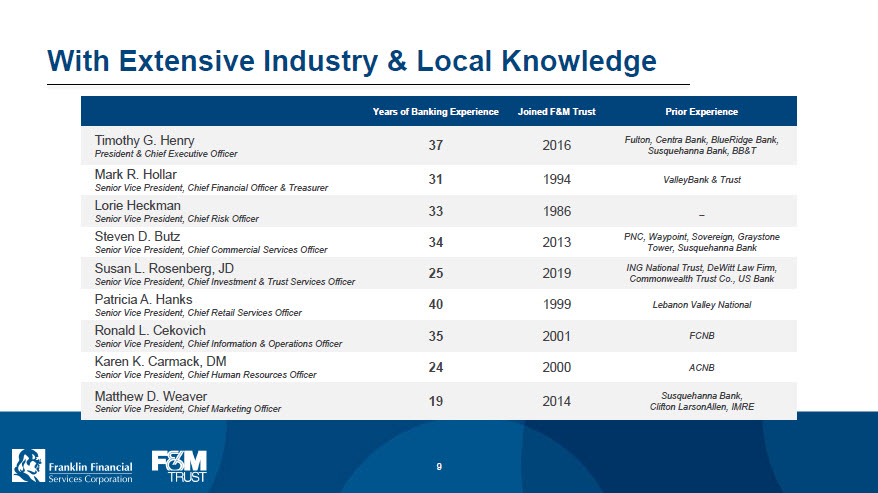

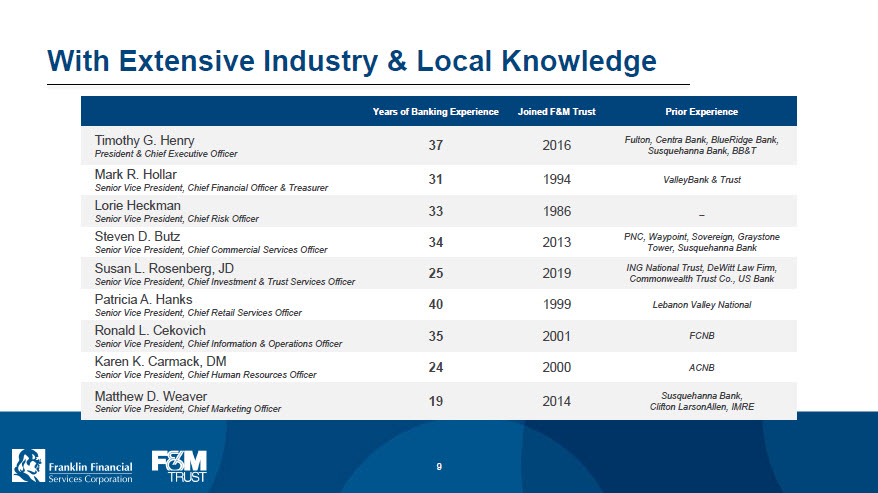

With Extensive Industry & Local Knowledge Years of Banking Experience Joined F&M Trust Prior Experience Timothy G. Henry President & Chief Executive Officer 37 2016 Fulton, Centra Bank, BlueRidge Bank, Susquehanna Bank, BB&T Mark R. Hollar Senior Vice President, Chief Financial Officer & Treasurer 31 1994 ValleyBank & Trust Lorie Heckman Senior Vice President, Chief Risk Officer 33 1986 _ Steven D. Butz Senior Vice President, Chief Commercial Services Officer 34 2013 PNC, Waypoint, Sovereign, Graystone Tower, Susquehanna Bank Susan L. Rosenberg, JD Senior Vice President, Chief Investment & Trust Services Officer 25 2019 ING National Trust, DeWitt Law Firm, Commonwealth Trust Co., US Bank Patricia A. Hanks Senior Vice President, Chief Retail Services Officer 40 1999 Lebanon Valley National Ronald L. Cekovich Senior Vice President, Chief Information & Operations Officer 35 2001 FCNB Karen K. Carmack, DM Senior Vice President, Chief Human Resources Officer 24 2000 ACNB Matthew D. Weaver Senior Vice President, Chief Marketing Officer 19 2014 Susquehanna Bank, Clifton LarsonAllen, IMRE 9

Financial Performance Based On… •Balanced revenue business model •Stable, low cost funding mix and strong liquidity position •A well diversified loan portfolio with an increasing emphasis on small business relationships and a reduction in reliance on participation loans •Strong credit quality metrics •Operating efficiencies from ongoing investments in technology and people 10

YTD Review Through June 30, 2019 •Earnings for the three months ending June 30, 2019 were $4.0 million, which ranks as the second highest quarter of earnings in the Corporation’s history, and $7.2 million for the year-to-date period ended June 30, 2019. •Total cash dividends declared during the first three quarters of 2019 were $0.87 per share compared to $0.78 per share in 2018, an increase of 11.5%. •Net interest income increased 4.6% to $10.6 million and the net interest margin increased five basis points to 3.80%. •Noninterest income increased year-over-year by 14.7% primarily from additional Investment and Trust Services fees and debit card income. •The Company and Bank remained well-capitalized with a total risk-based capital ratio of 15.19% as of December 31, 2018. •Commenced listing of common stock on the Nasdaq Stock Market on May 1, 2019. 11

Strategic Initiatives to Build Shareholder Value Strengthen Brand Recognition and Awareness Enhance Sales and Service Culture Extend Delivery Channels Deepen Customer Relationships 12

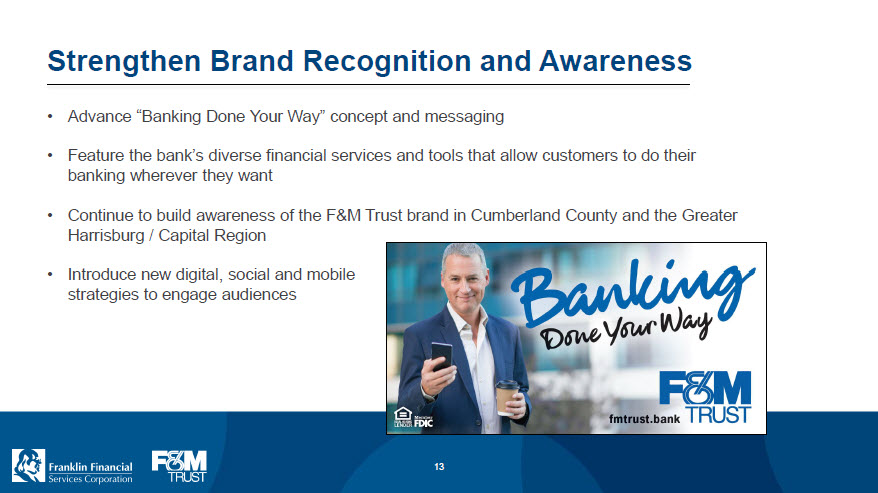

Strengthen Brand Recognition and Awareness •Advance “Banking Done Your Way” concept and messaging •Feature the bank’s diverse financial services and tools that allow customers to do their banking wherever they want •Continue to build awareness of the F&M Trust brand in Cumberland County and the Greater Harrisburg / Capital Region •Introduce new digital, social and mobile strategies to engage audiences 13

Enhance Sales and Service Culture •Integrated process to continue building sales and service culture •Assessment of sales training program showing quantifiable results •Continuation of in-house “Reach for M.O.R.E.” initiative to improve service levels with external and internal customers •Execution of employee engagement initiative intended to strengthen communication between employees and leadership and retain employees ANTHONY COLD TRAINING GROUP, LLC REACH FOR MORE TALENTKEEPERS 14

Extend Delivery Channels •Launched a new website, fmtrust.bank in the fourth quarter of 2018 •The first bank in South Central Pennsylvania to transition to the .bank domain which is a standardized, verified domain for financial institutions •Website is equipped with streamlined menus and simplified navigation and has more resources and information on the bank’s products and services •Introduced “Money Moves”, a new content hub (blog) in July 2019 which provides consumer education and thought leadership content that helps to drive social media engagement and increase search engine traffic fmtrust.bank A NEW SAFER WAY TO BANK F&M TRUST money moves done your way 15

Deepen Customer Relationships •Additional resources across all markets to focus on client support and relationship expansion •Introduction of Deposit Product Officer position reporting to President / CEO intended to coordinate and drive efforts to grow low-cost core deposits across all business lines •Restructured Residential Mortgage and Consumer Lending department with new leadership and increased emphasis on originations to deepen relationships in our core markets and increase fee income from sold mortgages •Enhancing customer experience through office transformations and call center including after business hours support •Successful introduction of Bank@Work program for participating business clients to offer banking services to their employees 16

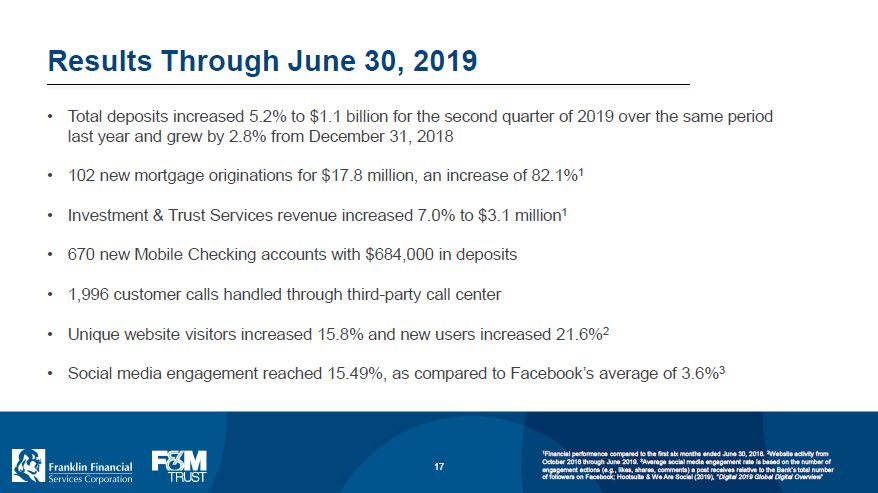

Results Through June 30, 2019 •Total deposits increased 5.2% to $1.1 billion for the second quarter of 2019 over the same period last year and grew by 2.8% from December 31, 2018 •102 new mortgage originations for $17.8 million, an increase of 82.1%1 •Investment & Trust Services revenue increased 7.0% to $3.1 million1 •670 new Mobile Checking accounts with $684,000 in deposits •1,996 customer calls handled through third-party call center •Unique website visitors increased 15.8% and new users increased 21.6%2 •Social media engagement reached 15.49%, as compared to Facebook’s average of 3.6%3 1Financial performance compared to the first six months ended June 30, 2018. 2Website activity from October 2018 through June 2019. 3Average social media engagement rate is based on the number of engagement actions (e.g., likes, shares, comments) a post receives relative to the Bank’s total number of followers on Facebook; Hootsuite & We Are Social (2019), “Digital 2019 Global Digital Overview” 17

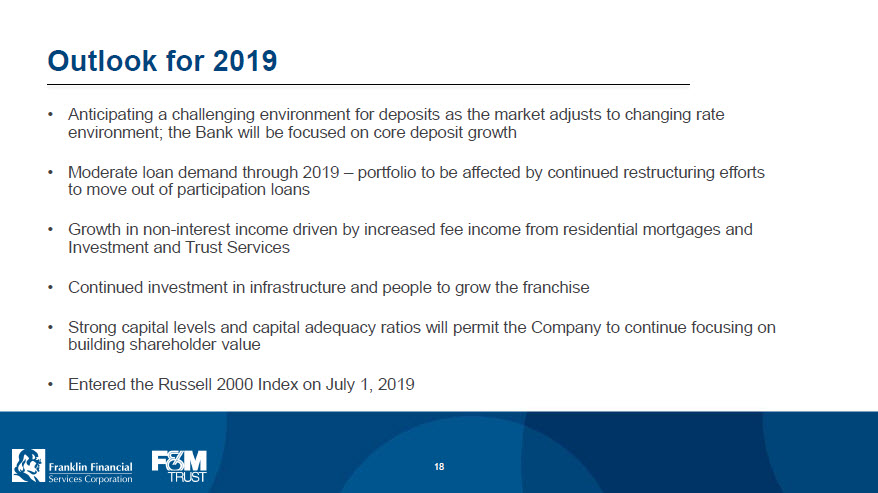

Outlook for 2019 •Anticipating a challenging environment for deposits as the market adjusts to changing rate environment; the Bank will be focused on core deposit growth •Moderate loan demand through 2019 – portfolio to be affected by continued restructuring efforts to move out of participation loans •Growth in non-interest income driven by increased fee income from residential mortgages and Investment and Trust Services •Continued investment in infrastructure and people to grow the franchise •Strong capital levels and capital adequacy ratios will permit the Company to continue focusing on building shareholder value •Entered the Russell 2000 Index on July 1, 2019 18

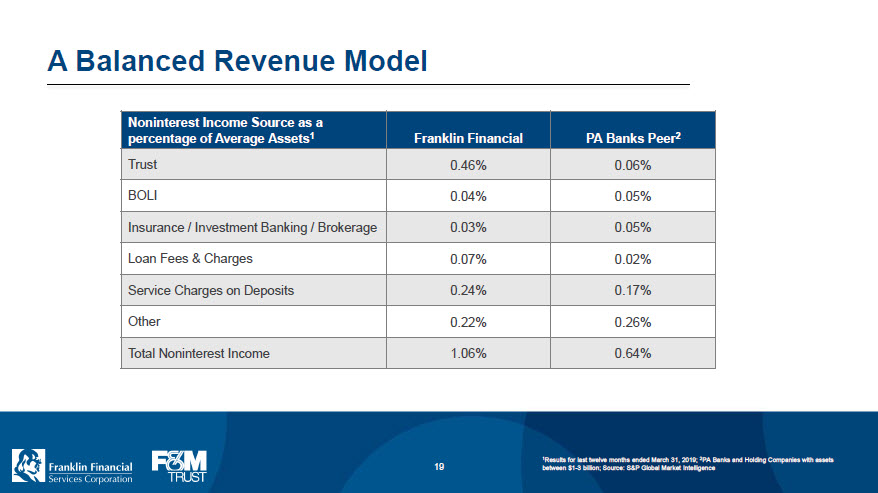

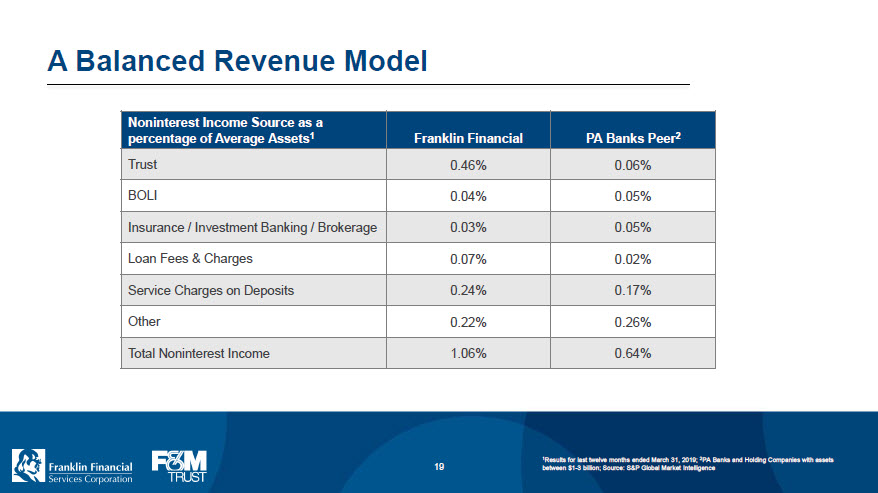

A Balanced Revenue Model Noninterest Income Source as a percentage of Average Assets1 Franklin Financial PA Banks Peer2 Trust 0.46% 0.06% BOLI 0.04% 0.05% Insurance / Investment Banking / Brokerage 0.03% 0.05% Loan Fees & Charges 0.07% 0.02% Service Charges on Deposits 0.24% 0.17% Other 0.22% 0.26% Total Noninterest Income 1.06% 0.64% 1Results for last twelve months ended March 31, 2019; 2PA Banks and Holding Companies with assets between $1-3 billion; Source: S&P Global Market Intelligence 19

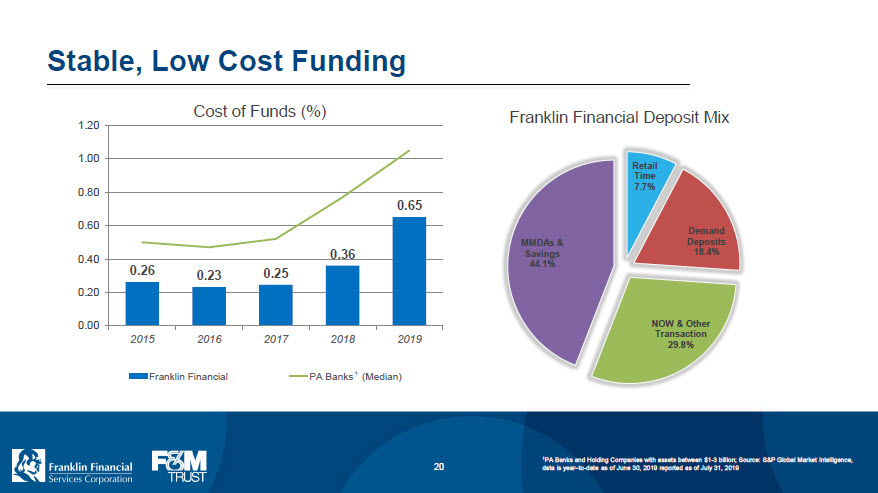

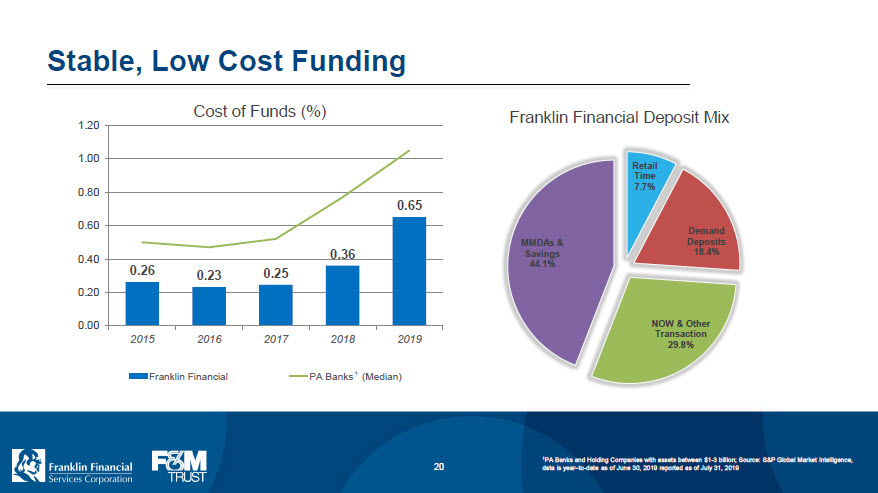

Stable, Low Cost Funding Cost of Funds (%) Franklin Financial PA Banks1 (Median) 0.26 0.23 0.25 0.36 0.65 0.00 0.20 0.40 0.60 0.80 1.00 1.20 2015 2016 2017 2018 2019 Franklin Financial Deposit Mix Retail Time 7.7% Demand Deposits 18.4% NOW & Other Transaction 29.8% MMDAs & Savings 44.1% 1PA Banks and Holding Companies with assets between $1-3 billion; Source: S&P Global Market Intelligence, data is year–to-date as of June 30, 2019 reported as of July 31, 2019 20

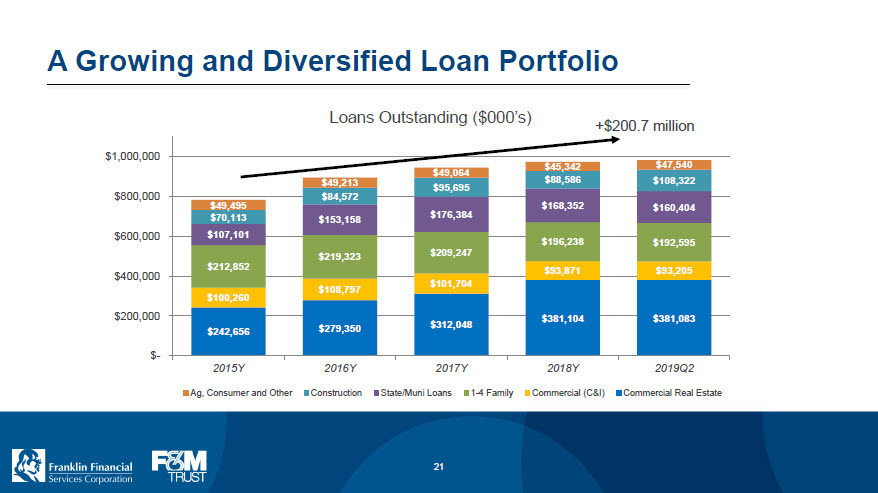

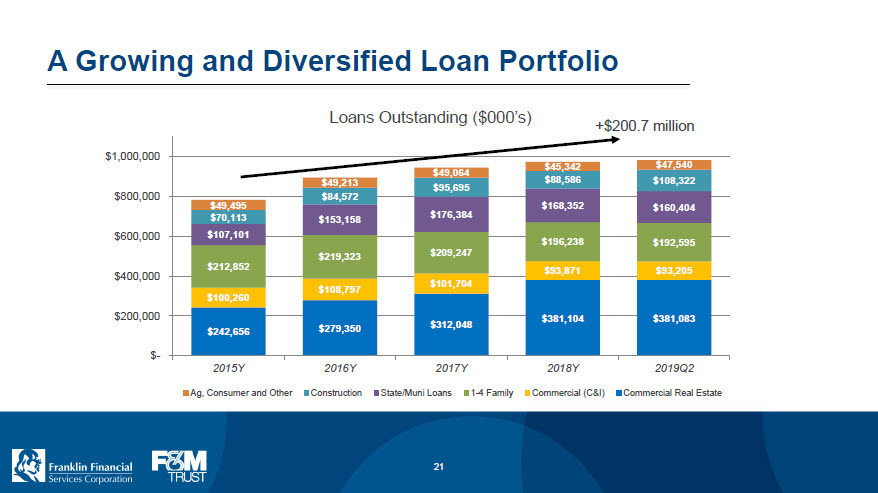

A Growing and Diversified Loan Portfolio Loans Outstanding ($000’s) +$200.7 million $242,656 $279,350 $312,048 $381,104 $381,083 $100,260 $108,797 $101,704 $93,871 $93,205 $212,852 $219,323 $209,247 $196,238 $192,595 $107,101 $153,158 $176,384 $168,352 $160,404 $70,113 $84,572 $95,695 $88,586 $108,322 $49,495 $49,213 $49,064 $45,342 $47,540 $- $200,000 $400,000 $600,000 $800,000 $1,000,000 2015Y 2016Y 2017Y 2018Y 2019Q2 Ag, Consumer and Other Construction State/Muni Loans 1-4 Family Commercial (C&I) Commercial Real Estate 21

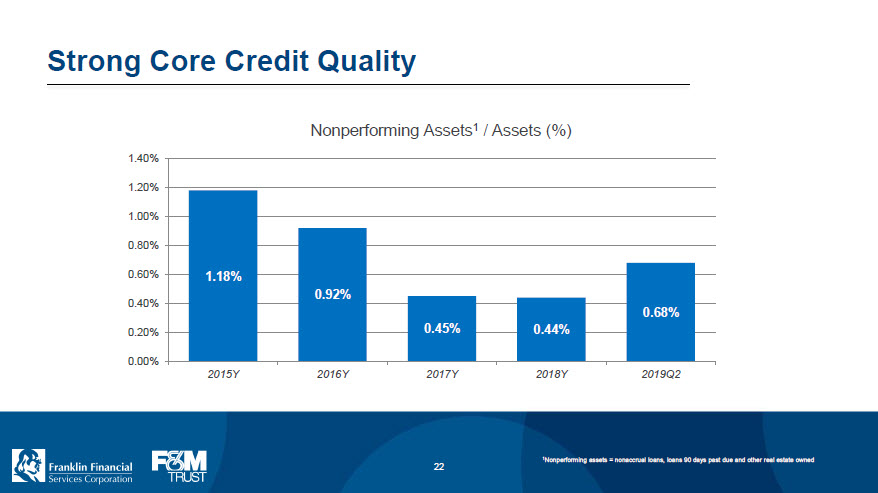

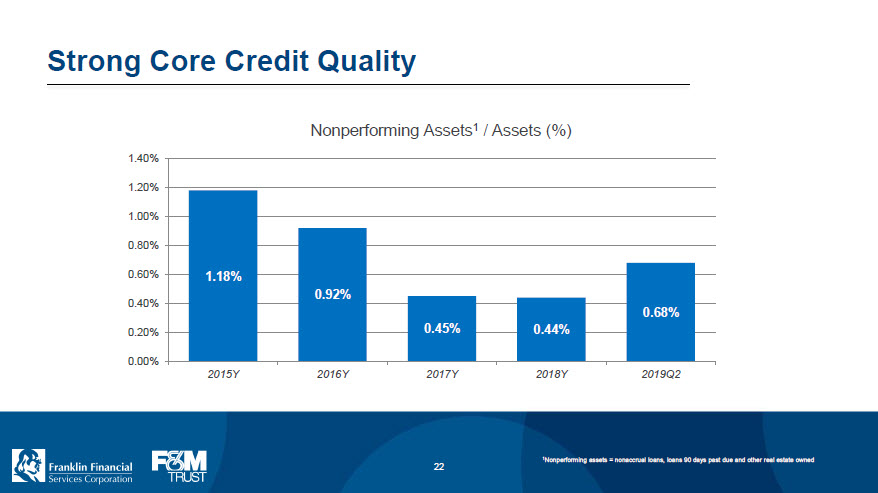

Strong Core Credit Quality Nonperforming Assets1 / Assets (%) 1.18% 0.92% 0.45% 0.44% 0.68% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 2015Y 2016Y 2017Y 2018Y 2019Q2 1Nonperforming assets = nonaccrual loans, loans 90 days past due and other real estate owned 22

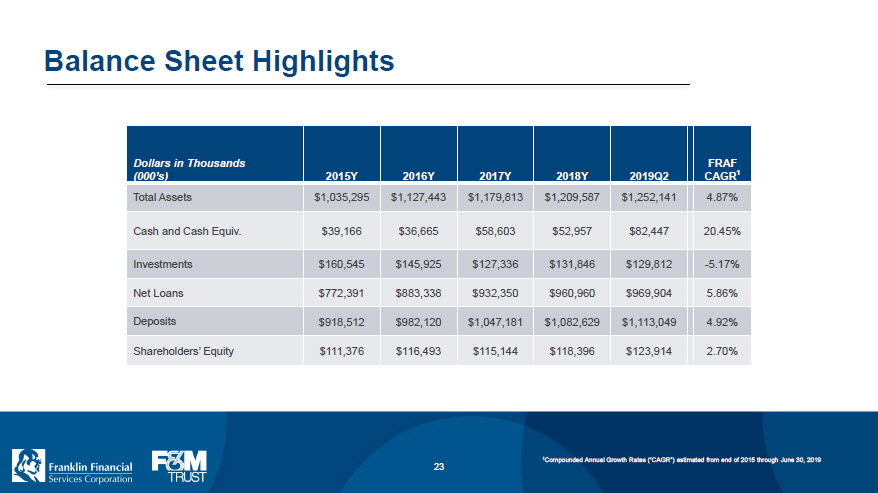

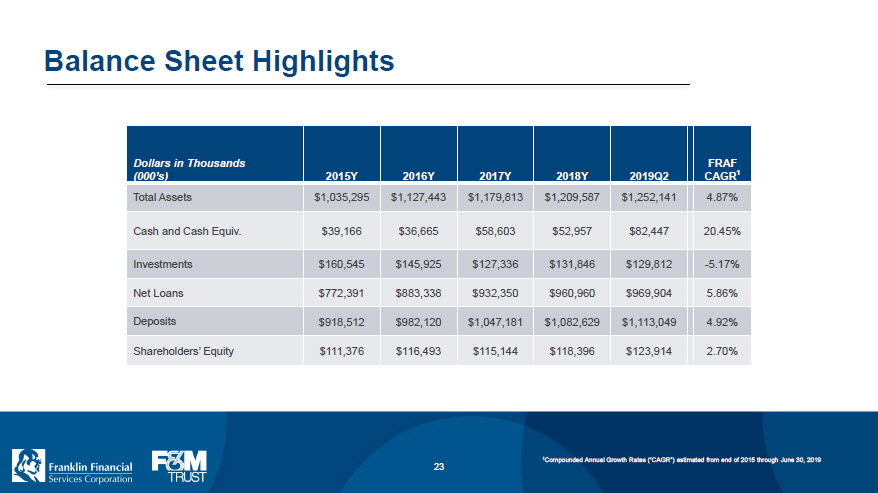

Balance Sheet Highlights Dollars in Thousands (000’s) 2015Y 2016Y 2017Y 2018Y 2019Q2 FRAF CAGR1 Total Assets $1,035,295 $1,127,443 $1,179,813 $1,209,587 $1,252,141 4.87% Cash and Cash Equiv. $39,166 $36,665 $58,603 $52,957 $82,447 20.45% Investments $160,545 $145,925 $127,336 $131,846 $129,812 -5.17% Net Loans $772,391 $883,338 $932,350 $960,960 $969,904 5.86% Deposits $918,512 $982,120 $1,047,181 $1,082,629 $1,113,049 4.92% Shareholders’ Equity $111,376 $116,493 $115,144 $118,396 $123,914 2.70% 1Compounded Annual Growth Rates (“CAGR”) estimated from end of 2015 through June 30, 2019 23

Income Statement Highlights Dollars in Thousands (000’s) 2015Y 2016Y 2017Y 2018Y 2019Q2 FRAF CAGR1 Interest Income $34,615 $36,979 $39,885 $44,868 $24,383 8.95% Interest Expense $2,371 $2,245 $2,491 $4,214 $3,493 31.02% Noninterest Income2 $11,630 $11,578 $12,212 $12,564 $6,593 3.19% Noninterest Expense $31,104 $33,206 $43,198 $37,369 $19,017 5.16% Net Income $10,204 $8,087 $2,176 $6,125 $7,221 9.07% 1Compounded Annual Growth Rates (“CAGR”) estimated from end of 2015 through June 30, 2019; 2Excludes securities gains 24

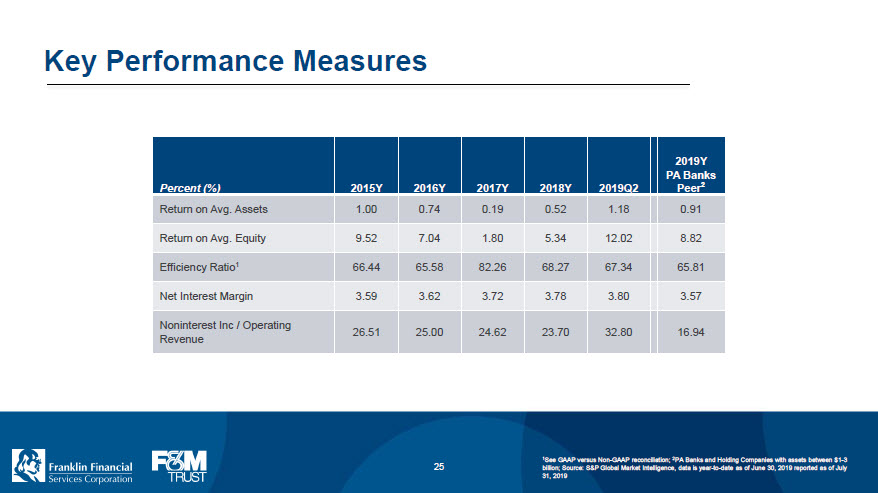

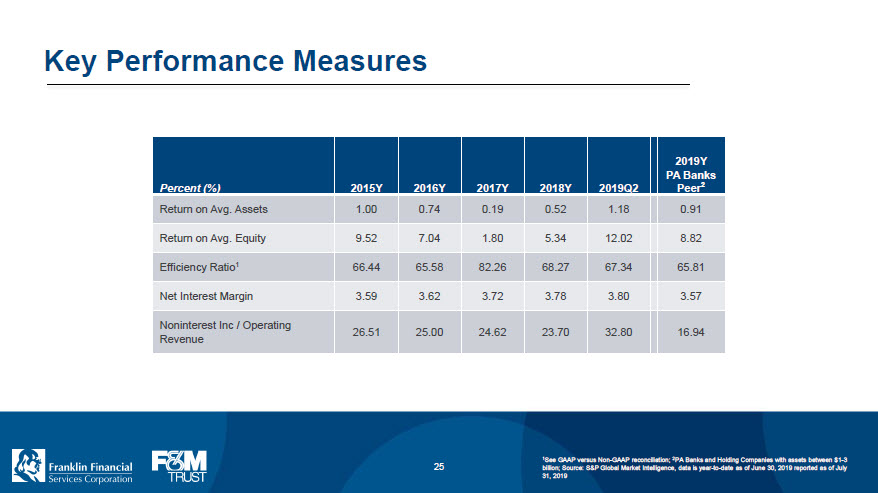

Key Performance Measures Percent (%) 2015Y 2016Y 2017Y 2018Y 2019Q2 2019Y PA Banks Peer2 Return on Avg. Assets 1.00 0.74 0.19 0.52 1.18 0.91 Return on Avg. Equity 9.52 7.04 1.80 5.34 12.02 8.82 Efficiency Ratio1 66.44 65.58 82.26 68.27 67.34 65.81 Net Interest Margin 3.59 3.62 3.72 3.78 3.80 3.57 Noninterest Inc / Operating Revenue 26.51 25.00 24.62 23.70 32.80 16.94 1See GAAP versus Non-GAAP reconciliation; 2PA Banks and Holding Companies with assets between $1-3 billion; Source: S&P Global Market Intelligence, data is year-to-date as of June 30, 2019 reported as of July 31, 2019 25

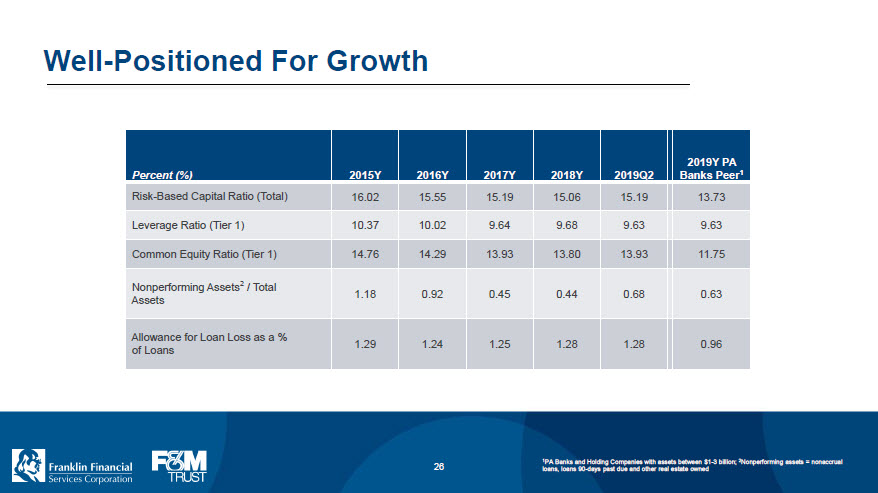

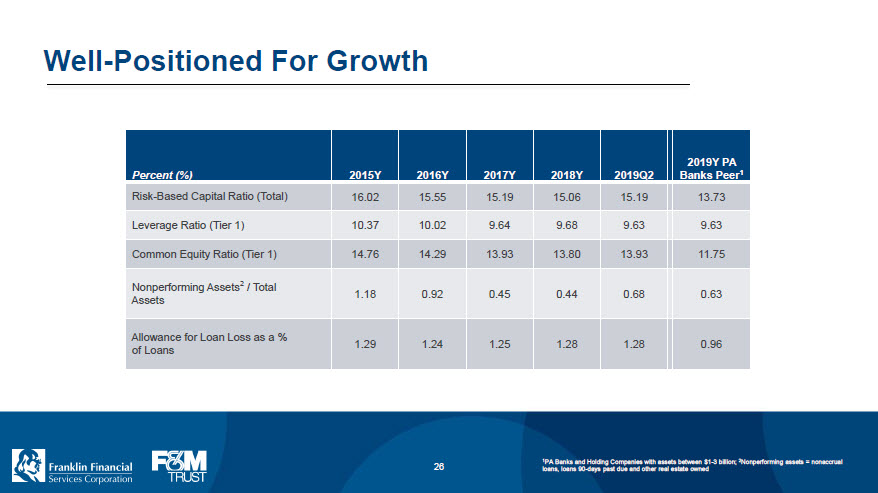

Well-Positioned For Growth Percent (%) 2015Y 2016Y 2017Y 2018Y 2019Q2 2019Y PA Banks Peer1 Risk-Based Capital Ratio (Total) 16.02 15.55 15.19 15.06 15.19 13.73 Leverage Ratio (Tier 1) 10.37 10.02 9.64 9.68 9.63 9.63 Common Equity Ratio (Tier 1) 14.76 14.29 13.93 13.80 13.93 11.75 Nonperforming Assets2 / Total Assets 1.18 0.92 0.45 0.44 0.68 0.63 Allowance for Loan Loss as a % of Loans 1.29 1.24 1.25 1.28 1.28 0.96 1PA Banks and Holding Companies with assets between $1-3 billion; 2Nonperforming assets = nonaccrual loans, loans 90-days past due and other real estate owned 26

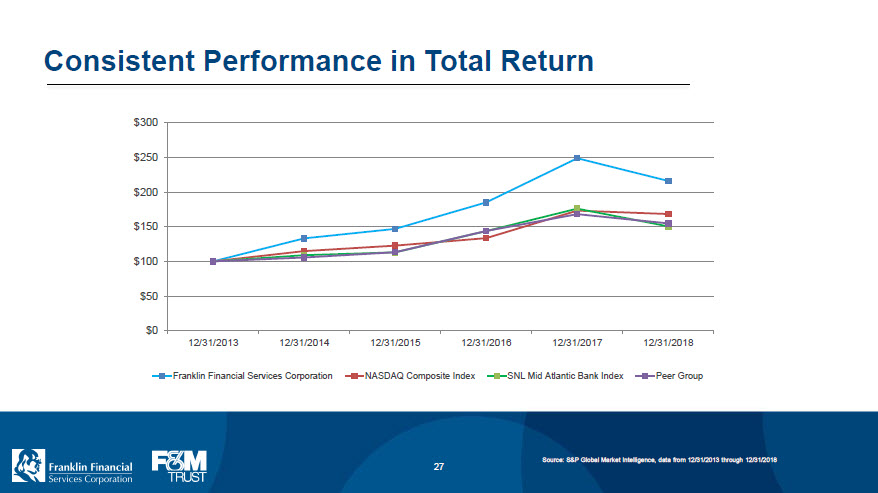

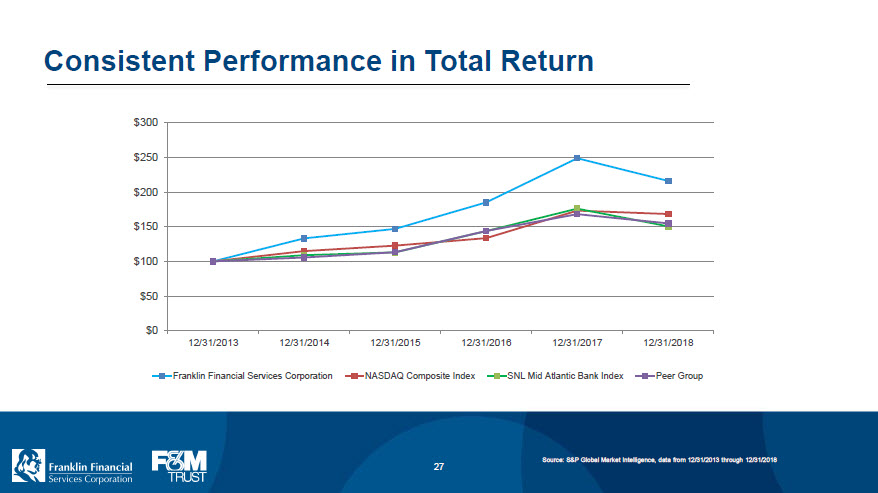

Consistent Performance in Total Return $0 $50 $100 $150 $200 $250 $300 12/31/2013 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 Franklin Financial Services Corporation NASDAQ Composite Index SNL Mid Atlantic Bank Index Peer Group Source: S&P Global Market Intelligence, data from 12/31/2013 through 12/31/2018 27

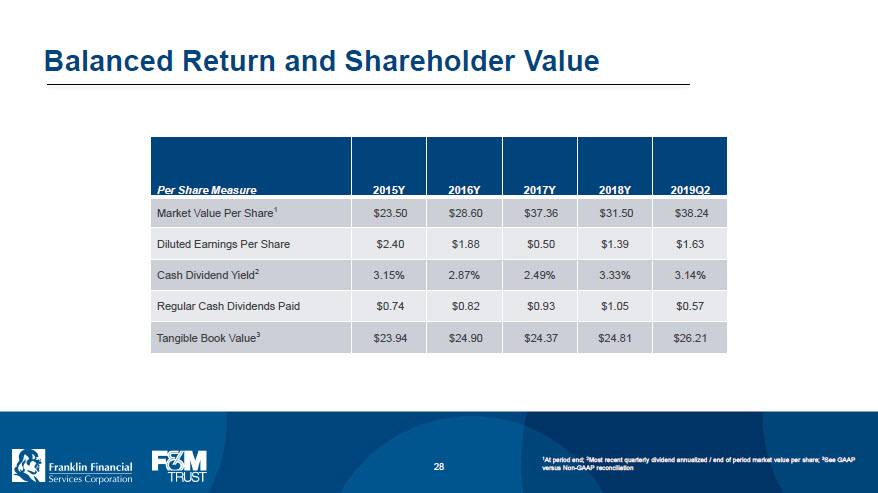

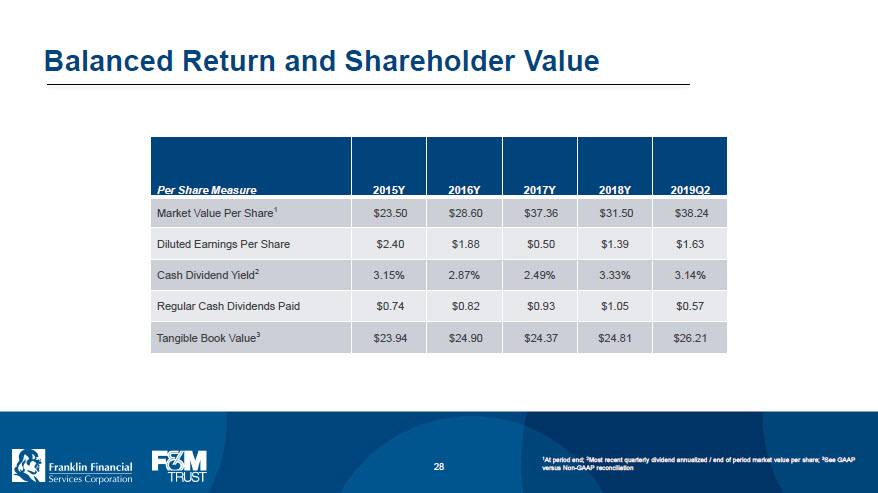

Balanced Return and Shareholder Value Per Share Measure 2015Y 2016Y 2017Y 2018Y 2019Q2 Market Value Per Share1 $23.50 $28.60 $37.36 $31.50 $38.24 Diluted Earnings Per Share $2.40 $1.88 $0.50 $1.39 $1.63 Cash Dividend Yield2 3.15% 2.87% 2.49% 3.33% 3.14% Regular Cash Dividends Paid $0.74 $0.82 $0.93 $1.05 $0.57 Tangible Book Value3 $23.94 $24.90 $24.37 $24.81 $26.21 1At period end; 2Most recent quarterly dividend annualized / end of period market value per share; 3See GAAP versus Non-GAAP reconciliation 28

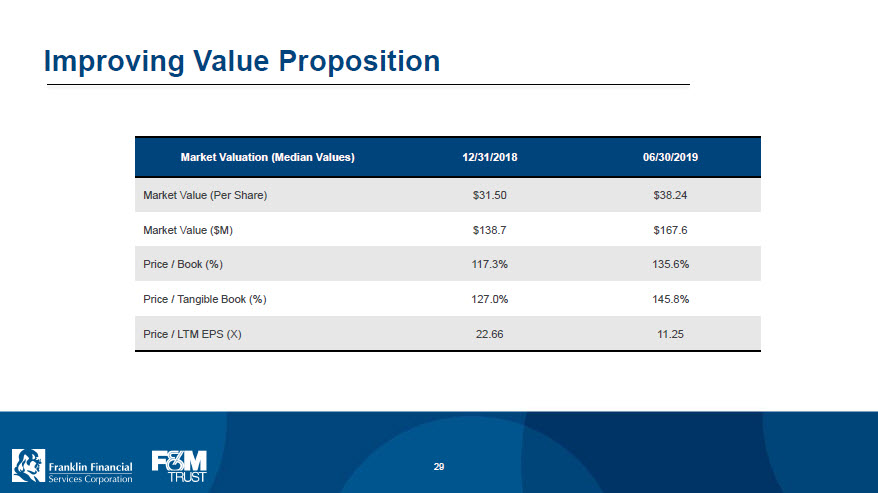

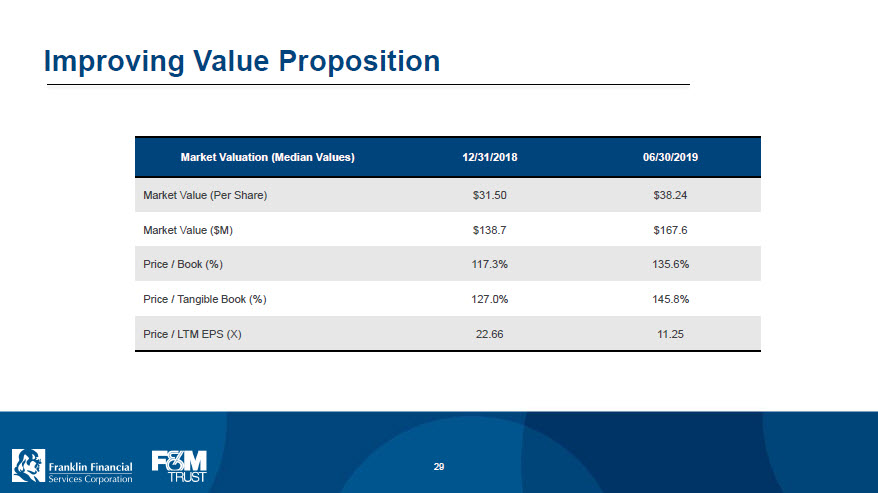

Improving Value Proposition Market Valuation (Median Values) 12/31/2018 06/30/2019 Market Value (Per Share) $31.50 $38.24 Market Value ($M) $138.7 $167.6 Price / Book (%) 117.3% 135.6% Price / Tangible Book (%) 127.0% 145.8% Price / LTM EPS (X) 22.66 11.25 29

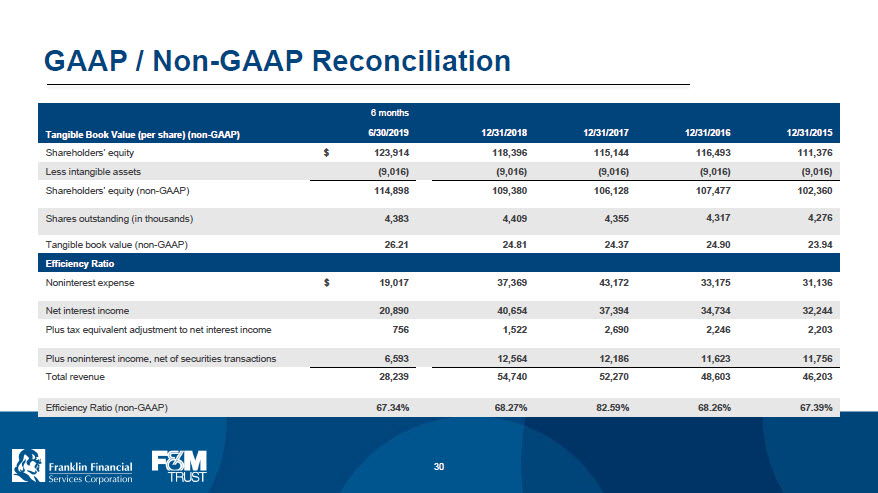

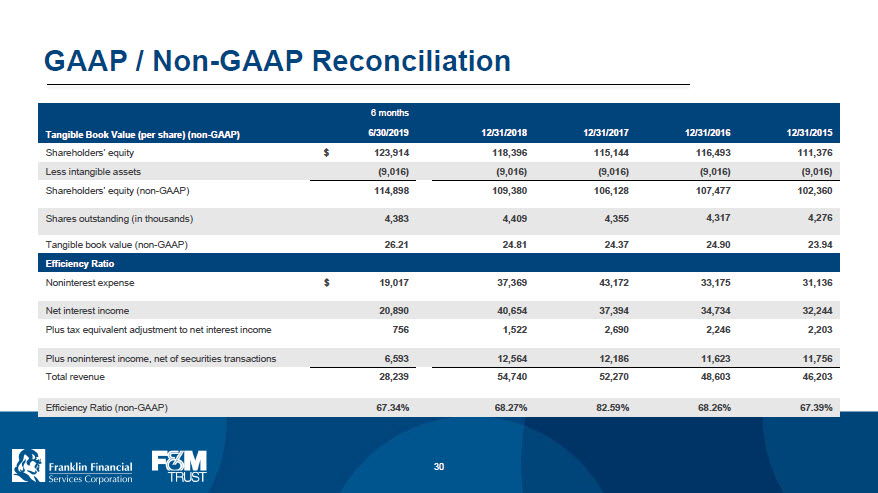

GAAP / Non-GAAP Reconciliation Tangible Book Value (per share) (non-GAAP) 6 months 6/30/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 Shareholders’ equity $ 123,914 118,396 115,144 116,493 111,376 Less intangible assets (9,016) (9,016) (9,016) (9,016) (9,016) Shareholders’ equity (non-GAAP) 114,898 109,380 106,128 107,477 102,360 Shares outstanding (in thousands) 4,383 4,409 4,355 4,317 4,276 Tangible book value (non-GAAP) 26.21 24.81 24.37 24.90 23.94 Efficiency Ratio Noninterest expense $ 19,017 37,369 43,172 33,175 31,136 Net interest income 20,890 40,654 37,394 34,734 32,244 Plus tax equivalent adjustment to net interest income 756 1,522 2,690 2,246 2,203 Plus noninterest income, net of securities transactions 6,593 12,564 12,186 11,623 11,756 Total revenue 28,239 54,740 52,270 48,603 46,203 Efficiency Ratio (non-GAAP) 67.34% 68.27% 82.59% 68.26% 67.39% 30

Thank You Stock Symbol: FRAF (Nasdaq) www.franklinfin.com www.fmtrust.bank 31