Exhibit 99.2

Annual Meeting April 26, 2022 F&M TRUST Franklin Financial Services Corporation

Call to Order G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Invocation Pam Johns F&M TRUST Franklin Financial Services Corporation

Minutes of Last Meeting G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Forward Looking Statements In order to help you to better understand the business of the Company where we have been and where we want to go my remarks today (and those of other Company officers who will speak or respond to questions) will include forward looking statements relating to anticipated financial performance, future operating results, business prospects, new products, and similar matters. These statements represent our best judgment, based upon present circumstances and the information now available to us, of what we think may occur in the future and, of course, it is possible that actual results may differ materially from those we envision today. For a more complete discussion on the subject of forward looking statements, including a list of some of the risk factors that might adversely affect operating results, I refer you to section 1A entitled “Risk Factors” which appears in our annual report on Form 10 K as filed with the Securities and Exchange Commission (SEC). F&M TRUST Franklin Financial Services Corporation

Introduction G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Board of Directors G. Warren Elliott Chairman of the Board Timothy (Tim) G. Henry President & CEO F&M TRUST Franklin Financial Services Corporation

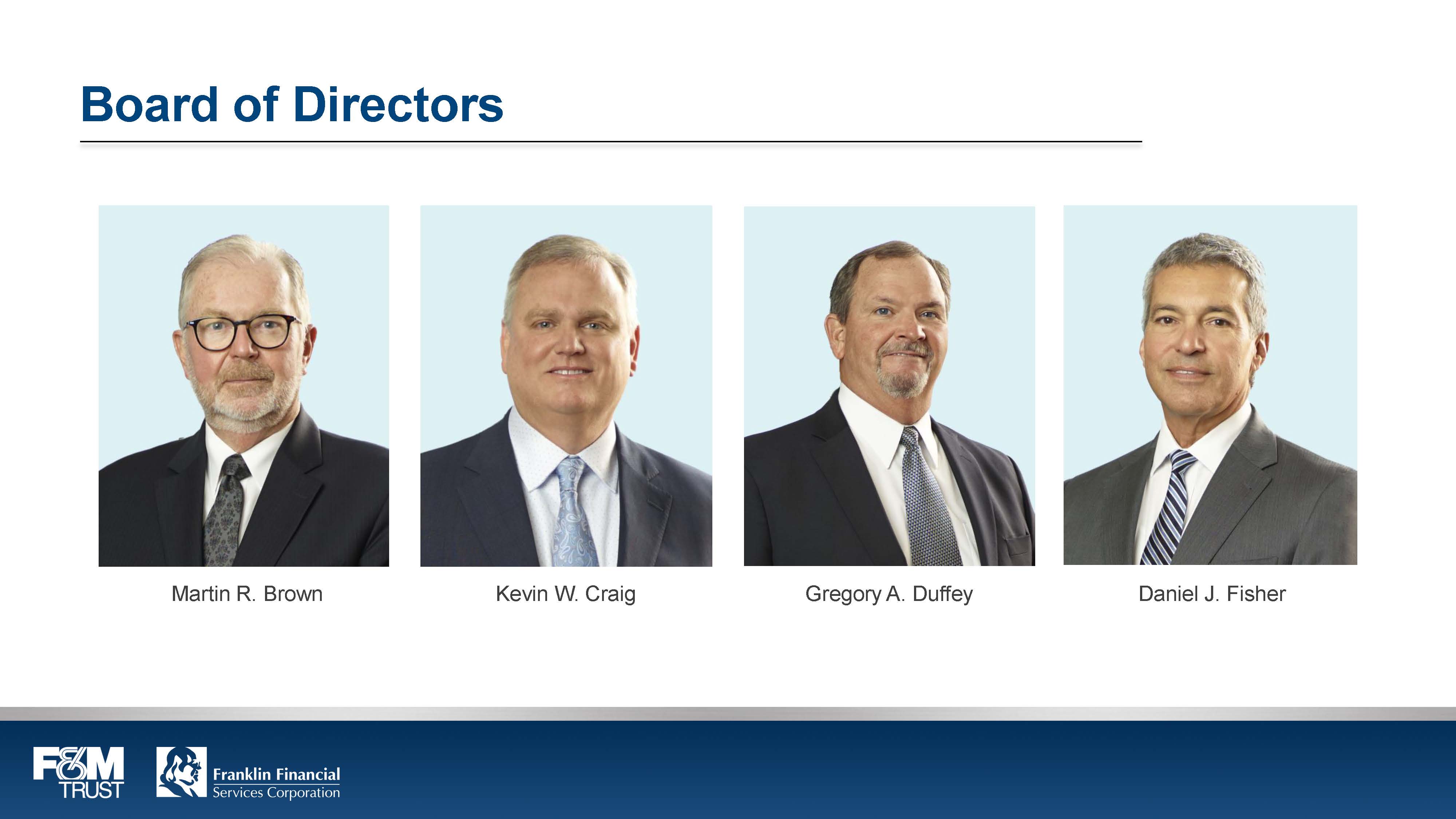

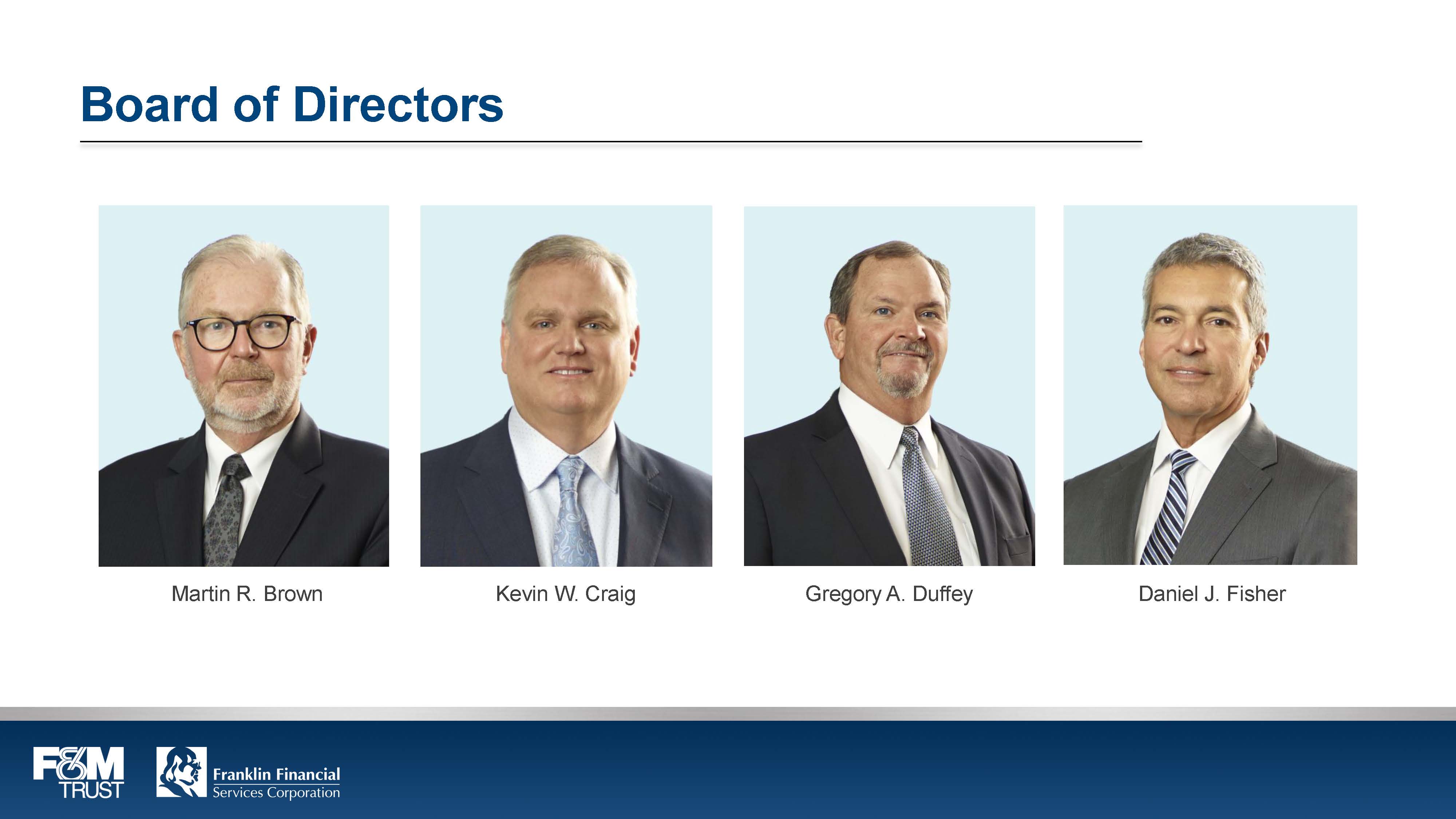

Board of Directors Martin R. Brown Kevin W. Craig Gregory A. Duffey Daniel J. Fisher F&M TRUST Franklin Financial Services Corporation

Board of Directors Allan E. Jennings, Jr. Stanley J.Kerlin Donald H. Mowery Kimberly M. Rzomp F&M TRUST Franklin Financial Services Corporation

Nick Bybel Partner, Bybel Rutledge LLP Zoe Clayton Assistant Corporate Secretary Judge of Elections Sara Dopkin CPA, Crowe F&M TRUST Franklin Financial Services Corporation

Chairman Comments G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

G. Warren Elliott Chairman of the Board F&M TRUST Franklin Financial Services Corporation

Election of Directors G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Martin R. Brown Allan E. Jennings, Jr. Gregory A. Duffey F&M TRUST Franklin Financial Services Corporation

Say On Pay Vote G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Ratification of Auditors G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Polls Open G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Financial Overview Mark R. Hollar, CFO F&M TRUST Franklin Financial Services Corporation

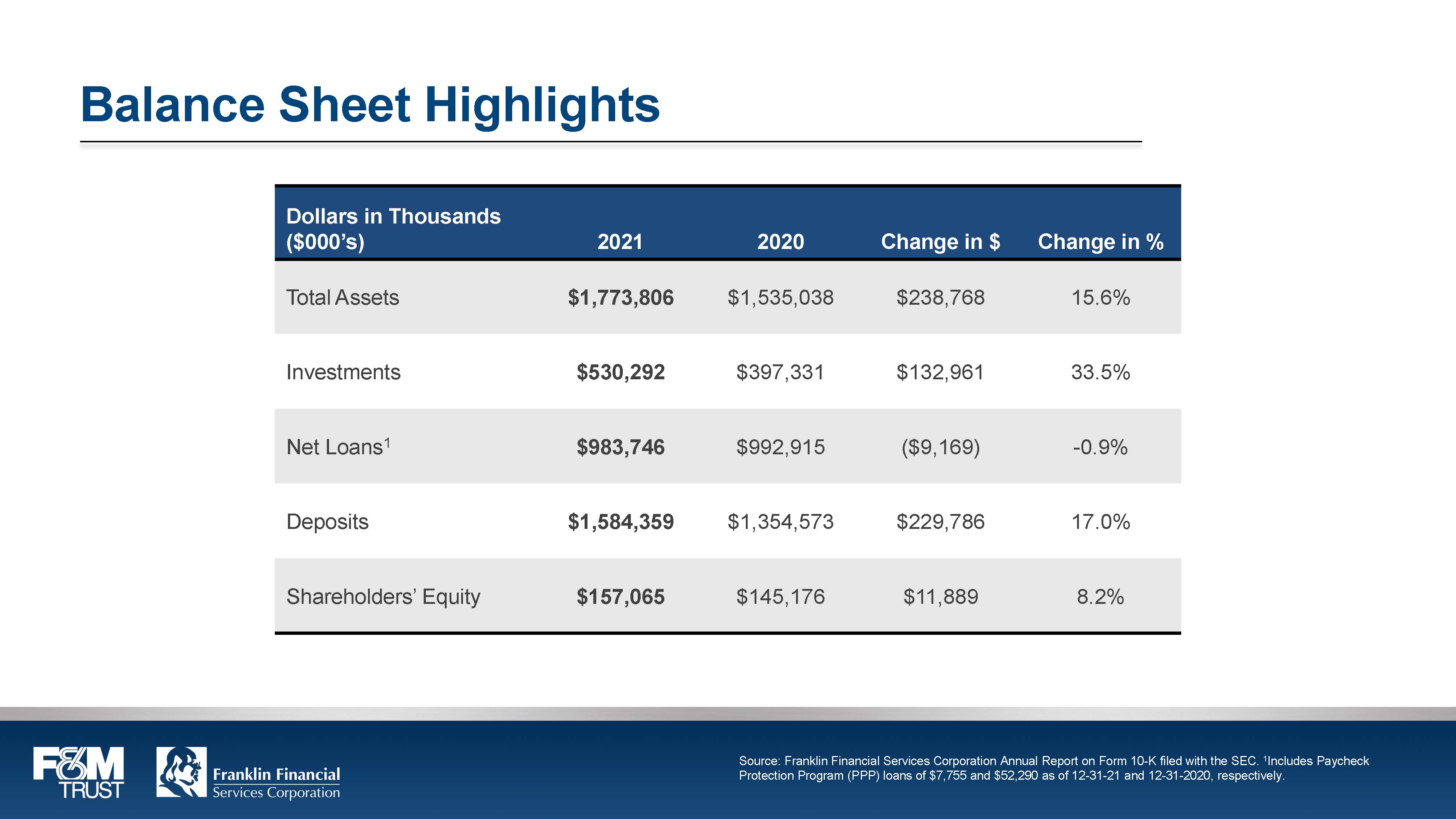

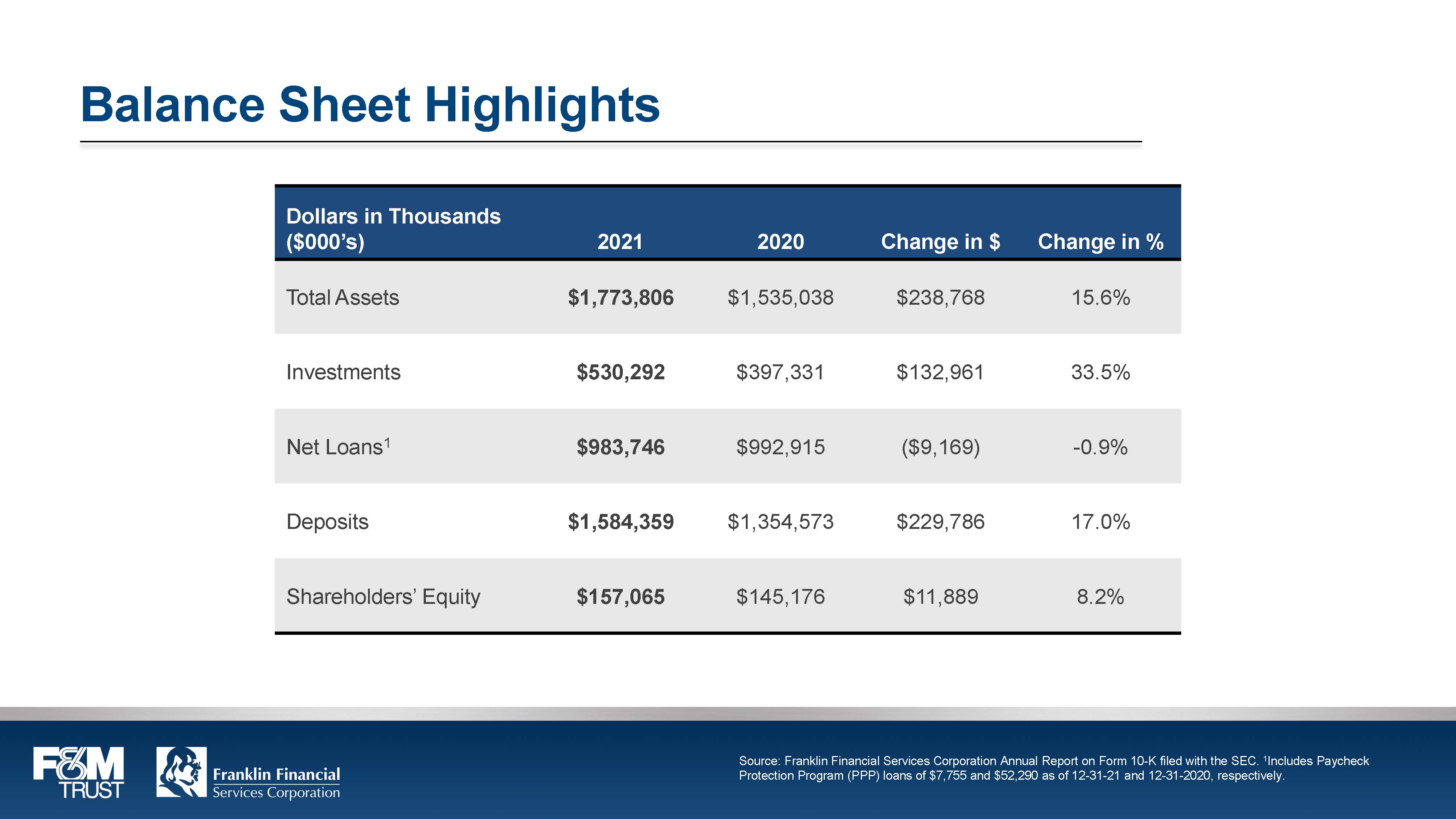

Balance Sheet Highlights Dollars in Thousands ($000’s) 2021 2020 Change in $ Change in % Total Assets $1,773,806 $1,535,038 $238,768 15.6% Investments $530,292 $397,331 $132,961 33.5% Net Loans 1 $983,746 $992,915 ($9,169) - 0.9% Deposits $1,584,359 $1,354,573 $229,786 17.0% Shareholders’ Equity $157,065 $145,176 $11,889 8.2% F&M TRUST Franklin Financial Services Corporation Source: Franklin Financial Services Corporation Annual Report on Form 10 K filed with the SEC. 1 Includes Paycheck Protection Program (PPP) loans of $7,755 and $52,290 as of 12 31 21 and 12 31 2020, respectively. F&M TRUST Franklin Financial Services Corporation

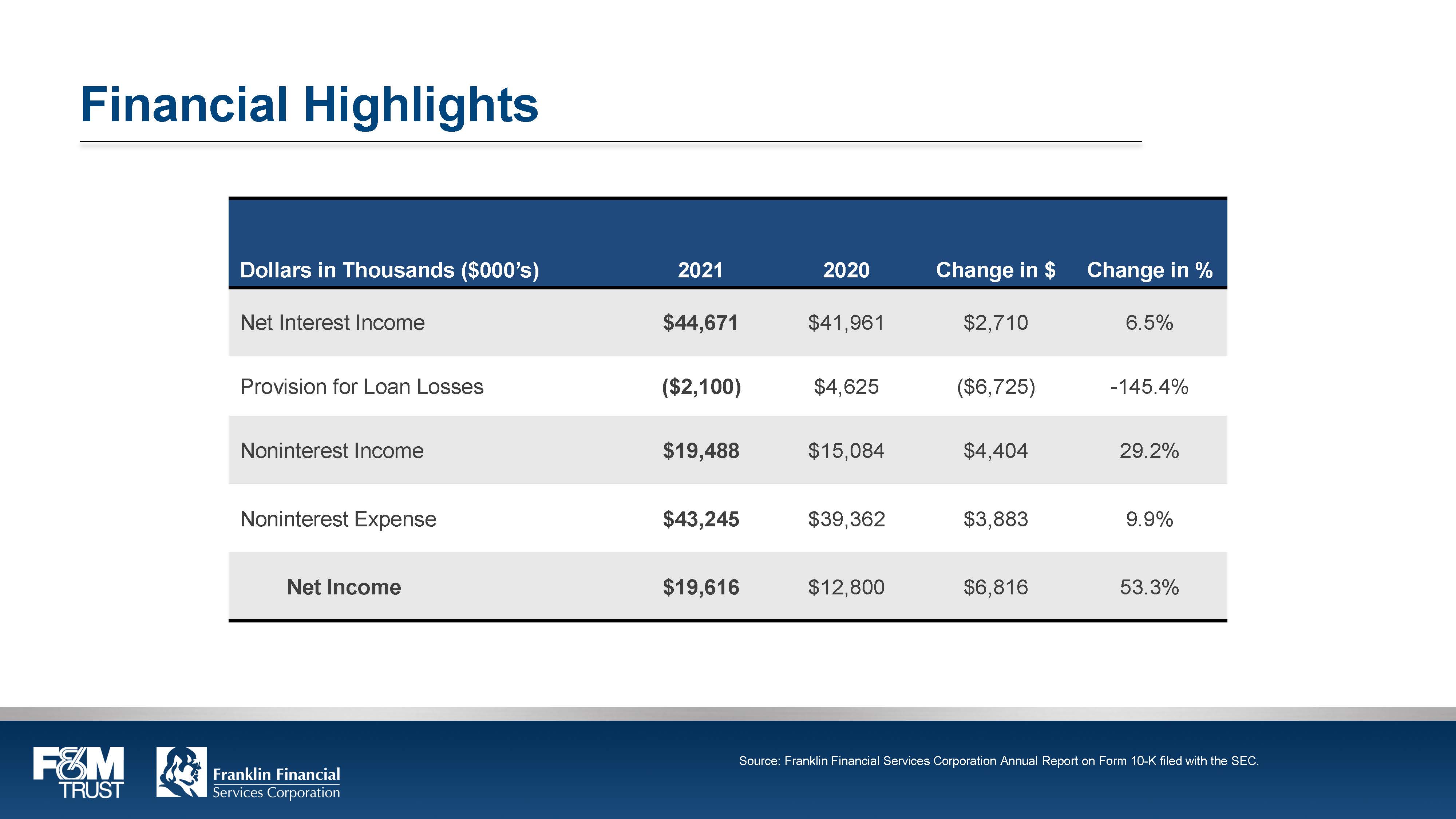

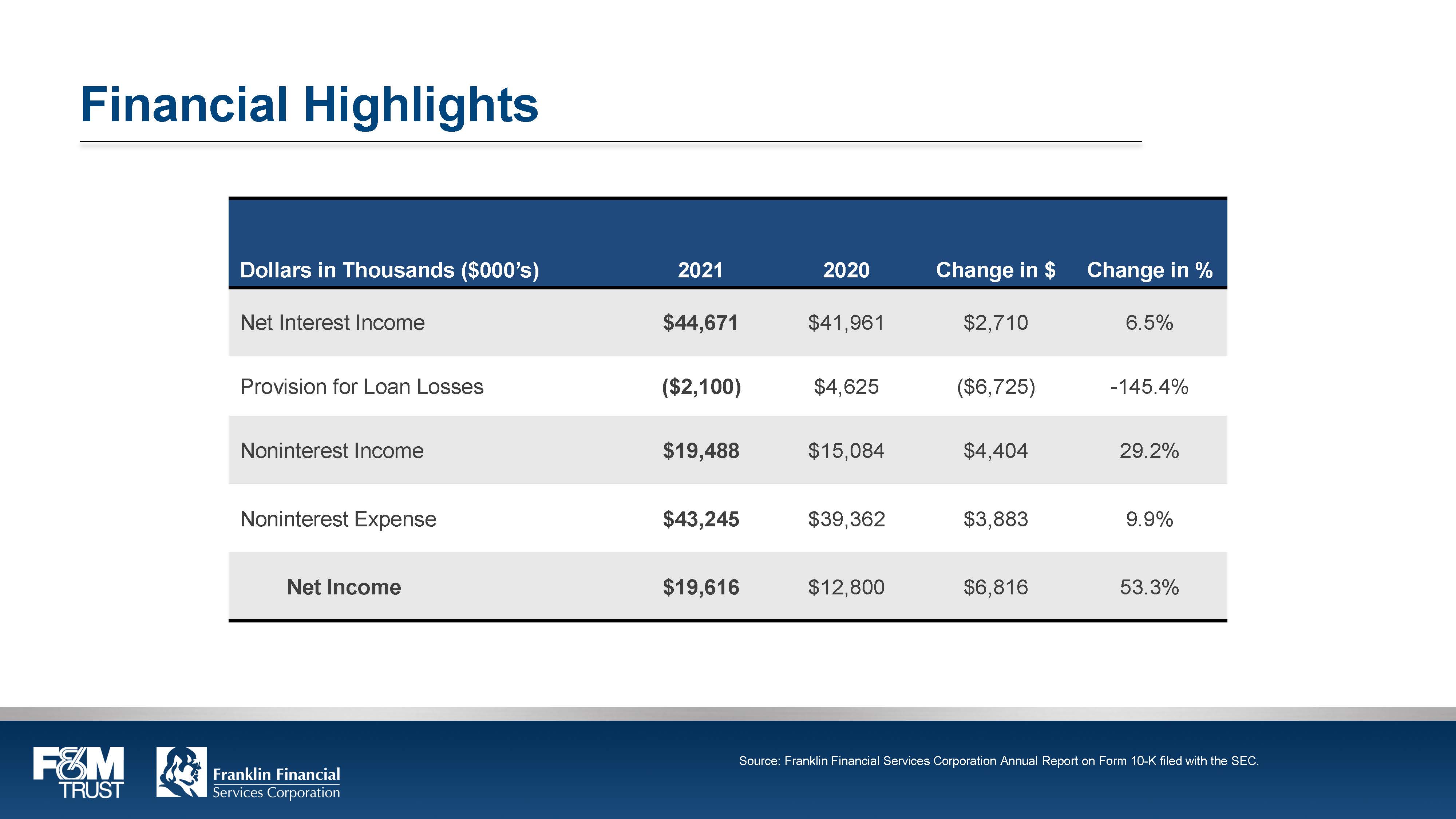

Financial Highlights Dollars in Thousands ($000’s) 2021 2020 Change in $ Change in % Net Interest Income $44,671 $41,961 $2,710 6.5% Provision for Loan Losses ($2,100) $4,625 ($6,725) - 145.4% Noninterest Income $19,488 $15,084 $4,404 29.2% Noninterest Expense $43,245 $39,362 $3,883 9.9% Net Income $19,616 $12,800 $6,816 53.3% Source: Franklin Financial Services Corporation Annual Report on Form 10 K filed with the SEC. F&M TRUST Franklin Financial Services Corporation

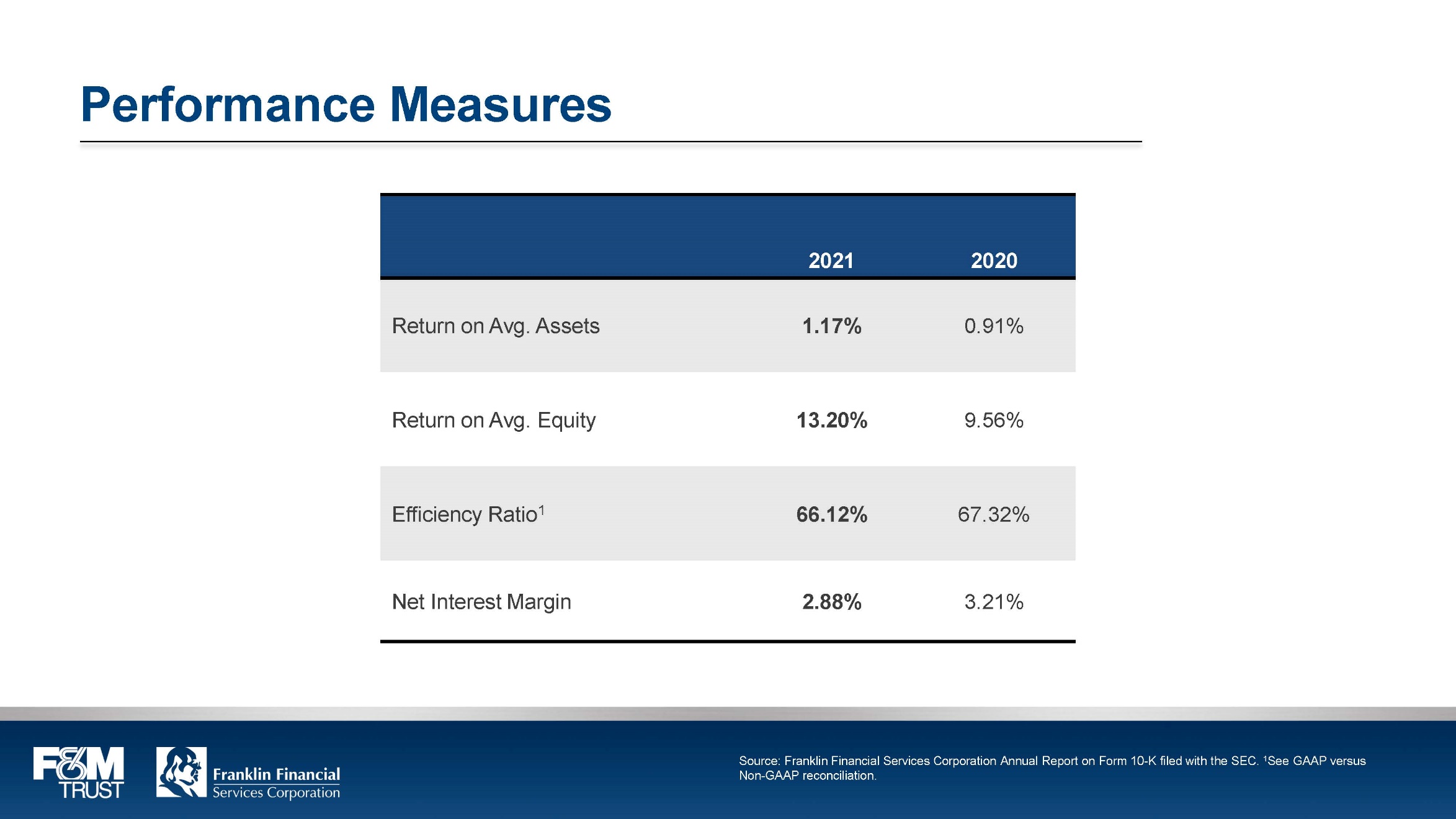

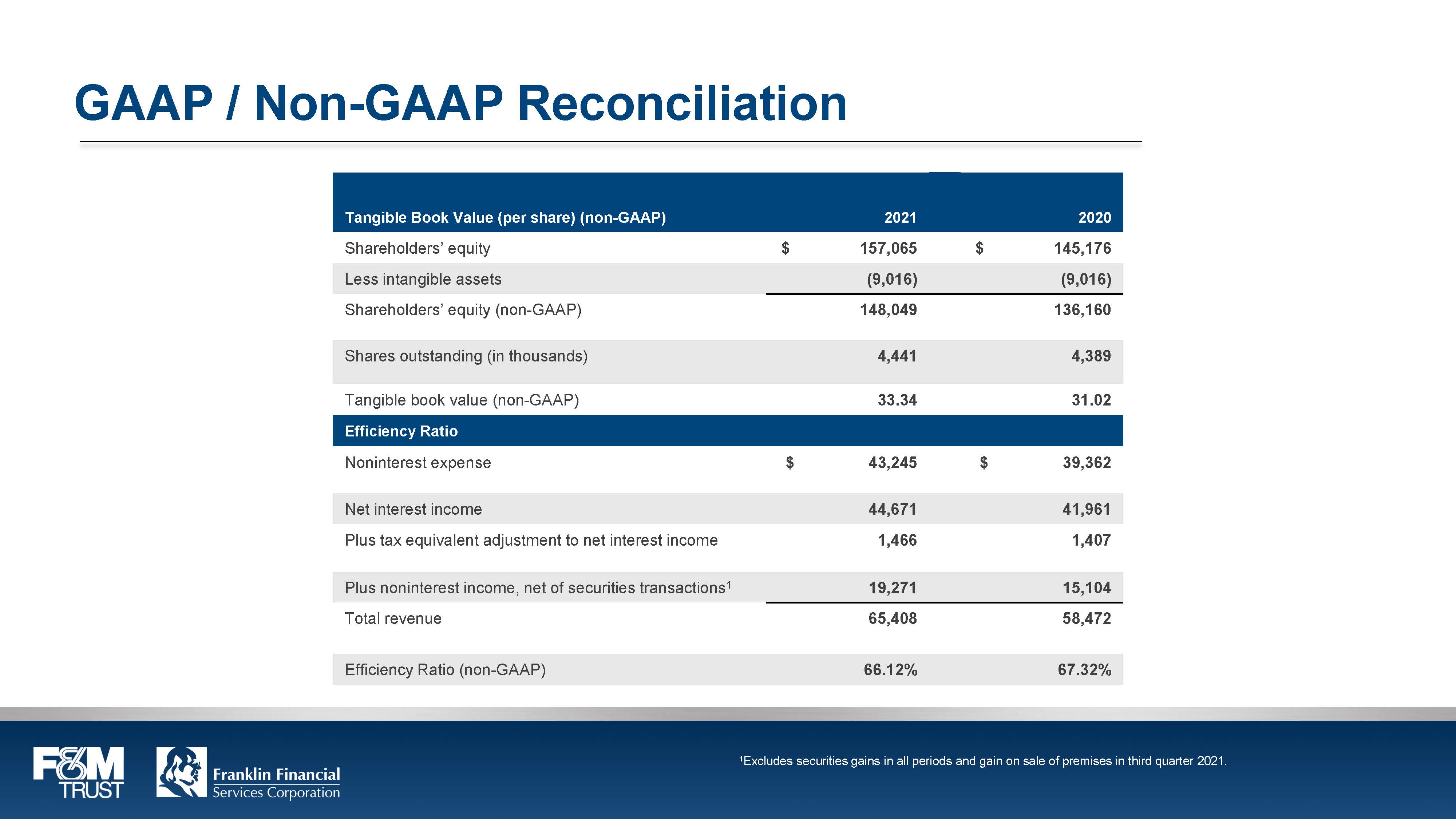

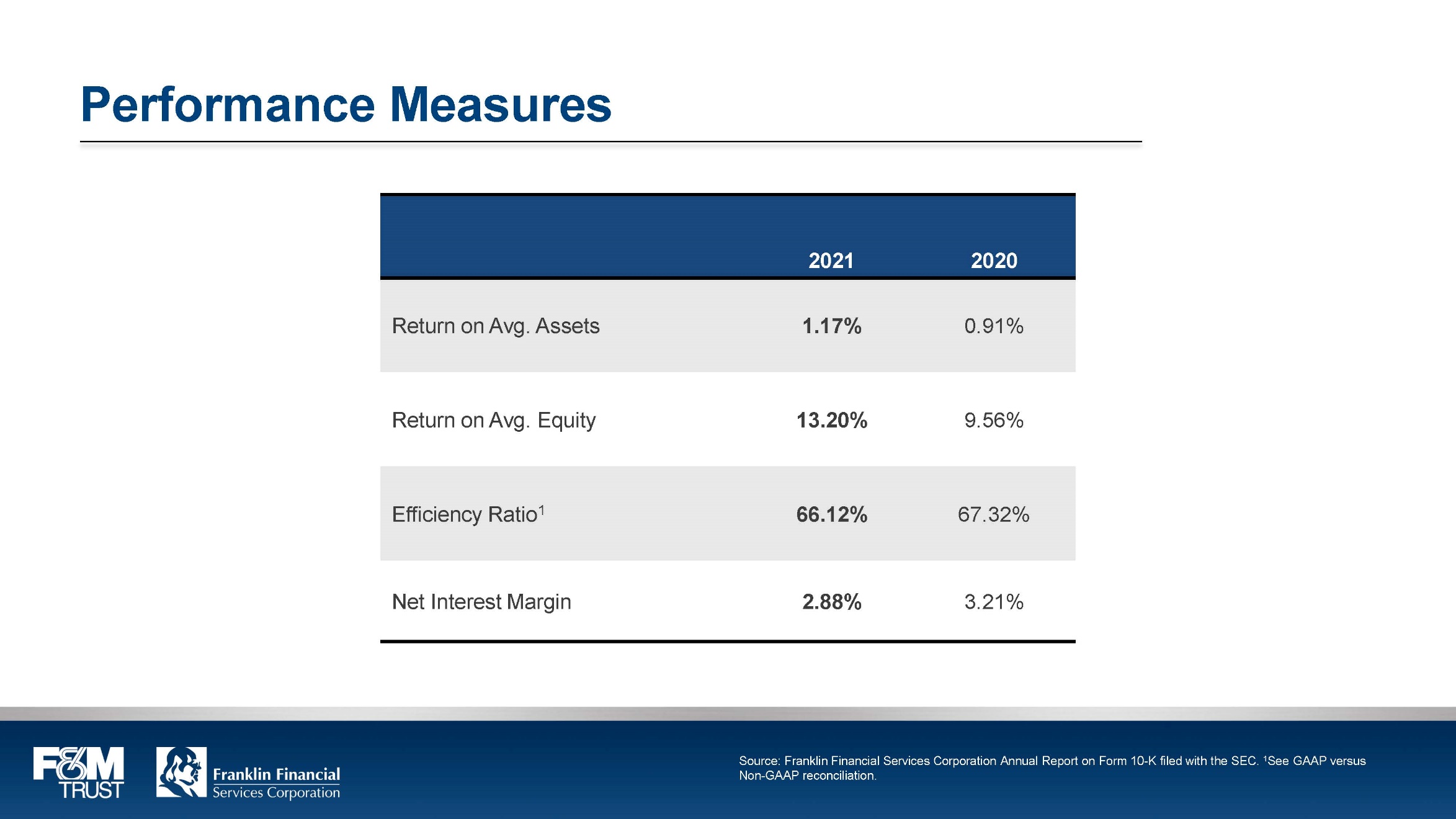

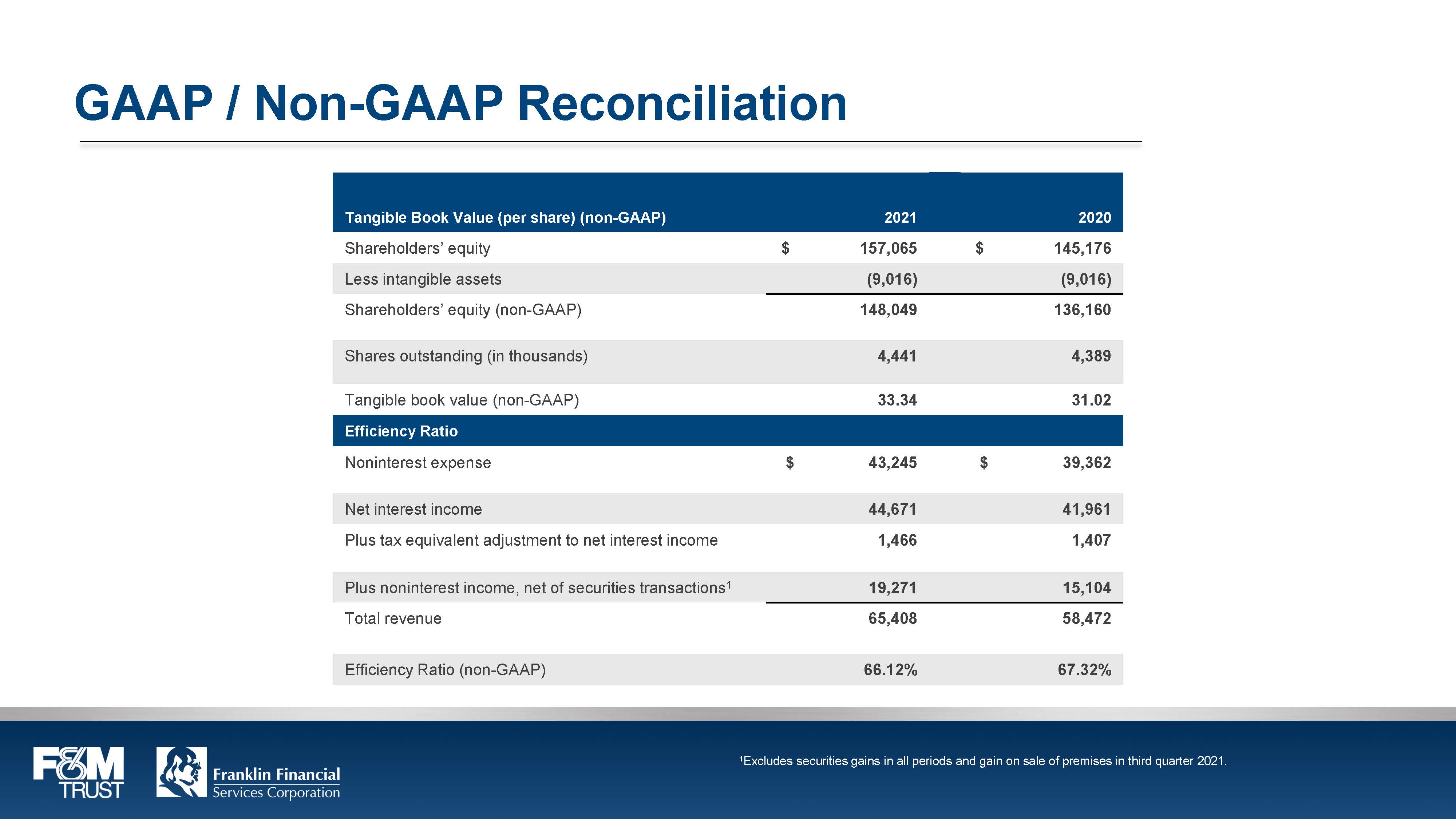

Performance Measures 2021 2020 Return on Avg. Assets 1.17% 0.91% Return on Avg. Equity 13.20% 9.56% Efficiency Ratio 1 66.12% 67.32% Net Interest Margin 2.88% 3.21% Source: Franklin Financial Services Corporation Annual Report on Form 10 K filed with the SEC. 1 See GAAP versus Non GAAP reconciliation. F&M TRUST Franklin Financial Services Corporation

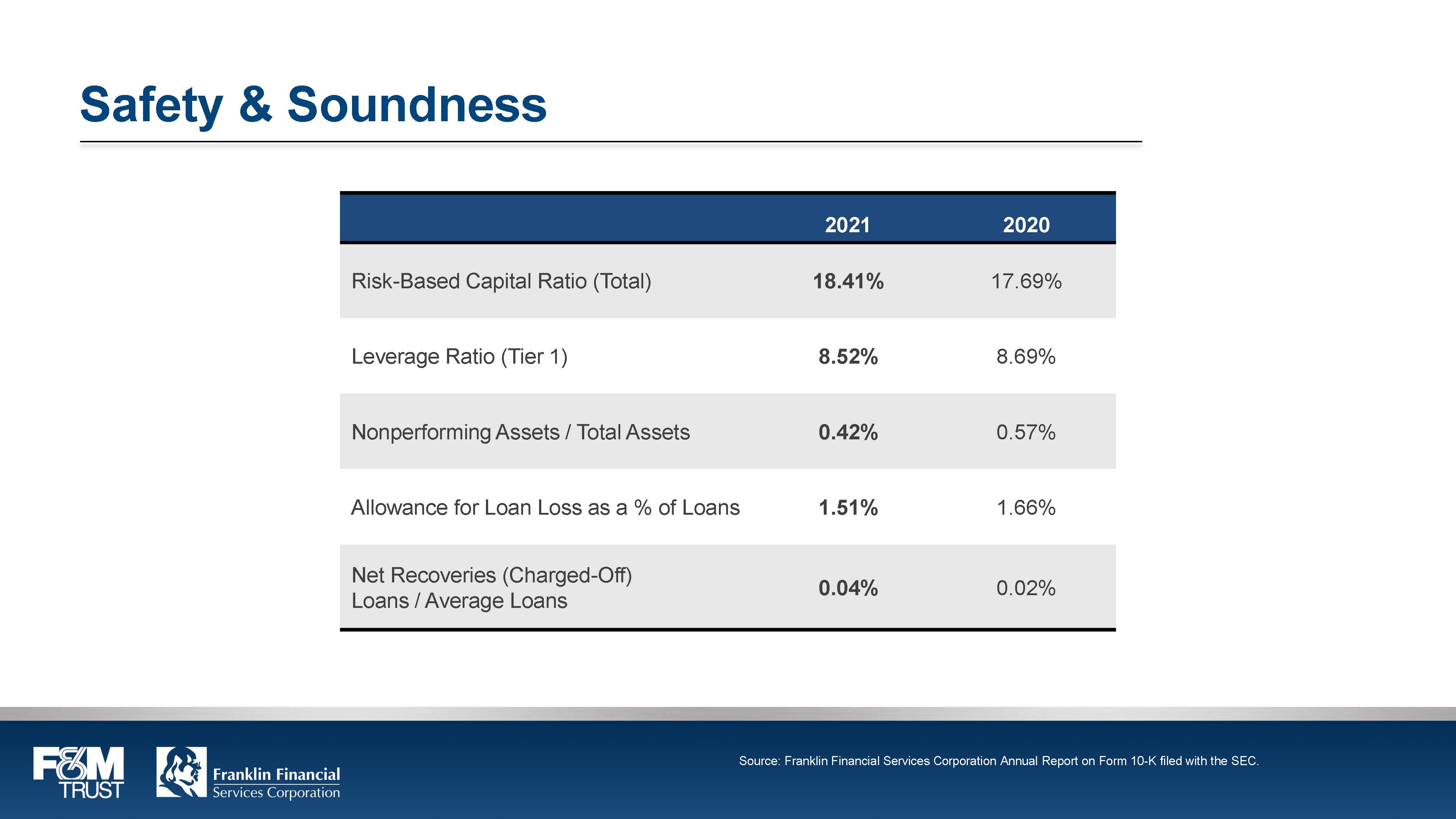

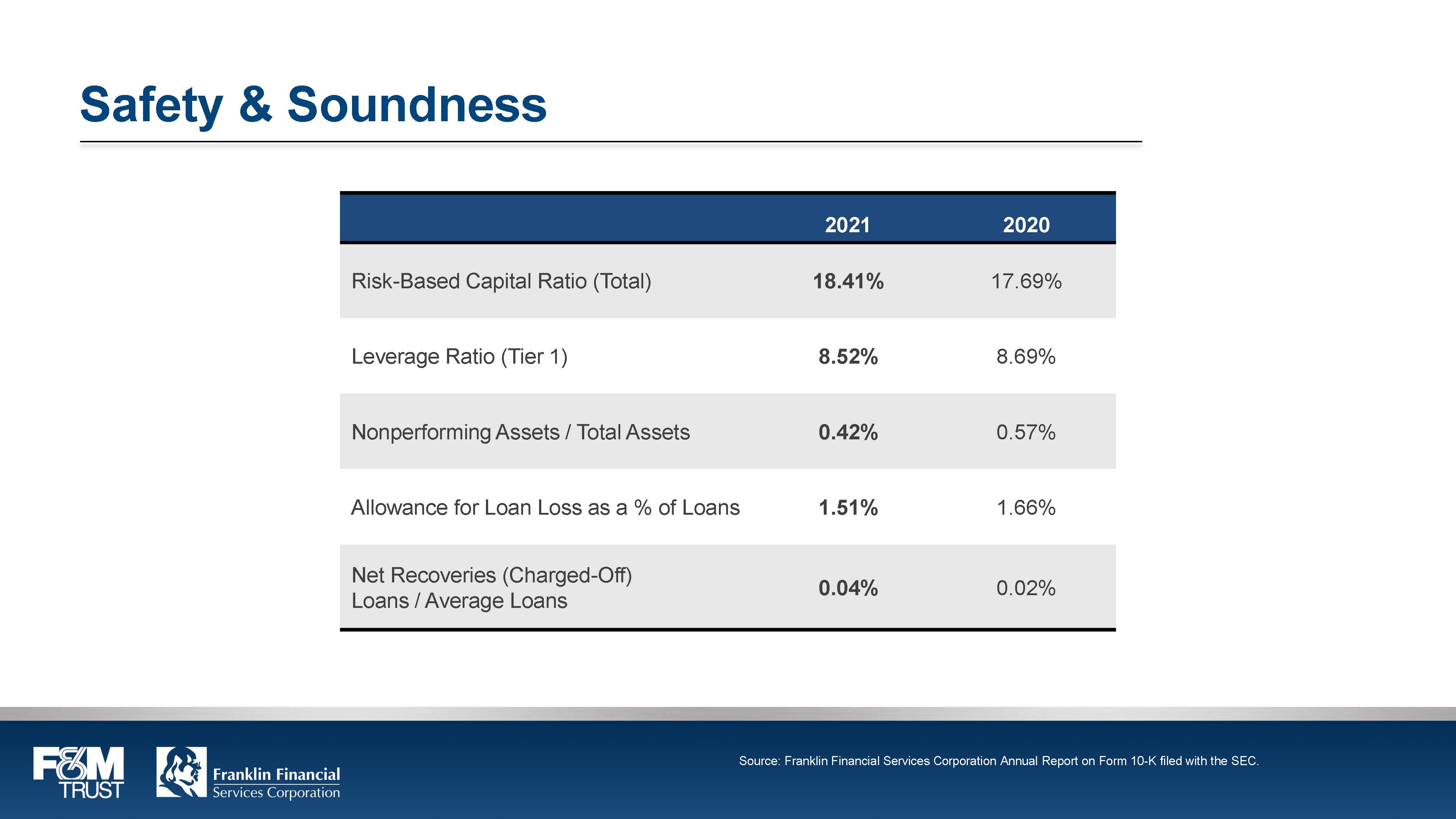

Safety & Soundness 2021 2020 Risk Based Capital Ratio (Total) 18.41% 17.69% Leverage Ratio (Tier 1) 8.52% 8.69% Nonperforming Assets / Total Assets 0.42% 0.57% Allowance for Loan Loss as a % of Loans 1.51% 1.66% Net Recoveries (Charged Off) Loans / Average Loans 0.04% 0.02% Source: Franklin Financial Services Corporation Annual Report on Form 10 K filed with the SEC. F&M TRUST Franklin Financial Services Corporation

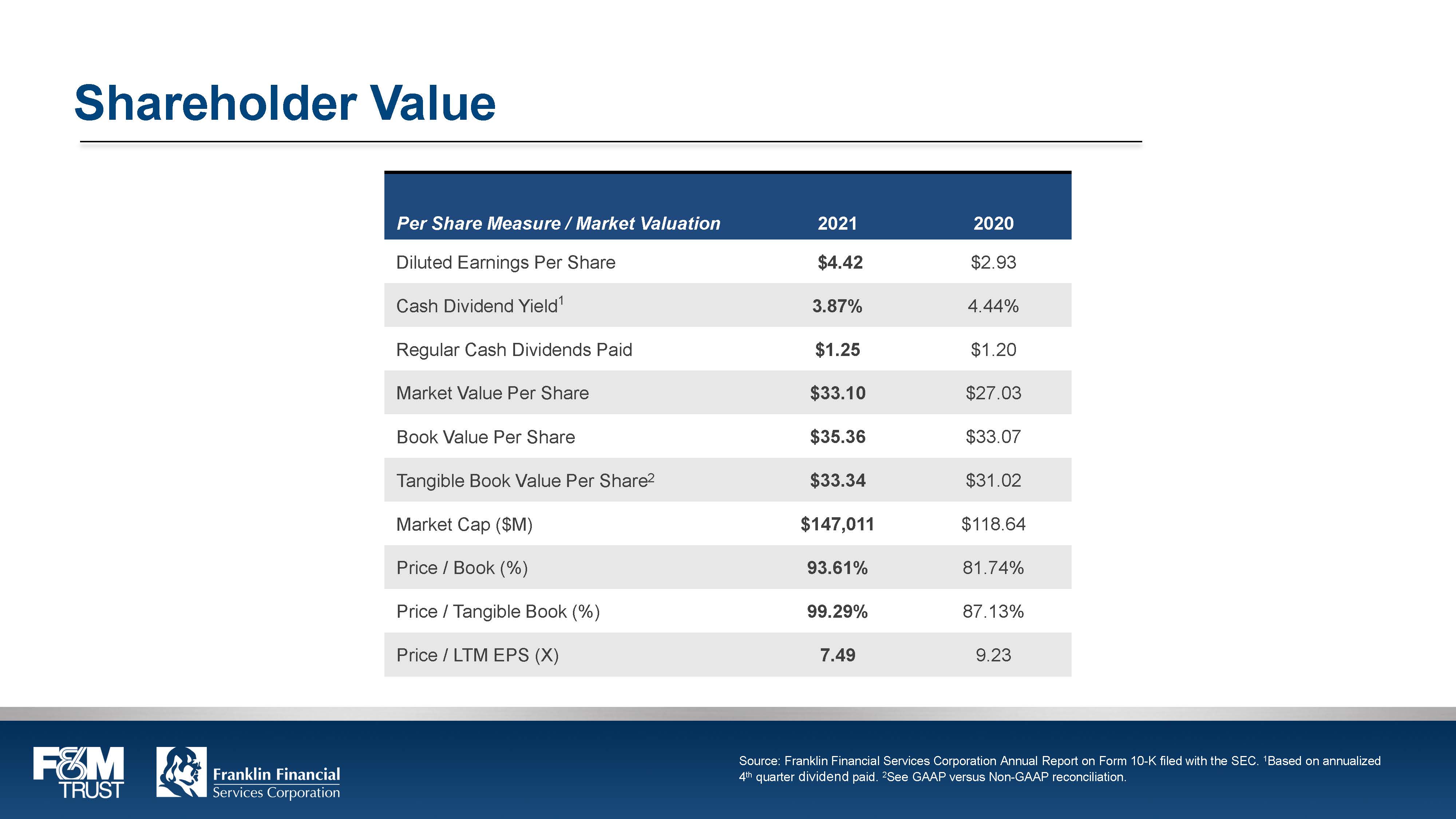

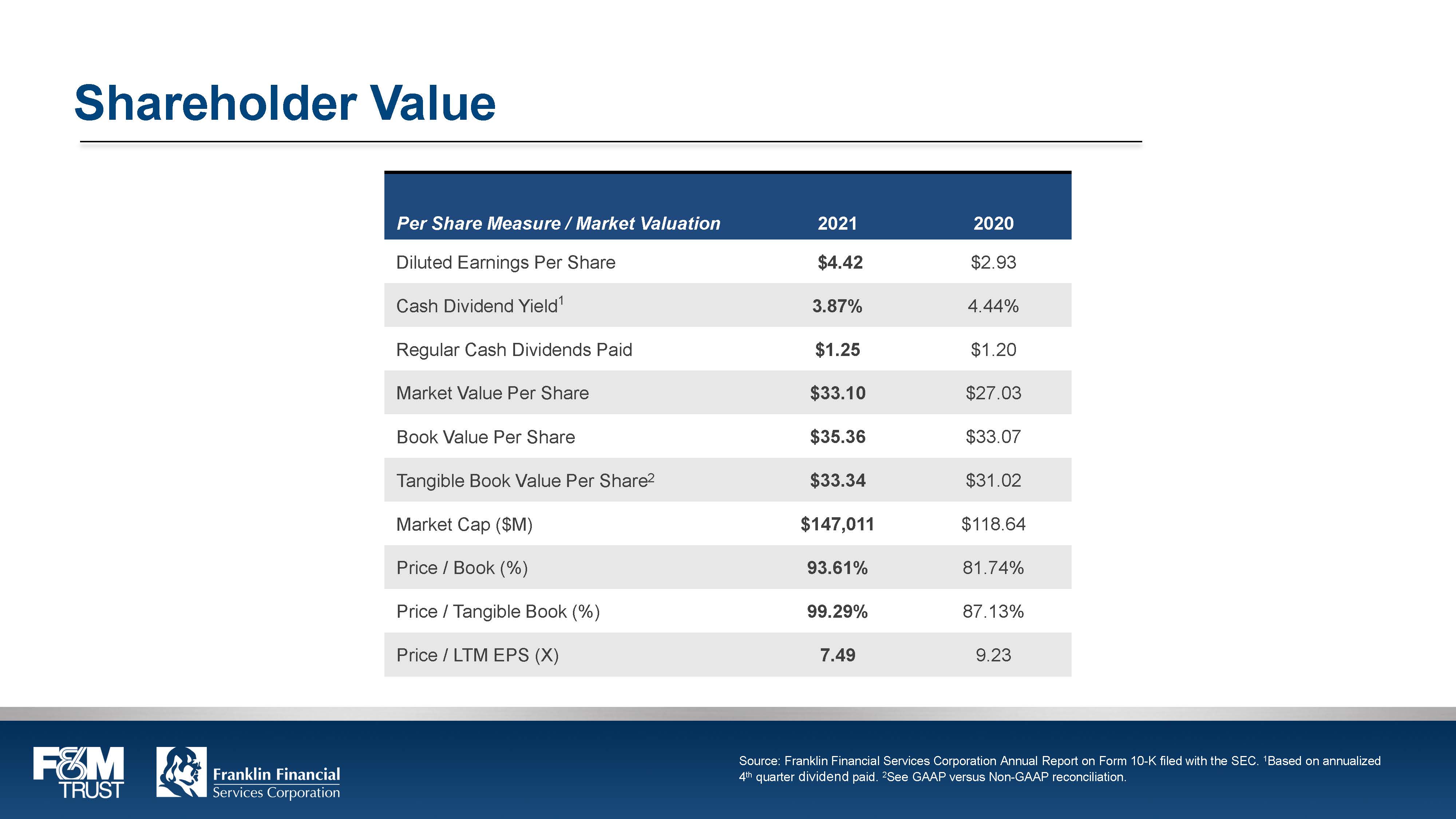

Shareholder Value Per Share Measure / Market Valuation 2021 2020 Diluted Earnings Per Share $4.42 $2.93 Cash Dividend Yield 1 3.87% 4.44% Regular Cash Dividends Paid $1.25 $1.20 Market Value Per Share $33.10 $27.03 Book Value Per Share $35.36 $33.07 Tangible Book Value Per Share 2 $33.34 $31.02 Market Cap ($M) $147,011 $118.64 Price / Book (%) 93.61% 81.74% Price / Tangible Book 99.29% 87.13% Price / LTM EPS ( 7.49 9.23 Source: Franklin Financial Services Corporation Annual Report on Form 10 K filed with the SEC. 1 Based on annualized 4 th quarter dividend paid. 2 See GAAP versus Non GAAP reconciliation. F&M TRUST Franklin Financial Services Corporation

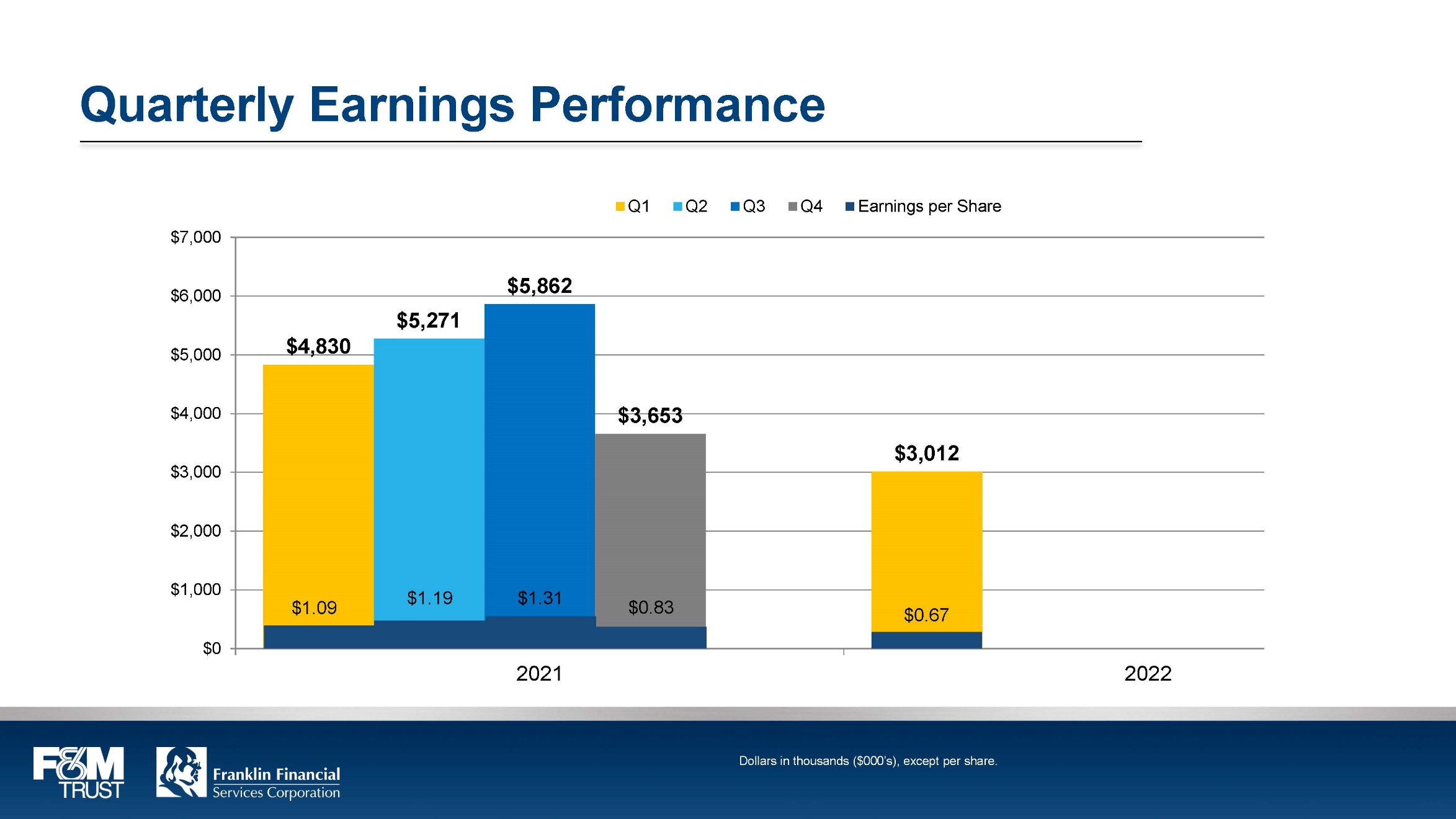

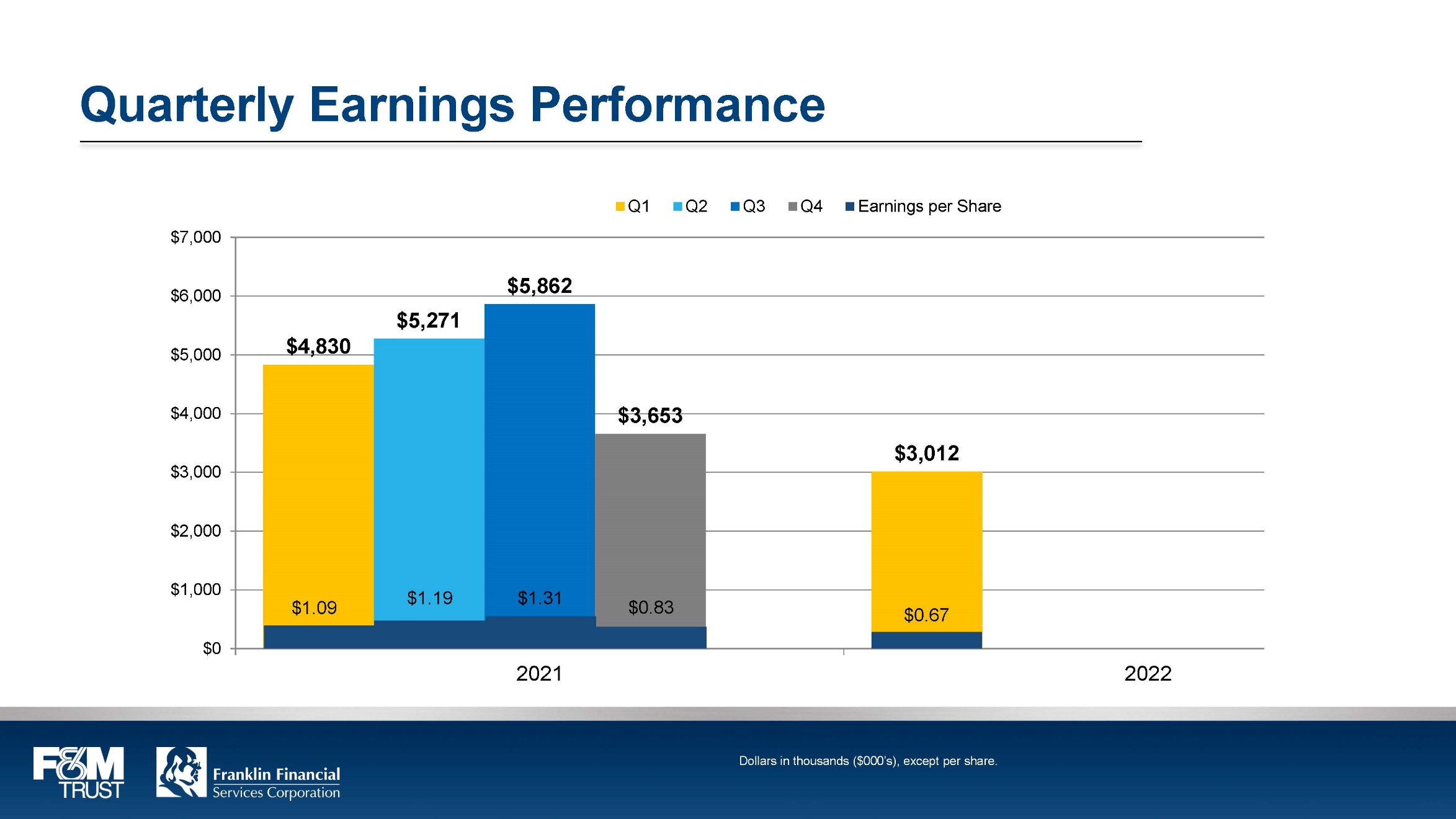

Quarterly Earnings Performance $4,830 $3,012 $5,271 $5,862 $3,653 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 2021 2022 Q1 Q2 Q3 Q4 Earnings per Share Dollars in thousands ($000’s), except per share. F&M TRUST Franklin Financial Services Corporation

President & CEO Comments Timothy (Tim) G. Henry F&M TRUST Franklin Financial Services Corporation

Timothy (Tim) G. Henry President & CEO F&M TRUST Franklin Financial Services Corporation

Questions Timothy (Tim) G. Henry F&M TRUST Franklin Financial Services Corporation

Polls Closed G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Report by Judge of Election G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Announcement G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Thank You G. Warren Elliott F&M TRUST Franklin Financial Services Corporation

Meeting Adjourned F&M TRUST Franklin Financial Services Corporation

GAAP / Non GAAP Reconciliation Tangible Book Value (per share) (non GAAP) 2021 2020 Shareholders’ equity $ 157,065 $ 145,176 Less intangible assets (9,016) (9,016) Shareholders’ equity (non GAAP) 148,049 136,160 Shares outstanding (in thousands) 4,441 4,389 Tangible book value (non GAAP) 33.34 31.02 Efficiency Ratio Noninterest expense $ 43,245 $ 39,362 Net interest income 44,671 41,961 Plus tax equivalent adjustment to net interest income 1,466 1,407 Plus noninterest income, net of securities transactions 1 19,271 15,104 Total revenue 65,408 58,472 Efficiency Ratio (non GAAP) 66.12% 67.32% 1 Excludes securities gains in all periods and gain on sale of premises in third quarter 2021. F&M TRUST Franklin Financial Services Corporation