Exhibit 99.1

Investor Presentation First Quarter 2022 Highlights F&M Trust Franklin Financial Services Corporation

Forward Looking Statements

Certain statements appearing herein which are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements refer to a future period or periods, reflecting management’s current views as to likely future developments, and use words “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” or similar terms. Because forward-looking statements involve certain risks, uncertainties and other factors over which Franklin Financial Services Corporation has no direct control, actual results could differ materially from those contemplated in such statements. These factors include (but are not limited to) the following: general economic conditions particularly with regard to the negative impact of severe, wide-ranging and continuing disruptions caused by the spread of the coronavirus COVID-19 pandemic and responses thereto, changes in interest rates, changes in the Corporation’s cost of funds, changes in government monetary policy, changes in government regulation and taxation of financial institutions, changes in the rate of inflation, changes in technology, the intensification of competition within the Corporation’s market area, and other similar factors. We caution readers not to place undue reliance on these forward-looking statements. They only reflect management’s analysis as of this date. The Corporation does not revise or update these forward-looking statements to reflect events or changed circumstances. Please carefully review the risk factors described in other documents the Corporation files from time to time with the SEC, including the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and any Current Reports on Form 8-K. F&M TRUST Franklin Financial Services Corporation 2

CEO Comments

2022 certainly began much differently than the previous two years. While we have, for the most part, been able to put the pandemic in the rearview mirror, its effects and our national response to them are still being realized. Rising interest rates, supply chain disruptions, and world conflicts are but a few of the macro changes that are affecting the economy as a whole and, as a result, our customers and our company. At times like these, I appreciate that we are a well-diversified company with sources of income from both commercial and consumer markets. Clearly our residential mortgage business, and the fee income we derive from it, has dropped off from the comparative period last year as mortgage refinancing has dried up in the face of rising rates. While we are still doing well in the purchase mortgage line of business, we expect this will be tempered over the course of the year by rising rates. Our Investment and Trust business has gotten off to a good start as we continue to add clients and bring in new assets. While ahead of last year’s results for the same period, we expect some pressure on earnings if the equity and bond markets continue to lose value. The pipeline for commercial lending looks good and rising rates are lifting the income we generate from our floating-rate assets. If rates continue to rise, I anticipate our net interest margin also improving throughout the year. Deposits continue to grow, and our cost of deposits has remained steady at 12 basis points. The growth of deposits demonstrates the depth of customer relationships, which continue to be extremely important to us. We continue to work to establish a full-service community office in Hagerstown, which will be our first in Maryland. We have received all necessary approvals and are renovating a downtown office and hiring retail, commercial, and trust employees. We expect to open the office July 1. F&M TRUST Franklin Financial Services Corporation 3

CEO Comments (continued)

We also have two community office renovations underway and will move into our new headquarters on Nitterhouse Drive in July. We also will be going live with Salesforce in July as we start using the software to improve customer service, increase sales, and create efficiencies within the bank. The bank’s senior management team has evolved as several members have retired or will retire this year. We have onboarded Chief Operations Officer Steve Poynot, Chief Retail Services Officer Louis Giustini, and Chief Technology Officer David Long, and each is making valuable contributions to the company. I am very thankful that we have been able to add these leaders to our team. 2022 is setting up to be a challenging year, one that will require us to adapt to a changing economic environment. Our first quarter results were good, and we will look to build upon them throughout the year. Our sights are set on the future and taking the steps now that will help us succeed not just in 2022 but in the years that follow. The following investor presentation, being released on Form 8-K, is a supplement to our quarterly earnings release. We appreciate the support of our shareholders and the interest of potential shareholders, and I am available at any time to listen to your concerns, thoughts, and ideas, and to answer your questions to the best of my ability. Sincerely, F&M TRUST Franklin Financial Services Corporation 4

Overview of Franklin Financial

Franklin Financial, which was formed in 1983, is the largest independent, locally owned and operated bank holding company headquartered in Franklin County, PA Franklin Financial’s wholly-owned subsidiary, F&M Trust, was founded in Chambersburg, PA in 1906

Total assets of the Company were $1.77 billion as of March 31, 2022

As of March 31, 2022, Franklin Financial reported $976.5 million in brokerage and trust assets under management Franklin Financial stock is trading on the Nasdaq Stock Market (NASDAQ: FRAF) F&M TRUST Franklin Financial Services Corporation 5

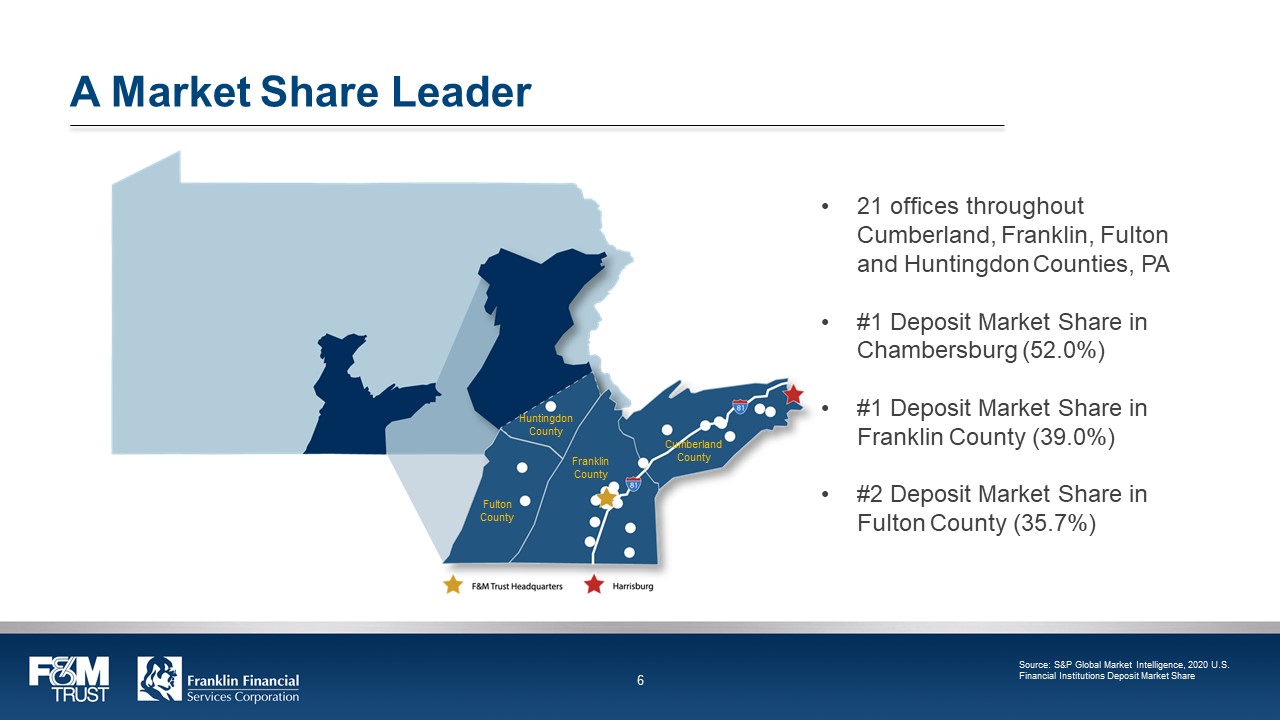

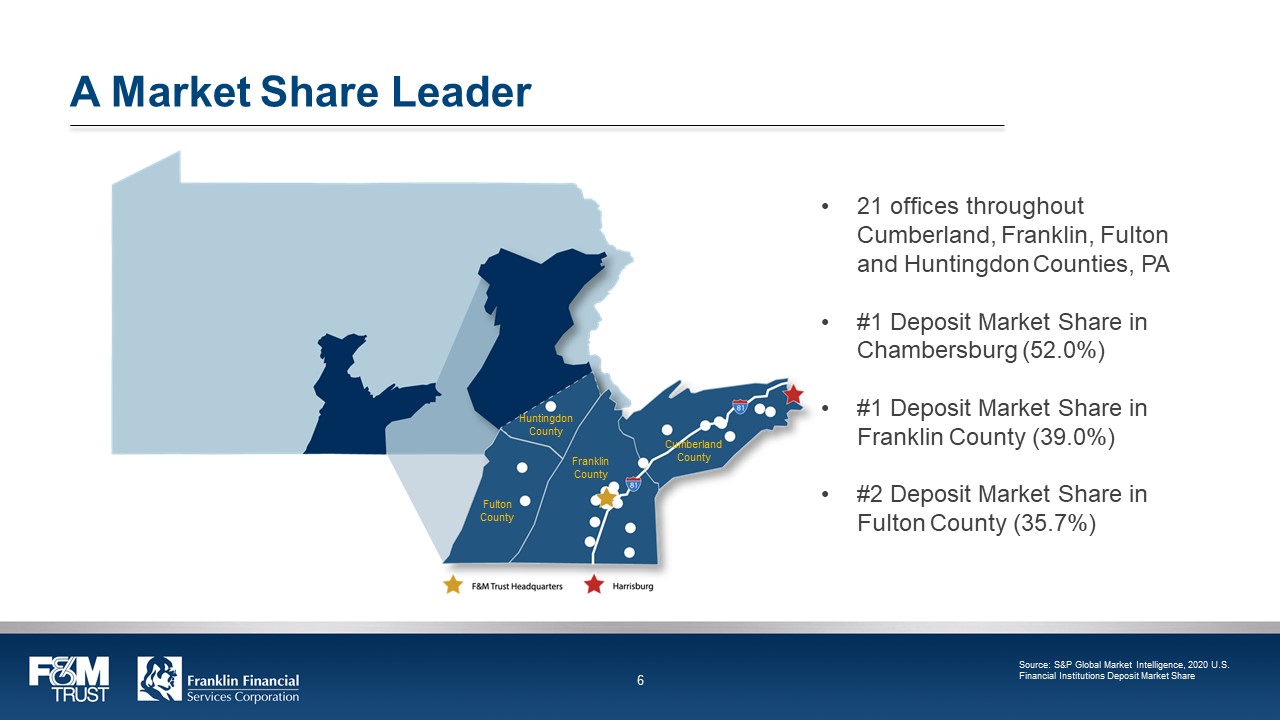

A Market Share Leader

21 offices throughout Cumberland, Franklin, Fulton and Huntingdon Counties, PA #1 Deposit Market Share in Chambersburg (52.0%)

#1 Deposit Market Share in

Franklin County (39.0%)

#2 Deposit Market Share in

Fulton County (35.7%) Huntingdon County Fulton County Franklin County Cumberland County F&M Trust Headquarters Harrisburtg F&M TRUST Franklin Financial Services Corporation 6 Source: S&P Global Market Intelligence, 2020 U.S. Financial Institutions Deposit Market Share

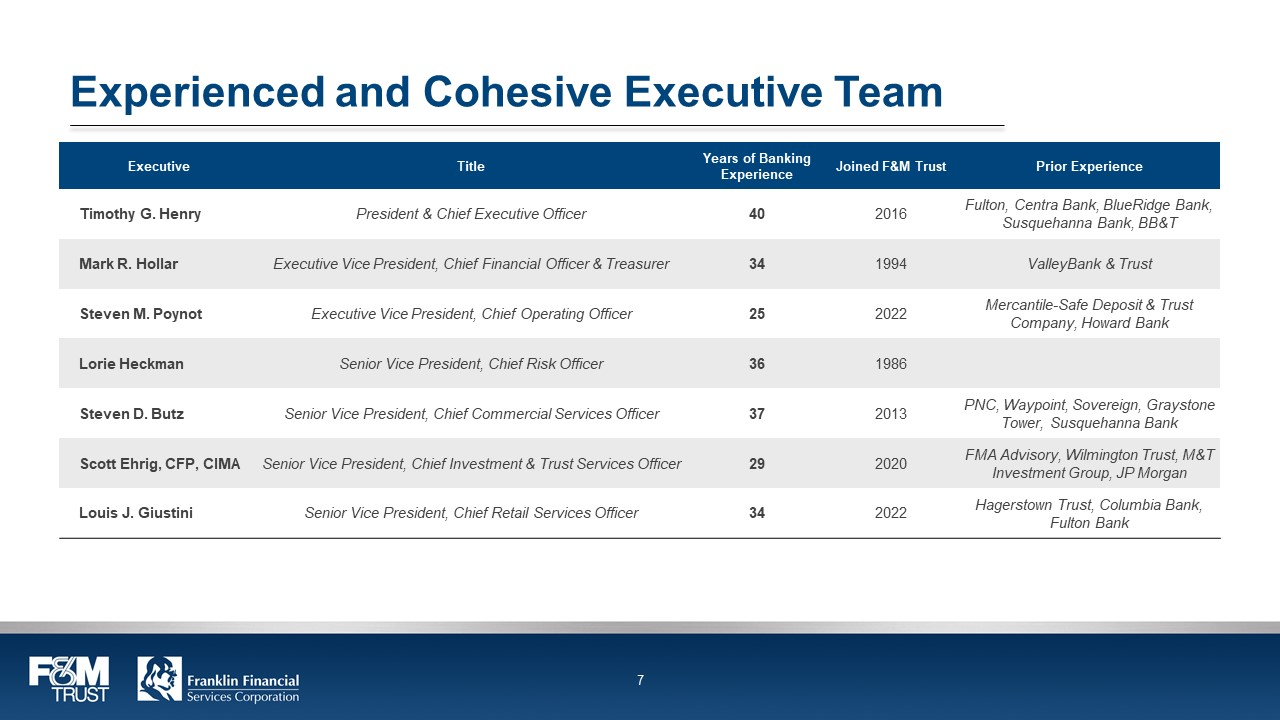

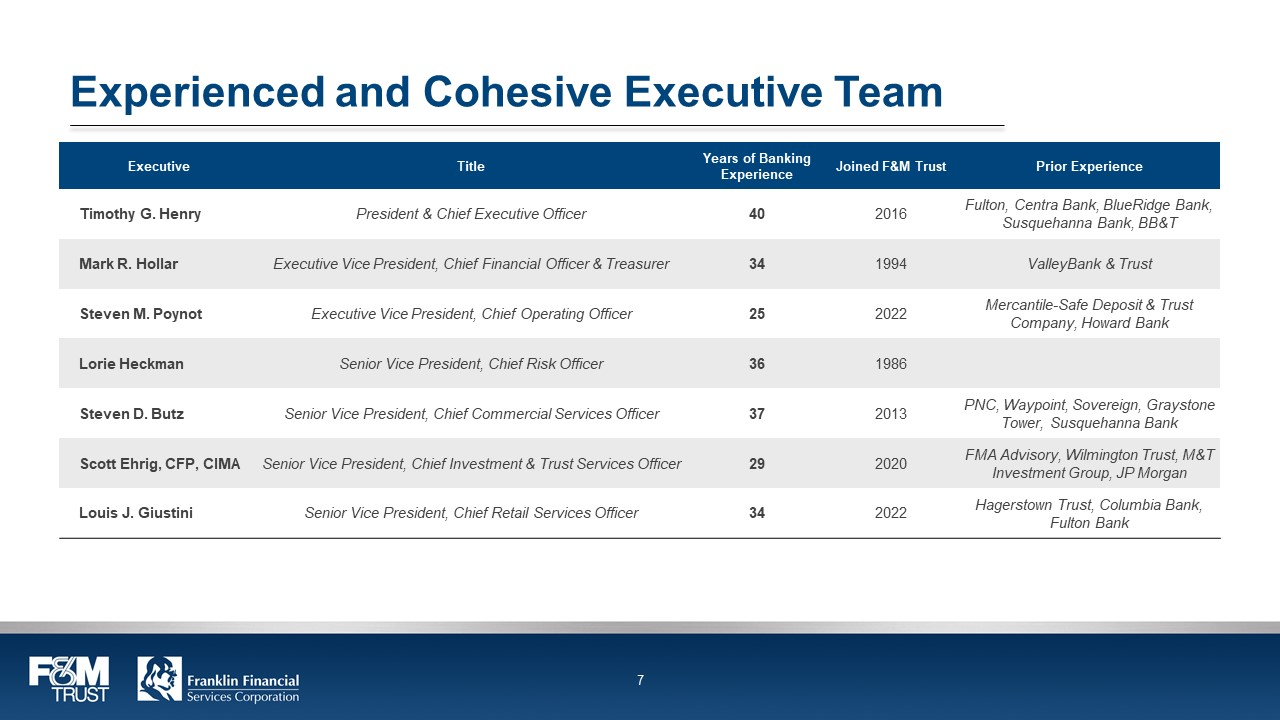

Experienced and Cohesive Executive Team

Executive Title Years of Banking Experience Joined F&M Trust Prior Experience Timothy G. Henry President & Chief Executive Officer 40 2016 Fulton, Centra Bank, BlueRidge Bank, Susquehanna Bank, BB&T Mark R. Hollar Executive Vice President, Chief Financial Officer & Treasurer 34 1994 ValleyBank & Trust Steven M. Poynot Executive Vice President, Chief Operating Officer 25 2022 Mercantile-Safe Deposit & Trust Company, Howard Bank Lorie Heckman Senior Vice President, Chief Risk Officer 36 1986 Steven D. Butz Senior Vice President, Chief Commercial Services Officer 37 2013 PNC, Waypoint, Sovereign, Graystone Tower, Susquehanna Bank Scott Ehrig, CFP, CIMA Senior Vice President, Chief Investment & Trust Services Officer 29 2020 FMA Advisory, Wilmington Trust, M&T Investment Group, JP Morgan Louis J. Giustini Senior Vice President, Chief Retail Services Officer 34 2022 Hagerstown Trust, Columbia Bank, Fulton Bank F&M TRUST Franklin Financial Services Corporation 7

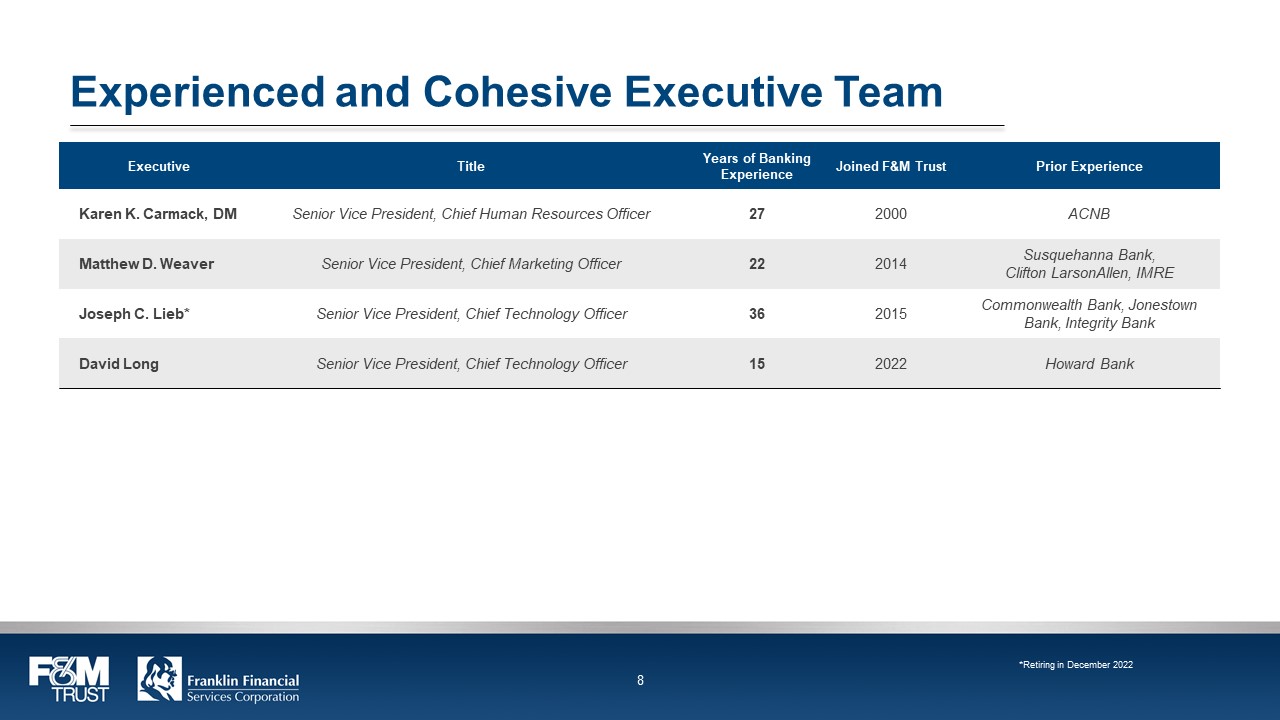

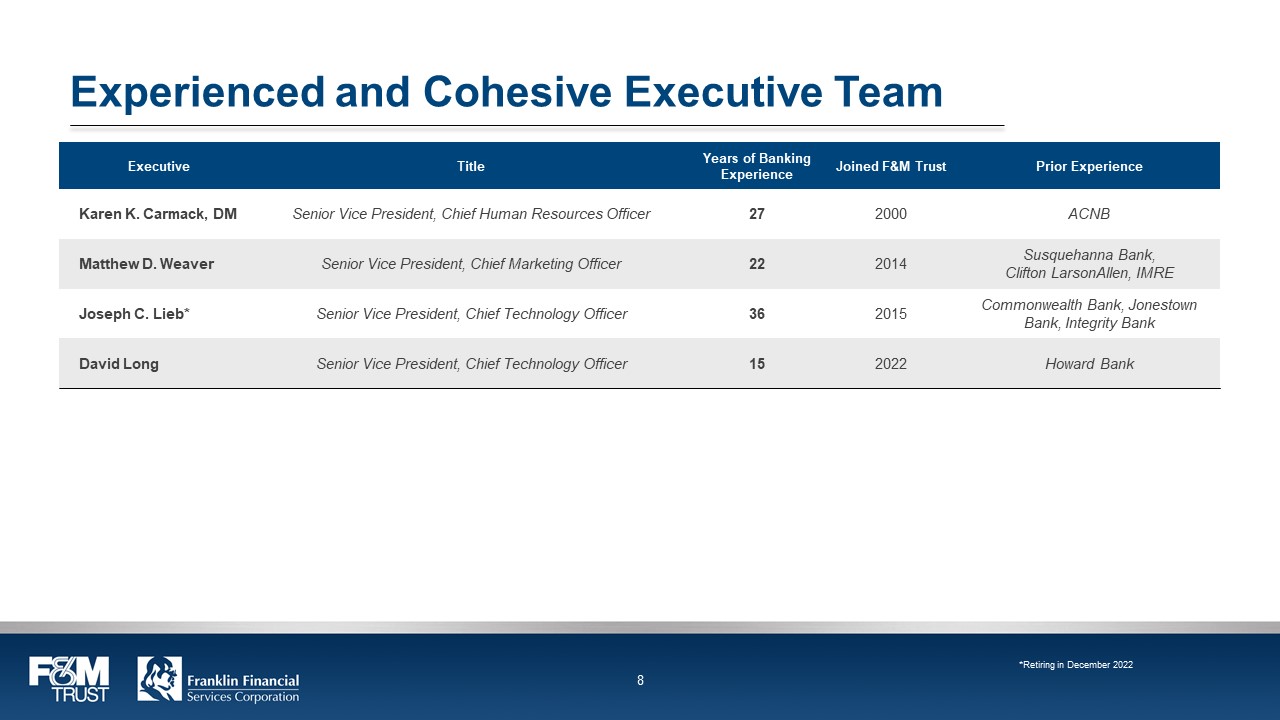

Experienced and Cohesive Executive Team

Executive Title Years of Banking Experience Joined F&M Trust Prior Experience Karen K. Carmack, DM Senior Vice President, Chief Human Resources Officer 27 2000 ACNB Matthew D. Weaver Senior Vice President, Chief Marketing Officer 22 2014 Susquehanna Bank, Clifton LarsonAllen, IMRE Joseph C. Lieb* Senior Vice President, Chief Technology Officer 36 2015 Commonwealth Bank, Jonestown Bank, Integrity Bank David Long Senior Vice President, Chief Technology Officer 15 2022 Howard Bank F&M TRUST Franklin Financial Services Corporation 8 *Retiring in December 2022

Well-Established Corporation

Market share leader in core deposit, loan, and asset-management segments in economically stable and historically growing local markets

New executive team members with extensive banking industry experience and market knowledge

Consistently strong core operating fundamentals with a diverse revenue mix

Strong capital position, sound risk management, and neutral to slightly asset-sensitive balance sheet

Stable, low-cost core deposit base and strong liquidity position, which becomes more valuable in a rising rate environment

A well-diversified loan portfolio with an emphasis on small-business relationships without reliance on participation loans Accelerating digital transformation and technology adoption to support business continuity F&M TRUST Franklin Financial Services Corporation 9

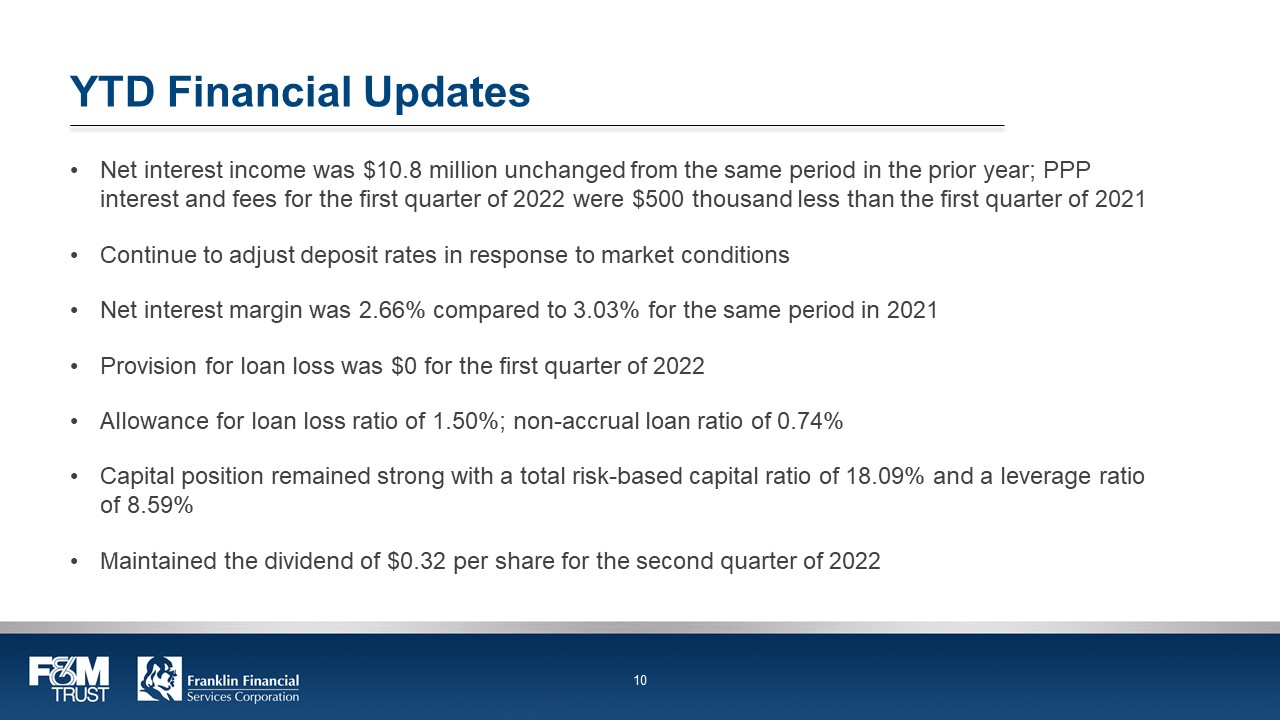

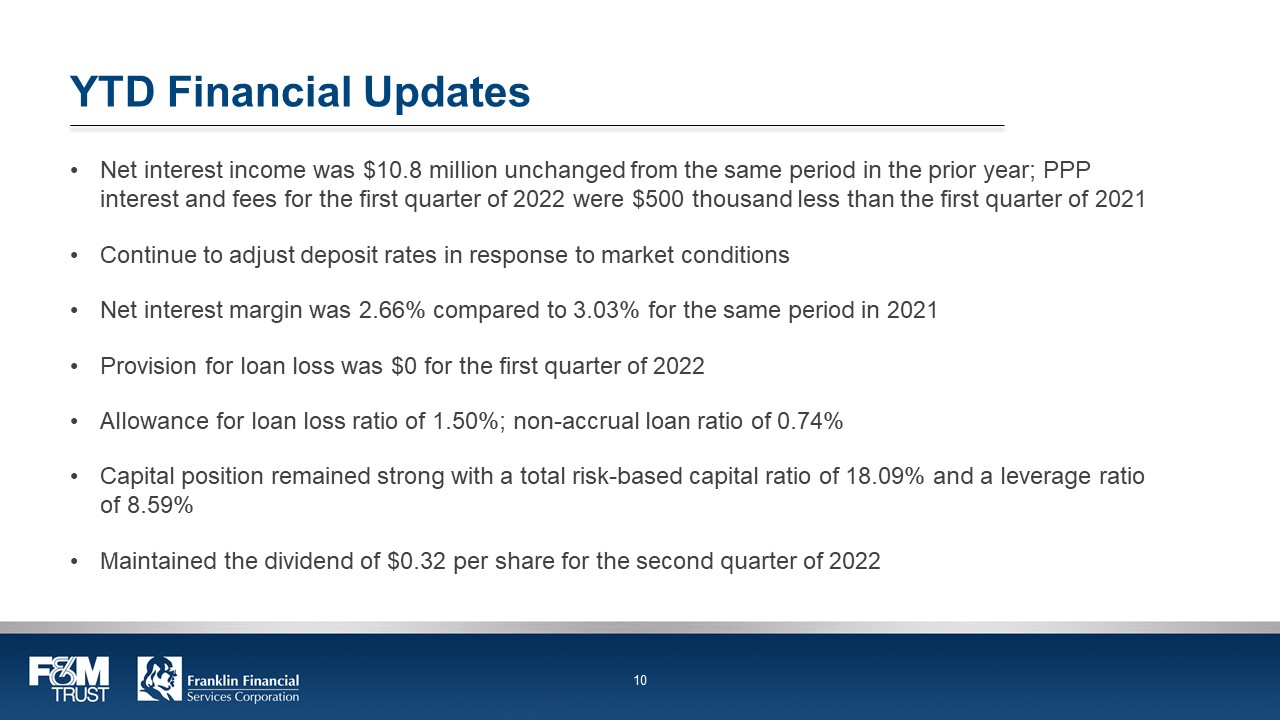

YTD Financial Updates

Net interest income was $10.8 million unchanged from the same period in the prior year; PPP interest and fees for the first quarter of 2022 were $500 thousand less than the first quarter of 2021 Continue to adjust deposit rates in response to market conditions Net interest margin was 2.66% compared to 3.03% for the same period in 2021 Provision for loan loss was $0 for the first quarter of 2022 Allowance for loan loss ratio of 1.50%; non-accrual loan ratio of 0.74% Capital position remained strong with a total risk-based capital ratio of 18.09% and a leverage ratio of 8.59% Maintained the dividend of $0.32 per share for the second quarter of 2022 F&M TRUST Franklin Financial Services Corporation 10

YTD Financial Updates

Loan-to-deposit ratio of 63% enhances liquidity position and allows for quality lending opportunities as the economy reopens Fee income from new mortgages originated for sale in the secondary market decreased $528 thousand over the same period in 2021 Deposits increased 12.3% over the same period in 2021, with money management accounts and interest-bearing checking products showing the largest increases A new retail checking account lineup introduced in 2021 helped to generate a 33% increase in deposit fees over the year F&M TRUST Franklin Financial Services Corporation 11

Digital Transformation

Registered Zelle® users increased 27.6% and mobile banking users increased 7.2% from the same period in 2021 as customers transition to digital banking channels Introduced MX Personal Finance and Credit Score powered by SavvyMoney® as online and mobile banking enhancements Treasury services provide digital solutions to help business customers streamline payment and collection processes, manage liquidity and prevent fraud Business online banking customers increased 35.4% from the same period in 2021 Utilize AI-driven predictive modeling to deliver targeted marketing content through the bank’s online and mobile banking platforms, website, and at the point-of-sale F&M TRUST Franklin Financial Services Corporation 12

Outlook for the Remainder of 2022

Adapting to the challenges and changes brought on by the pandemic over the past two years Building for the future by making investments in our physical, technological, and sales infrastructure including: Establishing a new corporate headquarters in Chambersburg, PA Adopting Salesforce, a digital sales platform to be used throughout the bank Expanding our banking presence in Hagerstown, MD Enhancing our team of employees with the addition of several key positions and expanded training Continue to transition commercial and consumer customers to digital banking and call center channels for day-to-day financial needs F&M TRUST Franklin Financial Services Corporation 13

Outlook for the Remainder of 2022

Increased competition for quality credit in the market will challenge loan demand Net income generated by the Investment & Trust Services business line will continue to grow due to the origination of new customers and cost controls that are in place, though fee income will be challenged by if there is deterioration in the equity and bond markets A focus on cross-selling between Commercial, Retail, and Investment & Trust Services lines of business should yield new opportunities across the bank with our existing customers F&M TRUST Franklin Financial Services Corporation 14

Summary

The Company is well capitalized and positioned to successfully work through the current complex social and economic conditions to the benefit of our customers and shareholders Liquidity remains strong with additional resources available if needed Asset quality is good with continued improvement and the Company is well provisioned for losses should they occur in future quarters The Company is actively working to bring more digitally based products and services to its customers The Company is positioning for future growth and expansion following the completed purchase of a new corporate headquarters and operations center, the addition of Salesforce, transitioning of senior leadership, and a new full-service community office in Maryland F&M TRUST Franklin Financial Services Corporation 15

Financial Updates First Quarter Ended March 31, 2022 F&M TRUST Franklin Financial Services Corporation 16

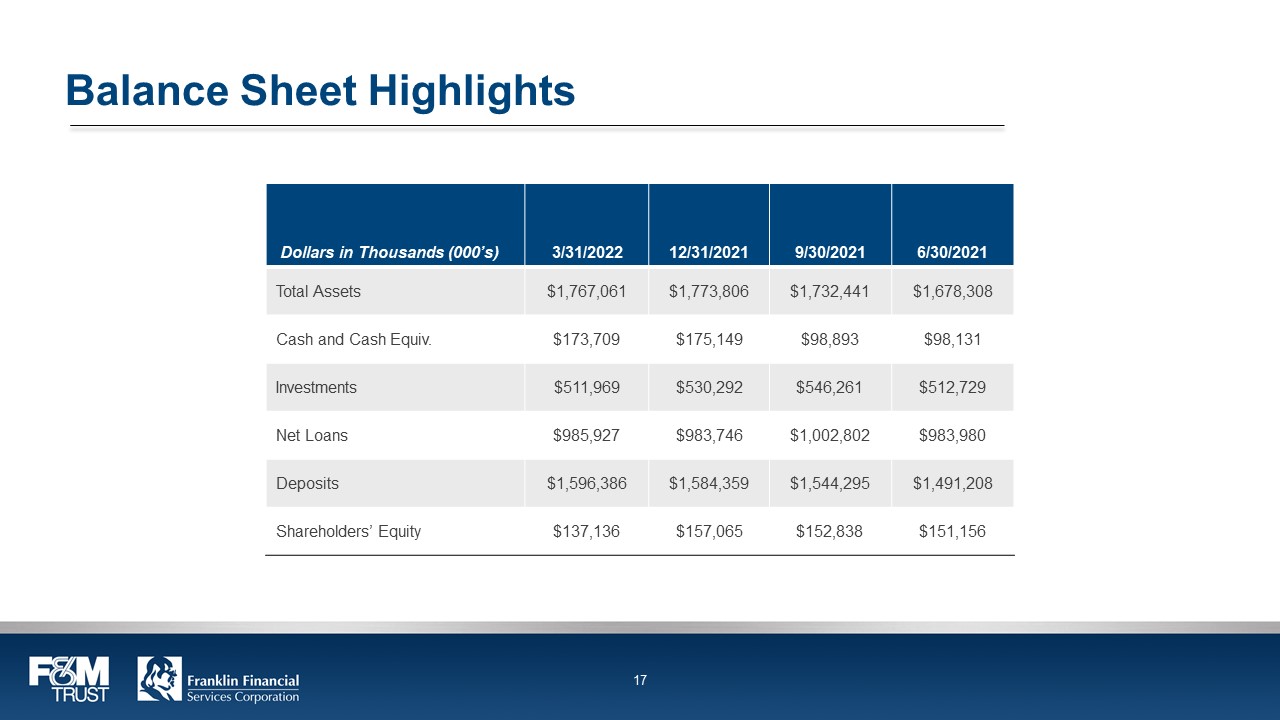

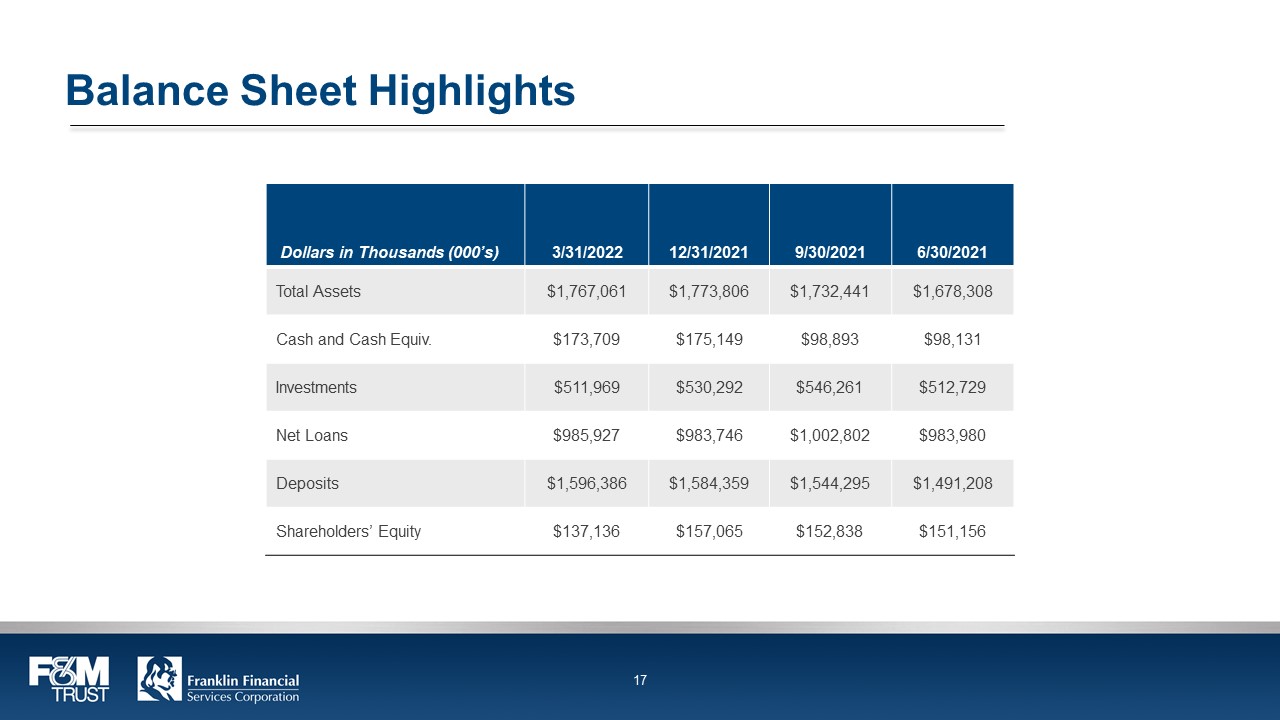

Balance Sheet Highlights Dollars in Thousands (000’s) 3/31/2022 12/31/2021 9/30/2021 6/30/2021 Total Assets $1,767,061 $1,773,806 $1,732,441 $1,678,308 Cash and Cash Equiv. $173,709 $175,149 $98,893 $98,131 Investments $511,969 $530,292 $546,261 $512,729 Net Loans $985,927 $983,746 $1,002,802 $983,980 Deposits $1,596,386 $1,584,359 $1,544,295 $1,491,208 Shareholders’ Equity $137,136 $157,065 $152,838 $151,156 F&M TRUST Franklin Financial Services Corporation 17

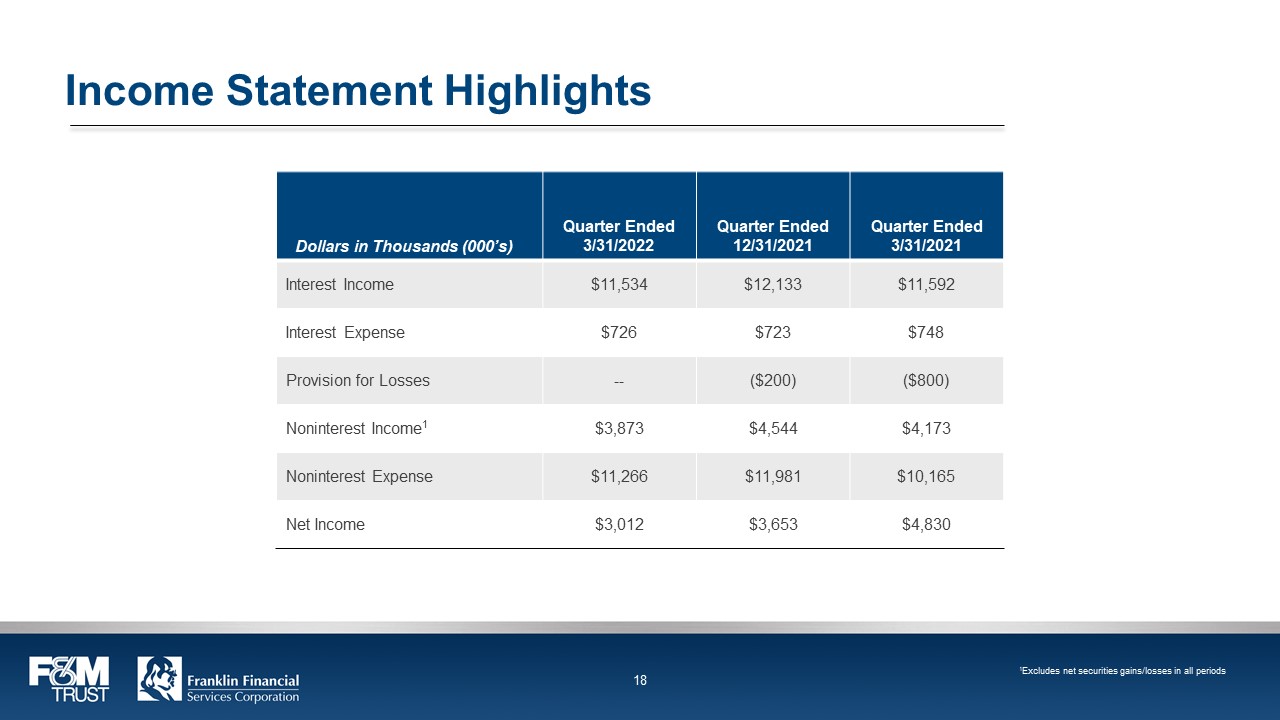

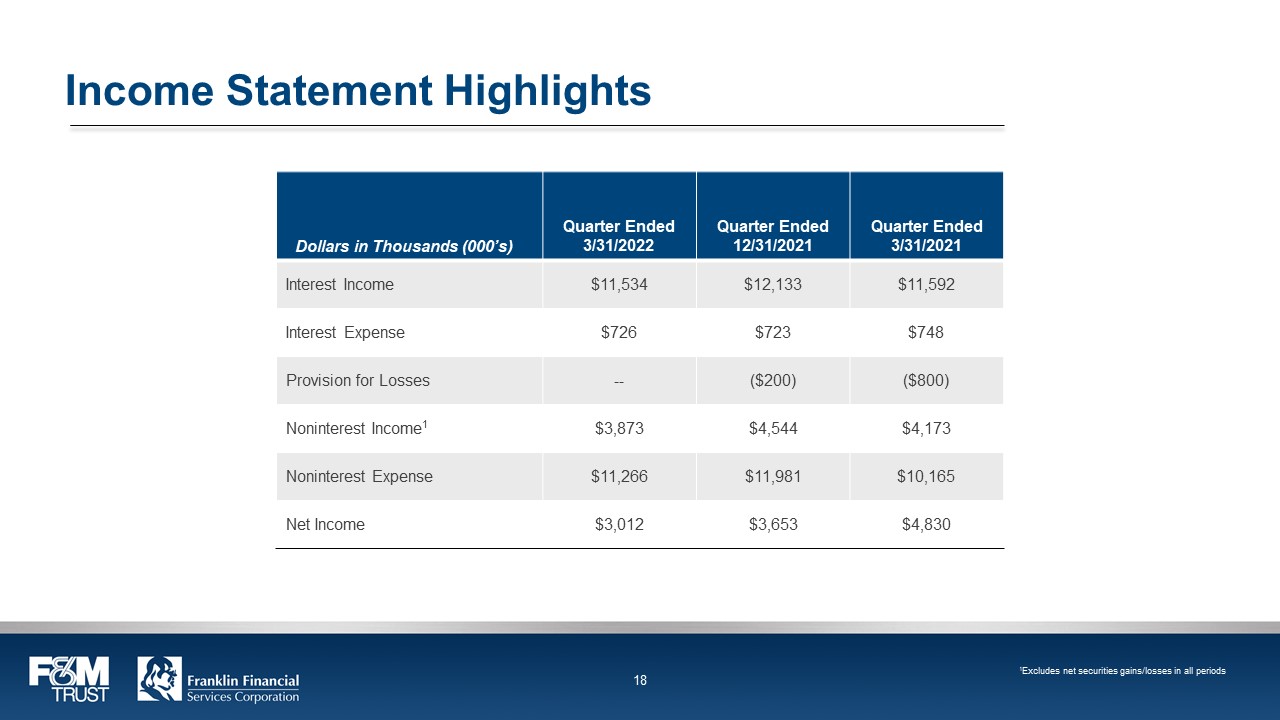

Income Statement Highlights Dollars in Thousands (000’s) Quarter Ended 3/31/2022 Quarter Ended 12/31/2021 Quarter Ended 3/31/2021 Interest Income $11,534 $12,133 $11,592 Interest Expense $726 $723 $748 Provision for Losses -- ($200) ($800) Noninterest Income1 $3,873 $4,544 $4,173 Noninterest Expense $11,266 $11,981 $10,165 Net Income $3,012 $3,653 $4,830 F&M TRUST Franklin Financial Services Corporation 18 1Excludes net securities gains/losses in all periods

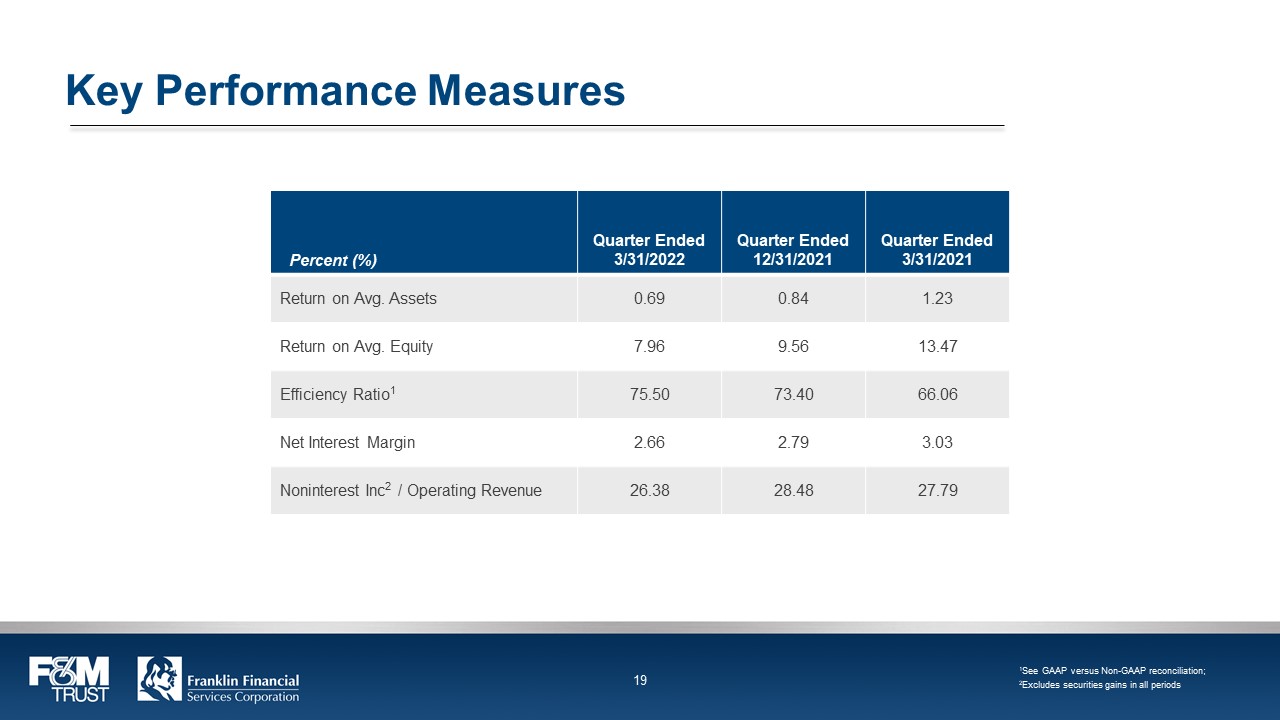

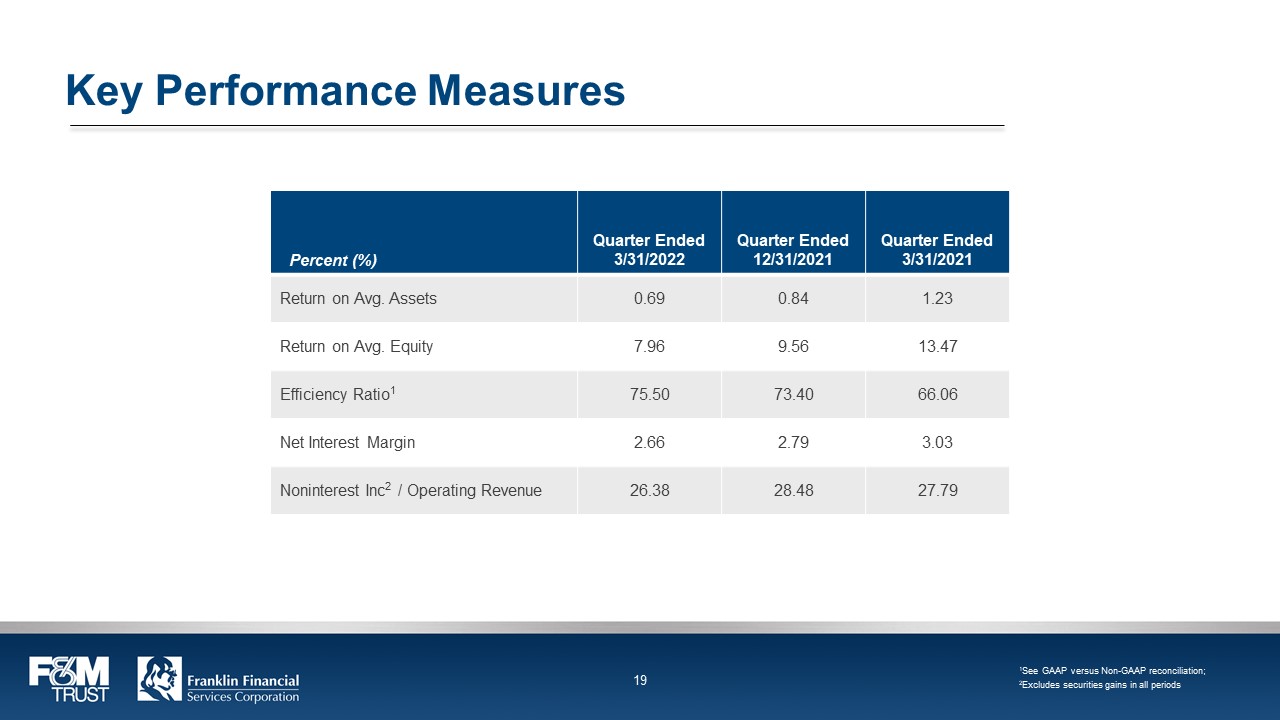

Key Performance Measures Percent (%) Quarter Ended 3/31/2022 Quarter Ended 12/31/2021 Quarter Ended 3/31/2021 Return on Avg. Assets 0.69 0.84 1.23 Return on Avg. Equity 7.96 9.56 13.47 Efficiency Ratio1 75.50 73.40 66.06 Net Interest Margin 2.66 2.79 3.03 Noninterest Inc2 / Operating Revenue 26.38 28.48 27.79 F&M TRUST Franklin Financial Services Corporation 19 1See GAAP versus Non-GAAP reconciliation; 2Excludes securities gains in all periods

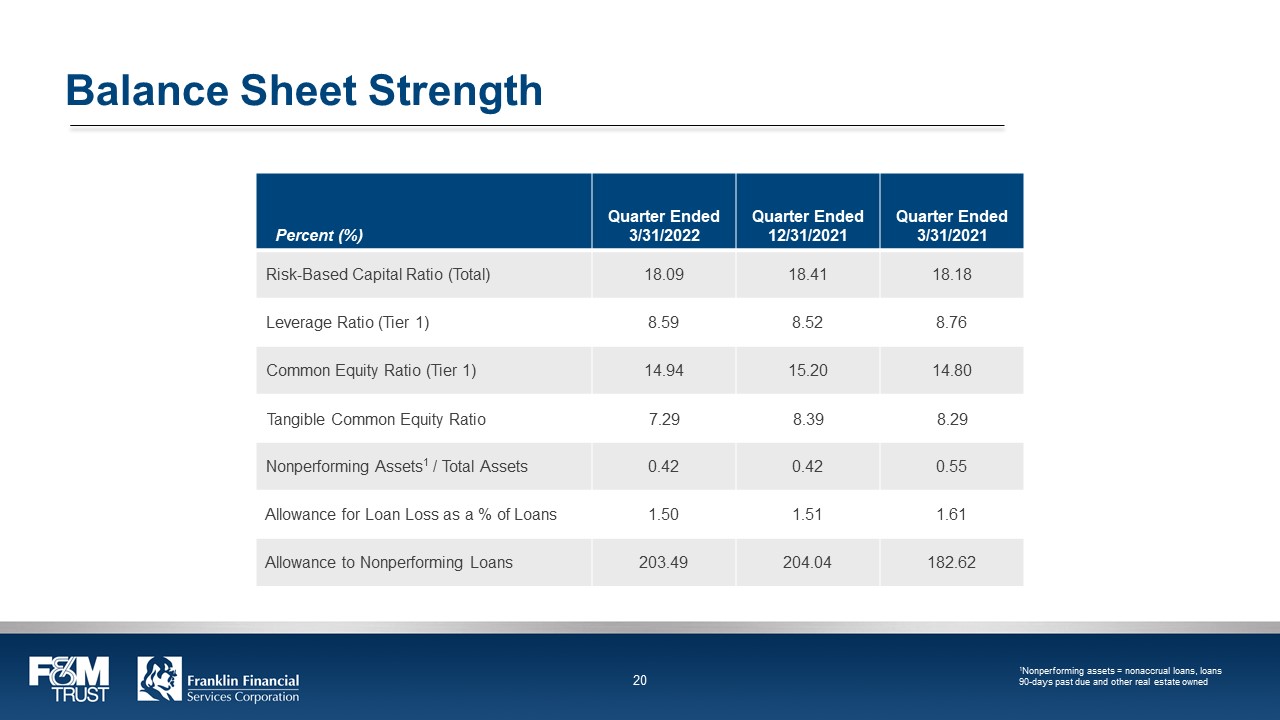

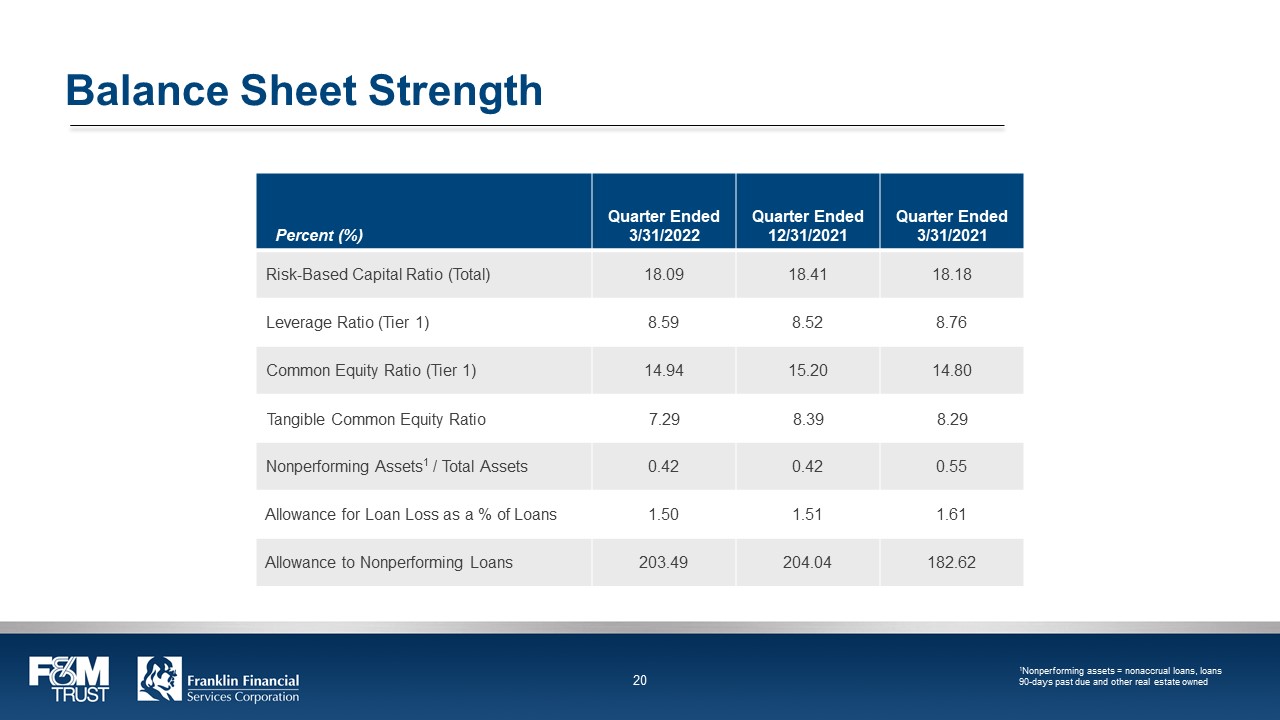

Balance Sheet Strength Percent (%) Quarter Ended 3/31/2022 Quarter Ended 12/31/2021 Quarter Ended 3/31/2021 Risk-Based Capital Ratio (Total) 18.09 18.41 18.18 Leverage Ratio (Tier 1) 8.59 8.52 8.76 Common Equity Ratio (Tier 1) 14.94 15.20 14.80 Tangible Common Equity Ratio 7.29 8.39 8.29 Nonperforming Assets1 / Total Assets 0.42 0.42 0.55 Allowance for Loan Loss as a % of Loans 1.50 1.51 1.61 Allowance to Nonperforming Loans 203.49 204.04 182.62 F&M TRUST Franklin Financial Services Corporation 20 1Nonperforming assets = nonaccrual loans, loans 90-days past due and other real estate owned

Market Statistics Per Share Measure / Market Valuation Quarter Ended 3/31/2022 Quarter Ended 12/31/2021 Quarter Ended 3/31/2021 Diluted Earnings Per Share $0.67 $0.82 $1.09 Cash Dividend Yield 3.81% 3.87% 3.85% Regular Cash Dividends Paid $0.32 $0.32 $0.30 Dividend Payout Ratio 47.18% 38.83% 27.29% Market Value Per Share $33.58 $33.10 $31.18 Book Value $30.77 $35.36 $31.92 Tangible Book Value1 $28.75 $33.34 $29.87 Market Cap ($M) $128,120 $148,049 $131,683 Price / Book (%) 109.13% 93.61% 97.68% Price / Tangible Book (%) 116.80% 99.29% 104.39% Price / LTM EPS (X) 8.42 7.51 8.59 F&M TRUST Franklin Financial Services Corporation 21 1See GAAP versus Non-GAAP reconciliation

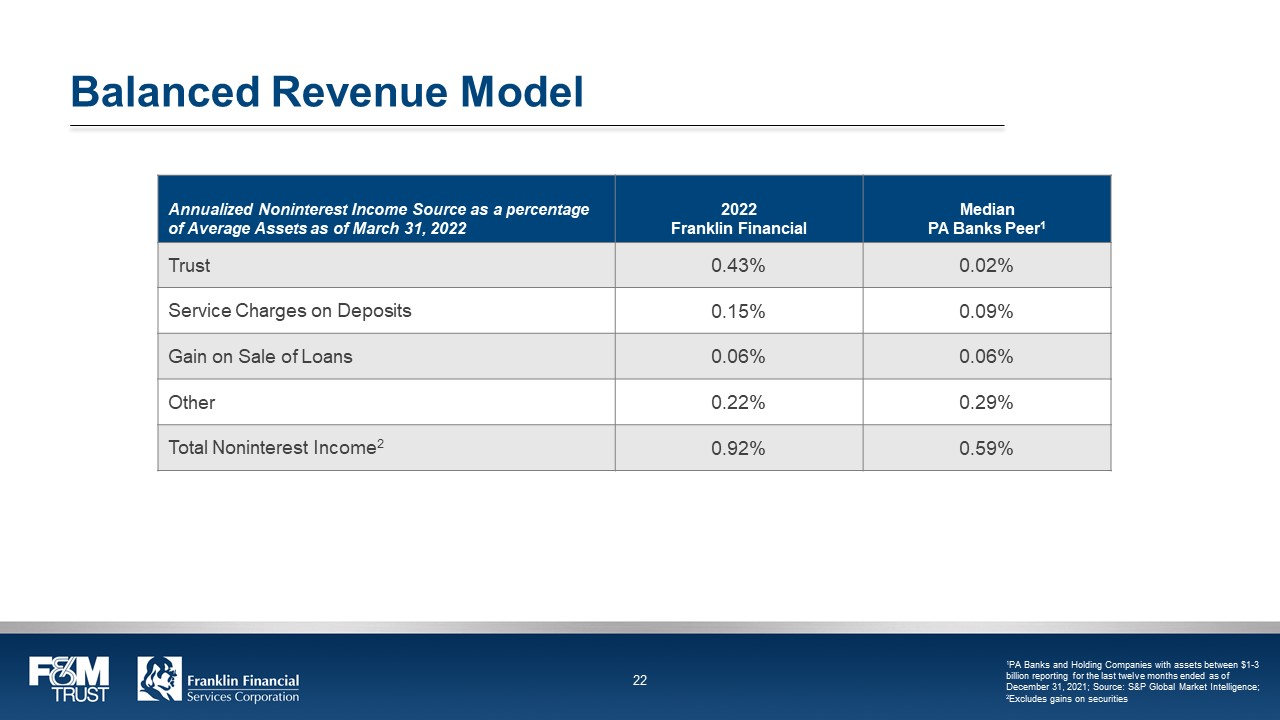

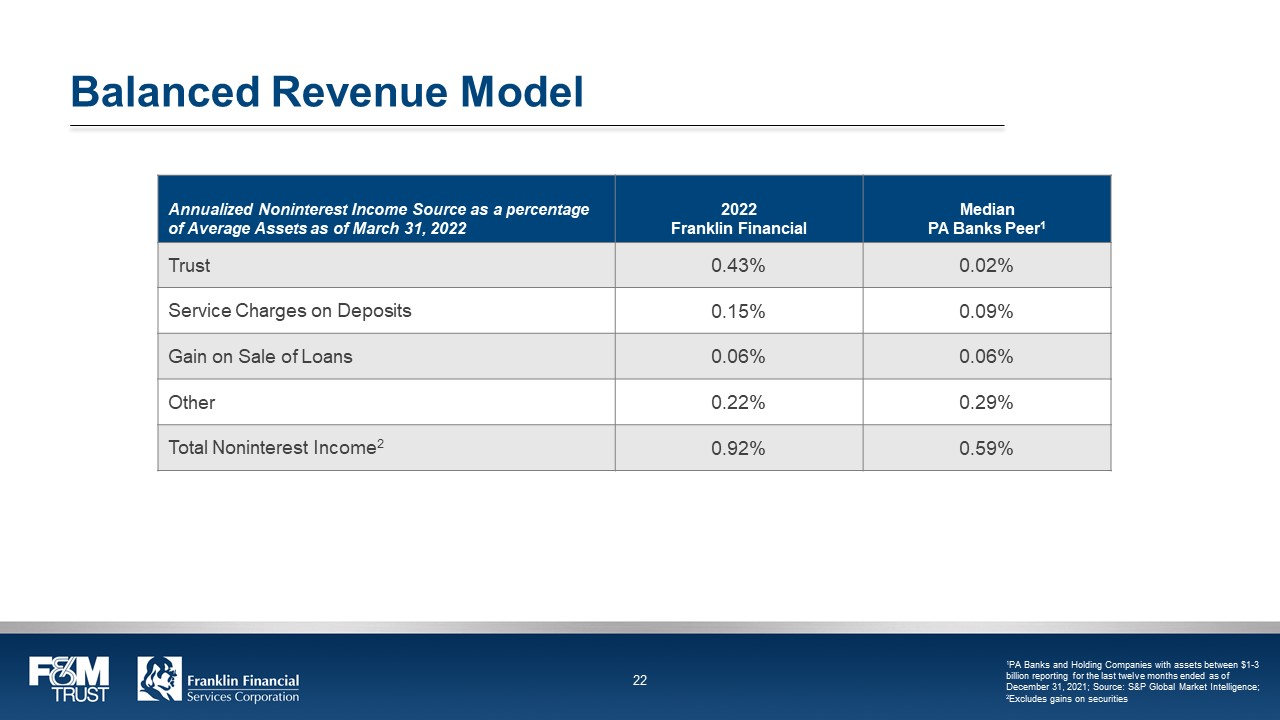

Balanced Revenue Model

Annualized Noninterest Income Source as a percentage of Average Assets as of March 31, 2022 2022 Franklin Financial Median PA Banks Peer1 Trust 0.43% 0.02% Service Charges on Deposits 0.15% 0.09% Gain on Sale of Loans 0.06% 0.06% Other 0.22% 0.29% Total Noninterest Income2 0.92% 0.59% 1PA Banks and Holding Companies with assets between $1-3 billion reporting for the last twelve months ended as of December 31, 2021; Source: S&P Global Market Intelligence; 2Excludes gains on securities F&M TRUST Franklin Financial Services Corporation 22

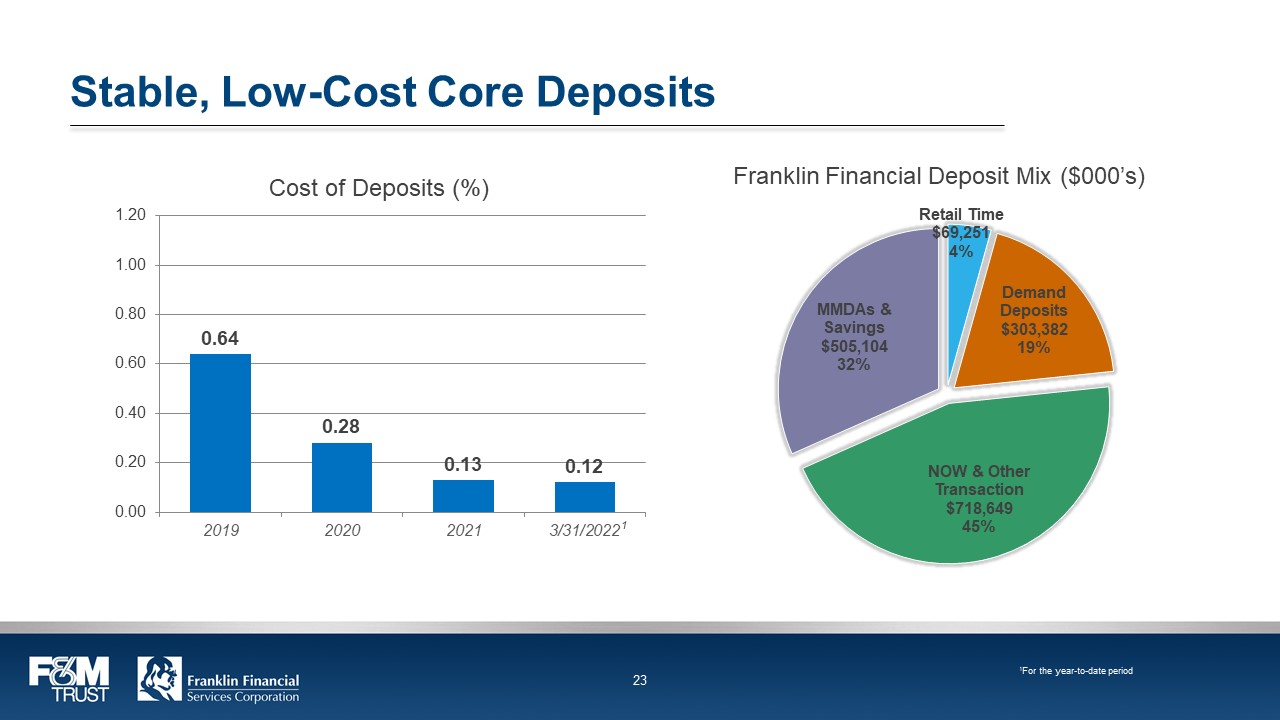

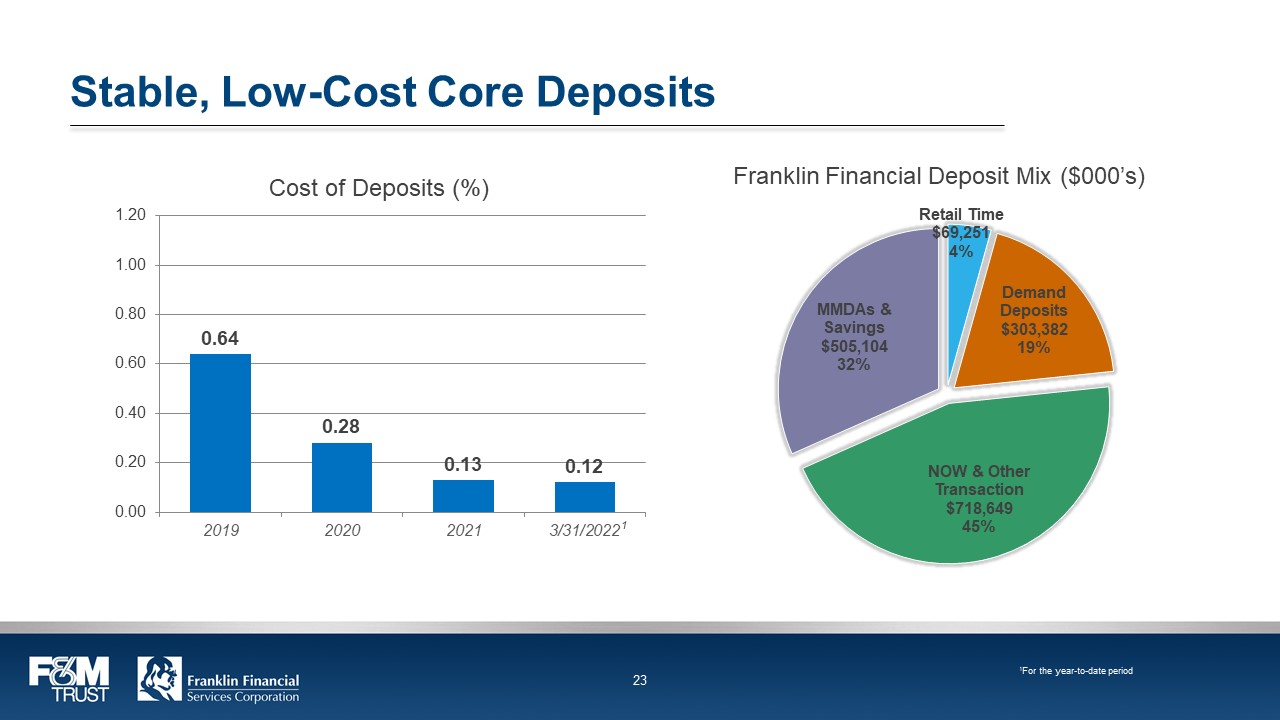

Stable, Low-Cost Core Deposits

Cost of Deposits (%) 1.20 1.00 0.80 0.60 0.40 0.20 0.00 0.64 0.28 0.13 0.12 2019 2020 2021 3/31/2022 1 Franklin Financial Deposit Mix ($000’s) Retail Time Demand Deposits NOW & Other Transaction MMDAs & Savings $9,251 $303,382 $718,649 $505,104 4% 19% 45% 32% 1For the year-to-date period F&M TRUST Franklin Financial Services Corporation 23

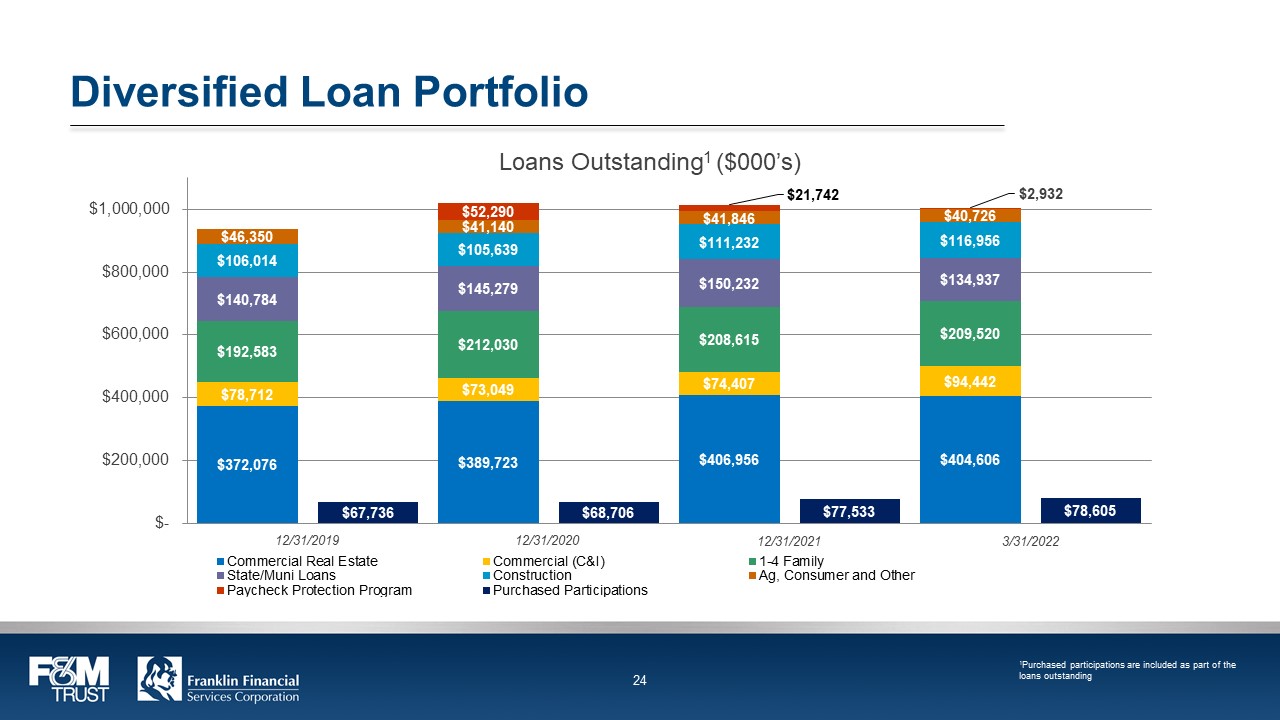

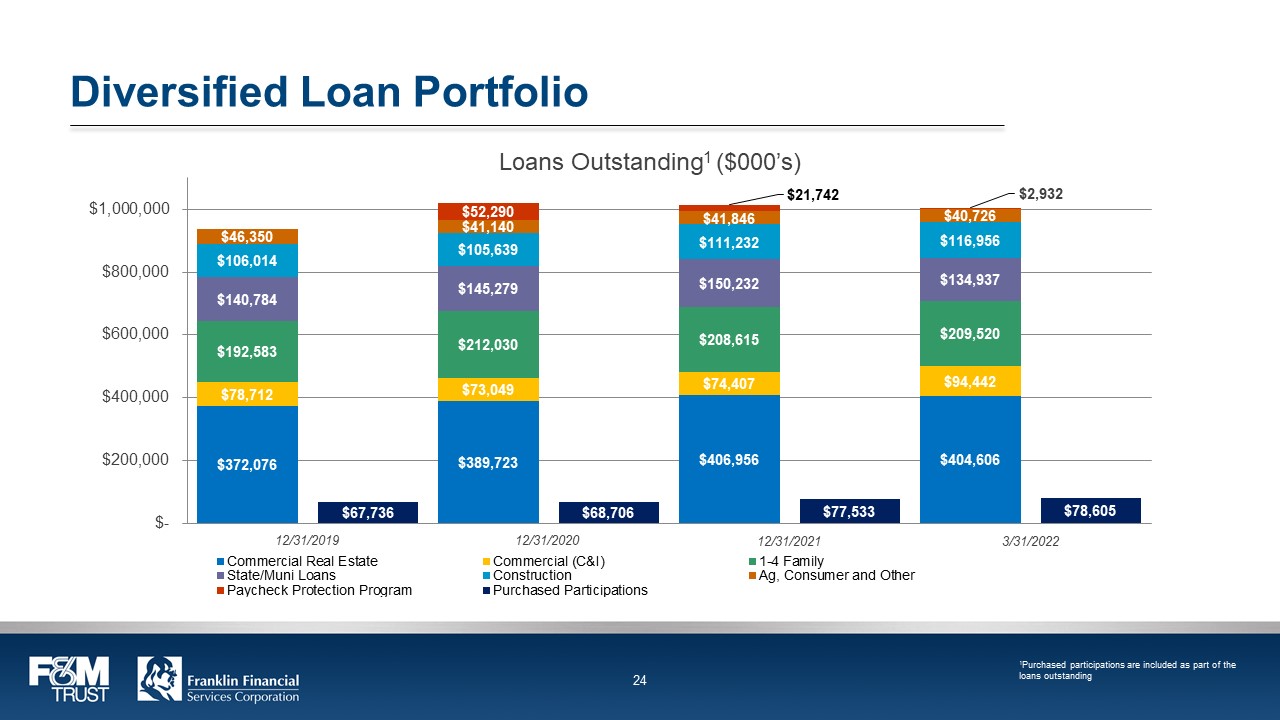

Diversified Loan Portfolio

Loans Outstanding1 ($000’s) $52,290 $21,742 $2,932 $46,350 $41,140 $41,846 $40,726 $1,000,000 $106,014 $105,639 $111,232 $116,956 $800,000 $140,784 $145,279 $150,232 $134,937 $600,000 $192,583 $212,030 $208,615 $209,520 $400,000 $78,712 $73,049 $74,407 $94,442 $200,000 $372,076 $67,736 $389,723 $68,706 $406,956 $77,533 $404,606 78605 $0 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Commercial Real Estate Commercial (C&I) 1-4 Family Staet/Muni Loans Construction Ag, Consumer and Other Paycheck Protection Program Purchased Participants 1Purchased participations are included as part of the loans outstanding F&M TRUST Franklin Financial Services Corporation 24

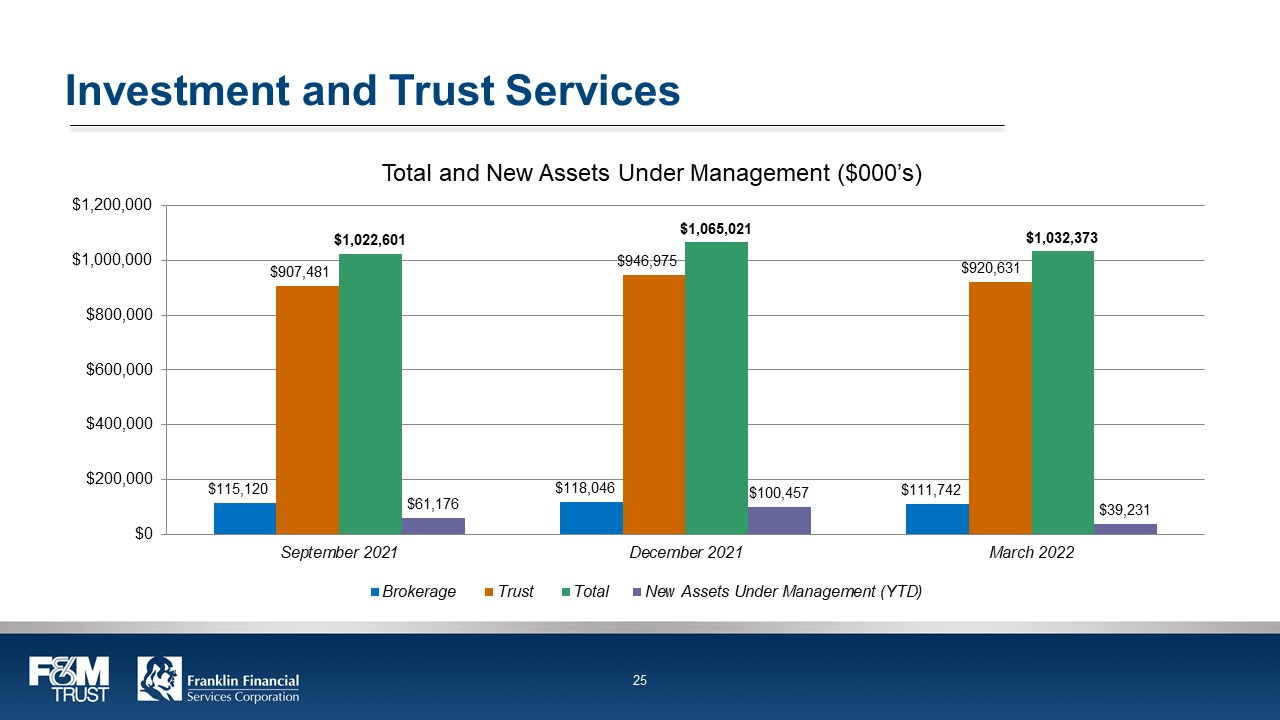

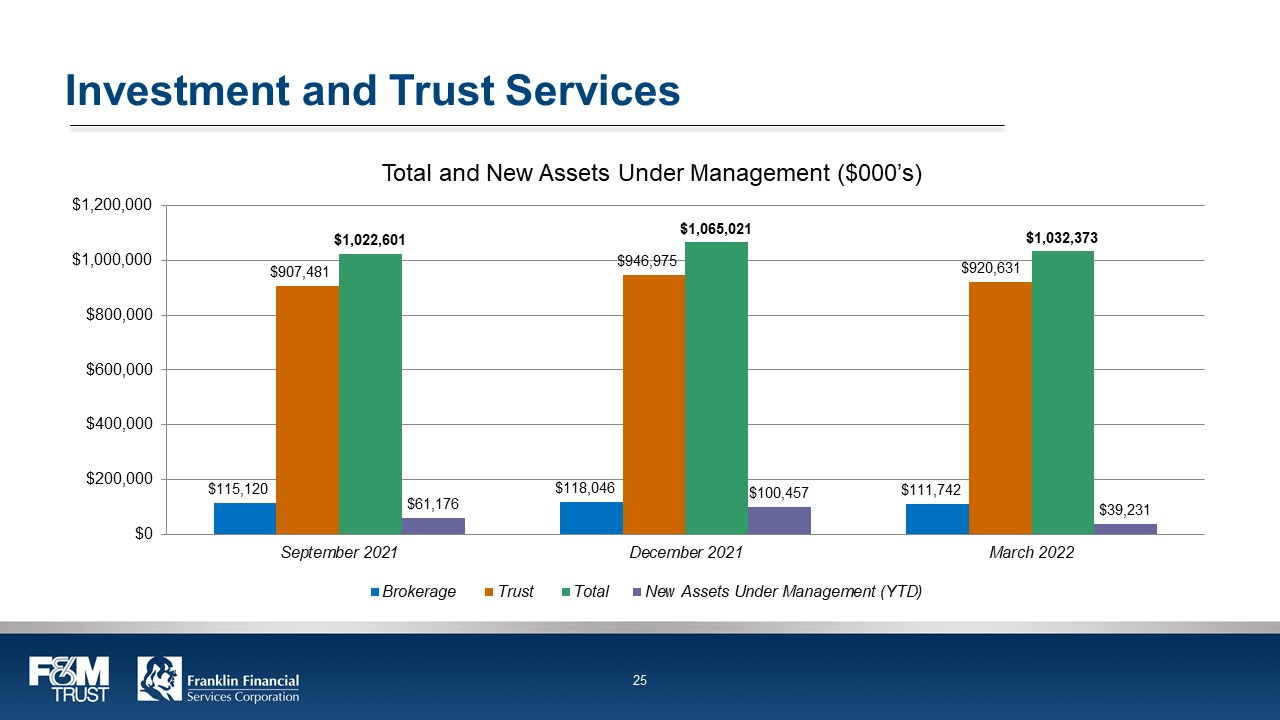

Investment and Trust Services Total and New Assets Under Management ($000’s) $1,200,000 $115,120 $907,481 $1,022,601 $61,176 $118,046 $946,975 $1,065,021 $100,457 $111,742 $920,631 $1,032,373 $39,231 $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 September 2021 December 2021 March 2022 Brokerage Trust Total New Assets Under Management (YTD) F&M TRUST Franklin Financial Services Corporation 25

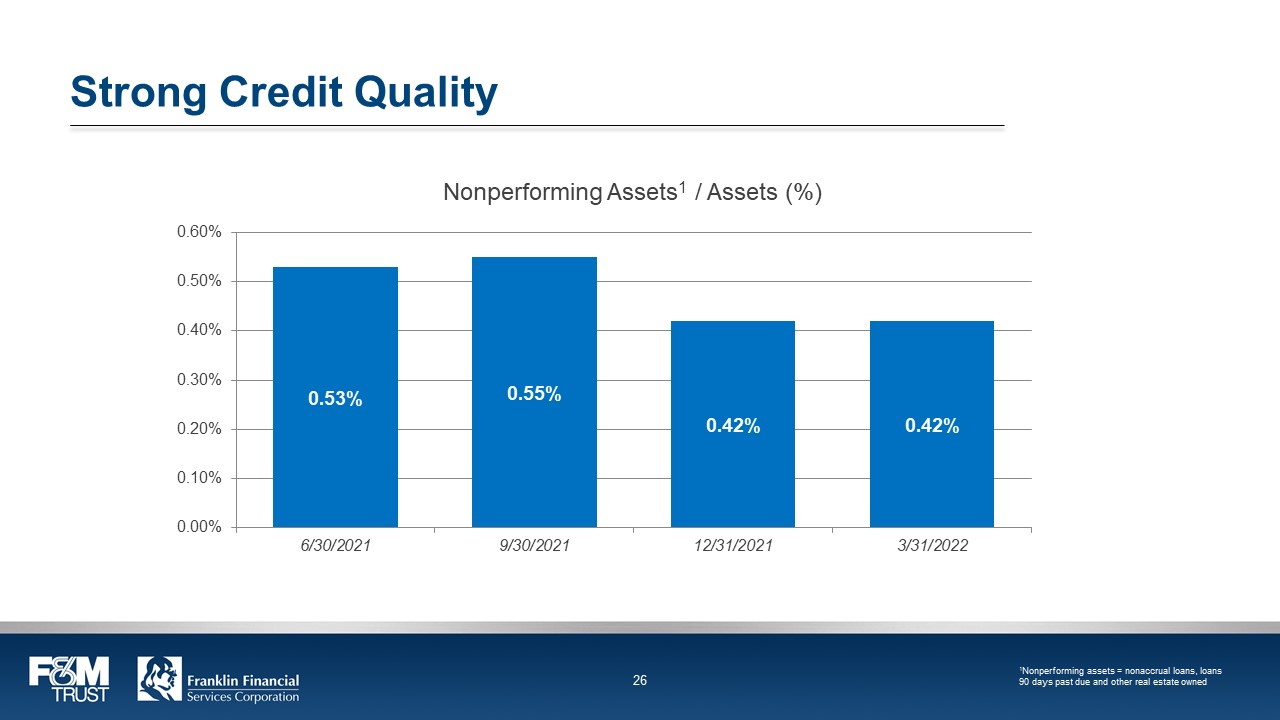

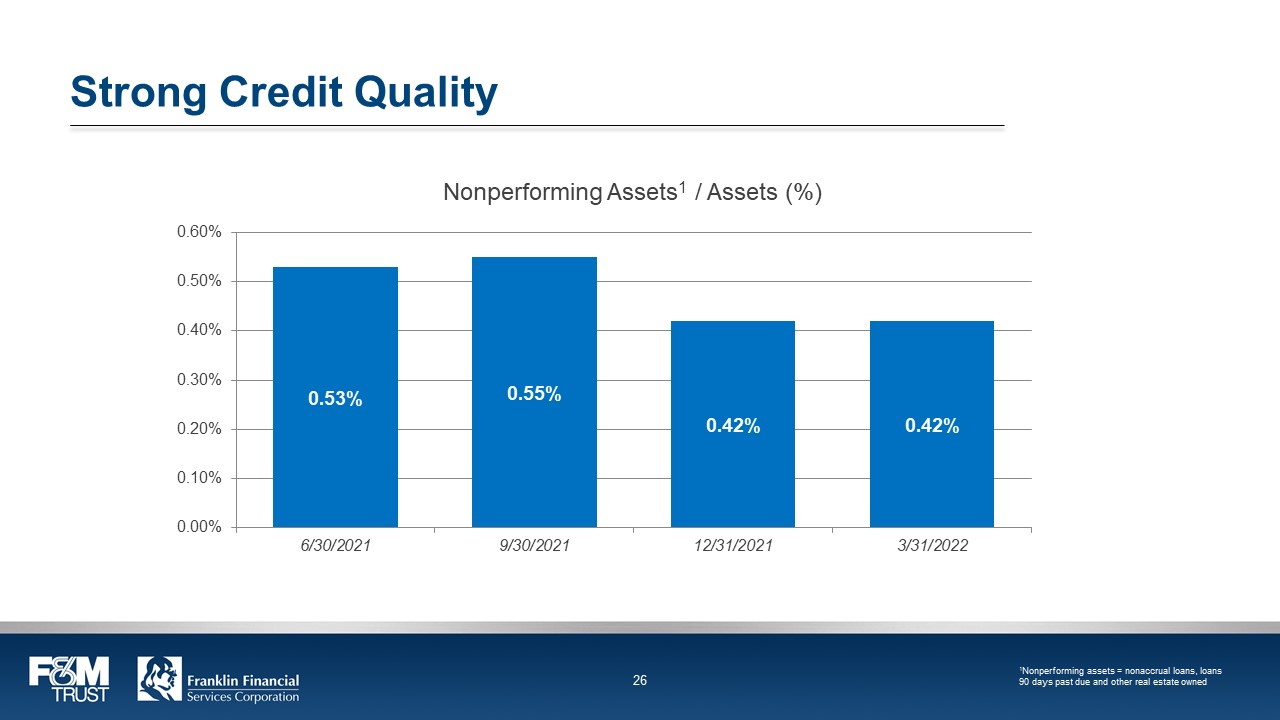

Strong Credit Quality

Nonperforming Assets1 / Assets (%) 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% 0.00% 0.53% 0.55% 0.42% 0.42% 6/30/221 9/30/2021 12/31/2021 3/31/2022 1Nonperforming assets = nonaccrual loans, loans 90 days past due and other real estate owned F&M TRUST Franklin Financial Services Corporation 26

Stock Symbol: FRAF (Nasdaq) www.franklinfin.com www.fmtrust.bank F&M TRUST Franklin Financial Services Corporation 27

Appendix F&M TRUST Franklin Financial Services Corporation 28

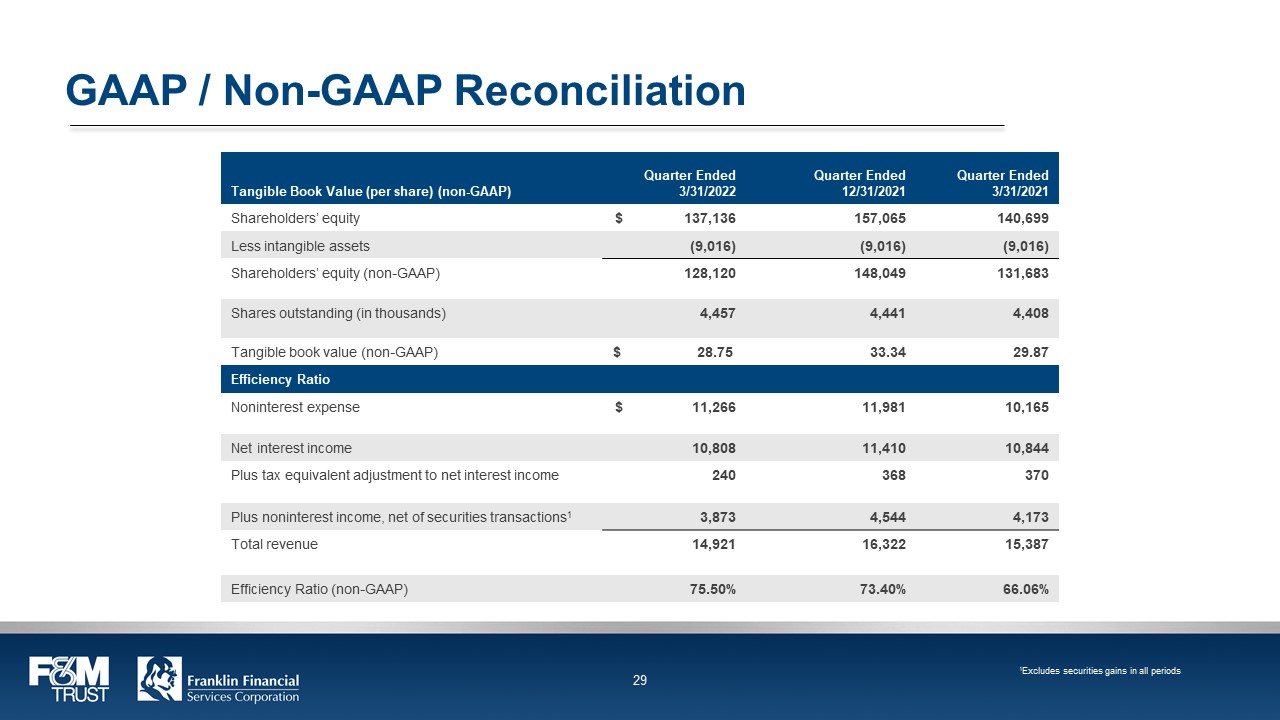

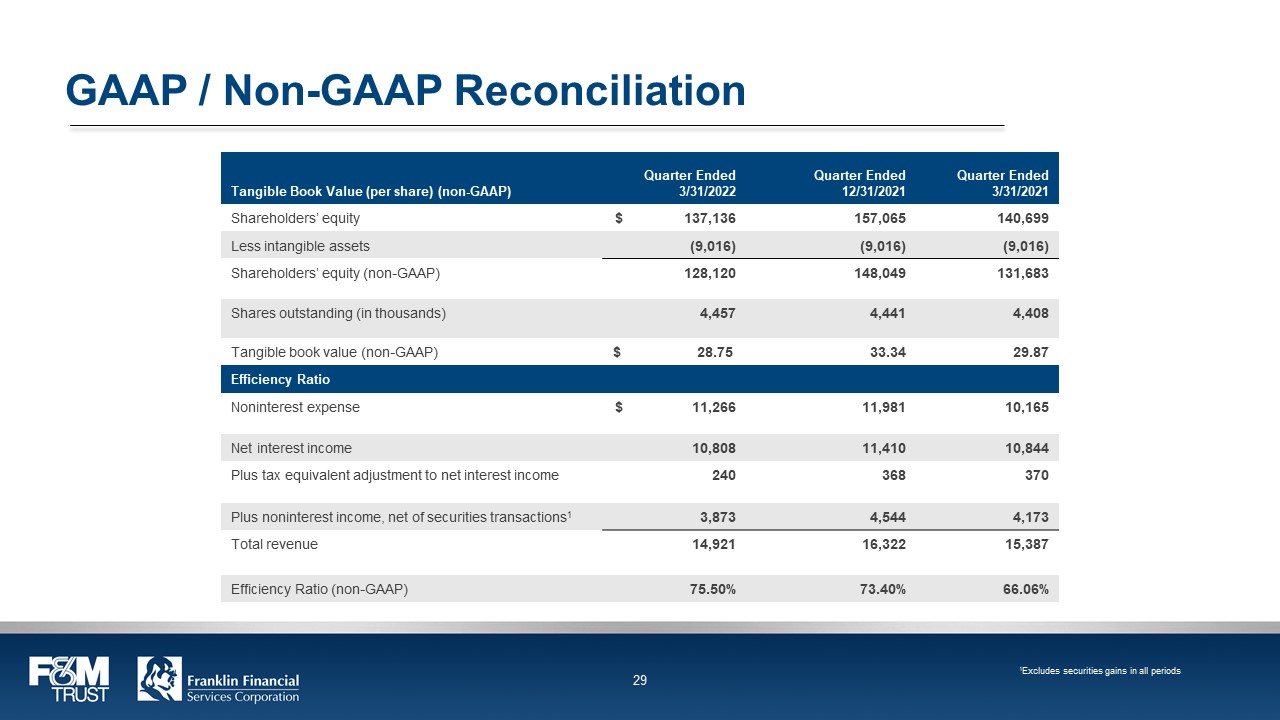

GAAP / Non-GAAP Reconciliation Tangible Book Value (per share) (non-GAAP) Quarter Ended 3/31/2022 Quarter Ended 12/31/2021 Quarter Ended 3/31/2021 Shareholders’ equity $ 137,136 157,065 140,699 Less intangible assets (9,016) (9,016) (9,016) Shareholders’ equity (non-GAAP) 128,120 148,049 131,683 Shares outstanding (in thousands) 4,457 4,441 4,408 Tangible book value (non-GAAP) $ 28.75 33.34 29.87 Efficiency Ratio Noninterest expense $ 11,266 11,981 10,165 Net interest income 10,808 11,410 10,844 Plus tax equivalent adjustment to net interest income 240 368 370 Plus noninterest income, net of securities transactions1 3,873 4,544 4,173 Total revenue 14,921 16,322 15,387 Efficiency Ratio (non-GAAP) 75.50% 73.40% 66.06% 1Excludes securities gains in all periods F&M TRUST Franklin Financial Services Corporation 29