UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Electro Scientific Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| Notice of Annual Meeting of Shareholders |

To the Shareholders of Electro Scientific Industries, Inc.:

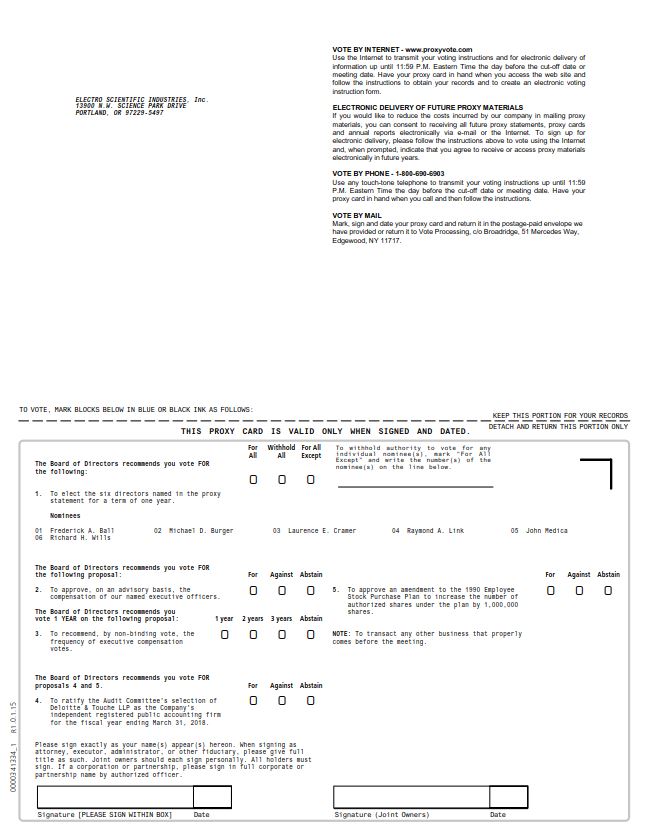

The Annual Meeting of Shareholders of Electro Scientific Industries, Inc. (ESI) will be held at ESI’s offices, 13900 NW Science Park Drive, Portland, Oregon, on Thursday, August 10, 2017 at 2:30 p.m. Pacific Daylight Time, for the following purposes:

| 1. | To elect the six directors named in the proxy statement for a term of one year. Frederick A. Ball, Michael Burger, Laurence E. Cramer, Raymond A. Link, John Medica and Richard H. Wills are nominees for election for a one-year term. |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers. |

| 3. | To recommend, on an advisory basis, the frequency of executive compensation votes. |

| 4. | To ratify the Audit Committee’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2018. |

| 5. | To approve an amendment to the 1990 Employee Stock Purchase Plan to increase the number of authorized shares under the plan by 1,000,000 shares. |

| 6. | To transact any other business that properly comes before the meeting. |

Only shareholders of record at the close of business on June 1, 2017 will be entitled to vote at the 2017 Annual Meeting.

Your vote is very important. Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. Promptly voting your shares by phone, via the internet, or by signing, dating, and returning the enclosed proxy card will ensure the presence of a quorum at the meeting. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Retention of the proxy is not necessary for admission to or identification at the meeting.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON THURSDAY, AUGUST 10, 2017: This proxy statement and the Company’s 2017 Annual Report to Shareholders are also available at http://investors.esi.com/proxy.cfm.

By Order of the Board of Directors

Paul Oldham

Vice President of Administration, Chief

Financial Officer and Corporate Secretary

Portland, Oregon

July 10, 2017

ELECTRO SCIENTIFIC INDUSTRIES, INC.

PROXY STATEMENT

The mailing address of the principal executive offices of the Company is 13900 NW Science Park Drive, Portland, Oregon 97229-5497. The approximate date this proxy statement and the accompanying proxy forms are first being mailed to shareholders is July 10, 2017.

SOLICITATION AND REVOCABILITY OF PROXY

The enclosed proxy is solicited on behalf of the Board of Directors (the "Board") of Electro Scientific Industries, Inc., an Oregon corporation, for use at the Annual Meeting of Shareholders to be held on August 10, 2017 (the "2017 Annual Meeting"). The Company will bear the cost of preparing and mailing the proxy, proxy statement and any other material furnished to the shareholders by the Company in connection with the 2017 Annual Meeting. Proxies will be solicited by use of the mail and the internet, and officers and employees of the Company may, without additional compensation, also solicit proxies by telephone, fax or personal contact. Copies of solicitation materials will be furnished to fiduciaries, custodians and brokerage houses for forwarding to beneficial owners of the stock held in their names.

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Corporate Secretary of the Company. The proxy may also be revoked by affirmatively electing to vote in person while in attendance at the meeting. However, a shareholder who attends the meeting need not revoke the proxy and vote in person unless he or she wishes to do so. All valid, un-revoked proxies will be voted at the 2017 Annual Meeting in accordance with the instructions given.

Common Stock is the only outstanding authorized voting security of the Company. The record date for determining holders of Common Stock entitled to vote at the 2017 Annual Meeting is June 1, 2017. On that date there were 33,103,704 shares of Common Stock outstanding, entitled to one vote per share. The Common Stock does not have cumulative voting rights.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

The statements contained in this proxy statement that are not statements of historical fact, including without limitation statements containing the words “believes”, “expects”, “projects”, “anticipates,” “plan,” “continue,” “will,” “may” and similar words, constitute forward-looking statements that are subject to a number of risks and uncertainties. Forward looking statements include any statements regarding anticipated operating results and expense reduction. From time to time, we may make other forward-looking statements. Investors are cautioned that such forward-looking statements involve estimates, assumptions, risks, and uncertainties and are subject to an inherent risk that actual results may differ materially. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section titled “Risk Factors” in our Forms 10-K and 10-Q. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

PROPOSAL 1: ELECTION OF DIRECTORS

A Board of six directors will be elected at the 2017 Annual Meeting. The directors are elected at each annual meeting to serve until the next annual meeting or until their successors are elected and qualified. Frederick A. Ball, Michael Burger, Laurence E. Cramer, Raymond A. Link, John Medica and Richard H. Wills are nominees for re-election for a one-year term. These nominees are recommended by the Corporate Governance and Nominating Committee. Under Oregon law, if a quorum of shareholders is present at the 2017 Annual Meeting, the directors elected will be the six nominees for election as directors who receive the greatest number of votes cast at the meeting. Abstentions and broker non-votes will have no effect on the results of the vote. Unless otherwise instructed, proxy holders will vote the proxies they receive for Messrs. Ball, Burger, Cramer, Link, Medica and Wills. If any of the nominees for election as director at the 2017 Annual Meeting becomes unavailable for election for any reason (none being known at this time), the proxy holders will have discretionary authority to vote pursuant to the proxy for a substitute or substitutes. Proxies may not be voted for a greater number of persons than the number of nominees named below.

The term of Edward C. Grady expires at the 2017 Annual Meeting. Pursuant to retirement policy in the Company’s Corporate Governance Guidelines, Mr. Grady, age 70, will conclude his service as a director of the Company as of the 2017 Annual Meeting. Robert R. Walker retired from the Board in August of 2016.

2

The following table briefly describes the Company’s nominees for directors:

| Name, Age, Principal Occupation, and Other Directorships | Director Since | |

| Nominees | ||

Frederick A. Ball, 55, served as Executive Vice President and Chief Administrative Officer of Marketo Inc., a leading marketing automation company from February 2016 through August 2016. Prior to that Mr. Ball served as the Senior Vice President and Chief Financial Officer from May 2011 to March 2016. Prior to joining Marketo, Mr. Ball was the Chief Financial Officer for a number of public and private technology companies including Webfoot Software, Inc., BigBand Networks, Inc., and Borland Software Corporation. Mr. Ball also served as Vice President, Mergers and Acquisitions for KLA-Tencor Corporation, a manufacturer of semiconductor equipment, and prior to that as its Vice President of Finance. Mr. Ball was with PricewaterhouseCoopers LLC for over 10 years. Mr. Ball is a director at Advanced Energy Industries, Inc. and is chair of its audit committee and a member of its nominating and governance committee. Mr. Ball is also on the Board of Directors of two private companies; Sendgrid, where he is also the chair of its audit committee, and Engagio. Mr. Ball brings to the Board important financial management experience and financial expertise, having served as Chief Financial Officer of several high-technology companies. He also brings significant experience with mergers and acquisitions within the semiconductor equipment industry as well as experience as a result of serving on the board of directors of another public company. | 2003 | |

Michael D. Burger, 59, was appointed President and CEO of ESI on October 3, 2016. Prior to joining ESI, Mr. Burger was President and Chief Executive Officer of Cascade Microtech since 2010. Prior to joining Cascade Microtech, Mr. Burger served as the President and Chief Executive Officer of Merix Corporation, a printed circuit board manufacturer, from April 2007 to February 2010, and as a member of the Board of Directors of ViaSystems after it acquired Merix. From November 2004 until joining Merix, Mr. Burger served as President of the Components Business of Flextronics Corporation. From 1999 to November 2004, Mr. Burger was employed by ZiLOG, Inc., a supplier of devices for embedded control and communications applications. From May 2002 until November 2004, Mr. Burger served as ZiLOG's President and a member of its board of directors. Mr. Burger holds a B.S. degree in Electrical Engineering from New Mexico State University and a certificate from the Stanford University International Executive Management Program. Mr. Burger brings to the Board his prior experience with other electronics manufacturers, including former service as a chief executive officer and director. | 2016 | |

Laurence E. Cramer, 66, was with Continuum Electro-Optics, a manufacturer of high energy laser systems for medical, industrial and scientific research, until August 2015 where he held the positions of Vice President of R&D, Vice President / General Manager and President. Prior to that, he was President of Laser Diode Inc., a manufacturer of GaAs laser diodes for military and telecom applications. Prior to that he spent 15 years at Spectra-Physics in a range of management roles including, Manager of Marketing and Sales, Strategic Product Group Manger, and President of Spectra-Physics Laser diode systems, developer of advanced diode pumped solid state laser systems. He was a Board Member and past President of the Laser Institute of America, and was a member of the U.S. Department of Commerce Technical Advisory Committee in Electronics from 1988 to 1994. He holds a BA degree in Chemistry and Physics from DePauw University, a PhD in Chemistry from Northwestern University and a Masters Certificate in Six Sigma from Villanova University. Mr. Cramer brings to the Board significant expertise in lasers and laser development. | 2015 | |

Raymond A. Link, 63, served as Executive Vice President and Chief Financial Officer of FEI Company, a leading supplier of scientific and analytical instruments for nanoscale imaging from July 2005 to April 2015. He remained with FEI to assist with transitioning this role to his successor until November 2015. Prior to this, Mr. Link served as Vice President and Chief Financial Officer of TriQuint Semiconductor, Inc. from July 2001 to July 2005. He is also on the Board of Directors of nLight Inc., a private company and FormFactor Inc., a manufacturer of probe cards and electrical test and measurement equipment for the semiconductor industry. Mr. Link received a B.S. degree from the State University of New York at Buffalo and an M.B.A. from the Wharton School at the University of Pennsylvania. He is a licensed Certified Public Accountant and a Fellow with the National Association of Corporate Directors. Mr. Link brings to the Board important financial management experience and expertise, as well as operations experience with another high-technology public company. | 2015 | |

3

| Name, Age, Principal Occupation, and Other Directorships | Director Since | |

| Nominees (continued) | ||

John Medica, 58, served from 2007 until 2015 as Vice Chairman and Corporate Adviser of Compal Group, a leading global electronics Original Design Manufacturer (ODM) based in Taiwan with annual revenues in excess of $25 billion. Mr. Medica also served as a member of the Board of Directors of National Instruments from June 2008 through May 2014 and is a Trustee at Wake Forest University. He retired as a Senior Vice President and co-leader of the Product Development organization at Dell Inc. in April 2007 after fourteen years of service and, prior to joining Dell, he served ten years at Apple Inc. in a variety of product development and operations-related executive roles. He also has served as a Board Member or Advisor of two start-up/private technology companies, Artificial Solutions, Aviacomm, Cloverleaf Media and Packsize over the past two years. Mr. Medica brings to the Board significant expertise in the electronics consumer products industries and Asian electronics manufacturing, as well as experience serving on the boards of other public companies. | 2015 | |

Richard H. Wills, 62, (Chairman), was President and CEO of Tektronix, Inc., a test, measurement, and monitoring company, from 2000 until 2008, and its Chairman from 2001 through 2008. He joined Tektronix in 1979 and served in a range of marketing, product development and management roles, including President of the Measurement Business and President of Regional Operations for both Europe and the Americas. He holds a master's degree in business administration from the University of Oregon and a bachelor's degree in computer systems from Linfield College. Mr. Wills was a director of FEI Company until the company was acquired in 2016 and was Chairman of the Board of General Fusion, a private energy company in Vancouver, Canada until his retirement from the Board in March of 2017. Mr. Wills was appointed as a director by the Board of Directors in August 2014 and has served as the Chairman of the Board of Directors since February 2015. Mr. Wills brings to the Board expertise in strategic planning, corporate governance, marketing and technology, as well as experience serving on the board of another public company. | 2014 | |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT

4

CORPORATE GOVERNANCE GUIDELINES AND INDEPENDENCE

The Company’s Board of Directors has approved and adopted the Corporate Governance Guidelines and Corporate Governance and Nominating Committee Charter that are on the Company’s website at http://investors.esi.com/governance.cfm. Under the Company’s Corporate Governance Guidelines, which reflect the current standards for “independence” under the NASDAQ Stock Market listing standards and the Securities and Exchange Commission rules, two-thirds of the members of the Board of Directors must be independent as determined by the Board of Directors. The Board of Directors has made the following determinations with respect to each director’s independence for each director that served during the year:

| Director | Status (1) | |

| Frederick A. Ball | Independent | |

| Michael D. Burger | Not Independent (2) | |

| Laurence E. Cramer | Independent | |

| Edward C. Grady | Not Independent (2) | |

| Raymond A. Link | Independent | |

| John Medica | Independent | |

| Robert R. Walker | Independent | |

| Richard H. Wills | Independent | |

| (1) | The Board’s determination that a director is independent was made on the basis of the standards set forth in the Corporate Governance Guidelines. |

| (2) | Mr. Grady was President and Chief Executive Officer (CEO) of ESI until he was succeeded by Mr. Burger on October 3, 2016. Therefore, neither are independent in accordance with the standards set forth in the Corporate Governance Guidelines. |

The Company has also adopted a Code of Conduct and Business Practices applicable to the Company’s directors, officers, employees and agents of ESI and its subsidiaries and a Code of Ethics for Financial Managers. Copies of the Company’s Code of Conduct and Business Practices and Code of Ethics for Financial Managers are available on the Company’s website at http://investors.esi.com/governance.cfm.

BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

Board Leadership

In accordance with our Corporate Governance Guidelines, it is the practice of the Board of Directors to select a director as Chairman of the Board who qualifies as independent as defined in the Corporate Governance Guidelines. If the Chairman of the Board ceases to qualify as independent, the Board of Directors will designate an independent director to serve as Lead Director. The Company believes that this structure enhances the Board’s oversight of management, strengthens the Board’s ability to communicate its views to management, increases the Board’s independence and otherwise enhances our governance.

Risk Oversight

The Board as a whole is responsible for overseeing our risk management function and certain members of the Company’s senior management team are expressly authorized by the Board to be responsible for implementation of the Company’s day-to-day risk management processes. In connection with the Board’s annual strategic and financial plan review, senior management makes a multidisciplinary presentation to the Board on significant strategic, operational, financial, legal and compliance risks facing the Company. At the other three quarterly Board meetings, senior management provides an update to the Board on specific risk-related issues. Additionally, the Board reviews a comprehensive assessment of the Company's risk and associated mitigating factors and actions annually.

5

Additionally, the Board is actively involved in oversight of certain risk areas conducted primarily through committees of the Board, as described in the charters of each of the committees. The Compensation Committee is responsible for overseeing the management of the Company’s executive compensation plans and incentive arrangements and routinely reviews these programs and incentive programs for all employees to ensure that these programs do not present inappropriate risk and are aligned with shareholder interests. The Audit Committee oversees management of financial reporting, information technology, legal, the external audit relationship, functioning of internal controls and insurance related risks. This oversight includes meeting with management on at least a quarterly basis. As frequently as necessary, the Audit Committee Chair meets with senior management, the Company’s outside counsel and the Company’s independent auditors to discuss any hotline complaints, allegations of violations of the Code of Ethics and other ethical, legal or compliance matters. As applicable, which is generally on a quarterly basis, internal audit reports on the progress of the annual control testing to the Audit Committee and any related findings. Any significant findings are followed up on and corrected under the direction of the Audit Committee and the senior management team.

The Corporate Governance and Nominating Committee manages risks associated with the qualifications and independence of the Board of Directors and potential conflicts of interest. The Board satisfies their risk oversight responsibility through reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from management responsible for oversight of particular risks within the Company.

MEETING ATTENDANCE

During fiscal 2017, the Board of Directors held eight meetings, and each member of the Board of Directors attended at least 75 percent of the aggregate number of the meetings of the Board of Directors and the committees of which he was a member. Directors are expected to attend shareholder meetings. All directors then in office attended the fiscal 2016 Annual Meeting of Shareholders.

BOARD COMPENSATION

Non-employee director compensation consists of a mix of cash and equity. The combination of cash and equity compensation is intended to provide incentives for non-employee directors to continue to serve on the Board of Directors, to align the interests of the Board of Directors and stockholders, and to attract new non-employee directors with outstanding qualifications. The Compensation Committee periodically reviews the non-employee director compensation program and makes recommendations to the Board of Directors as appropriate. The Committee has engaged Compensia, Inc., (“Compensia”) as its independent compensation consultant to provide advice with respect to non-employee director compensation matters. During fiscal 2017, Compensia reviewed and recommended updates for the Company’s peer group and provided related advice with respect to director compensation. Compensia also provided advice and information on material compensation trends to provide a general understanding of current compensation practices.

Directors who are not employees of the Company receive the following fees to the extent applicable to the individual directors: (a) an annual cash retainer of $75,000 for the service as the Chairman of the Board; (b) an annual cash retainer of $45,000 for non-Chairman Board service; and (c) an annual fee of $20,000, $15,000, and $10,000 for service as Chair of the Audit Committee, Compensation Committee, and Nominating & Governance Committee, respectively; and (d) an annual fee of $7,500, $5,000, and $4,000 for non-chairman service on the Audit Committee, Compensation Committee, and Nominating & Governance Committee, respectively. The Company also provides for reimbursement of costs for continuing education programs relating to the performance of duties as a director of a public company, subject to approval by the Chairman of the Board. Directors were reimbursed for reasonable expenses incurred in attending meetings.

Non-employee directors also receive equity grants of restricted stock units (RSUs) as a component of their total compensation.

On August 18, 2016, each non-employee director was granted 12,000 RSUs under the 2004 Stock Incentive Plan to vest 100% immediately prior to the 2017 Annual Meeting, provided, however, that if any director terminates service prior to such time, the award shall be prorated. For those directors only serving a partial term, the awards and cash retainers were prorated accordingly.

6

FISCAL YEAR 2017 DIRECTOR COMPENSATION

The following table shows compensation earned by the Company’s non-employee directors in fiscal 2017. Compensation for Mr. Burger and Mr. Grady is set forth in the Summary Compensation Table.

| Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) | All Other Compensation ($) | Total ($) | ||||||||||||||

| Frederick A. Ball | $ | 62,802 | $ | 62,760 | (3) | $ | — | $ | 125,562 | |||||||||

| Laurence E. Cramer | $ | 56,500 | $ | 62,760 | (3) | $ | — | $ | 119,260 | |||||||||

| Raymond A. Link | $ | 68,054 | (4) | $ | 62,760 | (3) | $ | — | $ | 130,814 | ||||||||

| John Medica | $ | 58,582 | $ | 62,760 | (3) | $ | — | $ | 121,342 | |||||||||

Robert R. Walker(5) | $ | 26,250 | (4) | $ | — | $ | — | $ | 26,250 | |||||||||

| Richard H. Wills | $ | 80,000 | $ | 62,760 | (3) | $ | — | $ | 142,760 | |||||||||

| (1) | Reflects total cash compensation paid in fiscal 2017 and includes amounts deferred at the Director's election pursuant to the Company's deferred compensation plan. |

| (2) | Represents the full grant date fair value of the awards granted to each director in the fiscal year ended April 1, 2017, computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718 “Compensation – Stock Compensation” (ASC Topic 718). Awards are valued at the closing market price of the Company’s common stock on the grant date. |

| (3) | Comprises a grant of 12,000 RSUs on August 18, 2016, which vests on the August 9, 2017, the day prior to the 2017 Annual Meeting date. This grant represents the total number of unvested RSUs held by each non-employee director as of April 1, 2017. |

| (4) | Both Messrs. Link and Walker elected to defer cash compensation to the Company's deferred compensation plan during fiscal 2017. |

| (5) | Robert R. Walker retired from the board in August 2016 during the 2016 Annual Meeting. |

Under the deferred compensation plan, directors can generally elect to defer a minimum of 10% and a maximum of 100% of the fees they receive from the Company for their service on the Board. Cash amounts credited to the deferred compensation plan will earn a rate of return based on investment funds selected by the participants from a prescribed menu of investment options. Generally, deferred amounts will be paid in a lump sum upon termination, except in the case of retirement, in which case the deferred amounts will be paid in a lump sum or in annual installments for up to ten years, as elected by the director. Directors may also defer payment of RSUs granted to them by the Company. Payment will be in shares of Company common stock under the same terms as cash amounts.

Our stock ownership guidelines require directors to own stock equal to or greater than 3x their annual retainer, and all directors met the stock ownership requirements as of June 1, 2017.

BOARD COMMITTEES

Audit Committee

The Company maintains an Audit Committee that consists of Raymond A. Link (Chairman), Frederick A. Ball, and Laurence E. Cramer. All of the members of the Audit Committee are “independent directors” in accordance with the NASDAQ Stock Market listing standards and pursuant to the criteria established in Section 10A(m) of the Securities Exchange Act of 1934, as amended. Each of Messrs. Link and Ball has financial reporting oversight experience, including serving as chief financial officer of a public company. The Board of Directors has determined that each of Messrs. Link, Ball and Cramer is an audit committee financial expert as defined in SEC rules. On a regular basis, the Audit Committee meets with management and with representatives of the Company's independent registered public accounting firm, Deloitte & Touche LLP, including meetings without the presence of management. The Audit Committee met nine times in fiscal 2017.

Compensation Committee

The Company maintains a Compensation Committee that currently consists of Frederick A. Ball (Chairman), Richard H. Wills and John Medica. All members of the Compensation Committee have been determined to be independent by the Board of Directors in accordance with the NASDAQ Stock Market listing standards and Securities and Exchange Commission rules. The Compensation Committee has been delegated authority to set officers’ compensation and to grant awards under the Company’s stock incentive plan. For additional information about the Compensation Committee, see “Compensation Discussion and Analysis”. The Compensation Committee met six times in fiscal 2017.

7

Corporate Governance and Nominating Committee

The Company maintains a Corporate Governance and Nominating Committee that currently consists of John Medica (Chairman), Laurence E. Cramer and Raymond A. Link. All members of the Corporate Governance and Nominating Committee have been determined to be independent by the Board of Directors in accordance with the NASDAQ Stock Market listing standards and Securities and Exchange Commission rules. The Corporate Governance and Nominating Committee assists the Board of Directors in fulfilling its oversight responsibilities related to seeking candidates for membership on the Board of Directors, assessing the corporate governance policies and processes of the Board of Directors and reviewing from time to time the policies of the Board of Directors related to director qualifications, compensation, tenure and retirement. The Corporate Governance and Nominating Committee met four times in fiscal 2017.

Shareholder Nominations

Shareholders may recommend individuals for consideration by the Corporate Governance and Nominating Committee to become nominees for election to the Board of Directors by submitting a written recommendation to the Corporate Governance and Nominating Committee c/o Chairman of the Corporate Governance and Nominating Committee, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229-5497. Communications should be sent by overnight or certified mail, return receipt requested. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether the individual can read and understand financial statements, and board memberships, if any, for the Corporate Governance and Nominating Committee to consider. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders. Recommendations received by January 31, 2018 will be considered for nomination for election at the 2018 Annual Meeting of Shareholders. Recommendations received after January 31, 2018 will be considered for nomination for election at the 2019 Annual Meeting of Shareholders. Following the identification of the director candidates, the Corporate Governance and Nominating Committee will meet to discuss and consider each candidate’s qualifications and shall determine by majority vote the candidate(s) whom the Corporate Governance and Nominating Committee believes would best serve the Company. In evaluating director candidates, the Corporate Governance and Nominating Committee will consider a variety of factors, including the composition of the Board as a whole, the characteristics (including independence, age, skills and experience) of each candidate, and the performance and continued tenure of incumbent Board members. The Committee believes that candidates for director should have certain minimum qualifications, including high ethical character, a reputation that enhances the image and reputation of the Company, being highly accomplished and a leader in his or her respective field, relevant expertise and experience, the ability to exercise sound business judgment and the ability to work with management collaboratively and constructively. The Committee also values diversity. In addition, the Committee believes that at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission rules and that at least two-thirds of the members of the Board should meet the definition of independent under the NASDAQ Stock Market listing standards and Securities and Exchange Commission rules. The Committee also believes the Company’s Chief Executive Officer should participate as a member of the Board. A candidate recommended by a shareholder will be evaluated in the same manner as a candidate identified by the Committee.

COMMUNICATIONS WITH BOARD

Any shareholder who desires to communicate with the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board of Directors, c/o Corporate Secretary, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229-5497. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be compiled by the Secretary and submitted to the Board of Directors in a timely manner.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Common Stock of the Company as of June 1, 2017 by (i) each person known to the Company to be the beneficial owner of more than 5% of the Company’s Common Stock, (ii) each of the Company’s current directors and nominees for director, (iii) each individual named in the Summary Compensation Table and (iv) all directors and executive officers of the Company on June 1, 2017 as a group. Applicable percentage of ownership is based on 33,103,704 shares of Common Stock outstanding as of June 1, 2017 together with applicable options (including stock appreciation rights) and RSUs held by such shareholders. Shares of Common Stock subject to options exercisable at June 1, 2017 or exercisable within 60 days after June 1, 2017 and shares of Common Stock underlying RSUs vested at June 1, 2017 or vesting within 60 days after June 1, 2017, are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage ownership of any other person.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Approximate Percent of Class | |||||

| Frederick A. Ball | 73,390 | (2) | * | ||||

| Laurence E. Cramer | 6,000 | * | |||||

| Edward C. Grady | 963,427 | (3) | * | ||||

| Raymond A. Link | 27,000 | * | |||||

| John K. Medica | 28,050 | * | |||||

| Richard H. Wills | 49,107 | * | |||||

| Michael Burger | 84,000 | * | |||||

| Paul Oldham | 435,412 | (4) | * | ||||

| Robert DeBakker | 172,744 | (5) | * | ||||

| Bing-Fai Wong | 189,216 | (6) | * | ||||

| BlackRock Institutional Trust Company, N.A. | 3,578,595 | (7) | 10.81% | ||||

| 400 Howard Street, San Francisco, CA 94105 | |||||||

| Dimensional Fund Advisors LP | 2,513,438 | (7) | 7.59% | ||||

Palisades West, Building One, 6300 Bee Cave Road, Austin, TX 78746 | |||||||

| 12 directors and executive officers (as of June 1, 2017) as a group | 2,059,627 | (8) | 6.22% | ||||

| * | Less than 5 percent. |

| (1) | Shares are held directly with sole investment and voting power unless otherwise indicated. |

| (2) | Includes 28,515 shares deferred under the Company’s deferred compensation plan. |

| (3) | Includes 436,853 shares subject to stock options and stock appreciation rights that were exercisable at or that would become exercisable within 60 days after June 1, 2017. In addition, includes 390,762 shares deferred under the Company’s deferred compensation plan. |

| (4) | Includes 295,750 shares subject to stock options and stock appreciation rights that were exercisable at or that would become exercisable within 60 days after June 1, 2017. |

| (5) | Includes 138,750 shares subject to stock options and stock appreciation rights that were exercisable at or that would become exercisable within 60 days after June 1, 2017. |

| (6) | Includes 105,000 shares subject to stock options and stock appreciation rights that were exercisable at or that would become exercisable within 60 days after June 1, 2017. In addition, includes 6,883 shares deferred under the Company’s deferred compensation plan. |

| (7) | Based on the institutional holding report provided by Nasdaq as of June 1, 2017, which reflects the most recent Schedule 13D, 13F or 13G (or amendments thereto) filed by such person with the SEC. |

| (8) | Includes shares held by John Williams and Steve Harris, who were named as executive officers after fiscal 2017 and before June 1, 2017. |

9

EXECUTIVE OFFICERS

As of June 1, 2017, the executive officers of the Company were as shown in the below table. During fiscal 2017, Edward C. Grady, Robert DeBakker and Bing-Fai Wong were also executive officers, but they ceased to be the executive officers as of June 1, 2017. Steve Harris and John Williams became executive officers after the end of fiscal 2017.

| Name | Age | Position | |||

| Michael Burger | 59 | President and Chief Executive Officer beginning October 2016 | |||

| Paul Oldham | 54 | Senior VP of Administration, Chief Financial Officer and Corporate Secretary | |||

| Steve Harris | 54 | Vice President of Engineering | |||

| John Williams | 48 | Vice President of Marketing | |||

See Mr. Burger's biography under “Election of Directors”.

Mr. Oldham joined the Company on January 7, 2008 as Vice President of Administration, Chief Financial Officer and Corporate Secretary. Mr. Oldham was promoted to Senior Vice President of Administration, Chief Financial Officer, and Corporate Secretary in the fourth quarter of fiscal 2016. Prior to joining ESI, Mr. Oldham was employed at Tektronix, Inc., a test, measurement, and monitoring company, since 1988, where he held several senior leadership positions including Vice President Finance and Corporate Controller, European Operations Controller, and most recently Vice President Treasurer and Investor Relations.

Mr. Harris joined the ESI team in February of 2017 as Vice President of Engineering. Mr. Harris brings over 30 years of engineering, engineering management and business management experience. Prior to joining ESI, Mr. Harris spent 7 years at Cascade Microtech where he served as Vice President of Engineering, and as VP & General Manager. Prior to joining Cascade Microtech, Mr. Harris worked 11 years at ESI where he held roles of Vice President Research, Development & Engineering and VP & General Manager Semiconductor Products division. Mr. Harris spent the first 13 years of his career at Tektronix in development engineering, program management, and engineering management roles. Mr. Harris holds a B.S. degree in Electrical Engineering from the University of Idaho and a certificate in General Management from Oregon Graduate Institute.

Mr. Williams joined the ESI team in February of 2017 as Vice President of Marketing. Mr. Williams brings over 20 years of experience in increasingly responsible roles involving marketing management and strategy. Prior to joining ESI, John was Vice President, Marketing for Thermo Fischer Scientific, previously FEI, where he had served for ten years—seven as Vice President, Corporate and Strategic Marketing. Prior to FEI, he spent five years as Director of Marketing at Brooks Automation. John had previously held Product Marketing Manager responsibilities at a number of technology-focused firms. He has a degree in Mechanical Engineering from Cal Poly - San Luis Obispo.

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Discussion and Analysis (CD&A) describes our executive compensation philosophy and how the Compensation Committee (the “Committee”) of the Board of Directors applies this philosophy in compensating our executive officers.

| The Company's named executive officers for fiscal 2017 (the “NEOs”) were as follows: | |

Michael Burger Edward C. Grady Paul Oldham Robert DeBakker Bing-Fai Wong | President & Chief Executive Officer1 President & Chief Executive Officer1 Senior Vice President of Administration, Chief Financial Officer & Corporate Secretary Senior Vice President of Worldwide Operations2 Vice President of Customer Operations3 |

| 1. | Michael Burger succeeded Edward C. Grady as President and Chief Executive Officer beginning October 3, 2016. |

| 2. | Robert DeBakker ceased to be an executive officer of the Company in February 2017. |

| 3. | Bing-Fai Wong ceased to be an executive officer of the Company in May 2017. |

10

Executive Summary

Fiscal 2017 represented a pivotal year of positive change for Electro Scientific Industries, Inc. (“ESI” or the “Company”), including the completion of an anticipated CEO transition, as the Company continued the transformation of its business in pursuit of profitable growth and shareholder returns. In fiscal 2015 and 2016, the strategic direction was revised and much of the groundwork critical to the Company's success was put in place by Edward Grady who served as our President and Chief Executive Officer (CEO) from February 2014 until he was succeeded by Michael Burger on October 3, 2016.

The Board of Directors believes that Mr. Burger is uniquely qualified to lead ESI and drive the Company’s performance to the next level. Mr. Burger has over 30 years of broad industry and technology leadership experience. Prior to joining ESI, he was President and Chief Executive Officer of Cascade Microtech, Inc. from 2010 until its acquisition by FormFactor, Inc. in June 2016, and was recognized as the 2014 Technology Executive of the Year by the Technology Association of Oregon. Mr. Burger also served as a Board member of Viasystems Inc. following its acquisition of Merix Corporation where he served as President, Chief Executive Officer and Director. Mr. Burger’s experience in technology and proven leadership are directly applicable to ESI’s strategy, and he is expected to have a significant positive impact in driving improvement in the Company’s growth and profitability.

During his first 90 days as President and CEO, Mr. Burger immersed himself in the Company’s operations by meeting with employees and members of the leadership team, visiting key customers, and soliciting feedback from investors and board members to gain balanced and critical insight. After conducting a thoughtful review and analysis, he has taken the following actions:

| • | Developed top corporate priorities to deliver more consistent earnings over time, improve execution, focus investments, and drive adoption of new products. |

| • | Reorganized the Company from a business unit to a functional structure. |

| • | Hired a new executive leadership team including Vice Presidents of Marketing, Engineering, Sales, Operations and Business Development. |

| • | Relocated sales, service, and operations leadership to Asia to be closer to customers. |

| • | Initiated restructuring of the Company that is expected to reduce expenses by $10-12 million annually and lower the adjusted EBITDA breakeven point to $35 million of quarterly revenue. |

| • | Consolidated operations and closed facilities in Montreal, Napa Valley, and Sunnyvale. |

| • | Initiated a thorough portfolio review of the Company’s products and markets to determine investment priorities. |

| • | Created and communicated initial financial success model targets for gross margin of 44% and adjusted EBITDA of 8% on an annual basis. |

Since joining the Company, Mr. Burger’s impact has been significant. He has brought renewed energy, focus and accountability to the organization, and made significant structural and organizational improvements that should enable ESI’s success going forward. In addition, during this time, the Company added several new institutional shareholders, increased its research coverage, and experienced an increase in the stock price of 48% through the end of May 2017.

In February 2014, Mr. Grady, who was previously a member of the Board of Directors, was appointed CEO with an anticipated tenure of approximately 3 years. Under Mr. Grady’s leadership the Company made critical changes to its strategic direction, introduced the Gemstone, Cornerstone, nViant, and Garnet families of products, lowered its cost structure, and began to improve its financial performance trends, which continued through early fiscal 2017. During fiscal 2017 the Company’s primary market for flex drilling products experienced a significant slowdown in capital spending as a result of temporary overcapacity, which impacted full year 2017 results. However, the flex market and overall business levels began to recover late in the third quarter and order levels in the fourth quarter were at their highest in over five years. Mr. Grady aided in the transition and provided advisory support to Mr. Burger throughout the remainder of fiscal 2017, and continues to serve as a member of ESI’s Board of Directors. Mr. Grady will not stand for reelection when his current term expires at the August 2017 Annual Meeting in compliance with the Company’s retirement policy for directors.

Compensation Philosophy

The Board of Directors and the Committee believe that the Company's executive compensation program objectives should attract and retain talented executives, motivate executives to execute long-term business strategies while achieving near-term financial targets, and align executive performance with the Company's short-term and long-term goals for delivering shareholder value.

11

The Company has developed a total compensation philosophy with significant portion of executive compensation tied to the achievement of pre-established financial and operational results. The elements of the Company's compensation program for executives are base salary, annual cash incentives, long-term equity incentives and a non-qualified deferred compensation plan which allows executives to defer a portion of their incentive cash compensation and restricted stock units granted during the plan year. Performance-based pay is a major element of executive compensation, which includes annual cash incentives and long-term stock-based equity incentives.

Additionally, the Company has an employee stock purchase plan, a 401(k) retirement plan and provides health care and other benefits to executives on the same basis as it does for all other employees. The current named executive officers have change in control agreements, under which they are eligible to receive certain payments and benefits in the event of a termination of employment under certain circumstances following a change in control of the Company. The change in control agreements include double-trigger provisions and do not allow for excise tax gross-ups.

Each element of the Company's executive compensation program serves a different purpose, but in combination, enable the Company to support its compensation philosophy and to offer compensation competitive with companies with similar business focus and similar revenue levels and market capitalization.

Pay for Performance Alignment

The Board of Directors and the Committee have designed the Company’s pay practices to be aligned with the Company’s performance. This is reflected in the following features of the Company’s short and long-term incentive pay plans and payouts based on performance:

| • | The Company sets performance targets annually and does not make revisions to incentive opportunities during the year. |

| • | The Company’s short-term incentive program is based on certain strategic business objectives and is fully at risk. |

| • | The Company’s long-term executive incentive program includes equity awards that are 50% performance-based and are fully at risk. |

| • | In fiscal 2017, the Company implemented a performance equity award structure based on the return of the Company’s common stock relative to the Russell 2000 Index, aligning management incentives directly to shareholder return. |

| • | The Company’s short and long-term incentive programs do not vest until the end of the performance period, supporting both performance and retention. |

| • | Long term incentives generally have performance periods of three to four years, providing long-term alignment between pay and performance. |

| • | The Company’s policy is to not accelerate vesting for equity awards, except with a double-trigger change in control. |

| • | The new CEO’s pay for fiscal 2018 will be approximately 50% performance-based with performance-related amounts normalized to target the 50th percentile of the peer group following his new-hire inducement grant in fiscal 2017. |

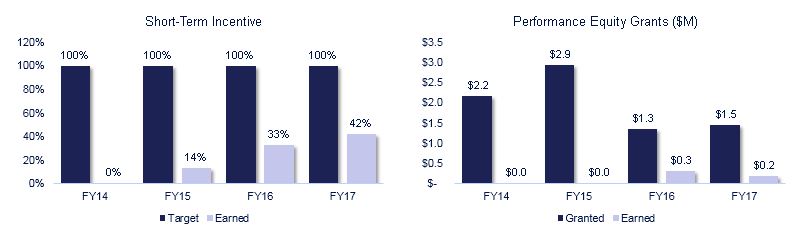

The Company’s pay for performance alignment is evidenced for both performance equity grants and short-term incentives as illustrated below.

Granted/Target Awards vs. Earned: Tables show the grants and target levels for all individuals receiving those grants for each fiscal year, and the cumulative earnings to-date related to those awards. The above tables exclude the new CEO and new executive grants and short-term incentives due to their recent hire date.

12

Compensation Best Practices

We maintain the following corporate governance policies to ensure our executive compensation practices support our pay-for-performance philosophy and manage our compensation risks:

| • | The Committee is comprised solely of independent directors. |

| • | The Committee has engaged an independent compensation consultant to assist it with its review of executive compensation. |

| • | Half of the executive long-term incentive grants are awarded in performance-based equity. |

| • | Annual bonus plan is tied to both a top-line and bottom-line financial performance metric, while long-term performance awards are based on total shareholder return. |

| • | Short-term and long-term performance awards are capped at 200% of target. |

| • | We only offer minimal perquisites that are supported by a business interest and are consistent with broad-based benefit plans available to other employees. |

| • | We have a claw-back policy for equity awards. |

| • | We prohibit our executive officers from engaging in hedging or other speculative transactions involving Company stock. |

| • | Our directors and executive officers are subject to stock ownership guidelines that encourage alignment with the interests of shareholders. |

| • | We do not provide tax gross-ups other than for certain relocation and temporary housing expenses. |

| • | Our change in control agreements with executives contain a “double-trigger” feature. |

| • | We conduct an annual shareholder advisory vote on executive compensation. |

The Compensation Committee

The Committee consists entirely of independent non-employee directors as defined by the rules of the NASDAQ Stock Market, the Company's Corporate Governance Guidelines, and the Committee's charter. The current members of the Committee are Frederick A. Ball (Chairman), John Medica and Richard H. Wills. The Committee's authority and responsibilities are set forth in a charter adopted by the Board of Directors, which the Committee reviews annually. The Committee’s charter is available on the Company’s website at http://investors.esi.com/governance.cfm. The Committee may, under its charter, form and delegate responsibilities to subcommittees of the Committee as appropriate.

The Committee reviews and approves the compensation of all of the Company's executives, including the Chief Executive Officer (CEO). The Committee has full authority to determine annual base salary and incentive compensation, equity incentives and all other compensation for the executives including any employment or severance arrangements, change in control agreements and provisions. The Committee reviews and approves all equity grants to executives and annual equity grants to all other employees.

Determinations regarding annual cash incentives, long-term incentives and other elements of compensation are made consistent with the Committee's compensation philosophy and in a manner that the Committee believes to be appropriate and reasonable based on Company performance.

Base salary and incentive compensation award decisions for all executive officers are made at the first quarterly meeting of the Committee in each fiscal year in conjunction with the annual performance reviews for the prior fiscal year. The Committee reviews historical and current information regarding each element of compensation for each executive. It receives recommendations from the CEO as to compensation of other executives, and the CEO participates in discussions regarding their compensation. The Committee meets in executive session without the CEO to determine his compensation.

Role of Independent Consultant. The Committee has engaged Compensia Inc., a national compensation consulting firm, as an independent outside compensation consultant with respect to executive and director compensation. The Committee has sole authority to retain and terminate Compensia. Compensia reports solely to the Committee for all services related to executive compensation, and did not provide any other services to the Company in fiscal 2017 except for those related to executive and director compensation. The Committee has assessed the independence of Compensia taking into account, among other things, the factors set forth in Exchange Act Rule 10C-1 and the rules of the NASDAQ Stock Market, and has concluded that no conflict of interest exists with respect to the work that Compensia performs for the Committee.

13

Role of Management and Other Employees. The CEO and the Vice President of Human Resources make recommendations on program design and pay levels, where appropriate, and implement the program approved by the Committee. The CEO makes recommendations with respect to the compensation of other officers, including the other named executive officers, and is assisted in pay administration by the Vice President of Human Resources. The CFO provides the financial information used by the Committee to make decisions with respect to incentive compensation goals based on achievement of financial targets and related payouts for our annual and long-term incentive programs.

Compensation-Related Risks

The Committee believes that the Company's executive incentive compensation arrangements do not encourage executives to take unnecessary or excessive risks that could threaten the value of the Company. For example, a significant portion of the executives' performance-based compensation is in the form of long-term equity incentives which generally vest over three to four years, thereby focusing the executives on the Company's long-term interests. As a matter of best practice, the Company will continue to monitor its executive compensation program to ensure that it continues to align the interest of executives with those of its shareholders while avoiding unnecessary or excessive risk.

The Committee also periodically evaluates with management risks arising from the Company’s compensation programs for all employees and has determined that such programs are not reasonably likely to have a material adverse effect on the Company.

Competitive Positioning

The Committee uses comparative information from a group of similarly-situated business and labor market competitors as well as similarly-sized broad technology industry companies in reviewing the compensation of our executives, shown below.

In October 2015, the Committee conducted a detailed review and approved a new peer group intended to provide greater financial comparability, determined primarily with reference to revenue and market capitalization. Peer companies were selected based on the following criteria:

| • | Comparable revenue size (.5 - 2.5X ESI’s revenue or, ~$100 million - $460 million) |

| • | Comparable market capitalization (.5X - 4.0X ESI’s current market cap) |

| • | Similar business focus, including companies selling high technology equipment or components such as lasers, photonics, optical components, semiconductors, particularly where the ultimate end-products serve a broad array of consumer or industrial markets |

The fiscal 2017 peer group was made up of the following companies, with the only change from the peer group for fiscal 2016 being the addition of RadiSys Corporation:

Affymetrix, Inc.* Nanometrics, Inc.

Axcelis Technologies, Inc. RadiSys Corporation

Cascade Microtech, Inc.* Rudolph Technologies, Inc.

Cohu, Inc. Ultratech, Inc.

FormFactor, Inc. Veeco Instruments, Inc.

Mattson Technology, Inc.* Vishay Precision Group, Inc.

Novanta Inc (formerly GSI Group) Xcerra Corporation

*Beginning in fiscal 2018, Affymetrix, Cascade Microtech and Mattson Technology will not be included in the peer group because they have ceased to be publicly traded companies. Veeco Instruments and FormFactor will be removed from the peer group as it was believed they no longer met the peer group criteria provided above. Hurco Companies, Maxwell Technologies and Faro Technologies will be added to the peer group.

The resulting fiscal 2018 peer group is made up of the following companies:

Axcelis Technologies, Inc. Novanta Inc

Cohu, Inc. RadiSys Corporation

Faro Technologies, Inc. Rudolph Technologies, Inc.

Hurco Companies, Inc. Ultratech, Inc.

Maxwell Technologies, Inc. Vishay Precision Group, Inc.

Nanometrics, Inc. Xcerra Corporation **

** In April, 2017 Xcerra Corporation announced that it was being acquired, we will evaluate inclusion in our peer group as appropriate.

14

Compensia provided a market analysis to the Committee for fiscal 2017 executive compensation using publicly available peer group proxy filings, Peer Company Radford January 2016 High Tech Industry Survey and the Radford January 2016 High Tech Industry broad high-tech industry data for companies with revenue of $50 million to $500 million. These data points were blended together to create a “market average”. The Committee reviewed the analysis provided by Compensia and believes that this information reflects the pool from which the Company competes for executive talent.

The Committee generally targets total compensation at the 50th percentile of similarly-situated peer group companies, with variance based on tenure, experience and individual performance. The number of equity awards granted is calculated as the target equity compensation amount divided by an average closing price of our common stock for approximately 30 trading days preceding the grant date. The actual equity compensation may vary from the target due to stock price volatility.

Consideration of Say-on-Pay Vote Results

The advisory (non-binding) proposal regarding compensation of the named executive officers submitted to shareholders at the August 2016 Annual Meeting of Shareholders was approved by over 93% of the votes cast. The Committee considered this vote to reflect strong alignment of the Company's executive compensation program with shareholder interests. The Committee monitors and considers the results of such advisory votes and will continue to consider results from future advisory votes as appropriate when making compensation decisions.

CEO Compensation

New CEO

In determining Mr. Burger’s fiscal 2017 compensation elements, the Committee carefully considered Mr. Burger’s unique qualifications, his executive level experience, and market data to develop a compensation package specifically designed to induce him to join the Company. Given Mr. Burger’s extremely successful track record and completion of the sale of Cascade Microtech to FormFactor in June of 2016, the Committee recognized that he had multiple next career opportunities from which to choose.

For fiscal 2017, Mr. Burger’s base salary of $575,000 approximated the 65th percentile of peer Company CEOs. The Committee believes that this salary was necessary to induce Mr. Burger to join the Company. His base salary will remain unchanged for fiscal 2018.

Mr. Burger is eligible for a target annual bonus opportunity under ESI’s Management Incentive Plan (MIP) of 100% of his base salary, with a cap of 200%. As part of his inducement to join the Company, Mr. Burger received an incentive payment in May 2017 equal to $287,500 (the greater of the prorated bonus he would receive under the MIP at 100%, or the actual payout earned if performance was above 100% for the period). In fiscal 2018, Mr. Burger will participate in the same incentive plan as the rest of the Company with the entire bonus opportunity at risk based on achievement of performance measures.

Mr. Burger received a new-hire long-term incentive award with the target value allocated 48% to time-based RSUs (TRSUs) and 52% to performance-based RSUs (PRSUs). The TRSUs (229,445 shares) vest 25% on each of the first four anniversaries of the date of grant. The PRSUs (248,565 shares) are earned based upon the Company’s total shareholder return (TSR) relative to the Russell 2000 Index over a three-year service period, as described in more detail under Long-Term Incentive Compensation. Mr. Burger’s equity grant for fiscal 2018 was 73,900 PRSUs and 73,900 TRSUs with a combined target value of approximately $1 million which is consistent with the Company’s regular long-term incentive program and targets the 50th percentile of peers, with the number of units based on the 30 trading days average closing price preceding the grant date.

Mr. Burger entered into an employment agreement with the Company that provides for terms of his employment including his compensation in the case of termination. If his employment is terminated without cause by ESI or for good reason by Mr. Burger, he will be entitled to receive severance in the amount of 1.5 times his base salary in effect at that time. If his employment is terminated without cause or for good reason in connection with a change in control or within twelve months following a change in control Mr. Burger will be entitled to (1) severance in an amount of two times his base salary in effect at that time, plus the amount of his target bonus for the year in which termination occurs (or, if greater, the year in which the change in control occurs), (2) one year of COBRA premiums for Mr. Burger and his dependents, and (3) full acceleration of all time-based equity awards and acceleration of performance-based equity awards at the greater of actual performance or target.

These benefits are conditioned on his execution of a release of claims. If the change in control severance benefits trigger 280G excise tax, Mr. Burger will receive either the full change in control benefits or a reduced amount that would not trigger such tax whichever results in the greater after-tax result. This agreement contains a “double-trigger” provision that provides

15

payments and benefits only in the event that (i) ESI is involved in a change in control transaction and (ii) his employment is terminated (or constructively terminated) in connection with the change in control within a 12-month period.

Departing CEO

Edward Grady was named as Chief Executive Officer of the Company in February of 2014. Mr. Grady, who had been serving as a board member was appointed CEO to identify and implement changes in the strategic direction of the Company. It was anticipated that Mr. Grady’s tenure in this role would be approximately 3 years. During his tenure Mr. Grady received salary, short-term incentives, and long-term equity incentives that were structured to retain Mr. Grady and reward him for improving performance during this time frame. As a result, the board set relatively aggressive performance goals for both short-term and long-term incentives. In January of 2016, the board began the process of identifying and recruiting a new CEO, targeting an executive transition on or around the end of fiscal 2017. Given the uncertainty of successfully hiring the new CEO, in May 2016 Mr. Grady was awarded 155,000 TRSUs vesting 100% on the first anniversary of the date of grant, which was timed to coincide with the expected transition date. This vesting period was selected to reflect the importance of retaining Mr. Grady during the search process and the transition of full responsibilities to a new CEO.

On October 3, 2016, Mr. Grady was succeeded by Mr. Burger as President and CEO. Mr. Grady continued as an employee of the Company through a transition period ending June 30, 2017 to provide transition and advisory support to Mr. Burger. Mr. Grady received his regular salary through December 31, 2016 and then $50,000 per month through June, 30, 2017. Mr. Grady participated in ESI’s Management Incentive Plan, prorated for service as CEO through October 3, 2017, based on the same measures as all executives. Mr. Grady will continue to serve on the Board of Directors but will not be compensated for such service. He will not stand for reelection when his current term expires in August 2017, in compliance with the Company’s retirement policy for directors.

Through December 31, 2016, the Company provided temporary housing for Mr. Grady near corporate headquarters in Portland and limited benefits for spousal travel to Portland from his home base in Nevada as part of his role as CEO. He was also compensated for the income tax liability he incurred as a result of these temporary benefits.

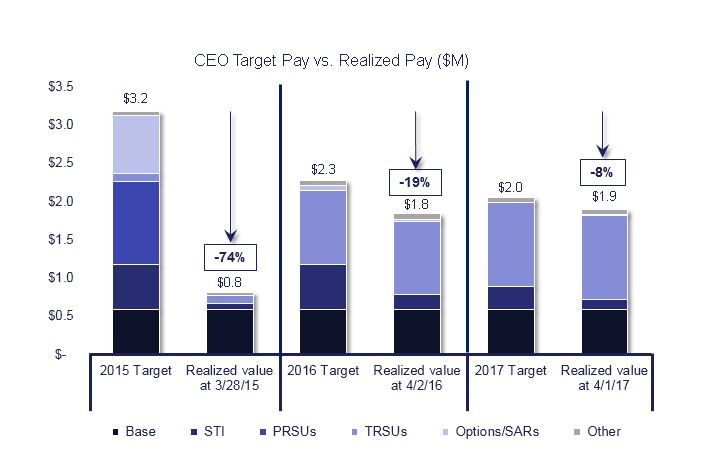

The following table represents target and realized pay for Mr. Grady during his role as interim CEO. Mr. Grady is not entitled to any additional severance, equity awards, or accelerated vesting of stock awards. The Committee believes that this pay is consistent with its pay for performance philosophy and Mr. Grady’s contribution to the transition of the Company.

CEO Target vs. Realized Pay: Table shows target compensation and actual realized compensation for each of the last three years. Fiscal 2016 and 2017 reflect TRSU awards to the approximate anticipated tenure of Mr. Grady and to support a smooth leadership transition.

Elements of Executive Compensation

In setting executive compensation for fiscal 2017, the Committee reviewed the Company's existing compensation programs and philosophy in light of current industry compensation practices and trends. Applying this philosophy for each executive officer, the Committee reviewed base salary, annual cash incentives, long-term incentives and all other elements of total compensation and compared these components to comparable elements of compensation at the peer group companies.

16

Base Salaries

Base salary levels are reviewed annually at the first fiscal quarterly meeting of the Committee. Base salaries for executives are determined by evaluating the responsibilities of the position and the experience of the individual and by reference to the competitive marketplace for corporate executives, including a comparison to base salaries for comparable positions at peer group companies. The Committee targets base salary compensation levels for executives, including the named executive officers, generally at levels approximating the 50th percentile of the compensation market ranges provided by Compensia. The Committee believes targeting these salary levels is required to attract and retain talented executives. In fiscal 2017, executives received merit increases ranging from 1.7 to 2.6%, a level consistent with all employees.

Annual Cash Incentive Compensation

The Company's executives, including Mr. Burger and Mr. Grady, are eligible to participate in an annual cash incentive plan, referred to as the Management Incentive Plan (MIP). Payouts for fiscal 2017 were based 80% on financial objectives included in the Profit Sharing Plan (PSP) which is applicable to all employees, and 20% based on a set of shared management objectives (MBOs). Approximately 92% of the Company's employees participated in the PSP and approximately 8% in the MIP in fiscal 2017. The financial measures under the PSP and the MBOs are established at the beginning of the year.

Mr. Grady and Mr. Burger were eligible to receive a target incentive equal to 100% of their respective base salaries (pro-rated for length of service as President & CEO), with the target incentive for other executives ranging from 60% to 70% of base salary. Amounts earned under the MIP are only payable to individuals still employed on the date of payout.

Financial Measures - Profit-Sharing Plan (PSP)

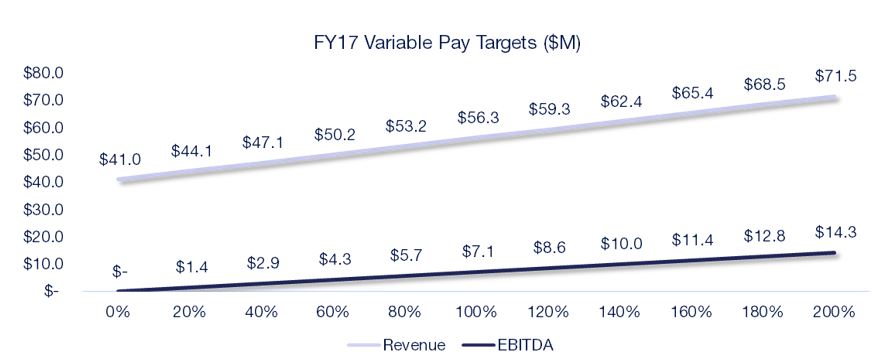

Of the total target incentive under the MIP, 80% is based on performance against target financial measures, consistent with the measures under the Company’s PSP. ESI’s fiscal 2017 PSP measures were focused on both top and bottom line performance, with 50% of the target based on revenue and 50% of the target based on adjusted EBITDA. Adjusted EBITDA equals GAAP operating income before purchase price accounting, share based compensation, restructuring, goodwill and other asset impairments, and other similar items, less depreciation and non-purchase accounting amortization. The targeted payout for the PSP was 80% for 100% achievement of the revenue and adjusted EBITDA targets. The Committee believes that this approach focused the entire Company on growth and profitability, which is critical to the Company's success.

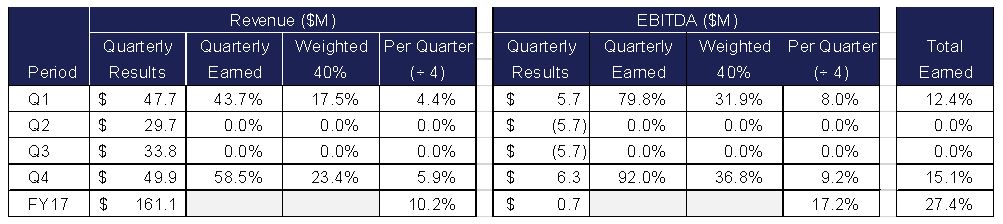

The Company’s markets are inherently cyclical with little forward visibility. In addition, uncertainty regarding the timing of the Company transition and adoption of new products make it difficult to project annual results. As a result, for fiscal 2016 and fiscal 2017, the PSP objectives were measured and earned based on quarterly financial objectives, but paid at the end of the year. The quarterly measurement was instituted in order to increase retention and motivate employees to deliver results each quarter. For fiscal 2017 the Committee set a baseline target for revenue of $53.2M and adjusted EBITDA before short-term incentives of $5.7M per quarter, which would result in an 80% payout. The minimum payment threshold for revenue was set at $41M per quarter and for adjusted EBITDA before short term incentives of $0, or breakeven, at which point payouts would commence.

The Committee also set an additional payout for cumulative annual revenue greater than $212.8M and adjusted EBITDA greater than $22.7M to incent and reward employees for superior performance. Based on fiscal 2017 performance, the accelerated payout was not applied.

For fiscal 2017, the quarterly thresholds and targets for revenue and EBITDA were as follows:

17

As a result of the overall performance of the Company and the pause in demand from our primary market in the middle of the year, the Company did not fully achieve the target payout in Q1 and Q4 and had zero attainment in Q2 and Q3. For fiscal 2017, the cumulative quarterly revenue results earned a total of 10.23% of target levels and the quarterly adjusted EBITDA results earned 17.18% of target levels for a weighted total achievement of 27.40% for the PSP.

For fiscal 2018, the Company is eliminating the quarterly measurement feature and the annual cash incentive will be earned and paid based on an annual measurement. In addition, the Company is combining the PSP and MIP plans such that all employees will be measured and paid on the same financial and nonfinancial measures.

Fiscal 2017 Shared Management Objectives (MBOs)

Of the total target incentive under the MIP, 20% is based on MBOs. The MBOs in the MIP are performance measures against an aggressive set of shared strategic business objectives related to new product introductions, market penetration, use of internally developed lasers and localization of operations and cash flow. Given the confidential nature of the objectives and the potential competitive harm, we are providing a summary of the objectives and achievements below:

| Fiscal 2017 MBOs | Achievement |

| Defend and grow laser process position | Maintained share in Flex Drilling, launched Lodestone and Redstone products, placed tools at key customers for Cornerstone and nViant |

| Expand Micromachining customer base | Received Garnet orders from multiple new customers |

| Ramp use of internal developed laser source | Met ramp for internal laser production |

| Implement hybrid manufacturing strategy and quality system | Met operational benchmarks and implemented improved quality system |

| Achieve cash objectives | Met cash plan in 1st half, secured long-term debt financing, renegotiated line of credit |

| Strategic account penetration | Penetrated targeted key account with sales of more than 3 different system families |

The Committee reviewed the results and approved a score of 14.5 out of 20 points, which resulted in 14.5% attainment of the MIP targets based on the weighted achievement for the MBO portion.

In fiscal 2017, the MIP program delivered compensation below the targeted levels with a total attainment of 41.91% to executives, commensurate with Company performance.

18

Long-Term Incentive Compensation

As part of the overall compensation philosophy, the Board of Directors and the Committee believes that long-term incentive compensation should be aligned to shareholder and executive interests. The Committee will continue to evaluate compensation decisions, focusing on the alignment of executive compensation with shareholder value growth.

In considering potential changes to the executive pay program for fiscal 2017, the management team and the Committee engaged in thoughtful conversation and research to determine the appropriate long-term equity vehicle and performance based measures. After careful consideration, the Committee determined that the most appropriate and motivating executive annual long-term incentive compensation program for fiscal 2017 would consist of a mix of 50% of the value in PRSUs and 50% of the value in TRSUs. PRSUs, tied to relative TSR performance, were designed to focus on long-term shareholder value creation relative to other similar investments, while TRSUs provided stock ownership, retentive value and alignment with shareholder interests.

Our performance shares are market based and have the following design elements

| • | Awards are tied to long-term performance against the Russell 2000 Index. |

| • | Payout is based on the relative return on the Company’s stock as compared to the index. |

| • | Awards only vest if the executive is still employed at the end of the three-year performance period. |

| • | Payout is decreased on a 3-1 ratio for performance below the index and increased on a 2-1 ratio for performance above the index. |

The awards contain provisions that limit the potential payout to reasonable levels. The overall payout is capped at a number of shares with an aggregate value on the vesting date that is five times the result of (1) the number of shares subject to the award at target performance multiplied by (2) the closing price of the Company’s common stock on the date of grant. The measurement of performance is based on the average closing prices for the 20 trading days immediately preceding the applicable measurement date, and awards only vest if the executive is still employed at the end of the three-year performance period. The awards are earned annually on each of the first three anniversaries of the grant. The number of shares that may be earned is capped at 150% and 200% of target for the first and second performance periods, when one-third of the shares are available to be earned, and 200% of the total award in the third performance period such that the overall payout is capped at 200%. Approximately 12% of total available shares would be earned based on actual performance for the first annual period ending May 15, 2017.

These design elements were adopted because we believe that measurement of performance over a multiple year period based on total return to our shareholders or TSR, closely aligns our executive’s objectives of those of our shareholders. Further, given the cyclical nature of the Company’s business, the Committee believes that this structure encourages strong executive performance each year and increases the retentive aspects of the award while maintaining a rigorous performance scale that still rewards long term performance.

Previous Performance-based Restricted Stock Unit Awards

Consistent with the Company’s pay for performance philosophy, the executives, including the departing CEO, have realized little to no value from previous PRSU awards, which is commensurate with the Company’s slower than expected financial improvements during the last several years. Specifically:

| • | None of the fiscal 2015 PRSUs granted November, 2014 were earned based on fiscal 2017 revenue and return on net assets (RONA). |

| • | None of the CEO’s fiscal 2015 PRSUs were earned based on fiscal 2017 revenue and non-GAAP operating income. |

| • | None of the fiscal 2014 PRSUs were earned during fiscal 2017 (based on fiscal 2015, 2016 and 2017 revenue and RONA) and therefore, none vested at the end of the 3-year period. |

Special Retention Agreement