UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Electro Scientific Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| Notice of Annual Meeting of Shareholders |

To the Shareholders of Electro Scientific Industries, Inc.:

The Annual Meeting of Shareholders of Electro Scientific Industries, Inc. (ESI) will be held at ESI’s offices, 13900 NW Science Park Drive, Portland, Oregon, on Wednesday, August 8, 2018 at 11:00 a.m. Pacific Daylight Time, for the following purposes:

| 1. | To elect the six directors named in the proxy statement for a term of one year. Frederick A. Ball, Michael D. Burger, Lynne J. Camp, Laurence E. Cramer, Raymond A. Link and Richard H. Wills are nominees for election for a one-year term. |

| 2. | To approve, on an advisory basis, the compensation of our named executive officers. |

| 3. | To ratify the Audit Committee’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 30, 2019. |

| 4. | To transact any other business that properly comes before the meeting. |

Only shareholders of record at the close of business on June 5, 2018 will be entitled to vote at the 2018 Annual Meeting.

Your vote is very important. Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. Promptly voting your shares by phone, via the internet, or by signing, dating, and returning the enclosed proxy card will ensure the presence of a quorum at the meeting. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Retention of the proxy is not necessary for admission to or identification at the meeting.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON WEDNESDAY, AUGUST 8, 2018: This proxy statement and the Company’s 2018 Annual Report to Shareholders are also available at http://investors.esi.com/financial-information/proxy-online.

By Order of the Board of Directors

Allen L. Muhich

Vice President, Chief Financial Officer

and Corporate Secretary

Portland, Oregon

July 9, 2018

ELECTRO SCIENTIFIC INDUSTRIES, INC.

PROXY STATEMENT

The mailing address of the principal executive offices of the Company is 13900 NW Science Park Drive, Portland, Oregon 97229-5497. The approximate date this proxy statement and the accompanying proxy forms are first being mailed to shareholders is July 9, 2018.

SOLICITATION AND REVOCABILITY OF PROXY

The enclosed proxy is solicited on behalf of the Board of Directors (the "Board") of Electro Scientific Industries, Inc., an Oregon corporation, for use at the Annual Meeting of Shareholders to be held on August 8, 2018 (the "2018 Annual Meeting"). The Company will bear the cost of preparing and mailing the proxy, proxy statement and any other material furnished to the shareholders by the Company in connection with the 2018 Annual Meeting. Proxies will be solicited by use of the mail and the internet, and officers and employees of the Company may, without additional compensation, also solicit proxies by telephone, fax or personal contact. Copies of solicitation materials will be furnished to fiduciaries, custodians and brokerage houses for forwarding to beneficial owners of the stock held in their names.

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Corporate Secretary of the Company. The proxy may also be revoked by affirmatively electing to vote in person while in attendance at the meeting. However, a shareholder who attends the meeting need not revoke the proxy and vote in person unless he or she wishes to do so. All valid, un-revoked proxies will be voted at the 2018 Annual Meeting in accordance with the instructions given.

Common Stock is the only outstanding authorized voting security of the Company. The record date for determining holders of Common Stock entitled to vote at the 2018 Annual Meeting is June 5, 2018. On that date there were 34,104,459 shares of Common Stock outstanding, entitled to one vote per share. The Common Stock does not have cumulative voting rights.

A majority of the Common Stock entitled to vote at the 2018 Annual Meeting, present either in person or by proxy, will constitute a quorum. Shareholders who abstain from voting on any or all proposals will be included in the number of shareholders present at the meeting for purposes of determining the presence of a quorum. Abstentions and broker non-votes will not be included in the total of votes cast and will not affect the outcome of the vote.

With respect to proposal 1, the election of directors, the six directors receiving the highest number of votes will be elected. With respect to proposals 2 and 3, to approve each proposal the votes that shareholders cast “for” must exceed the votes that shareholders cast “against.” If your shares are held by a broker or other financial institution on your behalf (that is, in “street name”), and you do not instruct that firm as to how to vote these shares, Nasdaq rules allow the firm to vote your shares only on routine matters. Proposal 3, the ratification of the selection of the Company’s independent auditors for fiscal 2019, is the only matter for consideration at the meeting that Nasdaq rules deem to be routine. For all other proposals, you must submit voting instructions to the firm that holds your shares if you want your vote to count. When a firm votes a client’s shares on some but not all of the proposals, the missing votes are referred to as “broker non-votes.” Please instruct your broker or other financial institution so your vote can be counted.

PROPOSAL 1: ELECTION OF DIRECTORS

A Board of six directors will be elected at the 2018 Annual Meeting. The directors are elected at each annual meeting to serve until the next annual meeting or until their successors are elected and qualified. Frederick A. Ball, Michael Burger, Lynne J. Camp, Laurence E. Cramer, Raymond A. Link and Richard H. Wills are nominees for re-election for a one-year term. These nominees are recommended by the Corporate Governance and Nominating Committee. Under Oregon law, if a quorum of shareholders is present at the 2018 Annual Meeting, the directors elected will be the six nominees for election as directors who receive the greatest number of votes cast at the meeting. Abstentions and broker non-votes will have no effect on the results of the vote. If any of the nominees for election as director at the 2018 Annual Meeting becomes unavailable for election for any reason (none being known at this time), the proxy holders will have discretionary authority to vote pursuant to the proxy for a substitute or substitutes. Proxies may not be voted for a greater number of persons than the number of nominees named below.

John Medica was a member of the Board in fiscal 2018 until his passing on October 13, 2017.

2

The following table briefly describes the Company’s nominees for directors:

| Name, Age, Principal Occupation, and Other Directorships | Director Since | |

| Nominees | ||

Frederick A. Ball, 56, served as Executive Vice President and Chief Administrative Officer of Marketo Inc., a leading marketing automation company from February 2016 through August 2016. Prior to that Mr. Ball served as the Senior Vice President and Chief Financial Officer from May 2011 to March 2016. Prior to joining Marketo, Mr. Ball was the Chief Financial Officer for a number of public and private technology companies including Webfoot Software, Inc., BigBand Networks, Inc., and Borland Software Corporation. Mr. Ball also served as Vice President, Mergers and Acquisitions for KLA-Tencor Corporation, a manufacturer of semiconductor equipment, and prior to that as its Vice President of Finance. Mr. Ball was with PricewaterhouseCoopers LLC for over 10 years. Mr. Ball is a director at Advanced Energy Industries, Inc. and SendGrid and is chair of their audit committees and a member of their nominating and governance committees. Mr. Ball is also on the Board of Directors of Engagio, a private company. Mr. Ball is Chair of the Compensation Committee and a member of the Audit Committee. Mr. Ball brings to the Board important financial management experience and financial expertise, having served as Chief Financial Officer of several high-technology companies. He also brings significant experience with mergers and acquisitions within the semiconductor equipment industry as well as experience as a result of serving on the board of directors of two public companies. | 2003 | |

Michael D. Burger, 60, was appointed President and CEO of ESI on October 3, 2016. Prior to joining ESI, Mr. Burger was President and Chief Executive Officer of Cascade Microtech since 2010. Prior to joining Cascade Microtech, Mr. Burger served as the President and Chief Executive Officer of Merix Corporation, a printed circuit board manufacturer, from April 2007 to February 2010, and as a member of the Board of Directors of ViaSystems after it acquired Merix. From November 2004 until joining Merix, Mr. Burger served as President of the Components Business of Flextronics Corporation. From 1999 to November 2004, Mr. Burger was employed by ZiLOG, Inc., a supplier of devices for embedded control and communications applications. From May 2002 until November 2004, Mr. Burger served as ZiLOG's President and a member of its board of directors. Mr. Burger holds a B.S. degree in Electrical Engineering from New Mexico State University and a certificate from the Stanford University International Executive Management Program. Mr. Burger brings to the Board his prior experience with other electronics manufacturers, including former service as a chief executive officer and director. | 2016 | |

Lynne J. Camp, 60, is the owner and founder of Lynne Camp, LLC, a consulting and executive coaching services firm she created in 2012. Previously, Ms. Camp was the Vice President of the Performance Instruments business at Tektronix, Inc., an industry-leading test and measurement equipment manufacturing company, from 2006 to 2007, and Danaher Corporation from 2007 to 2011 after it acquired Tektronix. Prior to joining Tektronix/Danaher, Ms. Camp spent 26 years with Hewlett-Packard and Agilent Technologies, where she held several senior positions including Vice President roles of HP/Agilent’s Remarketing Solutions group, Wireless Test Business group, Communications Test Equipment Services group, Multi-Industry Solutions group and Systems Generation and Delivery group. In these roles, Ms. Camp had direct responsibility for research and development, operations, program management, marketing and customer service in geographic areas throughout the world. Ms. Camp holds a Master’s Degree in Engineering Management and a Bachelor’s in Mechanical Engineering, both from Stanford University. Ms. Camp received an Executive Coaching Certification from the Hudson Institute of Santa Barbara, and is on faculty with the Center for Higher Ambition Leadership. Ms. Camp is a member of the Compensation Committee. Ms. Camp brings to the Board a wide-ranging skillset for setting and executing strategy, developing and aligning teams to deliver superior results, as well as experience in high-tech operations and manufacturing. | 2017 | |

Laurence E. Cramer, 67, was with Continuum Electro-Optics, a manufacturer of high energy laser systems for medical, industrial and scientific research, until August 2015 where he held the positions of Vice President of R&D, Vice President / General Manager and President. Prior to that, he was President of Laser Diode Inc., a manufacturer of GaAs laser diodes for military and telecom applications. Prior to that he spent 15 years at Spectra-Physics in a range of management roles including, Manager of Marketing and Sales, Strategic Product Group Manger, and President of Spectra-Physics Laser diode systems, developer of advanced diode pumped solid state laser systems. He was a Board Member and past President of the Laser Institute of America, and was a member of the U.S. Department of Commerce Technical Advisory Committee in Electronics from 1988 to 1994. He holds a BA degree in Chemistry and Physics from DePauw University, a PhD in Chemistry from Northwestern University and a Masters Certificate in Six Sigma from Villanova University. Mr. Cramer is a member of the Compensation Committee and the Corporate Governance and Nominating Committee. Mr. Cramer brings to the Board significant expertise in lasers and laser development. | 2015 | |

3

| Name, Age, Principal Occupation, and Other Directorships | Director Since | |

| Nominees (continued) | ||

Raymond A. Link, 64, served as Executive Vice President and Chief Financial Officer of FEI Company, a leading supplier of scientific and analytical instruments for nanoscale imaging from July 2005 to April 2015. Prior to this, Mr. Link served as Vice President and Chief Financial Officer of TriQuint Semiconductor, Inc. from July 2001 to July 2005. He is also on the Board of Directors of nLight Inc., a manufacturer of semiconductor and fiber lasers primarily for industrial applications, and FormFactor Inc., a manufacturer of probe cards and electrical test and measurement equipment for the semiconductor industry, and was a Director of Cascade Microtech, Inc., a semiconductor equipment manufacturer, from February 2005 through June 24, 2016. Mr. Link received a B.S. degree from the State University of New York at Buffalo and an M.B.A. from the Wharton School at the University of Pennsylvania. He is a licensed Certified Public Accountant and a Fellow with the National Association of Corporate Directors. Mr. Link is Chair of the Audit Committee and a member of the Corporate Governance and Nominating Committee. Mr. Link brings to the Board important financial management experience and expertise, as well as operations experience with another high-technology public company. | 2015 | |

Richard H. Wills, 63, (Chairman), was President and CEO of Tektronix, Inc., a test, measurement, and monitoring company, from 2000 until 2008, and its Chairman from 2001 through 2008. He joined Tektronix in 1979 and served in a range of marketing, product development and management roles, including President of the Measurement Business and President of Regional Operations for both Europe and the Americas. He holds a master's degree in business administration from the University of Oregon and a bachelor's degree in computer systems from Linfield College. Mr. Wills was a director of FEI Company until the company was acquired in 2016 and was Chairman of the Board of General Fusion, a private energy company in Vancouver, Canada until his retirement from the Board in March of 2017. He is currently a Board Member of StanCorp, an insurance provider in Portland Oregon. Mr. Wills has served as the Chairman of the Board of the Company since February 2015. He is Chair of the Corporate Governance and Nominating Committee and a member of the Compensation Committee. Mr. Wills brings to the Board expertise in strategic planning, corporate governance, marketing and technology, as well as experience serving on the board of other public companies. | 2014 | |

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT

4

CORPORATE GOVERNANCE GUIDELINES AND INDEPENDENCE

The Board has approved and adopted the Corporate Governance Guidelines and Corporate Governance and Nominating Committee Charter that are on the Company’s website at http://investors.esi.com/corporate-governance. Under the Company’s Corporate Governance Guidelines, which reflect the current standards for “independence” under the Nasdaq Stock Market listing standards and the Securities and Exchange Commission rules, two-thirds of the members of the Board must be independent as determined by the Board. The Board has made the following determinations with respect to each director’s independence for each director that served during fiscal 2018:

| Director | Status (1) | |

| Frederick A. Ball | Independent | |

| Michael D. Burger | Not Independent | |

| Lynne J. Camp | Independent | |

| Laurence E. Cramer | Independent | |

| Raymond A. Link | Independent | |

John Medica (2) | Independent | |

| Richard H. Wills | Independent | |

| (1) | The Board’s determination that a director is independent was made on the basis of the standards set forth in the Corporate Governance Guidelines. |

| (2) | John Medica was a member of the Board in fiscal 2018 until his passing on October 13, 2017. |

The Company has also adopted a Code of Conduct and Business Practices applicable to the Company’s directors, officers, employees and agents of ESI and its subsidiaries and a Code of Ethics for Financial Managers. Copies of the Company’s Code of Conduct and Business Practices and Code of Ethics for Financial Managers are available on the Company’s website at http://investors.esi.com/corporate-governance.

BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

Board Leadership

In accordance with our Corporate Governance Guidelines, it is the practice of the Board to select a director as Chairman of the Board who qualifies as independent as defined in the Corporate Governance Guidelines. If the Chairman of the Board ceases to qualify as independent, the Board will designate an independent director to serve as Lead Director. The Company believes that this structure enhances the Board’s oversight of management, strengthens the Board’s ability to communicate its views to management, increases the Board’s independence and otherwise enhances our governance. Mr. Wills has served as Chairman of the Board since 2015.

Risk Oversight

The Board as a whole is responsible for overseeing our risk management function and certain members of the Company’s senior management team are expressly authorized by the Board to be responsible for implementation of the Company’s day-to-day risk management processes. In connection with the Board’s annual strategic and financial plan review, senior management makes a multidisciplinary presentation to the Board on significant strategic, operational, financial, legal and compliance risks facing the Company. At the other three quarterly Board meetings, senior management provides an update to the Board on specific risk-related issues. Additionally, the Board reviews a comprehensive assessment of the Company's risk and associated mitigating factors and actions annually.

Additionally, the Board is actively involved in oversight of certain risk areas conducted primarily through committees of the Board, as described in the charters of each of the committees. The Board satisfies its risk oversight responsibility through reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from management responsible for oversight of particular risks within the Company.

The Compensation Committee is responsible for overseeing the management of the Company’s executive compensation plans and incentive arrangements and routinely reviews these programs and incentive programs for all employees to ensure that these programs do not present inappropriate risk and are aligned with shareholder interests.

5

The Audit Committee oversees management of financial reporting, information technology, legal, the external audit relationship, functioning of internal controls and insurance related risks. This oversight includes meeting with management on at least a quarterly basis. As frequently as necessary, the Audit Committee Chair meets with senior management, the Company’s outside counsel and the Company’s independent auditors to discuss any hotline complaints, allegations of violations of the Code of Ethics and other ethical, legal or compliance matters. As applicable, which is generally on a quarterly basis, internal audit reports on the progress of the annual control testing to the Audit Committee and any related findings. Any significant findings are followed up on and corrected under the direction of the Audit Committee and the senior management team.

The Corporate Governance and Nominating Committee manages risks associated with the qualifications and independence of the Board and potential conflicts of interest.

MEETING ATTENDANCE

During fiscal 2018, the Board held five meetings, and each member of the Board attended at least 75 percent of the aggregate number of the meetings of the Board and the committees of which they were members. Directors are expected to attend shareholder meetings. All directors then in office attended the 2017 Annual Meeting of Shareholders.

BOARD COMPENSATION

Non-employee director compensation consists of a mix of cash and equity. The combination of cash and equity compensation is intended to provide incentives for non-employee directors to continue to serve on the Board of Directors, to align the interests of the Board of Directors and stockholders, and to attract new non-employee directors with outstanding qualifications. The Compensation Committee periodically reviews the non-employee director compensation program and makes recommendations to the Board of Directors as appropriate. The Committee has engaged Compensia, Inc., (“Compensia”) as its independent compensation consultant to provide advice with respect to non-employee director compensation matters. During fiscal 2018, Compensia reviewed and recommended updates for the Company’s peer group and provided related advice with respect to director compensation. Compensia also provided advice and information on material compensation trends to provide a general understanding of current compensation practices.

Directors who are not employees of the Company receive the following fees to the extent applicable to the individual directors: (a) an annual cash retainer of $75,000 for the service as the Chairman of the Board; (b) an annual cash retainer of $45,000 for non-Chairman Board service; and (c) an annual fee of $20,000, $15,000, and $10,000 for service as Chair of the Audit Committee, Compensation Committee, and Nominating & Governance Committee, respectively; and (d) an annual fee of $7,500, $5,000, and $4,000 for non-chairman service on the Audit Committee, Compensation Committee, and Nominating & Governance Committee, respectively. The Company also provides for reimbursement of costs for continuing education programs relating to the performance of duties as a director of a public company, subject to approval by the Chairman of the Board. Directors were reimbursed for reasonable expenses incurred in attending meetings of the Board.

Non-employee directors also receive initial and annual equity grants of restricted stock units (RSUs) as a component of their total compensation. On August 10, 2017, each non-employee director serving on that date received an annual grant of 12,000 RSUs under the 2004 Stock Incentive Plan, which will vest 100% immediately prior to the 2018 Annual Meeting. In connection with her appointment to the Board on October 2, 2017, Ms. Camp received an initial grant of 16,000 RSUs under the 2004 Stock Incentive Plan, which will vest 25% on each of the first four anniversaries of the grant date. If a director terminates Board service prior to vesting, the equity award will be prorated. For those directors only serving a partial term, cash retainers are also prorated.

6

FISCAL YEAR 2018 DIRECTOR COMPENSATION

The following table shows compensation earned by the Company’s non-employee directors in fiscal 2018. Compensation for Mr. Burger is set forth in the Summary Compensation Table.

| Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2) | All Other Compensation ($) | Total ($) | ||||||||||||||

| Frederick A. Ball | $ | 67,500 | $ | 129,600 | (3) | $ | — | $ | 197,100 | |||||||||

| Lynne J. Camp | $ | 24,657 | $ | 225,120 | (4) | $ | — | $ | 249,777 | |||||||||

| Laurence E. Cramer | $ | 56,500 | $ | 129,600 | (3) | $ | — | $ | 186,100 | |||||||||

| Raymond A. Link | $ | 69,000 | $ | 129,600 | (3) | $ | — | $ | 198,600 | |||||||||

John Medica(5) | $ | 32,473 | $ | 129,600 | (3) | $ | — | $ | 162,073 | |||||||||

| Richard H. Wills | $ | 84,313 | $ | 129,600 | (3) | $ | — | $ | 213,913 | |||||||||

| (1) | Reflects total cash compensation paid in fiscal 2018 and includes amounts deferred at the Director's election pursuant to the Company's deferred compensation plan. |

| (2) | Represents the full grant date fair value of the awards granted to each director in the fiscal year ended March 31, 2018, computed in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718 “Compensation – Stock Compensation” (ASC Topic 718). Awards are valued at the closing market price of the Company’s common stock on the grant date. |

| (3) | For directors then serving, comprises an annual grant of 12,000 RSUs on August 10, 2017, which vests immediately prior to the 2018 Annual Meeting date. This grant represents the total number of unvested RSUs held by each such non-employee director as of March 31, 2018. |

| (4) | As part of her appointment to the Board, Lynne J. Camp received an initial grant of 16,000 RSUs on October 2, 2017, which vests on the first four anniversaries of the grant date. This grant represents the total number of unvested RSUs held by Ms. Camp as of March 31, 2018. |

| (5) | John Medica passed away on Friday, October 13, 2017 and his estate received a pro-rated vesting of his 2018 stock awards. |

Under the Company's deferred compensation plan, directors can generally elect to defer a minimum of 10% and a maximum of 100% of the fees they receive from the Company for their service on the Board. Cash amounts credited to the deferred compensation plan will earn a rate of return based on investment funds selected by the participants from a prescribed menu of investment options. Generally, deferred amounts will be paid in a lump sum upon termination, except in the case of retirement, in which case the deferred amounts will be paid in a lump sum or in annual installments for up to ten years, as elected by the director. Directors may also defer payment of RSUs granted to them by the Company. Payment will be in shares of Company common stock under the same terms as cash amounts.

Our stock ownership guidelines require directors to own stock equal to or greater than 3x their annual retainer. All directors met the stock ownership requirements as of June 5, 2018. See “Compensation Discussion and Analysis -- Stock Ownership Guidelines” for additional information regarding the stock ownership guidelines.

BOARD COMMITTEES

Audit Committee

The Company maintains an Audit Committee that consists of Raymond A. Link (Chairman), Frederick A. Ball, and Laurence E. Cramer. All of the members of the Audit Committee are “independent directors” in accordance with the Nasdaq Stock Market listing standards and pursuant to the criteria established in Section 10A(m) of the Securities Exchange Act of 1934, as amended. Each of Messrs. Link and Ball has financial reporting oversight experience, including serving as chief financial officer of a public company. The Board has determined that each of Messrs. Link, Ball and Cramer is an audit committee financial expert as defined in Securities and Exchange Commission (the “SEC”) rules. On a regular basis, the Audit Committee meets with management and with representatives of the Company's independent registered public accounting firm, Deloitte & Touche LLP, including meetings without the presence of management. The Audit Committee met eleven times in fiscal 2018.

7

Compensation Committee

The Company maintains a Compensation Committee that currently consists of Frederick A. Ball (Chairman), Lynne J. Camp, and Richard H. Wills with John Medica serving until his passing. All members of the Compensation Committee have been determined to be independent by the Board in accordance with the Nasdaq Stock Market listing standards and Securities and Exchange Commission rules. The Compensation Committee discharges the responsibilities of the Board relating to the compensation of our executive officers and non-employee directors and grants awards under the Company’s stock incentive plan. For additional information about the Compensation Committee, see “Compensation Discussion and Analysis.” The Compensation Committee met seven times in fiscal 2018.

Corporate Governance and Nominating Committee

The Company maintains a Corporate Governance and Nominating Committee that currently consists of Richard H. Wills (Chairman), Laurence E. Cramer and Raymond A. Link. John Medica was chairman up until his passing. All members of the Corporate Governance and Nominating Committee have been determined to be independent by the Board in accordance with the Nasdaq Stock Market listing standards and Securities and Exchange Commission rules. The Corporate Governance and Nominating Committee assists the Board in fulfilling its oversight responsibilities related to seeking candidates for membership on the Board, assessing the corporate governance policies and processes of the Board and reviewing from time to time the policies of the Board related to director qualifications, compensation, tenure and retirement. The Corporate Governance and Nominating Committee met four times in fiscal 2018.

Shareholder Nominations

Shareholders may recommend individuals for consideration by the Corporate Governance and Nominating Committee to become nominees for election to the Board by submitting a written recommendation to the Corporate Governance and Nominating Committee c/o Chairman of the Corporate Governance and Nominating Committee, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229-5497. Communications should be sent by overnight or certified mail, return receipt requested. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether the individual can read and understand financial statements, and board memberships, if any, for the Corporate Governance and Nominating Committee to consider. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders. Recommendations received by January 31, 2019 will be considered for nomination for election at the 2019 Annual Meeting of Shareholders. Recommendations received after January 31, 2019 will be considered for nomination for election at the 2020 Annual Meeting of Shareholders. Following the identification of the director candidates, the Corporate Governance and Nominating Committee will meet to discuss and consider each candidate’s qualifications and shall determine by majority vote the candidate(s) whom the Corporate Governance and Nominating Committee believes would best serve the Company. In evaluating director candidates, the Corporate Governance and Nominating Committee will consider a variety of factors, including the composition of the Board as a whole, the characteristics (including independence, age, skills and experience) of each candidate, and the performance and continued tenure of incumbent Board members. The Committee believes that candidates for director should have certain minimum qualifications, including high ethical character, a reputation that enhances the image and reputation of the Company, being highly accomplished and a leader in his or her respective field, relevant expertise and experience, the ability to exercise sound business judgment and the ability to work with management collaboratively and constructively. The Committee also values diversity. In addition, the Committee believes that at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission rules and that at least two-thirds of the members of the Board should meet the definition of independent under the Nasdaq Stock Market listing standards and Securities and Exchange Commission rules. The Committee also believes the Company’s Chief Executive Officer should participate as a member of the Board. A candidate recommended by a shareholder will be evaluated in the same manner as a candidate identified by the Committee.

COMMUNICATIONS WITH BOARD

Any shareholder who desires to communicate with the Board, individually or as a group, may do so by writing to the intended member or members of the Board, c/o Corporate Secretary, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229-5497. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be compiled by the Secretary and submitted to the Board in a timely manner.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Common Stock of the Company as of June 5, 2018 by (i) each person known to the Company to be the beneficial owner of more than 5% of the Company’s Common Stock, (ii) each of the Company’s current directors and nominees for director, (iii) each individual named in the Summary Compensation Table and (iv) all directors and executive officers of the Company on June 5, 2018 as a group. Applicable percentage of ownership is based on 34,104,459 shares of Common Stock outstanding as of June 5, 2018 together with time-vested RSUs held by such shareholders. Shares of underlying RSUs vested at June 5, 2018 or vesting within 60 days after June 5, 2018, are deemed outstanding for computing the percentage ownership of the person holding such RSUs, but are not deemed outstanding for computing the percentage ownership of any other person.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Approximate Percent of Class | |||||

| Frederick A. Ball | 85,390 | (2) | * | ||||

| Lynne J. Camp | — | * | |||||

| Laurence E. Cramer | 24,000 | * | |||||

| Raymond A. Link | 44,100 | * | |||||

| Richard H. Wills | 80,081 | * | |||||

| Michael Burger | 162,337 | (3) | * | ||||

| Allen Muhich | — | * | |||||

| Steve Harris | 36,647 | * | |||||

| John Williams | 17,231 | * | |||||

| Paul Oldham | 63,925 | * | |||||

| Bing-Fai Wong | 7,084 | (4) | * | ||||

| BlackRock Institutional Trust Company, N.A. | 4,148,771 | (5) | 12.16% | ||||

| 400 Howard Street, San Francisco, CA 94105 | |||||||

| The Vanguard Group, Inc. | 2,308,004 | (5) | 6.77% | ||||

| Valley Forge, PA 19355 | |||||||

| Dimensional Fund Advisors LP | 2,007,624 | (5) | 5.89% | ||||

Palisades West, Building One, 6300 Bee Cave Road, Austin, TX 78746 | |||||||

| Renaissance Technologies LLC | 1,748,700 | (5) | 5.13% | ||||

| 600 Route 25A, East Setauket, New York 11733 | |||||||

| 11 directors and executive officers (as of June 5, 2018) as a group | 520,795 | (7) | 1.53% | ||||

| * | Less than 5 percent. |

| (1) | Shares are held directly with sole investment and voting power unless otherwise indicated. |

| (2) | Includes 28,515 shares deferred under the Company’s deferred compensation plan. |

| (3) | Includes 75,837 shares deferred under the Company’s deferred compensation plan. |

| (4) | Includes 5,507 shares deferred under the Company's deferred compensation plan. |

| (5) | Based on the institutional holding report provided by Nasdaq as of June 5, 2018, which reflects the most recent Schedule 13D, 13F or 13G (or amendments thereto) filed by such person with the SEC. |

9

EXECUTIVE OFFICERS

As of June 5, 2018, the Executive Officers of the Company were as shown in the below table.

| Name | Age | Position | |||

| Michael Burger | 60 | President and Chief Executive Officer beginning October 2016 | |||

| Allen Muhich | 51 | Vice President, Chief Financial Officer and Corporate Secretary | |||

| Steve Harris | 55 | Vice President of Engineering | |||

| John Williams | 49 | Vice President of Marketing | |||

See Mr. Burger's biography under “Election of Directors.”

Allen Muhich joined the ESI team in December 2017 as Vice President, Chief Financial Officer and Corporate Secretary. Mr. Muhich brings over 25 years of global financial management experience in technology businesses. Prior to his role at ESI, Mr. Muhich served as the COO/CFO of ID Experts, a provider of identity protection services. Prior to ID Experts he was the CFO of Smarsh Inc., a provider of cloud-based archiving solutions, and the CFO of Radisys Corporation, a leading provider of open telecom solutions. Prior to Radisys he was the Vice President of Finance and Corporate Controller at Merix, a manufacturer of printed circuit boards, and he spent 15 years in financial management at Tektronix and Xerox. Mr. Muhich holds a B.A. degree in Accounting from Western Washington University.

Mr. Harris joined the ESI team in February 2017 as Vice President of Engineering. Mr. Harris brings over 30 years of engineering, engineering management and business management experience. Prior to joining ESI, Mr. Harris spent seven years at Cascade Microtech where he served as Vice President of Engineering, and as VP & General Manager. Prior to joining Cascade Microtech, Mr. Harris worked 11 years at ESI where he held roles of Vice President Research, Development & Engineering and VP & General Manager Semiconductor Products division. Mr. Harris spent the first 13 years of his career at Tektronix in development engineering, program management and engineering management roles. Mr. Harris holds a B.S. degree in Electrical Engineering from the University of Idaho and a certificate in General Management from Oregon Graduate Institute.

Mr. Williams joined the ESI team in February 2017 as Vice President of Marketing. Mr. Williams brings over 20 years of experience in increasingly responsible roles involving marketing management and strategy. Prior to joining ESI, John was Vice President, Marketing for Thermo Fischer Scientific, previously FEI, where he had served for ten years—seven as Vice President, Corporate and Strategic Marketing. Prior to FEI, he spent five years as Director of Marketing at Brooks Automation. John had previously held Product Marketing Manager responsibilities at a number of technology-focused firms. He has a degree in Mechanical Engineering from Cal Poly - San Luis Obispo.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the compensation program for our Named Executive Officers. During fiscal 2018, these individuals were:

| Name | Position | |

| Michael Burger | our President & Chief Executive Officer (“CEO”) | |

| Allen Muhich | our Chief Financial Officer & Corporate Secretary (“CFO”) (1) | |

| Steve Harris | our Vice President of Engineering (2) | |

| John Williams | our Vice President of Marketing (2) | |

| Paul Oldham | our former Senior Vice President Administration, Chief Financial Officer, & Corporate Secretary (3) | |

| Bing-Fai Wong | our former Vice President of Customer Operations (4) | |

(1)Allen Muhich was appointed CFO and Corporate Secretary on December 5, 2017.

(2)Steve Harris and John Williams became executive officers of the Company on May 11, 2017.

(3)Paul Oldham resigned from his position as Senior Vice President, CFO and Corporate Secretary effective December 4, 2017.

(4)Bing-Fai Wong ceased to be an executive officer of the Company on May 11, 2017.

This Compensation Discussion and Analysis describes the material elements of our executive compensation program for fiscal 2018, which ended on March 31, 2018. It also provides an overview of our executive compensation philosophy and objectives. Finally, it analyzes how and why the Compensation Committee of the Board (the “Committee”) arrived at the specific compensation decisions for our Named Executive Officers, for fiscal 2018, including the key factors that the Committee considered in determining their compensation.

10

Executive Summary

Who We Are |

We are a leading supplier of innovative laser-based microfabrication solutions for industries reliant on micro-technologies. Our integrated solutions control the power of laser light allowing industrial designers and process engineers to transform materials enabling the technology that differentiates their consumer electronics, wearable devices, semiconductor circuits and high-precision components for market advantage. Founded in 1944, we are headquartered in Portland, Oregon, with global operations in Asia, Europe and North America.

Over the past 18 months, we have begun to realize the benefits of the reorganization that we launched in fiscal 2017 to refocus our corporate priorities, to deliver more consistent earnings over time and improve our ability to execute. Key to this initiative was to identify investment opportunities that would significantly contribute to our focused corporate priorities and drive the development and introduction of new products in our key markets. During this period, we have accomplished the following:

Fiscal 2017

| • | Restructured our organization to move from a business unit to a functional structure |

| • | Refreshed our executive leadership team, including the appointment of a new President and Chief Executive Officer |

| • | Shifted leadership of our global sales, service and manufacturing operations to Asia |

| • | Closed multiple sites for reduced cost, better efficiency and collaboration |

| • | Improved our ability to develop, manufacture, market and sell our leading families of products |

| • | Created a “success” model for annual adjusted gross margin and adjusted EBITDA targets |

Fiscal 2018

| • | Focused our product offerings by discontinuing and divesting lower performing products and businesses that did not contribute to our corporate objectives |

| • | Achieved higher revenues and lower expenses that enabled us to generate 27% non-GAAP* operating margin, compared to negative 6% in fiscal 2017; and increased orders over the last four fiscal quarters by 249% over the prior four fiscal quarters |

| • | Generated GAAP earnings per diluted share of $3.30, compared to a loss of $1.15 per share in fiscal 2017 |

| • | Exceeded our “success” model for annual adjusted gross margin and adjusted EBITDA targets |

| • | Completed restructuring of key business processes to establish a reduced fixed cost structure |

| • | Achieved record orders for our flexible circuit drilling products based on a strong capacity build cycle and our customer’s investment in new technologies, materials and applications |

| • | Received multiple orders for our new UltrusTM semiconductor scribe tool |

*See Annex A for a reconciliation of non-GAAP and GAAP financial measures.

11

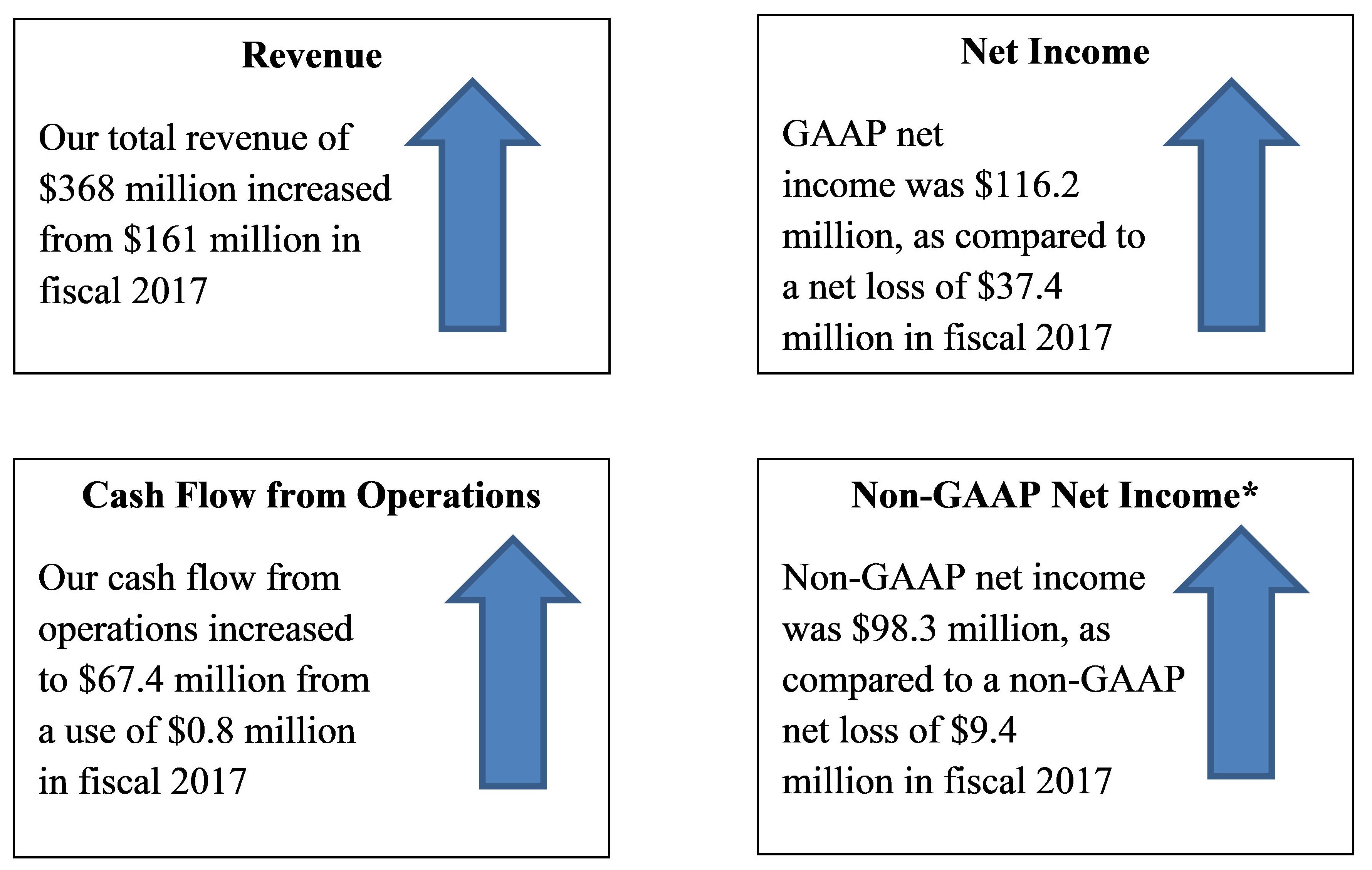

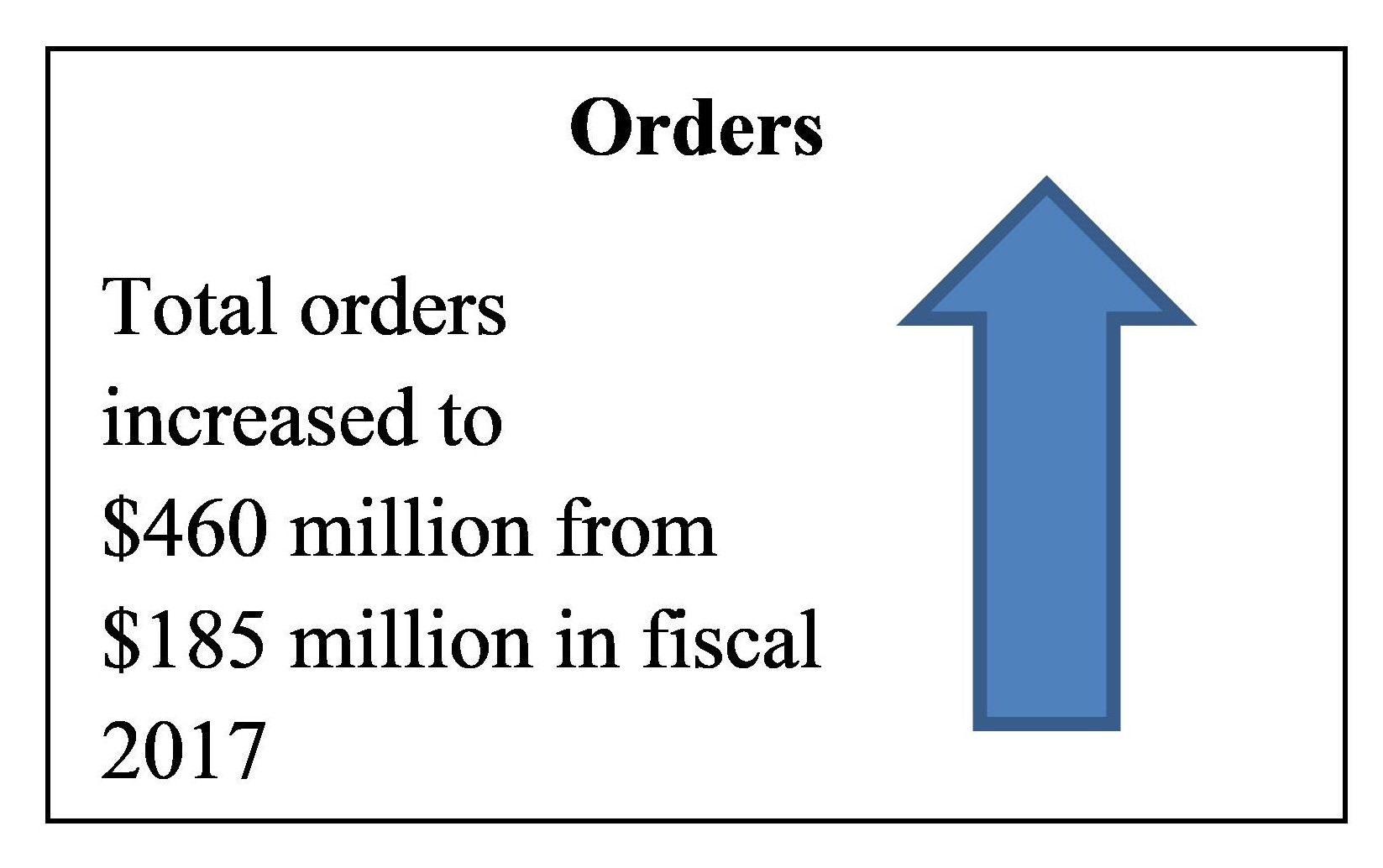

| Fiscal 2018 Financial Highlights |

Fiscal 2018 was a very strong year for ESI under the leadership of Mr. Burger, who was appointed our President and Chief Executive Officer on October 3, 2016. We continued to make progress on our business transformation and experienced record revenue growth and renewed profitability:

Fiscal 2018 Operational Highlights |

*See Annex A for a reconciliation of non-GAAP and GAAP financial measures.

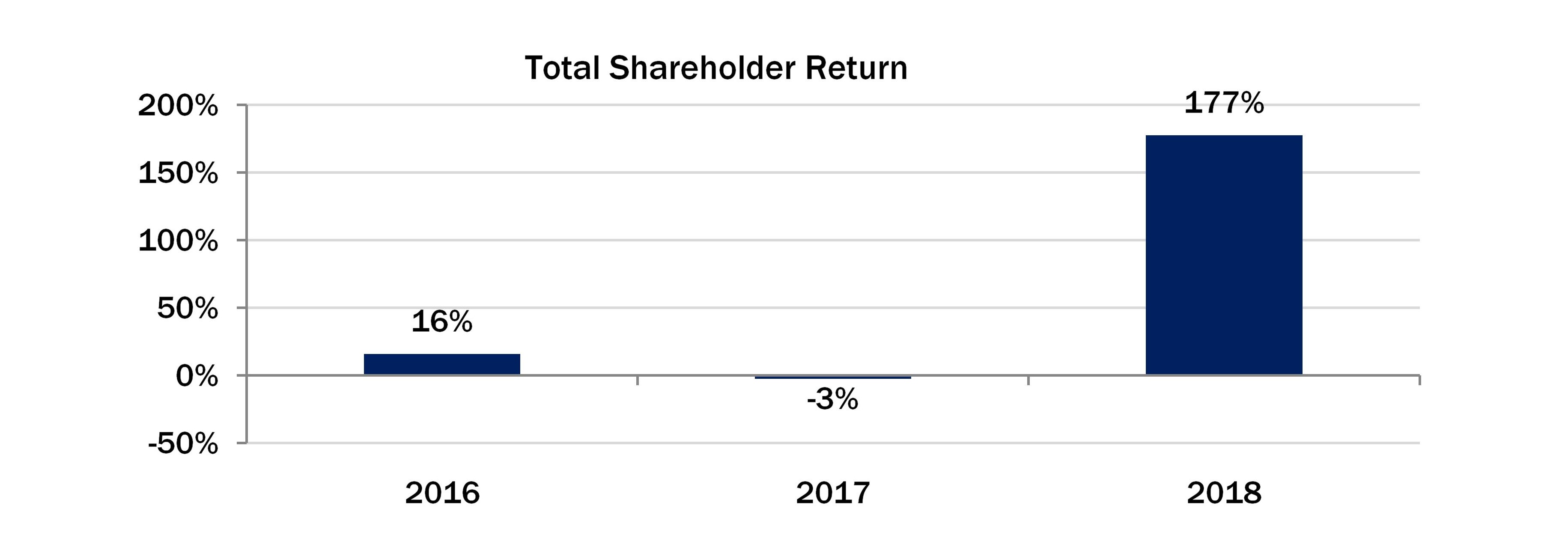

Overall, the impact of these achievements has been reflected in the closing market price of our common stock which was $19.33 per share on March 31, 2018, the last day of fiscal 2018. This represents an increase in total shareholder return ("TSR") of approximately 177% over the closing market price of our common stock on April 1, 2017, the last day of fiscal 2017, which was $6.97 per share.

12

Fiscal 2018 Executive Compensation Highlights |

Based on our overall operating environment and these results, the Committee took the following key actions with respect to the compensation of our Named Executive Officers for fiscal 2018:

| • | Base Salary - Approved annual base salary increases ranging from 0% to 4%, with the exclusion of our CEO whose base salary remained unchanged from fiscal 2017 at $575,000. |

| • | Annual Cash Incentive Awards - Approved annual cash incentive awards under our fiscal 2018 annual cash incentive plan based on achievement of an aggregate of 449% of target performance levels, which under the plan was capped at 200% of the executive officers’ target opportunities, including an annual cash incentive award for our CEO in the amount of $1.15 million, equal to 200% of his target annual cash incentive award opportunity. |

| • | Long-Term Incentive Compensation - Granted long-term incentive compensation opportunities in the form of performance-based restricted stock unit (“PRSU”) awards that may be settled for shares of our common stock subject to our relative TSR as compared to the Russell 2000 index (the "Index") and time-based restricted stock unit (“RSU”) awards that also may be settled for shares of our common stock, in amounts ranging from target levels of approximately $96,720 to $1,489,085 million, including a PRSU award and an RSU award for our CEO with an aggregate target value of $1,489,085 million. |

| • | Compensation Arrangements with Mr. Muhich - In connection with his appointment as our Chief Financial Officer and Corporate Secretary on December 5, 2017, approved the following compensation arrangements for Mr. Muhich: |

| ◦ | an annual base salary of $350,000; |

| ◦ | a target annual cash incentive award opportunity equal to 60% of his annual base salary, subject to a maximum cap of 200% of his annual base salary; |

| ◦ | a hiring bonus in the amount of $25,000; |

| ◦ | an RSU award that may be settled for 25,000 shares of our common stock, subject to a four-year vesting requirement with 25% of the shares subject to the award vesting on each of the first four anniversaries of the date of grant, contingent upon his remaining continuously employed through each applicable vesting date; and |

| ◦ | an RSU award that may be settled for a target of 25,000 shares of our common stock based on the performance of our common stock relative to the performance of the Russell 2000 over three overlapping performance periods, each beginning on December 5, 2017, with the first performance period ending on December 5, 2018, the second performance period ending on December 5, 2019 and the third performance period ending on December 5, 2020, subject to the lesser of a maximum cap of 200% of the target number of shares or the target number of shares multiplied by 5x grant date fair value. |

In addition, we also entered into an agreement with Mr. Muhich which provides for certain payments and benefits in the event of an involuntary loss of employment in connection with a change in control of the Company.

13

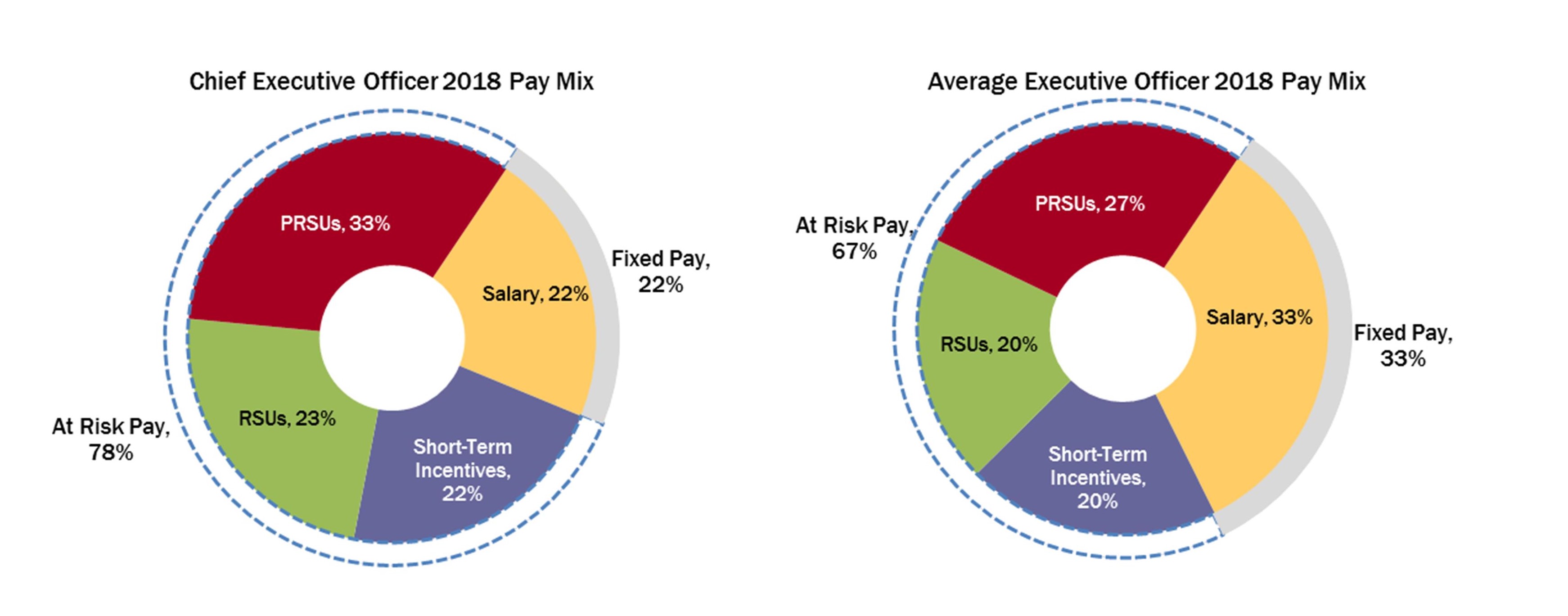

Pay-for-performance Philosophy |

We believe our executive compensation program is reasonable, competitive and appropriately balances the goals of attracting, motivating, rewarding and retaining our executive officers with the goal of aligning their interests with those of our shareholders. To ensure this alignment and to motivate and reward individual initiative and effort, a substantial portion of our executive officers’ target annual total direct compensation opportunity is both performance-based and “at-risk.”

Pay Mix

In addition to reasonable and competitive annual base salaries, we emphasize performance-based compensation that appropriately rewards our Named Executive Officers through two separate compensation elements:

| • | First, we provide the opportunity to participate in our annual cash incentive plan, which provides cash payments based two-thirds on short-term financial results and one-third on the achievement of short-term strategic objectives that meet or exceed the objectives set forth each year in our annual operating plan. |

| • | In addition, we grant PRSU awards, which at target comprise half of the total quantity of equity awards as a long-term incentive compensation opportunity that rewards executive officers for driving total shareholder return relative to an established stock price index that represents a reliable indicator of the general economy and reflects the unique and diverse nature of our operations. |

These variable pay elements ensure that, each year, a substantial portion of our executive officers’ total compensation is contingent (rather than fixed) in nature, with the amounts ultimately payable subject to variability above or below target levels commensurate with our actual performance.

The pay mix for our CEO and our other Named Executive Officers during fiscal 2018 reflected this “pay-for-performance” design:

| 1) | Average Executive Officer Pay Mix reflects pro-rated FY18 awards for executive officers hired during 2017. |

| 2) | Average Executive Officer Pay Mix excludes Paul Oldham and Bing-Fai Wong who ceased to be executive officers during the year and it also excludes Allen Muhich, who became our CFO on December 5, 2017. |

| 3) | Equity awards of PRSUs and RSUs are presented based on target quantities and grant date fair value. |

Annual Cash Incentives

Each year, we offer our executive officers the opportunity to earn cash incentive awards based on their performance as measured against a series of pre-established corporate goals. In fiscal 2018, these objectives were based on significant revenue growth and profitability, as measured by adjusted earnings before interest, taxes, depreciation and amortization (“adjusted EBITDA”), as well as a strategic performance measure involving cost reduction achievements. As in prior years, the Committee determined that this combination of performance measures incented our executive officers to work as a team to achieve the financial, operational and strategic objectives reflected in our fiscal 2018 operating plan.

14

The Committee sets the performance objectives for these annual cash incentive awards at levels it believes can be achieved with meaningful effort. Typically, on a year-over-year basis, we set specific growth rate targets with respect to certain corporate financial measures, after taking into account growth opportunities, our strategic initiatives and competitive market position, as well as any countervailing considerations. Therefore, unless unforeseeable or unique factors affect our business or our key markets, or if our executive officers fail to adequately plan or execute on specific initiatives, it is probable, though not certain, that the performance objectives will be achieved at the target performance level with dedicated and sustained effort. The variability inherent in our annual cash incentive plan over the past three fiscal years is as follows:

Long-Term Incentives

We believe that a balanced mix of performance-based and time-based restricted stock unit awards are an effective way to directly link the compensation of our executive officers to the creation of sustainable long-term value for our shareholders as the amount (if any) that an executive officer may realize from his or her awards depends largely on our ability to drive the appreciation in value of our common stock over an extended period. We believe this result is appropriate as our shareholders also will have benefited significantly from owning our common stock.

We believe that our approach to long-term incentive compensation is in our best interests and the best interests of our shareholders for the following reasons:

| • | It directly links the majority of our executive compensation to tangible financial results; |

| • | It emphasizes variable, “at risk” compensation; and |

| • | It ensures a strong “pay-for-performance” alignment. |

Through our equity awards, when our shareholders are rewarded, our executive officers are also rewarded. Similarly, when our performance is not reflected in our stock price, our executive officers realize less value from their equity awards.

We believe this design provides balanced incentives for our executive officers to drive financial performance and long-term growth. To ensure we remain faithful to our compensation philosophy, the Committee regularly evaluates the relationship between the reported values of the equity awards granted to our executive officers, and, ultimately, realized from such awards in subsequent years and our total shareholder return over this period.

Executive Compensation Policies and Practices |

We endeavor to maintain sound governance standards consistent with our executive compensation policies and practices. The Committee evaluates our executive compensation program on a regular basis to ensure it is consistent with our short- and long-term goals given the dynamic nature of our business and the market in which we compete for executive talent. The following summarizes our executive compensation and related policies and practices:

15

| What We Do | What We Don't Do | |||

¨ Maintain an Independent Compensation Committee. | ¨ No Executive Defined Benefit Retirement Plans. | |||

The Compensation Committee consists solely of independent directors. | We do not offer pension arrangements or defined benefit retirement plans or arrangements to our executive officers that are different from or in addition to those offered to our other employees. | |||

¨ Retain an Independent Compensation Advisor. | ||||

The Compensation Committee engaged its own compensation advisor to provide information and analysis with its fiscal 2018 compensation review, and other advice on executive compensation independent of management. This consultant performed no consulting or other services for us in fiscal 2018. | ¨ Minimal Perquisites. | |||

| We only provide perquisites or other personal benefits to our executive officers that are supported by a reasonable business purpose. | ||||

¨ Annual Executive Compensation Review. | ¨ No Tax Reimbursements on Perquisites. | |||

The Compensation Committee conducts an annual review and approval of our compensation strategy, including a review and determination of our compensation peer group used for comparative purposes and a review of our compensation-related risk profile to ensure that our compensation programs do not encourage excessive or inappropriate risk-taking and that the level of risk that they do encourage is not reasonably likely to have a material adverse effect on us. | We do not provide any tax reimbursement payments (including “gross-ups”) on any perquisites or other personal benefits, other than for standard relocation or temporary housing arrangements. | |||

¨ No Special Welfare or Health Benefits. | ||||

| Our executive officers participate in broad-based company-sponsored health and welfare benefits programs on the same basis as our other full-time, salaried employees. | ||||

¨ Compensation At-Risk. | ||||

Our executive compensation program is designed so that a significant portion of our executive officers’ compensation is “at risk” based on our corporate performance, as well as equity-based, to align the interests of our executive officers and shareholders. | ||||

¨ No Post-Employment Tax Payment Reimbursement. | ||||

| We do not provide any tax reimbursement payments (including “gross-ups”) on any severance or change-in-control payments or benefits. | ||||

¨ Performance-Based Incentive Award Opportunities. | ||||

Our annual cash incentive awards are subject to achievement of both “top-line” and “bottom-line” financial performance measures, while our long-term performance-based incentive awards are to be earned based on relative total shareholder return over a multi-year period. | ¨ No Hedging of Our Equity Securities. | |||

| We prohibit our executive officers, the non-employee members of the Board and other employees from hedging our equity securities. | ||||

¨ Incentive Award Opportunities Capped. | ¨ No Pledging of Our Equity Securities. | |||

We limit both our annual and long-term performance-based incentive awards to 200% of the target. | We prohibit our executive officers, the non-employee members of the Board and other employees from pledging our equity securities. | |||

¨ Stock Ownership Policy. | ¨ No Dividends or Dividend Equivalents Payable on Unvested Equity Awards. | |||

| We maintain a stock ownership policy that requires our CEO, other executive officers and the non-employee members of the Board to maintain a minimum ownership level of our common stock. | ||||

We do not pay dividends or dividend equivalents on unvested or unearned RSU awards. | ||||

¨ Compensation Recovery (“Clawback”) Policy. | ¨ No Stock Option Re-pricing. | |||

| In the event the Board determines that an executive officer has engaged in an act of embezzlement, fraud or breach of fiduciary duty that contributed to an obligation to restate our financial statements, the executive officer will be required to repay annual cash incentive awards and/or proceeds from the sale of equity awards within the 12-month period following the first public issuance or filing with the SEC of the financial statements required to be restated. | Our employee stock plan does not permit options or stock appreciation rights to be repriced to a lower exercise or strike price without the approval of our shareholders. | |||

¨ Conduct an Annual Shareholder Advisory Vote on Named Executive Officer Compensation. | ||||

We conduct an annual shareholder advisory vote on the compensation of our Named Executive Officers. | ||||

¨ “Double-Trigger” Change-in-Control Arrangements. | ||||

All change-in-control payments and benefits are based on a “double-trigger” arrangement (that is, they require both a change-in-control of the Company plus a qualifying termination of employment before payments and benefits are paid). | ||||

¨ Use a Pay-for-Performance Philosophy. | ||||

A significant portion of executive officers’ compensation is directly linked to corporate performance; we also structure their target total direct compensation opportunities with a significant long-term equity component, thereby making a substantial portion of each executive officer’s target total direct compensation dependent upon our stock price and/or total shareholder return. | ||||

¨ Succession Planning. | ||||

We review the risks associated with our key executive officer positions to ensure adequate succession plans are in place. | ||||

16

Shareholder Advisory Vote on Named Executive Officer Compensation |

At our 2017 Annual Meeting of Shareholders, we conducted a non-binding shareholder advisory vote on the compensation of our Named Executive Officers (commonly known as a “Say-on-Pay” vote). Our shareholders approved the Say-on-Pay proposal with approximately 78% of the votes cast in favor of the fiscal 2017 compensation of our Named Executive Officers. While this represented a majority support of the proposal, the Board recognized that these results were less than what it considered to be satisfactory, particularly in light of the fact that approximately 93% of the votes cast on our 2016 Say-on-Pay proposal were voted in favor of our Named Executive Officers' compensation.

At our 2017 Annual Meeting of Shareholders, we also conducted a non-binding shareholder advisory vote on the frequency of future Say-on-Pay votes (commonly known as a “Say-When-on-Pay” vote). Our shareholders expressed a preference for holding future Say-on-Pay votes on an annual, rather than a biennial or triennial, basis. In recognition of this preference and other factors considered, the Board determined that we should continue to hold annual Say-on-Pay votes.

Responsiveness to Shareholder Feedback |

Our shareholders’ opinions on how we operate our business are important to us. During fiscal 2018, we did not learn of any new concerns from our shareholders with respect to our executive compensation program. As the Committee made its compensation decisions for fiscal 2018, it was mindful of the level of support our shareholders have expressed in the past for our approach to executive compensation.

As part of its annual review of our executive compensation program, the Committee also considers enhancements to our program to strengthen the alignment of our financial and operational performance and our executive pay outcomes and to address shareholder concerns. Over the past two years, we have made the following changes to our executive compensation program:

| Compensation Practice | Issue | Our Response | Effective Date of Response |

| Type of equity awards granted | Excessive use of time-based equity awards | Introduced performance-based restricted stock unit awards with a TSR measure for our CEO and other executive officers | Fiscal 2017 |

| Design of CEO long-term incentive compensation opportunity | Desire for greater proportion of performance-based awards | At least half of value of all future equity awards granted to our CEO to be performance-based | Fiscal 2017 |

| Design of annual incentive program | Eliminated quarterly attainment under annual cash incentive plan; payments will be based solely on annual performance | Fiscal 2018 | |

The Board and the Committee will continue to consider the outcome of future Say-on-Pay votes, as well as feedback received throughout the year, when making compensation decisions for our executive officers.

Executive Compensation Philosophy and Design Principles |

We believe that our executive compensation program should attract and retain talented executive officers, motivate them to execute long-term business strategies while achieving our near-term financial objectives and align their performance with our short-term and long-term goals for delivering shareholder value. Based on this philosophy, we have developed a set of design principles which seek to link a significant portion of our executive officers’ target total direct compensation opportunity to the achievement of pre-established financial and operational results.

17

| Compensation Philosophy | Compensation Design Principles |

| Attract and retain talented executive officers | Our executive officers should have market competitive compensation and the Committee orients our target total direct compensation opportunities generally near the 50th percentile of our compensation peer group, with actual compensation falling above or below depending upon our financial performance and the performance of our stock price. Compensation elements may be set above or below such percentile target and vary by individual executive officer based on tenure, experience and individual performance. |

| Pay for performance. Motivate executive officers to execute long-term business strategies while achieving near term financial targets | A significant portion of the annual compensation of our executive officers is designed to, and aligned with, annual business performance and the long-term relative performance of our stock price in comparison to the Russell 2000 Index. |

| Link compensation outcomes to performance of core business | Our fiscal 2018 annual cash incentive awards were dependent upon corporate achievement of two demanding financial performance objectives: revenue and adjusted EBITDA and one strategic objective, to meet a defined cost model objective within the fiscal year. The Committee determined that these were the most effective measures for linking our executive officers’ compensation directly to our core operating results for fiscal 2018. |

| Align compensation with shareholder interests | Our shareholders benefit from our continued strong operating performance. Thus, we believe that having a significant portion of compensation tied to equity with both time-based and performance-based vesting requirements directly aligns our executive officer and shareholder returns. Performance-based RSU awards make up a significant potential portion of equity awards granted to our Named Executive Officers. |

We do not have a specific policy on the percentage allocation between short-term and long-term compensation elements.

Governance of Executive Compensation Program

Role of the Compensation Committee

The Committee consists entirely of independent non-employee directors as defined by the rules of the Nasdaq Stock Market, our Corporate Governance Guidelines and the Committee's charter. The current members of the Committee are Frederick A. Ball (Chairman), Lynne J. Camp, and Richard H. Wills. The Committee's authority and responsibilities are set forth in a charter adopted by the Board, which the Committee reviews annually. The Committee’s charter is available on our website at http://investors.esi.com/corporate-governance.

The Committee discharges the responsibilities of the Board relating to the compensation of our Named Executive Officers and the non-employee members of the Board. The Committee has overall responsibility for overseeing our compensation and benefits policies generally, and overseeing and evaluating the compensation plans, policies and practices applicable to our executive officers. The Committee may, under its charter, delegate responsibilities to subcommittees of the Committee as appropriate.

The Committee reviews and approves the compensation of all of Named Executive Officers. The Committee has full authority to approve annual base salaries, annual cash incentive award opportunities and payments, long-term incentive compensation opportunities and all other compensation for our executive officers including any employment agreements and post-employment compensation arrangements. The Committee reviews and approves all equity award grants to our executive officers and the annual equity award grants to all other employees.

The Committee retains a compensation consultant (as described below) to provide support in its review and assessment of our executive compensation program.

Compensation-Setting Process

The Committee reviews our executive compensation program and makes approval decisions with respect to our CEO’s recommendations for base salary levels, annual cash incentive award opportunities and long-term incentive compensation opportunities of our Named Executive Officers (other than with respect to his own compensation) each fiscal year at its first quarterly meeting, or more frequently as warranted. This review is conducted in conjunction with the annual performance reviews of our executive officers for the prior fiscal year. Base salary adjustments are generally effective in June of each year and equity awards are generally granted in May of each year.

When approving each compensation element and the target total direct compensation opportunity for our executive officers, the Committee considers the following factors:

18

| • | Our performance against the financial and operational objectives approved by the Committee and the Board |

| • | The Committee's, along with our CEO’s, assessment of each individual executive officer’s skills, experience and qualifications relative to other similarly-situated executives at the companies in our compensation peer group |

| • | The Committee's, along with our CEO’s, assessment of the scope of each executive officer’s role compared to other similarly-situated executives at the companies in our compensation peer group |

| • | Our CEO’s assessment of the performance of each individual executive officer, based on a subjective assessment of his or her contributions to our overall performance, ability to lead their function and work as part of a team, all of which reflect our core values |

| • | Compensation parity among our executive officers |

| • | Our financial performance relative to our peers |

| • | The compensation practices of our compensation peer group and the positioning of each executive officer’s compensation in a ranking of peer company compensation levels |

| • | Historical and current information regarding each element of compensation for each executive officer |

| • | The recommendations provided by our CEO with respect to the compensation of our other executive officers |

These factors provide the framework for compensation decision-making and final decisions regarding the compensation opportunity for each executive officer. No single factor is determinative in setting pay levels, nor is the impact of any factor on the determination of pay levels quantifiable. The Committee does not use a single method or measure in making its determinations, nor does it establish specific targets for the total direct compensation opportunities of our executive officers. The Committee references the median of the competitive market when considering compensation adjustments, however, and may approve pay levels that are higher for an executive officer where warranted by performance and other factors.

The Committee meets in executive session without the CEO present when determining his compensation.

Role of Management

In discharging its responsibilities, the Committee works with members of our management, including our CEO and Vice President of Human Resources. Our CEO and Vice President of Human Resources make recommendations on program design and pay levels, where appropriate, and implement the decisions approved by the Committee. Our CFO provides the financial information used by the Committee to make decisions with respect to the selection of performance measures and the setting of target levels and related payments for our annual and long-term incentive compensation arrangements.

In formulating recommendations with respect to the compensation of our other Named Executive Officers, our CEO considers the following factors:

| • | Performance against the financial and operational objectives established by the Committee and the Board |

| • | Each individual executive officer’s skills, experience and qualifications relative to other similarly-situated executives at the companies in our compensation peer group |

| • | The scope of each executive officer’s role compared to other similarly-situated executives at the companies in our compensation peer group |

| • | The performance of each individual executive officer, based on a subjective assessment of his or her contributions to our overall performance, ability to lead their function and work as part of a team, all of which reflect our core values |

| • | Compensation parity among our executive officers |

| • | Our financial performance relative to our peers |

| • | The compensation practices of our compensation peer group and the positioning of each executive officer’s compensation in a ranking of peer company compensation levels |

| • | Historical and current information regarding each element of compensation for each executive officer |

Our CEO is assisted in pay administration by our Vice President of Human Resources. The Committee solicits and reviews our CEO’s recommendations and proposals with respect to adjustments to annual cash compensation, annual and long-term incentive compensation opportunities, program structures and other compensation-related matters for our executive officers (other than with respect to his own compensation).

19

The Committee reviews and discusses these recommendations and proposals with our CEO and considers them as one factor in determining the compensation for our Named Executive Officers. As noted above, our CEO recuses himself from all discussions and recommendations regarding his own compensation.

Role of Compensation Consultant

The Committee has engaged Compensia, Inc., a national compensation consulting firm, as an independent outside compensation consultant with respect to executive officer and director compensation. The Committee has sole authority to retain and terminate Compensia. Compensia reports solely to the Committee for all services related to executive officer and non-employee Director compensation, and performed no other consulting services for us in fiscal 2018 except for those related to executive officer and director compensation. The Committee has assessed the independence of Compensia taking into account, among other things, the factors set forth in Exchange Act Rule 10C-1 and the rules of the Nasdaq Stock Market, and has concluded that no conflict of interest exists with respect to the work that Compensia performs for the Committee.

For fiscal 2018, the scope of Compensia’s engagement included:

| • | Review and analysis of the compensation for our Named Executive Officers |

| • | Review and input on the Compensation Discussion and Analysis section of our proxy statement for our 2018 Annual Meeting of Shareholders |

| • | Research, and assistance with development of our compensation peer group |

| • | Ad hoc support on other compensation-related matters throughout the year |

Competitive Positioning

For purposes of comparing our executive compensation against the competitive market, the Committee reviews and considers the compensation levels and practices of a group of similarly-situated business and labor market competitors. This compensation peer group consists of technology companies that are similar to us in terms of industry similarity, revenue, market capitalization and other factors.

In developing the compensation peer group for fiscal 2018, the following criteria were observed in identifying comparable companies:

| • | Similar industry and competitive market for talent (primary focus on companies selling technology equipment or components such as lasers, photonics, optical components, semiconductors, particularly where the ultimate end-products serve a broad array of consumer or industrial markets) |

| • | Similar revenue size - within a range of ~0.5x to ~2.5x our last four quarters’ revenue (approximately $95 million to approximately $470 million) |

| • | Similar market capitalization - within a range of ~0.5x to ~4.0x our market capitalization (approximately $100 million to approximately $730 million). |

For purposes of its executive compensation review at the beginning of fiscal 2018, the Committee used the following compensation peer group to assist with the determination of compensation for our executive officers:

Axcelis Technologies, Inc. Novanta Inc.

Cohu, Inc RadiSys

Faro Technologies Rudolph Technologies

Hurco Companies Ultratech, Inc.*

Maxwell Technologies Vishay Precision Group, Inc.

Nanometrics Xcerra Corporation

*Ultratech, Inc. was acquired by Veeco in May, 2017

The Committee reviews the compensation peer group at least annually, and has made adjustments to its composition as warranted to reflect changes in both our business and the businesses of the companies in the peer group. The fiscal 2018 peer group was approved by the Committee in February 2017; changes included removal of Affymetrix, Cascade Mictrotech, and Mattson Technology due to acquisitions; removal of Form Factor and Veeco based on their relative revenue/market capitalization size; and the addition of Faro Technologies, Hurco Companies and Maxwell Technologies.

20

When selected, the 12 companies in the compensation peer group had annual revenue (based on the most recent four quarters) and market capitalization in a somewhat higher range than our fiscal 2018 annual revenue and market capitalization. By the end of the fiscal year, ESI’s revenue and market capitalization had increased to $368 Million and $665 million, respectively, and accordingly were at the high end of the selected peer group.

The fiscal 2019 peer group as approved by the Committee in November 2017 is made up of the following companies:

Axcelis Technologies, Inc. Novanta Inc.

Cohu, Inc RadiSys

Faro Technologies Rudolph Technologies

Form Factor Veeco

Hurco Companies Vishay Precision Group, Inc.

Maxwell Technologies Xcerra Corporation

Nanometrics