UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Electro Scientific Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notice of Annual Meeting of Shareholders

To the Shareholders of Electro Scientific Industries, Inc.:

The Annual Meeting of Shareholders of Electro Scientific Industries, Inc. (ESI) will be held at ESI’s offices, 13900 NW Science Park Drive, Portland, Oregon, on Tuesday, August 5, 2008 at 2:00 p.m. Pacific Daylight Time, for the following purposes:

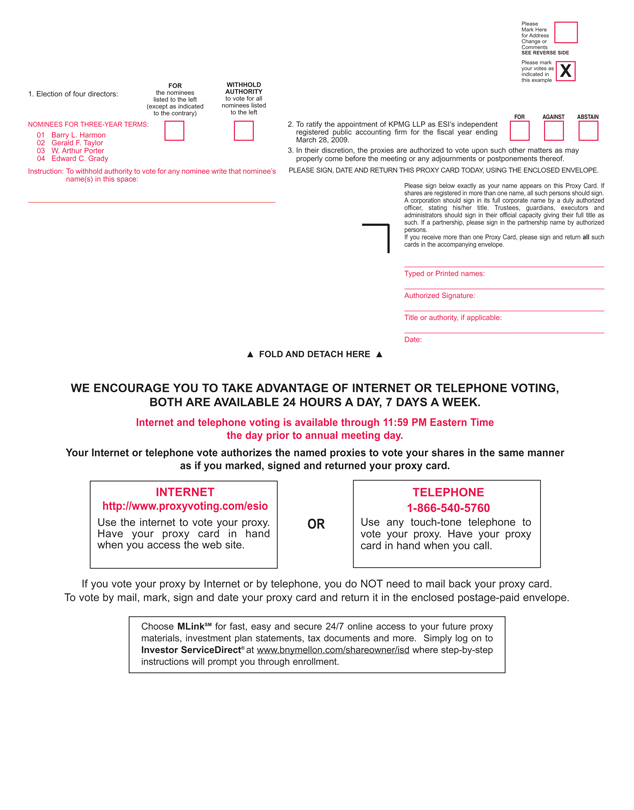

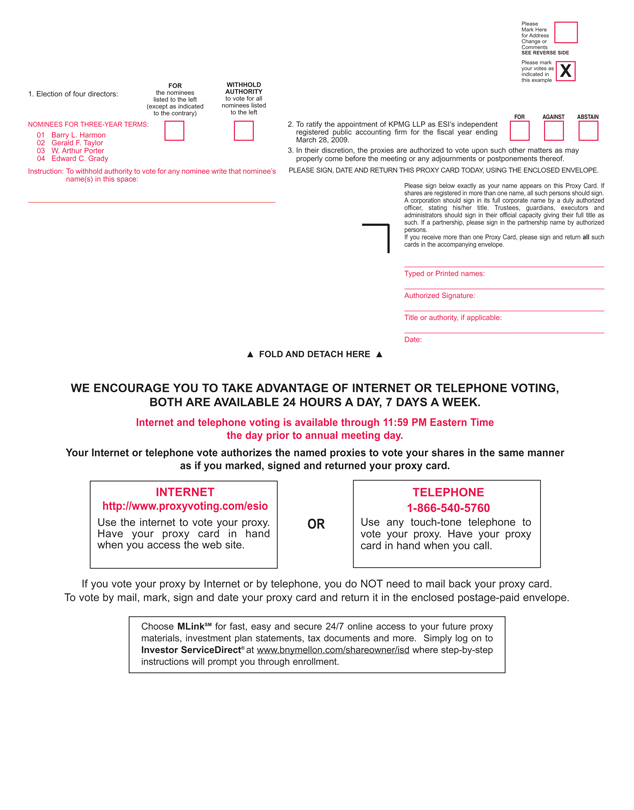

| | 1. | To elect four directors for a term of three years. |

| | 2. | To ratify the appointment of KPMG LLP as ESI’s independent registered public accounting firm for the fiscal year ending March 28, 2009. |

| | 3. | To transact any other business that properly comes before the meeting. |

Only shareholders of record at the close of business on May 30, 2008 will be entitled to vote at the annual meeting.

Your vote is very important. Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. Promptly voting your shares by phone, via the internet, or by signing, dating, and returning the enclosed proxy card will ensure the presence of a quorum at the meeting. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Retention of the proxy is not necessary for admission to or identification at the meeting.

By Order of the Board of Directors

/s/ Paul Oldham

Paul Oldham

Vice President of Administration, Chief Financial

Officer and Corporate Secretary

Portland, Oregon

July 7, 2008

ELECTRO SCIENTIFIC INDUSTRIES, INC.

PROXY STATEMENT

The mailing address of the principal executive offices of the Company is 13900 NW Science Park Drive, Portland, Oregon 97229-5497. The approximate date this proxy statement and the accompanying proxy forms are first being mailed to shareholders is July 7, 2008.

SOLICITATION AND REVOCABILITY OF PROXY

The enclosed proxy is solicited on behalf of the Board of Directors of Electro Scientific Industries, Inc., an Oregon corporation, for use at the Annual Meeting of Shareholders to be held on August 5, 2008. The Company will bear the cost of preparing and mailing the proxy, proxy statement and any other material furnished to the shareholders by the Company in connection with the annual meeting. Proxies will be solicited by use of the mail and the internet, and officers and employees of the Company may, without additional compensation, also solicit proxies by telephone, fax or personal contact. Copies of solicitation materials will be furnished to fiduciaries, custodians and brokerage houses for forwarding to beneficial owners of the stock held in their names.

Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Corporate Secretary of the Company. The proxy may also be revoked by affirmatively electing to vote in person while in attendance at the meeting. However, a shareholder who attends the meeting need not revoke the proxy and vote in person unless he or she wishes to do so. All valid, un-revoked proxies will be voted at the Annual Meeting in accordance with the instructions given.

Common Stock is the only outstanding authorized voting security of the Company. The record date for determining holders of Common Stock entitled to vote at the Annual Meeting is May 30, 2008. On that date there were 27,118,127 shares of Common Stock outstanding, entitled to one vote per share. The Common Stock does not have cumulative voting rights.

MULTIPLE SHAREHOLDERS SHARING THE SAME ADDRESS

If you and other residents at your mailing address each own shares of Common Stock in street name, your broker or bank may have sent you a notice that your household will receive only one annual report and proxy statement. This practice, known as “householding,” reduces the Company’s printing and postage costs. If any shareholder residing at that address wishes to receive a separate annual report or proxy statement, write or telephone the Company as follows: Investor Relations, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229, (503) 641-4141. Contact the Company in the same way if you and other residents at your mailing address are receiving multiple copies of the annual report and proxy statement and wish to receive single copies in the future.

1

PROPOSAL 1: ELECTION OF DIRECTORS

Pursuant to the Company’s Bylaws, the Board of Directors is divided into three classes, and the term of office of one class expires each year. The terms of Barry L. Harmon, Gerald F. Taylor, W. Arthur Porter and Edward C. Grady expire in 2008. Messrs. Harmon, Taylor and Porter are nominees for re-election and Mr. Grady is up for election having been appointed by the Board in January 2008. Edward C. Grady was appointed to the Board of Directors on January 22, 2008 and is a nominee for election. Under Oregon law, if a quorum of shareholders is present at the 2008 Annual Meeting, the directors elected will be the four nominees for election as directors for a term ending in 2011 who receive the greatest number of votes cast at the meeting. Abstentions and broker non-votes will have no effect on the results of the vote. Unless otherwise instructed, proxy holders will vote the proxies they receive for Messrs. Harmon, Taylor, Porter and Grady. If any of the nominees for election as director at the 2008 Annual Meeting becomes unavailable for election for any reason (none being known at this time), the proxy holders will have discretionary authority to vote pursuant to the proxy for a substitute or substitutes.

The following table briefly describes the Company’s nominees for directors and the directors whose terms will continue.

| | | | |

Name, Age, Principal Occupation, and Other Directorships | | Director

Since | | Term

Expires |

Nominees | | | | |

Barry L. Harmon, 54, served as President and Chief Executive Officer of ESI from April 2003 until January 2004. From July 2000 until September 2001, Mr. Harmon served as Senior Vice President—West Coast Operations for Avocent Corporation, a provider of KVM switching and solutions. Avocent is the company resulting from the merger of Apex, Inc. with Cybex Computer Products in 2000. Mr. Harmon served as Chief Financial Officer of Apex, Inc., also a provider of KVM switching and solutions, from 1999 until its merger with Cybex. From 1992 to 1999, he was Senior Vice President and Chief Financial Officer of ESI. | | 2002 | | 2008 |

| | |

Gerald F. Taylor,68, retired in 1998 as Senior Vice President and Chief Financial Officer of Applied Materials, Inc., a manufacturer of semiconductor equipment. He was employed by Applied Materials since 1984. He is also a director of Lithia Motors Inc. | | 1998 | | 2008 |

| | |

W. Arthur Porter, 67, served as University Vice President for Technology Development at the University of Oklahoma from July 1998 until July 2007. Until June 2005, he also served as the Dean of the College of Engineering and is currently Professor emeritus of electrical and computer engineering and Chairman of Southwest Nanotechnologies Inc. He was formerly President of the Houston Advanced Research Center. Dr. Porter is also a director of Stewart Information Services Corporation and Bookham, Inc. | | 1980 | | 2008 |

| | |

Edward C. Grady, 61, was President and Chief Executive Officer of Brooks Automation until September 2007. Brooks Automation offers hardware products, services and tightly integrated solutions that optimize manufacturing equipment, factory operations and productivity for the semiconductor and other complex manufacturing industries. Prior to joining Brooks in 2003, he successfully ran several divisions at KLA-Tencor. He started his career as an engineer for Monsanto/MEMC, and eventually rose to the position of vice president of worldwide sales. Mr. Grady is also a director of Brooks Automation and Evergreen Solar where he is an independent lead director and chairman of the nominating and governance committee. He is also a board member of Verigy Ltd., Integrated Materials Inc., Finesse LLC and Molecular Imprints Inc. | | Appointed

January 2008 | | 2008 |

2

| | | | |

Name, Age, Principal Occupation, and Other Directorships | | Director

Since | | Term

Expires |

Directors Whose Terms Continue | | | | |

Jon D. Tompkins, 68, (Chairman) retired as Chief Executive Officer of KLA-Tencor Corporation, a manufacturer of semiconductor equipment, in 1998 and retired as Chairman of the Board of Directors of KLA-Tencor in June 1999. Mr. Tompkins is a member of the Board of Directors of Cymer, Inc. | | 1998 | | 2009 |

| | |

Keith L. Thomson, 69, retired as Vice President and Oregon Site Manager of Intel Corporation, a manufacturer of chips, computers, networking and communications products, in 1998. Mr. Thomson joined Intel in 1969 and moved to Intel’s Oregon operation in 1978. | | 1994 | | 2009 |

| | |

Richard J. Faubert, 60, was appointed President and Chief Executive Officer of AmberWave Systems, Inc., a semiconductor technology company, in September 2003. He served as President, Chief Executive Officer and director of SpeedFam-IPEC, Inc., a manufacturer of semiconductor equipment, from 1998 through 2002. Upon the sale of SpeedFam-IPEC to Novellus Systems, Inc., a capital equipment manufacturer, he served as Executive Vice President of Novellus until April 2003. Prior to his employment with SpeedFam-IPEC, Inc., he held executive and management positions at Tektronix, Inc., a test, measurement, and monitoring company, and GenRad, Inc., an electronics testing and manufacturing company. Mr. Faubert is also on the Board of Directors of Radisys Corp. and is on the North American Advisory Board of Semiconductor Equipment and Materials, Inc. | | 2003 | | 2009 |

| | |

Frederick A. Ball, 46, was Senior Vice President and Chief Financial Officer of Big Band Networks, a provider of network platforms for broadband multimedia services from August 2004 until November 2007. From November 2003 until May 2004, Mr. Ball served as Chief Operating Officer of CallTrex Corporation, a provider of customer service solutions. Prior to his employment with CallTrex, he was employed with Borland Software Corporation, a provider of enterprise software development solutions, from September 1999 until July 2003. Beginning in 1999, he was Senior Vice President and Chief Financial Officer. In October 2002, he was appointed Executive Vice President of Corporate Development and Mergers and Acquisitions. Prior to his employment with Borland, Mr. Ball served as Vice President, Mergers and Acquisitions for KLA-Tencor Corporation, a manufacturer of semiconductor equipment. Mr. Ball served as the Vice President of Finance for KLA-Tencor Corporation following KLA’s merger with Tencor Instruments in 1997. | | 2003 | | 2010 |

| | |

Nicholas Konidaris, 63, was appointed President and Chief Executive Officer of ESI in January 2004. From July 1999 to January 2004, Mr. Konidaris served as President and Chief Executive Officer of Advantest America Corp., a holding company for Advantest America, Inc., an automatic test equipment supplier. From July 1997 to July 1999, Mr. Konidaris served as the Chief Executive Officer of Advantest America Corp. Additionally, from July 1997 to January 2004, Mr. Konidaris served as Chairman of the Board, President and Chief Executive Officer of Advantest America, Inc. Mr. Konidaris is also a director of Ultratech, Inc. | | 2004 | | 2010 |

| | |

Robert R. Walker, 57, is retired from Agilent Technologies, Inc., an electronic instrument company, where he served as Executive Vice President and Chief Financial Officer from May 2000 until December 2001. From May 1999 until May 2000, he was Senior Vice President and Chief Financial Officer. During 1997 and 1998, Mr. Walker served as Vice President and General Manager of Hewlett-Packard’s Professional Services Business Unit. From 1993 to 1997, he led Hewlett-Packard’s information systems function, serving as Vice President and Chief Information Officer from 1995 to 1997. | | 2003 | | 2010 |

3

CORPORATE GOVERNANCE GUIDELINES AND INDEPENDENCE

The Company’s Board of Directors has approved and adopted the Corporate Governance Guidelines and Governance and Nominating Committee Charter that are on the Company’s website atwww.esi.com. Under the Company’s Corporate Governance Guidelines, which reflect the current standards for “independence” under the NASDAQ National Market listing standards and the Securities and Exchange Commission rules, two-thirds of the members of the Board of Directors must be independent as determined by the Board of Directors. The Board of Directors has made the following determinations with respect to each director’s independence:

| | |

Director | | Status (1) |

Frederick A. Ball | | Independent |

Edward C. Grady | | Independent |

Richard J. Faubert | | Independent |

Barry L. Harmon | | Independent |

Nicholas Konidaris | | Not Independent (2) |

W. Arthur Porter | | Independent |

Gerald F. Taylor | | Independent |

Keith L. Thomson | | Independent |

Jon D. Tompkins | | Independent |

Robert R. Walker | | Independent |

| (1) | The Board’s determination that a director is independent was made on the basis of the standards set forth in the Corporate Governance Guidelines. |

| (2) | Mr. Konidaris is President and Chief Executive Officer of ESI and therefore is not independent in accordance with the standards set forth in the Corporate Governance Guidelines. |

The Company has also adopted a Code of Conduct and Business Practices applicable to the Company’s directors, officers, employees and agents of ESI and its subsidiaries and a Code of Ethics for Financial Managers. Copies of the Company’s Code of Conduct and Business Practices and Code of Ethics for Financial Managers are available on our website atwww.esi.com.

CHANGE IN FISCAL YEAR

The Company recently changed its fiscal year from consisting of 52 or 53 weeks ending on the Saturday nearest May 31 to the 52 or 53 weeks ending on the Saturday nearest March 31. Accordingly, all references to fiscal year/period 2008 in this document are to the 43 weeks ended March 29, 2008 (approximately ten months) and references to fiscal year 2007 are to the year ended June 2, 2007.

BOARD COMPENSATION

During fiscal 2008, the Board of Directors met eight times and each member of the Board of Directors attended at least 75 percent of the aggregate number of the meetings of the Board of Directors and the committees of which he was a member. All directors were reimbursed for all reasonable expenses incurred in attending meetings. Directors are expected to attend shareholders meetings. All directors then in office attended the 2007 annual meeting of shareholders.

Directors who are not employees of the Company received the following fees to the extent applicable to the individual directors: (a) an annual cash retainer of $30,000 for Board service, plus $1,500 for each Board meeting attended, $1,000 for each Committee meeting attended and $750 for each telephonic meeting attended; (b) an annual fee of $10,000 for service as chair of the Audit Committee and an annual fee of $8,000 for service as chair

4

of a committee other than the Audit Committee; and (c) an annual cash retainer of $60,000 for the service as the Chairman of the Board. The Company also provides for reimbursement in the amount of $2,500 every two years for continuing education programs relating to the performance of duties of a director of a public company.

Non-employee directors also receive equity grants as a component of their total compensation. Stock options were granted prior to fiscal year 2007. Beginning in fiscal year 2007, the Company has granted restricted stock units rather than stock options.

On July 26, 2007, each director who was not a full-time employee of the Company was granted 4,900 restricted stock units under the 2004 Stock Incentive Plan. These units cliff vest on the third anniversary of the grant date. Mr. Grady was granted 9,800 restricted stock units on January 22, 2008 upon his appointment as a member of the Board. These units vest 25% on each of the first four anniversaries of the grant date. If a director retires during the vesting period in accordance with the Board’s retirement policy, the units to vest during the year in which retirement occurs will be prorated for such period.

FISCAL YEAR 2008 DIRECTOR COMPENSATION

The following table shows compensation earned by the Company’s non-employee directors in fiscal 2008 (ten-month period).

| | | | | | | | | | | | | | |

Name | | Fees Earned or

Paid in Cash

($) | | Stock

Awards

($) (1) | | | Option

Awards

($) (2) | | | Total

($) |

Frederick A. Ball | | $ | 41,000 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 82,503 |

Richard J. Faubert | | $ | 36,750 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 78,253 |

Edward C. Grady (6) | | $ | 3,488 | | $ | 7,907 | (5) | | | — | | | $ | 11,395 |

Barry L. Harmon | | $ | 27,500 | | $ | 38,912 | (3) | | | — | | | $ | 66,412 |

W. Arthur Porter | | $ | 34,750 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 76,253 |

Gerald F. Taylor | | $ | 32,000 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 73,503 |

Keith L. Thomson | | $ | 40,250 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 81,753 |

Jon D. Tompkins | | $ | 67,083 | | $ | 38,912 | (3) | | $ | 2,591 | (4) | | $ | 108,586 |

Robert R. Walker | | $ | 32,750 | | $ | 38,912 | (3) | | | — | | | $ | 71,662 |

Footnotes:

| (1) | Represents the amount of compensation expense recognized under SFAS No. 123R “Share-Based Payment”, in fiscal 2008 for all unvested restricted stock units, excluding estimated forfeitures. Compensation expense is equal to the value of the restricted shares based on the closing market price of the Company’s Common Stock on the grant date, and is recognized ratably over the vesting period, which ranges from one to four years. Each of the directors in the table shown above held 6,750 unvested restricted stock units at March 29, 2008 except Mr. Grady who held 9,800 unvested restricted stock units. The grant date fair value of the 4,900 stock grant made on July 26, 2007 to each director then in office was $111,034. The grant date fair value of the stock grant made on January 22, 2008 to Mr. Grady was $172,774. |

| (2) | Represents the amount of compensation expense recognized under SFAS No. 123R in fiscal 2008 for all unvested stock options, excluding estimated forfeitures. Compensation expense is equal to the value of the options estimated using the Black-Scholes option pricing model, and is recognized over the vesting period. The assumptions made in determining the grant date fair values of options under SFAS No. 123R are disclosed in the Notes to Consolidated Financial Statements and in our annual report on Form 10-K for the fiscal period ended March 29, 2008. At March 29, 2008, the directors held outstanding options for the following number of shares of our common stock: Frederick A. Ball, 55,000; Richard J. Faubert, 55,000; Barry L. Harmon, 71,000; W. Arthur Porter, 59,500; Gerald F. Taylor, 61,000; Keith L. Thomson, 61,000; Jon D. Tompkins, 75,000; and Robert R. Walker, 55,000. |

| (3) | Comprised of an award grant for 2,775 shares on July 20, 2006 with a grant date fair value of $50,644 and an award for 4,900 shares on July 26, 2007 with a grant date fair value of $111,034. |

5

| (4) | Comprised of an option for 6,000 shares granted on July 31, 2003 with a grant date fair value of $64,168. |

| (5) | Comprised of an award grant for 9,800 shares on January 22, 2008 with a grant date fair value of $172,774. |

| (6) | Mr. Grady was appointed as a member of the Board of Directors on January 22, 2008. |

In May 2008, the Board amended the Company’s deferred compensation plan to provide for participation by the Company’s directors. Under the deferred compensation plan, directors can generally elect to defer a minimum of 10% and a maximum of 100% of the fees they receive from the Company for their service on the Board. Cash amounts credited to the deferred compensation plan will earn a rate of return based on investment funds selected by the participants from a prescribed menu of investment options. Generally, deferred amounts will be paid in a lump sum upon termination, except in the case of retirement, in which case the deferred amounts will be paid in a lump sum or in annual installments for up to ten years, as elected by the director. Directors may also defer payment of restricted stock units granted to them by the Company. Payment will be in shares of Company common stock under the same terms as cash amounts.

BOARD COMMITTEES

The Company maintains an Audit Committee that currently consists of Frederick A. Ball (Chairman), Gerald F. Taylor and Robert R. Walker. All of the members of the Audit Committee are “independent directors” within the meaning of Rule 4200(a)(14) of the National Association of Securities Dealers’ listing standards and pursuant to the criteria established in Section 10A(m) of the Securities Exchange Act of 1934, as amended. Each of Messrs. Ball, Taylor and Walker has financial reporting oversight experience, including serving as chief financial officer of a public company. See “Proposal 1: Election of Directors” for their biographies. The Board of Directors has determined that each of Messrs. Ball, Taylor and Walker is an audit committee financial expert as defined in SEC rules. The Audit Committee Charter requires the Audit Committee to review any transaction with a related person or in which a related person has a direct or indirect interest and to determine whether to ratify or approve the transaction, with such ratification or approval to occur only if the Committee determines that the transaction is fair to the Company or otherwise in the interest of the Company. The Audit Committee meets with management and with representatives of ESI’s independent registered public accounting firm, KPMG LLP, including meetings without the presence of management. The Audit Committee met seven times in fiscal 2008.

The Company maintains a Compensation Committee that currently consists of Keith L. Thomson (Chair), Richard J. Faubert, Edward C. Grady, Barry L. Harmon and Jon D. Tompkins. All members of the Compensation Committee have been determined to be independent by the Board of Directors in accordance with the Nasdaq National Market listing standards and Securities and Exchange Commission rules. None of the members of the Compensation Committee is a current or former officer or employee of the Company, except for Barry Harmon, who served as President and Chief Executive Officer of the Company from April 2003 until January 2004 and as Senior Vice President and Chief Financial Officer of the Company from 1992 to 1999. The Compensation Committee makes recommendations to the Board of Directors concerning officers’ compensation and has been delegated authority to grant options and other awards under the Company’s stock incentive plan. For additional information about the Compensation Committee, see “Compensation Discussion and Analysis,” set forth below. The Compensation Committee met five times in fiscal 2008.

The Company maintains a Corporate Governance and Nominating Committee that currently consists of Jon D. Tompkins (Chairman), Keith L. Thomson and W. Arthur Porter. All members of the Corporate Governance and Nominating Committee have been determined to be independent by the Board of Directors in accordance with the NASDAQ National Market listing standards and Securities and Exchange Commission rules. The Corporate Governance and Nominating Committee assists the Board of Directors in fulfilling its oversight responsibilities related to seeking candidates for membership on the Board of Directors, assessing the corporate governance policies and processes of the Board of Directors and reviewing from time to time the policies of the Board of Directors related to director qualifications, compensation, tenure and retirement. The Corporate Governance and Nominating Committee met three times in fiscal 2008.

6

DIRECTOR NOMINATION POLICY

Shareholders may recommend individuals for consideration by the Corporate Governance and Nominating Committee to become nominees for election to the Board of Directors by submitting a written recommendation to the Corporate Governance and Nominating Committee c/o Chairman of the Corporate Governance and Nominating Committee, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229. Communications should be sent by overnight or certified mail, return receipt requested. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether the individual can read and understand financial statements, and board memberships, if any, for the Corporate Governance and Nominating Committee to consider. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders. Recommendations received by January 31, 2009 will be considered for nomination for election at the 2009 Annual Meeting of Shareholders. Recommendations received after January 31, 2009 will be considered for nomination for election at the 2010 Annual Meeting of Shareholders. Following the identification of the director candidates, the Corporate Governance and Nominating Committee will meet to discuss and consider each candidate’s qualifications and shall determine by majority vote the candidate(s) whom the Corporate Governance and Nominating Committee believes would best serve the Company. In evaluating director candidates, the Corporate Governance and Nominating Committee will consider a variety of factors, including the composition of the Board as a whole, the characteristics (including independence, age, skills and experience) of each candidate, and the performance and continued tenure of incumbent Board members. The Committee believes that candidates for director should have certain minimum qualifications, including high ethical character, a reputation that enhances the image and reputation of the Company, being highly accomplished and a leader in his or her respective field, relevant expertise and experience, the ability to exercise sound business judgment and the ability to work with management collaboratively and constructively. In addition, the Committee believes that at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission rules and that at least two-thirds of the members of the Board should meet the definition of independent under NASDAQ National Market listing standards and Securities and Exchange Commission rules. The Committee also believes the Company’s Chief Executive Officer should participate as a member of the Board. A candidate recommended by a shareholder will be evaluated in the same manner as a candidate identified by the Committee.

COMMUNICATIONS WITH BOARD

Any shareholder who desires to communicate with the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board of Directors, c/o Corporate Secretary, Electro Scientific Industries, Inc., 13900 NW Science Park Drive, Portland, Oregon 97229. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be compiled by the Secretary and submitted to the Board of Directors in a timely manner.

RECOMMENDATION BY THE BOARD OF DIRECTORS

The Board of Directors recommends that shareholders vote FOR the election of the nominees named in this Proxy Statement.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of the Common Stock of the Company as of March 29, 2008 (or such other date as otherwise indicated in the footnotes below) by (i) each person known to the Company to be the beneficial owner of more than 5% of the Company’s Common Stock, (ii) each of the Company’s current directors and nominees for director, (iii) each individual named in the Summary Compensation Table and (iv) all directors and executive officers of the Company on March 29, 2008 as a group. Applicable percentage of ownership is based on 27,111,544 shares of Common Stock outstanding as of March 29, 2008 together with applicable options and restricted stock units held by such shareholders. Shares of Common Stock subject to options exercisable at March 29, 2008 or exercisable within 60 days after March 29, 2008 and shares of Common Stock underlying restricted stock units vested at March 29, 2008 or vesting within 60 days after March 29, 2008 are deemed outstanding for computing the percentage ownership of the person holding such options, but are not deemed outstanding for computing the percentage ownership of any other person.

| | | | | | |

Name of Beneficial Owner | | Amount and Nature of

Beneficial Ownership (1) | | | Approximate

Percent of Class | |

Frederick A. Ball | | 55,925 | (2) | | * | |

Richard J. Faubert | | 55,925 | (3) | | * | |

Edward C. Grady | | 0 | | | | |

Barry L. Harmon | | 71,925 | (4) | | * | |

Nicholas Konidaris | | 666,642 | (5) | | 2.46 | % |

W. Arthur Porter | | 60,425 | (6) | | * | |

Gerald F. Taylor | | 64,925 | (7) | | * | |

Keith L. Thomson | | 61,925 | (8) | | * | |

Jon D. Tompkins | | 77,925 | (9) | | * | |

Robert R. Walker | | 55,925 | (10) | | * | |

Robert DeBakker | | 113,085 | (11) | | * | |

Kerry Mustoe | | 59,500 | (12) | | * | |

Paul Oldham | | 0 | | | | |

Tung H. Tom Wu | | 97,333 | (13) | | * | |

Barclays Global Investors NA (CA) 1 Churchill Place, London, England | | 1,565,502 | (14) | | 5.77 | % |

Dimensional Fund Advisors LP 1299 Ocean Avenue, Santa Monica, CA 90401 | | 2,519,170 | (15) | | 9.29 | % |

Nierenberg Investment Management Company Inc. 19605 NE 8th Street, Camas, WA 98607 | | 3,562,927 | (16) | | 13.14 | % |

Third Avenue Management LLC 622 Third Avenue, New York, NY 10017 | | 3,353,852 | (17) | | 12.37 | % |

14 directors and executive officers (as of 3/29/08) as a group | | 1,441,460 | | | 5.32 | % |

| (1) | Shares are held directly with sole investment and voting power unless otherwise indicated. |

| (2) | Includes 55,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (3) | Includes 55,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (4) | Includes 71,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (5) | Includes 630,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. Mr. Konidaris shares voting and investment rights with his spouse. |

| (6) | Includes 59,500 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

8

| (7) | Includes 61,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (8) | Includes 61,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (9) | Includes 75,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (10) | Includes 55,000 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (11) | Includes 110,500 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (12) | Includes 59,500 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (13) | Includes 96,667 shares subject to stock options that were exercisable at or that would become exercisable within 60 days after March 29, 2008. |

| (14) | Based solely on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 5, 2008, in which the entity reported its beneficial ownership as of December 31, 2007. Barclays Global Investors, NA, reported it has sole voting power with respect to 532,929 shares and sole dispositive power with respect to 654,452 shares. Barclays Global Fund Advisors reported it has sole voting power with respect to 650,444 shares and sole dispositive power with respect to 882,528 shares. Barclays Global Investors, LTD reported it has sole dispositive power with respect to 28,522 shares. |

| (15) | Based solely on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 6, 2008, in which the entity reported its beneficial ownership as of December 31, 2007. Dimensional Fund Advisors LP, an investment advisor, reported it has sole voting and dispositive power with respect to the 2,519,170 shares held by four funds. |

| (16) | Based solely on information set forth in a Schedule 13D/A filed with the Securities and Exchange Commission on January 11, 2008, in which the entity reported its beneficial ownership as of January 8, 2008. |

| (17) | Based solely on information set forth in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2008, in which the entity reported its beneficial ownership as of December 31, 2007. Third Avenue Management LLC reported it has sole voting power with respect to 3,347,727 shares and sole dispositive power with respect to 3,353,852 shares. |

9

EXECUTIVE OFFICERS

At June 16, 2008, the executive officers of the Company were as follows:

| | | | |

Name | | Age | | Position |

Nicholas Konidaris | | 63 | | President, Chief Executive Officer and Director |

Paul Oldham | | 45 | | Vice President of Administration, Chief Financial Officer and Corporate Secretary |

Robert DeBakker | | 50 | | Vice President of Operations |

Steve Harris | | 45 | | Vice President of Research, Development & Engineering |

Sidney Wong | | 49 | | Senior Director of Sales |

Ian Corr | | 45 | | Vice President of Service |

R.A. Srinivas | | 42 | | Vice President of Marketing |

Kerry L. Mustoe | | 51 | | Vice President, Corporate Controller and Chief Accounting Officer |

See Mr. Konidaris’s biography under “Proposal 1: Election of Directors”.

Mr. Oldham joined the Company on January 7, 2008 as Vice President of Administration, Chief Financial Officer and Corporate Secretary. Prior to joining ESI, Mr. Oldham was employed at Tektronix, Inc. since 1988, where he held several senior leadership positions including Vice President Finance and Corporate Controller, European Operations Controller, and most recently Vice President Treasurer and Investor Relations.

Mr. DeBakker was appointed Vice President of Operations in September 2004. From 2000 to 2004, he was employed with IBM, first as Vice President i/p Series Manufacturing, then as Vice President Strategy Integrated Supply Chain and finally as Vice President x Series Integrated Supply Chain. From 1997 to 2000, Mr. DeBakker was Vice President of Operations of Sequent Computer Systems, a manufacturer and provider of information technology solutions.

Mr. Harris was appointed Vice President of Research, Development and Engineering in January 2005. Mr. Harris joined ESI in November 1997, and first led the Central Engineering group and later served as General Manager of the Semiconductor Link Processing business unit before being promoted to his current post. Prior to joining ESI, Mr. Harris was employed at Tektronix, where he began his career and spent 13 years in a variety of product development and engineering management positions. Mr. Harris currently serves as a director of Axsun Technologies, a leader in developing miniaturized optical micro-instruments for a variety of industries.

Mr. Wong was appointed Senior Director of Sales in April 2008 and joined ESI in May 1998 from Giga-tronics. During his tenure at ESI, Mr. Wong has held a variety of positions including director of sales and service, senior director of marketing and currently, senior director of sales. Mr. Wong previously worked for Hewlett-Packard, and began his career at Philips HK Ltd.

Mr. Corr was appointed Vice President of Service in August 2004. Prior to joining ESI in 2004, he held various management roles at National Semiconductor and Advantest while based in Europe. During his tenure at Advantest, Mr. Corr was responsible for all U.S. field operations and, under his leadership, achieved significantly higher levels of customer satisfaction including development and implementation of various marketing and e-business programs.

Dr. R. A. Srinivas was appointed Vice President of Marketing at ESI in March 2007. Dr. Srinivas came to ESI from Applied Materials, where he spent nearly 15 years in a succession of posts with increasing responsibilities. Most recently, Dr. Srinivas served as Chief Marketing Officer of multiple product groups at Applied Materials, including Applied Material’s Etec Systems Division, whose products include e-beam and laser pattern-generation systems. He began his career in research and development and has managed several product development teams.

10

Ms. Mustoe has served as the Company’s Corporate Controller and Chief Accounting Officer since September 2003. In December 2005, she was appointed Interim Chief Financial Officer and served as such until September 2006. She was appointed Vice President on January 18, 2007. She was appointed Interim Chief Financial Officer again from September 28, 2007 until January 7, 2008. Prior to joining the Company, Ms. Mustoe held director of accounting and finance positions at technology firms including FEI Company, a provider of products and systems used in the nanotechnology industry in 2003, Oresis Communications, a provider of switching products for the telecommunication industry, from 2001 through 2002, and RadiSys Corporation, a provider of communications systems components, from 1999 to 2001. Prior to that, Ms. Mustoe was accounting director at Sequent Computer Systems, a manufacturer and provider of information technology solutions, and an auditing manager and certified public accountant with PricewaterhouseCoopers in Portland, Oregon.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The Compensation Committee of the Board of Directors (the “Committee”) consists entirely of non-employee independent directors as defined by the rules of NASDAQ and the Company’s Corporate Governance Guidelines. The current members of the Committee are Keith Thomson (Chair), Richard Faubert, Ed Grady, Barry Harmon and Jon Tompkins. The Committee’s authority and responsibilities are set forth in a charter adopted by the Board of Directors, which the Committee reviews annually. The Charter is available for review on the Company’s Web site atwww.esi.com.

The Committee reviews and approves the compensation of all executives, including the Chief Executive Officer. The Committee has full authority to determine annual base salary and incentive compensation, equity incentives and all other compensation for the executives. The Committee reviews and approves all stock options and restricted stock unit grants to executives and annual restricted stock grants to all other employees. Base salary and incentive compensation award decisions for all executive officers are made at the Fiscal Year Quarter One meeting of the Committee in conjunction with annual performance reviews. The Committee reviews a tally sheet which sets forth historic and current information regarding each element of compensation for each executive officer. It receives recommendations from the CEO as to compensation of other executives, and the CEO participates in discussions regarding their compensation. The Committee meets in executive session without the CEO to determine his compensation.

The Committee engaged Compensation Strategies, Inc., an independent outside compensation consultant, to advise it with respect to executive and director compensation for the 2008 fiscal period, as it has done in prior years. Compensation Strategies assists in the evaluation of the competitiveness of executive and director compensation and provides overall input to the Committee in the design and operation of its compensation programs. The Committee has sole authority to retain and terminate Compensation Strategies.

Compensation Philosophy

The Board of Directors and the Committee believe that the Company’s executive compensation programs should be related to short and long-term corporate performance and improvement in shareholder value. The Company has developed a total compensation philosophy that ties a significant portion of executive compensation to achieving pre-established financial results. The overall objectives of these executive compensation programs are to:

| | • | | Attract and retain talented executives; |

| | • | | Motivate executives to execute long-term business strategies while achieving near-term financial targets; and |

| | • | | Align executive performance with the Company’s short-term and long-term goals for delivering shareholder value. |

11

The elements of the Company’s compensation program for executives are base pay, annual cash bonus incentives, equity incentives and a deferred compensation plan. The Company also has an employee stock purchase plan, a 401(k) retirement plan and provides health care and other benefits to executives on the same basis as it does for all other employees. A limited number of key executives have Change of Control Severance Agreements which entitle them to certain amounts in the event of termination under certain circumstances following a change of control in the Company.

Each element of the Company’s compensation program serves a somewhat different purpose, but in combination, the compensation program enables the Company to support its compensation philosophy and to offer compensation competitive with that offered by companies of similar size and complexity within high-technology electronics and similar industries.

The Committee uses comparative information from a group of companies in the high technology industry with which the Company competes for executive talent for establishing executive compensation goals (the “peer group companies”). The peer group companies were selected by the Committee with input from Compensation Strategies and the Company’s management. The following companies were the peer group companies for the purpose of setting compensation for the 2008 fiscal period:

| | |

Applied Materials, Inc. | | Kulicke and Soffa Industries, Inc. |

Asyst Technologies, Inc. | | Lam Research Corporation |

Axcelis Technologies, Inc. | | LTX Corporation |

Brooks Automation, Inc. | | Mattson Technology, Inc. |

Coherent, Inc. | | Newport Corporation |

Cohu, Inc. | | Novellus Systems, Inc. |

Credence Systems Corporation | | Photronics, Inc. |

Cymer, Inc. | | Teradyne, Inc. |

FEI Company | | Ultratech, Inc. |

FSI International, Inc. | | Varian Semiconductor Equipment |

GSI Group Inc. | | Veeco Instruments Inc. |

KLA—Tencor Corporation | | Zygo Corporation |

The comparison to the peer group companies was based on public information (proxy data), supplemented with public and private survey information. Market data was size adjusted (via statistical regression techniques) to remove the significant swings that occur between individual raw data points and construct market pay levels that are reflective of the Company’s size. On July 3, 2007, our Board of Directors approved a change in our reporting periods that results in a fiscal year consisting of 52 or 53 weeks ending on the Saturday nearest March 31. Accordingly, our fiscal 2008 reporting period consisted of a 43-week period ending on March 29, 2008 (approximately 10 months). All Committee decisions with regard to executive compensation were made on an annual basis.

The Committee believes that its total compensation philosophy should result in total compensation between the 50th and 75th percentile of similarly situated executives in the peer group companies. Generally, the committee targets the 50th percentile for solid performance, with the opportunity to achieve total compensation at the 75th percentile of similarly situated executives for superior performance.

In setting executive compensation for 2008 fiscal period, the Committee reviewed the Company’s existing compensation programs in light of current industry compensation practices and trends. For all executives, variable pay based on performance is a major element of compensation. Variable pay is comprised of annual cash bonuses and long-term stock-based equity incentives, with the stock-based incentives being made up of stock options, performance-based restricted stock units and, time-based restricted stock units. Applying this philosophy for each executive officer, the Committee reviewed base salary, annual cash incentives, long-term incentives and all other elements of total compensation and compared these compensation components to comparable elements

12

of compensation at the peer group companies. The Committee made determinations of base salary, annual cash incentives, long-term incentives and other elements of compensation consistent with its compensation philosophy and that it believed to be appropriate and reasonable based on individual and corporate performance.

Named executives in the Summary Compensation Table are as follows:

Nick Konidaris, CEO

John Metcalf, CFO and VP of Administration (9/28/07 termination date)

Tong H., Tom Wu, VP Customer Operations (5/09/08 termination date)

Robert DeBakker, VP Manufacturing Operations

Kerry Mustoe, Chief Accounting Officer and VP of Finance (Interim CFO 9/28/07 through 1/6/08)

Paul Oldham, VP of Administration, CFO and Corporate Secretary (January 7, 2008 start date)

Base Salaries

Base salary levels are reviewed annually at the first quarterly meeting of the Committee. Base salaries for executives are determined by evaluating the responsibilities of the position and the experience of the individual and by reference to the competitive marketplace for corporate executives, including a comparison to base salaries for comparable positions at the peer group companies provided by Compensation Strategies. The Committee established base salary compensation levels for executives, including the named executive officers, generally at levels approximating the 50th percentile of similarly situated executives in the peer group companies. Individuals with outstanding performance in any given year may be provided with base pay up to the level of the 75th percentile.

During the 2008 fiscal period, Mr. Konidaris’s annual base salary was increased to $500,000, a 4.4% increase over his base salary for the prior year. Mr. Konidaris’s base salary places him at approximately the 50th percentile for chief executive officers at the peer group companies and reflects the Committee’s assessment of his solid performance and the improved performance of the Company under his leadership. Other named executive officers’ annual base salary increases ranged from 2.98 % to 4.65% which resulted in base salaries in general paid at the 50th percentile except that John Metcalf did not receive an increase to his base salary due to his planned departure in September 2008.

Annual Cash Incentive Compensation

The Company’s executives are eligible to participate in the Company’s Annual Executive Bonus Plan. The performance objectives are established at the beginning of the year and are comprised of specific Company financial objectives based on the Company’s annual operating plan approved by the Board of Directors and individual management objectives established for each executive individually. The Company’s financial performance objectives for the 2008 fiscal period were specified levels of actual revenue and operating profit (adjusted for certain nonrecurring and/or discretionary items) as a percentage of forecasted revenue, based on 10 months due to the change in the fiscal year end. Of the total awards available to each executive under the Annual Executive Bonus Plan for the 2008 fiscal period, 33% of the award was based on the revenue objective, 33% was based on the operating profit objective and 34% was based on the executive’s shared and individual objectives.

The Committee set a baseline plan, a minimum threshold amount and maximum amount for both the revenue and operating profit (as a percentage of revenue) measures for payouts under the Plan. Attainment of the minimum threshold under the Plan results in a bonus payout of 50% for the revenue and operating profit targets. When the operating profit attainment exceeds 100%, that attainment percentage is used as a multiplier towards the payout of the MBO attainment percentage. The maximum award payable is 200% of bonus target.

13

The Committee assigned each executive officer a percentage of base pay (the targeted amount) which was used to calculate benefits under that plan. The bonus target for the CEO was 100% of base pay and the target for the other named executive officers ranged from 45% to 60% of base pay.

For the 2008 fiscal period, the baseline plan for revenue was $236 million with the minimum threshold and maximum amounts set at 86% and 114%, respectively, of the baseline plan. The baseline plan operating profit percentage, as adjusted, was 13.5% with the minimum threshold and maximum amounts set at 56% and 144%, respectively, of the baseline plan percentage.

For the 2008 fiscal period, the Company’s total revenues and operating profit percentage exceeded the target award levels, resulting in 135% attainment for the revenue objective and 126% attainment for the operating profit objective. The percentage of target for the individual objectives is determined for each executive separately based upon his or her performance review. If all of the objectives are achieved, the executive receives 100% of target for that bonus factor.

Mr. Konidaris’s personal objectives for the 2008 fiscal period related to margin goals, expense management, revenue growth, executive development, systemization of an operating income model, new product introduction process improvement, and the level of achievement of the objectives of his direct reports. Based on revenue, operating profit and the above personal objectives, Mr. Konidaris was awarded 121% of his target or $502,327 for the 2008 fiscal period.

Other named executive officers’ personal objectives for the 2008 fiscal period related to growth, margin goals, operating profit, market share improvement, globalization, operational efficiency and optimization of ERP functionality. Named executive officers were awarded bonus payments ranging from 108% to 126% of target.

Long-Term Incentive Compensation

To align shareholder and executive interests and to create incentives for improving shareholder value, the long-term component of the Company’s executive compensation program uses a model of 40% stock option awards, 40% performance-based restricted stock unit awards, 20% time-based restricted stock unit awards and, on a selective basis for superior performance, additional time-based restricted stock unit awards. The program has three primary objectives as follows: (1) incremental shareholder value, (2) focus on achievement of specific performance goals and (3) rewarding and retaining high-impact employees.

The award levels for stock option and performance-based restricted stock unit awards are generally established at levels approximating the 50th percentile of similarly situated executives in the peer group companies. For purposes of this comparison, long-term incentive awards made by the Company and by the peer group companies are valued using the Black-Scholes valuation method. The number of performance-based restricted stock units awarded in the 2008 fiscal period was determined by comparison with the long-term incentive data for executives at peer group companies. In addition, time-based restricted stock units were awarded to all executives (other than John Metcalf). Additional time-based restricted stock units were awarded to those executives the Committee believed were superior performers.

Stock Options and Performance Based Restricted Stock Units.Stock options provide rewards to executives upon creation of incremental shareholder value and the attainment of long-term goals. Options are awarded at the market closing price on the grant date. The Committee has not granted, nor does it intend in the future to grant, equity awards in anticipation of the release of material nonpublic information. Similarly, the Company has not timed, nor does it intend in the future to time, the release of material nonpublic information based upon equity award grant dates. The Committee’s schedule is generally determined several months in advance, and the proximity of any awards to earnings announcements or other market events is coincidental.

14

Performance-based restricted stock unit awards entitle recipients to receive shares of the Company’s common stock based upon the average three-year growth of earnings per share versus the peer group companies. The units are earned depending on the Company’s ultimate percentile rank achieved compared against the peer group companies. Generally, none of the units are earned for a ranking below the 25th percentile and 200% of the units are earned for a ranking at or above the 90th percentile. At a 50th percentile ranking, 100% of the units are earned. The performance-based restricted stock units awarded during fiscal 2008 will be earned based on the achieved average earnings/loss per share of the Company for fiscal 2008-2010 as compared to the average earnings/loss per share of the Company for fiscal 2005-2007, relative to that same comparison for the peer group companies. The Compensation Committee has the discretion to permit vesting of units for a ranking below the 25th percentile. The Company believes compensation plans that are tied to the Company’s performance in relation to peer companies are the optimum way of providing incentives to executives and to reward success, since success in this area will, over the long term, enhance shareholder value.

Time-based Restricted Stock Unit Awards.Time-based restricted stock unit awards are intended to serve as a retention incentive for all executives, with additional time-based restricted stock units awarded to those executives the Committee believes to be superior performers. The value of these awards, when added to the value of an executive’s other long-term equity-based incentive awards, are intended to result in long-term incentive opportunity to the executive over the 50th percentile of the peer group companies for similarly situated executives. The time-based restricted stock units awarded during the 2008 fiscal period cliff vest on the third anniversary of the date of grant. The additional time-based restricted stock units granted for superior performance vest on the fifth anniversary of the grant date (except for the special provision in the event of Mr. Konidaris’s earlier retirement described below).

During the 2008 fiscal period, Mr. Konidaris was awarded 40,000 stock options with four-year pro rata vesting, 16,000 performance-based restricted stock units, and 35,500 time-based restricted stock units. The 16,000 performance-based restricted stock unit award was made on the same basis as the awards for other officers. Eight thousand five hundred time-based restricted stock units cliff vest on the third anniversary of the date of grant and 27,000 time-based restricted stock units cliff vest on the fifth anniversary of the grant date; however, upon retirement after age 65, they vest on a pro rata basis equal to the proportion of the three and five years that he has been employed.

Change In Control and Severance Agreements

The Company entered into an employment agreement containing change in control and severance provisions with Nicholas Konidaris at the time of his employment as CEO of the Company. The Company also has change in control severance agreements in place for Robert DeBakker and Paul Oldham. The Committee believes that these agreements could be an important factor in maintaining stability of the management team at a time when there is uncertainty about their continued employment by the Company. The terms of the change in control severance agreements for these executives were established by the Committee to provide what it believes to be reasonable benefits in the event of termination following a change of control. See “Potential Payments upon Termination or Change in Control” in this proxy statement for more information regarding these agreements.

Deferred Compensation Plan

Executives can generally elect to defer receipt of up to 50% of their salary and 100% of their bonuses. Cash amounts credited to the Deferred Compensation Plan will earn a rate of return based on investment funds selected by the participants from a prescribed menu of investment options. Generally, deferred amounts will be paid in a lump sum upon termination, except in the case of retirement, in which case the deferred amounts will be paid in a lump sum or in annual installments for up to 10 years, as elected by the executive.

Officers and other eligible employees may defer payment of restricted stock units granted to them by the Company. Issuance of shares of Company common stock is under the same terms as cash amounts. The Company intends to set aside amounts in a grantor trust to cover the Company’s obligation to pay deferred compensation.

15

The deferred compensation plan is offered to executives in order to allow them to defer more compensation than they otherwise would be permitted to defer under a tax-qualified retirement plan, such as the Company’s 401(k) retirement plan. The Company offers the deferred compensation plan as a competitive practice to enable it to attract and retain top talent.

Other Benefits

The Company’s executives are eligible to participate in the 401(k) retirement plan, employee stock purchase plan and health and welfare plans on the same basis as other employees.

Deductibility of Compensation

It is the Company’s policy to make reasonable efforts to cause executive compensation to be eligible for deductibility under Section 162(m) of the Internal Revenue Code. Under Section 162(m), the federal income tax deductibility of compensation paid to the Company’s chief executive officer and to each of its four other most highly compensated executive officers may be limited to the extent that such compensation exceeds $1 million in any one year. Under Section 162(m), the Company may deduct compensation in excess of $1 million if it qualifies as “performance-based compensation,” as defined in Section 162(m).

In recent years, compensation paid to the Company’s chief executive officer and to each of its four other most highly-compensated executive officers has been deductible by the Company even though certain compensation may not have qualified as “performance-based compensation.” However, it is possible that non-qualifying compensation paid to the Company’s executives may exceed $1 million in a taxable year and therefore limit the deductibility by the Company of a portion of such compensation. For example, some of the Company’s executives have been granted time-based restricted stock units that will vest over the next several years; some of the Company’s executives have been awarded inducement option grants outside of shareholder approved plans in connection with their hire and Mr. Konidaris received a grant of restricted stock at the time he was hired in January 2004 that compensated him for stock options from his former employer that he forfeited by joining the Company. These awards will not qualify as “performance-based compensation.” The Company believes that all of the stock options granted to its executives under its shareholder approved plans qualify under Section 162(m) as performance-based compensation.

16

EXECUTIVE COMPENSATION

The following table sets forth information concerning compensation paid or accrued for services to the Company in all capacities for the 2008 ten-month fiscal period and fiscal year 2007 for:

| | • | | The Company’s chief executive officer; |

| | • | | The Company’s chief financial officer and the two other individuals who held that position during fiscal year 2008; and |

| | • | | The two other individuals who were serving as executive officers of the Company at the end of fiscal year 2008 |

The above individuals are referred to hereafter as the “named executive officers.”

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Fiscal

Year

(1) | | Salary | | Bonus | | Stock

Awards

(2) | | Option

Awards

(3) | | Non-Equity

Incentive Plan

Compensation | | All Other

Compensation

(4) | | | Total |

Nicholas Konidaris | | 2008 | | $ | 416,667 | | | — | | $ | 452,115 | | $ | 66,097 | | $ | 502,327 | | $ | 4,563 | | | $ | 1,441,769 |

President, and Chief Executive Officer | | 2007 | | $ | 475,000 | | | | | $ | 491,060 | | | — | | $ | 739,918 | | $ | 7,359 | | | $ | 1,713,337 |

| | | | | | | | |

Paul Oldham (5) | | 2008 | | $ | 65,872 | | | — | | $ | 13,103 | | $ | 33,878 | | $ | 45,614 | | $ | 700 | | | $ | 159,167 |

Vice President of Administration, Chief Financial Officer and Corporate Secretary | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

John Metcalf (6) | | 2008 | | $ | 90,000 | | | — | | $ | 16,082 | | $ | 77,195 | | | — | | $ | 151,848 | (7) | | $ | 335,125 |

Former Sr. Vice President of Administration, Chief Financial Officer and Secretary | | 2007 | | $ | 196,442 | | | | | $ | 58,458 | | $ | 169,829 | | $ | 172,343 | | $ | 5,738 | | | $ | 602,810 |

| | | | | | | | |

Robert DeBakker | | 2008 | | $ | 200,000 | | | — | | $ | 130,625 | | $ | 131,377 | | $ | 136,403 | | $ | 5,675 | | | $ | 604,080 |

Vice President of Operations | | 2007 | | $ | 230,334 | | | | | $ | 71,344 | | $ | 130,574 | | $ | 213,159 | | $ | 7,000 | | | $ | 652,411 |

| | | | | | | | |

Tung H. Tom Wu (8) | | 2008 | | $ | 225,000 | | | — | | $ | 116,475 | | $ | 23,402 | | $ | 152,301 | | $ | 33,027 | (9) | | $ | 550,205 |

Vice President of Worldwide Sales | | 2007 | | $ | 260,000 | | | | | $ | 51,396 | | | — | | $ | 240,614 | | $ | 186,649 | (10) | | $ | 738,659 |

| | | | | | | | |

Kerry Mustoe (11) | | 2008 | | $ | 182,500 | | | — | | $ | 88,046 | | $ | 28,430 | | $ | 103,164 | | $ | 6,291 | | | $ | 408,431 |

Vice President of Finance, Corporate Controller and Chief Accounting Officer | | 2007 | | $ | 172,260 | | $ | 50,000 | | $ | 47,948 | | $ | 46,348 | | $ | 119,174 | | $ | 6,950 | | | $ | 442,680 |

| (1) | The Company recently changed its fiscal year from consisting of 52 or 53 weeks ending on the Saturday nearest May 31 to the 52 or 53 weeks ending on the Saturday nearest March 31. Accordingly, references in this table to fiscal year/period 2008 are to the 43 weeks ended March 29, 2008 (approximately ten months) and references to fiscal year 2007 are to the year ended June 2, 2007. |

| (2) | Represents the amount of compensation expense recognized under SFAS No. 123R in 2008 for all unvested restricted stock awards, excluding estimated forfeitures. Compensation expense is equal to the value of the restricted shares based on the closing market price of the Company’s common stock on the grant date, and is recognized ratably over the vesting period, which ranges from one to five years. |

| (3) | Represents the amount of compensation expense recognized under SFAS No. 123R in 2008 for all unvested stock options, excluding estimated forfeitures. Compensation expense is equal to the value of the options estimated using the Black-Scholes option pricing model, and is recognized over the vesting period. The assumptions made in determining the grant date fair values of options under SFAS No. 123R are disclosed in the Notes to Consolidated Financial Statements in our annual report on Form 10-K for the fiscal period ended March 29, 2008. |

17

| (4) | Except as otherwise indicated, represents 401(k) matching contributions made by the Company. |

| (5) | Mr. Oldham commenced employment as Vice President of Administration, Chief Financial Officer and Corporate Secretary on January 7, 2008. |

| (6) | Mr. Metcalf served as Sr. Vice President of Administration, Chief Financial Officer and Secretary from September 11, 2006 through September 29, 2007. |

| (7) | This amount consists of (a) ESI’s matching contribution of $2,700 under the tax-qualified 401(k) plan, (b) a payment of $14,148 for vacation balance payout, and (c) severance payments totaling $135,000 pursuant to a separation agreement. |

| (8) | Mr. Wu resigned as of May 9, 2008. |

| (9) | Represents perquisites for expatriate benefits for Mr. Wu. This total includes housing, dependents’ educational expenses and $23,422 towards taxes. |

| (10) | Represents perquisites for expatriate benefits for Mr. Wu. This total includes $55,528 towards housing, $33,145 towards dependent’s educational expenses and $50,000 towards taxes. |

| (11) | Ms. Mustoe also served as Interim Chief Financial Officer and Secretary from September 30, 2007 until January 7, 2008, and from December 7, 2005 until September 11, 2006. |

18

FISCAL 2008 GRANTS OF PLAN-BASED AWARDS

The following table contains information concerning the fiscal 2008 bonus opportunities for the named executive officers and the restricted stock unit awards and stock option awards granted to the named executive officers in fiscal 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Grant

Date | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (1) | | Estimated Future Payouts

Under Equity Incentive Plan

Awards (2) | | All

Other

Stock

Awards:

Number

of Shares

of Stock

or Units

(#) | | | All Other

Option

Awards:

Number

of

Securities

Underlying

Options

(#) | | | Exercise

or Base

Price of

Option

Awards

($/Share) | | Grant

Date

Fair

Value

(#) |

| | | Threshold

($) | | Target

($) | | Maximum

($) | | Threshold

(#) | | Target

(#) | | Maximum

(#) | | | | |

Nicholas Konidaris | | — | | — | | $ | 416,667 | | $ | 833,334 | | — | | — | | — | | — | | | — | | | | — | | | — |

| | 7/26/2007 | | — | | | — | | | — | | — | | 16,000 | | 32,000 | | — | | | — | | | | — | | $ | 362,560 |

| | 7/26/2007 | | — | | | — | | | — | | — | | — | | — | | 8,500 | (3) | | — | | | | — | | $ | 192,610 |

| | 7/26/2007 | | — | | | — | | | — | | — | | — | | — | | 27,000 | (4) | | — | | | | — | | $ | 611,820 |

| | 7/26/2007 | | — | | | — | | | — | | — | | — | | — | | — | | | 40,000 | (5) | | $ | 22.66 | | $ | 390,964 |

| | | | | | | | | | | |

Paul Oldham | | — | | — | | $ | 39,523 | | $ | 79,046 | | — | | — | | — | | — | | | — | | | | — | | | — |

| | 1/9/2008 | | — | | | — | | | — | | — | | — | | — | | 1,500 | (6) | | — | | | | — | | $ | 28,125 |

| | 1/7/2008 | | — | | | — | | | — | | — | | — | | — | | — | | | 80,000 | (7) | | $ | 18.91 | | $ | 780,920 |

| | | | | | | | | | | |

John Metcalf | | — | | — | | | — | | | — | | — | | — | | — | | — | | | — | | | | — | | | — |

| | | | — | | | — | | | — | | — | | — | | — | | — | | | — | | | | — | | | — |

| | | | | | | | | | | |

Robert DeBakker | | — | | — | | $ | 120,000 | | $ | 240,000 | | — | | — | | — | | — | | | — | | | | — | | | — |

| | 7/25/2007 | | — | | | — | | | — | | — | | 5,000 | | 10,000 | | — | | | — | | | | — | | $ | 114,150 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 2,500 | (8) | | — | | | | — | | $ | 57,075 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 6,000 | (9) | | — | | | | — | | $ | 136,980 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | — | | | 14,000 | (10) | | $ | 22.83 | | $ | 137,865 |

| | | | | | | | | | | |

Tung H. Tom Wu | | — | | — | | $ | 135,000 | | $ | 270,000 | | — | | — | | — | | — | | | — | | | | — | | | — |

| | 7/25/2007 | | — | | | — | | | — | | — | | 5,000 | | 10,000 | | — | | | — | | | | — | | $ | 114,150 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 2,500 | (8) | | — | | | | — | | $ | 57,075 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 6,000 | (9) | | — | | | | — | | $ | 136,980 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | — | | | 14,000 | (10) | | $ | 22.83 | | $ | 137,865 |

| | | | | | | | | | | |

Kerry Mustoe | | — | | — | | $ | 82,125 | | $ | 164,250 | | — | | — | | — | | — | | | — | | | | — | | | — |

| | 7/25/2007 | | — | | | — | | | — | | — | | 3,000 | | 6,000 | | — | | | — | | | | — | | $ | 68,490 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 2,000 | (8) | | — | | | | — | | $ | 45,660 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | 5,000 | (9) | | — | | | | — | | $ | 114,150 |

| | 7/25/2007 | | — | | | — | | | — | | — | | — | | — | | — | | | 10,000 | (10) | | $ | 22.83 | | $ | 98,475 |

| (1) | Represents the incentive for 2008 under the Company’s annual executive team bonus plan and estimated payouts at threshold, target and maximum levels of performance. The actual amount earned by each named executive officer for fiscal 2008 is set forth in the Summary Compensation Table under “Non-Equity Incentive Plan Compensation.” |

(2) | Represents performance-based restricted stock unit awards. Performance conditions are based on the average earnings/loss per share of the Company for fiscal 2008-2010 as compared to the average earnings/loss per share of the Company for fiscal 2005-2007, relative to that same comparison for the peer group companies. The units vest proportionately, depending on the Company’s percentile rank versus the peer group companies, with none of the units vesting for a ranking below the 25th percentile and 200% of the units vesting for a ranking at or above the 90th percentile. At a 50th percentile ranking, 100% of the units vest. The Compensation Committee has the discretion to permit vesting of the units for a ranking below the 25th percentile. |

| (3) | Represents restricted stock units granted on July 26, 2007 that vest 100% on July 26, 2010, subject to employment criteria. |

| (4) | Represents restricted stock units granted on July 26, 2007 that vest 100%.on July 26, 2012, subject to employment criteria. |

| (5) | Represents options granted on July 26, 2007 which vest 25% per year on each of the first four anniversaries of the grant date. |

| (6) | Represents new hire restricted stock units granted to Paul Oldham on January 9, 2008 that vest 100% on July 1, 2008. |

| (7) | Represents new hire options granted to Paul Oldham on January 7, 2008 that vest 25% per year on each of the first four anniversaries of the grant date. |

| (8) | Represents restricted stock units granted on July 25, 2007 that vest 100% on July 25, 2010, subject to employment criteria. |

| (9) | Represents restricted stock units granted on July 25, 2007 that vest 100% on July 25, 2012, subject to employment criteria. |

| (10) | Represents options granted on July 25, 2007 which vest 25% per year on each of the first four anniversaries of the grant date. |

19

OUTSTANDING EQUITY AWARDS AT END OF FISCAL 2008

The following table sets forth the information concerning outstanding options and unvested restricted stock units by the named executive officers at March 29, 2008.

| | | | | | | | | | | | | | | | | | | | | | | | | |

Option Awards | | Stock Awards |

Name | | Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#) | | | Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#) | | | Equity Incentive Plan

Awards: Number of

Securities Underlying

Unexercised

Unearned Options (#) | | Option

Exercise

Price ($) | | Option

Expiration

Date | | Number of

Shares or

Units of Stock

That Have

Not Vested (#) | | | Market Value of

Shares or Units

of Stock That

Have Not

Vested ($) (1) | | Equity Incentive Plan

Awards: Number of

Unearned Shares,

Units or Other

Rights That Have

Not Vested (#) | | | Equity Incentive Plan

Awards: Market or

Payout Value of

Unearned Shares, Units

or Other Rights That

Have Not Vested ($) (1) |

Nicholas Konidaris | | 70,000 | (2) | | — | | | — | | $ | 20.00 | | 5/24/2016 | | 10,000 | (6) | | $ | 161,800 | | 3,450 | (10) | | $ | 55,821 |

| | 100,000 | (3) | | — | | | — | | $ | 19.42 | | 7/21/2015 | | 20,000 | (7) | | $ | 323,600 | | 10,000 | (11) | | $ | 161,800 |

| | 40,000 | (4) | | — | | | — | | $ | 25.50 | | 7/13/2014 | | 20,000 | (7) | | $ | 323,600 | | 16,000 | (12) | | $ | 258,880 |

| | 420,000 | | | — | | | — | | $ | 25.71 | | 1/7/2014 | | 27,000 | (8) | | $ | 436,860 | | | | | | |

| | | | | 40,000 | (5) | | | | $ | 22.66 | | 7/25/2017 | | 8,500 | (9) | | $ | 137,530 | | | | | | |

| | | | | | | | | |

Paul Oldham | | — | | | 80,000 | (13) | | — | | $ | 18.91 | | 1/6/2018 | | 1,500 | (14) | | $ | 24,270 | | — | | | | — |

| | | | | | | | | |

Robert DeBakker | | 35,000 | (2) | | — | | | — | | $ | 20.00 | | 5/24/2016 | | 4,000 | (6) | | $ | 64,720 | | 6,000 | (11) | | $ | 97,080 |

| | 38,000 | (15) | | — | | | — | | $ | 19.84 | | 7/20/2015 | | 10,000 | (18) | | $ | 161,800 | | 5,000 | (12) | | $ | 80,900 |

| | 37,500 | | | 12,500 | (16) | | — | | $ | 17.32 | | 9/26/2014 | | 2,500 | (19) | | $ | 40,450 | | | | | | |

| | | | | 14,000 | (17) | | | | $ | 22.83 | | 7/24/2017 | | 6,000 | (20) | | $ | 97,080 | | | | | | |

| | | | | | | | | |

Tung H. Tom Wu (21) | | 16,667 | (2) | | — | | | — | | $ | 20.00 | | 5/24/2016 | | 10,000 | (6) | | $ | 161,800 | | 6,000 | (11) | | $ | 97,080 |

| | 80,000 | (22) | | — | | | — | | $ | 24.49 | | 1/15/2016 | | 2,500 | (19) | | $ | 40,450 | | 5,000 | (12) | | $ | 80,900 |

| | | | | 14,000 | (17) | | | | $ | 22.83 | | 7/24/2017 | | 6,000 | (20) | | $ | 97,080 | | | | | | |

| | | | | | | | | |

Kerry Mustoe | | 20,000 | (2) | | — | | | — | | $ | 20.00 | | 5/24/2016 | | 2,000 | (6) | | $ | 32,360 | | 2,000 | (11) | | $ | 32,360 |

| | 15,000 | (15) | | — | | | — | | $ | 19.84 | | 7/20/2015 | | 3,500 | (24) | | $ | 56,630 | | 3,000 | (12) | | $ | 48,540 |

| | 9,000 | (23) | | — | | | — | | $ | 16.92 | | 4/19/2015 | | 2,000 | (19) | | $ | 32,360 | | | | | | |

| | 8,000 | | | — | | | — | | $ | 25.00 | | 11/12/2013 | | 5,000 | (20) | | $ | 80,900 | | | | | | |

| | 7,500 | | | | | | — | | $ | 20.16 | | 9/1/2013 | | | | | | | | | | | | |

| | | | | 10,000 | (17) | | | | $ | 22.83 | | 7/24/2017 | | | | | | | | | | | | |

| (1) | Based on closing stock price on March 28, 2008 of $16.18. |

| (2) | Option granted on May 24, 2006 and became 100% exercisable on May 26, 2006. The shares underlying the option are subject to sale restrictions that lapse as to one-third of the shares on each of the first three anniversaries of the grant date. |