THE LINCOLN NATIONAL LIFE INSURANCE COMPANY

Lincoln Level Advantage 2SM B-Share Index-Linked Annuity

Lincoln Level Advantage 2SM Access Index-Linked Annuity

Lincoln Level Advantage 2SM Advisory Index-Linked Annuity

Lincoln Level Advantage 2SM Advisory Class Index-Linked Annuity

Lincoln Level Advantage 2SM Select Index-Linked Annuity

Supplement dated May 30, 2023 to the Prospectus dated February 1, 2023

This supplement describes changes to the prospectus for your Lincoln Level Advantage 2SM Index-Linked Annuity contract. It is for informational purposes and requires no action on your part. All other provisions in your prospectus remain unchanged.

OVERVIEW

Several new Indexed Accounts will be available beginning June 15, 2023. Each account offers a 1-year Indexed Term, a 10% Protection Level, and a Dual Performance Trigger Rate. You can find complete details about all the features of your contract in your prospectus.

DESCRIPTION OF CHANGES

The following Indexed Accounts are available for all contractowners beginning June 15, 2023:

1-Year Dual Performance Trigger Rate Indexed Account with Protection Level

| • | S&P 500® Dual Performance Trigger, 10% Protection |

| • | Russell 2000® Dual Performance Trigger, 10% Protection |

| • | Capital Strength Net Fee IndexSM Dual Performance Trigger, 10% Protection |

| • | First Trust American Leadership IndexTM Dual Performance Trigger, 10% Protection |

| • | iShares® MSCI ACWI ETF Dual Performance Trigger, 10% Protection |

The following discussion describes changes that are now incorporated into the sections of your prospectus as specified.

Special Terms – The following term is added to the Special Terms section:

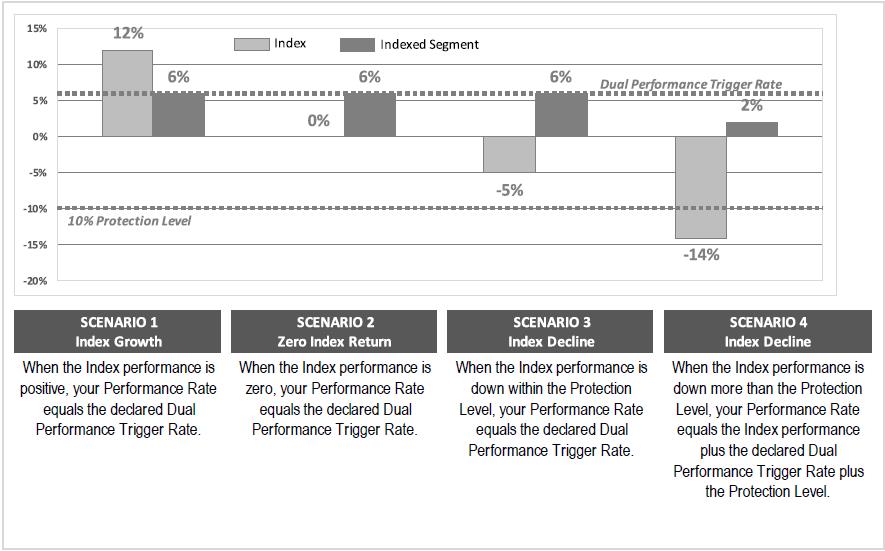

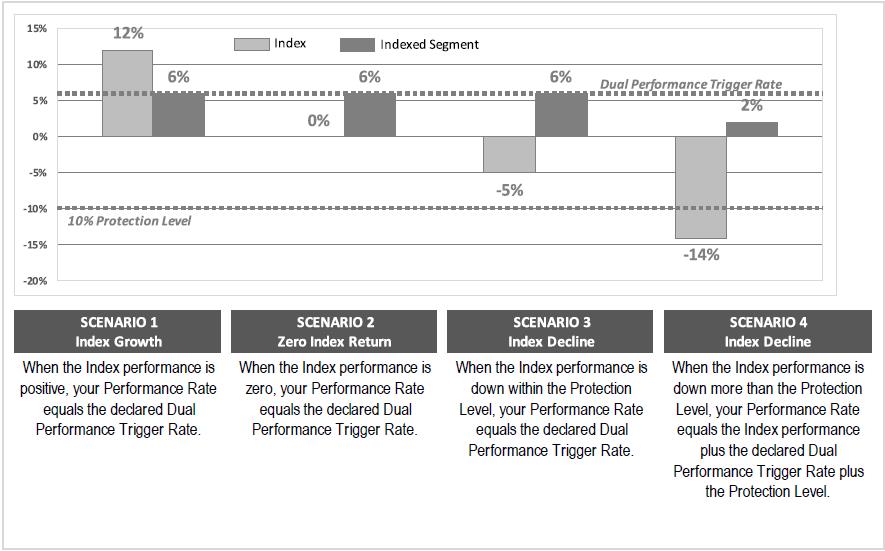

Dual Performance Trigger Rate –The rate used to determine the Performance Rate for an Indexed Segment at the end of an Indexed Term if the Index performance is positive, negative, or equal to zero.

The following term is revised:

Crediting Method – The method used in determining the Performance Rate for an Indexed Segment. There are several Crediting Methods including Performance Cap, Participation Rate, Performance Trigger Rate, Dual Performance Trigger Rate, and Spread Rate.

Risk Factors – In addition to those Risk Factors outlined in Risks of Investing in the Indexed Accounts section, the following potential risk is associated with Dual Performance Trigger Rate Indexed Accounts and is added to the Risks of Investing in the Indexed Accounts section.

| • | Gains in your Indexed Segment are limited by any applicable Dual Performance Trigger Rate. If the performance of the Index is zero, positive, or negative, a specified rate is used to determine the Segment Ending Value. The Dual Performance Trigger Rate may be lower than the actual performance of the Index, which means that your return could be lower than if you had invested directly in a fund based on the applicable Index. The Dual Performance Trigger Rate applies for the full term of the Indexed Segment. The Dual Performance Trigger Rate will be lower for contracts with the Guarantee of Principal Death Benefit. Dual Performance Trigger Rates for new Segments will be declared at least 5 business days in advance of the beginning of a Segment. |

Investments of the Indexed Accounts -- The following discussion describes changes and additions to the sub-sections of the Investments of the Indexed Accounts section.

The following Indexed Accounts are added to the list of available Indexed Accounts, noted as available to all contracts beginning June 15, 2023:

Indexed Accounts with Dual Performance Trigger Rates:

1-Year Dual Performance Trigger Rate Indexed Account with Protection Level

| • | S&P 500® Dual Performance Trigger, 10% Protection |

| • | Russell 2000® Dual Performance Trigger, 10% Protection |

| • | Capital Strength Net Fee IndexSM Dual Performance Trigger, 10% Protection |

| • | First Trust American Leadership IndexTM Dual Performance Trigger, 10% Protection |

| • | iShares® MSCI ACWI ETF Dual Performance Trigger, 10% Protection |

The first paragraph of the Crediting Methods and Protection Levels sub-section is changed; it is replaced with the following paragraph:

Different Crediting Methods and Protection Levels are available for your Indexed Account and are listed in the chart below. Interest is credited for any performance earned or deducted for any loss only on the End Date of a Segment. If the End Date is not a Valuation Date, then the amount will be credited or deducted on the next business day. Please note: There are minimum guaranteed rates for the Performance Cap, Participation Rate, Performance Trigger Rate, and Dual Performance Trigger Rate, as well as a maximum for the Spread Rate.

The following line item is added to the chart in the Crediting Methods and Protection Levels sub-section:

Dual Performance Trigger Rate •1-Year Dual Performance Trigger Rate – 1.00% minimum rate | You receive the Dual Performance Trigger Rate 1) if the Index performance is zero, positive, or negative within the Protection Level; or 2) if the percentage change in the Index Value is down more than the Protection Level the Dual Performance Trigger Rate is used to offset loss. |

The following section is added as a new sub-section immediately prior to the Protection Levels sub-section:

Dual Performance Trigger Rates – The

Dual Performance Trigger Rate is a rate of return for an Index Segment that we declare at the beginning of the Indexed Term. It is used to determine the Segment Ending Value if the Index return for the Indexed Term is zero, positive, or negative. Lincoln will not change the Dual Performance Trigger Rate during the Indexed Term unless

Secure Lock+

SM feature is elected. If Lincoln does change the trigger rate for an Indexed Account, that change will only apply to new investments, and will not impact any current investments in that Indexed Account.

The Dual Performance Trigger Rate may vary depending on the Death Benefit option, the Index, the Term, and the Protection Level. This feature will not be discontinued during the Indexed Term.

The initial Dual Performance Trigger Rate applies to the initial Indexed Term. Indexed Segments with a Guarantee of Principal Death Benefit will have lower Dual Performance Trigger Rates than Indexed Segments with the Account Value Death Benefit. The Company will declare, at its discretion, a Dual Performance Trigger Rate for each subsequent Indexed Term, if any. Subsequent Dual Performance Trigger Rates may differ from the Dual Performance Trigger Rate used for new Contracts or for other Contracts issued at different times.

The Performance Rate is the percentage change in the Index Value from the Start Date to the End Date, adjusted by the Protection Level and the Dual Performance Trigger Rate. The Performance Rate can be positive, negative, or zero. The percentage change in the Index Value is calculated by subtracting the Index Value on the Start Date from the Index Value on the End Date, with the difference then divided by the Index Value on the Start Date. The daily Index Value is posted on the Index’s website. If an Index Value is not published for a particular day, we will use the Index Value at the close of the next Valuation Date the Index is published.

If the percentage change of the Index Value is greater than or equal to zero on the End Date, the Performance Rate is equal to the Dual Performance Trigger Rate. If the percentage change in the Index Value is less than zero, but the percent decline is not greater than the amount of the Protection Level, the Performance Rate is equal to the Dual Performance Trigger Rate. If the percentage change in the Index Value is less than zero, and the percent decline is greater than the amount of the Protection Level, the Performance Rate is the percentage change in the Index Value, plus the Dual Performance Trigger Rate, plus the Protection Level. The Performance Rate could be negative.

The amount credited to or deducted from the Indexed Segment is equal to the Performance Rate multiplied by the Indexed Crediting Base on the End Date. This will be used to determine the Segment Ending Value as set forth below. The Indexed Crediting Base is the amount that you allocated to the Indexed Segment, less any reallocations and withdrawals during the Indexed Term deducted proportionately by the amount that the reallocation or withdrawal reduced the Interim Value. Withdrawals include any applicable surrender charge, Interest Rate Adjustments, premium tax or rider fees and charges. If the Performance Rate is positive, the value of your Indexed Segment will increase. If the Performance Rate is negative (after calculation including the Protection Level), the value of your Indexed Segment will be reduced. If the Performance Rate is zero, the value of your Indexed Segment will not change.

The Indexed Crediting Base is used only to calculate the performance of Indexed Accounts on the End Date, to calculate the Interim Value, and to calculate any Interest Rate Adjustment that may apply. This amount is not available for surrender, withdrawal, reallocation, annuitization, or as a Death Benefit.

Depending on market conditions, subsequent Dual Performance Trigger Rates may be higher or lower than the initial Dual Performance Trigger Rate. Subsequent Dual Performance Trigger Rates may differ from the Dual Performance Trigger Rate used for new contracts or for other contracts issued at different times. The Company will determine new Dual Performance Trigger Rates on a basis that does not discriminate unfairly within any class of contracts. There is no guarantee that the Dual Performance Trigger Rate will be available in the future. In addition, we may make different rates available to new purchasers.

The following bullet is added to the Crediting Methods Considerations sub-section:

| • | If you choose an Indexed Segment with a Dual Performance Trigger Rate, and there is positive performance, the Performance Rate on the Indexed Segment End Date could be lower, possibly significantly lower, than the actual index return. |

The Protection Level Considerations sub-section is re-stated as follows:

Protection Level Considerations. You should choose a level of protection that is consistent with your risk tolerance and investment objectives.

| • | For accounts with a Performance Cap, Participation Rate, Performance Trigger Rate, or Spread Rate, if there is negative index performance, we absorb the first portion of the negative performance up to the stated percentage and you bear the risk of loss after your chosen Protection Level, including the loss of any previously credited amount. |

| • | For accounts with a Dual Performance Trigger Rate, if there is negative index performance, we absorb the first portion of the negative performance up to the stated percentage of the Protection Level. If there is negative index performance beyond the Protection Level, we continue to absorb the portion of the negative performance up to the stated percentage of the Dual Performance Trigger Rate. For example, if the Dual Performance Trigger Rate is 5%, we would absorb the first 5% of loss beyond the Protection Level. You bear the risk of loss thereafter, including the loss of any previously credited amount. |

The following disclosure is added in the Protection Levels sub-section:

For the Dual Performance Trigger Indexed Accounts, the Protection Level is used to determine the Performance Rate on the End Date of the Segment when there is negative Index performance. If the percentage change in the Index Value is less than zero, but the percent decline is not greater than the amount of the Protection Level, the Performance Rate is equal to the Dual Performance Trigger Rate. However, if the percentage change in the Index Value has decreased by a greater percentage than the Protection Level then the amount of your investment in the Indexed Segment may be reduced. The Performance Rate would equal the percentage change in the Index Value, plus the Dual Performance Trigger Rate, plus the Protection Level. The amount of loss or gain is dependent on the percentage change in the Index Value, the Dual Performance Trigger Rate and the Protection Level on the Indexed Segment.

ADDITIONAL INFORMATION – Information Incorporated by Reference. The second paragraph of this section of the prospectus is re-stated as follows:

Lincoln Life files reports and other information with the SEC, as required under the Securities Exchange Act of 1934 (“the Exchange Act”). Lincoln Life’s annual report on

Form 10-K and its amended annual report on

Form 10-K/A for the year ended December 31, 2022, as well as Lincoln Life’s quarterly reports filed on

Form 10-Q for the periods ending March 31, 2023, are incorporated by reference into this prospectus. Lincoln Life’s annual reports contain information about Lincoln Life, including its consolidated audited financial statements for Lincoln Life’s latest fiscal year. Lincoln Life files its Exchange Act documents and reports (including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K) electronically with the SEC under File No. 000-55871. In addition, all documents subsequently filed by Lincoln Life pursuant to sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering are also incorporated by reference into this prospectus. We are not incorporating by reference, in any case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules.

Independent Registered Public Accounting Firm. This section is re-stated as follows:

The consolidated financial statements and financial statement schedules of The Lincoln National Life Insurance Company (LNL) included in LNL’s Current Report on Form 8-K (

Form 8-K) dated May 23, 2023, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

APPENDIX A – The following example is added to Appendix A of your prospectus.

Interim Value for Indexed Segment(s) with Dual Performance Trigger Rates and Protection Level

The Interim Value of a Segment is equal to the sum of (1) and (2), where:

(1) is the value of the fixed income asset proxy of a Segment on the Valuation Date the Interim Value is calculated. It is determined for a Segment as C x [1 + (D x (E - 1))] where:

C = the Crediting Base of the Segment on the Valuation Date of the calculation.

D = the ask price of the derivative asset proxy as a percentage of the Crediting Base on the Start Date of the Segment.

If an election to lock and reset a Segment is exercised during a Term:

D = the ask price of the derivative asset proxy on the most recent Valuation Date that the Segment was reset as a percentage of the Crediting Base.

E = the total days elapsed in the Term divided by the total days in the Term.

If an election to lock and reset a Segment is exercised during the Term:

E = the total days elapsed in the Term since the most recent Valuation Date that the Segment was reset divided by the total days in the Term. The total days in the Term is measured from the most recent Valuation Date that the Segment was reset to the End Date of the Term.

(2) is the fair value of the derivative asset proxy, determined solely by Us, on any Valuation Date that the Interim Value is calculated for a Segment.

The Derivative Asset Proxy section of Appendix A is restated as follows:

2. Derivative Asset Proxy. This is meant to represent the fair market value methodology we use to value the replicating portfolio of derivatives that support the Indexed Accounts.

For each Segment, we solely designate and value derivatives, each of which is tied to the performance of the index associated with the Segment and consider the Crediting Method and Protection Level of the Segment. These are used to estimate the gain or loss on the market value of the derivative portfolio replicating the Segment on a given Valuation Date and considers the cost of exiting the portfolio prior to the End Date of the Segment.

The valuation of the derivatives is based on standard, market consistent methodologies and inputs from recognized market data service providers. The methodology used to value these derivatives is determined solely by us and may vary, higher or lower, from other estimated valuations or the actual selling price of identical derivatives. Any variance between our estimated fair value price and other estimated or actual prices may be different from Segment type to Segment type and may also change from day to day. Additionally, inputs obtained from these outside market data service providers may vary over time based on market conditions and changes in valuation standards.

If any of the values used to calculate the derivative asset proxy are delayed and prevent us from calculating the Interim Value on a particular Valuation Date, we will use the prior business day’s value to calculate the Interim Value.

The options or other instruments valued for each Indexed Account type are as follows:

| A. | At-the money call option: This represents the market value of the potential to receive an amount equal to the percentage growth in the Index during the Indexed Term. |

| B. | Out-of-the-money call option: This represents the market value of the potential for gain in excess of the Performance Cap rate or Spread Rate, as applicable. |

| C. | Digital option: This represents the market value of the option to provide the Performance Trigger Rate under zero or positive Index returns. |

| D. | Out-of-the-money put option: This represents the market value of the potential to receive an amount equal to the excess loss beyond the Protection Level. |

| E. | U.S. Treasury bond: This represents the market value of the bond to provide the Dual Performance Trigger Rate. |

Note: Put option D will always reduce the Interim Value even if the Index has increased during the Indexed Term.

For each Segment with a Performance Cap Rate and Protection Level,

the replicating portfolio of derivatives is equal to: A minus B minus D.

For each Segment with a Participation Rate and Protection Level, the replicating portfolio of derivatives is equal to: A multiplied by the Participation Rate minus D.

For each Segment with a Performance Trigger Rate and Protection Level, the replicating portfolio of derivatives is equal to: C minus D.

For each Segment with a Spread Rate and Protection Level, the replicating portfolio of derivatives is equal to: B minus D.

For each Segment with a Dual Performance Trigger Rate and Protection Level, the replicating portfolio of derivatives is equal to: E minus D.

The key inputs, including but not limited to the following, are also incorporated into the models:

| (1) | Implied Volatility of the Index—This input varies with (i) how much time remains until the Segment End Date, which is determined by using an expiration date for the designated derivative that corresponds to that time remaining and (ii) the relationship between the strike price of that derivative and the level of the Index at the time of the calculation. |

This relationship is referred to as the “moneyness” of the derivative described above, and is calculated as the ratio of current price to the strike price. Direct market data for these inputs for any given early withdrawal is generally not available. This is because derivatives on the Index that actually trade in the market have specific maturity dates and moneyness values that are unlikely to precisely match the Segment End Date and moneyness of the designated derivative that we use in our calculations. Accordingly, we interpolate between the implied volatility quotes that are based on the actual maturities and moneyness values.

(2) Interest Rate—We use interest rates, as applicable for each instrument, obtained from information provided by independent third parties which are recognized financial reporting vendors. Interest rates are obtained for maturities adjacent to the actual time remaining in the Segment at the time of the early withdrawal. We use linear interpolation to derive the exact remaining duration rate needed as the input.

(3) Index Dividend Yield—On a daily basis, we use the projected annual dividend yield across the entire Index obtained from information provided by independent third-party financial institutions. This value is a widely used assumption and is readily available from recognized financial reporting vendors. In addition, when we calculate the Interim Value, we obtain market values of derivatives each business day from outside vendors. Inputs obtained from these outside vendors may vary over time based on market conditions and changes in valuation standards. If we are delayed in receiving these values, we will use the prior business day’s values to calculate the Interim Value.

The following examples are added to the Examples section of Appendix A.

The following examples demonstrate how the Interim Value is calculated in different scenarios for Indexed Segments with Dual Performance Trigger Rates and Protection Levels.

| | | 1 Year | | | 1 Year | |

| Indexed Term length …………………………………………………………. | | 12 months | | | 12 months | |

| Months since Indexed Term Start Date ……………………………………. | | | 9 | | | | 3 | |

| Indexed Crediting Base ……………………………………………………… | | $ | 1,000 | | | $ | 1,000 | |

| Protection Level ………………………………………………………………. | | | 10 | % | | | 10 | % |

| Dual Performance Trigger Rate…………………………………………….. | | | 6 | % | | | 6 | % |

| Months to End Date ………………………………………………………….. | | | 3 | | | | 9 | |

| Change in Index Value is -15% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | (40 | ) | | $ | (40 | ) |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 983 | | | $ | 956 | |

| Account Interim Value ………………………..…………………………….. | | $ | 983 | | | $ | 956 | |

| Change in Index Value is -5% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 8 | | | $ | 3 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,031 | | | $ | 999 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,031 | | | $ | 999 | |

| Change in Index Value is 10% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 27 | | | $ | 31 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,050 | | | $ | 1,027 | |

| Account Interim Value ……………………………………………………….. | | $ | 1,050 | | | $ | 1,027 | |

| Change in Index Value is 20% | | 1 Year | | | 1 Year | |

| 1. Fair Value of Indexed Crediting Base …………….…………………… | | $ | 1,023 | | | $ | 996 | |

| 2. Fair Value of Replicating Portfolio of Options………………………….. | | $ | 30 | | | $ | 39 | |

| A. Sum of 1 + 2 …………………………………………………………….. | | $ | 1,053 | | | $ | 1,035 | |

| Account Interim Value ……………………….…………………………….. | | $ | 1,053 | | | $ | 1,035 | |

PART I

The prospectuses for

Lincoln Level Advantage 2SM B-Share Index-Linked Annuity,

Lincoln Level Advantage 2SM Access Index-Linked Annuity,

Lincoln Level Advantage 2SM Advisory Index-Linked Annuity,

Lincoln Level Advantage 2SM Advisory Class Index-Linked Annuity, and

Lincoln Level Advantage 2SM Select Index-Linked Annuity are incorporated herein by reference to

Pre-Effective Amendment No. 1 (File No. 333-267670) filed on January 25, 2023.

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The estimated expenses for the issuance and distribution of the contracts described in the prospectus are as follows:

Accountant’s Fees & Expenses: | |

| |

Printing Fees & Expenses: | |

| |

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our Amended and Restated Bylaws, pursuant to authority contained in the Indiana Business Corporation Law and the Indiana Insurance Law, respectively, provide for the indemnification of our officers, directors and employees against the following:

•

reasonable expenses (including attorneys’ fees) incurred in connection with the defense of any action, suit or proceeding to which they are made or threatened to be made parties (including those brought by, or on behalf of, us) if they are successful on the merits or otherwise in the defense of such proceeding.

•

reasonable costs of judgments, settlements, penalties, fines and reasonable expenses (including attorneys’ fees) incurred with respect to any action, suit or proceeding, if the person’s conduct was in good faith and the person reasonably believed that his/her conduct was in our best interest. In the case of a criminal proceeding, the person must also have reasonable cause to believe his/her conduct was lawful or have no reasonable cause to believe his/her conduct was unlawful.

Indiana law requires that a corporation, unless limited by its articles of incorporation, indemnify its directors and officers against reasonable expenses incurred in the successful defense of any proceeding arising out of their service as a director or officer of the corporation.

No indemnification or reimbursement will be made to an individual judged liable to us, unless a court determines that in spite of a judgment of liability to the corporation, the individual is reasonably entitled to indemnification, but only to the extent that the court deems proper. Additionally, if an officer, director or employee does not meet the standards of conduct described above, such individual will be required to repay us for any advancement of expenses it had previously made.

In the case of directors, a determination as to whether indemnification or reimbursement is proper will be made by a majority of the disinterested directors or, if it is not possible to obtain a quorum of directors not party to or interested in the proceeding, then by a committee thereof or by special legal counsel. In the case of individuals who are not directors, such determination will be made by the chief executive officer of the respective corporation or, if the chief executive officer so directs, in the manner it would be made if the individual were a director of the corporation.

Such indemnification may apply to claims arising under the Securities Act. Insofar as indemnification for liabilities arising under the Securities Act may be permitted for our directors, officers or controlling persons pursuant to the foregoing provisions, we have been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by us of expenses incurred or paid by one of our directors, officers or controlling persons in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of the issue by the court.

We maintain a program of insurance under which our directors and officers are insured, subject to specified exclusions and deductible and maximum amounts, against actual or alleged errors, misstatements, misleading statements, acts or omissions, or neglect or breach of duty while acting in their respective capacities for us.

The indemnification and advancement of expenses provided for in our Amended and Restated Bylaws does not exclude or limit any other rights to indemnification and advancement of expenses that a person may be entitled to under other agreements, shareholders’ and board resolutions and our Amended and Restated Articles of Incorporation.

ITEM 16. EXHIBITS

2. None.

8. None.

15. None.

22. None.

25. None.

96. None.

99. None.

101. None.

ITEM 17. UNDERTAKINGS

The undersigned registrant hereby undertakes as follows, pursuant to Item 512 of Regulation S-K:

1. To file, during any period in which offers or sales of the registered securities are being made, a post-effective amendment to this registration statement:

i. to include any prospectus require by Section 10(a)(3) of the Securities Act of 1933;

ii. to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price set represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement, and

iii. to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

Provided, however, that Paragraphs 1.i, 1.ii, and 1.iii do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2. That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser, each prospectus filed by the registrant pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

5. That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

i. Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 242;

ii. Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

iii. The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

iv. Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6. The undersigned registrant herby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

7. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Post-Effective Amendment No. 2 to the registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Hartford, and State of Connecticut on this 23rd day of May, 2023, at 10:34 am.

| THE LINCOLN NATIONAL LIFE INSURANCE COMPANY (Registrant) |

| | |

| | |

| | |

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on the 23rd day of May, 2023, at 10:34 am.

| |

*/s/ Ellen Cooper

Ellen Cooper | President and Director (Principal Executive Officer) |

*/s/ Randal J. Freitag

Randal J. Freitag | Executive Vice President, Chief Financial Officer, and Director (Principal Financial Officer) |

*/s/Craig T. Beazer

Craig T. Beazer | Executive Vice President, Director, and General Counsel |

*/s/ Jayson R. Bronchetti

Jayson R. Bronchetti | Executive Vice President, Chief Investment Officer, and Direc- tor |

*/s/ Adam M. Cohen

Adam M. Cohen | Senior Vice President and Chief Accounting Officer (Principal Accounting Officer) |

| Assistant Vice President and Director |

*By: /s/ Kimberly A. Genovese

Kimberly A. Genovese | Pursuant to a Power of Attorney |

EXHIBIT INDEX

The following exhibit is filed herewith:

4(h).

Indexed Accounts Rider (AR23-717) (Dual Performance Trigger with Protection Level)

5.

Opinion and Consent of Counsel re: Legality of securities being registered

23.

Consent of Independent Registered Public Accounting Firm