UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | |

| ¨ | | Definitive Additional Materials | | |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

AMERICANWEST BANCORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

| | |

TIME | | 1:00 p.m. Pacific Daylight Time on Thursday, May 28, 2009 |

| |

PLACE | | AmericanWest Bank Support Center, 110 South Ferrall Street, Spokane, Washington 99202 |

| |

ITEMS OF BUSINESS | | 1. Election of the seven individuals nominated by the Board of Directors as directors to hold office until the next annual meeting of shareholders and until their successors are duly elected and qualified. |

| |

| | 2. Ratification of the appointment of Moss Adams LLP as AmericanWest Bancorporation’s independent auditors for the year ending December 31, 2009. |

| |

| | 3. To take action on any other business that may properly be considered at the Meeting or any adjournments or postponements thereof. |

| |

RECORD DATE | | You may vote at the Meeting if you were a shareholder of record at the close of business on April 15, 2009. |

| |

VOTING BY PROXY | | If you cannot attend the Meeting, you may vote your shares by completing and promptly returning the enclosed proxy card in the envelope provided, or by following the instructions for voting by telephone or on the Internet. |

| |

ANNUAL REPORT | | AmericanWest Bancorporation’s 2008 Annual Report on Form 10-K, which is not part of the proxy soliciting material, is enclosed. |

By Order of the Board of Directors,

Jay B. Simmons

Secretary

This Notice of Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about April 27th, 2009.

TABLE OF CONTENTS

i

ii

41 West Riverside Avenue

Suite 400

Spokane, Washington 99201

PROXY STATEMENT

Annual Meeting of Shareholders

May 28, 2009

We are providing these proxy materials in connection with the solicitation by the Board of Directors of AmericanWest Bancorporation (the “Company”) of proxies to be voted at the Company’s Annual Meeting of Shareholders (the “Meeting”) to be held on May 28, 2009 at 1:00 p.m. Pacific Daylight Time at the AmericanWest Support Center, 110 S. Ferrall Street, Spokane, Washington, and at any adjournments or postponements of the Meeting. This Proxy Statement and accompanying Proxy Card are first being sent to shareholders on or about April 27th, 2009.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 28, 2009

The proxy statement and the annual report are also available athttps://www.sendd.com/EZProxy/?project_id=268

You may access the following proxy materials athttps://www.sendd.com/EZProxy/?project_id=268.

| | • | | The Company’s 2008 Annual Report on Form 10-K; and |

| | • | | The Chairman’s and President’s Letter to Shareholders. |

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

Who may vote at the Meeting?

The Board of Directors of the Company (the “Board”) has set April 15, 2009 as the record date for the Meeting. If you were the owner of Company common stock at the close of business on the record date, you may vote at the Meeting. On each matter to be voted on (including each director nominee to be voted upon), you are entitled to one vote for each share of Company common stock you held on the record date, including:

| | • | | Shares held of record in your name on the books of the Company, whether in certified or uncertified form. |

| | • | | Shares held for you in an account with a broker, bank or other nominee (a “Broker”), commonly referred to as shares held “in street name”. Your name does not appear in the books of the Company with respect to these shares. |

| | • | | Shares credited to your account in the AmericanWest Bank 401(k) Retirement Savings Plan (“401(k) Plan”). |

1

How many shares must be present to hold the Meeting?

A majority of the Company’s shares of outstanding common stock as of the record date must be present at the Meeting in order to hold the Meeting and conduct business. On the record date, there were approximately 17,213,288 shares of Company common stock outstanding. As of the record date, the directors and executive officers held 571,657 shares entitled to vote at the Meeting. Shares are counted as present at the Meeting if the owner of the shares:

| | • | | is present in person at the Meeting; or |

| | • | | has properly submitted a proxy card. |

Shareholders of record who are present at the Meeting in person or by proxy and who abstain, including Brokers holding customers’ shares who cause abstentions to be recorded at the Meeting, are considered shareholders who are present and entitled to vote, and will count toward the presence of a quorum. Broker non-votes will also be counted towards the presence of a quorum.

What proposals will be voted on at the Meeting?

There are two agenda items scheduled to be voted on at the Meeting:

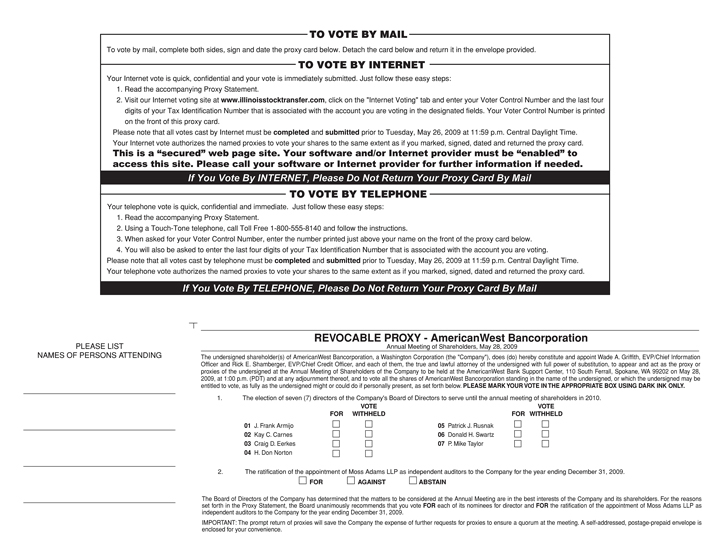

| | 1. | Election of the seven individuals nominated by the Board of Directors as directors to hold office until the next annual meeting of shareholders and until their successors are duly elected and qualified. |

| | 2. | Ratification of the appointment of Moss Adams LLP as the Company’s independent auditors for the year ending December 31, 2009. |

How many votes are required to approve the proposals?

If a quorum exists at the Meeting, each proposal will be approved as follows:

Proposal 1: The seven nominees receiving the largest number of votes cast by the shares entitled to vote in the election will be elected as directors. Consequently, abstentions and broker non-votes will have no impact on whether or not the nominees will be elected to the Board.

Proposal 2: The number of votes cast in favor of the proposal exceeds the number of votes cast against it. Consequently, abstentions and broker non-votes will have no impact on the ratification of Moss Adams LLP and effectively reduce the number of votes necessary to approve the proposal.

How are votes counted?

You may vote “FOR” or “VOTE WITHHELD” for each nominee for the Board of Directors (Proposal 1). You may vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal to ratify the appointment of Moss Adams LLP as independent auditors for the year ending December 31, 2009 (Proposal 2). If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee, and “FOR” Proposal 2.

If you hold your shares in street name (i.e., through a Broker) and do not provide voting instructions to your Broker, your shares will be counted towards the presence of a quorum, but will not be voted on any proposal on which your Broker does not have discretionary authority to vote. In this situation, a “broker non-vote” occurs. Shares that constitute broker non-votes effectively reduce the number of shares needed to approve the proposal.

How does the Board recommend that I vote?

The Board recommends that you vote your shares “FOR” each of the director nominees (Proposal 1), and “FOR” the ratification of the appointment of Moss Adams LLP as independent auditors for the year ending December 31, 2009 (Proposal 2).

2

How do I vote my shares without attending the Meeting?

If you are a shareholder of record, you may vote your shares without attending the Meeting as follows:

| | • | | By Mail—You may vote by mail by properly marking your selections on the proxy card included with this Proxy Statement (the “Proxy Card”), signing and dating the Proxy Card, and mailing it in the enclosed postage-paid envelope. You should sign your name exactly as it appears on the Proxy Card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate both your name and title or capacity. Votes by mail must be received prior to the Meeting. |

| | • | | By Internet—You may vote by Internet by logging on tohttp://www.illinoisstocktransfer.com, clicking on the heading “Internet Voting” and following the instructions on the screen. When prompted for your Voter Control Number, enter the number printed just above your name on the front of the Proxy Card. Please note that all votes cast by Internet must be completed and submitted prior to Tuesday, May 26, 2009 at 11:59 p.m. Central Daylight Time. Your Internet vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your Proxy Card. |

| | • | | By Telephone—You may vote by telephone by calling Toll Free 1-800-555-8140 and following the instructions. When asked for your Voter Control Number, enter the number printed just above your name on the front of the Proxy Card. Please note that all votes cast by telephone must be completed and submitted prior to Tuesday, May 26, 2009 at 11:59 p.m. Central Daylight Time. Your telephone vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your Proxy Card. |

If you vote by more than one method, or more than once by one or more methods, the last votereceivedwill be counted as your vote. For example, if you vote by mailing in your Proxy Card, but then vote the next day by telephone, but your Proxy Card is received in the mail after your telephone vote, your vote as shown on the Proxy Card will control.

For shares held in street name (i.e., by a Broker), your Broker will determine the methods of voting and communicate them to you. Typically, you may complete and mail a voting instruction card to your Broker, or, in most cases, submit voting instructions by telephone or the Internet at the phone number or website address provided by your Broker. You should follow the voting directions provided by your Broker. If you timely provide specific voting instructions by mail, telephone or the Internet (as applicable), your shares will be voted by your Broker as you have directed. The website address and phone number indicated above will not allow you to vote shares held in street name.

How do I vote my shares in person at the Meeting?

If you are a shareholder of record, to vote your shares at the Meeting you should bring the enclosed Proxy Card and proof of identification.

You may vote shares held in street name at the Meeting only if you (1) follow the instructions provided by your Broker to obtain from your Broker a signed legal proxy to vote in person, giving you the right to vote the shares, and (2) present that form at the Meeting.

Even if you plan to attend the Meeting, we encourage you to vote by mail, telephone or Internet so your vote will be counted if you later decide not to attend the Meeting.

What does it mean if I receive more than one Proxy Card?

It means you hold shares registered in more than one account. To ensure that all your shares are voted, sign and return each Proxy Card or vote by phone or on the Internet for each Proxy Card received.

3

May I revoke my proxy or change my vote?

If you are a shareholder of record and voted by mail, you may revoke your proxy and change your vote as follows:

| | • | | You may revoke your proxy by sending a written statement to that effect to the Secretary of the Company, which must be received prior to the Meeting. This will revoke your prior Proxy Card, but will not constitute a new proxy or direction to vote. |

| | • | | You may revoke any prior proxy card and change your vote by requesting a new Proxy Card from the Secretary of the Company and submitting that new Proxy Card properly signed. |

| | • | | You may revoke your proxy by voting by telephone or by Internetafteryour Proxy Card is received by the Company. |

| | • | | You may always vote in person at the Meeting, which will constitute revocation of any previous proxy card. (Note: simply attending the Meeting will not, of itself, revoke a proxy.) |

If you are a shareholder of record and voted by telephone or by Internet, you may revoke your proxy by (i) voting again by telephone or by Internet, (ii) by signing, dating and returning the Proxy Card, if such Proxy Card is received by the Company after your telephone or Internet vote, or (iii) by voting in person at the Meeting.

If your shares are held in street name (i.e., by a Broker), you will need to follow the instructions (if any) provided by your Broker to revoke your proxy or change your vote.

4

PROPOSAL 1—ELECTION OF DIRECTORS

Directors and Nominees

The Company’s Articles of Incorporation, as amended (the “Articles”), allow the Board of Directors to set the number of directors on the Board within a range of 5 to 25. The Articles also allow the Board to fill vacancies created on the Board, whether those vacancies occur as a result of resignation or by increase in the number of directors. The Board by resolution has set the number of directors to serve on the Board of Directors, effective with the Meeting, at seven directors. Directors are elected for terms of one year or until their successors are elected and qualified.

At the Meeting, seven directors are to be elected, each to serve until the 2010 Annual Meeting of Shareholders or until his or her successor is elected and qualified. Currently the Board consists of eight directors. Douglas K. Anderson has not been re-nominated, at his request, and the Board determined to reduce the size of the Board accordingly to seven directors, as a cost savings measure.

The Board of Directors has nominated the following seven individuals, who currently serve as directors, for election as directors at the Meeting: J. Frank Armijo, Kay C. Carnes, Craig D. Eerkes, H. Don Norton, Patrick J. Rusnak, Donald H. Swartz and P. Mike Taylor. All nominees, with the exception of H. Don Norton and Patrick J. Rusnak, are independent as defined in the NASDAQ Marketplace Rules. None of the independent directors is a party to any transaction or has a relationship or arrangement with the Company that is not disclosed under “Related Party Transactions and Business Relationships” below. The Articles do not provide for cumulative voting. It is the intent of the Company to have all nominees attend the Meeting, but the Company does not have a formal policy regarding attendance. All directors attended the 2008 Annual Meeting of Shareholders.

The following is a description of the business experience for at least the past five years for each of the current directors and director nominees:

| | | | |

| J. FRANK ARMIJO | | | | Director since 2006 |

J. Frank Armijo, age 46, is the Program Director and General Manager of West Coast Advanced Technology Solutions Programs for Lockheed Martin Information Systems and Global Services. Mr. Armijo served on the Columbia Trust Bancorp and Columbia Trust Bank boards of directors from October 2003 until March 2006, the effective date of the merger between the Company and Columbia Trust Bancorp. Upon completion of the merger, Mr. Armijo was appointed to the Board of the Company as of such effective date. Mr. Armijo currently serves as Vice Chairman of TRIDEC, the Tri-Cities Regional Economic Development Organization.

| | | | |

| KAY C. CARNES | | | | Director since 2006 |

Kay C. Carnes, age 70, is an Accounting Professor, Coordinator of Accounting Programs and Associate Dean of the School of Business Administration at Gonzaga University. She is a Certified Public Accountant and Certified Internal Auditor. She is past chair of the Washington State Board of Accountancy and currently serves on the International Qualifications Appraisals Board which negotiates international accounting reciprocity under WTO and NAFTA agreements.

| | | | |

| CRAIG D. EERKES | | | | Director since 2003 |

Craig D. Eerkes, age 57, is President and CEO of Sun Pacific Energy, Inc., in Kennewick, Washington. He is also a director of Western Mutual Insurance Co. in Salt Lake City, Utah.

5

| | | | |

| H. DON NORTON | | | | Director since 2007 |

H. Don Norton, age 63, is the Regional Director for the Far West Bank division of AmericanWest Bank in Utah. Mr. Norton served as a director and President and Chief Executive Officer of Far West Bank and Far West Bancorporation prior to the completion of the merger between the Company and Far West Bancorporation in 2007. Upon completion of the merger, Mr. Norton was appointed to the Board of Directors of the Company.

| | | | |

| PATRICK J. RUSNAK | | | | Director since 2008 |

Patrick J. Rusnak, age 45, joined the Company in September 2006 as Executive Vice President and Chief Operating Officer, and has served as President and Chief Executive Officer since July 2008. Mr. Rusnak has over 20 years of banking experience, including serving in executive management roles at Western Sierra Bancorp, Umpqua Holdings Corporation and Humboldt Bancorp.

| | | | |

| DONALD H. SWARTZ | | | | Director since 1998 |

Donald H. Swartz, age 63, is the President of J & M Electric, Inc., which performs electrical construction and maintenance services for industrial and commercial facilities. Mr. Swartz was a founder of Grant National Bank of Ephrata, Washington in 1989 and served as a director and as Chair of its board of directors until its acquisition by AmericanWest Bancorporation in 1998.

| | | | |

| P. MIKE TAYLOR | | | | Director since 2001 |

P. Mike Taylor, age 65, a licensed civil engineer, is Director of Engineering Services for the City of Spokane, Washington. He is the founder, and prior to December 19, 2008 was the President, of Taylor Engineering, Inc., Spokane, Washington. He is also an owner and Managing Partner of P. Mike Taylor, LLC, a business consulting and software development company.

All of the above nominees have indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the Proxy Card.

| | | | |

| DOUGLAS K. ANDERSON | | | | Director since 2007 |

Douglas K. Anderson, age 46, is the President and CEO of Pacific Commercial Properties Corp. a real-estate development entity specializing in resort development, office and industrial parks development, leasing and management. His current and past business experience includes general contracting and development in military housing on installations through the U.S., as well as big box retail, golf and ski resort construction and development principally throughout the western U.S. and Canada. He was a director for five years of First Utah Bank and First Utah Bancorporation based in Salt Lake City before being appointed to the Board of the Company effective October 2007. Mr. Anderson has not been re-nominated for election as a director, at his request.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE SEVEN NOMINEES.

6

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF MOSS ADAMS LLP AS INDEPENDENT AUDITORS FOR THE YEAR ENDING DECEMBER 31, 2009

The Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work and the independent auditors. Shareholder approval of the selection of Moss Adams LLP as our independent auditors is not required by law, by our Bylaws or otherwise, and the Audit Committee is not bound by the shareholder vote. The Audit Committee will consider the results of the shareholder vote on this proposal. In the event of a vote against ratification, the Audit Committee will reconsider its selection of Moss Adams LLP, but may, in its discretion, retain Moss Adams LLP. In the event of a vote for ratification, the Audit Committee may, in its discretion, appoint a new independent registered public accounting firm at any time if it determines that such a change would be in the best interest of the Company and its shareholders.

THE BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 2.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the shares of common stock beneficially owned as of April 15, 2009,1 by each person known to beneficially own more than 5% of AmericanWest Bancorporation’s common stock, which is the only class of stock with issued and outstanding shares.

| | | | | | | |

Title of Class | | Name and Address of Beneficial

Owner | | Amount and Nature of Ownership | | Percent of

Class | |

Common Stock | | Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | 896,904 shares(2) | | 5.21 | % |

| (1) | This information is to the best of the Company’s knowledge, based on a Schedule 13G filed on February 9. 2009 by Dimensional Fund Advisors LP with respect to its ownership of shares as of December 31, 2008. |

| (2) | Dimensional Fund Advisors LP (DFA) is an investment advisor to four investment companies and investment manager to their commingled group trusts and separate accounts (collectively, the “Funds”). As investment advisor and manager, DFA possesses investment and/or voting power over these shares of common stock of the Company, but disclaims beneficial ownership of the shares. DFA holds to dispose or to direct the disposition of 869,904 shares, and sole power to vote 863,524 of those shares. |

The following table sets forth the shares of common stock beneficially owned as of April 15, 2009, by each Director, by each named executive officer (as such term is defined below), and by the Directors and Executive Officers as a group.

7

For purposes of this table, in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934 (“Exchange Act”), a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting and/or investment power with respect to such common stock. The table includes (i) shares owned by spouses, (ii) shares owned by certain other immediate family members, (iii) shares held in trust, (iv) shares held in retirement accounts or funds for the benefit of the named individuals, and (iv) shares held in other forms of ownership, over which shares the persons named in the table possess voting and/or investment power.

| | | | | | | | | | | | | |

Name of Beneficial Owner(1) | | Direct Beneficial

Ownership | | | Indirect

Beneficial

Ownership | | | Exercisable

Options(2) | | Total Beneficial

Ownership(3) | | Percent of

Class | |

Douglas K. Anderson | | 2,000 | | | 3,000 | | | — | | 5,000 | | 0.03 | % |

J. Frank Armijo | | 9,792 | | | — | | | 6,902 | | 16,694 | | 0.10 | % |

Kay C. Carnes | | 1,365 | | | — | | | 1,500 | | 2,865 | | 0.02 | % |

Craig D. Eerkes | | 33,177 | | | — | | | 11,722 | | 44,899 | | 0.26 | % |

H. Don Norton | | — | | | 424,136 | (4) | | — | | 424,136 | | 2.46 | % |

Donald H. Swartz | | 46,411 | | | 5,067 | (5) | | 17,400 | | 68,878 | | 0.40 | % |

P. Mike Taylor | | 8,668 | | | — | | | 15,200 | | 23,868 | | 0.14 | % |

Patrick J. Rusnak | | — | | | 15,500 | (6) | | 600 | | 16,100 | | 0.09 | % |

Rick E. Shamberger | | — | | | — | | | 9,300 | | 9,300 | | 0.05 | % |

B. Nicole Sherman | | — | | | 20,541 | (7) | | 600 | | 21,141 | | 0.12 | % |

Jay B. Simmons | | — | | | — | | | 1,000 | | 1,000 | | 0.01 | % |

Brad L. Smith | | 2,000 | (8) | | — | | | — | | 2,000 | | 0.01 | % |

| | | | | | | | | | | | | |

All Directors & Executive Officers as a group (12 persons) | | 103,413 | | | 468,244 | | | 64,224 | | 635,881 | | 3.69 | % |

| | | | | | | | | | | | | |

| (1) | Robert M. Daugherty served as President and CEO until July 2008. He is not included in the table above as he is not currently an executive officer of the Company. Likewise, R. Blair Reynolds served as General Counsel until April 2008. He is not included in the table above as he is not currently an Executive Officer of the Company. |

| (2) | Shares of common stock subject to options currently exercisable within 60 days after April 15th are deemed outstanding for the purpose of computing the percentage of ownership interest of the person holding such options, but are not deemed outstanding for the purpose of computing the percentage ownership for any other person. |

| (3) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, based on factors including voting and investment power with respect to shares. Applicable percentage ownership is based on 17,213,288 aggregate shares outstanding as of 4/15/09. |

| (4) | Total includes shares held by HD & RR Norton Investments (397,047), IRA FBO Mr. Norton’s spouse (18,839) and IRA FBO H. Don Norton (8,250). |

| (5) | Total includes 4,418 shares held by J & M Electric Inc. and 649 shares held as custodian for Mr. Swartz’s grandchildren over which Mr. Swartz’s spouse shares voting and investment power. |

| (6) | Total includes shares held by Family Trust. |

| (7) | Shares held for Ms. Sherman through the Company’s 401(k) plan. |

| (8) | Mr. Smith resigned from the Company and AmericanWest Bank effective March 6, 2009. |

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission (“Commission”). The rules promulgated by the Commission under Section 16(a) of the Exchange Act require those persons to furnish the Company with copies of all reports filed with the Commission pursuant to Section 16(a).

8

Based solely upon a review of Forms 3, Forms 4 and Forms 5 and amendments thereto furnished to the Company pursuant to Rule 16(a)(3)(e) during the year ended December 31, 2008, and written representations from certain of its directors and executive officers that no Forms 5 were required to by filed, the Company believes that all directors, executive officers and beneficial owners of more than 10% of the common stock have filed with the Commission on a timely basis all reports required to be filed under Section 16(a) of the Exchange Act.

BOARD COMMITTEES AND MEETINGS

During the year ended December 31, 2008, the Board of Directors held 12 regular meetings. The Board of Directors also held 17 Special Board meetings during 2008. The Board has an Audit and Compliance Committee (“Audit Committee”), a Compensation Committee, and a Corporate Governance Committee that serves as the nominating committee of the Board. Each Board member attended at least 75% of the aggregate of the meetings of the Board and of the committees on which he or she served and that were held during the period for which he or she was a Board or Committee member.

The following table summarizes the membership of the Board and each of its standing committees, as well as the number of times each met during 2008.

| | | | | | | | |

Director | | Board | | Audit &

Compliance | | Compensation | | Corporate

Governance |

Douglas K. Anderson | | þ | | þ | | | | |

J. Frank Armijo | | þ | | | | þ | | |

Kay C. Carnes | | þ | | Chair | | | | |

Robert M. Daugherty(1) | | þ | | | | | | |

Craig D. Eerkes | | Chair | | | | þ | | þ |

H. Don Norton | | þ | | | | | | |

Patrick J. Rusnak(2) | | þ | | | | | | |

Donald H. Swartz | | þ | | | | Chair | | þ |

P. Mike Taylor | | þ | | þ | | | | Chair |

| | | | |

Total Meetings held in 2008 | | 29 | | 13 | | 14 | | 4 |

| (1) | Mr. Daugherty resigned from the Board effective July 2008. |

| (2) | Mr. Rusnak was appointed to the Board effective November 2008. |

Audit and Compliance Committee

The Audit Committee is comprised solely of independent directors (as defined in the NASDAQ Marketplace Rules) and meets at least quarterly with the Company’s management and independent auditors to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements; recommend to the Board the independent auditors to be retained; receive and consider the auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls; and review and oversee the Company’s compliance with applicable laws and regulations. The Audit Committee met 13 times during 2008. A copy of the Audit and Compliance Committee’s charter is available on the Company’s website atwww.awbank.net.

The Board has determined that Director Carnes is an “audit committee financial expert.” As an Accounting Professor, Certified Public Accountant and Certified Internal Auditor, Ms. Carnes has both an understanding of generally accepted accounting principles (“GAAP”) and the ability and experience to prepare, audit, evaluate and analyze financial statements which present the breadth and level of complexity of issues that the Company reasonably expects to be raised by its financial statements.

9

Compensation Committee

The Compensation Committee is comprised solely of independent directors (as defined in the NASDAQ Marketplace Rules) and meets at least quarterly with the Company’s management to, among other things, review compensation and award levels; discuss the individual performance of and approve compensation awards (including salary adjustments, non-equity incentive plans, equity awards and bonus amounts) for each member of executive management, including the chief executive officer; and act as Administrator of, and administer and interpret, the Company’s 2006 Equity Incentive Plan. The Compensation Committee met 14 times during 2008. A copy of the Compensation Committee’s charter is available on the Company’s website atwww.awbank.net.

Corporate Governance Committee

Although it is not a requirement under applicable law and regulations, the Board of Directors believes that it is good governance policy, and therefore has adopted a Board policy to provide, that the Corporate Governance Committee be comprised solely of independent directors (as defined in the NASDAQ Marketplace Rules).

The Committee is primarily responsible for considering and making recommendations to the Board of Directors concerning the development, implementation and monitoring of the Company’s corporate governance principles, including the structure, size, functions and needs of the Board and Board committees. This includes establishing the criteria, and recruiting and screening candidates, for Board membership; recommending director nominees for Board and shareholder approval; recommending director compensation; making recommendations regarding committee assignments and functions; reviewing succession plans for the Chief Executive Officer (“CEO”) of the Company and making recommendations to the Board with respect to the selection of the CEO of the Company; and reviewing and making recommendations to the Board of Directors on the Company’s corporate governance guidelines, Code of Ethics and committee charters.

The Committee’s policy for consideration of director candidates nominated by shareholders is to apply the Company’s rules for shareholder proposals which are included in this document under “Shareholder Proposals.” The Committee’s practice is to consider a candidate’s primary attributes of personal integrity and character, judgment, knowledge and leadership in a business or related setting, business acumen, and other commitments. These factors are considered in the context of the Company’s needs at that point in time. The Committee does not have a separate policy with respect to candidates recommended (but not nominated) by shareholders but would review any such recommendation using the same criteria set forth above.

Any proposed nomination or recommendation of a director candidate should be directed to Mr. Taylor, the Chair of the Corporate Governance Committee, at the address indicated at the beginning of this Proxy Statement.

The Corporate Governance Committee met four times during 2008. A copy of the Corporate Governance Committee’s charter is available on the Company’s website atwww.awbank.net.

CODE OF ETHICS

The Company has adopted a Code of Ethics that is applicable to all officers, directors and employees of the Company, including the Company’s principal executive officer, principal financial officer and principal accounting officer. The Company has also adopted a Code of Ethics for Directors and Senior Financial Officers that is applicable to the directors and all officers of the Company who are “executive officers” as such term is defined for purposes of Regulation O of the Federal Reserve Board, including the Company’s principal executive officer, principal financial officer and principal accounting officer. Both Codes of Ethics may be viewed on the Company’s website atwww.awbank.net. The Company intends to post any amendments to either code of ethics, and all waivers thereof relating to any director or senior executive officer, on its website at the web address set forth above.

10

DIRECTORS’ COMPENSATION

The Company uses a combination of cash and stock-based incentive compensation to attract and retain qualified individuals to serve on the Board. In setting director compensation, the Board, upon the recommendation of its Corporate Governance Committee, considers the significant amount of time that directors expend in fulfilling their duties to the Company as well as the position each holds on the Board (see discussion of fees below). Directors are subject to a minimum share ownership requirement, as established from time to time by the Board upon the recommendation of the Corporate Governance Committee, following a reasonable phase-in period for new directors.

Cash Compensation Paid to Board Members

For the fiscal year ended December 31, 2008, members of the Board of Directors who are not employees of the Company received an annual cash retainer of $14,400 and an attendance fee of $650 for regular Board meetings and special meetings requiring in-person attendance or of significant duration as determined by the Chairman; an attendance fee of $100 was paid for all other special meetings. Committee members received $300 per committee meeting, except for members of the Audit & Compliance Committee who received $500 per meeting. With the exception of the Audit Committee chair, committee chairs received an additional $150 per committee meeting. The chairman of the Board received an additional $250 per Board meeting and the chair of the Audit Committee received an additional monthly payment of $150. Directors who were employees of the Company during 2008 (Messrs. Daugherty, Norton and Rusnak) did not receive any compensation for service as a director.

The Board has reduced all forms of cash compensation for Directors by 20%, effective in January 2009, as a cost savings measure. These reductions will not affect the Director Fee Continuation Agreements described below.

Stock Options

Although the Company traditionally granted stock options to non-employee directors on an annual basis, no such grants were made during 2008. No awards were made as the result of directors being aware of material non-public information related to the Company’s capital raising efforts during the course of the year. It is the Company’s practice to grant equity awards to directors and executive officers at such times that the individuals would be free to trade the Company’s stock under the provisions of the Insider Trading Policy.

Director Fee Continuation Agreements

On January 1, 2003, Mr. Swartz and Mr. Taylor entered into individual Director Fee Continuation Agreements with the Company. Each such Director Fee Agreement provides that the named Director will receive a monthly payment of $500 for 120 months commencing upon retirement from service as a director.

11

Director Compensation Table

The following table sets forth information regarding the compensation received by each of the Company’s directors during the year ended December 31, 2008:

Director Compensation—2008

| | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash ($) | | Stock

Awards

($) | | Option

Awards

($) | | Non-equity

Incentive Plan

Compensation

($) | | Change in Pension

Value and

Non-Qualified

Deferred

Compensation

Earnings(1) ($) | | All Other

Compensation

($) | | | Total ($) |

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | | (h) |

Douglas K. Anderson | | 30,650 | | — | | — | | — | | — | | — | | | 30,650 |

J. Frank Armijo | | 25,900 | | — | | — | | — | | — | | — | | | 25,900 |

Ivan T. Call(2) | | 27,850 | | — | | — | | — | | — | | 20,000 | (3) | | 47,850 |

Kay C. Carnes | | 32,600 | | — | | — | | — | | — | | — | | | 32,600 |

Robert M. Daugherty(4) | | — | | — | | — | | — | | — | | — | | | — |

Craig D. Eerkes | | 33,150 | | — | | — | | — | | — | | — | | | 33,150 |

H. Don Norton(5) | | — | | — | | — | | — | | — | | — | | | — |

Patrick J. Rusnak(4) | | — | | — | | — | | — | | — | | — | | | — |

Donald H. Swartz | | 34,300 | | — | | — | | — | | 2,464 | | — | | | 36,764 |

P. Mike Taylor | | 32,750 | | — | | — | | — | | 8,229 | | — | | | 40,979 |

| (1) | Reflects increase in accrual for benefit under Director Fee Continuation Agreement. |

| (2) | Dr. Call’s service as a director ended on April 30, 2008, as he was not nominated for re-election in accordance with the mandatory retirement age provision of the Company’s By-laws. He was appointed as an advisory director effective May, 2008. As an advisory director, Dr. Call received the same cash fees as if he were a director. |

| (3) | Dr. Call received $20,000 during 2008 for distributions under his Director Supplemental Compensation Agreement. This agreement was assumed by the Company in connection with the Far West Bancorporation merger. As of December 31, 2008, 40 of 60 monthly installments remained payable under the agreement. |

| (4) | Served as an executive officer of the Company and did not receive any compensation for service as a director. |

| (5) | Mr. Norton is an employee of AmericanWest Bank, though he is not an executive officer, and did not receive any additional compensation for serving as a Board member of AmericanWest Bank or the Company. As a result Mr. Norton’s compensation is not required to be disclosed in the Summary Compensation Table or in the Director Compensation Table above. Mr. Norton was paid a salary of $150,000 in 2008. Pursuant to the terms of his employment agreement he also received a car allowance of $6,000, 401(k) employer match of $6,006 and had reportable compensation of $9,832 related to an Amended and Restated Joint Beneficiary Designation Agreement and Life Insurance Method Split Dollar Agreement. |

12

COMPENSATION DISCUSSION AND ANALYSIS

Terms

Throughout this Proxy Statement, the individuals who served as the Company’s Chief Executive Officer (Principal Executive Officer, or “PEO”) during 2008, as well as the other officers included in the Summary Compensation Table on page 20, are referred to as the “named executive officers.” The term “Committee,” unless the context clearly indicates otherwise, refers to the Compensation Committee of the Board.

Compensation Philosophy and Objectives

We believe that the most effective executive compensation program is one which compensates executive management through a mix of base salary, cash performance-based incentives and equity compensation. In addition, cash bonuses are awarded under certain circumstances. We established the compensation packages for each executive officer with the following objectives:

| | • | | To remain competitive with comparable employers in seeking out superior employees in key positions; |

| | • | | To induce talented and experienced executives to join and remain with the Company; and |

| | • | | To align management’s incentives with the long-term interests of our shareholders, with the ultimate objective of creating and improving shareholder value. |

Based on the foregoing, the Committee has structured the Company’s annual cash and long-term non-cash compensation to motivate our top executives to achieve the business goals of the Company and reward them for achieving such goals and increasing shareholder value through stock price appreciation.

Role of the Committee and the Chief Executive Officer in Compensation Decisions

The Compensation Committee annually reviews with the Chief Executive Officer his performance for the prior year and goals for the next succeeding year, and establishes his compensation and award levels. The Chief Executive Officer is not present during voting and deliberations by the Committee on his compensation and award levels. The Chief Executive Officer annually reviews the performance of each member of executive management, including the named executive officers, other than himself. His conclusions and recommendations based on those reviews are presented to the Committee, which can exercise its discretion to modify his recommendations but, generally, accepts his recommendations with minor adjustments. The Chief Executive Officer’s recommendations include base salary adjustments, equity awards and potential performance-based incentive award amounts. The Committee determines the compensation of and awards to all executive vice presidents, including all of the named executive officers.

Decisions relating to the non-equity compensation of all other employees of the Company are made by the Chief Executive Officer and other executive officers, as appropriate, through the normal budgetary process. The Chief Executive Officer also presents the annual operating budget, which serves as a key element of gauging corporate performance, each year to the Board for its approval.

Review of Executive Compensation Packages for 2008

In December 2007, the Company engaged a national consulting firm with a specialized executive compensation consulting practice to conduct a review of the Company’s executive officer compensation packages. This review was completed during the first quarter of 2008 and included a review of and recommendations for establishing appropriate base salary, non-equity performance-based compensation, equity compensation and other compensation elements based on a recommended peer group and consistent with the Company’s strategic performance and shareholder return objectives.

13

Targeted Overall Compensation

To assist in establishing “targeted overall compensation” – i.e., the aggregate level of compensation that the Company will pay if performance goals are fully met – we periodically review the compensation of senior management at banking institutions on the West Coast of the United States that have market capitalization and asset size comparable to ours and which generally recruit individuals to fill executive management positions who have similar skills and background to those we recruit. In 2008, this group of financial institutions included:

| | |

• Banner Corporation | | • Heritage Commerce Corporation |

| |

• Capital Corp of the West | | • Horizon Financial Corporation |

| |

• Cascade Bancorp | | • Premier West Bancorp |

| |

• Cascade Financial Corporation | | • Sierra Bancorp |

| |

• City Bank | | • Temecula Valley Bancorp Inc. |

| |

• Columbia Bancorp | | • TriCo Bancshares |

| |

• Columbia Banking System, Inc. | | • Westamerica Bancorp |

| |

• Farmers & Merchants Bancorp | | • West Coast Bancorp |

| |

• Frontier Financial Corporation | | • Vineyard National Bancorp |

| |

• Glacier Bancorp Inc. | | |

The Committee periodically reviews the list of peer institutions and management internally develops data based on public information from proxy statements filed by these institutions with the SEC.

Overview of Executive Compensation

The overall mix of executive compensation includes base salary, non-equity incentive compensation, equity-based incentives issued under the Company’s 2006 Equity Incentive Plan, discretionary bonuses and other benefits that are generally available to all employees. In cases where a new executive officer is recruited to the Company, a relocation reimbursement package may be negotiated. The Company does not currently offer any defined pension benefits or non-qualified supplemental executive retirement plan (“SERP”) benefits to any named executive officers. Although all employment agreements for named executive officers provide the executive the elective option to defer compensation under a non-qualified plan, to date no officer has made such an election.

In July 2008 Mr. Rusnak was appointed interim President and Chief Executive Officer, and on October 31, 2008, was appointed as permanent President and Chief Executive Officer. Mr. Rusnak’s targeted overall compensation was established at the time of his initial recruitment and appointment as Chief Operating Officer in September 2006, and included a mix of base salary, first year guaranteed bonus and equity compensation. Mr. Rusnak’s compensation did not increase upon his appointment as Chief Executive Officer. With respect to all other executive officers, including the named executive officers, we established their overall compensation through individual negotiation at the time they were initially hired. The base salary and incentive compensation of all of the named executive officers may be adjusted annually in accordance with our standard compensation practices. Employee performance evaluations are reviewed for the purposes of determining a salary increase for all employees, including the named executive officers, on an annual basis.

Base Salary

The base salaries for the named executive officers were initially established as part of the overall compensation package negotiation when they were initially hired by the Company. Generally speaking, the initial base salary amounts were based upon competitive market analysis, internal pay equity consideration, and the executive officer’s compensation immediately prior to being hired.

14

As the result of the third party executive compensation review noted above and job performance assessments, the base salaries of Mr. Rusnak, Ms. Sherman and Mr. Shamberger were increased effective January 1, 2008. In addition, in December 2008 the Company agreed to increase Ms. Sherman’s base salary in connection with her relocation to the Utah market area at the request of the Company, to compensate for the cost of living differential and higher state taxes. The following table presents information about the base salary increases awarded in 2008:

| | | | | | | | | | | | | | |

| | | Previous Base

Salary | | New Base

Salary | | Amount

Increase | | % Increase | | | Date of Last

Increase |

Patrick J. Rusnak | | $ | 230,000 | | $ | 250,000 | | $ | 20,000 | | 8.7 | % | | January 2008 |

Rick E. Shamberger | | $ | 165,375 | | $ | 185,000 | | $ | 19,625 | | 11.9 | % | | January 2008 |

B. Nicole Sherman(1) | | $ | 165,375 | | $ | 185,000 | | $ | 19,625 | | 11.9 | % | | January 2008 |

| (1) | In December 2008, the Company agreed to increase Ms. Sherman’s salary in connection with her relocation to the Utah market area, and the increase was implemented in February 2009 when her relocation was complete. |

The Company has instituted a freeze on salary increases for all executive officers effective as of January 2009. Accordingly, it is the Board’s intention not to consider any annual or merit increases in the salaries of executive officers until January 2010 at the earliest, subject to exceptions for promotions to new positions or unusual circumstances.

Non-equity Incentive Compensation Plans

In March 2008, the Committee approved the 2008 Annual Executive Officer Incentive Compensation Plan (“2008 Plan”). The 2008 Plan established the following threshold, target and maximum level of incentive compensation as a percentage of the participating officer’s base salary in effect at December 31, 2008:

| | | | | | | | | |

| | | Threshold | | | Target | | | Maximum | |

Patrick J. Rusnak (PEO, PFO) | | 25.0 | % | | 50.0 | % | | 62.5 | % |

Rick E. Shamberger | | 20.0 | % | | 40.0 | % | | 50.0 | % |

B. Nicole Sherman | | 20.0 | % | | 40.0 | % | | 50.0 | % |

Robert M. Daugherty (PEO)(1) | | 37.5 | % | | 75.0 | % | | 93.8 | % |

| (1) | Mr. Daugherty, held the position of President and Chief Executive Officer until July 24, 2008. |

The following table presents the actual incentive opportunities for each named executive officer based on his/her base salary in effect at December 31, 2008:

| | | | | | | | | |

| | | Threshold | | Target | | Maximum |

Patrick J. Rusnak (PEO, PFO) | | $ | 62,500 | | $ | 125,000 | | $ | 156,250 |

Rick E. Shamberger | | $ | 37,000 | | $ | 74,000 | | $ | 92,500 |

B. Nicole Sherman | | $ | 37,000 | | $ | 74,000 | | $ | 92,500 |

Robert M. Daugherty (PEO) | | $ | 157,500 | | $ | 315,000 | | $ | 393,960 |

The Target level of performance was defined as achievement of targeted or desired results established by the Board, whether on a corporate or individual basis. The Threshold level of performance, which provided an incentive payout equal to 50% of the Target level, represented achievement of results below Target but still of sufficient accomplishment to merit a financial award. The Maximum level of performance provided for a payout equal to 125% of the Target level, commensurate with achievement of results significantly in excess of the expected level to a point where additional compensatory reward was warranted based on the incremental financial and other tangible benefits inured to the Company as a result. Results falling below the standards prescribed for the Threshold level for the Corporate or Individual Goals component resulted in no incentive award being earned for that particular measure.

15

The 2008 Plan provided for the incentive opportunity for each participant to be allocated among three categories: Corporate Goal, Individual Goals and Discretionary. The Committee considered the roles of each named executive officer, including the ability to influence overall corporate performance, and determined that the following allocations fairly weighted the influence and responsibility for each named executive officer based on his/her position:

| | | | | | | | | |

| | | Corporate | | | Individual | | | Discretionary | |

Patrick J. Rusnak (PEO, PFO) | | 60 | % | | 25 | % | | 15 | % |

Rick E. Shamberger | | 35 | % | | 50 | % | | 15 | % |

B. Nicole Sherman | | 35 | % | | 50 | % | | 15 | % |

Robert M. Daugherty (PEO) | | 75 | % | | 10 | % | | 15 | % |

The Committee believed that Mr. Daugherty and Mr. Rusnak, in their roles as Chief Executive Officer and Chief Operating Officer, respectively, had a significantly greater ability to influence the overall financial performance of the Company than the other named executive officers. Accordingly, the portion of their potential award for the Corporate Goal was weighted significantly greater than the other named executive officers, with a corresponding reduction in the portion attributable to Individual Goals. Mr. Rusnak’s potential incentive award under the 2008 Plan and individual goals were not modified as result of his appointment as Chief Executive Officer on an interim basis in July 2008 or permanent basis in October 2008.

For example, in the case of Mr. Rusnak, the total potential award for Target level performance of $125,000 was apportioned to the Corporate Goal ($75,000), Individual Goals ($31,250) and Discretionary ($18,750). Achievement of performance above or below the prescribed Target levels would result in the individual award amounts being greater or less than these amounts, as the case may be.

In 2008, the Corporate Goal was comprised of equally-weighted measures: return on average assets (“ROA”) and diluted earnings per share (“EPS”). ROA is a widely-used metric in the banking industry and is calculated by dividing net income by total average assets. It provides a relative measure of overall profitability. For 2008, the Company had a budgeted ROA of 0.40% (as approved by the Board of Directors), which was established as the Threshold performance level for the Corporate Goal. The Target Corporate Goal ROA was established as 0.50% and the Maximum as 0.60%. The EPS Threshold, like the ROA, was established as the budgeted amount, or $0.50 per share, with the Target and Maximum amounts being $0.64 and $0.77, respectively. The Company’s net income would have increased by approximately $2 million as the result of performance being achieved at the Target level instead of Threshold, and an additional $2 million for attaining the Maximum level. Since the Company recognized a net loss in 2008, no incentive awards were earned for either of the two the Corporate Goal components of the 2008 Plan.

Up to four Individual Goals were established for each executive officer as part of the 2008 Plan. The Individual Goals and performance target levels were selected based upon each executive’s scope of responsibility. The overall potential Individual Goals award for each performance level was allocated to each goal based on its relative importance. For example, in the case of Mr. Rusnak, the Target level award of 25% was allocated to three goals at 10%, 10% and 5%, respectively.

Since the Company is regulated by government agencies and the results of periodic regulatory examinations can have a significant impact on the Company’s ability to execute its strategic plan, two of the four named executive officers were assigned an individual goal related to regulatory matters. The performance targets for individual goals related to regulatory matters were based on the rating results of the annual safety and soundness examination and differ among the named executive officers based on areas of primary responsibility. Generally, the threshold level would mean that the Company has no significant regulatory issues. Under existing federal regulations, such examination ratings must be treated as confidential information. Accordingly, specific information regarding these performance targets and actual results may not be disclosed in this report. Other individual goals are based on the performance of specific areas of Company operations for which the named executive is primarily responsible.

16

The third component of the 2008 Plan was the Discretionary award. The purpose of the Discretionary component is to recognize and reward the efforts of each named executive officer for areas that are not covered under individual goals due to the difficulty in measuring performance in a purely objective manner. This would include the subjective assessment of an individual’s leadership ability, effort, and commitment to achieving corporate performance goals. In light of the Company’s overall financial results for 2008, Mr. Rusnak recommended that no discretionary award be made and this recommendation was accepted by the Committee.

Following are the “scorecards” which present the Individual goals for each named executive officer, with the exception of Mr. Daugherty, who was not eligible for and did not receive any incentive award under the 2008 Plan as a result of his resignation in July 2008. The scorecard summaries include a summary of the individual goals, actual performance results and related awards. As previously discussed, no awards were earned for Corporate Goal performance or the Discretionary component. Although Mr. Rusnak was eligible for an award under the plan based on attainment of specified performance levels for Individual goals, he declined to accept any payment.

| | | | | | | | | | | | |

P. Rusnak (PEO, PFO) | | | | | | | | | | | | |

| | | Threshold | | Target | | Maximum | | Actual | | | Award |

Corporate Performance | | 0.40% | | 0.50% | | 0.60% | | -4.88 | % | | $ | 0 |

Individual Goal(s) | | | | | | | | | | | $ | 0 |

1. Regulatory Compliance | | * | | * | | * | | — | | | $ | 0 |

2. Residential Lending pre-tax income | | ³85%; <95% of | | ³95%; <105% of | | ³105% of budget | | <85 | % | | $ | 0 |

| | budget | | budget | | | | | | | | |

3. Internal Control | | No material weakness; no more than 2 significant deficiencies; all Finance related internal audit reports Satisfactory or higher. | | No material weakness; no more than 1 significant deficiency; all Finance related internal audit reports Satisfactory or higher. | | No material weakness; no significant deficiencies; all Finance related internal audit reports Satisfactory or higher. | | Maximum | | | $ | 15,625 |

Discretionary | | | | | | | | | | | $ | 0 |

Total Award | | | | | | | | | | | | ** |

| * | Specific information cannot be disclosed due to federal banking regulations. |

| ** | Mr. Rusnak declined the award of $15,625. |

| | | | | | | | | | | | | | | |

R. Shamberger | | | | | | | | | | | | | | | |

| | | Threshold | | | Target | | | Maximum | | | Actual | | | Award |

Corporate Performance | | 0.40 | % | | 0.50 | % | | 0.60 | % | | -4.88 | % | | $ | 0 |

Individual Goal(s) | | | | | | | | | | | | | | | |

1. Regulatory Compliance | | * | | | * | | | * | | | — | | | $ | 0 |

2. Average non-performing assets | | 0.75 | % | | 0.50 | % | | 0.35 | % | | 3.45 | % | | $ | 0 |

3. Average delinquent loans | | 0.45 | % | | 0.35 | % | | 0.20 | % | | 1.01 | % | | $ | 0 |

4. Net charge-offs | | 0.45 | % | | 0.30 | % | | 0.20 | % | | 6.21 | % | | $ | 0 |

Discretionary | | — | | | — | | | — | | | — | | | $ | 0 |

Total Award | | | | | | | | | | | | | | $ | 0 |

| * | Specific information cannot be disclosed due to federal banking regulations. |

17

| | | | | | | | | | | | |

N. Sherman | | | | | | | | | | | | |

| | | Threshold | | Target | | Maximum | | Actual | | | Award |

Corporate Performance | | 0.40% | | 0.50% | | 0.60% | | -4.88 | % | | $ | 0 |

Individual Goal(s) | | | | | | | | | | | | |

1. Core deposit growth | | ³75%; <90% of budget | | ³90%; <110% of budget | | ³110% of budget | | <75 | % | | $ | 0 |

2. Retail loan growth | | ³90%; <95% of budget | | ³95%; <110% of budget | | ³110% of budget | | >110 | % | | $ | 4,625 |

3. Non-interest expense control | | >103%; £106% of budget | | ³97%;£102% of budget | | <97% of budget | | 101.5 | % | | $ | 11,100 |

Discretionary | | — | | — | | — | | — | | | $ | 0 |

Total Award | | | | | | | | | | | $ | 15,725 |

In view of the Company’s current financial condition and general economic conditions, the Committee determined that it was both difficult and inappropriate to establish a short term incentive compensation plan for 2009, and does not currently intend to consider, approve or recommend to the Board any cash incentive compensation to the executive officers with respect to 2009.

Equity Compensation

All stock options and restricted shares have been granted pursuant to the Company’s 2006 Equity Incentive Plan (“2006 Plan”), which was approved by the shareholders at the Company’s 2006 Annual Meeting of Shareholders, or its predecessor, the AmericanWest Bancorporation 2001 Employee Incentive Stock Plan. All stock options and restricted shares granted are approved by the Committee. The 2006 Plan provides the Company the ability to design stock-based incentive compensation programs to:

| | • | | Promote high performance and achievement of corporate goals by directors and key employees, |

| | • | | Encourage the growth of shareholder value, |

| | • | | Allow key employees to participate in the long-term growth and profitability of the Company, and |

| | • | | Maintain the Company’s competitiveness with its peers. |

The exercise price of stock options granted under the 2006 Plan is the closing price of the Company common stock on the grant date (in cases where they are being offered to a potential employee prior to his or her hire, the date of hire is the grant date). When an option is granted the exercise price may not be less than one hundred percent (100%) of the Fair Market Value of the Company’s common stock on the date of grant. No stock options were granted to any named executive officers or directors during 2008.

Since 2005, grants of restricted stock with performance vesting conditions (“Performance Shares”) have been used as the principal equity compensation for the named executive officers. These grants have varied in amount from 1,000 to 15,000 shares, with vesting subject to the Company attaining an ROA of 1.0% and continued employment through a prescribed vesting date. As a result of the required ROA not being achieved for 2008, each named executive officer who was employed by the Company prior to 2008 forfeited 20% of his or her previously granted Performance Shares. There were no Performance Shares or stock options granted to directors or named executive officers in 2008. The Committee periodically reviews appropriate targets and may use other incentive targets for future awards. The Plan also gives the Committee the authority to amend existing grant agreements but the Committee has not done so to date.

Although the Committee considered establishing a long-term incentive compensation program for executive officers using equity awards, and engaged and received recommendations from a third party consultant with respect to the design of such a program, no action was taken to implement such a program in light of the Company’s financial performance and condition. The Committee expects that such a long-term incentive compensation program will be reconsidered in the future, as it will allow the alignment of a significant component of overall compensation directly with increased shareholder value and provide a mechanism for retention.

18

Bonuses

During 2008, the Committee considered two recommendations by Mr. Rusnak for payment of a bonus to a named executive officer based upon special circumstances. The Committee considered and ultimately approved the following bonus payments as it determined the payments were in the Company’s best interests.

In response to Mr. Shamberger’s announced resignation from the Company and its wholly-owned subsidiary, AmericanWest Bank, in July 2008, the Company determined that Mr. Shamberger’s continued employment as Chief Credit Officer would be crucial in connection with the Company’s ongoing efforts to resolve credit quality issues and to attract new capital, and that his departure would result in significant increased expense and potentially jeopardize discussions with prospective investors. In order to retain the employment of Mr. Shamberger, his employment agreement was amended in July 2008 to provide for a retention bonus in the amount of $150,000. This bonus is subject to repayment by Mr. Shamberger on a proportional basis in the event his employment is terminated for certain reasons prior to July 31, 2009.

Ms. Sherman was paid $61,667 as a moving bonus in connection with the Company’s reorganization and her relocation to the Utah market area. In addition, the Company agreed to reimburse Ms. Sherman for direct costs incurred in connection with her relocation, including costs of temporary housing in Utah, closing costs on the purchase of a residence in Utah, moving and storage of household goods, and related income taxes.

Employment Agreements

The Company has entered into employment agreements with each of the named executive officers. These agreements contain severance and change in control benefits designed to promote stability and continuity of executive management and to align the interests of our executive officers with those of our shareholders by enabling such executives to consider all alternatives that could be in the shareholder interests without having reason to be concerned about their individual futures. Detailed information regarding applicable payments under all such provisions for the named executive officers is provided under the heading “Disclosure Regarding Post-Termination and Change in Control Benefits.”

Perquisites and Other Personal Benefits

As a general rule, the Company does not provide named executive officers with perquisites or other personal benefits not generally available to all full time employees, other than modest amounts for an automobile allowance (in which case the executive is not eligible for mileage reimbursements). None of the named executive officers other than former President and Chief Executive Officer Robert M. Daugherty received any reimbursement of club membership dues during 2008. In some instances, executive officers are provided with relocation assistance. The Company believes that relocation expenses are essential to recruiting talented officers from outside of the Company’s market area and are justified in cases when existing executives agree to relocate at the Company’s request.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board of Directors has reviewed and discussed the above Compensation Discussion and Analysis with management and, based on such review and discussion, has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

Submitted by the Compensation Committee:

Donald H. Swartz, Chairman

J. Frank Armijo

Craig D. Eerkes

19

EXECUTIVECOMPENSATION

The following tables set forth information regarding compensation earned by, awarded to or paid our Chief Executive Officer, Patrick J. Rusnak, who served as Chief Operating Officer from January 1, 2008 until his appointment as Chief Executive Officer effective July 25, 2008. Mr. Rusnak also holds the position of Chief Financial Officer and is considered the Principal Executive Officer (PEO) and Principal Financial Officer (PFO) of the Company. The tables also include the two other most highly compensated executive officers as of December 31, 2008 whose total compensation exceeded $100,000 for 2008: Rick E. Shamberger (EVP/Chief Credit Officer) and Nicole Sherman (EVP/Chief Banking Officer–Utah). In addition, the table includes Robert M. Daugherty, who served as President and Chief Executive Officer until July 24, 2008. The identification of such “named executive officers” is determined based on each individual’s total compensation for the year ended December 31, 2008, as reported below in the Summary Compensation Table. The Company did not have any other executive officers who met the requirements for inclusion as a named executive officer.

| | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary

($) | | | Bonus

($) | | Stock

Awards(1)

($) | | Option

Awards(1)

($) | | Non-equity

Incentive Plan

Compensation(2)

($) | | All Other

Compensation

($) | | | Total ($) |

(a) | | (b) | | (c) | | | (d) | | (e) | | (f) | | (g) | | (i) | | | (j) |

Patrick J. Rusnak | | 2008 | | 250,000 | | | | | — | | 3,894 | | | | 14,000 | (3) | | 267,894 |

EVP/Chief Executive Officer (PEO/PFO) | | 2007 | | 230,782 | | | — | | — | | 6,880 | | 47,438 | | 15,838 | (4) | | 300,938 |

| | | | | | | | |

Rick E. Shamberger | | 2008 | | 185,000 | | | 150,000 | | | | 3,943 | | — | | 6,623 | (5) | | 345,566 |

EVP/Chief Credit Officer | | 2007 | | 165,375 | | | 22,000 | | — | | 9,626 | | 24,216 | | — | | | 221,217 |

| | | | | | | | |

B. Nicole Sherman | | 2008 | | 185,000 | | | 61,667 | | | | 3,894 | | 15,725 | | 16,400 | (6) | | 282,686 |

EVP/Chief Banking Officer Utah | | 2007 | | 165,375 | | | — | | — | | 6,880 | | 43,824 | | 15,020 | (7) | | 231,099 |

| | | | | | | | |

Robert M. Daugherty (PEO) | | 2008 | | 319,492 | (8) | | — | | 20,704 | | 72,102 | | | | 88,713 | (9) | | 501,011 |

| | 2007 | | 420,000 | | | — | | 48,132 | | 177,989 | | 90,594 | | 17,061 | (10) | | 753,776 |

| (1) | The amounts in column (e) and column (f) reflect the compensation cost of stock awards and option awards during the year indicated. The FAS 123(R) value is spread over the number of months of service required for the grant to vest which is referred to as the requisite service period in FAS 123(R). See the note to the AmericanWest Bancorporation Consolidated Financial Statements entitled “Stock Options” for a description of the assumptions made in determining FAS 123(R) values. |

| (2) | The amounts in column (g) were earned with respect to the year indicated and the compensation was paid in the first quarter of the following year. |

| (3) | The amount includes $4,800 in car allowance and $9,200 in 401(k) employer match. |

| (4) | The amount includes $4,521 in relocation expenses, $4,800 in car allowance and $6,517 in 401(k) employer match. |

| (5) | The amount includes $6,623 in 401(k) employer match. |

| (6) | The amount includes $ 7,200 in car allowance and $9,200 in 401(k) employer match. |

| (7) | The amount includes $7,200 in car allowance and $7,820 in 401(k) employer match. |

| (8) | The amount includes $70,000 of salary continuation paid in accordance with the terms of Mr. Daugherty’s employment agreement for the period of July 25, 2008 through September 20, 2008. |

| (9) | The amount includes $75,000 paid in connection with Mr. Daugherty’s execution of a separation and release agreement, $4,200 in car allowance and $8,852 in 401(k) employer match. |

| (10) | The amount includes $861 in membership dues, $7,200 in car allowance and $9,000 in 401(k) employer match. |

20

Narrative

The Company has entered into employment agreements with each of the named executive officers which provide for, among other things, payment of a specified base annual salary (which may be increased on an annual basis in consideration of job performance and other relevant factors); eligibility for incentive, equity and deferred compensation programs; paid vacation; employee welfare benefits; automobile allowance in some cases; club membership dues in some cases; moving expenses in some cases; business expense reimbursement and post-termination benefits. The employment agreements for all of the named executive officers, with the exception of Mr. Shamberger, were entered into in connection with the initial hiring of the executive.

Information regarding the termination dates, post-termination benefits (including benefits payable by the Company in the event of a change in control) and restrictive covenants for each named executive officer’s employment agreement is included under the heading “Disclosure Regarding Post-Termination and Change in Control Benefits” on page 22 of this Proxy Statement.

Grants of Plan-Based Awards for the Fiscal Year Ended 2008

The Company made no grants of equity-based awards to the named executive officers during 2008.

OutstandingEquity Awards at Fiscal Year-End

The following table sets forth information on outstanding option and stock awards held by the named executive officers at December 31, 2008, including the number of shares underlying both exercisable and unexercisable portions of each stock option as well as the exercise price and expiration date of each outstanding option.

| | | | | | | | | | | | | | | | | | | | | |

| Name | | Number of

Securities

underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

underlying

Unexercised

Options (#)

Unexercisable | | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options (#) | | Option

Exercise

Price ($) | | Option

Expiration

Date | | Number of

Shares or

Units of

Stock that

have not

Vested (#) | | Market

Value of

Shares or

Units of

Stock that

have not

Vested(1) ($) | | Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

that have

not

Vested (#) | | | Equity

Incentive

Plan Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

that

have not

Vested ($) | |

(a) | | (b) | | (c) | | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) | | | (j) | |

Patrick J. Rusnak, | | 300 | | 1,200 | (1) | | — | | 24.22 | | 1/2/2017 | | — | | — | | — | | | — | |

President and Chief Executive Officer (PEO/PFO) | | — | | — | | | — | | — | | — | | — | | — | | 9,000 | (2) | | 6,750 | (3) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Rick E. Shamberger | | 300 | | 1,200 | (1) | | — | | 24.22 | | 1/2/2017 | | — | | — | | — | | | — | |

EVP/Chief Credit Officer | | 1,000 | | — | | | — | | 21.14 | | 2/16/2014 | | — | | — | | — | | | — | |

| | 3,850 | | — | | | — | | 17.79 | | 10/31/2012 | | — | | — | | — | | | — | |

| | 3,850 | | — | | | — | | 17.79 | | 10/31/2013 | | — | | — | | — | | | — | |

| | — | | — | | | — | | — | | — | | — | | — | | 3,000 | (4) | | 2,250 | (3) |

| | | | | | | | | | | | | | | | | 900 | (5) | | 675 | (3) |

| | | | | | | | | |

B. Nicole Sherman | | 300 | | 1,200 | (1) | | — | | 24.22 | | 1/2/2017 | | — | | — | | | | | | |

EVP/Chief Banking Officer, Utah | | — | | — | | | — | | — | | — | | — | | — | | 1,200 | (5) | | 2,250 | (3) |

| | | | | | | | | | | | | | | | | 3,000 | (6) | | 675 | (3) |

| | | | | | | | | |

Robert M. Daugherty | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | |

President & CEO (PEO) | | — | | — | | | — | | — | | — | | — | | — | | — | | | — | |

| (1) | Future vesting of 300 options on January 2, 2009, 2010, 2011 and 2012. |

| (2) | Performance stock award will vest on September 17, 2011, subject to achievement of specified performance targets. |

21

| (3) | The closing market value as of the close December 31, 2008 was $0.75. This value was used in the calculation of the market value for the unvested restricted shares. |

| (4) | Performance stock award will vest on January 2, 2010, subject to achievement of specified performance targets. |

| (5) | Performance stock award will vest on January 2, 2012, subject to achievement of specified performance targets. |

| (6) | Performance stock award will vest on January 4, 2010, subject to achievement of specified performance targets. |

As of December 31, 2008, the following restricted stock and Performance Share grants were outstanding and subject to forfeiture should the performance targets for 2009 through 2011 not be achieved. In all cases, the performance target was established as the Company achieving an ROA of at least 1.00% for each fiscal year:

| | | | | | | | |

| | | 2009 | | 2010 | | 2011 | | Total |

P. Rusnak | | 3,000 | | 3,000 | | 3,000 | | 9,000 |

R. Shamberger | | 1,800 | | 1,800 | | 300 | | 3,900 |

N. Sherman | | 1,800 | | 1,800 | | 300 | | 3,900 |

Pension Benefits

At the present time, the Company does not provide any pension benefits for any of the named executive officers.

Non-Qualified Deferred Compensation

At the present time, the Company does not have any deferred compensation agreements or plans for any of the named executive officers, although they have the elective option for such provided in their employment agreements.

DISCLOSURE REGARDING POST-TERMINATION AND CHANGE IN CONTROL BENEFITS

The Company has entered into employment agreements (“Agreements”) with each of its named executive officers which provide for financial benefits in the event of termination of his or her employment under the circumstances described below. In addition, stock options and restricted shares granted to the named executive officers provide for accelerated vesting and waiver of performance-based conditions for awards not previously vested in the event of a change in control.

The triggering events under the Agreements include:

| | • | | Resignation for “good reason” and |

| | • | | Termination “without cause” |