United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

AMERICANWEST BANCORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

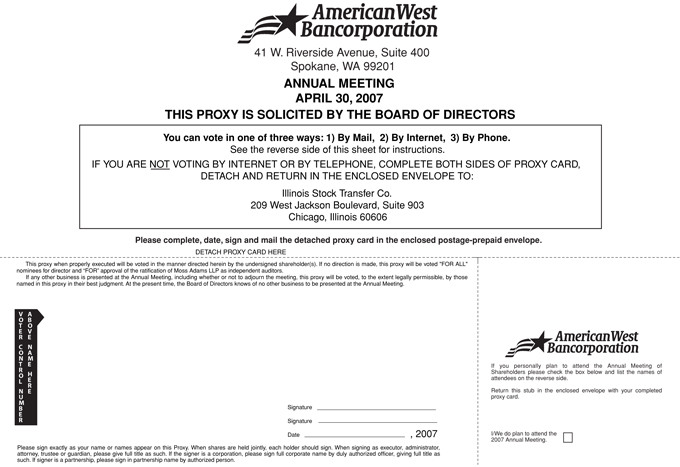

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

| | |

TIME | | 1:30 p.m. on Monday, April 30, 2007 |

| |

PLACE | | Courtyard by Marriott—Spokane 401 North Riverpoint Boulevard Spokane, WA 99202 |

| |

ITEMS OF BUSINESS | | 1. To elect eight directors to hold office until the next annual meeting of shareholders and until their successors are duly elected and qualified. 2. Ratification of the appointment of Moss Adams LLP as independent auditors for AmericanWest’s financial statements for the year ended December 31, 2007. 3. To take action on any other business that may properly be considered at the Meeting or any adjournments or postponements thereof. |

| |

RECORD DATE | | You may vote at the Meeting if you were a shareholder of record at the close of business on April 2, 2007. |

| |

VOTING BY PROXY | | If you cannot attend the Meeting, you may vote your shares by completing and promptly returning the enclosed proxy card in the envelope provided. |

| |

ANNUAL REPORT | | AmericanWest Bancorporation’s 2006 Annual Report on Form 10-K, which is not part of the proxy soliciting material, is enclosed. |

By Order of the Board of Directors,

R. Blair Reynolds, EVP/General Counsel

Secretary

This Notice of Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about April 4, 2007.

TABLE OF CONTENTS

41 West Riverside Avenue

Suite 400

Spokane, Washington 99201

PROXY STATEMENT

Annual Meeting of Shareholders

April 30, 2007

We are providing these proxy materials in connection with the solicitation by the Board of Directors of AmericanWest Bancorporation (“Company”) of proxies to be voted at the Company’s Annual Meeting of Shareholders (“Meeting”) to be held on April 30, 2007, and at any adjournments or postponements of the Meeting.

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

Who may vote at the Meeting?

The Board of Directors of the Company (“Board”) has set April 2, 2007 as the record date for the Meeting. If you were the owner of Company common stock at the close of business on April 2, 2007, you may vote at the Meeting. You are entitled to one vote for each share of Company common stock you held in an account with a broker, bank or other nominee (shares held in “street name”) on the record date.

Each share of common stock has one vote on each matter to be voted upon.

How many shares must be present to hold the Meeting?

A majority of the Company’s shares of outstanding common stock as of the record date must be present at the Meeting in order to hold the Meeting and conduct business. On the record date, there were approximately 11,424,721 shares of Company common stock outstanding. Shares are counted as present at the Meeting if the owner of the shares:

| | • | | is present and votes in person at the Meeting; or |

| | • | | has properly submitted a proxy card. |

Shareholders of record who are present at the Meeting in person or by proxy, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Meeting, are considered shareholders who are present and entitled to vote, and will count toward the quorum. Broker non-votes will also be counted towards the quorum.

What proposals will be voted on at the Meeting?

There are two proposals scheduled to be voted on at the Meeting:

| | • | | Election of eight directors to hold office until the next annual meeting of shareholders, and |

1

| | • | | Ratification of the appointment of Moss Adams LLP as independent auditors for AmericanWest’s financial statements for the year ended December 31, 2007. |

How many votes are required to approve the proposals?

If a quorum exists at the Meeting, each proposal will be approved as follows:

Proposal 1: The eight nominees receiving the largest number of votes cast by the shares entitled to vote in the election will be elected as directors. Consequently, abstentions and broker non-votes will have no impact on whether or not the nominees will be elected to the Board.

Proposal 2: The number of votes cast in favor of the proposal exceeds the number of votes cast against it.

How are votes counted?

You may either vote “FOR” or to “WITHHOLD” authority to vote for each nominee for the Board of Directors (Proposal 1). You may either vote “FOR”, “AGAINST” or “ABSTAIN” on the proposal to ratify the appointment of Moss Adams LLP as independent auditors for the year ended December 31, 2007 (Proposal 2). If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee and “FOR” (Proposal 2).

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. In this situation, a “broker non-vote” occurs. Shares that constitute broker non-votes are not considered as entitled to vote on the proposals in question, thus effectively reducing the number of shares needed to approve the proposal.

How does the Board recommend that I vote?

The Board recommends that you vote your shares “FOR” each of the director nominees (Proposal 1) and “FOR” the ratification of the appointment of Moss Adams LLP as independent auditors for the year ended December 31, 2007 (Proposal 2).

How do I vote my shares without attending the Meeting?

Without attending the Meeting, you may vote:

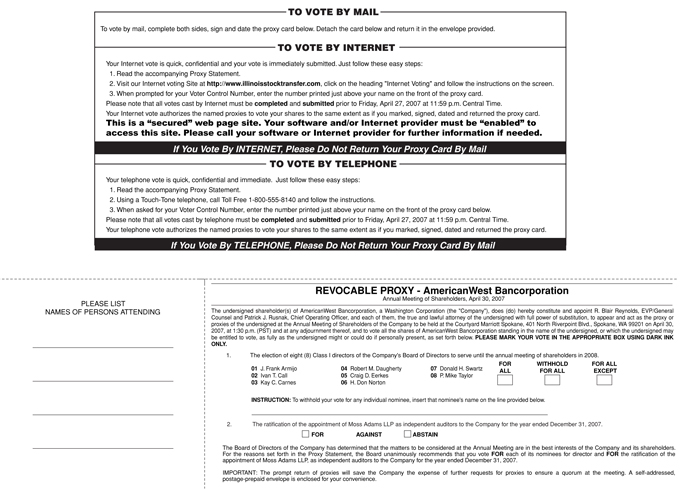

| | • | | By Mail—You may vote by Mail by marking your selections on the proxy card, signing and dating your proxy card and mailing it in the enclosed postage-paid envelope. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. |

| | • | | By Internet—You may vote by Internet by logging on tohttp://www.illinoisstocktransfer.com, click on the heading “Internet Voting” and follow the instructions on the screen. When prompted for your Voter Control Number, enter the number printed just above your name on the front of the proxy card. Please note that all votes cast by Internet must be completed and submitted prior to Friday, April 27, 2007 at 11:59 p.m. Central Time. Your Internet vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your proxy card. |

| | • | | By Telephone—You may vote by Telephone by calling Toll Free 1-800-555-8140 and follow the instructions. When asked for your Voter Control Number, enter the number printed just above your name on the front of the proxy card. Please note that all votes cast by telephone must be completed and submitted prior to Friday, April 27, 2007 at 11:59 p.m. Central Time. Your telephone vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your proxy card. |

2

For shares held in street name, you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee, or, in most cases, submit voting instructions by telephone or the Internet. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you have directed.

How do I vote my shares in person at the Meeting?

If you are a shareholder of record, to vote your shares at the Meeting you should bring the enclosed proxy card or proof of identification. You may vote shares held in street name at the Meeting only if you obtain a signed proxy card from the record holder (broker or other nominee) giving you the right to vote the shares.

Even if you plan to attend the Meeting, we encourage you to vote by mail, so your vote will be counted even if you later decide not to attend the Meeting.

What does it mean if I receive more than one proxy card?

It means you hold shares registered in more than one account. To ensure that all your shares are voted, sign and return each proxy card.

May I change my vote?

Yes. If you have voted by mail (and have not voted through your broker), you may change your vote and revoke your proxy card by:

| | • | | Sending a written statement to that effect to the Secretary of the Company, which must be received prior to the Meeting; or |

| | • | | Submitting a properly signed proxy card; or |

| | • | | Voting in person at the Meeting. (Note: simply attending the Meeting will not, of itself, revoke a proxy.) |

3

PROPOSAL 1—ELECTION OF DIRECTORS

Directors and Nominees

The Company’s Articles of Incorporation, as amended (“Articles”), allow the Board of Directors or shareholders to set the number of directors on the Board within a range of 5 to 25. The Articles also allow the Board to fill vacancies created on the Board. The Board by resolution has set the number of directors to serve on the Board of Directors at eight directors. Directors are elected for terms of one year or until their successors are elected and qualified.

At the Meeting, eight directors are to be elected, each to serve until the next annual meeting of shareholders or until his successor is elected and qualified.

The Board of Directors has nominated eight of the current directors: J. Frank Armijo, Ivan T. Call, Kay C. Carnes, Robert M. Daugherty, Craig D. Eerkes, H. Don Norton, Donald H. Swartz, and P. Mike Taylor to serve as directors, for one-year terms or until their successors are elected and qualified. All directors, with the exception of Robert M. Daugherty and H. Don Norton, are independent as defined in the National Association of Securities Dealers (“NASD”) rules. None of the independent directors is a party to any transaction or has a relationship or arrangement with the Company that is not disclosed under “Related Party Transactions and Business Relationships” below. The Company’s Articles do not provide for cumulative voting. It is the intent of the Company to have all directors attend the Company’s Annual Meeting, but the Company does not have a formal policy regarding attendance. All directors attended last year’s Annual Meeting.

The following is a description of the business experience for at least the past five years for each of the existing directors and director nominees:

| | |

| J. FRANK ARMIJO | | Director since 2006 |

J. Frank Armijo, age 44, is the Program Director and General Manager of West Coast Programs for Lockheed Martin Information Technology. Mr. Armijo served on the Columbia Trust Bancorp and Bank Board of Directors from October 15, 2003 until March 15, 2006, the effective date of the merger between the Company and Columbia Trust Bancorp. In connection with the merger, Mr. Armijo was appointed to the Board of the Company as of such effective date.

| | |

| IVAN T. CALL | | Director since 2007 |

Dr. Ivan T. Call, age 72, is Professor Emeritus in the Marriott School of Management at Brigham Young University where he taught Financial Management for 37 years before retiring in 2000. He served on the boards of directors for both Far West Bank and Far West Bancorporation, and as chairman of both boards from March 1997 to the effective date of the merger of Far West Bancorporation with the Company. He also serves on the investment committee of Deseret Mutual Benefit Association.

| | |

| KAY C. CARNES | | Director since 2006 |

Kay Carnes, age 68, is an Accounting Professor and Director of Graduate Business Programs at Gonzaga University. She is a Certified Public Accountant and Certified Internal Auditor. She is past chair of the Washington State Board of Accountancy and currently serves on the International Qualifications Appraisals Board which negotiates international accounting reciprocity under WTO and NAFTA agreements.

| | |

| ROBERT M. DAUGHERTY | | Director since 2004 |

Robert M. Daugherty, age 53, is the President and Chief Executive Officer of AmericanWest Bancorporation and its subsidiary, AmericanWest Bank. Mr. Daugherty previously held the position of President and Chief Executive Officer of Humboldt Bancorp of California. Prior to Humboldt, Mr. Daugherty held the

4

position of President, Chief Executive Officer and Chairman of the Board of Draper Bank & Trust of Utah. Previously, he held executive positions in both the Zions Bank and US Bank and currently serves as a board member for the Western Independent Bankers Association, the Western Independent Bankers Service Corporation, Pacific Coast Bankers Bank and the Washington Bankers Association.

| | |

| CRAIG D. EERKES | | Director since 2003 |

Craig D. Eerkes, age 55, is President and CEO of Sun Pacific Energy in Kennewick, Washington. He also currently serves as the president of Pecten Funding in Houston, Texas, as the chairman of the Petroleum Marketers Association in Alexander, Virginia, and as a director of Western Mutual Insurance Co. in Salt Lake City, Utah

| | |

| H. DON NORTON | | Director since 2007 |

H. Don Norton, age 61, is the Regional Director for AmericanWest’s Far West Bank division in Utah. Mr. Norton served as a Director and President & Chief Executive Officer of Far West Bank and Far West Bancorporation, prior to the completion of the merger between the Company and Far West Bancorporation earlier this year. In connection with the merger, Mr. Norton was appointed to the Board of Directors of the Company.

| | |

| DONALD H. SWARTZ | | Director since 1998 |

Donald H. Swartz, age 61, is the President of J & M Electric, Inc. Mr. Swartz was a founder of Grant National Bank in Ephrata, Washington in 1989 and served as a director and as Board Chair until its acquisition by AmericanWest Bancorporation in 1998.

| | |

| P. MIKE TAYLOR | | Director since 2001 |

P. Mike Taylor, age 63, a licensed civil engineer, is founder and President of Taylor Engineering, Inc., Spokane, Washington. He is Vice Chair and serves on the Executive Committee for Empire Health Services, a two-hospital, tertiary care medical system.

All of the above nominees have indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board.

| | |

| DONALD H. LIVINGSTONE | | Director since 2005 |

Donald H. Livingstone, age 64, is the Director of the Center for Entrepreneurship and tenured professor in the Marriott School of Business at Brigham Young University (BYU) in Provo, Utah. Prior to joining the University in 1994, Mr. Livingstone was a partner at Arthur Andersen in San Francisco (1966-88) and Los Angeles (1988-95), specializing in serving the banking industry. Mr. Livingstone has served as a director on boards of several banks, most recently as director and Chairman of the Audit Committee for AmericanWest Bancorporation and American Express Centurion Bank, a wholly-owned subsidiary of American Express Corporation. Mr. Livingstone also presently serves on the boards of Micrel Corporation, Sento Corporation and the Polynesian Cultural Center, serving as the Audit Committee chairman for these entities.

After two years of dedicated service on the Board of Directors, Mr. Livingstone has decided not to seek renomination and election to the Board at the end of his current term for personal reasons.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES.

5

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF MOSS ADAMS LLP AS INDEPENDENT AUDITORS FOR THE YEAR ENDED DECEMBER 31, 2007

Shareholder approval of the selection of Moss Adams LLP as our independent auditors is not required by law, by our Bylaws or otherwise. The Sarbanes-Oxley Act of 2002 requires the audit committee to be directly responsible for the appointment, compensation and oversight of the audit work and the Company’s independent auditors.

However, the committee is not bound by the shareholder vote. The committee will consider the results of the shareholder vote on this proposal and, in the event of a vote against ratification, will reconsider its selection of Moss Adams LLP. Even if Moss Adams LLPs appointment is ratified by the shareholders, the committee may, in its discretion, appoint a new independent registered public accounting firm at any time if it determines that such a change would be in the best interest of the Company and its shareholders.

Board Committees and Meetings

During the year ended December 31, 2006, the Board of Directors held 12 regular meetings and two Special Board meetings. The Board has an Audit and Compliance Committee (“Audit Committee”), a Compensation Committee and a Corporate Governance Committee. Each Board member attended at least 75% of the aggregate of the meetings of the Board and of the committees on which he/she served and that were held during the period for which he/she was a Board or Committee member.

The following table summarizes the membership of the Board and each of its standing committees, as well as the number of times each met during 2006. The following does not include information regarding Mr. Call or Mr. Norton as they were appointed to the Board in April, 2007, effective with the close of the merger with Far West Bank.

| | | | | | | | |

Director | | Board | | Audit & Compliance | | Compensation | | Corporate Governance |

Mr. J. Frank Armijo(1) | | þ | | | | þ | | þ |

Ms. Kay C. Carnes(2) | | þ | | þ | | | | |

Mr. Robert M. Daugherty | | þ | | | | | | |

Mr. Craig D. Eerkes | | Chair | | þ | | þ | | þ |

Mr. Donald H. Livingstone | | þ | | Chair | | | | |

Mr. Donald H. Swartz | | þ | | þ | | Chair | | |

Mr. P. Mike Taylor | | þ | | þ | | | | Chair |

Total Meetings held in 2006 | | 12(3) | | 9 | | 9 | | 5 |

| (1) | Mr. Armijo was appointed to the board effective March 2006. |

| (2) | Ms. Carnes was appointed to the board effective July 2006. |

| (3) | The board held two Special Board Meetings during 2006. |

The Audit Committee

The Audit Committee is comprised solely of independent directors (as defined in the NASD rules) and meets at least quarterly with the Company’s management and independent auditors to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements, recommend to the Board the independent auditors to be retained and receive and consider the auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee met nine times during the past year. A copy of the Audit Committee’s charter is located on the Company’s website:www.awbank.net.

Director Carnes is deemed by the Company to be an “audit committee financial expert.” As an Accounting Professor, Certified Public Accountant and Certified Internal Auditor, Ms. Carnes has both an understanding of

6

generally accepted accounting principles (GAAP) and the ability and experience to prepare, audit, evaluate and analyze financial statements which present the breadth and level of complexity of issues that the Company reasonably expects to be raised by its financial statements.

The Corporate Governance Committee

The Corporate Governance Committee is comprised solely of independent directors (as defined in the NASD rules) and is primarily responsible for considering and making recommendations to the Board concerning matters of corporate governance. This includes establishing the criteria for Board membership, recruiting and screening candidates for Board membership, recommending Director nominees for Board and shareholder approval, recommending Director compensation, making recommendations regarding committee assignments and functions, Board size and meetings, reviewing succession plans for the Chief Executive Officer (“CEO”) of the Company, and making recommendations to the Board with respect to the selection of the CEO of the Company.

The Committee’s policy for consideration of director candidates nominated by shareholders is to apply the Company’s rules for shareholder proposals which are included in this document under “Shareholder Proposals.” The Committee’s practice is to consider a Board candidate’s primary attributes of personal integrity and character, judgment, knowledge and leadership in a business or related setting, business acumen and other commitments. These factors are considered in the context of the Company’s needs at that point in time. Any proposed nomination, and any communications to the Board, should be directed to Mr. Taylor, the Chair of the Corporate Governance Committee. A copy of the Corporate Governance Committee’s charter is located on the Company’s website:www.awbank.net.

Compensation Committee

The Compensation Committee is comprised solely of independent directors (as defined in the NASD rules) and meets at least quarterly with the Company’s management to, among other things, review compensation and award levels, discuss individual performance of each member of executive management, approve compensation awards including salary adjustments, equity awards and bonus amounts. A copy of the Compensation Committee’s charter is located on the Company’s website:www.awbank.net.

Code of Ethics

The Company has adopted a Code of Ethics that is applicable to the officers, directors and employees of the Company, including the Company’s principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. The Code of Ethics is available on the Company’s website at www.awbank.net.

Compensation Discussion and Analysis

Terms

Throughout this proxy statement, the individuals who served as AmericanWest’s Chief Executive Officer and Chief Financial Officer during 2006, as well as the other officers included in the Summary Compensation Table on page 13, are referred to as the “named executive officers.” The term “Committee,” unless the context clearly indicates otherwise, refers to the Compensation Committee of the Company’s board of directors.

Compensation Philosophy and Objectives

We believe that the most effective executive compensation program is one which compensates executive management through a mix of base salary, cash bonus and equity compensation. We establish a “targeted overall compensation” for each executive officer with the following objectives:

| | • | | To remain competitive with comparable employers in seeking out superior employees in key positions; |

7

| | • | | To induce talented and experienced executives to join and remain with the Company; and |

| | • | | To align management’s incentives with the long-term interests of our shareholders, with the ultimate objective of creating and improving shareholder value. |

Based on the foregoing, the Committee has structured the Company’s annual cash and long-term non-cash compensation to motivate our top executives to achieve the business goals of the Company and reward them for achieving such goals.

Role of the Committee and the Chief Executive Officer in Compensation Decisions

The Compensation Committee annually reviews with the Chief Executive Officer his performance for the prior year and goals for the next succeeding year, and establishes his compensation and award levels. The Chief Executive Officer annually reviews the performance of each member of executive management, including the named executive officers, other than himself. His conclusions and recommendations based on those reviews are presented to the Committee, which can exercise its discretion in modifying the recommendations but, generally, accepts his recommendations with minor adjustments. The Chief Executive Officer’s recommendations include base salary adjustments, equity awards and target bonus amounts, the latter being, in 2006, a collective pool from which the Chief Executive Officer proposed to make cash bonus awards. Based upon the recommendation of the Chief Executive Officer, the Committee approves the compensation of and awards to all executive vice presidents, including all of the named executive officers.

Decisions regarding the non-equity compensation of all other officers of the Company are made by the Chief Executive Officer and his executive team, as appropriate. The Chief Executive Officer presents his recommendations to the Committee for equity awards for non-executive officers, for the Committee’s approval.

Elements of Targeted Overall Compensation

The key components of our executive compensation program consist of base salary, performance-based cash bonus, 401(k) plan, and equity-based incentives under our 2006 Equity Incentive Plan. To assist in establishing “targeted overall compensation”—i.e., the aggregate level of compensation that the Company will pay if performance goals are fully met—we periodically review the compensation of senior management at banking institutions on the West Coast of the United States that have market capitalization and asset size comparable to ours and which generally recruit individuals to fill executive management positions who are similar in skills and background to those we recruit. In 2006, this group of financial institutions included:

| | • | | Cascade Financial Corporation |

| | • | | Columbia Banking System, Inc. |

| | • | | Frontier Financial Corporation |

| | • | | Heritage Commerce Corp. |

| | • | | Vineyard National Bancorp |

The Committee periodically reviews the list of peer institutions and management internally develops data based on public information from proxy statements filed by these institutions with the SEC.

8

Chief Executive Officer and Chief Operating Officer

In the case of the Chief Executive Officer, his targeted overall compensation was established at the time of his initial recruitment and hiring in September 2004, which included a mix of base salary, first year guaranteed bonus and equity compensation levels. His equity compensation over the four-year term of his employment contract was established at the time of his hire. When reviewing his performance each year for purposes of his cash bonus for the past year’s performance and any annual adjustment to his base salary for the following year, the Committee considers:

| | • | | The performance of the Company and the extent of his attainment of pre-established performance goals over the prior year, and |

| | • | | The anticipated level of difficulty of replacing our Chief Executive Officer with someone of comparable experience and skill. |

Both subjective and objective factors enter into this decision. In 2006, the subjective factors included:

| | • | | Recruitment and development of an executive leadership team, including the EVP of Commercial Lending for Utah and a Chief Operating Officer, and |

| | • | | Continued improvement in the level of employee morale. |

In 2006, the objective factors were:

| | • | | Overall financial performance of the Company relative to the budget and our peers |

| | • | | Improvement in asset quality, including a reduction in the levels of non-performing and adversely classified loans |

| | • | | Regulatory safety and soundness examination ratings |

| | • | | Regulatory compliance examination ratings |

| | • | | Successful completion and integration of the Columbia Trust Bank acquisition |

| | • | | Successful launch of a new loan production office in Utah, and |

| | • | | Successful negotiation of the purchase of Far West Bank in Utah. |

At the same time, performance goals are established for 2007.

With respect to our Chief Operating Officer, we established his overall compensation when he was initially hired in September, 2006 by reviewing his immediately preceding compensation package for the same position at a similar-size financial institution and using that as a negotiation basis.

Base Salary for Other Senior Executives

Base salary ranges for all executive officers other than the CEO and COO are established in the same manner as for all other employees. We seek to establish base salary ranges for all employees which are comparable to those of other companies with which we compete for personnel. We have established a system of base salary ranges, which set minimum, midpoint and maximum amounts according to position and responsibility, by means of an internal point factor analysis process and evaluation of market data using software and data (Compease©) provided by HRN Management Group. Therefore, each executive officer has been assigned to an appropriate salary tier which takes into consideration the position's internal value as well as external comparisons to relevant positions in the companies provided us by HRN Management Group for comparison purposes. All but one of the Company’s executive vice presidents has been hired since our Chief Executive Officer joined the Company in September 2004, each being recruited to resolve in his or her area of responsibility very specific issues facing the Company at the time of his or her hire. Although the specific issues

9

facing each such executive officer varied according to his or her position, we viewed the entire management team as a single unit with responsibility to resolve credit quality, regulatory and cultural issues facing the Company when the new management was brought aboard. Thus, the overall amount and mix of compensation for each of the Company’s executive vice presidents is similar at the present time, with the exception of the Chief Operating Officer, whose responsibilities encompass a larger framework than any of the others and to whom some of the other executive vice presidents report. We believe that the initial credit quality, regulatory and culture issues facing new management are now substantially resolved and, therefore, beginning in 2007, the Company, through the Compensation Committee, intends to look at individual and Company-wide performance targets and tie adjustments in compensation to meeting such targets.

Equity Compensation

All stock options and restricted shares have been granted pursuant to the Company’s 2006 Equity Incentive Plan (“Plan”), which was approved by the shareholders at the Company’s 2006 Annual Meeting of Shareholders, or its predecessor, the AmericanWest Bancorporation 2001 Employee Incentive Stock Plan. The Plan provides the opportunity to design stock-based incentive compensation programs to:

| | • | | Promote high performance and achievement of corporate goals by directors and key employees, |

| | • | | Encourage the growth of shareholder value, |

| | • | | Allow key employees to participate in the long-term growth and profitability of the Company, and |

| | • | | Maintain the Company’s competitiveness with its peers with regard to total compensation. |

The exercise price of stock options under the Plan is the closing price of the Company common stock on the date such grants are approved by the Committee or, in cases where they are being offered to a potential employee prior to his or her hire, on the date of hire if that is after the grant approval date.

We believe that restricted stock provides a motivating form of incentive compensation while at the same time tying the financial interests of the recipients to the interests of the shareholders. In addition, using restricted stock permits us to issue fewer shares, thereby reducing potential dilution, than otherwise would be the case if equity incentive compensation was primarily in the form of stock options. Therefore, over the past two years, we have used grants of restricted stock (“Performance Shares”) as the principal equity compensation for our executive vice presidents. These grants have varied in amount from 5,000 to 15,000 Performance Shares, with the actual amount in a particular case depending upon:

| | • | | A subjective determination by the Chief Executive Officer and the Committee of what number would be required to entice the officer to enter into an employment agreement with the Company, and |

| | • | | A comparison with equity compensation granted to officers in comparable positions with competitive peer banking organizations. |

In granting these awards the Committee, as Administrator of the plans, may establish any conditions or restrictions it deems appropriate. It has been our philosophy to encourage our executive officers to remain with the Company for at least five years in order for them to benefit from restricted shares. Therefore, at the present time, grants of Performance Shares generally are cliff-vested at the end of a five year period so that the officer’s entire grant will lapse if he or she is not employed with the Company at the end of the five-year period (except for accelerated vesting upon a change in control of the Company). They generally are further conditioned on the Company’s performance so that, for each fiscal year for which the Company’s return on average assets (ROAA) does not equal at least 1.0% (which we believe to be the minimum acceptable level of return), 20% of the Performance Shares so granted will lapse. Since the target ROAA was not met in 2006, each of the named executive officers forfeited 20% of his or her previously granted Performance Shares. The Committee may consider other targets for future awards.

10

Bonuses

Annual cash bonus compensation for executive management is awarded after the completion of each fiscal year and, for 2006, was based primarily upon the progress of the Company as a whole during the year. No specific goals were established for this purpose during the year but, at the end of the fiscal year, a variety of factors were discussed by the Committee to gauge the Company’s success in 2006. These factors included return on average assets, return on equity, share price, overall shareholder value, specific accomplishments in regulatory matters and compliance, the opening of new branches, the improvements in credit quality and the acquisitions of both Columbia Trust and Far West Banks. These officers have been viewed by the Chief Executive Officer and the Board as a team working together to bring the Company out of regulatory restrictions and asset quality problems having their roots under prior management, and thus the Committee established equal incentive cash bonus amounts for all such executive officers in 2006.

Because the Company has substantially accomplished the goals established in 2004 for new management, we intend, beginning in 2007, to base executive management annual cash bonus compensation on individual job performance reviews which will include both subjective and objective criteria, the latter based upon goals set for the officer at the beginning of the annual review period (as may be modified by circumstances during the year) and the degree of their accomplishment by that officer during the year. These performance goals will be diverse, varying according to the respective responsibilities of the individual officer, in each case designed to be achievable while at the same time requiring growth over previous objectives. We may use other goals as well. However, the Company’s overall performance, including but not necessarily limited to profitability, growth, asset quality and regulatory matters, is expected to be a factor in the bonuses awarded each executive officer.

Employment Agreements

The Company has entered into employment agreements with each of the named executive officers and the other executive vice presidents. These agreements contain severance and change in control benefits designed to promote stability and continuity of executive management and to align the interests of our executive officers with those of our shareholders by enabling such executives to consider all alternatives that could be in the shareholder interests without having reason to be concerned about their individual futures. Detailed information regarding applicable payments under all such provisions for the named executive officers is provided under the heading “Disclosure Regarding Post-Termination and Change in Control Benefits.”

Perquisites and Other Personal Benefits

As a general rule, the Company does not provide named executive officers with perquisites or other personal benefits not generally available to all fulltime employees, other than modest amounts for an automobile allowance in some cases, relocation expenses and club memberships. We believe that relocation expenses are essential to recruiting talented officers from outside of our market area. We reimburse monthly dues for club memberships only where the memberships offer business development opportunities.

11

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the board of directors has reviewed and discussed the above Compensation Discussion & Analysis with management and, based on such review and discussion, has recommended to the board of directors that the Compensation Discussion & Analysis be included in the Company’s proxy statement.

Submitted by the Compensation Committee:

Donald H. Swartz, Chairman

J. Frank Armijo

Craig D. Eerkes

12

EXECUTIVE COMPENSATION

The following tables set forth information regarding compensation earned by, awarded or paid to our Principal Executive Officer (PEO), Robert M. Daugherty, Principal Financial Officer (PFO), Patrick J. Rusnak, and our three other most highly compensated executive officers whose total compensation exceeded $100,000 and who were serving as executive officers as of December 31, 2006.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | |

Name and principal Position (a) | | Year (b) | | Salary ($) (c) | | | Bonus ($) (d) | | Stock Awards(1) ($) (e) | | Option Awards(1)

($) (f) | | | Non-equity incentive plan

compensation ($) (g) | | Change in

pension

value and

non-

qualified

deferred

compen-

sation

earnings ($) (h) | | All other compensation ($) (i) | | | Total ($) (j) |

Robert M. Daugherty, | | 2006 | | 400,000 | | | 130,000 | | 53,436 | | 344,900 | (2) | | — | | — | | 16,000 | (3) | | 944,336 |

President and Chief Executive Officer (PEO) | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Patrick J. Rusnak | | 2006 | | 67,083 | (4) | | 18,675 | | 21,412 | | — | | | — | | — | | 102,621 | (5) | | 209,791 |

EVP/Chief Operating Officer (PFO) | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Gregory Hansen | | 2006 | | 154,374 | | | 37,000 | | — | | — | | | — | | — | | 17,996 | (6) | | 209,370 |

EVP/Director of Commercial Lending | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Diane L. Kelleher, | | 2006 | | 154,289 | | | 37,000 | | — | | — | | | — | | — | | 46,678 | (7) | | 237,967 |

EVP/Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Rick E. Shamberger | | 2006 | | 158,814 | | | 37,000 | | — | | 6,798 | | | — | | — | | — | | | 202,612 |

EVP/Chief Credit Officer | | | | | | | | | | | | | | | | | | | | | |

| (1) | The amounts in column (e) and column (f) reflect the compensation cost of the stock award and option award for the year 2006. The FAS 123(R) value is spread over the number of months of service required for the grant to vest which is referred to as the requisite service period in FAS 123(R).Seethe note to the AmericanWest Bancorporation Consolidated Financial Statements entitled “Stock Options” for a description of the assumptions made in determining FAS 123(R) values. |

| (2) | The impact of repricing Mr. Daugherty’s Non-Qualified stock option of 173,545 shares that were issued on September 20, 2004, from $18.07 to $18.71 reduced the compensation expense reflected in the table above; however, the Company did not recognize this reduction for income statement purposes. |

| (3) | The amount includes $7,200 in car allowance and $8,800 in 401-(k) employer match paid to Mr. Daugherty. |

| (4) | Mr. Rusnak joined the company on September 18, 2006. His annual base salary for 2006 was set at $230,000. The amount shown reflects base salary paid in 2006. |

| (5) | The amount includes $1,400 in car allowance, $2,435 in temporary living expense, $3,489 in travel expense related to moving, $11,060 in transporting personal effects, $33,350 in taxes paid on gross up of expenses and $50,887 in closing cost expenses paid to Mr. Rusnak. |

| (6) | The amount includes $5,634 in membership dues, $5,162 in 401-(k) employer match and $7,200 in car allowance paid to Mr. Hansen. |

| (7) | The amount includes $878 in membership dues, $6,830 in 401-(k) employer match, $4,359 in transporting personal effects and $34,140 in closing cost expenses paid to Ms. Kelleher. |

13

The following table sets forth information regarding all incentive plan awards granted to the named executive officers during 2006, including incentive plan awards (equity-based and non-equity based). Disclosure on a separate line item is provided for each grant of an award made to a named executive officer during the year. The amount of these awards that was expensed is shown in the Summary Compensation Table. Equity incentive-based awards are subject to a performance condition or a market condition as those terms are defined by FAS 123(R). Non-equity incentive plan awards are awards that are not subject to FAS 123(R) and are intended to serve as an incentive for performance to occur over a specified period.

Grants of Plan-Based Awards For the Fiscal Year Ended 2006

| | | | | | | | | | | | | | | | | | | | | | |

Name (a) | | Grant Date (b) | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards | | Estimated Future Payouts

Under Equity Incentive Plan

Awards | | All

other

stock

awards: number

of

shares

or stock

units (#) (i) | | All other

option awards:

number of

securities underlying options (#) (j) | | Exercise

or base price of

option

awards

($/Sh) (k) | | Grant

date

fair

value

of

stock

and

option

awards (l) |

| | | Threshold ($) (c) | | Target ($) (d) | | Maximum ($) (e) | | Threshold (#) (f) | | Target (#) (g) | | Maximum (#) (h) | | | | |

Robert M. Daugherty, | | 11/28/06 | | — | | — | | — | | — | | — | | — | | 5,433 | | — | | — | | 117,407 |

President and Chief Executive Officer (PEO) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Patrick J. Rusnak | | 9/26/06 | | — | | — | | — | | — | | 12,000 | | — | | 3,000 | | — | | — | | 321,150 |

EVP/Chief Operating Officer (PFO) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Greg Hansen | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

EVP/Director of Commercial Lending | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Diane L. Kelleher, | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

EVP/Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Rick E. Shamberger | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

EVP/Chief Credit Officer | | | | | | | | | | | | | | | | | | | | | | |

NARRATIVE:On November 28, 2006, the Company issued Mr. Daugherty a restricted stock award for 5,433 shares. The closing price of the Company’s stock on NASDAQ on the date of grant was $21.61. The shares vest as follows; 2,033 vest on January 2, 2007, 1,529 shares vest on September 20, 2007 if the Initial Measurement price is at least $18.71 and 1,871 shares vest on September 20, 2008 if the Initial Measurement Price is at least $18.07. If the Initial Measurement Price on September 20, 2008 if greater than $18.07, but less than $18.71, then the percentage vesting will equal the difference between the Initial Measurement Price and $18.07 divided by $0.64. If the Initial Measurement Price is less than $18.07, then no shares of stock in the tranche will vest. The Initial Measurement Price means the weighted average closing price of the Company’s common stock on the NASDAQ market for the five trading days immediately preceding the Initial Measurement Dates on September 20, 2007 (1,529 shares) and September 20, 2008 (1,871 shares). These shares contain restrictions on transferability and have no voting or dividend rights until vested.

On September 26, 2006, the Company issued Mr. Rusnak a restricted stock award for 15,000 shares. The closing price of the Company’s stock on NASDAQ on the date of grant was $21.41. The shares cliff vest on September 17, 2011, and 12,000 of the shares are subject to earlier forfeiture at a rate of 20% each year if certain annual performance targets for the Company are not met for fiscal years 2007 through 2010.

On May 23, 2005, Mr. Hansen was issued 7,500 Performance Shares. The closing price of the Company’s stock on NASDAQ on the trading date prior to the grant date was $19.32. On June 6, 2005, Ms. Kelleher and Mr. Shamberger were each issued 7,500 Performance Shares. The closing price of the Company’s stock on NASDAQ on the date of grant was $20.56. The performance shares issued to NEO’s were subject to an early

14

forfeiture rate of 20% each year if certain annual performance targets for the Company were not met. The compensation cost of the awards for the requisite service period 2006 was, respectively, $31,368, $31,368 and $34,272. The performance target set for the fiscal year 2006 was not met. As a result, each of these officers forfeited 20% of the restricted shares that would have otherwise been earned in 2006; therefore, no amount was reflected in the Stock Award Column (e) of the Summary Compensation Table.

On September 20, 2004, Mr. Daugherty received an award of 26,455 incentive options at $18.90 per share and 173,545 non-qualified options at $18.07 per share. The option for 173,545 non-qualified shares was amended as of November 28, 2006 to increase the exercise price on those shares vesting after December 31, 2004 to $18.71, which was the closing price on the grant date, September 20, 2004, to prevent the Option from being deemed “deferred compensation” under Section 409A of the Internal Revenue Code. Mr. Daugherty exercised 14,709 of the non-qualified options and 10,582 of the incentive options in 2005. [Note, since the options were awarded in 2004, they do not appear on the Summary Compensation Table, additionally, the income recognized on the exercises is not represented on the Option Exercises and Stock Vested Table.]

15

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth information on outstanding option and stock awards held by the named executive officers at December 31, 2006, including the number of shares underlying both exercisable and unexercisable portions of each stock option as well as the exercise price and expiration date of each outstanding option.

Outstanding Equity Awards at Fiscal Year-End

| | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

Name (a) | | Number of securities underlying unexercised options (#) exercisable (b) | | Number of securities underlying unexercised options (#) unexercisable (c) | | | Equity incentive plan

awards: number of securities

underlying unexercised unearned options (#) (d) | | Option exercise price ($) (e) | | Option expiration date (f) | | Number of

shares or units of stock that have not

vested (#) (g) | | Market

value of

shares or units of

stock that

have not vested(1) ($) (h) | | Equity incentive

plan

awards: number of unearned shares,

units or other

rights that have

not vested (#) (i) | | | Equity Incentive

plan awards: market

or payout

value of

unearned shares,

units or other

rights

that

have not vested(1) ($) (j) |

Robert M. Daugherty, | | 5,291 | | 10,582 | (2) | | — | | 18.90 | | 9/19/2014 | | — | | — | | — | | | — |

President and Chief Executive Officer (PEO) | | 59,418 | | 99,418 | (3) | | — | | 18.71 | | 9/19/2014 | | — | | — | | — | | | — |

| | — | | — | | | — | | — | | — | | — | | — | | 5,433 | (4) | | 131,587 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Patrick J. Rusnak | | — | | — | | | — | | — | | — | | — | | — | | 15,000 | (5) | | 363,300 |

EVP/Chief Operating Officer (PFO) | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Gregory Hansen | | — | | — | | | — | | — | | — | | — | | — | | 6,000 | (6) | | 145,320 |

EVP/Director of Commercial Lending | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Diane L. Kelleher, | | — | | — | | | — | | — | | — | | — | | — | | 6,000 | (7) | | 145,320 |

EVP/Chief Financial Officer | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Rick E. Shamberger | | 3,080 | | 770 | (8) | | — | | 17.79 | | 10/31/2012 | | — | | — | | — | | | — |

EVP/Chief Credit Officer | | 3,080 | | 770 | (9) | | — | | 17.79 | | 10/31/2013 | | — | | — | | — | | | — |

| | 600 | | 400 | (10) | | — | | 21.14 | | 2/16/2014 | | — | | — | | — | | | — |

| | — | | — | | | — | | — | | — | | — | | — | | 6,000 | (11) | | 145,320 |

| (1) | The closing market value as of the close December 31, 2006 was $24.22. This value was used in the calculation of the market value for the unvested restricted shares. |

| (2) | Future vesting of 5,291 shares on September 20, 2007 and 5,291shares on September 20, 2008. |

| (3) | Future vesting of 44,709 on September 20, 2007 and 54,709 on September 20, 2008. |

| (4) | Future vesting of 2,033 shares on January 1, 2007, 1,529 shares on September 20, 2007 and 1,871 shares on September 20, 2008. |

| (5) | Performance stock award will cliff vest on September 17, 2011. |

| (6) | Performance stock award will cliff vest on May 22, 2010. |

| (7) | Performance stock award will cliff vest on June 6, 2010. |

| (8) | Future vesting of 770 shares on October 31, 2007. |

| (9) | Future vesting of 770 shares on October 31, 2007. |

| (10) | Future vesting of 200 shares on February 16, 2007 and 200 shares on February 16, 2008. |

| (11) | Performance stock award will cliff vest on January 2, 2010. |

16

OPTION EXERCISES AND STOCK VESTED

The following table sets forth information regarding each exercise of stock options and vesting of restricted/performance stock during 2006 for each of the named executive officers on an aggregated basis:

Option Exercises and Stock Vested for the Fiscal Year-End

| | | | | | | | |

| | | Option Awards | | Stock Awards |

Name (a) | | Number of shares acquired on

exercise (#) (b) | | Value realized

on exercise ($) (c) | | Number of shares acquired on

vesting (#) (d) | | Value realized

on Vesting ($) (e) |

Robert M. Daugherty, | | — | | — | | — | | — |

President and Chief Executive Officer (PEO) | | | | | | | | |

| | | | |

Patrick J. Rusnak, | | — | | — | | — | | — |

EVP/Chief Operating Officer (PFO) | | | | | | | | |

| | | | |

Gregory Hansen, | | — | | — | | — | | — |

EVP/Director of Commercial Lending | | | | | | | | |

| | | | |

Diane L. Kelleher, | | — | | — | | — | | — |

EVP/Chief Financial Officer | | | | | | | | |

| | | | |

Rick E. Shamberger, | | — | | — | | — | | — |

EVP/Chief Credit Officer | | | | | | | | |

There were no options exercised by the named executive officers in the fiscal year 2006, nor did any of the granted restricted/performance shares vest during fiscal year 2006.

17

PENSION BENEFITS

The following table sets forth the actuarial present value of each named executive officer’s accumulated benefit under each defined benefit plan, assuming benefits are paid at normal retirement age based on current levels of compensation. The table also shows the number of years of credited service under each such plan, computed as of the same pension plan measurement date used in the company’s audited financial statements for the year ended December 31, 2006. The table also reports any pension benefits paid to each named executive officer during the year.

Pension Benefits

| | | | | | | | |

Name (a) | | Plan

name (b) | | Number of years credited service (#) (c) | | Present value of Accumulated benefit ($) (d) | | Payments

during last fiscal year ($) (e) |

Robert M. Daugherty, | | — | | — | | — | | — |

President and Chief Executive Officer (PEO) | | | | | | | | |

| | | | |

Patrick J. Rusnak, | | — | | — | | — | | — |

EVP/Chief Operating Officer (PFO) | | | | | | | | |

| | | | |

Gregory Hansen, | | — | | — | | — | | — |

EVP/Director of Commercial Lending | | | | | | | | |

| | | | |

Diane L. Kelleher, | | — | | — | | — | | — |

EVP/Chief Financial Officer | | | | | | | | |

| | | | |

Rick E. Shamberger, | | — | | — | | — | | — |

EVP/Chief Credit Officer | | | | | | | | |

At the present time, AWBC does not have any pension benefits for any of the named executive officers.

18

NONQUALIFIED DEFERRED COMPENSATION

The following table sets forth annual executive and Company contributions under non-qualified defined contribution and other deferred compensation plans, as well as each named executive officer’s withdrawals, earnings and fiscal-year end balances in those plans.

Non-Qualified Deferred Compensation at and for the Fiscal Year 2006

| | | | | | | | | | |

Name (a) | | Executive

contributions

in last FY ($) (b) | | Registrant

contributions

in last FY ($) (c) | | Aggregate earnings

in last FY ($) (d) | | Aggregate

withdrawals/

distributions ($) (e) | | Aggregate

balance at

last FYE ($) (f) |

Robert M. Daugherty, | | — | | — | | — | | — | | — |

President and Chief Executive Officer (PEO) | | | | | | | | | | |

| | | | | |

Patrick J. Rusnak, | | — | | — | | — | | — | | — |

EVP/Chief Operating Officer (PFO) | | | | | | | | | | |

| | | | | |

Gregory Hansen, | | — | | — | | — | | — | | — |

EVP/Director of Commercial Lending | | | | | | | | | | |

| | | | | |

Diane L. Kelleher, | | — | | — | | — | | — | | — |

EVP/Chief Financial Officer | | | | | | | | | | |

| | | | | |

Rick E. Shamberger, | | — | | — | | — | | — | | — |

EVP/Chief Credit Officer | | | | | | | | | | |

At the present time, AWBC does not have any deferred compensation or deferred compensation plan for any of the named executive officers.

19

DISCLOSURE REGARDING POST-TERMINATION AND CHANGE IN CONTROL BENEFITS

The Company has entered into employment agreements (“Agreements”) with each of its named executive officers which provide for financial benefits in the event of termination under the circumstances described below. In addition, stock options and restricted shares granted to the named executive officers provide for accelerated vesting and waiver of performance-based conditions for awards not previously in the event of a change in control.

The triggering events under the Agreements which provide for payments to the named executive officers include:

| | • | | Resignation for “good reason” |

| | • | | Termination “without cause” and |

| | • | | Termination following a “change in control” |

These are defined terms in each of the agreements, with the following meanings:

Good Reason—termination by the executive because of a material reduction in compensation or benefits or a material reduction in title or responsibilities; a relocation of the executive’s principal office so that his or her one-way commuting distance is increased by more than 40 miles; failure of the Company (or a successor) to assume and perform obligations under the agreement; or any material breach of the agreement by the Company.

Without Cause—termination for any reason other than the executive’s willful misfeasance or gross negligence in the performance of job duties; conviction of a crime in connection with job duties; conduct that is demonstrably and significantly harmful to the Company; or the inability of the executive to qualify for a surety bond.

Change in Control—termination without cause or for good reason occurring within a specified period of time after a change in the ownership or effective control, or the ownership of a substantial portion of the assets, of the Company or AmericanWest Bank (other than any internal reorganization).

The following table sets forth the amounts payable for termination of the named executive officers on the basis of a resignation for good reason or termination without cause (assuming an effective termination date and change in control as of December 31, 2006) related to a change in control and the current agreement termination dates:

| | | | | | |

Name | | Payment Basis | | Amount

Payable ($) | | Termination

Date |

R. Daugherty(1) | | Base salary for two years, plus amount bonus paid in prior 12 months | | 1,015,000 | | 9/19/2008 |

P. Rusnak(2) | | Base salary for the greater of the remaining term of the agreement or two years, plus amount of prior 12 months | | 624,466 | | 9/17/2009 |

G. Hansen(2) | | Base salary for two years, plus amount bonus paid in prior 12 months | | 345,000 | | 5/22/2007 |

D. Kelleher(2) | | Base salary for two years, plus amount bonus paid in prior 12 months | | 345,000 | | 6/5/2007 |

R. Shamberger(2) | | Base salary for two years, plus amount bonus paid in prior 12 months | | 380,750 | | 1/27/2007 |

| (1) | Executive is entitled to payment in the event of a voluntary termination within one year following a change in control or in the event of termination without cause or for good reason occurs within two years following a change in control. |

| (2) | Executive is entitled to payment in the event termination with out cause or for good reason occurs within two years following a change in control. |

20

The Agreements provide for the payments noted in the table above to be made in equal monthly installments, in accordance with the Company’s standard payroll practice and, if so required under the provisions of Section 409A of the Internal Revenue Code, to commence on the first day of the seventh month following the last day of employment.

The employment agreements and equity award agreements also provide for the acceleration of vesting for equity awards, including stock option and restricted stock grants to named executive officers under certain termination events. For Mr. Daugherty, all unvested equity awards will become immediately vested upon a change in control or in the event of a termination without cause or for good reason. In the case of all other named executive officers, all unvested equity awards not previously forfeited will become immediately vested upon termination without cause or for good reason, including such termination occurring within two years of any change in control.

The following table sets for the value of unvested stock options and restricted stock grants based on the December 31, 2006 closing NASDAQ price of $24.22 per share:

| | | | | | |

Name | | Stock Options | | Restricted Stock | | Total Equity Awards |

R. Daugherty | | 604,089 | | 131,587 | | 735,677 |

P. Rusnak(1) | | — | | 363,300 | | 363,300 |

G. Hansen(1) | | — | | 181,650 | | 181,650 |

D. Kelleher(1) | | — | | 181,650 | | 181,650 |

R. Shamberger(1) | | 11,134 | | 181,650 | | 192,784 |

| (1) | Each officer received a restricted stock award of 1,500 shares granted on January 2, 2007. The closing price on the date of grant was $24.22. The awards were not included on the Grants of Plan-Based Awards For the Fiscal Year Table. |

The Agreements limit the amount of any payments made to any named executive officer as the result of a change in control, including the value of acceleration of any equity awards and continuation of employee benefits, to the maximum amount permissible to avoid an “excess parachute payment” under Section 280(g) of the Internal Revenue Code.

The following table sets forth the amounts payable for termination of the named executive officers on the basis of a resignation for good cause of termination without cause unrelated to a change in control. The amounts shown in the table assumes the date of termination was December 31, 2006:

| | | | | | |

Name | | Payment Basis | | Amount

Payable ($) | | Termination

Date |

R. Daugherty | | Base salary for remaining contract term | | 853,630 | | 9/19/2008 |

P. Rusnak | | Base salary for greater of remaining term or one year | | 643,141 | | 9/17/2009 |

G. Hansen | | Base salary for greater of remaining term or one year | | 194,500 | | 5/22/2007 |

D. Kelleher | | Base salary for greater of remaining term or one year | | 194,500 | | 6/5/2007 |

R. Shamberger | | Base salary for greater of remaining term or one year | | 202,375 | | 1/27/2007 |

The Agreements provide for the payments noted in the table above to be made in equal monthly installments, in accordance with the Company’s standard payroll practices, and if so required under the provisions of Section 409A of the Internal Revenue Code, to commence on the first day of the seventh month following the last day of employment.

The Agreements also provide for continuation of employee welfare benefits for the named executive officers (and any dependents, if applicable) for a period 90 days following termination without cause or for good reason whether or not such is in connection with a change in control. To the extent it is not feasible for the

21

Company to provide such coverage under existing group plans, it must provide alternative comparable coverage. The Company’s obligation to provide continuation of employee welfare benefits will terminate if the named executive officer becomes eligible for comparable coverage in connection with new employment. The estimated value of this benefit is approximately $3,400 per individual for a period of 90 days.

Each of the agreements contains covenants prohibiting the named executive officer from soliciting any of the Company’s employees or customers to work for a competing financial institution (within a defined geographic area) following termination for any reason. The non-solicitation provisions are effective for a period equal to the greater of one year following the date of termination or the balance remaining under the employment agreement as of the date of termination. In addition, each of the agreements provides for the named executive officer to strictly comply with the Company’s non-disclosure policies related to proprietary information while employed and subsequent to termination. Proprietary information includes such items as trade secrets, customer and prospective customer information and information related to the Company’s affiliates and subsidiaries.

As the date of this report, no triggering events had occurred for any named executive officers.

Director Compensation

The Company uses a combination of cash and stock-based incentive compensation to attract and retain qualified individuals to serve on our board of directors. In setting director compensation the Board, upon the recommendation of its Corporate Governance Committee, considers the significant amount of time that directors expend in fulfilling their duties to the Company as well as the position each holds on the board (see discussion of fees below). Directors are subject to a minimum share ownership requirement, as established from time to time by the board upon the recommendation of the Corporate Governance Committee, following a reasonable phase-in period for new directors.

Cash Compensation Paid to Board Members

For the fiscal year ended December 31, 2006, members of the board of directors who are not employees of the Company received an annual cash retainer of $14,400 and an attendance fee of $650 for regular board meetings and $100 for special meetings of the board. Committee members received $300 per committee meeting except for members of the Audit & Compliance Committee who received $500 per meeting. Committee chairs received $150 per committee meeting. The chairman of the board received $250 per board meeting and the chairman of the Audit Committee receives an additional monthly payment of $150. The only director who was an employee of the Company during 2006 was the Chief Executive Officer, who received no compensation for his service as a director.

Stock Options

Each non-employee director receives an annual stock option grant in an amount determined by the board of directors upon the recommendation of the Corporate Governance Committee. On April 25, 2006, each of the five independent directors nominated to serve on the board for the upcoming year was granted 3,000 stock options at the closing price of the Company’s common stock on the date of grant, or $25.92. Such options were immediately vested and exercisable over 10 years. Until an option is exercised, shares subject to options cannot be voted nor do they receive dividends or dividend equivalents.

Director Fee Continuation Agreements

On January 1, 2003, Mr. Swartz and Mr. Taylor entered into individual Director Fee Continuation Agreements with the Company. Each such Director Fee Agreement states that the named Director will receive a monthly payment of $500 for 120 months beginning the next month after he retires.

22

The following table sets forth information regarding the compensation received by each of the Company’s directors during the year ended December 31, 2006:

Director Compensation—2006

| | | | | | | | | | | | | | |

Name (a) | | Fees earned

or paid in

cash ($) (b) | | Stock

awards ($) (c) | | Option awards(1) ($) (d) | | Non-equity

incentive plan

compensation ($) (e) | | Change in pension value and non- qualified deferred

compensation

earnings(2) ($) (f) | | All other

compensation ($) (g) | | Total ($) (h) |

J. Frank Armijo(3) | | 24,550 | | — | | 25,388 | | — | | — | | — | | 49,938 |

Kay C. Carnes(4) | | 12,150 | | — | | — | | — | | — | | — | | 12,150 |

Craig D. Eerkes | | 30,100 | | — | | 25,388 | | — | | — | | — | | 55,488 |

James Rand Elliott(5) | | 6,050 | | — | | — | | — | | 2,187 | | — | | 8,237 |

Allen F. Ketelsen(6) | | 3,650 | | — | | — | | — | | — | | — | | 3,650 |

Donald H. Livingstone | | 29,700 | | — | | 25,388 | | — | | — | | — | | 55,088 |

Donald H. Swartz | | 34,200 | | — | | 25,388 | | — | | 2,187 | | — | | 61,775 |

P. Mike Taylor | | 30,850 | | — | | 25,388 | | — | | 5,753 | | — | | 61,991 |

| (1) | The amounts in column (d) reflect the compensation cost of the stock award for the year 2006. The FAS 123(R) value is spread over the number of months of service required for the grant to vest, which is referred to as the requisite service period in FAS 123(R).See note to the AmericanWest Bancorporation Consolidated Financial Statements entitled “Stock Options” for a description of the assumptions made in determining FAS 123(R) values. The options were 100% vested upon the date of grant. |

| (2) | Reflects increase in accrual for benefit under Director Fee Continuation Agreement. |

| (3) | Mr. Armijo joined the board effective March, 2006. |

| (4) | Ms. Carnes joined the board member effective July, 2006. |

| (5) | Mr. Elliott resigned from the board effective April, 2006. |

| (6) | Mr. Ketelsen resigned from the board effective February, 2006. |

23

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the shares of common stock beneficially owned as of March 10, 2007, by each Director and each Named Executive Officer, the Directors and Executive Officers as a group and those persons known to beneficially own more than 5% of AmericanWest Bancorporation’s common stock, which is the only class of stock with issued and outstanding shares.

For purposes of this table, in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (“Exchange Act”), a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting and/or investment power with respect to such security. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power.

| | | | | | | | | | | | | |

Name of Beneficial Owner | | Direct

Beneficial

Ownership | | | Indirect

Beneficial

Ownership | | | Exercisable

Options(1) | | Total

Beneficial

Ownership(2) | | Percent

of

Class | |

J. Frank Armijo | | 5,392 | | | — | | | 3,902 | | 9,294 | | * | |

Ivan T. Call | | 206,277 | (3) | | — | | | — | | 206,277 | | 1.81 | % |

Kay C. Carnes | | 885 | | | — | | | — | | 885 | | * | |

Robert M. Daugherty | | 27,324 | | | — | | | 64,709 | | 92,033 | | * | |

Craig D. Eerkes | | 24,617 | | | — | | | 8,722 | | 33,339 | | * | |

Donald H. Livingstone | | 2,714 | | | — | | | 6,000 | | 8,714 | | * | |

H. Don Norton | | 704,374 | (4) | | — | | | — | | 704,374 | | 6.17 | % |

Donald H. Swartz | | 49,329 | | | 879 | (5) | | 14,400 | | 64,608 | | * | |

P. Mike Taylor | | 8,668 | | | — | | | 14,400 | | 23,068 | | * | |

Gregory Hansen | | — | | | — | | | — | | — | | * | |

Diane L. Kelleher | | 1,000 | | | — | | | — | | 1,000 | | * | |

Patrick J. Rusnak | | — | | | — | | | — | | — | | * | |

Rick E. Shamberger | | — | | | — | | | 6,960 | | 6,960 | | * | |

| | | | | | | | | | | | | |

All Directors & Executive Officers as a group (15 persons) | | 1,030,580 | | | 879 | | | 121,545 | | 1,153,004 | | 10.09 | % |

| | | | | | | | | | | | | |

| * | Represents holdings of less than one percent |

| (1) | Shares of common stock subject to options currently exerciseable or exercisable within 60 days after March 10, 2007 are deemed outstanding for the purpose of computing the percentage of ownership interest of the person holding such options, but are not deemed outstanding for the purpose of computing the percentage ownership for any other person. |

| (2) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, based on factors including voting and investment power with respect to shares. Applicable percentage ownership is based on 11,424,721 aggregate shares outstanding as of March 10, 2007. |

| (3) | Represents 3,675 shares of Far West common stock that will be exchanged to receive approximately 206,277 shares of AmericanWest Bancorporation common stock following the close of the merger. |

| (4) | Represents 12,549 shares of Far West common stock that will be exchanged to receive approximately 704,374 shares of AmericanWest, Bancorporation common stock following the close of the merger. |

| (5) | Includes 649 shares held as custodian for Mr. Swartz’s grandchildren over which Mr. Swartz’s spouse shares voting and investment power and 248 shares held by Mr. Swartz’s son. |

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission (“Commission”). The rules promulgated by the Commission under Section 16(a) of the Exchange Act require those persons to furnish the Company with copies of all reports filed with the Commission pursuant to Section 16(a).

24

Based solely upon a review of Forms 3, Forms 4 and Forms 5 and amendments thereto furnished to the Company pursuant to Rule 16(a)(3)(e) during the year ended December 31, 2006, and written representations of certain of its directors and officers that no Forms 5 were required to be filed, the Company believes that all directors, executive officers and beneficial owners of more than 10% of the common stock have filed with the Commission on a timely basis all reports required to be filed under Section 16(a) of the Exchange Act.

Executive Officers

The following table sets forth the age, position and the business experience during the past five years of the executive officers of the Company. All executive officers are elected annually and serve at the discretion of the Board of Directors.

| | | | |

Name | | Age | | Position and Principal Occupation for the Past Five Years |

Robert M. Daugherty | | 53 | | President and Chief Executive Officer of the Company and Bank since September 2004. From April 2002 until July 2004, Mr. Daugherty was President and Chief Executive Officer of Humboldt Bancorp. |

Gregory Hansen | | 48 | | Executive Vice President/Director of Commercial Lending of the Company and Bank since 2005. Previously employed by U.S. Bank where, during his tenure, he was Team Leader for its Spokane Commercial Lending Team. Employment terminated as of March 27, 2007. |

Diane L. Kelleher | | 47 | | Executive Vice President & Chief Financial Officer of the Company and Bank since 2005. Prior to joining the Company, Ms. Kelleher served as SVP, Treasury Division for Washington Mutual from February 1997 to May 2005. Employment terminated as of March 27, 2007. |

R. Blair Reynolds | | 66 | | Executive Vice President & General Counsel of the Company and Bank since 2004. Prior to joining the Company, Mr. Reynolds served as Senior Vice President & General Counsel for Humboldt Bancorp. Prior to that, he was a sole practitioner specializing in banking and commercial law in his law practice in Walnut Creek, California. |

Patrick J. Rusnak | | 43 | | Executive Vice President/Chief Operating Officer of the Company and Bank since 2006. From May 2005 until June 2006, Mr. Rusnak served as Executive Vice President/Chief Operating Officer of Western Sierra Bancorp. Prior to that he served as Executive Vice President of Umpqua Holdings Corporation and Executive Vice President/Chief Financial Officer of Humboldt Bancorp. |

Rick E. Shamberger | | 46 | | Executive Vice President & Chief Credit Officer of the Company and Bank since 2003. Previously employed by U.S. Bank for more than 20 years with experience in credit risk management. |

Nicole Sherman | | 36 | | Executive Vice President/Director of Retail Banking of the Company and Bank since 2004. Prior to joining the Company, Ms. Sherman was CEO for Power Trainings International. Prior to PTI, she was employed by Zions First National Bank overseeing the corporate learning and development department. |

25

Securities Authorized for Issuance Under Equity Compensation Plans. The following table provides information as of December 31, 2006 with respect to AWBC’s compensation plans under which shares of the Company’s common stock are authorized for issuance:

| | | | | | | | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | | Weighted average

exercise price of

outstanding

options, warrants

and rights | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column)(a) |

| | | (a) | | | (b) | | (c) |

Equity compensation plans approved by security holders | | 444,049 | | | $ | 16.51 | | 285,073 |

Equity compensation plans not approved by security holders | | — | | | | — | | — |

Total | | 444,049 | (1) | | $ | 16.51 | | 285,073 |