UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

¨ Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement | | | | |

| | |

¨ Definitive Additional Materials | | | | |

| | |

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 | | | | |

AMERICANWEST BANCORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

AMERICANWEST BANCORPORATION

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

| | | | |

| TIME | | 5:00 p.m. on Tuesday, April 26, 2005 |

| |

| PLACE | | Northwest Museum of Arts and Culture |

| | | 2316 West First Avenue |

| | | Spokane, Washington 99204 |

| |

| ITEMS OF BUSINESS | | 1. To elect eight directors to hold office until the next annual meeting of shareholders. |

| |

| | | 2. To take action on any other business that may properly be considered at the Meeting or any adjournment thereof. |

| |

| RECORD DATE | | You may vote at the Meeting if you were a shareholder of record at the close of business on March 23, 2005. |

| |

| VOTING BY PROXY | | If you cannot attend the Meeting, you may vote your shares by completing and promptly returning the enclosed proxy card in the envelope provided. |

| |

| ANNUAL REPORT | | AmericanWest Bancorporation’s 2004 Annual Report, which is not part of the proxy soliciting material, is enclosed. |

| | |

| | | | | By Order of the Board of Directors, |

| | |

| | | | | /s/ C. Tim Cassels

|

| | | | | Secretary |

This Notice of Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about March 31, 2005.

AMERICANWEST BANCORPORATION

41 West Riverside Avenue

Suite 400

Spokane, Washington 99201

PROXY STATEMENT

Annual Meeting of Shareholders

April 26, 2005

We are providing these proxy materials in connection with the solicitation by the Board of Directors of AmericanWest Bancorporation (“Company”) of proxies to be voted at the Company’s Annual Meeting of Shareholders to be held on April 26, 2005, and at any adjournment of the meeting.

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

Who may vote at the meeting?

The Board of Directors of the Company (“Board”) has set March 23, 2005, as the record date for the meeting. If you were the owner of Company common stock at the close of business on March 23, 2005, you may vote at the meeting. You are entitled to one vote for each share of common stock you held on the record date, including shares:

| | • | | Held for you in an account with a broker, bank or other nominee (shares held in “street name”) or |

| | • | | Credited to your account in the Company’s Employee Stock Ownership Plan (“ESOP”). |

Each share of your common stock has one vote on each matter to be voted on.

How many shares must be present to hold the meeting?

A majority of the Company’s outstanding common shares as of the record date must be present at the meeting in order to hold the meeting and conduct business. On the record date, there were approximately 10,360,129 shares of Company common stock outstanding. Shares are counted as present at the meeting if the owner of the shares:

| | • | | is present and votes in person at the meeting; or |

| | • | | has properly submitted a proxy card. |

1

Shareholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered shareholders who are present and entitled to vote, and will count toward the quorum.

What proposals will be voted on at the meeting?

There is one proposal scheduled to be voted on at the meeting:

| | • | | Election of the eight nominees to the Board of Directors to hold office until the next annual meeting of shareholders. |

How many votes are required to approve the proposal?

If a quorum exists at the Annual Meeting, the eight nominees receiving the largest number of votes cast by the shares entitled to vote in the election will be elected as directors. Consequently, abstentions and broker non-votes will have no impact on whether or not the nominees will be elected to the Board.

How are votes counted?

You may either vote “FOR” or to “WITHHOLD” authority to vote for each nominee for the Board of Directors. If you withhold authority to vote on the election of all directors, your shares will not be considered entitled to vote on the election of directors. If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee.

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. In this situation, a “broker non-vote” occurs. Shares that constitute broker non-votes are not considered as entitled to vote on the proposal in question, thus effectively reducing the number of shares needed to approve the proposal.

How does the Board recommend that I vote?

The Board recommends that you vote your shares “FOR” each of the director nominees (Proposal 1).

How do I vote my shares without attending the meeting?

Without attending the meeting, you may vote:

| | • | | By Mail – You may vote by mail by marking your selections on the proxy card, signing and dating your proxy card and mailing it in the enclosed postage-paid envelope. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. |

2

For shares held in street name, you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee, or, in most cases, submit voting instructions by telephone or the Internet. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you have directed.

How do I vote my shares in person at the meeting?

If you are a shareholder of record, to vote your shares at the meeting you should bring the enclosed proxy card or proof of identification. You may vote shares held in street name at the meeting only if you obtain a signed proxy card from the record holder (broker or other nominee) giving you the right to vote the shares.

Even if you plan to attend the meeting, we encourage you to vote by mail, so your vote will be counted even if you later decide not to attend the meeting.

What does it mean if I receive more than one proxy card?

It means you hold shares registered in more than one account. To ensure that all your shares are voted, sign and return each proxy card.

May I change my vote?

Yes. If you have voted by mail (and have not voted through your broker), you may change your vote and revoke your proxy card by:

| | • | | Sending a written statement to that effect to the Secretary of the Company, which must be received prior to the meeting; |

| | • | | Submitting a later properly signed proxy card; or |

| | • | | Voting in person at the Annual Meeting. (Note: simply attending the meeting will not of itself, revoke a proxy.) |

3

PROPOSAL 1 – ELECTION OF DIRECTORS

Directors and Nominees

The Company’s Articles of Incorporation, as amended (“Articles”), allow the Board of Directors or shareholders to set the number of directors on the Board within a range of 5 to 25. The Articles also allow the Board to fill vacancies created on the Board. The Board by resolution has set the number of directors to serve on the Board of Directors at eight directors. Directors are elected for terms of one year or until their successors are elected and qualified.

At the annual meeting, eight directors are to be elected, each to serve until the next annual meeting of shareholders or until his successor is elected and qualified.

The Board of Directors has nominated the eight current directors, Gary M. Bolyard, Robert M. Daugherty, Craig D. Eerkes, James Rand Elliott, Donald H. Livingstone, Allen Ketelsen, Donald Swartz, and P. Mike Taylor, as directors, to serve a one-year term or until their successors are elected and qualified. All directors, with the exception of Robert M. Daugherty, are independent as defined in the National Association of Securities Dealers (“NASD”) rules. The Company’s Articles do not provide for cumulative voting.

The following is a description of the business experience for at least the past five years for each of the nominees:

| | |

| GARY M. BOLYARD | | Director since 2004 |

Gary M. Bolyard, age 69, is a retired banker with 37 years of experience. For 21 years he served as President of two banks - First Mutual Bank and Central Washington Bank. He was also President of Central Washington Bancorp. When Central Washington Bank was sold to InterWest Bancorp, the last three years of his career were spent as Vice Chairman of Corporate Development. He retired from that position in 1999. During his career, Mr. Bolyard served as a Director on seven bank boards, most recently with Pacific Northwest Bank and Bancorp until October 2003.

| | |

| ROBERT M. DAUGHERTY | | Director since 2004 |

Robert M. Daugherty, age 51, is the President and Chief Executive Officer of AmericanWest Bancorporation and its subsidiary, AmericanWest Bank. Mr. Daugherty previously held the position of President and Chief Executive Officer of Humboldt Bancorporation and Humboldt Bank of California. Prior to Humboldt, Mr. Daugherty held the position of President, Chief Executive Officer and Chairman of the Board of Draper Bank & Trust of Utah. In addition, he has spent time in the Zions and US Bank organizations. Mr. Daugherty was appointed to this position and elected to the Board by the other directors in September 2004.

4

| | |

| CRAIG D. EERKES | | Director since 2004 |

Craig D. Eerkes, age 53, is President of Sun Pacific Energy, Inc. Mr. Eerkes has served on three bank boards. He was instrumental in founding American National Bank in Kennewick, Washington in 1980 and served as Chairman of the bank from 1984 until its sale to First Hawaiian Bank in 1996, at which time he became Vice Chairman of the Northwest Region. During 2000, he also served as a Board Member of Columbia Trust Bank.

| | |

| JAMES RAND ELLIOTT | | Director since 1996 |

James Rand Elliott, age 54, is a General Partner of Premium Finance Company. Mr. Elliot previously served on the board of Home Security Bank prior to its merger with AmericanWest Bank in 2001.

| | |

| DONALD H. LIVINGSTONE | | Director since 2005 |

Donald H. Livingstone, age 62, is the Director of the Center for Entrepreneurship and tenured professor in the Marriot School of Business at Brigham Young University (BYU) in Provo, Utah. Prior to joining the University in 1994, Mr. Livingstone was a partner at Arthur Andersen in San Francisco (1966-88) and Los Angeles (1988-95), specializing in serving the banking industry. Mr. Livingstone has served as a director on several boards, most recently as director and the Chairman of the Audit Committee for Humboldt Bancorp in Roseville, California and California Independent Bancorp in Yuba City, California. Mr. Livingstone also served as Vice Chairman of the Audit Committee overseeing Brigham Young University, BYU-Hawaii and BYU-Idaho, and has served on the boards of four public companies and mutual funds.

| | |

| ALLEN KETELSEN | | Director since 2003 |

Allen Ketelsen, age 48, is the President of Ketelsen Construction. Mr. Ketelsen previously served on the board of Bank of the West of Walla Walla, Washington prior to its acquisition by AmericanWest Bancorporation in 1998.

| | |

| DONALD SWARTZ | | Director since 1998 |

Donald Swartz, age 59, is the President of J & M Electric, Inc. Mr. Swartz served on the board of Grant National Bank prior to its acquisition by AmericanWest Bancorporation in 1998.

| | |

| P. MIKE TAYLOR | | Director since 2001 |

P. Mike Taylor, age 61, is a civil engineer and the President of Taylor Engineering, Inc. Mr. Taylor currently serves on three non-profit boards in Spokane, Washington.

All the nominees have indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the proxy card.

5

THE BOARD RECOMMENDS A VOTEFOR EACH OF THE NOMINEES.

Board Committees and Meetings

During the year ended December 31, 2004, the Board of Directors held twelve meetings. The Board has an Audit and Compliance Committee (“Audit Committee”), a Compensation Committee, and a Corporate Governance Committee. Each Board member attended at least 75% of the aggregate of the meetings of the Board and of the committees on which he served and that were held during the period for which he was a Board or Committee member.

The Audit Committee is comprised solely of independent directors (as defined in the NASD rules) and meets at least quarterly with the Company’s management and independent auditors to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements, recommend to the Board the independent auditors to be retained and receive and consider the auditors’ comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee met five times during the last year.

The Compensation Committee acts as an ongoing advisory group to the Board of Directors on executive compensation policies and procedures and other compensation-related items that are corporate in nature (i.e., company-wide 401(k) plans, stock option plans, benefit plans, etc.). The Compensation Committee is comprised solely of independent directors (as defined in the NASD rules) and met four times during the last year.

The Corporate Governance Committee is primarily responsible for considering and making recommendations to the Board concerning its size, functions and needs. This includes establishing the criteria for Board membership, recruiting and screening candidates for Board membership, recommending Director nominees for Board and shareholder approval, recommending Director compensation, making recommendations regarding committee functions and Board meetings, reviewing succession plans for the Chief Executive Officer (“CEO”) of the Company, and making recommendations to the Board with respect to the selection of the CEO of the Company. The Corporate Governance Committee met eight times during the last year.

The Corporate Governance Committee is comprised solely of independent directors as defined in the NASD rules. The Committee’s policy for consideration of director candidates nominated by security holders is to apply the Company’s rules for shareholder proposals which are included in this document under “Shareholder Proposals”. The Committee’s practice is to consider a Board candidate’s primary attributes of personal integrity and character, judgment, knowledge and leadership in a business or related setting, business acumen, and other commitments. These factors are considered in the context of the Company’s needs at a point in time. Any proposed nomination, and any communications to the Board, should be directed to Mr. Taylor, the Chair of the Governance Committee. (A copy of the Corporate Governance Committee’s charter is located on the Company’s website: www.awbank.net.)

6

The following table summarizes the membership of the Board and each of its standing committees as well as the number of times each met during 2004. The following table does not include information regarding Mr. Livingstone since he was appointed to the Board in January 2005. Mr Livingstone is a member of the Audit and Corporate Governance Committees.

| | | | | | | | |

| | | Board

| | Audit

| | Compensation

| | Corporate

Governance

|

| Mr. Bolyard | | Member | | Member | | Member | | Member |

| | | | |

| Mr. Colley (1) | | Member | | | | | | |

| | | | |

| Mr.Daugherty (2) | | Member | | | | | | |

| | | | |

| Mr. Eerkes | | Member | | | | Member | | Member |

| | | | |

| Mr. Elliott | | Member | | Member | | Chair | | |

| | | | |

| Mr. Gardner (3) | | Member | | | | | | Member |

| | | | |

| Mr. Ketelsen | | Member | | | | Member | | |

| | | | |

| Mr. Swartz | | Chair | | Chair | | | | Member |

| | | | |

| Mr. Taylor | | Member | | Member | | | | Chair |

| | | | |

| Number of 2004 Meetings | | 12 | | 5 | | 4 | | 8 |

| (1) | Mr. Colley resigned as a Director September 2004. |

| (2) | Mr. Daugherty was elected to the Board of Directors September 2004. |

| (3) | Mr. Gardner retired as a Director October 2004. |

7

Directors’ Compensation

Directors of the Company receive a monthly retainer of $1,000 and $500 for each meeting of the Board of Directors attended. The Chairman of the Board receives $700 for each meeting of the Board of Directors attended. Members of the Audit Committee receive $300 for each meeting attended and Directors also receive $100 for all other committee meetings attended. During the year ended December 31, 2004, the Company paid an aggregate of $159,300 in director fees pursuant to such arrangements.

Directors of the Company have been eligible to receive options under the 1995 and 2001 Incentive Stock Option Plans. The plans are described in the Executive Compensation section under the heading “1995 and 2001 Incentive Stock Option Plans.”

In addition, on January 1, 2003, Mr. Swartz and the Company entered into a director fee continuation agreement pursuant to which Mr. Swartz will receive $500 per month for 120 months beginning the next month after he retires.

Compensation Committee Interlocks and Insider Participation

At December 31, 2004, the Compensation Committee consisted of James Rand Elliott, Chairman, Allen Ketelsen, Craig D. Eerkes, and Gary M. Bolyard.

8

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the number of shares of the Company’s common stock beneficially owned as of March 23, 2005, by shareholders owning more than five percent of the Company’s common stock, the Company’s current Directors and nominees for Director, those persons who served as directors during the calendar year, Executive Officers identified in the Summary Compensation Table below, and all Directors and Executive Officers as a group.

| | | | | | |

Name

| | Number of Shares

Beneficially

Owned(1)

| | | Percent of

Shares

Outstanding

| |

| Five Percent Shareholders: | | | | | | |

| | |

Banc Funds Co. LLC Suite 1680 208 South LaSalle Street Chicago, Illinois 60604 | | 653,954 | | | 6.37 | % |

Wesley E. Colley | | 517,342 | | | 5.04 | % |

| | |

| Directors: | | | | | | |

| | |

Gary M. Bolyard | | 1,100 | | | * | |

| | |

Craig D. Eerkes | | 6,578 | | | * | |

| | |

James Rand Elliott | | 47,339 | (2) | | * | |

| | |

Robert J. Gardner | | 80,136 | (3) | | * | |

| | |

Allen Ketelsen | | 17,820 | | | * | |

| | |

Donald H. Livingstone | | 1,500 | | | * | |

| | |

Donald Swartz | | 66,776 | (4) | | * | |

| | |

P. Mike Taylor | | 26,550 | | | * | |

| | |

| Executive Officers: | | | | | | |

| | |

Robert M. Daugherty | | 19,174 | | | * | |

| | |

Rick E. Shamberger | | 3,480 | | | * | |

| | |

C. Tim Cassels | | 9,860 | | | * | |

| | |

Wade A. Griffith | | 12,804 | | | * | |

| | |

All Executive Officers, Directors and Nominees as a Group (12) | | 292,017 | | | 2.84 | % |

| * | Less than 1% of shares outstanding. |

| (1) | Share amounts reflect stock dividends, including the 10% dividend declared January 27, 2004. The amounts shown also include the following amount of common stock which the indicated individuals have the right to acquire within 60 days through the exercise of options granted pursuant to the Company’s 1995 and 2001 Incentive Stock Option Plans: Mr. Elliott 19,895 shares; Mr. Ketelsen |

9

4,000 shares; Mr. Swartz 13,640 shares; Mr. Taylor 15,902 shares; Mr. Daugherty 19,174 shares; Mr. Shamberger 3,480 shares; Mr. Cassels 8,860 shares, Mr. Griffith 7,998 shares and all executive officers and directors as a group, 92,949 shares. Shares held in accounts under the Company’s ESOP, as to which the holders have voting power but not investment power, are also included as follows: Mr. Colley 2,740 shares, Mr. Griffith 2,940 and all executive officers and directors as a group, 5,680 shares.

In accordance with Rule 13d-3 under the Exchange Act, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of common stock if he or she has voting and/or investment power with respect to such security. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power as follows:

| (2) | Includes 4,723 shares held of record by Mr. Elliott’s spouse and 5,074 shares held of record by Premium Finance of which he serves as a general partner. |

| (3) | Includes 17,827 shares held of record by Gardner Logging and Trucking, Inc. and 5,550 shares held of record by Mr. Gardner’s spouse. Mr. Gardner retired as a director in October 2004. |

| (4) | Includes 3,918 shares held of record by J&M Electric, a company which he controls. |

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 (“Exchange Act”) requires the Company’s directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission (“Commission”). The rules promulgated by the Commission under Section 16(a) of the Exchange Act require those persons to furnish the Company with copies of all reports filed with the Commission pursuant to Section 16(a).

Based solely upon a review of Forms 3, Forms 4 and Forms 5 and amendments thereto furnished to the Company pursuant to Rule 16(a)(3)(e) during the year ended December 31, 2004, and written representations of certain of its directors and officers that no Forms 5 were required to be filed, the Company believes that all directors, executive officers and beneficial owners of more than 10% of the common stock have filed with the Commission on a timely basis all reports required to be filed under Section 16(a) of the Exchange Act, except that Wesley E. Colley, James Rand Elliott, Donald Swartz, Allen Ketelsen, Robert J. Gardner, Rick E. Shamberger, C. Tim Cassels and P. Mike Taylor each inadvertently filed one report late covering one stock option grant.

10

Executive Officers Who Are Not Directors

The following table sets forth the age, position, and the business experience during the past five years of those executive officers of the Company who are not also directors or nominees for director of the Company. As of December 31, 2004, all executive officers were appointed and serve at the discretion of the Company.

| | |

Name and Age

| | Current Position with the Company and Prior Five Years Business Experience

|

| Rick E. Shamberger, 44 | | Executive Vice President & Chief Credit Officer of the Company since 2003. Previously employed by a major regional bank for more than 20 years. |

| |

| C. Tim Cassels, 35 | | Executive Vice President and Chief Financial Officer of the Company since 2002. Previously employed by a community bank for 9 years. |

| |

| Wade A. Griffith, 48 | | Senior Vice President and Chief Administrative Officer of the Company since 1996. |

11

EXECUTIVE COMPENSATION

The following table sets forth the cash and non-cash compensation for each of the last three fiscal years ended December 31, 2004, 2003, and 2002, awarded to or earned by the Chief Executive Officer and the other most highly compensated executive officers of the Company, whose total compensation in 2004 exceeded $100,000.

Summary Compensation Table

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long-Term

Compensation Awards

| | All Other

Compensa-

tion(4)

|

Name and Position

| | Year

| | Salary

| | Bonus(2)

| | Other Annual

Compensation(1)

| | Securities Underlying

Options/ SARs(3)

| |

Wesley E. Colley* President and Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 252,916

216,000

209,000 | | $

$

$ | 60,000

58,000

62,000 | |

| —

—

— | | 4,000

3,300

4,400 | | $

$

$ | 106,617

100,284

73,668 |

| | | | | | |

Robert M. Daugherty** President and Chief Executive Officer | | 2004

2003

2002 | | $

| 89,603

—

— | |

| —

—

— | |

| —

—

— | | 200,000

—

— | | $

| 51,135

—

— |

| | | | | | |

C. Tim Cassels*** Exec. Vice President and Chief Financial Officer | | 2004

2003

2002 | | $

$

$ | 101,400

97,000

7,500 | | $

| 27,667

—

— | |

$

| —

15,000

— | | 4,000

12,100

— | | $

$

| 3,980

1,449

— |

| | | | | | |

Rick E. Shamberger**** Executive Vice President and Chief Credit Officer | | 2004

2003

2002 | | $

$

| 130,838

20,833

— | | $

| 40,000

—

— | |

| —

—

— | | 1,000

7,700

— | |

| —

—

— |

| | | | | | |

Wade A. Griffith Senior Vice President and Chief Administrative Officer | | 2004

2003

2002 | | $

$

$ | 90,000

90,000

90,000 | | $

$

$ | 27,667

29,000

31,000 | |

| —

—

— | | 2,000

2,750

3,630 | | $

$

$ | 3,657

2,531

2,340 |

| * | Mr. Colley retired on September 15, 2004 |

| ** | Mr. Daugherty was appointed President and Chief Executive Officer on September 20, 2004. It is the Company’s policy to report Annual Compensation based on amounts paid to such executive officer during the calendar year. In January 2005, Mr. Daugherty received a $150,000 bonus which will be recorded in the compensation table for 2005. |

| *** | Mr. Cassels was hired on December 1, 2002. |

| **** | Mr. Shamberger was hired on October 31, 2003. |

| (1) | Does not include amounts attributable to miscellaneous benefits received by executive officers, including the use of company-owned automobiles and the payment of certain club dues. In the opinion of management, the costs to the Company of providing such benefits to any individual executive officer during the year ended December 31, 2004, did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for the individual. |

12

| (2) | Bonus amounts represent W-2 earnings as reported. In 2005, named executives will receive bonuses in the amount of $150,000, $25,000, $50,000 and $10,000 for Messrs. Daugherty, Cassels, Shamberger and Griffith, respectively. |

| (3) | Represents options to acquire shares of common stock that were granted under stock option plans. |

| (4) | Represents the value attributed to the named executive officer during the year pursuant to agreements entered into between the Bank and such officers as part of the Bank’s salary continuation plan, Company 401(k) match and ESOP contributions. Additionally, Mr. Colley was paid $100,000 as part of the Separation Agreement between him and the Company. Furthermore, Mr. Daugherty was paid $51,135 for certain expenses related to his relocation. |

Salary Continuation Agreements. The Bank and its predecessor companies entered into Executive Salary Continuation Agreements with certain of its directors and employees, including certain named executive officers. Under the terms of the respective agreements, the director or officer will receive an annual sum based on his salary or director’s fee from the Company, payable on a monthly basis, for a period of up to fifteen years upon retirement. Mr. Colley is receiving $72,000 per year under this agreement.

Employment Agreements.The Company entered into an Employment Agreement with Mr. Daugherty on September 20, 2004, and has a term of four years. Under the terms of the Employment Agreement, Mr. Daugherty is paid a salary of $300,000 annually which will be increased annually, taking into consideration Mr. Daugherty’s results for the most recent performance period and other relevant factors. Mr. Daugherty’s bonus in 2005 will be $150,000 per the terms of the Employment Agreement and will be at least $100,000 in 2006 provided the Return on Average Assets for the Company is at least 1.0% in 2005. Mr. Daugherty was granted 200,000 stock options in 2004 per the terms of the Employment Agreement.

The Employment Agreement provides that, in the event of a change of control, he will receive an amount equal to two (2) times Mr. Daugherty’s then-current annual base salary, plus an amount equal to his bonus for the year immediately preceding the effective date of any such change in control.

13

Option Grants in Last Fiscal Year. The following table sets forth information concerning the grant of stock options to the Chief Executive Officer and the other named executive officers during the year ended December 31, 2004.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | | | | |

Individual Grants

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price

Appreciation for Option

Term(2)

|

Name

| | Number of Shares Underlying

Options Granted (1)

| | % of Total Options Granted to

Employees in Fiscal Year

| | | Exercise Price ($/Share)

| | Expiration

Date

| | 5%

| | 10%

|

Wesley E. Colley | | 4,000 | | 1.02 | % | | $ | 21.14 | | 3/28/13 | | $ | 23,362 | | $ | 51,625 |

Robert M. Daugherty | | 26,455 | | 50.79 | % | | $ | 18.90 | | 9/20/14 | | $ | 138,141 | | $ | 305,255 |

Robert M. Daugherty | | 173,545 | | 50.79 | % | | $ | 18.07 | | 9/20/14 | | $ | 866,407 | | $ | 1,914,534 |

Rick E. Shamberger | | 2,000 | | 0.25 | % | | $ | 21.14 | | 2/16/14 | | $ | 5,841 | | $ | 12,906 |

C. Tim Cassels | | 2,000 | | 1.02 | % | | $ | 21.14 | | 2/16/13 | | $ | 11,681 | | $ | 25,812 |

C. Tim Cassels | | 2,000 | | 1.02 | % | | $ | 21.14 | | 2/16/14 | | $ | 11,681 | | $ | 25,812 |

Wade A. Griffith | | 2,000 | | 0.51 | % | | $ | 21.14 | | 2/16/14 | | $ | 11,681 | | $ | 25,812 |

| (1) | The options vest in annual increments beginning at the time the agreement is signed. Each option was granted under the Company’s 2001 Incentive Stock Option Plan. No share appreciation rights (SARs) were granted. |

| (2) | The hypothetical dollar gains under these columns result from calculations required by the Securities and Exchange Commission rules. The gains are based on assumed rates of annual compound stock price appreciation of 5% and 10% from the date the options were granted over the full option term. The actual value, if any, the executive officers may realize will depend on the spread between the market price and the exercise price on the date the option is exercised. Actual gains, if any, on stock options exercised and common stock holding are dependent upon future performance of the Company and overall stock market conditions. There can be no assurance that the amounts reflected in this table will be achieved. |

Option Exercise/Value Table. The following information with respect to options exercised during the year ended December 31, 2004, and remaining unexercised at the end of 2004, is presented for the Chief Executive Officer and the other named executive officers.

14

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND YEAR-END OPTION VALUES

| | | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on

Exercise(#)

| | Value

Realized ($)

| | Number of Securities Underlying Unexercised Options at Year-End

| | Value of Unexercised In-the-Money Options at Fiscal Year - End(1)

|

| | | | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Wesley E. Colley | | 154,550 | | $ | 1,855,723 | | 146,412 | | — | | $ | 1,565,000 | | | — |

Robert M. Daugherty | | — | | | — | | 19,174 | | 180,826 | | $ | 39,208 | | $ | 374,834 |

C. Tim Cassels | | — | | | — | | 5,640 | | 10,460 | | | 41,091 | | | 61,637 |

Rick E. Shamberger | | — | | | — | | 3,280 | | 5,420 | | $ | 7,577 | | $ | 11,365 |

Wade A. Griffith | | — | | | — | | 6,872 | | 5,501 | | $ | 66,779 | | $ | 32,716 |

| (1) | On December 31, 2004, the closing price of common stock was $20.25. For purposes of the foregoing table, stock options with an exercise price less than that amount are considered to be “in-the-money” and are considered to have a value equal to the difference between this amount and the exercise price of the stock option multiplied by the number of shares covered by the stock option. |

Employee Stock Ownership Plan

The Company maintains an employee stock ownership plan and trust, known as the Employee Stock Ownership Plan (“Plan”), for the benefit of employees of the Company and its subsidiaries. The Plan became effective January 1, 1989, and is intended to enable participating employees to share in the growth and prosperity of the Company and thereby accumulate funds for retirement needs. The Plan is qualified under Section 401(a) of the Internal Revenue Code of 1986, as amended (“Code”), as a stock bonus plan. Employees of the Company or its subsidiaries who are 21 years of age or older become eligible for participation in the Plan in any Plan Year after achieving 1,000 hours or more of service.

At December 31, 2004, the Plan owned 268,509 shares of common stock of the Company, representing approximately 2.59% of the then outstanding shares. At such date, the Plan had no outstanding debt.

The Company makes annual contributions to the trust created under the Plan (for which the Company receives a deduction) and the trust invests such contributions and trust earnings in common stock of the Company. Contributions to the Plan in 2004 totaled $159,996.

15

1995 and 2001 Incentive Stock Option Plans

The Company presently maintains two stock option plans, known as the 1995 Incentive Stock Option Plan (“1995 Plan”) and the 2001 Incentive Stock Option Plan (“2001 Plan”). The 1995 Plan was approved by the shareholders on May 24, 1995. The 2001 Plan was approved by the shareholders on May 29, 2001, to replace the 1995 Plan. Both plans provide for the issuance of stock options intended to qualify under Section 422 of the Code, and options that are not qualified under the Code. The 2001 Plan provides for the granting of Performance Shares. Key individuals of the Company and its subsidiaries (including directors, executive officers, and advisors or consultants to the Company) are eligible to receive grants of options or performance shares.

All shares have been issued in the form of options under the 1995 Plan, but that Plan continues to apply to any outstanding options granted under the 1995 Plan. A balance of 237,310 shares remains available for issuance in the form of options and performance shares under the 2001 Plan.

Further, as part of the merger with Latah Bancorporation, Inc. effective July 31, 2002, the Company assumed the options that had been issued by Latah to its directors and officers pursuant to its stock option plans. Options to purchase 94,001 shares of Company common stock are presently outstanding under these options, separate from the Company’s 1995 and 2001 plans as described above, and will be exercised, terminated or expire in accordance with the terms of the options and the Latah plans.

REPORT OF THE COMPENSATION COMMITTEE(1)

The Compensation Committee of the Company is responsible for establishing and implementing all compensation policies of the Company and its subsidiaries, as well as setting the compensation for the executive officers of the Company’s subsidiaries. The Committee is also responsible for evaluating the performance of the Chief Executive Officer of the Company and approving an appropriate compensation level. The Chief Executive Officer evaluates the performance of all corporate officers and recommends to the Committee individual compensation levels for approval by the Committee.

The Company believes that the compensation of its executive officers and other key personnel should reflect and support the goals and strategies that the Company has established.

Compensation Philosophy. There are two principal objectives in determining executive compensation: (1) to attract, reward and retain key executive officers, and (2) to motivate executive officers to perform to the best of their abilities and to achieve short-term and long-term corporate objectives that will contribute to the overall goal of enhancing stockholder value. In furtherance of these objectives, the Committee has adopted the following policies:

| | • | | The Company will compensate competitively with the practices of other leading companies in the related fields; |

| (1) | This section is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

16

| | • | | Performance at the corporate, subsidiary and individual executive officer levels will determine a significant portion of compensation; |

| | • | | The attainment of realizable but challenging objectives will determine performance-based compensation; and |

| | • | | The Company will encourage executive officers to hold substantial, long-term equity stakes in the Company so that the interest of executive officers will coincide with the interest of stockholders; accordingly, stock options, performance shares and incentives will constitute a significant portion of compensation. |

Elements of Executive Compensation. The elements of the Company’s compensation of executive officers are: (1) annual cash compensation in the form of base salary and performance bonuses, the latter based on the Company achieving targeted levels performance established by the Committee for the fiscal year and the executive officer’s individual performance; (2) long-term incentive compensation in the form of stock options granted under the Company’s 1995 Incentive Stock Option Plan and the 2001 Incentive Stock Option Plan; (3) long-term incentive compensation in the form of performance share awards under the 2001 Incentive Stock Plan; and (4) other compensation and employee benefits generally available to all employees of the Company, such as health insurance and the employer contribution under the Company’s Profit Sharing and 401(k) Plan.

Base salary is determined by considering the overall performance of each executive officer with respect to the duties and responsibilities assigned. Salary surveys of other community banks are reviewed and factored into the process to ensure fair rates of compensation.

During the year ended December 31, 2004, the base salary paid to Wesley E. Colley, the former President and Chief Executive Officer of the Company was $252,916. Mr. Colley also received a performance bonus of $60,000 paid in 2004 based on his achieving the bonus objectives established by the Committee for 2003. This resulted in total compensation of $312,916 for 2004. The Committee believes the compensation paid to Mr. Colley during the fiscal year is appropriate based on competitive salary surveys and the performance of the Company.

A recruiting firm was engaged to assist the search process for a new President and Chief Executive Officer and to provide the Compensation Committee with guidance regarding the appropriate compensation package based on peer bank holding companies of similar size. It was the Compensation Committee’s and Board’s belief that, in order to attract the most qualified and best possible candidate, a competitive compensation package was essential. Accordingly, the Compensation Committee negotiated a four-year employment agreement with Robert M. Daugherty that included a base salary of $300,000, specific performance based bonus opportunities, which included a payment of a bonus of $150,000 in January of 2005, relocation costs and a multi-year grant of stock options.

17

The amount of options granted to an employee is based on the employee’s performance and relative responsibilities within the Company. Options may have a deferred vesting and will not be exercisable prior to vesting.

During the year ended December 31, 2004, the Committee granted stock options totaling 393,816 shares to employees of the Company and its subsidiaries.

|

COMPENSATION COMMITTEE: |

|

James Rand Elliott (Chair) |

Allen Ketelsen |

Gary M. Bolyard |

Craig D. Eerkes |

RELATED PARTY TRANSACTIONS AND BUSINESS RELATIONSHIPS

Some of the Company’s directors and executive officers were customers of the Bank during 2004 and had transactions with the Bank in the ordinary course of business. In addition, some of the Company’s directors and executive officers are officers, directors or shareholders of corporations or members of partnerships, which were customers of the Bank during the last fiscal year and had transactions with the Bank in the ordinary course of business. All loans included in such transactions were made in the ordinary course of business, were on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with other persons, and in the opinion of management, did not involve more than any normal risk of collectibility or present other unfavorable features. The amount of loans outstanding as of December 31, 2004 issued to directors, executive officers, and their affiliates was approximately $1,024,000.

AUDIT COMMITTEE MATTERS(1)

During calendar year 2004, the Audit Committee was comprised by Mr. Swartz, Chairman, Mr. Taylor, Mr. Bolyard, and Mr. Elliott. On January 25, 2005, Mr. Donald Livingstone was appointed as a director of the Audit Committee. Mr. Livingstone is deemed an audit committee financial expert within the meaning of Item 401(h), and independent within the meaning of Item 7(d)(3)(iv), of Regulation S-K. In 2004, Mr. Bolyard was the audit committee financial expert within the meaning of Item 401(h), and independent within the meaning of Item 7(d)(3)(iv), of Regulation S-K

Audit Committee Charter. The Audit Committee operates pursuant to a written charter approved by the Company’s Board of Directors. Each member of the Audit Committee is deemed “independent” in accordance with regulations under the Security Exchange Act of 1934, and the current listing standards of the National Association of Securities Dealers. The Audit

| (1) | This section is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

18

Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent accountants, the internal audit department and management of the Company.

Report of the Audit Committee. With respect to the Company’s audited financial statements for the year ended December 31, 2004, the Audit Committee has:

| | • | | completed its review and discussion of the Company’s 2004 audited financial statements with management; |

| | • | | discussed with the independent auditors, Moss Adams LLP, the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including, matters related to the conduct of the audit of the Company’s financial statements; |

| | • | | received written disclosures, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, indicating all relationships, if any, between the independent auditor and its related entities and the Company and its related entities which, in the auditor’s professional judgment, reasonably may be thought to bear on the auditors’ independence, and the letter from the independent auditors confirming that, in its professional judgment, it is independent from the Company and its related entities, has discussed with the auditors the auditors’ independence from the Company, and has considered whether the provision of non-audit services is compatible with maintaining their independence; and |

| | • | | recommended to the Board of Directors, based on its review and discussions with management and discussions with the independent auditors, that the Company’s audited financial statements for the year ended December 31, 2004 be included in the Company’s Annual Report on Form 10-K. |

| | |

| Audit Committee consisting of: | | Donald Swartz, Chair |

| | | P. Mike Taylor |

| | | Gary M. Bolyard |

| | | James Rand Elliott |

| | | Donald H. Livingstone |

19

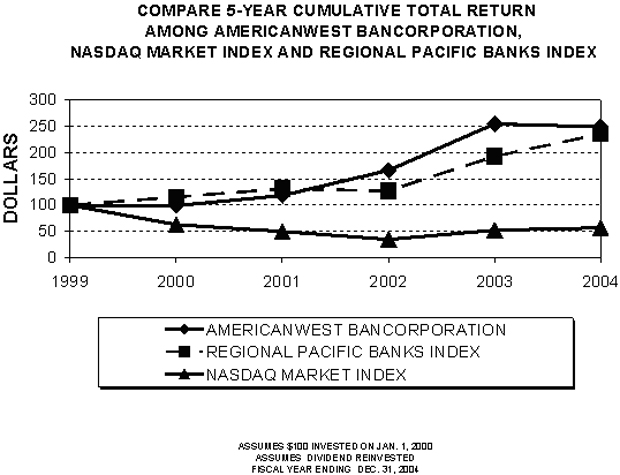

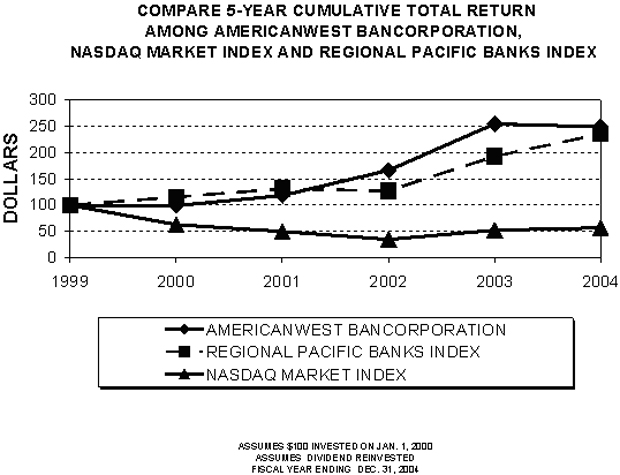

SHAREHOLDER RETURN PERFORMANCE GRAPH(1)

The following graph compares the cumulative total shareholder return on the Company’s common stock during the period beginning December 31, 1999, and ending December 31, 2004, with the cumulative total return on the Regional Pacific Banks Index, and the NASDAQ Market Index for the same period. The stock price information shown on the graph is not necessarily indicative of future price performance.

Comparison of Five Year Cumulative Return *

Total Return Performance

| * | CoreData, Inc. is the source of the graph and the accompanying table. |

| (1) | This section is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing |

20

INDEPENDENT AUDITORS

The Audit Committee selected Moss Adams LLP as its independent auditors for the current year and for the year ended December 31, 2005.

Fees Billed To the Company by Moss Adams LLP During 2004 and 2003

Audit Fees. The aggregate fees billed by Moss Adams LLP for the audit of the Company’s annual consolidated financial statements for the year ended December 31, 2004 and the review of the consolidated financial statements included in the Company’s Forms 10-Q for 2004 were $260,599 compared to $131,282 for the year ended December 31, 2003.

Audit Related Fees.Audit related fees for 2004 were $20,270 and consisted mainly of benefit plan audits. Audit related fees for 2003 were $30,338 and consisted mainly of advice related to FDICIA and benefit plan audits.

Tax Fees.The aggregate fees billed by Moss Adams LLP for tax fees for the year ended December 31, 2004 were $27,955 compared to $65,322 for the year ended December 31, 2003. These fees include tax planning, cost segregation services, tax rehabilitation credit analysis, and state tax analysis.

All Other Fees. The aggregate fees billed to the Company for all other services rendered by Moss Adams LLP for the year ended December 31, 2004 and 2003 were $0.

All fees for the year ended December 31, 2004 were pre-approved by the Audit Committee.

It is anticipated that a representative of Moss Adams will be attending the meeting with an opportunity to make a statement, if any, and to respond to appropriate questions.

OTHER INFORMATION

Expenses of Solicitation

The Company will bear the costs of soliciting proxies, including the reimbursement to record holders of their expenses in forwarding proxy materials to beneficial owners. Directors, officers and regular employees of the Company, without extra compensation, may solicit proxies personally or by mail, telephone, facsimile or electronic mail.

Shareholder Proposals

Under the Company’s Bylaws, no business may be brought before an annual meeting unless it is specified in the notice of the meeting or is otherwise brought before the meeting by or at the direction of the Board or by a shareholder entitled to vote who has delivered notice to the Company (containing certain information specified in the Bylaws) not less than 100 and not more than 150 days prior to the first anniversary of the date of the Company’s Proxy Statement released to shareholders in connection with the previous year’s annual meeting. These

21

requirements are separate from and in addition to the Commission’s requirements that a shareholder must meet in order to have a shareholder proposal included in the Company’s proxy statement.

Shareholders interested in submitting a proposal for inclusion in the proxy materials for the Annual Meeting of Shareholders in 2006 may do so by complying with the requirements of the Rules and Regulations promulgated by the Securities and Exchange Commission applicable to such shareholder proposals. To be eligible for inclusion, shareholder proposals must be received by the Company’s Secretary no later than December 15, 2005.

“Householding” of Documents

The Company is sending one annual report and proxy statement to eligible shareholders who share a single address unless the Company receives instructions to the contrary from any shareholder at that address. This practice, known as “householding,” is designed to reduce the Company’s printing and postage costs. If a shareholder of record residing at an address with other shareholders of record wishes to receive a separate annual report or proxy statement in the future, he or she may contact the Company’s transfer agent, American Stock Transfer & Trust Company (“AST”), 59 Maiden Lane – Plaza Level, New York, New York 10038, or call (800) 937-5449. An eligible shareholder of record receiving multiple copies of the Company’s annual report and proxy statement can request householding by contacting the Company at the same address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures. Even if your household has received only one annual report and one proxy statement, a separate proxy card has been provided for each shareholder account. Each proxy card should be signed, dated, and returned in the enclosed self-addressed envelope.

Other

The Company’s 2004 Annual Report, including financial statements, is being sent to shareholders of record as of March 23, 2005, together with this Proxy Statement.

The Company will furnish to shareholders without charge a copy of its Annual Report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission, upon receipt of written request addressed to AmericanWest Bancorporation, Investor Relations, 41 West Riverside, Suite 400, Spokane, Washington 99201.

The Board of Directors knows of no other matters to be presented at the Annual Meeting. If any other business properly comes before the Annual Meeting or any adjournment thereof, the proxies will vote on that business in accordance with their best judgment.

|

| By Order of the Board of Directors, |

|

/s/ C. Tim Cassels

|

| Secretary |

22

ANNUAL MEETING OF SHAREHOLDERS OF

AMERICANWEST BANCORPORATION

April 26, 2005

Please date, sign and mail

your proxy card in the

envelope provided as soon

as possible.

ò Please detach along perforated line and mail in the envelope provided.ò

The Board of Directors recommends a vote “FOR” Proposal 1.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

| | | | | | | | |

1. Election of Directors: | | | | | | THIS PROXY AUTHORIZE(S) EACH OF THE PERSONS NAMED ON THE REVERSE TO VOTE AT HIS OR HER DISCRETION ON ANY OTHER MATTER THAT MAY COME BEFORE THE MEETING OR ANY ADJOURNMENT THEREOF. |

| | | | | NOMINEES: | | | |

| ¨ | | FOR ALL NOMINEES | | O Gary M. Bolyard | |

| | | | | O Robert M. Daugherty | | |

| ¨ | | WITHHOLD AUTHORITY | | O Craig D. Eerkes | | IF THIS CARD CONTAINS NO SPECIFIC VOTING INSTRUCTIONS, MY (OUR) SHARES WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATION OF THE BOARD OF DIRECTORS. |

| | FOR ALL NOMINEES | | O James Rand Elliott | |

| | | | | O Donald H. Livingstone | |

| ¨ | | FOR ALL EXCEPT | | O Allen Ketelsen | |

| | (See instructions below) | | O Donald Swartz | |

| | | | | O P. Mike Taylor | | The Shareholder hereby revokes any proxy previously given to attend and vote at the Meeting. |

| | | | | | | | |

| | |

| INSTRUCTION: | | To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:l | | |

| | | | | | | | |

| | |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | | ¨ | | |

| | | | | | |

Signature of Shareholder

| | Date:

| | Signature of Shareholder

| | Date:

|

| | | | | | |

Note: | | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. | | |

AMERICANWEST BANCORPORATION

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 26, 2005

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The undersigned holder of common shares of AmericanWest Bancorporation (“AWBC”) hereby constitutes and appoints DONALD SWARTZ, Chairman of the Board of AWBC, or C. TIM CASSELS, Executive Vice President and Chief Financial Officer of AWBC, or either of them as proxy with full power of substitution, to attend, vote all shares of common stock of AmericanWest Bancorporation owned of record by the undersigned on March 23, 2005, and otherwise act on behalf of the undersigned at the Annual Meeting of Shareholders of AmericanWest Bancorporation to be held on April 26, 2005 at 5:00 p.m. (Pacific Time) at the Northwest Museum of Arts and Culture, 2316 West First Avenue, Spokane, Washington, and at any adjournment(s) thereof.

A shareholder has the right to appoint a person (who need not be a shareholder) to represent the shareholder at the Annual Meeting and at any adjournment(s) thereof other than those persons designated above. To exercise this right, contact C. Tim Cassels, Secretary, at AmericanWest Bancorporation, 41 W. Riverside Avenue, Suite 400, Spokane, WA 99200.

(Continued and to be signed on the reverse side)