United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

AMERICANWEST BANCORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

AMERICANWEST BANCORPORATION

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

| | |

| TIME | | 5:00 p.m. on Tuesday, April 25, 2006 |

| |

| PLACE | | Northwest Museum of Arts and Culture 2316 West First Avenue Spokane, Washington 99204 |

| |

| ITEMS OF BUSINESS | | 1. To elect six directors to hold office until the next annual meeting of shareholders; |

| |

| | 2. To adopt the AmericanWest Bancorporation 2006 Equity Incentive Plan; and |

| |

| | 3. To take action on any other business that may properly be considered at the Meeting or any adjournment thereof. |

| |

| RECORD DATE | | You may vote at the Meeting if you were a shareholder of record at the close of business on March 20, 2006. |

| |

| VOTING BY PROXY | | If you cannot attend the Meeting, you may vote your shares by completing and promptly returning the enclosed proxy card in the envelope provided. |

| |

| ANNUAL REPORT | | AmericanWest Bancorporation’s 2005 Annual Report, which is not part of the proxy soliciting material, is enclosed. |

By Order of the Board of Directors,

Secretary

This Notice of Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about March 27, 2006.

AMERICANWEST BANCORPORATION

41 West Riverside Avenue

Suite 400

Spokane, Washington 99201

PROXY STATEMENT

Annual Meeting of Shareholders

April 25, 2006

We are providing these proxy materials in connection with the solicitation by the Board of Directors of AmericanWest Bancorporation (“Company”) of proxies to be voted at the Company’s Annual Meeting of Shareholders (“Meeting”) to be held on April 25, 2006, and at any adjournment of the Meeting.

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

Who may vote at the Meeting?

The Board of Directors of the Company (“Board”) has set March 20, 2006 as the record date for the Meeting. If you were the owner of Company common stock at the close of business on March 20, 2006, you may vote at the Meeting. You are entitled to one vote for each share of Company common stock you held on the record date, including shares:

| | • | | Held for you in an account with a broker, bank or other nominee (shares held in “street name”); |

| | • | | Credited to your account in the Company’s Employee Stock Ownership Plan (“ESOP”); or |

| | • | | Credited to your account in the Company’s 401(k) Retirement Savings Plan. |

Each share of common stock has one vote on each matter to be voted on.

How many shares must be present to hold the Meeting?

A majority of the Company’s shares of outstanding common stock as of the record date must be present at the Meeting in order to hold the Meeting and conduct business. On the record date, there were approximately 11,243,756 shares of Company common stock outstanding. Shares are counted as present at the Meeting if the owner of the shares:

| | • | | is present and votes in person at the Meeting; or |

| | • | | has properly submitted a proxy card. |

Shareholders of record who are present at the Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Meeting, are considered shareholders who are present and entitled to vote, and will count toward the quorum.

What proposals will be voted on at the Meeting?

There are two proposals scheduled to be voted on at the Meeting:

| | • | | Election of six directors to hold office until the next annual meeting of shareholders |

| | • | | Adoption of the Company’s 2006 Equity Incentive Plan (the “2006 Equity Incentive Plan”) |

1

How many votes are required to approve the proposals?

If a quorum exists at the Meeting, each proposal will be approved as follows:

Proposal 1: The six nominees receiving the largest number of votes cast by the shares entitled to vote in the election will be elected as directors. Consequently, abstentions and broker non-votes will have no impact on whether or not the nominees will be elected to the Board.

Proposal 2: The number of votes cast in favor of the proposal exceeds the number of votes cast against it.

How are votes counted?

You may either vote “FOR” or to “WITHHOLD” authority to vote for each nominee for the Board of Directors (Proposal 1). You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to adopt the 2006 Equity Incentive Plan (Proposal 2). If you withhold authority to vote on the election of directors, your shares will not be considered entitled to vote on the election of directors. If you just sign and submit your proxy card without voting instructions, your shares will be voted “FOR” each director nominee and “FOR” Proposal 2.

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. In this situation, a “broker non-vote” occurs. Shares that constitute broker non-votes are not considered as entitled to vote on the proposal in question, thus effectively reducing the number of shares needed to approve the proposal.

How does the Board recommend that I vote?

The Board recommends that you vote your shares “FOR” each of the director nominees (Proposal 1) and “FOR” the adoption of the 2006 Equity Incentive Stock Plan (Proposal 2).

How do I vote my shares without attending the Meeting?

Without attending the Meeting, you may vote:

| | • | | By Mail—You may vote by Mail by marking your selections on the proxy card, signing and dating your proxy card and mailing it in the enclosed postage-paid envelope. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity. |

| | • | | By Internet—You may vote by Internet by logging on to the following website:http://www.illinoisstocktransfer.com, click on the heading “Internet Voting” and follow the instructions on the screen. When prompted for your Voter Control Number, enter the number printed just above your name on the front of the proxy card. Please note that all votes cast by Internet must be completed and submitted prior to Friday, April 21, 2006 at 11:59 p.m. Central Time. Your Internet vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your proxy card. |

| | • | | By Telephone—You may vote by Telephone by calling Toll Free 1-800-555-8140 and follow the instructions. When asked for your Voter Control Number, enter the number printed just above your name on the front of the proxy card. Please note that all votes cast by Telephone must be completed and submitted prior to Friday, April 21, 2006 at 11:59 p.m. Central Time. Your Telephone vote authorizes the named proxies to vote your shares to the same extent as if you marked, signed, dated and returned your proxy card. |

For shares held in street name, you should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee, or, in most cases, submit voting instructions by telephone or the Internet. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you have directed.

2

How do I vote my shares in person at the Meeting?

If you are a shareholder of record, to vote your shares at the Meeting you should bring the enclosed proxy card or proof of identification. You may vote shares held in street name at the Meeting only if you obtain a signed proxy card from the record holder (broker or other nominee) giving you the right to vote the shares.

Even if you plan to attend the Meeting, we encourage you to vote by mail, so your vote will be counted even if you later decide not to attend the Meeting.

What does it mean if I receive more than one proxy card?

It means you hold shares registered in more than one account. To ensure that all your shares are voted, sign and return each proxy card.

May I change my vote?

Yes. If you have voted by mail (and have not voted through your broker), you may change your vote and revoke your proxy card by:

| | • | | Sending a written statement to that effect to the Secretary of the Company, which must be received prior to the Meeting; or |

| | • | | Submitting a properly signed proxy card; or |

| | • | | Voting in person at the Meeting. (Note: simply attending the Meeting will not, of itself, revoke a proxy.) |

3

PROPOSAL 1—ELECTION OF DIRECTORS

Directors and Nominees

The Company’s Articles of Incorporation, as amended (“Articles”), allow the Board of Directors or shareholders to set the number of directors on the Board within a range of 5 to 25. The Articles also allow the Board to fill vacancies created on the Board. The Board by resolution has set the number of directors to serve on the Board of Directors at six directors. Directors are elected for terms of one year or until their successors are elected and qualified.

At the Meeting, six directors are to be elected, each to serve until the next annual meeting of shareholders or until his successor is elected and qualified.

After a number of years of dedicated Board service, Director Allen Ketelsen determined that, due to the press of business at his construction company, he would not have the time required to commit to Board matters and thus resigned from the Board effective upon the completion of the merger transaction by which Columbia Trust Bancorp and Columbia Trust Bank were acquired by the Company (March 15, 2006). Director James Rand Elliott decided not to seek renomination and election at the end of his current term. The Board has reduced the size of the Board from seven to six directors as of the date of this Annual Meeting.

The Board of Directors has nominated six of the current directors: J. Frank Armijo, Robert M. Daugherty, Craig D. Eerkes, Donald H. Livingstone, Donald H. Swartz and P. Mike Taylor as directors, to serve a one-year term or until their successors are elected and qualified. All directors, with the exception of Robert M. Daugherty, are independent as defined in the National Association of Securities Dealers (“NASD”) rules. The Company’s Articles do not provide for cumulative voting. It is the intent of the Company to have all Board Members attend the Company’s Annual Meeting. All Board members attended last year’s Annual Meeting.

The following is a description of the business experience for at least the past five years for each of the nominees:

| | |

| J. FRANK ARMIJO | | Director since 2006 |

J. Frank Armijo, age 42, is the Program Director and General Manager of West Coast Programs for Lockheed Martin Information Technology. Mr. Armijo served on the Columbia Trust Bancorp and Bank Board of Directors from October 15, 2003 until March 15, 2006, the effective date of the merger between the Company and Columbia Trust Bancorp. In connection with the merger, Mr. Armijo was appointed to the Board of the Company as of such effective date. Mr. Armijo has also served on the Washington Technology Center Board, the Washington Software Alliance and the Columbia Basin College Board of Trustees (three years as chairman). Mr. Armijo served as Chairman of TRIDEC, the regional economic development organization, and is currently Immediate Past Chair. He is Co-Founder of the Hispanic Academic Achievers Program and a founding board member of Leadership Tri-Cities and the Reading Foundation.

| | |

| ROBERT M. DAUGHERTY | | Director since 2004 |

Robert M. Daugherty, age 52, is the President and Chief Executive Officer of AmericanWest Bancorporation and its subsidiary, AmericanWest Bank. Mr. Daugherty previously held the position of President and Chief Executive Officer of Humboldt Bancorporation and Humboldt Bank of California. Prior to Humboldt, Mr. Daugherty held the position of President, Chief Executive Officer and Chairman of the Board of Draper Bank & Trust of Utah. In addition, he has held executive positions in both the Zions Bank and US Bank organizations and currently serves as the Chairman and a board member for the Western Independent Bankers Association, and is on the Board of the Washington Bankers Association.

4

| | |

| CRAIG D. EERKES | | Director since 2003 |

Craig D. Eerkes, age 54, is President of Sun Pacific Energy, Inc; President of Pectin Funding Corporation in Houston, Texas. Mr. Eerkes currently serves as a director of Western Mutual Insurance Co. in Salt Lake City, Utah. Mr. Eerkes has served on three bank boards. He was instrumental in founding American National Bank in Kennewick, Washington in 1980 and served as Chairman of the Board from 1984 until the bank’s sale to First Hawaiian Bank in 1996, at which time he became Vice Chairman of the Northwest Region. During 2000, he also served as a Board Member of Columbia Trust Bank.

| | |

| DONALD H. LIVINGSTONE | | Director since 2005 |

Donald H. Livingstone, age 63, is the Director of the Center for Entrepreneurship and tenured professor in the Marriott School of Business at Brigham Young University (BYU) in Provo, Utah. Prior to joining the University in 1994, Mr. Livingstone was a partner at Arthur Andersen in San Francisco (1966-88) and Los Angeles (1988-95), specializing in serving the banking industry. Mr. Livingstone has served as a director on boards of several banks, most recently as director and the Chairman of the Audit Committee for Humboldt Bancorp in Sacramento, California and American Express Centurion Bank, a wholly owned subsidiary of American Express Corporation. Mr. Livingstone also served as Vice Chairman of the Audit Committee overseeing BYU, BYU-Hawaii and BYU-Idaho, and presently serves on the boards of Micrel Corporation, Sento Corporation and the Polynesian Cultural Center, serving as the Audit Committee Chairman for these entities.

| | |

| DONALD H. SWARTZ | | Director since 1998 |

Donald H. Swartz, age 60, is the President of J & M Electric, Inc. Mr. Swartz served on the board of Grant National Bank prior to its acquisition by AmericanWest Bancorporation in 1998.

| | |

| P. MIKE TAYLOR | | Director since 2001 |

P. Mike Taylor, age 62, a licensed civil engineer, is founder and President of Taylor Engineering, Inc., Spokane, Washington. Mr. Taylor has served as Chair of several community and professional organizations including the Spokane Regional Economic Development Council; the Washington Society of Professional Engineers, Spokane Chapter; and the Professional Engineers in Private Practice State Committee. He is Immediate Past Chair and serves on the Executive Committee for Empire Health Services, a 2-hospital, tertiary care medical system.

All the nominees have indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the Board, unless a contrary instruction is indicated on the proxy card.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES.

Board Committees and Meetings

During the year ended December 31, 2005, the Board of Directors held twelve regular meetings and five Special Board meetings. The Board has an Audit and Compliance Committee (“Audit Committee”), a Compensation Committee and a Corporate Governance Committee. Each Board member attended at least 75% of the aggregate of the meetings of the Board and of the committees on which he served and that were held during the period for which he was a Board or Committee member.

The Audit Committee

The Audit Committee is comprised solely of independent directors (as defined in the NASD rules) and meets at least quarterly with the Company’s management and independent auditors to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements, recommend to the Board the independent auditors to be retained and receive and consider the auditors’ comments as to controls,

5

adequacy of staff and management performance and procedures in connection with audit and financial controls. The Audit Committee met nine times during the past year. A copy of the Audit and Compliance Committee’s charter is located on the Company’s website:www.awbank.net.

Director Livingstone is deemed by the Company to be an “audit committee financial expert.” Mr. Livingstone has an understanding of generally accepted auditing principles (GAAP) and has the ability and experience to prepare, audit, evaluate and analyze financial statements which present the breadth and level of complexity of issues that the Company reasonably expects to be raised by its financial statements. Mr. Livingstone acquired these attributes as former Audit Committee Chairman of Humboldt Bancorp and as a partner specializing in the banking industry for a former international accounting firm.

The Compensation Committee

The Compensation Committee is comprised solely of independent directors as defined in the NASD rules. The Compensation Committee makes recommendations to the Board of Directors on executive compensation policies and procedures and other compensation-related items that are corporate in nature (i.e., company-wide 401(k) plans, stock option plans, benefit plans, etc.) with power to act in certain matters. A copy of the Compensation Committee’s charter is located on the Company’s website:www.awbank.net. The Compensation Committee met seven times during the past year.

The Corporate Governance Committee

The Corporate Governance Committee is comprised solely of independent directors (as defined in the NASD rules) and is primarily responsible for considering and making recommendations to the Board concerning its size, functions and needs. This includes establishing the criteria for Board membership, recruiting and screening candidates for Board membership, recommending Director nominees for Board and shareholder approval, recommending Director compensation, making recommendations regarding committee assignments and functions and Board meetings, reviewing succession plans for the Chief Executive Officer (“CEO”) of the Company, and making recommendations to the Board with respect to the selection of the CEO of the Company. The Corporate Governance Committee met seven times during the last year.

The Committee’s policy for consideration of director candidates nominated by shareholders is to apply the Company’s rules for shareholder proposals which are included in this document under “Shareholder Proposals.” The Committee’s practice is to consider a Board candidate’s primary attributes of personal integrity and character, judgment, knowledge and leadership in a business or related setting, business acumen and other commitments. These factors are considered in the context of the Company’s needs at that point in time. Any proposed nomination, and any communications to the Board, should be directed to Mr. Taylor, the Chair of the Governance Committee. A copy of the Corporate Governance Committee’s charter is located on the Company’s website:www.awbank.net.

The following table summarizes the membership of the Board and each of its standing committees, as well as the number of times each met during 2005. The following does not include information regarding Mr. Armijo since he was appointed to the Board in February 2006, effective March 15, 2006.

| | | | | | | | |

| | | C—Chairperson | | · Member |

| | | Board | | Audit | | Compensation | | Corporate Governance |

Mr. Bolyard(1) | | · | | · | | · | | · |

Mr. Daugherty | | · | | | | | | |

Mr. Eerkes | | · | | | | · | | · |

Mr. Elliott | | · | | · | | C | | |

Mr. Ketelsen | | · | | | | · | | |

Mr. Livingstone | | · | | C | | | | |

Mr. Swartz | | C | | · | | | | · |

Mr. Taylor | | · | | · | | | | C |

| | | | |

Total Meetings in 2005 | | 12(2) | | 9 | | 7 | | 7 |

| (1) | Mr. Bolyard resigned as a Director in September 2005 due to health reasons. |

| (2) | In addition, the Board held five Special Board Meetings during 2005. |

6

Directors’ Compensation

During the period of January–April 2005, Directors of the Company received a monthly retainer of $1,000 and $500 for each meeting of the Board of Directors attended. The Chairman of the Board received an additional $700 for each meeting of the Board of Directors. Members of the Audit Committee received $300 for each meeting attended. Members of the Compensation Committee received $100 for each meeting attended. Members of the Corporate Governance Committee received $100 for each meeting attended. Directors received $100 for each Management Committee meeting attended.

It was resolved by the Board of Directors during the Board meeting in April, 2005, to change the Directors’ compensation, effective May, 2005. Directors of the Company now receive a monthly retainer of $1,200 and $650 for each meeting of the Board of Directors attended. The Chairman of the Board receives an additional $250 for each meeting of the Board of Directors. Members of the Audit Committee receive $500 for each meeting attended. The Board of Directors approved an additional monthly payment of $150 to the Chairman of the Audit Committee, effective June 2005. Members of the Compensation Committee receive $300 for each meeting attended. Members of the Corporate Governance Committee receive $300 for each meeting attended. Committee Chairs receive $150 for each month in which a meeting is held. Directors receive $100 for each Management Committee meeting attended. During the year ended December 31, 2005, the Company paid an aggregate of $176,400 in director fees pursuant to such arrangements.

Directors of the Company have been eligible to receive options under the 1995 and 2001 Incentive Stock Option Plans. (The plans are described in the Executive Compensation section under the heading “1995 and 2001 Incentive Stock Option Plans.”) In May, 2005, each of the seven independent directors was granted 3,000 options to purchase common stock of the Company as additional consideration for service as a director.

In addition, on January 1, 2003, Mr. Swartz, Mr. Taylor and Mr. Elliott entered into individual Director Fee Continuation Agreements with the Company. Each such Director Fee Agreement states that the named Director will receive a monthly payment of $500 for 120 months beginning the next month after he retires.

Compensation Committee Interlocks and Insider Participation

At December 31, 2005, the Compensation Committee consisted of James Rand Elliott, Chairman, Allen Ketelsen and Craig D. Eerkes, each of whom is an independent director (as defined in the NASD rules).

Code of Ethics

The Company has adopted a Code of Ethics that is applicable to the officers, directors and employees of the Company, including the Company’s principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. The Code of Ethics is available on the Company’s website at www.awbank.com. Amendments to and waivers from the Code of Ethics will also be disclosed on the Company’s website.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the shares of common stock beneficially owned as of March 16, 2005, by each Director and each Named Executive Officer, the Directors and Executive Officers as a group and those persons known to beneficially own more than 5% of AmericanWest Bancorporation’s common stock.

For purposes of this table, in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (“Exchange Act”), a person is deemed to be the beneficial owner of any shares of common stock if he or she has voting and/or investment power with respect to such security. The table includes shares owned by spouses, other immediate family members in trust, shares held in retirement accounts or funds for the benefit of the named individuals, and other forms of ownership, over which shares the persons named in the table possess voting and/or investment power.

| | | | | | |

Name and Position | | Number of

Shares

Beneficially

Owned | | | Percentage

of Class | |

Donald H. Swartz, Chairman | | 61,626 | (1) | | * | |

James Rand Elliott, Director | | 53,652 | (2) | | * | |

Robert M. Daugherty, President/Chief Executive Officer | | 50,000 | (3) | | * | |

P. Mike Taylor, Director | | 29,550 | (4) | | * | |

Allen Ketelsen, Director | | 20,820 | (5) | | * | |

Craig D. Eerkes, Director | | 12,235 | (6) | | * | |

Gary M. Bolyard, Director | | 7,400 | (7) | | * | |

Donald H. Livingstone, Director | | 5,714 | (8) | | * | |

J. Frank Armijo, Director | | 5,294 | (9) | | * | |

Rick E. Shamberger, EVP/Chief Credit Officer | | 5,220 | (10) | | * | |

R. Blair Reynolds, EVP/General Counsel | | 880 | (11) | | * | |

Gregory Hansen, EVP/Director of Commercial Lending | | -0- | | | * | |

Diane L. Kelleher, EVP/Chief Financial Officer | | -0- | | | * | |

Nicole Sherman, EVP/Director of Retail Banking | | -0- | | | * | |

All Directors & Executive Officers as a group (14 persons) | | 269,574 | (12) | | 2.562 | % |

AXA Assurances I.A.R.D. Mutuelle AXA Assurances Vie Mutuelle AXA Courtage Assurance Mutuelle 26, Rue Drovot, 75009 Paris, France | | 538,351 | (13) | | 5.1 | % |

| (1) | Mr. Swartz’s beneficial ownership to the shares listed above is as follows: shared voting and investment powers for 45,829 shares; 649 shares are held by Mr. Swartz’s spouse as custodian for minors; 248 shares are held by Mr. Swartz’s son; and 14,900 shares are acquirable by exercise of stock options within 60 days. |

| (2) | Mr. Elliott’s beneficial ownership to the shares listed above is as follows: shared voting and investment powers for 24,665 shares; 5,425 shares are held by Mr. Elliott’s spouse; 7,322 shares are held by Premium Finance of which Mr. Elliott serves as a general partner; and 16,240 shares are acquirable by exercise of stock options within 60 days. |

| (3) | Mr. Daugherty’s beneficial ownership to the shares listed above is as follows: sole voting and investment powers for 25,291 shares, and 24,709 shares are acquirable by exercise of stock options within 60 days. |

| (4) | Mr. Taylor’s beneficial ownership to the shares listed above is as follows: sole voting and investment powers for 13,310 shares, and 16,240 shares are acquirable by exercise of stock options within 60 days. |

| (5) | Mr. Ketelsen’s beneficial ownership to the shares listed above is as follows: sole voting and investment powers for 13,820 shares, and 7,000 shares are acquirable by exercise of stock options within 60 days. |

| (6) | Mr. Eerkes’ beneficial ownership to the shares listed above is as follows: sole voting and investment powers for 7,235 shares, and 5,000 shares are acquirable by exercise of stock options within 60 days. |

8

| (7) | Mr. Bolyard’s beneficial ownership to the shares listed above is as follows: shared voting and investment powers for the total 7,400 shares. |

| (8) | Mr. Livingstone’s beneficial ownership to the shares listed above is as follows: sole voting and investment powers for 2,714 shares, and 3,000 shares are acquirable by exercise of stock options within 60 days. |

| (9) | Mr. Armijo’s beneficial ownership to the shares listed above is as follows: after the close of the merger between Columbia Trust and AWBC March 15, 2006, 2,435 shares of Columbia Trust Bancorp common stock previously held by Mr. Armijo were converted to AWBC shares at an exchange ratio of 1 : 1.8035 for each share of Columbia Trust Bancorp stock; in addition, the total amount includes 500 Columbia Trust Bancorp stock options that were converted using the same ratio into 902 AWBC stock options which are acquirable by exercise within 60 days. |

| (10) | Mr. Shamberger’s beneficial ownership to the shares listed above is as follows: 5,220 shares are acquirable by exercise of stock options within 60 days. |

| (11) | Mr. Reynolds’ beneficial ownership to the shares listed above is as follows: 880 shares held through the Company’s 401(k) Plan of which Mr. Reynolds does have both voting and investment powers. |

| (12) | This amount includes 100,241 shares acquirable by exercise of stock options within 60 days. Furthermore, the number of shares owned by all Directors & Executive Officers as a group includes the following shares owned and not listed separately in the table above: 17,085 shares owned by Mr. Griffith, of which 7,030 are acquirable by exercise within 60 days and 3,396 are held through the Company’s ESOP, where Mr. Griffith has voting power but not investment power; 98 shares owned by Ms. Krasselt which are held through the Company’s 401(k) Plan where Ms. Krasselt does have both voting and investment power. |

| (13) | Information based on Schedule 13G which was filed as a group with the SEC on February 14, 2006 with respect to holdings as of December 31, 2005. |

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons who own more than 10% of a registered class of the Company’s equity securities to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission (“Commission”). The rules promulgated by the Commission under Section 16(a) of the Exchange Act require those persons to furnish the Company with copies of all reports filed with the Commission pursuant to Section 16(a).

Based solely upon a review of Forms 3, Forms 4 and Forms 5 and amendments thereto furnished to the Company pursuant to Rule 16(a)(3)(e) during the year ended December 31, 2005, and written representations of certain of its directors and officers that no Forms 5 were required to be filed, the Company believes that all directors, executive officers and beneficial owners of more than 10% of the common stock have filed with the Commission on a timely basis all reports required to be filed under Section 16(a) of the Exchange Act.

9

Executive Officers

The following table sets forth the age, position and the business experience during the past five years of the executive officers of the Company. All executive officers are elected annually and serve at the discretion of the Board of Directors.

| | | | |

Name | | Age | | Position and Principal Occupation for the Past Five Years |

Robert M. Daugherty | | 52 | | Chief Executive Officer and President of the Company and Bank since September 2004. From April 2002 until July 2004, Mr. Daugherty was President of Humboldt Bancorp. Prior to that, he was President and CEO of Draper Bank of Utah. |

Wade A. Griffith | | 49 | | Senior Vice President & Chief Information Officer of AmericanWest Bank since 1996. Prior to joining the Bank, he held similar positions with Frontier Bank, The First National Bank of North Idaho and First Security Bank. |

Gregory Hansen | | 47 | | Executive Vice President/Director of Commercial Lending of AmericanWest Bank since 2005. Previously employed by U.S. Bank where, during his tenure, he was Team Leader for its Spokane Commercial Lending Team. |

Diane L. Kelleher | | 46 | | Executive Vice President & Chief Financial Officer of the Company and Bank since 2005. Previously employed by Washington Mutual Bank since 1997, she has over 20 years of experience in asset/liability and treasury management. |

Shelly L. Krasselt | | 29 | | Vice President & Controller of the Bank since 2003. Previously employed by BDO Seidman, LLP. |

R. Blair Reynolds | | 65 | | Executive Vice President & General Counsel of the Company and Bank since 2004. Previously employed by Humboldt Bancorp where he served in the same capacity. Prior to Humboldt, he was a sole practitioner specializing in banking and commercial law in his law practice in Walnut Creek, California. |

Rick E. Shamberger | | 45 | | Executive Vice President & Chief Credit Officer of AmericanWest Bank since 2003. Previously employed by U.S. Bank for more than 20 years with experience in credit risk management. |

Nicole Sherman | | 35 | | Executive Vice President/Director of Retail Banking of AmericanWest Bank since December, 2004. Previously CEO for Power Trainings International. Prior to PTI, she was employed by Zions First National Bank overseeing the corporate learning and development department. |

10

EXECUTIVE COMPENSATION

The following table sets forth the cash and non-cash compensation for each of the last three fiscal years ended December 31, 2005, 2004 and 2003, awarded to or earned by the Chief Executive Officer and the other most highly compensated executive officers of the Company, whose total compensation in 2005 exceeded $100,000.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | | | | Long-Term Compensation Awards | | |

Named Executive Officer and Position | | Year | | Salary | | Bonus(1) | | Other

Annual

Compensa-

tion(2) | | Restricted

Stock

Awards | | | Securities

Underlying Options/

SARs(3) | | All other

Compensa-

tion(4) |

Robert M. Daugherty* | | 2005 | | $ | 328,417 | | $ | 175,000 | | — | | | — | | | — | | $ | 145,155 |

President and Chief | | 2004 | | $ | 87,503 | | $ | 150,000 | | — | | | — | | | 200,000 | | $ | 51,135 |

Executive Officer | | 2003 | | | | | | | | | | | — | | | — | | | — |

| | | | | | | |

C. Tim Cassels* | | 2005 | | $ | 65,813 | | | — | | — | | | | | | — | | $ | 50,700 |

Executive Vice President and | | 2004 | | $ | 101,400 | | $ | 25,000 | | — | | | | | | 4,000 | | $ | 3,980 |

Chief Financial Officer | | 2003 | | $ | 96,599 | | $ | 42,667 | | — | | | | | | 12,100 | | $ | 1,449 |

| | | | | | | |

Diane L. Kelleher* | | 2005 | | $ | 85,795 | | $ | 30,000 | | — | | $ | 154,200 | (5) | | | | $ | 8,229 |

Executive Vice President and | | 2004 | | | — | | | — | | — | | | | | | — | | | — |

Chief Financial Officer | | 2003 | | | — | | | — | | | | | | | | — | | | — |

| | | | | | | |

Rick E. Shamberger* | | 2005 | | $ | 151,249 | | $ | 50,000 | | — | | $ | 154,200 | (6) | | | | | — |

Executive Vice President and | | 2004 | | $ | 130,838 | | $ | 50,000 | | — | | | | | | 1,000 | | | — |

Chief Credit Officer | | 2003 | | $ | 21,668 | | $ | 40,000 | | — | | | | | | 7,700 | | | — |

| | | | | | | |

R. Blair Reynolds* | | 2005 | | $ | 151,249 | | $ | 50,000 | | — | | $ | 102,800 | (7) | | — | | $ | 3,313 |

Executive Vice President & | | 2004 | | $ | 25,000 | | $ | 5,000 | | �� | | | — | | | — | | $ | 11,140 |

General Counsel | | 2003 | | | — | | | — | | — | | | | | | — | | | — |

| | | | | | | |

Nicole Sherman* | | 2005 | | $ | 150,313 | | $ | 50,000 | | — | | $ | 154,200 | (8) | | | | | — |

Executive Vice President/ | | 2004 | | | — | | $ | 25,000 | | — | | | | | | — | | | — |

Director of Retail Banking | | 2003 | | | — | | | — | | — | | | | | | — | | | — |

| | | | | | | |

Gregory Hansen* | | 2005 | | $ | 88,021 | | $ | 55,000 | | — | | $ | 144,900 | (9) | | | | | — |

Executive Vice President/ | | 2004 | | | — | | | — | | — | | | | | | — | | | — |

Director of Commercial Lending | | 2003 | | | — | | | — | | — | | | | | | — | | | — |

| * | Mr. Daugherty was appointed President and Chief Executive Officer on September 20, 2004; Mr. Cassels was hired on December 1, 2003 and left the Company on July 1, 2005; Ms. Kelleher was hired on June 6, 2005; Mr. Shamberger was hired on October 31, 2003; Mr. Reynolds was hired on November 1, 2004; Ms. Sherman was hired on December 20, 2004; and Mr. Hansen was hired on May 23, 2005. |

| (1) | Includes bonus earned during 2005, but paid in 2006. |

| (2) | Does not include amounts attributable to miscellaneous benefits received by executive officers, including the use of company-owned automobiles and the payment of automobile allowances and certain club dues. In the opinion of management, the costs to the Company of providing such benefits to any individual executive officer during the year ended December 31, 2005, did not exceed the lesser of $50,000 or 10% of the total of annual salary and bonus reported for the individual. |

| (3) | Represents options to acquire shares of common stock that were granted under stock option plans. |

| (4) | Represents the following values attributed to the named executive officer during the year pursuant to agreements entered into between the Bank and such officers: (a) certain relocation expenses to Mr. Daugherty |

11

| | of $51,135 in 2004 and $145,155 in 2005; to Ms. Kelleher of $8,229 in 2005; and to Mr. Reynolds of $11,140 in 2004; (b) as severance pay to Mr. Cassels upon his leaving the Company, $50,700 in 2005; and (c) as part of the Bank’s salary continuation plan, Company 401(k) match and ESOP contributions, to Mr. Cassels $3,980 in 2004 and $1,449 in 2003; and to Mr. Reynolds, $3,313 in 2005. |

| (5) | Represents the value of 7,500 restricted shares based on the closing price of $20.56 on the date of grant (June 6, 2005). All shares will vest on June 6, 2010 except 20% of the restricted shares will lapse for any fiscal year the Company does not achieve a return on average assets of at least 1%. The value of such restricted shares as of December 30, 2005 was $177,225 based on the closing price of $23.63 as of such date. No dividends will be paid on the restricted shares until they are fully vested. |

| (6) | Represents the value of 7,500 restricted shares based on the closing price of $20.56 on the date of grant (June 6, 2005). All shares will vest on January 2, 2010 except 20% of the restricted shares will lapse for any fiscal year the Company does not achieve a return of average assets of at least 1%. The value of such restricted shares as of December 30, 2005 was $177,225 based on the closing price of $23.63 as of such date. No dividends will be paid on the restricted shares until they are fully vested. |

| (7) | Represents the value of 5,000 restricted shares based on the closing price of $20.56 on the date of grant (June 6, 2005). All shares will vest on January 25, 2010 except 20% of the restricted shares will lapse for any fiscal year the Company does not achieve a return on average assets of at least 1%. The value of such restricted shares as of December 30, 2005 was $118,150 based on the closing price of $23.63 as of such date. No dividends will be paid on the restricted shares until they are fully vested. |

| (8) | Represents the value of 7,500 restricted shares based on the closing price of $20.56 on the date of grant (June 6, 2005). All shares will vest on January 4, 2010 except 20% of the restricted shares will lapse for any fiscal the Company does not achieve a return of average assets of at least 1%. The value of such restricted shares as of December 30, 2005 was $177,225 based on the closing price of $23.63 as of such date. No dividends will be paid on the restricted shares until they are fully vested. |

| (9) | Represents the value of 7,500 restricted shares based on the closing price of $19.32 on the date of grant (May 23, 2005). All shares will vest on May 22, 2010 except 20% of the restricted shares will lapse for any fiscal year the Company does not achieve a return of average assets of at least 1%. The value of such restricted shares as of December 30, 2005 was $177,225 based on the closing price of $23.63 as of such date. No dividends will be paid on the restricted shares until they are fully vested. |

Salary Continuation Agreements.

The Bank and its predecessor companies entered into Executive Salary Continuation Agreements with certain of its directors and employees. Under the terms of the respective agreements, the director or officer will receive an annual sum based on his salary or director’s fee from the Company, payable on a monthly basis, for a period of up to fifteen years upon retirement. None of the Company’s Named Executives have entered into any such agreement and no current Director is receiving any payment thereunder.

Employment Agreements.

The Company entered into an Employment Agreement with Mr. Daugherty on September 20, 2004, which has a term of four years. Under the terms of his Employment Agreement, Mr. Daugherty is paid an annual salary of $300,000 which may be increased annually, taking into consideration Mr. Daugherty’s performance for the most recent performance period and other relevant factors. Mr. Daugherty received a bonus of $150,000 in 2005, per the terms of his Employment Agreement, and he will receive a bonus of at least $100,000 in 2006 per the terms of his Employment Agreement provided the Return on Average Assets for the Company is at least 1.0% in 2005. Mr. Daugherty was granted 200,000 stock options in 2004 per the terms of the Employment Agreement.

The Employment Agreement provides that, in the event of a change of control, he will receive an amount equal to two (2) times Mr. Daugherty’s then-current annual base salary, plus an amount equal to his bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all of his then unvested stock options.

12

The Company entered into an Employment Agreement with Mr. Reynolds on January 25, 2005, which was amended on December 15, 2005, which has a term of two years commencing on its effective date. Under the terms of such Employment Agreement, Mr. Reynolds is paid an annual salary of $150,000 which may be increased annually, taking into consideration Mr. Reynolds’ performance for the most recent performance period and other relevant factors. Mr. Reynolds’ bonus in 2005 was $50,000. The Company may from time to time grant Mr. Reynolds restricted shares of AWBC common stock (“Performance Shares”) as a “Performance Stock Award” at the Company’s sole discretion. Mr. Reynolds was granted a Performance Stock Award of 5,000 shares of AWBC common stock upon the execution of his Employment Agreement under the following terms: for each full calendar year between January 1, 2005 and January 1, 2010 for which the Company has a Return on Average Assets of less than one percent (1.0%), twenty percent (20%) of the Performance Shares that otherwise would vest on the vesting date (January 25, 2010) shall lapse and all of Mr. Reynolds’ rights thereto shall thereupon cease. The Company also may from time to time grant Mr. Reynolds stock options to purchase shares of AWBC common stock at the closing price of AWBC’s common stock on the date of grant, at the Company’s sole discretion.

The Employment Agreement provides that, in the event of a change of control, Mr. Reynolds will receive an amount equal to not less than two (2) times his then-current annual base salary, plus an amount equal to his bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all Performance Shares and/or stock options that have been granted him.

The Company entered into an Employment Agreement with Mr. Shamberger on January 28, 2005, which has a term of two years commencing on its effective date. Under the terms of such Employment Agreement, Mr. Shamberger is paid an annual salary of $150,000 which may be increased annually, taking into consideration Mr. Shamberger’s performance for the most recent performance period and other relevant factors. Mr. Shamberger’s bonus in 2005 was $50,000. The Company may from time to time grant Mr. Shamberger restricted shares of AWBC common stock (“Performance Shares”) as a “Performance Stock Award” at the Company’s sole discretion. Mr. Shamberger was granted a Performance Stock Award of 7,500 shares of AWBC common stock upon the execution of his Employment Agreement under the following terms: for each full calendar year between January 1, 2005 and January 1, 2010 for which the Company has a Return on Average Assets of less than one percent (1.0%), twenty percent (20%) of the Performance Shares that otherwise would vest on the vesting date (January 2, 2010) shall lapse and all of Mr. Shamberger’s rights thereto shall thereupon cease. The Company also may from time to time grant Mr. Shamberger stock options to purchase shares of AWBC common stock at the closing price of AWBC’s common stock on the date of grant, at the Company’s sole discretion.

The Employment Agreement provides that, in the event of a change of control, Mr. Shamberger will receive an amount equal to not less than two (2) times his then-current annual base salary, plus an amount equal to his bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all Performance Shares and/or stock options that have been granted him.

The Company entered into an Employment Agreement with Ms. Sherman on January 28, 2005, which has a term of two years commencing on its effective date. Under the terms of such Employment Agreement, Ms. Sherman is paid an annual salary of $150,000 which can may be increased annually, taking into consideration Ms. Sherman’s performance for the most recent performance period and other relevant factors. Ms. Sherman’s bonus in 2005 was $50,000. She was paid a signing bonus of $25,000 in December, 2004. The Company may from time to time grant Ms. Sherman restricted shares of AWBC common stock (“Performance Shares”) as a “Performance Stock Award” at the Company’s sole discretion. Ms. Sherman was granted a Performance Stock Award of 7,500 shares of AWBC common stock upon the execution of her Employment Agreement under the following terms: for each full calendar year between January 1, 2005 and January 1, 2010 for which the Company has a Return on Average Assets of less than one percent (1.0%), twenty percent (20%) of the Performance Shares that otherwise would vest on the vesting date (January 4, 2010) shall lapse and all of Ms. Sherman’s rights thereto shall thereupon cease. The Company may from time to time grant Ms. Sherman stock options to purchase shares of AWBC common stock at the closing price of AWBC’s common stock on the date of grant, at the Company’s sole discretion.

13

The Employment Agreement provides that, in the event of a change of control, Ms. Sherman will receive an amount equal to not less than two (2) times her then-current annual base salary, plus an amount equal to her bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all Performance Shares and/or stock options that have been granted her.

The Company entered into an Employment Agreement with Mr. Hansen on May 23, 2005, which has a term of two years commencing on its effective date. Under the terms of such Employment Agreement, Mr. Hansen is paid an annual salary of $150,000 which may be increased annually, taking into consideration Mr. Hansen’s performance for the most recent performance period and other relevant factors. Per the terms of his Employment Agreement, Mr. Hansen’s bonus in 2005 was $30,000, plus a signing bonus of $25,000 which was paid on June 1, 2005. The Company may from time to time grant Mr. Hansen restricted shares of AWBC common stock (“Performance Shares”) as a “Performance Stock Award” at the Company’s sole discretion. Mr. Hansen was awarded a Performance Stock Award of 7,500 shares of AWBC common stock upon the execution of his Employment Agreement under the following terms: for each full calendar year between January 1, 2005 and January 1, 2010 for which the Company has a Return on Average Assets of less than one percent (1.0%), twenty percent (20%) of the Performance Shares that otherwise would vest on the vesting date (May 22, 2010) shall lapse and all of Mr. Hansen’s rights thereto shall thereupon cease. The Company may from time to time grant Mr. Hansen stock options to purchase shares of AWBC common stock at the closing price of AWBC’s common stock on the date of grant, at the Company’s sole discretion.

The Employment Agreement provides that, in the event of a change of control, Mr. Hansen will receive an amount equal to not less than two (2) times his then-current annual base salary, plus an amount equal to his bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all Performance Shares and/or stock options that have been granted him.

The Company entered into an Employment Agreement with Ms. Kelleher on June 6, 2005, which has a term of two years commencing on its effective date. Under the terms of such Employment Agreement, Ms. Kelleher is paid an annual salary of $150,000 which may be increased annually, taking into consideration Ms. Kelleher’s performance for the most recent performance period and other relevant factors. Ms. Kelleher’s bonus in 2005 was $30,000. Pursuant to her Employment Agreement, Ms. Kelleher may be awarded a bonus of up to fifty percent (50%) of her base salary, subject to the Bank’s overall performance and her specific contributions towards profitability. The Company may from time to time grant Ms. Kelleher restricted shares of AWBC common stock (“Performance Shares”) as a “Performance Stock Award” at the Company’s sole discretion. Ms. Kelleher was granted a Performance Stock Award of 7,500 shares of AWBC common stock upon the execution of her Employment Agreement under the following terms: for each full calendar year between January 1, 2005 and January 1, 2010 for which the Company has a Return on Average Assets of less than one percent (1.0%), twenty percent (20%) of the Performance Shares that otherwise would vest on the vesting date (June 6, 2010) shall lapse and all of Ms. Kelleher’s rights thereto shall thereupon cease. The Company may from time to time grant Ms. Kelleher stock options to purchase shares of AWBC common stock at the closing price of AWBC’s common stock on the date of grant, at the Company’s sole discretion.

The Employment Agreement provides that, in the event of a change of control, Ms. Kelleher will receive an amount equal to not less than two (2) times Ms. Kelleher’s then-current annual base salary, plus an amount equal to her bonus for the year immediately preceding the effective date of any such change in control and immediate acceleration of vesting of all Performance Shares and/or stock options that have been granted her.

14

Option Exercise/Value Table.

The following information with respect to options exercised during the year ended December 31, 2005, and remaining unexercised at the end of 2005, is presented for the Chief Executive Officer and the other Named Executive Officers.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND YEAR-END OPTION VALUES

| | | | | | | | | | | | | | | |

Name† | | Shares

Acquired

on

Exercise(#) | | Value

Realized($) | | Number of Securities

Underlying Unexercised

Options at Year-End | | Value of Unexercised

In-the-Money Options at

Fiscal Year-End* |

| | | | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Robert M. Daugherty | | 25,291 | | $ | 58,913 | | 24,709 | | 150,000 | | $ | 137,382 | | $ | 820,825 |

| † | No other Named Executive Officers exercised options in 2005. |

| * | On December 31, 2005, the closing price of common stock was $23.63 for purposes of the foregoing table. Stock options with an exercise price of less than that amount are considered to be “in-the-money” and to have a value equal to the difference between this amount and the exercise price of the stock option multiplied by the number of shares covered by the stock option. |

Option Grants in Last Fiscal Year.

There were no stock options granted to any Named Executive Officer during 2005.

Employee Stock Ownership Plan

The Company sponsors an ESOP. An ESOP is a form of retirement plan whereby the Company receives a deduction for contributions to the Plan and the Plan invests all or a portion of the employer contributions and earnings in stock of AWBC. The Plan is qualified under Section 401(a) of the Internal Revenue Code as a stock bonus plan. All employees 21 years or older are eligible to participate in the ESOP on the January 1st following completion of a minimum of 1,000 hours in their first full year of service or in any following Plan Year, and benefits fully vest after five years of service. Contributions to the ESOP plan are discretionary and totaled approximately $90,000 and $288,000 for 2004 and 2003, respectively, and were based on a percentage of the Company’s earnings. Contributions are allocated pro rata based on eligible employees’ annual compensation on December 31. Stock dividends are allocated on a pro rata basis on allocated shares per participant at the record date of the stock dividend. Subsequent to December 31, 2005 the Company has made the decision to merge the ESOP into the 401(k) Retirement Savings Plan. The merger is subject to the Internal Revenue Service’s approval. For the year ended December 31, 2005, the Company did not make a contribution to the Plan.

The Company also has a 401(k) Retirement Savings Plan. Employees are eligible to contribute to the plan after completing six months of employment and attaining age 18. The Company matches employee deferrals at 100% up to 3% of participant compensation and at 50% from 3% to 5% of participant compensation. Employees are fully vested in all contributions made to the 401(k) Retirement Savings Plan. Contributions to the 401(k) Retirement Savings Plan in 2005, 2004 and 2003 were approximately $449,000, $523,000 and $279,000, respectively.

1995 and 2001 Incentive Stock Option Plans

The Company presently maintains two stock option plans, known as the 1995 Incentive Stock Option Plan (“1995 Plan”) and the 2001 Incentive Stock Option Plan (“2001 Plan”). The 1995 Plan was approved by the shareholders on May 24, 1995. The 2001 Plan was approved by the shareholders on May 29, 2001, to replace the 1995 Plan. Both plans provide for the issuance of stock options intended to qualify under Section 422 of the Code, and options that are not qualified under the Code. The 2001 Plan also provides for the granting of

15

performance shares of AWBC common stock. Key individuals of the Company and its subsidiaries (including directors, executive officers and advisors or consultants to the Company) are eligible to receive grants of options or performance shares.

All authorized shares have been issued in the form of options under the 1995 Plan. In addition, there are no options outstanding under the 1995 Plan. Under the 2001 Plan, a balance of 315,666 shares remain available for issuance in the form of options and performance shares under the 2001 Plan. See, however, Proposal 2. There are 435,496 options outstanding under the 2001 Plan.

As part of the merger with Latah Bancorporation, Inc., effective July 31, 2003, the Company assumed the options that had been issued by Latah Bancorporation to its directors and officers pursuant to its stock option plans. Options to purchase 44,613 shares of Company common stock are presently outstanding under these plans, separate from the Company’s 1995 and 2001 plans as described above, and will be exercised, terminated or expire in accordance with the terms of the options and the Latah plans.

As a part of the merger with Columbia Trust Bancorp, Inc., effective March 15, 2006, the Company assumed the options that had been issued by Columbia Trust Bancorp to its directors and officers pursuant to its stock option plans. Outstanding options to purchase 89,170 shares of Columbia Trust common stock have been converted into options to purchase 160,818 shares of the Company’s common stock based on an exchange ratio of 1 : 1.8035. These options are separate from the Company’s 1995 and 2001 plans, described above, and will be exercised, terminated or expire in accordance with the terms of the options and the Columbia Trust plans.

Securities Authorized for Issuance Under Equity Compensation Plans. The following table provides information as of December 31, 2005 with respect to AWBC’s compensation plans under which shares of the Company’s common stock are authorized for issuance:

| | | | | | | |

Plan Category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | Weighted average

exercise price of

outstanding

options, warrants

and rights | | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column)(a) |

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by security holders | | 454,136 | | $ | 15.96 | | 316,933 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

Total | | 454,136 | | $ | 15.96 | | 316,933 |

The above number of securities to be issued upon exercise of outstanding options, warrants and rights and the weighted average exercise price of outstanding options, warrants and rights, does not reflect grants of 74,000 restricted performance shares made during 2005 to certain officers of the Company, of which 56,500 are currently outstanding. These grants were issued subject to an equity compensation plan approved by shareholders and the shares are taken into account in the number of securities remaining available for future issuance under equity compensation plans shown above.

16

REPORT OF THE COMPENSATION COMMITTEE(1)

The Compensation Committee of the Company is responsible for establishing and implementing all compensation policies of the Company and its subsidiaries, as well as setting the compensation for the executive officers of the Company and its subsidiaries. The Committee is also responsible for evaluating the performance of the Chief Executive Officer of the Company and approving an appropriate compensation level. The Chief Executive Officer evaluates the performance of all corporate officers and recommends to the Committee individual compensation levels for approval by the Committee.

The Company believes that the compensation of its executive officers and other key personnel should reflect and support the goals and strategies that the Company has established.

Compensation Philosophy. There are two principal objectives in determining executive compensation: (1) to attract, reward and retain key executive officers, and (2) to motivate executive officers to perform to the best of their abilities and to achieve short-term and long-term corporate objectives that will contribute to the overall goal of enhancing stockholder value. In furtherance of these objectives, the Committee has adopted the following policies:

| | • | | The Company will compensate competitively with the practices of other leading companies in related fields; |

| | • | | Performance at the corporate, subsidiary and individual executive officer levels will determine a significant portion of compensation; |

| | • | | The attainment of realizable but challenging objectives will determine performance-based compensation; and |

| | • | | The Company will encourage executive officers to hold substantial, long-term equity stakes in the Company so that the interest of executive officers will coincide with the interest of stockholders; accordingly, stock options, performance shares and incentives will constitute a significant portion of compensation. |

Elements of Executive Compensation. The elements of the Company’s compensation of executive officers are: (1) annual cash compensation in the form of base salary and performance bonuses, the latter based on the Company achieving targeted levels of performance established by the Committee for the fiscal year and the individual executive officer’s performance; (2) long-term incentive compensation in the form of stock options granted under the Company’s 1995 Incentive Stock Option Plan and the 2001 Incentive Stock Option Plan; (3) long-term incentive compensation in the form of performance share awards under the 2001 Incentive Stock Plan; and (4) other compensation and employee benefits generally available to all employees of the Company, such as health insurance and the employer contribution under the Company’s 401(k) Plan.

Base salary is determined by considering the overall performance of each executive officer with respect to the duties and responsibilities assigned. Salary surveys of other community banks are reviewed and factored into the process to ensure fair rates of compensation.

During the year ended December 31, 2005, the base salary paid to Robert M. Daugherty, the President and Chief Executive Officer of the Company was $328,417. Mr. Daugherty also received a performance bonus of $175,000 paid in 2006 based on his achieving the bonus objectives and his employment agreement established by

| (1) | This section is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

17

the Committee for 2005. This resulted in total salary and bonus for Mr. Daugherty of $503,417 for 2005. The Committee believes the compensation paid to Mr. Daugherty during the fiscal year is appropriate based on competitive salary surveys and the performance of the Company.

The amount of options granted to an employee is based on the employee’s performance and relative responsibilities within the Company. Options may have a deferred vesting and will not be exercisable prior to vesting. During the year ended December 31, 2005, the Committee granted stock options totaling 45,293 shares to employees of the Company and its subsidiaries.

The amount of restricted performance awards to an employee is based on the employee’s performance and relative responsibilities within the Company. Restricted performance awards have a deferred vesting and will not be exercisable prior to vesting. During the year ended December 31, 2005, the Committee granted restricted performance awards totaling 74,000 shares to employees of the Company and its subsidiaries, of which 56,500 were outstanding as of December 31, 2005.

| | |

| COMPENSATION COMMITTEE: | | James Rand Elliott (Chair) |

| | Allen Ketelsen |

| | Craig D. Eerkes |

18

RELATED PARTY TRANSACTIONS AND BUSINESS RELATIONSHIPS

Some of the Company’s directors and executive officers were customers of the Bank during 2005 and had transactions with the Bank in the ordinary course of business. In addition, some of the Company’s directors and executive officers are officers, directors or shareholders of corporations or members of partnerships, which were customers of the Bank during the last fiscal year and had transactions with the Bank in the ordinary course of business. All loans included in such transactions were made in the ordinary course of business, were on substantially the same terms (including interest rates and collateral) as those prevailing at the time for comparable transactions with other persons and, in the opinion of management, did not involve more than any normal risk of collectability or present other unfavorable features. The amount of loans outstanding as of December 31, 2005 issued to directors, executive officers and their affiliates was approximately $1,034,000.

AUDIT COMMITTEE MATTERS

During calendar year 2005, the Audit Committee was from time to time comprised of Mr. Livingstone, Chairman, Mr. Taylor, Mr. Elliott, Mr. Swartz and Mr. Bolyard. On September 1, 2005, Mr. Bolyard resigned from the Board of Directors and his position on the Audit Committee was taken by Mr. Taylor. Mr. Livingstone is deemed an audit committee financial expert within the meaning of Item 401h of Regulation S-K, and independent within the meaning of Item 7(d)(3)(iv), of Schedule 14A.

Audit Committee Charter. The Audit Committee operates pursuant to a written charter approved by the Company’s Board of Directors. Each member of the Audit Committee is deemed “independent” in accordance with regulations under the Security Exchange Act of 1934 and the current listing standards of the National Association of Securities Dealers. The Audit Committee reports to the Board of Directors and is responsible for overseeing and monitoring financial accounting and reporting, the system of internal controls established by management and the audit process of the Company. The Audit Committee Charter sets out the responsibilities, authority and specific duties of the Audit Committee. The Charter specifies, among other things, the structure and membership requirements of the Audit Committee, as well as the relationship of the Audit Committee to the independent auditors, the internal audit department and management of the Company. A copy of the Company’s Audit Committee Charter may be obtained from the Company’s website:www.awbank.com.

REPORT OF THE AUDIT COMMITTEE.(1)

With respect to the Company’s audited financial statements for the year ended December 31, 2005, the Audit Committee has:

| | • | | completed its review and discussion of the Company’s 2005 audited financial statements with management; |

| | • | | discussed with the Company’s independent auditors, Moss Adams LLP, the matters required to be discussed by Statement on Auditing Standards (“SAS”) No. 61,Communication with Audit Committees, as amended by SAS No. 90,Audit Committee Communications, including matters related to the conduct of the audit of the Company’s financial statements; |

| | • | | received written disclosures, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, indicating all relationships, if any, between the |

| (1) | This section is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

19

| | independent auditors and its related entities and the Company and its related entities which, in the auditors’ professional judgment, reasonably may be thought to bear on the auditors’ independence, and the letter from the independent auditors confirming that, in its professional judgment, it is independent from the Company and its related entities, has discussed with the auditors the auditors’ independence from the Company, and has considered whether the provision of non-audit services is compatible with maintaining their independence; and |

| | • | | recommended to the Board of Directors, based on its review and discussions with management and discussions with the independent auditors, that the Company’s audited financial statements for the year ended December 31, 2005 be included in the Company’s Annual Report on Form 10-K. |

| | |

| AUDIT COMMITTEE: | | Donald H. Livingstone (Chair) |

| | J. Rand Elliott |

| | Donald H. Swartz |

| | P. Mike Taylor |

20

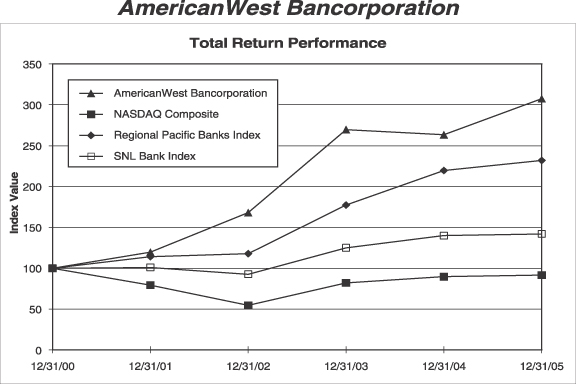

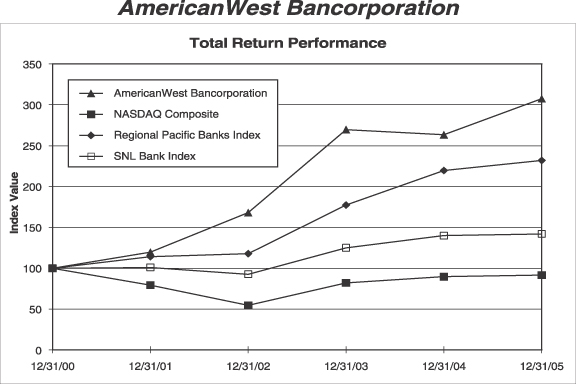

SHAREHOLDER RETURN PERFORMANCE GRAPH

The following graph compares the cumulative total shareholder return on the Company’s common stock during the period beginning December 31, 2000, and ending December 31, 2005, with the cumulative total return on the NASDAQ Composite, Regional Pacific Banks Index and the SNL Bank Index for the same period. The stock price information shown on the graph is not necessarily indicative of future price performance.

Comparison of Five Year Cumulative Return

Total Return Performance

| | | | | | | | | | | | |

| | | Period Ending |

Index | | 12/31/00 | | 12/31/01 | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 |

AmericanWest Bancorporation | | 100.00 | | 119.78 | | 168.11 | | 269.75 | | 263.54 | | 307.53 |

NASDAQ Composite | | 100.00 | | 79.18 | | 54.44 | | 82.09 | | 89.59 | | 91.54 |

Regional Pacific Banks Index | | 100.00 | | 114.16 | | 117.80 | | 177.44 | | 219.70 | | 232.02 |

SNL Bank Index | | 100.00 | | 101.00 | | 92.61 | | 124.93 | | 140.00 | | 141.91 |

Source: SNL Financial LC, Charlottesville, VA

© 2006

21

PROPOSAL 2—ADOPTION OF THE AMERICANWEST BANCORPORATION

2006 EQUITY INCENTIVE PLAN

Currently, the Company has two adopted incentive stock option plans: the 1995 and 2001 Incentive Stock Option Plans. Subject to stockholder approval, the Board has approved the AmericanWest Bancorporation 2006 Equity Incentive Plan (the “Plan”). The Board is seeking shareholder approval to adopt the Plan to assume the remaining shares of common stock that may be subject to stock options and may be issued as performance shares under the 2001 Incentive Stock Option Plan and have not yet been issued. Under the Plan, the total number of shares that may be issued is 315,666 shares (representing the number of unissued shares remaining under the 2001 Incentive Stock Option Plan) plus any shares under the Company’s 2001 Incentive Stock Option Plan as to which options or other benefits granted thereunder and currently outstanding may lapse, expire, terminate or be canceled. If the Plan is adopted, no stock options or performance shares will be further issued under the 1995 and 2001 Incentive Stock Option Plans.Therefore, upon approval of the Plan, the Company is not seeking to increase the aggregated number of shares that were previously approved under the 2001 Incentive Stock Option Plan.

The Plan is summarized below. The summary is qualified in its entirety by reference to the full text of the Plan, a copy of which is attached as Appendix A.

Overview of the Plan

The Plan covers 315,666 shares of the Company’s common stock. At all times, the Company shall reserve and keep available a sufficient number of shares as shall be required to satisfy the requirements of all outstanding awards granted under the Plan.

Eligibility. The Plan provides for the grant of awards to eligible persons. Eligible persons include, in the case of an incentive stock option, employees of the Company or a subsidiary, and in the case of non-qualified stock options, restricted stock and unrestricted stock, employees, directors or consultants of the Company or a subsidiary.

Administration. Authority to control and manage the operation and administration of the Plan is vested in the Board. The Board may delegate such responsibility to a committee or subcommittee consisting of two or more members of the board who are Non-Employee Directors as defined under the Exchange Act. The administrator has the authority to interpret the Plan. Any decision or action of the administrator in connection with the Plan is final and binding.

Terms and Conditions of Option Grants. One or more options may be granted to each eligible person. The options granted under the Plan will be evidenced by an award agreement, which will expressly identify the option as an incentive stock option or a non-qualified stock option. The administrator shall specify the grant date, exercise price, terms and conditions for the exercise of the options. No option under the Plan shall terminate later than ten years after the date of grant subject to certain restrictions. In the case of an incentive stock option when the optionee owns more than 10% of the total combined voting power of all classes of stock, the option shall expire not later than five years after the date of grant.

Exercise of the Option. Options may be exercised by delivery of a written stock option exercise agreement together with payment in full in the manner specified in the Plan of the exercise price for the number of shares being purchased. The exercise price shall be 100% of the fair market value of the shares on the date of grant. The exercise price of any incentive stock option granted to a ten percent shareholder will not be less than 110% of the fair market value of the share on the date of grant. The holder of the option may exercise such option by payment of cash, existing shares or through a cashless exercise.

Transferability of Options. No option shall be transferable other than by will or by the laws of descent and distribution and, during the lifetime of the participant, only the participant, his guardian or legal representative may exercise an option. The administrator may provide for transfer of an option (other than an incentive stock

22

option) without payment of consideration to designated family members and certain other entities specified in the Plan. The terms applicable to the assigned portion shall be the same as those in effect for the option immediately prior to such assignment. A request to assign an option may be made only by delivery to the Company of a written stock option assignment request.

Termination of Employment. If a participant’s employment is terminated, vested incentive stock options may be exercised at any time within three months after the date of such termination, but in no event after the termination of the option as specified in the award agreement. If an employee continues service to the Company after termination of employment, the employee need not exercise the option within three months of termination of employment, but may exercise within three months of termination of his or her continuing service as a consultant, advisor or work performed in a similar capacity, but if the options held are incentive stock options and the employee exercises after three months of termination of employment, the options will not be treated as incentive stock options.

Retirement, Death or Permanent Disability. If a participant in the Plan ceases to be an employee of the Company due to retirement, the participant may exercise vested options within three months from the date of retirement. If the participant does not exercise within three months of retirement, no option shall qualify as an incentive stock option if it was otherwise so qualified. If a participant becomes permanently and totally disabled or dies while employed by the Company or its subsidiary, or within three months after termination of employment, vested options may be exercised by the participant, the participant’s personal representative, or by the person to whom the option is transferred by will or the laws of descent and distribution, at any time within twelve months after the disability or death, but in no event after the expiration of the option as set forth in the award agreement.

Current or Former Directors. Current or former directors may exercise vested options at any time as set forth in the option agreement by the Board or Compensation Committee, but no later than one year from termination of service as a director. Upon permanent and total disability of a current or former director or his or her spouse who holds a community property interest or joint tenancy interest in the option, the individual or his or her representative shall be entitled to exercise vested options held at such time as set forth in the option agreement. Upon the death of a former director or the death of an interested spouse, the estate of, or administrator to, the deceased individual shall be entitled to exercise vested options held at any time during the time set forth in the option agreement. In no event may an option be exercised after the expiration of its term.

Restricted and Unrestricted Stock Awards. The administrator shall determine all terms and conditions of restricted and unrestricted stock that may be awarded. Unless the administrator provides otherwise, no grant of restricted shares may be assigned, encumbered or transferred except in the event of death, or by will or the laws of descent and distribution.

Securities Laws. No award shall be effective unless made in compliance with all federal and state securities laws, rules and regulations, and in compliance with any rules on any exchange on which shares are quoted.