SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

COMMUNICATION INTELLIGENCE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

COMMUNICATION INTELLIGENCE CORPORATION

275 Shoreline Drive, Suite 500

Redwood Shores, California 94065

___________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

___________

June 14, 2006

___________

To the Stockholders of Communication Intelligence Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Annual Meeting") of Communication Intelligence Corporation, a Delaware corporation (the "Company"), will be held at the Hotel Sofitel, 223 Twin Dolphin Drive, Redwood Shores, California 94065, on June 14, 2006, at 1:00 p.m. Pacific Time, for the following purposes, all as more fully described in the attached Proxy Statement:

| 1. | To consider and vote upon a proposal to elect four directors, each with a term of one year; and |

| 2. | To transact such other business as may properly come before the Annual Meeting. |

You are urged to carefully read the attached proxy statement and the additional information concerning the matters to be considered at the meeting. The Board of Directors has fixed the close of business on April 21, 2006 as the record date. Only stockholders of record at the close of business on the record date will be entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment thereof. A list of the stockholders will be available for inspection at the Company’s headquarters, 275 Shoreline Drive, Redwood Shores, California 94065, at least ten days before the annual meeting and at the Annual Meeting.

YOUR VOTE IS IMPORTANT

EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY IN THE ENVELOPE PROVIDED SO THAT YOUR SHARES MAY BE VOTED AT THE ANNUAL MEETING. IF YOU EXECUTE A PROXY, YOU STILL MAY ATTEND THE ANNUAL MEETING AND VOTE IN PERSON.

| Redwood Shores, California | By Order of the Board of Directors |

| May 5, 2006 | /s/ Guido DiGregorio Guido DiGregorio Chairman, President and Chief Executive Officer |

TABLE OF CONTENTS

Page

INTRODUCTION 1

VOTING SECURITIES 1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT 2

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE 3

ELECTION OF DIRECTORS 3

EXECUTIVE OFFICERS ; 6

EXECUTIVE COMPENSATION 7

COMPENSATION COMMITTEE REPORT 11

AUDIT COMMITTEE REPORT 12

INFORMATION REGARDING THE COMPANY’S INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM 15

PERFORMANCE GRAPH 16

COMPANY CODE OF ETHICS 17

SHAREHOLDER PROPOSALS AND SHAREHOLDER NOMINATIONS OF DIRECTORS 17

SOLICITATION OF PROXIES � 60; 18

OTHER MATTERS 18

ADDITIONAL INFORMATION 18

COMMUNICATION INTELLIGENCE CORPORATION

275 Shoreline Drive, Suite 500

Redwood Shores, California 94065

_____________

PROXY STATEMENT

_____________

ANNUAL MEETING OF STOCKHOLDERS

_____________

INTRODUCTION

This Proxy Statement and the accompanying proxy is being furnished to stockholders of Communication Intelligence Corporation, a Delaware corporation (the "Company"), in connection with the solicitation of proxies by the Board of Directors for use in voting at the Company's Annual Meeting of Stockholders to be held at the Hotel Sofitel, 223 Twin Dolphin Drive, Redwood Shores, California 94065, on June 14, 2006, at 1:00 p.m. Pacific Time, and any and all adjournments or postponements thereof (the "Annual Meeting").

At the Annual Meeting, stockholders of the Company will be asked to consider and vote upon the following:

| (i) | To consider and vote upon a proposal to elect four directors, each with a term of one year; and |

| (ii) | such other matters as may properly be brought before the meeting. |

This Proxy Statement and the accompanying proxy, together with a copy of the Company's Annual Report to Stockholders, are first being mailed or delivered to stockholders of the Company on or about May 5, 2006.

WHETHER OR NOT YOU ATTEND THE ANNUAL MEETING, YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE ASKED TO SIGN AND RETURN THE PROXY, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. SHARES CAN BE VOTED AT THE ANNUAL MEETING ONLY IF THE HOLDER IS REPRESENTED BY PROXY OR IS PRESENT.

VOTING SECURITIES

The Board of Directors has fixed April 21, 2006 as the record date for purposes of determining the stockholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of the Company’s common stock (“Common Stock”) at the close of business on such date are entitled to notice of and to vote at the Annual Meeting. At the close of business on the record date, there were approximately 933 beneficial owners of the 107,473,297 outstanding shares of our Common Stock. Each stockholder is entitled to one vote for each share of our Common Stock held by that stockholder as of the record date. If a choice as to the matters coming before the Annual Meeting has been specified by a stockholder “for,” “against” or “abstain” on the proxy, which is duly returned and properly executed, the shares will be voted accordingly. If no choice is specified on the returned proxy, the shares will be voted in favor of the approval of the proposal described in the Notice of Annual Meeting and in this proxy statement. The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. The presence in person or by proxy of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

Attendance at the meeting will not automatically revoke previously-submitted, properly-executed proxies. A stockholder executing a proxy pursuant to this solicitation may revoke his or her proxy at any time prior to its use by:

| · | delivering to the Secretary of the Company a signed notice of revocation; delivering a later-dated, properly executed proxy; or |

· attending the meeting and voting in person.

In order to be effective, all revocations or later-filed proxies must be delivered to the Company at the address listed above not later than June 13, 2006, 5:00 p.m., local time. All valid unrevoked proxies will be voted at the Annual Meeting. Under Delaware law, stockholders are not entitled to appraisal rights with respect to any of the proposals set forth in this proxy statement.

Proxies marked as abstaining will be treated as present for the purpose of determining whether there is a quorum for the Annual Meeting, but will not be counted as voting on any matter as to which abstinence is indicated. Broker "non-votes" (i.e., the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on the matter) will not be treated as present for purposes of determining whether there is a quorum for the Annual Meeting unless the broker is given discretion to vote on at least one matter on the agenda.

If a quorum is present at the annual meeting, the four nominees for director receiving the greatest number of votes (a plurality) will be elected. Abstentions and broker non-votes will not be considered in determining whether director nominees have received the requisite number of affirmative votes.

Each enclosed proxy gives discretionary authority to the persons named therein with respect to any amendments or modifications of the Company’s proposal and any other matters that may be properly proposed at the Annual Meeting. The shares represented by all valid non-revoked proxies returned in time to be voted at the Annual Meeting will be voted in accordance with the instructions marked therein. EXECUTED BUT UNMARKED PROXIES WILL BE VOTED FOR THE ELECTION OF THE DIRECTORS NAMED IN THE PROXY. If any other matter(s) properly comes before the Annual Meeting, the proxies solicited hereby will be exercised in accordance with the reasonable judgment of the proxy holders named therein. If the meeting is adjourned or postponed, your shares will be voted by the proxy holders on the new meeting date as well, unless you have revoked your proxy instructions before that date.

The Company will pay the cost of its proxy solicitation. Upon request, the Company will reimburse brokers, banks, and other nominees for their reasonable expenses in sending proxy material to their principals and obtaining their proxies. Some of the Company’s employees may also solicit stockholders personally and by telephone. None of these employees will receive any additional or special compensation for doing this. Your cooperation in promptly completing and returning the enclosed proxy card to vote your shares of Common Stock will help to avoid additional expense.

If you are a stockholder of record and you plan to attend the annual meeting, please indicate this when you vote. If you are a beneficial owner of shares of Common Stock held by a bank, broker or other nominee, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from the bank, broker, or other nominee are examples of proof of ownership. If you want to vote in person your shares of Company’s common stock held in street name, you will have to obtain a proxy, executed in your favor, from the holder of record. You will need to provide proof of identification to gain entry to the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of May 5, 2006, with respect to the beneficial ownership of (i) any person known to be the beneficial owner of more than 5% of any class of voting securities of the Company, (ii) each director and director nominee of the Company, (iii) each of the current executive officers of the Company named in the Summary Compensation Table of this Proxy Statement under the heading "Executive Compensation" and (iv) all directors and executive officers of the Company as a group.

| | | | | Common Stock | |

Name of Beneficial Owner | | | | Number of Shares | | Percent of Class | |

| Holders of 5% or More of the outstanding shares of the Company’s voting securities | | | | | | | |

| | | | | | | | | | | |

| Michael W. Engmann (1) | | | | | | 7,947,714 | | | 7.40 | % |

| | | | | | | | | | | |

Directors and Executive Officers | | | | | | | | | | |

| | | | | | | | | | | |

| Guido DiGregorio (2) | | | | | | 1,950,000 | | | 1.81 | % |

| C. B. Sung (3) | | | | | | 1,807,610 | | | 1.68 | % |

| Louis P. Panetta (4) | | | | | | 203,125 | | | * | |

| Davie E. Welch, (5) | | | | | | 100,000 | | | * | |

| Francis V. Dane (6) | | | | | | 394,175 | | | * | |

| Russel L. Davis (6) | | | | | | 500,000 | | | * | |

| All directors and executive officers as a group (6 persons) | | | | | | 4,954,910 | | | 4.61 | % |

___________

| (1) | Represents (a) 2,622,907 shares held by MDNH Partners, L.P. of which Mr. Engmann is a partner and (b) 5,324,807 held by Mr. Engmann. Such shares were reported on Schedule 13G dated December 28, 2005. Mr. Engmann may be deemed to beneficially own the 2,622,907 shares held by MDNH Partners, L.P. Mr. Engmann disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

| (2) | Represents 1,950,000 shares, issuable upon the exercise of stock options exercisable within 60 days hereof. The business address of Mr. DiGregorio is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. See “Executive Compensation; Option Grants in 2005.” |

| (3) | Includes (a) 1,568,051 shares held by the Sung Family Trust, of which Mr. Sung is a trustee, (b) 3,369 shares held by the Sung-Kwok Foundation, of which Mr. Sung is the Chairman, and (c) 236,190 shares of common stock issuable upon the exercise of stock options , exercisable within 60 days hereof. Mr. Sung may be deemed to beneficially own the shares held by the Sung Family Trust and the Sung-Kwok Foundation. Mr. Sung disclaims beneficial ownership of such shares except to the extent of his pecuniary interests therein. The business address of Mr. Sung is, UNISON Group, 1001 Bayhill Dr., 2nd Floor, San Bruno, California 94066. See “Certain Relationships and Related Transactions.” |

| (4) | Represents 203,125 shares issuable upon the exercise of options exercisable within 60 days hereof. Mr. Panetta’s business address is 827 Via Mirada, Monterey, California 93940. See “Certain Relationships and Related Transactions.” |

| (5) | Represents 100,000 shares issuable upon the exercise of stock options exercisable within 60 days hereof. The business address of Mr. Welch is 1729 East Otero Avenue, Littleton, CO 80122. See “Certain Relationships and Related Transactions.” |

| (6) | Represents (a) 212 shares held by Mr. Dane and (b) 393,963 shares issuable upon the exercise of stock options exercisable within 60 days hereof. The business address of Mr. Dane is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. See “Executive Compensation; Option Grants in 2005.” |

| (7) | Represents 500,000 shares issuable upon the exercise of stock options within 60 days hereof. The business address of Mr. Davis is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. See “Executive Compensation; Option Grants in 2005.” |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company's officers, directors and persons who own more than ten percent of a registered class of the Company's equity securities to file certain reports with the Securities and Exchange Commission (the "SEC") regarding ownership of, and transactions in, the Company's securities. These officers, directors and stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) reports that are filed with the SEC. Based solely on a review of copies of such forms received by the Company with respect to fiscal year 2005 and written representations received by the Company from certain reporting persons, the Company believes that for the year ended December 31, 2005 all Section 16(a) reports required to be filed by the Company's executive officers, directors and 10% stockholders were filed on a timely basis.

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board of Directors shall consist of such number of directors, with a minimum of three, as the Board of Directors may determine from time to time. The authorized number of directors is four (4). The four persons listed below are the nominees for election as directors at the Annual Meeting. Each director elected at this Meeting will serve for one (1) year or until his successor is duly elected and qualified or his earlier resignation, removal or disqualification.

Unless otherwise instructed, the proxy holders named in the accompanying proxy will vote the shares represented by proxies received by them for the election of the four nominees to the Board of Directors named below. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the shares will be voted for the election of any nominee designated by the present Board of Directors. The Company is not aware of any nominee who will be unable or will decline to serve as a director.

Director Nominees

The following table sets forth certain information concerning the nominees:

Name | Age | Year First Elected or Appointed |

| | | |

| Guido D. DiGregorio | 67 | 1997 |

| Louis P. Panetta | 56 | 2000 |

| C. B. Sung | 80 | 1986 |

| David E. Welch | 59 | 2004 |

The business experience of each of the director nominees for at least the past five years includes the following:

Guido D. DiGregorio was elected Chairman of the Board in February 2002, Chief Executive Officer in June 1999 and President in November 1997. From November 1997 to June 1999, he was also the Company's Chief Operating Officer. He was a partner in DH Partners, Inc. (a management consultant firm) from 1996 to 1997. Prior to 1996, Mr. DiGregorio was recruited by a number of companies to reverse trends of financial losses, serving as President and CEO of each of the following companies: Display Technologies, Inc. (a manufacturer of video data monitors) from 1994 to 1996, Superior Engineering Corp. (a producer of factory-built gas fireplaces) from 1991 to 1993, Proxim, Inc. (wireless data communications) from 1989 to 1991, Maxitron Corp. (a manufacturer of computer products) from 1986 to 1989 and Exide Electronics (producer of computer power conditioning products) from 1983 to 1986. From 1966 to 1983, Mr. DiGregorio was employed by General Electric in various management positions, rising to the position of General Manager of an industrial automation business.

Louis P. Panetta was elected a director of the Company in October 2000. From November 2001 to September 2003, Mr. Panetta was a member of the Board of Directors of Active Link. From February 2001 until April 2003, Mr. Panetta was Vice President of Marketing and Investor Relations with Mobility Concepts, Inc. (a wireless Systems Integrator), a subsidiary of Active Link Communications. From September 1999 to October 2000, Mr. Panetta was President and Chief Operating Officer of PortableLife.com (e-commerce products provider) and from December 1992 to September 1999 he was President and Chief Executive Officer of Fujitsu Personal Systems (a manufacturer of computer hardware). From 1995 to 1999, Mr. Panetta served on the Board of Directors of Fujitsu Personal Systems.

C.B. Sung was elected a director of the Company in 1986. Mr. Sung has been the Chairman and Chief Executive Officer of Unison Group, Inc. (a multi-national corporation involved in manufacturing, computer systems, international investment and trade) since 1986 and Unison Pacific Corporation since 1979. He also serves on the Board of Directors of several private companies and non-profit organizations.

David E. Welch was elected a director in March 2004 and serves as the financial expert on the Audit Committee. From July 2002 to present Mr. Welch has been the principal of David E. Welch Consulting, a financial consulting firm, Mr. Welch has also been Vice President and Chief Financial Officer of American Millennium Corporation, Inc., a provider of satellite based asset tracking and reporting equipment, from April 2004 to present. Mr. Welch was Vice President and Chief Financial Officer of Active Link Communications, a manufacturer of telecommunications equipment, from 1999 to 2002. Mr. Welch has held positions as Director of Management Information Systems and Chief Information Officer with Micromedex, Inc and Language Management International from 1995 through 1998. Mr. Welch is a member of the Board of Directors of Advanced Neutraceuticals, Inc. and AspenBio, Inc. Mr. Welch is a Certified Public Accountant licensed in the state of Colorado.

Board of Director Meetings and Committees

The Company's affairs are managed under the direction of the Board of Directors. Members of the Board receive information concerning the Company's affairs through oral and written reports by management, Board and committee meetings and other means. The Company's directors generally attend Board of Directors meetings, committee meetings and informal meetings with management and others, participate in telephone conversations and have other communications with management and others regarding the Company's affairs.

Directors of the Company serve until their successors are duly elected and qualified or until their earlier resignation, removal or disqualification. There are no family relationships between the Company's directors and executive officers.

Board Committees

The Company's Board of Directors has four committees as set forth below. The members of each committee are appointed by the Board of Directors.

Audit Committee. The Audit Committee oversees our financial reporting process on behalf of the Board of Directors and reports to the Board of Directors the results of these activities, including the systems of internal controls that management and the Board of Directors have established, our audit and compliance process and financial reporting. The Audit Committee, among other duties, engages the independent public accountants retained as the registered public accounting firm, pre-approves all audit and non-audit services provided by the independent public accountants, reviews with the independent public accountants the plans and results of the audit engagement, considers the compatibility of any non-audit services provided by the independent public accountants with the independence of such auditors and reviews the independence of the independent public accountants. The members of the Audit Committee are Louis P. Panetta, C. B. Sung and David E. Welch. Mr. Welch serves as the Audit Committee’s financial expert. Each member of the Audit Committee is independent as defined under applicable rules and regulations. The Audit Committee conducted four meetings in the year ended December 31, 2005 and all members attended the meetings. A copy of the Audit Committee charter can be found at our website, www.cic.com.

Finance Committee. The Finance Committee develops strategies for the financing and development of the Company and monitors and evaluates progress toward established objectives. The members of the Finance Committee are Louis P. Panetta and C. B. Sung. During the year the Finance Committee discussions were held concurrently with the meetings of the Board of Directors.

Compensation Committee. The Compensation Committee generally reviews compensation matters with respect to executive and senior management arrangements and administers the Company's stock option plans. The members of the Compensation Committee are Louis P. Panetta and C. B. Sung. . The Compensation Committee held no formal meetings but acted by unanimous written consent thirteen times. The Board has adopted a Compensation Committee Charter, a copy of which can be found on our website, www.cic.com.

Nominating Committee. The Nominating Committee is responsible for considering and making recommendations to the Board concerning the appropriate size, functions and needs of the Board. The Nominating Committee reviews the appropriate skills and characteristics required of directors in the context of prevailing business conditions. The objective of the Nominating Committee is to create and sustain a Board that brings to the Company a variety of perspectives and skills derived from high-quality business and professional experience. Directors should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of the stockholders. They must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. We endeavor to have a Board representing diverse experience at policy-making levels in business, government, education, and technology, and in areas that are relevant to the Company’s business activities. Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serving on the Board for an extended period of time.

During the year Nominating Committee discussions were held concurrently with the meetings of the Board of Directors. The Nominating Committee determined that a Board of Directors constituted of the current nominees, considering the varying and relevant industry experience of each nominee and tenure as a director, would best serve the Company’s current needs. The members of the Nominating Committee are Louis P. Panetta, C. B. Sung and David E. Welch. The Board has adopted a Nominating Committee Charter, a copy of which can be found on our website, www.cic.com.

See SHAREHOLDER PROPOSALS AND SHAREHOLDER NOMINATIONS OF DIRECTORS, page 17, for information regarding the process for stockholders to nominate individuals for election to the Board of Directors.

Board and Committee Meetings

During 2005, the Board of Directors held three formal meetings and acted by unanimous written consent on two occasions. Except for the meetings of the Audit Committee, which were held separately, and in cases where the committees acted by unanimous consent, all committee meetings were held concurrently with the formal meetings of the Board of Directors. For the year ended December 31, 2005, each incumbent director participated in all of the formal meetings of the Board and each Committee on which he served, except for Mr. Sung who missed one formal board meeting.

Director Compensation

For their services as directors of the Company, all non-employee directors receive a fee of $1,000 for each Board meeting attended and all directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attending such meetings. Directors are also eligible to receive stock options. In June 2005, Louis Panetta, C. B. Sung and David Welch were each granted immediately exercisable non-qualified options to purchase 25,000 shares of common stock at an exercise price of $0.46 per share, which options expire on June 21, 2012.

In January, 1999, C. B. Sung was granted options to purchase 10,000 shares of the Company’s common stock for work performed related to our Chinese joint venture, outside of the normal activities expected of a director. Those option expired on January 27, 2006. In recognition of his past and continuing contribution to our Chinese joint venture, on December 19, 2005, Mr. Sung was granted 10,000 options. Such options vested immediately, have a seven year life and an exercise price at $0.39 per share, the fair market value of a share of our Common Stock on December 19, 2005, for 25% of the options and at $0.75 per share, which was the exercise price of the January 27, 1999 option grants, for the remaining 75%. Such options expire on December 19, 2012.

Communications to the Board

The Board of Directors welcomes and encourages stockholders to share their thoughts regarding the Company. Towards that end, the Board of Directors has adopted a policy whereby all communications should first be directed to Investor Relations. Investor Relations will then, for other than routine communications, distribute a copy of the communication to the Chairman of the Board, the Chairman of the Audit Committee and the Company’s Chief Legal Officer. Based on the input and decision of these persons, along with the entire board, if it is deemed necessary, the Company will respond to the communications. Stockholders should not communicate with individual directors unless requested to do so.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE FOR EACH OF THE NOMINEES NAMED HEREIN. THE FOUR NOMINEES RECEIVING THE MOST VOTES, EVEN IF LESS THAN A MAJORITY, WILL BE ELECTED TO THE BOARD OF DIRECTORS.

EXECUTIVE OFFICERS

The following table sets forth, as of May 5, 2006, the name and age of each executive officer of the Company, and all positions and offices of the Company presently held by each of them.

| | Name | Age | Positions Currently Held | |

| | | | | |

| | Guido D. DiGregorio | 67 | Chairman of the Board, Chief Executive Officer and President, | |

| | Francis V. Dane | 55 | Chief Legal Officer, Secretary, Chief Financial Officer, and Human Resource Executive | |

| | Russel L. Davis | 41 | Chief Product Officer | |

The business experience of each of the executive officers for at least the past five years includes the following:

Guido D. DiGregorio - see above.

Francis V. Dane was appointed the Company's Secretary in February of 2002, its Chief Financial Officer in October 2001, its Human Resources Executive in September 1998 and he assumed the position of Chief Legal Officer in December of 1997. From 1991 to 1997 he served as a Vice President and Secretary of the Company, and from 1988 to 1992 as its Chief Financial Officer and Treasurer. Since July of 2000, Mr. Dane has also been the Secretary and Treasurer of Genyous Biomed International Inc. (including its predecessors and affiliates), a biotechnology venture capital and incubation company. From October 2000 to April 2004, Mr. Dane served as a director of Perceptronix Medical, Inc. and SpectraVu Medical Inc., two companies focused on developing improved methods for the early detection of cancer. From October 2000 to June 2003. Mr. Dane was a director of CPC Cancer Prevention Centers Inc., a company that was formed to develop a comprehensive cancer prevention program based upon the detection of early stage, non-invasive cancer. Prior to this Mr. Dane spent over a decade with PricewaterhouseCoopers, his last position was that of Senior Manager, Entrepreneurial Services Division. Mr. Dane is a member of the State Bar of California and has earned a CPA certificate from the states of Connecticut and California.

Russell L. Davis rejoined the Company as Chief Product Officer in August of 2005. He served as CTO of SiVault Systems, from November of 2004 to August of 2005. Mr. Davis originally joined CIC in May of 1997 and was appointed Vice President of Product Development & Support in October of 1998. Prior to this, Mr. Davis served in a number of technical management roles including; Director of Service for Everex Systems, Inc., a Silicon Valley based PC manufacturer and member of the Formosa Plastics Group, managing regional field engineering operations for Centel Information Systems, which was acquired by Sprint. He also served in the United States Navy supervising shipboard Electronic Warfare operations.

EXECUTIVE COMPENSATION

The following table sets forth compensation awarded to, earned by or paid to the Company's President, regardless of the amount of compensation, and each executive officer of the Company serving as of December 31, 2005 whose total annual salary and bonus for 2005 exceeded $100,000 (collectively, the "Named Executive Officers").

Summary Compensation Table

| | | Annual Compensation | Long-Term Compensation |

Name and Principal Position | Year | Salary | All Other Annual Compensation | Securities Underlying Options |

Guido DiGregorio Chairman, President and Chief Executive Officer | 2005 2004 2003 | $322,875(1) $259,371(1) $206,250(1) | - - - | 1,700,000 - - |

Francis V. Dane Chief Legal Officer, Secretary and Chief Financial Officer | 2005 2004 2003 | $146,643 $138,125 $128,500 | - - - | 143,943 100,000 100,000 |

Russel L. Davis Chief Product Officer | 2005 | $48,303(2) | - | 500,000 |

___________

(1) In September of 2005 Mr. DiGregorio’s salary was increased to $285,000. In order to ease monthly cash flow requirements, commencing in February 2002 and through September 2005, Mr. DiGregorio deferred approximately $70,000 of his annual salary to the first quarter of each subsequent year. Thus, in the first quarter of 2005, Mr. DiGregorio was paid $70,000 of his salary deferred form 2004. The exception to this general rule occurred in the first two quarters of 2005, in which Mr. DiGregorio deferred $47,000 of his annual salary to the third quarter of that year. The Company does not anticipate further deferrals of Mr. DiGregoio’s salary at this time.

(2) Mr. Davis was named as an executive officer as of August 31, 2005.

Option Grants in 2005

In late 1998, the Company assessed the option position of each of its employees, considering factors such as job descriptions and responsibilities, potential for future contributions and current option positions and salaries in relation to competitive employment opportunities that might be available to individual employees. As a result of this assessment, on January 12, 1999, the Company issued options to virtually all of its employees. Such options were issued with a seven year life , unexercised options from those grants expired on January 12, 2006. To acknowledge the past seven years (and in many cases more) of service and to motivate employees to remain with the Company, on December 19, 2005, the Company granted options to employees in an amount equal to their options expiring on January 12, 2006. Such options were granted with immediate vesting, a seven year life and with an exercise price at $0.39 per share, the fair market value of a share of our Common Stock on December 19, 2005, for 25% of the options and at $0.75 per share, which was the exercise price of the January 12, 1999 option grants for the remaining 75%. Accordingly, on December 19, 2005, Francis V. Dane and Guido DiGregorio were granted options to purchase 143,943 and 1,700,000 shares of the Company’s common stock respectively.

In August 2005 Mr. Davis was hired as Chief Product Officer and was granted options to purchase 500,000 shares of the Company’s common stock. Such options were granted with immediate vesting, a seven year life and with an exercise price for 25% of the options at $0.57 (market value on the date of grant) and the remaining 75% at $0.75.

The following table summarizes the aforementioned grants:

Name | Number of Securities Underlying Options Granted (1) | Percent of Total Options Granted Employees in 2005 | Exercise Price per Share | Expiration Date | Potential Realizable Value At Assumed Annual Rates of Stock Appreciation for Options Term (2) 5%/10% |

Guido D. DiGregorio | 425,000 1,275,000 | 44% | $0.39 $0.75 | 12/19/2012 12/19/2012 | $ 67,477 / $ 157,250 $ 389,290 / $ 907,211 |

| | | | | | |

| Francis V. Dane | 35,985 107,958 | 4% | $0.39 $0.75 | 12/19/2012 12/19/2012 | $ 5,713 / $ 13,314 $ 32,962 / $ 76,816 |

| | | | | | |

| Russel L. Davis | 125,000 375,000 | 13% | $0.57 $0.75 | 8/31/2012 8/31/2012 | $ 29,006 / $ 67,596 $ 114,497 / $ 266,827 |

| | | | | | |

| 1. | Common stock issuable upon exercise of options. |

| 2. | Estimated value of stock appreciation over the seven year life of the issued options. |

Aggregate Option Exercises in 2005 and Year-End Option Values

The following table sets forth certain information concerning the Named Executive Officers with respect to the exercise of options in 2005, the number of shares covered by exercisable and unexercisable stock options at December 31, 2005 and the aggregate value of exercisable and unexercisable "in-the-money" options at December 31, 2005.

Name | Shares Acquired On Exercise | Value Realized | Number of Securities Underlying Unexercised Options at Fiscal Year-End Exercisable(E)/ Unexercisable(U) | Value of Unexercised In-The-Money Options at Fiscal Year-End(1) Exercisable(E)/ Unexercisable(U) |

| | | | | |

| Guido DiGregorio | - | $ - | 3,650,000 (1) (E) | $42,500 (E)(2) |

| Francis V. Dane | - | $ - | 309,852 (1) (E) | $12,916 (E)(2) |

| | | | 134,091 (U) | 682 (U)(2) |

| Russel L. Davis | - | $ - | 500,000 (E) | $- (E)(2) |

___________

| | (1) | The number of securities underlying unexercised options at fiscal year-end includes shares related to 1,700,000 options for Mr. DiGregorio and shares related to 143,943 options for Mr. Dane, all of which expired on January 12, 2006. The grants for an equivalent number of options for each individual were reported on a Form 8-K filed on December 20, 2005. |

| | (2) | The value of unexercised in-the-money options was determined by using the difference between the closing sale price of the common stock on the Nasdaq Over the Counter Market as of December 31, 2005 ($0.43) and the exercise price of such options. |

1999 Stock Option Plan

The Company’s 1999 Stock Option Plan (the “1999 Plan”) provides for the granting to the Company’s directors and employees of non-transferable incentive stock options (“Incentive Options”) , as defined in Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), and non-transferable non-statutory stock options (“Non-Qualified Options”). A total of 4,000,000 shares of common stock are authorized for issuance under the 1999 Plan. As of May 5, 2006, options to purchase an aggregate 3,652,823 shares of common stock were outstanding, 162,216 shares have been issued upon exercise of options granted under the 1999 Plan and 184,961 shares remain available for future grants. Unless terminated sooner, the 1999 Plan will terminate in June 2009.

The 1999 Plan is administered by the Board of Directors or a committee of the Board. The Board or such committee has the authority to determine the terms of the options granted, including the exercise price, number of shares subject to each option, vesting provisions, if any, and the form of consideration payable upon exercise. The exercise price of Incentive Options must be the fair market value of the common stock valued at the date of grant. The 1999 Plan allows the exercise price of Non-Qualified Options to be at least 85% of the fair market value of the common stock valued at the date of grant. The expiration date of Options is determined by the Board or a committee of the Board, but Options cannot expire later than ten years from the date of grant, and in the case of Incentive Options granted to 10% stockholders, cannot expire later than five years from the date of grant. Options have typically been granted with an expiration date seven years after the date of grant.

If an employee to whom an award has been granted under the 1999 Plan dies while providing services to the Company, retires from employment with the Company after attaining his retirement date, or terminates employment with the Company as a result of permanent and total disability, the restrictions then applicable to such award shall continue as if the employee had not terminated employment and such award shall thereafter be exercisable, in whole or in part by the person to whom it was granted (or by his or her duly appointed, qualified, and acting personal representative, his estate, or by a person who acquired the right to exercise such option by bequest or inheritance from the grantee), in the manner set forth in the award, at any time within the remaining term of such award. Except as provided in the preceding paragraph, generally if a person to whom an option has been granted under the 1999 Plan ceases to be an employee of the Company, such option shall continue to be exercisable to the same extent that it was exercisable on the last day on which such person was an employee for a period of 90 days thereafter, or for such longer period as may be determined by the Board or a committee of the Board whereupon such option shall terminate and shall not thereafter be exercisable.

The Board has the authority to amend or terminate the 1999 Plan, provided that such action does not impair the rights of any optionee under any option previously granted under the 1999 Plan, without the consent of such optionee.

1994 Stock Option Plan

The Company’s 1994 Stock Option Plan (the “1994 Plan”) provides for the granting to the Company’s directors and employees of Incentive Stock Options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended and Non-Qualified Options. A total of 6,000,000 shares of common stock were authorized for issuance under the 1994 Plan. As of May 5, 2006, options to purchase an aggregate 137,888 shares of common stock were outstanding and no shares remain available for future grants, as the 1994 Plan expired in November 2004. The termination of the 1994 Plan had no effect on the 137,888 issued and outstanding stock options which will remain outstanding until they are exercised, terminated or the expiration of the individual grants in September 2006.

Individual Plan Options

The Company also grants options to employees, directors and consultants outside of the 1999 Plan and 1994 Plan pursuant to individual plans. These options are typically granted with the same terms as those granted under the 1999 Plan, except all such options are Non-Qualified. As of May 5, 2006, non-plan options to purchase an aggregate of 2,214,443 shares of common stock were outstanding under such individual plans.

The following table sets forth certain information relating to the Company’s equity compensation plans for employees and directors under which the Company’s Common Stock may be acquired.

Equity Compensation Plan Information

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (C)(1)(2) |

Equity compensation plans approved by security holders | | 3,765,711 | | $0.78 | | 184,961 |

Equity compensation plans not approved by security holders (3) | | 2,214,443 | | $0.75 | | − |

Total | | 5,980,154 | | $0.77 | | 184,961 |

[Missing Graphic Reference]

(1) A total of 4,000,000 shares are reserved for issuance under the Company’s 1999 Stock option Plan, of which options to purchase 3,652,823 shares are outstanding, 162,216 shares have been issued upon exercise of options granted thereunder and 184,961 remain available for future grants as of May 5, 2006.

(2) A total of 6,000,000 shares are authorized for issuance under the Company’s 1994 Stock option Plan, of which options to purchase 137,888 are outstanding and 4,315,624 shares were issued upon exercise of options granted thereunder as of May 5, 2006. No shares remain available for future grants as the plan expired in November 2004.

(3) Granted under individual option plans entered into by the Company with certain employees, officers and directors between 1999 and 2005.

COMPENSATION COMMITTEE REPORT

Under rules established by the Securities and Exchange Commission (the “SEC”), the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company’s Chief Executive Officer and the four other most highly compensated executive officers. In fulfillment of this requirement, the Compensation Committee has prepared the following report for inclusion in this Proxy Statement.

Compensation Philosophy and Objectives. The Committees' compensation philosophy is based upon the belief that the success of the Company results from the coordinated efforts of all employees working as a team to achieve objectives of providing superior products and services to the Company's customers and maximizing the Company's value for the benefit of its stockholders.

The Company's compensation programs are designed to attract, retain and reward personnel whose individual and team performance contributes significantly to the short and long-term objectives of the Company. The Company's executive compensation programs are guided by the following principles, which may also be considered in making compensation decisions for employees:

| | ● | To ensure competitiveness, the Company monitors industry standards and considers this information when it makes compensation decisions; and |

| | ● | The compensation of executive officers is affected by individual, team and overall Company performance. Overall Company performance is based upon achievement of strategic and operating goals. Such factors include revenues generated, technology validations, timely product introductions, capturing market share and preservation of and increases in stockholder value. Individual and team performance is considered to the extent of whether departmental goals are achieved within the time and budget constraints of Company operating plans. Additionally, individual performance is measured, in part, against the extent to which an individual executive officer is able to foster team spirit and loyalty and minimize employee turnover. |

Methods of Compensation. The key elements of the Company's executive compensation program consist primarily of base salary and stock options.

The base salaries of the Company’s executive officers are established as part of an annual compensation review cycle. In establishing those salaries, the Compensation Committee considered information about salaries paid by companies of comparable size in our industry, individual performance, position and internal comparability considerations. While all of these factors were considered, the Compensation Committee did not assign specific weights to any of these factors. Base salary for the Company's executive officers is generally determined by performance, the combined base salary and annual bonus for competitive positions in the industry and general market and Company conditions. Currently, the Company does not have an annual bonus plan.

The Committees believe that the use of stock options as a means of compensation provides an incentive for executives and aligns their interests with those of the stockholders. All employees are eligible to receive stock options under the Company's stock option plans. The long-term, performance-based compensation of executive officers takes the form of option awards, which are designed to align a significant portion of the executive compensation program with long-term stockholder interests. The Compensation Committee believes that equity-based compensation ensures that the Company’s executive officers have a continuing stake in the long-term success of the Company. All options granted by the Company have been granted with an exercise price equal to or above the market price of the Company’s Common Stock on the date of grant and, accordingly, will only have value if the Company’s stock price increases. In granting options the Compensation Committee generally takes into account each executive’s responsibilities, relative position in the Company, past grants, and approximate grants to individuals in similar positions for companies of comparable size in the software industry.

President and Chief Executive Officer's Compensation. Mr. Guido DiGregorio, the Chairman of the Board, Chief Executive Officer and President of the Company, was appointed to the Presidency by the Board of Directors in November1997, to the office of Chief Executive in June 1999 and to the Chairmanship in February 2002. The Company does not currently have an employment agreement with Mr. DiGregorio. Mr. DiGregorio currently receives an annual salary of $285,000.

Compensation Committee Interlocks and Insider Participation In Compensation Decisions

.

During the fiscal year ended December 31, 2005, there were no employee directors on the Compensation Committee and no interlocks. On May 15, 2004, the Board of Directors adopted a Compensation Committee charter, a copy of the Compensation Committee charter can be found at our website, www.cic.com.

| | The Compensation Committee |

| | of the Board of Directors |

| | |

| | Louis P. Panetta |

| | C. B. Sung |

AUDIT COMMITTEE REPORT

General. Under the Company’s Audit Committee Charter ("Charter"), a copy of which can be found on our website, the general purpose of the Audit Committee is to assist the Board of Directors in the exercise of its fiduciary responsibility of providing oversight of the Company's financial statements and the financial reporting processes, internal accounting and financial controls, the annual independent audit of the Company's financial statements, and other aspects of the financial management of the Company. The Audit Committee is appointed by the Board of Directors and is to be comprised of at least three directors, each of whom shall be independent, as such term is defined under the listing standards of the Nasdaq Stock Market. All committee members must be financially literate, or shall become financially literate within a reasonable period of time after appointment to the Committee. All of the members of the Company’s Audit Committee are independent and Mr. Welch is the committee’s financial expert as such term is defined in applicable regulations and rules.

Audit and other Fees. Stonefield Josephson LLP has been the Company’s auditors since 1999. During fiscal years 2005 and 2004, the fees for audit and other services performed by Stonefield Josephson LLP for the Company were as follows:

| | Amount and percentage of fees |

| Nature of Services | 2005 | | 2004 |

| | | | |

| Audit | $ 169,000 (93%) | | $ 245,000 ( 83%) |

| Audit related | $ − | | $ − |

| Tax fees | $ 6,000 ( 3%) | | $ 6,000 ( 2%) |

| Financial Information System Design and Implementation Fees | $ − | | $ − |

| All other fees (1) | $ 7,000 ( 4%) | | $ 43,000 (15%) |

| | | | |

| Total | $ 183,000 (100%) | | $ 294,000 (100%) |

| (1) | In 2005, “all other fees” related primarily to guidance in the application of new accounting pronouncements. In 2004 “all other fees” related primarily to preparation of the Company’s proxy and Registration Statement on Form S-1. The Audit Committee has considered whether the provision of non-audit services has impaired the independence of Stonefield Josephson and has concluded that Stonefield Josephson is independent under applicable SEC and Nasdaq rules and regulations. |

Responsibilities and Duties. The Company's management is responsible for preparing the Company's financial statements and the independent auditors are responsible for auditing those financial statements. The Committee is responsible for overseeing the conduct of these activities by the Company's management and the independent auditors. The financial management and the independent auditors of the Company have more time, knowledge and more detailed information on the Company than do Committee members. Consequently, in carrying out its oversight responsibilities, the Committee does not provide any expert or special assurance as to the Company's financial statements or any professional certification as to the independent auditors' work.

The specific duties of the Audit Committee include the following:

| 1. | Select, retain, and, when appropriate, terminate the engagement of the independent auditor and set the independent auditors' compensation; |

| 2. | Pre-approve all permitted non-audit services to be performed by the independent auditors and establish policies and procedures for the engagement of the independent auditors to provide permitted non-audit services; |

| 3. | Periodically discuss and review with the independent auditors their independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board, including whether the provision by the independent auditors of permitted non-audit services is compatible with independence and obtain and review a report from the independent auditors describing all relationships between the independent auditors and the Company; |

| 4. | Receive and review: (a) a report by the independent auditors describing the independent auditors' internal quality-control procedures and any material issues raised by the most recent internal quality-control review, or peer review, of the independent auditors, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and (b) other required reports from the independent auditors; |

| 5. | Meet with management and the independent auditors prior to commencement of the annual audits to review and discuss the planned scope and objectives of the audit; |

| 6. | Meet with the independent auditors, with and without management present, after completion of the annual audit to review and discuss the results of the examinations of the independent auditors and appropriate analyses of the financial statements; |

| 7. | Review the recommendations of the independent auditors for improving internal accounting controls and management's responses thereto; |

| 8. | Review and discuss (a) the reports of the independent auditors, with and without management present, as to the state of the Company's financial reporting systems and procedures, the adequacy of internal accounting and financial controls, the integrity and competency of the financial and accounting staff, disclosure controls and procedures, other aspects of the financial management of the Company and (b) current accounting trends and developments, and (c) take such action with respect thereto as may be deemed appropriate; |

| 9. | Review the interim financial statements with management and the independent auditors prior to the filing of the Company's Quarterly Reports on Form 10-Q and discuss the results of the quarterly reviews and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards; |

| 10. | Review and discuss with management and the independent auditors the financial statements to be included in the Company's Annual Report on Form 10-K (or the annual report to stockholders if distributed prior to the filing of Form 10-K), including the judgment of the independent auditors about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements; |

| 11. | Recommend to the Board of Directors, based upon the Committee's review, whether the financial statements should be included in the annual report on Form 10-K; |

| 12. | Review press releases, as well as Company policies with respect to earnings press releases, financial information and earnings guidance provided to analysts and rating agencies and review such releases, information and guidance for compliance with regulations governing the use of non-Generally Accepted Accounting Principles financial measures and related disclosure requirements; |

| 13. | Discuss Company policies with respect to risk assessment and risk management, and review contingent liabilities and risks that may be material to the Company and major legislative and regulatory developments that could materially impact the Company's contingent liabilities and risks; |

| 14. | Review (a) the status of compliance with laws, regulations, and internal procedures, including, without limitation, the Company's policies on ethical business practices; and (b) the scope and status of systems designed to promote Company compliance with laws, regulations and internal procedures, through receiving reports from management, legal counsel and third parties as determined by the Committee and report on the same to the Board of Directors; |

| 15. | Establish procedures for the confidential and anonymous receipt, retention and treatment of complaints regarding the Company's accounting, internal controls, auditing matters and compliance with the Company's ethical business policies; |

| 16. | Establish policies for the hiring of employees and former employees of the independent auditor; |

| 17. | Prepare a report of the Committee each year for inclusion in the Company's proxy statement in accordance with SEC rules; |

| 18. | Review and assess the adequacy of this Charter annually with the Board of Directors as a whole and report to the Board of Directors any significant matters as they occur during the year; and |

| 19. | Conduct such other duties and undertake such other tasks as may be appropriate to the overall purposes for the Committee and as may be assigned from time to time by the Board of Directors consistent with such purposes |

Specific Audit Committee Actions Related to Review of the Company’s Audited Financial Statements. In discharging its duties, the Audit Committee, among other actions, has (i) reviewed and discussed the audited financial statements to be included in the company's Annual Report on Form 10-K for the twelve months ended December 31, 2005 with management, (ii) discussed with the Company's independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standard, AU380) related to such financial statements, (iii) received the written disclosures and the letter from the Company's independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) and has discussed with the independent accountant the independent accountant's independence, (iv) the Audit Committee has considered whether the provision of service represented under the headings on "Financial Information Systems Design and Implementation Fees" and "All Other Fees" as set forth below is compatible with maintaining the independent auditor’s independence, and (v) based on such reviews and discussions, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the company's Annual Report on Form 10-K for the twelve months ended December 31, 2005.

The Audit Committee

Of the Board of Directors

Louis P. Panetta

C. B. Sung

David E. Welch

INFORMATION REGARDING THE COMPANYS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected Stonefield Josephson, Inc. (“Stonefield Josephson”) as the Company’s independent registered public accounting firm to audit the financial statements for fiscal year 2005. Stonefield Josephson has audited the Company’s financial statements since fiscal year 1999. Prior to the retention of Stonefield Josephson neither the Company nor any person on its behalf consulted with Stonefield Josephson regarding the application of accounting principles to any transaction or the types of audit opinion that might be rendered on the Company’s financial statements. Representatives of Stonefield Josephson are expected to be present at the annual meeting with the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

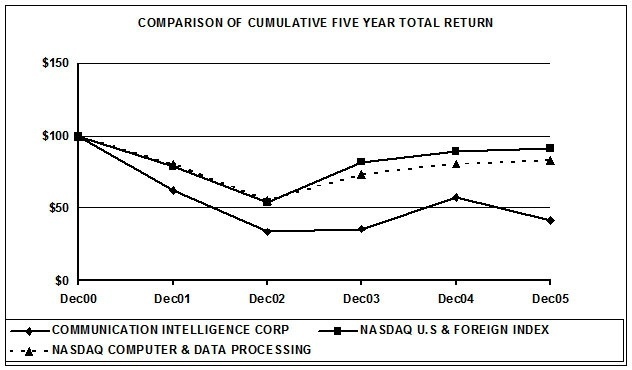

PERFORMANCE GRAPH

The Securities and Exchange Commission requires the Company to include in this Proxy Statement a graph comparing the Company's cumulative five-year return on its common stock with a broad-based stock index and either a nationally recognized industry index or an index of peer companies selected by the Company. This performance graph compares the cumulative five-year returns on the common stock with the Nasdaq Computer and Data Processing Index and the Nasdaq Index. Since March 14, 2003, the Company’s common stock is traded on the Nasdaq OTC Bulletin Board.

Total Return To Stockholders |

(Includes reinvestment of dividends) |

| | | | | | | |

| | | | | | | |

| | | ANNUAL RETURN PERCENTAGE |

| | | Years Ending |

| | | | | | | |

Company / Index | | Dec01 | Dec02 | Dec03 | Dec04 | Dec05 |

COMMUNICATION INTELLIGENCE CORP | | -37.94 | -45.31 | 5.71 | 60.81 | -27.73 |

NASDAQ U.S & FOREIGN INDEX | | -21.14 | -31.19 | 50.84 | 8.81 | 2.27 |

NASDAQ COMPUTER & DATA PROCESSING | | -19.47 | -31.04 | 31.74 | 10.14 | 3.39 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | INDEXED RETURNS |

| | Base | Years Ending |

| | Period | | | | | |

Company / Index | Dec00 | Dec01 | Dec02 | Dec03 | Dec04 | Dec05 |

COMMUNICATION INTELLIGENCE CORP | 100 | 62.06 | 33.94 | 35.88 | 57.70 | 41.70 |

NASDAQ U.S & FOREIGN INDEX | 100 | 78.86 | 54.26 | 81.85 | 89.06 | 91.08 |

NASDAQ COMPUTER & DATA PROCESSING | 100 | 80.53 | 55.53 | 73.15 | 80.57 | 83.30 |

COMPANY CODE OF ETHICS

The Company has adopted a Code of Ethics (“Code”), which is applicable to all Company employees , including the principal executive officer, the principal financial officer and controller and principal accounting officer (“Senior Executive and Financial Officers”). The Code is available on the Company’s website, www.cic.com,. The Company intends, when applicable, to post amendments to or waivers from the Code (to the extent applicable to its Senior Executive and Financial Officers) on its website and in any manner otherwise required by the applicable standards or best practices.

SHAREHOLDER PROPOSALS AND SHAREHOLDER NOMINATIONS OF DIRECTORS

The Nominating Committee considers, selects and recommends to the Board of Directors for approval nominees for director and committee member positions. The Board then considers the recommendation of the Nominating Committee and decides which nominees to present to the Company’s shareholders for election to the Board of Directors.

Proposals by shareholders intended to be presented for action, including proposed nominees for election to the Board of Directors, at the 2007 annual meeting of shareholders must be received by the Company at its principal executive offices, 275 Shoreline Drive, Suite 500, Redwood Shores, CA 94065, not later than January 5, 2007. It is suggested that such proposals be submitted by Certified Mail-Return Receipt Requested. The SEC has amended Rule 14a-4(c) under the Exchange Act that governs the Company’s use of discretionary proxy voting authority with respect to shareholder proposals that are not included in the Company’s proxy solicitation materials pursuant to Rule 14a-8 of the Exchange Act. Therefore, in the event a shareholder does not notify the Company by at least March 22, 2007 (which is 45 days before the expected date the Company intends to mails its proxy material for the year 2007 annual meeting of shareholders, based upon the current year’s schedule ) of an intent to present such a proposal at the Company’s 2007 Annual Meeting, the Company’s management proxies will have the right to exercise their discretionary authority in connection with the matter submitted by the stockholder, without discussion of the matter in the proxy statement.

Shareholders who wish to submit a proposed nominee for election to the Board of Directors of the Company for consideration by the Nominating Committee should send written notice to the Chairman of the Nominating Committee, Communication Intelligence Corporation, 275 Shoreline Drive, Suite 500, Redwood Shores, CA 94065 within the time periods set forth above. Such notification should set forth all information relating to the proposed nominee, as is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act. This includes the proposed nominee’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected; the name and address of such shareholder or beneficial owner on whose behalf the nomination is being made; and the number of shares of the Company stock owned beneficially and of record by such shareholder or beneficial owner. The Nominating Committee will consider shareholder nominees on the same terms as nominees selected by the Nominating Committee.

The Nominating Committee has not established specific minimum age, education, years of business experience or specific types of skills for potential candidates, but, in general, expects qualified candidates will have ample experience and a proven record of business success and leadership. In general, each director will have the highest personal and professional ethics, integrity and values and will consistently exercise sound and objective business judgment. It is expected that the Board of Directors as a whole will have individuals with significant appropriate senior management and leadership experience, a long-term and strategic perspective, the ability to advance constructive debate, and a global perspective. These qualifications and attributes are not the only factors the Nominating Committee will consider in evaluating a candidate for nomination to the Board of Directors, and the Nominating Committee may reevaluate these qualifications and attributes at any time.

Except as set forth above, the Nominating Committee does not currently have a formal policy regarding the handling or consideration of director candidate recommendations received from shareholders, nor does the Nominating Committee have a formal process for identifying and evaluating nominees for director (including nominees recommended by shareholders). The Nominating Committee does not currently engage any third party director search firms but may do so in the future if it deems appropriate and in the best interests of the Company. These issues will be considered by the Nominating Committee in due course, and, if appropriate, the Nominating Committee will make a recommendation to the Board of Directors addressing the nomination process.

SOLICITATION OF PROXIES

The Company will bear the cost of the Annual Meeting and the solicitation of proxies related thereto, including the costs relating to printing and mailing the proxy materials. The Company has retained American Stock Transfer and Trust Co., the Company’s transfer agent, to assist the Company in the solicitation of proxies. Directors, officers and employees of the Company may make additional solicitations in person or by telephone in respect to the Meeting.

OTHER MATTERS

The Board of Directors knows of no other matter that may be presented for action at the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, the persons named as proxies will vote in accordance with their judgment in respect to any such matter.

Copies of the Company's Annual Report on Form 10-K/A, its Quarterly Reports on Form 10-Q, including any amendments thereto, and the notice of annual meeting of stockholders, proxy statement and proxies, are available upon written request, without cost, from the Company's principal executive offices at 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065 (Attention: Corporate Secretary), Telephone (650) 802-7888.

Stockholders are urged to complete, sign, date and return the enclosed proxy promptly in the envelope provided, regardless of whether or not they expect to attend the Annual Meeting. The prompt return of such proxy will assist the Company in preparing for the Annual Meeting. Your cooperation is greatly appreciated.

ADDITIONAL INFORMATION

A copy of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2005 accompanies this Proxy statement. The Company is required to file an Annual Report on Form 10-K for its fiscal year ended December 31, 2005 with the Securities and Exchange Commission (the “SEC”). The SEC maintains a web site, www.sec.gov, that contains reports, proxy statements, and certain other information filed electronically by the Company with the SEC. Stockholders may obtain, free of charge, a copy of the Form 10-K by writing to Communication Intelligence Corporation, Attn: Corporate Secretary, 275 Shoreline Drive, Suite 500, Redwood Shores, CA, 94065, or visiting the Company’s web site at www.cic.com.

| | | | | | | BY ORDER OF THE BOARD OF DIRECTORS |

/s/ Guido DiGregorio

| | | | | | | Chairman, President and Chief Executive Officer |

May 5, 2004

18