SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ X] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

COMMUNICATION INTELLIGENCE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

[ ] Fee paid previously with preliminary materials.

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

COMMUNICATION INTELLIGENCE CORPORATION

275 Shoreline Drive, Suite 500

Redwood Shores, California 94065

___________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

___________

June 25, 2007

___________

To the Stockholders of Communication Intelligence Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Communication Intelligence Corporation, a Delaware corporation (the “Company”), will be held at the Hotel Sofitel, 223 Twin Dolphin Drive, Redwood Shores, California 94065, on June 25, 2007, at 1:00 p.m. Pacific Time, for the following purposes, all as more fully described in the attached Proxy Statement:

| 1. | To consider and vote upon a proposal to elect four directors, each with a term of one year; |

| 2. | To consider and take action upon a proposal to increase the number of shares of Common Stock available for issuance from 125,000,000 to 155,000,000; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

You are urged to carefully read the attached Proxy Statement and the additional information concerning the matters to be considered at the meeting. The Board of Directors has fixed the close of business on May 2, 2007 as the record date. Only stockholders of record at the close of business on the record date will be entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment thereof. A list of the stockholders will be available for inspection at the Company’s headquarters, 275 Shoreline Drive, Redwood Shores, California 94065, at least ten days before the Annual Meeting and at the Annual Meeting.

YOUR VOTE IS IMPORTANT

EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD IN THE ENVELOPE PROVIDED SO THAT YOUR SHARES MAY BE VOTED AT THE ANNUAL MEETING. IF YOU EXECUTE A PROXY CARD, YOU STILL MAY ATTEND THE ANNUAL MEETING AND VOTE IN PERSON.

| Redwood Shores, California | By Order of the Board of Directors |

| May 14, 2007 | Guido DiGregorio Chairman, President and Chief Executive Officer |

TABLE OF CONTENTS

Page

| INTRODUCTION | 1 |

| VOTING SECURITIES | 2 |

PROPOSAL 1 ELECTION OF DIRECTORS | 3 |

PROPOSAL 2 AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | 4 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 5 |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 7 |

| BOARD OF DIRECTOR MEETINGS AND COMMITTEES | 7 |

| DIRECTOR COMPENSATION | 8 |

| EXECUTIVE OFFICERS | 9 |

| EXECUTIVE COMPENSATION | 9 |

| COMPENSATION COMMITTEE REPORT | 16 |

| AUDIT COMMITTEE REPORT | 17 |

INFORMATION REGARDING THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 19 |

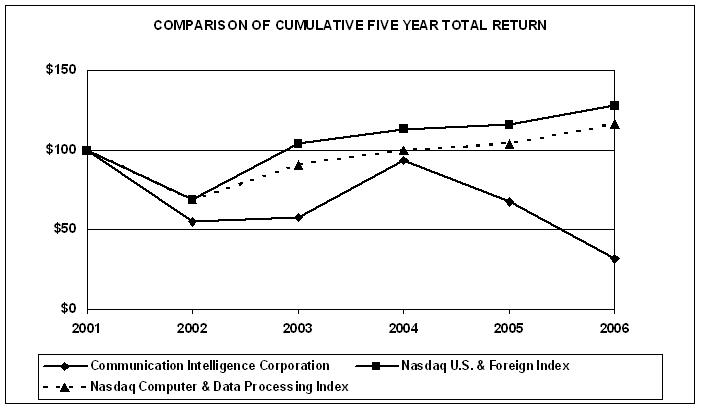

| PERFORMANCE GRAPH | 20 |

| STOCKHOLDER PROPOSALS AND STOCKHOLDER NOMINATIONS OF DIRECTORS | 21 |

| SOLICITATION OF PROXIES | 22 |

| OTHER MATTERS | 22 |

| ADDITIONAL INFORMATION | 22 |

COMMUNICATION INTELLIGENCE CORPORATION

275 Shoreline Drive, Suite 500

Redwood Shores, California 94065

_____________

PROXY STATEMENT

_____________

ANNUAL MEETING OF STOCKHOLDERS

_____________

INTRODUCTION

This Proxy Statement and the accompanying proxy card is being furnished to stockholders of Communication Intelligence Corporation, a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors for use in voting at the Company's Annual Meeting of Stockholders to be held at the Hotel Sofitel, 223 Twin Dolphin Drive, Redwood Shores, California 94065, on June 25, 2007, at 1:00 p.m. Pacific Time, and any and all adjournments or postponements thereof (the “Annual Meeting”).

At the Annual Meeting, stockholders of the Company will be asked to consider and vote upon the following:

| (i) | To consider and vote upon a proposal to elect four directors, each with a term of one year; |

| (ii) | To consider and take action upon a proposal to increase the number of common shares available for issuance from 125,000,000 to 155,000,000; and |

| (iii) | such other matters as may properly be brought before the meeting. |

This Proxy Statement and the accompanying proxy card, together with a copy of the Company's Annual Report to Stockholders, are first being mailed or delivered to stockholders of the Company on or about May 28, 2007.

WHETHER OR NOT YOU ATTEND THE ANNUAL MEETING, YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE ASKED TO SIGN AND RETURN THE PROXY CARD, REGARDLESS OF THE NUMBER OF SHARES YOU OWN. SHARES CAN BE VOTED AT THE ANNUAL MEETING ONLY IF THE HOLDER IS REPRESENTED BY PROXY OR IS PRESENT.

VOTING SECURITIES

The Board of Directors has fixed May 2, 2007 as the record date for purposes of determining the stockholders entitled to notice of and to vote at the Annual Meeting. Accordingly, only holders of record of shares of the Company’s common stock (“Common Stock”) at the close of business on such date are entitled to notice of and to vote at the Annual Meeting. At the close of business on the record date, there were approximately 921 beneficial owners of the 107,557,161 outstanding shares of our Common Stock. Each stockholder is entitled to one vote for each share of our Common Stock held by that stockholder as of the record date. If a choice as to the matters coming before the Annual Meeting has been specified by a stockholder “FOR,” “AGAINST” or “ABSTAIN” on the proxy card, which is duly returned and properly executed, the shares will be voted accordingly. If no choice is specified on the returned proxy card, the shares will be voted FOR approval of all proposals described in the Notice of Annual Meeting and in this Proxy Statement. The Board of Directors does not know of any matters other than those described in the Notice of Annual Meeting that are to come before the Annual Meeting. The presence in person or by proxy of a majority of the total number of outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

Attendance at the meeting will not automatically revoke a previously-submitted, properly-executed proxy. A stockholder executing a proxy card pursuant to this solicitation may revoke his or her proxy at any time prior to its use by:

| · | delivering to the Secretary of the Company a signed notice of revocation; delivering a later-dated, properly executed proxy card; or |

· attending the meeting, revoking the previously-granted proxy and voting in person.

In order to be effective, all revocations or a later-filed proxy card must be delivered to the Company at the address listed above not later than June 24, 2007, 5:00 p.m., local time. All valid unrevoked proxies will be voted at the Annual Meeting. Under Delaware law, stockholders are not entitled to appraisal rights with respect to any of the proposals set forth in this Proxy Statement.

Proxy cards marked as abstaining will be treated as present for the purpose of determining whether there is a quorum for the Annual Meeting, but will not be counted as voting on any matter as to which abstention is indicated. Broker “non-votes” (i.e., the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on the matter) will not be treated as present for purposes of determining whether there is a quorum for the Annual Meeting unless the broker is given discretion to vote on at least one matter on the agenda.

If a quorum is present at the Annual Meeting:

(a) the four nominees for director receiving the greatest number of votes (a plurality) will be elected. Accordingly, abstentions and broker non-votes will not affect whether director nominees have received the requisite number of affirmative votes; and

(b) the proposal to amend the Company’s Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 125,000,000 to 155,000,000 will be approved only if a majority of the shares of Common Stock issued and outstanding are voted in favor of the proposal. Accordingly, abstentions and broker non-votes have the effect of a voted against the proposal.

A proxy card gives discretionary authority to the persons named therein with respect to any amendments or modifications of the Company’s proposals and any other matters that may be properly proposed at the Annual Meeting. The shares represented by all valid non-revoked proxies returned in time to be voted at the Annual Meeting will be voted in accordance with the instructions marked therein. EXECUTED BUT UNMARKED PROXIES WILL BE VOTED FOR ALL PROPOSALS. If any other matter(s) properly comes before the Annual Meeting, the proxies solicited hereby will be exercised in accordance with the reasonable judgment of the proxy holders named therein. If the meeting is adjourned or postponed, your shares will be voted by the proxy holders on the new meeting date as well, unless you have revoked your proxy instructions before that date.

The Company will pay the cost of its proxy solicitation. Upon request, the Company will reimburse brokers, banks, and other nominees for their reasonable expenses in sending proxy materials to their principals and obtaining their proxies. Some of the Company’s employees may also solicit stockholders personally and by telephone. None of these employees will receive any additional or special compensation for doing this. Your cooperation in promptly completing and returning the enclosed proxy card to vote your shares of Common Stock will help to avoid additional expense.

If you are a stockholder of record and you plan to attend the Annual Meeting, please indicate this when you execute your proxy card. If you are a beneficial owner of shares of Common Stock held by a bank, broker or other nominee, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from the bank, broker, or other nominee are examples of proof of ownership. If you want to vote in person your shares of Company’s common stock held in street name, you will have to obtain a proxy, executed in your favor, from the holder of record.

Unless otherwise noted, all amounts are in thousands except share and per-share amounts

PROPOSAL 1

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board of Directors shall consist of such number of directors, with a minimum of three, as the Board of Directors may determine from time to time. The authorized number of directors is four (4). The four persons listed below are the nominees for election as directors at the Annual Meeting. Each director elected at this Annual Meeting will serve for one (1) year or until his successor is duly elected and qualified or his earlier resignation, removal or disqualification.

Unless otherwise instructed, the proxy holders named in the proxy card will vote the shares represented by proxies received by them for the election of the four nominees to the Board of Directors named below. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the shares will be voted for the election of any nominee designated by the present Board of Directors. The Company is not aware of any nominee who will be unable or will decline to serve as a director. THE BOARD OF DIRECTORS CONSIDERED THE PROPOSAL AND UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE IN FAVOR OF THE PROPOSAL.

Director Nominees

The following table sets forth certain information concerning the nominees:

Name | Age | Year First Elected or Appointed |

| | | |

| Guido D. DiGregorio | 68 | 1997 |

| Louis P. Panetta (1), (2), (3), (4) | 57 | 2000 |

| C. B. Sung (1), (2), (3), (4) | 81 | 1986 |

| David E. Welch (1), (4) | 60 | 2004 |

1. Member of the Audit Committee (Chairman David E. Welch)

2. Member of the Finance Committee (Chairman C. B. Sung)

3. Member of the Compensation Committee (Chairman Louis P. Panetta)

4. Member of the Nominating Committee (Chairman C. B. Sung)

The business experience of each of the directors for at least the past five years includes the following:

Guido D. DiGregorio was elected Chairman of the Board in February 2002, Chief Executive Officer in June 1999 and President & Chief Operating Officer in November 1997. Mr. DiGregorio began his career with General Electric, from 1966 to 1986, where, after successive promotions in product development, sales, strategic marketing and venture management assignments, he rose to the position of General Manager of an industrial automation business. Prior to joining CIC, Mr. DiGregorio was recruited as CEO of several companies to position those businesses for sustained sales and earnings growth. Those companies include Exide Electronics, Maxitron Corp., Proxim and Display Technologies Inc.

Louis P. Panetta was elected a director of the Company in October 2000. Mr. Panetta is currently the principal of Louis Panetta Consulting, a management consulting firm, and also teaches at the graduate school of business at California State University, Monterey Bay. He served as Vice President-Client Services for Valley Oak Systems from September 2003 to December 2003. From November 2001 to September 2003 Mr. Panetta was a member of the Board of Directors of Active Link. He was Vice President of Marketing and Investor Relations with Mobility Concepts, Inc. (a wireless Systems Integrator), a subsidiary of Active Link Communications, from February 2001 to April 2003. He was President and Chief Operating Officer of PortableLife.com (eCommerce products provider) from September 1999 to October 2000 and President and Chief Executive Officer of Fujitsu Personal Systems (a computer manufacturer) from December 1992 to September 1999. From 1995 to 1999, Mr. Panetta served on the Board of Directors of Fujitsu Personal Systems. Mr. Panetta’s prior positions include Vice President-Sales for Novell, Inc. (the leading supplier of LAN network software) and Director-Product Marketing for Grid Systems (a leading supplier of Laptop & Pen Based Computers).

C.B. Sung was elected a director of the Company in 1986. Mr. Sung has been the Chairman and Chief Executive Officer of Unison Group, Inc. (a multi-national corporation involved in manufacturing, computer systems, international investment and trade) since 1986 and Unison Pacific Corporation since 1979. Unison Group manages investment funds specializing in China-related businesses and is a pioneer in investing in China. Mr. Sung’s background includes over twenty years in various US high technology operating assignments during which time he rose to the position of Corporate Vice President-Engineering & Development for the Bendix Corporation. Mr. Sung was recently acknowledged and honored for his contributions by his native China (PRC) with a documentary produced by China’s National TV focusing on his life and career as an entrepreneurial scholar, successful US high technology executive and for his pioneering and continuing work in fostering capital investment and economic growth between the US and China. He has been a member of the Board of Directors of Capital Investment of Hawaii, Inc. since 1985 and serves on the Board of Directors of several private companies and non-profit organizations.

David E. Welch was elected a director in March 2004 and serves as the financial expert on the Audit Committee. From July 2002 to the present Mr. Welch has been the principal of David E. Welch Consulting, a financial consulting firm, Mr. Welch has also been Vice President and Chief Financial Officer of American Millennium Corporation, Inc., a provider of satellite based asset tracking and reporting equipment, from April 2004 to the present. Mr. Welch was Vice President and Chief Financial Officer of Active Link Communications, a manufacturer of telecommunications equipment, from 1999 to 2002. Mr. Welch has held positions as Director of Management Information Systems and Chief Information Officer with Micromedex, Inc. and Language Management International from 1995 through 1998. Mr. Welch is a member of the Board of Directors of Security With Advanced Technology, Inc. and AspenBio Pharma, Inc. Mr. Welch is a Certified Public Accountant licensed in the state of Colorado.

PROPOSAL 2

AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

The Company's Amended and Restated Certificate of Incorporation currently authorizes the issuance of 125 million shares of common stock and 10 million shares of preferred stock, par value $0.01 per share. As of May 14, 2007, approximately 107,557,161 shares of common stock were issued and outstanding. In addition, as of that date, approximately 17,442,839 shares are reserved for issuance for the conversion of outstanding debt and the exercise of outstanding options and warrants (subject to adjustments). Additionally in March of 2007, as part of a financing, the Company issued warrants to purchase 3,733,200 shares of its common stock and agreed to seek stockholder approval for additional common shares to underlie those warrants. As of May 14, 2007, 3,536,391 of those warrants do not have common shares reserved for use upon their exercise. Accordingly, the Company has no shares available for future issuance. The warrants associated with the March financing first become exercisable on June 30, 2007, have a three year life and an exercise price of $0.51 per share. Approval of this proposal will increase the number of authorized shares of common stock from 125,000,000 shares to 155,000,000 shares.

THE BOARD OF DIRECTORS CONSIDERED AND UNANIMOUSLY CONCLUDED THAT THE PROPOSED AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION WAS ADVISABLE AND RECOMMENDS THAT STOCKHOLDERS VOTE FOR THIS PROPOSAL. Stockholders are being asked to approve the following resolution amending the Company's Amended and Restated Certificate of Incorporation:

RESOLVED, that Article Fourth, paragraph (a) of the Company's Amended and Restated Certificate of Incorporation, shall be amended and restated in its entirety as follows:

“FOURTH: (a) The total number of shares of stock which the Corporation shall have authority to issue is 165,000,000 of which 155,000,000 shares shall be Common Stock, par value $0.01 per share, and 10,000,000 shares shall be Preferred Stock, par value $0.01 per share.”

REASONS FOR THE PROPOSAL

The Board of Directors believes it is necessary to have the ability to issue additional shares of Common Stock for general corporate purposes. Authorizing an additional 30,000,000 shares of Common Stock would give the Board of Directors the ability, without further action of the stockholders unless such stockholder action is specifically required by applicable law or the rules of the Nasdaq Stock Market or any stock exchange on which our securities may then be listed, to issue additional shares of Common Stock from time to time as the Board of Directors deems necessary. In addition to meeting the requirements of the above mentioned financing, primary corporate purposes include, if and when needed, meeting general working capital requirements and equity financings to retire existing debt. Apart from meeting the existing obligations described above, the Company does not have a current intention to issue shares. .

The proposed increase in the authorized number of shares of common stock could have a number of effects on stockholders depending upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The increase could have an anti-takeover effect in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult. For example, we could issue additional shares to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company. Similarly, the issuance of additional shares to certain persons allied with our management and/or our directors could have the effect of making it more difficult to remove our current management and directors by diluting the stock ownership or voting rights of persons seeking to cause such removal. This proposal is not being presented with the intent that it be utilized as a type of anti-takeover device.

Stockholders do not have any preemptive or similar rights to subscribe for or purchase any additional shares of Common Stock that may be issued in the future. Therefore, future issuances of common stock may, depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of the existing stockholders.

STOCKHOLDER APPROVAL

The affirmative vote of a majority of the outstanding shares of our Common Stock is required for approval of the amendment to our Amended and Restated Certificate of Incorporation. Abstentions and broker non-votes will be counted towards the tabulation of votes cast on this proposal and will have the same effect as negative votes. If this proposal is approved at the Annual Meeting, the proposed amendment would become effective upon filing a Certificate of Amendment to our Amended and Restated Certificate with the Secretary of State of Delaware, which filing is expected to take place shortly after such stockholder approval.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR APPROVAL OF THE AMENDMENT TO THE COMPANY'S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION INCREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK OF THE COMPANY FROM 125,000,000 TO 155,000,000 SHARES.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of May 14, 2007, with respect to the beneficial ownership of (i) any person known to be the beneficial owner of more than 5% of any class of voting securities of the Company, (ii) each director and director nominee of the Company, (iii) each of the current executive officers of the Company named in the Summary Compensation Table on page 12 of this Proxy Statement and (iv) all directors and executive officers of the Company as a group.

| | | Common Stock |

| | Name of Beneficial Owner | Number of Shares | Percent of Class |

| | Guido DiGregorio President, CEO and Director (1) | 2,073,900 | 1.93% |

| | C. B. Sung, Director (2) | 1,797,610 | 1.67% |

| | Louis P. Panetta, Director (3) | �� 228,125 | * |

| | David E. Welch, Director(4) | 125,000 | * |

| | Francis V. Dane, Chief Financial Officer and Chief Legal Officer (5) | 427,495 | * |

| | Russel L. Davis, Chief Technology Officer (6) | 500,000 | * |

| | All directors and executive officers as a group (6 persons) | 5,143,800 | 4.78% |

| | Holders of 5% or more of the outstanding shares of the Company’s voting securities | | |

| | Michael W. Engmann (7) | 8,033,877 | 7.46% |

___________

| (1) | Represents (a) 123,900 shares held by Mr. DiGregorio and (b) 1,950,000 shares, issuable upon the exercise of stock options exercisable within 60 days of May 2, 2007. The business address of Mr. DiGregorio is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. |

| (2) | Includes (a) 1,568,051 shares held by the Sung Family Trust, of which Mr. Sung is a trustee, (b) 3,369 shares held by the Sung-Kwok Foundation, of which Mr. Sung is the Chairman, and (c) 226,190 shares of common stock issuable upon the exercise of stock options, exercisable within 60 days of May 2, 2007. Mr. Sung may be deemed to beneficially own the shares held by the Sung Family Trust and the Sung-Kwok Foundation. The business address of Mr. Sung is, UNISON Group, 1001 Bayhill Dr., 2nd Floor, San Bruno, California 94066. |

| (3) | Represents 228,125 shares issuable upon the exercise of options exercisable within 60 days of May 2, 2007. Mr. Panetta’s business address is 827 Via Mirada, Monterey, California 93940. |

| (4) | Represents 125,000 shares issuable upon the exercise of stock options exercisable within 60 days of May 2, 2007. The business address of Mr. Welch is 1729 East Otero Avenue, Littleton, CO 80122. |

| (5) | Represents (a) 212 shares held by Mr. Dane and (b) 427,283 shares issuable upon the exercise of stock options exercisable within 60 days of May 2, 2007. The business address of Mr. Dane is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. |

| (6) | Represents 500,000 shares issuable upon the exercise of stock options within 60 days of May 2, 2007. The business address of Mr. Davis is 275 Shoreline Drive, Suite 500, Redwood Shores, California 94065. |

| (7) | Represents 8,033,877 shares beneficially owned by Mr. Engmann, of which 3,360,311 are held by MDNH Partners, L.P. of which Mr. Engmann is a partner. Such shares were reported on Schedule 13G dated December 31, 2006. In addition, Mr. Engmann, directly or beneficially, holds warrants to purchase 3,992,450 shares of the Company’s common stock at $0.51 per share. Such warrants were issued in connection with a two notes in the aggregate amount of $770,000 (See notes 5 and 10 to the Consolidated Financial Statements in the Company’s 2006 Annual Report). The warrants first become exercisable on June 30, 2007. |

REVIEW, APPROVAL OR RATIFICATION OF TRANSACTIONS WITH RELATED PARTIES

Pursuant to the Code Ethics, authorization from the Audit Committee is required for a director or officer to enter into a related party transaction or a similar transaction which could result in a conflict of interest. Conflicts of interest are prohibited unless specifically authorized in accordance with the Code of Ethics.

TRANSACTIONS WITH RELATED PERSONS

In August 2006, the Company entered into a Note and Warrant Purchase Agreement (the “2006 Purchase Agreement”) and a Registration Rights Agreement (the “2006 Registration Rights Agreement”), each dated as of August 10, 2006. The Company secured the right to borrow up to six hundred thousand dollars ($600).

On November 19, 2006 the Company borrowed the $600 available under the 2006 Purchase Agreement, of which $450 was borrowed from an approximate 7% shareholder of the Company and the remaining $150 from an unrelated third party. The Company expects to use the proceeds of the financing for additional working capital. In addition, the Company issued warrants to purchase 3,111,000 of the Company’s common stock.

In February 2007, the Company entered into a Note and Warrant Purchase Agreement (the “2007 Purchase Agreement”) and a Registration Rights Agreement (the “2007 Registration Rights Agreement”), each dated as of February 5, 2007, with Michael W. Engmann, an owner of approximately 7% of the outstanding shares. The Company secured the right to borrow up to six hundred thousand dollars ($600).

On March 15, 2007 the Company and Mr. Engmann signed an amendment to the 2007 Purchase Agreement. The maximum amount of borrowing after the amendment was increased from $600, to $1,000. The maximum number of warrants that may be issued under the 2007 Purchase Agreement was increased from 3,111,000 to 5,185,000. The warrants have a three year life and an exercise price of $0.51. The Warrants will include piggyback registration rights, for the underlying shares, to participate in any future registrations of the Company’s common stock.

On March 30, 2007 the Company borrowed $670 under the 2007 Purchase Agreement of which $350 was borrowed from Kendu Partners Company of which Mr. Engmann is a principle, and the remaining $320 from unrelated third parties. The proceeds will be used for working capital purposes. The notes will bear interest at the rate of fifteen percent (15%) per annum payable quarterly in cash and are due August 30, 2008.

As of May 14, 2007 the Company has paid to Mr. Engmann $25 in interest related to the 2006 Purchase Agreement. At May 14, 2007, $600 in notes associated with the 2006 Purchase Agreement and $670 in notes associated with the 2007 Purchase Agreements are outstanding. Of the total $1,270 outstanding notes, $770 is owed to Mr. Engmann and the remaining $500 is owed to unrelated third parties. Accrued but unpaid interest on the 2006 and 2007 Purchase Agreements is approximately $25 as of May 14, 2007. Of the approximate $25 accrued but unpaid interest, $14 is owed to Mr. Engmann and the balance is owed to unrelated third parties.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company's officers, directors and persons who own more than ten percent of a registered class of the Company's equity securities to file certain reports with the Securities and Exchange Commission (the “SEC”) regarding ownership of, and transactions in, the Company's securities. These officers, directors and stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) reports that are filed with the SEC. Based solely on a review of copies of such forms received by the Company with respect to fiscal year 2006 and written representations received by the Company from certain reporting persons, the Company believes that for the year ended December 31, 2006 all Section 16(a) reports required to be filed by the Company's executive officers, directors and 10% stockholders were filed on a timely basis.

BOARD OF DIRECTOR MEETINGS AND COMMITTEES

The Company's affairs are managed under the direction of the Board of Directors. Members of the Board receive information concerning the Company's affairs through oral and written reports by management, Board and committee meetings and other means. The Company's directors generally attend Board of Directors meetings, committee meetings and informal meetings with management and others, participate in telephone conversations and have other communications with management and others regarding the Company's affairs. During 2006, the Board of Directors held three formal meetings and acted by unanimous written consent on two occasions. Except for the meetings of the Audit Committee, which were held separately, and in cases where the committees acted by unanimous consent, all committee meetings were held concurrently with the formal meetings of the Board of Directors. For the year ended December 31, 2006, each incumbent director participated in all of the formal meetings of the Board and each Committee on which he served, except for Mr. Panetta who missed two formal Board meetings.

Directors of the Company serve until their successors are duly elected and qualified or until their earlier resignation, removal or disqualification. There are no family relationships between the Company's directors and executive officers.

Board Committees

The Company's Board of Directors has four committees as set forth below. The members of each committee are appointed by the Board of Directors.

Audit Committee. The Audit Committee oversees our financial reporting process on behalf of the Board of Directors and reports to the Board of Directors the results of these activities, including the systems of internal controls that management and the Board of Directors have established, our audit and compliance process and financial reporting. The Audit Committee, among other duties, engages the independent public accountants retained as the registered public accounting firm, pre-approves all audit and non-audit services provided by the independent public accountants, reviews with the independent public accountants the plans and results of the audit engagement, considers the compatibility of any non-audit services provided by the independent public accountants with the independence of such auditors and reviews the independence of the independent public accountants. The members of the Audit Committee are Louis P. Panetta, C. B. Sung and David E. Welch. Mr. Welch serves as the Audit Committee’s financial expert. Each member of the Audit Committee is independent as defined under applicable rules and regulations. The Audit Committee conducted four meetings in the year ended December 31, 2006 and all members attended the meetings, except for Louis P. Panetta, who missed two meetings. A copy of the Audit Committee charter can be found at our website, www.cic.com.

Finance Committee. The Finance Committee develops strategies for the financing and development of the Company and monitors and evaluates progress toward established objectives. The members of the Finance Committee are Louis P. Panetta and C. B. Sung. During the year the Finance Committee discussions were held concurrently with the three meetings of the Board of Directors.

Compensation Committee. The Compensation Committee generally reviews compensation matters with respect to executive and senior management arrangements and administer the Company's stock option plans. The members of the Compensation Committee are Louis P. Panetta and C. B. Sung. . The Compensation Committee held no formal meetings but acted by unanimous written consent eleven times. The Board has adopted a Compensation Committee Charter, a copy of which can be found on our website, www.cic.com.

Nominating Committee. The Nominating Committee is responsible for considering and making recommendations to the Board concerning the appropriate size, functions and needs of the Board. The Nominating Committee reviews the appropriate skills and characteristics required of directors in the context of prevailing business conditions. The objective of the Nominating Committee is to create and sustain a Board that brings to the Company a variety of perspectives and skills derived from high-quality business and professional experience. Directors should possess the highest personal and professional ethics, integrity, and values, and be committed to representing the long-term interests of the stockholders. They must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. We endeavor to have a Board representing diverse experience at policy-making levels in business, government, education, and technology, and in areas that are relevant to the Company’s business activities. Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serving on the Board for an extended period of time.

During the year Nominating Committee discussions were held concurrently with the meetings of the Board of Directors. The Nominating Committee determined that a Board of Directors constituted of the current nominees, considering the varying and relevant industry experience of each nominee and tenure as a director, would best serve the Company’s current needs. The members of the Nominating Committee are Louis P. Panetta, C. B. Sung and David E. Welch. The Board has adopted a Nominating Committee Charter, a copy of which can be found on our website, www.cic.com.

Communications to the Board

The Board of Directors welcomes and encourages stockholders to share their thoughts regarding the Company. Towards that end, the Board of Directors has adopted a policy whereby all communications should first be directed to Investor Relations. Investor Relations will then, for other than routine communications, distribute a copy of the communication to the Chairman of the Board, the Chairman of the Audit Committee and the Company’s Chief Legal Officer. Based on the input and decision of these persons, along with the entire board, if it is deemed necessary, the Company will respond to the communications. Stockholders should not communicate with individual directors unless requested to do so.

See STOCKHOLDER PROPOSALS AND STOCKHOLDER NOMINATIONS OF DIRECTORS, page 17, for information regarding the process for stockholders to nominate individuals for election to the Board of Directors.

DIRECTOR COMPENSATION

For their services as directors of the Company, all non-employee directors receive a fee of $1,000 for each Board of Directors meeting attended and all directors are reimbursed for all reasonable out-of-pocket expenses incurred in connection with attending such meetings. First time directors receive options to acquire 50,000 shares of the Company’s common stock upon joining the board and options to acquire 25,000 shares each time they are elected to the board thereafter. The exercise price of all options granted to directors are equal to the market closing price on the date of grant, vest immediately and have a seven year life. In June 2006, Louis Panetta, C. B. Sung and David Welch were each granted immediately exercisable non-qualified options to purchase 25,000 shares of common stock at an exercise price of $0.40 per share (the then current market price of the Company’s stock), which options expire on June 27, 2013.

The following table sets forth a summary of the compensation paid to our directors during 2006.

Name | Fees Earned Or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

Louis P. Panetta (1) | $ 1,000 | $ − | $ 7,072 | $ − | $ − | $ − | $ 8,072 |

C. B. Sung (2) | $ 3,000 | $ − | $ 7,072 | $ − | $ − | $ − | $ 10,072 |

David E. Welch (3) | $ 3,000 | $ − | $ 7,072 | $ − | $ − | $ − | $ 10,072 |

| | | | | | | | |

1. Mr. Panetta holds options to acquire 228,125 shares of stock at December 31, 2006, all of which were vested. The Option award represent the grant date fair value and the amount recognized as expense in the Company’s 2006 financial statements in accordance with SFAS No. 123R.

2. Mr. Sung holds options to acquire 226,190 shares of stock at December 31, 2006, all of which were vested The Option award represent the grant date fair value and the amount recognized as expense in the Company’s 2006 financial statements in accordance with SFAS No. 123R.

3. Mr. Welch holds options to acquire 125,000 shares of stock at December 31, 2006, all of which were vested. . The Option award represent the grant date fair value and the amount recognized as expense in the Company’s 2006 financial statements in accordance with SFAS No. 123R.

EXECUTIVE OFFICERS

The following table sets forth, as of May 2, 2007, the name and age of each executive officer of the Company, and all positions and offices of the Company presently held by each of them.

| | Name | Age | Positions Currently Held | |

| | | | | |

| | Guido D. DiGregorio | 68 | Chairman of the Board, Chief Executive Officer and President | |

| | Francis V. Dane | 55 | Chief Legal Officer, Secretary , Senior Executive HR, and Chief Financial Officer | |

| | Russel L. Davis | 42 | Chief Technology Officer & Vice President, Product Development | |

The business experience of each of the executive officers for at least the past five years includes the following:

Guido D. DiGregorio - see above under the heading “Director Nominees.”

Francis V. Dane was appointed the Company's Secretary in February 2002, its Chief Financial Officer in October 2001, its Human Resources Executive in September 1998 and he assumed the position of Chief Legal Officer in December 1997. From 1991 1997 he served as a Vice President and Secretary of the Company, and from 1988 to 1992 as its Chief Financial Officer and Treasurer. Since July 2000, Mr. Dane has also been the Secretary and Treasurer of Genyous Biomed International Inc. (including its predecessors and affiliates) a company in the biopharmaceutical field focused on the development of medical products and services for the prevention, detection and treatment of chronic illnesses such as cancer. From October 2000 to April 2004, Mr. Dane served as a director of Perceptronix Medical, Inc. and SpectraVu Medical Inc., two companies focused on developing improved methods for the early detection of cancer. From October 2000 to June 2003 Mr. Dane was a director of CPC Cancer Prevention Centers Inc., a company focused on developing a comprehensive cancer prevention program based upon the detection of early stage, non-invasive cancer. Prior to October 2006, Mr. Dane spent over a decade with PricewaterhouseCoopers, his last position was that of Senior Manager, Entrepreneurial Services Division. Mr. Dane is a member of the State Bar of California and has earned a CPA certificate from the states of Connecticut and California.

Russel L. Davis rejoined the Company as Chief Product Officer in August 2005 and now serves as its Chief Technology Officer and Vice President of Product Development. He served as CTO of SiVault Systems, from November 2004 to August 2005. Mr. Davis originally joined CIC in May 1997 and was appointed Vice President of Product Development & Support in October 1998. Prior to this, Mr. Davis served in a number of technical management roles including; Director of Service for Everex Systems, Inc., a Silicon Valley based PC manufacturer and member of the Formosa Plastics Group, managing regional field engineering operations for Centel Information Systems, which was acquired by Sprint. He also served in the United States Navy supervising shipboard Electronic Warfare operations.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee’s philosophy is based upon the belief that the success of the Company requires the development of, and adherence to, an overall business strategy which achieves the objective of market leadership with the resultant financial results that maximize the Company’s value for the benefit of its stockholders. The achievement of market leadership in the emerging businesses that CIC is addressing requires effective sales coverage of target markets and accounts, developing and maintaining product differentiation consistent with achieving market share leadership within those target markets and highly coordinated and motivated efforts of all employees working as a team to achieve results. In essence, the major objective for the Company, and the underlying basis for its compensation philosophy, is based on achievement of sustained earnings growth, which, for an emerging business, requires achieving and maintaining market share leadership; and the added objective of achieving and maintaining that leadership position with minimum stockholder dilution.

The primary goals of the Compensation Committee of the Board of Directors with respect to its philosophy and executive compensation are to attract, motivate, reward and retain the most talented executives possible and to link annual and long-term compensation incentives to the achievement of the Company objectives and performance. To achieve these goals, the Compensation Committee and the board have implemented and intend to maintain compensation policies that link a substantial portion of executives’ overall compensation to key strategic, operational and financial goals such as capturing market share, revenue, timely product introductions, technology validation, expense and cash control, preservation of and increases in stockholder value, and other non-financial goals that the board may from time to time deem important. The Compensation Committee and the board evaluate individual executive performance with a goal of setting compensation at levels the board believes, based on the general business and industry knowledge and experience of the directors, are comparable with executives in other companies of similar size and stage of development operating in the eCommerce and the eSignature software markets, while taking into account our relative performance and our own strategic goals.

The base salaries of the Company’s executive officers are established by the Board of Directors as part of an annual compensation review cycle, which includes determining the operating metrics and non-financial elements used to measure performance and progress. This review is based on our knowledge of how other, biometric/signature software companies and related emerging businesses measure their executive performance and on the key operating metrics that are critical in the effort to increase the value of the Company. The granting of stock options is also considered as part of this annual review process. In performing its review the board considers recommendations made by the Company’s Chief Executive Officer regarding other named executives.

Mr. DiGregorio, the Company’s Chief Executive Officer, President and Chairman currently has a salary of $285,000. As of January 2007, $85,000 is being deferred in order to ease cash constraints on the Company. This level of compensation falls within peer ranges according to information obtained from PayScale and SalarySource in December 2006. Mr. DiGregorio’s salary was brought to its current level in September 2005, when it was increased from $250,000, representing the first increase in his salary since 2002 when he assumed the positions of Chairman and CEO in addition to his position as President. This consolidation of positions eliminated approximately $150,000 in annual salary expense that the previous Chairman had been receiving. However, this saving, although significant, was not the driving factor in determining Mr. DiGregorio’s salary. The September 2005 evaluation and the 2006 evaluation (during which Mr. DiGregorio declined any increase, again, in order to ease cash constraints) by the Compensation Committee reflects, Mr. DiGregorio’s leadership in the face of adversity, which has resulted in CIC being the recognized leader in the developing eSignature market, most recently recognized in an industry analyst report. by Frost and Sullivan in its North American Biometrics Markets - Investment Analysis and Growth Opportunities Report, 2005. This recognition was a follow-on to the 2003 Frost & Sullivan Growth Strategy Leadership Award which CIC received for demonstrating outstanding ability to expand despite difficult market conditions.

When Mr. DiGregorio joined the Company in late 1997 he initially implemented a strategy focused on natural input/text entry embeds on mobile computing devices and retail sales through our website, www.cic.com. This strategy resulted in an increase in the per share price of CIC stock in 2000, from under $1.00 to nearly $13.00. However, by early 2001, handheld device shipments of both PDAs and touch screen enabled phones began a sharp decline, driven by the economic downturn, negatively impacted by the dot com bubble burst, a recession, and the geopolitical environment. In the face of this adversity, the Company rapidly refocused and identified eSignature as a viable growth opportunity and continues to focus on that developing market.

Whereas in established markets the CEO is typically evaluated, to a large extent, on his ability to deliver increasing profitability, the board believes that the better measure in a developing market is the achievement and maintenance of market and product leadership that positions the Company for significant increases in stockholder value as the market matures and enters take-off. As stated above, despite significant adverse market conditions, CIC is now the recognized leader in the developing eSignature market, including product leadership through three generations of products.

Mr. Dane’s current salary is $160,000. In December 1997 Mr. Dane became the Company’s Chief Legal Officer. In October of 2001, upon the resignation of the Company’s then Chief Financial Officer (“CFO”), Mr. Dane assumed the position of Acting CFO at no additional salary. This consolidation of positions eliminated the former CFO’s salary of $125,000 and resulted in Mr. Dane’s salary being increased from $84,000 to $130,000 in July of 2002 when he accepted the position of CFO in addition to his position of Chief Legal Officer. Mr. Dane’s salary was increased to its current level in September of 2005. This increase was based upon the same factors taken into account in determining the CEO’s increase at that time, as discussed above.

Mr. Davis first joined the Company in May 1997 and has been continuously employed by the Company since that time except for the period from November 2004 through August 2005. In August 2005 he rejoined the Company as its Chief Technology Officer at his current salary of $165,000. That salary is considered to be at a competitive level for the position of Chief Technology Officer and appropriate given Mr. Davis’ knowledge of the Company, his past contributions and expectations as to his future contributions.

All of the Company’s officers are evaluated under the same criteria as they relate to specific duties and functional responsibilities in achieving the overall Company objectives.

We have not retained a compensation consultant to review our policies and procedures with respect to executive compensation.

The Board of Directors may, at its discretion, increase or decrease compensation. Any increase or decrease would be based upon the cash constraints and the factors discussed above.

There are no agreements with any executive officers entitling them to compensation upon termination, change in control or any other reason.

The Company does not have any guidelines or policies with respect to stock ownership by its management, except for its Insider Trading Policy.

The named executive officers of the Company play no role in determining their own compensation, or the compensation of other named executive officers, except for recommendations that the Chief Executive Officer may from time to time make to the Compensation Committee.

Elements of Compensation

Executive compensation consists of the following elements. The Compensation Committee and board determine the portion of compensation allocated to each element for each individual named executive officer:

Base Salary. Base salaries for the Company’s executives are established based on the scope of their responsibilities, taking into account competitive market compensation for similar positions, as well as seniority of the individual, the Company’s ability to replace the individual and other primarily judgmental factors deemed relevant by the board. Generally, we believe that executive base salaries should be targeted near the median of the range of salaries for executives in similar positions with similar responsibilities at comparable companies, in line with our compensation philosophy. Base salaries are reviewed annually by the Compensation Committee and the board, and adjusted from time to time pursuant to such review and or at other appropriate times, to realign salaries with market levels after taking into account individual responsibilities, performance and experience. For 2007, this review will occur during the second quarter of 2007 as part of our annual performance review process.

Annual Bonus. The Company does not have an annual bonus plan and currently has no plans to implement one.

Long-Term Incentive Program. The Committee believes that the use of stock options as a means of compensation provides an incentive for executives and aligns their interests with those of the stockholders. All employees, officers and directors are eligible to receive stock options under the Company's 1999 Stock Option Plan. Additionally from time to time the board grants non-qualified options outside of the 1999 Stock Option Plan, referred to as Individual Plans (the “Individual Plans”). There are no shares of common stock reserved for future Individual Plans. Grants under individual plans are granted by the Compensation Committee from the authorized but unissued shares of common stock. The terms of grants under the Individual Plans are identical to grants made under the 1999 Stock Option Plan and the stock option agreements under the Individual Plans are in the same form as those used for options granted under the 1999 Stock Option Plan. All shares granted under Individual Plans are non qualified options. Messer’s DiGregorio and Dane received nonqualified grants under Individual Plans as discussed in the foot notes to the Outstanding Equity Awards Table below. The Company does not grant or issue restricted stock or other equity-based incentives.

The long-term, performance-based compensation of executive officers takes the form of option awards under the Company’s 1999 Stock Option Plan and under Individual Plans, which are designed to align a significant portion of the executive compensation program with long-term stockholder interests. The Compensation Committee believes that equity-based compensation ensures that the Company’s executive officers have a continuing stake in the long-term success of the Company. All options granted by the Company are granted with an exercise price equal to or above the market price of the Company’s Common Stock on the date of grant and, accordingly, will only have value if the Company’s stock price increases subsequent to the dates of grants and the options are vested and exercised by the respective officers. In granting options under the plans, the Compensation Committee generally takes into account each executive’s responsibilities and performance, relative position in the Company, past grants, and approximate grants to individuals in similar positions for companies of comparable size in comparable industries.

Other Compensation. The Company’s executive officers do not have employment agreements. As with other employees of the Company, executive officers are employed on an “at will” basis.

The following table sets forth compensation awarded to, earned by or paid to the Company's President and Chief Financial Officer, regardless of the amount of compensation, and each executive officer of the Company as of December 31, 2006 whose total annual salary, bonus and option awards for 2006 exceeded $100,000 (collectively, the “Named Executive Officers”).

Summary Compensation Table

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) (2) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value And Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

Guido DiGregorio President & CEO | 2006 2005 2004 | 285,000(1) 322,875(1) 250,334(1) | − − − | − − − | − 502,732 − | − − − | − − − | 9,072 8,885 9,037 | 294,072 834,492 268,408 |

Frank Dane CLO & CFO | 2006 2005 2004 | 160,000 146,643 138,125 | − − − | − − − | − 42,567 39,390 | − − − | − − − | − − − | 160,000 189,210 177,515 |

Russel Davis CTO | 2006 2005(3) | 165,000 48,303 | − − | − − | − 225,425 | − − − | − − | − − | 166,179 273,728 |

| (1) | Mr. DiGregorio's salary was increased in February 2002 to $250,000. In 2003 and 2004, Mr. DiGregorio voluntarily deferred approximately $70,000 in salary payments to ease cash flow requirements. Mr. DiGregorio was paid his deferred salary from 2003 and 2004 of approximately $70,000 and $70,000 in January 2004 and 2005, respectively. In September of 2005, Mr. DiGregorio’s salary was increased to $285,000. As of January 2007, $85,000 of his 2007 salary is being deferred in order to ease cash constraints on the Company. |

| | (2) | On January 1, 2006, the Company adopted SFAS No. 123(R), “Share-Based Payment” Share-based compensation expense is based on the estimated grant date fair value of the portion of share-based payment awards that are ultimately expected to vest during the period. The grant date fair value of stock-based awards to officers, employees and directors is calculated using the Black-Scholes option pricing model. Mr. DiGregorio has 1,950,000 options that are vested and exercisable within sixty days of December 31, 2006. Mr. Dane has 410,623 options that are vested and exercisable within sixty days of December 31, 2006. Mr. Davis has 500,000 options that are vested and exercisable within sixty days of December 31, 2006. In accordance with applicable regulations, the value of such options does not reflect an estimate for features related to service-based vesting used by the Company for financial statement purposes. (See footnote 6 in the Notes to Consolidated Financial Statements). |

| | (3) | Mr. Davis commenced his employment with the Company on August 31, 2005. |

There are no employment agreements with any named executives, either written or oral. All employment is at will.

Grants of Plan-Based Awards in 2006

The Board of Directors approves awards under the Company’s 1999 Stock Option Plan and awards that are outside of the 1999 Stock Option Plan (“Individual Plans’). There were no awards made to our named executive officers under our 1999 Stock Option Plan or otherwise during fiscal year 2006 as the board’s review indicated that the number of options held by each named executive officer at that time were adequate to satisfy the long term goal underlying the granting of options in prior years.

The 1999 Stock Option Plan is administered by the Board of Directors or a Compensation Committee of the board. The board or any such committee has the authority to determine the terms of the options granted, including the exercise price, number of shares subject to each option, vesting provisions, if any, and the form of consideration payable upon exercise. The exercise price of incentive options must not be less than the fair market value of the common stock valued at the date of grant and the exercise price for non-qualified options must be at least 85% of the fair market value of the common stock valued at the date of grant. The expiration date of options is determined by the board or committee, but options cannot expire later than ten years from the date of grant, and in the case of incentive options granted to stockholders owning at least 10% of the Company’s stock, cannot expire later than five years from the date of grant. Options have typically been granted with an expiration date seven years after the date of grant.

If an employee to whom an award has been granted under the 1999 Stock Option Plan dies while providing services to the Company, retires from employment with the Company after attaining his retirement date, or terminates employment with the Company as a result of permanent and total disability, the restrictions then applicable to such award shall continue as if the employee had not terminated employment and such award shall thereafter be exercisable, in whole or in part by the person to whom it was granted (or by his duly appointed, qualified, and acting personal representative, his estate, or by a person who acquired the right to exercise such option by bequest or inheritance from the grantee), in the manner set forth in the award, at any time within the remaining term of such award. Options not vested at the time of death, retirement, termination or disability cease to vest. Except as provided in the preceding paragraph, generally if a person to whom an option has been granted under the 1999 Stock Option Plan ceases to be an employee of the Company, such options vested at the date of termination shall continue to be exercisable to the same extent that it was exercisable on the last day on which such person was an employee for a period of 90 days thereafter, or for such longer period as may be determined by the Committee, whereupon such option shall terminate and shall not thereafter be exercisable.

The board has the authority to amend or terminate the 1999 Stock Option Plan, provided that such action does not impair the rights of any optionee under any option previously granted under the 1999 Stock Option Plan, without the consent of such optionee.

Incentive and non-qualified options under the 1999 Stock Option Plan may be granted to employees, officers, and consultants of the Company. There are 4,000,000 shares of common stock authorized for issuance under the 1999 Stock Option Plan. The options generally have a seven year life and vest quarterly over three years. As of December 31, 2006, options to acquire 3,629,000 shares of common stock were outstanding under the 1999 Stock Option Plan and options to acquire 2,801,000 shares of common stock were exercisable with a weighted average exercise price of $0.75 per share. At December 31, 2006, there were 190,000 shares available for future grants under the 1999 Stock Option Plan.

The Company has issued non-plan options to its employees and directors pursuant to Individual Plans.

As of May 14, 2007, options to acquire 2,264,443 shares under such Individual Plans were outstanding and exercisable with a weighted average exercise price of $0.73 per share.

Individual Plan Options

The Company also grants options to employees, directors and consultants outside of the 1999 Plan pursuant to individual plans. These options are granted with the same terms as those granted under the 1999 Plan, except all such options have been Non-Qualified As of May 14, 2006, non-plan options to purchase an aggregate of 2,264,443 shares of common stock were outstanding under such individual plans.

Option Exercises and Stock Vested

In 2006, no stock options were exercised and 25,000 options to purchase stock granted to Mr. Dane vested during the period. The Company does not grant or issue restricted stock or other equity-based incentives.

Outstanding Equity Awards at Fiscal 2006 Year End

The following table summarizes the outstanding equity award holdings held by our named executive officers.

| | Name and Principal Position | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) (4) | Option Expiration Date (5) |

| | Guido DiGregorio, President & CEO (1) | 250,000 425,000 1,275,000 | − − − | $ 0.79 $ 0.39 $ 0.75 | 2009 2012 2012 |

| | Frank Dane, CLO & CFO (2) | 100,000 100,000 66,680 35,985 107,958 | − − 33,320 − − | $ 0.79 $ 0.33 $ 0.55 $ 0.39 $ 0.75 | 2009 2010 2011 2012 2012 |

| | Russel Davis, CIO (3) | 125,000 375,000 | − − | $ 0.57 $ 0.75 | 2012 2012 |

| | (1) | Mr. DiGregorio options vest as follows: 250,000 options vested prorata quarterly over three years; 425,000 options vested on the date of grant; and 1,275,000 options vested on the date of grant |

| | (2) | Mr. Danes options vest as follows: 100,000 options vested prorata quarterly over three years; 100,000 options vested prorata quarterly over three years; 100,000 options vest prorata quarterly over three years; 35,985 options vested on the date of grant; and 107,958 options vested on the date of grant |

| | (3) | Mr. Davis’s options vest as follows: 125,000 options vested on the date of grant; and 375,000 options vested on the date of grant. . |

| | (4) | Mr. DiGregorio holds options to acquire 250,000 shares granted under the 1999 Stock Option Plan and options to acquire 1,700,000 shares under Individual Plans. Mr. Dane holds 300,000 options to acquire shares granted under the 1999 Stock Option Plan and options to acquire 143,943 shares granted under Individual Plans. Mr. Davis holds options to acquire 500,000 shares granted under the 1999 Stock Option Plan. |

| | (5) | All options granted will expire seven years from the date of grant, subject to continuous employment with the Company. |

Pension Benefits

None of the Company’s named executive officers participate in or have account balances in qualified or non-qualified defined benefit plans sponsored by the Company.

Nonqualified Deferred Compensation

None of the named executives participate in or have account balances in non-qualified defined contribution plans or other deferred compensation plans maintained by the Company, except the Chief Executive Officer who, as stated above, began deferring a portion of his salary in January of 2007 in order to ease cash constraints on the Company. The Compensation Committee, which is comprised solely of “outside directors” as defined for purposes of Section 162(m) of the Internal Revenue Code, may elect to provide our officers and other employees with non-qualified defined contribution or deferred compensation benefits if the Compensation Committee determines that doing so is in our best interests.

Potential Payments Upon Termination or Change in Control

There are no agreements with any named executive officers entitling them to compensation upon termination, change in control or any other reason.

The following table sets forth, as of May 14, 2007, certain information relating to the Company’s equity compensation plans for employees and directors under which the Company’s Common Stock may be acquired.

Equity Compensation Plan Information

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | Weighted-average exercise price of outstanding options, warrants and rights (b) | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (C)(1)(2) |

Equity compensation plans approved by security holders (1) | | 3,600,341 | | $0.78 | | 218,514 |

Equity compensation plans not approved by security holders (2) | | 2,264,443 | | $0.75 | | − |

Total | | 5,864,784 | | $0.77 | | 218,514 |

[Missing Graphic Reference]

(1) A total of 4,000,000 shares are reserved for issuance under the Company’s 1999 Stock option Plan, of which options to purchase 3,775,341 shares are outstanding, 181,145 shares have been issued upon exercise of options granted thereunder and 43,514 remain available for future grants as of May 23, 2006.

(2) Granted under the Individual Plans entered into by the Company with certain employees, officers and directors between 1999 and 2005.

As of May 14, 2007, the market price of the Company’s common stock as reported was $0.21.

COMPENSATION COMMITTEE REPORT

Under rules established by the Securities and Exchange Commission (the “SEC”), the Company is required to provide certain data and information in regard to the compensation and benefits provided to the Company’s Chief Executive Officer and the four other most highly compensated executive officers. In fulfillment of this requirement, the Compensation Committee has prepared the following report for inclusion in this Proxy Statement.

Compensation Philosophy and Objectives. The Committees' compensation philosophy is based upon the belief that the success of the Company results from the coordinated efforts of all employees working as a team to achieve objectives of providing superior products and services to the Company's customers and maximizing the Company's value for the benefit of its stockholders.

The Company's compensation programs are designed to attract, retain and reward personnel whose individual and team performance contributes significantly to the short and long-term objectives of the Company. The Company's executive compensation programs are guided by the following principles, which may also be considered in making compensation decisions for employees:

| | ● | To ensure competitiveness, the Company monitors industry standards and considers this information when it makes compensation decisions; and |

| | ● | The compensation of executive officers is affected by individual, team and overall Company performance. Overall Company performance is based upon achievement of strategic and operating goals. Such factors include revenues generated, technology validations, timely product introductions, capturing market share and preservation of and increases in stockholder value. Individual and team performance is considered to the extent of whether departmental goals are achieved within the time and budget constraints of Company operating plans. Additionally, individual performance is measured, in part, against the extent to which an individual executive officer is able to foster team spirit and loyalty and minimize employee turnover. |

Methods of Compensation. The key elements of the Company's executive compensation program consist primarily of base salary and stock options.

The base salaries of the Company’s executive officers are established as part of an annual compensation review cycle. In establishing those salaries, the Compensation Committee considered information about salaries paid by companies of comparable size in our industry, individual performance, position and internal comparability considerations. While all of these factors were considered, the Compensation Committee did not assign specific weights to any of these factors. Base salary for the Company's executive officers is generally determined by performance, the combined base salary and annual bonus for competitive positions in the industry and general market and Company conditions. Currently, the Company does not have an annual bonus plan.

The Committees believe that the use of stock options as a means of compensation provides an incentive for executives and aligns their interests with those of the stockholders. All employees are eligible to receive stock options under the Company's stock option plans. The long-term, performance-based compensation of executive officers takes the form of option awards, which are designed to align a significant portion of the executive compensation program with long-term stockholder interests. The Compensation Committee believes that equity-based compensation ensures that the Company’s executive officers have a continuing stake in the long-term success of the Company. All options granted by the Company have been granted with an exercise price equal to or above the market price of the Company’s Common Stock on the date of grant and, accordingly, will only have value if the Company’s stock price increases. In granting options the Compensation Committee generally takes into account each executive’s responsibilities, relative position in the Company, past grants, and approximate grants to individuals in similar positions for companies of comparable size in the software industry.

President and Chief Executive Officer's Compensation. Mr. Guido DiGregorio, the Chairman of the Board, Chief Executive Officer and President of the Company, was appointed to the Presidency by the Board of Directors in November1997, to the office of Chief Executive in June 1999 and to the Chairmanship in February 2002. The Company does not currently have an employment agreement with Mr. DiGregorio. Mr. DiGregorio currently receives an annual salary of $285,000.

Compensation Committee Interlocks and Insider Participation In Compensation Decisions

During the fiscal year ended December 31, 2006, there were no employee directors on the Compensation Committee and no interlocks.

| | The Compensation Committee |

| | of the Board of Directors |

| | |

| | Louis P. Panetta |

| | C. B. Sung |

AUDIT COMMITTEE REPORT

General. Under the Company’s Audit Committee Charter (“Charter”), a copy of which can be found on our website, the general purpose of the Audit Committee is to assist the Board of Directors in the exercise of its fiduciary responsibility of providing oversight of the Company's financial statements and the financial reporting processes, internal accounting and financial controls, the annual independent audit of the Company's financial statements, and other aspects of the financial management of the Company. The Audit Committee is appointed by the Board of Directors and is to be comprised of at least three directors, each of whom shall be independent, as such term is defined under the listing standards of the Nasdaq Stock Market. All committee members must be financially literate, or shall become financially literate within a reasonable period of time after appointment to the Committee. All of the members of the Company’s Audit Committee are independent and Mr. Welch is the committee’s financial expert as such term is defined in applicable regulations and rules.

Audit and other Fees. GHP Horwath, P.C. as been the Company’s auditors since September 2006. Stonefield Josephson, Inc had been the Company’s auditors since 1999. During fiscal years 2006 and 2005, the fees for audit and other services performed by GHP Horwath and Stonefield Josephson LLP for the Company were as follows:

| | Amount and percentage of fees |

| Nature of Services | 2006 | | 2005 |

| | | | |

| Audit | Audit fees are expected to be: $ 102,000 (94%) | | $ 169,000 (93%) |

Audit related | $ − | | $ − |

| Tax fees | Tax fees are expected to be: $ 7,000 ( 6%) | | $ 6,000 ( 3%) |

Financial Information System Design and Implementation Fees | $ − | | $ − |

| All other fees (1) | $ − | | $ 7,000 ( 4%) |

| | | | |

| Total | $ 109,000 | | $ 183,000 (100%) |

| (1) | In 2005, “all other fees” related primarily to guidance in the application of new accounting pronouncements. In 2004 “all other fees” related primarily to preparation of the Company’s proxy and Registration Statement on Form S-1. The Audit Committee has considered whether the provision of non-audit services has impaired the independence of Stonefield Josephson and has concluded that Stonefield Josephson is independent under applicable SEC and Nasdaq rules and regulations. |

Responsibilities and Duties. The Company's management is responsible for preparing the Company's financial statements and the independent auditors are responsible for auditing those financial statements. The Committee is responsible for overseeing the conduct of these activities by the Company's management and the independent auditors. The financial management and the independent auditors of the Company have more time, knowledge and more detailed information on the Company than do Committee members. Consequently, in carrying out its oversight responsibilities, the Committee does not provide any expert or special assurance as to the Company's financial statements or any professional certification as to the independent auditors' work.

The specific duties of the Audit Committee include the following:

| 1. | Select, retain, and, when appropriate, terminate the engagement of the independent auditor and set the independent auditors' compensation; |

| 2. | Pre-approve all permitted non-audit services to be performed by the independent auditors and establish policies and procedures for the engagement of the independent auditors to provide permitted non-audit services; |

| 3. | Periodically discuss and review with the independent auditors their independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board, including whether the provision by the independent auditors of permitted non-audit services is compatible with independence and obtain and review a report from the independent auditors describing all relationships between the independent auditors and the Company; |

| 4. | Receive and review: (a) a report by the independent auditors describing the independent auditors' internal quality-control procedures and any material issues raised by the most recent internal quality-control review, or peer review, of the independent auditors, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and (b) other required reports from the independent auditors; |

| 5. | Meet with management and the independent auditors prior to commencement of the annual audits to review and discuss the planned scope and objectives of the audit; |

| 6. | Meet with the independent auditors, with and without management present, after completion of the annual audit to review and discuss the results of the examinations of the independent auditors and appropriate analyses of the financial statements; |

| 7. | Review the recommendations of the independent auditors for improving internal accounting controls and management's responses thereto; |

| 8. | Review and discuss (a) the reports of the independent auditors, with and without management present, as to the state of the Company's financial reporting systems and procedures, the adequacy of internal accounting and financial controls, the integrity and competency of the financial and accounting staff, disclosure controls and procedures, other aspects of the financial management of the Company and (b) current accounting trends and developments, and (c) take such action with respect thereto as may be deemed appropriate; |

| 9. | Review the interim financial statements with management and the independent auditors prior to the filing of the Company's Quarterly Reports on Form 10-Q and discuss the results of the quarterly reviews and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards; |