UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

IPALCO ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

1-8644

(Commission File Number)

35-1575582

(IRS Employer Identification No.)

One Monument Circle

Indianapolis, Indiana 46204

(Address of principal executive offices, including zip code)

317-261-8261

(Registrant's telephone number, including area code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☑

(The registrant was a voluntary filer during 2021 until its March 22, 2021 Registration Statement on Form S-4 filed with the Securities and Exchange Commission was declared effective on April 7, 2021. The registrant has filed all applicable reports under Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months.)

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller reporting company

| Emerging growth company

|

| ☐ | ☐ | ☑ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

At May 5, 2021, 108,907,318 shares of IPALCO Enterprises, Inc. common stock were outstanding, of which 89,685,177 shares were owned by AES U.S. Investments, Inc. and 19,222,141 shares were owned by CDP Infrastructures Fund G.P., a wholly-owned subsidiary of La Caisse de dépôt et placement du Québec.

IPALCO ENTERPRISES, INC.

QUARTERLY REPORT ON FORM 10-Q

For Quarter Ended March 31, 2021

TABLE OF CONTENTS

| | | | | | | | |

| Item No. | | Page No. |

| DEFINED TERMS | |

| | |

| FORWARD-LOOKING STATEMENTS | |

| | |

| PART I - FINANCIAL INFORMATION | |

| 1. | Financial Statements | |

| Unaudited Condensed Consolidated Statements of Operations for the Three Months Ended | |

| March 31, 2021 and 2020 | |

| Unaudited Condensed Consolidated Statements of Comprehensive Income (Loss) for the Three | |

| Months Ended March 31, 2021 and 2020 | |

| | Unaudited Condensed Consolidated Balance Sheets as of March 31, 2021 and December 31, 2020 | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the Three Months Ended | |

| March 31, 2021 and 2020 | |

| Unaudited Condensed Consolidated Statements of Common Shareholders' Equity and | |

| Noncontrolling Interest for the Three Months Ended March 31, 2021 and 2020 | |

| | Notes to Unaudited Condensed Consolidated Financial Statements | |

| Note 1 - Overview and Summary of Significant Accounting Policies | |

| Note 2 - Regulatory Matters | |

| Note 3 - Fair Value | |

| Note 4 - Derivative Instruments and Hedging Activities | |

| Note 5 - Debt | |

| Note 6 - Income Taxes | |

| Note 7 - Benefit Plans | |

| Note 8 - Commitments and Contingencies | |

| Note 9 - Business Segment Information | |

| Note 10 - Revenue | |

| Note 11 - Leases | |

| Note 12 - Risks and Uncertainties | |

| 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| 3. | Quantitative and Qualitative Disclosure About Market Risk | |

| 4. | Controls and Procedures | |

| | | |

| PART II - OTHER INFORMATION | |

| 1. | Legal Proceedings | |

| 1A. | Risk Factors | |

| 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| 3. | Defaults Upon Senior Securities | |

| 4. | Mine Safety Disclosures | |

| 5. | Other Information | |

| 6. | Exhibits | |

| | | |

| SIGNATURES | |

| | | | | |

| DEFINED TERMS |

| The following is a list of frequently used abbreviations or acronyms that are found in this Form 10-Q: |

| | |

| 2020 Form 10-K | IPALCO’s Annual Report on Form 10-K for the year ended December 31, 2020, as amended |

| 2024 IPALCO Notes | $405 million of 3.70% Senior Secured Notes due September 1, 2024 |

| 2030 IPALCO Notes | $475 million of 4.25% Senior Secured Notes due May 1, 2030 |

| AES | The AES Corporation |

| AES Indiana | Indianapolis Power & Light Company, which does business as AES Indiana |

| AES U.S. Investments | AES U.S. Investments, Inc. |

| AOCI | Accumulated Other Comprehensive Income |

| AOCL | Accumulated Other Comprehensive Loss |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| CAA | U.S. Clean Air Act |

| CCGT | Combined Cycle Gas Turbine |

| CCR | Coal Combustion Residuals |

| CDPQ | CDP Infrastructures Fund G.P., a wholly-owned subsidiary of La Caisse de dépôt et placement du Québec |

CO2 | Carbon Dioxide |

| COVID-19 | The disease caused by the novel coronavirus that caused a global pandemic beginning in 2020.

|

| CPCN | Certificate of Public Convenience and Necessity |

| CPP | Clean Power Plan |

| Credit Agreement | $250 million AES Indiana Revolving Credit Facilities Amended and Restated Credit Agreement, dated as of June 19, 2019 |

| CSAPR | Cross-State Air Pollution Rule |

| CWA | U.S. Clean Water Act |

| DOJ | U.S. Department of Justice |

| EPA | U.S. Environmental Protection Agency |

| FAC | Fuel Adjustment Clause |

| FERC | Federal Energy Regulatory Commission |

| Financial Statements | Unaudited Condensed Consolidated Financial Statements of IPALCO in “Item 1. Financial Statements” included in Part I – Financial Information of this Form 10-Q |

| FTRs | Financial Transmission Rights |

| GAAP | Generally Accepted Accounting Principles in the United States |

| GHG | Greenhouse Gas |

| IDEM | Indiana Department of Environmental Management |

| IPALCO | IPALCO Enterprises, Inc. |

| IPL | Indianapolis Power & Light Company, which does business as AES Indiana |

| IRP | Integrated Resource Plan |

| IURC | Indiana Utility Regulatory Commission |

| kWh | Kilowatt hours |

| LIBOR | London Interbank Offered Rate |

| MISO | Midcontinent Independent System Operator, Inc. |

| MW | Megawatts |

| MWh | Megawatt hours |

| NAAQS | National Ambient Air Quality Standards |

| NOV | Notice of Violation |

NOx

| Nitrogen Oxide |

| NSR | New Source Review |

| Pension Plans | Employees’ Retirement Plan of Indianapolis Power & Light Company and Supplemental Retirement Plan of Indianapolis Power & Light Company |

| PSD | Prevention of Significant Deterioration |

| SEC | United States Securities and Exchange Commission |

| | | | | |

| SIP | State Implementation Plan |

SO2

| Sulfur Dioxide |

| Term Loan | $65 million IPALCO Term Loan Facility Credit Agreement, dated as of October 31, 2018 |

| TDSIC | Transmission, Distribution, and Storage System Improvement Charge |

| U.S. | United States of America |

| USD | United States Dollars |

| VEBA | Voluntary Employees' Beneficiary Association |

| |

Throughout this document, the terms “the Company,” “we,” “us,” and “our” refer to IPALCO and its consolidated subsidiaries.

We encourage investors, the media, our customers and others interested in the Company to review the information we post at https://www.iplpower.com. None of the information on our website is incorporated into, or deemed to be a part of, this Quarterly Report on Form 10-Q or in any other report or document we file with the SEC, and any reference to our website is intended to be an inactive textual reference only.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 including, in particular, the statements about our plans, strategies and prospects under the heading “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I – Financial Information of this Form 10-Q. Forward-looking statements express an expectation or belief and contain a projection, plan or assumption with regard to, among other things, our future revenues, income, expenses or capital structure. Such statements of future events or performance are not guarantees of future performance and involve estimates, assumptions and uncertainties. The words “could,” “may,” “predict,” “anticipate,” “would,” “believe,” “estimate,” “expect,” “forecast,” “project,” “objective,” “intend,” “continue,” “should,” “plan,” and similar expressions, or the negatives thereof, are intended to identify forward-looking statements unless the context requires otherwise.

Some important factors that could cause our actual results or outcomes to differ materially from those discussed in the forward-looking statements include, but are not limited to:

•impacts of weather on retail sales;

•growth in our service territory and changes in retail demand and demographic patterns;

•weather-related damage to our electrical system;

•commodity and other input costs;

•performance of our suppliers;

•transmission and distribution system reliability and capacity, including natural gas pipeline system and supply constraints;

•regulatory actions and outcomes, including, but not limited to, the review and approval of our rates and charges by the IURC;

•federal and state legislation and regulations;

•changes in our credit ratings or the credit ratings of AES;

•fluctuations in the value of pension plan assets, fluctuations in pension plan expenses and our ability to fund defined benefit pension plans;

•changes in financial or regulatory accounting policies;

•environmental matters, including costs of compliance with, and liabilities related to, current and future environmental laws and requirements;

•interest rates and the use of interest rate hedges, inflation rates and other costs of capital;

•the availability of capital;

•the ability of subsidiaries to pay dividends or distributions to IPALCO;

•level of creditworthiness of counterparties to contracts and transactions;

•labor strikes or other workforce factors, including the ability to attract and retain key personnel;

•facility or equipment maintenance, repairs and capital expenditures;

•significant delays or unanticipated cost increases associated with construction projects;

•the availability and cost of funds to finance working capital and capital needs, particularly during periods when the time lag between incurring costs and recovery is long and the costs are material;

•local economic conditions;

•cyber-attacks and information security breaches;

•catastrophic events such as fires, explosions, terrorist acts, acts of war, pandemic events, including the outbreak of the novel coronavirus COVID-19, or natural disasters such as floods, earthquakes, tornadoes, severe winds, ice or snow storms, droughts, or other similar occurrences;

•costs and effects of legal and administrative proceedings, audits, settlements, investigations and claims and the ultimate disposition of litigation;

•industry restructuring, deregulation and competition;

•issues related to our participation in MISO, including the cost associated with membership, our continued ability to recover costs incurred, and the risk of default of other MISO participants;

•changes in tax laws and the effects of our tax strategies;

•the use of derivative contracts;

•product development, technology changes, and changes in prices of products and technologies; and

•the risks and other factors discussed in this report and other IPALCO filings with the SEC.

All of the above factors are difficult to predict, contain uncertainties that may materially affect actual results, and many are beyond our control. See “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in IPALCO’s 2020 Form 10-K for a more detailed discussion of the foregoing and certain other factors that could cause actual results to differ materially from those reflected in any forward-looking statements. These risks may also be specifically described in our Quarterly Reports on Form 10-Q in "Part II - Item 1A. Risk Factors", Current Reports on Form 8-K and other documents that we may file from time to time with the SEC. Except as required by the federal securities laws, we undertake no obligation to publicly update or review any forward-looking information, whether as a result of new information, future events or otherwise. If one or more forward-looking statements are updated, no inference should be drawn that additional updates will be made with respect to those or other forward-looking statements. Our SEC filings are available to the public from the SEC’s website at www.sec.gov.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Unaudited Condensed Consolidated Statements of Operations |

| (In Thousands) |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | 2021 | 2020 |

| | | | | |

| REVENUES | | | | $ | 362,201 | | $ | 357,382 | |

| | | | | |

| OPERATING COSTS AND EXPENSES: | | | | | |

| Fuel | | | | 84,731 | | 68,788 | |

| Power purchased | | | | 24,583 | | 35,467 | |

| Operation and maintenance | | | | 103,949 | | 105,590 | |

| Depreciation and amortization | | | | 63,089 | | 60,708 | |

| Taxes other than income taxes | | | | 12,951 | | 12,057 | |

| | | | | |

| Total operating costs and expenses | | | | 289,303 | | 282,610 | |

| | | | | |

| OPERATING INCOME | | | | 72,898 | | 74,772 | |

| | | | | |

| OTHER INCOME / (EXPENSE), NET: | | | | | |

| Allowance for equity funds used during construction | | | | 1,374 | | 857 | |

| Interest expense | | | | (30,067) | | (30,081) | |

| | | | | |

| Other income / (expense), net | | | | 4,614 | | 207 | |

| Total other income / (expense), net | | | | (24,079) | | (29,017) | |

| | | | | |

| EARNINGS FROM OPERATIONS BEFORE INCOME TAX | | | | 48,819 | | 45,755 | |

| | | | | |

| Less: Income tax expense | | | | 10,035 | | 9,772 | |

| NET INCOME | | | | 38,784 | | 35,983 | |

| | | | | |

| Less: Dividends on preferred stock | | | | 803 | | 803 | |

| NET INCOME APPLICABLE TO COMMON STOCK | | | | $ | 37,981 | | $ | 35,180 | |

| | | | | |

| See notes to unaudited condensed consolidated financial statements. |

| | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Unaudited Condensed Consolidated Statements of Comprehensive Income/(Loss) |

| (In Thousands) |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | 2021 | 2020 |

| | | | | |

| Net income applicable to common stock | | | | $ | 37,981 | | $ | 35,180 | |

| | | | | |

| Derivative activity: | | | | | |

| Change in derivative fair value, net of income tax (expense)/benefit of $(9,655) and $12,522, for each respective period | | | | 30,050 | | (36,313) | |

| Reclassification to earnings, net of income tax expense of $146 and $0, for each respective period | | | | (456) | | 0 | |

| Net change in fair value of derivatives | | | | 29,594 | | (36,313) | |

| | | | | |

| Other comprehensive income / (loss) | | | | 29,594 | | (36,313) | |

| | | | | |

| Net comprehensive income / (loss) | | | | $ | 67,575 | | $ | (1,133) | |

| | | | | |

See notes to unaudited condensed consolidated financial statements.

| | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Unaudited Condensed Consolidated Balance Sheets |

| (In Thousands) |

| | March 31, | December 31, |

| | 2021 | 2020 |

| ASSETS | | |

| CURRENT ASSETS: | | |

| Cash and cash equivalents | $ | 48,592 | | $ | 20,502 | |

| Restricted cash | 5 | | 6,120 | |

| Accounts receivable, net of allowance for credit losses of $1,966 and $3,155, respectively | 160,735 | | 165,193 | |

| Inventories | 80,610 | | 95,506 | |

| Regulatory assets, current | 47,675 | | 45,430 | |

| Taxes receivable | 15,270 | | 24,384 | |

| Prepayments and other current assets | 41,441 | | 17,842 | |

| Total current assets | 394,328 | | 374,977 | |

| NON-CURRENT ASSETS: | | |

| Property, plant and equipment | 6,559,864 | | 6,530,395 | |

| Less: Accumulated depreciation | 2,690,636 | | 2,643,695 | |

| 3,869,228 | | 3,886,700 | |

| Construction work in progress | 230,199 | | 209,584 | |

| Total net property, plant and equipment | 4,099,427 | | 4,096,284 | |

| OTHER NON-CURRENT ASSETS: | | |

| Intangible assets - net | 56,713 | | 59,141 | |

| Regulatory assets, non-current | 385,995 | | 392,801 | |

| Other non-current assets | 48,792 | | 46,716 | |

| Total other non-current assets | 491,500 | | 498,658 | |

| TOTAL ASSETS | $ | 4,985,255 | | $ | 4,969,919 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | |

| CURRENT LIABILITIES: | | |

| Short-term debt and current portion of long-term debt (Note 5) | $ | 184,945 | | $ | 169,907 | |

| Accounts payable | 122,399 | | 127,089 | |

| Accrued taxes | 37,831 | | 26,620 | |

| Accrued interest | 42,914 | | 31,733 | |

| Customer deposits | 26,685 | | 27,929 | |

| Regulatory liabilities, current | 10,968 | | 30,036 | |

| | |

| Accrued and other current liabilities | 14,426 | | 19,453 | |

| Total current liabilities | 440,168 | | 432,767 | |

| NON-CURRENT LIABILITIES: | | |

| Long-term debt (Note 5) | 2,556,848 | | 2,556,278 | |

| Deferred income tax liabilities | 288,825 | | 275,714 | |

| Taxes payable | 7,552 | | 7,458 | |

| Regulatory liabilities, non-current | 835,269 | | 839,360 | |

| Accrued pension and other postretirement benefits | 5,380 | | 5,334 | |

| Asset retirement obligations | 195,704 | | 195,236 | |

| Derivative liabilities, non-current | 23,511 | | 63,215 | |

| Other non-current liabilities | 13,683 | | 13,785 | |

| Total non-current liabilities | 3,926,772 | | 3,956,380 | |

| Total liabilities | 4,366,940 | | 4,389,147 | |

| COMMITMENTS AND CONTINGENCIES (Note 8) | | |

| SHAREHOLDERS' EQUITY: | | |

| Paid in capital | 589,007 | | 588,966 | |

| Accumulated other comprehensive loss | (13,826) | | (43,420) | |

| Accumulated deficit | (16,650) | | (24,558) | |

| Total common shareholders' equity | 558,531 | | 520,988 | |

| Preferred stock of subsidiary | 59,784 | | 59,784 | |

| Total shareholders' equity | 618,315 | | 580,772 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 4,985,255 | | $ | 4,969,919 | |

| | |

| See notes to unaudited condensed consolidated financial statements. |

| | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Unaudited Condensed Consolidated Statements of Cash Flows |

| (In Thousands) |

| | Three Months Ended |

| | March 31, |

| | 2021 | 2020 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net income | $ | 38,784 | | $ | 35,983 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| Depreciation and amortization | 63,089 | | 60,708 | |

| Amortization of deferred financing costs and debt discounts | 998 | | 1,100 | |

| Deferred income taxes and investment tax credit adjustments - net | 922 | | 2,467 | |

| Allowance for equity funds used during construction | (1,374) | | (857) | |

| | |

| Change in certain assets and liabilities: | | |

| Accounts receivable | 4,458 | | 4,655 | |

| Inventories | 12,568 | | (8,265) | |

| Accounts payable | 3,610 | | (7,940) | |

| Accrued and other current liabilities | (6,271) | | (2,514) | |

| Accrued taxes payable/receivable | 20,419 | | 15,382 | |

| Accrued interest | 11,181 | | 2,599 | |

| Pension and other postretirement benefit expenses | 46 | | (1,726) | |

| Short-term and long-term regulatory assets and liabilities | (14,905) | | (3,226) | |

| Prepayments and other current assets | (23,599) | | (5,488) | |

| Other - net | (2,038) | | 4,698 | |

| Net cash provided by operating activities | 107,888 | | 97,576 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | |

| Capital expenditures | (62,792) | | (54,490) | |

| Project development costs | (386) | | (751) | |

| Cost of removal and regulatory recoverable ARO payments | (6,589) | | (7,962) | |

| | |

| Net cash used in investing activities | (69,767) | | (63,203) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | |

| Borrowings under revolving credit facilities | 60,000 | | 0 | |

| Repayments under revolving credit facilities | (45,000) | | 0 | |

| | |

| | |

| Distributions to shareholders | (30,073) | | (26,631) | |

| Preferred dividends of subsidiary | (803) | | (803) | |

| Deferred financing costs paid | (270) | | 0 | |

| | |

| | |

| Net cash used in financing activities | (16,146) | | (27,434) | |

| Net change in cash, cash equivalents and restricted cash | 21,975 | | 6,939 | |

| Cash, cash equivalents and restricted cash at beginning of period | 26,622 | | 48,552 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 48,597 | | $ | 55,491 | |

| | |

| Supplemental disclosures of cash flow information: | | |

| Cash paid during the period for: | | |

| Interest (net of amount capitalized) | $ | 18,512 | | $ | 26,438 | |

| | |

| Non-cash investing activities: | | |

| Accruals for capital expenditures | $ | 46,060 | | $ | 28,184 | |

| | |

| See notes to unaudited condensed consolidated financial statements. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Unaudited Condensed Consolidated Statements of Common Shareholders' Equity |

| and Noncontrolling Interest |

| For the Three Months Ended March 31, 2021 and 2020 |

| (In Thousands) |

| | | Paid in

Capital | | Accumulated

Other Comprehensive Loss | | Accumulated

Deficit | | Total Common Shareholders' Equity | | Cumulative Preferred Stock of Subsidiary |

| 2021 | | | | | | | | | | |

| Beginning Balance | | $ | 588,966 | | | $ | (43,420) | | | $ | (24,558) | | | $ | 520,988 | | | $ | 59,784 | |

| Net comprehensive income/(loss) | | — | | | 29,594 | | | 37,981 | | | 67,575 | | | 803 | |

| Preferred stock dividends | | — | | | — | | | — | | | — | | | (803) | |

| Distributions to shareholders | | — | | | — | | | (30,073) | | | (30,073) | | | — | |

| Other | | 41 | | | — | | | — | | | 41 | | | — | |

| Balance at March 31, 2021 | | $ | 589,007 | | | $ | (13,826) | | | $ | (16,650) | | | $ | 558,531 | | | $ | 59,784 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| 2020 | | | | | | | | | | |

| Beginning Balance | | $ | 590,784 | | | $ | (19,750) | | | $ | (24,558) | | | $ | 546,476 | | | $ | 59,784 | |

| Net comprehensive income/(loss) | | — | | | (36,313) | | | 35,180 | | | (1,133) | | | 803 | |

| Preferred stock dividends | | — | | | — | | | — | | | — | | | (803) | |

| Distributions to shareholders | | — | | | — | | | (26,631) | | | (26,631) | | | — | |

| Other | | 49 | | | — | | | — | | | 49 | | | — | |

| Balance at March 31, 2020 | | $ | 590,833 | | | $ | (56,063) | | | $ | (16,009) | | | $ | 518,761 | | | $ | 59,784 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

See notes to unaudited condensed consolidated financial statements.

IPALCO ENTERPRISES, INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. OVERVIEW AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

IPALCO is a holding company incorporated under the laws of the state of Indiana. IPALCO is owned by AES U.S. Investments (82.35%) and CDPQ (17.65%). AES U.S. Investments is owned by AES U.S. Holdings, LLC (85%) and CDPQ (15%). IPALCO owns all of the outstanding common stock of IPL, which does business as AES Indiana. Substantially all of IPALCO’s business consists of generating, transmitting, distributing and selling of electric energy conducted through its principal subsidiary, AES Indiana. AES Indiana was incorporated under the laws of the state of Indiana in 1926. AES Indiana has approximately 513,000 retail customers in the city of Indianapolis and neighboring cities, towns and communities, and adjacent rural areas all within the state of Indiana, with the most distant point being approximately forty miles from Indianapolis. AES Indiana has an exclusive right to provide electric service to those customers. AES Indiana owns and operates 4 generating stations, all within the state of Indiana. AES Indiana’s largest generating station, Petersburg, is coal-fired, and AES Indiana has plans to retire approximately 630 MW of coal-fired generation at Petersburg Units 1 and 2 in 2021 and 2023, respectively (for further discussion, see Note 2, "Regulatory Matters - IRP Filing and Replacement Generation"). The second largest station, Harding Street, uses natural gas and fuel oil to power combustion turbines. In addition, AES Indiana operates a 20 MW battery energy storage unit at this location, which provides frequency response. The third station, Eagle Valley, is a CCGT natural gas plant. The fourth station, Georgetown, is a small peaking station that uses natural gas to power combustion turbines. As of March 31, 2021, AES Indiana’s net electric generation capacity for winter is 3,705 MW and net summer capacity is 3,560 MW.

Consolidation

The accompanying Financial Statements include the accounts of IPALCO, AES Indiana and Mid-America Capital Resources, Inc., a non-regulated wholly-owned subsidiary of IPALCO. All significant intercompany amounts have been eliminated in consolidation.

Interim Financial Presentation

The accompanying Financial Statements are unaudited; however, they have been prepared in accordance with GAAP, as contained in the FASB ASC, for interim financial information and Article 10 of Regulation S-X issued by the SEC. Accordingly, they do not include all the information and footnotes required by GAAP for annual fiscal reporting periods. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of the results of operations, financial position, comprehensive income, changes in equity, and cash flows. The electric utility business is affected by seasonal weather patterns throughout the year and, therefore, the operating revenues and associated operating expenses are not generated evenly by month during the year. These unaudited Financial Statements have been prepared in accordance with the accounting policies described in IPALCO’s 2020 Form 10-K and should be read in conjunction therewith.

Use of Management Estimates

The preparation of financial statements in conformity with GAAP requires that management make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The reported amounts of revenues and expenses during the reporting period may also be affected by the estimates and assumptions that management is required to make. Actual results may differ from those estimates.

Cash, Cash Equivalents and Restricted Cash

The following table provides a summary of cash, cash equivalents and restricted cash amounts as shown on the Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | | | | |

| | | March 31, | | December 31, |

| | | 2021 | | 2020 |

| | | (In Thousands) |

| Cash, cash equivalents and restricted cash | | | | |

| Cash and cash equivalents | | $ | 48,592 | | | $ | 20,502 | |

| Restricted cash | | 5 | | | 6,120 | |

| Total cash, cash equivalents and restricted cash | | $ | 48,597 | | | $ | 26,622 | |

| | | | |

Accounts Receivable

The following table summarizes our accounts receivable balances at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | |

| | | March 31, | | December 31, |

| | | 2021 | | 2020 |

| | | (In Thousands) |

| Accounts receivable, net | | | | |

| Customer receivables | | $ | 97,231 | | | $ | 91,335 | |

| Unbilled revenue | | 57,578 | | | 72,334 | |

| Amounts due from related parties | | 375 | | | 490 | |

| Other | | 7,517 | | | 4,189 | |

| Allowance for credit losses | | (1,966) | | | (3,155) | |

| Total accounts receivable, net | | $ | 160,735 | | | $ | 165,193 | |

| | | | |

The following table is a rollforward of our allowance for credit losses related to the accounts receivable balances for the periods indicated (in Thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 | | Beginning Allowance Balance at January 1, 2021 | | Current Period Provision | | Write-offs Charged Against Allowances | | Recoveries Collected | | Ending Allowance Balance at

March 31, 2021 |

| Allowance for credit losses | | $ | 3,155 | | | $ | 124 | | | $ | (1,885) | | | $ | 572 | | | $ | 1,966 | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2020 | | Beginning Allowance Balance at January 1, 2020 | | Current Period Provision | | Write-offs Charged Against Allowances | | Recoveries Collected | | Ending Allowance Balance at

March 31, 2020 |

| Allowance for credit losses | | $ | 921 | | | $ | 773 | | | $ | (1,114) | | | $ | 469 | | | $ | 1,049 | |

| | | | | | | | | | |

The allowance for credit losses primarily relates to utility customer receivables, including unbilled amounts. Expected credit loss estimates are developed by disaggregating customers into those with similar credit risk characteristics and using historical credit loss experience. In addition, we also consider how current and future economic conditions are expected to impact collectability, as applicable, including the economic impacts of the COVID-19 pandemic on our receivable balance as of March 31, 2021. Amounts are written off when reasonable collections efforts have been exhausted. During 2021, the current period provision and allowance for credit losses have decreased due to lower past due customer receivable balances.

Inventories

The following table summarizes our inventories balances at March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | |

| | | March 31, | | December 31, |

| | | 2021 | | 2020 |

| | | (In Thousands) |

| Inventories | | | | |

| Fuel | | $ | 20,215 | | | $ | 36,953 | |

| Materials and supplies, net | | 60,395 | | | 58,553 | |

| Total inventories | | $ | 80,610 | | | $ | 95,506 | |

| | | | |

Accumulated Other Comprehensive Income / (Loss)

The amounts reclassified out of Accumulated Other Comprehensive Income/(Loss) by component during the three months ended March 31, 2021 and 2020 are as follows (in thousands):

| | | | | | | | | | | | | | | | |

| Details about Accumulated Other Comprehensive Loss components | Affected line item in the Condensed Consolidated Statements of Operations | | | Three Months Ended March 31, |

| | | 2021 | 2020 |

| Gains and losses on cash flow hedges (Note 4): | Interest expense | | | | $ | (602) | | $ | 0 | |

| Income tax expense | | | | 146 | | 0 | |

| Total reclassifications for the period, net of income taxes | | | | | $ | (456) | | $ | 0 | |

| | | | | | |

The changes in the components of Accumulated Other Comprehensive Income/(Loss) during the three months ended March 31, 2021 and 2020 are as follows (in thousands):

| | | | | | | | | | | |

| | Three Months Ended March 31, |

| Gains and losses on cash flow hedges (Note 4): | | 2021 | 2020 |

| Balance at January 1 | | $ | (43,420) | | $ | (19,750) | |

| Other comprehensive gain (loss) before reclassifications | | 30,050 | | (36,313) | |

| Amounts reclassified from AOCI to earnings | | (456) | | 0 | |

| Balance at March 31 | | $ | (13,826) | | $ | (56,063) | |

| | | |

New Accounting Pronouncements Issued But Not Yet Effective

The following table provides a brief description of recent accounting pronouncements that could have a material impact on the Company’s Financial Statements once adopted. Accounting pronouncements not listed below were assessed and determined to be either not applicable or are expected to have no material impact on the Company’s Financial Statements.

| | | | | | | | | | | |

| New Accounting Standards Issued But Not Yet Effective |

| ASU Number and Name | Description | Date of Adoption | Effect on the Financial Statements upon adoption |

| 2020-04, Reference Rate Form (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting | The standard provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions that reference to LIBOR or another reference rate expected to be discontinued by reference rate reform. This standard is effective for a limited period of time (March 12, 2020 - December 21, 2022).

| March 12, 2020 - December 31, 2022

| The Company is currently evaluating the impact of adopting the standard on the Financial Statements.

|

2. REGULATORY MATTERS

IRP Filing and Replacement Generation

On February 5, 2021, AES Indiana announced an agreement to acquire a 195 MW solar project. Expected to be completed in 2023, the solar project will be located in Clinton County, Indiana and Invenergy will develop the project and manage construction. On February 12, 2021, AES Indiana filed a petition and case-in-chief with the IURC seeking a CPCN for this solar project.

On February 26, 2021, as a result of the plans to retire approximately 630 MW of coal-fired generation at Petersburg Units 1 and 2 in 2021 and 2023, respectively, AES Indiana filed a petition with the IURC for approvals and cost recovery associated with these retirements, including: (1) approval of AES Indiana's creation of regulatory assets for the net book value of Petersburg units 1 and 2 upon retirement; (2) amortization of the regulatory assets based upon the Company’s depreciation rates; and (3) recovery of the regulatory assets through inclusion in AES Indiana’s rate base and ongoing amortization in AES Indiana’s future rate cases.

Excess Distributed Generation Rates

On March 1, 2021, AES Indiana filed a petition with the IURC for approval of its proposed rate for the procurement of excess distributed generation ("EDG") and related consumer EDG credit issues. The EDG rate will replace the current net metering program and will be offered beginning July 2022, when net metering is no longer available to new customers.

Electric Vehicle Portfolio Program

On March 2, 2021, AES Indiana filed with the IURC a request to approve its Electric Vehicle (EV) portfolio and associated accounting and ratemaking treatment. The EV portfolio aims to accelerate electric car adoption by reducing friction in the car buying process, and by providing customers incentives to optimize electric car charging during off-peak periods. The EV portfolio is designed to produce net benefits for all customers through new retail margins and grid optimization. The projected costs to successfully implement the services proposed in the EV portfolio are estimated at $5.1 million over the 3 year period. AES Indiana requested approval to defer as a regulatory asset and recover in future base rates the cost necessary to implement the EV portfolio, including carrying charges.

3. FAIR VALUE

The fair value of financial assets and liabilities approximate their reported carrying amounts. The estimated fair values of the Company’s assets and liabilities have been determined using available market information. As these amounts are estimates and based on hypothetical transactions to sell assets or transfer liabilities, the use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value amounts. For further information on our valuation techniques and policies, see Note 4, "Fair Value" to IPALCO’s 2020 Form 10-K.

Financial Assets

VEBA Assets

IPALCO has VEBA investments that are to be used to fund certain employee postretirement health care benefit plans. These assets are primarily comprised of open-ended mutual funds, which are valued using the net assets value per unit. These investments are recorded at fair value within "Other non-current assets" on the accompanying Unaudited Condensed Consolidated Balance Sheets and classified as equity securities. All changes to fair value on the VEBA investments are included in income in the period that the changes occur. These changes to fair value were not material for the periods covered by this report. Any unrealized gains or losses are recorded in "Other income / (expense), net" on the accompanying Unaudited Condensed Consolidated Statements of Operations.

FTRs

In connection with AES Indiana’s participation in MISO, in the second quarter of each year AES Indiana is granted financial instruments that can be converted into cash or FTRs based on AES Indiana’s forecasted peak load for the period. FTRs are used in the MISO market to hedge AES Indiana’s exposure to congestion charges, which result

from constraints on the transmission system. AES Indiana’s FTRs are valued at the cleared auction prices for FTRs in MISO’s annual auction. Because of the infrequent nature of this valuation, the fair value assigned to the FTRs is considered a Level 3 input under the fair value hierarchy required by ASC 820. An offsetting regulatory liability has been recorded as these revenues or costs will be flowed through to customers through the FAC. As such, there is no impact on our Unaudited Condensed Consolidated Statements of Operations.

Financial Liabilities

Interest Rate Hedges

In March 2019, we entered into forward interest rate hedges, which were amended in April 2020. The interest rate hedges have a combined notional amount of $400.0 million. All changes in the market value of the interest rate hedges are recorded in AOCL. See also Note 4, "Derivative Instruments and Hedging Activities - Cash Flow Hedges" for further information.

Recurring Fair Value Measurements

The fair value of assets and liabilities at March 31, 2021 and December 31, 2020 measured on a recurring basis and the respective category within the fair value hierarchy for IPALCO was determined as follows:

| | | | | | | | | | | | | | |

| Assets and Liabilities at Fair Value |

| | Level 1 | Level 2 | Level 3 |

| Fair value at March 31, 2021 | Based on quoted market prices in active markets | Other observable inputs | Unobservable inputs |

| | (In Thousands) |

| Financial assets: | | | | |

| VEBA investments: | | | | |

| Money market funds | $ | 14 | | $ | 14 | | $ | 0 | | $ | 0 | |

| Mutual funds | 3,335 | | 0 | | 3,335 | | 0 | |

| Total VEBA investments | 3,349 | | 14 | | 3,335 | | 0 | |

| Financial transmission rights | 139 | | 0 | | 0 | | 139 | |

| Total financial assets measured at fair value | $ | 3,488 | | $ | 14 | | $ | 3,335 | | $ | 139 | |

| Financial liabilities: | | | | |

| Interest rate hedges | $ | 23,511 | | $ | 0 | | $ | 23,511 | | $ | 0 | |

| | | | |

| Total financial liabilities measured at fair value | $ | 23,511 | | $ | 0 | | $ | 23,511 | | $ | 0 | |

| | | | | | | | | | | | | | |

| Assets and Liabilities at Fair Value |

| | Level 1 | Level 2 | Level 3 |

| Fair value at December 31, 2020 | Based on quoted market prices in active markets | Other observable inputs | Unobservable inputs |

| | (In Thousands) |

| Financial assets: | | | | |

| VEBA investments: | | | | |

| Money market funds | $ | 16 | | $ | 16 | | $ | 0 | | $ | 0 | |

| Mutual funds | 3,209 | | 0 | | 3,209 | | 0 | |

| Total VEBA investments | 3,225 | | 16 | | 3,209 | | 0 | |

| Financial transmission rights | 543 | | 0 | | 0 | | 543 | |

| Total financial assets measured at fair value | $ | 3,768 | | $ | 16 | | $ | 3,209 | | $ | 543 | |

| Financial liabilities: | | | | |

| Interest rate hedges | $ | 63,215 | | $ | 0 | | $ | 63,215 | | $ | 0 | |

| Total financial liabilities measured at fair value | $ | 63,215 | | $ | 0 | | $ | 63,215 | | $ | 0 | |

Financial Instruments not Measured at Fair Value in the Consolidated Balance Sheets

Debt

The fair value of our outstanding fixed-rate debt has been determined on the basis of the quoted market prices of the specific securities issued and outstanding. In certain circumstances, the market for such securities was inactive and therefore the valuation was adjusted to consider changes in market spreads for similar securities. Accordingly, the purpose of this disclosure is not to approximate the value on the basis of how the debt might be refinanced.

The following table shows the face value and the fair value of fixed-rate and variable-rate indebtedness (Level 2) for the periods ending:

| | | | | | | | | | | | | | |

| | March 31, 2021 | December 31, 2020 |

| | Face Value | Fair Value | Face Value | Fair Value |

| | (In Thousands) |

| Fixed-rate | $ | 2,683,800 | | $ | 3,057,958 | | $ | 2,683,800 | | $ | 3,295,588 | |

| Variable-rate | 90,000 | | 90,000 | | 75,000 | | 75,000 | |

| Total indebtedness | $ | 2,773,800 | | $ | 3,147,958 | | $ | 2,758,800 | | $ | 3,370,588 | |

The difference between the face value and the carrying value of this indebtedness consists of the following:

•unamortized deferred financing costs of $25.4 million and $26.0 million at March 31, 2021 and December 31, 2020, respectively; and

•unamortized discounts of $6.6 million and $6.6 million at March 31, 2021 and December 31, 2020, respectively.

4. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

For further information on the Company’s derivative and hedge accounting policies, see Note 1, "Overview and Summary of Significant Accounting Policies - Financial Derivatives" and Note 5, "Derivative Instruments and Hedging Activities" to IPALCO’s 2020 Form 10-K.

At March 31, 2021, AES Indiana's outstanding derivative instruments were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commodity | | Accounting Treatment (a) | | Unit | | Purchases

(in thousands) | | Sales

(in thousands) | | Net Purchases/(Sales)

(in thousands) |

| Interest rate hedges | | Designated | | USD | | $ | 400,000 | | | $ | 0 | | | $ | 400,000 | |

| FTRs | | Not Designated | | MWh | | 1,046 | | | 0 | | | 1,046 | |

(a) Refers to whether the derivative instruments have been designated as a cash flow hedge.

Cash Flow Hedges

As part of our risk management processes, we identify the relationships between hedging instruments and hedged items, as well as the risk management objective and strategy for undertaking various hedge transactions. The fair values of cash flow hedges determined by current public market prices will continue to fluctuate with changes in market prices up to contract expiration.

The following tables provide information on gains or losses recognized in AOCL for the cash flow hedges for the periods indicated:

| | | | | | | | | | | |

| | Interest Rate Hedges for the Three Months Ended March 31, |

| $ in thousands (net of tax) | | 2021 | 2020 |

| Beginning accumulated derivative loss in AOCL | | $ | (43,420) | | $ | (19,750) | |

| | | |

| Net gains / (losses) associated with current period hedging transactions | | 30,050 | | (36,313) | |

| Net (gains) / losses reclassified to interest expense, net of tax | | (456) | | 0 | |

| Ending accumulated derivative loss in AOCL | | $ | (13,826) | | $ | (56,063) | |

| | | |

| Loss expected to be reclassified to earnings in the next twelve months | | $ | (5,375) | | |

| Maximum length of time that we are hedging our exposure to variability in future cash flows related to forecasted transactions (in months) | | 42 | |

Derivatives Not Designated as Hedge

FTRs do not qualify for hedge accounting or the normal purchases and sales exceptions under ASC 815. Accordingly, such contracts are recorded at fair value when acquired and subsequently amortized over the annual period as they are used. FTRs are initially recorded at fair value using the income approach.

Certain qualifying derivative instruments have been designated as normal purchases or normal sales contracts, as provided under GAAP. Derivative contracts that have been designated as normal purchases or normal sales under GAAP are not subject to hedge or mark to market accounting and are recognized in the consolidated statements of operations on an accrual basis.

When applicable, IPALCO has elected not to offset derivative assets and liabilities and not to offset net derivative positions against the right to reclaim cash collateral pledged (an asset) or the obligation to return cash collateral received (a liability) under derivative agreements. As of March 31, 2021, IPALCO did not have any offsetting positions.

The following table summarizes the fair value, balance sheet classification and hedging designation of IPALCO's derivative instruments:

| | | | | | | | | | | | | | | | | | | | | | | |

| Commodity | Hedging Designation | | Balance sheet classification | | March 31, 2021 | | December 31, 2020 |

| Financial transmission rights | Not a Cash Flow Hedge | | Prepayments and other current assets | | $ | 139 | | | $ | 543 | |

| | | | | | | |

| Interest rate hedges | Cash Flow Hedge | | Derivative liabilities, non-current | | $ | 23,511 | | | $ | 63,215 | |

5. DEBT

Long-Term Debt

The following table presents our long-term debt:

| | | | | | | | | | | |

| | | March 31, | December 31, |

| Series | Due | 2021 | 2020 |

| | | (In Thousands) |

| AES Indiana first mortgage bonds: | | |

3.875% (1) | August 2021 | $ | 55,000 | | $ | 55,000 | |

3.875% (1) | August 2021 | 40,000 | | 40,000 | |

3.125% (1) | December 2024 | 40,000 | | 40,000 | |

| 6.60% | January 2034 | 100,000 | | 100,000 | |

| 6.05% | October 2036 | 158,800 | | 158,800 | |

| 6.60% | June 2037 | 165,000 | | 165,000 | |

| 4.875% | November 2041 | 140,000 | | 140,000 | |

| 4.65% | June 2043 | 170,000 | | 170,000 | |

| 4.50% | June 2044 | 130,000 | | 130,000 | |

| 4.70% | September 2045 | 260,000 | | 260,000 | |

| 4.05% | May 2046 | 350,000 | | 350,000 | |

| 4.875% | November 2048 | 105,000 | | 105,000 | |

0.75% (2) | April 2026 | 30,000 | | 30,000 | |

0.95% (2) | April 2026 | 60,000 | | 60,000 | |

| Unamortized discount – net | | (5,968) | | (6,006) | |

| Deferred financing costs | | (17,159) | | (17,384) | |

| Total AES Indiana first mortgage bonds | 1,780,673 | | 1,780,410 | |

| Total Long-term Debt – AES Indiana | 1,780,673 | | 1,780,410 | |

| Long-term Debt – IPALCO: | | |

| 3.70% Senior Secured Notes | September 2024 | 405,000 | | 405,000 | |

| 4.25% Senior Secured Notes | May 2030 | 475,000 | | 475,000 | |

| Unamortized discount – net | | (600) | | (625) | |

| Deferred financing costs | | (8,280) | | (8,600) | |

| Total Long-term Debt – IPALCO | 871,120 | | 870,775 | |

| Total Consolidated IPALCO Long-term Debt | 2,651,793 | | 2,651,185 | |

| Less: Current Portion of Long-term Debt | | 94,945 | | 94,907 | |

| Net Consolidated IPALCO Long-term Debt | | $ | 2,556,848 | | $ | 2,556,278 | |

| | | |

(1)First mortgage bonds issued to the Indiana Finance Authority, to secure the loan of proceeds from tax-exempt bonds issued by the Indiana Finance Authority.

(2)First mortgage bonds issued to the Indiana Finance Authority, to secure the loan of proceeds from tax-exempt bonds issued by the Indiana Finance Authority. The notes have a final maturity date of December 31, 2038, but are subject to a mandatory put in April 2026.

AES Indiana First Mortgage Bonds

AES Indiana has $95 million of 3.875% first mortgage bonds that are due August 1, 2021. Management plans to refinance these first mortgage bonds with new debt. In the event that we are unable to refinance these first mortgage bonds on acceptable terms, AES Indiana has available borrowing capacity on its revolving credit facility that could be used to satisfy the obligation.

IPALCO’s Senior Secured Notes

IPALCO agreed to register the 2030 IPALCO Notes under the Securities Act by filing an exchange offer registration statement or, under specified circumstances, a shelf registration statement with the SEC pursuant to a Registration Rights Agreement dated April 14, 2020. IPALCO filed its registration statement on Form S-4 with respect to the 2030 IPALCO Notes with the SEC on March 22, 2021, and this registration statement was declared effective on April 7, 2021.

Line of Credit

As of March 31, 2021 and December 31, 2020, AES Indiana had $90.0 million and $75.0 million in outstanding borrowings on the committed line of credit, respectively.

6. INCOME TAXES

Effective Tax Rate

IPALCO’s effective combined state and federal income tax rate was 20.6% for the three months ended March 31, 2021, as compared to 21.4% for the three months ended March 31, 2020. The decrease in the effective tax rate versus the comparable period was primarily due to the impact of the reversal of excess deferred income taxes as a percentage of pre-tax income. The rate for the three months ended March 31, 2021 is lower than the combined federal and state statutory rate of 25.01% primarily due to the flowthrough of the net tax benefit related to the reversal of excess deferred taxes of AES Indiana, which was partially offset by the net tax expense related to the amortization of allowance for equity funds used during construction.

7. BENEFIT PLANS

Pension Expense

The following table presents net periodic benefit (credit) / cost information relating to the Pension Plans combined:

| | | | | | | | | | |

| | | For the Three Months Ended |

| | | March 31, |

| | | | 2021 | 2020 |

| | | (In Thousands) |

| Components of net periodic benefit (credit) / cost: | | | | |

| Service cost | | | $ | 2,334 | | $ | 2,068 | |

| Interest cost | | | 3,915 | | 5,538 | |

| Expected return on plan assets | | | (10,454) | | (9,445) | |

| Amortization of prior service cost | | | 736 | | 919 | |

| Amortization of actuarial loss | | | 1,382 | | 2,029 | |

| Net periodic benefit (credit) / cost | | | $ | (2,087) | | $ | 1,109 | |

| | | | |

In addition, AES Indiana provides postretirement health care benefits to certain active or retired employees and the spouses of certain active or retired employees. These postretirement health care benefits and the related unfunded obligation of $4.3 million at March 31, 2021 and December 31, 2020, were not material to the Financial Statements in the periods covered by this report.

8. COMMITMENTS AND CONTINGENCIES

Legal Loss Contingencies

IPALCO and AES Indiana are involved in litigation arising in the normal course of business. We accrue for litigation and claims when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated. As of March 31, 2021 and December 31, 2020, total legal loss contingencies accrued were $13.4 million and $13.4 million, respectively, which were included in "Other Non-Current Liabilities," on the accompanying Unaudited Condensed Consolidated Balance Sheets. A significant portion of these accrued liabilities relate to a personal injury legal claim involving injuries to a contractor. We maintain an amount of insurance protection for such litigation that we believe is adequate. While the ultimate outcome of such litigation cannot be predicted with certainty, management believes that final outcomes will not have a material adverse effect on IPALCO’s results of operations, financial condition and cash flows.

Environmental Loss Contingencies

We are subject to various federal, state, regional and local environmental protection and health and safety laws and regulations governing, among other things, the generation, storage, handling, use, disposal and transportation of regulated materials, including ash; the use and discharge of water used in generation boilers and for cooling purposes; the emission and discharge of hazardous and other materials into the environment; and the health and safety of our employees. These laws and regulations often require a lengthy and complex process of obtaining and renewing permits and other governmental authorizations from federal, state and local agencies. Violation of these laws, regulations or permits can result in substantial fines, other sanctions, permit revocation and/or facility shutdowns. We cannot assure that we have been or will be at all times in full compliance with such laws, regulations and permits.

New Source Review and Other CAA NOVs

In October 2009, AES Indiana received a NOV and Finding of Violation from the EPA pursuant to the CAA Section 113(a). The NOV alleged violations of the CAA at AES Indiana’s 3 primarily coal-fired electric generating facilities at the time, dating back to 1986. The alleged violations primarily pertain to the PSD and non-attainment New Source Review (NSR) requirements under the CAA. In addition, on October 1, 2015, AES Indiana received a NOV from the EPA pursuant to CAA Section 113(a) alleging violations of the CAA, the Indiana SIP, and the Title V operating permit related to alleged particulate matter and opacity violations at AES Indiana Petersburg Unit 3. Also, on February 5, 2016, the EPA issued a NOV pursuant to CAA Section 113(a) alleging violations of PSD, non-attainment NSR and other CAA regulations, the Indiana SIP, and the Title V operating permit at Petersburg Generating Station. On August 31, 2020, AES Indiana reached a settlement with the EPA, the DOJ and IDEM resolving the purported violations of the CAA with respect to AES Indiana's four coal-fired generation units currently operating at AES Indiana's Petersburg location. The settlement agreement, in the form of a proposed judicial consent decree, was approved and entered by the U.S. District Court for the Southern District of Indiana on March 23, 2021, and includes, among other items, the following requirements: annual caps on NOx and SO2 emissions and more stringent emissions limits than AES Indiana's current Title V air permit; payment of civil penalties totaling $1.525 million (which payment was satisfied by AES Indiana in April 2021); a $5 million environmental mitigation project consisting of the construction and operation of a new, non-emitting source of generation at the site; expenditure of $0.325 million on a state-only environmentally beneficial project to preserve local, ecologically-significant lands; and retirement of Units 1 and 2 prior to July 1, 2023. If AES Indiana does not meet this retirement obligation, it must install a Selective Non-Catalytic Reduction System (SNCR) on Unit 4. AES Indiana had a contingent liability recorded related to these New Source Review and other CAA NOV matters.

9. BUSINESS SEGMENT INFORMATION

Operating segments are components of an enterprise that engage in business activities from which it may earn revenues and incur expenses, for which separate financial information is available, and is evaluated regularly by the chief operating decision maker in assessing performance and deciding how to allocate resources. Substantially all of our business consists of the generation, transmission, distribution and sale of electric energy conducted through which is a vertically integrated electric utility. IPALCO’s reportable business segment is its utility segment, with all other nonutility business activities aggregated separately. The “All Other” nonutility category primarily includes the 2024 IPALCO Notes and 2030 IPALCO Notes and related interest expense, balance associated with IPALCO's interest rate hedges, cash and other immaterial balances. The accounting policies of the identified segment are consistent with those policies and procedures described in the summary of significant accounting policies.

The following table provides information about IPALCO’s business segments (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended |

| | | March 31, 2021 | | March 31, 2020 |

| | | Utility | | All Other | | Total | | Utility | | All Other | | Total |

| Revenues | | $ | 362,201 | | | $ | 0 | | | $ | 362,201 | | | $ | 357,382 | | | $ | 0 | | | $ | 357,382 | |

| Depreciation and amortization | | $ | 63,089 | | | $ | 0 | | | $ | 63,089 | | | $ | 60,708 | | | $ | 0 | | | $ | 60,708 | |

| Interest expense | | $ | 21,521 | | | $ | 8,546 | | | $ | 30,067 | | | $ | 21,920 | | | $ | 8,161 | | | $ | 30,081 | |

| Earnings/(loss) from operations before income tax | | $ | 57,295 | | | $ | (8,476) | | | $ | 48,819 | | | $ | 54,967 | | | $ | (9,212) | | | $ | 45,755 | |

| Capital expenditures | | $ | 62,792 | | | $ | 0 | | | $ | 62,792 | | | $ | 54,490 | | | $ | 0 | | | $ | 54,490 | |

| | | | | | | | | | | | |

| | As of March 31, 2021 | | As of December 31, 2020 |

| | Utility | | All Other | | Total | | Utility | | All Other | | Total |

| Total assets | | $ | 4,966,065 | | | $ | 19,190 | | | $ | 4,985,255 | | | $ | 4,952,408 | | | $ | 17,511 | | | $ | 4,969,919 | |

| | | | | | | | | | | | |

10. REVENUE

Revenue is primarily earned from retail and wholesale electricity sales and electricity transmission and distribution delivery services. Revenue is recognized upon transfer of control of promised goods or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services. Revenue is recorded net of any taxes assessed on and collected from customers, which are remitted to the governmental authorities. Please see Note 13, “Revenue” to IPALCO’s 2020 Form 10-K for further discussion of our retail, wholesale and miscellaneous revenues.

AES Indiana’s revenue from contracts with customers was $353.6 million and $351.9 million for the three months ended March 31, 2021 and 2020, respectively. The following table presents our revenue from contracts with customers and other revenue (in thousands):

| | | | | | | | |

| For the Three Months Ended | For the Three Months Ended |

| March 31, 2021 | March 31, 2020 |

| Retail Revenues | | |

| Retail revenue from contracts with customers: | | |

| Residential | $ | 160,503 | | $ | 155,408 | |

| Small commercial and industrial | 54,517 | | 54,253 | |

| Large commercial and industrial | 113,440 | | 122,038 | |

| Public lighting | 2,186 | | 2,305 | |

Other (1) | 4,191 | | 3,888 | |

| Total retail revenue from contracts with customers | 334,837 | | 337,892 | |

| Alternative revenue programs | 7,595 | | 4,896 | |

| Wholesale Revenues | | |

| Wholesale revenues from contracts with customers: | 16,109 | | 11,308 | |

| Miscellaneous Revenues | | |

| Transmission and other revenue from contracts with customers | 2,681 | | 2,732 | |

Other miscellaneous revenues (2) | 979 | | 554 | |

| Total Revenues | $ | 362,201 | | $ | 357,382 | |

| | |

(1)Other retail revenue from contracts with customers includes miscellaneous charges to customers

(2)Other miscellaneous revenue includes lease and other miscellaneous revenues not accounted for under ASC 606

The balances of receivables from contracts with customers were $152.8 million and $163.8 million as of March 31, 2021 and December 31, 2020, respectively. Payment terms for all receivables from contracts with customers typically do not extend beyond 30 days.

Contract Balances — The timing of revenue recognition, billings, and cash collections results in accounts receivable and contract liabilities. The contract liabilities from contracts with customers were $0.2 million and $0.5 million as of March 31, 2021 and December 31, 2020, respectively. During the three months ended March 31, 2021 and 2020, we recognized revenue of $0.3 million and $0.4 million related to this contract liability balance, respectively.

11. LEASES

LESSOR

The Company is the lessor under operating leases for land, office space and operating equipment. Minimum lease payments from such contracts are recognized as operating lease revenue on a straight-line basis over the lease term whereas contingent rentals are recognized when earned. Lease revenue included in the Unaudited Condensed Consolidated Statements of Operations was $0.3 million for the three months ended March 31, 2021 and 2020, respectively. Underlying gross assets and accumulated depreciation of operating leases included in Total net property, plant and equipment on the Unaudited Condensed Consolidated Balance Sheet were $4.6 million and $1.0 million, respectively, as of March 31, 2021 and $4.3 million and $0.8 million, respectively, as of December 31, 2020.

The option to extend or terminate a lease is based on customary early termination provisions in the contract. The Company has not recognized any early terminations as of March 31, 2021.

The following table shows the future minimum lease receipts as of March 31, 2021 for the remainder of 2021 through 2025 and thereafter (in thousands):

| | | | | |

| Operating Leases |

| 2021 | $ | 665 | |

| 2022 | 903 | |

| 2023 | 906 | |

| 2024 | 786 | |

| 2025 | 553 | |

| Thereafter | 2,113 | |

| Total | $ | 5,926 | |

12. RISKS AND UNCERTAINTIES

COVID-19 Pandemic

The COVID-19 pandemic has impacted global economic activity, including electricity and energy consumption, and caused significant volatility in financial markets. The global impact of the outbreak has been rapidly evolving and many countries, including the U.S., have reacted by instituting quarantines, mandating business and school closures and social distancing measures as well as restricting travel. Responses to the COVID-19 pandemic by the State of Indiana and its residents and businesses, in particular, continue to evolve, including with respect to business and school closures and limitations and other social distancing measures and the effectiveness and timing of vaccine availability and distribution efforts. Social distancing measures designed to slow the spread of the virus, such as business closures and operations limitations, impact energy demand within our service territory. We are taking a variety of measures in response to the spread of COVID-19 to ensure our ability to generate, transmit, distribute and sell electric energy, ensure the health and safety of our employees, contractors, customers and communities and provide essential services to the communities in which we operate. In addition to the impacts to demand within our service territory, we also have incurred and expect to continue to incur expenses relating to COVID-19, including those that relate to events outside of our control. The ultimate magnitude and duration of the COVID-19 pandemic is unknown at this time and may have material and adverse effects on our results of operations, financial condition and cash flows in future periods.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the Financial Statements and the notes thereto included in “Item 1. Financial Statements” included in Part I – Financial Information of this Form 10-Q.

FORWARD-LOOKING INFORMATION

The following discussion may contain forward-looking statements regarding us, our business, prospects and our results of operations that are subject to certain risks and uncertainties posed by many factors and events that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those described in “Item 1A. Risk Factors” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in IPALCO’s 2020 Form 10-K and subsequent filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise any forward-looking statements in order to reflect events or circumstances that may subsequently arise. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the SEC that advise of the risks and uncertainties that may affect our business.

OVERVIEW OF OUR BUSINESS

IPALCO is a holding company incorporated under the laws of the state of Indiana. Our principal subsidiary is AES Indiana, a regulated electric utility operating in the state of Indiana. Substantially all of our business consists of the generation, transmission, distribution and sale of electric energy conducted through AES Indiana. Our business segments are “utility” and “all other.” For additional information regarding our business, see "Item 1. Business” of our 2020 Form 10-K.

EXECUTIVE SUMMARY

Compared with the same periods in the prior year, the results for the three months ended March 31, 2021 reflect higher earnings from operations before income tax of $3.1 million, or 6.7%, respectively, primarily due to factors including, but not limited to:

•a net increase in margin due to higher volumes of retail kWh sold mostly due to favorable weather;

•a decrease in maintenance expenses; and

•lower pension costs.

These were partially offset by:

•lower demand resulting from impacts of the COVID-19 pandemic and

•a reduction in revenues in 2021 due to an accrued regulatory liability for excess earnings under the FAC provisions.

RESULTS OF OPERATIONS

The electric utility business is affected by seasonal weather patterns throughout the year and, therefore, operating revenues and associated expenses are not generated evenly by month during the year.

Statements of Operations Highlights

| | | | | | | | | | | | | | | | | |

| | | | Three Months Ended |

| | | | March 31, |

| | | | | 2021 | 2020 | $ change | % change |

| | | | | | | |

| REVENUES | | | | $ | 362,201 | | $ | 357,382 | | $ | 4,819 | | 1.3 | % |

| | | | | | | |

| OPERATING COSTS AND EXPENSES: | | | | | | | |

| Fuel | | | | 84,731 | | 68,788 | | 15,943 | | 23.2 | % |

| Power purchased | | | | 24,583 | | 35,467 | | (10,884) | | (30.7) | % |

| Operation and maintenance | | | | 103,949 | | 105,590 | | (1,641) | | (1.6) | % |

| Depreciation and amortization | | | | 63,089 | | 60,708 | | 2,381 | | 3.9 | % |

| Taxes other than income taxes | | | | 12,951 | | 12,057 | | 894 | | 7.4 | % |

| | | | | | | |

| Total operating costs and expenses | | | | 289,303 | | 282,610 | | 6,693 | | 2.4 | % |

| | | | | | | |

| OPERATING INCOME | | | | 72,898 | | 74,772 | | (1,874) | | (2.5) | % |

| | | | | | | |

| OTHER INCOME / (EXPENSE), NET: | | | | | | | |

| Allowance for equity funds used during construction | | | | 1,374 | | 857 | | 517 | | 60.3 | % |

| Interest expense | | | | (30,067) | | (30,081) | | 14 | | — | % |

| | | | | | | |

| Other income / (expense), net | | | | 4,614 | | 207 | | 4,407 | | 2129.0 | % |

| Total other income / (expense), net | | | | (24,079) | | (29,017) | | 4,938 | | (17.0) | % |

| | | | | | | |

| EARNINGS FROM OPERATIONS BEFORE INCOME TAX | | | | 48,819 | | 45,755 | | 3,064 | | 6.7 | % |

| | | | | | | |

| Less: Income tax expense | | | | 10,035 | | 9,772 | | 263 | | 2.7 | % |

| NET INCOME | | | | 38,784 | | 35,983 | | 2,801 | | 7.8 | % |

| | | | | | | |

| Less: Dividends on preferred stock | | | | 803 | | 803 | | — | | — | % |

| NET INCOME APPLICABLE TO COMMON STOCK | | | | $ | 37,981 | | $ | 35,180 | | $ | 2,801 | | 8.0 | % |

| | | | | | | |

Comparison of three months ended March 31, 2021 and three months ended March 31, 2020

Revenues

Revenues during the three months ended March 31, 2021 increased $4.8 million compared to the same period in 2020, which resulted from the following changes (dollars in thousands):

| | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | |

| | March 31, | | | Percentage |

| | 2021 | 2020 | | Change | Change |

| Revenues: | | | | | |

| Retail revenues | $ | 342,432 | | $ | 342,788 | | | $ | (356) | | (0.1)% |

| Wholesale revenues | 16,109 | | 11,308 | | | 4,801 | | 42.5% |

| Miscellaneous revenues | 3,660 | | 3,286 | | | 374 | | 11.4% |

| Total revenues | $ | 362,201 | | $ | 357,382 | | | $ | 4,819 | | 1.3% |

| | | | | |

| Heating degree days: | | | | | |

| Actual | 2,704 | | 2,434 | | | 270 | | 11.1% |

| 30-year average | 2,749 | | 2,780 | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

The following table presents additional data on kWh sold:

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | | |

| | | 2021 | | 2020 | kWh Change | % Change |

kWh Sales (In Millions): | | | | | | |

| Residential | | 1,529 | | | 1,422 | | 107 | | 7.5 | % |

| Small commercial and industrial | | 483 | | | 476 | | 7 | | 1.5 | % |

| Large commercial and industrial | | 1,389 | | | 1,437 | | (48) | | (3.3) | % |

| Public lighting | | 6 | | | 10 | | (4) | | (40.0) | % |

| Sales – retail customers | | 3,407 | | | 3,345 | | 62 | | 1.9 | % |

| Wholesale | | 647 | | | 485 | | 162 | | 33.4 | % |

| Total kWh sold | | 4,054 | | | 3,830 | | 224 | | 5.8 | % |

| | | | | | |

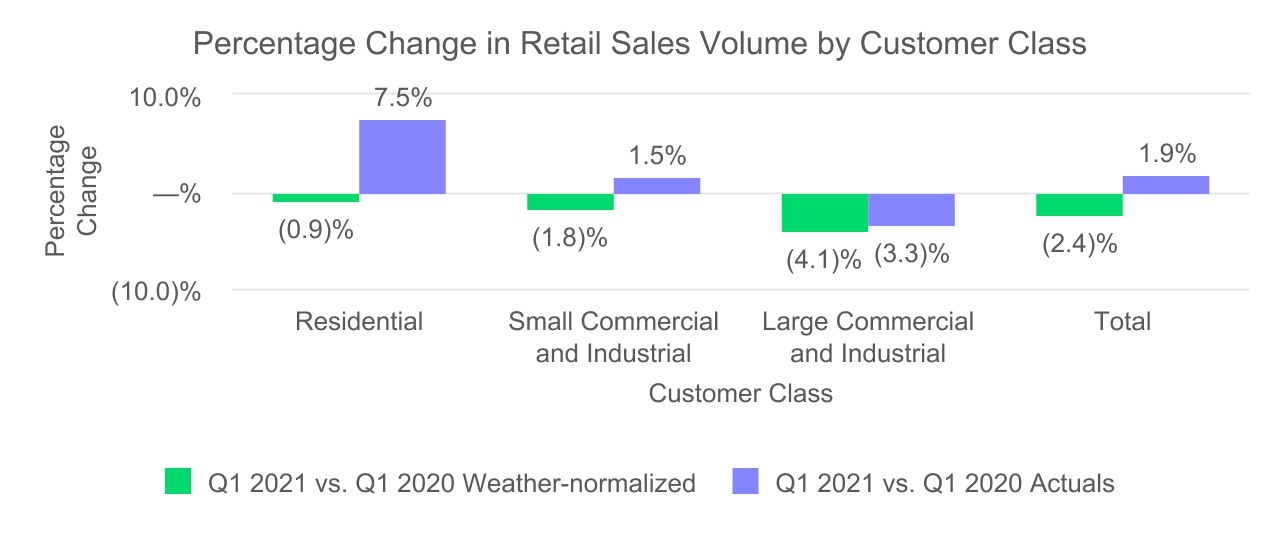

The following graph shows the percentage changes in weather-normalized and actual retail electric sales volumes by customer class for the three months ended March 31, 2021 as compared to the same period in the prior year:

Retail Revenues

The decrease in retail revenues of $0.4 million was primarily due to the following (in millions):

| | | | | |

| Volume: | |

| Net increase in the volume of kWh sold, primarily due to favorable weather in our service territory versus the comparable period, partially offset by lower weather normalized demand primarily due to the impacts of the COVID-19 pandemic | $ | 7.6 | |

| Price: | |

Net decrease in the weighted average price of retail kWh sold, primarily due to lower fuel revenues, including a $3.6 million reduction due to excess earnings under FAC provisions, and unfavorable block rate(1) and other retail rate variances | (11.0) | |

| |

| Other | 3.0 | |

| |

| Net decrease in retail revenues | $ | (0.4) | |

(1)Block rate variances are primarily attributable to our declining block rate structure, which generally provides for residential and commercial customers to be charged a lower per kWh rate at higher consumption levels. Therefore, as volumes increase, the weighted average price per kWh decreases and vice versa.

Wholesale Revenues

The increase in wholesale revenues of $4.8 million was primarily due to a $3.8 million volume increase and a $1.0 million increase in the weighted average price per kWh sold. We sold 646.8 million kWh in the wholesale market during the first three months of 2021 compared to 485.0 million kWh during the first three months of 2020. Our ability to be dispatched in the MISO market is primarily driven by the locational marginal price of electricity and variable generation costs. The amount of electricity available for wholesale sales is impacted by our retail load requirements, generation capacity and unit availability.

Operating Costs and Expenses

The following table illustrates our changes in Operating costs and expenses during the three months ended March 31, 2021 compared to the same period in 2020 (in thousands):

| | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, | | |

| 2021 | 2020 | $ Change | % Change |

| Operating costs and expenses: | | | | |

| Fuel | $ | 84,731 | | $ | 68,788 | | $ | 15,943 | | 23.2 | % |

| Power purchased | 24,583 | | 35,467 | | (10,884) | | (30.7) | % |

| Operation and maintenance | 103,949 | | 105,590 | | (1,641) | | (1.6) | % |

| Depreciation and amortization | 63,089 | | 60,708 | | 2,381 | | 3.9 | % |

| Taxes other than income taxes | 12,951 | | 12,057 | | 894 | | 7.4 | % |

| | | | |

| Total operating costs and expenses | $ | 289,303 | | $ | 282,610 | | $ | 6,693 | | 2.4 | % |

Fuel

The increase in fuel costs of $15.9 million was primarily due to the following:

•an $18.1 million increase due to the higher price of natural gas consumed versus the comparable period driven by increased market prices;

•a $14.3 million increase in the quantity of fuel consumed versus the comparable period;

•a $14.5 million decrease from deferred fuel costs; and

•a $1.7 million decrease due to the lower price of coal consumed versus the comparable period.

We are generally permitted to recover underestimated fuel and purchased power costs to serve our retail customers in future rates through quarterly FAC proceedings. These variances are deferred when incurred and amortized into expense in the same period that our rates are adjusted to reflect these variances. Additionally, fuel and purchased power costs incurred for wholesale energy sales are considered in the Off System Sales Margin rider.

Power Purchased

The decrease in purchased power costs of $10.9 million was primarily due to the following:

•a $19.2 million decrease due to a 65% decrease in the volume of power purchased during the period; partially offset by

•an $8.7 million increase in the market price of purchased power.