UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-8644

IPALCO ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Indiana | 35-1575582 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S Employer Identification No.) |

| |

| One Monument Circle | |

| Indianapolis, Indiana | 46204 |

| (Address of principal executive offices) | (Zip code) |

| Registrant’s telephone number, including area code: | (317)-261-8261 |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

(The registrant was a voluntary filer during 2024 until its May 28, 2024 Registration Statement on Form S-4 filed with the Securities and Exchange Commission was declared effective on June 6, 2024. The registrant has filed all applicable reports under Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months.)

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Smaller Reporting company | Emerging growth company |

| ☐ | ☐ | ☒ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

At October 31, 2024, 108,907,318 shares of IPALCO Enterprises, Inc. common stock were outstanding, of which 89,685,177 shares were owned by AES U.S. Investments, Inc. and 19,222,141 shares were owned by CDP Infrastructures Fund L.P., a wholly-owned subsidiary of La Caisse de dépôt et placement du Québec.

IPALCO ENTERPRISES, INC.

QUARTERLY REPORT ON FORM 10-Q

For Quarter Ended September 30, 2024

TABLE OF CONTENTS

| | | | | | | | |

| Item No. | | Page No. |

| GLOSSARY OF TERMS | |

| | |

| FORWARD-LOOKING STATEMENTS | |

| | |

| PART I - FINANCIAL INFORMATION | |

| 1. | Financial Statements (Unaudited) | |

| Condensed Consolidated Statements of Operations | |

| Condensed Consolidated Statements of Comprehensive Income | |

| | Condensed Consolidated Balance Sheets | |

| Condensed Consolidated Statements of Cash Flows | |

| Condensed Consolidated Statements of Changes in Equity | |

| | Notes to Condensed Consolidated Financial Statements | |

| Note 1 - Overview and Summary of Significant Accounting Policies | |

| Note 2 - Regulatory Matters | |

| Note 3 - Fair Value | |

| Note 4 - Derivative Instruments and Hedging Activities | |

| Note 5 - Debt | |

| Note 6 - Income Taxes | |

| Note 7 - Benefit Plans | |

| Note 8 - Equity | |

| Note 9 - Commitments and Contingencies | |

| Note 10 - Business Segments | |

| Note 11 - Revenue | |

| Note 12 - Leases | |

| 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Executive Summary | |

| Results of Operations | |

| Key Trends and Uncertainties | |

| Capital Resources and Liquidity | |

| Critical Accounting Policies and Estimates | |

| 3. | Quantitative and Qualitative Disclosure About Market Risk | |

| 4. | Controls and Procedures | |

| | | |

| PART II - OTHER INFORMATION | |

| 1. | Legal Proceedings | |

| 1A. | Risk Factors | |

| 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| 3. | Defaults Upon Senior Securities | |

| 4. | Mine Safety Disclosures | |

| 5. | Other Information | |

| 6. | Exhibits | |

| | | |

| SIGNATURES | |

| | | | | |

| GLOSSARY OF TERMS |

| The following is a list of frequently used terms, abbreviations or acronyms that are found in this Form 10-Q: |

| | |

| 2023 Form 10-K | IPALCO’s Annual Report on Form 10-K for the year ended December 31, 2023, as amended |

| 2024 Base Rate Order | The order issued in April 2024 by the IURC authorizing AES Indiana to, among other things, increase its basic rates and charges by $71 million annually |

| 2024 IPALCO Notes | $405 million of 3.70% IPALCO Enterprises, Inc. Senior Secured Notes due September 1, 2024 |

| 2030 IPALCO Notes | $475 million of 4.25% IPALCO Enterprises, Inc. Senior Secured Notes due May 1, 2030 |

| 2034 IPALCO Notes | $400 million of 5.75% IPALCO Enterprises, Inc. Senior Secured Notes due April 1, 2034 |

| $300 million Term Loan Agreement | $300 million AES Indiana Term Loan Agreement, dated as of November 21, 2023 |

| $400 million Term Loan Agreement | $400 million AES Indiana Term Loan Agreement, dated as of August 14, 2024 |

| ACE | Affordable Clean Energy |

| AES | The AES Corporation |

| AES Indiana | Indianapolis Power & Light Company and its consolidated subsidiaries, which does business as AES Indiana |

| AES U.S. Investments | AES U.S. Investments, Inc. |

| AFUDC | Allowance for Funds Used During Construction |

| AOCI | Accumulated Other Comprehensive Income |

| ARO | Asset Retirement Obligation |

| ASC | Accounting Standards Codification |

| ASU | Accounting Standards Update |

| BESS | Battery Energy Storage System |

| CAC | Citizens Action Coalition |

| CCGT | Combined Cycle Gas Turbine |

| CCR | Coal Combustion Residuals |

| CDPQ | CDP Infrastructures Fund L.P., a wholly-owned subsidiary of La Caisse de dépôt et placement du Québec |

CO2 | Carbon Dioxide |

| CPCN | Certificate of Public Convenience and Necessity |

| Credit Agreement | $350 million AES Indiana Revolving Credit Facilities Second Amended and Restated Credit Agreement, dated as of December 22, 2022 |

| CSAPR | Cross-State Air Pollution Rule |

| CWA | U.S. Clean Water Act |

| ECCRA | Environmental Compliance Cost Recovery Adjustment |

| EGUs | Electric Generating Units |

| EPA | U.S. Environmental Protection Agency |

| FAC | Fuel Adjustment Clause |

| FASB | Financial Accounting Standards Board |

| FERC | Federal Energy Regulatory Commission |

| Financial Statements | Unaudited Condensed Consolidated Financial Statements of IPALCO in “Item 1. Financial Statements” included in Part I – Financial Information of this Form 10-Q |

| FIP | Federal Implementation Plan |

| FTRs | Financial Transmission Rights |

| GAAP | Generally Accepted Accounting Principles in the United States |

| GHG | Greenhouse Gas |

| Hardy Hills JV | Hardy Hills JV, LLC |

| HLBV | Hypothetical Liquidation Book Value |

| IDEM | Indiana Department of Environmental Management |

| IPALCO | IPALCO Enterprises, Inc. and its consolidated subsidiaries |

| | | | | |

| IPL | Indianapolis Power & Light Company and its consolidated subsidiaries, which does business as AES Indiana |

| IRA | Inflation Reduction Act of 2022 |

| IRP | Integrated Resource Plan |

| ITC | Investment Tax Credit |

| IURC | Indiana Utility Regulatory Commission |

| kWh | Kilowatt hours |

| MATS | Mercury and Air Toxics Standards |

| MISO | Midcontinent Independent System Operator, Inc. |

| MW | Megawatts |

| MWh | Megawatt hours |

| NAAQS | National Ambient Air Quality Standards |

NOx

| Nitrogen Oxide |

| NPDES | National Pollutant Discharge Elimination System |

| NSPS | New Source Performance Standards |

| OUCC | Indiana Office of Utility Consumer Counselor |

| Pension Plans | Employees’ Retirement Plan of AES Indiana and Supplemental Retirement Plan of AES Indiana |

| PTC | Production Tax Credit |

| SEC | United States Securities and Exchange Commission |

SO2

| Sulfur Dioxide |

| TDSIC | Transmission, Distribution, and Storage System Improvement Charge |

| U.S. | United States of America |

| VEBA | Voluntary Employees' Beneficiary Association |

| VIE | Variable Interest Entity |

| |

Throughout this document, the terms “IPALCO,” “the Company,” “we,” “us,” and “our” refer to IPALCO Enterprises, Inc. and its consolidated subsidiaries. The term “IPALCO Enterprises, Inc.” refers only to the parent holding company, IPALCO Enterprises, Inc, excluding its subsidiaries.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 including, in particular, the statements about our plans, strategies and prospects under the heading “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part I – Financial Information of this Form 10-Q. Forward-looking statements express an expectation or belief and contain a projection, plan or assumption with regard to, among other things, our future revenue, income, expenses or capital structure. Such statements of future events or performance are not guarantees of future performance and involve estimates, assumptions and uncertainties. The words “could,” “may,” “predict,” “anticipate,” “would,” “believe,” “estimate,” “expect,” “forecast,” “project,” “objective,” “intend,” “continue,” “should,” “plan,” and similar expressions, or the negatives thereof, are intended to identify forward-looking statements unless the context requires otherwise.

Some important factors that could cause our actual results or outcomes to differ materially from those discussed in the forward-looking statements include, but are not limited to:

•impacts of weather on retail sales;

•growth in our service territory and changes in retail demand and demographic patterns;

•weather-related damage to our electrical system;

•commodity and other input costs;

•performance of our suppliers;

•transmission, distribution and generation system reliability and capacity, including natural gas pipeline system and supply constraints;

•regulatory actions and outcomes, including, but not limited to, the review and approval of our rates and charges by the IURC;

•federal and state legislation and regulations;

•changes in our credit ratings or the credit ratings of AES;

•fluctuations in the value of pension plan assets, fluctuations in pension plan expenses and our ability to fund defined benefit pension plans;

•changes in financial or regulatory accounting policies;

•environmental and climate change matters, including costs of compliance with, and liabilities related to, current and future environmental and climate change laws and requirements;

•interest rates and the use of interest rate hedges, inflation rates and other costs of capital;

•the availability of capital;

•the ability of subsidiaries to pay dividends or distributions to IPALCO Enterprises, Inc.;

•level of creditworthiness of counterparties to contracts and transactions;

•labor strikes or other workforce factors, including the ability to attract and retain key personnel;

•facility or equipment maintenance, repairs and capital expenditures;

•significant delays or unanticipated cost increases associated with construction or other projects;

•the availability and cost of funds to finance working capital and capital needs, particularly during periods when the time lag between incurring costs and recovery is long and the costs are material;

•local economic conditions;

•costs and effects of legal and administrative proceedings, audits, settlements, investigations and claims and the ultimate disposition of litigation;

•industry restructuring, deregulation and competition;

•issues related to our participation in MISO, including the cost associated with membership, our continued ability to recover costs incurred, and the risk of default of other MISO participants;

•changes in tax laws and the effects of our tax strategies;

•the use of derivative contracts;

•product development, technology changes, and changes in prices of products and technologies;

•cyber-attacks, information security breaches or information system failures;

•catastrophic events such as fires, explosions, terrorist acts, acts of war, pandemics, or the future outbreak of any other highly infectious or contagious disease, or natural disasters such as floods, earthquakes, tornadoes, severe winds, ice or snow storms, droughts, or other similar occurrences, including as a result of climate change; and

•the risks and other factors discussed in this report and other IPALCO filings with the SEC.

Forward-looking statements speak only as of the date of the document in which they are made. We disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in our expectations or any change in events, conditions or circumstances on which the forward-looking statement is based. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements.

All of the above factors are difficult to predict, contain uncertainties that may materially affect actual results, and many are beyond our control. See “Item 1A. Risk Factors” in IPALCO’s 2023 Annual Report on Form 10-K and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section in IPALCO’s 2023 Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q for the quarters ended March 31, and June 30, 2024 and this Quarterly Report on Form 10-Q for a more detailed discussion of the foregoing and certain other factors that could cause actual results to differ materially from those reflected in any forward-looking statements. These risks may also be specifically described in our other Quarterly Reports on Form 10-Q in “Part II - Item 1A. Risk Factors”, Current Reports on Form 8-K and other documents that we may file from time to time with the SEC.

SOURCES OF OTHER INFORMATION

We encourage investors, the media, our customers and others interested in the Company to review the information we post at www.aesindiana.com. None of the information on our website is incorporated into, or deemed to be a part of, this Quarterly Report on Form 10-Q or in any other report or document we file with the SEC, and any reference to our website is intended to be an inactive textual reference only.

Our SEC filings are available to the public from the SEC’s website at www.sec.gov.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| | | | | | | | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Condensed Consolidated Statements of Operations |

| (Unaudited) |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2024 | 2023 | | 2024 | 2023 |

| (In Thousands) |

| REVENUE | $ | 449,171 | | $ | 402,887 | | | $ | 1,254,566 | | $ | 1,290,580 | |

| | | | | |

| OPERATING COSTS AND EXPENSES: | | | | | |

| Fuel | 96,103 | | 96,698 | | | 276,661 | | 411,864 | |

| Power purchased | 31,100 | | 35,748 | | | 113,836 | | 122,410 | |

| Operation and maintenance | 125,849 | | 120,858 | | | 350,309 | | 356,386 | |

| Depreciation and amortization | 85,493 | | 72,021 | | | 248,846 | | 212,292 | |

| Taxes other than income taxes | 6,130 | | 6,359 | | | 20,572 | | 19,779 | |

| (Gain) / loss on asset disposals | (115) | | — | | | 1,422 | | — | |

| Total operating costs and expenses | 344,560 | | 331,684 | | | 1,011,646 | | 1,122,731 | |

| | | | | |

| OPERATING INCOME | 104,611 | | 71,203 | | | 242,920 | | 167,849 | |

| | | | | |

| OTHER (EXPENSE) / INCOME, NET: | | | | | |

| Allowance for equity funds used during construction | 1,485 | | 3,134 | | | 3,585 | | 7,089 | |

| Interest expense | (44,198) | | (34,471) | | | (131,681) | | (104,510) | |

| | | | | |

| Other income / (expense), net | 484 | | (633) | | | (266) | | 787 | |

| Total other expense, net | (42,229) | | (31,970) | | | (128,362) | | (96,634) | |

| | | | | |

| INCOME BEFORE INCOME TAX | 62,382 | | 39,233 | | | 114,558 | | 71,215 | |

| | | | | |

| Income tax expense | 8,314 | | 3,802 | | | 24,833 | | 8,663 | |

| NET INCOME | 54,068 | | 35,431 | | | 89,725 | | 62,552 | |

| | | | | |

| | | | | |

| Net loss attributable to noncontrolling interests | (872) | | — | | | (24,171) | | — | |

| | | | | |

| NET INCOME ATTRIBUTABLE TO COMMON STOCK | $ | 54,940 | | $ | 35,431 | | | $ | 113,896 | | $ | 62,552 | |

| | | | | |

| See Notes to Condensed Consolidated Financial Statements. |

| | | | | | | | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Condensed Consolidated Statements of Comprehensive Income |

| (Unaudited) |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2024 | 2023 | | 2024 | 2023 |

| (In Thousands) |

| NET INCOME | $ | 54,068 | | $ | 35,431 | | | $ | 89,725 | | $ | 62,552 | |

| | | | | |

| Derivative activity: | | | | | |

| Change in derivative fair value, net of income tax effect of $0, $(2,477), $(2,193) and $(2,425), for each respective period | — | | 7,482 | | | 6,626 | | 7,325 | |

| Reclassification to earnings, net of income tax effect of $144, $(449), $36 and $(1,348), for each respective period | (434) | | 1,358 | | | (108) | | 4,073 | |

| Net change in fair value of derivatives | (434) | | 8,840 | | | 6,518 | | 11,398 | |

| | | | | |

| Other comprehensive (loss) / income | (434) | | 8,840 | | | 6,518 | | 11,398 | |

| | | | | |

| Comprehensive income | 53,634 | | 44,271 | | | 96,243 | | 73,950 | |

| | | | | |

| | | | | |

| Less: comprehensive loss attributable to noncontrolling interests | (872) | | — | | | (24,171) | | — | |

| | | | | |

| COMPREHENSIVE INCOME ATTRIBUTABLE TO COMMON STOCK | $ | 54,506 | | $ | 44,271 | | | $ | 120,414 | | $ | 73,950 | |

| | | | | |

See Notes to Condensed Consolidated Financial Statements.

| | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES | | |

| Condensed Consolidated Balance Sheets | | |

| (Unaudited) | | |

| | September 30, | December 31, | | |

| | 2024 | 2023 | | |

| (In Thousands) | | |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | $ | 48,308 | | $ | 28,579 | | | |

| | | | |

| Accounts receivable, net of allowance for credit losses of $17,087 and $2,283, respectively | 322,701 | | 233,921 | | | |

| Inventories | 125,090 | | 143,590 | | | |

| Regulatory assets, current | 126,470 | | 89,419 | | | |

| Taxes receivable | 20,723 | | 36,481 | | | |

| Derivative assets, current | 2,817 | | 15,682 | | | |

| Prepayments and other current assets | 35,936 | | 26,358 | | | |

| Total current assets | 682,045 | | 574,030 | | | |

| NON-CURRENT ASSETS: | | | | |

| Property, plant and equipment | 7,560,533 | | 7,082,443 | | | |

| Less: Accumulated depreciation | 2,995,834 | | 2,954,555 | | | |

| 4,564,699 | | 4,127,888 | | | |

| Construction work in progress | 869,363 | | 359,014 | | | |

| Total net property, plant and equipment | 5,434,062 | | 4,486,902 | | | |

| OTHER NON-CURRENT ASSETS: | | | | |

| Intangible assets - net | 234,136 | | 235,656 | | | |

| Regulatory assets, non-current | 474,963 | | 541,784 | | | |

| Pension plan assets | 39,502 | | 41,172 | | | |

| | | | |

| Other non-current assets | 168,235 | | 301,979 | | | |

| Total other non-current assets | 916,836 | | 1,120,591 | | | |

| TOTAL ASSETS | $ | 7,032,943 | | $ | 6,181,523 | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| CURRENT LIABILITIES: | | | | |

| Short-term debt and current portion of long-term debt (see Notes 5 and 12) | $ | 430,383 | | $ | 899,159 | | | |

| Accounts payable | 278,667 | | 292,851 | | | |

| Accrued taxes | 29,898 | | 22,580 | | | |

| Accrued interest | 83,813 | | 33,639 | | | |

| Customer deposits | 21,319 | | 29,308 | | | |

| Regulatory liabilities, current | 8,322 | | 23,371 | | | |

| | | | |

| Asset retirement obligations, current | 26,384 | | — | | | |

| Accrued and other current liabilities | 28,548 | | 27,547 | | | |

| Total current liabilities | 907,334 | | 1,328,455 | | | |

| NON-CURRENT LIABILITIES: | | | | |

| Long-term debt (see Notes 5 and 12) | 3,641,207 | | 2,576,798 | | | |

| Deferred income tax liabilities | 387,512 | | 361,488 | | | |

| | | | |

| Regulatory liabilities, non-current | 443,691 | | 527,224 | | | |

| Accrued other postretirement benefits | 2,946 | | 2,776 | | | |

| Asset retirement obligations, non-current | 320,166 | | 249,930 | | | |

| | | | |

| Other non-current liabilities | 19,726 | | 5,130 | | | |

| Total non-current liabilities | 4,815,248 | | 3,723,346 | | | |

| Total liabilities | 5,722,582 | | 5,051,801 | | | |

| COMMITMENTS AND CONTINGENCIES (see Note 9) | | | | |

| EQUITY: | | | | |

| Common shareholders’ equity | | | | |

| Common stock (no par value, 290,000,000 shares authorized; 108,907,318 shares issued and outstanding at September 30, 2024 and December 31, 2023) | — | | — | | | |

| Paid in capital | 1,172,058 | | 1,021,992 | | | |

| Accumulated other comprehensive income | 35,812 | | 29,294 | | | |

| Retained earnings | 28,932 | | 25,182 | | | |

| Total common shareholders’ equity | 1,236,802 | | 1,076,468 | | | |

| | | | |

| Noncontrolling interests | 73,559 | | 53,254 | | | |

| Total equity | 1,310,361 | | 1,129,722 | | | |

| TOTAL LIABILITIES AND EQUITY | $ | 7,032,943 | | $ | 6,181,523 | | | |

| | | | |

| See Notes to Condensed Consolidated Financial Statements. | | |

| | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Condensed Consolidated Statements of Cash Flows |

| (Unaudited) |

| | Nine Months Ended |

| | September 30, |

| | 2024 | 2023 |

| (In Thousands) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | |

| Net income | $ | 89,725 | | $ | 62,552 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| Depreciation and amortization | 248,846 | | 212,292 | |

| Amortization of deferred financing costs and debt discounts | 2,735 | | 2,889 | |

| Deferred income taxes and investment tax credit adjustments - net | 8,072 | | 32,735 | |

| Allowance for equity funds used during construction | (3,585) | | (7,089) | |

| Loss on asset disposal | 1,422 | | — | |

| | |

| Change in certain assets and liabilities: | | |

| Accounts receivable | (69,259) | | 32,200 | |

| Inventories | 16,845 | | (30,264) | |

| Prepayments and other current assets | 819 | | (9,728) | |

| Accounts payable | (52,219) | | (28,669) | |

| Accrued and other current liabilities | (11,292) | | 2,137 | |

| Accrued taxes payable/receivable | 26,944 | | (20,103) | |

| Accrued interest | 50,174 | | 11,325 | |

| Pension and other postretirement benefit assets and liabilities | 1,840 | | 1,390 | |

| Current and non-current regulatory assets and liabilities | (119,289) | | 100,822 | |

| | |

| Other non-current liabilities | 5,173 | | (9,226) | |

| Other - net | (5,707) | | (6,176) | |

| Net cash provided by operating activities | 191,244 | | 347,087 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | |

| Capital expenditures | (727,152) | | (453,671) | |

| Project development costs | (3,164) | | (4,589) | |

| Acquisitions | (48,368) | | — | |

| Purchase of intangible assets | — | | (44,650) | |

| Cost of removal payments | (26,080) | | (36,749) | |

| Insurance proceeds | — | | 4,900 | |

| | |

| Net cash used in investing activities | (804,764) | | (534,759) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | |

| Borrowings under revolving credit facilities | 570,000 | | 75,000 | |

| Repayments under revolving credit facilities | (675,000) | | — | |

| Short-term borrowings | 300,000 | | — | |

| Short-term borrowings from affiliate | 92,000 | | — | |

| Repayments of short-term borrowings | (392,000) | | — | |

| Long-term borrowings | 1,050,000 | | — | |

| Retirement of long-term borrowings | (405,000) | | — | |

| Distributions to shareholders | (110,146) | | (66,941) | |

| Equity contributions from shareholders | 150,000 | | — | |

| Distributions to noncontrolling interests | (2,459) | | — | |

| Sales to noncontrolling interests | 46,935 | | — | |

| Payments for financing fees | (14,173) | | (85) | |

| | |

| Proceeds received from termination of interest rate swaps | 23,114 | | — | |

| Other | (22) | | (313) | |

| Net cash provided by financing activities | 633,249 | | 7,661 | |

| Net change in cash, cash equivalents and restricted cash | 19,729 | | (180,011) | |

| Cash, cash equivalents and restricted cash at beginning of period | 28,584 | | 201,553 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 48,313 | | $ | 21,542 | |

| | |

| Supplemental disclosures of cash flow information: | | |

| Cash paid during the period for: | | |

| Interest (net of amount capitalized) | $ | 78,842 | | $ | 82,541 | |

| | |

| Non-cash investing activities: | | |

| Accruals for capital expenditures | $ | 162,662 | | $ | 106,674 | |

| Changes to right-of-use assets - finance leases | $ | 72,066 | | $ | 983 | |

| Non-cash financing activities: | | |

| Changes to financing lease liabilities | $ | (69,089) | | $ | (1,408) | |

| | |

| See Notes to Condensed Consolidated Financial Statements. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| IPALCO ENTERPRISES, INC. and SUBSIDIARIES |

| Condensed Consolidated Statements of Changes in Equity |

| For the Three and Nine Months Ended September 30, 2024 and 2023 |

| (Unaudited) |

| | | | | | | | | | | | | | | | |

| | Common Shareholders’ Equity | | | | |

| | Common Stock | | | | | | | | | | | | |

| (in Thousands) | | Outstanding Shares | | Amount | | Paid in

Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Total Common Shareholders’ Equity | | | | Noncontrolling Interests |

| 2024 | | | | | | | | | | | | | | | | |

| Beginning Balance | | 108,907 | | | $ | — | | | $ | 1,021,992 | | | $ | 29,294 | | | $ | 25,182 | | | $ | 1,076,468 | | | | | $ | 53,254 | |

| Net income / (loss) | | | | | | — | | | — | | | 17,162 | | | 17,162 | | | | | (2,552) | |

| Other comprehensive income | | | | | | — | | | 7,386 | | | — | | | 7,386 | | | | | — | |

| | | | | | | | | | | | | | | | |

| Distributions to shareholders | | | | | | — | | | — | | | (26,720) | | | (26,720) | | | | | — | |

| | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | | | | | | — | | | — | | | — | | | — | | | | | (52) | |

| Other | | | | | | 26 | | | — | | | — | | | 26 | | | | | — | |

| Balance at March 31, 2024 | | 108,907 | | | $ | — | | | $ | 1,022,018 | | | $ | 36,680 | | | $ | 15,624 | | | $ | 1,074,322 | | | | | $ | 50,650 | |

| Net income / (loss) | | | | | | — | | | — | | | 41,794 | | | 41,794 | | | | | (20,747) | |

| Other comprehensive loss | | | | | | — | | | (434) | | | — | | | (434) | | | | | — | |

| Distributions to shareholders | | | | | | — | | | — | | | (30,374) | | | (30,374) | | | | | — | |

| Sales to noncontrolling interests | | | | | | — | | | — | | | — | | | — | | | | | 46,935 | |

| Distributions to noncontrolling interests | | | | | | — | | | — | | | — | | | — | | | | | (623) | |

| Contributions from shareholders | | | | | | 150,000 | | | — | | | — | | | 150,000 | | | | | — | |

| Other | | | | | | 29 | | | — | | | — | | | 29 | | | | | — | |

| Balance at June 30, 2024 | | 108,907 | | | $ | — | | | $ | 1,172,047 | | | $ | 36,246 | | | $ | 27,044 | | | $ | 1,235,337 | | | | | $ | 76,215 | |

| Net income / (loss) | | | | | | — | | | — | | | 54,940 | | | 54,940 | | | | | (872) | |

| Other comprehensive loss | | | | | | — | | | (434) | | | — | | | (434) | | | | | — | |

| Distributions to shareholders | | | | | | — | | | — | | | (53,052) | | | (53,052) | | | | | — | |

| | | | | | | | | | | | | | | | |

| Distributions to noncontrolling interests | | | | | | — | | | — | | | — | | | — | | | | | (1,784) | |

| | | | | | | | | | | | | | | | |

| Other | | | | | | 11 | | | — | | | — | | | 11 | | | | | — | |

| Balance at September 30, 2024 | | 108,907 | | | $ | — | | | $ | 1,172,058 | | | $ | 35,812 | | | $ | 28,932 | | | $ | 1,236,802 | | | | | $ | 73,559 | |

| | | | | | | | | | | | | | | | |

| 2023 | | | | | | | | | | | | | | | | |

| Beginning Balance | | 108,907 | | | $ | — | | | $ | 1,068,357 | | | $ | 22,269 | | | $ | (108) | | | $ | 1,090,518 | | | | | $ | — | |

| Net income | | | | | | — | | | — | | | 19,115 | | | 19,115 | | | | | — | |

| Other comprehensive loss | | | | | | — | | | (7,174) | | | — | | | (7,174) | | | | | — | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders(1) | | | | | | (12,280) | | | — | | | (19,115) | | | (31,395) | | | | | — | |

| | | | | | | | | | | | | | | | |

| Other | | | | | | 31 | | | — | | | — | | | 31 | | | | | — | |

| Balance at March 31, 2023 | | 108,907 | | | $ | — | | | $ | 1,056,108 | | | $ | 15,095 | | | $ | (108) | | | $ | 1,071,095 | | | | | $ | — | |

| Net income | | | | | | — | | | — | | | 8,006 | | | 8,006 | | | | | — | |

| Other comprehensive income | | | | | | | | 9,732 | | | | | 9,732 | | | | | — | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders(1) | | | | | | (34,177) | | | — | | | (1,369) | | | (35,546) | | | | | — | |

| Other | | | | | | 16 | | | — | | | — | | | 16 | | | | | — | |

| Balance at June 30, 2023 | | 108,907 | | | $ | — | | | $ | 1,021,947 | | | $ | 24,827 | | | $ | 6,529 | | | $ | 1,053,303 | | | | | $ | — | |

| Net income | | | | | | — | | | — | | | 35,431 | | | 35,431 | | | | | — | |

| Other comprehensive income | | | | | | — | | | 8,840 | | | — | | | 8,840 | | | | | — | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Other | | | | | | 21 | | | — | | | — | | | 21 | | | | | — | |

| | | | | | | | | | | | | | | | |

| Balance at September 30, 2023 | | 108,907 | | | $ | — | | | $ | 1,021,968 | | | $ | 33,667 | | | $ | 41,960 | | | $ | 1,097,595 | | | | | $ | — | |

| | | | | | | | | | | | | | | | |

| | |

(1) IPALCO made return of capital payments of $46.5 million during the nine months ended September 30, 2023 for the portion of current year distributions to shareholders in excess of current year net income at the time of distribution. |

| | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | | | |

See Notes to Condensed Consolidated Financial Statements.

IPALCO ENTERPRISES, INC. and SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2024 and 2023

(Unaudited)

1. OVERVIEW AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

IPALCO is a holding company incorporated under the laws of the state of Indiana. IPALCO is owned by AES U.S. Investments (82.35%) and CDPQ (17.65%). AES U.S. Investments is owned by AES U.S. Holdings, LLC (85%) and CDPQ (15%). IPALCO owns all of the outstanding common stock of IPL, which does business as AES Indiana. Substantially all of IPALCO’s business consists of generating, transmitting, distributing and selling of electric energy conducted through its principal subsidiary, AES Indiana. AES Indiana was incorporated under the laws of the state of Indiana in 1926. AES Indiana has approximately 530,000 retail customers in the city of Indianapolis and neighboring cities, towns and communities, and adjacent rural areas all within the state of Indiana. AES Indiana has an exclusive right to provide electric service to those customers.

AES Indiana owns and operates four generating stations, all within the state of Indiana. The first station, Petersburg, is coal-fired, and AES Indiana retired 230 MW Petersburg Unit 1 in May 2021 and 415 MW Petersburg Unit 2 in June 2023, which resulted in 630 MW of total retired economic capacity at this station. AES Indiana plans to convert the remaining two coal units at Petersburg to natural gas (for further discussion, see Note 2, ”Regulatory Matters - IRP Filings and Replacement Generation”). The second station, Harding Street, consists of three natural gas-fired boilers and steam turbines and uses natural gas and fuel oil to power five combustion turbines. In addition, AES Indiana operates a 20 MW battery energy storage unit at this location, which provides frequency response. The third station, Eagle Valley, is a CCGT natural gas plant. The fourth station, Georgetown, is a peaking station that uses natural gas to power combustion turbines. As of September 30, 2024, AES Indiana’s net electric generation capacity at these generating stations for winter is 3,070 MW and net summer capacity is 2,925 MW.

AES Indiana also owns and operates two renewable energy projects, including a 195 MW solar project located in Clinton County, Indiana (the ”Hardy Hills Solar Project”), which achieved full commercial operations in May 2024, and a 106 MW wind facility located in Benton County, Indiana (the ”Hoosier Wind Project”), which was acquired in February 2024. See Note 2, "Regulatory Matters - IRP Filings and Replacement Generation" for further information.

In August 2023, AES Indiana, through a wholly-owned subsidiary, completed the acquisition of Petersburg Energy Center, LLC, including the development of a 250 MW solar and 45 MW (180 MWh) energy storage facility (the ”Petersburg Energy Center Project”). The Petersburg Energy Center Project is expected to be completed in 2025.

In June 2023, AES Indiana, through a wholly-owned subsidiary, executed an agreement for the construction of the 200 MW (800 MWh) Pike County BESS Project to be developed at the AES Indiana Petersburg Plant site in Pike County, Indiana. The Pike County BESS Project is expected to be completed in early 2025.

For further discussion about AES Indiana’s plans for wind, solar, and battery energy storage projects, please see Note 2, ”Regulatory Matters - IRP Filings and Replacement Generation” to IPALCO’s 2023 Form 10-K.

Consolidation

The accompanying Financial Statements include the accounts of IPALCO Enterprises, Inc., AES Indiana and Mid-America Capital Resources, Inc., a non-regulated wholly-owned subsidiary of IPALCO. Furthermore, VIEs in which the Company has an ownership interest and is the primary beneficiary, thus controlling the VIE, have been consolidated. All significant intercompany amounts have been eliminated in consolidation.

Interim Financial Presentation

The accompanying unaudited condensed consolidated financial statements and footnotes have been prepared in accordance with GAAP, as contained in the FASB ASC, for interim financial information and Article 10 of Regulation S-X issued by the SEC. Accordingly, they do not include all the information and footnotes required by GAAP for annual fiscal reporting periods. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of the results of operations, financial position, comprehensive income, changes in equity, and cash flows. The results of operations for the three and nine months ended September 30, 2024 are not necessarily indicative of expected results for the year ending December

31, 2024. The accompanying condensed consolidated financial statements are unaudited and should be read in conjunction with the 2023 audited consolidated financial statements and notes thereto, which are included in IPALCO’s 2023 Form 10-K.

Use of Management Estimates

The preparation of financial statements in conformity with GAAP requires that management make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The reported amounts of revenue and expenses during the reporting period may also be affected by the estimates and assumptions management is required to make. Actual results may differ from those estimates. Significant items subject to such estimates and assumptions include: recognition of revenue including unbilled revenue; the carrying value of property, plant and equipment; the valuation of insurance and claims liabilities; the valuation of allowances for credit losses and deferred income taxes; regulatory assets and liabilities; liabilities recorded for income tax exposures; litigation; contingencies; and assets and liabilities related to AROs and employee benefits.

Cash, Cash Equivalents and Restricted Cash

The following table provides a summary of cash, cash equivalents and restricted cash amounts reported within the Condensed Consolidated Balance Sheets that reconcile to the total of such amounts as shown on the Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | | | | |

| | | September 30, | | December 31, |

| | | 2024 | | 2023 |

| | | (In Thousands) |

| Cash, cash equivalents and restricted cash | | | | |

| Cash and cash equivalents | | $ | 48,308 | | | $ | 28,579 | |

| Restricted cash (included in Prepayments and other current assets) | | 5 | | | 5 | |

| Total cash, cash equivalents and restricted cash | | $ | 48,313 | | | $ | 28,584 | |

| | | | |

Accounts Receivable and Allowance for Credit Losses

The following table summarizes our accounts receivable balances at September 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | |

| | | September 30, | | December 31, |

| | | 2024 | | 2023 |

| | | (In Thousands) |

| Accounts receivable, net | | | | |

| Customer receivables | | $ | 196,714 | | | $ | 125,715 | |

| Unbilled revenue | | 98,194 | | | 91,463 | |

| Amounts due from related parties | | 7,005 | | | 5,178 | |

| | | | |

| Other | | 37,875 | | | 13,848 | |

| Allowance for credit losses | | (17,087) | | | (2,283) | |

| Total accounts receivable, net | | $ | 322,701 | | | $ | 233,921 | |

| | | | |

The following table is a rollforward of our allowance for credit losses related to the accounts receivable balances for the periods indicated:

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| $ in Thousands | | 2024 | | 2023 |

| Allowance for credit losses: | | | | |

| Beginning balance | | $ | 2,283 | | | $ | 1,117 | |

| Current period provision | | 14,018 | | | 5,536 | |

| Net write-offs charged against allowance | | (577) | | | (6,940) | |

| Recoveries collected | | 1,363 | | | 1,351 | |

| Ending Balance | | $ | 17,087 | | | $ | 1,064 | |

| | | | |

The allowance for credit losses primarily relates to utility customer receivables, including unbilled amounts. Expected credit loss estimates are developed by disaggregating customers into those with similar credit risk characteristics and using historical credit loss experience. In addition, we also consider how current and future economic conditions are expected to impact the collectability, as applicable, of our receivables balance. Amounts are written off when reasonable collections efforts have been exhausted. During 2024, the current period provision and allowance for credit losses has increased due to higher past due customer receivables. AES Indiana temporarily paused customer disconnections and certain collection efforts and write-off processes after the implementation of AES Indiana's customer billing system upgrade in the fourth quarter of 2023. This has resulted in higher past due customer receivables and a higher allowance for credit losses as of September 30, 2024. AES Indiana currently anticipates reinstituting the customer disconnections process and collection efforts and write-off processes in the fourth quarter of 2024.

Inventories

The following table summarizes our inventory balances at September 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | |

| | | September 30, | | December 31, |

| | | 2024 | | 2023 |

| | | (In Thousands) |

| Inventories | | | | |

| Fuel | | $ | 55,977 | | | $ | 77,198 | |

| Materials and supplies, net | | 69,113 | | | 66,392 | |

| Total inventories | | $ | 125,090 | | | $ | 143,590 | |

| | | | |

ARO

AES Indiana’s ARO liabilities relate primarily to environmental issues involving asbestos-containing materials, ash ponds, landfills and miscellaneous contaminants associated with its generating plants, transmission system and distribution system. The following is a roll forward of the ARO legal liabilities for the nine months ended September 30, 2024 and 2023, respectively:

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | | 2024 | | 2023 |

| | | (In Thousands) |

| Balance as of January 1 | | $ | 249,930 | | | $ | 218,729 | |

| Liabilities incurred | | 8,864 | | | 656 | |

| Liabilities settled | | (3,202) | | | (9,946) | |

| Revisions to cash flow and timing estimates | | 81,714 | | | — | |

| Accretion expense | | 9,244 | | | 7,352 | |

| Balance as of September 30 | | $ | 346,550 | | | $ | 216,791 | |

| Less: ARO liabilities, current | | 26,384 | | | — | |

| ARO liabilities, non-current | | $ | 320,166 | | | $ | 216,791 | |

| | | | |

| | | | |

ARO liabilities incurred in 2024 primarily relate to decommissioning costs for AES Indiana’s renewable projects, including liabilities incurred through acquisition of Hoosier Wind Project, LLC. AES Indiana recorded revisions to its ARO liabilities in 2024 primarily to reflect revisions to cash flow estimates due to increases in closure costs and groundwater treatment measures for ash ponds and landfills. As of September 30, 2024 and December 31, 2023, AES Indiana did not have any assets that are legally restricted for settling its ARO liability. For further information on AES Indiana’s ARO, see Note 3, “Property, Plant and Equipment - ARO” to IPALCO’s 2023 Form 10-K.

AFUDC

AES Indiana capitalizes an allowance for the net cost of funds (interest on borrowed funds and a reasonable rate of return on equity funds) used for construction purposes during the period of construction with a corresponding credit to income. AFUDC equity and AFUDC debt were as follows for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ in thousands | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| AFUDC equity | | $ | 1,485 | | | $ | 3,134 | | | $ | 3,585 | | | $ | 7,089 | |

| AFUDC debt | | $ | 7,436 | | | $ | 3,841 | | | $ | 19,123 | | | $ | 9,505 | |

| | | | | | | | |

Intangible Assets

Finite-lived intangible assets primarily include capitalized software and project development intangible assets amortized over their useful lives. These capitalized software and project development intangible assets range from 7 to 35 year-weighted average amortization periods, respectively.

The following table presents information related to the Company’s intangible assets, including the gross amount capitalized and related amortization:

| | | | | | | | | |

| | September 30, | December 31, |

| $ in thousands | | 2024 | 2023 |

| Capitalized software | | $ | 279,878 | | $ | 261,872 | |

| Project development intangible assets | | 83,430 | | 84,097 | |

| Other | | 797 | | 797 | |

| Less: Accumulated amortization | | 129,969 | | 111,110 | |

| Intangible assets - net | | $ | 234,136 | | $ | 235,656 | |

| | | |

| | Three Months Ended September 30, |

| | 2024 | 2023 |

| Amortization expense | | $ | 6,729 | | $ | 3,654 | |

| | | |

| | Nine Months Ended September 30, |

| | 2024 | 2023 |

| Amortization expense | | $ | 20,458 | | $ | 9,665 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Accumulated Other Comprehensive Income

The amounts reclassified out of AOCI by component during the three and nine months ended September 30, 2024 and 2023 are as follows (in Thousands):

| | | | | | | | | | | | | | | | | | | | |

| Details about AOCI components | Affected line item in the Condensed Consolidated Statements of Operations | | Three Months Ended September 30, | Nine Months Ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| Net (gains) / losses on cash flow hedges (Note 4): | Interest expense | | $ | (578) | | $ | 1,807 | | $ | (144) | | $ | 5,421 | |

| Income tax effect | | 144 | | (449) | | 36 | | (1,348) | |

| Total reclassifications for the period, net of income taxes | | | $ | (434) | | $ | 1,358 | | $ | (108) | | $ | 4,073 | |

| | | | | | |

See Note 4, “Derivative Instruments and Hedging Activities - Cash Flow Hedges” for further information on the changes in the components of AOCI.

New Accounting Pronouncements Issued But Not Yet Effective

The following table provides a brief description of recent accounting pronouncements that could have a material impact on the Company’s Financial Statements once adopted. Accounting pronouncements not listed below were assessed and determined to be either not applicable or are expected to have no material impact on the Company’s Financial Statements.

| | | | | | | | | | | |

| ASU Number and Name | Description | Date of Adoption | Effect on the Financial Statements upon adoption |

| 2023-07 Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures | The amendments in this section are designed to improve the disclosures related to Segment reporting on an interim and annual basis. Public companies must disclose significant segment expenses and an amount for other segment items. This will also require that a company disclose its annual disclosures under Topic 280 in each interim period. Furthermore, companies will need to disclose the Chief Operating Decision Maker (CODM) and how the CODM assesses the performance of a segment. Lastly, public companies that have a single reportable segment must report the required disclosures under topic 280.

| The amendments in this Update are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. | This ASU only affects disclosures, which will be provided when the amendment becomes effective. |

| 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosures | The amendments in this Update require that public business entities on an annual basis (1) disclose specific categories in the rate reconciliation and (2) provide additional information for reconciling items that meet a quantitative threshold. Furthermore, companies are required to disclose a disaggregated amount of income taxes paid at a federal, state, and foreign level as well as a break down of income taxes paid in a jurisdiction that comprises 5% of a company’s total income taxes paid. Lastly, this ASU requires that companies disclose income (loss) from continuing operations before income tax at a domestic and foreign level and that companies disclose income tax expense from continuing operations on a federal, state, and foreign level. | The amendments in this Update are effective for fiscal years beginning after December 15, 2024. | This ASU only affects disclosures, which will be provided when the amendment becomes effective. |

2. REGULATORY MATTERS

Regulatory Rate Review

On April 17, 2024, the IURC issued an order (the “2024 Base Rate Order”) approving the Stipulation and Settlement Agreement that AES Indiana entered into on November 22, 2023, with the OUCC and the other intervening parties in AES Indiana’s base rate case filing. Among other matters and consistent with the Stipulation and Settlement Agreement, the 2024 Base Rate Order approves an increase in AES Indiana's total annual operating revenue of $71 million for AES Indiana’s electric service and provides a return on common equity of 9.9% and cost of long-term debt of 4.90% on a rate base of approximately $3.5 billion. Updated customer rates and charges became effective on May 9, 2024.

Storm Outage Restoration Inquiry

On July 11, 2023, the OUCC and the CAC filed a Joint Petition through which they requested the IURC open an investigation into AES Indiana’s practices and procedures regarding storm outage restoration. A technical conference was held on October 2, 2023, to discuss AES Indiana’s response to outages and storm restoration; particularly the storms that occurred between June 29, 2023 and July 2, 2023. In its 2024 Base Rate Order, the IURC stated, "The uncontested evidence established that AES Indiana’s response to the June 29 storm was equal to or better than the response provided by other utilities, as evidenced by a comparison of storm response with the information other utilities provided at a September 28, 2023 technical conference regarding their respective response. The evidence also established that the priorities used to guide each utility’s restoration efforts and overall effort were the same." Contemporaneous with the 2024 Base Rate Order, this Joint Petition was dismissed with prejudice.

DSM

AES Indiana filed a petition with the IURC on May 31, 2024 asking for approval of a two year DSM plan for the 2025-2026 program years. The petition includes requested recovery of program operating costs as well as net lost revenue and financial incentives, depending on the level of success of the programs consistent with prior DSM

plans. On October 1, 2024, AES Indiana and the OUCC filed settlement testimony with the IURC in support of approval of a Stipulation and Settlement Agreement reached between the settling parties (AES Indiana, OUCC, and CAC). An evidentiary hearing on this matter was held by the IURC on October 22, 2024. We expect the IURC to issue an order on this proceeding by the end of 2024.

IRP Filings and Replacement Generation

2022 IRP

In December 2022, AES Indiana filed its 2022 IRP with the IURC, which describes AES Indiana’s Preferred Resource Portfolio for meeting generation capacity needs for serving AES Indiana’s retail customers over the next several years. The Preferred Resource Portfolio is AES Indiana’s reasonable least cost option and provides a cleaner and more diverse generation mix for customers. The 2022 IRP short-term action plan includes converting the two remaining coal units at Petersburg to natural gas. Additionally, AES Indiana plans to add up to 1,300 MW of wind, solar, and battery energy storage by 2027.

Petersburg Repowering

On March 11, 2024, AES Indiana filed for approval of a CPCN with the IURC to convert Petersburg Units 3 and 4 from coal to natural gas and to recover costs through future rates. The conversion of Unit 3 is expected to begin in February 2026 and be completed by June 2026 and the conversion of Unit 4 is expected to begin in June 2026 and be completed by December 2026. An evidentiary hearing on this matter was held by the IURC on August 6, 2024. We expect the IURC to issue an order on this proceeding in the fourth quarter of 2024.

Hardy Hills Solar Project

In December 2023, the first stage of construction for the Hardy Hills Solar Project was completed and placed in service, with initial operations for over half of the project commencing on December 28, 2023. Construction was completed for the remaining MW and the project achieved full commercial operations in May 2024. Upon the final stage of the project being placed in service, the Company recognized $21.4 million of earnings from tax attributes using the HLBV method.

Hoosier Wind Project

In August 2023, AES Indiana filed for IURC issuance of a CPCN approving the acquisition of 100% of the membership interests in Hoosier Wind Project, LLC (the “Hoosier Wind Project”), which is an existing 106 MW wind facility located in Benton County, Indiana. IURC approval was received on January 24, 2024, and the transaction closed on February 29, 2024. Immediately following the acquisition of the Hoosier Wind Project, the legal entity was dissolved by AES Indiana. The transaction was accounted for as an asset acquisition that did not meet the definition of a business. Of the total consideration transferred of $92.6 million, including transaction costs, approximately $48.8 million was allocated to the identifiable assets acquired on a relative fair value basis, primarily consisting of tangible wind farm assets and typical working capital items. The remaining consideration was allocated to the termination of the pre-existing power purchase agreement between AES Indiana and the Hoosier Wind Project, which was deferred as a long-term regulatory asset.

Crossvine Project

On August 1, 2024, AES Indiana executed an agreement for the acquisition of a development stage solar and BESS project to be developed in Dubois County, Indiana. AES Indiana plans to build 85 MW of solar and 85 MW (340 MWh) of energy storage which is expected to be completed in mid-2027. This transaction is subject to approval from the IURC. AES Indiana filed a petition and case-in-chief with the IURC in August 2024, seeking a CPCN for this project.

3. FAIR VALUE

The fair value of current financial assets and liabilities approximate their reported carrying amounts. The estimated fair values of the Company’s assets and liabilities have been determined using available market information. Because these amounts are estimates and based on hypothetical transactions to sell assets or transfer liabilities, the use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value amounts. For further information on our valuation techniques and policies, see Note 4, “Fair Value” to IPALCO’s 2023 Form 10-K.

Financial Assets

VEBA Assets

IPALCO has VEBA investments that are to be used to fund certain employee postretirement health care benefit plans. These assets are primarily comprised of open-ended mutual funds, which are valued using the net assets value per unit. These investments are recorded at fair value within “Other non-current assets” on the accompanying Condensed Consolidated Balance Sheets and classified as equity securities. All changes to fair value on the VEBA investments are included in income in the period that the changes occur. These changes to fair value were not material for the periods covered by this report. Any unrealized gains or losses are recorded in “Other (expense) / income, net” on the accompanying Condensed Consolidated Statements of Operations.

FTRs

In connection with AES Indiana’s participation in MISO, in the second quarter of each year AES Indiana is granted financial instruments that can be converted into cash or FTRs based on AES Indiana’s forecasted peak load for the period. FTRs are used in the MISO market to hedge AES Indiana’s exposure to congestion charges, which result from constraints on the transmission system. AES Indiana’s FTRs are valued at the cleared auction prices for FTRs in MISO’s annual auction. Because of the infrequent nature of this valuation, the fair value assigned to the FTRs is considered a Level 3 input under the fair value hierarchy required by ASC 820. An offsetting regulatory liability has been recorded as these revenue or costs will be flowed through to customers through the FAC. As such, there is no impact on our Condensed Consolidated Statements of Operations.

Interest Rate Hedges

In March 2024, IPALCO’s interest rate hedges with a combined notional value of $400.0 million were terminated in conjunction with the issuance of the 2034 IPALCO Notes. See also Note 4, “Derivative Instruments and Hedging Activities - Cash Flow Hedges” for further information.

Recurring Fair Value Measurements

The fair value of assets and liabilities at September 30, 2024 and December 31, 2023 measured on a recurring basis and the respective category within the fair value hierarchy for IPALCO was determined as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value as of September 30, 2024 | | Fair Value as of December 31, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| (In Thousands) |

| Financial assets: | | | | | | | | | | | | | | | |

| VEBA investments: | | | | | | | | | | | | | | | |

| Money market funds | $ | 83 | | | $ | — | | | $ | — | | | $ | 83 | | | $ | 127 | | | $ | — | | | $ | — | | | $ | 127 | |

| Mutual funds | 3,855 | | | — | | | — | | | 3,855 | | | 3,425 | | | — | | | — | | | 3,425 | |

| Total VEBA investments | 3,938 | | | — | | | — | | | 3,938 | | | 3,552 | | | — | | | — | | | 3,552 | |

| FTRs | — | | | — | | | 2,817 | | | 2,817 | | | — | | | — | | | 1,388 | | | 1,388 | |

| Interest rate hedges | — | | | — | | | — | | | — | | | — | | | 14,294 | | | — | | | 14,294 | |

| Total financial assets measured at fair value | $ | 3,938 | | | $ | — | | | $ | 2,817 | | | $ | 6,755 | | | $ | 3,552 | | | $ | 14,294 | | | $ | 1,388 | | | $ | 19,234 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The following table presents a roll forward of financial instruments, measured at fair value on a recurring basis, classified as Level 3 in the fair value hierarchy (note, amounts in this table indicate carrying values, which approximate fair values):

| | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | Nine Months Ended September 30, |

| 2024 | 2023 | 2024 | 2023 |

| | (In Thousands) |

| Beginning Balance | | $ | 3,968 | | $ | 3,294 | | $ | 1,388 | | $ | 7,545 | |

| Issuances | | — | | — | | 3,811 | | 3,624 | |

| Settlements | | (1,151) | | (943) | | (2,382) | | (8,818) | |

| Ending Balance | | $ | 2,817 | | $ | 2,351 | | $ | 2,817 | | $ | 2,351 | |

| | | | | |

Financial Instruments not Measured at Fair Value in the Condensed Consolidated Balance Sheets

Debt

The fair value of our outstanding fixed-rate debt has been determined on the basis of the quoted market prices of the specific securities issued and outstanding. In certain circumstances, the market for such securities was inactive and therefore the valuation was adjusted to consider changes in market spreads for similar securities. Accordingly, the purpose of this disclosure is not to approximate the value on the basis of how the debt might be refinanced.

The following table shows the face value and the fair value of fixed-rate and variable-rate indebtedness (Level 2) for the periods ending:

| | | | | | | | | | | | | | |

| | September 30, 2024 | December 31, 2023 |

| | Face Value | Fair Value | Face Value | Fair Value |

| | (In Thousands) |

| Fixed-rate | $ | 3,678,800 | | $ | 3,644,584 | | $ | 3,033,800 | | $ | 2,860,467 | |

| Variable-rate | 350,000 | | 350,000 | | 455,000 | | 455,000 | |

| Total indebtedness | $ | 4,028,800 | | $ | 3,994,584 | | $ | 3,488,800 | | $ | 3,315,467 | |

The difference between the face value and the carrying value of this indebtedness consists of the following:

•unamortized deferred financing costs of $35.3 million and $24.8 million at September 30, 2024 and December 31, 2023, respectively; and

•unamortized discounts of $9.5 million and $6.8 million at September 30, 2024 and December 31, 2023, respectively.

4. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

For further information on the Company’s derivative and hedge accounting policies, see Note 1, “Overview and Summary of Significant Accounting Policies - Financial Derivatives” and Note 5, “Derivative Instruments and Hedging Activities” to IPALCO’s 2023 Form 10-K.

At September 30, 2024, AES Indiana’s outstanding derivative instruments were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commodity | | Accounting Treatment | | Unit | | Notional

(in thousands) | | Sales

(in thousands) | | Net Notional

(in thousands) |

| | | | | | | | | | |

| FTRs | | Not Designated | | MWh | | 6,987 | | | — | | | 6,987 | |

| | | | | | | | | | |

Cash Flow Hedges

As part of our risk management processes, we identify the relationships between hedging instruments and hedged items, as well as the risk management objective and strategy for undertaking various hedge transactions. The fair values of cash flow hedges are determined by current public market prices. IPALCO’s three forward-starting interest rate swaps with a combined notional value of $400 million were terminated for total cash proceeds of $23.1 million, in conjunction with the issuance of the 2034 IPALCO Notes in March 2024. The AOCI associated with the interest rate swaps through the date of the termination will be amortized out of AOCI into interest expense over the 10-year life of the 2034 IPALCO Notes.

The following table provides information on gains or losses recognized in AOCI for the cash flow hedges for the periods indicated:

| | | | | | | | | | | | | | | | | | | | |

| | Interest Rate Hedges for the Three Months Ended September 30, | | Interest Rate Hedges for the Nine Months Ended September 30, |

| $ in thousands (net of tax) | | 2024 | 2023 | | 2024 | 2023 |

| Beginning accumulated derivative gain | | $ | 36,246 | | $ | 24,827 | | | $ | 29,294 | | $ | 22,269 | |

| Net gains associated with current period hedging transactions | | — | | 7,482 | | | 6,626 | | 7,325 | |

| Net (gains) / losses reclassified to interest expense, net of tax | | (434) | | 1,358 | | | (108) | | 4,073 | |

| Ending accumulated derivative gain in AOCI | | $ | 35,812 | | $ | 33,667 | | | $ | 35,812 | | $ | 33,667 | |

| | | | | | |

| Net gain expected to be reclassified to earnings in the next twelve months | | 1,737 | | | | |

| | | | | | |

Derivatives Not Designated as Hedge

AES Indiana’s FTRs and forward power contracts do not qualify for hedge accounting or the normal purchases and sales exceptions under ASC 815. Accordingly, FTRs are recorded at fair value using the income approach when acquired and subsequently amortized over the annual period as they are used. The forward power contracts are recorded at fair value using the market approach with changes in the fair value charged or credited to the Condensed Consolidated Statements of Operations in the period in which the change occurred. This is commonly referred to as “MTM accounting”. Realized gains and losses on the forward power contracts are included in future FAC filings, therefore any realized and unrealized gains and losses are deferred as regulatory liabilities or regulatory assets.

Certain qualifying derivative instruments have been designated as normal purchases or normal sales contracts, as provided under GAAP. Derivative contracts that have been designated as normal purchases or normal sales under GAAP are not subject to hedge or MTM accounting and are recognized in the Condensed Consolidated Statements of Operations on an accrual basis.

When applicable, IPALCO has elected not to offset derivative assets and liabilities and not to offset net derivative positions against the right to reclaim cash collateral pledged (an asset) or the obligation to return cash collateral received (a liability) under derivative agreements. As of September 30, 2024 and December 31, 2023, IPALCO did not have any offsetting positions.

The following table summarizes the fair value, balance sheet classification and hedging designation of IPALCO’s derivative instruments (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Commodity | Hedging Designation | | Balance sheet classification | | September 30, 2024 | | December 31, 2023 |

| FTRs | Not a Cash Flow Hedge | | Derivative assets, current | | $ | 2,817 | | | $ | 1,388 | |

| Interest rate hedges | Cash Flow Hedge | | Derivative assets, current | | $ | — | | | $ | 14,294 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

5. DEBT

Long-Term Debt

The following table presents our long-term debt:

| | | | | | | | | | | |

| | | September 30, | December 31, |

| Series | Due | 2024 | 2023 |

| | | (In Thousands) |

| AES Indiana first mortgage bonds: | | |

3.125% (1) | December 2024 | $ | 40,000 | | $ | 40,000 | |

0.65% (1) | August 2025 | 40,000 | | 40,000 | |

0.75% (2) | April 2026 | 30,000 | | 30,000 | |

0.95% (2) | April 2026 | 60,000 | | 60,000 | |

1.40% (1) | August 2029 | 55,000 | | 55,000 | |

| 5.65% | December 2032 | 350,000 | | 350,000 | |

| 6.60% | January 2034 | 100,000 | | 100,000 | |

| 6.05% | October 2036 | 158,800 | | 158,800 | |

| 6.60% | June 2037 | 165,000 | | 165,000 | |

| 4.875% | November 2041 | 140,000 | | 140,000 | |

| 4.65% | June 2043 | 170,000 | | 170,000 | |

| 4.50% | June 2044 | 130,000 | | 130,000 | |

| 4.70% | September 2045 | 260,000 | | 260,000 | |

| 4.05% | May 2046 | 350,000 | | 350,000 | |

| 4.875% | November 2048 | 105,000 | | 105,000 | |

| 5.70% | April 2054 | 650,000 | | — | |

| Unamortized discount – net | | (8,150) | | (6,449) | |

| Deferred financing costs | | (25,770) | | (19,058) | |

| Total AES Indiana first mortgage bonds | 2,769,880 | | 2,128,293 | |

| Total long-term debt – AES Indiana | 2,769,880 | | 2,128,293 | |

| Long-term debt – IPALCO: | | |

| 3.70% Senior Secured Notes | September 2024 | — | | 405,000 | |

| 4.25% Senior Secured Notes | May 2030 | 475,000 | | 475,000 | |

| 5.75% Senior Secured Notes | April 2034 | 400,000 | | — | |

| Unamortized discount – net | | (1,353) | | (319) | |

| Deferred financing costs | | (8,490) | | (4,554) | |

| Total long-term debt – IPALCO | 865,157 | | 875,127 | |

| Total consolidated IPALCO long-term debt | 3,635,037 | | 3,003,420 | |

| Less: current portion of long-term debt | | 80,000 | | 445,000 | |

| Net consolidated IPALCO long-term debt | | $ | 3,555,037 | | $ | 2,558,420 | |

| | | |

(1)First mortgage bonds issued to the Indiana Finance Authority, to secure the loan of proceeds from tax-exempt bonds issued by the Indiana Finance Authority.

(2)First mortgage bonds issued to the Indiana Finance Authority, to secure the loan of proceeds from tax-exempt bonds issued by the Indiana Finance Authority. The notes have a final maturity date of December 31, 2038, but are subject to a mandatory put in April 2026.

Line of Credit

As of September 30, 2024 and December 31, 2023, AES Indiana had $50.0 million and $155.0 million in outstanding borrowings on the committed Credit Agreement, respectively.

Significant Transactions

AES Indiana First Mortgage Bonds and AES Indiana Term Loans

In August 2024, AES Indiana entered into an unsecured $400 million 364-day term loan agreement ("$400 million Term Loan Agreement"), which can be drawn in two tranches. AES Indiana drew $300 million at closing and drew the remaining $100 million in October 2024, with the proceeds being used for general corporate purposes. This agreement matures on August 13, 2025, and bears interest at variable rates as described in the $400 million Term

Loan Agreement. The $400 million Term Loan Agreement contains customary representations, warranties and covenants, including a leverage covenant consistent with the leverage covenant contained in AES Indiana's Credit Agreement. AES Indiana has classified the $400 million Term Loan Agreement, including the $300 million outstanding as of September 30, 2024, as short-term indebtedness as it matures August 2025. Management plans to repay the $400 million Term Loan Agreement through a combination of funds from debt financings and parent equity capital contributions.

In March 2024, AES Indiana issued $650 million aggregate principal amount of first mortgage bonds, 5.70% Series, due April 2054, pursuant to Rule 144A and Regulation S under the Securities Act. The net proceeds from this offering of approximately $640.5 million, after deducting the initial purchasers’ discounts and fees and expenses for the offering, were used to repay the $300 million Term Loan Agreement, outstanding borrowings on the Credit Agreement and for general corporate purposes.

IPALCO’s Senior Secured Notes

In March 2024, IPALCO completed the sale of the 2034 IPALCO Notes pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended. The net proceeds from this offering of $394.0 million, together with cash on hand, were used to redeem the 2024 IPALCO Notes on April 13, 2024, and to pay certain related fees and expenses.

Pursuant to a registration rights agreement dated March 14, 2024, IPALCO agreed to register the 2034 IPALCO Notes under the Securities Act by filing an exchange offer registration statement or, under specified circumstances, a shelf registration statement with the SEC. IPALCO filed a registration statement on Form S-4 with respect to the 2034 IPALCO Notes with the SEC on May 28, 2024 in respect of its obligations under such registration rights agreement, and this registration statement was declared effective on June 6, 2024. The exchange offer closed on July 12, 2024.

Other

In February 2024, AES Indiana received a $92 million short-term loan from AES. This loan was fully repaid in March 2024.

AES Indiana’s mortgage and deed of trust secures first mortgage bonds issued by AES Indiana. Pursuant to the terms of the mortgage and deed of trust, substantially all property owned by AES Indiana is subject to a direct first mortgage lien. In addition, IPALCO’s outstanding debt obligations are secured by its pledge of all of the outstanding common stock of AES Indiana.

6. INCOME TAXES

IPALCO’s provision for income taxes is based on the estimated annual effective tax rate, plus discrete items. The effective combined state and federal income tax rates were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Effective tax rate | | 13.3 | % | | 9.7 | % | | 21.7 | % | | 12.2 | % |

| | | | | | | | |

The year-to-date rate is different from the combined federal and state statutory rate of 24.9% primarily due to the impact of taxes on noncontrolling interest in subsidiaries and the net tax expense related to the amortization of allowance for equity funds used during construction, which is partially offset by the flowthrough of the net tax benefit related to the reversal of excess deferred taxes of AES Indiana.

IPALCO’s income tax expense for the nine months ended September 30, 2024, was calculated using the estimated annual effective income tax rate for 2024 of 17.3% on ordinary income. Management estimates the annual effective tax rate based on its forecast of annual pre-tax income or loss.

AES files federal and state income tax returns which consolidate IPALCO and its subsidiaries. Under a tax sharing agreement with AES, IPALCO is responsible for the income taxes associated with its own taxable income and records the provision for income taxes using a separate return method.

7. BENEFIT PLANS

The following table presents the net periodic benefit cost of the Pension Plans combined:

| | | | | | | | | | | | | | |

| | Three Months Ended | Nine Months Ended |

| | September 30, | September 30, |

| | 2024 | 2023 | 2024 | 2023 |

| | (In Thousands) |

| Components of net periodic benefit cost: | | | | |

| Service cost | $ | 1,253 | | $ | 1,297 | | $ | 3,759 | | $ | 3,892 | |

| Interest cost | 6,739 | | 7,455 | | 20,217 | | 22,365 | |

| Expected return on plan assets | (7,443) | | (8,277) | | (22,329) | | (24,830) | |

| Amortization of prior service cost | 475 | | 543 | | 1,425 | | 1,629 | |

| Amortization of actuarial loss | 1,207 | | 1,536 | | 3,621 | | 4,608 | |

| Net periodic benefit cost | $ | 2,231 | | $ | 2,554 | | $ | 6,693 | | $ | 7,664 | |

| | | | |

The components of net periodic benefit cost other than service cost are included in “Other (expense) / income, net” in the Condensed Consolidated Statements of Operations.

In addition, AES Indiana provides postretirement health care benefits to certain active or retired employees and the spouses of certain active or retired employees. These postretirement health care benefits and the related unfunded obligation were not material to the Financial Statements in the periods covered by this report.

8. EQUITY

Paid In Capital

On May 24, 2024, AES U.S. Investments received equity capital contributions totaling $123.5 million, of which $105 million was contributed by AES U.S. Holdings, LLC and $18.5 million was contributed by CDPQ. IPALCO then received equity capital contributions totaling $150.0 million, of which $123.5 million was contributed by AES U.S. Investments and $26.5 million was contributed by CDPQ. IPALCO then made the same investments in AES Indiana. The proceeds from the equity capital contributions are intended primarily for funding needs related to AES Indiana’s capital expenditure program. The equity capital contributions were made on a proportional share basis and, therefore, did not change CDPQ’s or AES’ ownership interests in IPALCO or AES U.S. Investments.

Equity Transactions with Noncontrolling Interests

The Hardy Hills Solar Project has been financed with a tax equity structure, in which a tax equity investor receives a portion of the economic attributes of the facility, including tax attributes, that vary over the life of the project. On December 1, 2023, AES Indiana, through a wholly-owned subsidiary (the "Class B Member"), and a third-party investor (the "Class A Member"), entered into an Equity Capital Contribution Agreement, pursuant to which each member made certain capital contributions to Hardy Hills JV. Through September 30, 2024, the Class A member has made total contributions of $126.2 million under the agreement, including $46.9 million contributed in May 2024 upon final completion of the project. A noncontrolling interest was recorded by AES Indiana at the amount of cash contributed by the Class A Member.

9. COMMITMENTS AND CONTINGENCIES

Contingencies

Legal Matters

IPALCO and AES Indiana are involved in litigation arising in the normal course of business. We accrue for litigation and claims when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated. While the ultimate outcome of outstanding litigation cannot be predicted with certainty, management believes that final outcomes will not have a material adverse effect on IPALCO’s results of operations, financial condition and cash flows. Accruals for legal loss contingencies were not material as of September 30, 2024 and December 31, 2023, respectively.

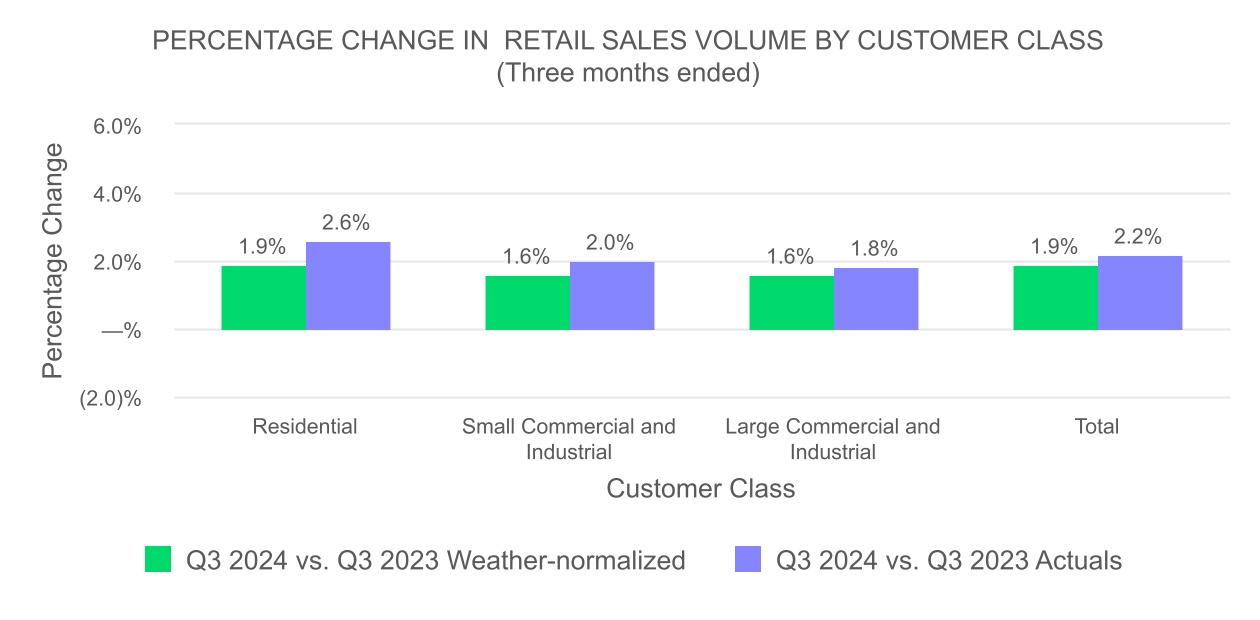

Environmental Matters