UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2006 |

Item 1. Reports to Stockholders

| | Fidelity® Advisor

Japan

Fund - Class A, Class T, Class B

and Class C

|

| | Semiannual Report

April 30, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 15 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 24 | | Notes to the financial statements. |

| Board Approval of | | 32 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of

the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw Hill Companies,

Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks

of FMR Corp. or an affiliated company.

|

| | This report and the financial statements contained herein are submitted for the general informa

tion of the shareholders of the fund. This report is not authorized for distribution to prospective

investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third

quarters of each fiscal year on Form N Q. Forms N Q are available on the SEC’s web site at

http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference

Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference

Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio hold

ings, view the most recent quarterly holdings report, semiannual report, or annual report on

Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

|

Chairman’s Message

(photograph of Edward C. Johnson 3d)

Dear Shareholder:

Although many securities markets made gains in early 2006, there is only one certainty when it comes to investing: There is no sure thing. There are, however, a number of time tested, fundamental investment principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets’ inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets’ best days can significantly diminish investor returns. Patience also affords the benefits of compounding of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn’t eliminate risk, it can considerably lessen the effect of short term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio’s long term success. The right mix of stocks, bonds and cash aligned to your particular risk tolerance and investment objective is very important. Age appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities which historically have been the best performing asset class over time is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more stable fixed investments (bonds or savings plans).

A third investment principle investing regularly can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won’t pay for all your shares at market highs. This strategy known as dollar cost averaging also reduces unconstructive “emotion” from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/ Edward C. Johnson 3d

Edward C. Johnson 3d

3 Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b 1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2005 to April 30, 2006).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | November 1, 2005 |

| | | | | November 1, 2005 | | | | April 30, 2006 | | | | to April 30, 2006 |

| Class A | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,219.10 | | | | $ 8.25 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,017.36 | | | | $ 7.50 |

| Class T | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,216.70 | | | | $ 9.62 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,016.12 | | | | $ 8.75 |

| Class B | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,214.60 | | | | $ 12.35 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,013.64 | | | | $ 11.23 |

| Class C | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,214.60 | | | | $ 12.14 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,013.84 | | | | $ 11.04 |

| Institutional Class | | | | | | | | | | | | |

| Actual | | | | $ 1,000.00 | | | | $ 1,221.40 | | | | $ 6.33 |

| HypotheticalA | | | | $ 1,000.00 | | | | $ 1,019.09 | | | | $ 5.76 |

| |

| A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.50% |

| Class T | | 1.75% |

| Class B | | 2.25% |

| Class C | | 2.21% |

| Institutional Class | | 1.15% |

5 Semiannual Report

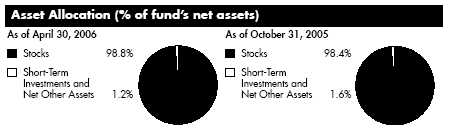

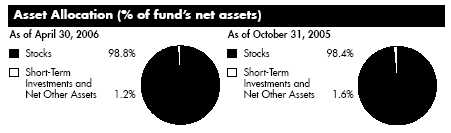

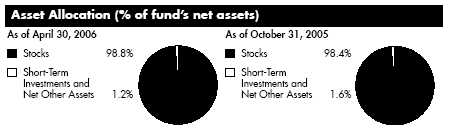

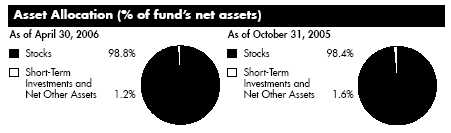

| Investment Changes | | | | |

| |

| |

| Top Ten Stocks as of April 30, 2006 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Sumitomo Mitsui Financial Group, Inc. | | 3.6 | | 2.7 |

| Toyota Motor Corp. | | 3.3 | | 3.3 |

| Mizuho Financial Group, Inc. | | 2.9 | | 2.0 |

| Stanley Electric Co. Ltd. | | 2.5 | | 1.6 |

| Access Co. Ltd. | | 2.1 | | 0.0 |

| Nissan Motor Co. Ltd. | | 1.6 | | 0.0 |

| ORIX Corp. | | 1.4 | | 0.9 |

| Canon, Inc. | | 1.4 | | 0.9 |

| Nippon Electric Glass Co. Ltd. | | 1.3 | | 1.7 |

| Hamakyorex Co. Ltd. | | 1.3 | | 2.3 |

| | | 21.4 | | |

Top Five Market Sectors as of April 30, 2006 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Consumer Discretionary | | 25.8 | | 23.1 |

| Financials | | 21.8 | | 24.3 |

| Information Technology | | 17.1 | | 17.5 |

| Industrials | | 14.5 | | 15.1 |

| Materials | | 7.4 | | 4.5 |

Semiannual Report 6

| Investments April 30, 2006 (Unaudited) |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks 98.8% | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – 25.8% | | | | | | |

| Auto Components 4.7% | | | | | | |

| Aisin Seiki Co. Ltd. | | 21,200 | | | | $ 796,804 |

| Musashi Seimitsu Industry Co. Ltd. | | 21,400 | | | | 586,327 |

| NOK Corp. | | 39,100 | | | | 1,188,022 |

| Stanley Electric Co. Ltd. | | 204,900 | | | | 4,768,255 |

| Toyoda Gosei Co. Ltd. | | 63,200 | | | | 1,742,683 |

| | | | | | | 9,082,091 |

| Automobiles – 5.2% | | | | | | |

| Nissan Motor Co. Ltd. | | 234,100 | | | | 3,081,927 |

| Toyota Motor Corp. | | 108,100 | | | | 6,330,877 |

| Yachiyo Industry Co. Ltd. | | 22,000 | | | | 598,902 |

| | | | | | | 10,011,706 |

| Distributors – 0.7% | | | | | | |

| Ohashi Technica, Inc. | | 89,600 | | | | 1,231,385 |

| Diversified Consumer Services – 0.6% | | | | | | |

| Riso Kyoiku Co. Ltd. | | 10,605 | | | | 1,126,854 |

| Hotels, Restaurants & Leisure 1.7% | | | | | | |

| Aeon Fantasy Co. Ltd. | | 41,140 | | | | 1,726,887 |

| Kyoritsu Maintenance Co. Ltd. | | 21,900 | | | | 865,423 |

| St. Marc Holdings Co. Ltd. | | 10,700 | | | | 737,607 |

| | | | | | | 3,329,917 |

| Household Durables – 3.9% | | | | | | |

| Daiwa House Industry Co. Ltd. | | 56,000 | | | | 954,520 |

| Goldcrest Co. Ltd. | | 15,210 | | | | 755,992 |

| Haseko Corp. (a)(d) | | 196,500 | | | | 745,449 |

| Matsushita Electric Industrial Co. Ltd. | | 66,000 | | | | 1,597,860 |

| Sony Corp. | | 31,600 | | | | 1,546,504 |

| Sumitomo Forestry Co. Ltd. | | 8,000 | | | | 81,423 |

| Token Corp. | | 27,800 | | | | 1,813,866 |

| | | | | | | 7,495,614 |

| Internet & Catalog Retail 0.3% | | | | | | |

| Rakuten, Inc. | | 707 | | | | 571,188 |

| Leisure Equipment & Products – 0.5% | | | | | | |

| Aruze Corp. | | 37,200 | | | | 909,787 |

| Media – 2.7% | | | | | | |

| Bandai Visual Co. Ltd. | | 205 | | | | 828,101 |

| cyber communications, Inc. (a) | | 120 | | | | 388,848 |

| CyberAgent, Inc. | | 278 | | | | 576,141 |

| Fuji Television Network, Inc. | | 404 | | | | 1,004,013 |

| Opt, Inc. (a) | | 186 | | | | 950,621 |

See accompanying notes which are an integral part of the financial statements.

7 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | | | |

| | | | | Shares | | Value (Note 1) |

| |

| CONSUMER DISCRETIONARY – continued | | | | | | |

| Media – continued | | | | | | | | |

| Oricon, Inc. | | | | 179 | | | | $ 254,648 |

| S.M. Entertainment Co. Ltd. | | | | 65,925 | | | | 702,483 |

| Usen Corp. (d) | | | | 28,360 | | | | 518,014 |

| | | | | | | | | 5,222,869 |

| Multiline Retail – 0.8% | | | | | | | | |

| Daiei, Inc. (a)(d) | | | | 33,200 | | | | 991,262 |

| Parco Co. Ltd. | | | | 50,700 | | | | 581,909 |

| | | | | | | | | 1,573,171 |

| Specialty Retail – 3.9% | | | | | | | | |

| EDION Corp. | | | | 60,000 | | | | 1,451,592 |

| Fujitsu Business Systems Ltd. | | | | 49,600 | | | | 901,620 |

| Jeans Mate Corp. | | | | 130,560 | | | | 1,642,964 |

| Kahma Co. Ltd. (d) | | | | 25,400 | | | | 691,460 |

| Mac House Co. Ltd. | | | | 16,700 | | | | 472,219 |

| Tsutsumi Jewelry Co. Ltd. | | | | 18,100 | | | | 729,563 |

| USS Co. Ltd. | | | | 5,290 | | | | 395,792 |

| Workman Co. Ltd. | | | | 33,500 | | | | 1,279,693 |

| | | | | | | | | 7,564,903 |

| Textiles, Apparel & Luxury Goods – 0.8% | | | | | | |

| Asics Corp. | | | | 100,000 | | | | 1,219,759 |

| Renown, Inc. (a) | | | | 19,300 | | | | 269,988 |

| | | | | | | | | 1,489,747 |

| |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | | 49,609,232 |

| |

| CONSUMER STAPLES 6.5% | | | | | | | | |

| Beverages – 1.1% | | | | | | | | |

| Oenon Holdings, Inc. | | | | 335,000 | | | | 1,417,958 |

| Takara Holdings, Inc. | | | | 101,000 | | | | 624,404 |

| | | | | | | | | 2,042,362 |

| Food & Staples Retailing – 3.4% | | | | | | | | |

| Aeon Co. Ltd. | | | | 35,800 | | | | 891,267 |

| Daikokutenbussan Co. Ltd. | | | | 45,000 | | | | 1,159,825 |

| Itochushokuhin Co. Ltd. | | | | 26,800 | | | | 1,141,427 |

| Kura Corp. Ltd. | | | | 150 | | | | 482,108 |

| UNY Co. Ltd. | | | | 52,000 | | | | 929,265 |

| Valor Co. Ltd. | | | | 94,600 | | | | 1,927,306 |

| | | | | | | | | 6,531,198 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| CONSUMER STAPLES – continued | | | | | | |

| Food Products 0.7% | | | | | | |

| Mitsui Sugar Co. Ltd. | | 151,000 | | | | $ 676,268 |

| Nissin Food Products Co. Ltd. | | 22,700 | | | | 723,609 |

| | | | | | | 1,399,877 |

| Household Products – 0.3% | | | | | | |

| Uni-Charm Corp. | | 10,300 | | | | 590,639 |

| Tobacco 1.0% | | | | | | |

| Japan Tobacco, Inc | | 495 | | | | 1,990,867 |

| |

| TOTAL CONSUMER STAPLES | | | | | | 12,554,943 |

| |

| ENERGY 1.9% | | | | | | |

| Oil, Gas & Consumable Fuels – 1.9% | | | | | | |

| AOC Holdings, Inc. | | 40,200 | | | | 847,245 |

| Inpex Holdings, Inc. | | 123 | | | | 1,123,337 |

| Nippon Mining Holdings, Inc. | | 182,500 | | | | 1,687,574 |

| | | | | | | 3,658,156 |

| |

| FINANCIALS – 21.8% | | | | | | |

| Capital Markets 1.6% | | | | | | |

| Japan Asia Investment Co. Ltd | | 106,000 | | | | 820,075 |

| Nikko Cordial Corp. | | 81,500 | | | | 1,319,030 |

| SBI Holdings, Inc. | | 1,899 | | | | 967,218 |

| | | | | | | 3,106,323 |

| Commercial Banks – 8.2% | | | | | | |

| Kansai Urban Banking Corp. | | 182,000 | | | | 858,257 |

| Mizuho Financial Group, Inc. | | 657 | | | | 5,602,169 |

| Sumitomo Mitsui Financial Group, Inc. | | 632 | | | | 6,937,433 |

| The Keiyo Bank Ltd. | | 121,000 | | | | 784,176 |

| Tokyo Tomin Bank Ltd. | | 32,100 | | | | 1,603,943 |

| | | | | | | 15,785,978 |

| Consumer Finance – 4.6% | | | | | | |

| Aiful Corp. | | 21,800 | | | | 1,301,778 |

| Credit Saison Co. Ltd. | | 25,600 | | | | 1,342,103 |

| Lopro Corp. (d) | | 75,100 | | | | 356,127 |

| Nissin Co. Ltd. | | 994,600 | | | | 952,021 |

| ORIX Corp. | | 9,180 | | | | 2,757,023 |

| SFCG Co. Ltd. | | 3,870 | | | | 885,979 |

| Takefuji Corp. | | 17,890 | | | | 1,162,555 |

| | | | | | | 8,757,586 |

See accompanying notes which are an integral part of the financial statements.

| Investments (Unaudited) continued | | | | |

| |

| |

| Common Stocks continued | | | | | | |

| | | | | Shares | | Value (Note 1) |

| |

| FINANCIALS – continued | | | | | | |

| Insurance – 2.1% | | | | | | |

| Sompo Japan Insurance, Inc | | | | 129,000 | | $ 1,869,155 |

| T&D Holdings, Inc. | | | | 29,350 | | 2,250,059 |

| | | | | | | 4,119,214 |

| Real Estate 5.3% | | | | | | |

| Aeon Mall Co. Ltd. | | | | 16,100 | | 805,884 |

| Japan Logistics Fund, Inc | | | | 193 | | 1,491,460 |

| Keihanshin Real Estate Co. Ltd. | | | | 139,000 | | 1,165,708 |

| Mitsubishi Estate Co. Ltd. | | | | 79,000 | | 1,727,420 |

| NTT Urban Development Co. | | | | 106 | | 870,340 |

| Sumitomo Realty & Development Co. Ltd. | | | | 59,000 | | 1,564,698 |

| Tachihi Enterprise Co. Ltd. | | | | 6,300 | | 320,325 |

| Toc Co. Ltd. | | | | 91,000 | | 543,403 |

| Urban Corp. (d) | | | | 55,400 | | 822,182 |

| Yasuragi Co. Ltd. | | | | 25,700 | | 823,754 |

| | | | | | | 10,135,174 |

| |

| TOTAL FINANCIALS | | | | | | 41,904,275 |

| |

| HEALTH CARE – 3.8% | | | | | | |

| Biotechnology – 0.4% | | | | | | |

| Shin Nippon Biomedical Laboratories Ltd. | | | | 40,000 | | 698,310 |

| Health Care Equipment & Supplies – 1.8% | | | | |

| Hogy Medical Co. | | | | 15,700 | | 829,980 |

| Miraca Holdings, Inc. | | | | 29,500 | | 683,908 |

| Sysmex Corp. | | | | 15,200 | | 682,081 |

| Terumo Corp. | | | | 34,300 | | 1,228,926 |

| | | | | | | 3,424,895 |

| Pharmaceuticals – 1.6% | | | | | | |

| Daiichi Sankyo Co. Ltd. (a) | | | | 53,700 | | 1,384,057 |

| Takeda Pharamaceutical Co. Ltd. | | | | 29,000 | | 1,772,470 |

| | | | | | | 3,156,527 |

| |

| TOTAL HEALTH CARE | | | | | | 7,279,732 |

| |

| INDUSTRIALS – 14.5% | | | | | | |

| Building Products 0.4% | | | | | | |

| Daikin Industries Ltd. | | | | 19,100 | | 665,879 |

| Commercial Services & Supplies – 1.3% | | | | | | |

| ARRK Corp. | | | | 37,400 | | 1,343,280 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | | | |

| | | Shares | | Value (Note 1) |

| |

| INDUSTRIALS – continued | | | | | | |

| Commercial Services & Supplies – continued | | | | | | |

| Teraoka Seisakusho Co. Ltd. | | 26,300 | | | | $ 258,670 |

| The Goodwill Group, Inc. (d) | | 1,053 | | | | 915,451 |

| | | | | | | 2,517,401 |

| Construction & Engineering – 1.5% | | | | | | |

| Commuture Corp. | | 117,000 | | | | 1,213,409 |

| Toenec Corp. | | 128,000 | | | | 633,958 |

| Toyo Engineering Corp. | | 179,000 | | | | 1,078,323 |

| | | | | | | 2,925,690 |

| Electrical Equipment – 1.2% | | | | | | |

| Furukawa Electric Co. Ltd. (a) | | 80,000 | | | | 638,595 |

| Sumitomo Electric Industries Ltd. | | 98,400 | | | | 1,562,303 |

| | | | | | | 2,200,898 |

| Machinery – 4.0% | | | | | | |

| Aida Engineering Ltd. | | 176,000 | | | | 1,293,629 |

| Ishikawajima-Harima Heavy Industries Co. Ltd. (a) | | 271,000 | | | | 966,200 |

| Nabtesco Corp. | | 60,000 | | | | 760,307 |

| Nittoku Engineering Co. Ltd. | | 51,000 | | | | 542,358 |

| NTN Corp. | | 85,000 | | | | 701,647 |

| Organo Corp. | | 92,000 | | | | 901,620 |

| Sasakura Engineering Co. Ltd. | | 79,000 | | | | 903,254 |

| Sumitomo Heavy Industries Ltd. | | 144,000 | | | | 1,517,453 |

| | | | | | | 7,586,468 |

| Marine – 1.3% | | | | | | |

| Iino Kaiun Kaisha Ltd. | | 189,000 | | | | 1,804,110 |

| Kawasaki Kisen Kaisha Ltd. | | 116,000 | | | | 729,361 |

| | | | | | | 2,533,471 |

| Road & Rail 2.1% | | | | | | |

| East Japan Railway Co | | 200 | | | | 1,561,361 |

| Hamakyorex Co. Ltd. | | 68,700 | | | | 2,503,666 |

| | | | | | | 4,065,027 |

| Trading Companies & Distributors – 2.4% | | | | | | |

| BSL Corp. (d) | | 190,000 | | | | 332,031 |

| Mitsubishi Corp. | | 84,800 | | | | 2,051,583 |

| Mitsui & Co. Ltd. | | 149,000 | | | | 2,251,846 |

| | | | | | | 4,635,460 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| Investments (Unaudited) continued | | | | | | |

| |

| |

| Common Stocks continued | | | | | | | | |

| | | | | Shares | | Value (Note 1) |

| |

| INDUSTRIALS – continued | | | | | | | | |

| Transportation Infrastructure 0.3% | | | | | | | | |

| The Sumitomo Warehouse Co. Ltd. | | | | 81,000 | | | | $ 629,506 |

| |

| TOTAL INDUSTRIALS | | | | | | | | 27,759,800 |

| |

| INFORMATION TECHNOLOGY – 17.1% | | | | | | | | |

| Computers & Peripherals – 0.6% | | | | | | | | |

| Fujitsu Ltd. | | | | 137,000 | | | | 1,141,717 |

| Electronic Equipment & Instruments – 7.2% | | | | | | |

| Hamamatsu Photonics KK (d) | | | | 31,100 | | | | 972,259 |

| Horiba Ltd. | | | | 32,000 | | | | 1,062,217 |

| Meiko Electronics Co. Ltd. | | | | 17,400 | | | | 1,329,352 |

| Nidec Corp. | | | | 12,300 | | | | 948,356 |

| Nippon Electric Glass Co. Ltd. | | | | 111,000 | | | | 2,505,115 |

| Omron Corp. | | | | 65,900 | | | | 1,840,281 |

| Optoelectronics Co. Ltd. | | | | 6,700 | | | | 241,229 |

| Osaki Electric Co. Ltd. | | | | 86,000 | | | | 901,726 |

| Seikoh Giken Co. Ltd. | | | | 1,300 | | | | 47,947 |

| SFA Engineering Corp. | | | | 16,000 | | | | 532,683 |

| Shizuki Electric Co., Inc. | | | | 7,000 | | | | 33,194 |

| Sunx Ltd. | | | | 69,800 | | | | 1,838,858 |

| Yaskawa Electric Corp. (a) | | | | 68,000 | | | | 836,602 |

| Yokogawa Electric Corp. | | | | 53,700 | | | | 850,712 |

| | | | | | | | | 13,940,531 |

| Internet Software & Services – 3.0% | | | | | | | | |

| Access Co. Ltd. (a)(d) | | | | 438 | | | | 3,923,249 |

| Dip Corp. | | | | 176 | | | | 265,835 |

| eAccess Ltd. (d) | | | | 1,126 | | | | 777,200 |

| Telewave, Inc. (d) | | | | 262 | | | | 759,254 |

| | | | | | | | | 5,725,538 |

| Office Electronics – 2.4% | | | | | | | | |

| Canon Finetech, Inc. | | | | 28,100 | | | | 556,448 |

| Canon, Inc. | | | | 35,900 | | | | 2,721,220 |

| Konica Minolta Holdings, Inc. | | | | 103,000 | | | | 1,356,751 |

| | | | | | | | | 4,634,419 |

| Semiconductors & Semiconductor Equipment – 1.2% | | | | | | |

| Axell Corp. | | | | 132 | | | | 499,600 |

| Phoenix PDE Co. Ltd. | | | | 151,880 | | | | 678,762 |

| Sumco Corp. | | | | 18,600 | | | | 1,112,325 |

| | | | | | | | | 2,290,687 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks continued | | | | |

| | | Shares | | Value (Note 1) |

| |

| INFORMATION TECHNOLOGY – continued | | | | |

| Software 2.7% | | | | |

| Intelligent Wave, Inc. (d) | | 422 | | $ 1,070,981 |

| KOEI Co. Ltd. | | 30 | | 561 |

| Konami Corp. | | 25,200 | | 645,076 |

| Nintendo Co. Ltd. | | 15,500 | | 2,313,941 |

| Trend Micro, Inc. | | 29,000 | | 1,123,074 |

| | | | | 5,153,633 |

| |

| TOTAL INFORMATION TECHNOLOGY | | | | 32,886,525 |

| |

| MATERIALS 7.4% | | | | |

| Chemicals – 7.1% | | | | |

| Ise Chemical Corp. | | 127,000 | | 1,282,547 |

| JSR Corp. | | 51,400 | | 1,584,316 |

| Kuraray Co. Ltd. | | 74,500 | | 919,188 |

| Lintec Corp. | | 55,100 | | 1,395,947 |

| Mitsubishi Gas Chemical Co., Inc. | | 109,000 | | 1,448,228 |

| Nissan Chemical Industries Co. Ltd. | | 32,000 | | 542,349 |

| Nitto Denko Corp. | | 14,300 | | 1,199,254 |

| Showa Denko KK | | 363,000 | | 1,606,604 |

| Teijin Ltd | | 187,000 | | 1,282,520 |

| The Nippon Synthetic Chemical Industry Co. Ltd. | | 163,000 | | 760,070 |

| Tohcello Co. Ltd. | | 75,500 | | 772,404 |

| Tokuyama Corp. | | 45,000 | | 742,525 |

| | | | | 13,535,952 |

| Metals & Mining – 0.3% | | | | |

| Hitachi Metals Ltd. | | 52,000 | | 580,847 |

| |

| TOTAL MATERIALS | | | | 14,116,799 |

| |

| TOTAL COMMON STOCKS | | | | |

| (Cost $159,871,213) | | | | 189,769,462 |

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

| Investments (Unaudited) continued | | | | |

| |

| Money Market Funds 5.7% | | | | | | |

| | | | | Shares | | Value (Note 1) |

| Fidelity Cash Central Fund, 4.8% (b) | | | | 690,051 | | $ 690,051 |

| Fidelity Securities Lending Cash Central Fund, 4.83% (b)(c) | | | | 10,331,470 | | 10,331,470 |

| TOTAL MONEY MARKET FUNDS | | | | | | |

| (Cost $11,021,521) | | | | | | 11,021,521 |

| TOTAL INVESTMENT PORTFOLIO 104.5% | | | | | | |

| (Cost $170,892,734) | | | | | | 200,790,983 |

| |

| NET OTHER ASSETS – (4.5)% | | | | | | (8,668,362) |

| NET ASSETS 100% | | | | | | $192,122,621 |

Legend

(a) Non-income producing

(b) Affiliated fund that is available only to

investment companies and other

accounts managed by Fidelity

Investments. The rate quoted is the

annualized seven-day yield of the fund

at period end. A complete unaudited

listing of the fund’s holdings as of its

most recent quarter end is available

upon request.

|

(c) Investment made with cash collateral received from securities on loan.

(d) Security or a portion of the security is on loan at period end.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the fund from the affiliated Central funds is as follows:

| Fund | | | | Income earned |

| Fidelity Cash Central Fund | | | | $ 69,321 |

| Fidelity Securities Lending Cash Central Fund | | | | 106,405 |

| Total | | | | $ 175,726 |

Income Tax Information

At October 31, 2005, the fund had a capital loss carryforward of approximately $20,478,737 of which $10,494,841 and $9,983,896 will expire on October 31, 2009 and 2010, respectively.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 14

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| | | | | April 30, 2006 (Unaudited) |

| |

| Assets | | | | | | |

| Investment in securities, at value (including securities | | | | | | |

| loaned of $9,749,957) See accompanying | | | | | | |

| schedule: | | | | | | |

| Unaffiliated issuers (cost $159,871,213) | | | | $ 189,769,462 | | |

| Affiliated Central Funds (cost $11,021,521) | | | | 11,021,521 | | |

| Total Investments (cost $170,892,734) | | | | | | $ 200,790,983 |

| Foreign currency held at value (cost $1) | | | | | | 1 |

| Receivable for investments sold | | | | | | 3,404,640 |

| Receivable for fund shares sold | | | | | | 1,012,092 |

| Dividends receivable | | | | | | 722,165 |

| Interest receivable | | | | | | 12,041 |

| Prepaid expenses | | | | | | 215 |

| Receivable from investment adviser for expense | | | | | | |

| reductions | | | | | | 1,966 |

| Other affiliated receivables | | | | | | 710 |

| Other receivables | | | | | | 27,823 |

| Total assets | | | | | | 205,972,636 |

| |

| Liabilities | | | | | | |

| Payable for investments purchased | | | | $ 2,832,363 | | |

| Payable for fund shares redeemed | | | | 373,132 | | |

| Accrued management fee | | | | 113,364 | | |

| Distribution fees payable | | | | 101,715 | | |

| Other affiliated payables | | | | 48,705 | | |

| Other payables and accrued expenses | | | | 49,266 | | |

| Collateral on securities loaned, at value | | | | 10,331,470 | | |

| Total liabilities | | | | | | 13,850,015 |

| |

| Net Assets | | | | | | $ 192,122,621 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | | $ 173,963,441 |

| Accumulated net investment loss | | | | | | (473,520) |

| Accumulated undistributed net realized gain (loss) on | | | | | | |

| investments and foreign currency transactions | | | | | | (11,283,146) |

| Net unrealized appreciation (depreciation) on | | | | | | |

| investments and assets and liabilities in foreign | | | | | | |

| currencies | | | | | | 29,915,846 |

| Net Assets | | | | | | $ 192,122,621 |

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

| Financial Statements continued | | | | |

| |

| |

| |

| Statement of Assets and Liabilities continued | | | | |

| | | April 30, 2006 (Unaudited) |

| |

| Calculation of Maximum Offering Price | | | | |

| Class A: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($50,451,961 ÷ 2,651,775 shares) | | | | $ 19.03 |

| Maximum offering price per share (100/94.25 of $19.03) | | | | $ 20.19 |

| Class T: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($26,506,892 ÷ 1,413,494 shares) | | | | $ 18.75 |

| Maximum offering price per share (100/96.50 of $18.75) | | | | $ 19.43 |

| Class B: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($24,558,947 ÷ 1,351,425 shares)A | | | | $ 18.17 |

| Class C: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($72,403,960 ÷ 3,960,536 shares)A | | | | $ 18.28 |

| Institutional Class: | | | | |

| Net Asset Value, offering price and redemption price per | | | | |

| share ($18,200,861 ÷ 937,208 shares) | | | | $ 19.42 |

| |

| A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report 16

| Statement of Operations | | | | | | |

| | | Six months ended April 30, 2006 (Unaudited) |

| |

| Investment Income | | | | | | |

| Dividends | | | | | | $ 881,267 |

| Interest | | | | | | 6 |

| Income from affiliated Central Funds (including | | | | | | |

| $106,405 from security lending) | | | | | | 175,726 |

| | | | | | | 1,056,999 |

| Less foreign taxes withheld | | | | | | (64,765) |

| Total income | | | | | | 992,234 |

| |

| Expenses | | | | | | |

| Management fee | | | | $ 569,821 | | |

| Transfer agent fees | | | | 221,526 | | |

| Distribution fees | | | | 514,421 | | |

| Accounting and security lending fees | | | | 53,752 | | |

| Independent trustees’ compensation | | | | 282 | | |

| Custodian fees and expenses | | | | 68,191 | | |

| Registration fees | | | | 63,714 | | |

| Audit | | | | 24,220 | | |

| Legal | | | | 397 | | |

| Miscellaneous | | | | 455 | | |

| Total expenses before reductions | | | | 1,516,779 | | |

| Expense reductions | | | | (51,025) | | 1,465,754 |

| |

| Net investment income (loss) | | | | | | (473,520) |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | 10,251,609 | | |

| Foreign currency transactions | | | | (5,913) | | |

| Total net realized gain (loss) | | | | | | 10,245,696 |

| Change in net unrealized appreciation (depreciation) on: | | | | | | |

| Investment securities | | | | 16,336,003 | | |

| Assets and liabilities in foreign currencies | | | | 31,584 | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | 16,367,587 |

| Net gain (loss) | | | | | | 26,613,283 |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | | | $ 26,139,763 |

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| Financial Statements continued | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | Six months ended | | | | Year ended |

| | | | | April 30, 2006 | | | | October 31, |

| | | | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | | | $ (473,520) | | | | $ (741,278) |

| Net realized gain (loss) | | | | 10,245,696 | | | | 5,524,736 |

| Change in net unrealized appreciation (depreciation) . | | | | 16,367,587 | | | | 11,366,758 |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 26,139,763 | | | | 16,150,216 |

| Share transactions - net increase (decrease) | | | | 62,655,888 | | | | 13,972,644 |

| Redemption fees | | | | 88,635 | | | | 38,032 |

| Total increase (decrease) in net assets | | | | 88,884,286 | | | | 30,160,892 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 103,238,335 | | | | 73,077,443 |

| End of period (including accumulated net investment | | | | | | | | |

| loss of $473,520 and $0, respectively) | | | | $ 192,122,621 | | | | $ 103,238,335 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class A | | | | | | | | | | | | |

| | Six months ended | | | | | | | | | | | | |

| | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | $ 15.61 | | $ 12.64 | | $ 11.78 | | $ 8.74 | | | | $ 10.18 | | $ 17.78 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | |

| (loss)E | | (.02) | | (.08) | | (.11) | | (.07) | | | | (.13) | | (.15) |

| Net realized and unre | | | | | | | | | | | | | | |

| alized gain (loss) | | 3.43 | | 3.04 | | .95 | | 3.11 | | | | (1.31) | | (6.13) |

| Total from investment | | | | | | | | | | | | | | |

| operations | | 3.41 | | 2.96 | | .84 | | 3.04 | | | | (1.44) | | (6.28) |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | — | | — | | — | | — | | | | — | | (1.32) |

| Redemption fees added | | | | | | | | | | | | | | |

| to paid in capitalE | | .01 | | .01 | | .02 | | — | | | | — | | — |

| Net asset value, end of | | | | | | | | | | | | | | |

| period | | $ 19.03 | | $ 15.61 | | $ 12.64 | | $ 11.78 | | | | $ 8.74 | | $ 10.18 |

| Total ReturnB,C,D | | 21.91% | | 23.50% | | 7.30% | | 34.78% | | | | (14.15)% | | (37.89)% |

| Ratios to Average Net AssetsF | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | 1.54%A | | 1.62% | | 1.80% | | 2.20% | | | | 2.13% | | 1.88% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | 1.50%A | | 1.56% | | 1.75% | | 1.75% | | | | 1.94% | | 1.88% |

| Expenses net of all | | | | | | | | | | | | | | |

| reductions | | 1.47%A | | 1.55% | | 1.75% | | 1.75% | | | | 1.94% | | 1.84% |

| Net investment income | | | | | | | | | | | | | | |

| (loss) | | (.22)%A | | (.54)% | | (.89)% | | (.76)% | | | | (1.27)% | | (1.10)% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (000 omitted) | | $50,452 | | $26,169 | | $17,884 | | $ 8,695 | | | | $ 3,380 | | $ 4,204 |

| Portfolio turnover rate | | 72%A | | 89% | | 83% | | 99% | | | | 128% | | 123% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

| Financial Highlights Class T | | | | | | | | | | | | |

| | Six months ended | | | | | | | | | | | | |

| | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | $ 15.41 | | $ 12.51 | | $ 11.68 | | $ 8.69 | | | | $ 10.17 | | $ 17.72 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | |

| (loss)E | | (.04) | | (.11) | | (.14) | | (.09) | | | | (.15) | | (.20) |

| Net realized and unre | | | | | | | | | | | | | | |

| alized gain (loss) | | 3.37 | | 3.00 | | .95 | | 3.08 | | | | (1.33) | | (6.14) |

| Total from investment | | | | | | | | | | | | | | |

| operations | | 3.33 | | 2.89 | | .81 | | 2.99 | | | | (1.48) | | (6.34) |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | — | | — | | — | | — | | | | — | | (1.21) |

| Redemption fees added | | | | | | | | | | | | | | |

| to paid in capitalE | | .01 | | .01 | | .02 | | — | | | | — | | — |

| Net asset value, end of | | | | | | | | | | | | | | |

| period | | $ 18.75 | | $ 15.41 | | $ 12.51 | | $ 11.68 | | | | $ 8.69 | | $ 10.17 |

| Total ReturnB,C,D | | 21.67% | | 23.18% | | 7.11% | | 34.41% | | | | (14.55)% | | (38.16)% |

| Ratios to Average Net AssetsF | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | 1.86%A | | 1.97% | | 2.19% | | 2.57% | | | | 2.45% | | 2.25% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | 1.75%A | | 1.81% | | 2.00% | | 2.00% | | | | 2.19% | | 2.25% |

| Expenses net of all | | | | | | | | | | | | | | |

| reductions | | 1.73%A | | 1.80% | | 2.00% | | 2.00% | | | | 2.18% | | 2.21% |

| Net investment income | | | | | | | | | | | | | | |

| (loss) | | (.47)%A | | (.79)% | | (1.14)% | | (1.01)% | | | | (1.52)% | | (1.48)% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (000 omitted) | | $26,507 | | $15,610 | | $11,493 | | $11,823 | | | | $ 7,731 | | $10,363 |

| Portfolio turnover rate | | 72%A | | 89% | | 83% | | 99% | | | | 128% | | 123% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Class B | | | | | | | | | | |

| |

| | Six months ended | | | | | | | | | | |

| | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | |

| beginning of period | | $ 14.96 | | $ 12.21 | | $ 11.46 | | $ 8.57 | | $ 10.07 | | $ 17.55 |

| Income from Investment | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | |

| (loss)E | | (.08) | | (.17) | | (.20) | | (.14) | | (.20) | | (.26) |

| Net realized and unre | | | | | | | | | | | | |

| alized gain (loss) | | 3.28 | | 2.91 | | .93 | | 3.03 | | (1.30) | | (6.09) |

| Total from investment | | | | | | | | | | | | |

| operations | | 3.20 | | 2.74 | | .73 | | 2.89 | | (1.50) | | (6.35) |

| Distributions from net | | | | | | | | | | | | |

| investment income | | — | | — | | — | | — | | — | | (1.13) |

| Redemption fees added | | | | | | | | | | | | |

| to paid in capitalE | | .01 | | .01 | | .02 | | — | | — | | — |

| Net asset value, end of | | | | | | | | | | | | |

| period | | $ 18.17 | | $ 14.96 | | $ 12.21 | | $ 11.46 | | $ 8.57 | | $ 10.07 |

| Total ReturnB,C,D | | 21.46% | | 22.52% | | 6.54% | | 33.72% | | (14.90)% | | (38.44)% |

| Ratios to Average Net AssetsF | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | |

| reductions | | 2.35%A | | 2.43% | | 2.62% | | 3.03% | | 2.90% | | 2.74% |

| Expenses net of fee | | | | | | | | | | | | |

| waivers, if any | | 2.25%A | | 2.31% | | 2.50% | | 2.50% | | 2.69% | | 2.74% |

| Expenses net of all | | | | | | | | | | | | |

| reductions | | 2.23%A | | 2.30% | | 2.50% | | 2.50% | | 2.68% | | 2.71% |

| Net investment income | | | | | | | | | | | | |

| (loss) | | (.97)%A | | (1.30)% | | (1.64)% | | (1.51)% | | (2.02)% | | (1.97)% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | |

| period (000 omitted) | | $24,559 | | $18,916 | | $18,218 | | $14,761 | | $10,229 | | $13,523 |

| Portfolio turnover rate | | 72%A | | 89% | | 83% | | 99% | | 128% | | 123% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

21 Semiannual Report

| Financial Highlights Class C | | | | | | | | | | | | |

| |

| | Six months ended | | | | | | | | | | | | |

| | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | $ 15.05 | | $ 12.28 | | $ 11.52 | | $ 8.61 | | | | $ 10.13 | | $ 17.58 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | |

| (loss)E | | (.08) | | (.17) | | (.19) | | (.14) | | | | (.20) | | (.24) |

| Net realized and unre | | | | | | | | | | | | | | |

| alized gain (loss) | | 3.30 | | 2.93 | | .93 | | 3.05 | | | | (1.32) | | (6.10) |

| Total from investment | | | | | | | | | | | | | | |

| operations | | 3.22 | | 2.76 | | .74 | | 2.91 | | | | (1.52) | | (6.34) |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | — | | — | | — | | — | | | | — | | (1.11) |

| Redemption fees added | | | | | | | | | | | | | | |

| to paid in capitalE | | .01 | | .01 | | .02 | | — | | | | — | | — |

| Net asset value, end of | | | | | | | | | | | | | | |

| period | | $ 18.28 | | $ 15.05 | | $ 12.28 | | $ 11.52 | | | | $ 8.61 | | $ 10.13 |

| Total ReturnB,C,D | | 21.46% | | 22.56% | | 6.60% | | 33.80% | | | | (15.00)% | | (38.27)% |

| Ratios to Average Net AssetsF | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | 2.21%A | | 2.27% | | 2.44% | | 2.82% | | | | 2.72% | | 2.59% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | 2.21%A | | 2.27% | | 2.44% | | 2.50% | | | | 2.67% | | 2.59% |

| Expenses net of all | | | | | �� | | | | | | | | | |

| reductions | | 2.19%A | | 2.26% | | 2.44% | | 2.49% | | | | 2.67% | | 2.55% |

| Net investment income | | | | | | | | | | | | | | |

| (loss) | | (.94)%A | | (1.25)% | | (1.58)% | | (1.51)% | | | | (2.00)% | | (1.81)% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (000 omitted) | | $72,404 | | $34,144 | | $21,564 | | $10,374 | | | | $ 6,497 | | $ 8,170 |

| Portfolio turnover rate | | 72%A | | 89% | | 83% | | 99% | | | | 128% | | 123% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights Institutional Class | | | | | | | | |

| |

| | Six months ended | | | | | | | | | | | | |

| | April 30, 2006 | | Years ended October 31, |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | |

| beginning of period | | $ 15.90 | | $ 12.83 | | $ 11.91 | | $ 8.82 | | | | $ 10.25 | | $ 17.88 |

| Income from Investment | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | |

| Net investment income | | | | | | | | | | | | | | |

| (loss)D | | 01 | | (.02) | | (.06) | | (.05) | | | | (.08) | | (.10) |

| Net realized and unre | | | | | | | | | | | | | | |

| alized gain (loss) | | 3.50 | | 3.08 | | .96 | | 3.14 | | | | (1.35) | | (6.16) |

| Total from investment | | | | | | | | | | | | | | |

| operations | | 3.51 | | 3.06 | | .90 | | 3.09 | | | | (1.43) | | (6.26) |

| Distributions from net | | | | | | | | | | | | | | |

| investment income | | — | | — | | — | | — | | | | — | | (1.37) |

| Redemption fees added | | | | | | | | | | | | | | |

| to paid in capitalD | | .01 | | .01 | | .02 | | — | | | | — | | — |

| Net asset value, end of | | | | | | | | | | | | | | |

| period | | $ 19.42 | | $ 15.90 | | $ 12.83 | | $ 11.91 | | | | $ 8.82 | | $ 10.25 |

| Total ReturnB,C | | 22.14% | | 23.93% | | 7.72% | | 35.03% | | | | (13.95)% | | (37.64)% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | |

| Expenses before | | | | | | | | | | | | | | |

| reductions | | 1.15%A | | 1.19% | | 1.36% | | 1.67% | | | | 1.52% | | 1.48% |

| Expenses net of fee | | | | | | | | | | | | | | |

| waivers, if any | | 1.15%A | | 1.19% | | 1.36% | | 1.50% | | | | 1.51% | | 1.48% |

| Expenses net of all | | | | | | | | | | | | | | |

| reductions | | 1.13%A | | 1.17% | | 1.36% | | 1.49% | | | | 1.51% | | 1.44% |

| Net investment income | | | | | | | | | | | | | | |

| (loss) | | .13%A | | (.17)% | | (.50)% | | (.51)% | | | | (.84)% | | (.70)% |

| Supplemental Data | | | | | | | | | | | | | | |

| Net assets, end of | | | | | | | | | | | | | | |

| period (000 omitted) | | $18,201 | | $ 8,399 | | $ 3,919 | | $ 3,905 | | | | $ 5,612 | | $ 795 |

| Portfolio turnover rate | | 72%A | | 89% | | 83% | | 99% | | | | 128% | | 123% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or

reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during

periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but

prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net

expenses paid by the class.

|

See accompanying notes which are an integral part of the financial statements.

23 Semiannual Report

Notes to Financial Statements

For the period ended April 30, 2006 (Unaudited)

1. Significant Accounting Policies.

Fidelity Advisor Japan Fund (the fund) is a fund of Fidelity Advisor Series VIII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The fund may invest in affiliated money market central funds (Money Market Central Funds), which are open end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require manage ment to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open end mutual funds, are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued.

| 1. Significant Accounting Policies continued |

Security Valuation continued | | |

Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securi ties markets, reviewing developments in foreign markets and evaluating the perfor mance of ADRs, futures contracts and exchange traded funds. Because the fund’s utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign denominated assets, including investment securities, and liabilities are trans lated into U.S. dollars at the exchange rate at period end. Purchases and sales of invest ment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transac tion date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex dividend date, except for certain dividends from foreign securities where the ex dividend date may have passed, which are recorded as soon as the fund is informed of the ex dividend date. Non cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

25 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

1. Significant Accounting Policies continued |

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distribu tions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

Book tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), net operating losses, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows:

| Unrealized appreciation | | | | $ 33,458,257 |

| Unrealized depreciation | | | | (4,540,381) |

| Net unrealized appreciation (depreciation) | | | | $ 28,917,876 |

| Cost for federal income tax purposes | | | | $ 171,873,107 |

Short Term Trading (Redemption) Fees. Shares held in the fund less than 90 days are subject to a redemption fee equal to 1.50% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the fund and accounted for as an addition to paid in capital.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default

2. Operating Policies continued

Repurchase Agreements continued

of the counterparty. The fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (includ ing accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

3. Purchases and Sales of Investments.

Purchases and sales of securities, other than short term securities, aggregated $117,707,727 and $56,080,981, respectively.

4. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the fund with investment management related services for which the fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the fund’s average net assets and a group fee rate that averaged .27% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annualized management fee rate was .72% of the fund’s average net assets.

Distribution and Service Plan. In accordance with Rule 12b 1 of the 1940 Act, the fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class’ average net assets. In addition, FDC may pay financial intermediaries for selling shares of the fund and providing shareholder support services. For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| | | Distribution | | Service | | | | Paid to | | | | Retained |

| | | Fee | | Fee | | | | FDC | | | | by FDC |

| Class A | | 0% | | .25% | | | | $ 50,973 | | | | $ 2,019 |

| Class T | | .25% | | .25% | | | | 56,300 | | | | 413 |

| Class B | | .75% | | .25% | | | | 116,324 | | | | 87,538 |

| Class C | | .75% | | .25% | | | | 290,824 | | | | 171,577 |

| | | | | | | | | $ 514,421 | | | | $ 261,547 |

27 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

4. Fees and Other Transactions with Affiliates continued |

Sales Load. FDC receives a front end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermedi aries for selling shares of the fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, 1.00% to .50% for certain purchases of Class A shares (.25% prior to February 24, 2006) and .25% for certain purchases of Class T shares.

| For the period, sales charge amounts retained by FDC were as follows: | | | | |

| |

| | | | | Retained |

| | | | | by FDC |

| Class A | | | | $ 87,702 |

| Class T | | | | 15,196 |

| Class B* | | | | 24,597 |

| Class C* | | | | 12,443 |

| | | | | $ 139,938 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servic ing agent for each class of the fund. FIIOC receives account fees and asset based fees that vary according to the account size and type of account of the shareholders of the respective classes of the fund. FIIOC pays for typesetting, printing and mailing of share holder reports, except proxy statements. For the period the total transfer agent fees paid by each class to FIIOC, were as follows:

| | | | | | | % of |

| | | | | | | Average |

| | | | | Amount | | Net Assets |

| Class A | | | | $ 62,406 | | .31* |

| Class T | | | | 41,882 | | .37* |

| Class B | | | | 41,879 | | .36* |

| Class C | | | | 63,887 | | .22* |

| Institutional Class | | | | 11,472 | | .16* |

| | | | | $ 221,526 | | |

| |

| * Annualized | | | | | | |

4. Fees and Other Transactions with Affiliates continued

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the fund’s accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Affiliated Central Funds. The fund may invest in Money Market Central Funds which seek preservation of capital and current income and are managed by Fidelity Invest ments Money Management, Inc. (FIMM), an affiliate of FMR.

The Money Market Central Funds do not pay a management fee.

5. Committed Line of Credit.

|

The fund participates with other funds managed by FMR in a $4.2 billion credit facility (the “line of credit”) to be utilized for temporary or emergency purposes to fund share holder redemptions or for other short term liquidity purposes. The fund has agreed to pay commitment fees on its pro rata portion of the line of credit, which amounts to $211 and is reflected in Miscellaneous Expense on the Statement of Operations. During the period, there were no borrowings on this line of credit.

The fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the fund’s Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less fees and expenses associated with the loan, plus any premium payments that may be received on the loan of certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from affiliated central funds.

29 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

7. Expense Reductions. | | |

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| | | | |

| | | Expense | | | | Reimbursement |

| | | Limitations | | | | from adviser |

| Class A | | 1.50% | | | | $ 9,983 |

| Class T | | 1.75% | | | | 12,422 |

| Class B | | 2.25% | | | | 11,577 |

| Class C | | 2.25% | | | | — |

| Institutional Class | | 1.25% | | | | — |

| | | | | | | $ 33,982 |

Many of the brokers with whom FMR places trades on behalf of the fund provided services to the fund in addition to trade execution. These services included payments of certain expenses on behalf of the fund totaling $17,043 for the period.

The fund’s organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, the fund may also enter into contracts that provide general indemnifications. The fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the fund. The risk of material loss from such claims is considered remote.

| 9. Share Transactions. | | | | | | | | | | |

| |

| Transactions for each class of shares were as follows: | | | | | | | | |

| |

| | | Shares | | | | Dollars |

| | | Six months ended | | Year ended | | | | Six months ended | | | | Year ended |

| | | April 30, | | October 31, | | | | April 30, | | | | October 31, |

| | | 2006 | | 2005 | | | | 2006 | | | | 2005 |

| Class A | | | | | | | | | | | | |

| Shares sold | | 1,653,240 | | 1,120,934 | | | | $ 29,841,251 | | | | $ 16,117,987 |

| Shares redeemed | | (678,201) | | (859,010) | | | | (12,220,123) | | | | (11,688,765) |

| Net increase (decrease) | | 975,039 | | 261,924 | | | | $ 17,621,128 | | | | $ 4,429,222 |

| Class T | | | | | | | | | | | | |

| Shares sold | | 602,489 | | 430,689 | | | | $ 10,578,187 | | | | $ 6,034,540 |

| Shares redeemed | | (202,283) | | (336,350) | | | | (3,590,022) | | | | (4,607,590) |

| Net increase (decrease) | | 400,206 | | 94,339 | | | | $ 6,988,165 | | | | $ 1,426,950 |

| Class B | | | | | | | | | | | | |

| Shares sold | | 329,565 | | 255,973 | | | | $ 5,663,328 | | | | $ 3,480,072 |

| Shares redeemed | | (242,274) | | (483,966) | | | | (4,206,989) | | | | (6,366,382) |

| Net increase (decrease) | | 87,291 | | (227,993) | | | | $ 1,456,339 | | | | $ (2,886,310) |

| Class C | | | | | | | | | | | | |

| Shares sold | | 2,085,702 | | 1,191,024 | | | | $ 35,894,068 | | | | $ 16,663,352 |

| Shares redeemed | | (393,705) | | (679,047) | | | | (6,809,035) | | | | (9,010,210) |

| Net increase (decrease) | | 1,691,997 | | 511,977 | | | | $ 29,085,033 | | | | $ 7,653,142 |

| Institutional Class | | | | | | | | | | | | |

| Shares sold | | 495,579 | | 316,545 | | | | $ 9,088,449 | | | | $ 4,655,271 |

| Shares redeemed | | (86,451) | | (93,863) | | | | (1,583,226) | | | | (1,305,631) |

| Net increase (decrease) | | 409,128 | | 222,682 | | | | $ 7,505,223 | | | | $ 3,349,640 |

31 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees

Advisor Japan Fund

On January 19, 2006, the Board of Trustees, including the Independent Trustees (together, the Board), voted to approve a general research services agreement (the Agreement) between FMR, FMR Co., Inc. (FMRC), Fidelity Investments Money Manage ment, Inc. (FIMM), and Fidelity Research & Analysis Company (FRAC) (together, the Investment Advisers) for the fund, effective January 20, 2006, pursuant to which FRAC may provide general research and investment advisory support services to FMRC and FIMM. The Board considered that it has approved previously various sub advisory agreements for the fund with affiliates of FMR that allow FMR to obtain research, non discretionary advice, or discretionary portfolio management at no additional expense to the fund. The Board, assisted by the advice of fund counsel and independent Trustees’ counsel, considered a broad range of information and determined that it would be beneficial for the fund to access the research and investment advisory support services supplied by FRAC at no additional expense to the fund.

The Board reached this determination in part because the new arrangement will involve no changes in (i) the contractual terms of and fees payable under the fund’s manage ment contract or sub advisory agreements; (ii) the investment process or strategies employed in the management of the fund’s assets; (iii) the nature or level of services provided under the fund’s management contract or sub advisory agreements; (iv) the day to day management of the fund or the persons primarily responsible for such man agement; or (v) the ultimate control or beneficial ownership of FMR, FMRC, or FIMM. The Board also considered that the establishment of the Agreement would not necessi tate prior shareholder approval of the Agreement or result in an assignment and termination of the fund’s management contract or sub advisory agreements under the Investment Company Act of 1940.

Because the Board was approving an arrangement with FRAC under which the fund will not bear any additional management fees or expenses and under which the fund’s portfolio manager would not change, it did not consider the fund’s investment perfor mance, competitiveness of management fee and total expenses, costs of services and profitability, or economies of scale to be significant factors in its decision.

In connection with its future renewal of the fund’s management contract and sub advisory agreements, the Board will consider: (i) the nature, extent, and quality of services provided to the fund, including shareholder and administrative services and investment performance; (ii) the competitiveness of the fund’s management fee and total expenses; (iii) the costs of the services and profitability, including the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering, and servicing the fund and its shareholders; and (iv) whether there have been economies of scale in respect of the management of the Fidelity funds, whether the Fidelity funds (including the fund) have

appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies.

Based on its evaluation of all of the conclusions noted above, and after considering all material factors, the Board ultimately concluded that the fund’s Agreement is fair and reasonable, and that the fund’s Agreement should be approved.

33 Semiannual Report

35 Semiannual Report

37 Semiannual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Investment Sub Advisers

FMR Co., Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Research & Analysis Company

(formerly Fidelity Management &

Research (Far East) Inc.)

Fidelity International

Investment Advisors

Fidelity Investments Japan Limited

Fidelity International Investment

Advisors (U.K.) Limited

General Distributor

Fidelity Distributors Corporation

Boston, MA

Transfer and Service Agents

Fidelity Investments Institutional

Operations Company, Inc.

Boston, MA

Fidelity Service Company, Inc.

Boston, MA

Custodian

State Street Bank and Trust Company

Quincy, MA

|

AJAF USAN-0606

1.784892.103

|

| | Fidelity® Advisor

Japan

Fund - Institutional Class

|

| | Semiannual Report

April 30, 2006

|

| Contents | | | | |

| |

| Chairman’s Message | | 3 | | Ned Johnson’s message to shareholders. |

| Shareholder Expense | | 4 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 6 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 7 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 15 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 24 | | Notes to the financial statements. |

| Board Approval of | | 32 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12 month period ended

June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commis

sion’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of

the proxy voting guidelines.