UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2007 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity® Advisor

Diversified International

Fund - Class A, Class T, Class B

and Class C

Annual Report

October 31, 2007

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | <Click Here> | Ned Johnson's message to shareholders. |

Note to Shareholders | <Click Here> | |

Performance | <Click Here> | How the fund has done over time. |

Management's Discussion | <Click Here> | The manager's review of fund performance, strategy and outlook. |

Shareholder Expense Example | <Click Here> | An example of shareholder expenses. |

Investment Changes | <Click Here> | A summary of major shifts in the fund's investments over the past six months. |

Investments | <Click Here> | A complete list of the fund's investments with their market values. |

Financial Statements | <Click Here> | Statements of assets and liabilities, operations, and changes in net assets,

as well as financial highlights. |

Notes | <Click Here> | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | <Click Here> | |

Trustees and Officers | <Click Here> | |

Distributions | <Click Here> | |

Proxy Voting Results | <Click Here> | |

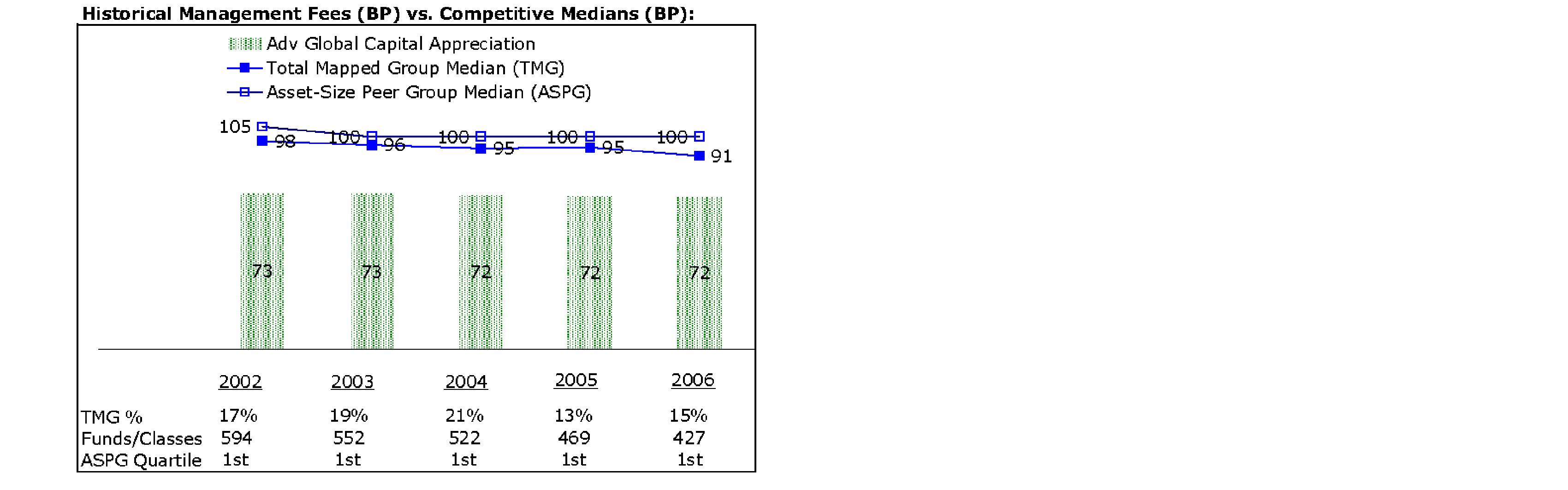

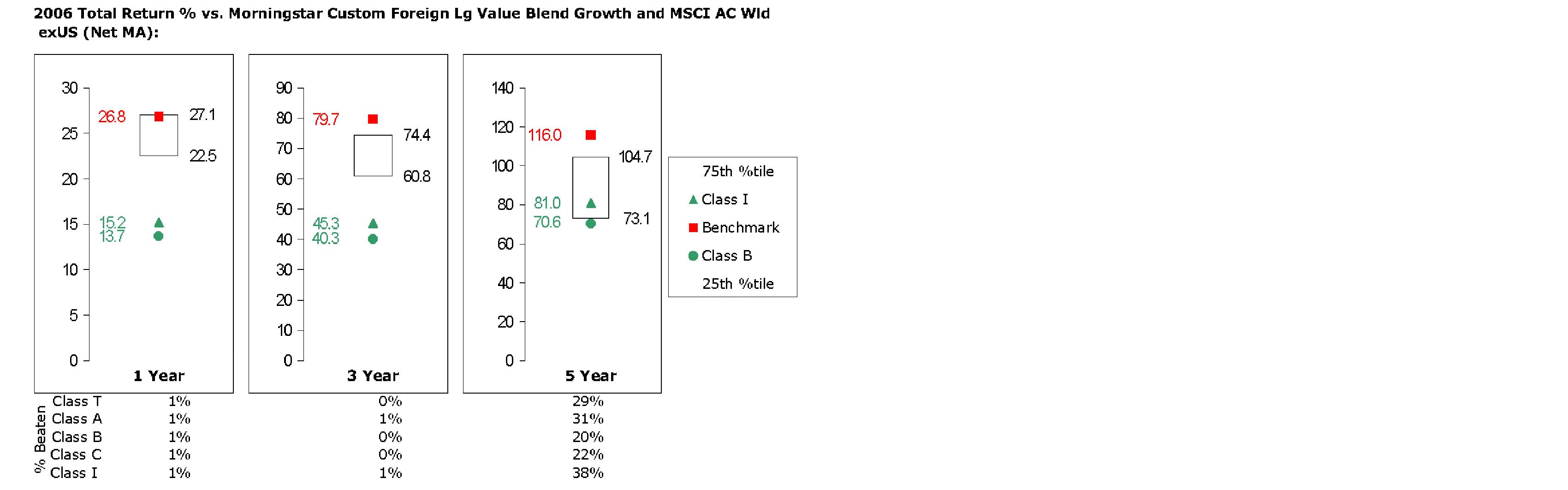

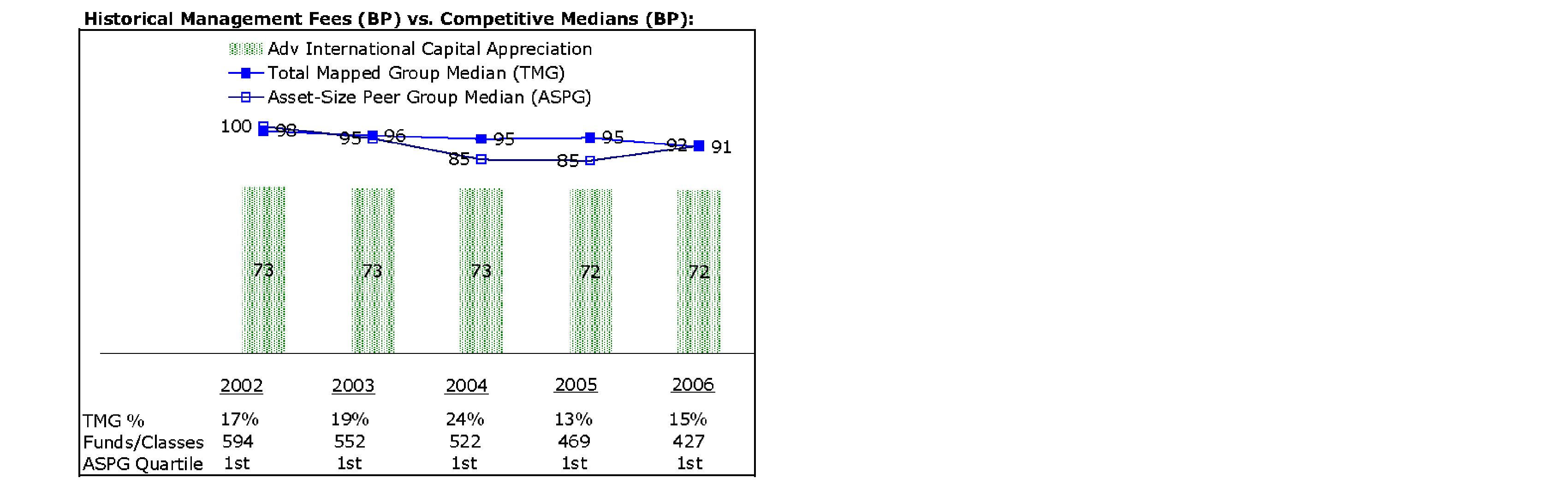

Board Approval of Investment Advisory Contracts and Management Fees | <Click Here> | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com(search for proxy voting results) or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Many stock and bond markets around the world have been unsettled of late; however, volatility can often lead to opportunity for patient investors. Financial markets are always unpredictable, but there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Annual Report

Note to Shareholders:

At a shareholder meeting of Fidelity® Advisor Diversified International Fund held on October 17, 2007, the proposal to approve a new management contract for the fund did not receive the vote required for approval. As a result, the current management contract will remain in effect for the fund.

Annual Report

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns may reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

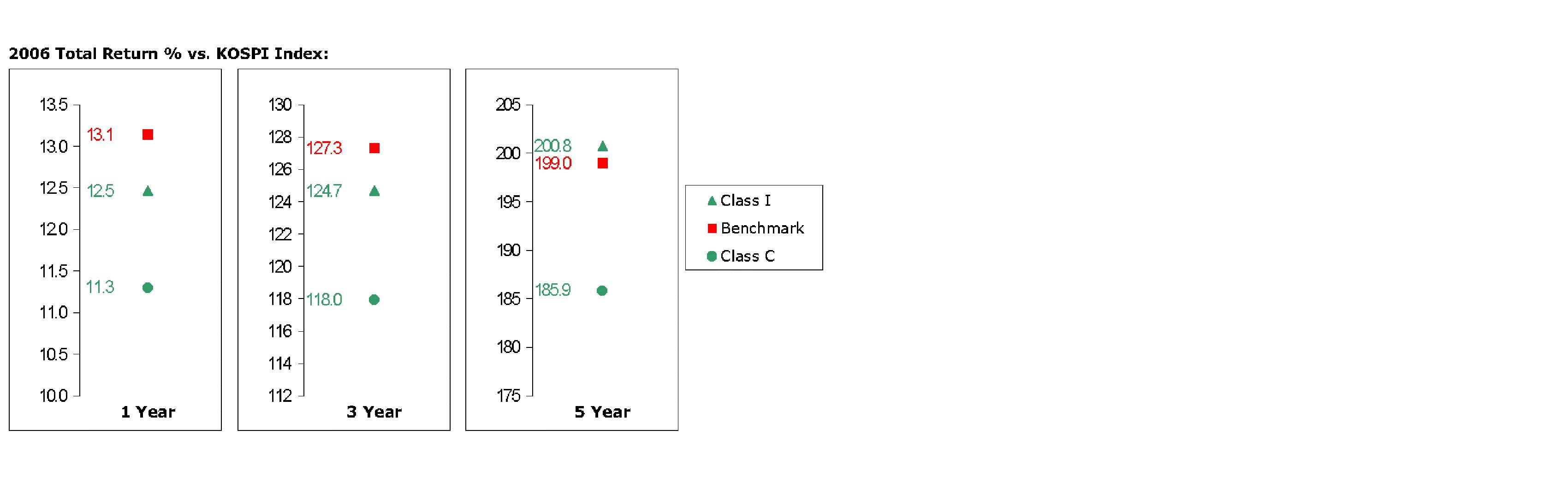

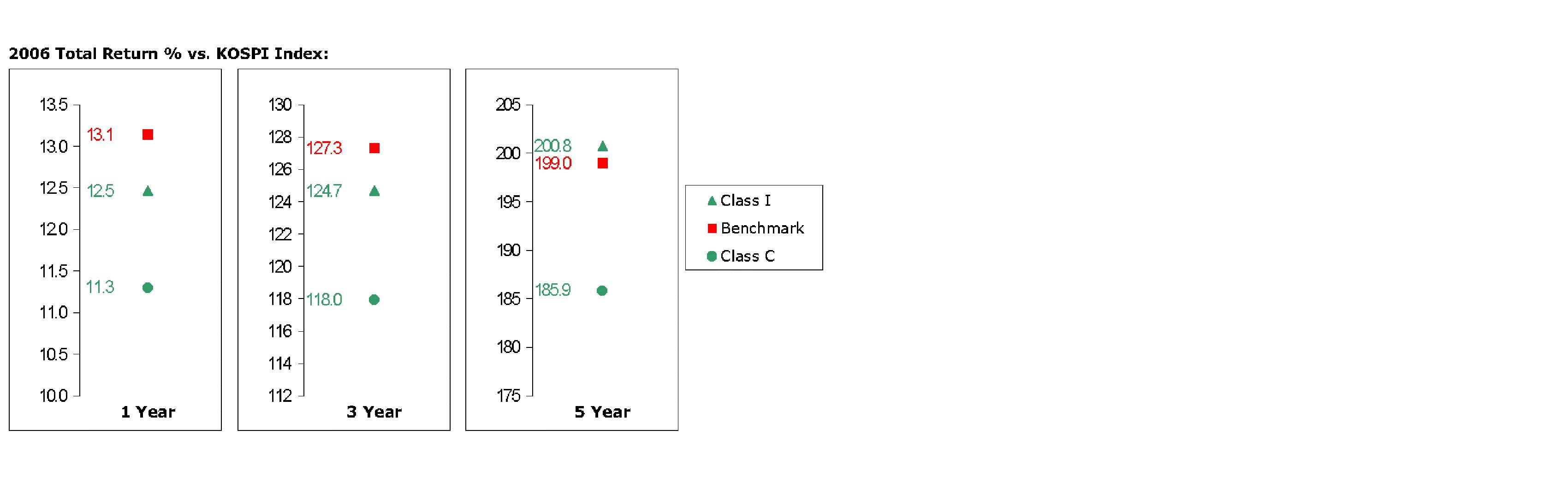

Average Annual Total Returns

Periods ended October 31, 2007 | | Past 1

year | Past 5

years | Life of

fund A |

Class A (incl. 5.75% sales

charge) | | 15.70% | 21.24% | 13.25% |

Class T (incl. 3.50% sales

charge) | | 18.14% | 21.50% | 13.24% |

Class B (incl. contingent

deferred sales charge) B | | 16.73% | 21.44% | 13.25% |

Class C (incl. contingent

deferred sales charge) C | | 20.81% | 21.72% | 13.12% |

A From December 17, 1998.

B Class B shares' contingent deferred sales charges included in the past one year, past five years, and life of fund total return figures are 5%, 2%, and 0%, respectively.

C Class C shares' contingent deferred sales charges included in the past one year, past five years, and life of fund total return figures are 1%, 0%, and 0%, respectively.

Annual Report

$10,000 Over Life of Fund*

Let's say hypothetically that $10,000 was invested in Fidelity® Advisor Diversified International Fund - Class T on December 31, 1998, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI® EAFE®) Index performed over the same period.

* From December 31, 1998 (first date following the fund's commencement for which the life of fund return for the MSCI EAFE Index is available).

Annual Report

Management's Discussion of Fund Performance

Comments from Penelope Dobkin, Portfolio Manager of Fidelity® Advisor Diversified International Fund

Foreign stocks, with a large assist from a weak U.S. dollar, generally had higher returns for U.S. investors than domestic equities during the 12-month period ending October 31, 2007. The backdrop for global stocks was solid, with robust economic growth and relatively high corporate profitability worldwide. Developed international equity markets, as measured by the Morgan Stanley Capital InternationalSM Europe, Australasia, and Far East (MSCI® EAFE®) Index - a performance monitor of established markets outside the United States and Canada - rose 25.09%. In comparison, the Standard & Poor's 500SM Index, a gauge of U.S. stocks, was up 14.56%. Among countries making up at least 1% of the EAFE benchmark, Finland had the best showing, soaring nearly 69%, while Hong Kong gained roughly 66%. The United Kingdom and Japan, the two largest components of the index, both underperformed. Fallout from the credit crunch and concerns about export growth tempered UK stocks, while Japan struggled with a slowdown in consumer spending and sluggish domestic growth. Emerging markets were the period's big winners, advancing 68.33% as measured by the MSCI Emerging Markets index.

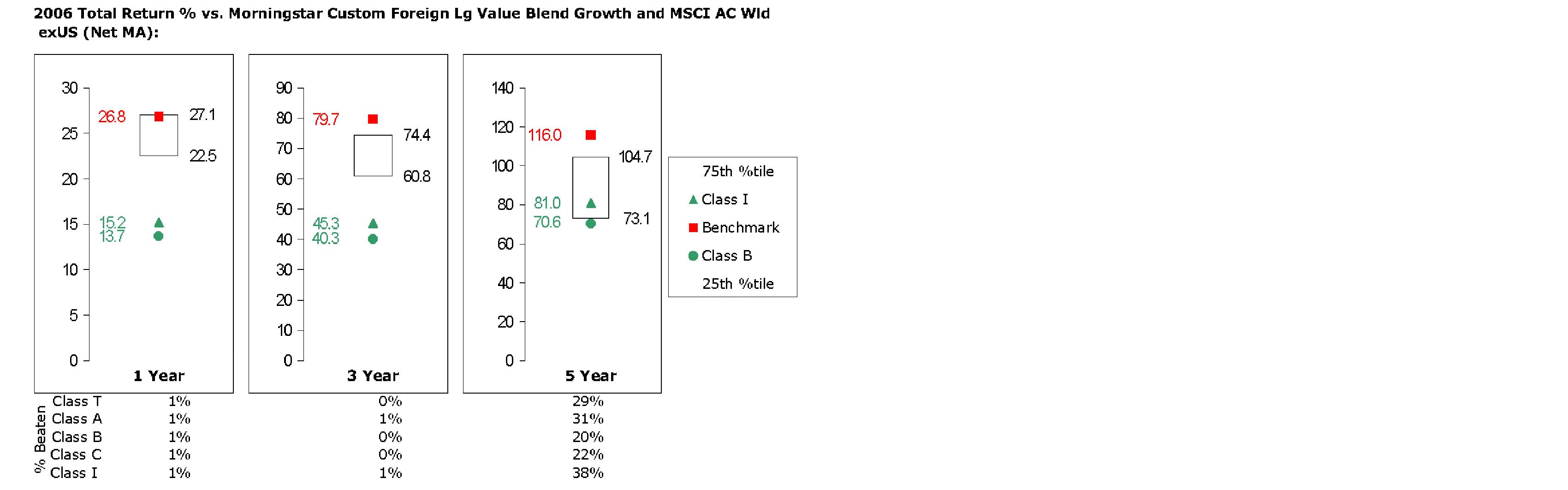

For the 12 months ending October 31, 2007, the fund's Class A, Class T, Class B and Class C shares returned 22.76%, 22.43%, 21.73% and 21.81%, respectively (excluding sales charges), trailing the MSCI EAFE index. The largest drag on performance was the fund's overweighting in Japan, combined with weak stock selection there. On a sector basis, we had disappointing results within financials, and our positioning in the consumer sectors also detracted. A modest cash position hurt as well. Conversely, from a geographic standpoint, good stock selection and an underweighting in the UK market made healthy contributions to relative returns. Our focus on capital goods worldwide and an overweighting in Germany also paid off, as did stock selection in energy, technology, health care and materials. On an individual stock basis, detractors included Japanese financials ORIX, Daiwa Securities and out-of-benchmark OMC Card. Contributors included German holding SGL Carbon AG, the world's largest producer of carbon and graphite products. Backed by European and Asian demand for its steel products, SGL saw its stock price soar. Australian pharmaceutical company CSL was another strong performer. It owns the sole license for blockbuster cervical-cancer drug Gardasil, and its share price surged as demand rose worldwide.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2007 to October 31, 2007).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

Shareholder Expense Example - continued

| Beginning

Account Value

May 1, 2007 | Ending

Account Value

October 31, 2007 | Expenses Paid

During Period*

May 1, 2007

to October 31, 2007 |

Class A | | | |

Actual | $ 1,000.00 | $ 1,079.50 | $ 6.60 |

HypotheticalA | $ 1,000.00 | $ 1,018.85 | $ 6.41 |

Class T | | | |

Actual | $ 1,000.00 | $ 1,077.90 | $ 7.75 |

HypotheticalA | $ 1,000.00 | $ 1,017.74 | $ 7.53 |

Class B | | | |

Actual | $ 1,000.00 | $ 1,075.20 | $ 10.93 |

HypotheticalA | $ 1,000.00 | $ 1,014.67 | $ 10.61 |

Class C | | | |

Actual | $ 1,000.00 | $ 1,075.50 | $ 10.52 |

HypotheticalA | $ 1,000.00 | $ 1,015.07 | $ 10.21 |

Institutional Class | | | |

Actual | $ 1,000.00 | $ 1,081.10 | $ 5.19 |

HypotheticalA | $ 1,000.00 | $ 1,020.21 | $ 5.04 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| Annualized

Expense Ratio |

Class A | 1.26% |

Class T | 1.48% |

Class B | 2.09% |

Class C | 2.01% |

Institutional Class | .99% |

Annual Report

Investment Changes

Top Five Stocks as of October 31, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Vodafone Group PLC (United Kingdom, Wireless Telecommunication Services) | 3.5 | 2.3 |

Allianz AG sponsored ADR (Germany, Insurance) | 2.6 | 2.5 |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 2.2 | 2.3 |

Nokia Corp. (Finland, Communications Equipment) | 2.0 | 0.9 |

Nestle SA (Switzerland, Food Products) | 1.9 | 2.4 |

| 12.2 | |

Top Five Market Sectors as of October 31, 2007 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 24.1 | 30.5 |

Industrials | 14.4 | 15.2 |

Information Technology | 12.3 | 11.5 |

Materials | 9.6 | 6.6 |

Consumer Discretionary | 7.7 | 9.5 |

Top Five Countries as of October 31, 2007 |

(excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

Japan | 26.0 | 25.4 |

Germany | 15.0 | 16.9 |

France | 10.9 | 8.5 |

United Kingdom | 9.0 | 9.7 |

Switzerland | 8.7 | 10.4 |

Percentages are adjusted for the effect of open futures contracts, if applicable. |

Asset Allocation (% of fund's net assets) |

As of October 31, 2007 | As of April 30, 2007 |

| Stocks and

Equity Futures 99.7% | |  | Stocks and

Equity Futures 96.6% | |

| Short-Term

Investments and

Net Other Assets 0.3% | |  | Short-Term

Investments and

Net Other Assets 3.4% | |

Annual Report

Investments October 31, 2007

Showing Percentage of Net Assets

Common Stocks - 98.0% |

| Shares | | Value (000s) |

Argentina - 0.0% |

Mercadolibre, Inc. | 78,700 | | $ 3,516 |

Australia - 4.1% |

Aristocrat Leisure Ltd. (d) | 3,680,300 | | 35,999 |

BHP Billiton Ltd. sponsored ADR (d) | 3,025,900 | | 264,040 |

Computershare Ltd. | 3,991,492 | | 32,184 |

CSL Ltd. | 6,147,900 | | 209,005 |

Downer EDI Ltd. | 4,046,122 | | 25,231 |

National Australia Bank Ltd. | 2,578,500 | | 104,321 |

Woolworths Ltd. | 740,300 | | 23,202 |

TOTAL AUSTRALIA | | 693,982 |

Austria - 0.4% |

voestalpine AG | 758,000 | | 68,165 |

Belgium - 0.2% |

Fortis | 1,066,800 | | 34,095 |

Bermuda - 0.3% |

Catlin Group Ltd. | 1,088,000 | | 11,344 |

Hiscox Ltd. | 3,778,100 | | 22,543 |

TPV Technology Ltd. | 15,168,000 | | 10,214 |

TOTAL BERMUDA | | 44,101 |

Brazil - 0.3% |

Bovespa Holding SA (a) | 1,328,000 | | 25,292 |

Medial Saude SA | 1,952,000 | | 25,724 |

TOTAL BRAZIL | | 51,016 |

Canada - 1.8% |

Canadian Natural Resources Ltd. | 1,438,000 | | 119,645 |

EnCana Corp. | 710,248 | | 49,722 |

Open Text Corp. (a)(d) | 1,234,400 | | 38,580 |

OPTI Canada, Inc. (a) | 1,484,800 | | 29,957 |

OZ Optics Ltd. unit (a)(g) | 5,400 | | 80 |

Suncor Energy, Inc. | 233,700 | | 25,605 |

Talisman Energy, Inc. | 1,931,100 | | 42,091 |

Westernzagros Resources Ltd. | 427,000 | | 1,628 |

Westernzagros Resources Ltd. warrants 1/18/08 (a) | 42,700 | | 50 |

TOTAL CANADA | | 307,358 |

Cayman Islands - 0.5% |

Alibaba.com Ltd. (a) | 698,000 | | 2,252 |

GlobalSantaFe Corp. | 147,200 | | 11,928 |

Common Stocks - continued |

| Shares | | Value (000s) |

Cayman Islands - continued |

Lee & Man Paper Manufacturing Ltd. | 5,423,700 | | $ 21,697 |

Subsea 7, Inc. (a)(d) | 1,414,500 | | 41,514 |

TOTAL CAYMAN ISLANDS | | 77,391 |

China - 0.1% |

Zhejiang Expressway Co. Ltd. (H Shares) | 13,346,000 | | 19,273 |

Denmark - 0.6% |

William Demant Holding AS (a) | 1,073,200 | | 98,357 |

Finland - 3.1% |

Cargotec Corp. (B Shares) | 542,240 | | 33,514 |

Metso Corp. | 1,447,500 | | 87,996 |

Neste Oil Oyj | 1,027,800 | | 36,944 |

Nokia Corp. | 1,111,500 | | 44,149 |

Nokia Corp. sponsored ADR | 7,450,500 | | 295,934 |

Wartsila Corp. (B Shares) | 271,700 | | 22,201 |

TOTAL FINLAND | | 520,738 |

France - 10.9% |

Alcatel-Lucent SA sponsored ADR | 13,185,500 | | 127,767 |

Alstom SA | 1,111,800 | | 262,395 |

Arkema sponsored ADR (a) | 2,572 | | 175 |

AXA SA sponsored ADR | 393,600 | | 17,606 |

BNP Paribas SA | 1,558,900 | | 171,852 |

Bureau Veritas SA (a) | 245,500 | | 14,220 |

Carbone Lorraine | 249,900 | | 22,364 |

CNP Assurances | 287,000 | | 36,587 |

Gaz de France | 1,856,400 | | 105,430 |

L'Air Liquide SA (a) | 454,740 | | 62,582 |

Lagardere S.C.A. (Reg.) | 580,982 | | 49,106 |

Neuf Cegetel | 1,217,511 | | 61,561 |

Orpea (a) | 512,400 | | 32,389 |

Pernod Ricard SA | 134,540 | | 31,090 |

Remy Cointreau SA | 1,234,000 | | 94,844 |

Renault SA | 604,700 | | 101,539 |

Sanofi-Aventis sponsored ADR | 1,775,300 | | 78,131 |

SCOR | 219,488 | | 5,978 |

Societe Generale Series A | 839,755 | | 141,499 |

Sodexho Alliance SA | 561,200 | | 40,466 |

Total SA: | | | |

Series B | 353,100 | | 28,463 |

sponsored ADR | 2,944,300 | | 237,340 |

Common Stocks - continued |

| Shares | | Value (000s) |

France - continued |

Unibail-Rodamco | 158,700 | | $ 39,460 |

Vivendi | 1,717,613 | | 77,342 |

TOTAL FRANCE | | 1,840,186 |

Germany - 14.7% |

Aareal Bank AG | 1,342,647 | | 69,581 |

Adidas-Salomon AG | 133,700 | | 8,920 |

Allianz AG sponsored ADR | 19,332,370 | | 436,912 |

Bayer AG | 3,047,700 | | 251,130 |

Bayerische Motoren Werke AG (BMW) | 888,000 | | 59,476 |

Bilfinger Berger AG | 758,900 | | 67,564 |

CompuGROUP Holding AG (a) | 826,400 | | 17,181 |

DaimlerChrysler AG (Reg.) | 796,000 | | 87,679 |

Deutz AG (a) | 875,800 | | 12,029 |

E.ON AG sponsored ADR | 4,279,300 | | 278,582 |

GFK AG | 178,956 | | 7,223 |

Henkel KGaA | 350,537 | | 16,251 |

Hochtief AG | 281,200 | | 38,830 |

K&S AG | 447,800 | | 93,624 |

KUKA AG (a)(d) | 496,413 | | 20,145 |

Lanxess AG | 437,000 | | 21,824 |

Linde AG | 556,256 | | 70,388 |

MAN AG | 281,000 | | 50,156 |

MTU Aero Engines Holding AG | 105,351 | | 6,432 |

Muenchener Rueckversicherungs-Gesellschaft AG (Reg.) | 1,415,500 | | 271,564 |

Patrizia Immobilien AG (d) | 1,171,800 | | 15,636 |

RWE AG | 971,900 | | 132,698 |

SAP AG sponsored ADR (d) | 713,600 | | 38,734 |

SGL Carbon AG (a) | 284,287 | | 16,586 |

Siemens AG: | | | |

(Reg.) | 798,400 | | 108,878 |

sponsored ADR | 1,515,200 | | 206,628 |

Wacker Chemie AG | 277,100 | | 68,048 |

TOTAL GERMANY | | 2,472,699 |

Greece - 0.2% |

Hellenic Exchanges Holding SA | 1,070,800 | | 37,233 |

Hong Kong - 1.9% |

Hysan Development Co. Ltd. | 58,250 | | 176 |

New World Development Co. Ltd. | 26,081,000 | | 94,001 |

Sino Land Co. | 12,044,000 | | 37,753 |

Common Stocks - continued |

| Shares | | Value (000s) |

Hong Kong - continued |

Sun Hung Kai Properties Ltd. | 3,765,000 | | $ 71,952 |

Wharf Holdings Ltd. | 18,388,000 | | 110,869 |

TOTAL HONG KONG | | 314,751 |

Indonesia - 0.2% |

PT Bank Mandiri Persero Tbk | 75,233,500 | | 31,874 |

Ireland - 0.2% |

Smurfit Kappa Group plc | 1,465,200 | | 29,485 |

Israel - 0.7% |

Bank Hapoalim BM (Reg.) | 7,390,800 | | 40,665 |

Mizrahi Tefahot Bank Ltd. | 9,841,265 | | 76,430 |

TOTAL ISRAEL | | 117,095 |

Italy - 1.6% |

ASM SpA | 3,645,538 | | 25,547 |

Fiat SpA | 1,655,500 | | 53,414 |

Milano Assicurazioni SpA | 1,337,400 | | 11,143 |

Pirelli & C. Real Estate SpA | 706,325 | | 34,875 |

Prysmian SpA | 1,873,700 | | 53,834 |

Unicredito Italiano SpA | 11,035,700 | | 94,332 |

TOTAL ITALY | | 273,145 |

Japan - 24.8% |

Aeon Co. Ltd. | 5,835,800 | | 91,884 |

Aeon Mall Co. Ltd. (d) | 1,695,800 | | 44,112 |

Aioi Insurance Co. Ltd. | 8,628,000 | | 50,158 |

Aoyama Trading Co. Ltd. | 1,633,400 | | 42,708 |

Arealink Co. Ltd. (d)(e) | 87,229 | | 43,272 |

Asics Corp. | 3,382,000 | | 53,942 |

Bank of Nagoya Ltd. | 6,814,000 | | 50,409 |

Bridgestone Corp. | 2,209,400 | | 48,917 |

Canon Fintech, Inc. | 595,800 | | 10,025 |

Canon, Inc. | 675,100 | | 34,140 |

Canon, Inc. sponsored ADR | 2,356,100 | | 119,148 |

Chiba Bank Ltd. | 5,205,000 | | 41,786 |

Credit Saison Co. Ltd. | 848,300 | | 27,055 |

Daiei, Inc. (a) | 2,113,050 | | 15,051 |

Daiwa House Industry Co. Ltd. | 4,107,000 | | 58,621 |

Daiwa Securities Group, Inc. | 18,548,000 | | 178,787 |

DCM Japan Holdings Co. Ltd. (d) | 3,112,820 | | 24,010 |

Fuji Machine Manufacturing Co. Ltd. | 1,833,600 | | 40,933 |

Fujitsu Ltd. | 9,681,000 | | 76,029 |

Common Stocks - continued |

| Shares | | Value (000s) |

Japan - continued |

Fukuoka Financial Group, Inc. (a) | 10,181,000 | | $ 65,631 |

Hokuhoku Financial Group, Inc. | 15,384,000 | | 47,532 |

Ibiden Co. Ltd. | 862,600 | | 73,134 |

Inpex Holdings, Inc. | 5,875 | | 63,348 |

Isetan Co. Ltd. | 1,706,400 | | 23,061 |

Juroku Bank Ltd. | 9,501,000 | | 57,504 |

Kansai Paint Co. Ltd. | 4,243,000 | | 31,860 |

Konica Minolta Holdings, Inc. | 3,961,000 | | 69,355 |

Kubota Corp. | 1,603,000 | | 13,461 |

Marubeni Corp. | 5,082,000 | | 43,646 |

Marui Group Co. Ltd. | 4,410,200 | | 45,759 |

Matsui Securities Co. Ltd. (d) | 8,961,400 | | 71,218 |

Millea Holdings, Inc. | 1,552,600 | | 60,955 |

Misumi Group, Inc. | 1,530,700 | | 25,909 |

Mitsubishi Corp. | 3,023,100 | | 94,146 |

Mitsubishi Estate Co. Ltd. | 2,829,000 | | 84,827 |

Mitsui & Co. Ltd. | 4,098,000 | | 106,317 |

Mitsui Fudosan Co. Ltd. | 2,189,000 | | 60,570 |

Mizuho Financial Group, Inc. | 3,159 | | 17,759 |

Monex Beans Holdings, Inc. (d) | 10,893 | | 7,531 |

Murata Manufacturing Co. Ltd. | 1,990,100 | | 121,138 |

Namco Bandai Holdings, Inc. | 1,242,400 | | 19,159 |

Nidec Corp. | 1,338,100 | | 100,563 |

Nintendo Co. Ltd. | 129,500 | | 81,326 |

Nippon Chemi-con Corp. | 3,839,900 | | 30,465 |

Nippon Electric Glass Co. Ltd. | 7,655,200 | | 130,141 |

Nomura Holdings, Inc. | 4,531,700 | | 80,800 |

Nomura Holdings, Inc. sponsored ADR | 4,015,900 | | 71,603 |

NSK Ltd. | 6,117,000 | | 54,246 |

Okamura Corp. | 4,931,000 | | 44,569 |

Okinawa Cellular Telephone Co. | 7,759 | | 22,730 |

OMC Card, Inc. (d)(e) | 11,455,100 | | 42,243 |

Omron Corp. | 1,838,100 | | 45,217 |

ORIX Corp. | 155,150 | | 31,832 |

Promise Co. Ltd. (d) | 896,950 | | 26,985 |

SBI E*TRADE Securities Co. Ltd. (d) | 52,205 | | 56,057 |

Sekisui House Ltd. | 4,321,000 | | 55,292 |

Seven & I Holdings Co. Ltd. | 943,500 | | 24,368 |

SFCG Co. Ltd. | 376,930 | | 62,533 |

SMC Corp. | 426,700 | | 57,170 |

Sompo Japan Insurance, Inc. | 9,988,000 | | 117,496 |

Sony Corp. sponsored ADR | 356,300 | | 17,623 |

Common Stocks - continued |

| Shares | | Value (000s) |

Japan - continued |

Sony Financial Holdings, Inc. | 1,336 | | $ 4,807 |

Sumitomo Corp. | 7,643,000 | | 133,200 |

Sumitomo Electric Industries Ltd. | 4,612,500 | | 74,694 |

Sumitomo Metal Industries Ltd. | 4,987,000 | | 24,689 |

Sumitomo Mitsui Financial Group, Inc. | 1,265 | | 10,364 |

Sumitomo Osaka Cement Co. Ltd. | 17,933,000 | | 44,953 |

T&D Holdings, Inc. | 608,500 | | 36,631 |

Takeda Pharmaceutical Co. Ltd. | 859,600 | | 53,706 |

Tokai Carbon Co. Ltd. (d) | 9,268,000 | | 116,252 |

Tokuyama Corp. (d) | 4,418,000 | | 61,723 |

Tokyo Tomin Bank Ltd. | 2,001,100 | | 66,619 |

Toyota Motor Corp. | 1,440,100 | | 82,403 |

Yamada Denki Co. Ltd. | 161,460 | | 16,651 |

Yamaguchi Financial Group, Inc. | 3,169,000 | | 37,190 |

TOTAL JAPAN | | 4,171,948 |

Korea (South) - 0.5% |

Daewoo Shipbuilding & Marine Engineering Co. Ltd. | 775,510 | | 49,265 |

Kookmin Bank | 292,010 | | 23,882 |

Samsung Electronics Co. Ltd. | 16,050 | | 9,897 |

TOTAL KOREA (SOUTH) | | 83,044 |

Luxembourg - 0.8% |

ArcelorMittal SA (NY Shares) Class A | 1,730,800 | | 138,377 |

Malaysia - 1.0% |

DiGi.com Bhd | 5,697,700 | | 42,915 |

Gamuda Bhd | 52,592,000 | | 72,513 |

Public Bank BHD (For. Reg.) | 8,688,500 | | 29,878 |

YTL Corp. BHD | 6,796,800 | | 15,396 |

TOTAL MALAYSIA | | 160,702 |

Netherlands - 4.7% |

Akzo Nobel NV (d) | 403,300 | | 32,446 |

Heineken NV (Bearer) | 2,658,700 | | 185,577 |

Koninklijke KPN NV | 5,301,900 | | 100,012 |

Koninklijke Philips Electronics NV (NY Shares) | 2,235,100 | | 92,399 |

Reed Elsevier NV sponsored ADR | 2,850,100 | | 110,983 |

SBM Offshore NV | 1,769,610 | | 68,095 |

Unilever NV: | | | |

(Certificaten Van Aandelen) | 1,917,700 | | 62,208 |

(NY Shares) | 4,369,400 | | 141,831 |

TOTAL NETHERLANDS | | 793,551 |

Common Stocks - continued |

| Shares | | Value (000s) |

Norway - 1.1% |

Aker Kvaerner ASA | 3,928,950 | | $ 136,907 |

Hafslund ASA (B Shares) | 1,249,863 | | 37,031 |

Odfjell Se (B Shares) | 237,650 | | 3,786 |

TOTAL NORWAY | | 177,724 |

Singapore - 0.1% |

City Developments Ltd. | 1,636,000 | | 18,064 |

Spain - 1.5% |

Banco Santander SA sponsored ADR | 1,021,400 | | 22,175 |

Inditex SA | 368,500 | | 27,415 |

Telefonica SA sponsored ADR | 2,076,900 | | 206,548 |

TOTAL SPAIN | | 256,138 |

Sweden - 1.3% |

Scania AB (B Shares) | 4,083,200 | | 111,499 |

SSAB Svenskt Stal AB (A Shares) | 216,200 | | 7,010 |

Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR | 3,526,200 | | 105,962 |

TOTAL SWEDEN | | 224,471 |

Switzerland - 8.7% |

ABB Ltd.: | | | |

(Reg.) | 4,987,147 | | 150,006 |

sponsored ADR | 1,898,700 | | 57,379 |

Basilea Pharmaceutica AG (a) | 132,140 | | 24,915 |

Credit Suisse Group sponsored ADR | 919,400 | | 62,243 |

Credit Suisse Group (Reg.) | 456,032 | | 30,873 |

Julius Baer Holding AG (Bearer) | 968,951 | | 83,820 |

Nestle SA: | | | |

(Reg.) | 424,214 | | 195,987 |

sponsored ADR | 1,103,600 | | 127,466 |

Novartis AG sponsored ADR | 1,125,900 | | 59,864 |

Roche Holding AG (participation certificate) | 2,172,980 | | 371,362 |

SGS Societe Generale de Surveillance Holding SA (Reg.) | 98,154 | | 128,635 |

Sonova Holding AG | 6,217 | | 698 |

Swiss Life Holding | 209,248 | | 57,808 |

Swisscom AG (Reg.) | 45,111 | | 16,679 |

Zurich Financial Services AG (Reg.) | 310,744 | | 93,561 |

TOTAL SWITZERLAND | | 1,461,296 |

Taiwan - 2.3% |

Advanced Semiconductor Engineering, Inc. | 79,815,374 | | 96,098 |

Compal Electronics, Inc. | 23,928,045 | | 30,321 |

Common Stocks - continued |

| Shares | | Value (000s) |

Taiwan - continued |

Siliconware Precision Industries Co. Ltd. sponsored ADR (d) | 6,680,541 | | $ 77,361 |

Taiwan Mobile Co. Ltd. | 42,544,000 | | 56,997 |

Taiwan Semiconductor Manufacturing Co. Ltd. | 14,013,708 | | 27,599 |

Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 3,084,141 | | 32,846 |

Wistron Corp. | 32,869,618 | | 65,445 |

TOTAL TAIWAN | | 386,667 |

United Kingdom - 9.0% |

Anglo American PLC ADR | 1,771,042 | | 61,898 |

BP PLC | 6,596,300 | | 85,741 |

BP PLC sponsored ADR | 2,242,700 | | 174,908 |

Dawnay Day Treveria PLC (e) | 34,888,528 | | 44,102 |

GlaxoSmithKline PLC | 609,800 | | 15,626 |

Intertek Group PLC | 1,513,300 | | 32,375 |

Misys PLC | 1,770,444 | | 8,898 |

NETeller PLC (a) | 4,254,500 | | 6,324 |

Next PLC | 305,400 | | 14,020 |

Rentokil Initial PLC | 18,789,300 | | 67,190 |

Rio Tinto PLC: | | | |

(Reg.) | 464,400 | | 43,537 |

sponsored ADR | 190,800 | | 71,550 |

Royal Dutch Shell PLC Class A sponsored ADR | 1,275,400 | | 111,610 |

Serco Group PLC | 1,418,748 | | 13,296 |

Tesco PLC | 11,472,054 | | 117,589 |

Unilever PLC | 516,300 | | 17,482 |

Unilever PLC sponsored ADR | 1,509,260 | | 51,104 |

Vodafone Group PLC | 8,708,600 | | 34,199 |

Vodafone Group PLC sponsored ADR | 13,988,100 | | 549,311 |

TOTAL UNITED KINGDOM | | 1,520,760 |

United States of America - 0.4% |

Microsoft Corp. | 1,956,400 | | 72,015 |

TOTAL COMMON STOCKS (Cost $13,668,780) | 16,499,217 |

Preferred Stocks - 0.5% |

| | | |

Convertible Preferred Stocks - 0.0% |

Canada - 0.0% |

MetroPhotonics, Inc. Series 2 (a)(g) | 8,500 | | 0 |

Preferred Stocks - continued |

| Shares | | Value (000s) |

Nonconvertible Preferred Stocks - 0.5% |

Germany - 0.3% |

Henkel KGaA | 362,700 | | $ 18,513 |

Volkswagen AG | 163,000 | | 30,936 |

TOTAL GERMANY | | 49,449 |

Italy - 0.2% |

Buzzi Unicem SpA (Risp) | 1,569,595 | | 30,131 |

Fondiaria-Sai SpA (Risp) | 321,300 | | 10,953 |

TOTAL ITALY | | 41,084 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS | | 90,533 |

TOTAL PREFERRED STOCKS (cost $87,709) | | 90,533 |

Government Obligations - 0.1% |

| Principal Amount (000s) | | |

United States of America - 0.1% |

U.S. Treasury Bills, yield at date of purchase 3.86% to 4.85% 11/1/07 to 1/31/08 (f)

(Cost $14,533) | $ 14,600 | | 14,536 |

Money Market Funds - 5.3% |

| Shares | | |

Fidelity Cash Central Fund, 4.97% (b) | 420,841,930 | | 420,842 |

Fidelity Securities Lending Cash Central Fund, 5.02% (b)(c) | 477,582,702 | | 477,583 |

TOTAL MONEY MARKET FUNDS (Cost $898,425) | 898,425 |

Cash Equivalents - 0.1% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at 4.54%, dated 10/31/07 due 11/1/07 (Collateralized by U.S. Treasury Obligations) #

(Cost $6,750) | $ 6,751 | | $ 6,750 |

TOTAL INVESTMENT PORTFOLIO - 104.0% (Cost $14,676,197) | | 17,509,461 |

NET OTHER ASSETS - (4.0)% | | (668,159) |

NET ASSETS - 100% | $ 16,841,302 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Purchased |

Equity Index Contracts |

2,455 Nikkei 225 Index Contracts (Japan) | Dec. 2007 | | $ 206,895 | | $ 10,753 |

|

The face value of futures purchased as a percentage of net assets - 1.2% |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Affiliated company |

(f) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At the period end, the value of securities pledged amounted to $10,377,000. |

(g) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $80,000 or 0.0% of net assets. |

Additional information on each holding is as follows: |

Security | Acquisition Date | Acquisition Cost (000s) |

MetroPhotonics, Inc. Series 2 | 9/29/00 | $ 85 |

OZ Optics Ltd. unit | 8/18/00 | $ 80 |

# Additional Information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(000s) |

$6,750,000 due 11/01/07 at 4.54% |

Banc of America Securities LLC | $ 3,833 |

Lehman Brothers, Inc. | 2,917 |

| $ 6,750 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned

(Amounts in thousands) |

Fidelity Cash Central Fund | $ 42,393 |

Fidelity Securities Lending Cash Central Fund | 13,653 |

Total | $ 56,046 |

Other Affiliated Issuers |

An affiliated company is a company in which the fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliates

(Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds | Dividend Income | Value,

end of

period |

Arealink Co. Ltd. | $ 6,046 | $ 45,150 | $ - | $ 30 | $ 43,272 |

Dawnay Day Treveria PLC | 40,978 | 19,267 | 4,857 | 2,294 | 44,102 |

KUKA AG

(formerly IWKA AG) | 31,757 | - | 42,021 | - | - |

OMC Card, Inc. | 51,128 | 35,323 | - | 506 | 42,243 |

SGL Carbon AG | 79,939 | - | 175,743 | - | - |

Total | $ 209,848 | $ 99,740 | $ 222,621 | $ 2,830 | $ 129,617 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amounts) | October 31, 2007 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $472,136 and repurchase agreements of $6,750) - See accompanying schedule: Unaffiliated issuers (cost $13,564,590) | $ 16,481,419 | |

Fidelity Central Funds (cost $898,425) | 898,425 | |

Other affiliated issuers (cost $213,182) | 129,617 | |

Total Investments (cost $14,676,197) | | $ 17,509,461 |

Receivable for investments sold | | 151,863 |

Receivable for fund shares sold | | 15,972 |

Dividends receivable | | 24,030 |

Distributions receivable from Fidelity Central Funds | | 2,490 |

Receivable for daily variation on futures contracts | | 2,578 |

Prepaid expenses | | 6 |

Other receivables | | 1,457 |

Total assets | | 17,707,857 |

| | |

Liabilities | | |

Payable to custodian bank | $ 6,903 | |

Payable for investments purchased | 323,145 | |

Payable for fund shares redeemed | 36,676 | |

Accrued management fee | 9,799 | |

Distribution fees payable | 4,466 | |

Other affiliated payables | 2,947 | |

Other payables and accrued expenses | 5,036 | |

Collateral on securities loaned, at value | 477,583 | |

Total liabilities | | 866,555 |

| | |

Net Assets | | $ 16,841,302 |

Net Assets consist of: | | |

Paid in capital | | $ 11,712,337 |

Undistributed net investment income | | 152,430 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 2,132,259 |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 2,844,276 |

Net Assets | | $ 16,841,302 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities - continued

Amounts in thousands (except per-share amounts) | October 31, 2007 |

| | |

Calculation of Maximum Offering Price

Class A: Net Asset Value and redemption price per share ($5,774,215 ÷ 216,942 shares) | | $ 26.62 |

| | |

Maximum offering price per share (100/94.25 of $26.62) | | $ 28.24 |

Class T:

Net Asset Value and redemption price per share ($3,568,880 ÷ 135,677 shares) | | $ 26.30 |

| | |

Maximum offering price per share (100/96.50 of $26.30) | | $ 27.25 |

Class B:

Net Asset Value and offering price per share

($558,966 ÷ 21,976 shares)A | | $ 25.44 |

| | |

Class C:

Net Asset Value and offering price per share ($1,672,927 ÷ 65,599 shares)A | | $ 25.50 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($5,266,314 ÷ 194,651 shares) | | $ 27.06 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Year ended October 31, 2007 |

| | |

Investment Income | | |

Dividends (including $2,830 earned from other affiliated issuers) | | $ 370,521 |

Interest | | 1,336 |

Income from Fidelity Central Funds | | 56,046 |

| | 427,903 |

Less foreign taxes withheld | | (39,454) |

Total income | | 388,449 |

| | |

Expenses | | |

Management fee | $ 111,628 | |

Transfer agent fees | 32,939 | |

Distribution fees | 52,312 | |

Accounting and security lending fees | 2,250 | |

Custodian fees and expenses | 3,195 | |

Independent trustees' compensation | 53 | |

Registration fees | 555 | |

Audit | 156 | |

Legal | 187 | |

Miscellaneous | 4,641 | |

Total expenses before reductions | 207,916 | |

Expense reductions | (6,590) | 201,326 |

Net investment income (loss) | | 187,123 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 2,063,333 | |

Other affiliated issuers | 136,144 | |

Foreign currency transactions | (5,589) | |

Futures contracts | 16,138 | |

Total net realized gain (loss) | | 2,210,026 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 805,767 | |

Assets and liabilities in foreign currencies | 169 | |

Futures contracts | 148 | |

Total change in net unrealized appreciation (depreciation) | | 806,084 |

Net gain (loss) | | 3,016,110 |

Net increase (decrease) in net assets resulting from operations | | $ 3,203,233 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Amounts in thousands | Year ended

October 31,

2007 | Year ended

October 31,

2006 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 187,123 | $ 153,748 |

Net realized gain (loss) | 2,210,026 | 1,020,572 |

Change in net unrealized appreciation (depreciation) | 806,084 | 889,367 |

Net increase (decrease) in net assets resulting

from operations | 3,203,233 | 2,063,687 |

Distributions to shareholders from net investment income | (133,151) | (64,018) |

Distributions to shareholders from net realized gain | (974,839) | (425,957) |

Total distributions | (1,107,990) | (489,975) |

Share transactions - net increase (decrease) | 320,019 | 4,317,582 |

Redemption fees | 467 | 520 |

Total increase (decrease) in net assets | 2,415,729 | 5,891,814 |

| | |

Net Assets | | |

Beginning of period | 14,425,573 | 8,533,759 |

End of period (including undistributed net investment income of $152,430 and undistributed net investment income of $144,715, respectively) | $ 16,841,302 | $ 14,425,573 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 23.42 | $ 20.30 | $ 16.97 | $ 14.60 | $ 11.12 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .31 | .30 | .19 | .08 | .09 |

Net realized and unrealized gain (loss) | 4.69 | 3.91 | 3.27 | 2.41 | 3.45 |

Total from investment operations | 5.00 | 4.21 | 3.46 | 2.49 | 3.54 |

Distributions from net investment income | (.23) | (.14) | (.05) | (.12) | (.06) |

Distributions from net realized gain | (1.57) | (.95) | (.08) | - | - |

Total distributions | (1.80) | (1.09) | (.13) | (.12) | (.06) |

Redemption fees added to paid in capital C | - G | - G | - G | - G | - |

Net asset value, end of period | $ 26.62 | $ 23.42 | $ 20.30 | $ 16.97 | $ 14.60 |

Total Return A, B | 22.76% | 21.54% | 20.50% | 17.15% | 31.99% |

Ratios to Average Net Assets D, F | | | | | |

Expenses before reductions | 1.25% | 1.26% | 1.27% | 1.31% | 1.42% |

Expenses net of fee waivers, if any | 1.25% | 1.26% | 1.27% | 1.31% | 1.42% |

Expenses net of all reductions | 1.21% | 1.20% | 1.20% | 1.27% | 1.39% |

Net investment income (loss) | 1.26% | 1.33% | 1.02% | .51% | .71% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 5,774 | $ 4,694 | $ 2,792 | $ 1,294 | $ 241 |

Portfolio turnover rate E | 105% | 83% | 59% | 72% | 49% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 23.17 | $ 20.12 | $ 16.82 | $ 14.47 | $ 11.01 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .25 | .25 | .15 | .03 | .05 |

Net realized and unrealized gain (loss) | 4.63 | 3.89 | 3.23 | 2.39 | 3.43 |

Total from investment operations | 4.88 | 4.14 | 3.38 | 2.42 | 3.48 |

Distributions from net investment income | (.18) | (.14) | - | (.07) | (.02) |

Distributions from net realized gain | (1.57) | (.95) | (.08) | - | - |

Total distributions | (1.75) | (1.09) | (.08) | (.07) | (.02) |

Redemption fees added to paid in capital C | - G | - G | - G | - G | - |

Net asset value, end of period | $ 26.30 | $ 23.17 | $ 20.12 | $ 16.82 | $ 14.47 |

Total Return A, B | 22.43% | 21.33% | 20.16% | 16.78% | 31.66% |

Ratios to Average Net Assets D, F | | | | | |

Expenses before reductions | 1.47% | 1.48% | 1.51% | 1.61% | 1.75% |

Expenses net of fee waivers, if any | 1.47% | 1.48% | 1.51% | 1.61% | 1.75% |

Expenses net of all reductions | 1.43% | 1.42% | 1.45% | 1.57% | 1.72% |

Net investment income (loss) | 1.04% | 1.12% | .77% | .21% | .38% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 3,569 | $ 3,609 | $ 2,420 | $ 1,510 | $ 552 |

Portfolio turnover rate E | 105% | 83% | 59% | 72% | 49% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 22.46 | $ 19.60 | $ 16.46 | $ 14.19 | $ 10.84 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .10 | .10 | .02 | (.07) | (.02) |

Net realized and unrealized gain (loss) | 4.50 | 3.79 | 3.16 | 2.35 | 3.37 |

Total from investment operations | 4.60 | 3.89 | 3.18 | 2.28 | 3.35 |

Distributions from net investment income | (.05) | (.08) | - | (.01) | - |

Distributions from net realized gain | (1.57) | (.95) | (.04) | - | - |

Total distributions | (1.62) | (1.03) | (.04) | (.01) | - |

Redemption fees added to paid in capital C | - G | - G | - G | - G | - |

Net asset value, end of period | $ 25.44 | $ 22.46 | $ 19.60 | $ 16.46 | $ 14.19 |

Total Return A, B | 21.73% | 20.55% | 19.35% | 16.08% | 30.90% |

Ratios to Average Net Assets D, F | | | | | |

Expenses before reductions | 2.08% | 2.12% | 2.16% | 2.24% | 2.32% |

Expenses net of fee waivers, if any | 2.08% | 2.12% | 2.16% | 2.24% | 2.32% |

Expenses net of all reductions | 2.04% | 2.06% | 2.10% | 2.20% | 2.29% |

Net investment income (loss) | .42% | .48% | .12% | (.42)% | (.19)% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 559 | $ 508 | $ 351 | $ 196 | $ 89 |

Portfolio turnover rate E | 105% | 83% | 59% | 72% | 49% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 22.53 | $ 19.65 | $ 16.48 | $ 14.22 | $ 10.86 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | .12 | .12 | .04 | (.05) | (.01) |

Net realized and unrealized gain (loss) | 4.50 | 3.79 | 3.17 | 2.35 | 3.37 |

Total from investment operations | 4.62 | 3.91 | 3.21 | 2.30 | 3.36 |

Distributions from net investment income | (.08) | (.08) | - | (.04) | - |

Distributions from net realized gain | (1.57) | (.95) | (.04) | - | - |

Total distributions | (1.65) | (1.03) | (.04) | (.04) | - |

Redemption fees added to paid in capital C | - G | - G | - G | - G | - |

Net asset value, end of period | $ 25.50 | $ 22.53 | $ 19.65 | $ 16.48 | $ 14.22 |

Total Return A, B | 21.81% | 20.62% | 19.51% | 16.21% | 30.94% |

Ratios to Average Net Assets D, F | | | | | |

Expenses before reductions | 2.00% | 2.02% | 2.05% | 2.13% | 2.23% |

Expenses net of fee waivers, if any | 2.00% | 2.02% | 2.05% | 2.13% | 2.23% |

Expenses net of all reductions | 1.96% | 1.96% | 1.99% | 2.09% | 2.20% |

Net investment income (loss) | .51% | .57% | .23% | (.31)% | (.10)% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 1,673 | $ 1,395 | $ 758 | $ 381 | $ 124 |

Portfolio turnover rate E | 105% | 83% | 59% | 72% | 49% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended October 31, | 2007 | 2006 | 2005 | 2004 | 2003 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 23.78 | $ 20.56 | $ 17.18 | $ 14.74 | $ 11.22 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .38 | .37 | .25 | .13 | .13 |

Net realized and unrealized gain (loss) | 4.76 | 3.98 | 3.30 | 2.44 | 3.48 |

Total from investment operations | 5.14 | 4.35 | 3.55 | 2.57 | 3.61 |

Distributions from net investment income | (.29) | (.18) | (.09) | (.13) | (.09) |

Distributions from net realized gain | (1.57) | (.95) | (.08) | - | - |

Total distributions | (1.86) | (1.13) | (.17) | (.13) | (.09) |

Redemption fees added to paid in capital B | - F | - F | - F | - F | - |

Net asset value, end of period | $ 27.06 | $ 23.78 | $ 20.56 | $ 17.18 | $ 14.74 |

Total Return A | 23.07% | 21.96% | 20.81% | 17.54% | 32.41% |

Ratios to Average Net Assets C, E | | | | | |

Expenses before reductions | .98% | .97% | .97% | 1.03% | 1.09% |

Expenses net of fee waivers, if any | .98% | .97% | .97% | 1.03% | 1.09% |

Expenses net of all reductions | .94% | .92% | .91% | .98% | 1.06% |

Net investment income (loss) | 1.53% | 1.62% | 1.32% | .80% | 1.04% |

Supplemental Data | | | | | |

Net assets, end of period (in millions) | $ 5,266 | $ 4,220 | $ 2,213 | $ 1,185 | $ 391 |

Portfolio turnover rate D | 105% | 83% | 59% | 72% | 49% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of the underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

F Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2007

(Amounts in thousands except ratios)

1. Organization.

Fidelity Advisor Diversified International Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund may invest in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete list of holdings for each Fidelity Central Fund is available upon request or at the SEC's web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's web site or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Fund:

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the Fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securities markets, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange-traded funds. Because the Fund's utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used cannot be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The Fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

Annual Report

3. Significant Accounting Policies - continued

Foreign Currency - continued

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received.

Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The Fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the Fund will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to futures transactions, foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), market discount and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

Unrealized appreciation | $ 3,355,737 | |

Unrealized depreciation | (560,220) | |

Net unrealized appreciation (depreciation) | 2,795,517 | |

Undistributed ordinary income | 302,420 | |

Undistributed long-term capital gain | 1,706,995 | |

| | |

Cost for federal income tax purposes | $ 14,713,944 | |

The tax character of distributions paid was as follows:

| October 31, 2007 | October 31, 2006 |

Ordinary Income | $ 313,217 | $ 171,628 |

Long-term Capital Gains | 794,773 | 318,347 |

Total | $ 1,107,990 | $ 489,975 |

Short-Term Trading (Redemption) Fees. Shares held in the Fund less than 30 days are subject to a redemption fee equal to 1.00% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncements. In July 2006, Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement 109 (FIN 48), was issued and is effective on the last business day of the semiannual reporting period for fiscal years beginning after December 15, 2006. FIN 48 sets forth a threshold for financial statement recognition, measurement and disclosure of a tax position taken or expected to be taken on a tax return. Management has concluded that the adoption of FIN 48 will not result in a material impact on the Fund's net assets, results of operations and financial statement disclosures.

Annual Report

3. Significant Accounting Policies - continued

New Accounting Pronouncements - continued

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund's financial statement disclosures.

4. Operating Policies.

Repurchase Agreements. FMR has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits the Fund and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Futures Contracts. The Fund may use futures contracts to manage its exposure to the stock market and to fluctuations in currency values. Buying futures tends to increase a fund's exposure to the underlying instrument, while selling futures tends to decrease a fund's exposure to the underlying instrument or hedge other fund investments. Upon entering into a futures contract, a fund is required to deposit with a clearing broker, no later than the following business day, an amount ("initial margin") equal to a certain percentage of the face value of the contract. The initial margin may be in the form of cash or securities and is transferred to a segregated account on settlement date. Subsequent payments ("variation margin") are made or received by a fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized gains or losses. Realized gains (losses) are recorded upon the expiration or closing of the futures contract. Securities deposited to meet margin requirements are identified in the Schedule of Investments. Futures contracts involve, to varying degrees, risk of loss in excess of any futures variation margin reflected in the Statement of Assets and Liabilities. The underlying face amount at value of any open futures contracts at period end is shown in the Schedule of Investments under the caption "Futures Contracts." This amount reflects each contract's exposure to the underlying instrument at period end.

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

4. Operating Policies - continued

Futures Contracts - continued

Losses may arise from changes in the value of the underlying instruments or if the counterparties do not perform under the contract's terms. Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $15,731,642 and $15,964,220, respectively.

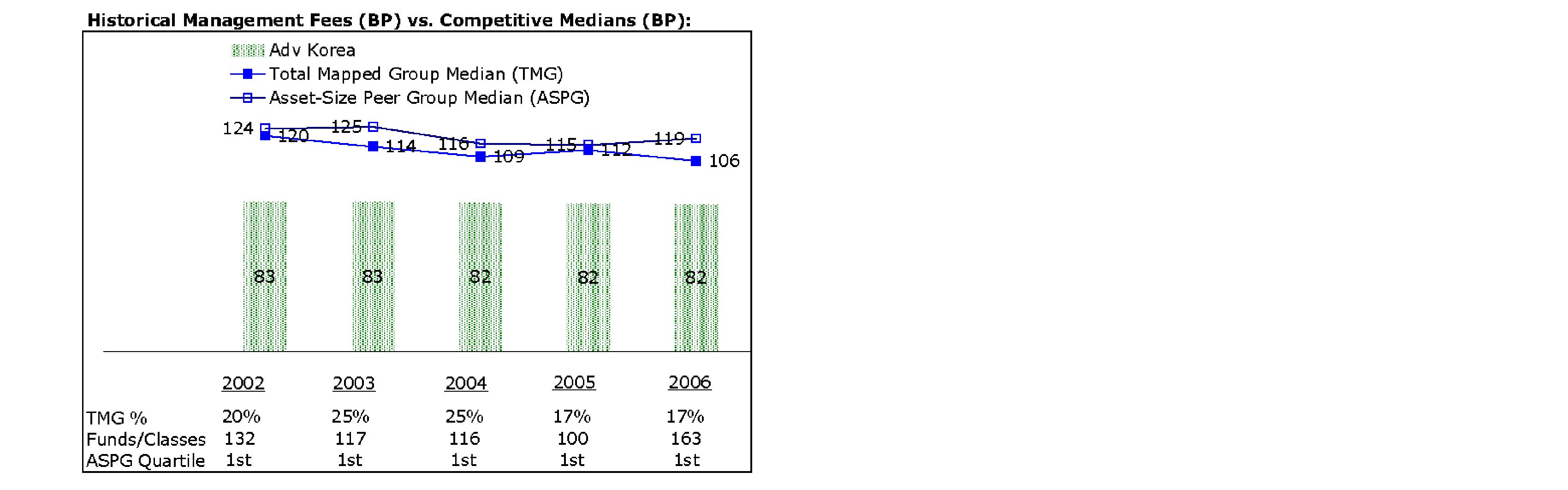

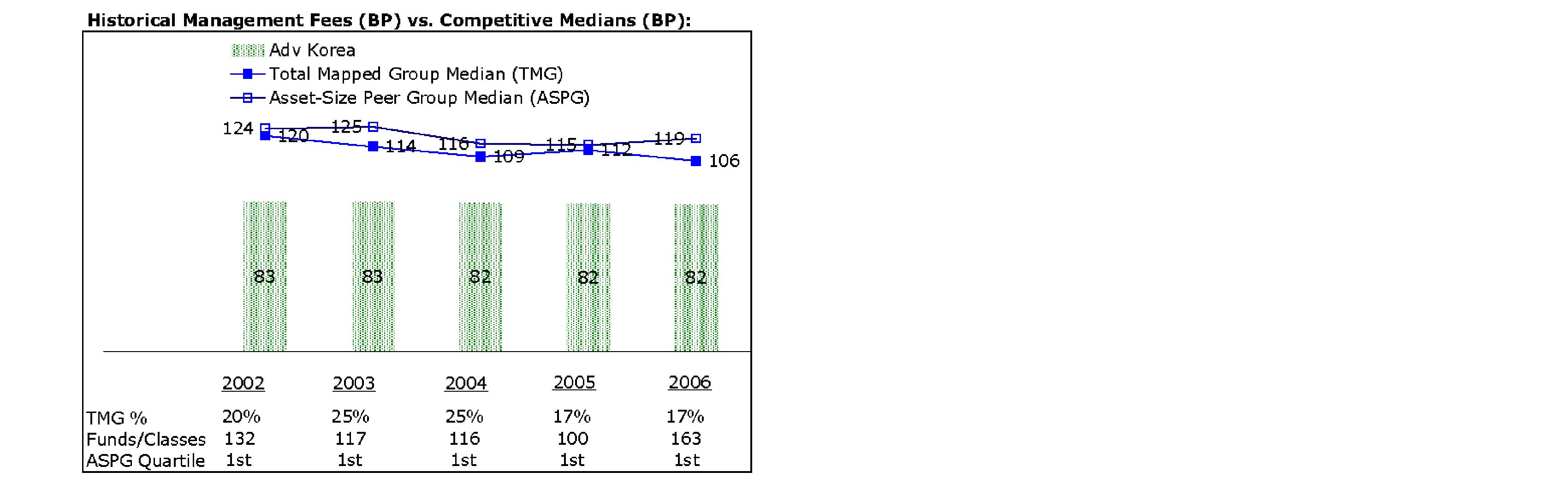

6. Fees and Other Transactions with Affiliates.

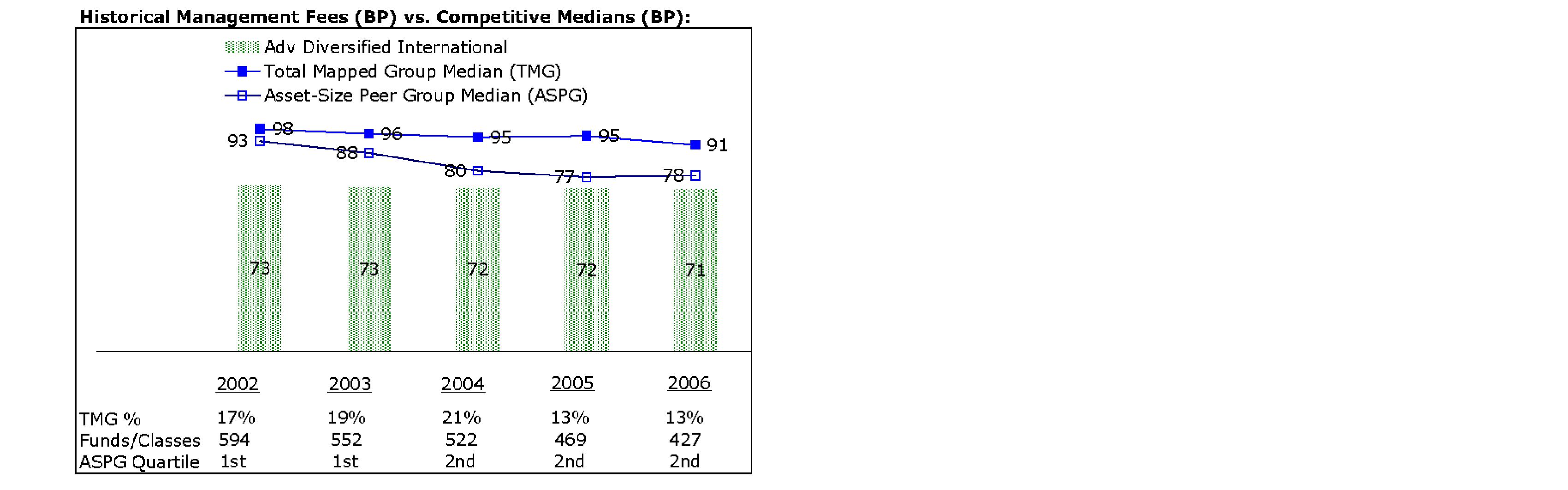

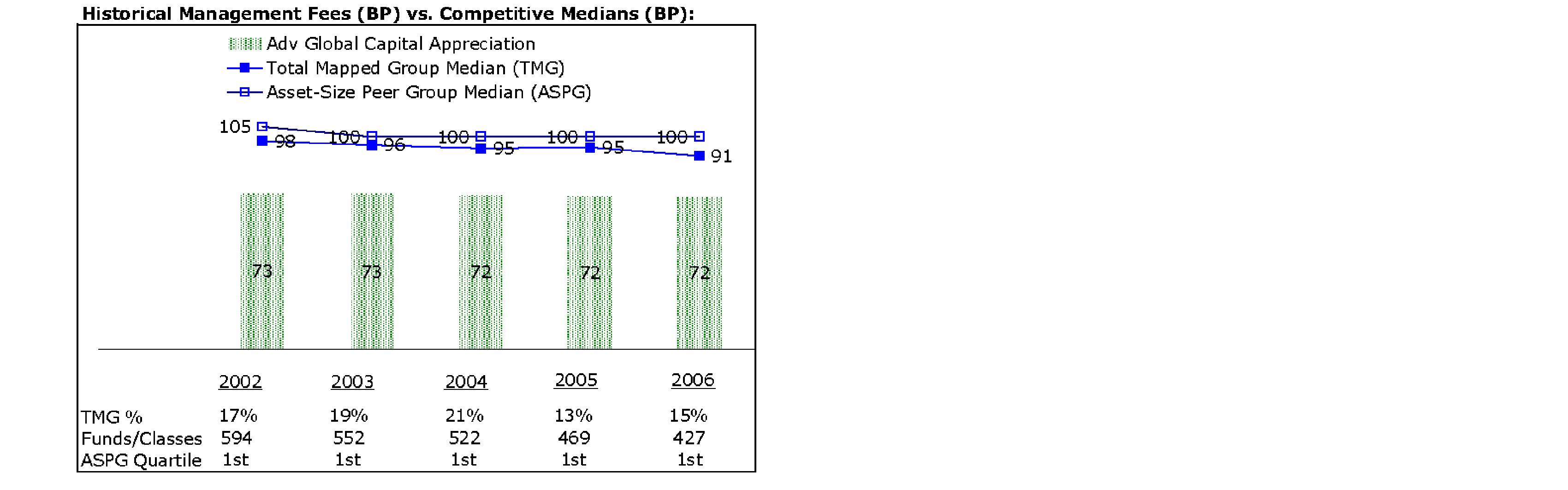

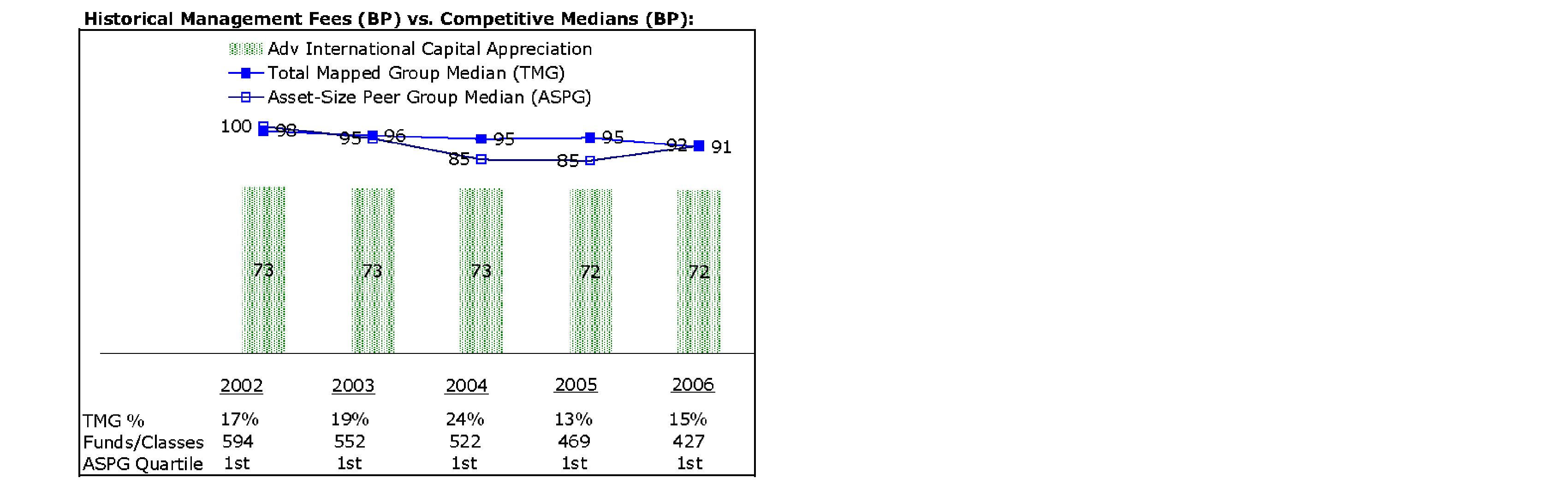

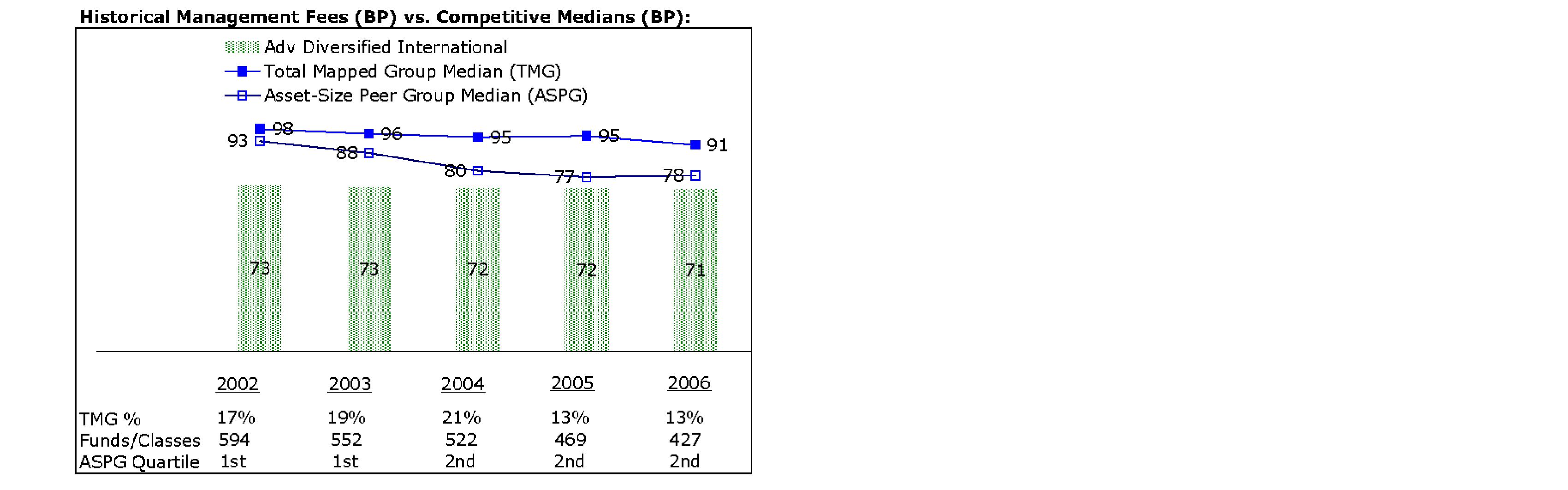

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and a group fee rate that averaged ..26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the period, the total annual management fee rate was .71% of the Fund's average net assets.

In December 2006, the Board of Trustees approved a new management contract, subject to shareholder approval, to add a performance adjustment to the management fee. The proposal did not receive the number of votes required at the shareholder meeting on October 17, 2007 and as a result no changes were made to the Fund's management contract.

Distribution and Service Plan. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage

Annual Report

6. Fees and Other Transactions with Affiliates - continued

Distribution and Service Plan - continued

of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates and the total amounts paid to and retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Paid to

FDC | Retained

by FDC |

Class A | 0% | .25% | $ 12,912 | $ 797 |

Class T | .25% | .25% | 18,557 | 577 |

Class B | .75% | .25% | 5,356 | 4,020 |

Class C | .75% | .25% | 15,487 | 3,642 |

| | | $ 52,312 | $ 9,036 |

Sales Load. FDC receives a front-end sales charge of up to 5.75% for selling Class A shares, and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. FDC receives the proceeds of contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. These charges depend on the holding period. The deferred sales charges range from 5% to 1% for Class B, 1% for Class C, 1.00% to .50% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC |

Class A | $ 1,065 |

Class T | 244 |

Class B* | 833 |

Class C* | 233 |

| $ 2,375 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. FIIOC pays for typesetting, printing and mailing of

Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

6. Fees and Other Transactions with Affiliates - continued

Transfer Agent Fees - continued

shareholder reports, except proxy statements. For the period, the total transfer agent fees paid by each class to FIIOC, were as follows:

| Amount | % of

Average

Net Assets |

Class A | $ 11,350 | .22 |

Class T | 7,114 | .19 |

Class B | 1,632 | .30 |

Class C | 3,418 | .22 |

Institutional Class | 9,425 | .20 |

| $ 32,939 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for the month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.