UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | October 31, 2012 |

Item 1. Reports to Stockholders

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

International

Capital Appreciation

Fund - Institutional Class

Annual Report

October 31, 2012

(Fidelity Cover Art)

Contents

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

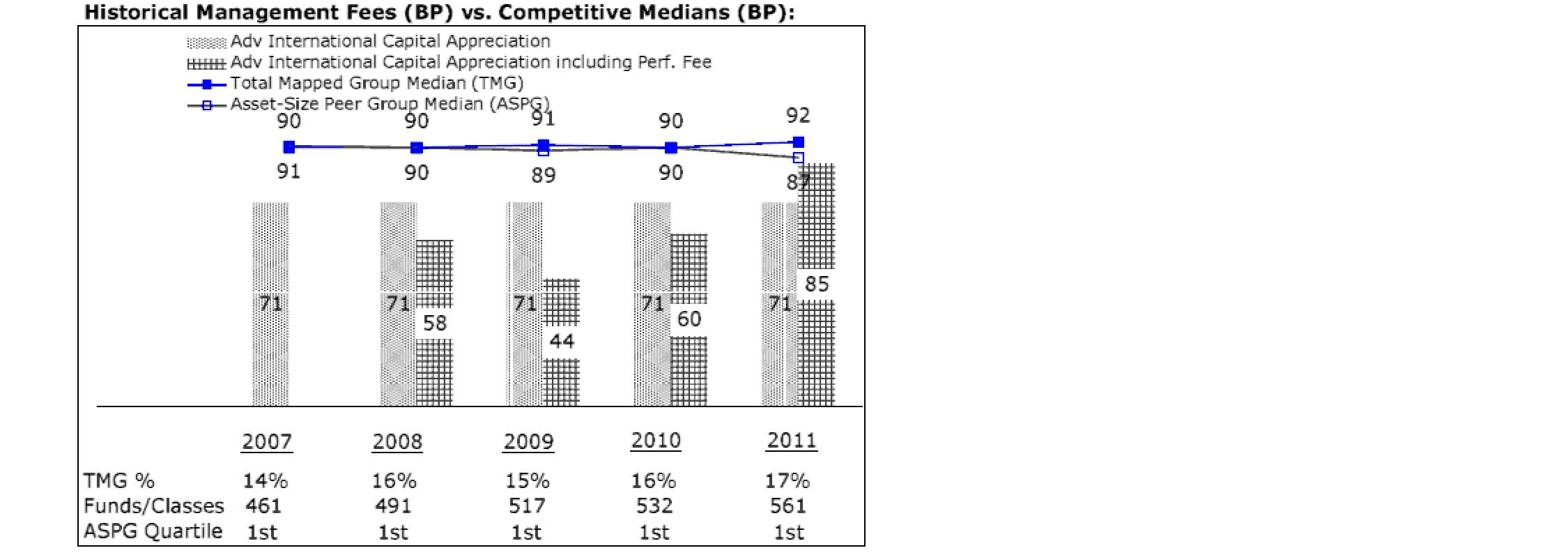

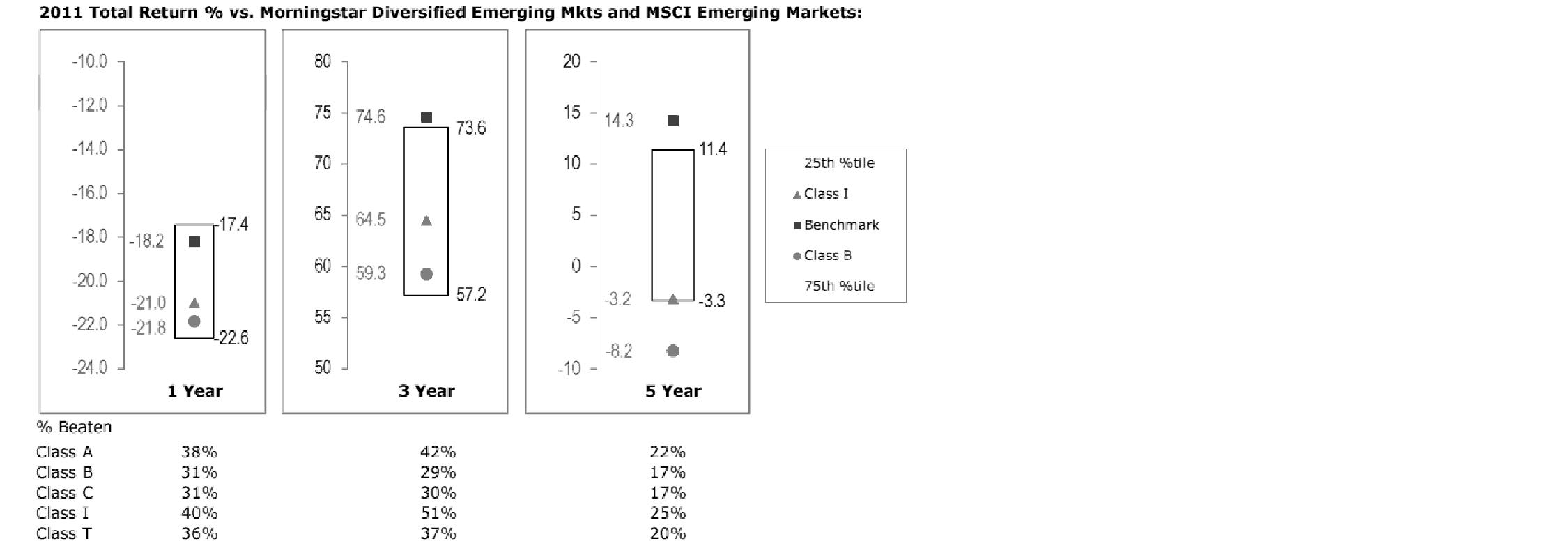

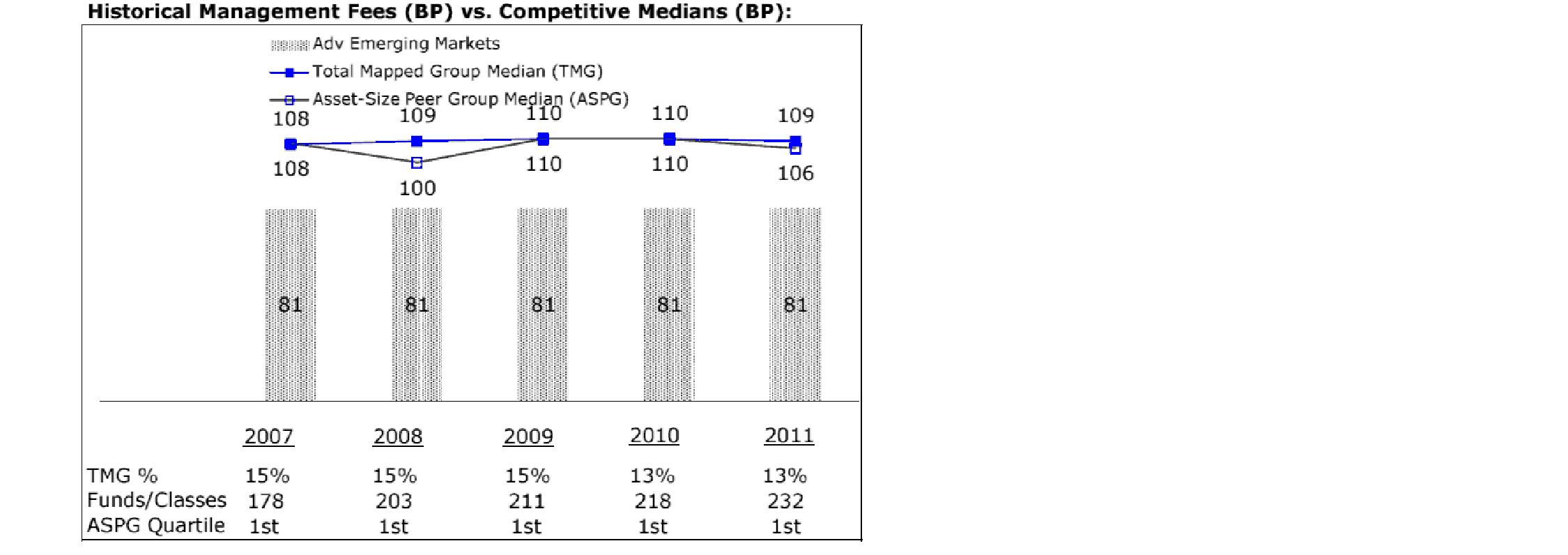

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2012 FMR LLC. All rights reserved.

Annual Report

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Annual Report

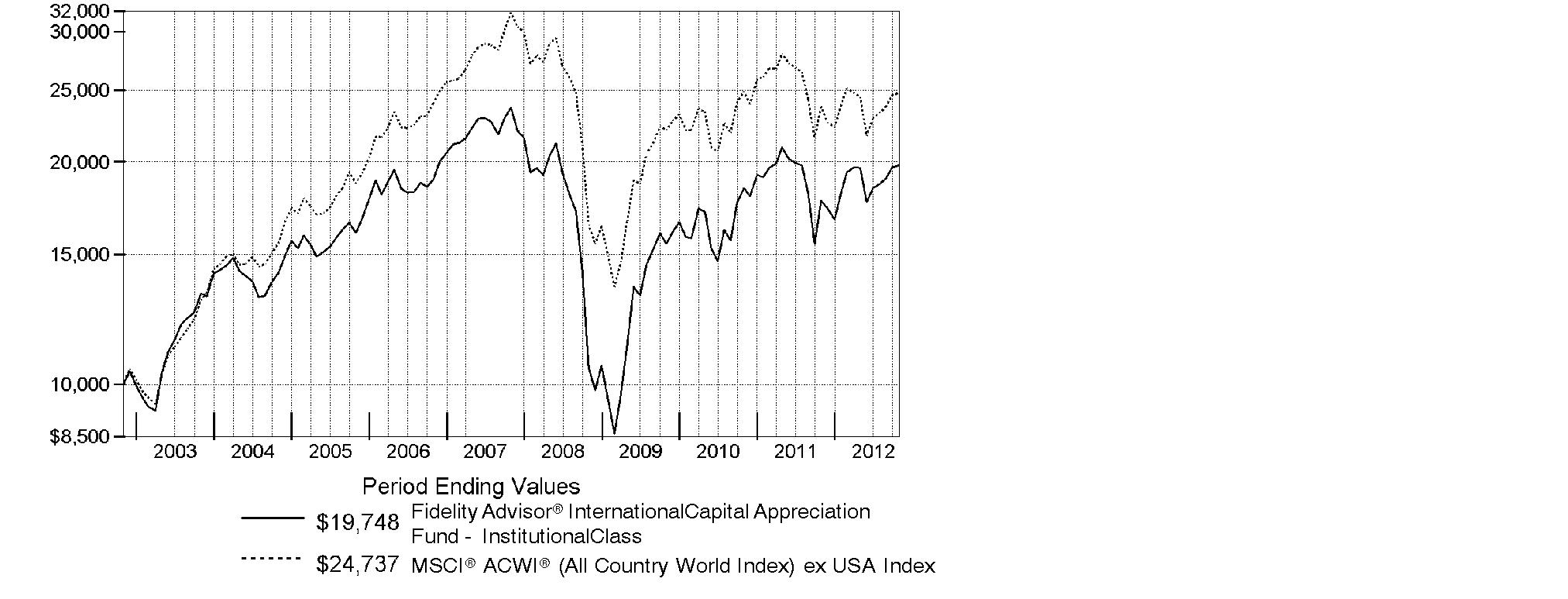

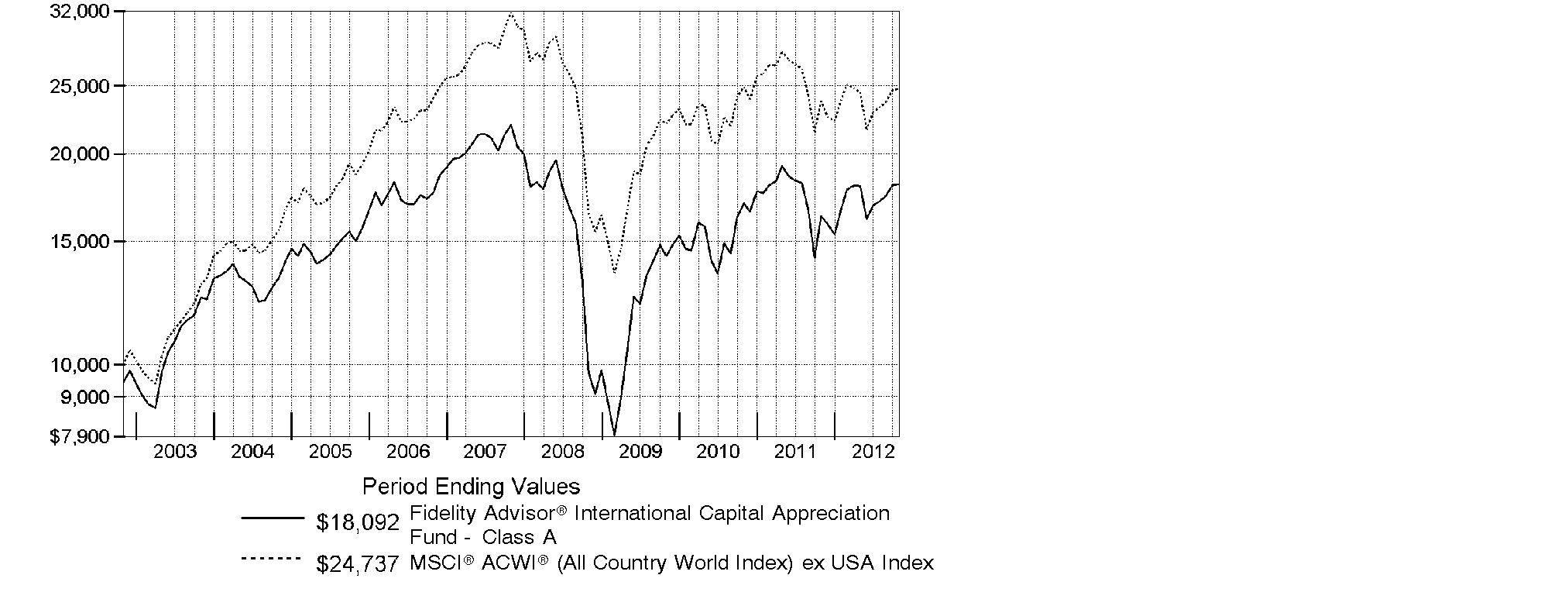

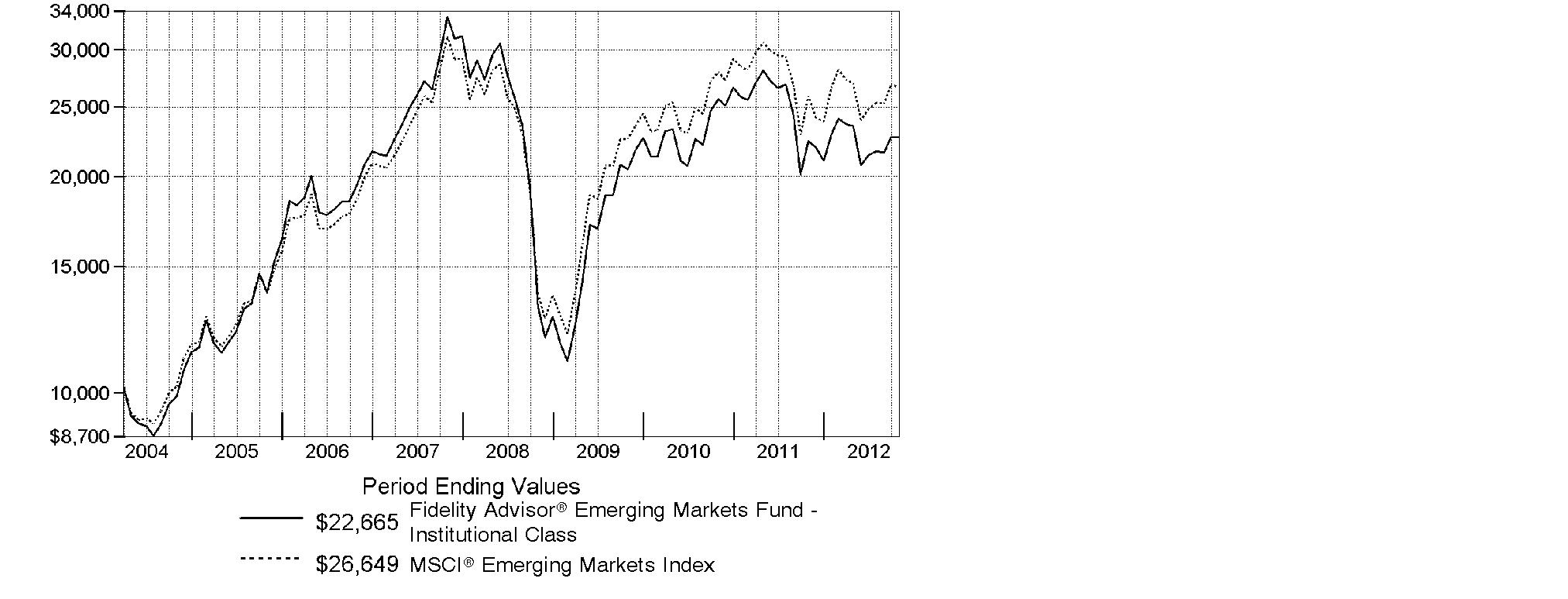

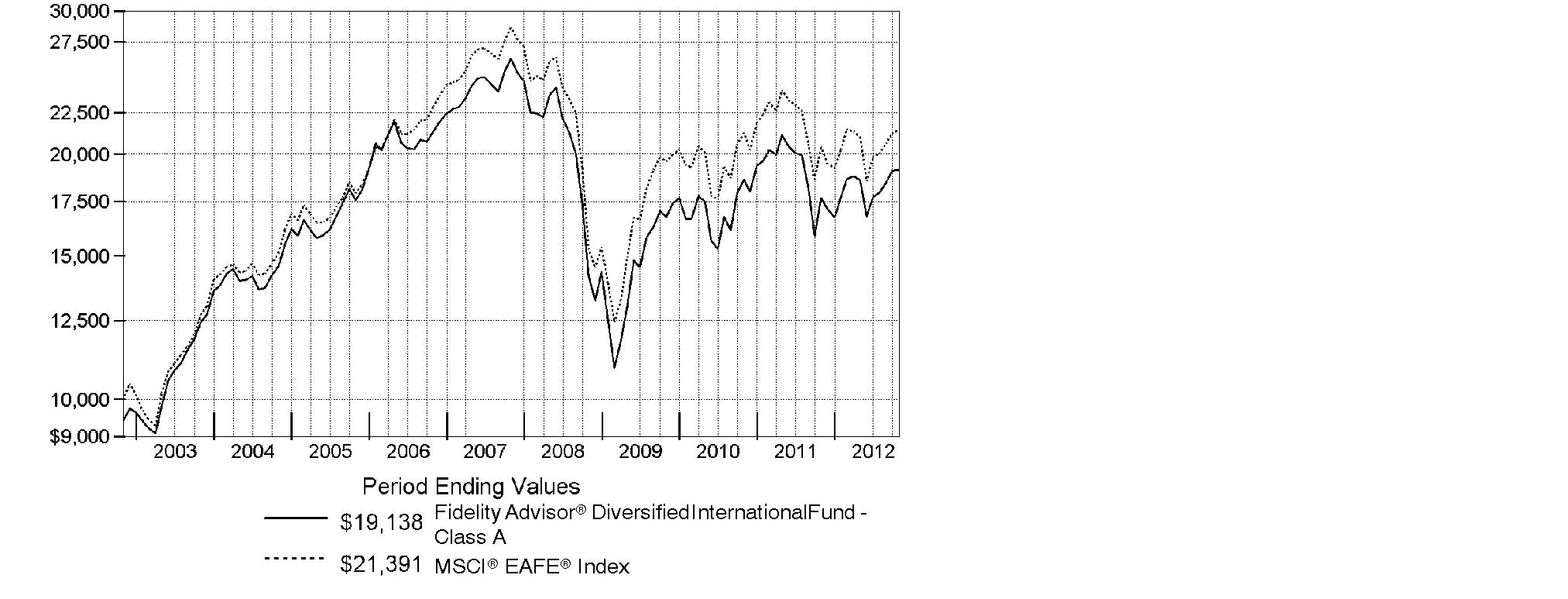

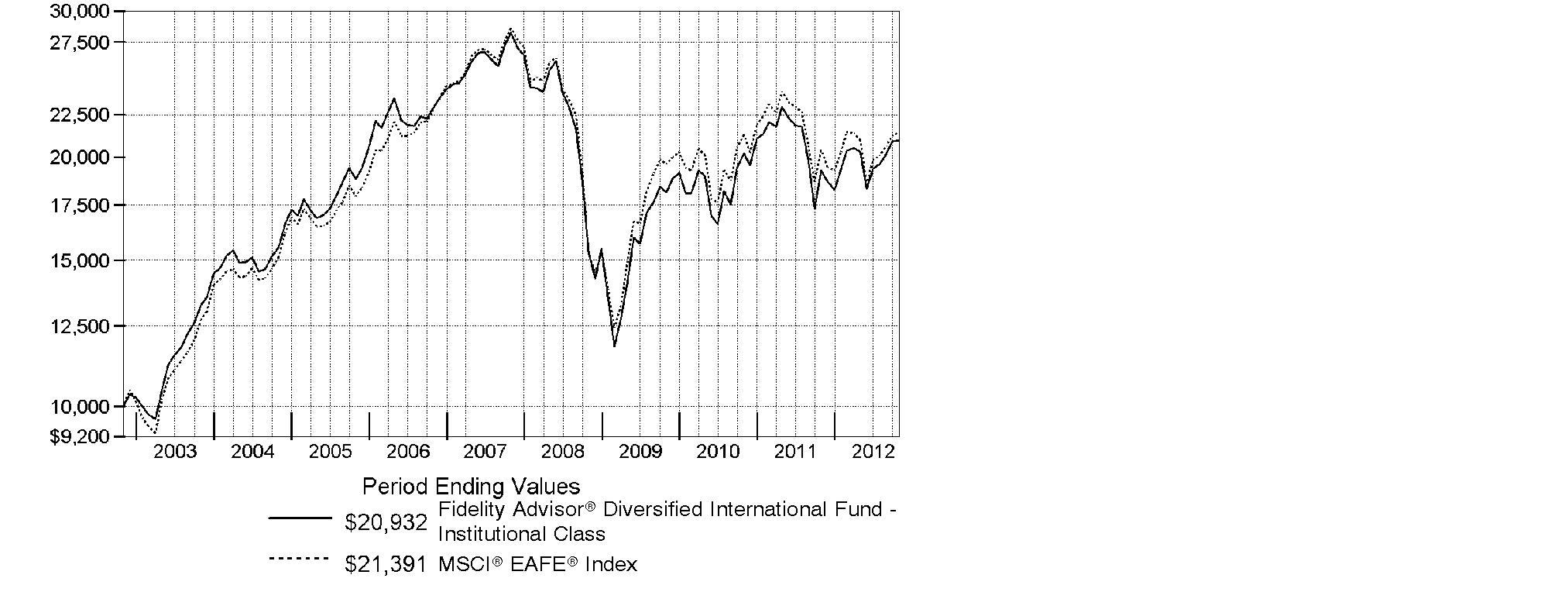

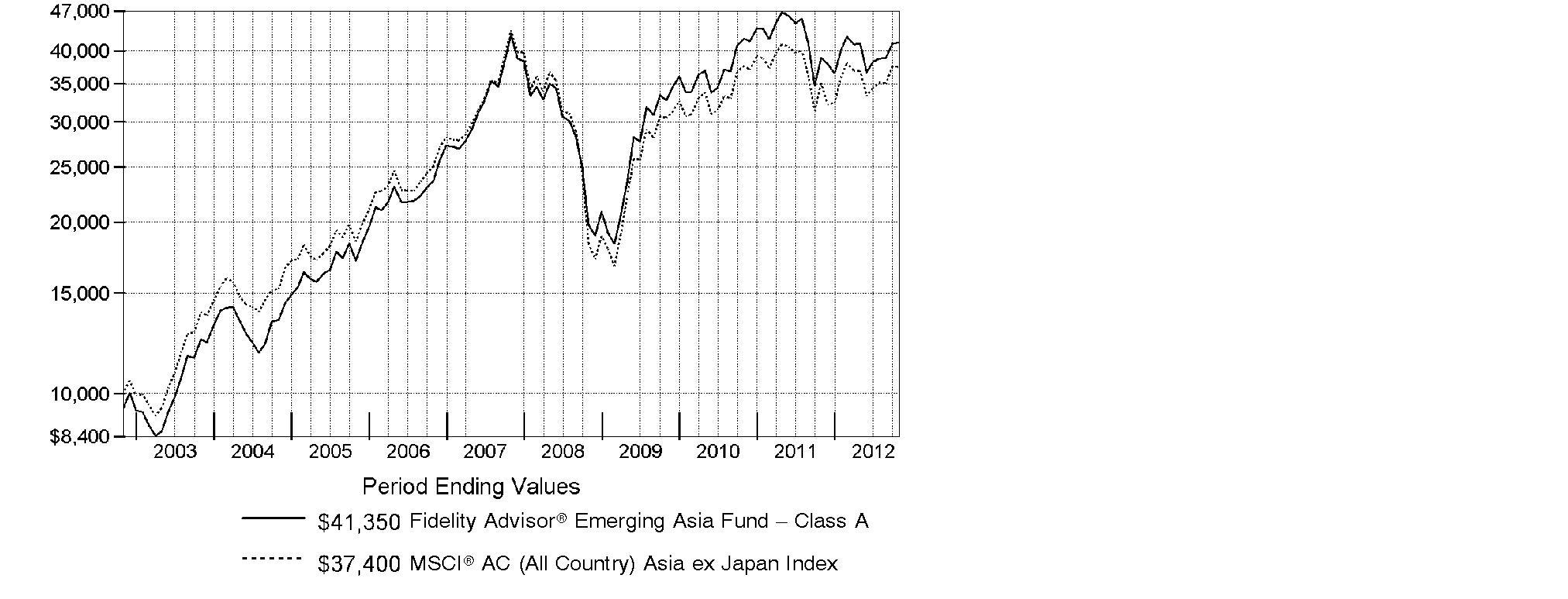

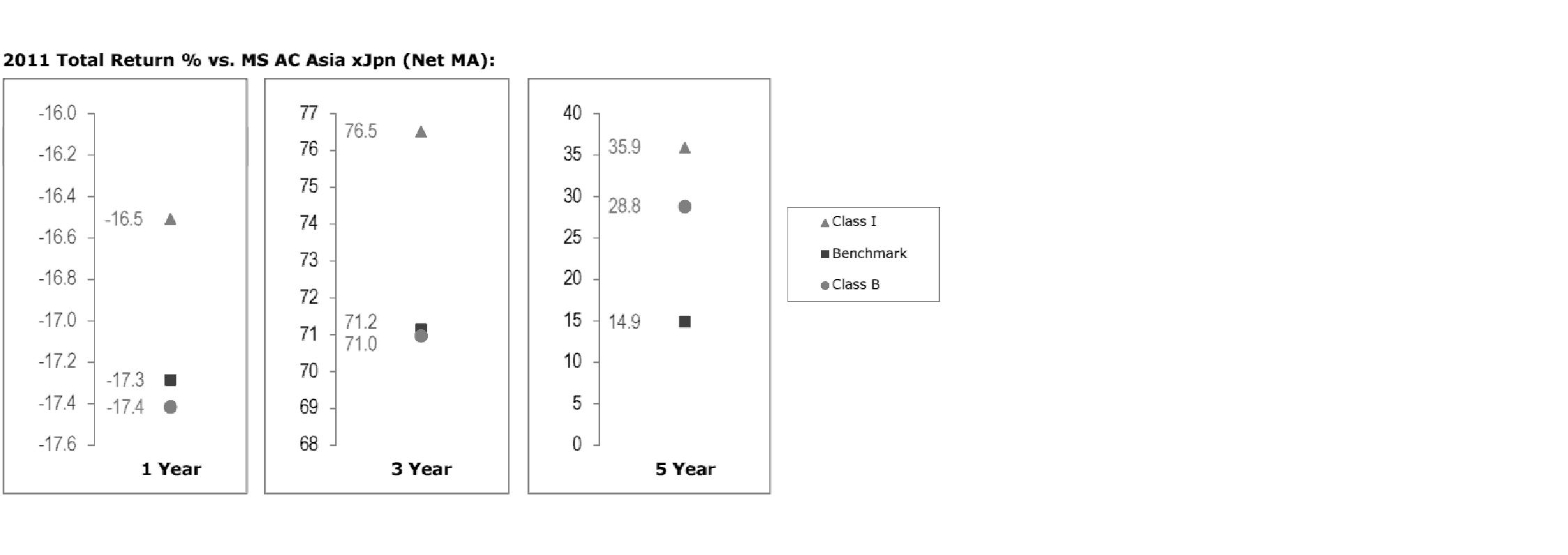

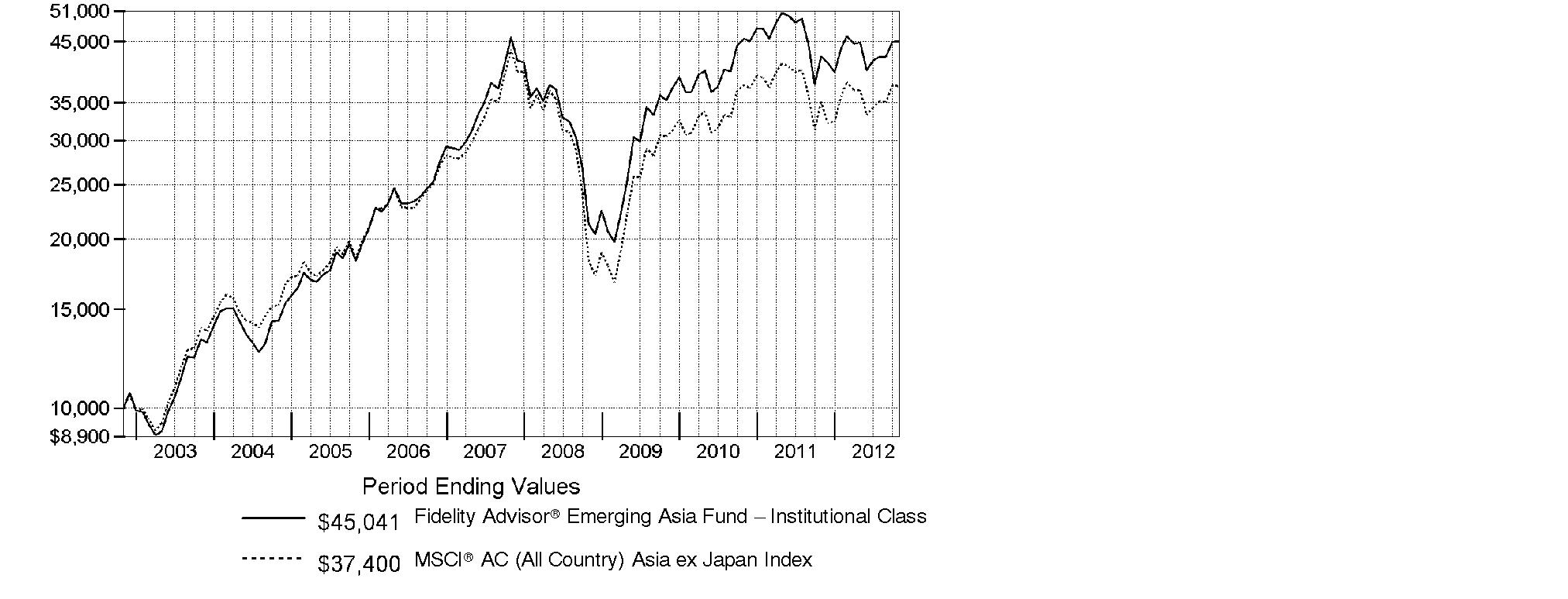

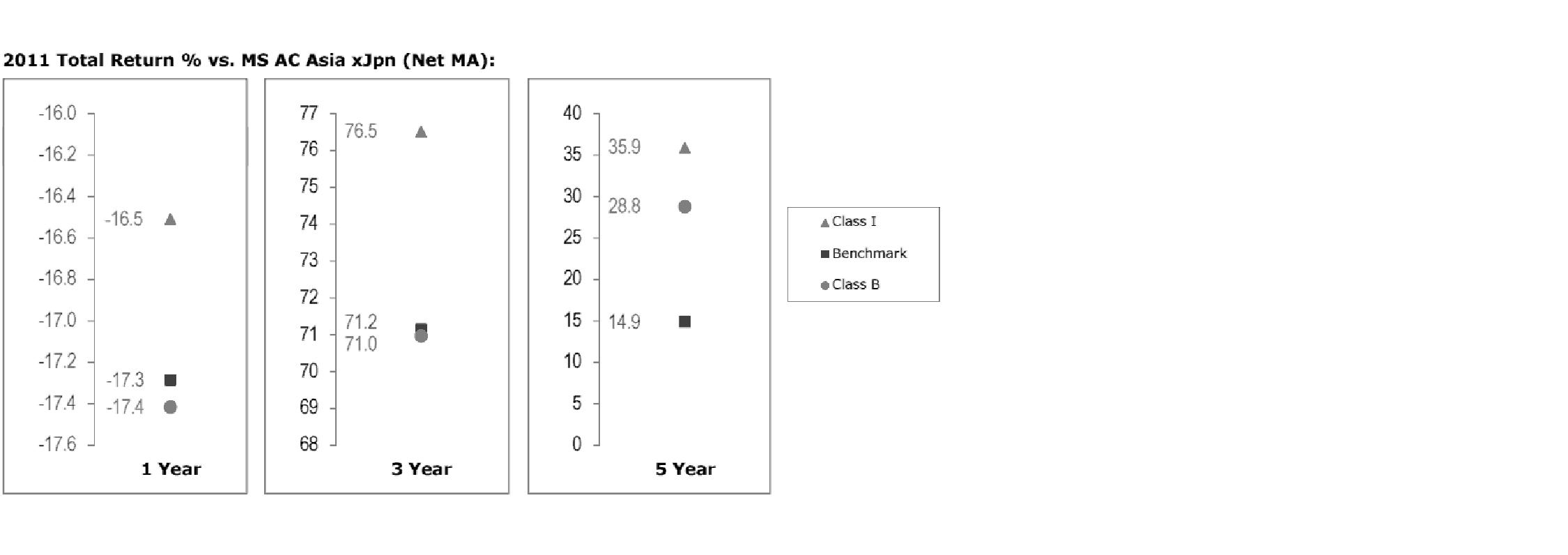

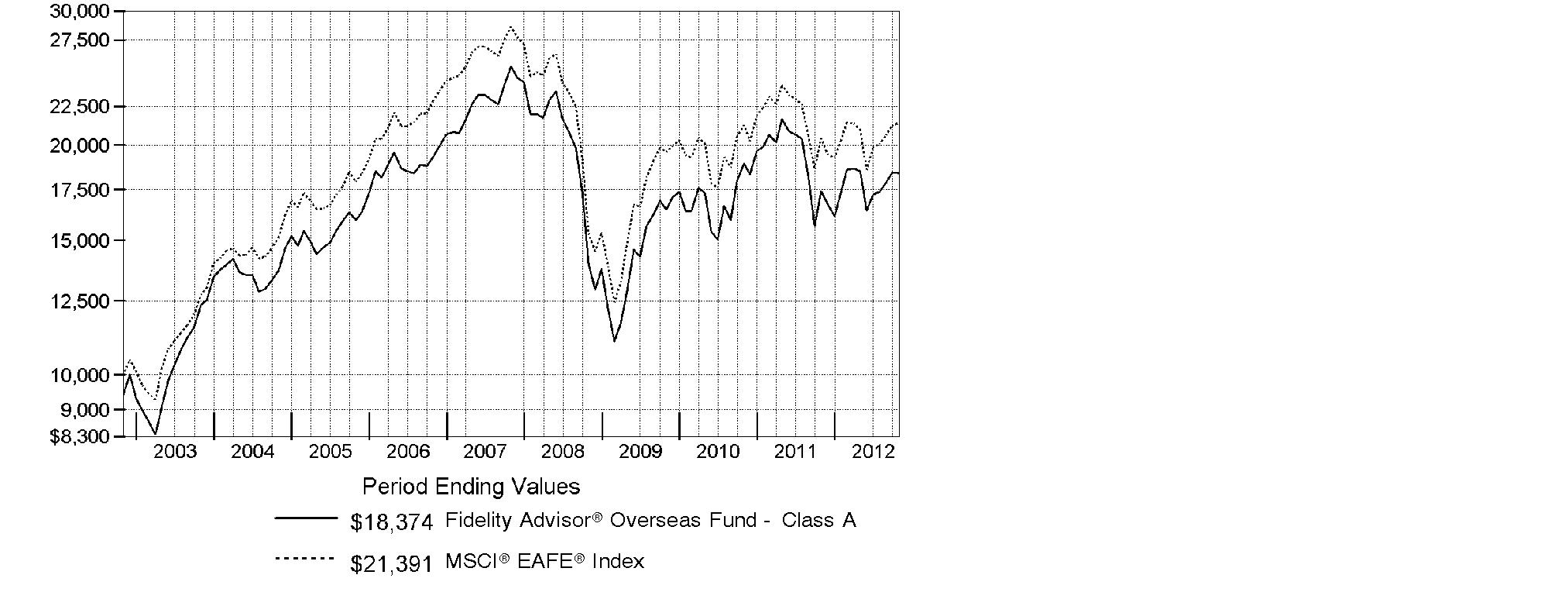

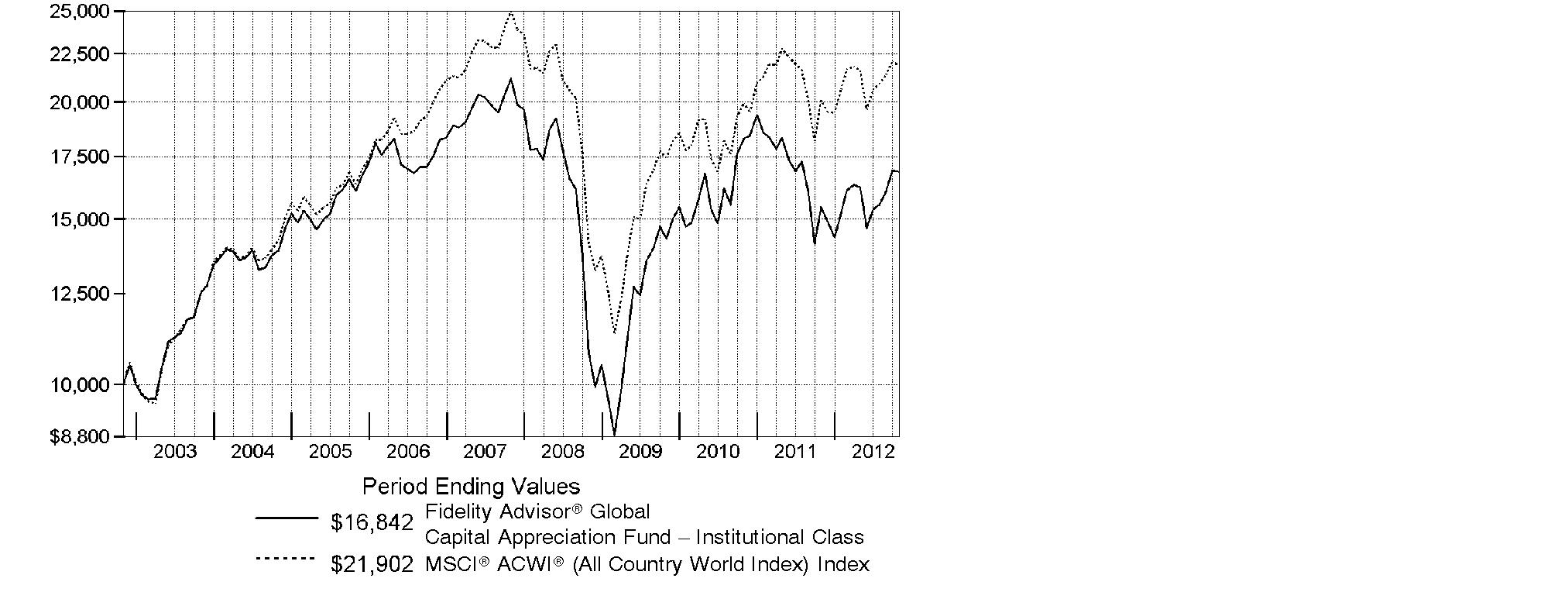

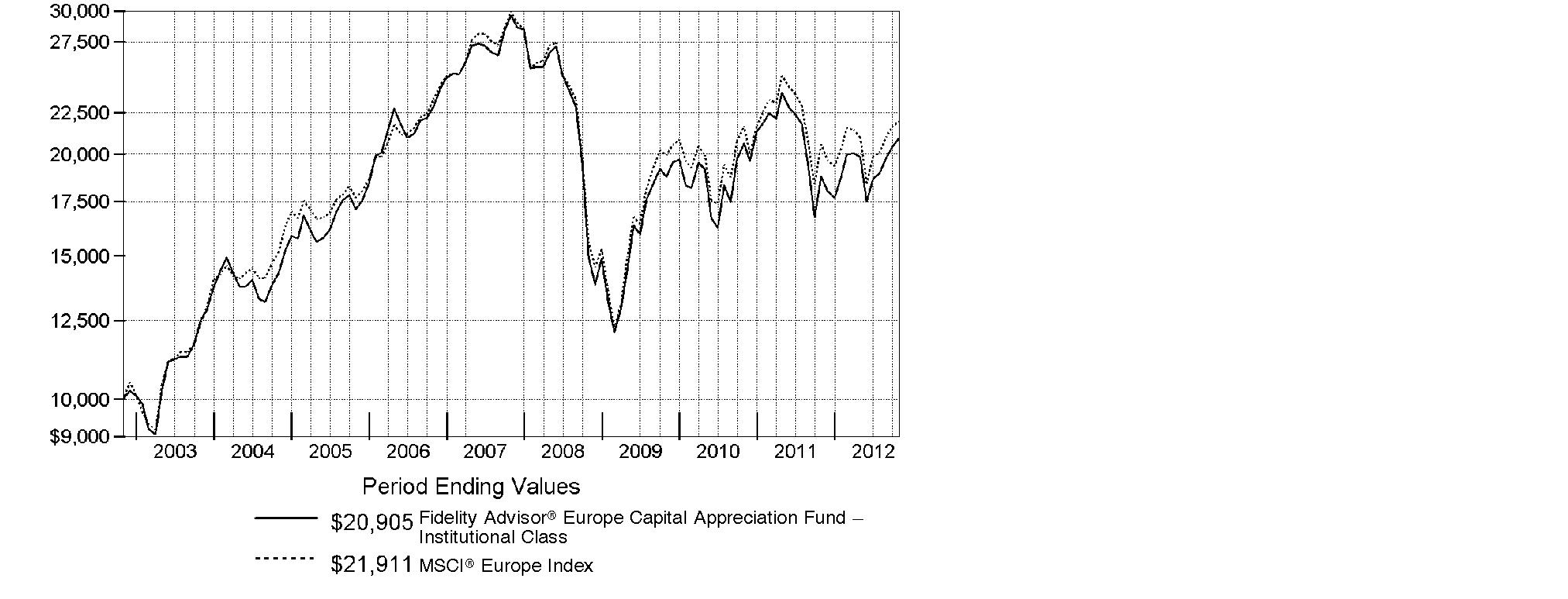

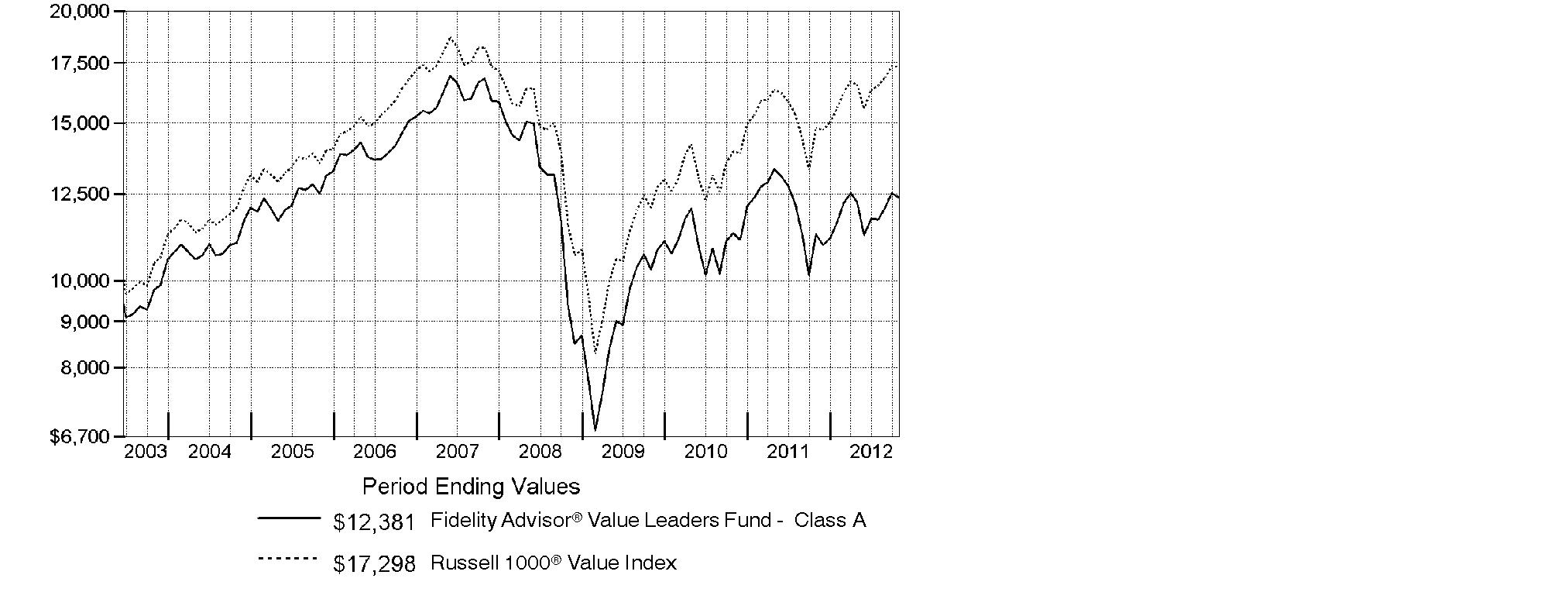

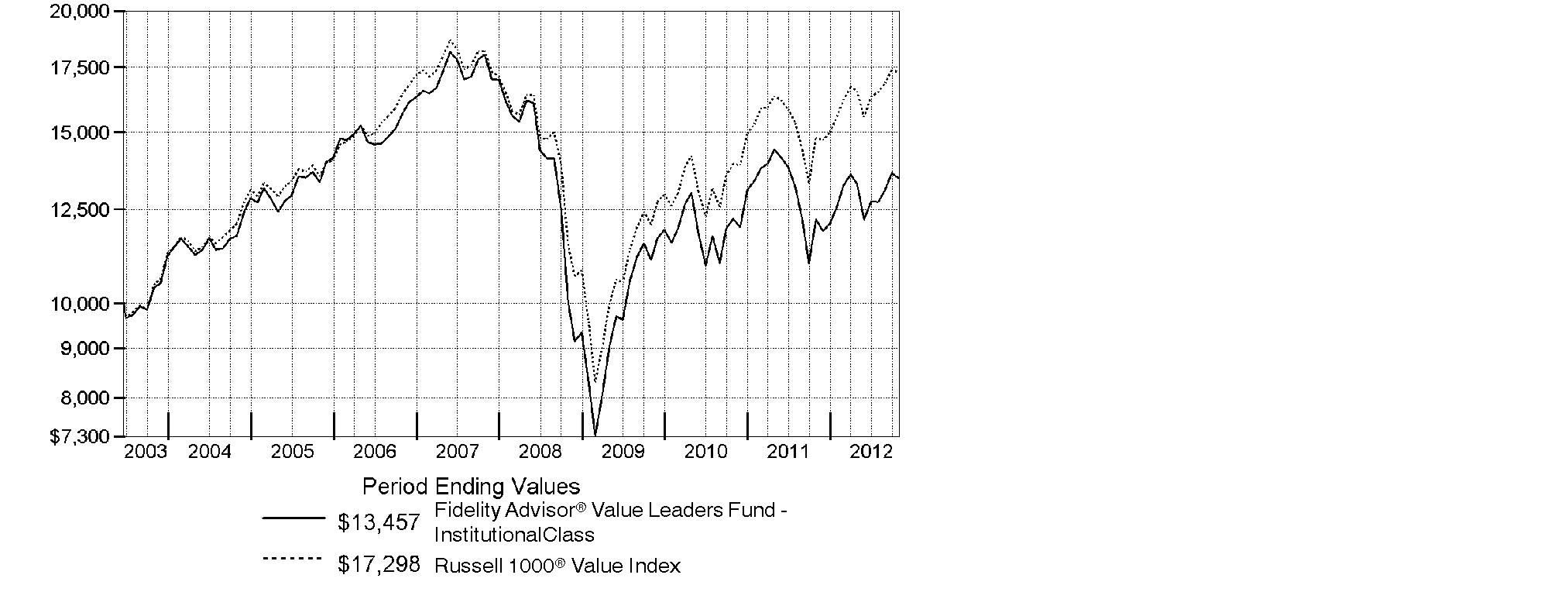

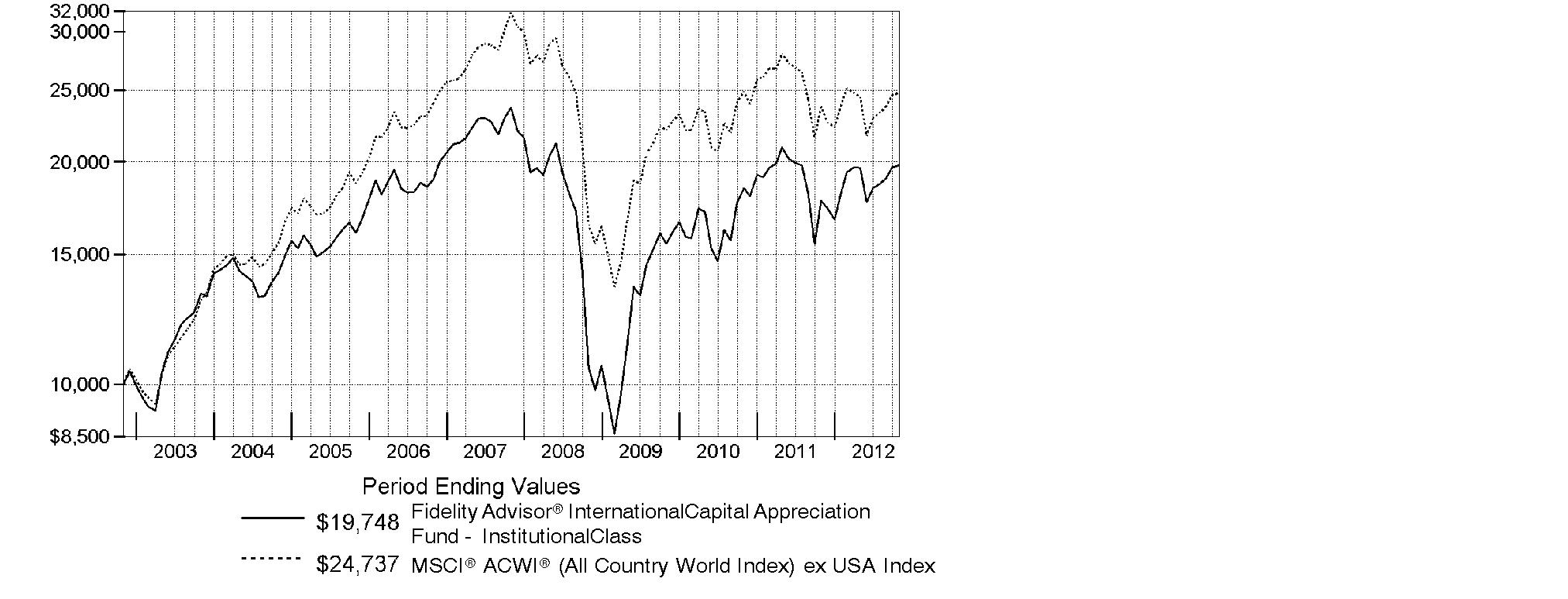

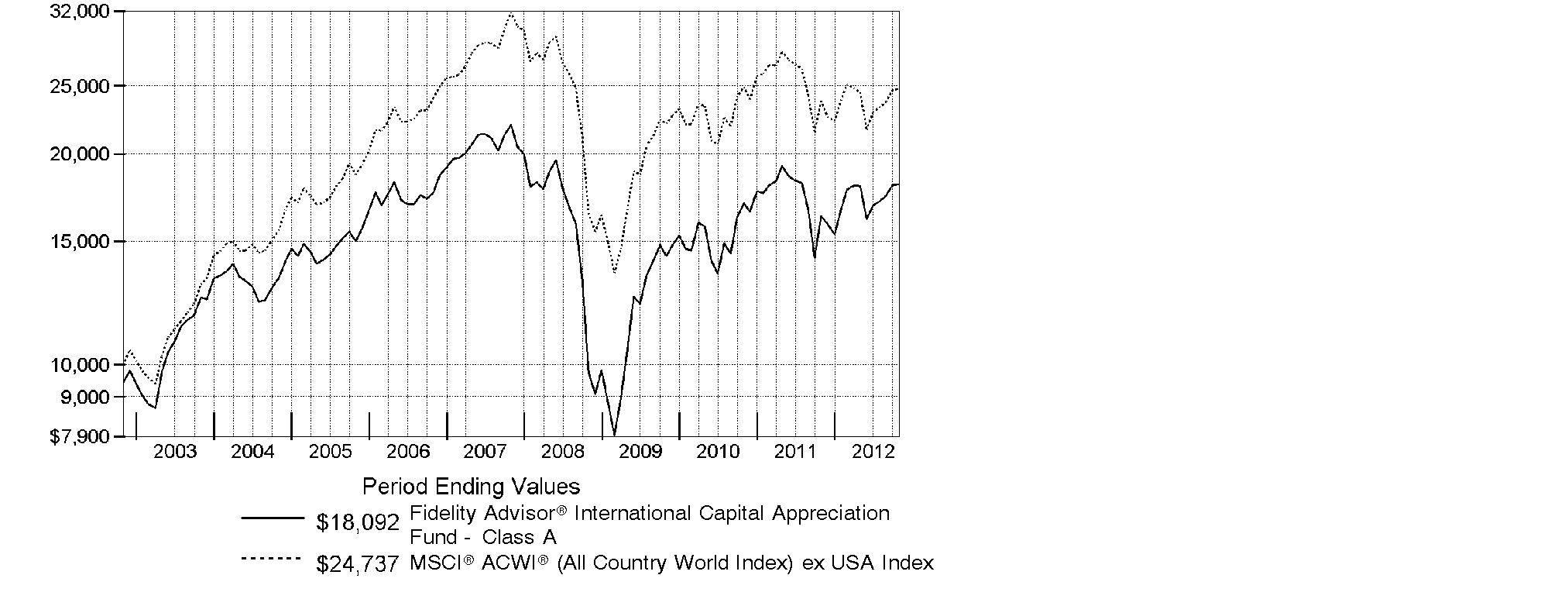

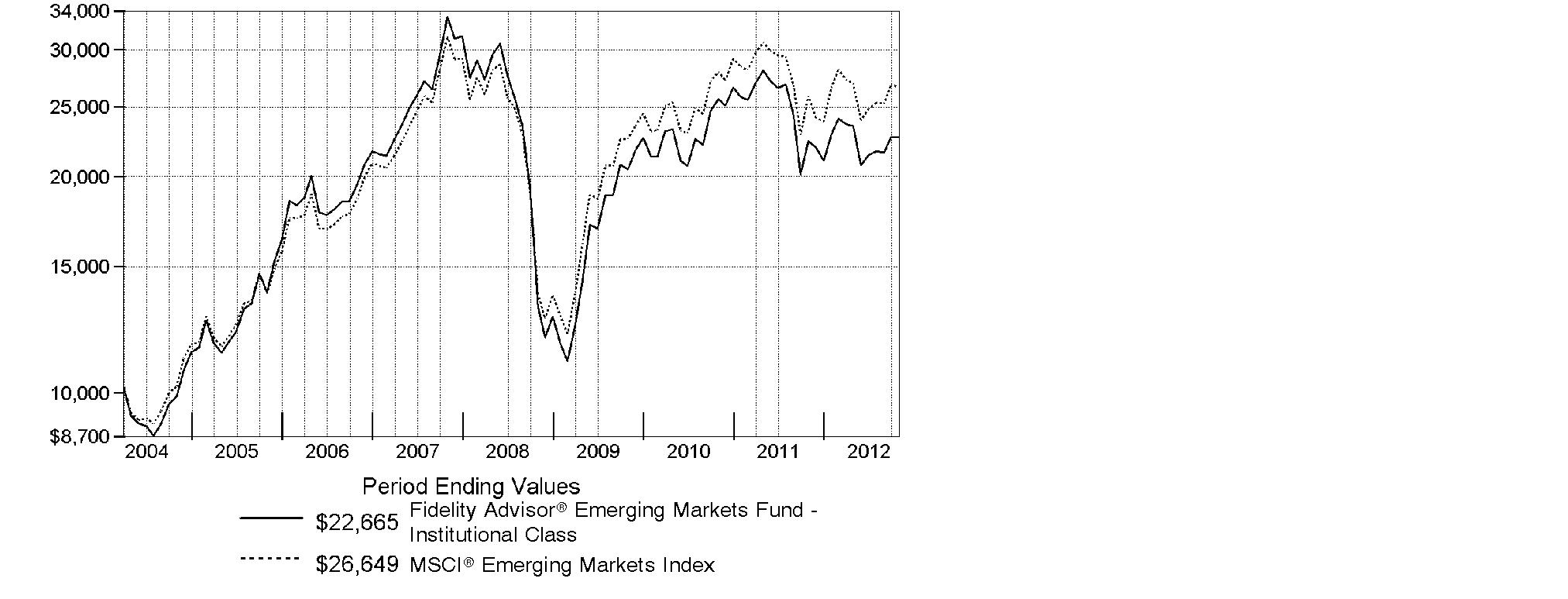

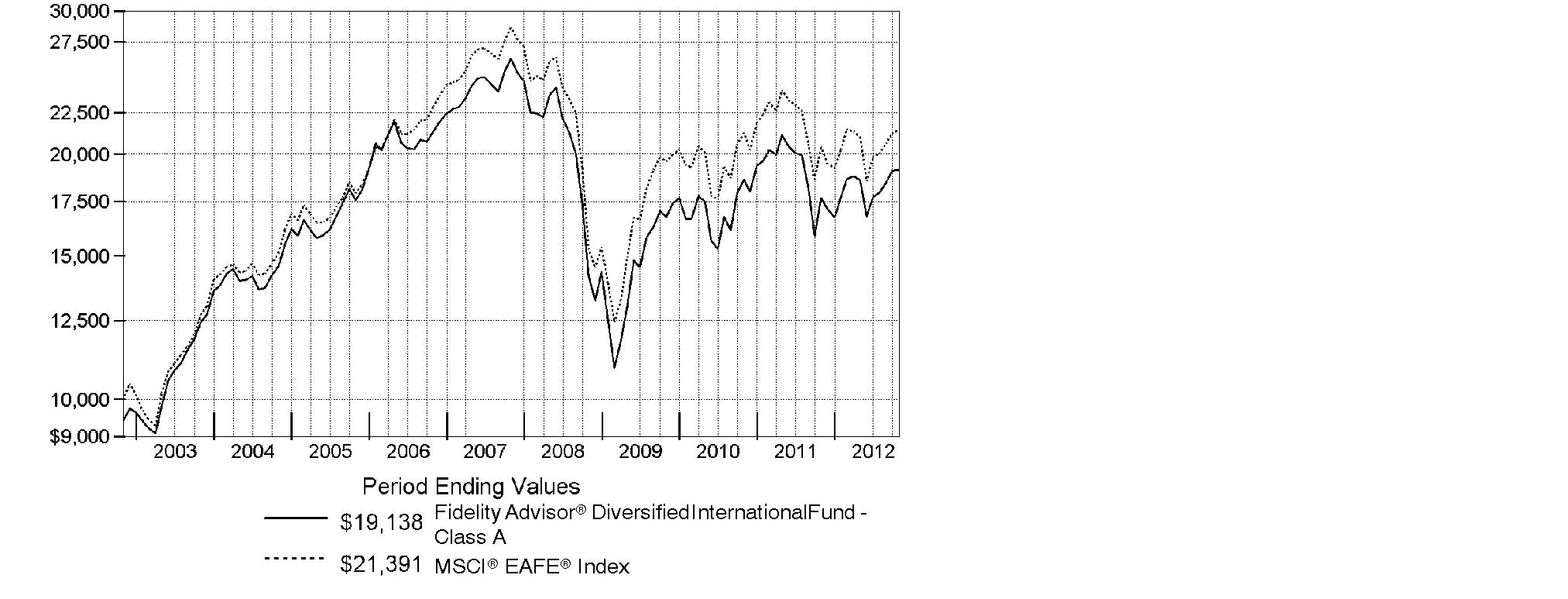

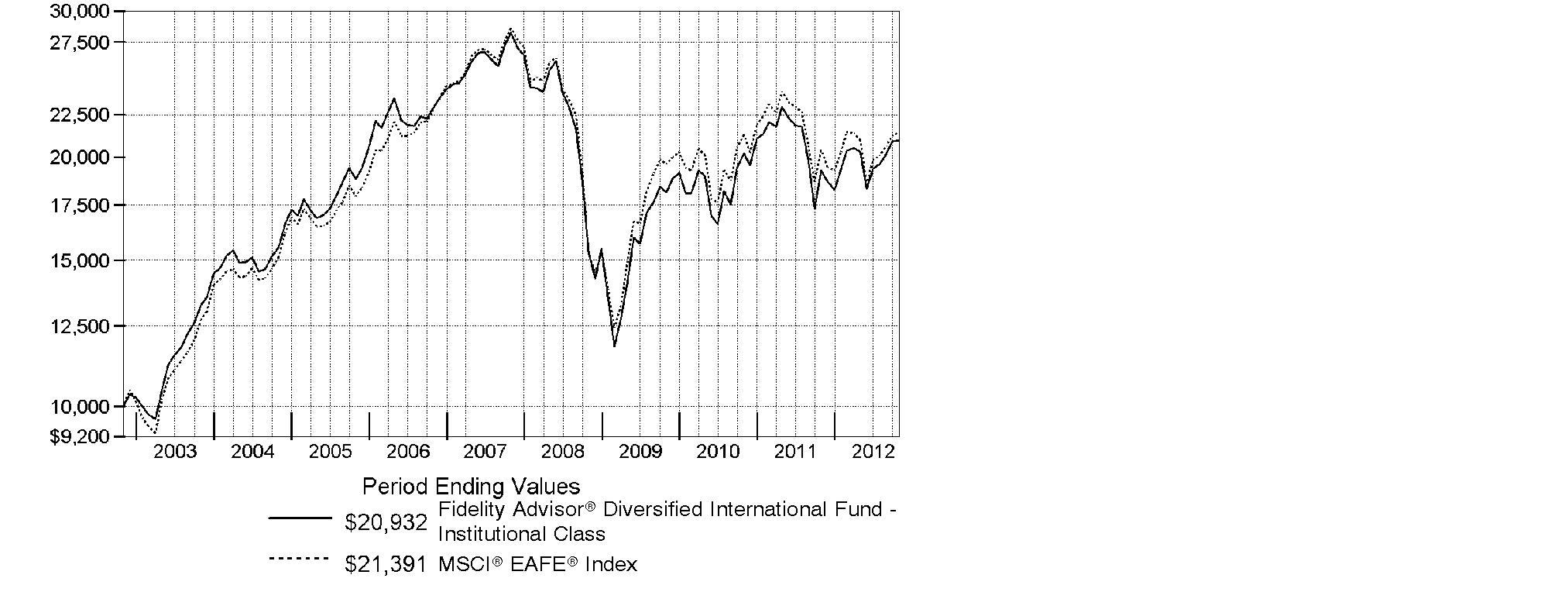

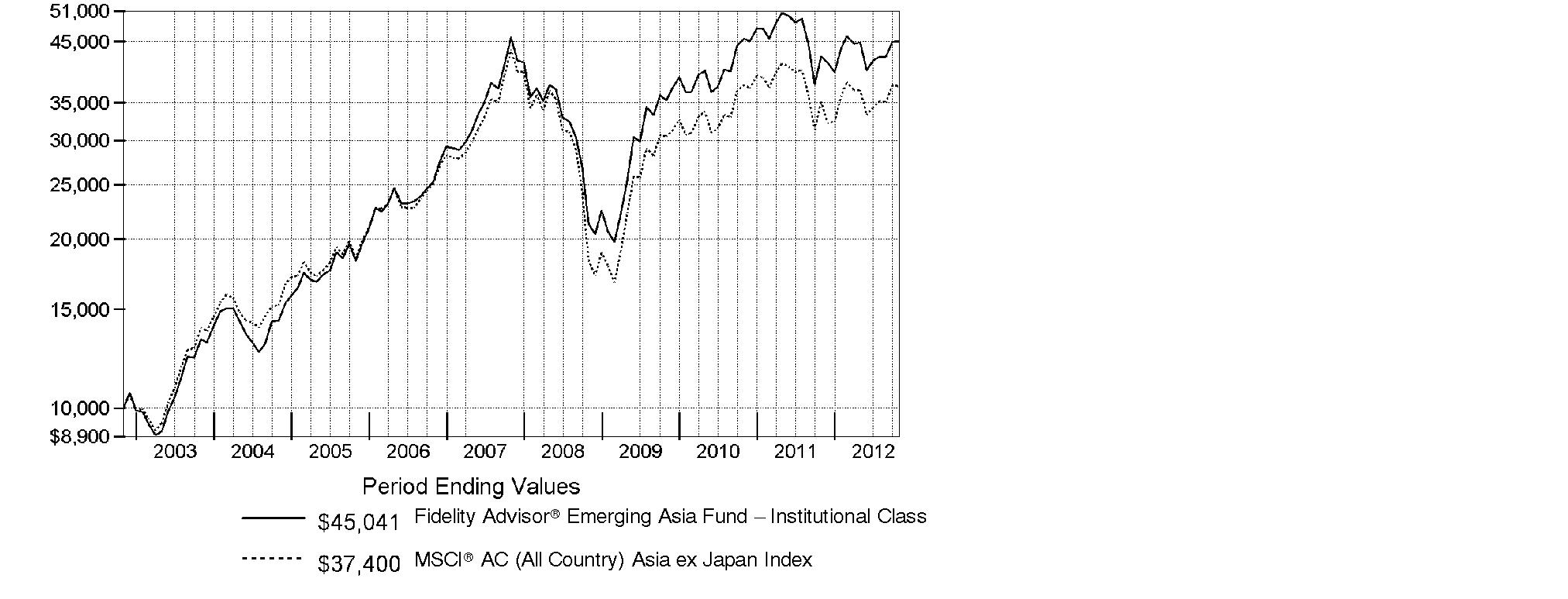

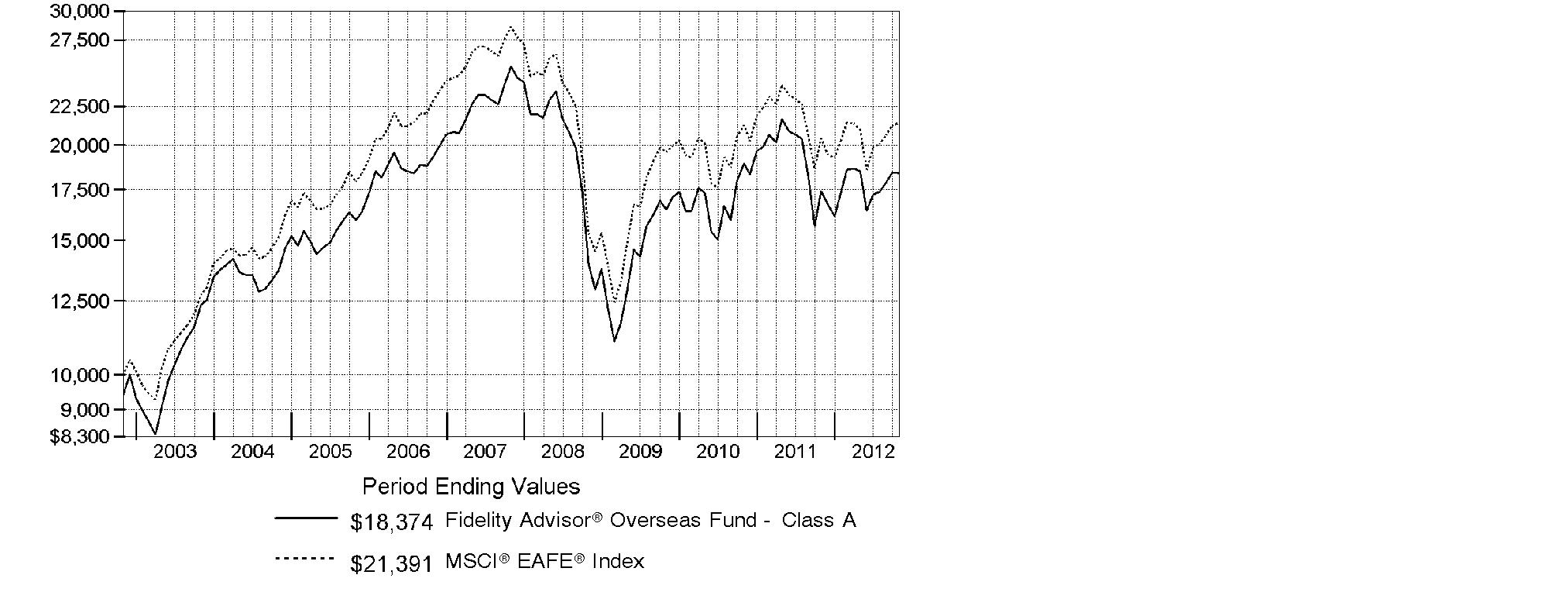

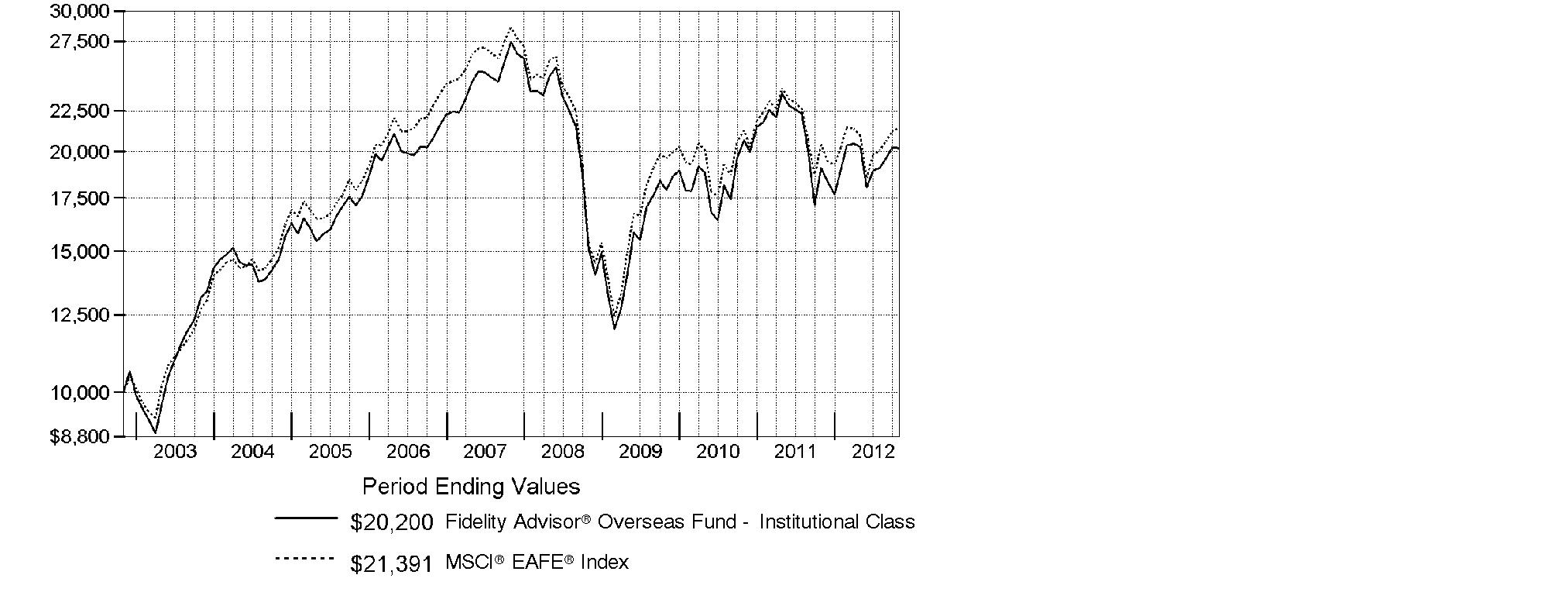

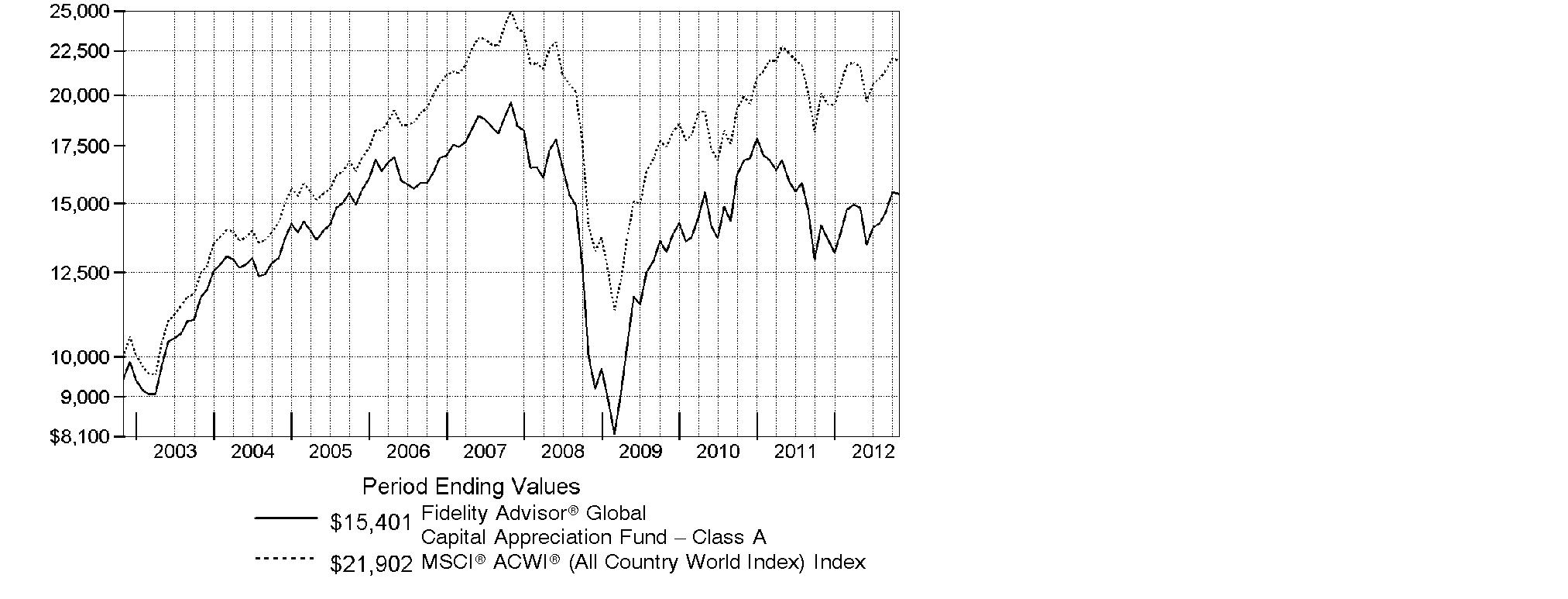

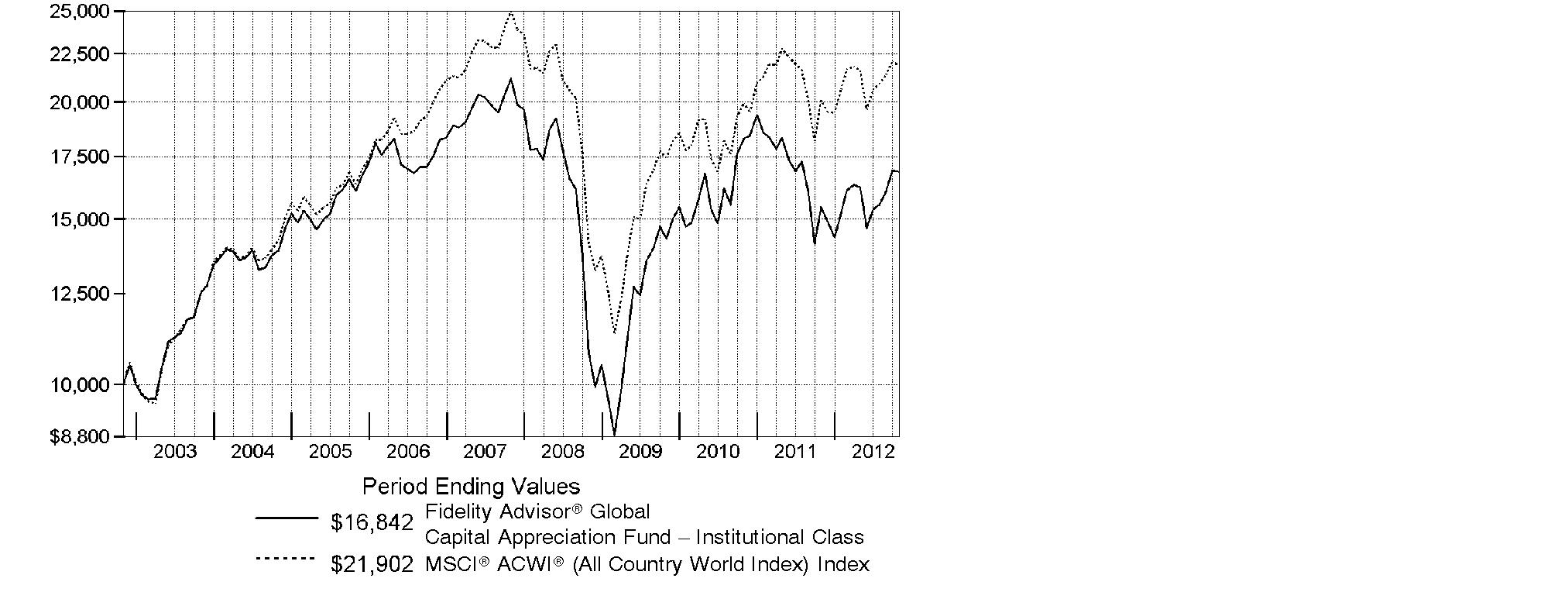

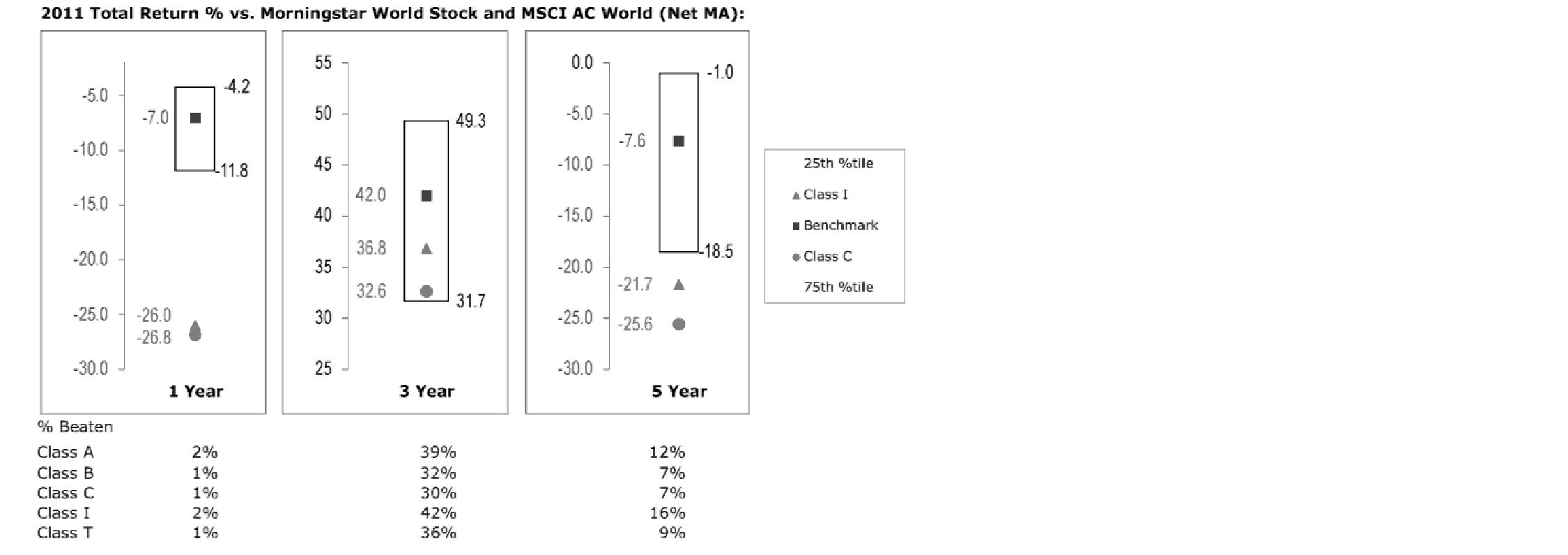

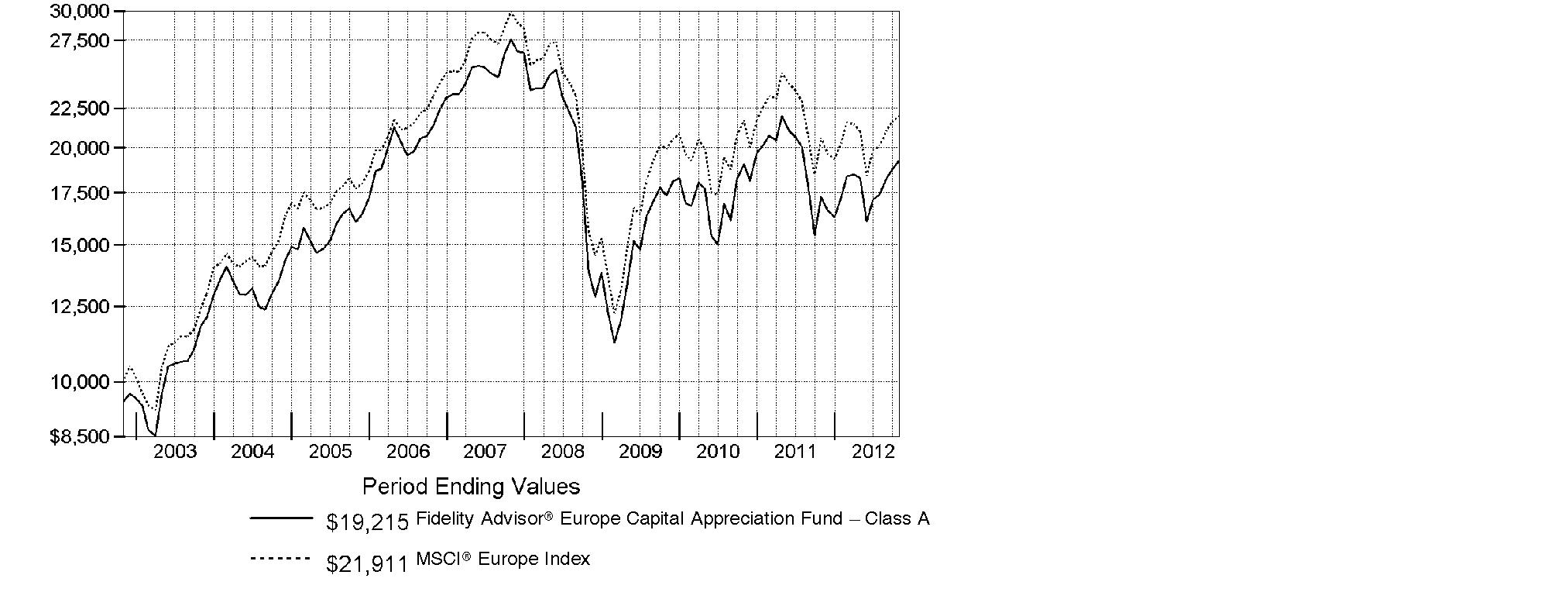

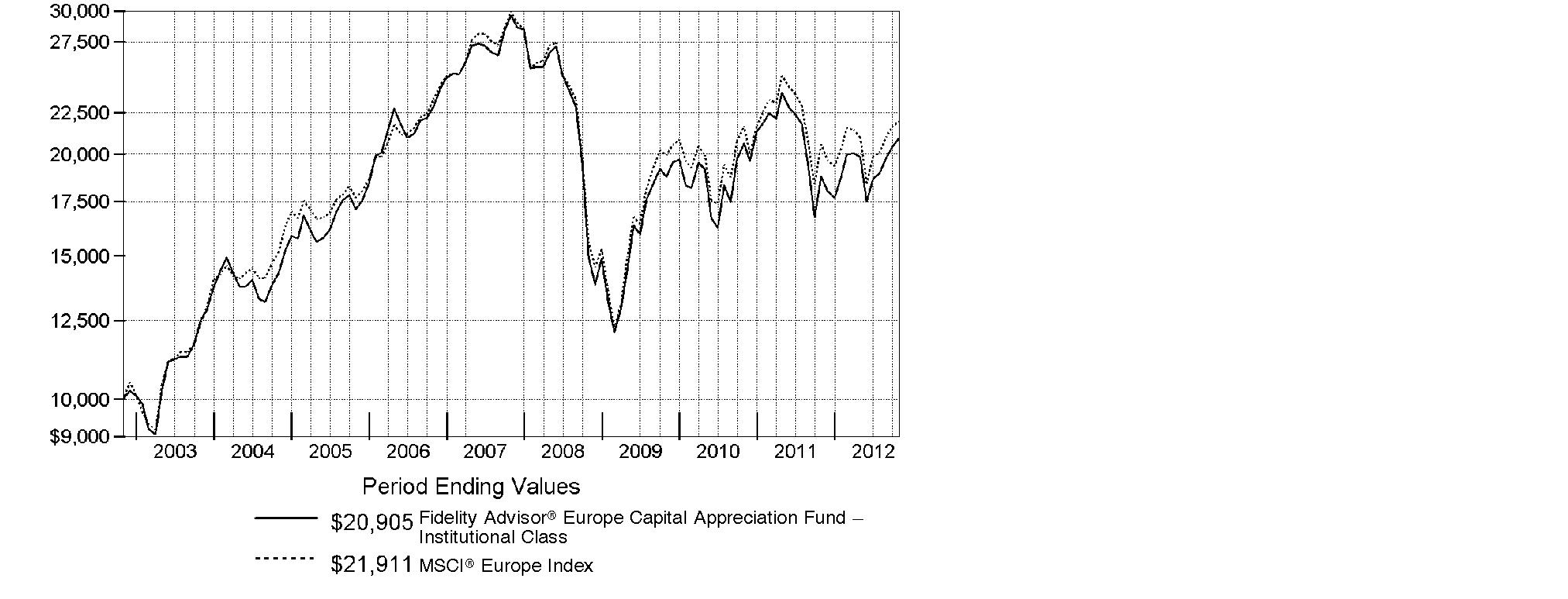

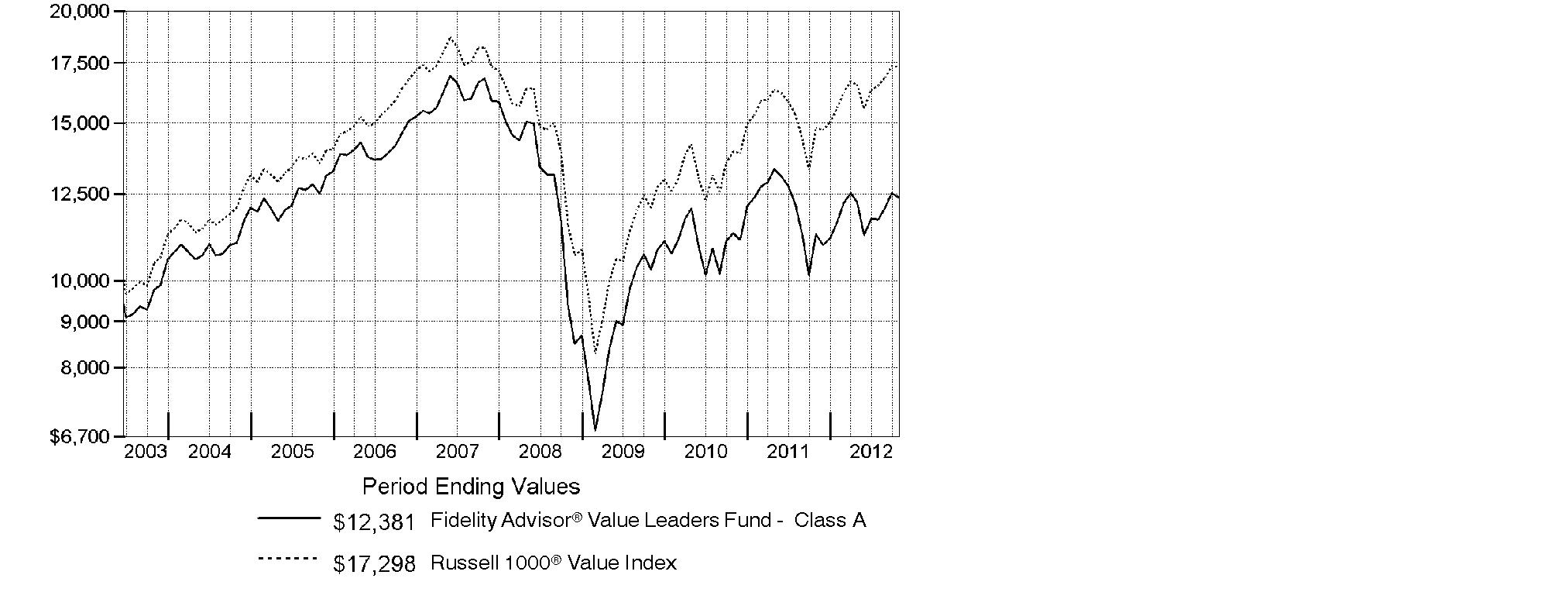

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

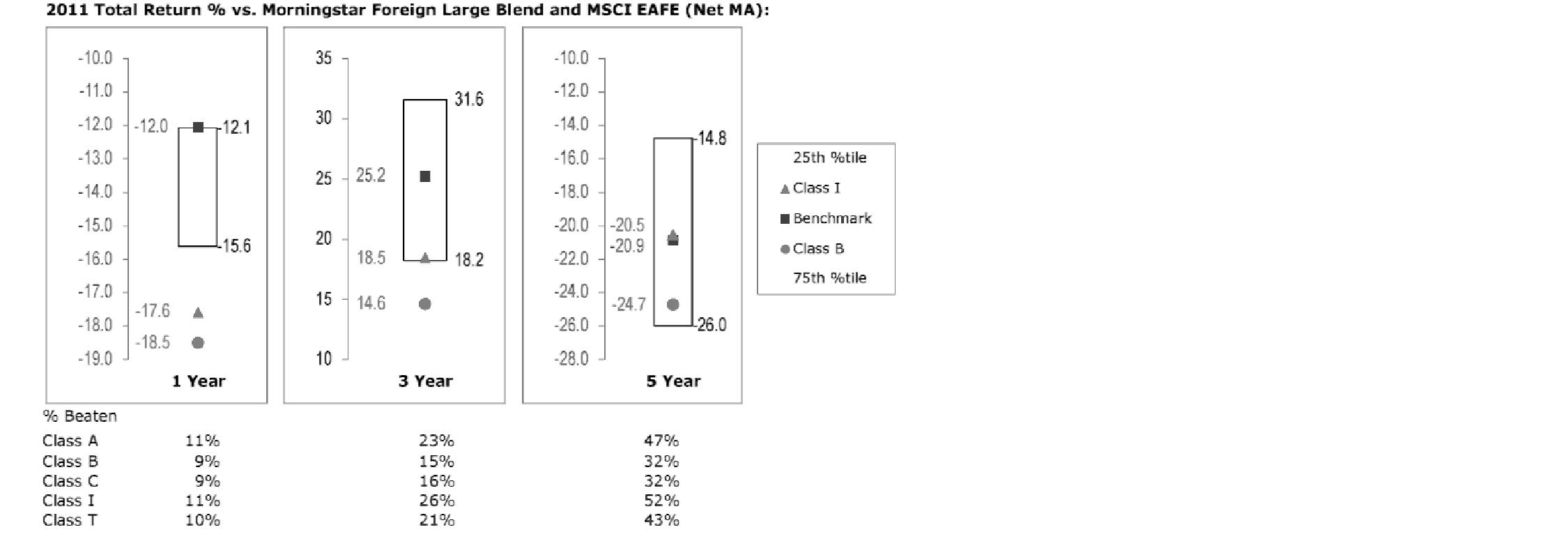

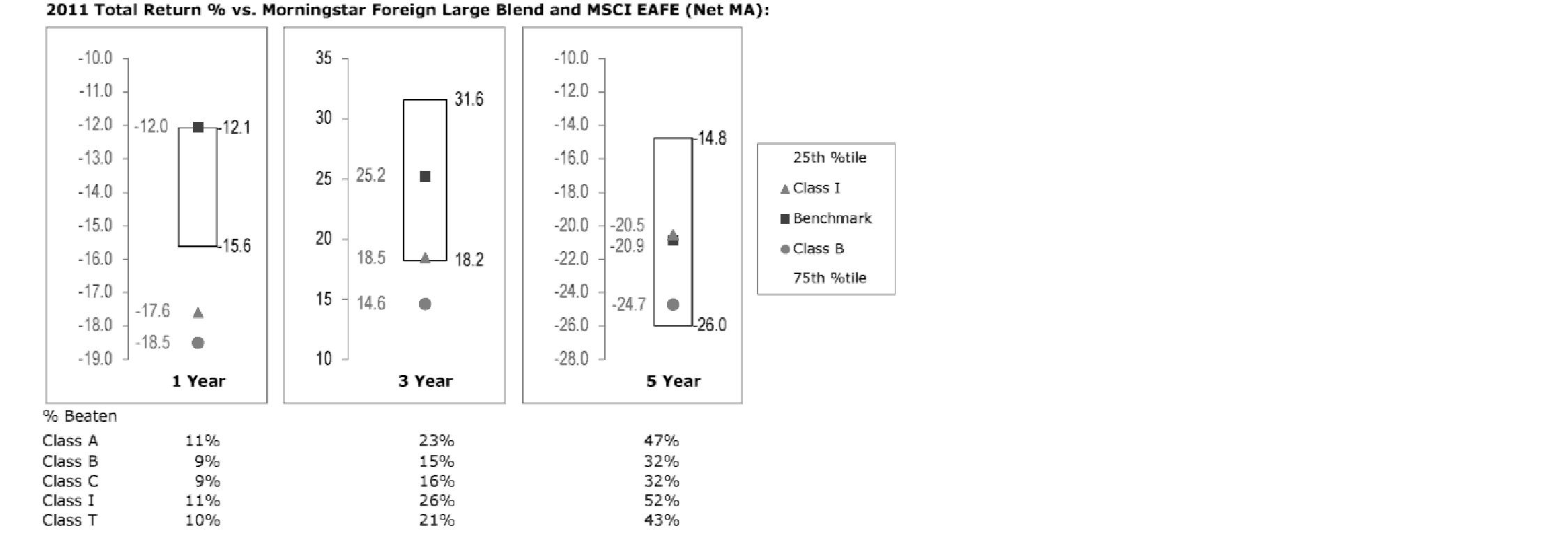

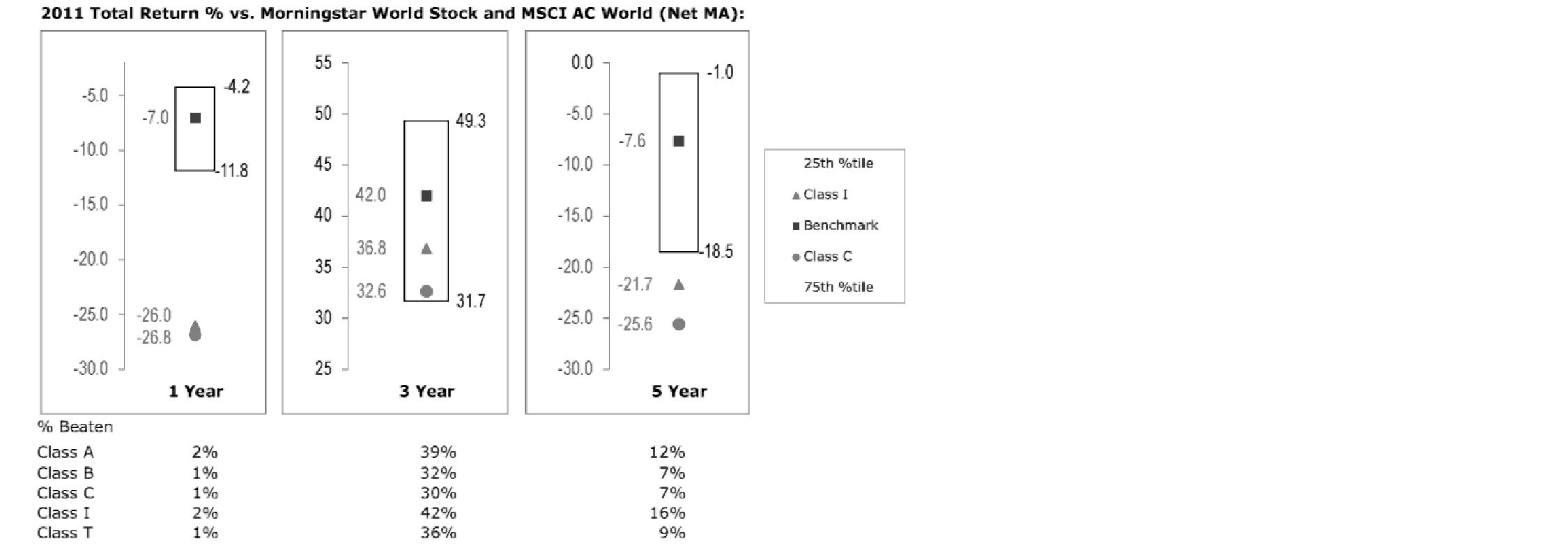

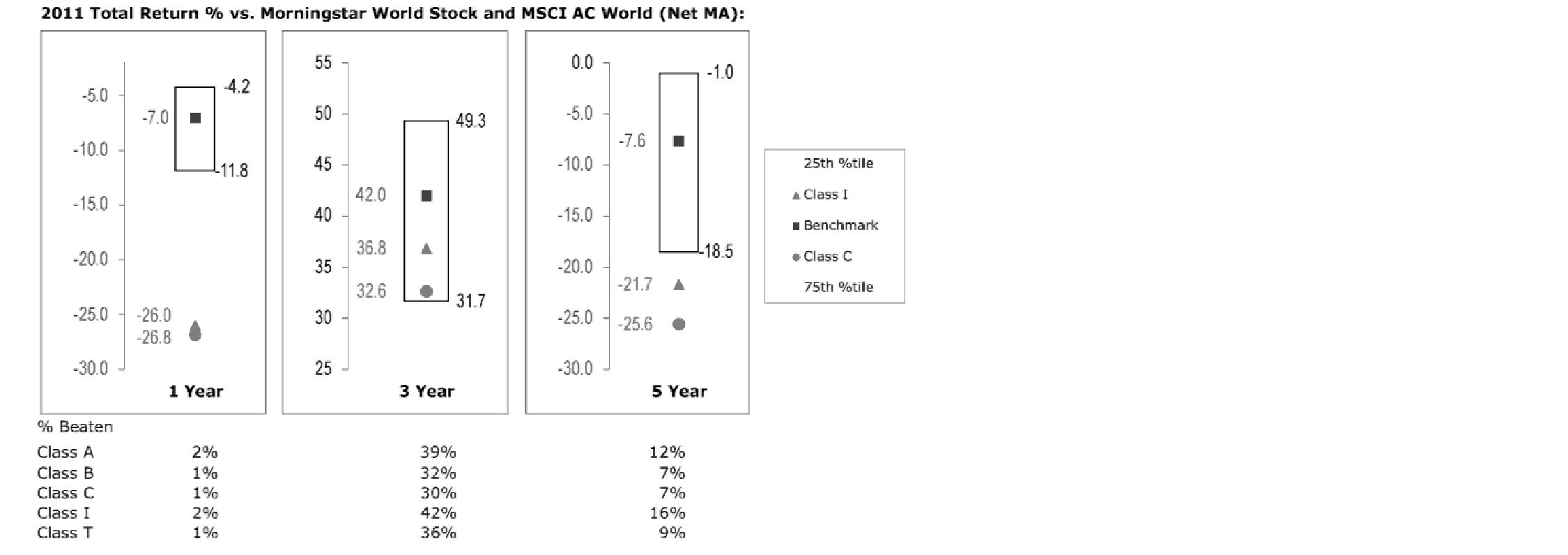

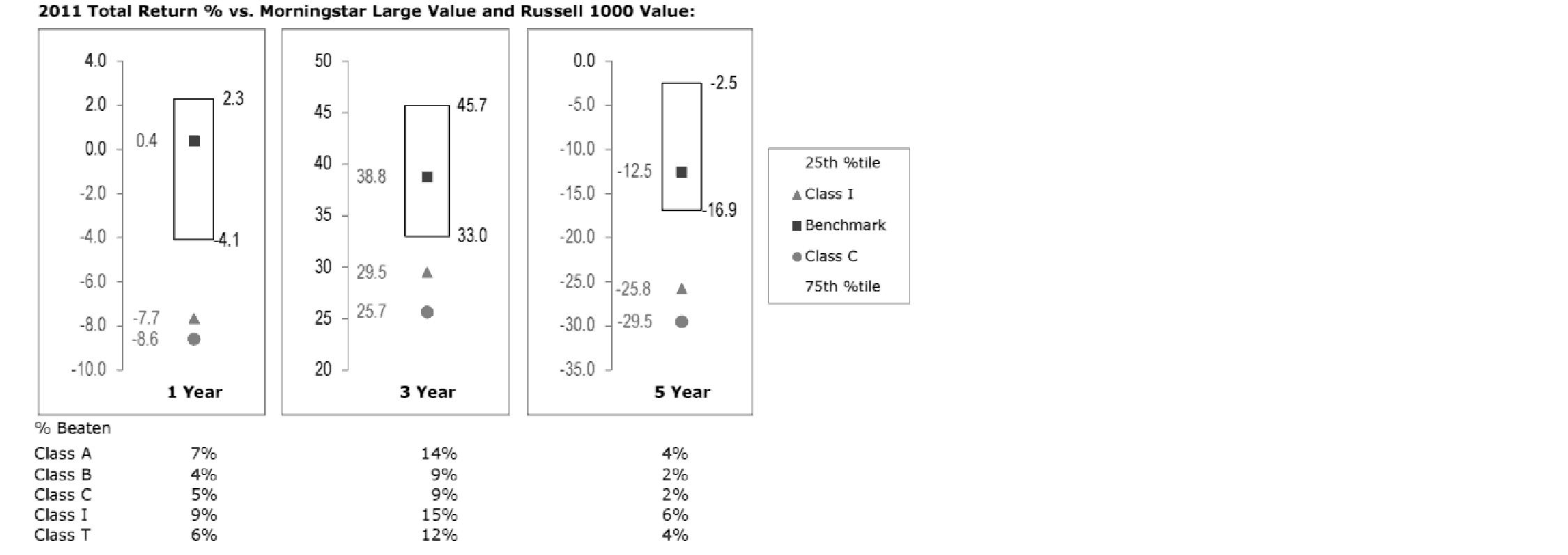

Average Annual Total Returns

Periods ended October 31, 2012 | | Past 1

year | Past 5

years | Past 10

years |

Institutional Class | | 11.56% | -3.56% | 7.04% |

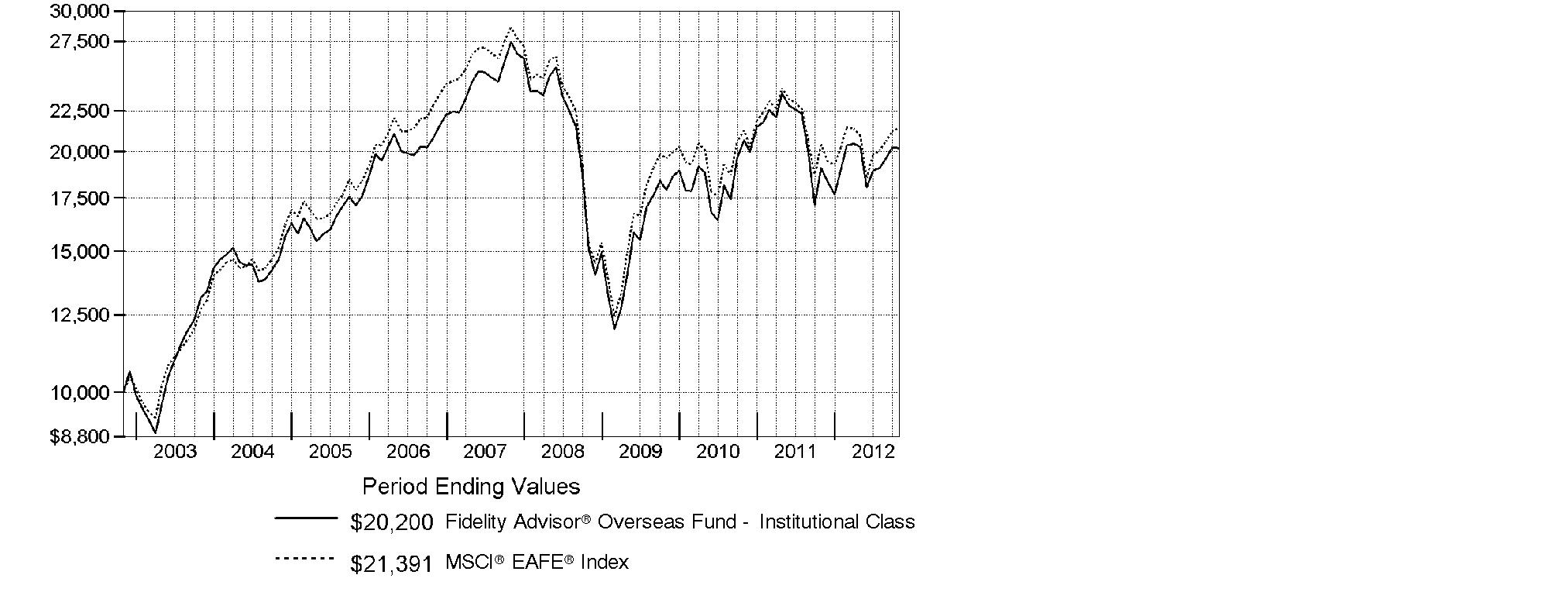

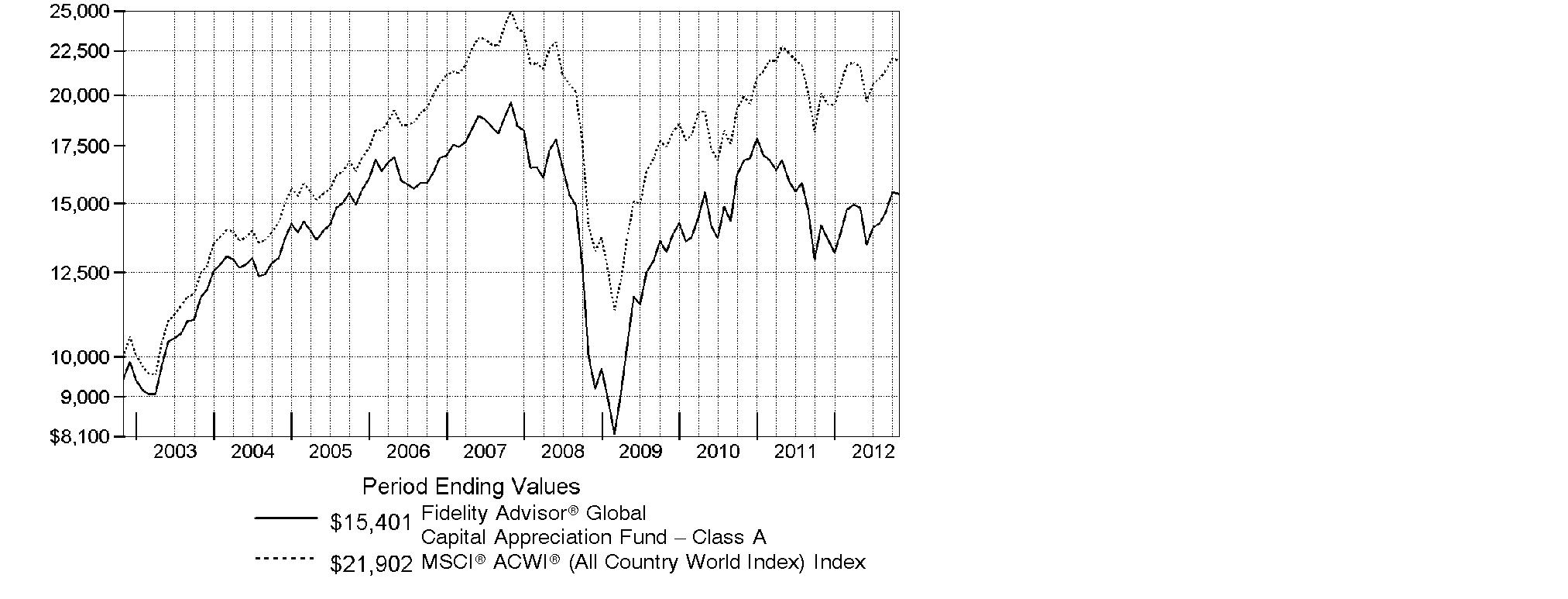

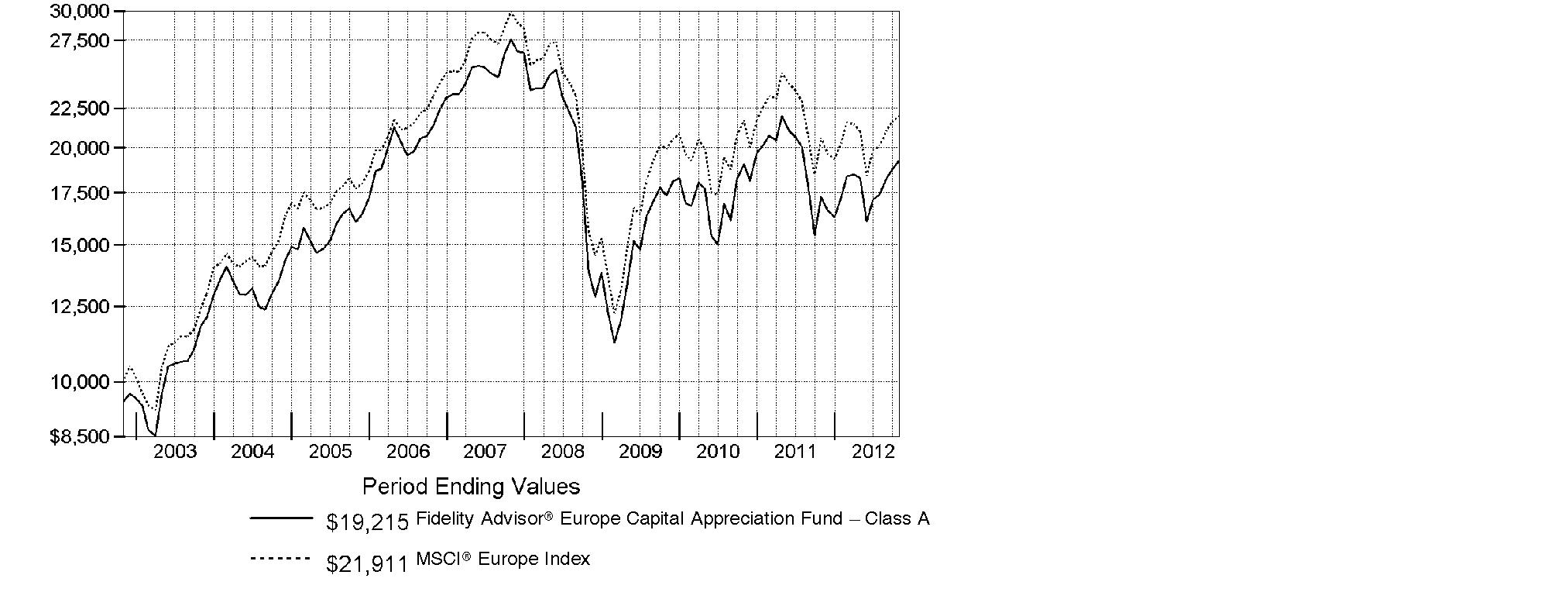

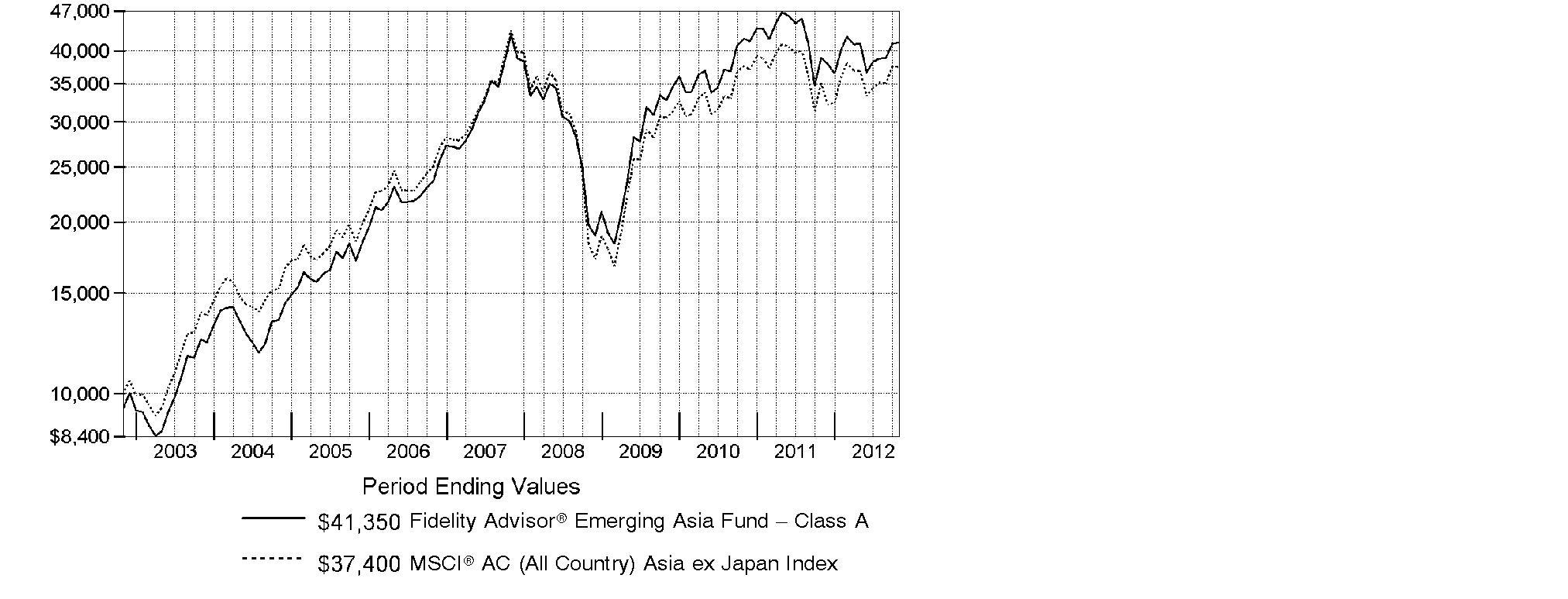

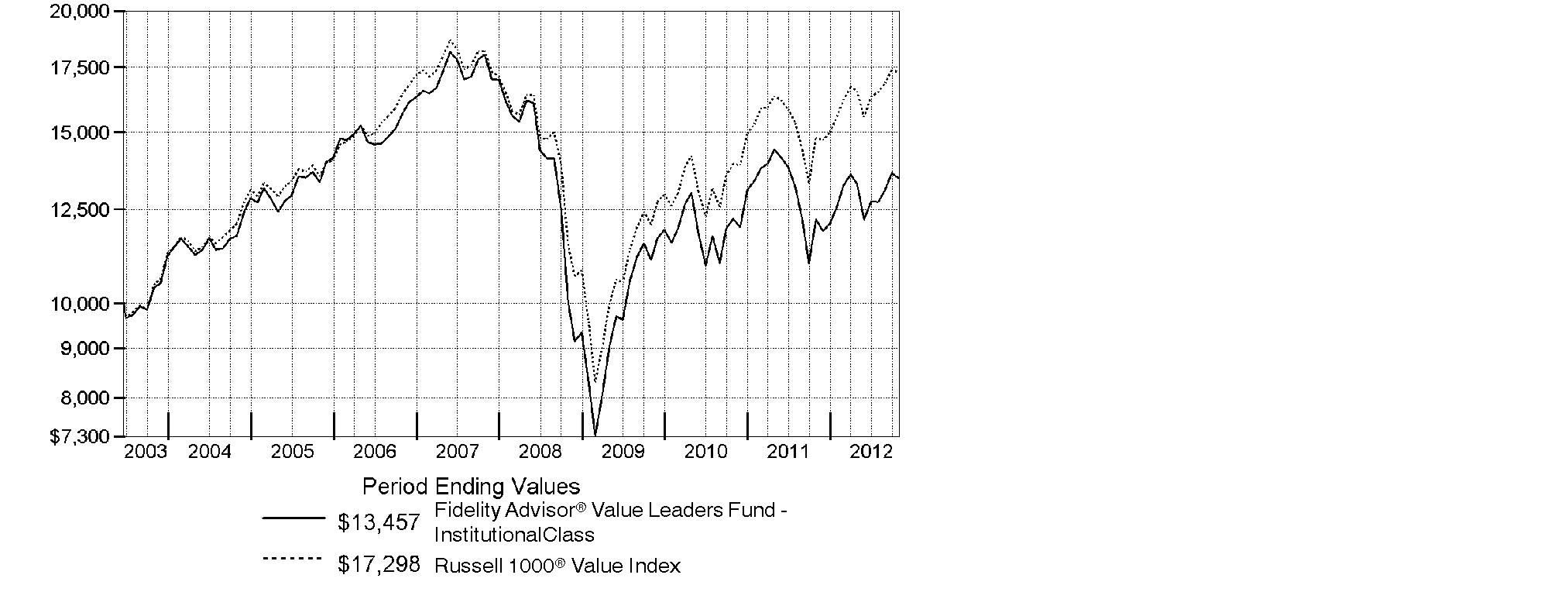

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Advisor® International Capital Appreciation Fund - Institutional Class on October 31, 2002. The chart shows how the value of your investment would have changed, and also shows how the MSCI® ACWI® (All Country World Index) ex USA Index performed over the same period.

Annual Report

Market Recap: International stocks experienced pendulum-like swings during the 12 months ending October 31, 2012, finishing the period with a modest advance. The market faced periodic bouts of volatility this past year, as a number of macroeconomic concerns - including the eurozone debt crisis, the strength and pace of the U.S. economic recovery, and a slowdown in China's once-blistering growth - dominated headlines and weighed on investors. While a stronger U.S. dollar provided an additional head wind, foreign developed- and emerging-markets stocks still managed a gain for the 12 months, as the MSCI® ACWI® (All Country World Index) ex USA Index rose 4.11%, largely buttressed in the summertime by pledges of accommodative monetary action from eurozone officials, as well as signs that the U.S. housing market was on the mend. Within the index, Asia-Pacific ex Japan showed the most impressive gains, advancing roughly 11%. A number of core European components, most notably Germany (+11%), Switzerland (+10%) and the U.K. (+9%), benefited from optimism about the eurozone's ability to resolve its debt woes, which also helped the region outpace the index overall. Elsewhere, results from Canada (+3%) and the generally more volatile emerging markets (+2%) each fell short of the MSCI index, while Japan was among the few benchmark constituents to finish in the red, returning about -3%.

Comments from Sammy Simnegar, Portfolio Manager of Fidelity Advisor® International Capital Appreciation Fund: For the year, the fund's Institutional Class shares returned 11.56%, handily outpacing the MSCI index. Stock selection in consumer staples, consumer discretionary and materials meaningfully lifted relative performance. Within staples, a large overweighting in food, beverage and tobacco also helped. Geographically, the fund was aided by a sizable out-of-benchmark stake in the United States and by stock picking in Brazil, Indonesia and Italy. Our U.S. holdings also benefited from an appreciating dollar. Three of the four biggest relative contributors were Indonesian stocks: Global Mediacom, Ace Hardware Indonesia and Tower Bersama Infrastructure, a cellular tower operator. Thailand-based big-box discount retailer Siam Makro - which I sold - helped as well. All of the contributors I've mentioned were non-benchmark holdings. Conversely, financials and health care detracted. Geographically, Australia hurt. Not owning strong-performing South Korean benchmark component Samsung Electronics during the period's first half hampered results, as did overweightings in Australia's Iluka Resources and Fortescue Metals Group, the latter of which I sold.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2012 to October 31, 2012).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Annual Report

| Annualized

Expense Ratio | Beginning

Account Value

May 1, 2012 | Ending

Account Value

October 31, 2012 | Expenses Paid

During Period*

May 1, 2012 to October 31, 2012 |

Class A | 1.45% | | | |

Actual | | $ 1,000.00 | $ 1,005.40 | $ 7.31 |

HypotheticalA | | $ 1,000.00 | $ 1,017.85 | $ 7.35 |

Class T | 1.70% | | | |

Actual | | $ 1,000.00 | $ 1,004.60 | $ 8.57 |

HypotheticalA | | $ 1,000.00 | $ 1,016.59 | $ 8.62 |

Class B | 2.20% | | | |

Actual | | $ 1,000.00 | $ 1,001.00 | $ 11.07 |

HypotheticalA | | $ 1,000.00 | $ 1,014.08 | $ 11.14 |

Class C | 2.20% | | | |

Actual | | $ 1,000.00 | $ 1,001.00 | $ 11.07 |

HypotheticalA | | $ 1,000.00 | $ 1,014.08 | $ 11.14 |

Institutional Class | 1.20% | | | |

Actual | | $ 1,000.00 | $ 1,006.70 | $ 6.05 |

HypotheticalA | | $ 1,000.00 | $ 1,019.10 | $ 6.09 |

A 5% return per year before expenses

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Annual Report

Investment Changes (Unaudited)

Top Five Stocks as of October 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Nestle SA (Switzerland, Food Products) | 1.6 | 1.7 |

BHP Billiton PLC ADR (United Kingdom, Metals & Mining) | 1.5 | 1.6 |

Samsung Electronics Co. Ltd. (Korea (South), Semiconductors & Semiconductor Equipment) | 1.3 | 0.0 |

Unilever PLC (United Kingdom, Food Products) | 1.0 | 1.0 |

British American Tobacco PLC (United Kingdom) (United Kingdom, Tobacco) | 0.9 | 1.4 |

| 6.3 | |

Top Five Market Sectors as of October 31, 2012 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Consumer Discretionary | 19.3 | 19.7 |

Consumer Staples | 19.0 | 21.5 |

Industrials | 17.3 | 13.8 |

Financials | 12.2 | 12.6 |

Information Technology | 10.8 | 8.8 |

Top Five Countries as of October 31, 2012 |

(excluding cash equivalents) | % of fund's

net assets | % of fund's net assets

6 months ago |

United States of America | 16.0 | 16.2 |

United Kingdom | 13.4 | 15.6 |

France | 8.6 | 7.9 |

Japan | 6.9 | 9.2 |

Germany | 5.4 | 3.8 |

Percentages are adjusted for the effect of open futures contracts, if applicable. |

Asset Allocation (% of fund's net assets) |

As of October 31, 2012 | As of April 30, 2012 |

| Stocks 99.5% | |  | Stocks 99.1% | |

| Short-Term Investments and Net Other Assets (Liabilities) 0.5% | |  | Short-Term Investments and Net Other Assets (Liabilities) 0.9% | |

Annual Report

Investments October 31, 2012

Showing Percentage of Net Assets

Common Stocks - 98.9% |

| Shares | | Value |

Australia - 1.6% |

ALS Ltd. | 50,080 | | $ 481,906 |

Coca-Cola Amatil Ltd. | 31,792 | | 443,873 |

Iluka Resources Ltd. | 50,045 | | 515,336 |

Orica Ltd. | 18,382 | | 479,326 |

TOTAL AUSTRALIA | | 1,920,441 |

Austria - 0.4% |

Andritz AG | 8,098 | | 487,759 |

Bailiwick of Jersey - 0.5% |

Experian PLC | 35,600 | | 614,710 |

Belgium - 1.2% |

Anheuser-Busch InBev SA NV | 10,680 | | 893,181 |

Umicore SA | 9,677 | | 496,634 |

TOTAL BELGIUM | | 1,389,815 |

Bermuda - 0.8% |

Credicorp Ltd. (NY Shares) | 4,220 | | 545,815 |

Jardine Matheson Holdings Ltd. | 7,600 | | 468,160 |

TOTAL BERMUDA | | 1,013,975 |

Brazil - 3.8% |

BR Malls Participacoes SA | 36,300 | | 477,197 |

CCR SA | 53,400 | | 469,572 |

Cielo SA | 20,400 | | 504,714 |

Companhia de Bebidas das Americas (AmBev) (PN) sponsored ADR | 16,500 | | 673,035 |

Iguatemi Empresa de Shopping Centers SA | 33,800 | | 429,354 |

Itau Unibanco Holdings SA sponsored ADR | 45,750 | | 667,035 |

Multiplan Empreendimentos Imobiliarios SA | 15,900 | | 465,794 |

Qualicorp SA (a) | 41,000 | | 420,689 |

Souza Cruz SA | 34,300 | | 447,527 |

TOTAL BRAZIL | | 4,554,917 |

Canada - 0.6% |

Canadian National Railway Co. | 8,200 | | 708,053 |

Cayman Islands - 0.8% |

Baidu.com, Inc. sponsored ADR (a) | 4,200 | | 447,804 |

Sands China Ltd. | 140,000 | | 526,577 |

TOTAL CAYMAN ISLANDS | | 974,381 |

Common Stocks - continued |

| Shares | | Value |

Chile - 0.8% |

Embotelladora Andina SA Class A | 93,938 | | $ 472,472 |

Parque Arauco SA | 195,889 | | 447,432 |

TOTAL CHILE | | 919,904 |

Denmark - 1.1% |

FLSmidth & Co. A/S | 8,057 | | 475,971 |

Novo Nordisk A/S Series B sponsored ADR | 5,400 | | 865,566 |

TOTAL DENMARK | | 1,341,537 |

Finland - 0.8% |

Kone Oyj (B Shares) (d) | 7,500 | | 537,092 |

Nokian Tyres PLC | 11,214 | | 465,121 |

TOTAL FINLAND | | 1,002,213 |

France - 8.6% |

Air Liquide SA | 5,520 | | 651,082 |

Bollore | 1,305 | | 386,756 |

Bureau Veritas SA | 4,900 | | 520,348 |

Casino Guichard Perrachon SA | 5,282 | | 461,301 |

Christian Dior SA | 3,640 | | 522,517 |

Dassault Systemes SA | 4,400 | | 463,602 |

Edenred SA | 14,900 | | 431,155 |

Essilor International SA | 5,913 | | 533,041 |

Eurofins Scientific SA | 2,758 | | 426,471 |

Hermes International SCA | 1,480 | | 403,994 |

L'Oreal SA | 5,000 | | 636,863 |

LVMH Moet Hennessy - Louis Vuitton SA | 4,806 | | 781,154 |

Pernod Ricard SA | 5,800 | | 624,192 |

PPR SA | 3,300 | | 580,215 |

Publicis Groupe SA | 9,700 | | 522,582 |

Remy Cointreau SA (d) | 4,825 | | 500,439 |

Schneider Electric SA | 10,639 | | 665,148 |

Technip SA | 4,800 | | 540,650 |

Vivendi SA | 32,626 | | 667,519 |

TOTAL FRANCE | | 10,319,029 |

Germany - 4.8% |

adidas AG | 6,100 | | 519,695 |

BASF AG | 11,846 | | 981,594 |

Bayerische Motoren Werke AG (BMW) | 8,818 | | 702,340 |

Brenntag AG | 3,600 | | 453,735 |

Fresenius Medical Care AG & Co. KGaA sponsored ADR (d) | 7,700 | | 541,926 |

Henkel AG & Co. KGaA | 9,500 | | 614,686 |

Common Stocks - continued |

| Shares | | Value |

Germany - continued |

Hugo Boss AG | 4,700 | | $ 470,478 |

Linde AG | 3,500 | | 588,614 |

SAP AG | 12,210 | | 890,390 |

TOTAL GERMANY | | 5,763,458 |

Hong Kong - 1.0% |

AIA Group Ltd. | 182,200 | | 721,742 |

Galaxy Entertainment Group Ltd. (a) | 146,000 | | 502,048 |

TOTAL HONG KONG | | 1,223,790 |

India - 4.4% |

Asian Paints India Ltd. | 6,168 | | 443,780 |

Bajaj Auto Ltd. | 13,605 | | 459,303 |

Bosch Ltd. (a) | 2,592 | | 428,659 |

Colgate-Palmolive (India) | 18,317 | | 437,661 |

HDFC Bank Ltd. | 50,379 | | 591,549 |

Housing Development Finance Corp. Ltd. (a) | 40,528 | | 574,231 |

ITC Ltd. | 104,981 | | 551,294 |

Page Industries Ltd. | 7,002 | | 436,302 |

Smithkline Beecham Consumer Healthcare Ltd. | 8,424 | | 475,489 |

Titan Industries Ltd. (a) | 95,357 | | 459,550 |

TTK Prestige Ltd. (a) | 7,121 | | 424,276 |

TOTAL INDIA | | 5,282,094 |

Indonesia - 3.9% |

PT ACE Hardware Indonesia Tbk | 676,000 | | 492,658 |

PT Bank Central Asia Tbk | 546,000 | | 466,130 |

PT Bank Rakyat Indonesia Tbk | 620,500 | | 478,051 |

PT Global Mediacom Tbk | 1,932,000 | | 457,603 |

PT Jasa Marga Tbk | 751,500 | | 453,793 |

PT Mitra Adiperkasa Tbk | 598,000 | | 407,796 |

PT Modern Internasional Tbk (a) | 6,254,500 | | 481,865 |

PT Modern Internasional Tbk rights 11/8/12 (a) | 1,876,350 | | 37,117 |

PT Semen Gresik (Persero) Tbk | 307,000 | | 476,240 |

PT Surya Citra Media Tbk | 2,020,000 | | 410,097 |

PT Tower Bersama Infrastructure Tbk (a) | 950,000 | | 494,532 |

TOTAL INDONESIA | | 4,655,882 |

Ireland - 0.7% |

Accenture PLC Class A | 6,300 | | 424,683 |

Dragon Oil PLC | 47,300 | | 423,634 |

TOTAL IRELAND | | 848,317 |

Common Stocks - continued |

| Shares | | Value |

Israel - 0.4% |

Check Point Software Technologies Ltd. (a) | 9,700 | | $ 431,941 |

Italy - 1.9% |

Fiat Industrial SpA | 43,588 | | 472,029 |

Pirelli & C SpA (d) | 41,340 | | 478,763 |

Prada SpA | 60,100 | | 490,103 |

Saipem SpA | 11,108 | | 499,022 |

Salvatore Ferragamo Italia SpA (d) | 18,800 | | 381,841 |

TOTAL ITALY | | 2,321,758 |

Japan - 6.9% |

Daihatsu Motor Co. Ltd. | 28,000 | | 490,342 |

Daito Trust Construction Co. Ltd. | 4,300 | | 434,148 |

Fanuc Corp. | 4,300 | | 684,617 |

Fast Retailing Co. Ltd. | 2,300 | | 512,264 |

Hitachi Ltd. | 117,000 | | 619,955 |

Japan Tobacco, Inc. | 23,400 | | 646,629 |

Kansai Paint Co. Ltd. | 42,000 | | 451,935 |

Keyence Corp. | 1,940 | | 514,709 |

Komatsu Ltd. | 27,700 | | 580,163 |

Kubota Corp. | 50,000 | | 511,086 |

Nabtesco Corp. | 24,700 | | 459,780 |

Rakuten, Inc. | 51,700 | | 464,996 |

SMC Corp. | 3,400 | | 535,789 |

Sysmex Corp. | 9,700 | | 456,263 |

Unicharm Corp. | 8,600 | | 465,389 |

USS Co. Ltd. | 4,130 | | 434,056 |

TOTAL JAPAN | | 8,262,121 |

Korea (South) - 1.3% |

Samsung Electronics Co. Ltd. | 1,305 | | 1,567,934 |

Mexico - 1.3% |

Fomento Economico Mexicano SAB de CV sponsored ADR | 6,000 | | 543,660 |

Grupo Mexico SA de CV Series B | 170,600 | | 546,691 |

Grupo Televisa SA de CV (CPO) sponsored ADR | 21,400 | | 483,640 |

TOTAL MEXICO | | 1,573,991 |

Netherlands - 2.5% |

ASML Holding NV (Netherlands) | 11,400 | | 626,684 |

Core Laboratories NV | 4,475 | | 463,879 |

Heineken Holding NV (A Shares) | 11,100 | | 563,261 |

Kweichow Moutai Co. Ltd. (BNP Paribas Warrant Program) warrants 8/20/13 (a)(e) | 12,200 | | 483,795 |

Common Stocks - continued |

| Shares | | Value |

Netherlands - continued |

LyondellBasell Industries NV Class A | 8,090 | | $ 431,925 |

Yandex NV (a) | 17,300 | | 402,744 |

TOTAL NETHERLANDS | | 2,972,288 |

Nigeria - 0.7% |

Guaranty Trust Bank PLC | 3,615,519 | | 455,796 |

Nigerian Breweries PLC | 498,349 | | 384,566 |

TOTAL NIGERIA | | 840,362 |

Panama - 0.4% |

Intergroup Financial Services Corp. | 14,121 | | 451,872 |

Philippines - 2.4% |

Alliance Global Group, Inc. | 1,265,800 | | 458,275 |

International Container Terminal Services, Inc. | 265,800 | | 459,168 |

Metropolitan Bank & Trust Co. | 200,800 | | 464,136 |

Security Bank Corp. | 112,840 | | 444,496 |

SM Investments Corp. | 25,760 | | 503,291 |

SM Prime Holdings, Inc. | 1,440,950 | | 508,364 |

TOTAL PHILIPPINES | | 2,837,730 |

Portugal - 0.3% |

Jeronimo Martins SGPS SA | 24,500 | | 428,702 |

Russia - 1.4% |

Magnit OJSC GDR (Reg. S) | 14,395 | | 511,023 |

NOVATEK OAO GDR (Reg. S) | 4,400 | | 501,600 |

Sberbank (Savings Bank of the Russian Federation) | 219,300 | | 641,983 |

TOTAL RUSSIA | | 1,654,606 |

Singapore - 0.4% |

Jardine Cycle & Carriage Ltd. | 11,000 | | 444,040 |

South Africa - 1.7% |

Mr Price Group Ltd. | 31,700 | | 489,723 |

Nampak Ltd. | 128,000 | | 426,635 |

Naspers Ltd. Class N | 10,000 | | 649,213 |

Shoprite Holdings Ltd. | 25,400 | | 522,316 |

TOTAL SOUTH AFRICA | | 2,087,887 |

Spain - 1.0% |

Amadeus IT Holding SA Class A | 20,500 | | 507,508 |

Inditex SA | 5,219 | | 665,908 |

TOTAL SPAIN | | 1,173,416 |

Common Stocks - continued |

| Shares | | Value |

Sweden - 2.2% |

ASSA ABLOY AB (B Shares) | 16,006 | | $ 533,541 |

Atlas Copco AB (A Shares) | 27,000 | | 663,918 |

Elekta AB (B Shares) | 34,800 | | 495,801 |

Getinge AB (B Shares) | 14,600 | | 449,034 |

Swedish Match Co. AB | 14,200 | | 483,831 |

TOTAL SWEDEN | | 2,626,125 |

Switzerland - 5.3% |

Compagnie Financiere Richemont SA Series A | 11,208 | | 726,901 |

Dufry AG (a) | 3,660 | | 464,525 |

Nestle SA | 30,826 | | 1,956,208 |

Schindler Holding AG (Reg.) | 4,030 | | 521,438 |

SGS SA (Reg.) | 250 | | 529,368 |

Swatch Group AG (Bearer) | 1,460 | | 604,192 |

Syngenta AG (Switzerland) | 1,990 | | 775,880 |

UBS AG | 49,320 | | 739,977 |

TOTAL SWITZERLAND | | 6,318,489 |

Taiwan - 0.8% |

Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 59,200 | | 941,280 |

Thailand - 1.6% |

C.P. ALL PCL (For. Reg.) | 402,000 | | 521,014 |

Home Product Center PCL (For. Reg.) | 1,145,280 | | 425,699 |

Kasikornbank PCL (For. Reg.) | 81,300 | | 477,144 |

Siam Commercial Bank PCL (For. Reg.) | 87,200 | | 457,750 |

TOTAL THAILAND | | 1,881,607 |

Turkey - 1.2% |

Coca-Cola Icecek A/S | 24,000 | | 465,941 |

TAV Havalimanlari Holding A/S | 97,000 | | 481,618 |

Turkiye Garanti Bankasi A/S | 114,000 | | 544,402 |

TOTAL TURKEY | | 1,491,961 |

United Kingdom - 13.4% |

Aggreko PLC | 14,300 | | 496,147 |

AMEC PLC | 25,411 | | 434,674 |

Antofagasta PLC | 26,200 | | 531,463 |

BHP Billiton PLC ADR | 27,689 | | 1,771,542 |

British American Tobacco PLC (United Kingdom) | 22,600 | | 1,120,951 |

Burberry Group PLC | 29,600 | | 556,963 |

Diageo PLC sponsored ADR | 7,800 | | 891,072 |

Halma PLC | 62,500 | | 415,944 |

Common Stocks - continued |

| Shares | | Value |

United Kingdom - continued |

IMI PLC | 32,700 | | $ 503,686 |

Imperial Tobacco Group PLC | 19,275 | | 727,858 |

InterContinental Hotel Group PLC ADR | 16,766 | | 412,779 |

Intertek Group PLC | 11,700 | | 532,252 |

Johnson Matthey PLC | 13,031 | | 472,937 |

Meggitt PLC | 78,600 | | 489,605 |

Prudential PLC | 52,499 | | 721,000 |

Reckitt Benckiser Group PLC | 11,500 | | 695,930 |

Rexam PLC | 68,400 | | 493,070 |

Rolls-Royce Group PLC | 46,500 | | 641,211 |

Rolls-Royce Group PLC Class C | 3,632,800 | | 5,862 |

Rotork PLC | 11,900 | | 437,459 |

SABMiller PLC | 16,300 | | 698,243 |

Spectris PLC | 17,300 | | 482,421 |

Standard Chartered PLC (United Kingdom) | 35,620 | | 841,246 |

The Weir Group PLC | 16,700 | | 469,462 |

Unilever PLC | 32,000 | | 1,193,702 |

TOTAL UNITED KINGDOM | | 16,037,479 |

United States of America - 16.0% |

Allergan, Inc. | 4,769 | | 428,828 |

Altria Group, Inc. | 11,000 | | 349,800 |

American Tower Corp. | 6,100 | | 459,269 |

Apple, Inc. | 693 | | 412,404 |

Caterpillar, Inc. | 5,400 | | 457,974 |

Citrix Systems, Inc. (a) | 5,900 | | 364,679 |

Coach, Inc. | 7,000 | | 392,350 |

Colgate-Palmolive Co. | 4,180 | | 438,733 |

Crown Castle International Corp. (a) | 6,600 | | 440,550 |

Cummins, Inc. | 5,020 | | 469,772 |

Danaher Corp. | 7,469 | | 386,371 |

Deere & Co. | 4,800 | | 410,112 |

EMC Corp. (a) | 17,700 | | 432,234 |

Estee Lauder Companies, Inc. Class A | 7,188 | | 442,925 |

FMC Corp. | 7,700 | | 412,104 |

FMC Technologies, Inc. (a) | 9,800 | | 400,820 |

Freeport-McMoRan Copper & Gold, Inc. | 11,284 | | 438,722 |

Google, Inc. Class A (a) | 520 | | 353,480 |

Intuitive Surgical, Inc. (a) | 800 | | 433,776 |

Joy Global, Inc. | 7,570 | | 472,747 |

KLA-Tencor Corp. | 9,200 | | 427,984 |

Limited Brands, Inc. | 8,800 | | 421,432 |

Common Stocks - continued |

| Shares | | Value |

United States of America - continued |

Lorillard, Inc. | 3,906 | | $ 453,135 |

MasterCard, Inc. Class A | 960 | | 442,493 |

McGraw-Hill Companies, Inc. | 8,015 | | 443,069 |

Mead Johnson Nutrition Co. Class A | 6,759 | | 416,760 |

Mettler-Toledo International, Inc. (a) | 2,600 | | 440,362 |

Monsanto Co. | 4,276 | | 368,035 |

Moody's Corp. | 9,300 | | 447,888 |

National Oilwell Varco, Inc. | 5,850 | | 431,145 |

NIKE, Inc. Class B | 4,600 | | 420,348 |

Oceaneering International, Inc. | 7,600 | | 397,708 |

Oracle Corp. | 14,180 | | 440,289 |

Perrigo Co. | 3,801 | | 437,153 |

Philip Morris International, Inc. | 5,342 | | 473,088 |

QUALCOMM, Inc. | 7,000 | | 410,025 |

Rockwood Holdings, Inc. | 9,400 | | 431,460 |

SBA Communications Corp. Class A (a) | 6,900 | | 459,747 |

Starbucks Corp. | 8,975 | | 411,953 |

The Coca-Cola Co. | 11,200 | | 416,416 |

TJX Companies, Inc. | 9,700 | | 403,811 |

Union Pacific Corp. | 3,500 | | 430,605 |

Visa, Inc. Class A | 3,200 | | 444,032 |

Waters Corp. (a) | 5,500 | | 449,955 |

Yum! Brands, Inc. | 7,000 | | 490,770 |

TOTAL UNITED STATES OF AMERICA | | 19,207,313 |

TOTAL COMMON STOCKS (Cost $105,494,246) |

118,573,177

|

Nonconvertible Preferred Stocks - 0.6% |

| | | |

Germany - 0.6% |

Volkswagen AG

(Cost $582,736) | 3,600 | |

744,716

|

Money Market Funds - 1.6% |

| Shares | | Value |

Fidelity Securities Lending Cash Central Fund, 0.19% (b)(c)

(Cost $1,864,522) | 1,864,522 | | $ 1,864,522 |

TOTAL INVESTMENT PORTFOLIO - 101.1% (Cost $107,941,504) | | 121,182,415 |

NET OTHER ASSETS (LIABILITIES) - (1.1)% | | (1,319,840) |

NET ASSETS - 100% | $ 119,862,575 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $483,795 or 0.4% of net assets. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 436 |

Fidelity Securities Lending Cash Central Fund | 43,177 |

Total | $ 43,613 |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of October 31, 2012, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 23,396,344 | $ 23,359,227 | $ 37,117 | $ - |

Consumer Staples | 23,043,166 | 19,835,332 | 3,207,834 | - |

Energy | 4,093,132 | 4,093,132 | - | - |

Financials | 14,437,596 | 11,901,275 | 2,536,321 | - |

Health Care | 6,378,865 | 6,378,865 | - | - |

Industrials | 20,751,504 | 20,751,504 | - | - |

Information Technology | 12,969,933 | 11,452,859 | 1,517,074 | - |

Materials | 12,185,005 | 11,409,125 | 775,880 | - |

Telecommunication Services | 2,062,348 | 2,062,348 | - | - |

Money Market Funds | 1,864,522 | 1,864,522 | - | - |

Total Investments in Securities: | $ 121,182,415 | $ 113,108,189 | $ 8,074,226 | $ - |

The following is a summary of transfers between Level 1 and Level 2 for the period ended October 31, 2012. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total |

Level 1 to Level 2 | $ 0 |

Level 2 to Level 1 | $ 14,753,550 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Assets and Liabilities

| October 31, 2012 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $1,753,785) - See accompanying schedule: Unaffiliated issuers (cost $106,076,982) | $ 119,317,893 | |

Fidelity Central Funds (cost $1,864,522) | 1,864,522 | |

Total Investments (cost $107,941,504) | | $ 121,182,415 |

Foreign currency held at value (cost $16,193) | | 16,193 |

Receivable for investments sold | | 2,065,672 |

Receivable for fund shares sold | | 101,786 |

Dividends receivable | | 299,498 |

Distributions receivable from Fidelity Central Funds | | 1,539 |

Receivable from investment adviser for expense reductions | | 24,134 |

Other receivables | | 269,625 |

Total assets | | 123,960,862 |

| | |

Liabilities | | |

Payable to custodian bank | $ 100,464 | |

Payable for investments purchased | 1,529,291 | |

Payable for fund shares redeemed | 291,050 | |

Accrued management fee | 95,137 | |

Distribution and service plan fees payable | 48,957 | |

Other affiliated payables | 34,491 | |

Other payables and accrued expenses | 134,375 | |

Collateral on securities loaned, at value | 1,864,522 | |

Total liabilities | | 4,098,287 |

| | |

Net Assets | | $ 119,862,575 |

Net Assets consist of: | | |

Paid in capital | | $ 211,267,935 |

Undistributed net investment income | | 532,563 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (105,052,276) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 13,114,353 |

Net Assets | | $ 119,862,575 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

| October 31, 2012 |

| | |

Calculation of Maximum Offering Price | | |

Class A:

Net Asset Value and redemption price per share ($40,624,485 ÷ 3,610,960 shares) | | $ 11.25 |

| | |

Maximum offering price per share (100/94.25 of $11.25) | | $ 11.94 |

Class T:

Net Asset Value and redemption price per share ($53,834,806 ÷ 4,882,971 shares) | | $ 11.03 |

| | |

Maximum offering price per share (100/96.50 of $11.03) | | $ 11.43 |

Class B:

Net Asset Value and offering price per share ($2,745,364 ÷ 268,552 shares)A | | $ 10.22 |

| | |

Class C:

Net Asset Value and offering price per share ($18,090,206 ÷ 1,776,200 shares)A | | $ 10.18 |

| | |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($4,567,714 ÷ 381,117 shares) | | $ 11.99 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended October 31, 2012 |

| | |

Investment Income | | |

Dividends | | $ 2,771,155 |

Income from Fidelity Central Funds | | 43,613 |

Income before foreign taxes withheld | | 2,814,768 |

Less foreign taxes withheld | | (210,901) |

Total income | | 2,603,867 |

| | |

Expenses | | |

Management fee

Basic fee | $ 860,534 | |

Performance adjustment | 292,951 | |

Transfer agent fees | 360,582 | |

Distribution and service plan fees | 597,133 | |

Accounting and security lending fees | 63,466 | |

Custodian fees and expenses | 139,257 | |

Independent trustees' compensation | 802 | |

Registration fees | 62,236 | |

Audit | 76,485 | |

Legal | 515 | |

Miscellaneous | 1,196 | |

Total expenses before reductions | 2,455,157 | |

Expense reductions | (445,311) | 2,009,846 |

Net investment income (loss) | | 594,021 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 3,362,667 | |

Foreign currency transactions | (88,127) | |

Total net realized gain (loss) | | 3,274,540 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $38,920) | 8,560,477 | |

Assets and liabilities in foreign currencies | (9,406) | |

Total change in net unrealized appreciation (depreciation) | | 8,551,071 |

Net gain (loss) | | 11,825,611 |

Net increase (decrease) in net assets resulting from operations | | $ 12,419,632 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

October 31,

2012 | Year ended

October 31,

2011 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 594,021 | $ 730,290 |

Net realized gain (loss) | 3,274,540 | 8,411,487 |

Change in net unrealized appreciation (depreciation) | 8,551,071 | (14,294,405) |

Net increase (decrease) in net assets resulting

from operations | 12,419,632 | (5,152,628) |

Distributions to shareholders from net investment income | (721,694) | (760,710) |

Distributions to shareholders from net realized gain | (61,587) | (1,721,042) |

Total distributions | (783,281) | (2,481,752) |

Share transactions - net increase (decrease) | (20,248,751) | (24,900,583) |

Redemption fees | 1,999 | 3,558 |

Total increase (decrease) in net assets | (8,610,401) | (32,531,405) |

| | |

Net Assets | | |

Beginning of period | 128,472,976 | 161,004,381 |

End of period (including undistributed net investment income of $532,563 and undistributed net investment income of $717,375, respectively) | $ 119,862,575 | $ 128,472,976 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class A

Years ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.21 | $ 10.85 | $ 9.34 | $ 6.39 | $ 18.64 |

Income from Investment Operations | | | | | |

Net investment income (loss)C | .08 | .08 F | .06 | .09 | .11 |

Net realized and unrealized gain (loss) | 1.05 | (.53) | 1.69 | 2.88 | (8.42) |

Total from investment operations | 1.13 | (.45) | 1.75 | 2.97 | (8.31) |

Distributions from net investment income | (.09) | (.08) | (.08) | (.02) | (.05) |

Distributions from net realized gain | (.01) | (.12) | (.16) | - | (3.89) |

Total distributions | (.09) I | (.19) J | (.24) | (.02) | (3.94) |

Redemption fees added to paid in capital C, H | - | - | - | - | - |

Net asset value, end of period | $ 11.25 | $ 10.21 | $ 10.85 | $ 9.34 | $ 6.39 |

Total Return A, B | 11.19% | (4.25)% | 18.98% | 46.61% | (55.70)% |

Ratios to Average Net AssetsD, G | | | | | |

Expenses before reductions | 1.78% | 1.64% | 1.45% | 1.27% | 1.42% |

Expenses net of fee waivers, if any | 1.45% | 1.45% | 1.45% | 1.27% | 1.42% |

Expenses net of all reductions | 1.41% | 1.38% | 1.27% | 1.15% | 1.25% |

Net investment income (loss) | .73% | .74% F | .66% | 1.22% | .95% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 40,624 | $ 40,364 | $ 49,058 | $ 43,389 | $ 35,517 |

Portfolio turnover rate E | 142% | 254% | 490% | 414% | 394% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .49%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I Total distributions of $.09 per share is comprised of distributions from net investment income of $.085 and distributions from net realized gain of $.005 per share.

J Total distributions of $.19 per share is comprised of distributions from net investment income of $.077 and distributions from net realized gain of $.116 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class T

Years ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.00 | $ 10.63 | $ 9.16 | $ 6.28 | $ 18.38 |

Income from Investment Operations | | | | | |

Net investment income (loss)C | .05 | .05F | .04 | .07 | .08 |

Net realized and unrealized gain (loss) | 1.04 | (.52) | 1.65 | 2.82 | (8.28) |

Total from investment operations | 1.09 | (.47) | 1.69 | 2.89 | (8.20) |

Distributions from net investment income | (.06) | (.05) | (.06) | (.01) | (.01) |

Distributions from net realized gain | (.01) | (.12) | (.16) | - | (3.89) |

Total distributions | (.06) I | (.16) J | (.22) | (.01) | (3.90) |

Redemption fees added to paid in capital C, H | - | - | - | - | - |

Net asset value, end of period | $ 11.03 | $ 10.00 | $ 10.63 | $ 9.16 | $ 6.28 |

Total ReturnA, B | 10.99% | (4.51)% | 18.65% | 46.23% | (55.79)% |

Ratios to Average Net AssetsD, G | | | | | |

Expenses before reductions | 2.03% | 1.88% | 1.69% | 1.52% | 1.65% |

Expenses net of fee waivers, if any | 1.70% | 1.70% | 1.69% | 1.52% | 1.65% |

Expenses net of all reductions | 1.66% | 1.62% | 1.51% | 1.41% | 1.48% |

Net investment income (loss) | .48% | .49% F | .42% | .96% | .71% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 53,835 | $ 59,914 | $ 74,056 | $ 78,005 | $ 57,603 |

Portfolio turnover rate E | 142% | 254% | 490% | 414% | 394% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .24%.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I Total distributions of $.06 per share is comprised of distributions from net investment income of $.056 and distributions from net realized gain of $.005 per share.

J Total distributions of $.16 per share is comprised of distributions from net investment income of $.047 and distributions from net realized gain of $.116 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class B

Years ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.26 | $ 9.84 | $ 8.51 | $ 5.86 | $ 17.36 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | - H | - F, H | (.01) | .03 | .02 |

Net realized and unrealized gain (loss) | .96 | (.48) | 1.53 | 2.63 | (7.75) |

Total from investment operations | .96 | (.48) | 1.52 | 2.66 | (7.73) |

Distributions from net investment income | - | (.01) | (.03) | (.01) | - |

Distributions from net realized gain | - | (.09) | (.16) | - | (3.77) |

Total distributions | - | (.10) | (.19) | (.01) | (3.77) |

Redemption fees added to paid in capital C,H | - | - | - | - | - |

Net asset value, end of period | $ 10.22 | $ 9.26 | $ 9.84 | $ 8.51 | $ 5.86 |

Total ReturnA, B | 10.37% | (4.99)% | 18.03% | 45.50% | (56.02)% |

Ratios to Average Net AssetsD, G | | | | | |

Expenses before reductions | 2.54% | 2.39% | 2.20% | 2.02% | 2.17% |

Expenses net of fee waivers, if any | 2.20% | 2.20% | 2.20% | 2.02% | 2.17% |

Expenses net of all reductions | 2.16% | 2.13% | 2.02% | 1.90% | 2.01% |

Net investment income (loss) | (.02)% | (.01)% F | (.09)% | .47% | .19% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 2,745 | $ 4,241 | $ 8,737 | $ 10,661 | $ 10,356 |

Portfolio turnover rate E | 142% | 254% | 490% | 414% | 394% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.26) %.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Class C

Years ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.23 | $ 9.84 | $ 8.51 | $ 5.87 | $ 17.42 |

Income from Investment Operations | | | | | |

Net investment income (loss) C | - H | -F, H | (.01) | .03 | .02 |

Net realized and unrealized gain (loss) | .96 | (.49) | 1.53 | 2.62 | (7.75) |

Total from investment operations | .96 | (.49) | 1.52 | 2.65 | (7.73) |

Distributions from net investment income | (.01) | (.01) | (.04) | (.01) | - |

Distributions from net realized gain | (.01) | (.11) | (.16) | - | (3.82) |

Total distributions | (.01) I | (.12) | (.19) J | (.01) | (3.82) |

Redemption fees added to paid in capital C,H | - | - | - | - | - |

Net asset value, end of period | $ 10.18 | $ 9.23 | $ 9.84 | $ 8.51 | $ 5.87 |

Total Return A, B | 10.41% | (5.07)% | 18.12% | 45.26% | (55.95)% |

Ratios to Average Net Assets D, G | | | | | |

Expenses before reductions | 2.53% | 2.39% | 2.20% | 2.02% | 2.16% |

Expenses net of fee waivers, if any | 2.20% | 2.20% | 2.20% | 2.02% | 2.16% |

Expenses net of all reductions | 2.16% | 2.13% | 2.02% | 1.90% | 2.00% |

Net investment income (loss) | (.02)% | (.01)% F | (.09)% | .47% | .20% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 18,090 | $ 19,619 | $ 24,809 | $ 24,575 | $ 20,973 |

Portfolio turnover rate E | 142% | 254% | 490% | 414% | 394% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

E Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

F Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been (.26) %.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I Total distributions of $.01 per share is comprised of distributions from net investment income of $.005 and distributions from net realized gain of $.005 per share.

J Total distributions of $.19 per share is comprised of distributions from net investment income of $.037 and distributions from net realized gain of $.155 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights - Institutional Class

Years ended October 31, | 2012 | 2011 | 2010 | 2009 | 2008 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.87 | $ 11.54 | $ 9.91 | $ 6.77 | $ 19.49 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .11 | .12 E | .10 | .11 | .16 |

Net realized and unrealized gain (loss) | 1.13 | (.57) | 1.78 | 3.05 | (8.88) |

Total from investment operations | 1.24 | (.45) | 1.88 | 3.16 | (8.72) |

Distributions from net investment income | (.12) | (.11) | (.09) | (.02) | (.11) |

Distributions from net realized gain | (.01) | (.12) | (.16) | - | (3.89) |

Total distributions | (.12) H | (.22) I | (.25) | (.02) | (4.00) |

Redemption fees added to paid in capital B, G | - | - | - | - | - |

Net asset value, end of period | $ 11.99 | $ 10.87 | $ 11.54 | $ 9.91 | $ 6.77 |

Total ReturnA | 11.56% | (4.01)% | 19.22% | 46.85% | (55.51)% |

Ratios to Average Net AssetsC, F | | | | | |

Expenses before reductions | 1.48% | 1.35% | 1.19% | 1.00% | 1.12% |

Expenses net of fee waivers, if any | 1.20% | 1.20% | 1.19% | 1.00% | 1.12% |

Expenses net of all reductions | 1.16% | 1.12% | 1.01% | .89% | .95% |

Net investment income (loss) | .98% | 1.00% E | .93% | 1.48% | 1.24% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 4,568 | $ 4,335 | $ 4,345 | $ 3,292 | $ 3,620 |

Portfolio turnover rateD | 142% | 254% | 490% | 414% | 394% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

D Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

E Investment income per share reflects a large, non-recurring dividend which amounted to $.03 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .74%.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Amount represents less than $.01 per share.

H Total distributions of $.12 per share is comprised of distributions from net investment income of $.115 and distributions from net realized gain of $.005 per share.

I Total distributions of $.22 per share is comprised of distributions from net investment income of $.107 and distributions from net realized gain of $.116 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended October 31, 2012

1. Organization.

Fidelity Advisor International Capital Appreciation Fund (the Fund) is a fund of Fidelity Advisor Series VIII (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C and Institutional Class shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Effective after the close of business on September 1, 2010, Class B shares were closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies available only to other investment companies and accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of FMR.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) web site at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC web site or upon request.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or rates are not readily available or reliable, securities will be fair valued in good faith by the FMR Fair Value Committee (the Committee), in accordance with procedures adopted by the Fund's Board. Factors used in determining fair value vary by security type and may include market or security specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when significant market or security specific events arise, comparisons to the valuation of American Depositary Receipts

Annual Report

3. Significant Accounting Policies - continued

Security Valuation - continued

(ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities are used and are categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of October 31, 2012, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency Translation. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income and distributions from the Fidelity Central Funds are accrued as earned. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for income taxes is required. As of October 31, 2012, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. A fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), equity-debt classifications, capital loss carryforwards, and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 14,580,827 |

Gross unrealized depreciation | (2,452,537) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 12,128,290 |

| |

Tax Cost | $ 109,054,125 |

Annual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Undistributed ordinary income | $ 532,563 |

Capital loss carryforward | $ (103,999,529) |

Net unrealized appreciation (depreciation) | $ 12,061,606 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. Capital loss carryforwards were as follows:

Fiscal year of expiration | |

2016 | $ (80,031,657) |

2017 | (23,967,872) |

Total capital loss carryforward | $ (103,999,529) |

The tax character of distributions paid was as follows:

| October 31, 2012 | October 31, 2011 |

Ordinary Income | $ 783,281 | $ 2,481,752 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days are subject to a redemption fee equal to 1.00% of the net asset value of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

New Accounting Pronouncement. In December 2011, the Financial Accounting Standards Board issued Accounting Standard Update No. 2011-11, Disclosures about Offsetting Assets and Liabilities. The update creates new disclosure requirements requiring entities to disclose both gross and net information for derivatives and other financial instruments that are either offset in the Statement of Assets and Liabilities or

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

New Accounting Pronouncement - continued

subject to an enforceable master netting arrangement or similar agreement. The disclosure requirements are effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. Management is currently evaluating the impact of the update's adoption on the Fund's financial statement disclosures.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $171,987,771 and $190,378,005, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .26% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by FMR. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of the Institutional Class of the Fund as compared to an appropriate benchmark index. For the period, the total annual management fee rate, including the performance adjustment, was .95% of the Fund's average net assets.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of FMR, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

Class A | -% | .25% | $ 99,529 | $ 1,057 |

Class T | .25% | .25% | 277,013 | 1,728 |

Class B | .75% | .25% | 33,850 | 25,495 |

Class C | .75% | .25% | 186,741 | 8,859 |

| | | $ 597,133 | $ 37,139 |

Annual Report

5. Fees and Other Transactions with Affiliates - continued

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC |

Class A | $ 6,896 |

Class T | 3,151 |

Class B* | 10,045 |

Class C* | 669 |

| $ 20,761 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of FMR, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. For the period, transfer agent fees for each class were as follows:

| Amount | % of

Average

Net Assets |

Class A | $ 119,875 | .30 |

Class T | 163,509 | .30 |

Class B | 10,211 | .30 |

Class C | 56,261 | .30 |

Institutional Class | 10,726 | .25 |

| $ 360,582 | |

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of FMR, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Annual Report

Notes to Financial Statements - continued

5. Fees and Other Transactions with Affiliates - continued

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. The commissions paid to these affiliated firms were $843 for the period.

6. Committed Line of Credit.

The Fund participates with other funds managed by FMR or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $336 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, there were no borrowings on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund could experience delays and costs in recovering the securities loaned or in gaining access to the collateral. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $43,177. During the period, there were no securities loaned to FCM.

Annual Report

8. Expense Reductions.

FMR voluntarily agreed to reimburse each class to the extent annual operating expenses exceeded certain levels of average net assets as noted in the table below. Some expenses, for example interest expense, including commitment fees, are excluded from this reimbursement.

The following classes were in reimbursement during the period:

| Expense

Limitations | Reimbursement

from adviser |

| | |

Class A | 1.45% | $ 132,366 |

Class T | 1.70% | 181,526 |

Class B | 2.20% | 11,457 |

Class C | 2.20% | 62,372 |

Institutional Class | 1.20% | 12,038 |

| | $ 399,759 |

Many of the brokers with whom FMR places trades on behalf of the Fund provided services to the Fund in addition to trade execution. These services included payments of certain expenses on behalf of the Fund totaling $45,552 for the period.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

Years ended October 31, | 2012 | 2011 |

From net investment income | | |

Class A | $ 338,785 | $ 351,944 |

Class T | 327,446 | 323,075 |

Class B | - | 9,663 |

Class C | 10,467 | 29,995 |

Institutional Class | 44,996 | 46,033 |

Total | $ 721,694 | $ 760,710 |

From net realized gain | | |

Class A | $ 19,929 | $ 529,480 |

Class T | 29,236 | 797,756 |

Class B | - | 70,707 |

Class C | 10,466 | 273,307 |

Institutional Class | 1,956 | 49,792 |

Total | $ 61,587 | $ 1,721,042 |

Annual Report

Notes to Financial Statements - continued

10. Share Transactions.

Transactions for each class of shares were as follows:

| Shares | Dollars |

Years ended October 31, | 2012 | 2011 | 2012 | 2011 |

Class A | | | | |

Shares sold | 501,429 | 721,944 | $ 5,286,360 | $ 7,956,982 |