UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3855

Fidelity Advisor Series VIII

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

|

Registrant's telephone number, including area code: 617-563-7000

| Date of fiscal year end: | | October | | 31 |

| Date of reporting period: | | October | | 31, 2005 |

| Item 1. | | Reports to Stockholders |

Fidelity® Advisor

Diversified International

Fund - Class A, Class T, Class B and Class C

Annual Report

October 31, 2005

| Contents | | | | |

| |

| Chairman’s Message | | 4 | | Ned Johnson’s message to shareholders. |

| Performance | | 6 | | How the fund has done over time. |

| Management’s Discussion | | 8 | | The manager’s review of fund |

| | | | | performance, strategy and outlook. |

| Shareholder Expense | | 9 | | An example of shareholder expenses. |

| Example | | | | |

| Investment Changes | | 11 | | A summary of major shifts in the fund’s |

| | | | | investments over the past six months. |

| Investments | | 12 | | A complete list of the fund’s investments |

| | | | | with their market values. |

| Financial Statements | | 23 | | Statements of assets and liabilities, |

| | | | | operations, and changes in net assets, |

| | | | | as well as financial highlights. |

| Notes | | 32 | | Notes to the financial statements. |

| Report of Independent | | 41 | | |

| Registered Public | | | | |

| Accounting Firm | | | | |

| Trustees and Officers | | 42 | | |

| Distributions | | 52 | | |

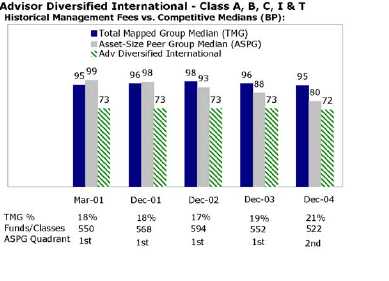

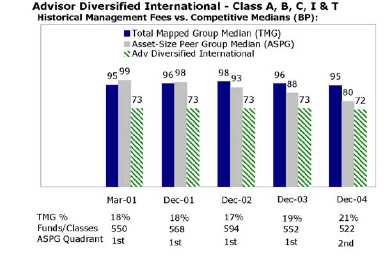

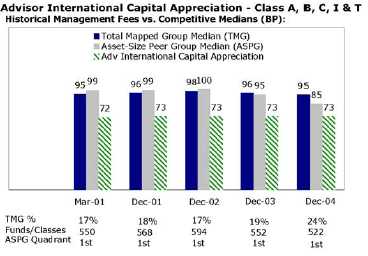

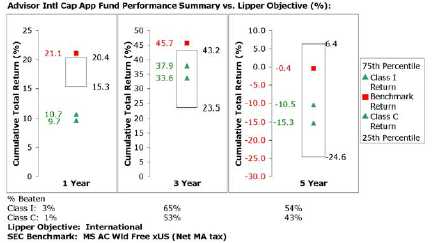

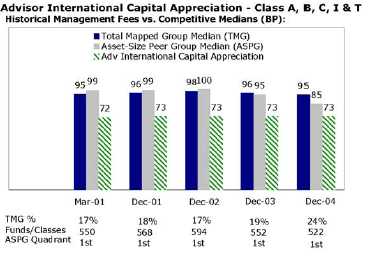

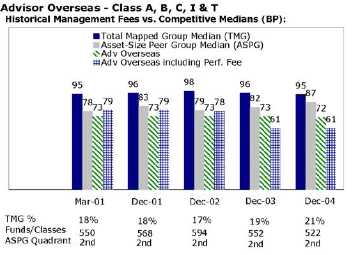

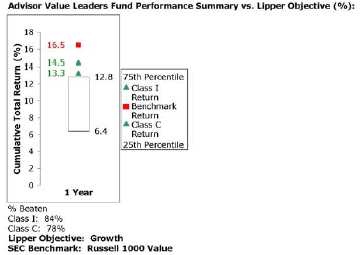

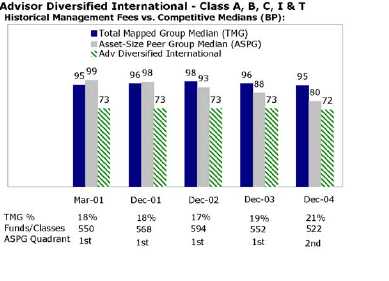

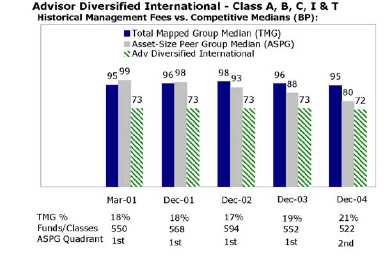

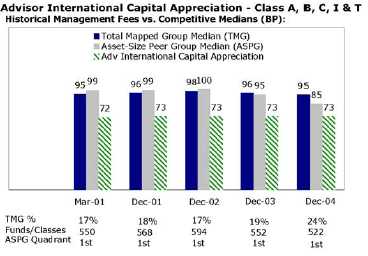

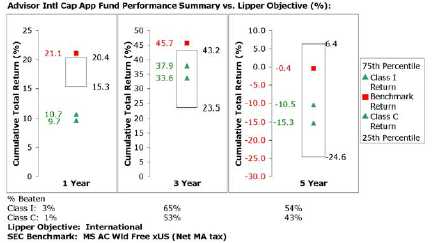

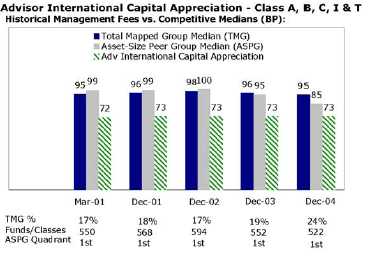

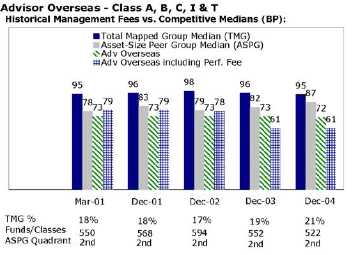

| Board Approval of | | 53 | | |

| Investment Advisory | | | | |

| Contracts and | | | | |

| Management Fees | | | | |

To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund’s portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity’s web site at http://www.advisor.fidelity.com.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

3 Annual Report

Chairman’s Message

(Photograph of Edward C. Johnson 3d)

Dear Shareholder:

During the past year or so, much has been reported about the mutual fund industry, and much of it has been more critical than I believe is warranted. Allegations that some companies have been less than forthright with their shareholders have cast a shadow on the entire industry. I continue to find these reports disturbing, and assert that they do not create an accurate picture of the industry overall. Therefore, I would like to remind everyone where Fidelity stands on these issues. I will say two things specifically regarding allegations that some mutual fund companies were in violation of the Securities and Exchange Commission’s forward pricing rules or were involved in so-called “market timing” activities.

First, Fidelity has no agreements that permit customers who buy fund shares after 4 p.m. to obtain the 4 p.m. price. This is not a new policy. This is not to say that someone could not deceive the company through fraudulent acts. However, we are extremely diligent in preventing fraud from occurring in this manner — and in every other. But I underscore again that Fidelity has no so-called “agreements” that sanction illegal practices.

Second, Fidelity continues to stand on record, as we have for years, in opposition to predatory short-term trading that adversely affects shareholders in a mutual fund. Back in the 1980s, we initiated a fee — which is returned to the fund and, therefore, to investors — to discourage this activity. Further, we took the lead several years ago in developing a Fair Value Pricing Policy to prevent market timing on foreign securities in our funds. I am confident we will find other ways to make it more difficult for predatory traders to operate. However, this will only be achieved through close cooperation among regulators, legislators and the industry.

Yes, there have been unfortunate instances of unethical and illegal activity within the mutual fund industry from time to time. That is true of any industry. When this occurs, confessed or convicted offenders should be dealt with appropriately. But we are still concerned about the risk of over-regulation and the quick application of simplistic solutions to intricate problems. Every system can be improved, and we support and applaud well thought out improvements by regulators, legislators and industry representatives that achieve the common goal of building and protecting the value of investors’ holdings.

For nearly 60 years, Fidelity has worked very hard to improve its products and service to justify your trust. When our family founded this company in 1946, we had only a few hundred customers. Today, we serve more than 18 million customers including individual investors and participants in retirement plans across America.

Annual Report 4

Let me close by saying that we do not take your trust in us for granted, and we realize that we must always work to improve all aspects of our service to you. In turn, we urge you to continue your active participation with your financial matters, so that your interests can be well served.

Best regards,

/s/Edward C. Johnson 3d

5 Annual Report

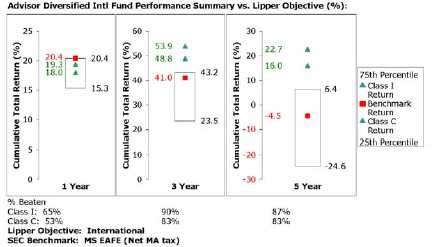

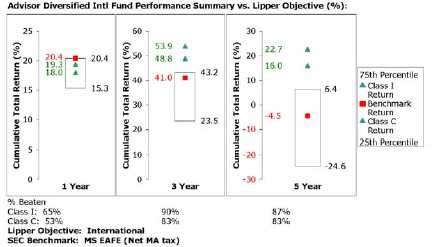

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class’ dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund’s returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow. Returns may reflect the conversion of Class B shares to Class A shares after a maximum of seven years.

| Average Annual Total Returns | | | | | | |

| Periods ended October 31, 2005 | | Past 1 | | Past 5 | | Life of |

| | | year | | years | | fundA |

| Class A (incl. 5.75% sales | | | | | | |

| charge) | | 13.57% | | 6.51% | | 10.79% |

| Class T (incl. 3.50% sales | | | | | | |

| charge) | | 15.96% | | 6.69% | | 10.84% |

| Class B (incl. contingent | | | | | | |

| deferred sales charge)B | | 14.35% | | 6.52% | | 10.79% |

| Class C (incl. contingent | | | | | | |

| deferred sales charge)C | | 18.51% | | 6.93% | | 10.86% |

A From December 17, 1998.

B Class B shares’ contingent deferred sales charges included in the past one year, past five year, and

life of fund total return figures are 5%, 2%, and 0%, respectively.

C Class C shares’ contingent deferred sales charges included in the past one year, past five year, and life of fund total return figures are 1%, 0%, and 0%, respectively.

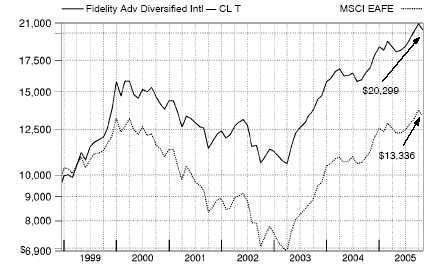

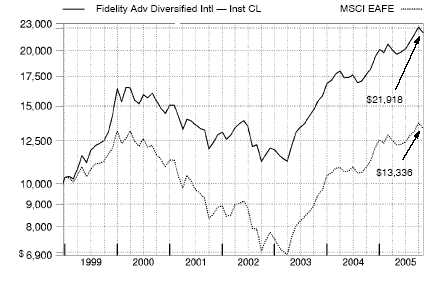

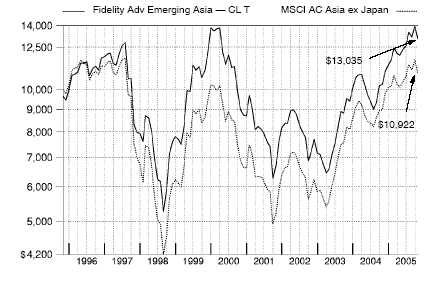

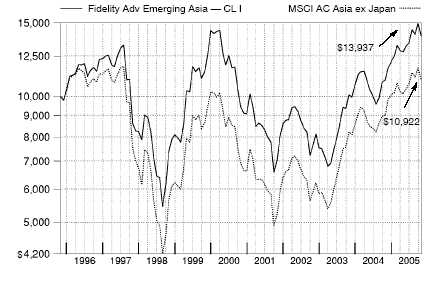

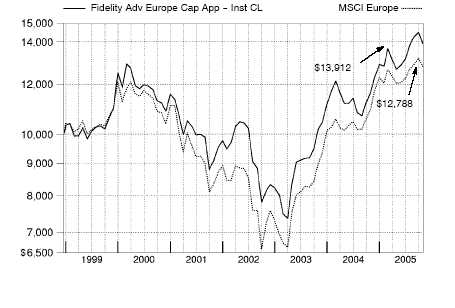

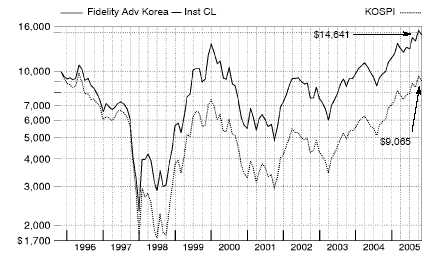

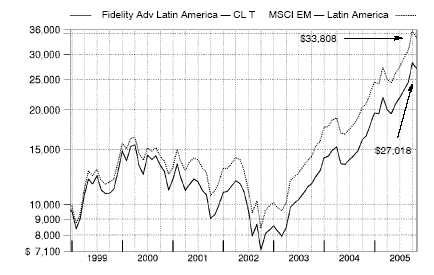

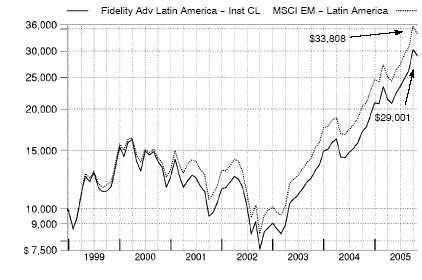

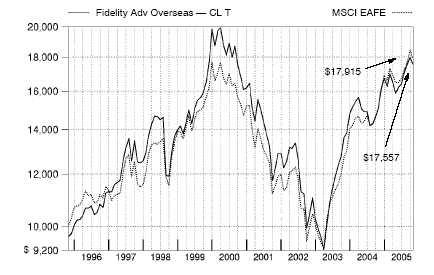

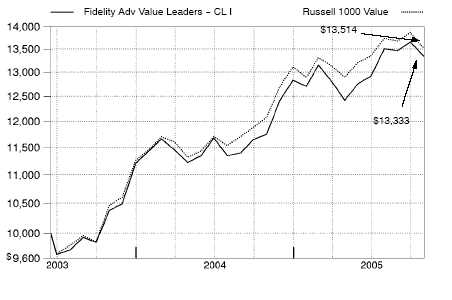

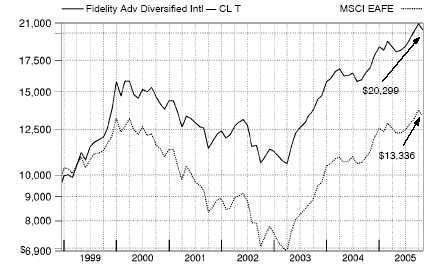

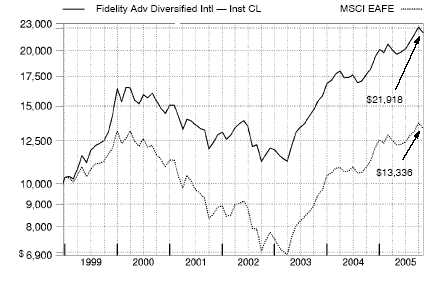

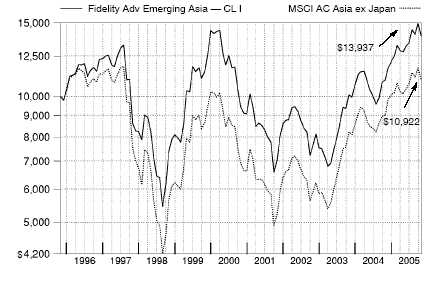

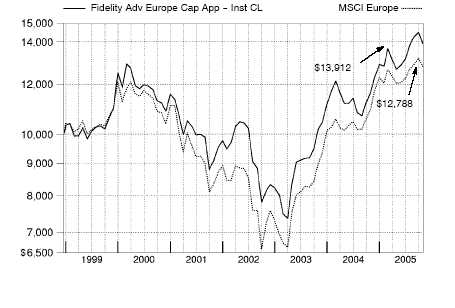

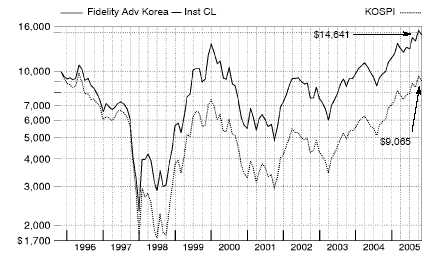

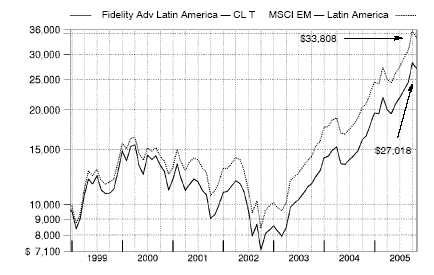

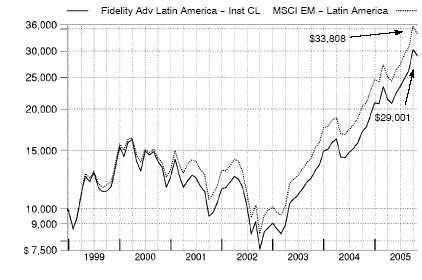

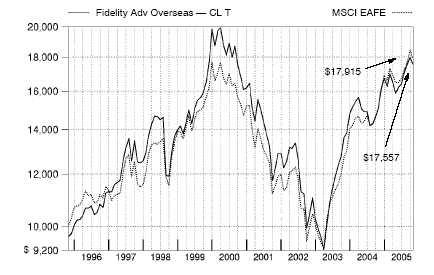

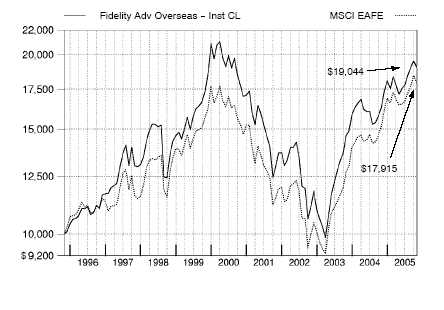

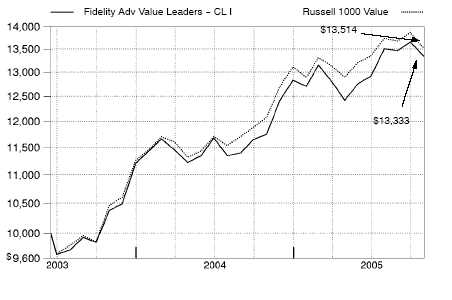

| | $10,000 Over Life of Fund

|

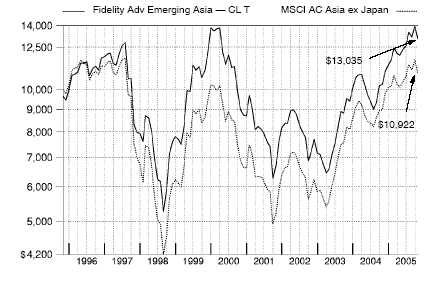

Let’s say hypothetically that $10,000 was invested in Fidelity® Advisor Diversified International Fund — Class T on December 17, 1998, when the fund started, and the current 3.50% sales charge was paid. The chart shows how the value of your investment would have changed, and also shows how the Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI® EAFE®) Index performed over the same period.

Management’s Discussion of Fund Performance

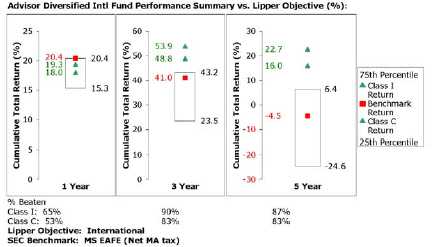

Comments from Penelope Dobkin, Portfolio Manager of Fidelity® Advisor Diversified International Fund

Foreign stock markets enjoyed broad-based advances during the 12 months ending Octo-ber 31, 2005, encouraged by better-than-expected corporate earnings and markedly improved economies. For the 12 months overall, the Morgan Stanley Capital InternationalSM Europe, Australasia, Far East (MSCI® EAFE®) Index — a performance measure of developed stock markets outside the United States and Canada — gained 18.28% . The Japanese stock market climbed to its highest level in more than four years. Positive economic indicators and Prime Minister Koizumi’s decisive election victory attracted record inflows from overseas investors. In response, the Tokyo Stock Exchange Stock Price Index (TOPIX) soared 22.89% . Southeast Asian equities outside of Japan, particularly South Korea, also responded well to the better macroeconomic environment, illustrated by the 19.44% return for the MSCI All Country Far East ex Japan index. European stock markets were up as well, despite investors’ concern about higher energy prices and potential downgrades to economic growth in the region. For the year overall, the MSCI Europe index rose 16.51% . Although robust, returns for U.S. investors in foreign markets were tempered by the strength of the dollar versus many major currencies.

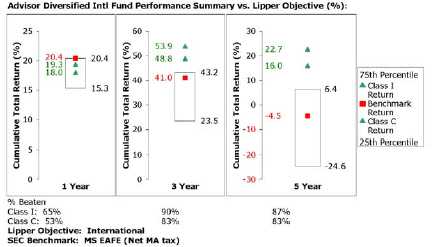

During the past year, the fund’s Class A, Class T, Class B and Class C shares returned 20.50%, 20.16%, 19.35% and 19.51%, respectively, outpacing the MSCI EAFE index and the LipperSM International Funds Average, which rose 17.75% . Favorable stock selection in banks and diversified financials contributed the most to the fund’s return relative to the index, with holdings in Japanese and emerging-markets banks among the best performers. Stocks in such key markets as Germany, which enjoyed a resurgence in real estate values and in corporate restructuring after 15 years of economic stagnation, also provided a boost to returns, as did Canadian energy stocks, which benefited from healthy production growth. Canadian energy company EnCana was the top contributor versus the index, joined by the strong performance of Brazilian bank Unibanco and State Bank of India. Favorable currency movements in emerging markets such as India and Brazil enhanced our returns in the latter two stocks. By contrast, Brazilian paper company Votorantim Celulose lagged due to a lack of pricing power amid rising energy costs, while weak demand hurt Japanese consumer electronics companies Ricoh and Victor Company. An underweighting in the materials sector also hurt relative performance, as several of the period’s top gainers from this group were absent from the portfolio.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2005 to October 31, 2005).

The first line of the table below for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | May 1, 2005 |

| | | | | May 1, 2005 | | | | October 31, 2005 | | | | to October 31, 2005 |

| Class A | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,114.20 | | $ | | 6.77 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,018.80 | | $ | | 6.46 |

| Class T | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,112.20 | | $ | | 7.99 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,017.64 | | $ | | 7.63 |

| Class B | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,108.60 | | $ | | 11.43 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,014.37 | | $ | | 10.92 |

9 Annual Report

| Shareholder Expense Example - continued | | | | |

| |

| |

| | | | | | | | | | | | | Expenses Paid |

| | | | | Beginning | | | | Ending | | | | During Period* |

| | | | | Account Value | | | | Account Value | | | | May 1, 2005 |

| | | | | May 1, 2005 | | | | October 31, 2005 | | | | to October 31, 2005 |

| Class C | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,109.50 | | $ | | 10.90 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,014.87 | | $ | | 10.41 |

| Institutional Class | | | | | | | | | | | | |

| Actual | | $ | | 1,000.00 | | $ | | 1,115.60 | | $ | | 5.12 |

| HypotheticalA | | $ | | 1,000.00 | | $ | | 1,020.37 | | $ | | 4.89 |

| |

| A 5% return per year before expenses | | | | | | | | |

* Expenses are equal to each Class’ annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

| | | Annualized |

| | | Expense Ratio |

| Class A | | 1.27% |

| Class T | | 1.50% |

| Class B | | 2.15% |

| Class C | | 2.05% |

| Institutional Class | | 96% |

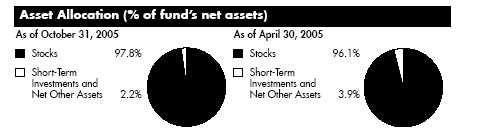

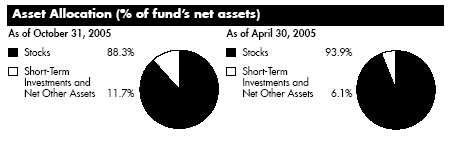

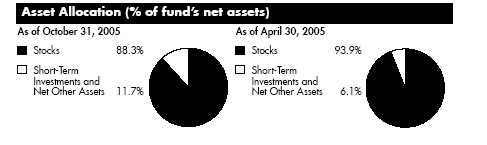

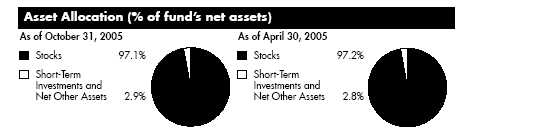

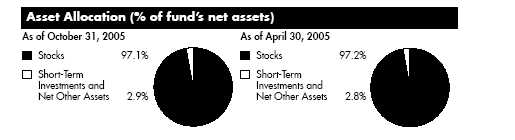

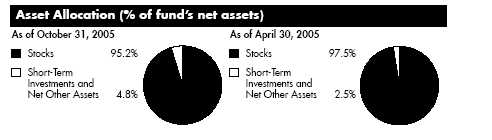

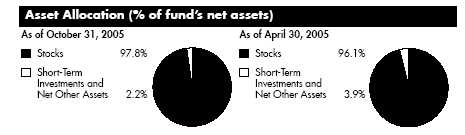

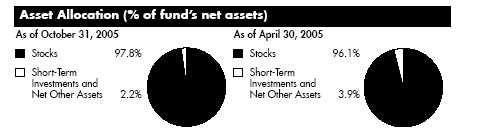

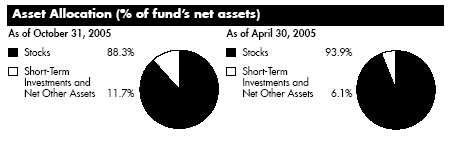

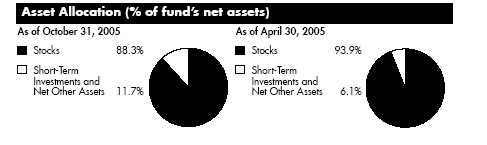

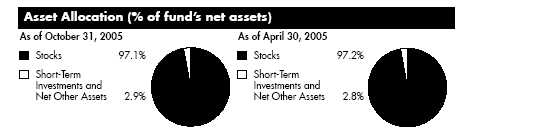

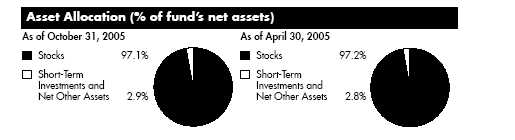

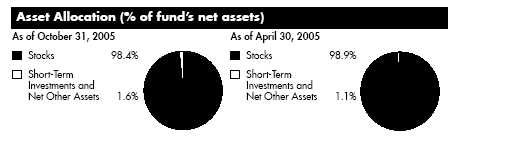

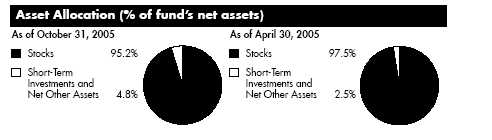

Investment Changes

| Top Five Stocks as of October 31, 2005 | | | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Total SA (France, Oil, Gas & Consumable Fuels) | | 2.5 | | 2.5 |

| BP PLC sponsored ADR (United Kingdom, Oil, | | | | |

| Gas & Consumable Fuels) | | 2.2 | | 2.1 |

| Novartis AG sponsored ADR (Switzerland, | | | | |

| Pharmaceuticals) | | 2.1 | | 1.6 |

| Vodafone Group PLC sponsored ADR (United | | | | |

| Kingdom, Wireless Telecommunication | | | | |

| Services) | | 2.0 | | 2.3 |

| Allianz AG sponsored ADR (Germany, | | | | |

| Insurance) | | 1.8 | | 1.5 |

| | | 10.6 | | |

| Top Five Market Sectors as of October 31, 2005 | | |

| | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Financials | | 28.1 | | 22.9 |

| Industrials | | 12.9 | | 11.7 |

| Consumer Discretionary | | 12.5 | | 12.8 |

| Energy | | 10.2 | | 8.4 |

| Information Technology | | 9.0 | | 10.6 |

| Top Five Countries as of October 31, 2005 | | |

| (excluding cash equivalents) | | % of fund’s | | % of fund’s net assets |

| | | net assets | | 6 months ago |

| Japan | | 21.0 | | 16.4 |

| France | | 11.6 | | 12.2 |

| Germany | | 11.0 | | 9.4 |

| United Kingdom | | 11.0 | | 11.7 |

| Switzerland | | 8.4 | | 9.4 |

Percentages are adjusted for the effect of open futures contracts, if applicable.

11 Annual Report

| Investments October 31, 2005 | | | | |

| Showing Percentage of Net Assets | | | | | | |

| |

| Common Stocks — 96.6% | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Australia – 0.7% | | | | | | |

| CSL Ltd. | | 1,142,744 | | $ | | 32,043 |

| Macquarie Bank Ltd. | | 658,352 | | | | 31,836 |

| TOTAL AUSTRALIA | | | | | | 63,879 |

| |

| Belgium – 0.2% | | | | | | |

| KBC Groupe SA | | 182,138 | | | | 14,847 |

| Bermuda – 0.0% | | | | | | |

| Clear Media Ltd. (a) | | 907,100 | | | | 761 |

| Brazil – 1.8% | | | | | | |

| Banco Bradesco SA (PN) sponsored ADR (non-vtg.) (d) | | 457,500 | | | | 23,740 |

| Banco Nossa Caixa SA | | 222,200 | | | | 3,681 |

| Uniao de Bancos Brasileiros SA (Unibanco) GDR | | 1,443,832 | | | | 75,512 |

| Usinas Siderurgicas de Minas Gerais SA (Usiminas) (PN-A) | | 1,162,900 | | | | 23,446 |

| Votorantim Celulose e Papel SA sponsored ADR (non-vtg.) | | 2,216,200 | | | | 26,528 |

| TOTAL BRAZIL | | | | | | 152,907 |

| |

| Canada – 2.8% | | | | | | |

| ACE Aviation Holdings, Inc. Class A (a) | | 586,200 | | | | 15,387 |

| Canadian Natural Resources Ltd. | | 699,100 | | | | 28,586 |

| Canadian Western Bank, Edmonton | | 685,300 | | | | 20,426 |

| EnCana Corp. | | 1,465,248 | | | | 66,997 |

| ITF Optical Technologies, Inc. Series A (f) | | 1,792 | | | | 0 |

| Jean Coutu Group, Inc.: | | | | | | |

| Class A (e) | | 100 | | | | 1 |

| Class A (sub. vtg.) | | 1,050,940 | | | | 12,805 |

| NOVA Chemicals Corp. | | 489,000 | | | | 17,419 |

| OZ Optics Ltd. unit (a)(f) | | 5,400 | | | | 80 |

| Precision Drilling Corp. (a) | | 841,200 | | | | 38,677 |

| Talisman Energy, Inc. | | 910,600 | | | | 40,333 |

| TOTAL CANADA | | | | | | 240,711 |

| |

| Cayman Islands – 0.5% | | | | | | |

| Apex Silver Mines Ltd. (a)(d) | | 434,100 | | | | 6,650 |

| Foxconn International Holdings Ltd. | | 28,542,000 | | | | 30,559 |

| The9 Computer Technology Consulting Co. Ltd. sponsored | | | | | | |

| ADR (d) | | 245,900 | | | | 4,633 |

| TOTAL CAYMAN ISLANDS | | | | | | 41,842 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| China – 0.2% | | | | | | |

| China Construction Bank Corp. (H Shares) | | 54,234,000 | | $ | | 16,441 |

| Global Bio-Chem Technology Group Co. Ltd. | | 11,470,000 | | | | 4,550 |

| TOTAL CHINA | | | | | | 20,991 |

| |

| Denmark – 1.1% | | | | | | |

| Danske Bank AS | | 1,207,875 | | | | 37,881 |

| GN Store Nordic AS | | 1,023,800 | | | | 12,333 |

| Novo Nordisk AS Series B | | 366,993 | | | | 18,804 |

| Vestas Wind Systems AS (a) | | 1,196,000 | | | | 25,886 |

| TOTAL DENMARK | | | | | | 94,904 |

| |

| Finland – 2.1% | | | | | | |

| Fortum Oyj | | 1,857,400 | | | | 32,886 |

| Metso Corp. | | 1,241,700 | | | | 32,300 |

| Neste Oil Oyj | | 874,600 | | | | 27,102 |

| Nokia Corp. sponsored ADR | | 5,135,700 | | | | 86,382 |

| TOTAL FINLAND | | | | | | 178,670 |

| |

| France – 11.6% | | | | | | |

| Accor SA | | 778,600 | | | | 38,883 |

| AXA SA | | 177,200 | | | | 5,132 |

| AXA SA sponsored ADR | | 3,083,300 | | | | 89,292 |

| Bacou Dalloz | | 76,915 | | | | 6,915 |

| BNP Paribas SA | | 1,001,746 | | | | 75,953 |

| CNP Assurances | | 439,993 | | | | 30,618 |

| Eiffage SA | | 268,005 | | | | 23,132 |

| Financiere Marc de Lacharriere SA (Fimalac) | | 431,479 | | | | 23,431 |

| France Telecom SA sponsored ADR | | 2,075,200 | | | | 53,934 |

| L’Air Liquide SA | | 206,700 | | | | 37,588 |

| Lagardere S.C.A. (Reg.) | | 805,682 | | | | 55,389 |

| Neopost SA | | 274,629 | | | | 26,502 |

| Nexity | | 695,066 | | | | 31,737 |

| NRJ Group | | 1,202,020 | | | | 26,772 |

| Orpea (a) | | 187,100 | | | | 10,093 |

| Pernod Ricard SA | | 105,003 | | | | 18,365 |

| Pinault Printemps-Redoute SA | | 46,262 | | | | 4,861 |

| Sanofi-Aventis sponsored ADR | | 1,504,900 | | | | 60,377 |

| Societe des Autoroutes du Nord et de l’Est de la France | | 464,600 | | | | 27,708 |

| Total SA: | | | | | | |

| Series B | | 109,670 | | | | 27,641 |

| sponsored ADR | | 1,440,600 | | | | 181,544 |

See accompanying notes which are an integral part of the financial statements.

13 Annual Report

| Investments - continued | | | | | | |

| |

| |

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| France – continued | | | | | | |

| Vinci SA | | 431,106 | | $ | | 33,695 |

| Vivendi Universal SA sponsored ADR | | 3,266,600 | | | | 102,637 |

| TOTAL FRANCE | | | | | | 992,199 |

| |

| Germany – 11.0% | | | | | | |

| Aareal Bank AG (a) | | 319,896 | | | | 9,771 |

| Allianz AG sponsored ADR | | 10,848,370 | | | | 153,396 |

| Axel Springer Verlag | | 12,220 | | | | 1,562 |

| Bayer AG | | 970,100 | | | | 33,759 |

| Bayer AG sponsored ADR | | 1,060,600 | | | | 36,909 |

| Bilfinger & Berger Bau AG | | 623,800 | | | | 26,995 |

| DaimlerChrysler AG | | 1,102,200 | | | | 55,165 |

| Deutsche Post AG | | 771,500 | | | | 17,202 |

| Deutsche Telekom AG sponsored ADR | | 5,531,200 | | | | 97,902 |

| E.ON AG sponsored ADR | | 2,222,800 | | | | 67,151 |

| Epcos AG (a) | | 679,800 | | | | 8,206 |

| GFK AG | | 378,067 | | | | 12,531 |

| Heidelberger Druckmaschinen AG | | 1,253,500 | | | | 39,820 |

| Hochtief AG | | 1,283,200 | | | | 51,854 |

| Hypo Real Estate Holding AG | | 1,175,040 | | | | 56,822 |

| Interhyp AG | | 47,943 | | | | 2,874 |

| IWKA AG | | 967,900 | | | | 21,465 |

| K&S AG | | 300,432 | | | | 19,711 |

| MAN AG | | 474,143 | | | | 22,013 |

| Merck KGaA | | 105,500 | | | | 8,726 |

| Metro AG | | 676,300 | | | | 30,759 |

| Muenchener Rueckversicherungs-Gesellschaft AG (Reg.) | | 436,000 | | | | 51,220 |

| Q-Cells AG | | 11,950 | | | | 656 |

| RWE AG | | 409,661 | | | | 26,165 |

| SAP AG sponsored ADR | | 852,000 | | | | 36,585 |

| SGL Carbon AG (a) | | 421,900 | | | | 6,175 |

| SolarWorld AG | | 289,406 | | | | 39,105 |

| TOTAL GERMANY | | | | | | 934,499 |

| |

| Greece – 0.3% | | | | | | |

| Greek Organization of Football Prognostics SA | | 946,360 | | | | 27,318 |

| Hong Kong – 0.9% | | | | | | |

| ASM Pacific Technology Ltd. | | 618,500 | | | | 2,860 |

| Cheung Kong Holdings Ltd. | | 1,471,000 | | | | 15,304 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Hong Kong – continued | | | | | | |

| Hutchison Whampoa Ltd. | | 2,255,000 | | $ | | 21,351 |

| Wharf Holdings Ltd. | | 10,710,000 | | | | 36,542 |

| TOTAL HONG KONG | | | | | | 76,057 |

| |

| India – 0.3% | | | | | | |

| Housing Development Finance Corp. Ltd. | | 382,125 | | | | 8,206 |

| Infrastructure Development Finance Co. Ltd. | | 1,266,464 | | | | 1,825 |

| State Bank of India | | 329,089 | | | | 6,824 |

| Suzlon Energy Ltd. (a) | | 630,349 | | | | 9,994 |

| TOTAL INDIA | | | | | | 26,849 |

| |

| Ireland – 0.6% | | | | | | |

| Allied Irish Banks PLC | | 1,559,698 | | | | 32,800 |

| C&C Group PLC | | 2,382,700 | | | | 14,710 |

| TOTAL IRELAND | | | | | | 47,510 |

| |

| Israel – 1.0% | | | | | | |

| Bank Hapoalim BM (Reg.) | | 8,613,900 | | | | 32,992 |

| Bank Leumi le-Israel BM | | 8,532,400 | | | | 27,846 |

| Teva Pharmaceutical Industries Ltd. sponsored ADR | | 565,700 | | | | 21,564 |

| TOTAL ISRAEL | | | | | | 82,402 |

| |

| Italy – 3.0% | | | | | | |

| Autostrade Spa | | 290,316 | | | | 6,636 |

| Banca Intesa Spa | | 10,887,854 | | | | 50,811 |

| Banche Popolari Unite S.c.a.r.l. | | 1,435,200 | | | | 30,383 |

| Banco Popolare di Verona e Novara | | 1,355,466 | | | | 25,023 |

| Davide Campari-Milano Spa | | 1,823,000 | | | | 12,360 |

| ENI Spa sponsored ADR | | 342,800 | | | | 45,850 |

| Lottomatica Spa New | | 486,700 | | | | 17,678 |

| Mediobanca Spa | | 1,112,700 | | | | 19,701 |

| Unicredito Italiano Spa | | 8,816,600 | | | | 49,230 |

| TOTAL ITALY | | | | | | 257,672 |

| |

| Japan – 21.0% | | | | | | |

| Advantest Corp. | | 66,800 | | | | 4,836 |

| Aiful Corp. | | 57,000 | | | | 4,280 |

| Aoyama Trading Co. Ltd. | | 1,147,400 | | | | 34,580 |

| Asahi Breweries Ltd. | | 1,787,800 | | | | 22,403 |

| Asics Corp. | | 1,551,000 | | | | 13,378 |

| Astellas Pharma, Inc. | | 871,500 | | | | 31,321 |

| Bank of Nagoya Ltd. | | 2,275,000 | | | | 20,549 |

See accompanying notes which are an integral part of the financial statements.

15 Annual Report

| Investments - continued | | | | | | |

| |

| |

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Japan – continued | | | | | | |

| Canon, Inc. sponsored ADR | | 813,400 | | $ | | 43,167 |

| Credit Saison Co. Ltd. | | 1,388,500 | | | | 63,129 |

| Daihatsu Motor Co. Ltd. | | 2,322,000 | | | | 22,160 |

| Daiwa Securities Group, Inc. | | 7,352,000 | | | | 60,422 |

| E*TRADE Securities Co. Ltd. (d) | | 8,321 | | | | 43,741 |

| East Japan Railway Co | | 6,136 | | | | 36,666 |

| Hokuhoku Financial Group, Inc. | | 5,808,000 | | | | 24,093 |

| Honda Motor Co. Ltd. | | 263,400 | | | | 14,650 |

| JAFCO Co. Ltd. | | 281,600 | | | | 16,973 |

| JSR Corp. | | 1,591,600 | | | | 37,698 |

| Juroku Bank Ltd. | | 2,428,000 | | | | 20,270 |

| Kayaba Industry Co. Ltd. | | 2,575,000 | | | | 10,191 |

| Matsushita Electric Industrial Co. Ltd. | | 2,300,000 | | | | 42,320 |

| Millea Holdings, Inc. | | 1,050 | | | | 19,104 |

| Mitsubishi Estate Co. Ltd. | | 1,127,000 | | | | 16,719 |

| Mitsubishi UFJ Financial Group, Inc. | | 1,644 | | | | 20,862 |

| Mitsubishi UFJ Securities Co. Ltd. | | 1,632,000 | | | | 18,670 |

| Mitsui Fudosan Co. Ltd. | | 2,176,000 | | | | 35,710 |

| Mitsui Trust Holdings, Inc. | | 3,905,000 | | | | 47,142 |

| Mizuho Financial Group, Inc. | | 5,509 | | | | 36,831 |

| Murata Manufacturing Co. Ltd. | | 530,200 | | | | 26,494 |

| Nikko Cordial Corp. | | 7,370,000 | | | | 89,356 |

| Nikon Corp. (d) | | 1,893,000 | | | | 24,328 |

| Nippon Chemi-con Corp. | | 5,443,900 | | | | 33,143 |

| Nippon Electric Glass Co. Ltd. | | 2,006,800 | | | | 38,495 |

| Nippon Oil Corp. | | 1,643,000 | | | | 13,987 |

| Nishi-Nippon City Bank Ltd. (a) | | 5,706,000 | | | | 33,306 |

| Nitori Co. Ltd. | | 194,800 | | | | 14,846 |

| Nitto Denko Corp. | | 724,500 | | | | 43,983 |

| Nomura Holdings, Inc. | | 1,559,000 | | | | 24,149 |

| NTT Urban Development Co. | | 3,474 | | | | 20,398 |

| Obayashi Corp. | | 3,146,000 | | | | 23,131 |

| Okamura Corp. | | 1,684,000 | | | | 12,440 |

| OMC Card, Inc. | | 581,000 | | | | 9,776 |

| ORIX Corp. | | 279,100 | | | | 52,378 |

| Ricoh Co. Ltd. | | 1,955,000 | | | | 31,135 |

| Seven & I Holdings Co. Ltd. (a) | | 367,540 | | | | 12,095 |

| SFCG Co. Ltd. | | 130,010 | | | | 31,402 |

| SHIMIZU Corp. | | 6,208,000 | | | | 42,096 |

| Sompo Japan Insurance, Inc | | 1,979,000 | | | | 29,821 |

| Sumitomo Electric Industries Ltd. | | 3,745,000 | | | | 49,362 |

| Sumitomo Forestry Co. Ltd. | | 2,053,000 | | | | 19,042 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Japan – continued | | | | | | |

| Sumitomo Mitsui Financial Group, Inc. | | 10,771 | | $ | | 99,808 |

| Sumitomo Osaka Cement Co. Ltd. | | 8,325,000 | | | | 23,575 |

| T&D Holdings, Inc. | | 433,650 | | | | 27,377 |

| Taiheiyo Cement Corp. | | 4,508,000 | | | | 16,319 |

| Takara Holdings, Inc. | | 569,000 | | | | 3,375 |

| Takefuji Corp. | | 170,700 | | | | 11,989 |

| Tokuyama Corp. | | 3,207,000 | | | | 31,939 |

| Tokyo Electron Ltd. | | 1,537,000 | | | | 77,335 |

| Tokyo Star Bank Ltd. (a) | | 706 | | | | 2,482 |

| Tokyo Tomin Bank Ltd. | | 631,400 | | | | 23,239 |

| Toyoda Machine Works Ltd. | | 1,433,000 | | | | 17,300 |

| Victor Co. of Japan Ltd. (d) | | 3,241,200 | | | | 17,684 |

| TOTAL JAPAN | | | | | | 1,789,450 |

| |

| Korea (South) – 1.8% | | | | | | |

| Hyundai Heavy Industries Co. Ltd. | | 238,250 | | | | 15,495 |

| Hyundai Mipo Dockyard Co. Ltd. | | 271,720 | | | | 16,787 |

| Kookmin Bank sponsored ADR | | 691,410 | | | | 40,392 |

| LG Electronics, Inc. | | 315,190 | | | | 20,439 |

| LG.Philips LCD Co. Ltd. sponsored ADR (a) | | 485,200 | | | | 9,224 |

| Samsung Electronics Co. Ltd. | | 33,771 | | | | 17,856 |

| Shinhan Financial Group Co. Ltd. | | 1,063,534 | | | | 35,451 |

| TOTAL KOREA (SOUTH) | | | | | | 155,644 |

| |

| Luxembourg – 1.6% | | | | | | |

| SES Global unit | | 3,316,753 | | | | 51,886 |

| Stolt-Nielsen SA | | 173,200 | | | | 6,096 |

| Stolt-Nielsen SA Class B sponsored ADR | | 2,137,400 | | | | 76,669 |

| TOTAL LUXEMBOURG | | | | | | 134,651 |

| |

| Mexico – 0.3% | | | | | | |

| Fomento Economico Mexicano SA de CV sponsored ADR | | 312,600 | | | | 21,254 |

| Industrias Penoles SA de CV | | 767,000 | | | | 3,355 |

| TOTAL MEXICO | | | | | | 24,609 |

| |

| Netherlands – 4.7% | | | | | | |

| ASM International NV (Nasdaq) (a) | | 1,358,600 | | | | 18,042 |

| ASML Holding NV (NY Shares) (a) | | 3,702,400 | | | | 62,867 |

| Axalto Holding NV (a) | | 663,700 | | | | 18,068 |

| Fugro NV (Certificaten Van Aandelen) unit | | 492,800 | | | | 13,315 |

| ING Groep NV sponsored ADR | | 2,281,700 | | | | 65,850 |

| Koninklijke Ahold NV (a) | | 2,957,000 | | | | 20,640 |

See accompanying notes which are an integral part of the financial statements.

17 Annual Report

| Investments - continued | | | | | | |

| |

| |

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Netherlands – continued | | | | | | |

| Koninklijke Numico NV (a) | | 431,286 | | $ | | 17,464 |

| Koninklijke Philips Electronics NV (NY Shares) | | 2,130,000 | | | | 55,721 |

| Koninklijke Wessanen NV | | 2,426,032 | | | | 35,626 |

| Reed Elsevier NV | | 223,900 | | | | 3,017 |

| Reed Elsevier NV sponsored ADR | | 1,466,400 | | | | 39,607 |

| Unilever NV (NY Shares) | | 218,600 | | | | 15,370 |

| VNU NV | | 1,196,553 | | | | 38,054 |

| TOTAL NETHERLANDS | | | | | | 403,641 |

| |

| Netherlands Antilles – 0.4% | | | | | | |

| Schlumberger Ltd. (NY Shares) | | 408,300 | | | | 37,061 |

| New Zealand – 0.0% | | | | | | |

| The Warehouse Group Ltd. | | 730,295 | | | | 1,993 |

| Norway – 0.8% | | | | | | |

| DnB NOR ASA | | 2,104,880 | | | | 21,515 |

| Fred Olsen Energy ASA (a) | | 874,500 | | | | 24,127 |

| Odfjell ASA: | | | | | | |

| (A Shares) | | 40,500 | | | | 777 |

| (B Shares) | | 1,065,750 | | | | 18,511 |

| TOTAL NORWAY | | | | | | 64,930 |

| |

| Portugal – 0.5% | | | | | | |

| Brisa Auto-Estradas de Portugal SA | | 3,785,680 | | | | 29,951 |

| Impresa SGPS (a) | | 2,186,400 | | | | 12,187 |

| TOTAL PORTUGAL | | | | | | 42,138 |

| |

| Russia – 0.5% | | | | | | |

| Novatek JSC: | | | | | | |

| GDR (a) | | 307,700 | | | | 6,917 |

| GDR (a)(e) | | 468,166 | | | | 10,524 |

| Sistema JSFC sponsored GDR (e) | | 976,800 | | | | 21,880 |

| TOTAL RUSSIA | | | | | | 39,321 |

| |

| Singapore – 0.3% | | | | | | |

| STATS ChipPAC Ltd. sponsored ADR (a)(d) | | 4,459,100 | | | | 25,016 |

| South Africa – 1.4% | | | | | | |

| Edgars Consolidated Stores Ltd. | | 4,306,000 | | | | 19,124 |

| FirstRand Ltd. | | 6,481,800 | | | | 15,253 |

| Massmart Holdings Ltd. | | 1,333,776 | | | | 10,297 |

| Standard Bank Group Ltd. | | 2,529,600 | | | | 26,088 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| South Africa – continued | | | | | | |

| Steinhoff International Holdings Ltd. | | 13,403,402 | | $ | | 35,077 |

| Sun International Ltd. | | 1,500,000 | | | | 16,990 |

| TOTAL SOUTH AFRICA | | | | | | 122,829 |

| |

| Spain – 1.3% | | | | | | |

| Antena 3 Television SA | | 1,498,088 | | | | 29,128 |

| Banco Bilbao Vizcaya Argentaria SA sponsored ADR | | 408,000 | | | | 7,193 |

| Compania de Distribucion Integral Logista SA | | 105,220 | | | | 5,576 |

| Gestevision Telecinco SA | | 1,123,940 | | | | 24,939 |

| Telefonica SA sponsored ADR | | 970,880 | | | | 46,554 |

| TOTAL SPAIN | | | | | | 113,390 |

| |

| Sweden – 1.5% | | | | | | |

| Eniro AB (d) | | 3,214,100 | | | | 35,122 |

| Gambro AB (A Shares) | | 2,033,072 | | | | 28,728 |

| Securitas AB (B Shares) | | 1,150,600 | | | | 17,487 |

| Telefonaktiebolaget LM Ericsson (B Shares) sponsored ADR (d) | | 1,511,400 | | | | 49,589 |

| TOTAL SWEDEN | | | | | | 130,926 |

| |

| Switzerland – 8.4% | | | | | | |

| ABB Ltd. (Reg.) (a) | | 8,141,450 | | | | 62,269 |

| Actelion Ltd. (Reg.) (a) | | 338,125 | | | | 38,031 |

| Alcon, Inc. | | 200,800 | | | | 26,686 |

| Clariant AG (Reg.) | | 438,315 | | | | 5,848 |

| Compagnie Financiere Richemont unit | | 1,137,738 | | | | 43,289 |

| Credit Suisse Group sponsored ADR | | 642,200 | | | | 28,456 |

| Nestle SA (Reg.) | | 339,614 | | | | 101,161 |

| Novartis AG sponsored ADR | | 3,360,132 | | | | 180,842 |

| Phonak Holding AG | | 265,982 | | | | 11,090 |

| Roche Holding AG (participation certificate) | | 977,215 | | | | 145,997 |

| Societe Generale de Surveillance Holding SA (SGS) (Reg.) | | 20,496 | | | | 15,104 |

| Syngenta AG sponsored ADR | | 1,187,700 | | | | 25,524 |

| UBS AG (NY Shares) | | 369,147 | | | | 31,625 |

| TOTAL SWITZERLAND | | | | | | 715,922 |

| |

| Taiwan – 1.3% | | | | | | |

| Advanced Semiconductor Engineering, Inc. | | 51,971,692 | | | | 31,677 |

| Chi Mei Optoelectronics Corp. | | 24,332,623 | | | | 24,440 |

| Compal Electronics, Inc. | | 14,491,000 | | | | 12,784 |

See accompanying notes which are an integral part of the financial statements.

19 Annual Report

| Investments - continued | | | | | | |

| |

| |

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| Taiwan – continued | | | | | | |

| United Microelectronics Corp. | | 42,384,347 | | $ | | 22,486 |

| United Microelectronics Corp. sponsored ADR (d) | | 6,283,700 | | | | 18,348 |

| TOTAL TAIWAN | | | | | | 109,735 |

| |

| Thailand – 0.1% | | | | | | |

| Thai Oil PCL (For. Reg.) | | 3,184,000 | | | | 5,504 |

| United Kingdom – 11.0% | | | | | | |

| 3i Group PLC | | 1,679,905 | | | | 22,544 |

| Babcock International Group PLC | | 3,347,600 | | | | 11,127 |

| BAE Systems PLC | | 9,191,280 | | | | 53,781 |

| BP PLC sponsored ADR | | 2,781,400 | | | | 184,689 |

| Capita Group PLC | | 5,784,313 | | | | 39,939 |

| EMI Group PLC | | 4,486,500 | | | | 16,998 |

| Group 4 Securicor PLC: | | | | | | |

| (Denmark) | | 2,975,530 | | | | 7,934 |

| (United Kingdom) | | 5,355,100 | | | | 14,269 |

| HSBC Holdings PLC sponsored ADR | | 826,800 | | | | 65,119 |

| Informa PLC | | 1,128,700 | | | | 7,479 |

| Legal & General Group PLC | | 6,762,900 | | | | 12,841 |

| National Grid PLC | | 2,962,375 | | | | 27,089 |

| Prudential PLC | | 3,283,700 | | | | 27,557 |

| Rank Group PLC | | 4,140,427 | | | | 21,698 |

| Reckitt Benckiser PLC | | 155,538 | | | | 4,701 |

| Royal Dutch Shell PLC Class A sponsored ADR | | 1,047,200 | | | | 64,968 |

| Serco Group PLC | | 5,026,248 | | | | 23,604 |

| Smiths Group PLC | | 2,000,700 | | | | 32,322 |

| Tesco PLC | | 9,852,242 | | | | 52,460 |

| Unilever PLC sponsored ADR | | 1,392,200 | | | | 56,523 |

| Vodafone Group PLC sponsored ADR | | 6,479,800 | | | | 170,160 |

| Yell Group PLC | | 2,119,870 | | | | 16,608 |

| TOTAL UNITED KINGDOM | | | | | | 934,410 |

| |

| United States of America – 1.6% | | | | | | |

| Advanced Energy Industries, Inc. (a) | | 320,900 | | | | 3,450 |

| Halliburton Co. | | 464,500 | | | | 27,452 |

| News Corp. Class A | | 1,811,500 | | | | 25,814 |

See accompanying notes which are an integral part of the financial statements.

| Common Stocks – continued | | | | | | |

| | | Shares | | Value (Note 1) |

| | | | | | | (000s) |

| |

| United States of America – continued | | | | | | |

| Synthes, Inc. | | 548,046 | | $ | | 58,029 |

| Transocean, Inc. (a) | | 323,800 | | | | 18,615 |

| TOTAL UNITED STATES OF AMERICA | | | | | | 133,360 |

| |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $7,081,650) | | | | | | 8,238,548 |

| |

| Preferred Stocks — 1.2% | | | | | | |

| |

| Convertible Preferred Stocks – 0.0% | | | | | | |

| |

| Canada – 0.0% | | | | | | |

| MetroPhotonics, Inc. Series 2 (f) | | 8,500 | | | | 0 |

| Nonconvertible Preferred Stocks – 1.2% | | | | | | |

| |

| Italy – 1.2% | | | | | | |

| Banca Intesa Spa (Risp) | | 6,478,900 | | | | 28,061 |

| Buzzi Unicem Spa (Risp) | | 641,893 | | | | 6,400 |

| Telecom Italia Spa (Risp) | | 26,037,100 | | | | 62,955 |

| Unicredito Italiano Spa (Risp) | | 1,329,088 | | | | 7,939 |

| TOTAL ITALY | | | | | | 105,355 |

| |

| TOTAL PREFERRED STOCKS | | | | | | |

| (Cost $111,653) | | | | | | 105,355 |

| |

| Money Market Funds — 2.8% | | | | | | |

| |

| Fidelity Cash Central Fund, 3.92% (b) | | 165,258,587 | | | | 165,259 |

| Fidelity Securities Lending Cash Central Fund, | | | | | | |

| 3.94% (b)(c) | | 76,889,140 | | | | 76,889 |

| TOTAL MONEY MARKET FUNDS | | | | | | |

| (Cost $242,148) | | | | | | 242,148 |

| |

| TOTAL INVESTMENT PORTFOLIO – 100.6% | | | | | | |

| (Cost $7,435,451) | | | | 8,586,051 |

| |

| NET OTHER ASSETS – (0.6)% | | | | | | (52,292) |

| NET ASSETS – 100% | | $ | | 8,533,759 |

See accompanying notes which are an integral part of the financial statements.

21 Annual Report

Investments - continued

Legend

|

(a) Non-income producing

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund’s holdings as of its most recent quarter end is available upon request.

(c) Investment made with cash collateral received from securities on loan.

(d) Security or a portion of the security is on loan at period end.

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $32,404,000 or 0.4% of net assets.

(f) Restricted securities – Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $80,000 or 0.0% of net assets.

| Additional information on each holding is as follows: | | | | |

| Security | | Acquisition Date | | | | Acquisition Cost (000s) |

| ITF Optical Technologies, Inc. Series A | | 10/11/00 | | $ | | 90 |

| MetroPhotonics, Inc. Series 2 | | 9/29/00 | | $ | | 85 |

| OZ Optics Ltd. unit | | 8/18/00 | | $ | | 80 |

See accompanying notes which are an integral part of the financial statements.

| Financial Statements | | | | | | | | |

| |

| |

| Statement of Assets and Liabilities | | | | | | | | |

| Amounts in thousands (except per-share amounts) | | | | | | | | October 31, 2005 |

| |

| Assets | | | | | | | | |

| Investment in securities, at value (including securities | | | | | | | | |

| loaned of $76,752) (cost $7,435,451) — See | | | | | | | | |

| accompanying schedule | | | | | | $ | | 8,586,051 |

| Foreign currency held at value (cost $12,402) | | | | | | | | 12,376 |

| Receivable for investments sold | | | | | | | | 107,221 |

| Receivable for fund shares sold | | | | | | | | 29,024 |

| Dividends receivable | | | | | | | | 8,970 |

| Interest receivable | | | | | | | | 566 |

| Other affiliated receivables | | | | | | | | 2 |

| Other receivables | | | | | | | | 878 |

| Total assets | | | | | | | | 8,745,088 |

| |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | $ | | 113,454 | | | | |

| Payable for fund shares redeemed | | | | 9,739 | | | | |

| Accrued management fee | | | | 5,015 | | | | |

| Distribution fees payable | | | | 2,462 | | | | |

| Other affiliated payables | | | | 1,635 | | | | |

| Other payables and accrued expenses | | | | 2,135 | | | | |

| Collateral on securities loaned, at value | | | | 76,889 | | | | |

| Total liabilities | | | | | | | | 211,329 |

| |

| Net Assets | | | | | | $ | | 8,533,759 |

| Net Assets consist of: | | | | | | | | |

| Paid in capital | | | | | | $ | | 6,909,645 |

| Undistributed net investment income | | | | | | | | 60,354 |

| Accumulated undistributed net realized gain (loss) on | | | | | | | | |

| investments and foreign currency transactions | | | | | | | | 414,935 |

| Net unrealized appreciation (depreciation) on | | | | | | | | |

| investments and assets and liabilities in foreign | | | | | | | | |

| currencies | | | | | | | | 1,148,825 |

| Net Assets | | | | | | $ | | 8,533,759 |

See accompanying notes which are an integral part of the financial statements.

23 Annual Report

| Financial Statements - continued | | | | |

| |

| |

| Statement of Assets and Liabilities — continued | | | | |

| Amounts in thousands (except per-share amounts) | | | | October 31, 2005 |

| |

| Calculation of Maximum Offering Price | | | | |

| Class A: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($2,791,730 ÷ 137,546 shares) | | $ | | 20.30 |

| Maximum offering price per share (100/94.25 of | | | | |

| $20.30) | | $ | | 21.54 |

| Class T: | | | | |

| Net Asset Value and redemption price per share | | | | |

| ($2,419,981 ÷ 120,268 shares) | | $ | | 20.12 |

| Maximum offering price per share (100/96.50 of | | | | |

| $20.12) | | $ | | 20.85 |

| Class B: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($350,685 ÷ 17,888 shares)A | | $ | | 19.60 |

| Class C: | | | | |

| Net Asset Value and offering price per share | | | | |

| ($758,303 ÷ 38,595 shares)A | | $ | | 19.65 |

| Institutional Class: | | | | |

| Net Asset Value, offering price and redemption | | | | |

| price per share ($2,213,060 ÷ 107,617 | | | | |

| shares) | | $ | | 20.56 |

| |

| A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | | | | |

See accompanying notes which are an integral part of the financial statements.

Annual Report 24

| Statement of Operations | | | | | | |

| Amounts in thousands | | | | Year ended October 31, 2005 |

| |

| Investment Income | | | | | | |

| Dividends | | | | $ | | 153,468 |

| Interest | | | | | | 5,494 |

| Security lending | | | | | | 5,615 |

| | | | | | | 164,577 |

| Less foreign taxes withheld | | | | | | (16,915) |

| Total income | | | | | | 147,662 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 47,855 | | |

| Transfer agent fees | | | | 14,379 | | |

| Distribution fees | | | | 23,448 | | |

| Accounting and security lending fees | | | | 1,818 | | |

| Independent trustees’ compensation | | | | 29 | | |

| Custodian fees and expenses | | | | 2,230 | | |

| Registration fees | | | | 679 | | |

| Audit | | | | 138 | | |

| Legal | | | | 21 | | |

| Miscellaneous | | | | 42 | | |

| Total expenses before reductions | | | | 90,639 | | |

| Expense reductions | | | | (4,086) | | 86,553 |

| |

| Net investment income (loss) | | | | | | 61,109 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities (net of foreign taxes of $2,850) . | | 439,484 | | |

| Foreign currency transactions | | | | (3,631) | | |

| Total net realized gain (loss) | | | | | | 435,853 |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment securities (net of increase in deferred for- | | | | |

| eign taxes of $607) | | | | 646,472 | | |

| Assets and liabilities in foreign currencies | | | | (592) | | |

| Total change in net unrealized appreciation | | | | | | |

| (depreciation) | | | | | | 645,880 |

| Net gain (loss) | | | | | | 1,081,733 |

| Net increase (decrease) in net assets resulting from | | | | | | |

| operations | | | | $ | | 1,142,842 |

See accompanying notes which are an integral part of the financial statements.

25 Annual Report

| Financial Statements - continued | | | | | | | | |

| |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| | | | | Year ended | | | | Year ended |

| | | | | October 31, | | | | October 31, |

| Amounts in thousands | | | | 2005 | | | | 2004 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | | 61,109 | | $ | | 11,332 |

| Net realized gain (loss) | | | | 435,853 | | | | 69,269 |

| Change in net unrealized appreciation (depreciation) . | | | | 645,880 | | | | 311,354 |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | | | 1,142,842 | | | | 391,955 |

| Distributions to shareholders from net investment income . | | | | (10,883) | | | | (10,785) |

| Distributions to shareholders from net realized gain | | | | (21,643) | | | | — |

| Total distributions | | | | (32,526) | | | | (10,785) |

| Share transactions — net increase (decrease) | | | | 2,857,486 | | | | 2,786,474 |

| Redemption fees | | | | 289 | | | | 95 |

| Total increase (decrease) in net assets | | | | 3,968,091 | | | | 3,167,739 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 4,565,668 | | | | 1,397,929 |

| End of period (including undistributed net investment | | | | | | | | |

| income of $60,354 and undistributed net investment | | | | | | | | |

| income of $8,576, respectively) | | $ | | 8,533,759 | | $ | | 4,565,668 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights — Class A | | | | | | | | | | | | | | | | |

| |

| Years ended October 31, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | | $ | | 16.97 | | $ | | 14.60 | | $ | | 11.12 | | $ | | 11.87 | | $ | | 14.54 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | 19 | | | | .08 | | | | .09 | | | | .07 | | | | .10 |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 3.27 | | | | 2.41 | | | | 3.45 | | | | (.82) | | | | (2.48) |

| Total from investment operations | | | | 3.46 | | | | 2.49 | | | | 3.54 | | | | (.75) | | | | (2.38) |

| Distributions from net investment | | | | | | | | | | | | | | | | | | | | |

| income | | | | (.05) | | | | (.12) | | | | (.06) | | | | — | | | | (.29) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | (.08) | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.13) | | | | (.12) | | | | (.06) | | | | — | | | | (.29) |

| Redemption fees added to paid in | | | | | | | | | | | | | | | | | | | | |

| capitalC | | | | —E | | | | —E | | | | — | | | | — | | | | — |

| Net asset value, end of period | | $ | | 20.30 | | $ | | 16.97 | | $ | | 14.60 | | $ | | 11.12 | | $ | | 11.87 |

| Total ReturnA,B | | | | 20.50% | | | | 17.15% | | | | 31.99% | | | | (6.32)% | | | | (16.69)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before expense | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 1.27% | | | | 1.31% | | | | 1.42% | | | | 1.46% | | | | 1.50% |

| Expenses net of voluntary | | | | | | | | | | | | | | | | | | | | |

| waivers, if any | | | | 1.27% | | | | 1.31% | | | | 1.42% | | | | 1.46% | | | | 1.50% |

| Expenses net of all reductions | | | | 1.20% | | | | 1.27% | | | | 1.39% | | | | 1.43% | | | | 1.46% |

| Net investment income (loss) | | | | 1.02% | | | | .51% | | | | .71% | | | | .54% | | | | .77% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | | 2,792 | | $ | | 1,294 | | $ | | 241 | | $ | | 52 | | $ | | 38 |

| Portfolio turnover rate | | | | 59% | | | | 72% | | | | 49% | | | | 53% | | | | 84% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions repre sent the net expenses paid by the class.

E Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

27 Annual Report

| Financial Highlights — Class T | | | | | | | | | | | | | | | | |

| |

| Years ended October 31, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | | $ | | 16.82 | | $ | | 14.47 | | $ | | 11.01 | | $ | | 11.80 | | $ | | 14.46 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | 15 | | | | .03 | | | | .05 | | | | .02 | | | | .06 |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 3.23 | | | | 2.39 | | | | 3.43 | | | | (.81) | | | | (2.46) |

| Total from investment operations | | | | 3.38 | | | | 2.42 | | | | 3.48 | | | | (.79) | | | | (2.40) |

| Distributions from net investment | | | | | | | | | | | | | | | | | | | | |

| income | | | | — | | | | (.07) | | | | (.02) | | | | — | | | | (.26) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | (.08) | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.08) | | | | (.07) | | | | (.02) | | | | — | | | | (.26) |

| Redemption fees added to paid in | | | | | | | | | | | | | | | | | | | | |

| capitalC | | | | —E | | | | —E | | | | — | | | | — | | | | — |

| Net asset value, end of period | | $ | | 20.12 | | $ | | 16.82 | | $ | | 14.47 | | $ | | 11.01 | | $ | | 11.80 |

| Total ReturnA,B | | | | 20.16% | | | | 16.78% | | | | 31.66% | | | | (6.69)% | | | | (16.90)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before expense | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 1.51% | | | | 1.61% | | | | 1.75% | | | | 1.79% | | | | 1.81% |

| Expenses net of voluntary | | | | | | | | | | | | | | | | | | | | |

| waivers, if any | | | | 1.51% | | | | 1.61% | | | | 1.75% | | | | 1.79% | | | | 1.81% |

| Expenses net of all reductions | | | | 1.45% | | | | 1.57% | | | | 1.72% | | | | 1.76% | | | | 1.76% |

| Net investment income (loss) | | | | 77% | | | | .21% | | | | .38% | | | | .21% | | | | .47% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | | 2,420 | | $ | | 1,510 | | $ | | 552 | | $ | | 204 | | $ | | 153 |

| Portfolio turnover rate | | | | 59% | | | | 72% | | | | 49% | | | | 53% | | | | 84% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the sales charges.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions repre sent the net expenses paid by the class.

E Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights — Class B | | | | | | | | | | | | | | | | |

| |

| Years ended October 31, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | | $ | | 16.46 | | $ | | 14.19 | | $ | | 10.84 | | $ | | 11.68 | | $ | | 14.33 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | 02 | | | | (.07) | | | | (.02) | | | | (.04) | | | | (.01) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 3.16 | | | | 2.35 | | | | 3.37 | | | | (.80) | | | | (2.44) |

| Total from investment operations | | | | 3.18 | | | | 2.28 | | | | 3.35 | | | | (.84) | | | | (2.45) |

| Distributions from net investment | | | | | | | | | | | | | | | | | | | | |

| income | | | | — | | | | (.01) | | | | — | | | | — | | | | (.20) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | (.04) | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.04) | | | | (.01) | | | | — | | | | — | | | | (.20) |

| Redemption fees added to paid in | | | | | | | | | | | | | | | | | | | | |

| capitalC | | | | —E | | | | —E | | | | — | | | | — | | | | — |

| Net asset value, end of period | | $ | | 19.60 | | $ | | 16.46 | | $ | | 14.19 | | $ | | 10.84 | | $ | | 11.68 |

| Total ReturnA,B | | | | 19.35% | | | | 16.08% | | | | 30.90% | | | | (7.19)% | | | | (17.33)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before expense | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 2.16% | | | | 2.24% | | | | 2.32% | | | | 2.32% | | | | 2.35% |

| Expenses net of voluntary | | | | | | | | | | | | | | | | | | | | |

| waivers, if any | | | | 2.16% | | | | 2.24% | | | | 2.32% | | | | 2.32% | | | | 2.35% |

| Expenses net of all reductions | | | | 2.10% | | | | 2.20% | | | | 2.29% | | | | 2.29% | | | | 2.30% |

| Net investment income (loss) | | | | 12% | | | | (.42)% | | | | (.19)% | | | | (.32)% | | | | (.07)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | | 351 | | $ | | 196 | | $ | | 89 | | $ | | 49 | | $ | | 42 |

| Portfolio turnover rate | | | | 59% | | | | 72% | | | | 49% | | | | 53% | | | | 84% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions repre sent the net expenses paid by the class.

E Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

29 Annual Report

| Financial Highlights — Class C | | | | | | | | | | | | | | | | |

| |

| Years ended October 31, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | �� | $ | | 16.48 | | $ | | 14.22 | | $ | | 10.86 | | $ | | 11.68 | | $ | | 14.34 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)C | | | | 04 | | | | (.05) | | | | (.01) | | | | (.03) | | | | —E |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 3.17 | | | | 2.35 | | | | 3.37 | | | | (.79) | | | | (2.45) |

| Total from investment operations | | | | 3.21 | | | | 2.30 | | | | 3.36 | | | | (.82) | | | | (2.45) |

| Distributions from net investment | | | | | | | | | | | | | | | | | | | | |

| income | | | | — | | | | (.04) | | | | — | | | | — | | | | (.21) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | (.04) | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.04) | | | | (.04) | | | | — | | | | — | | | | (.21) |

| Redemption fees added to paid in | | | | | | | | | | | | | | | | | | | | |

| capitalC | | | | —E | | | | —E | | | | — | | | | — | | | | — |

| Net asset value, end of period | | $ | | 19.65 | | $ | | 16.48 | | $ | | 14.22 | | $ | | 10.86 | | $ | | 11.68 |

| Total ReturnA,B | | | | 19.51% | | | | 16.21% | | | | 30.94% | | | | (7.02)% | | | | (17.33)% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | |

| Expenses before expense | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 2.05% | | | | 2.13% | | | | 2.23% | | | | 2.25% | | | | 2.28% |

| Expenses net of voluntary | | | | | | | | | | | | | | | | | | | | |

| waivers, if any | | | | 2.05% | | | | 2.13% | | | | 2.23% | | | | 2.25% | | | | 2.28% |

| Expenses net of all reductions | | | | 1.99% | | | | 2.09% | | | | 2.20% | | | | 2.22% | | | | 2.24% |

| Net investment income (loss) | | | | 23% | | | | (.31)% | | | | (.10)% | | | | (.25)% | | | | (.01)% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | | 758 | | $ | | 381 | | $ | | 124 | | $ | | 54 | | $ | | 44 |

| Portfolio turnover rate | | | | 59% | | | | 72% | | | | 49% | | | | 53% | | | | 84% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the contingent deferred sales charge.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions repre sent the net expenses paid by the class.

E Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights — Institutional Class | | | | | | | | | | | | |

| |

| Years ended October 31, | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per-Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of | | | | | | | | | | | | | | | | | | | | |

| period | | $ | | 17.18 | | $ | | 14.74 | | $ | | 11.22 | | $ | | 11.94 | | $ | | 14.60 |

| Income from Investment | | | | | | | | | | | | | | | | | | | | |

| Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)B | | | | 25 | | | | .13 | | | | .13 | | | | .11 | | | | .14 |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gain (loss) | | | | 3.30 | | | | 2.44 | | | | 3.48 | | | | (.83) | | | | (2.48) |

| Total from investment operations | | | | 3.55 | | | | 2.57 | | | | 3.61 | | | | (.72) | | | | (2.34) |

| Distributions from net investment | | | | | | | | | | | | | | | | | | | | |

| income | | | | (.09) | | | | (.13) | | | | (.09) | | | | — | | | | (.32) |

| Distributions from net realized | | | | | | | | | | | | | | | | | | | | |

| gain | | | | (.08) | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.17) | | | | (.13) | | | | (.09) | | | | — | | | | (.32) |

| Redemption fees added to paid in | | | | | | | | | | | | | | | | | | | | |

| capitalB | | | | —D | | | | —D | | | | — | | | | — | | | | — |

| Net asset value, end of period | | $ | | 20.56 | | $ | | 17.18 | | $ | | 14.74 | | $ | | 11.22 | | $ | | 11.94 |

| Total ReturnA | | | | 20.81% | | | | 17.54% | | | | 32.41% | | | | (6.03)% | | | | (16.38)% |

| Ratios to Average Net AssetsC | | | | | | | | | | | | | | | | | | | | |

| Expenses before expense | | | | | | | | | | | | | | | | | | | | |

| reductions | | | | 97% | | | | 1.03% | | | | 1.09% | | | | 1.11% | | | | 1.17% |

| Expenses net of voluntary | | | | | | | | | | | | | | | | | | | | |

| waivers, if any | | | | 97% | | | | 1.03% | | | | 1.09% | | | | 1.11% | | | | 1.17% |

| Expenses net of all reductions | | | | 91% | | | | .98% | | | | 1.06% | | | | 1.07% | | | | 1.12% |

| Net investment income (loss) | | | | 1.32% | | | | .80% | | | | 1.04% | | | | .89% | | | | 1.11% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | | 2,213 | | $ | | 1,185 | | $ | | 391 | | $ | | 88 | | $ | | 43 |

| Portfolio turnover rate | | | | 59% | | | | 72% | | | | 49% | | | | 53% | | | | 84% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions repre sent the net expenses paid by the class.

D Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

31 Annual Report

Notes to Financial Statements

For the period ended October 31, 2005

(Amounts in thousands except ratios)

|

1. Significant Accounting Policies.

Fidelity Advisor Diversified International Fund (the fund) is a fund of Fidelity Advisor Series VIII (the trust) and is authorized to issue an unlimited number of shares. The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

The fund offers Class A, Class T, Class B, Class C, and Institutional Class shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase. Investment income, realized and unrealized capital gains and losses, the common expenses of the fund, and certain fund-level expense reductions, if any, are allocated on a pro rata basis to each class based on the relative net assets of each class to the total net assets of the fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions also differ by class.

The fund’s investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

The fund may invest in affiliated money market central funds (Money Market Central Funds) which are open-end investment companies available to investment companies and other accounts managed by Fidelity Management & Research Company (FMR) and its affiliates. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the fund:

Security Valuation. Investments are valued and net asset value (NAV) per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time. Wherever possible, the fund uses independent pricing services approved by the Board of Trustees to value its investments.

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price. Investments in open-end mutual funds, are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

1. Significant Accounting Policies - continued

Security Valuation - continued

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. For example, when developments occur between the close of a market and the close of the NYSE that may materially affect the value of some or all of the securities, or when trading in a security is halted, those securities may be fair valued. Factors used in the determination of fair value may include monitoring news to identify significant market or security specific events such as changes in the value of U.S. securities market, reviewing developments in foreign markets and evaluating the performance of ADRs, futures contracts and exchange-traded funds. Because the fund’s utilization of fair value pricing depends on market activity, the frequency with which fair value pricing is used can not be predicted and may be utilized to a significant extent. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities.

Foreign Currency. The fund uses foreign currency contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rate at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered return of capital distributions or capital gain distributions. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

33 Annual Report

Notes to Financial Statements - continued

(Amounts in thousands except ratios)

1. Significant Accounting Policies - continued

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Income Tax Information and Distributions to Shareholders. Each year, the fund intends to qualify as a regulated investment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements. Foreign taxes are provided for based on the fund’s understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. In addition, the fund will claim a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), market discount and losses deferred due to wash sales.

The tax-basis components of distributable earnings and the federal tax cost as of period end were as follows:

| Unrealized appreciation | | $ | | 1,287,906 | | | | |

| Unrealized depreciation | | | | (186,136) | | | | |

| Net unrealized appreciation (depreciation) | | | | 1,101,770 | | | | |

| Undistributed ordinary income | | | | 160,691 | | | | |

| Undistributed long-term capital gain | | | | 315,179 | | | | |

| Cost for federal income tax purposes | | $ | | 7,484,281 | | | | |

| |

| The tax character of distributions paid was as follows: | | | | |

| | | | | October 31, 2005 | | | | October 31, 2004 |

| Ordinary Income | | $ | | 20,958 | | $ | | 10,785 |

| Long-term Capital Gains | | | | 11,568 | | | | — |

| Total | | $ | | 32,526 | | $ | | 10,785 |

1. Significant Accounting Policies - continued

Short-Term Trading (Redemption) Fees. Shares held in the fund less than 30 days are subject to a redemption fee equal to 1.00% of the proceeds of the redeemed shares. All redemption fees, including any estimated redemption fees paid by FMR, are retained by the fund and accounted for as an addition to paid in capital.