Investor Presentation August 8, 2022 Acquisition of Professional Holding Corp.

This presentation contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, including Professional Holding Corp. (“PFHD”), as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts, any of which may be impacted by the COVID-19 pandemic and any variants thereof and related effects on the U.S. economy. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward- looking statements through the use of words such as “may”, “will”, “anticipate”, “assume”, “should”, “support”, “indicate”, “would”, “believe”, “contemplate”, “expect”, “estimate”, “continue”, “further”, “plan”, “point to”, “project”, “could”, “intend”, “target” or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality; the adverse effects of COVID-19 (economic and otherwise) on the Company and its customers, counterparties, employees, and third- party service providers, and the adverse impacts to our business, financial position, results of operations and prospects; government or regulatory responses to the COVID-19 pandemic; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes including those that impact the money supply and inflation; changes in accounting policies, rules and practices, including the impact of the adoption of the current expected credit losses (“CECL”) methodology; participation in the Paycheck Protection Program (“PPP”); the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securities, loans and debt; changes in borrower credit risks and payment behaviors, including as a result of the financial impact of COVID-19; changes in retail distribution strategies, customer preferences and behavior; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply with any regulatory requirements; changes in the prices, values and sales volumes for residential and commercial real estate; our ability to comply with any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect Seacoast or the banking industry; the Company's concentration in commercial real estate loans and in real estate collateral in Florida; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions, and realize expected revenues and revenue synergies; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company's ability to identify and address increased cybersecurity risks, including as a result of employees working remotely; inability of Seacoast’s risk management framework to manage risks associated with the Company's business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that are critical to the Company's business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions; unexpected outcomes of and the costs associated with, existing or new litigation involving the Company, including as a result of the Company’s participation in the PPP; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company's operations and tax planning strategies are less than currently estimated and sales of capital stock could trigger a reduction in the amount of net operating loss carryforwards that the Company may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in the Company's market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; the failure of assumptions underlying the establishment of reserves for possible loan losses. The risks relating to the proposed Professional Holding Corp. (“PFHD”) merger include, without limitation, failure to obtain the approval of shareholders of PFHD and Seacoast (if required by Nasdaq) in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to the closing of the proposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obtained subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merger; the parties' ability to promptly and effectively integrate the businesses of Seacoast and PFHD, including unexpected transaction costs, the costs of integrating operations, severance, professional fees and other expenses; the diversion of management time on issues related to the merger; the failure to consummate or any delay in consummating the merger for other reasons; changes in laws or regulations; the risks of customer and employee loss and business disruption, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures and solicitations of customers and employees by competitors; the difficulties and risks inherent with entering new markets All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2021 under “Special Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors”, and otherwise in the Company’s SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC’s Internet website at www.sec.gov. 2 Cautionary Notice Regarding Forward-Looking Statements ACQUISITION OF PROFESSIONAL HOLDING CORP.

Important Information For Investors And Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Securities and Exchange Commission (the "SEC") a registration statement on Form S-4 for the transaction containing a proxy statement of Professional Holding Corp. (“PFHD”) and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed merger. A definitive proxy statement/prospectus will be mailed to shareholders of PFHD. Investors and security holders of Seacoast and PFHD are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, PFHD, and their respective directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Seacoast is set forth in its proxy statement for its 2022 annual meeting of shareholders, which was filed with the SEC on April 12, 2022 and its Current Reports on Form 8-K. Information about the directors and executive officers of PFHD is set forth in its proxy statement for its 2022 annual meeting of shareholders, which was filed with the SEC on April 26, 2022 and its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. 3ACQUISITION OF PROFESSIONAL HOLDING CORP.

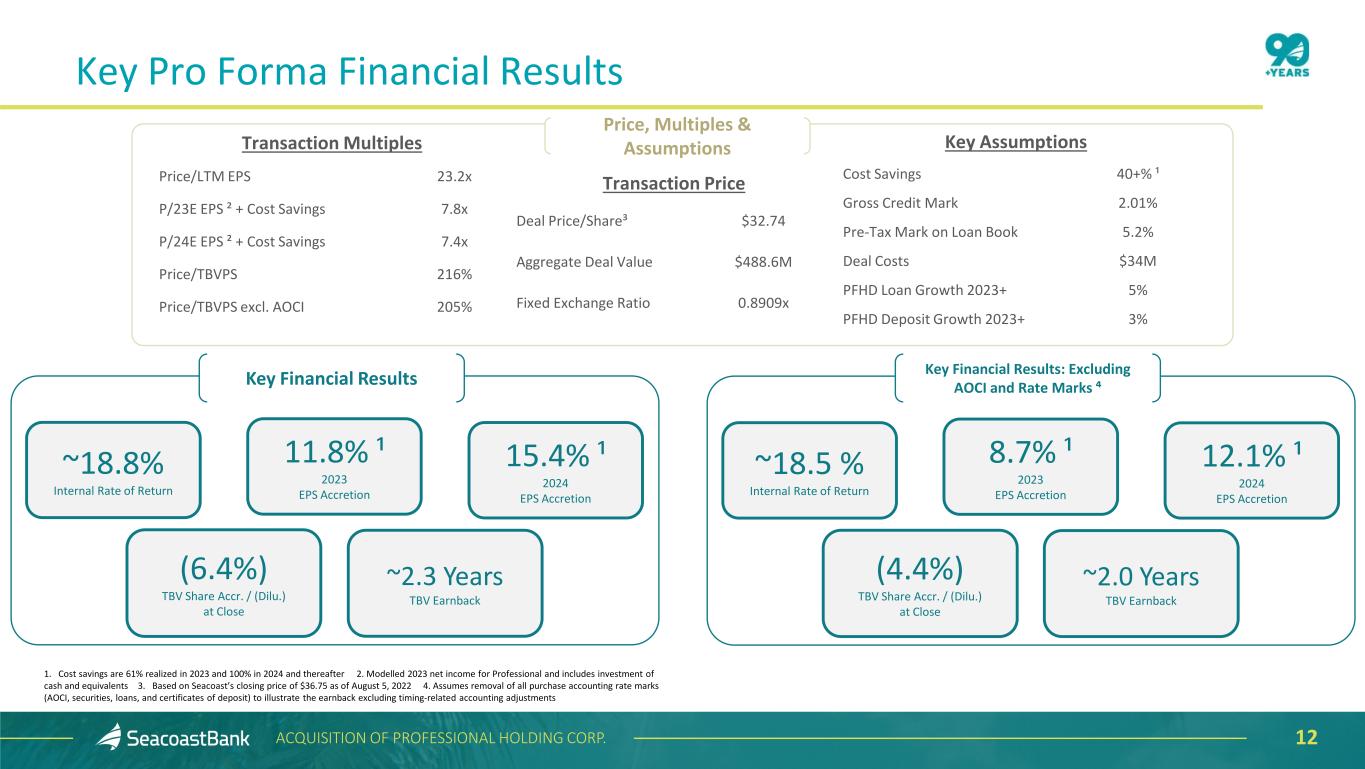

4 Key Transaction Themes 1) Increased market share in South Florida – one of the top banking markets in the country that has seen continuing inflow of sustainable business, people and wealth 2) Addition of long-term, in-market banking professionals and a loan portfolio that complements Seacoast’s legacy franchise. Very limited exposure to non- resident alien relationships, at 3% of deposits and 4% of loans (primarily 1-4 family mortgages) 3) Transaction multiples are in-line with past transactions with a 2023 Price/Earnings plus fully phased-in cost saves (and balance sheet reposition) of 7.8x and Price/TBV of 216% (205% when adjusted for PFHD’s AOCI) 4) Our conservative modeling assumptions are focused on limiting downside risk… a) 5% loan growth and 3% deposit growth in one of the fastest growing MSAs in the country – allows Seacoast to target top tier relationships and still achieve outsized returns b) Despite pristine credit performance, a conservative credit mark was used leaning heavily into the Moody’s S3 recessionary forecast – CECL loan mark of 2.01% and a loan rate mark of 1.50% create effective credit coverage of ~5.2%. This significantly limits any downside risk c) ~50+% of incremental earnings from the transaction generated by cost savings and balance sheet repositioning which carry limited execution risk 5) …Even with a very conservative credit mark and limited growth assumptions, the transaction generates outsized EPS accretion, manageable “at-risk” TBV dilution and best-in-class performance ratios a) TBV dilution of 6.4% and TBV dilution of 4.4% when adjusted for accounting driven dilution from rate marks (including AOCI) that will be earned back through accretion of those marks b) 2024 EPS accretion of ~15.4% and 2024 EPS accretion of ~12.1% when adjusted for earnings from the accretion of rate marks c) TBV earn-back period of ~2.3 years and TBV earn-back period of ~2.0 years when adjusted for the impact of rate marks 6) Further increases scarcity value for Seacoast as we remain the only Florida pure-play bank driving market share in all of the key Florida metro markets ACQUISITION OF PROFESSIONAL HOLDING CORP.

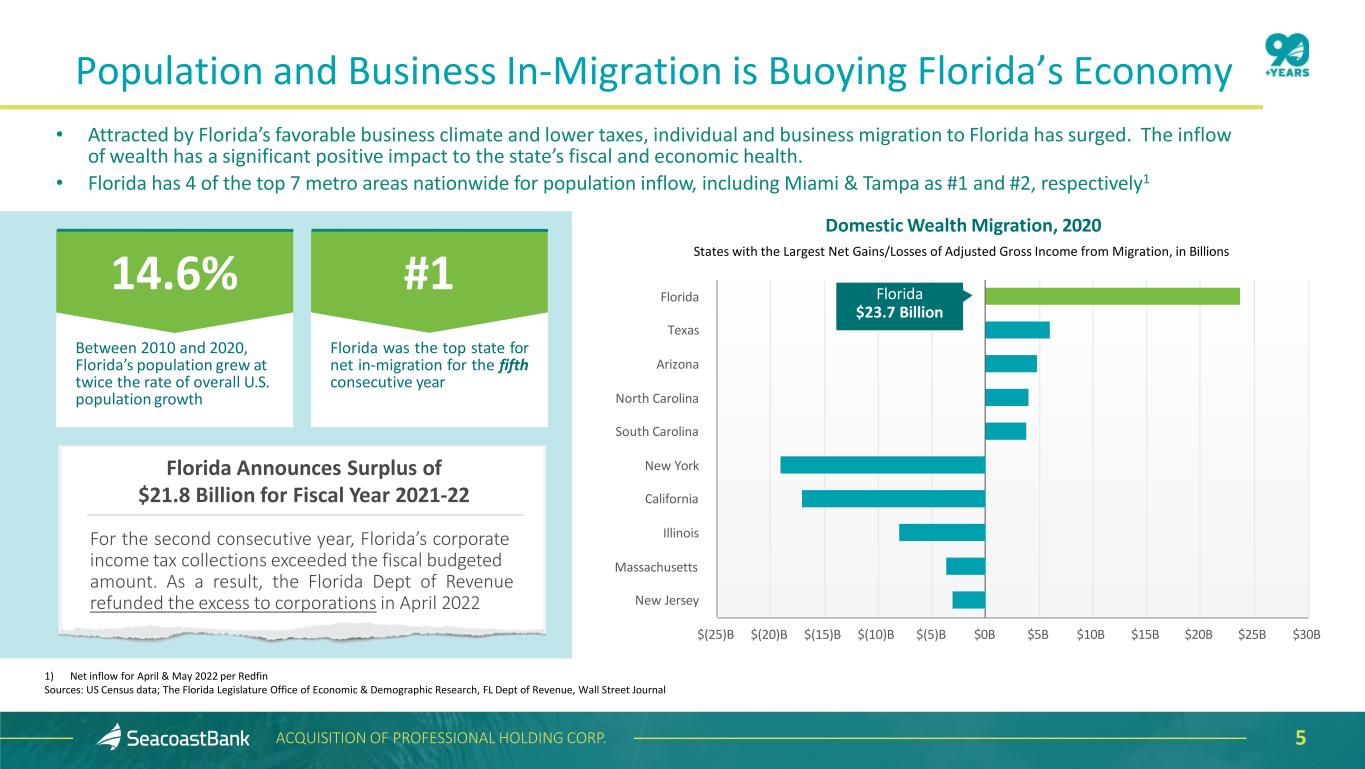

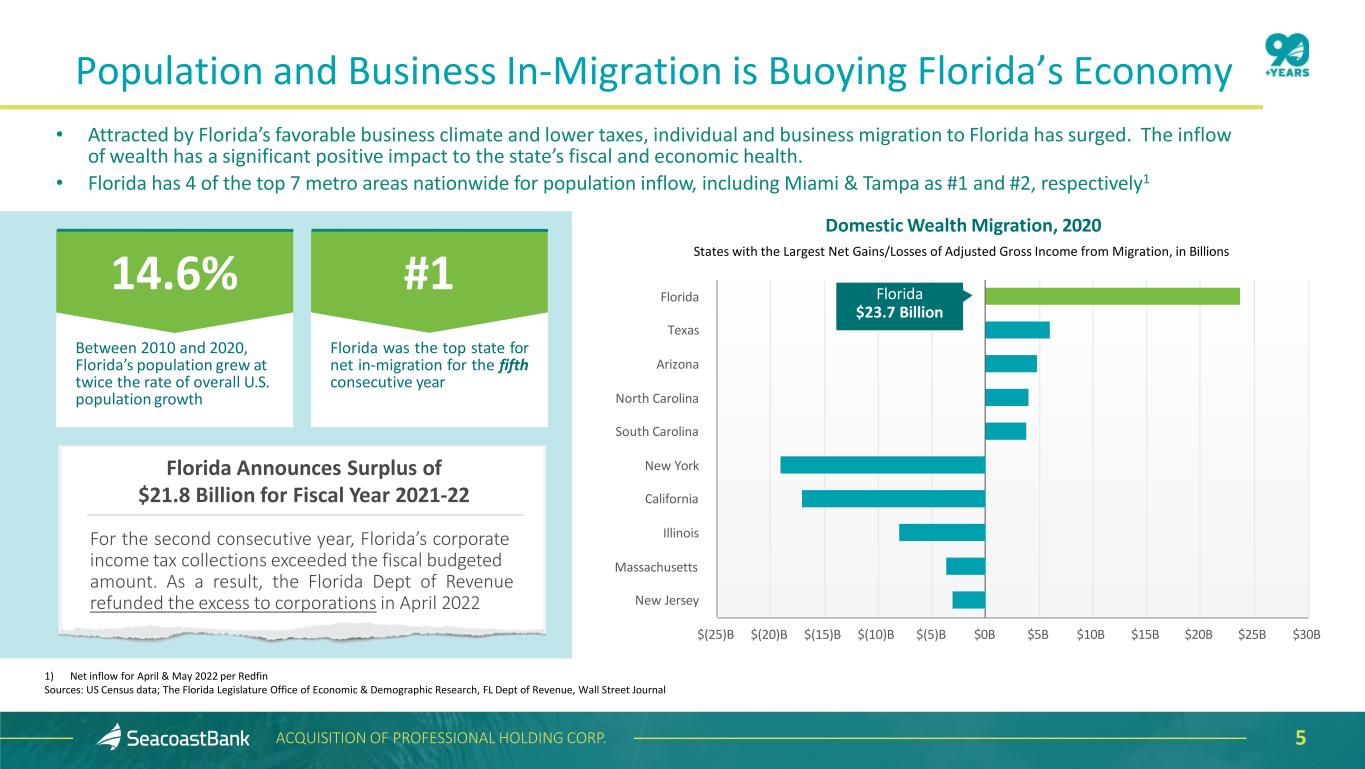

• Attracted by Florida’s favorable business climate and lower taxes, individual and business migration to Florida has surged. The inflow of wealth has a significant positive impact to the state’s fiscal and economic health. • Florida has 4 of the top 7 metro areas nationwide for population inflow, including Miami & Tampa as #1 and #2, respectively1 1) Net inflow for April & May 2022 per Redfin Sources: US Census data; The Florida Legislature Office of Economic & Demographic Research, FL Dept of Revenue, Wall Street Journal Between 2010 and 2020, Florida’s population grew at twice the rate of overall U.S. population growth Florida was the top state for net in-migration for the fifth consecutive year 14.6% #1 Domestic Wealth Migration, 2020 States with the Largest Net Gains/Losses of Adjusted Gross Income from Migration, in Billions Florida Texas Arizona North Carolina South Carolina New York California Illinois Massachusetts New Jersey $(25)B $(20)B $(15)B $(10)B $(5)B $0B $5B $10B $15B $20B $25B $30B Florida $23.7 Billion For the second consecutive year, Florida’s corporate income tax collections exceeded the fiscal budgeted amount. As a result, the Florida Dept of Revenue refunded the excess to corporations in April 2022 Florida Announces Surplus of $21.8 Billion for Fiscal Year 2021-22 Population and Business In-Migration is Buoying Florida’s Economy 5ACQUISITION OF PROFESSIONAL HOLDING CORP.

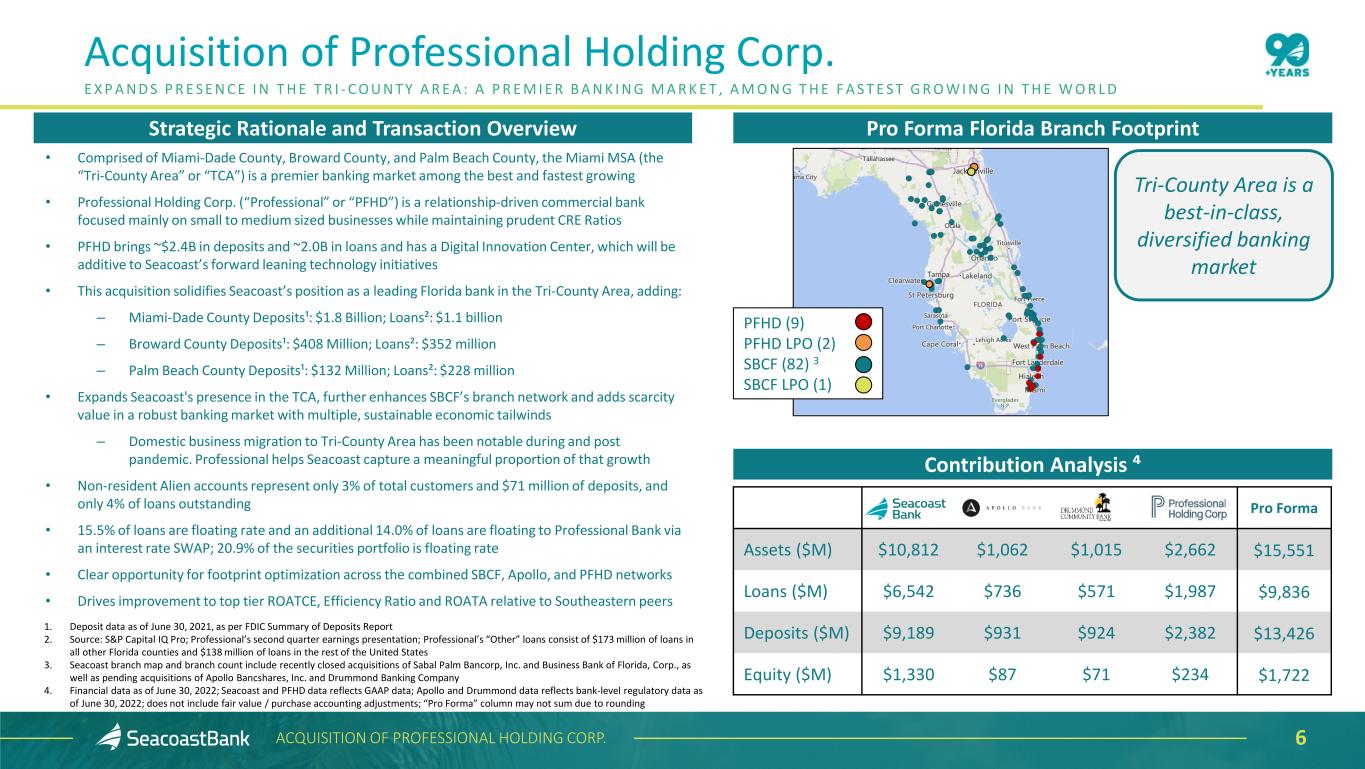

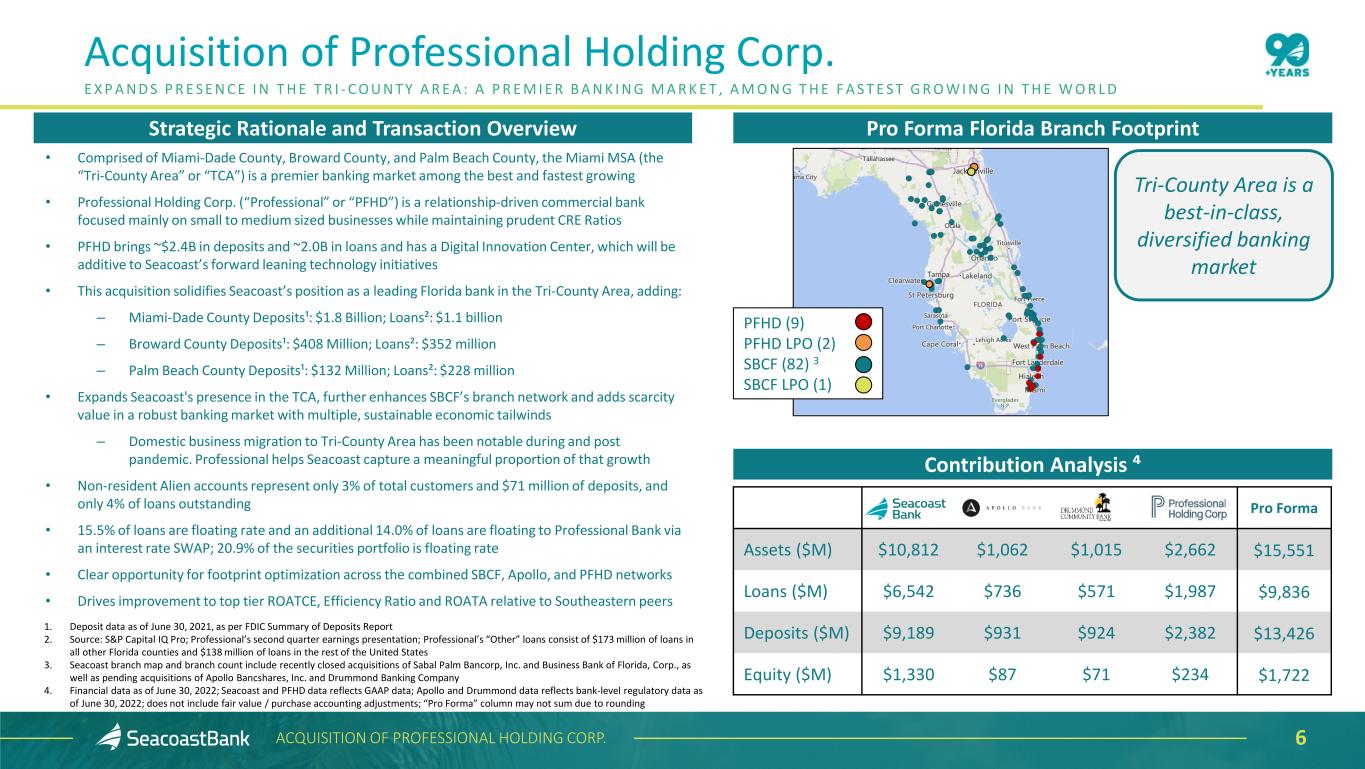

6 Strategic Rationale and Transaction Overview Pro Forma Florida Branch Footprint Contribution Analysis ⁴ • Comprised of Miami-Dade County, Broward County, and Palm Beach County, the Miami MSA (the “Tri-County Area” or “TCA”) is a premier banking market among the best and fastest growing • Professional Holding Corp. (“Professional” or “PFHD”) is a relationship-driven commercial bank focused mainly on small to medium sized businesses while maintaining prudent CRE Ratios • PFHD brings ~$2.4B in deposits and ~2.0B in loans and has a Digital Innovation Center, which will be additive to Seacoast’s forward leaning technology initiatives • This acquisition solidifies Seacoast’s position as a leading Florida bank in the Tri-County Area, adding: ‒ Miami-Dade County Deposits¹: $1.8 Billion; Loans²: $1.1 billion ‒ Broward County Deposits¹: $408 Million; Loans²: $352 million ‒ Palm Beach County Deposits¹: $132 Million; Loans²: $228 million • Expands Seacoast's presence in the TCA, further enhances SBCF’s branch network and adds scarcity value in a robust banking market with multiple, sustainable economic tailwinds ‒ Domestic business migration to Tri-County Area has been notable during and post pandemic. Professional helps Seacoast capture a meaningful proportion of that growth • Non-resident Alien accounts represent only 3% of total customers and $71 million of deposits, and only 4% of loans outstanding • 15.5% of loans are floating rate and an additional 14.0% of loans are floating to Professional Bank via an interest rate SWAP; 20.9% of the securities portfolio is floating rate • Clear opportunity for footprint optimization across the combined SBCF, Apollo, and PFHD networks • Drives improvement to top tier ROATCE, Efficiency Ratio and ROATA relative to Southeastern peers Acquisition of Professional Holding Corp. E X P A N D S P R E S E N C E I N T H E T R I - C O U N T Y A R E A : A P R E M I E R B A N K I N G M A R K E T , A M O N G T H E F A S T E S T G R O W I N G I N T H E W O R L D 1. Deposit data as of June 30, 2021, as per FDIC Summary of Deposits Report 2. Source: S&P Capital IQ Pro; Professional’s second quarter earnings presentation; Professional’s “Other” loans consist of $173 million of loans in all other Florida counties and $138 million of loans in the rest of the United States 3. Seacoast branch map and branch count include recently closed acquisitions of Sabal Palm Bancorp, Inc. and Business Bank of Florida, Corp., as well as pending acquisitions of Apollo Bancshares, Inc. and Drummond Banking Company 4. Financial data as of June 30, 2022; Seacoast and PFHD data reflects GAAP data; Apollo and Drummond data reflects bank-level regulatory data as of June 30, 2022; does not include fair value / purchase accounting adjustments; “Pro Forma” column may not sum due to rounding Pro Forma Assets ($M) $10,812 $1,062 $1,015 $2,662 $15,551 Loans ($M) $6,542 $736 $571 $1,987 $9,836 Deposits ($M) $9,189 $931 $924 $2,382 $13,426 Equity ($M) $1,330 $87 $71 $234 $1,722 ACQUISITION OF PROFESSIONAL HOLDING CORP. Tri-County Area is a best-in-class, diversified banking market PFHD (9) PFHD LPO (2) SBCF (82) 3 SBCF LPO (1)

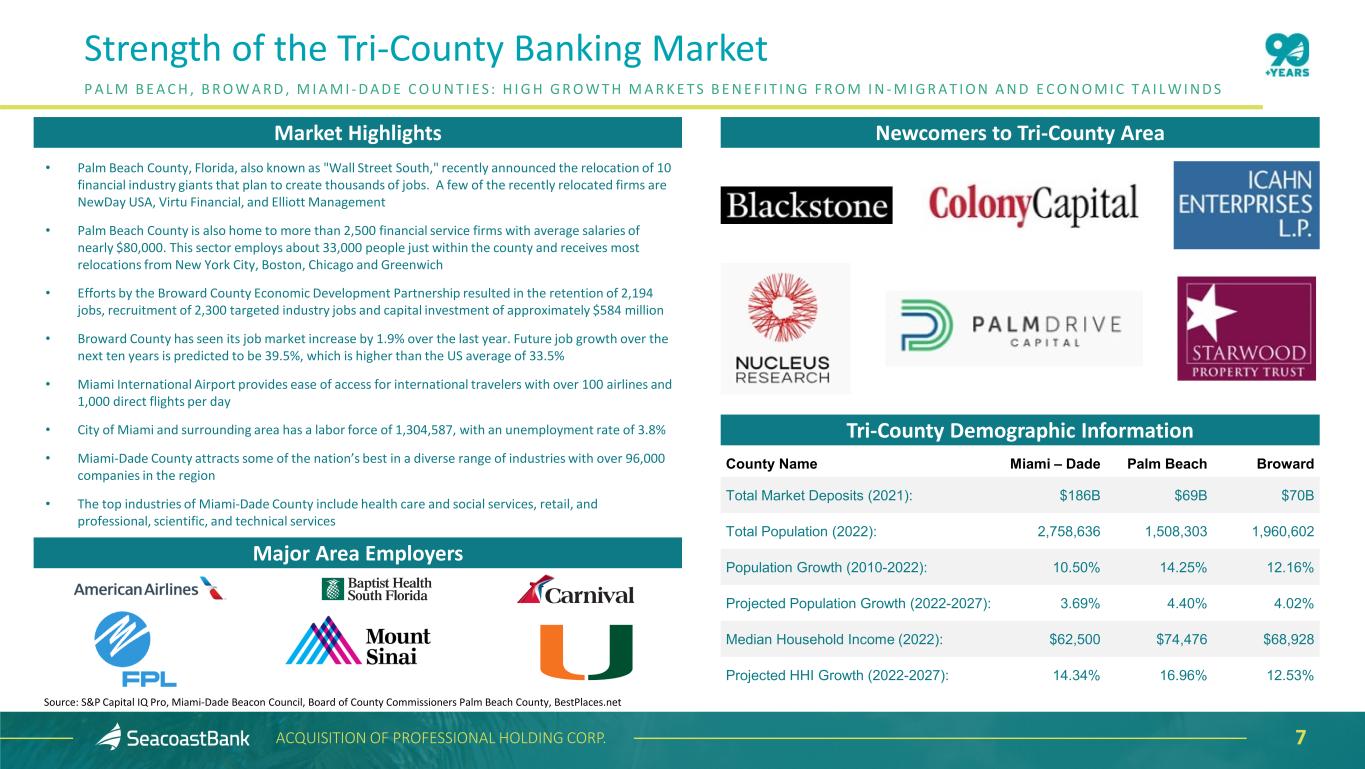

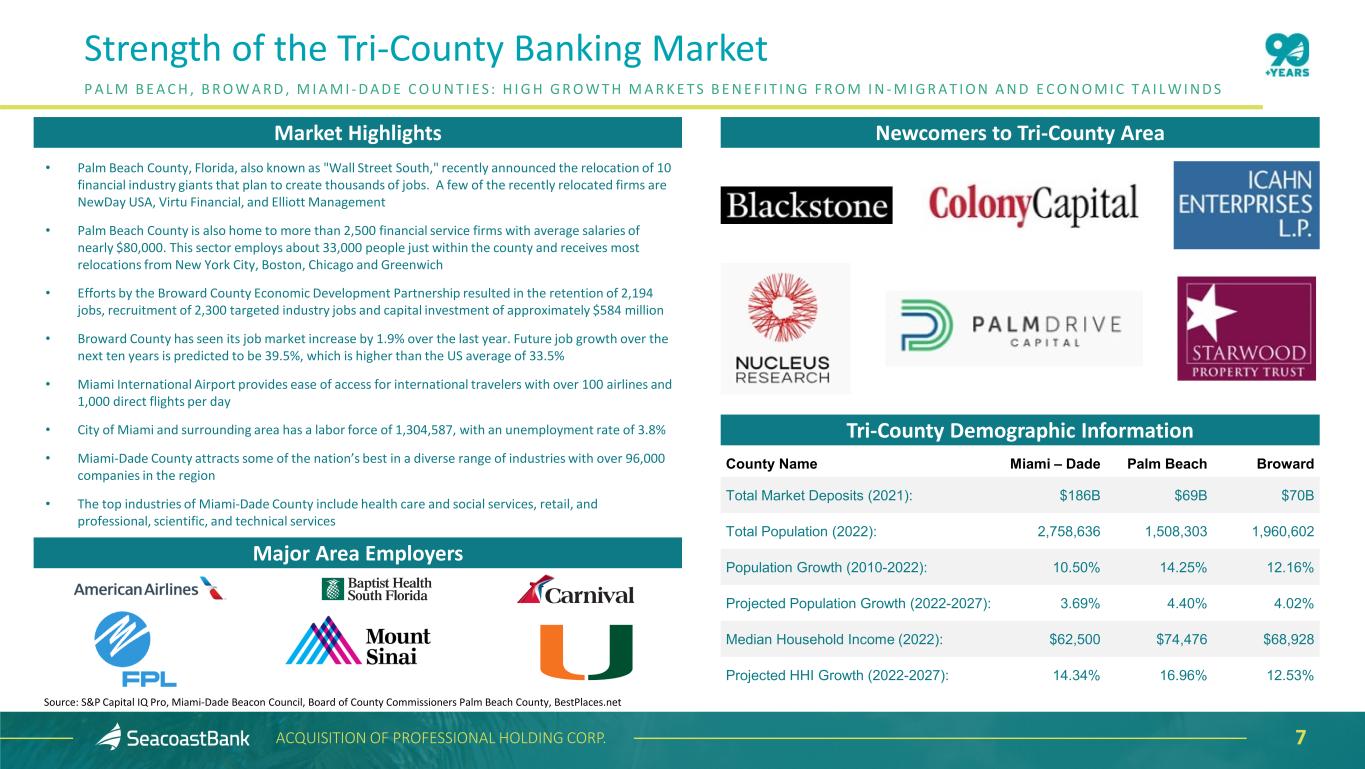

• Palm Beach County, Florida, also known as "Wall Street South," recently announced the relocation of 10 financial industry giants that plan to create thousands of jobs. A few of the recently relocated firms are NewDay USA, Virtu Financial, and Elliott Management • Palm Beach County is also home to more than 2,500 financial service firms with average salaries of nearly $80,000. This sector employs about 33,000 people just within the county and receives most relocations from New York City, Boston, Chicago and Greenwich • Efforts by the Broward County Economic Development Partnership resulted in the retention of 2,194 jobs, recruitment of 2,300 targeted industry jobs and capital investment of approximately $584 million • Broward County has seen its job market increase by 1.9% over the last year. Future job growth over the next ten years is predicted to be 39.5%, which is higher than the US average of 33.5% • Miami International Airport provides ease of access for international travelers with over 100 airlines and 1,000 direct flights per day • City of Miami and surrounding area has a labor force of 1,304,587, with an unemployment rate of 3.8% • Miami-Dade County attracts some of the nation’s best in a diverse range of industries with over 96,000 companies in the region • The top industries of Miami-Dade County include health care and social services, retail, and professional, scientific, and technical services Market Highlights Newcomers to Tri-County Area Tri-County Demographic Information County Name Miami – Dade Palm Beach Broward Total Market Deposits (2021): $186B $69B $70B Total Population (2022): 2,758,636 1,508,303 1,960,602 Population Growth (2010-2022): 10.50% 14.25% 12.16% Projected Population Growth (2022-2027): 3.69% 4.40% 4.02% Median Household Income (2022): $62,500 $74,476 $68,928 Projected HHI Growth (2022-2027): 14.34% 16.96% 12.53% Major Area Employers Strength of the Tri-County Banking Market P A L M B E A C H , B R O W A R D , M I A M I - D A D E C O U N T I E S : H I G H G R O W T H M A R K E T S B E N E F I T I N G F R O M I N - M I G R A T I O N A N D E C O N O M I C T A I L W I N D S Source: S&P Capital IQ Pro, Miami-Dade Beacon Council, Board of County Commissioners Palm Beach County, BestPlaces.net ACQUISITION OF PROFESSIONAL HOLDING CORP. 7

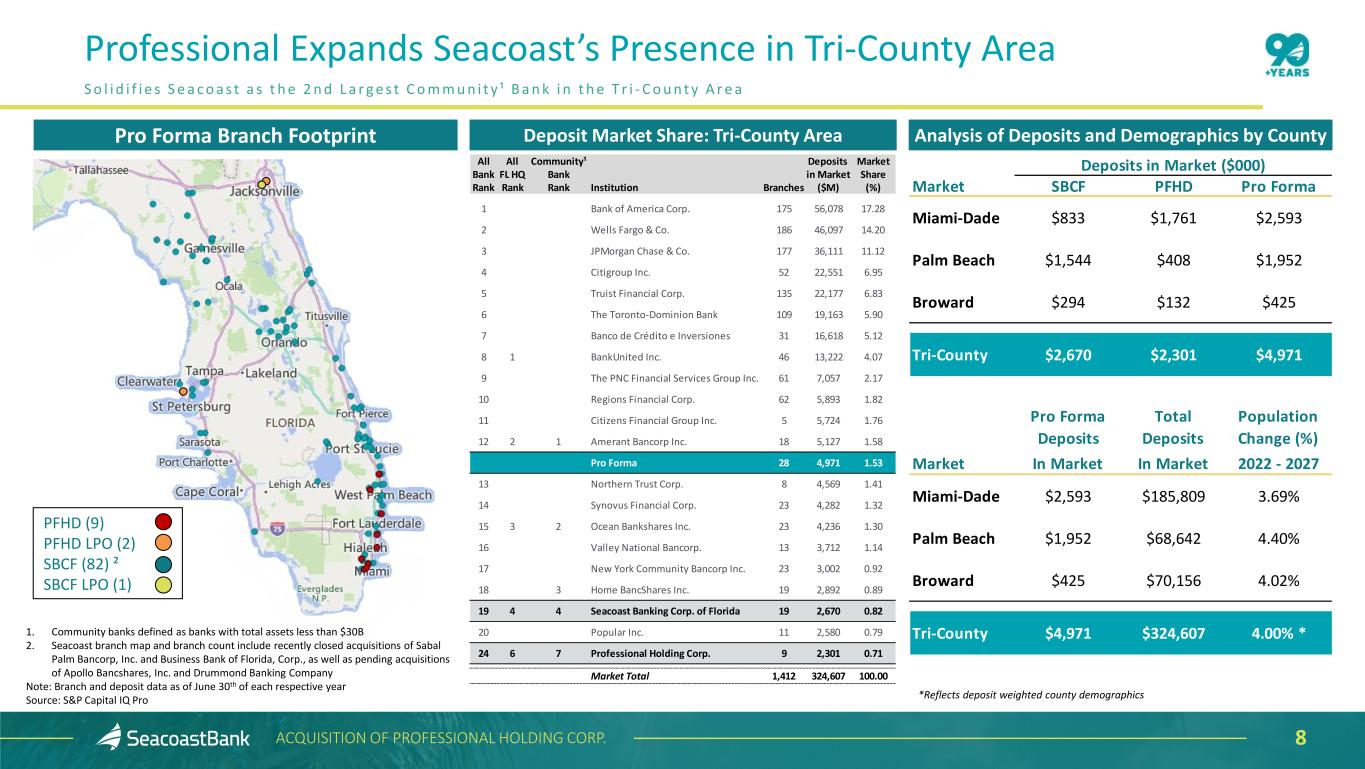

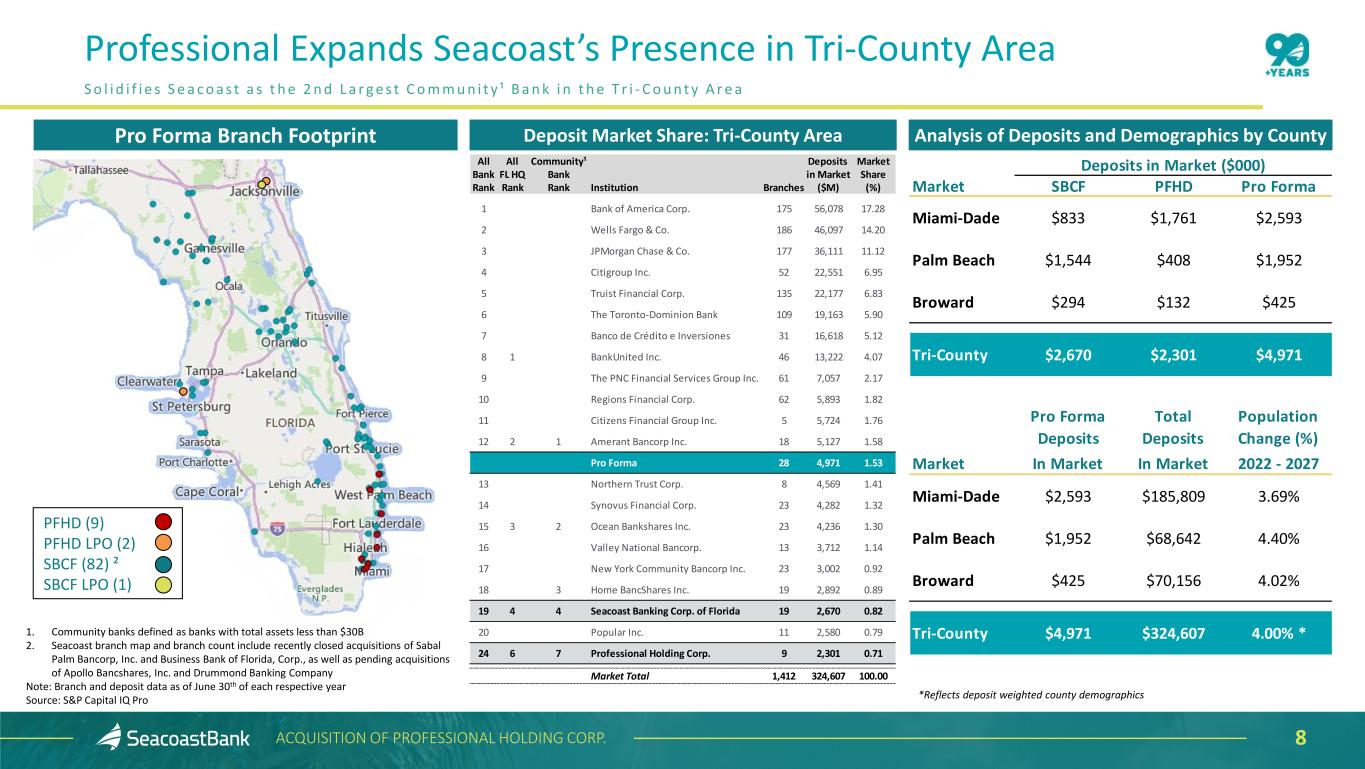

1. Community banks defined as banks with total assets less than $30B 2. Seacoast branch map and branch count include recently closed acquisitions of Sabal Palm Bancorp, Inc. and Business Bank of Florida, Corp., as well as pending acquisitions of Apollo Bancshares, Inc. and Drummond Banking Company Note: Branch and deposit data as of June 30th of each respective year Source: S&P Capital IQ Pro Pro Forma Branch Footprint Deposit Market Share: Tri-County Area 8ACQUISITION OF PROFESSIONAL HOLDING CORP. Professional Expands Seacoast’s Presence in Tri-County Area S o l i d i f i e s S e a c o a s t a s t h e 2 n d L a r g e s t C o m m u n i t y ¹ B a n k i n t h e T r i - C o u n t y A r e a Analysis of Deposits and Demographics by County All All Community¹ Deposits Market Bank FL HQ Bank in Market Share Rank Rank Rank Institution Branches ($M) (%) 1 Bank of America Corp. 175 56,078 17.28 2 Wells Fargo & Co. 186 46,097 14.20 3 JPMorgan Chase & Co. 177 36,111 11.12 4 Citigroup Inc. 52 22,551 6.95 5 Truist Financial Corp. 135 22,177 6.83 6 The Toronto-Dominion Bank 109 19,163 5.90 7 Banco de Crédito e Inversiones 31 16,618 5.12 8 1 BankUnited Inc. 46 13,222 4.07 9 The PNC Financial Services Group Inc. 61 7,057 2.17 10 Regions Financial Corp. 62 5,893 1.82 11 Citizens Financial Group Inc. 5 5,724 1.76 12 2 1 Amerant Bancorp Inc. 18 5,127 1.58 Pro Forma 28 4,971 1.53 13 Northern Trust Corp. 8 4,569 1.41 14 Synovus Financial Corp. 23 4,282 1.32 15 3 2 Ocean Bankshares Inc. 23 4,236 1.30 16 Valley National Bancorp. 13 3,712 1.14 17 New York Community Bancorp Inc. 23 3,002 0.92 18 3 Home BancShares Inc. 19 2,892 0.89 19 4 4 Seacoast Banking Corp. of Florida 19 2,670 0.82 20 Popular Inc. 11 2,580 0.79 24 6 7 Professional Holding Corp. 9 2,301 0.71 Market Total 1,412 324,607 100.00 Deposits in Market ($000) Market SBCF PFHD Pro Forma Miami-Dade $833 $1,761 $2,593 Palm Beach $1,544 $408 $1,952 Broward $294 $132 $425 Tri-County $2,670 $2,301 $4,971 Pro Forma Deposits Total Deposits Population Change (%) Market In Market In Market 2022 - 2027 Miami-Dade $2,593 $185,809 3.69% Palm Beach $1,952 $68,642 4.40% Broward $425 $70,156 4.02% Tri-County $4,971 $324,607 4.00% * *Reflects deposit weighted county demographics PFHD (9) PFHD LPO (2) SBCF (82) ² SBCF LPO (1)

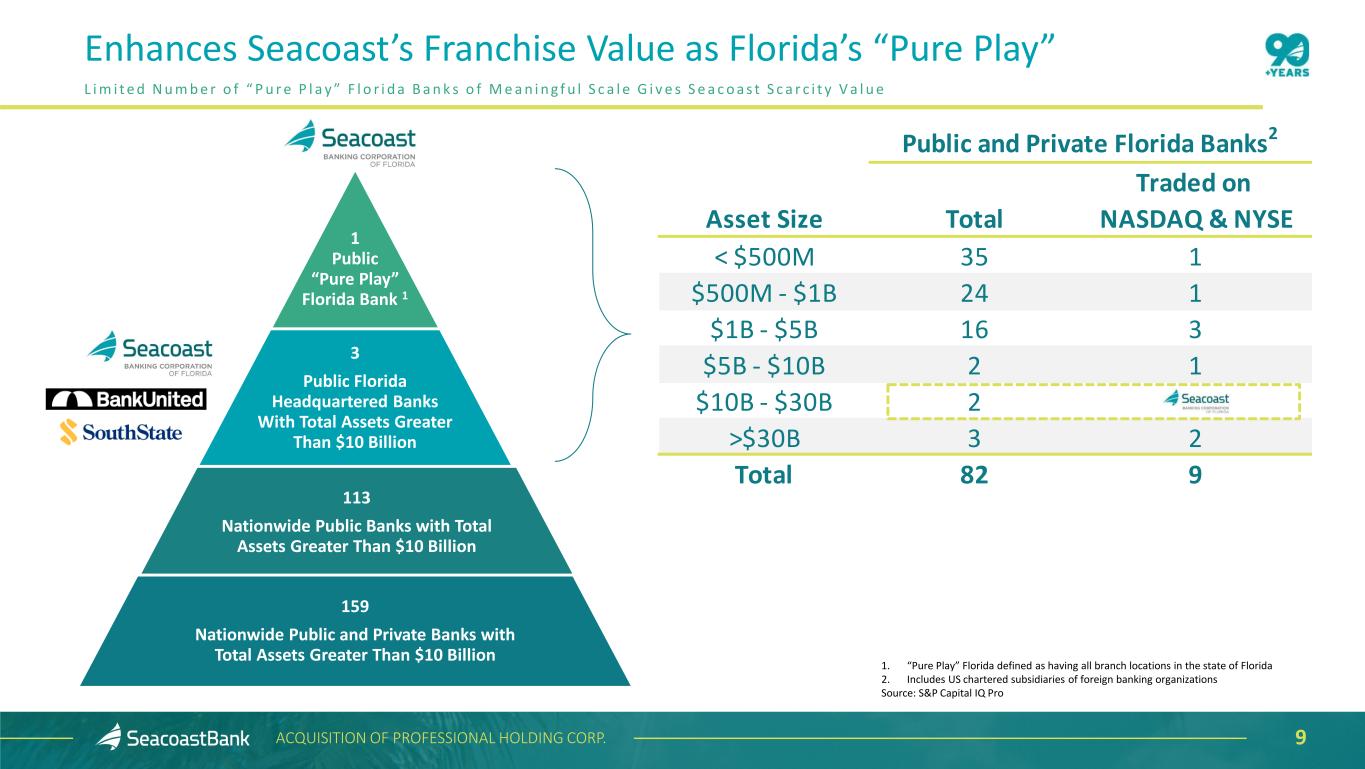

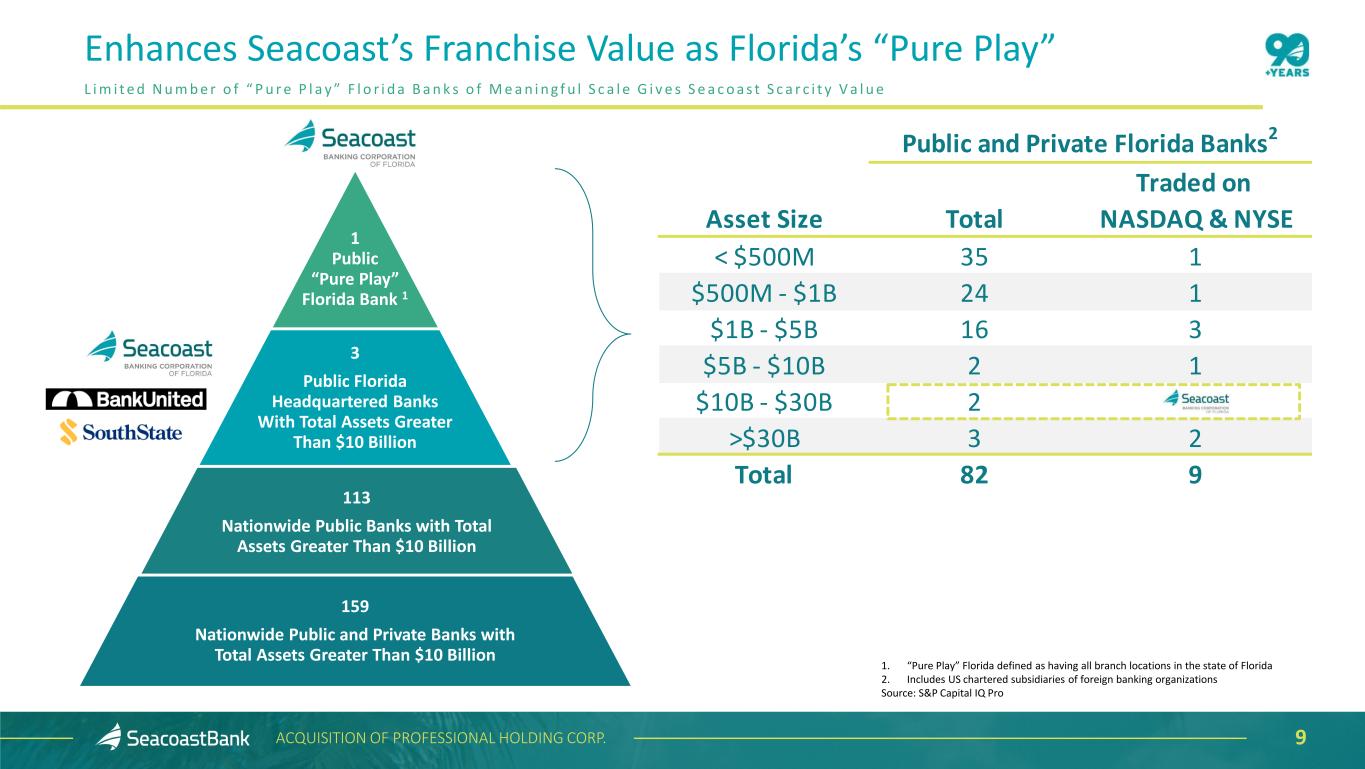

Public and Private Florida Banks2 Traded on Asset Size Total NASDAQ & NYSE < $500M 35 1 $500M - $1B 24 1 $1B - $5B 16 3 $5B - $10B 2 1 $10B - $30B 2 1 >$30B 3 2 Total 82 9 9 Enhances Seacoast’s Franchise Value as Florida’s “Pure Play” ACQUISITION OF PROFESSIONAL HOLDING CORP. 1 Public “Pure Play” Florida Bank 1 3 Public Florida Headquartered Banks With Total Assets Greater Than $10 Billion 113 Nationwide Public Banks with Total Assets Greater Than $10 Billion 159 Nationwide Public and Private Banks with Total Assets Greater Than $10 Billion 1. “Pure Play” Florida defined as having all branch locations in the state of Florida 2. Includes US chartered subsidiaries of foreign banking organizations Source: S&P Capital IQ Pro L i m i t e d N u m b e r o f “ P u r e P l a y ” F l o r i d a B a n k s o f M e a n i n g f u l S c a l e G i v e s S e a c o a s t S c a r c i t y V a l u e

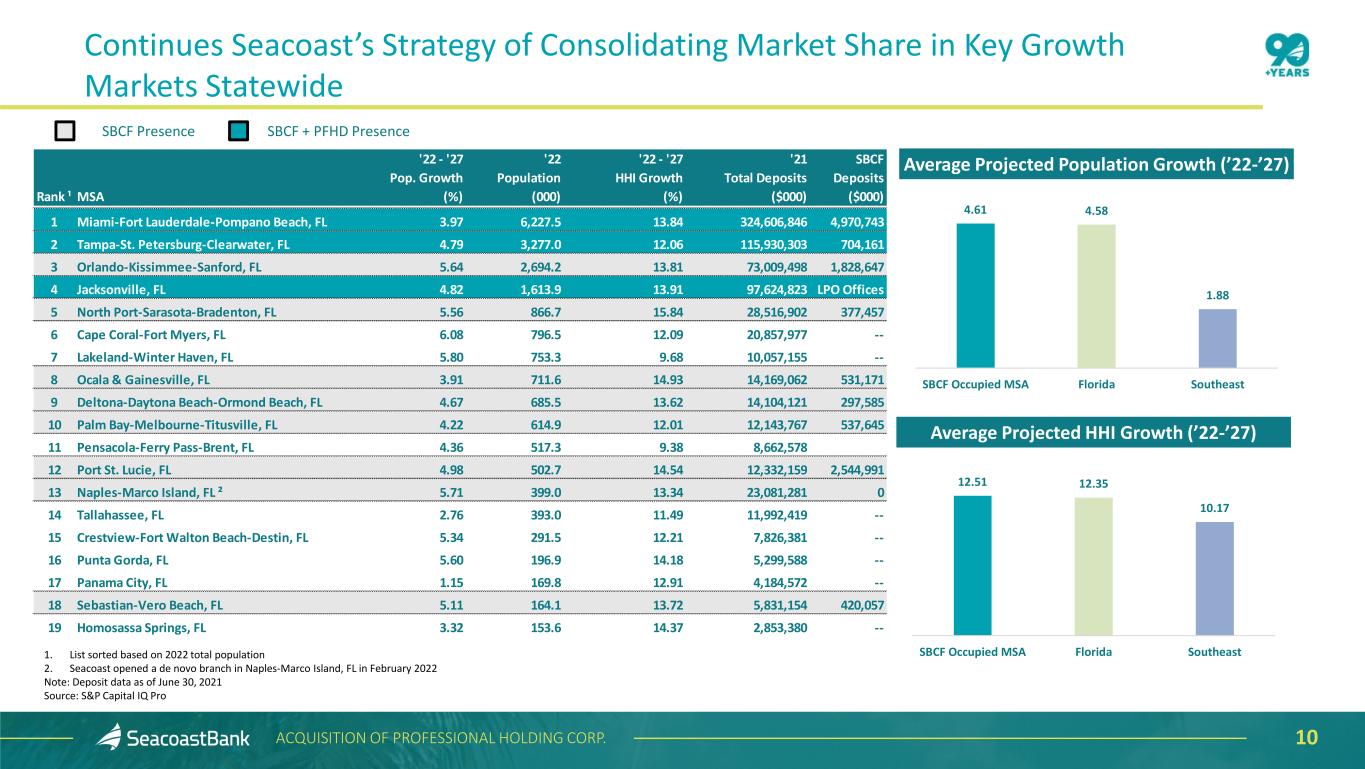

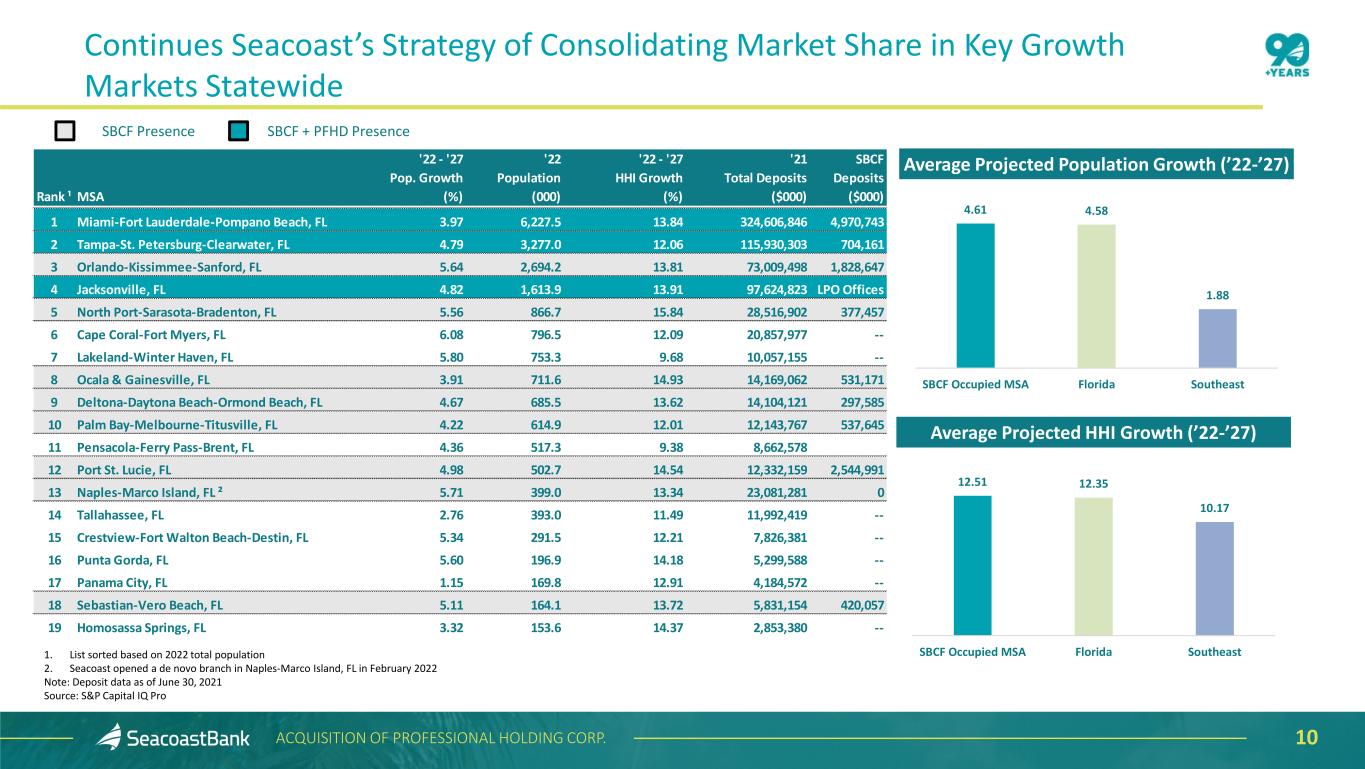

1. List sorted based on 2022 total population 2. Seacoast opened a de novo branch in Naples-Marco Island, FL in February 2022 Note: Deposit data as of June 30, 2021 Source: S&P Capital IQ Pro Rank ¹ MSA '22 - '27 Pop. Growth (%) '22 Population (000) '22 - '27 HHI Growth (%) '21 Total Deposits ($000) SBCF Deposits ($000) 1 Miami-Fort Lauderdale-Pompano Beach, FL 3.97 6,227.5 13.84 324,606,846 4,970,743 2 Tampa-St. Petersburg-Clearwater, FL 4.79 3,277.0 12.06 115,930,303 704,161 3 Orlando-Kissimmee-Sanford, FL 5.64 2,694.2 13.81 73,009,498 1,828,647 4 Jacksonville, FL 4.82 1,613.9 13.91 97,624,823 LPO Offices 5 North Port-Sarasota-Bradenton, FL 5.56 866.7 15.84 28,516,902 377,457 6 Cape Coral-Fort Myers, FL 6.08 796.5 12.09 20,857,977 -- 7 Lakeland-Winter Haven, FL 5.80 753.3 9.68 10,057,155 -- 8 Ocala & Gainesville, FL 3.91 711.6 14.93 14,169,062 531,171 9 Deltona-Daytona Beach-Ormond Beach, FL 4.67 685.5 13.62 14,104,121 297,585 10 Palm Bay-Melbourne-Titusville, FL 4.22 614.9 12.01 12,143,767 537,645 11 Pensacola-Ferry Pass-Brent, FL 4.36 517.3 9.38 8,662,578 12 Port St. Lucie, FL 4.98 502.7 14.54 12,332,159 2,544,991 13 Naples-Marco Island, FL ² 5.71 399.0 13.34 23,081,281 0 14 Tallahassee, FL 2.76 393.0 11.49 11,992,419 -- 15 Crestview-Fort Walton Beach-Destin, FL 5.34 291.5 12.21 7,826,381 -- 16 Punta Gorda, FL 5.60 196.9 14.18 5,299,588 -- 17 Panama City, FL 1.15 169.8 12.91 4,184,572 -- 18 Sebastian-Vero Beach, FL 5.11 164.1 13.72 5,831,154 420,057 19 Homosassa Springs, FL 3.32 153.6 14.37 2,853,380 -- 10ACQUISITION OF PROFESSIONAL HOLDING CORP. SBCF Presence SBCF + PFHD Presence Average Projected Population Growth (’22-’27) Average Projected HHI Growth (’22-’27) 4.61 4.58 1.88 SBCF Occupied MSA Florida Southeast 12.51 12.35 10.17 SBCF Occupied MSA Florida Southeast Continues Seacoast’s Strategy of Consolidating Market Share in Key Growth Markets Statewide

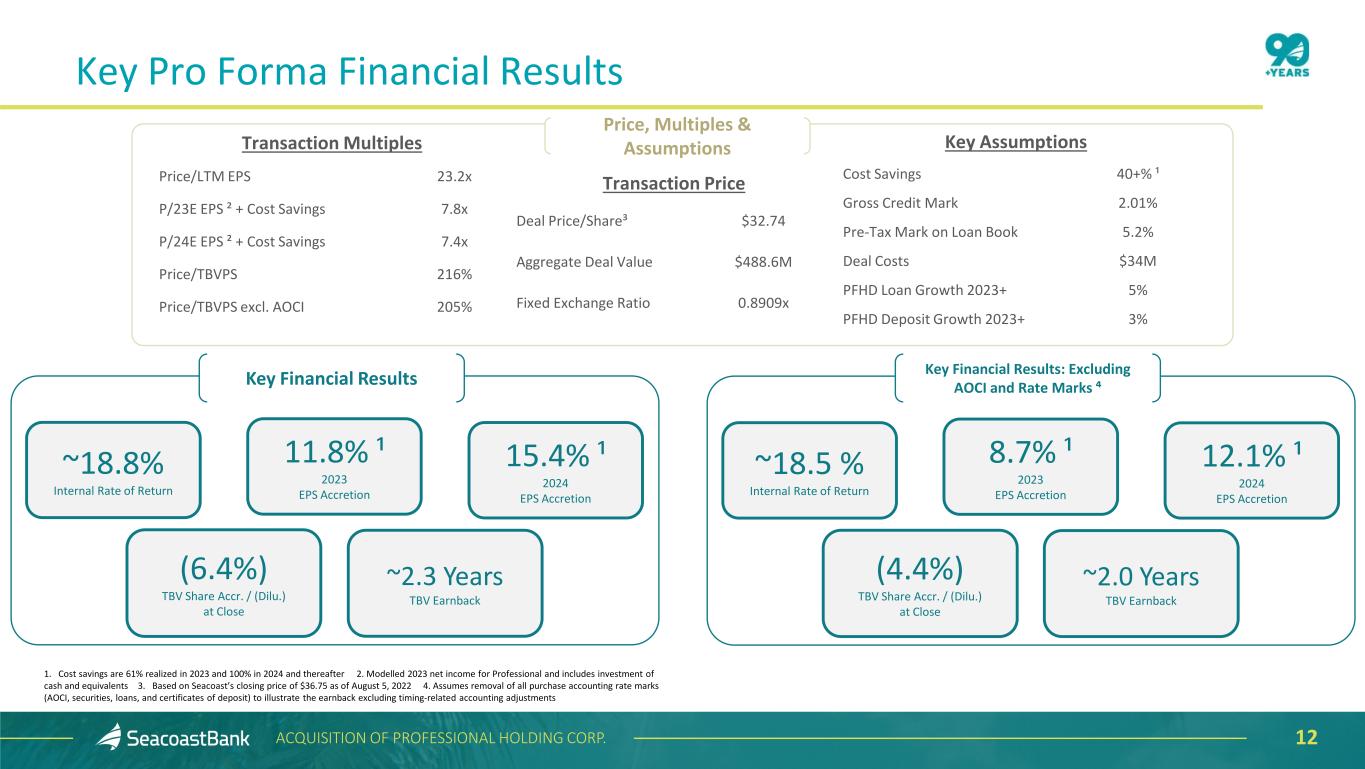

11 Financially Attractive Transaction With Compelling Pro Forma Financial Impact and Conservative Model Assumptions • Financially Attractive Acquisition: – 6.4% upfront dilution to TBV per share, earnback of ~2.3 years, and exceptional EPS accretion of ~11.8% in 2023 and ~15.4% in 2024 – Removing the impact of interest rate purchase accounting marks (see below), the transaction has 4.4% dilution to TBV per share and earnback of ~2.0 years – Loan and deposit growth modelled 5% and 3%, respectively, resulting in conservative balance sheet growth assumptions. • Conservative Transaction Assumptions and Thorough Credit Due Diligence: – Seacoast conducted thorough loan diligence on Professional, with conservative CECL modelling leaning into Moody’s S3 recessionary model driving a pre-tax gross credit mark of 2.01% and a total pre-tax mark on the loan book of 5.2% (including the CECL provision) – Fixed exchange ratio of 0.8909x provides market protection – Attractive earnings multiples of 7.8x P/2023E EPS ² + fully phased-in cost savings + balance sheet reposition – Bottom up approach to analyzing cost savings modeled with precise detail, and a history of executing cost savings in prior transactions – Granular approach to identifying efficiencies gives the management team high confidence in our ability to realize those savings – Pro forma for pending transactions and the acquisition of Professional, Seacoast maintains robust pro forma capital ratios – The acquisition of Professional meaningfully improves ROATA, ROATCE, and Efficiency Ratio. This improvement from Professional is in addition to the enhancements to these performance ratios from the pending acquisitions of Drummond and Apollo • TBV Dilution at Closing from Interest Rate Marks May be Viewed as “Accounting Driven Earnback”1: – Since interest rate marks are accreted back through the income statement over time per accounting rules, the earnback of their TBV dilution can be viewed, theoretically, as having no execution risk – When adjusting the transaction for rate-driven purchase accounting marks including Professional’s AOCI and additional rate marks on securities, loans, and CDs, as well as the forward earnings benefit from the accretion of those marks, it is possible to differentiate between the upfront TBV dilution that is “at risk” and the upfront TBV dilution whose earnback is simply the result of timing due to accounting marks 1. Assumes removal of all purchase accounting rate marks (AOCI, securities, loans, and certificates of deposit) to illustrate the earnback excluding timing-related accounting adjustments 2. Modelled 2023 net income for Professional ACQUISITION OF PROFESSIONAL HOLDING CORP.

~2.3 Years TBV Earnback 15.4% ¹ 2024 EPS Accretion Key Financial Results (6.4%) TBV Share Accr. / (Dilu.) at Close ~18.8% Internal Rate of Return 11.8% ¹ 2023 EPS Accretion Transaction Price Deal Price/Share³ $32.74 Aggregate Deal Value $488.6M Fixed Exchange Ratio 0.8909x Price, Multiples & Assumptions ~2.0 Years TBV Earnback 12.1% ¹ 2024 EPS Accretion Key Financial Results: Excluding AOCI and Rate Marks ⁴ (4.4%) TBV Share Accr. / (Dilu.) at Close ~18.5 % Internal Rate of Return 8.7% ¹ 2023 EPS Accretion 12 Transaction Multiples Price/LTM EPS 23.2x P/23E EPS ² + Cost Savings 7.8x P/24E EPS ² + Cost Savings 7.4x Price/TBVPS 216% Price/TBVPS excl. AOCI 205% Key Assumptions Cost Savings 40+% ¹ Gross Credit Mark 2.01% Pre-Tax Mark on Loan Book 5.2% Deal Costs $34M PFHD Loan Growth 2023+ 5% PFHD Deposit Growth 2023+ 3% ACQUISITION OF PROFESSIONAL HOLDING CORP. 1. Cost savings are 61% realized in 2023 and 100% in 2024 and thereafter 2. Modelled 2023 net income for Professional and includes investment of cash and equivalents 3. Based on Seacoast’s closing price of $36.75 as of August 5, 2022 4. Assumes removal of all purchase accounting rate marks (AOCI, securities, loans, and certificates of deposit) to illustrate the earnback excluding timing-related accounting adjustments Key Pro Forma Financial Results

Disciplined and Experienced Acquirer • Seacoast is an experienced acquirer with 16 transactions since 2014 • Track record of successful integration and realization of cost savings through a “bottom up” and individualized approach to cost savings analyses • Conservative and “downside” balance sheet growth rates assumed for pro forma model 13 Comprehensive Due Diligence Process ACQUISITION OF PROFESSIONAL HOLDING CORP. Comprehensive Diligence Process • Comprehensive process led by seasoned SBCF and PFHD leadership and included business, operational, credit, financial, legal, HR and regulatory review • SBCF’s extensive credit review focused on the largest relationships, adversely classified assets and watch list loans by assessing performance, strength of guarantee, collateral, financial condition, probability of default, and loss given default • Legal review supplemented by external counsel

Extensive Credit Diligence Completed Diligence Process: • 70% of total loan exposure reviewed • Risk-based Loan Sample – Large balance commitments – Loans originated YTD 2022 – I-CRE (income producing commercial real estate) – ADC (land acquisition, development and construction) – Non-residential alien loans – Loan participation purchases – Loans on non-accrual, history of delinquency and matured – Watch and criticized loans • Loan Review Assessed – Sponsor selection and strength of guarantee – Quality of underwriting and portfolio administration – Historical cash flow and payment performance – Collateral types and industry segments – Financial condition and annual reviews – Probability of default and loss given default Conclusions: • Satisfactory asset quality that aligns well with Seacoast as to relationship size, project type, and granularity. • Diverse portfolio with customer selection focused on high net worth individuals, commercial real estate investors, and South Florida operating companies. • Effective underwriting that analyzes financial capacity and support for purpose, repayment sources, and collateral. • Comparable loan-to-value and leverage ratios across the portfolio and is in line with Seacoast’s portfolio. • Limited non-resident alien exposure of $88 million or 4% of total loans outstanding, which are predominately residential mortgages with low loan-to-values. • Few loan participation purchases that total less than 2% of loans outstanding. • CRE portfolio does not alter Seacoast’s mix of collateral types post close. 14ACQUISITION OF PROFESSIONAL HOLDING CORP.

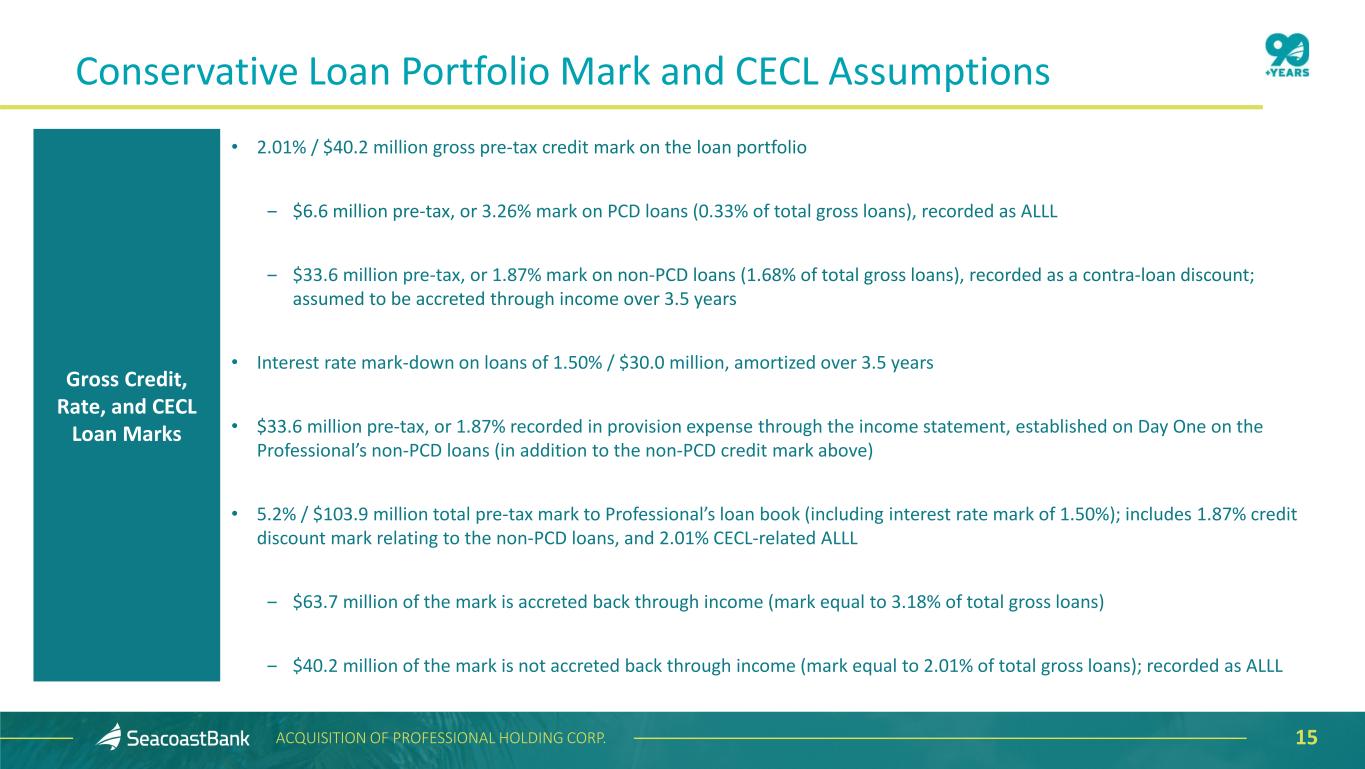

Gross Credit, Rate, and CECL Loan Marks • 2.01% / $40.2 million gross pre-tax credit mark on the loan portfolio ‒ $6.6 million pre-tax, or 3.26% mark on PCD loans (0.33% of total gross loans), recorded as ALLL ‒ $33.6 million pre-tax, or 1.87% mark on non-PCD loans (1.68% of total gross loans), recorded as a contra-loan discount; assumed to be accreted through income over 3.5 years • Interest rate mark-down on loans of 1.50% / $30.0 million, amortized over 3.5 years • $33.6 million pre-tax, or 1.87% recorded in provision expense through the income statement, established on Day One on the Professional’s non-PCD loans (in addition to the non-PCD credit mark above) • 5.2% / $103.9 million total pre-tax mark to Professional’s loan book (including interest rate mark of 1.50%); includes 1.87% credit discount mark relating to the non-PCD loans, and 2.01% CECL-related ALLL ‒ $63.7 million of the mark is accreted back through income (mark equal to 3.18% of total gross loans) ‒ $40.2 million of the mark is not accreted back through income (mark equal to 2.01% of total gross loans); recorded as ALLL 15 Conservative Loan Portfolio Mark and CECL Assumptions ACQUISITION OF PROFESSIONAL HOLDING CORP.

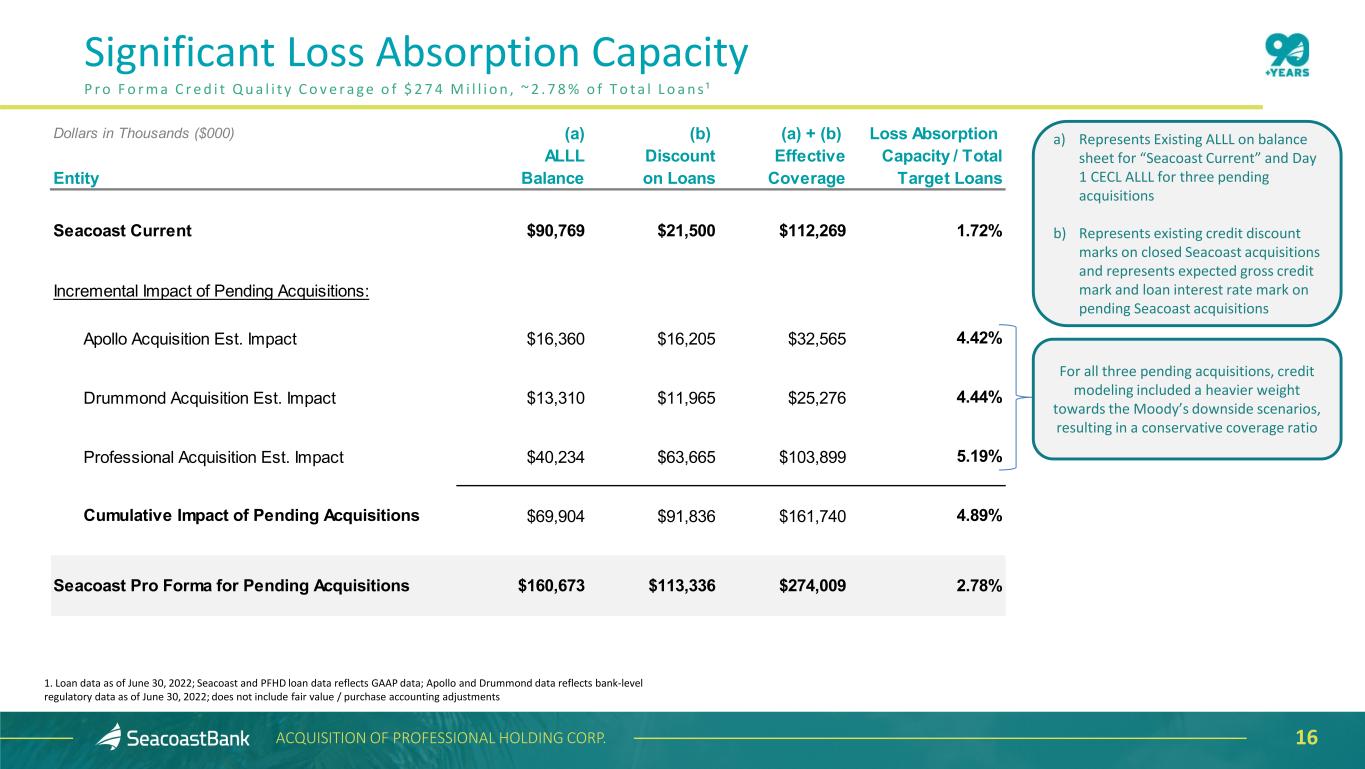

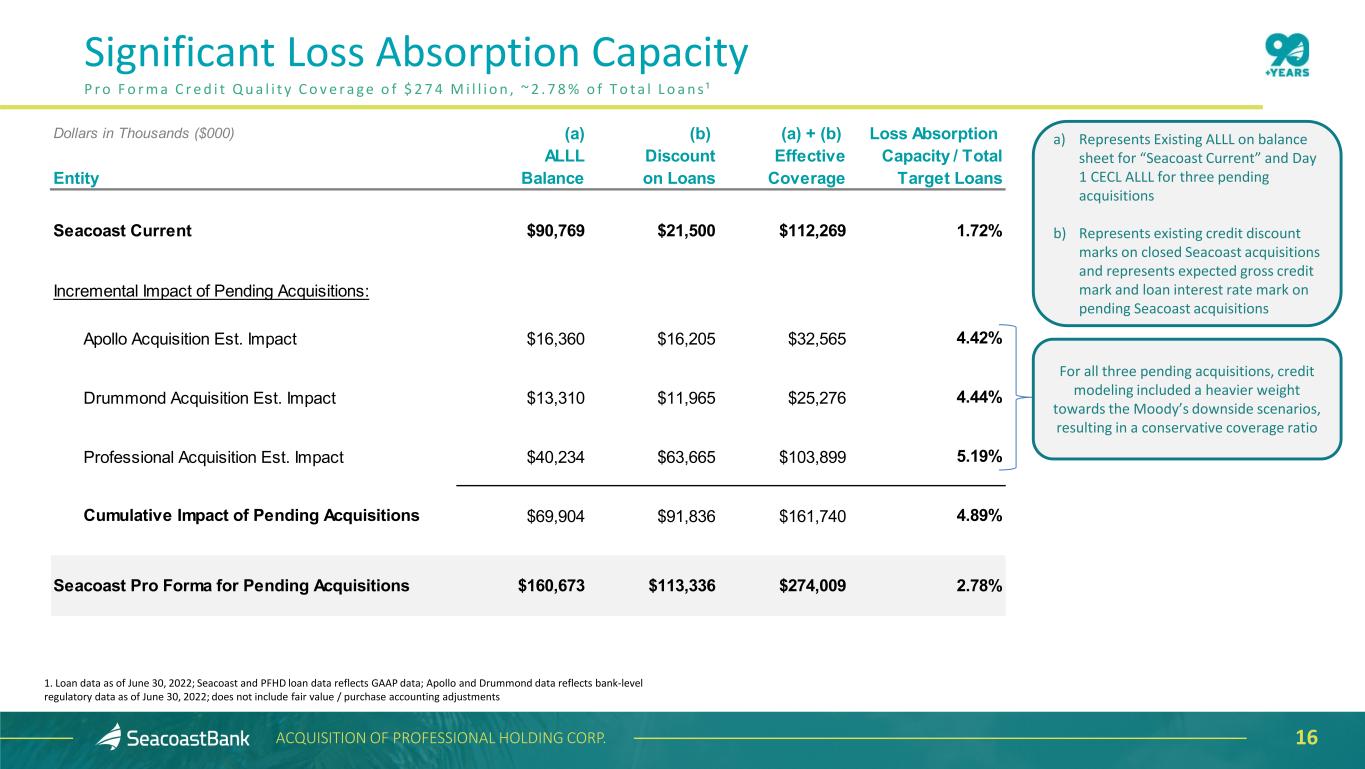

16 Significant Loss Absorption Capacity ACQUISITION OF PROFESSIONAL HOLDING CORP. 1. Loan data as of June 30, 2022; Seacoast and PFHD loan data reflects GAAP data; Apollo and Drummond data reflects bank-level regulatory data as of June 30, 2022; does not include fair value / purchase accounting adjustments Dollars in Thousands ($000) (a) (b) (a) + (b) Loss Absorption ALLL Discount Effective Capacity / Total Entity Balance on Loans Coverage Target Loans Seacoast Current $90,769 $21,500 $112,269 1.72% Incremental Impact of Pending Acquisitions: Apollo Acquisition Est. Impact $16,360 $16,205 $32,565 4.42% Drummond Acquisition Est. Impact $13,310 $11,965 $25,276 4.44% Professional Acquisition Est. Impact $40,234 $63,665 $103,899 5.19% Cumulative Impact of Pending Acquisitions $69,904 $91,836 $161,740 4.89% Seacoast Pro Forma for Pending Acquisitions $160,673 $113,336 $274,009 2.78% For all three pending acquisitions, credit modeling included a heavier weight towards the Moody’s downside scenarios, resulting in a conservative coverage ratio P r o F o r m a C r e d i t Q u a l i t y C o v e r a g e o f $ 2 7 4 M i l l i o n , ~ 2 . 7 8 % o f T o t a l L o a n s ¹ a) Represents Existing ALLL on balance sheet for “Seacoast Current” and Day 1 CECL ALLL for three pending acquisitions b) Represents existing credit discount marks on closed Seacoast acquisitions and represents expected gross credit mark and loan interest rate mark on pending Seacoast acquisitions

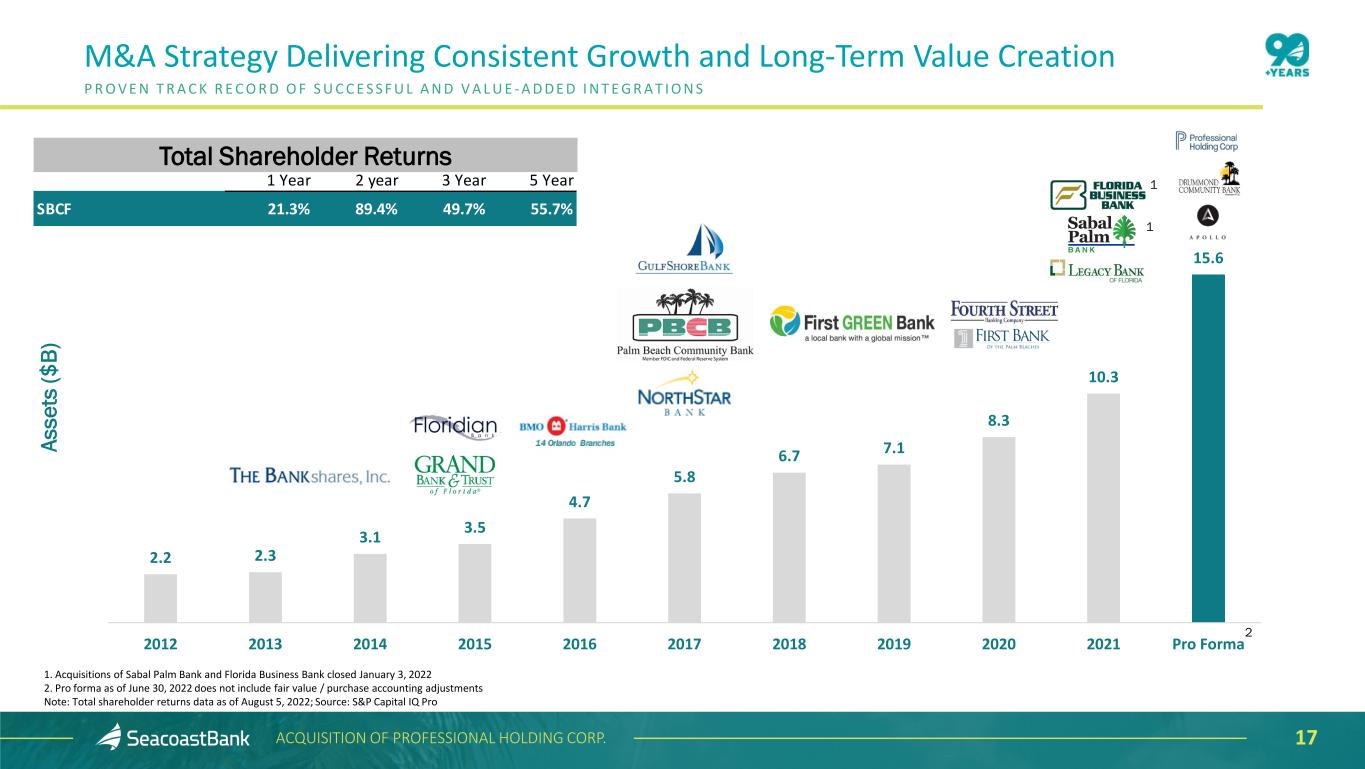

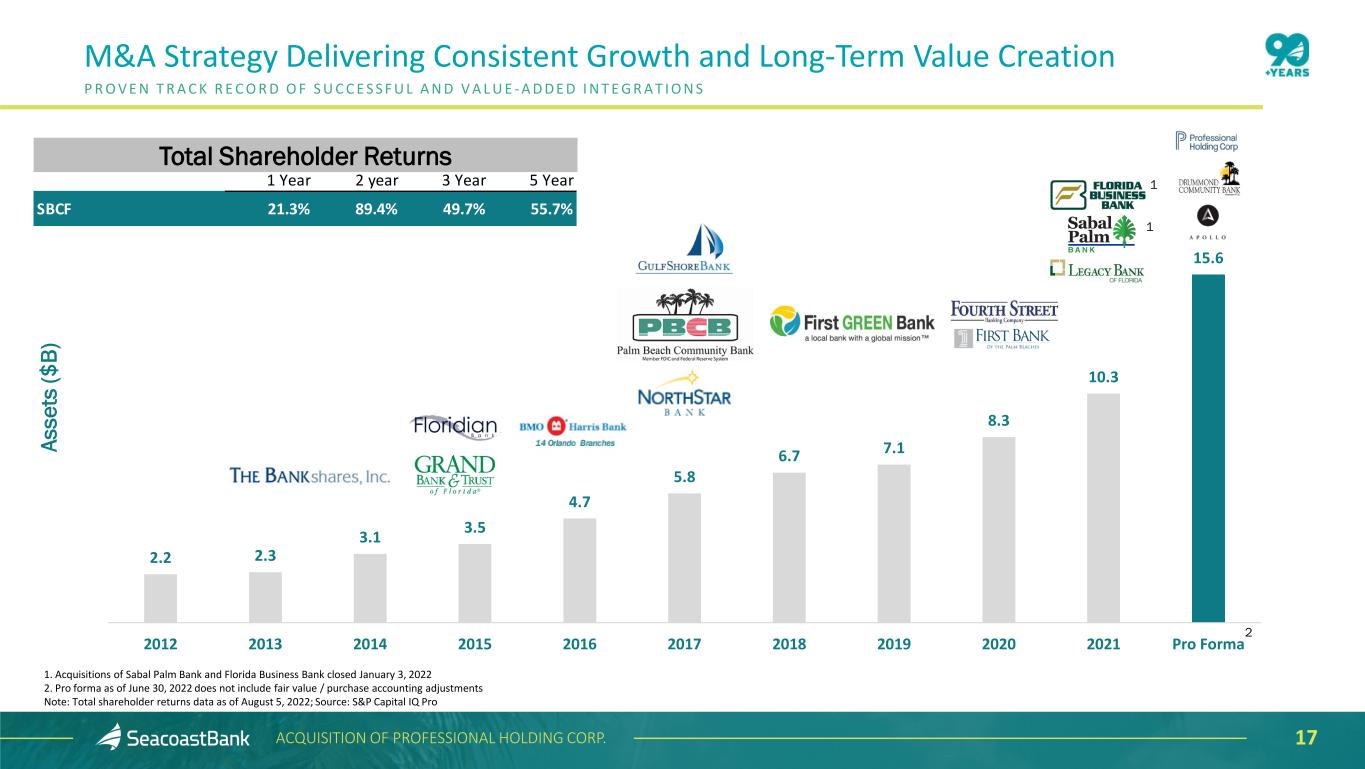

2.2 2.3 3.1 3.5 4.7 5.8 6.7 7.1 8.3 10.3 15.6 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Pro Forma Total Shareholder Returns P R O V E N T R A C K R E C O R D O F S U C C E S S F U L A N D V A L U E - A D D E D I N T E G R A T I O N S M&A Strategy Delivering Consistent Growth and Long-Term Value Creation 17 As se ts ($ B) 1 1. Acquisitions of Sabal Palm Bank and Florida Business Bank closed January 3, 2022 2. Pro forma as of June 30, 2022 does not include fair value / purchase accounting adjustments Note: Total shareholder returns data as of August 5, 2022; Source: S&P Capital IQ Pro 1 ACQUISITION OF PROFESSIONAL HOLDING CORP. 2 1 Year 2 year 3 Year 5 Year SBCF 21.3% 89.4% 49.7% 55.7%

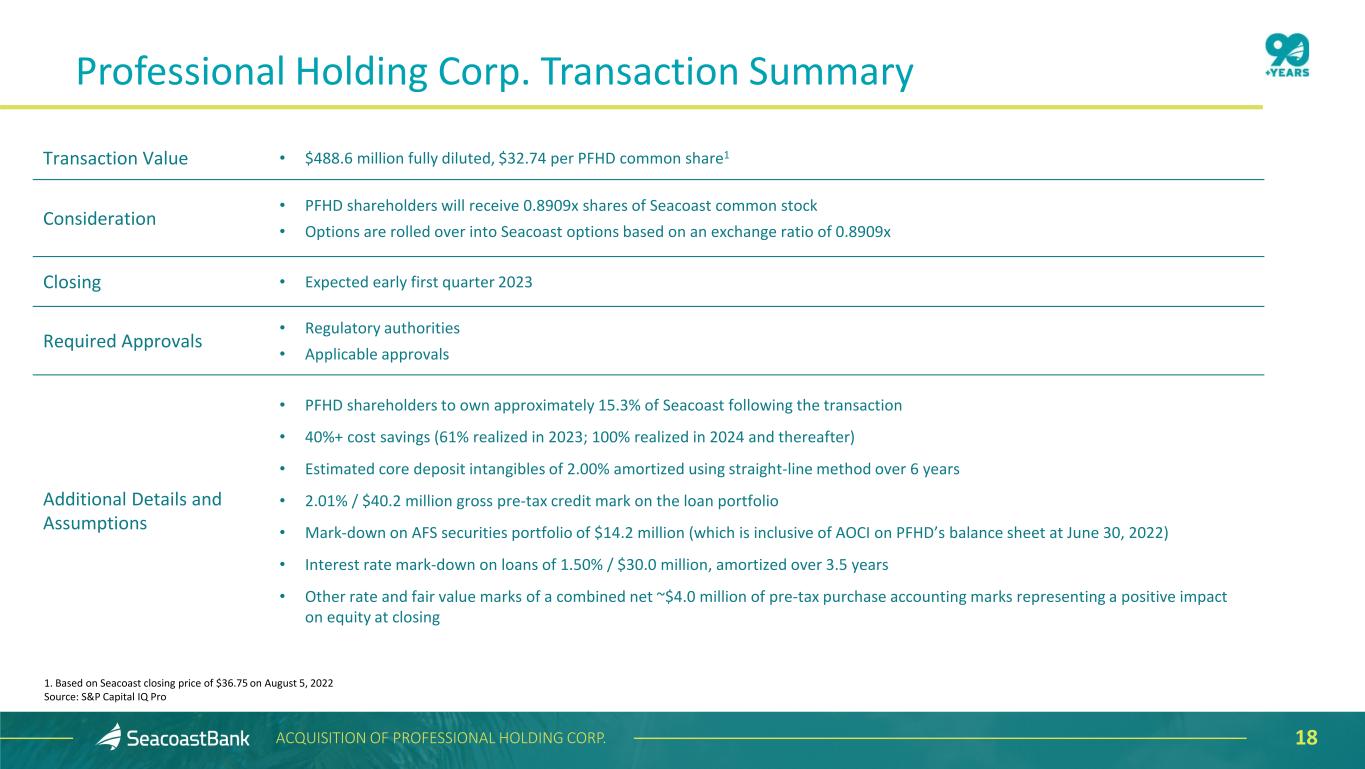

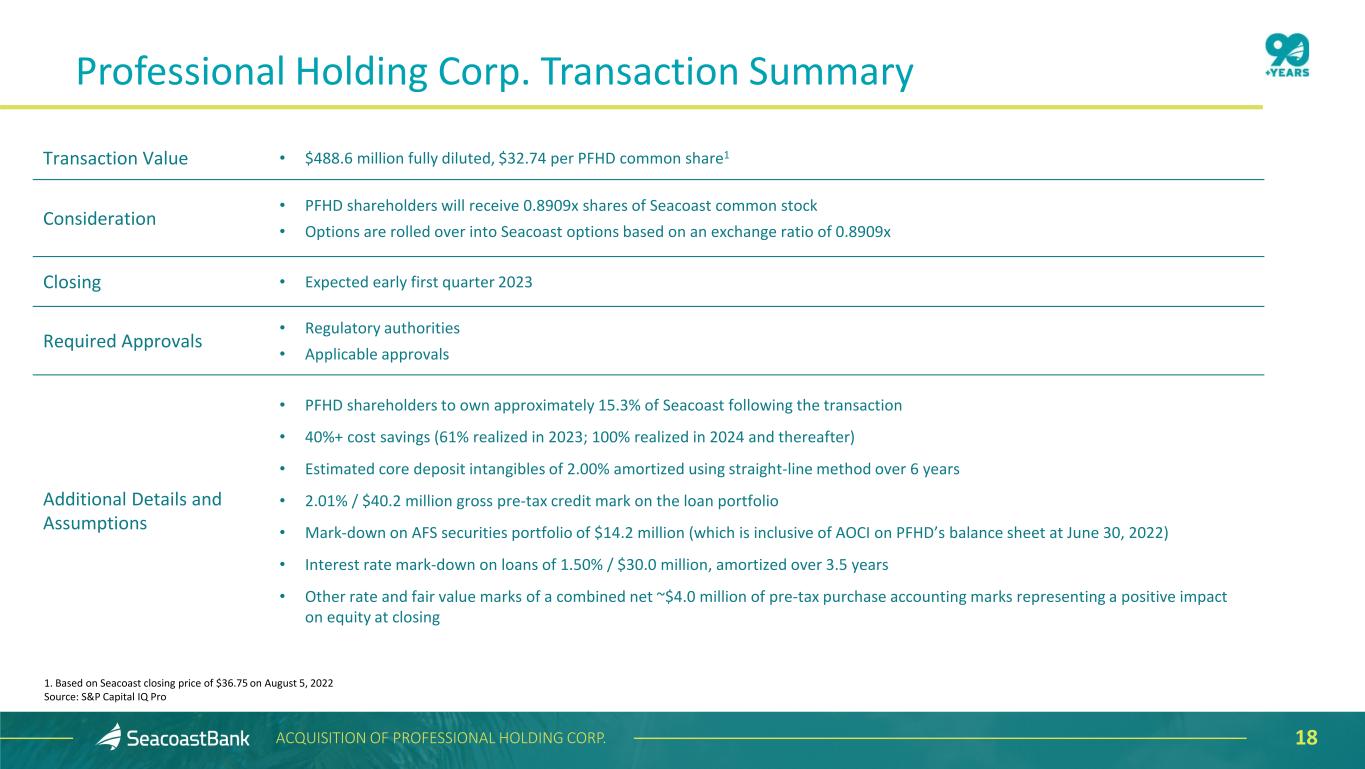

Professional Holding Corp. Transaction Summary 18 Transaction Value • $488.6 million fully diluted, $32.74 per PFHD common share1 Consideration • PFHD shareholders will receive 0.8909x shares of Seacoast common stock • Options are rolled over into Seacoast options based on an exchange ratio of 0.8909x Closing • Expected early first quarter 2023 Required Approvals • Regulatory authorities • Applicable approvals Additional Details and Assumptions • PFHD shareholders to own approximately 15.3% of Seacoast following the transaction • 40%+ cost savings (61% realized in 2023; 100% realized in 2024 and thereafter) • Estimated core deposit intangibles of 2.00% amortized using straight-line method over 6 years • 2.01% / $40.2 million gross pre-tax credit mark on the loan portfolio • Mark-down on AFS securities portfolio of $14.2 million (which is inclusive of AOCI on PFHD’s balance sheet at June 30, 2022) • Interest rate mark-down on loans of 1.50% / $30.0 million, amortized over 3.5 years • Other rate and fair value marks of a combined net ~$4.0 million of pre-tax purchase accounting marks representing a positive impact on equity at closing 1. Based on Seacoast closing price of $36.75 on August 5, 2022 Source: S&P Capital IQ Pro ACQUISITION OF PROFESSIONAL HOLDING CORP.

Appendix 19ACQUISITION OF PROFESSIONAL HOLDING CORP.

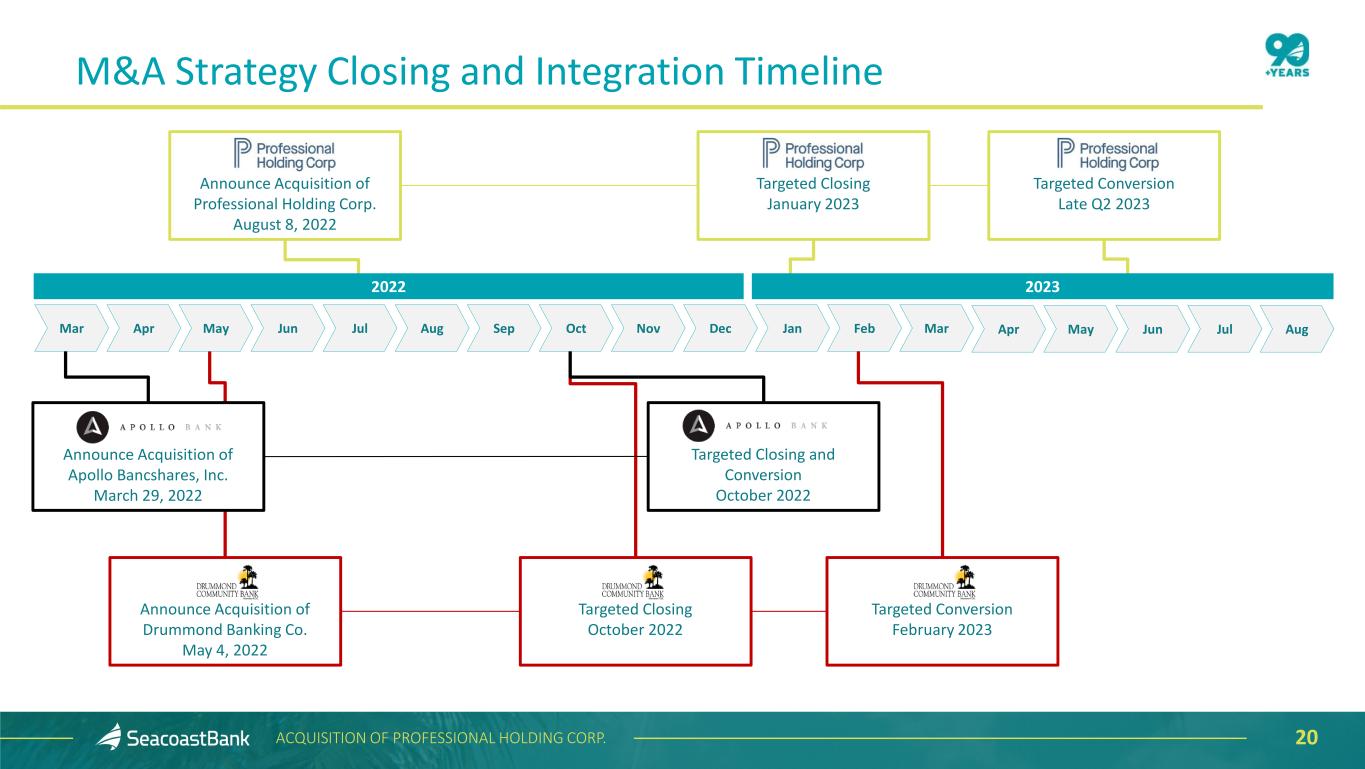

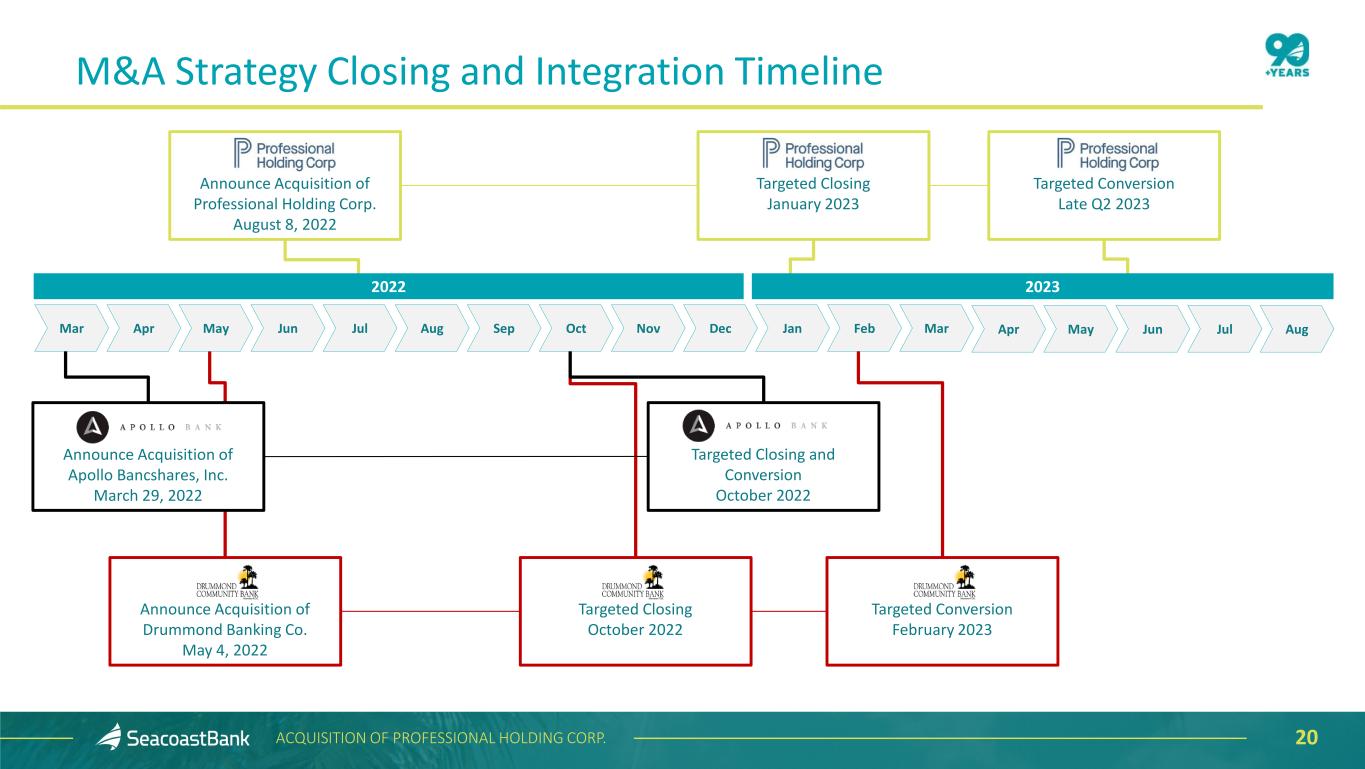

20 M&A Strategy Closing and Integration Timeline ACQUISITION OF PROFESSIONAL HOLDING CORP. Mar Announce Acquisition of Professional Holding Corp. August 8, 2022 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Announce Acquisition of Apollo Bancshares, Inc. March 29, 2022 Announce Acquisition of Drummond Banking Co. May 4, 2022 Targeted Closing and Conversion October 2022 Targeted Closing October 2022 Targeted Closing January 2023 Targeted Conversion February 2023 Targeted Conversion Late Q2 2023 2022 2023

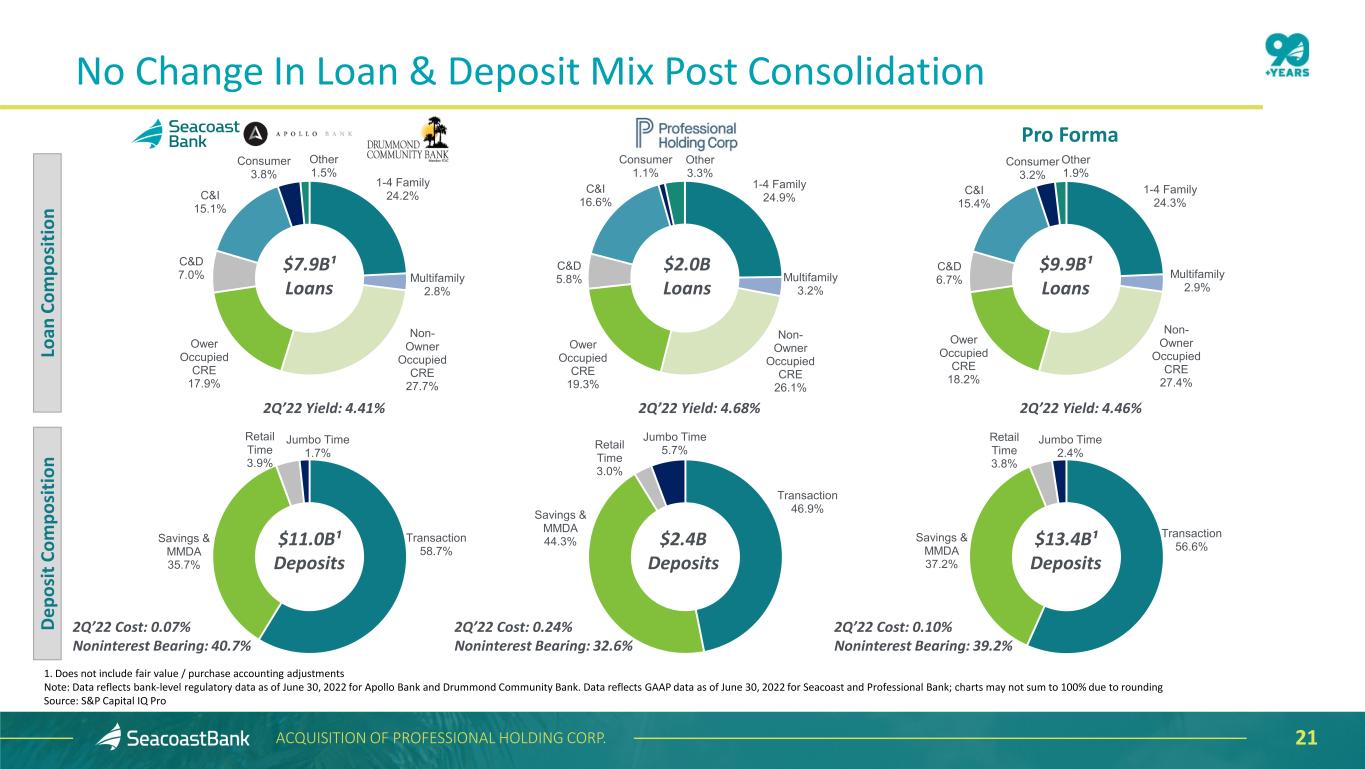

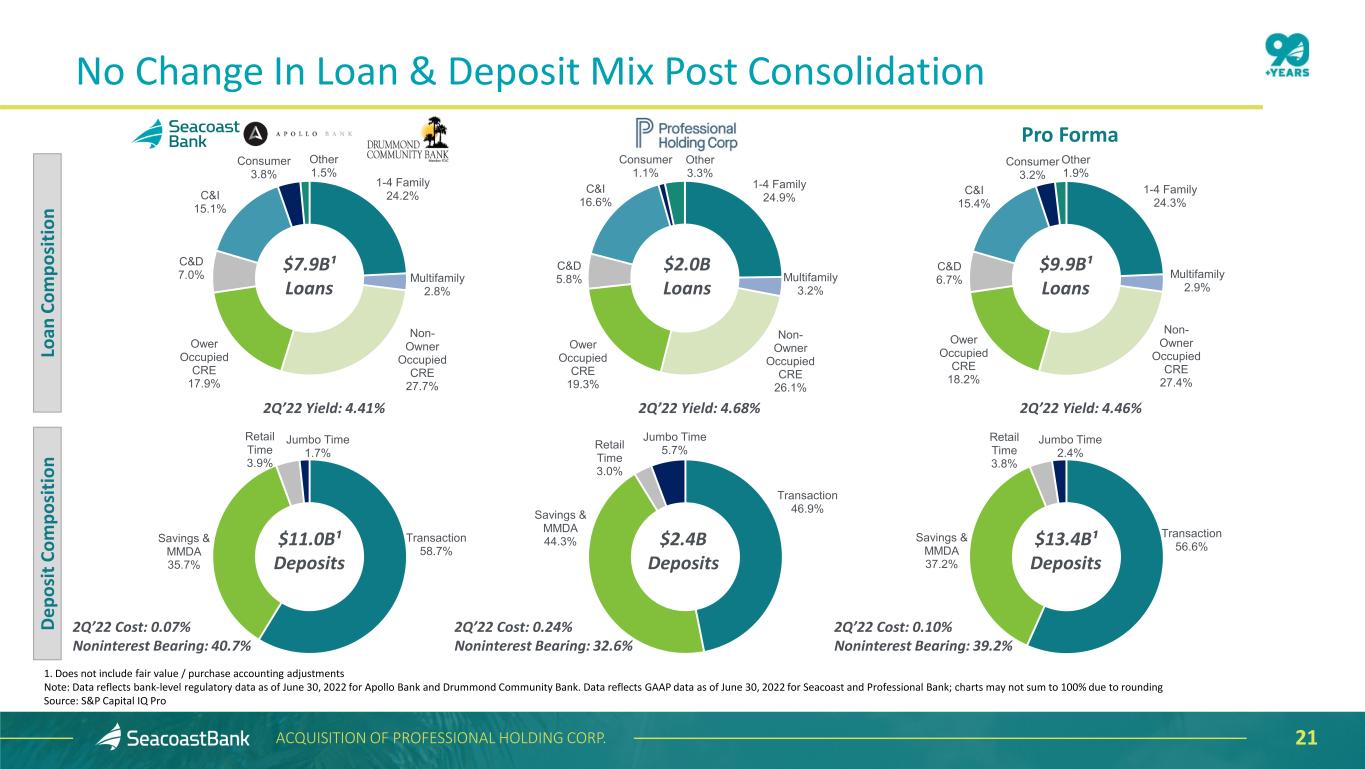

No Change In Loan & Deposit Mix Post Consolidation 21 Transaction 56.6% Savings & MMDA 37.2% Retail Time 3.8% Jumbo Time 2.4% Transaction 46.9%Savings & MMDA 44.3% Retail Time 3.0% Jumbo Time 5.7% Transaction 58.7% Savings & MMDA 35.7% Retail Time 3.9% Jumbo Time 1.7% 1-4 Family 24.3% Multifamily 2.9% Non- Owner Occupied CRE 27.4% Ower Occupied CRE 18.2% C&D 6.7% C&I 15.4% Consumer 3.2% Other 1.9% 1-4 Family 24.9% Multifamily 3.2% Non- Owner Occupied CRE 26.1% Ower Occupied CRE 19.3% C&D 5.8% C&I 16.6% Consumer 1.1% Other 3.3% 1-4 Family 24.2% Multifamily 2.8% Non- Owner Occupied CRE 27.7% Ower Occupied CRE 17.9% C&D 7.0% C&I 15.1% Consumer 3.8% Other 1.5% Lo an C om po si tio n D ep os it Co m po si tio n 2Q’22 Yield: 4.41% 2Q’22 Yield: 4.68% 2Q’22 Yield: 4.46% $7.9B¹ Loans $2.0B Loans $9.9B¹ Loans $11.0B¹ Deposits $2.4B Deposits $13.4B¹ Deposits 2Q’22 Cost: 0.07% Noninterest Bearing: 40.7% 2Q’22 Cost: 0.24% Noninterest Bearing: 32.6% 2Q’22 Cost: 0.10% Noninterest Bearing: 39.2% Pro Forma 1. Does not include fair value / purchase accounting adjustments Note: Data reflects bank-level regulatory data as of June 30, 2022 for Apollo Bank and Drummond Community Bank. Data reflects GAAP data as of June 30, 2022 for Seacoast and Professional Bank; charts may not sum to 100% due to rounding Source: S&P Capital IQ Pro ACQUISITION OF PROFESSIONAL HOLDING CORP.