UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | | ¨ | Confidential, for use of the Commission Only (as |

| ¨ | Definitive Proxy Statement | | | permitted by Rule 14(a)-6(e)(2)) |

| | | | | |

| x | Definitive Additional Materials | | | |

| | | | | |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 | | | |

SEACOAST BANKING CORPORATION OF FLORIDA

(Name of Registrant as Specified in its Charter)

| |

| (Name of Person(s) Filing Proxy Statement, if other than Registrant) |

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule, or Registration Statement No.: |

April 9, 2015

To our Shareholders and Friends,

We are transforming Seacoast Bank, by improving the efficiency of our operations, recruiting exceptional people to join our team, and delivering world-class banking services to our customers. The investments we are making today and have made over the past couple of years are changing the way we are doing business and the way we relate to our customers. We are seeing the results of these efforts in our financial performance, and we are confident our shareholders will benefit from our initiatives in the coming years.

Like the economy in Florida, our growth is accelerating at a rate that is pretty remarkable. Part of the fuel fanning our growth is the strength of our markets. Last year, Florida edged past New York to become the third most populated state in the U.S., putting it behind only California and Texas. The Sunshine State added over 700 new residents a day, registering population growth of roughly twice the national average. Construction, services, transportation, manufacturing, tourism, and utilities are all contributing to the robust recovery in our markets.

More important than our location, however, are the investments we are making in our franchise. We are continuing to invest in digital delivery and mobile products to better serve our customers and improve our growth in core deposit funding. In addition, we launched person-to-person payments, online account opening and online external transfers. Our branch renovation initiative kicked off in 2014, transforming the branch experience and leveraging technology to educate customers in the benefits and ease of our digital products.

We made significant investments in our new distribution channel – Accelerate Commercial Banking – delivering greater value to small business customers and expanding our brand into several metro areas adjacent to our legacy markets. These investments are helping us drive our growth rates for both loans and deposits and are generating strong profitability for us.

Another important highlight for the year was our acquisition of The BANKshares, Inc., which closed on October 1, 2014 and was fully integrated by year end. This acquisition increased our size by more than 25% and expanded our presence in central Florida, particularly the greater Orlando market. The impact of the acquired business, combined with stronger organic growth and additional fourth quarter cost reductions, produced improvement in earnings at the end of the year and will be significant starting in the first quarter of 2015.

Just recently, we announced the agreement to acquire Grand Bankshares, Inc., headquartered in West Palm Beach, Florida. This acquisition will add approximately $208 million in assets, $184 million in deposits, and $127 million in gross loans to Seacoast's operations, along with three branch locations in Palm Beach County, one of the best markets in the country. We are very excited about this addition to our network.

Our Accomplishments in 2014

| · | Adjusted net income,(1) (excluding merger costs and other adjustments) for the year 2014 increased to $13.0 million or $0.48 per diluted share. Based on GAAP, the net income for 2014 was $5.7 million or $ 0.21 per diluted share, including merger charges and other adjustments. |

| · | Fully implemented legacy expense reductions during the year of $5.2 million and merger savings of $5.5 million with the total impacts realized beginning in the first quarter of 2015. |

| · | Improved net interest margin from organic loan growth, lower funding costs, investment purchases and the acquisition. |

| · | Achieved 12% annual loan growth, excluding the acquired loans for 2014, and 15% annualized loan growth for the fourth quarter. |

| · | Assets increased $824 million or 36.3% for the year, reflecting $683 million from the acquisition of The BANKshares, Inc. and solid organic growth. |

| · | Deposits increased $611 million or 33.8% for the year; excluding deposits acquired, total deposits increased $94 million. |

| · | Noninterest bearing deposits grew to 30.0% of total deposits, from 25.7% one year ago. |

(1)Non-GAAP measure

The investments we are making in technology, people and infrastructure are engaging our customers and associates and building value for shareholders. Here are a few highlights.

| · | Added digital deposit of checks using a smart phone saving customer time and expense. |

| · | Introduced senior classic checking, which earns interest, has no fees, and features online and mobile banking and the convenience of 1000+ free ATMs. |

| · | 24/7 local customer support call center support. |

| · | New online home equity line offer and application process makes switching to Seacoast incredibly simple. Consumer loan originations up $20 million or 235% in fourth quarter 2014 compared to 2013. |

| · | Seacoast has been the number one mortgage lender in its core markets for the past three years leading to more than $1 billion in total home loans originated. |

| · | Customer households meaningfully increased as a result of legacy growth and from acquisition, while ten branches have been closed and two new branches opened. |

| · | Increased promotion and new household growth, combined with the acquisition, resulted in significantly higher interchange revenue, up 23% in December 2014 compared to a year ago. |

| · | Launched automated cross-sell, delivering targeted marketing through multiple channels (email, outbound phone calls, ATMs, website). |

| · | Ramped up social media activities and are now connecting with thousands of customers and potential customers across Facebook and LinkedIn. |

| · | Invested in analytics, building out this critical function within the bank. |

Our Outlook for 2015

With the improved economy and our increased footprint in the attractive markets of central and southeast Florida, we believe that our growth prospects for 2015 and beyond are excellent. Our capital strength will allow us to continue to build on our momentum, both organically and through acquisitions. As we have demonstrated, acquisitions can be solidly accretive to earnings and provide improved operating leverage. We believe there are a number of attractive community banks that will allow us to continue to expand in our markets.

In addition, we believe we have only begun to hit our stride in new household acquisition and expanding services to existing customers through our automated delivery channels. Improving operating efficiencies by expanding and enhancing our digital and online channels will allow us to further streamline our branch footprint over time without sacrificing service to our customers.

Over the last three years, we have re-dedicated our efforts to improving profitability and building an enduring franchise for our shareholders. Generating double-digit loan growth, while containing overhead expenses and investing for the future, is essential to improving profitability. In 2014, we achieved double-digit organic loan growth, added an accretive acquisition, streamlined our operations, and demonstrated our resolve to build a sustainable and profitable franchise. While we are proud of what we were able to achieve so far, we know it is just a down payment on our commitment to our shareholders.

We appreciate your investment in Seacoast Banking and invite you to come along for the ride in 2015. We think it is just the beginning of a great journey.

Sincerely,

Dennis S. Hudson, III

Chairman and Chief Executive Officer

NO MATTER

HOW FAR

BACK YOU GO,

YOU’LL FIND US

LOOKING AHEAD.

2014 FINANCIAL HIGHLIGHTS:Fourth Quarter 2014 $3,093,335 3.56% 74.8 3.19 $1,821,885 $2,416,534 $4,179 $0.13 0.55% $7,464 $2,361,813 3.17% 80.2 3.24 $1,391,082 $1,808,550 $3,286 $0.13 0.57% $4,341 $2,294,156 3.10% 82.1 3.27 $1,335,192 $1,805,537 $2,990 $0.12 0.52% $3,821 $2,315,992 3.07% 83.3 3.26 $1,312,456 $1,819,795 $2,533 $0.10 0.45% $3,395 $2,268,940 3.08% 82.6 3.29 $1,304,207 $1,806,045 $600 $0.03 0.33% $3,617 Third Quarter 2014 Second Quarter 2014 First Quarter 2014 Fourth Quarter 2013 (Dollars in thousands, except share data) Total assets Net interest margin Adjusted efficiency ratio* Annualized core operating expenses as a percent of average assets Loans Deposits Adjusted net income available to common shareholders* Adjusted diluted earnings per share* Adjusted return on average assets* Adjusted pretax, pre-provision income* SeacoastBank.com *Non-GAAP measure, see reconcilement to GAAP at the end of this document. Management believes that the Non-GAAP measures presented facilitates the understanding of the Company’s underlying operational performance and potential future prospects. ADJUSTED PRETAX, PREPROVISION INCOME* $7.5M $3.6MQ4 2014 Q4 201367% 74.8% 82.6% vs. vs.Q4 2014 Q4 2013ADJUSTED EFFICIENCY RATIO* EVEN THE MOST FORWARD-THINKING INSTITUTION DESERVES A FOND LOOK BACK. 01 SECTION ADJUSTED RETURN ON AVERAGE ASSETS*FROM Q4 2013 TO Q4 2014 +NASDAQ: SBCF

The world around us is constantly morphing and evolving. Change is inevitable and must be embraced, not feared or resisted or soft-pedaled.Modern consumers, investors and businesses alike are quickly discovering and demanding new, more convenient ways to access and manage their financial lives. By offering a wealth of these conveniences, Seacoast Bank is superbly positioned to help bring growth and prosperity to the communities we serve, while growing and prospering right along with them. At the same time, we’re more committed than ever to core principles that remain the cornerstones of our success: • Since 1926, Seacoast has been a strong and stable presence, with deep roots in the neighborhoods we serve, and we continue to forge a secure place in the hearts of our customers. • Our strong leadership team never stops developing strategies to recognize and capitalize upon the opportunities that come with change. • We are a leader among community banks because we continue to anticipate how we’ll harness technology to meet the evolving needs and demands of our customers today, tomorrow and in the future. • Most importantly, in an increasingly techno-reliant world, we remain personally connected and committed to our customers and our communities at every level. WHEN OPPORTUNITY KNOCKS, WE’RE ALREADY OPENING DOORS. 02 SECTION SeacoastBank.com

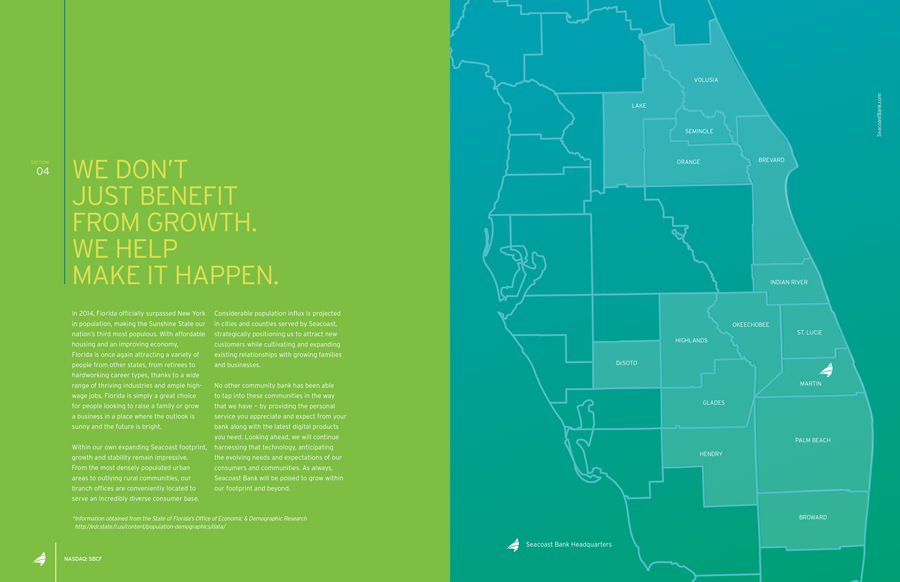

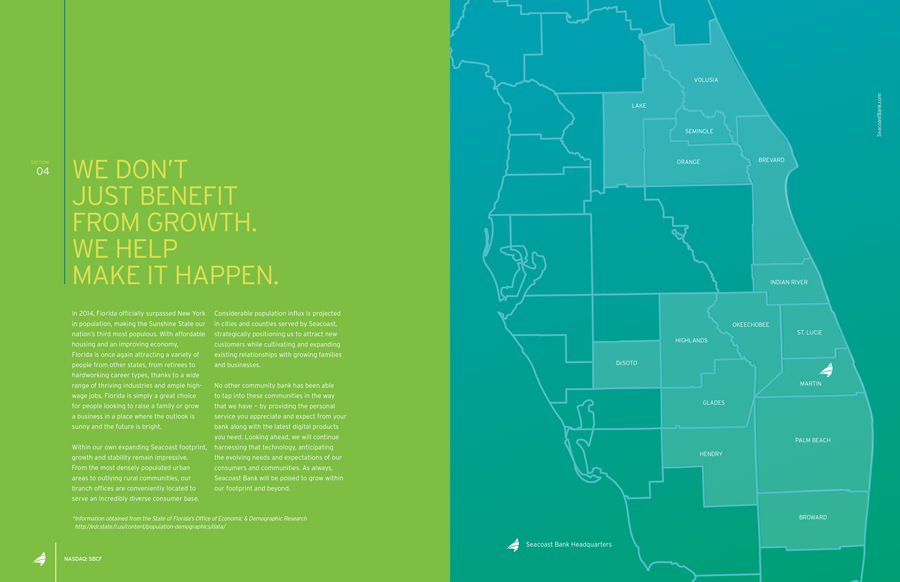

WE’VE BEEN MAKING, AND KEEPING, PROMISES TO CUSTOMERSSINCE 1926. 03 Seacoast Bank was founded three generations ago, and the secret of our success is no secret at all. From the start, thanks to solid leadership, a family-centric approach and our commitment to personalized service, Seacoast began earning a unique level of customer loyalty that endures to this day. Nearly a century later, Seacoast is now the 4th largest Florida-based bank* with 42 Seacoast branches — and 5 commercial banking centers called Accelerate — covering 15 counties in South and Central Florida. We believe in investing in the communities we serve because that’s where we live. This is our home, too. When local consumers bank with Seacoast, it allows us to make loans for homes and businesses right here in neighborhoods all over South and Central Florida. We continue to offer all the traditional banking products and conveniences our customers want — and the technology they’ve grown to expect — along with the personal service our customers have been banking on for nearly 100 years. Consumers today are adopting digital technologies more rapidly than is widely believed, and Seacoast Bank is taking a leadership role in satisfying that demand. We’re constantly pushing the envelope in terms of the services we offer and how easy we make it to utilize them. Seacoast continues to implement comprehensive online and mobile banking services with enhanced features that appeal to a broad swath of our loyal consumer base and attract new customers as well. Today our customers are using online and mobile banking with more frequency than ever before — depositing checks digitally, paying bills online, managing their money from anywhere, at any time. Our unique position as one of the largest consumer and small-business banks within our footprint allows us to test and explore new tactics to stay in tune with our customers and communities. We’ll continue to anticipate these digital demands and develop more products as customer expectations continue to evolve. SECTION *In deposits, excluding banks headquatered in Miami and Miami Lakes, FL. SeacoastBank.com NASDAQ: SBCF Seacoast Bank Headquarters PALM BEACH BROWARD HENDRY GLADES MARTIN ST. LUCIE DeSOTO HIGHLANDS OKEECHOBEE INDIAN RIVER BREVARD LAKE ORANGE SEMINOLE VOLUSIA

SeacoastBank.com04 In 2014, Florida officially surpassed New York in population, making the Sunshine State our nation’s third most populous. With affordable housing and an improving economy, Florida is once again attracting a variety of people from other states, from retirees to hardworking career types, thanks to a wide range of thriving industries and ample highwage jobs. Florida is simply a great choice for people looking to raise a family or grow a business in a place where the outlook is sunny and the future is bright. Within our own expanding Seacoast footprint, growth and stability remain impressive. From the most densely populated urban areas to outlying rural communities, our branch offices are conveniently located to serve an incredibly diverse consumer base. Considerable population influx is projected in cities and counties served by Seacoast, strategically positioning us to attract new customers while cultivating and expanding existing relationships with growing families and businesses. No other community bank has been able to tap into these communities in the way that we have — by providing the personal service you appreciate and expect from your bank along with the latest digital products you need. Looking ahead, we will continue harnessing that technology, anticipating the evolving needs and expectations of our consumers and communities. As always, Seacoast Bank will be poised to grow within our footprint and beyond. *Information obtained from the State of Florida’s Office of Economic & Demographic Research http://edr.state.fl.us/content/population-demographics/data/ WE DON’T JUST BENEFIT FROM GROWTH. WE HELP MAKE IT HAPPEN.SECTION

NASDAQ: SBCFJENNIFER & PETER JONES StarStruck Academy & Theatre “Creating. Inspiring. Believing. StarStruck Academy & Theatre changes the lives of children and families each and every day. Thank you Seacoast for being a part of our theatrical magic and making a difference in our community. Reach for the Stars!” THE HENDRY FAMILY Multi-generational Customers “We’ve been banking with Seacoast for over 45 years and it makes me proud to say that 4 generations bank with Seacoast today. They are truly committed to helping local families and business owners. The associates at Seacoast are more like family than banking staff.” SeacoastBank.com SEAN VERNE & KIMBERLY CONTI Paw Prints “As the owners of Paw Prints, every day we get to do what we truly love, and we couldn’t do it without the support of our local bank. Seacoast really is a customer’s best friend.” DR. MARK LIVELY Lively Orthodontics “It really puts a smile on my face to help out my community by donating to local charities every year, and I couldn’t be happier to have a bank that cares as much about my community as we do at Lively Orthodontics.” WE LOVE OUR CUSTOMERS, AND VICE VERSA. 05 SECTION

NASDAQ: SBCF

06As consumers and businesses demand more convenience and mobility from mega banks and community banks alike, Seacoast is uniquely poised to take advantage of the transformational marketplace and offer greater value for our customers, communities and shareholders. • By adopting digital strategies early on and embracing the technologies our consumers need, we are redefining the traditional business model of the community bank. • By working to enhance our customer interactions and experiences at our branches, we continue to out-service the big, impersonal banks. • By developing innovative platforms like Seacoast Accelerate Commercial Banking centers – a fully integrated, yet entirely different, commercial banking experience – we’re helping businesses reach their financial goals faster. At Seacoast, we will continue to refine our strategies, advance the integration of our digital products, and improve our branch-based delivery programs because opportunities for growth are significant. Join us as we continue to invest in the communities we serve, grow and prosper with our customers all over South and Central Florida, and face the future with foresight, anticipation and great expectations. To participate in our Stock Purchase Program, please contact the plan administrator and independent agent, Continental Stock Transfer, at 800.509.5586 or visit us at SeacoastBanking.net. OUR INTEREST IN CUSTOMERS GOES WAY BEYOND THEIR ACCOUNTS. SECTION SeacoastBank.com NASDAQ: SBCF

Making your day-to-day banking simple is a Seacoast Bank promise, and that begins with switching accounts from your old bank.We’re available day or night, 24/7, to help set up your Seacoast online and mobile banking, set up direct deposit and e-statements, switch your auto payments, order debit cards and more. With our Easy Switch Concierge, it really is e-a-s-y. And all it takes is a phone call. Take advantage of Easy Switch Concierge: • Call us 24/7 at 800.706.9991 • Visit SeacoastBank.com • Contact us at CustomerService@SeacoastBank.com • Stop by your local branch MAKE THE SWITCH TO SEACOAST. BETTER YET, LET US DO IT FOR YOU. 07 SECTION SeacoastBank.com NASDAQ: SBCF Presented below is net income excluding adjustments for merger related charges, branch closure charges, and other non-core expenses. The company believes that these results of operations are a more meaningful depiction of the underlying fundamentals of its business and overall performance.

SeacoastBank.com | 800 706 9991