UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14(a)-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

SEACOAST BANKING CORPORATION OF FLORIDA

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule, or Registration Statement No.: |

CHAIRMAN’S LETTER

To Our Shareholders and Friends, Seacoast’s financial results – our best since the 2008 financial crisis – establish that our balanced growth strategy, combining outsized organic growth and strategic acquisitions with prudent risk management, delivers consistent results and generates value for shareholders. In 2015:

| • | Revenue grew a strong 42 percent to $142 million. |

| • | Net income increased 288 percent to $22.1 million from $5.7 million, while fully diluted earnings per share tripled to 66 cents from 21 cents. |

| • | Core customer funding increased 21 percent, up 13 percent after adjusting for our acquisitions. Our cost of deposits stands at a low 0.13 percent, reflecting strong customer relationships. |

| • | Loans rose 18 percent, with $688 million of loan production retained versus $424 million a year ago. We maintained prudent concentration limits, with commercial real estate loans as a percent of risk based capital remaining nearly flat for the year and our top 10 loan relationships totaling 31 percent of total risk-based capital, down by over 40 percent since 2011. We also maintained a high level of granularity in our loan portfolio, with our average commercial loan size decreasing 43 percent since 2011. |

| • | Households we serve increased at a solid 8 percent rate, 5 percent excluding 2015 acquisitions. |

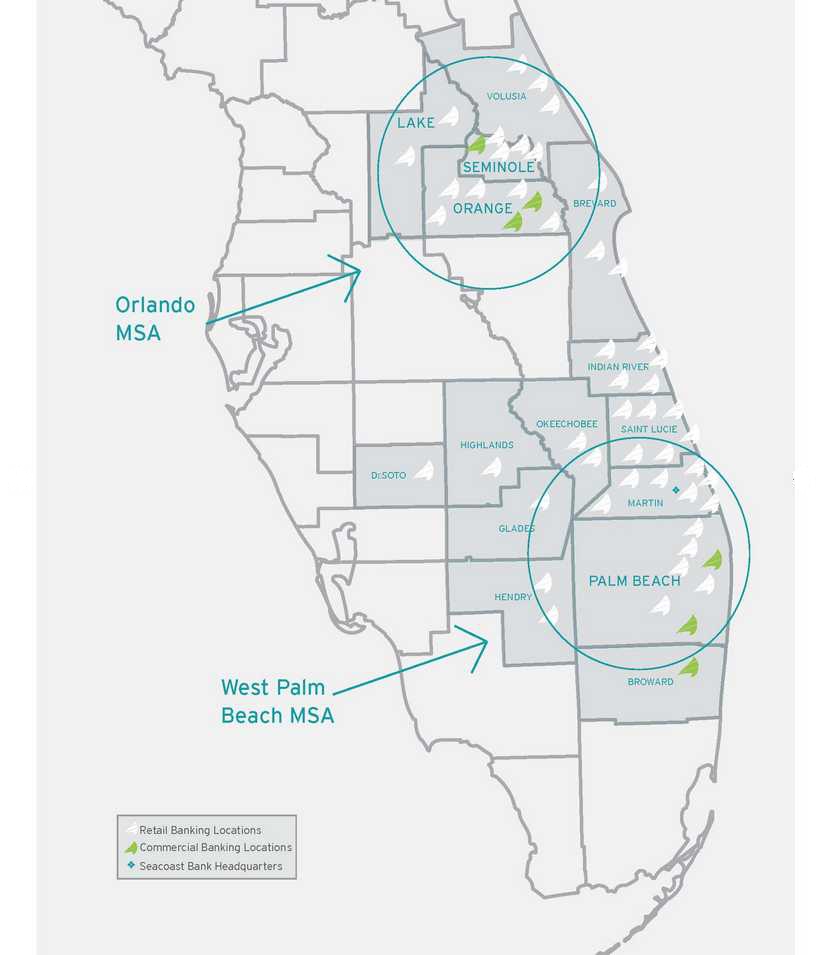

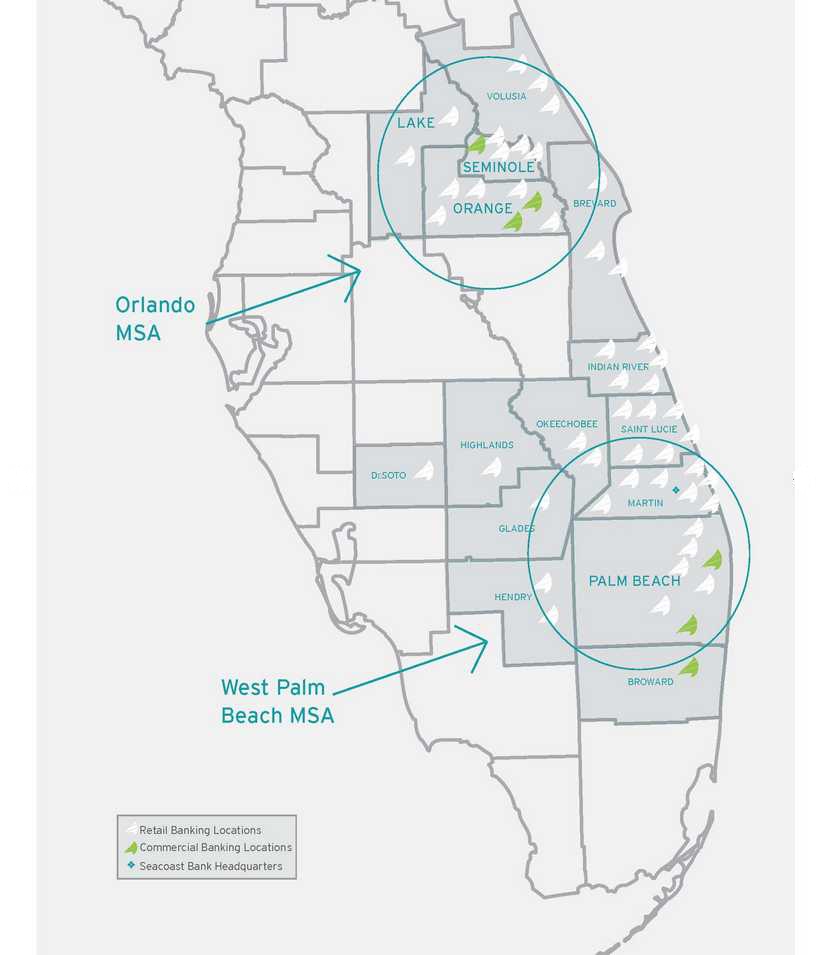

In addition, we agreed to acquire Floridian Financial Group in Central Florida and BMO Harris’ Orlando banking operations, setting the stage for further growth as we complete these two acquisitions in Q1 and Q2 2016, respectively. Our prior acquisitions of BankFIRST in Orlando in Q4 2014, as well as Grand Bankshares in Palm Beach, completed in Q3 2015, significantly expanded our service area and the number of households we serve in two of Florida’s most attractive areas.

Seacoast is in the vanguard of digital change that promises to transfigure community banking. The benefit to progressive financial institutions such as ours that capitalize on transformational opportunities are enormous. We believe that the digital investments detailed below, combined with our other investments in organic growth, including our Accelerate commercial banking platform, position us well to deliver future value for shareholders.

Our goal in 2016 is to increase our adjusted earnings* to $1.00 a share, representing approximately 33 percent growth year-over-year. Moreover, we expect that Seacoast’s commitment to the ongoing innovation of our industry-leading banking platform will drive further operational gains.

Seacoast’s Transformation-Gathering Momentum

Digital technology has created the Age of the Consumer. Banking customers today want the convenience and personalization that mobile devices deliver and expect the customer experience to revolve around them, not the other way around. Consequently, Seacoast today competes, not just with other home-grown Florida banks and out-of-state mega-banks, but with competitors from unexpected places – Amazon and even Silicon Valley via lending and payment startups.

Seacoast’s board of directors and senior leadership team were among the first in the community banking industry to see the potential of applying a comprehensive digital strategy to transform the bank. Taking advantage of the nimbleness that our relatively small size confers, Seacoast adapted early to the ability of digital servicing, sales and data analytics to drive increased growth while also moving transactions out of high-cost branches.

Today, the results from our digital investments – combined with our 24x7 call center, ATM network, and mobile-friendly online presence – continue to drive consistent results. Increasingly, customers are choosing lower-cost non-branch channels for routine servicing needs, and our adoption of mobile banking and other non-branch delivery outpaces not only our community bank peers, but that of bigger banks as well:

| • | Sixty-seven percent of Seacoast’s customers with online access use their mobile devices toaccess their Seacoast accounts, up from 49 percent in the first quarter of 2014. This compares to only 44 percent for peer community banks and 48 percent for big banks. |

| • | Over 30 percent of all physical checks are now deposited outside the branch as of February 2016, up from 22 percent in February 2015, driven by steady adoption of mobile check deposit along with our ATM network. |

• *Non GAAP measure

Our industry leading cross-selling sales platform, fueled by investments in software and analytics, is driving meaningful results, increasingly outside the traditional branch network:

| • | Cross-selling of consumer loans is up nearly 50 percent year over year, withnearly one-quarter of all consumer sales now taking place outside of the branch. |

| • | Cross-selling of small business loans is up nearly 190 percent year over year, reflecting our focus on growing our small business portfolio. |

| • | Cross-selling of new deposit accounts to existing customers is up 27 percent,with over 15 percent of these sales now taking place outside of the branch. |

These metrics, driven by our digital investments, enable us to reenvision our fixed-cost branch network. In 2015, we closed three branches with minimal impact on customers, and we expect to consolidate four more in the first half of 2016. Evidence of our continued transformation is quite clear. Since 2012, our deposits have increased 62 percent while our branch network has only grown by less than 20 percent.

Customers continue to tell us they are delighted with our service. Our customer satisfactions scores remain high, with 70 percent of our customers rating us a 9 or 10. Further, more than three-fourths of customers say they have recommended Seacoast to a friend.

Expanding in the Attractive Florida Market

Seacoast is a disciplined acquirer and integrator of other banks, and growth via acquisitions is a critical part of our balanced growth strategy for creating shareholder value.

In Q4 2014, we acquired The BANKshares Inc., parent of BankFIRST, which expanded our presence in the Orlando and Central Florida market. In Q3 2015, we acquired and converted Grand Bankshares, further strengthening our presence in Palm Beach County. For both acquisitions, we have converted customers seamlessly into the Seacoast family and, in fact, have driven growth via cross-selling and by attracting new customers. Household growth and cross-selling metrics for these markets prove that we are building value through these acquisitions.

Last year, we announced two prudent acquisitions that deepened our presence in the Orlando market, purchasing BMO Harris’ 14 branches and acquiring Floridian Financial Group, with 10 branches in Orlando and Daytona Beach. These acquisitions will further strengthen our presence in the Orlando and broader Central Florida area, making us the largest community bank in this vibrant growth market.

Florida’s economy continues to generate tailwinds for us. Orlando led the nation in job growth in 2015, and in February 2016, Florida accounted for 9.4 percent of job growth nationally with just 6.3 percent of the nation’s population according to ADP. Overall, Florida’s economy continues to diversify, with job creation in health care, technology and business services balancing the state’s traditional reliance on tourism and real estate.

Board and Employee Update

Over the past four years, we have actively recruited new talent to our board to increase its diversity of thought and experience and better align overall board capability with Seacoast’s strategic focus. We have focused considerable attention on board development, during which time we have appointed an independent lead director and added five new directors.

In March 2016, following the close of our fiscal year, we announced the appointment of two additional directors, Herb Lurie, Senior Advisor, Guggenheim Securities, and Tim Huval, Senior Vice President, Chief Human Resources Officer, Humana, bringing our board to 14 directors. Each ofour directors possesses skills needed to help us navigate the changing environment impacting our business, and we have a vibrant board culture with an unrelenting focus on creating value for all shareholders.

On behalf of our Board and customers, I would like to thank our associates. They are a tremendous asset to Seacoast. In our most recent engagement survey, 80 percent of employees said they are extremely satisfied to work for Seacoast. This compares to a global average of 72 percent, according to IBM research. Their commitment to our customers is certainly apparent in our high customer service ratings. We were honored that our employees voted us a “2015 Best Places to Work in Central Florida” in the Orlando Business Journal annual survey.

Looking Ahead

Seacoast benefits from committed employees and directors and our resolute focus on customers. Ninety years of experience have firmly established our brand and lets us hone our service model of convenience. These attributes in particular equip us with a unique brand, built through those decades of service and through modern technology that helps us best meet our customers’ needs through the delivery channel they prefer.

As a result, our revenue grows and our costs decline while we continue to invest in the areas that will further transform Seacoast. We are early in this transformation. Yet, our shareholder returns indicate that our shareowners recognize our journey and the opportunities our strategic direction can contribute to our performance.

We eagerly look forward to continuing to serve our shareholders, customers and communities in 2016 and beyond.

Sincerely,

Dennis S. Hudson III

Chairman and Chief Executive Officer

PALM BEACH BROWARD HENDRY GLADES MARTIN DeSOTO HIGHLANDS OKEECHOBEE BREVARD INDIAN RIVER LAKE ORANGE SEMINOLE VOLUSIA v SAINT LUCIE Orlando MSA West Palm Beach MSA Commercial Banking Locations Retail Banking Locations v Seacoast Bank Headquarters