NorthWestern Energy Annual Meeting April 27, 2017 Beethoven Wind Farm near Tripp, South Dakota

2 Company Information & Forward Looking Statements Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company‟s Form 10-K and 10-Q along with other public filings with the SEC. Company Information NorthWestern Corporation dba: NorthWestern Energy www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57106 Montana Operational Support Office 11 East Park Street Butte, MT 59701 SD/NE Operational Support Office 600 Market Street West Huron, SD 57350 Director of Investor Relations Travis Meyer 605-978-2945 travis.meyer@northwestern.com

NWE - An Investment for the Long Term 3 • 100% Regulated electric & natural gas utility business • 100 year history of competitive customer rates, system reliability and customer satisfaction • Solid economic indicators in service territory • A diverse electric supply portfolio that is approximately 54% hydro and wind (combined MT & SD) • Solid & improving JD Power Overall Customer Satisfaction scores • Residential electric and natural gas rates below the national average • Solid system reliability (EEI 2nd quartile) • Low leaks per 100 miles of pipe (AGA 1st quartile) • Named a “Utility Customer Champion” by Cogent Reports (top trusted utility brand in the West region) • Consistent track record of earnings and dividend growth • Strong cash flows aided by net operating loss carry-forwards • Strong balance sheet and solid investment grade credit ratings • Recent hydro & wind transactions increase rate base & provide energy supply stability • Disciplined maintenance capital investment program • Further opportunity to reintegrate energy supply portfolio to meet capacity shortfalls • Significant future investment in a comprehensive transmission, distribution, and substation infrastructure project to address asset lives, safety, capacity and grid modernization Pure Electric & Gas Utility Solid Utility Foundation Strong Earnings & Cash Flows Attractive Future Growth Prospects (NYSE Ethics) Best Practices Corporate Governance

About NorthWestern 4 Montana Operations Electric 363,800 customers 24,450 miles – transmission & distribution lines 809 MW nameplate owned power generation Natural Gas 194,100 customers 7,250 miles of transmission and distribution pipeline 18 Bcf of gas storage capacity Own 61 Bcf of proven natural gas reserves Nebraska Operations Natural Gas 42,300 customers 787 miles of distribution pipeline South Dakota Operations Electric 63,200 customers 3,550 miles – transmission & distribution lines 440 MW nameplate owned power generation Natural Gas 46,200 customers 1,673 miles of transmission and distribution pipeline

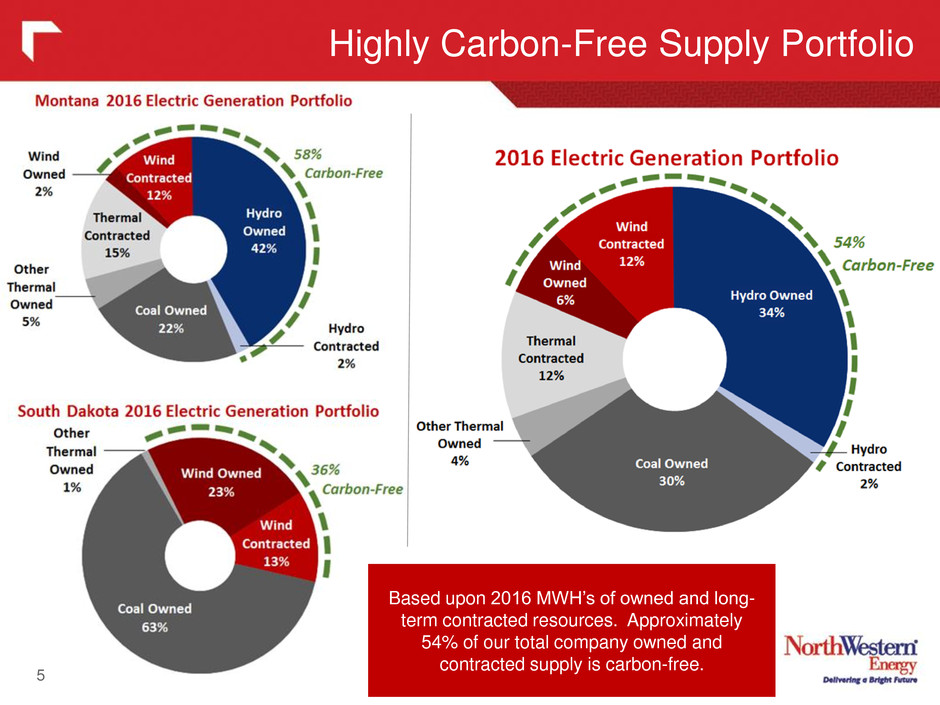

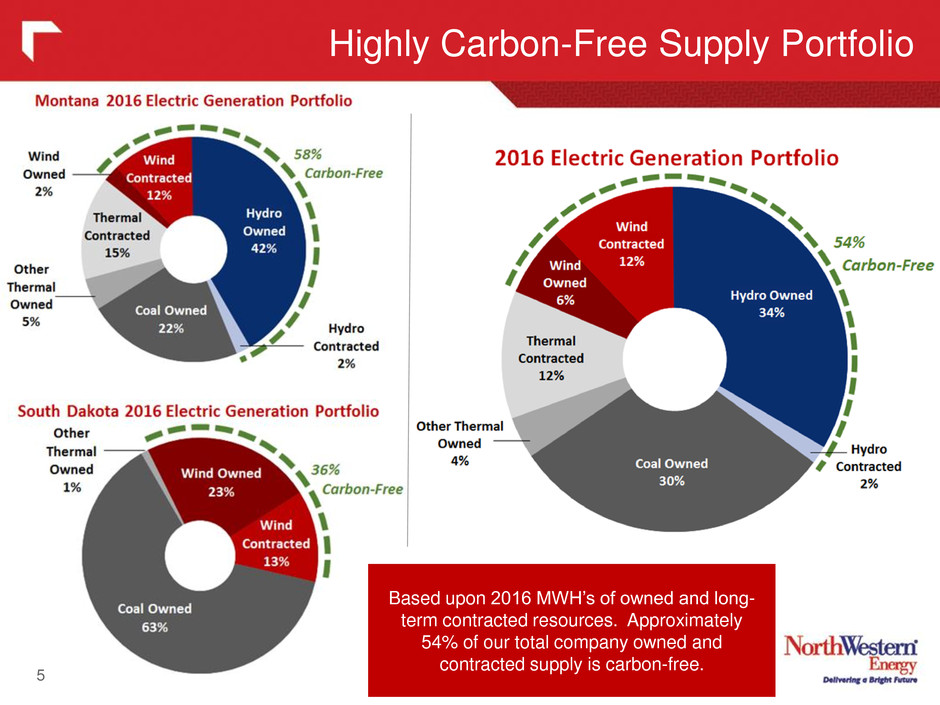

5 Based upon 2016 MWH‟s of owned and long- term contracted resources. Approximately 54% of our total company owned and contracted supply is carbon-free. Highly Carbon-Free Supply Portfolio

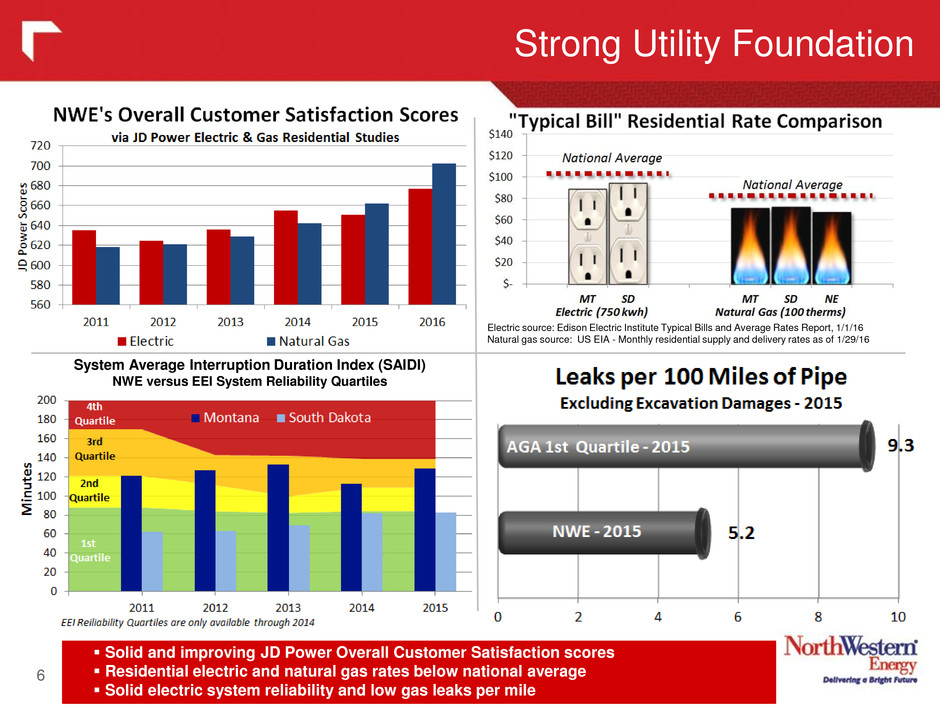

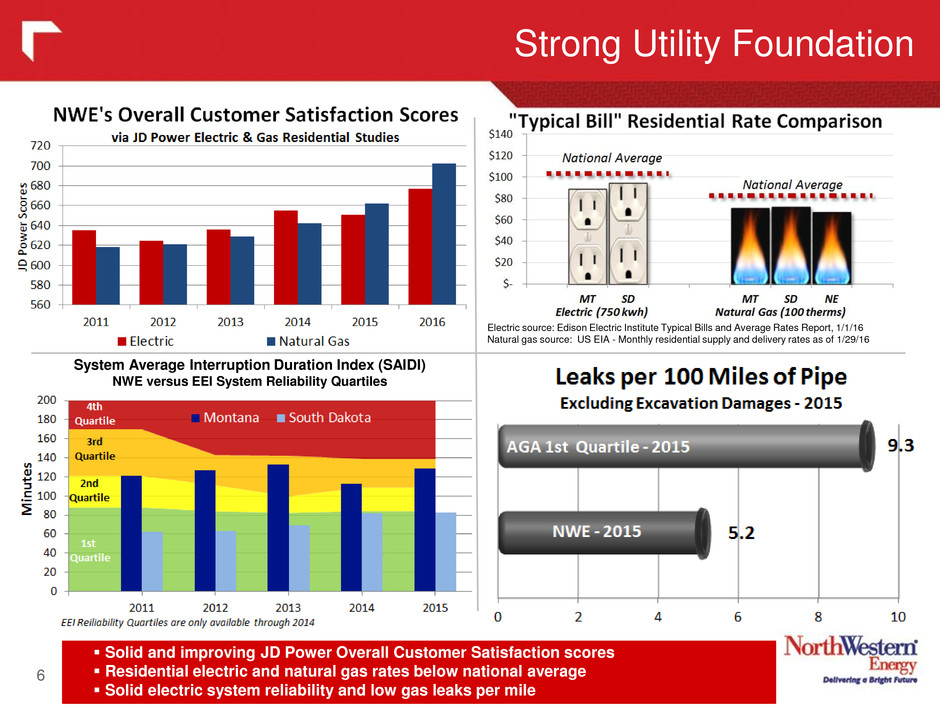

Strong Utility Foundation 6 Electric source: Edison Electric Institute Typical Bills and Average Rates Report, 1/1/16 Natural gas source: US EIA - Monthly residential supply and delivery rates as of 1/29/16 Solid and improving JD Power Overall Customer Satisfaction scores Residential electric and natural gas rates below national average Solid electric system reliability and low gas leaks per mile System Average Interruption Duration Index (SAIDI) NWE versus EEI System Reliability Quartiles

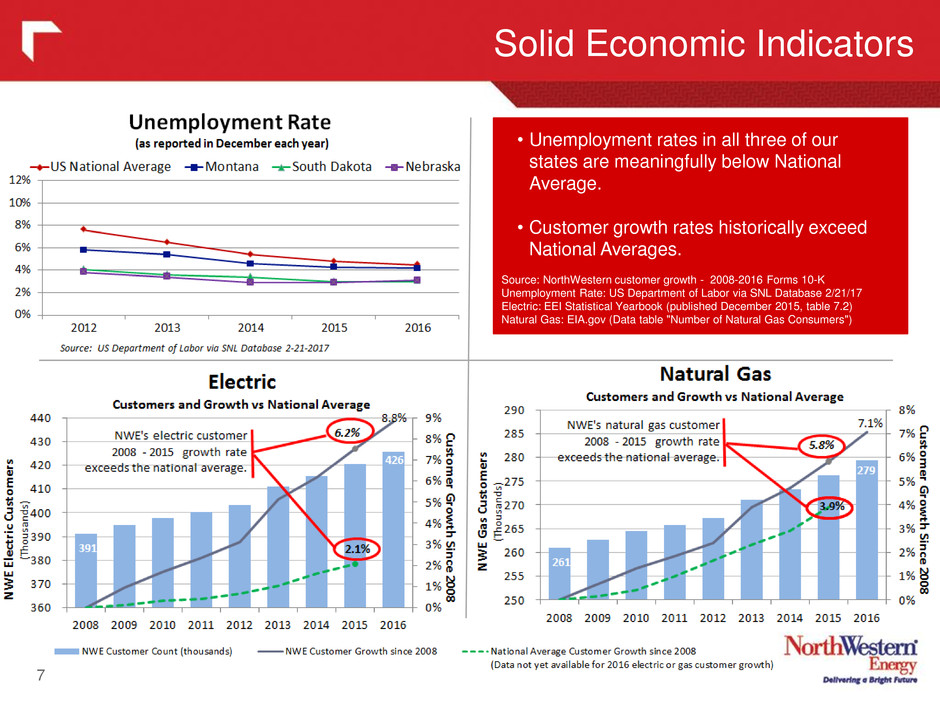

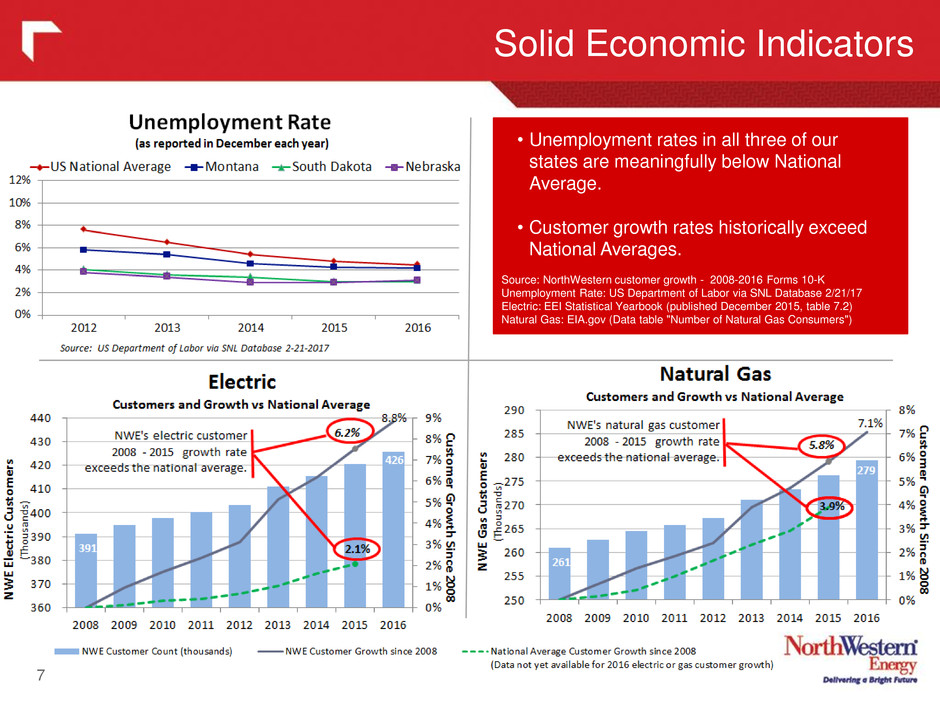

Solid Economic Indicators 7 • Unemployment rates in all three of our states are meaningfully below National Average. • Customer growth rates historically exceed National Averages. Source: NorthWestern customer growth - 2008-2016 Forms 10-K Unemployment Rate: US Department of Labor via SNL Database 2/21/17 Electric: EEI Statistical Yearbook (published December 2015, table 7.2) Natural Gas: EIA.gov (Data table "Number of Natural Gas Consumers")

Strong Corporate Governance 8

Strong Corporate Governance 9

2017 Earnings Guidance 10 NorthWestern reaffirms 2017 earnings guidance range of $3.30 - $3.50 per diluted share is based upon, but not limited to, the following major assumptions and expectations: • Normal weather in our electric and natural gas service territories; • A consolidated income tax rate of approximately 7% to 11% of pre-tax income; and • Diluted average shares outstanding of approximately 48.5 million. Continued investment in our system to serve our customers and communities is expected to provide a targeted 7-10% total return to our investors through a combination of earnings growth and dividend yield. However in light of recent regulatory headwinds and reduced & delayed generation spending, we anticipate in the near-term to be at the lower end of the 7-10% range. See “Non-GAAP Financial Measures” slide in appendix for “Non-GAAP “Adjusted EPS”. $2.60 - $2.75 $3.10 - $3.30 $3. 0-$3.40 $3.30-$3.50

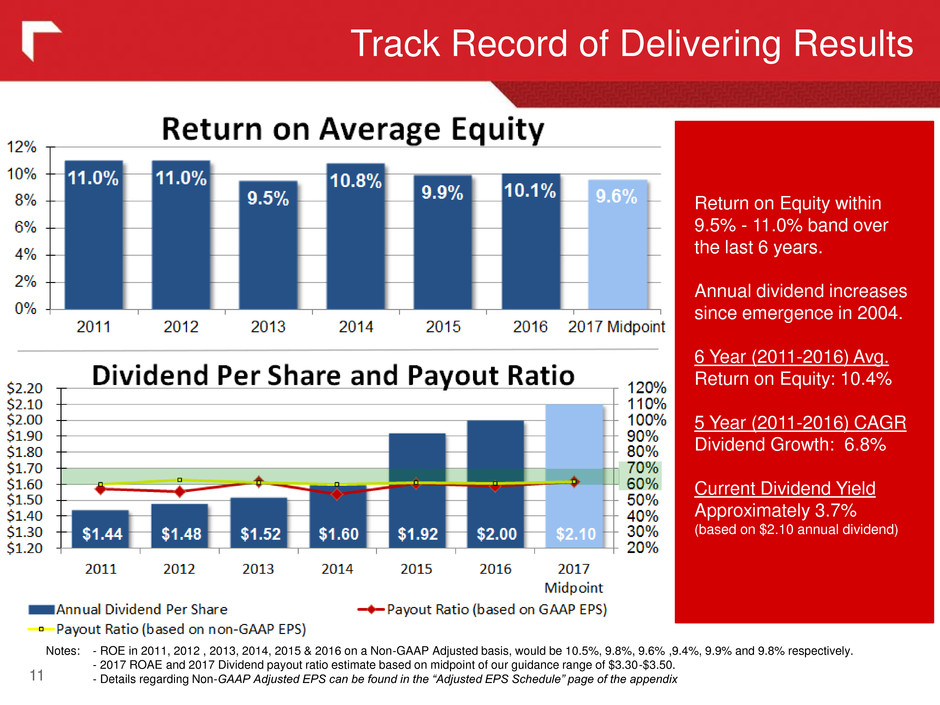

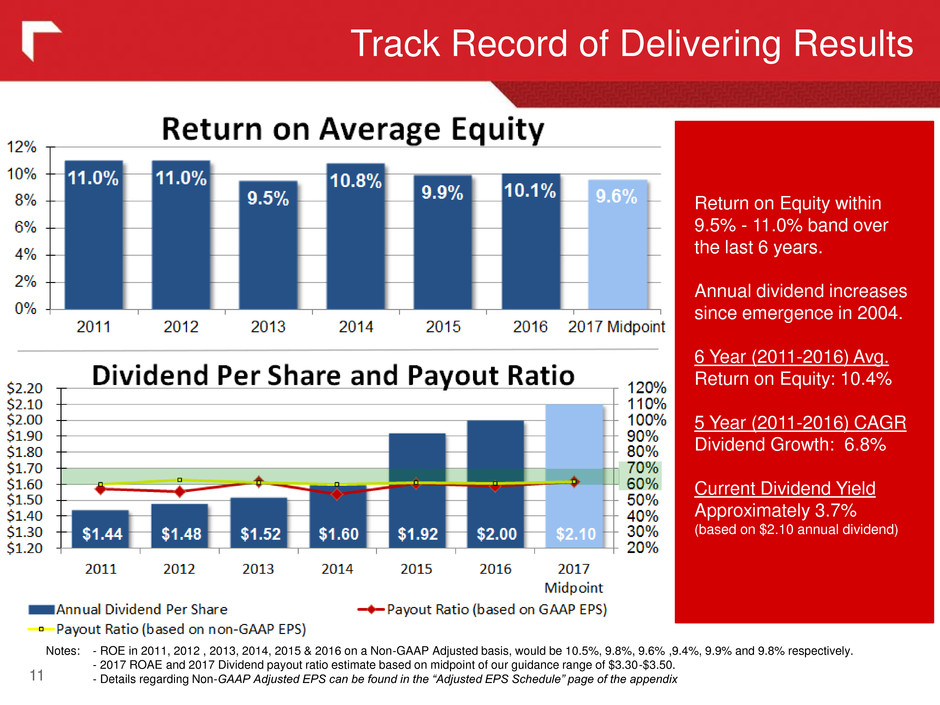

Track Record of Delivering Results 11 Notes: - ROE in 2011, 2012 , 2013, 2014, 2015 & 2016 on a Non-GAAP Adjusted basis, would be 10.5%, 9.8%, 9.6% ,9.4%, 9.9% and 9.8% respectively. - 2017 ROAE and 2017 Dividend payout ratio estimate based on midpoint of our guidance range of $3.30-$3.50. - Details regarding Non-GAAP Adjusted EPS can be found in the “Adjusted EPS Schedule” page of the appendix Return on Equity within 9.5% - 11.0% band over the last 6 years. Annual dividend increases since emergence in 2004. 6 Year (2011-2016) Avg. Return on Equity: 10.4% 5 Year (2011-2016) CAGR Dividend Growth: 6.8% Current Dividend Yield Approximately 3.7% (based on $2.10 annual dividend)

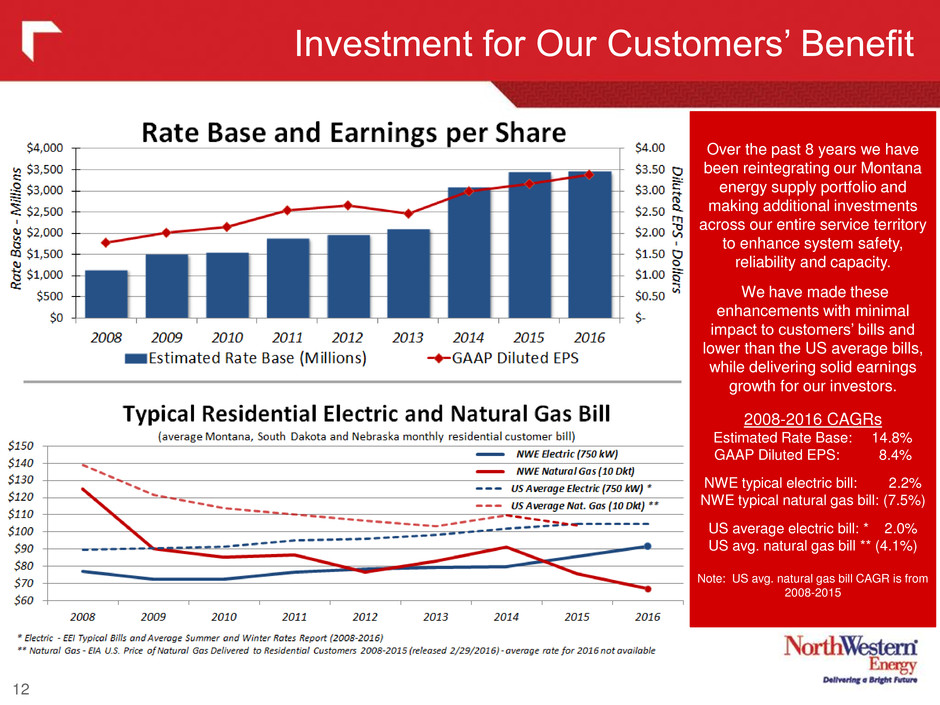

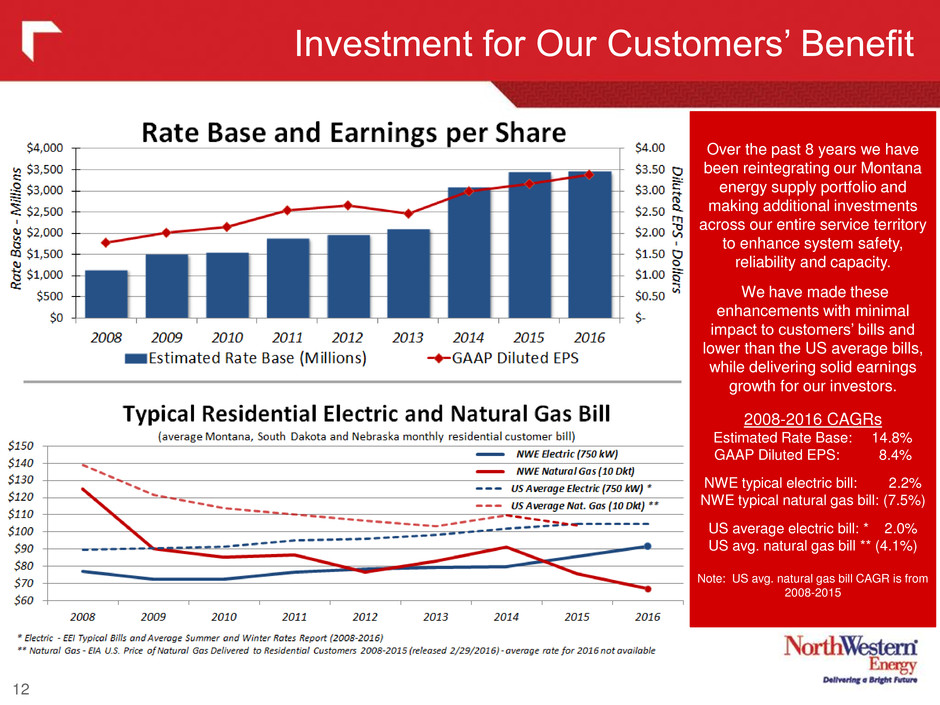

Investment for Our Customers‟ Benefit 12 Over the past 8 years we have been reintegrating our Montana energy supply portfolio and making additional investments across our entire service territory to enhance system safety, reliability and capacity. We have made these enhancements with minimal impact to customers‟ bills and lower than the US average bills, while delivering solid earnings growth for our investors. 2008-2016 CAGRs Estimated Rate Base: 14.8% GAAP Diluted EPS: 8.4% NWE typical electric bill: 2.2% NWE typical natural gas bill: (7.5%) US average electric bill: * 2.0% US avg. natural gas bill ** (4.1%) Note: US avg. natural gas bill CAGR is from 2008-2015

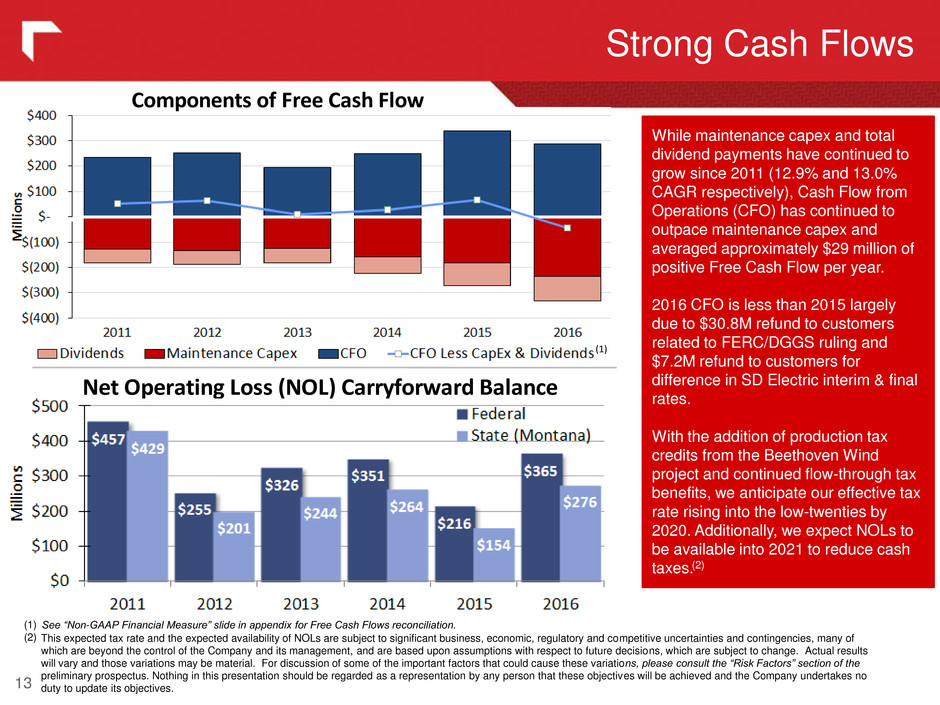

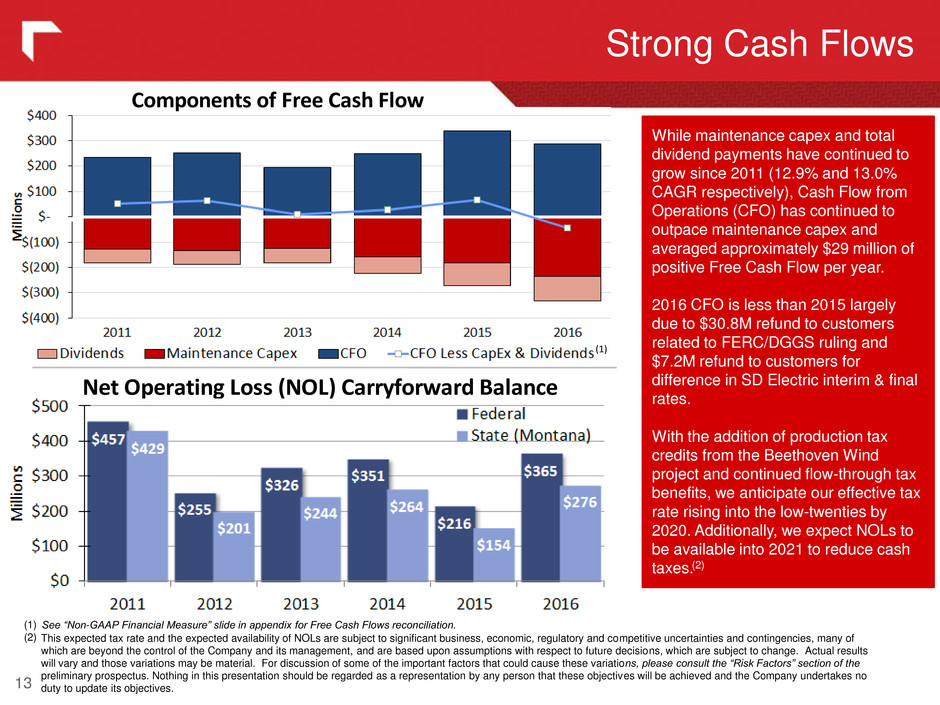

While maintenance capex and total dividend payments have continued to grow since 2011 (12.9% and 13.0% CAGR respectively), Cash Flow from Operations (CFO) has continued to outpace maintenance capex and averaged approximately $29 million of positive Free Cash Flow per year. 2016 CFO is less than 2015 largely due to $30.8M refund to customers related to FERC/DGGS ruling and $7.2M refund to customers for difference in SD Electric interim & final rates. With the addition of production tax credits from the Beethoven Wind project and continued flow-through tax benefits, we anticipate our effective tax rate rising into the low-twenties by 2020. Additionally, we expect NOLs to be available into 2021 to reduce cash taxes. Strong Cash Flows 13 See “Non-GAAP Financial Measure” slide in appendix for Free Cash Flows reconciliation. This expected tax rate and the expected availability of NOLs are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the preliminary prospectus. Nothing in this presentation should be regarded as a representation by any person that these objectives will be achieved and the Company undertakes no duty to update its objectives. Net Opera ing Loss (NOL) Carryforward Balance (2) (1) (2) (1) Components of Free Cash Flow

Total Shareholder Return 14 • 13 member peer group: ALE (ALLETE), AVA (Avista), BKH (Black Hills Corp), EE (El Paso Electric), GXP (Great Plains Energy), IDA (IDACORP), MGEE (MGE Energy), OGE (OGE Energy), OTTR (Otter Tail Power), PNM (PNM Resources), POR (Portland General Electric), VVC (Vectren) and WR (Westar)

Balance Sheet Strength and Liquidity 15

Credit Ratings 16 Moody’s: A2 Fitch: A S&P: A- On March 10, 2017 Moody‟s downgraded our senior secured and unsecured credit rating and maintained its Negative Outlook on NWE. However, even after the downgrade, Moody‟s rating is in line with Fitch and above S&P on a secured basis (and between them on an unsecured basis).

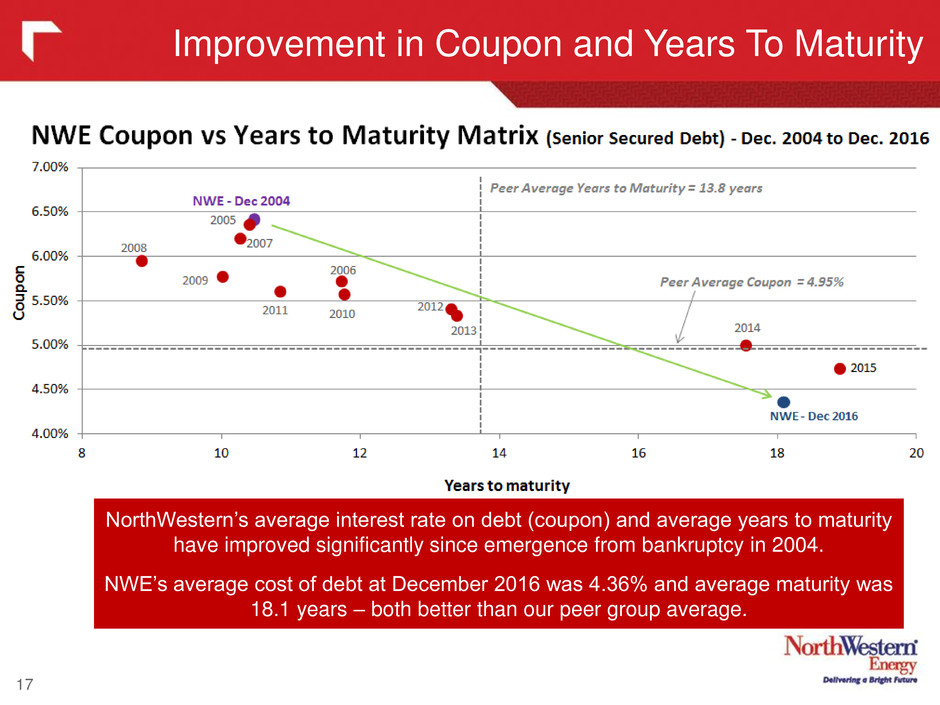

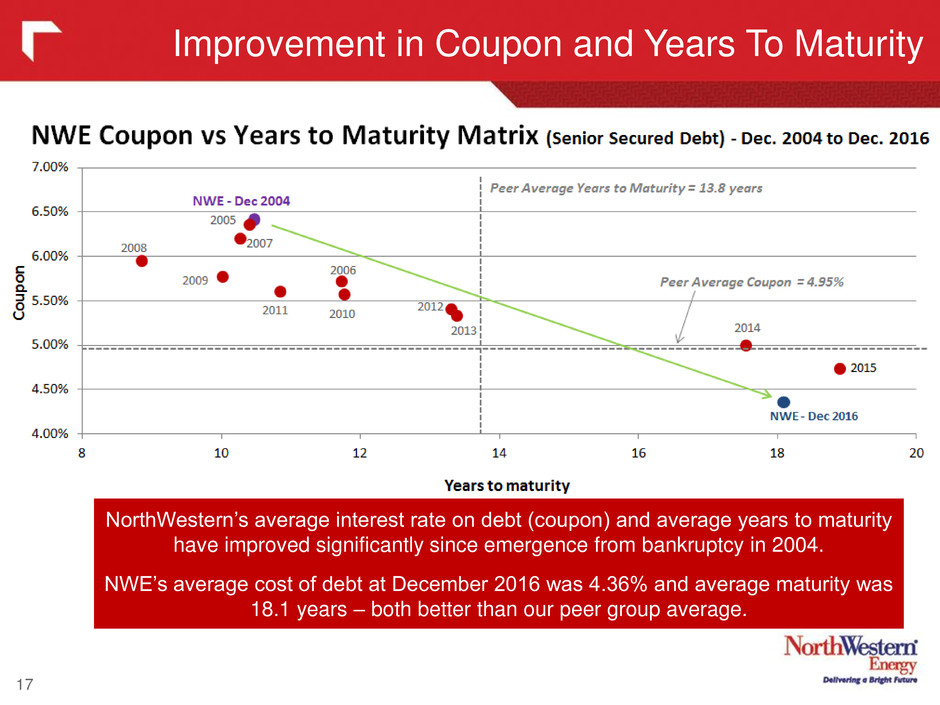

Improvement in Coupon and Years To Maturity 17 NorthWestern‟s average interest rate on debt (coupon) and average years to maturity have improved significantly since emergence from bankruptcy in 2004. NWE‟s average cost of debt at December 2016 was 4.36% and average maturity was 18.1 years – both better than our peer group average.

Significant Achievements in 2016 18 Strong year for safety at NorthWestern • Fewest OSHA recordable events of any year. • Best year for lost time incidents. Record best customer satisfaction scores with JD Power & Associates • Received our best Overall Customer Satisfaction scores in the JD Power residential utility survey in 2016. Corporate Governance Finalist • NorthWestern’s 2016 proxy statement was recognized as a finalist in 2016 by Corporate Secretary magazine for Best Proxy Statement (Small to Mid Cap). We won the award in 2014. Echo Lake Nordic Trail Recognized for Strong Dividend • In March 2016, NorthWestern Corporation was added to the NASDAQ US Broad Dividend AchieversTM Index, which aims to represent the country’s leading stocks by dividend yield in addition to Dow Jones US Dividend Select TM Index in 2015. New Board Member • Added Tony Clark, former FERC commissioner and ND Public Service Commissioner, to our board of directors in December 2016.

What we are working on in 2017 19 Natural Gas Rate Case in Montana • Intervenor testimony received and rebuttal testimony filed April 7th • Hearing commences May 9th and final decision expected in mid 2017 Cost control efforts • Continue to monitor costs, especially labor and benefits • Monitor property tax valuations in Montana Continue to invest in our existing transmission and distribution infrastructure. • Transition from DSIP/TSIP to overall infrastructure capital plan • Natural gas pipeline investment (Integrity Verification Process and PHMSA Requirements) • Advanced Metering Infrastructure (AMI) investment Refining our Supply Plan in Montana • Capacity generation additions • Continue to work with MPSC and other stakeholder groups to refine energy supply plans Continue to search for natural gas reserve acquisition opportunities • Acquisitions at a price that benefits both customers and shareholders Echo Lake Nordic Trail

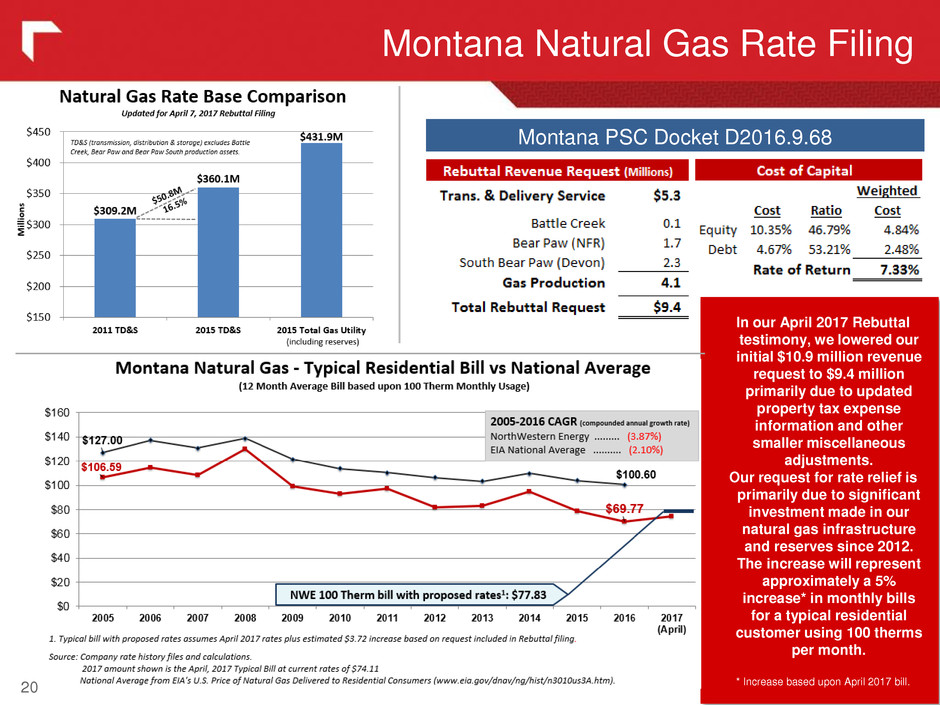

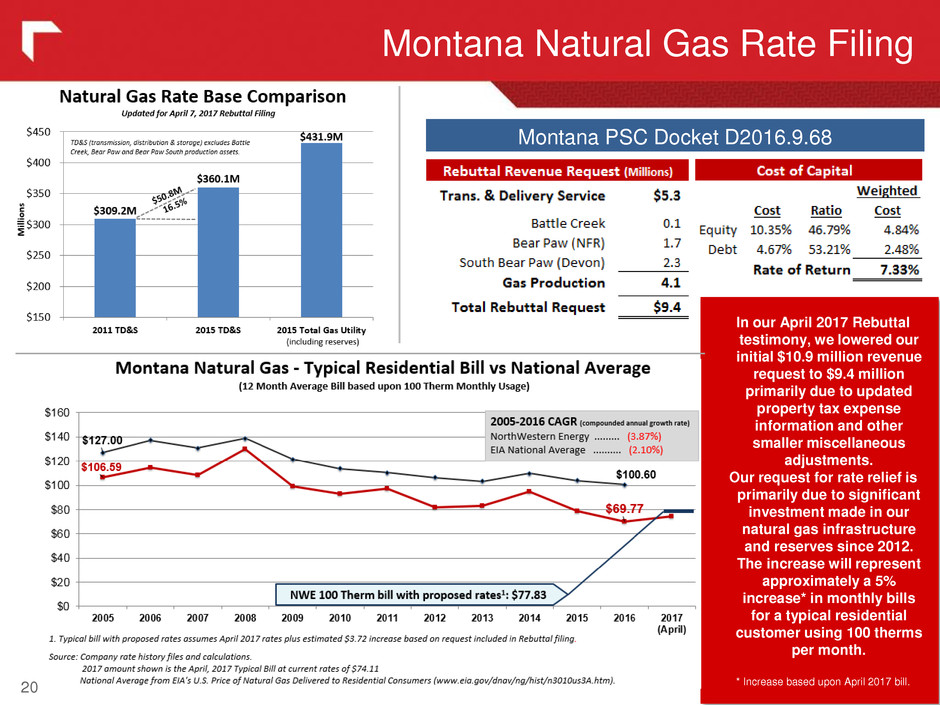

Montana Natural Gas Rate Filing 20 Montana PSC Docket D2016.9.68 In our April 2017 Rebuttal testimony, we lowered our initial $10.9 million revenue request to $9.4 million primarily due to updated property tax expense information and other smaller miscellaneous adjustments. Our request for rate relief is primarily due to significant investment made in our natural gas infrastructure and reserves since 2012. The increase will represent approximately a 5% increase* in monthly bills for a typical residential customer using 100 therms per month. * Increase based upon April 2017 bill.

Capital Spending Forecast 21 The updated current estimated cumulative capital spending for 2017 through 2021 is $1.58 billion. Capital spending has been reduced, from the prior $1.66 billion plan, primarily as a result of reduced and delayed spending on necessary generation assets in both Montana and South Dakota. We anticipate managing capital expenditures to provide a more levelized annual spend (including spending on generation assets) and anticipate funding the expenditures with a combination of cash flows, aided by NOLs now anticipated to be available into 2021, and long-term debt. If other opportunities arise that are not in the above projections (natural gas reserves, acquisitions, etc.), new equity funding may be necessary. *

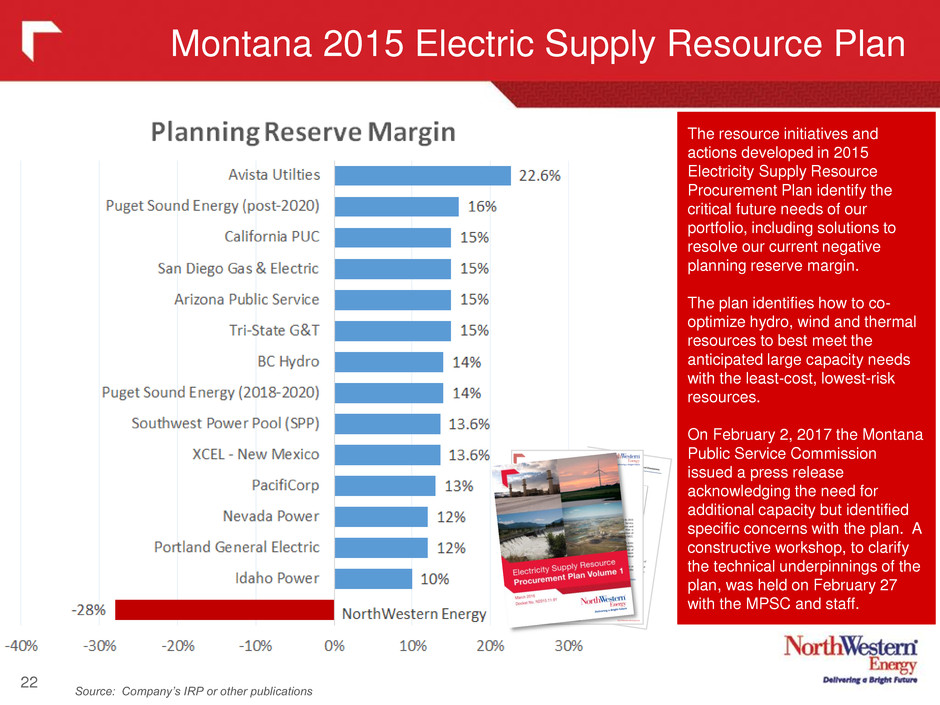

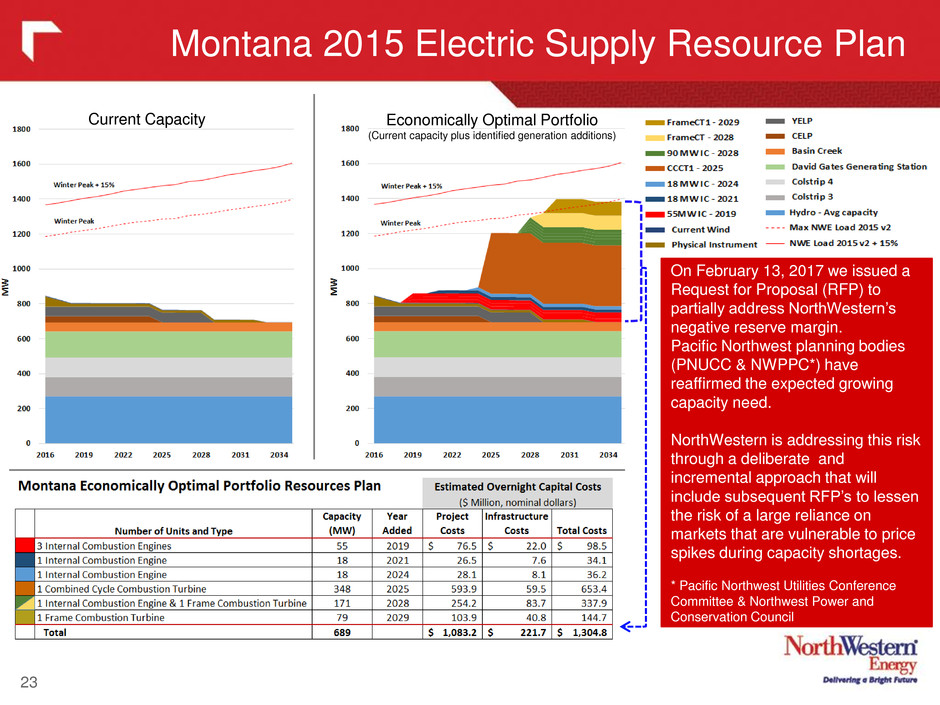

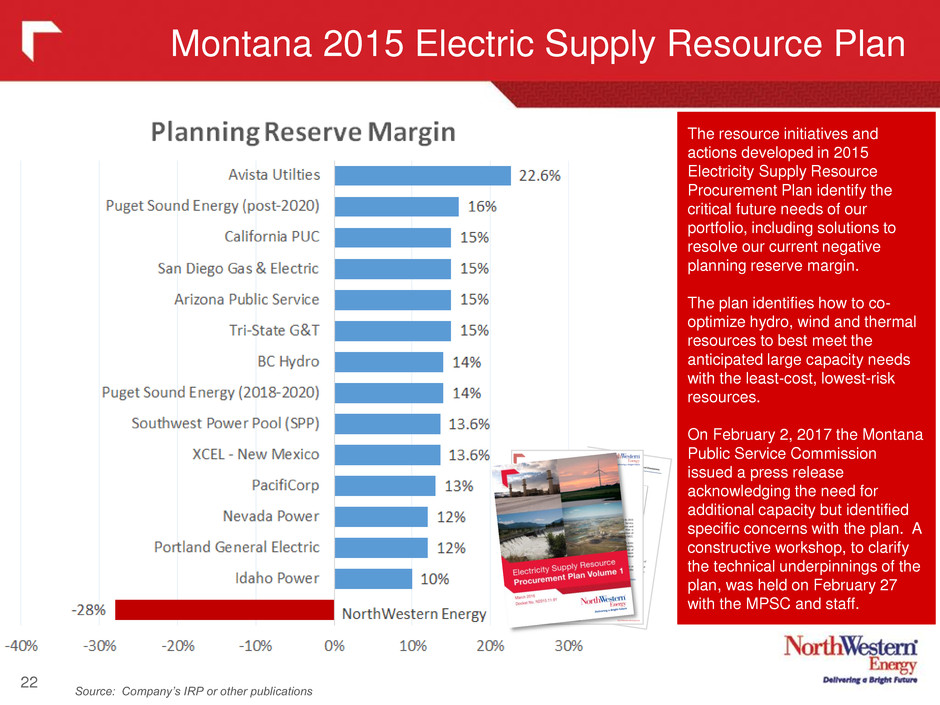

Montana 2015 Electric Supply Resource Plan 22 The resource initiatives and actions developed in 2015 Electricity Supply Resource Procurement Plan identify the critical future needs of our portfolio, including solutions to resolve our current negative planning reserve margin. The plan identifies how to co- optimize hydro, wind and thermal resources to best meet the anticipated large capacity needs with the least-cost, lowest-risk resources. On February 2, 2017 the Montana Public Service Commission issued a press release acknowledging the need for additional capacity but identified specific concerns with the plan. A constructive workshop, to clarify the technical underpinnings of the plan, was held on February 27 with the MPSC and staff. Spending on the generation assets will be subject to the development of a plan for clear regulatory recovery. Source: Company’s IRP or other publications

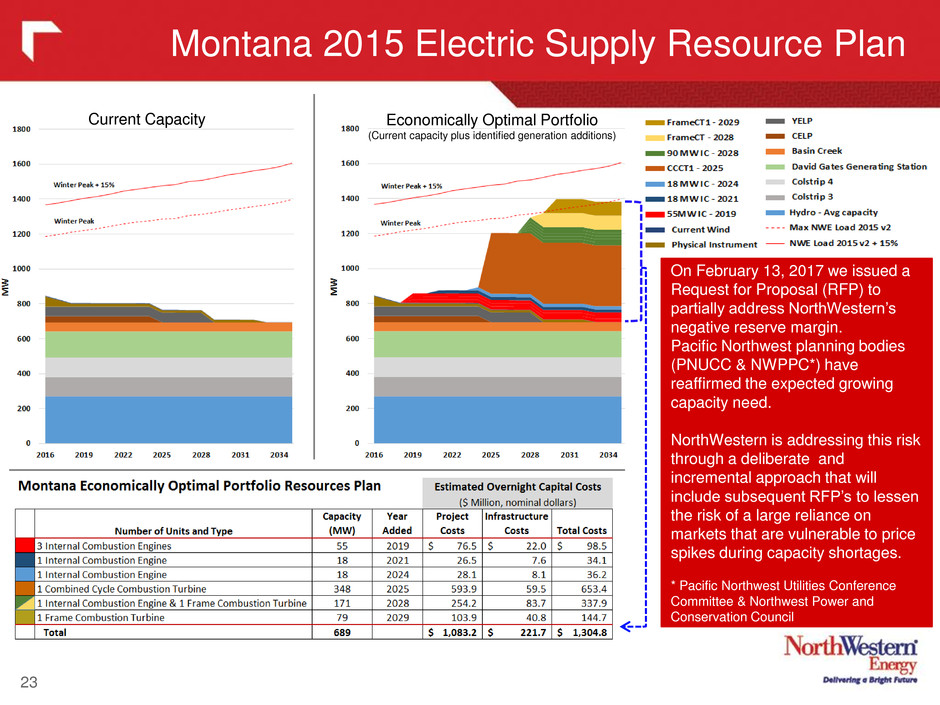

Montana 2015 Electric Supply Resource Plan 23 On February 13, 2017 we issued a Request for Proposal (RFP) to partially address NorthWestern‟s negative reserve margin. Pacific Northwest planning bodies (PNUCC & NWPPC*) have reaffirmed the expected growing capacity need. NorthWestern is addressing this risk through a deliberate and incremental approach that will include subsequent RFP‟s to lessen the risk of a large reliance on markets that are vulnerable to price spikes during capacity shortages. * Pacific Northwest Utilities Conference Committee & Northwest Power and Conservation Council Current Capacity Economically Optimal Portfolio (Current capacity plus identified generation additions)

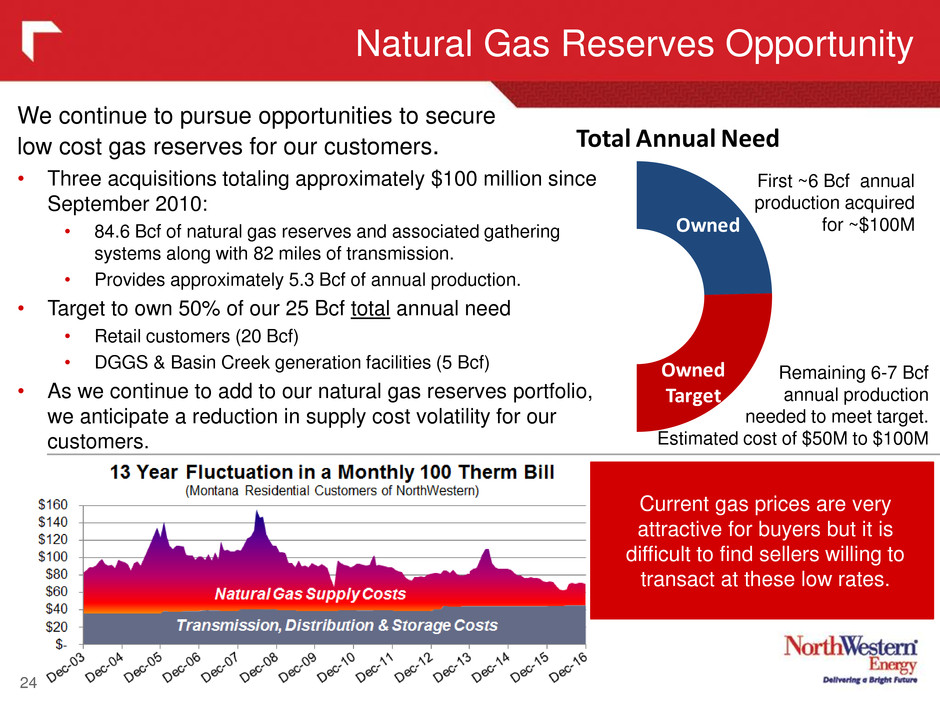

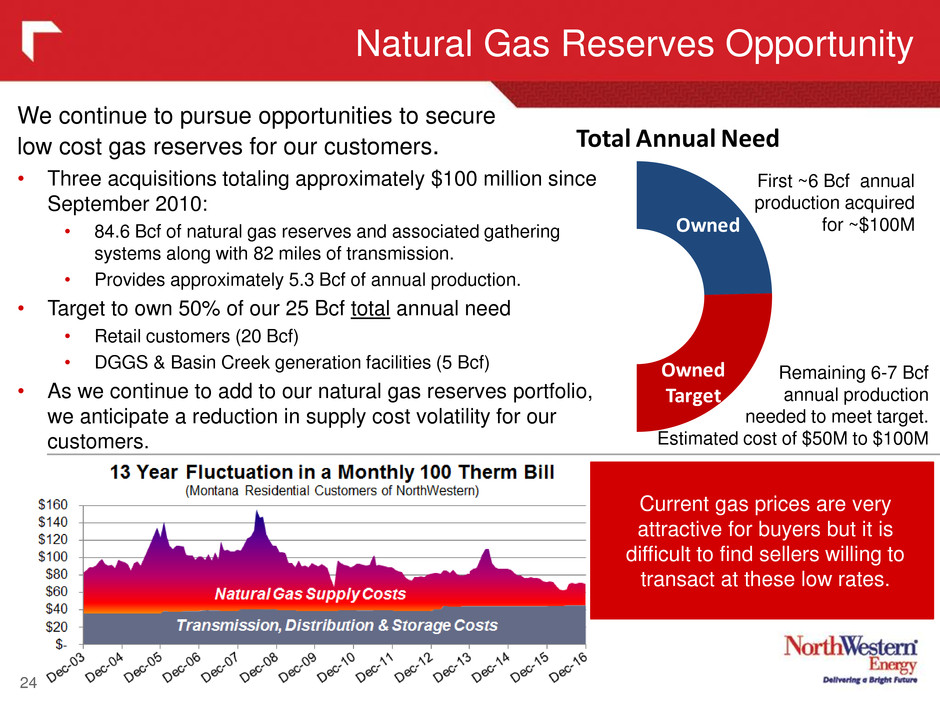

Owned Owned Target Total Annual Need Natural Gas Reserves Opportunity 24 Current gas prices are very attractive for buyers but it is difficult to find sellers willing to transact at these low rates. First ~6 Bcf annual production acquired for ~$100M Remaining 6-7 Bcf annual production needed to meet target. Estimated cost of $50M to $100M We continue to pursue opportunities to secure low cost gas reserves for our customers. • Three acquisitions totaling approximately $100 million since September 2010: • 84.6 Bcf of natural gas reserves and associated gathering systems along with 82 miles of transmission. • Provides approximately 5.3 Bcf of annual production. • Target to own 50% of our 25 Bcf total annual need • Retail customers (20 Bcf) • DGGS & Basin Creek generation facilities (5 Bcf) • As we continue to add to our natural gas reserves portfolio, we anticipate a reduction in supply cost volatility for our customers.

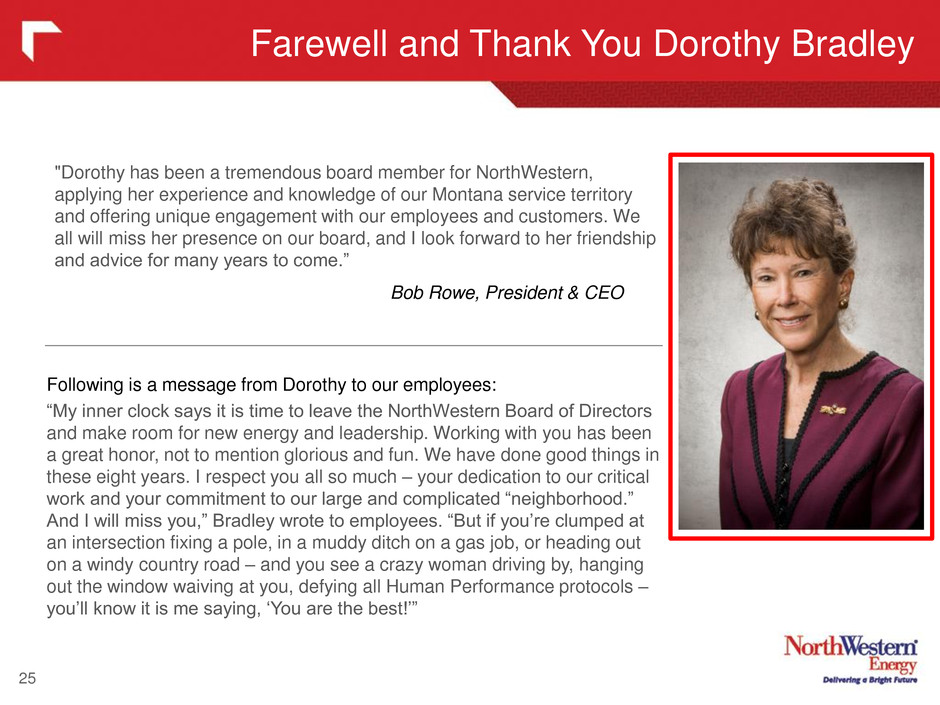

Farewell and Thank You Dorothy Bradley 25 "Dorothy has been a tremendous board member for NorthWestern, applying her experience and knowledge of our Montana service territory and offering unique engagement with our employees and customers. We all will miss her presence on our board, and I look forward to her friendship and advice for many years to come.” Bob Rowe, President & CEO Following is a message from Dorothy to our employees: “My inner clock says it is time to leave the NorthWestern Board of Directors and make room for new energy and leadership. Working with you has been a great honor, not to mention glorious and fun. We have done good things in these eight years. I respect you all so much – your dedication to our critical work and your commitment to our large and complicated “neighborhood.” And I will miss you,” Bradley wrote to employees. “But if you‟re clumped at an intersection fixing a pole, in a muddy ditch on a gas job, or heading out on a windy country road – and you see a crazy woman driving by, hanging out the window waiving at you, defying all Human Performance protocols – you‟ll know it is me saying, „You are the best!‟”

New Board Member 26 Utility, Regulatory, and Public Policy experience as a senior advisor at Wilkinson Barker Knauer, LLP, and prior service as Commissioner (2012-16) of the Federal Energy Regulatory Commission, prior service as Commissioner (2001-12) of the North Dakota Public Utilities Commission (including five years as its chair), former President of the National Association of Regulatory Utility Commissioners (NARUC) (2010-11), chair of the NARUC telecommunications committee, former North Dakota Labor Commissioner (1999-2000), and former North Dakota state legislator (1994-97). We believe Mr. Clark is Qualified to Serve on our Board because of his • Experience in the state and federal public utility regulatory arena, as a regulator • Public policy background which provides a wide perspective on regulatory and political issues • Demonstrated commitment to boardroom excellence – working to attain NACD Governance Fellow status in 2017 Anthony T. Clark Independent Director since December 10, 2016

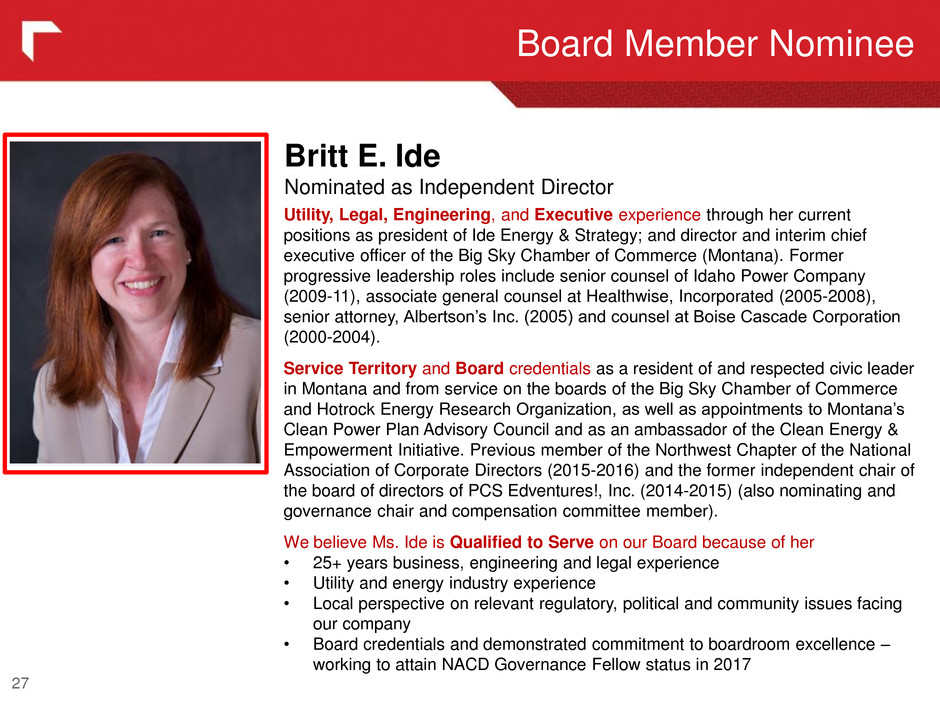

Board Member Nominee 27 Utility, Legal, Engineering, and Executive experience through her current positions as president of Ide Energy & Strategy; and director and interim chief executive officer of the Big Sky Chamber of Commerce (Montana). Former progressive leadership roles include senior counsel of Idaho Power Company (2009-11), associate general counsel at Healthwise, Incorporated (2005-2008), senior attorney, Albertson‟s Inc. (2005) and counsel at Boise Cascade Corporation (2000-2004). Service Territory and Board credentials as a resident of and respected civic leader in Montana and from service on the boards of the Big Sky Chamber of Commerce and Hotrock Energy Research Organization, as well as appointments to Montana‟s Clean Power Plan Advisory Council and as an ambassador of the Clean Energy & Empowerment Initiative. Previous member of the Northwest Chapter of the National Association of Corporate Directors (2015-2016) and the former independent chair of the board of directors of PCS Edventures!, Inc. (2014-2015) (also nominating and governance chair and compensation committee member). We believe Ms. Ide is Qualified to Serve on our Board because of her • 25+ years business, engineering and legal experience • Utility and energy industry experience • Local perspective on relevant regulatory, political and community issues facing our company • Board credentials and demonstrated commitment to boardroom excellence – working to attain NACD Governance Fellow status in 2017 Britt E. Ide Nominated as Independent Director

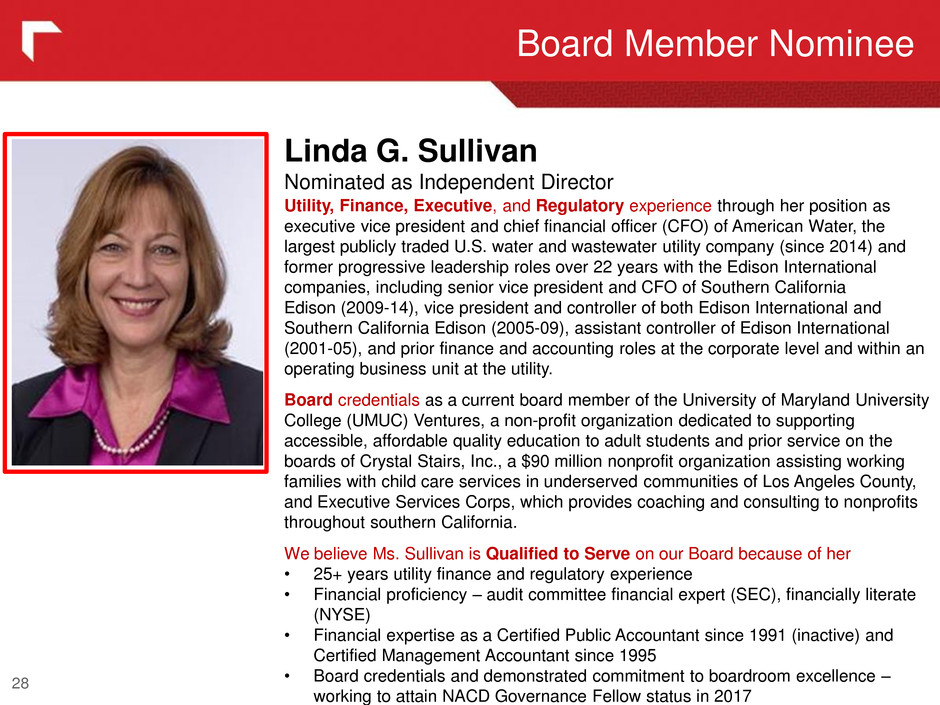

Board Member Nominee 28 Linda G. Sullivan Nominated as Independent Director Utility, Finance, Executive, and Regulatory experience through her position as executive vice president and chief financial officer (CFO) of American Water, the largest publicly traded U.S. water and wastewater utility company (since 2014) and former progressive leadership roles over 22 years with the Edison International companies, including senior vice president and CFO of Southern California Edison (2009-14), vice president and controller of both Edison International and Southern California Edison (2005-09), assistant controller of Edison International (2001-05), and prior finance and accounting roles at the corporate level and within an operating business unit at the utility. Board credentials as a current board member of the University of Maryland University College (UMUC) Ventures, a non-profit organization dedicated to supporting accessible, affordable quality education to adult students and prior service on the boards of Crystal Stairs, Inc., a $90 million nonprofit organization assisting working families with child care services in underserved communities of Los Angeles County, and Executive Services Corps, which provides coaching and consulting to nonprofits throughout southern California. We believe Ms. Sullivan is Qualified to Serve on our Board because of her • 25+ years utility finance and regulatory experience • Financial proficiency – audit committee financial expert (SEC), financially literate (NYSE) • Financial expertise as a Certified Public Accountant since 1991 (inactive) and Certified Management Accountant since 1995 • Board credentials and demonstrated commitment to boardroom excellence – working to attain NACD Governance Fellow status in 2017

Conclusion 29 Pure Electric and Gas Utility Solid Utility Foundation Strong Earnings and Cash Flows Attractive Future Growth Prospects Best Practices Corporate Governance

30

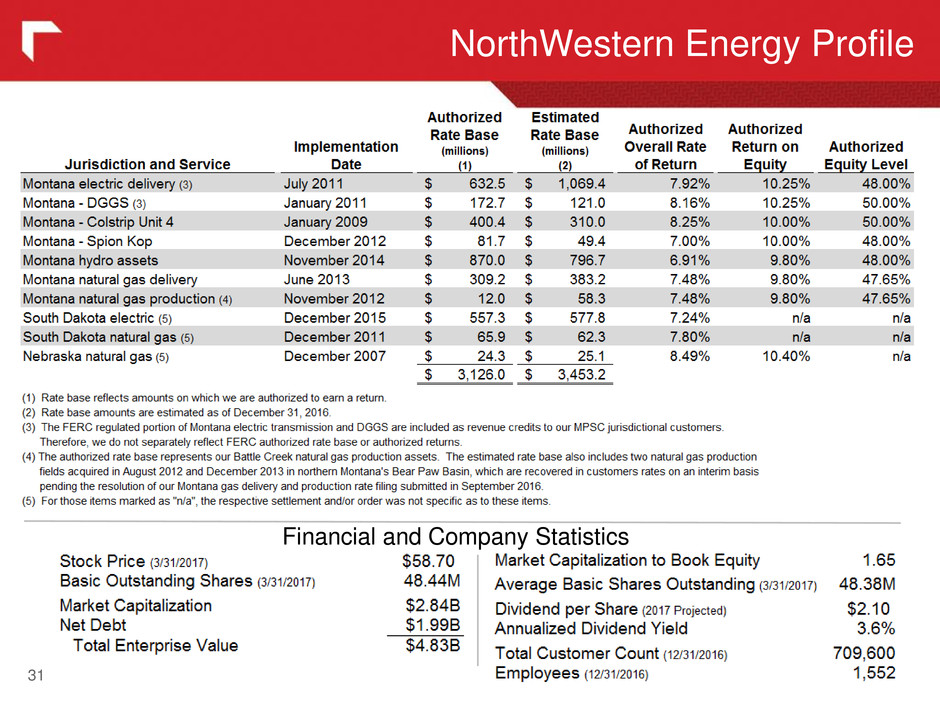

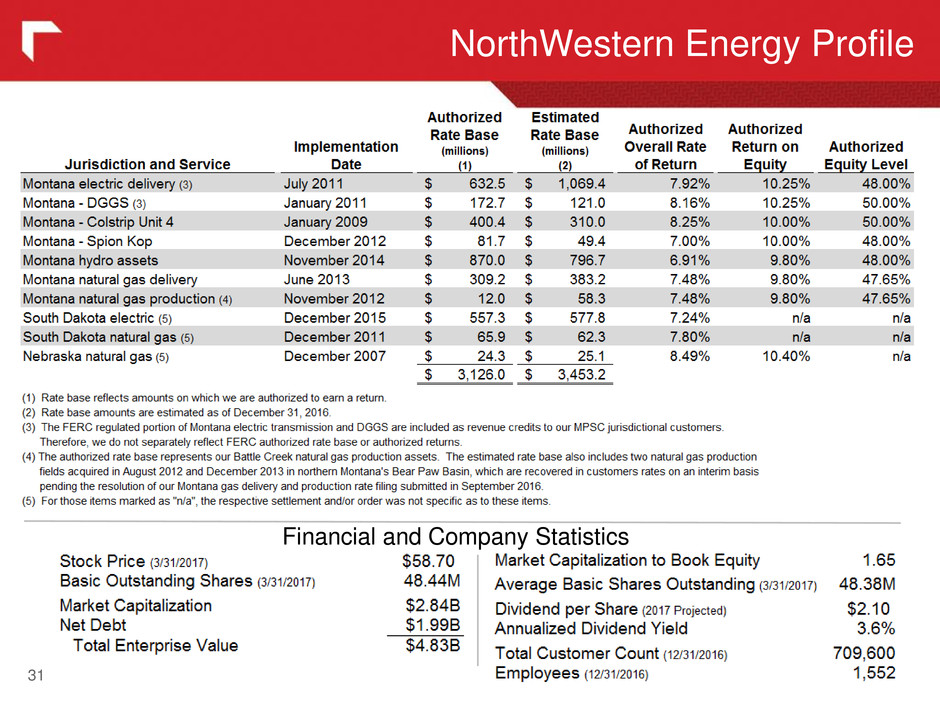

NorthWestern Energy Profile 31 Financial and Company Statistics

Non-GAAP Financial Measures 32 The data presented in this presentation includes financial information prepared in accordance with GAAP, as well as other Non-GAAP financial measures such as Gross Margin (Revenues less Cost of Sales), Free Cash Flows (Cash flows from operations less maintenance capex and dividends) and Net Debt (Total debt less capital leases), that are considered “Non-GAAP financial measures.” Generally, a Non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of Gross Margin, Free Cash Flows and Net Debt is intended to supplement investors’ understanding of our operating performance. Gross Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs. Net Debt is used by our company to determine whether we are properly levered to our Total Capitalization (Net Debt plus Equity). Our Gross Margin, Free Cash Flows and Net Debt measures may not be comparable to other companies’ similarly labeled measures. Furthermore, these measures are not intended to replace measures as determined in accordance with GAAP as an indicator of operating performance.