- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

DEF 14A Filing

NorthWestern (NWE) DEF 14ADefinitive proxy

Filed: 6 Mar 20, 2:49pm

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| SCHEDULE 14A |

| Proxy Statement Pursuant to Section 14(a) of |

| the Securities Exchange Act of 1934 (Amendment No. ) |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| NorthWestern Corporation |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): | |||

| x | No fee required. | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | ||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

| ||||

| This proxy statement contains information related to the solicitation of proxies by the Board of Directors (the Board) of NorthWestern Corporation d/b/a NorthWestern Energy (NorthWestern, the company, we, us, or our) in connection with our 2020 Annual Meeting of Shareholders. See the Proxy Statement Glossary on the inside back cover for additional definitions used in this proxy statement. | ||||

IMPORTANT VOTING INFORMATION If you owned shares of NorthWestern Corporation common stock at the close of business on February 24, 2020 (the Record Date), you are entitled to one vote per share upon each matter presented at the annual meeting of shareholders to be held on April 23, 2020. Shareholders whose shares are held in an account at a brokerage firm, bank, or other nominee (i.e., in “street name”) will need to obtain a proxy from the broker, bank, or other nominee that holds their shares authorizing them to vote at the annual meeting. Your broker is not permitted to vote on your behalf on the election of directors and other matters to be considered at this shareholders meeting, except on the ratification of our appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2020, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares via telephone or the internet. For your vote to be counted, you will need to communicate your voting decisions to your broker, bank, or other financial institution before the date of the annual meeting. YOUR VOTE IS IMPORTANT Your vote is important. Our Board strongly encourages you to exercise your right to vote. Voting early helps ensure that we receive a quorum of shares necessary to hold the annual meeting. ASSISTANCE If you have any questions about the proxy voting process, please contact the broker, bank, or other financial institution where you hold your shares. The Securities and Exchange Commission also has a website (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a shareholder. You also may contact our Investor Relations Department by phone at (605) 978-2945 or by email at investor.relations@northwestern.com. | ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 23, 2020 The Notice of Annual Meeting, Proxy Statement, and 2019 Annual Report to Shareholders are available on the internet at www.proxyvote.com. | ||

ATTENDING THE ANNUAL MEETING IN PERSON OR BY WEBCAST Only shareholders of record or their legal proxy holders as of the record date or our invited guests may attend the annual meeting in person. If you wish to attend the annual meeting and your shares are held in street name at a brokerage firm, bank, or other nominee, you will need to bring your notice or a copy of your brokerage statement or other documentation reflecting your stock ownership as of the record date. You may be asked to provide photo identification, such as a driver’s license. The annual meeting will be webcast (audio and slides) simultaneously with the meeting. You may access the webcast from our website at NorthWesternEnergy.com under Our Company / Investor Relations / Presentations and Webcasts. A replay of the webcast will be available at the same location on our website through April 23, 2021. | ||

|  |

| Notice of 2020 Annual Meeting and Proxy Statement March 6, 2020 Dear Fellow NorthWestern Corporation Shareholder: You are cordially invited to attend the 2020 Annual Meeting of Shareholders to be held on Thursday, April 23, 2020, at 10:00 a.m. Mountain Daylight Time at the Big Horn Hotel, 1801 Majestic Lane, Billings, Montana. At the meeting, shareholders will be asked to elect the Board of Directors, to ratify the appointment of our independent registered public accounting firm for 2020, to hold an advisory “say-on-pay” vote on the compensation of our named executive officers and to transact any other matters and business as may properly come before the annual meeting or any postponement or adjournment of the annual meeting. The proxy statement included with this letter provides you with information about the annual meeting and the business to be conducted. YOUR VOTE IS IMPORTANT. We urge you to read this proxy statement carefully. Whether or not you plan to attend the annual meeting in person, we encourage you to vote promptly through the internet, by telephone, or by mail. If you are unable to attend our annual meeting in person, we are pleased to offer an audio webcast of the meeting. The webcast can be accessed live on our website at NorthWesternEnergy.com under Our Company / Investor Relations / Presentations and Webcasts, or you can listen to a replay of the webcast, which will be archived on our website at the above location for one year after the meeting. Thank you for your continued support of NorthWestern Corporation. | ||

| Very truly yours, | |||

| |||

Robert C. Rowe President and Chief Executive Officer | |||

3010 West 69th Street|Sioux Falls, SD 57108 NorthWesternEnergy.com | |||

| Table of Contents | ||||

| 2019 Executive Pay Overview | ||||

| 2019 Corporate Governance Overview | ||||

| Environmental Stewardship | ||||

| Social Initiatives | ||||

| 2019 Executive Pay | ||||

| 2019 Director Pay | ||||

Proxy Statement Glossary (inside back cover) | ||||

|  |

| Meeting Date: | April 23, 2020 | ||

| Meeting Time: | 10:00 a.m. Mountain Daylight Time | ||

| Location: | Big Horn Hotel, 1801 Majestic Lane, Billings, Montana | ||

| Record Date: | February 24, 2020 | ||

|

3010 West 69th Street|Sioux Falls, SD 57108 | NorthWesternEnergy.com | |||

| Proxy Summary |

Proxy Summary Items of Business to Be Considered at the Annual Meeting | ||||||||||||

| Proposal | Board Recommendation | Page | ||||||||||

| 1 | Election of Directors |  | FOR each director nominee | |||||||||

| 2 | Ratification of Deloitte & Touche LLP as Independent Registered Public Accounting Firm for 2020 |  | FOR | |||||||||

| 3 |  | FOR | ||||||||||

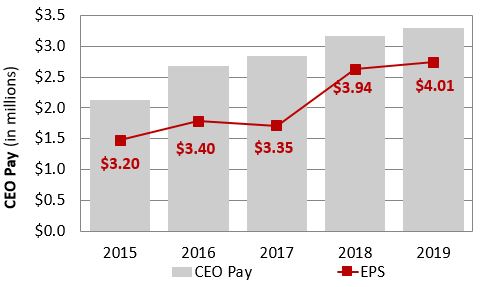

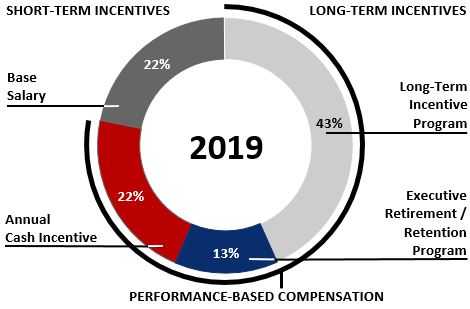

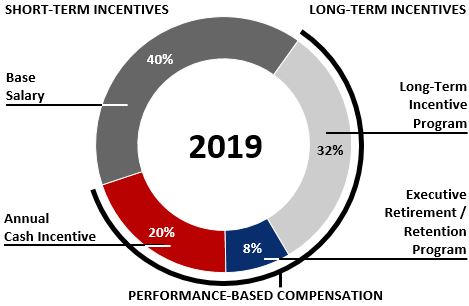

2019 Executive Pay Overview Alignment of Pay with Shareholder and Customer Interests Our executive pay program is designed to align the long-term interests of our executives, shareholders, and customers. Approximately 78 percent of the compensation of our CEO and about 60 percent of the compensation of our other named executive officers is at risk in the form of performance-based incentive awards. Our Board establishes the metrics and targets for these incentive awards, based upon advice from the Board’s independent compensation consultant. The 2019 performance metrics did not change from 2018. We also require our executives to retain meaningful ownership of our stock (from 2x to 6x their annual base salary). This structure encourages our executives to focus on short- and long-term performance and provides a reward to our executives, shareholders, and customers when we achieve our financial and operating objectives. Our CEO to median employee pay ratio for 2019 was 27:1. | ||||||||||||

| Executive Pay Components at a Glance | ||||||||||||

| Percent of Total Compensation | ||||||||||||

| Component | Description | CEO | Other NEO Avg. | Changes in 2019 | ||||||||

Base Salary Fixed, paid in cash | Target middle of competitive range of peer group, with adjustments for trade area economics, turnover, tenure, and experience | 22% | 40% | Named executive officers received a 3 percent cost of living adjustment provided to some employees; one named executive officer received an additional increase to remain market competitive | ||||||||

Annual Cash Incentive Variable, paid in cash | Based on net income, safety, reliability, and customer satisfaction metrics and individual performance | 22% | 20% | Increased target opportunity for two executives to align with market median; updated performance targets | ||||||||

Long-Term Incentive Program Awards Variable, paid in equity | Based on earnings per share, return on average equity and relative total shareholder return performance over a three-year vesting period | 43% | 32% | Updated performance targets | ||||||||

Executive Retention / Retirement Program Awards Variable, paid in equity | Based on net income performance over a five-year vesting period; paid over five-year period following separation from service | 13% | 8% | None | ||||||||

| Proxy Summary |

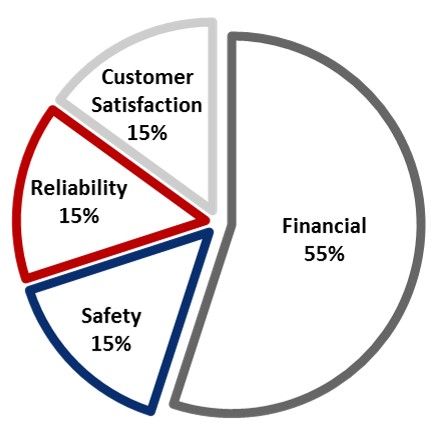

Performance Against Incentive Targets In 2019, we managed our business through a challenging electric rate case, with significant increases in net income, all-time high customer satisfaction and near all-time best safety performance. We achieved an average return on equity of 10.0 percent, an EPS growth rate of nearly 6.0 percent, and a total shareholder return of 37.0 percent for the three‑year period ending December 31, 2019. As a result, we achieved above target performance for our 2019 annual incentive awards and our long-term incentive awards. | |||||||||||||||

| 2019 Annual Cash Incentive Outcome | 2017 Long-Term Incentive Program Vesting | ||||||||||||||

Financial (55%) – % of Target Achieved | 150 | % | ROAE / Avg. EPS Growth – % of Target Achieved | 92 | % | ||||||||||

Safety (15%) – % of Target Achieved | 92 | % | Relative TSR – % of Target Achieved | 30 | % | ||||||||||

Reliability (15%) – % of Target Achieved | 79 | % | Total Payout to Participants* | 122 | % | ||||||||||

Customer Sat. (15%) – % of Target Achieved | 118 | % | |||||||||||||

| Total Funding | 126 | % | * Each component weighted 50% for total payout | ||||||||||||

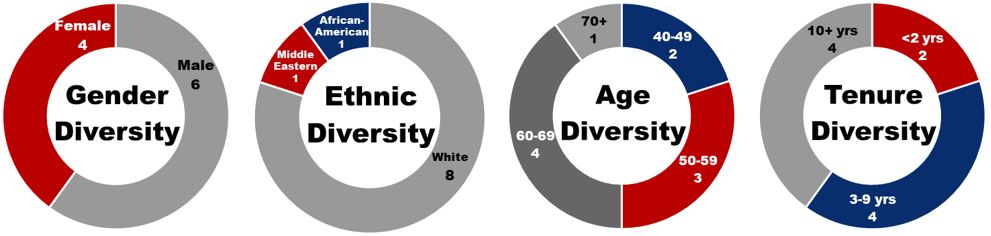

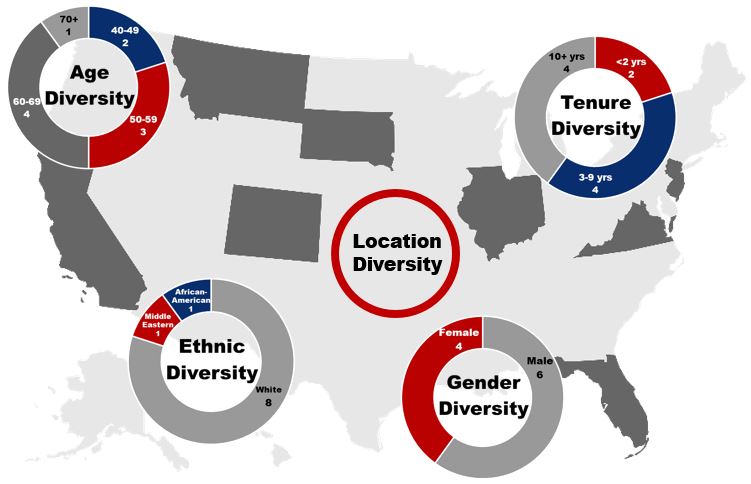

Shareholder Feedback on Executive Pay At our 2019 annual meeting, shareholders approved our 2018 named executive officer pay by over 96 percent of the votes cast. In light of the overwhelming approval from our shareholders, we have not changed the overall structure of our named executive officer pay program for 2019. We continue to use the same executive pay components and operate within the parameters our shareholders previously approved. 2019 Corporate Governance Overview Last year, shareholders elected eight of our director nominees by an average of 98 percent of the votes cast. Our Board has nominated each of those eight individuals for re-election as director. Our Board also has nominated Mahvash Yazdi and Jeffrey Yingling for election. Ms. Yazdi and Mr. Yingling joined our board during the fourth quarter of 2019 as part of our Board’s ongoing succession planning process to serve terms through our 2020 annual meeting. Ms. Yazdi was recommended by a Board member, and Mr. Yingling was recommended by the Board and management. As described in more detail later in this Proxy Statement, our Board also determined that it was advantageous to the company to have Stephen Adik and Julia Johnson continue their service as Board members beyond 15 years. Thus, our Board has nominated 10 individuals for election as director. Each of the nominees currently serves on our Board, and we list these individuals in Proposal No. 1—Election of Directors. Each of our nominees is independent, with the sole exception of our CEO. Our Board is led by an independent non-executive chair, and our four Board committees – Audit, Compensation, Governance, and Operations – are chaired by and composed entirely of independent directors. In 2020, we added the Operations Committee to oversee safety, environment, technology, and operations matters. We made no other material changes to our corporate governance practices in 2019. Diversity is important to our Board, as reflected in the graphs below regarding our slate of nominees. | |||||||||||||||

| Diverse Slate of Director Nominees | |||||||||||||||

| |||||||||||||||

| Proxy Summary |

| Environmental Stewardship | ||||||||||||

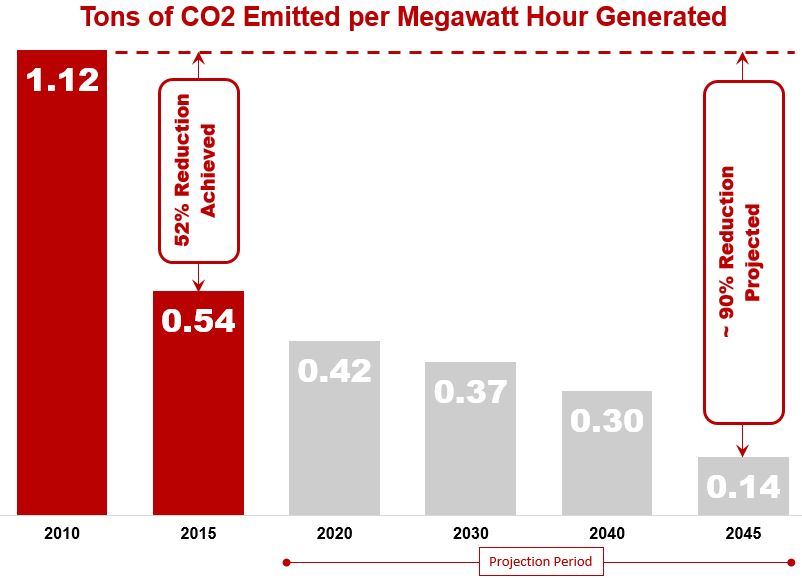

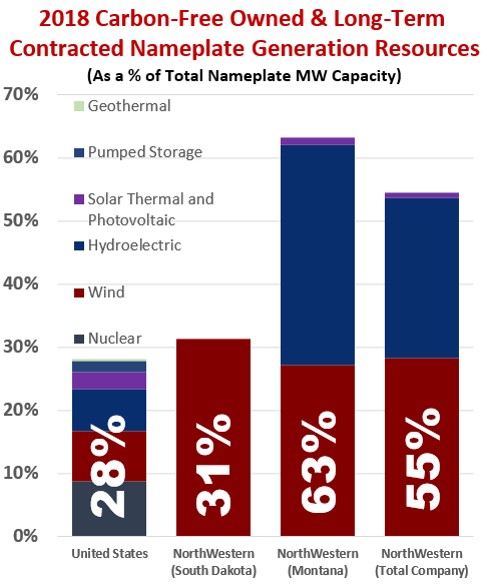

| NorthWestern’s Carbon Reduction Vision for Montana | ||||||||||||

90% Carbon Reduction by 2045 | Already Over 60% Carbon Free | How We’re Going to Get There | ||||||||||

| NorthWestern commits to reduce the carbon intensity of its electric energy portfolio for Montana 90% by 2045 from a 2010 baseline. | Today, NorthWestern Energy serves Montana with an electric portfolio that is over 60% carbon free and more than two times better than the total U.S electric power industry (28% carbon free). Over the last decade, we have already reduced the carbon intensity of our energy generation in Montana by more than 50%. | Our vision for the future builds on the progress we have already made. The foundation of our vision for future energy generation is our hydro system, which is 100% carbon free and is available 24 hours a day, 365 days a year. Wind generation is a close second and continues to grow. While utility-scale solar energy is not a significant portion of our energy mix today, we expect it to evolve along with advances in energy storage. We are committed to working with our customers and communities to help them achieve their sustainability goals and add new technology on our system. | ||||||||||

| ||||||||||||

55% Carbon Free Nameplate Portfolio vs 28% National Average | Environmental Stewardship Report | |||||||||||

|  | |||||||||||

| Proxy Summary |

| Social Initiatives | ||||||||||||

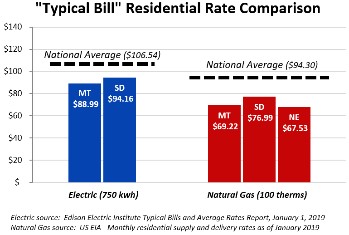

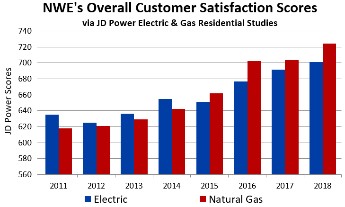

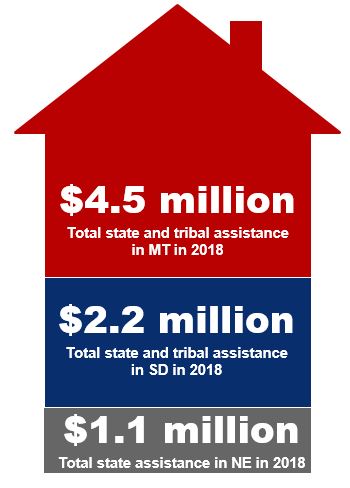

| At NorthWestern, we serve the communities in which we live, and we know that when our communities thrive, our business also thrives. That is why we lift up our communities through donations, sponsorships, economic development, and volunteer activities. We help our customers who need it most with income assistance and provide all our customers with affordable service at rates below the national average. We are proud that our customers have continued to recognize our efforts through all-time high customer satisfaction scores. And we couldn’t have done any of it without highly engaged employees who have helped us transform our safety culture, while earning a competitive compensation package that is fair to all. | ||||||||||||

| Community | Customers | Employees | ||||||||||

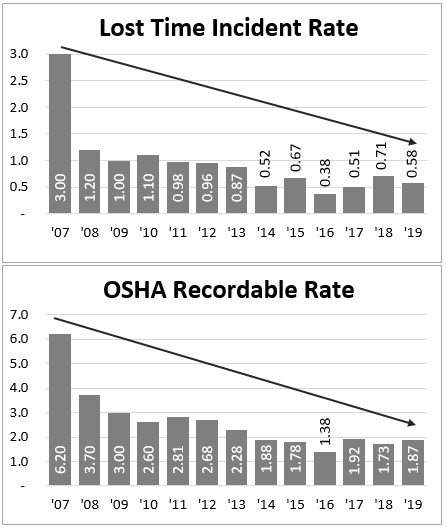

$2.1 billion Economic Output in 2018 ($1.88B in Montana & $266M in SD/NE) $1.75 million Donations, Sponsorships & Economic Development in 2018 184 Number of nonprofits that received grants through Employee Volunteer Program $7.8 million Low-Income Energy Assistance in 2018 | Typical Residential Bills Lower than National Average | Safety Culture Transformation | ||||||||||

|  | |||||||||||

| Building on our best -- Improved Customer Satisfaction Scores | ||||||||||||

| Strong Employee Engagement | |||||||||||

| 86% Employees proud to work for NorthWestern Energy | |||||||||||

| Employee Compensation | ||||||||||||

| CEO to Median Employee Pay Ratio for 2019 | Review of Compensation Practices | |||||||||||

| 27 to 1 | As part of our 2019 pay administration process, we worked with outside counsel to review our compensation system with respect to certain protected groups of employees. The review confirmed that 2019 compen-sation for such groups is in line with our established practices and policies. | |||||||||||

| For additional details concerning our 2019 pay ratio, please see the pay for performance section of our CD&A in this Proxy Statement. | ||||||||||||

Proposal No. 1 Election of Directors | |||||||||

The Board of Directors recommends you vote “FOR” each of the 10 director nominees. | Our Board is nominating 10 people for election as directors at the annual meeting. All of the nominees currently serve as a director of our Board. Elected directors will serve for one year, until the next annual meeting of shareholders (or until a successor is able to serve). Our nominees are listed below, and we provide additional background information and individual qualifications for each nominee in the Corporate Governance—Individual Directors section of this proxy statement, beginning on page 46. | ||||||||

Name Occupation | Independent | Age | Director Since | Committee Membership | |||||

Stephen P. Adik, Board Chair Retired Vice Chair, NiSource, Inc. | Yes | 76 | 2004 | N/A | |||||

Anthony T. Clark Senior Advisor, Wilkinson Barker Knauer, LLP; former Commissioner, FERC and NDPSC (and Chair) | Yes | 48 | 2016 | Comp.; Gov. | |||||

Dana J. Dykhouse CEO, First PREMIER Bank | Yes | 63 | 2009 | Comp. (Chair); Audit | |||||

Jan R. Horsfall CEO, Maxletics Corporation | Yes | 59 | 2015 | Operations (Chair); Audit | |||||

Britt E. Ide President, Ide Energy & Strategy | Yes | 48 | 2017 | Gov.; Operations | |||||

Julia L. Johnson President, NetCommunications, LLC; former Commissioner and Chair, Florida PSC | Yes | 57 | 2004 | Gov. (Chair); Comp. | |||||

Robert C. Rowe President and CEO, NorthWestern Energy | No | 64 | 2008 | N/A | |||||

Linda G. Sullivan Retired Executive Vice President and CFO, American Water | Yes | 56 | 2017 | Audit (Chair); Operations | |||||

Mahvash Yazdi President, Feasible Management Consulting | Yes | 68 | 2019 | Comp.; Operations | |||||

Jeffrey W. Yingling Partner, Energy Capital Ventures | Yes | 60 | 2019 | Audit; Gov. | |||||

| (continued on next page) | |||||||||

| Items of Business |

Unless you specifically withhold your authority to vote for the election of directors, the persons named in the accompanying proxy intend to vote “FOR” the election of each of the director nominees. All nominees have advised the Board that they are able and willing to serve as directors. If any nominee becomes unavailable for any reason (which is not anticipated), the shares represented by the proxies may be voted for such other person or persons as may be determined by the holders of the proxies (unless a proxy contains instructions to the contrary). In no event will the proxy be voted for more than 10 nominees. Board Nomination Process Our Board values the diversity of its members. When selecting this slate of nominees, our Board concluded these nominees will provide insight from a number of perspectives based on their diversity with respect to gender, age, ethnicity, skills and background, as well as location of residence. We believe these varied perspectives expand the Board’s ability to provide relevant guidance to our business. Our Board also concluded that these individuals bring extensive professional experience from both within and outside our industry. This diversity of experience provides our Board with a broad collective skill set which is advantageous to the Board’s oversight of our company. While the industry-specific expertise possessed by certain of the nominees is essential, we also will benefit from the viewpoints of directors with expertise outside our industry. Over the past several years, our Governance Committee has led our Board through a director succession planning process to allow for a smooth and gradual transition from our directors who were nearing 15 years of service to new directors, while preserving the culture of the Board. The process reviewed individual skill sets and tenures of current members and considered additional skills that could be beneficial for the Board in the future, with a particular focus on the company’s strategy and emerging risks. In October and December of 2019, our Board invited, respectively, Jeffrey Yingling and Mahvash Yazdi to join our Board and serve an initial term through our 2020 annual meeting. Mr. Yingling was recommended for the Board by management and members of the Board, and Ms. Yazdi was recommended by a member of the Board. Consistent with achieving a smooth and gradual succession plan for our Board, our Board also determined that it would be advantageous for Stephen Adik (Board chair) and Julia Johnson (Governance Committee chair) to continue their Board service beyond 15 years. Several factors contributed to this determination. The Board wanted to preserve continuity of culture while new board members transition to service. The Board also values the transaction and regulatory experience Mr. Adik and Ms. Johnson provide while the company completes its proposed acquisition of an additional interest in Colstrip Unit 4 and the Colstrip transmission system. Accordingly, the Board nominated Mr. Adik and Ms. Johnson to serve another term. Our Board recommends a vote “FOR” election of each of the nominees. Vote Required Directors will be elected by a favorable vote of a plurality of the shares of voting stock present in person or by proxy and entitled to vote, in person or by proxy, at the annual meeting. You may vote “FOR” all of the nominees or you may “WITHHOLD AUTHORITY” for one or more of the nominees. Withheld votes will not count as votes cast for the nominee, but will count for purposes of determining whether a quorum is present. Shareholders do not have the right to cumulate their vote for directors. If your shares are held through a broker, bank, or other nominee and you do not vote your shares, your bank, broker, or other nominee may not vote your shares in this proposal, as it is considered a “non-routine” matter. Abstentions or broker non-votes as to the election of directors will not affect the election of the candidates receiving a plurality of votes; however, under our Majority Plus Resignation Vote Policy described on page 52 of this proxy statement, if a nominee for director receives more “WITHHOLD AUTHORITY” votes than “FOR” votes, such nominee shall immediately tender his or her resignation under the procedures in the policy. | ||||||

| Items of Business |

Proposal No. 2 Ratification of Deloitte & Touche LLP, as Independent Registered Public Accounting Firm for 2020 | ||||||||||||

Our Audit Committee oversees the integrity of our accounting, financial reporting and auditing processes. To assist with those responsibilities, the committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm to audit our financial statements for 2020. The Board is asking you to ratify the committee’s decision at the annual meeting. The Board values your input on the committee’s appointment of Deloitte, but approval by shareholders is not required by law. If shareholders do not ratify the appointment of Deloitte, the committee will reconsider its selection. Regardless of the voting result, the committee may appoint a new firm at any time if the committee believes a change would be in the best interests of the company and its shareholders. | ||||||||||||

Deloitte representatives will be present at the annual meeting. They will have the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions. Description of Fees The table below presents a summary of the fees Deloitte billed us for professional services for the fiscal years ended December 31, 2018 and 2019. | ||||||||||||

The Board of Directors recommends you vote “FOR” the ratification of Deloitte as our independent accounting firm for 2020. | ||||||||||||

| Fee Category | 2019 Fees ($) | 2018 Fees ($) | ||||||||||

| Audit fees | 1,349,114 | 1,418,264 | ||||||||||

| Audit-related fees | — | — | ||||||||||

| Tax fees | 187,395 | 91,971 | ||||||||||

| All other fees | — | — | ||||||||||

| Total fees | 1,536,509 | 1,510,235 | ||||||||||

As reflected in the table: Audit fees are fees billed for professional services rendered for the audit of our financial statements, internal control over financial reporting, review of the interim financial statements included in quarterly reports, services in connection with debt and equity securities offerings, and services that are normally provided by Deloitte in connection with statutory and regulatory filings or engagements. For 2019, this amount includes estimated billings for the completion of the 2019 audit, which Deloitte rendered after year-end. Audit-related fees are fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements and are not reported under “Audit Fees.” There were no audit-related fees in fiscal 2018 and 2019. Tax fees are fees billed for tax compliance, tax advice and tax planning. All other fees are fees for products and services other than the services reported above. In fiscal years 2018 and 2019, there were no other fees. | ||||||||||||

| (continued on next page) | ||||||||||||

| Items of Business |

Pre-approval Policies and Procedures SEC rules require public company audit committees to pre-approve audit and non-audit services. Our Audit Committee follows procedures pursuant to which audit, audit-related, and tax services and all permissible non-audit services, are pre-approved by category of service. The fees are budgeted, and actual fees versus the budget are monitored throughout the year. During the year, circumstances may arise when it may become necessary to engage the independent public accountants for additional services not contemplated in the original pre-approval. In those instances, we will obtain the specific pre-approval of the Audit Committee before engaging the independent public accountants. The procedures require the Audit Committee to be informed of each service, and the procedures do not include any delegation of the Audit Committee’s responsibilities to management. The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated will report any pre-approval decisions to the Audit Committee at its next scheduled meeting. Pursuant to the provisions of the Audit Committee Charter, before Deloitte is engaged to render audit or non-audit services, the Audit Committee must pre-approve such engagement. For 2019, the Audit Committee (or the Chair of the Audit Committee pursuant to delegated authority) pre-approved 100 percent of the audit and tax fees. | |||||||||

Leased Employees In connection with their audit of our 2019 annual financial statements, more than 50 percent of Deloitte’s work was performed by full-time, permanent employees of Deloitte. Vote Required The affirmative vote of the holders of a majority in voting power of the shares of our common stock which are present in person or represented by proxy and entitled to vote thereon is required to ratify the appointment of Deloitte as our independent registered public accounting firm for 2020. If voting instructions are not provided, brokers may vote a client’s proxy in their own discretion on this proposal, as it is considered a “routine” matter. Abstentions will have the same effect as a vote against the proposal. Unless instructed to the contrary in the proxy, the shares represented by the proxies will be voted “FOR” the proposal to ratify the selection of Deloitte to serve as the independent registered public accounting firm for NorthWestern Corporation for the fiscal year ending December 31, 2020. | |||||||||

Proposal No. 3 Advisory Vote to Approve Named Executive Officer Compensation | |||||

| We would like your input as to how we pay our named executive officers, as required by Section 14A of the Exchange Act, through an advisory vote to approve named executive officer compensation (or a say-on-pay vote). Your vote will provide insight and guidance to us and our Board regarding your sentiment about our executive pay philosophy, policies and practices, as described in this proxy statement. Our Board will consider the guidance received by the say-on-pay vote when determining executive pay for the remainder of 2020 and beyond. We ask you to support our executive pay and vote in favor of the say-on-pay resolution. | |||||

| (continued on next page) | |||||

| Items of Business |

Last year, through the say-on-pay vote, over 96 percent of the votes cast approved how we pay our named executive officers. In fact, since our first say-on-pay vote in 2011, at least 94 percent of the votes cast have approved our executive pay each year. We view your voting guidance over the years as strong support for the way we pay our executives. Thus, in 2019, we left intact the executive pay program you previously approved and continued to use the same four components: base salary, annual cash incentive awards, long-term incentive awards, and retention/retirement awards. We did not change the design of these components. In fact, the only changes for 2019 from the 2018 program you approved, were (1) three percent base salary increases (the same increase available to some employees) and (2) certain annual incentive adjustments for certain executive officers to align with the market median. If you would like additional information about what we do with our executive pay program, we have provided a more detailed discussion in the Compensation Discussion and Analysis section, or CD&A, starting on page 11 of this proxy statement, and the 2019 Executive Pay section, starting on page 33. Our Human Resources Committee, or Compensation Committee, and our Board believe the company’s overall executive pay program is structured to reflect a strong pay-for-performance philosophy and aligns the long-term interests of our executives and our shareholders. Accordingly, the Board recommends that shareholders approve our executive pay program by voting “FOR” the following advisory resolution: RESOLVED, that the compensation paid to the company’s named executive officers (as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in the company’s 2020 proxy statement) is hereby APPROVED. | |||||

The Board of Directors recommends you vote “FOR” the resolution approving named executive officer compensation. | |||||

This advisory vote to approve named executive officer pay is not binding on the company. However, we and our Board will take into account the result of the vote when determining future executive pay arrangements. Vote Required The affirmative vote of the holders of a majority in voting power of the shares of our common stock which are present in person or represented by proxy and entitled to vote thereon is required to approve the say-on-pay resolution set forth above. If your shares are held through a broker, bank, or other nominee and you do not vote your shares, your bank, broker, or other nominee may not vote your shares in this proposal, as it is considered a “non-routine” matter. Assuming a quorum is present, broker non-votes or the failure to vote – either by not returning a properly executed proxy card or not voting in person at the annual meeting – will have no effect on the outcome of the voting on this proposal. Abstentions will have the same effect as a vote against the proposal. Unless instructed to the contrary in the proxy, the shares represented by the proxies will be voted “FOR” the proposal to approve, on an advisory basis, the pay of the company’s named executive officers, as set forth in the company’s 2020 proxy statement. | |||||

| Section | Summary | Page | ||

| Highlights of our 2019 executive pay program and results | ||||

| How our pay and performance, relative to our peers, provides value to shareholders | ||||

| Details about how our Board uses shareholder feedback to set pay | ||||

| How our Compensation Committee governs our executive pay programs | ||||

| How our Compensation Committee determined the amount of 2019 executive pay | ||||

| Details about the different parts of 2019 executive pay | ||||

| Information on other aspects of our pay program | ||||

2019 Basic Earnings Per Share Our basic EPS increased 1.8 percent to $4.01 in 2019 from $3.94 in 2018. | Total Shareholder Return Our TSR was 40.1 percent for the three-year period ending December 31, 2019, ranking 7th of our 2019 peer group (41.8 percent average). | Dividend Yield Our dividend of $2.30 per share provided a dividend yield of 3.2 percent based on our stock price at the end of 2019. | ||||||||

Safety In 2019, we worked safely, with lost time and total recordable incident rates near target. | Reliability The reliability of our electric system was better than target, while our natural gas system was below target. | Customer Service For the third year in a row, our JD Power results showed customer satisfaction at our highest level ever. | ||||||||

NorthWestern Energy | Proxy Statement | Page 11 |

| Compensation Discussion and Analysis |

| ● | Completing a Montana electric rate case. In 2019, our first electric rate case in the state of Montana in almost 10 years concluded with an order from the Montana Public Service Commission, which approved a settlement with an annual increase to electric revenue of $6.5 million, based on a return on equity of 9.65%; |

| ● | Announcing our proposed Colstrip acquisition. In December 2019, we announced our proposed acquisition of an additional 25% (185 megawatts) of Colstrip Unit 4 for $1 from Puget Sound Energy (Puget). We also agreed to (a) enter into a power purchase agreement (PPA) to sell Puget 90 megawatts of power for approximately five years, the net proceeds of which will be placed in a fund and applied against future decommissioning and remediation costs related to Colstrip Unit 4, and (b) acquire a piece of Puget’s interest in the 500 kilovolt Colstrip Transmission System at an estimated cost between $2.50 million – $3.75 million, with an option to acquire an additional piece of the transmission system after the roughly five-year PPA with Puget ends; and |

| ● | Announcing our carbon reduction commitment. At the same time as our Colstrip acquisition announcement, we announced our carbon reduction vision for Montana and committed to reduce the carbon intensity of our energy generation in Montana by 90% by 2045, from a 2010 baseline. |

● Our named executive officers had an average compensation per named executive officer that was less than all but five of the other 12 companies in our 2019 peer group ($1.4 million for us versus $1.5 million for the peer median). ● Our CEO’s total compensation was approximately 98 percent of the median total compensation (excluding change in pension value) of the CEOs in our 2019 peer group. | |||||

| Named Executive Officers for 2019 | |||||

| Robert C. Rowe | |||||

| President and Chief Executive Officer | |||||

| Brian B. Bird | |||||

| Chief Financial Officer | |||||

| Heather H. Grahame | |||||

| General Counsel and Vice President - Regulatory & Federal Gov't Affairs | |||||

| Curtis T. Pohl | |||||

| Vice President - Distribution | |||||

| Bobbi L. Schroeppel | |||||

| Vice President - Customer Care, Communications and HR | |||||

| ● | Attract and retain a high-quality executive team by providing competitive pay and benefits that reflect our financial operational size; |

| ● | Reward executives for both individual and company performance (based on financial, reliability, customer care, and safety metrics) through performance-based, at-risk pay; and |

| ● | Maximize long-term shareholder value by emphasizing financial performance, reliability, safety, and customer satisfaction. |

NorthWestern Energy | Proxy Statement | Page 12 |

| Compensation Discussion and Analysis |

| Our Pay Practices | |||

| Our executive pay program accomplishes our goals by incorporating certain pay practices while avoiding other, more problematic or controversial practices. | |||

| What We Do | |||

| ● | Place a significant portion of executive pay at risk by granting incentive awards that are paid, if earned, based on continuing annual and long-term individual and company performance. | ||

| ● | Utilize multiple performance metrics for long-term incentive awards that align executive and shareholder interests. | ||

| ● | Target executive pay around the median of our peers, while also considering trade area economics, turn-over, tenure, experience, and other factors. | ||

| What We Don’t Do | |||

| ● | Use employment or golden parachute agreements. | ||

| ● | Provide change in control payments exceeding three times base salary and target bonus. Our only change in control provision appears in our Equity Compensation Plan and provides for the immediate vesting or cash payment of any unvested equity awards upon a change in control. | ||

| ● | Grant stock options. No stock options are currently outstanding, and none have been issued under our Equity Compensation Plan. | ||

| ● | Allow option repricing or liberal share recycling. These practices are expressly prohibited under our Equity Compensation Plan. | ||

| ● | Promise multi-year guarantees for salary increases. | ||

| ● | Provide perquisites for executives that differ materially from those available to employees generally. | ||

| ● | Maintain a non-performance-based top hat plan or separate retirement plan available only to our executive officers. We do maintain a performance-based executive retirement / retention program, with five-year cliff vesting and a five-year payout period after the recipient’s separation from service. | ||

| ● | Pay tax gross-ups to our executives. | ||

| ● | Pay dividends or dividend equivalents on unvested performance shares or units. | ||

| ● | Allow our executives or directors to hedge company securities. | ||

NorthWestern Energy | Proxy Statement | Page 13 |

| Compensation Discussion and Analysis |

| Component | Description | Why we include this component | How we determine amount | Decisions for 2019 | Reason for Change |

Base Salary | Short-term fixed cash compensation | Provide a base level of compensation for executive talent | Target middle of competitive range of peer group, with adjustments for trade area economics, turnover, tenure, and experience | Most executives received the same three percent increase we provided to some employees, and one named executive officer received an additional increase to align with market median | Remain market competitive and provide cost of living adjustment |

Annual Cash Incentive | Short-term variable cash compensation, based on corporate performance against annually established metrics (financial, safety, reliability, and customer satisfaction) and individual performance | Motivate employees to meet and exceed annual company objectives that are part of our strategic plan | Target middle of competitive range of peer group, with adjustments for trade area economics, turnover, tenure, and experience | Increased target opportunity for two executives to align with market median; updated performance targets | Increase cash compensation opportunity to align with market median |

| Performance Unit Awards under Long-Term Incentive Program (LTIP) | Long-term variable, equity compensation, paid following three-year vesting period if financial performance metrics (EPS, ROAE, and TSR) are achieved | Provide market-competitive, performance-based compensation opportunities while aligning interests of executives and shareholders | Market survey of similar peer group roles and responsibilities and assessment of the strategic value of each position | Updated performance targets | N/A |

| Restricted Share Grants under Executive Retention / Retirement Program (ERRP) | Long-term variable, equity compensation, with corporate performance metrics over a five-year vesting period; paid over five-year period following separation from service | In lieu of a non-performance based supplemental retirement benefit, provide market-competitive, performance-based compensation opportunity that aligns interests of executives and shareholders, while encouraging retention and the continuity of our strategic plan | Peer group and competitive survey data and judgment on internal equity of positions and scope of responsibilities, as well as an assessment of the strategic value of each position | None | N/A |

NorthWestern Energy | Proxy Statement | Page 14 |

| Compensation Discussion and Analysis |

| THREE-YEAR TSR |

|

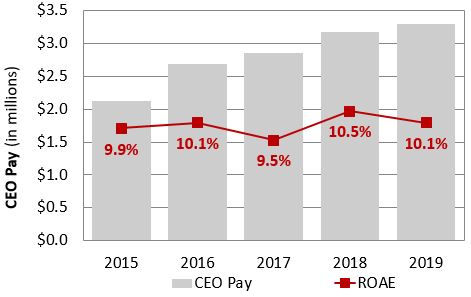

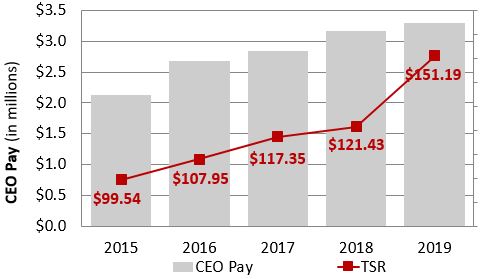

| 5-YEAR CEO PAY ALIGNMENT | ||

| VS. BASIC EPS | VS. ROAE | VS. CUMULATIVE TSR |

|  |  |

| EPS reflects diluted earnings per average share of our common stock. TSR illustrates the growth of $100 invested in our common stock on December 31, 2014, assuming reinvestment of dividends. CEO Compensation is total compensation (excluding change in pension value) as published in the proxy statement Summary Compensation Table. | ||

NorthWestern Energy | Proxy Statement | Page 15 |

| Compensation Discussion and Analysis |

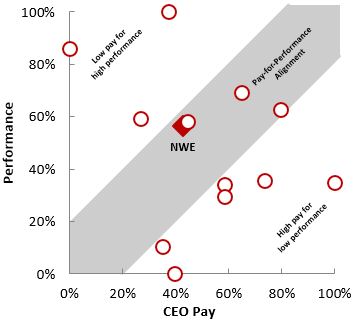

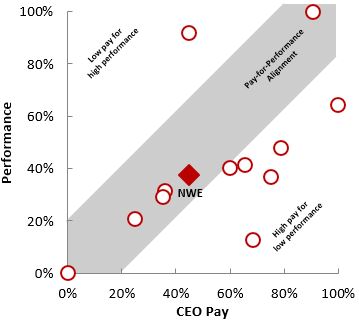

| CEO PAY FOR PERFORMANCE VS. 2019 PEERS | |||

| 1-YEAR | 3-YEAR | ||

|  | ||

| Relative 1-Year CEO Pay* | Relative 1-Year TSR* | Relative 3-Year CEO Pay* | Relative 3-Year TSR* | |||||||

| OGE Energy Corp. | 100% | El Paso Electric Co. | 100% | OGE Energy Corp. | 100% | PNM Resources Inc. | 100% | |||

| PNM Resources Inc. | 80% | MGE Energy Inc. | 86% | PNM Resources Inc. | 91% | El Paso Electric Co. | 92% | |||

| IDACORP, Inc. | 73% | Black Hills Corporation | 69% | IDACORP, Inc. | 79% | OGE Energy Corp. | 64% | |||

| Black Hills Corporation | 65% | PNM Resources Inc. | 62% | Black Hills Corporation | 75% | IDACORP, Inc. | 48% | |||

| Avista Corp. | 59% | Northwest Natural Holding | 59% | Avista Corp. | 68% | Spire Inc. | 41% | |||

| Spire Inc. | 58% | Portland General Electric | 58% | Spire Inc. | 65% | Portland General Electric | 40% | |||

| Portland General Electric | 45% | NorthWestern Energy | 56% | Portland General Electric | 60% | NorthWestern Energy | 37% | |||

| NorthWestern Energy | 43% | IDACORP, Inc. | 35% | NorthWestern Energy | 45% | Black Hills Corporation | 37% | |||

| Otter Tail Corporation | 40% | OGE Energy Corp. | 35% | El Paso Electric Co. | 45% | ALLETE, Inc. | 32% | |||

| El Paso Electric Co. | 38% | Avista Corp. | 34% | ALLETE, Inc. | 36% | Otter Tail Corporation | 29% | |||

| ALLETE, Inc. | 35% | Spire Inc. | 29% | Otter Tail Corporation | 35% | Northwest Natural Holding | 21% | |||

| Northwest Natural Holding | 27% | ALLETE, Inc. | 10% | Northwest Natural Holding | 25% | Avista Corp. | 13% | |||

| MGE Energy Inc. | —% | Otter Tail Corporation | —% | MGE Energy Inc. | —% | MGE Energy Inc. | —% | |||

| *Relative CEO pay and TSR are expressed as a percentile of the range between the highest and lowest values. | ||||||||||

| Source: CEO Pay for the one-year period is the 2018 total compensation and for the three-year period is the 2016-18 total compensation, as published in the 2017, 2018, and 2019 proxy statement Summary Compensation Tables for each respective company. We have excluded any change in pension value from the total compensation calculation because its inclusion could lead to inconsistent comparisons from company to company based upon differing pension plan provisions, length of employee tenure, and other factors. Total Shareholder Return is from S&P Global Market Intelligence for the one- and three-year periods ended December 31, 2019, and assumes reinvestment of dividends. | ||||||||||

NorthWestern Energy | Proxy Statement | Page 16 |

| Compensation Discussion and Analysis |

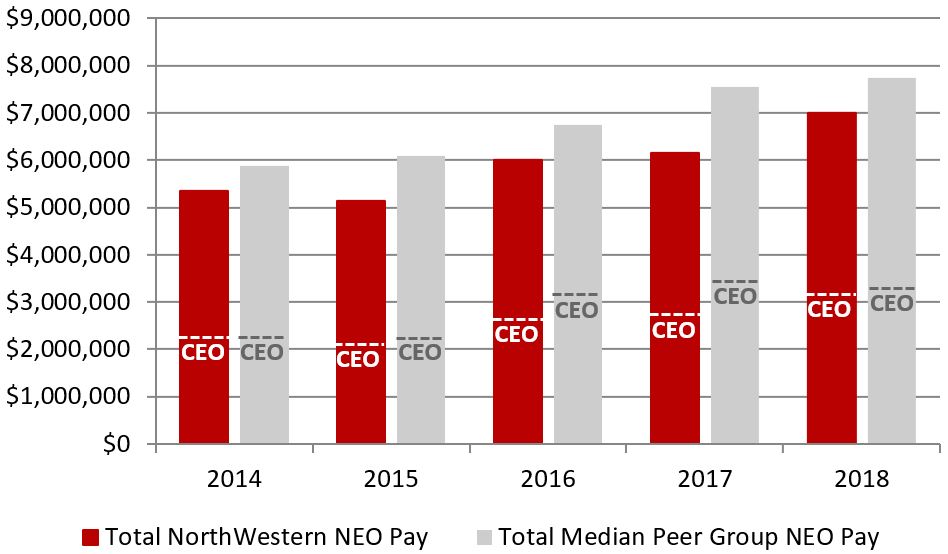

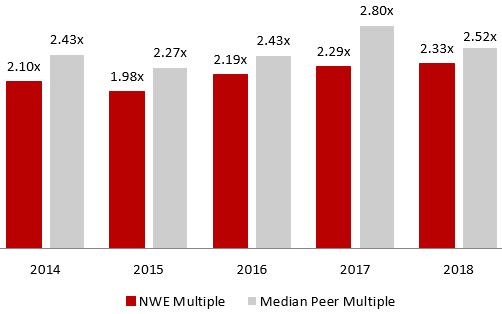

| NAMED EXECUTIVE OFFICER PAY VS. 2019 PEERS | PAY MULTIPLE OF CEO TO SECOND HIGHEST PAID NAMED EXECUTIVE OFFICER | ||

|  | ||

| Source: Total compensation (excluding change in pension value) as published in the proxy statement summary compensation table for each respective company. We excluded change in pension value because its inclusion could lead to inconsistent comparisons from company to company based upon differing pension plan provisions, length of employee tenure, and other factors. | |||

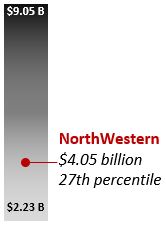

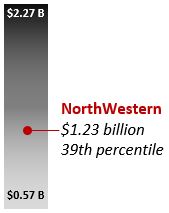

| Our 2019 Peer Group | ||||||

Our Compensation Committee (a) selects the members of our peer group and periodically examines whether peers continue to meet the criteria for inclusion described below, and (b) uses our peer group for both compensation and performance benchmarking. As part of the peer group selection process, the Compensation Committee receives advice from its independent compensation consultant to create a peer group that includes companies that: (1) maintain a regulated utility industry perspective which emphasizes operational excellence and customer satisfaction as a means to create shareholder value; (2) reflect our labor market for key executive talent and are part of high-cost geographic areas; and (3) have similar revenue, market capitalization and return-based measures of performance. For 2019, based on these criteria and the advice of its independent compensation consultant, our Compensation Committee added Avista Corp. (which we previously had removed from our peer group in 2018 due to a proposed merger transaction that ultimately was not consummated) and removed Vectren Corporation following its acquisition by another company. | ||||||

2019 Peer Group ALLETE, Inc. (ALE) Avista Corporation (AVA) Black Hills Corporation (BKH) El Paso Electric Co. (EE) IDACORP, Inc. (IDA) MGE Energy Inc. (MGEE) NorthWestern Energy (NWE) Northwest Natural Holding Co. (NWN) OGE Energy Corp. (OGE) Otter Tail Corporation (OTTR) PNM Resources Inc. (PNM) Portland General Electric Company (POR) Spire Inc. (SR) | Market Capitalization (1) | Revenue (2) | ||||

|  | |||||

| (1) Market capitalization range of our peer group as of February 19, 2020. | ||||||

| (2) Range of publicly available trailing twelve months total revenues for our peer group as of February 19, 2020. | ||||||

NorthWestern Energy | Proxy Statement | Page 17 |

| Compensation Discussion and Analysis |

| • | Pay, benefits, and other employment matters for executives; |

| • | Stock-based pay plans for employees; |

| • | The election and appointment of executive officers and other corporate officers; |

| • | CEO performance; and |

| • | Director pay. |

Align Interests. Provide pay that aligns management (and employee) interests with those of shareholders and customers. | Peer Comparison. Establish overall pay approximating the median of our peer group and applicable position comparisons. | Attract Talent. Set pay that will attract talent from both within and outside the utility industry. | ||||||||

Economic Circumstances. Set pay based on economic circumstances, including turnover and retention considerations. | Pay for Performance. Tie all components of incentive pay to the company’s short-and long-term financial and operational performance. | No Executive Perks. Executives participate in same benefits plans available to all non‑union employees, with no additional perquisites, other than executive physicals. | ||||||||

NorthWestern Energy | Proxy Statement | Page 18 |

| Compensation Discussion and Analysis |

July Review and discuss timeline for setting executive pay | October Review materials from independent compensation consultant: | |||||||

| ● | Executive pay overview | |||||||

| ● | Peer compensation analysis | |||||||

| ● | Preliminary design of annual and long-term incentive opportunities | |||||||

December Evaluate overall executive pay program: | February Finalize executive pay: | |||||||

| ● | Review preliminary five-year financial plan | ● | Review final five-year financial plan | |||||

| ● | Approve upcoming annual incentive plan grants | ● | Approve executive pay | |||||

| ● | Review proposed long-term incentive grants | ● | Approve long-term incentive program grants | |||||

| ● | Approve annual executive retention / retirement grants | ● | Review performance metrics results for prior year and approve payouts for current annual incentive plan and vesting of long-term incentive program | |||||

| ● | The level of achievement of our pre-established performance goals; |

| ● | Our TSR compared against our peer group; |

| ● | Individual performance and scope of job responsibilities; |

| ● | Internal equity considerations; |

| ● | Market competitiveness and internal executive turnover; and |

| ● | The executive’s industry and position experience and tenure. |

NorthWestern Energy | Proxy Statement | Page 19 |

| Compensation Discussion and Analysis |

| CEO PAY MIX | OTHER NAMED EXECUTIVE OFFICER AVERAGE PAY MIX | ||

|  | ||

| Charts represent target level for each component of compensation. | |||

NorthWestern Energy | Proxy Statement | Page 20 |

| Compensation Discussion and Analysis |

| We believe executive pay must be internally consistent and equitable to motivate our employees to create shareholder value. We are committed to internal pay equity, and the Compensation Committee monitors the relationship between the pay our executive officers receive and the pay our non-managerial employees receive. The Compensation Committee reviewed a comparison of CEO pay (base salary and incentive pay) to the pay of all our employees (other than our CEO) in 2019. The compensation for our CEO in 2019 was approximately 27 times the median pay of our employees, the same as it was in 2018, using the same methodology. | 27:1 CEO Pay Ratio |

NorthWestern Energy | Proxy Statement | Page 21 |

| Compensation Discussion and Analysis |

| CEO to Median Employee | |||||||

| Pay Ratio | |||||||

| President and CEO | Median Employee | ||||||

| Base Salary | $643,770 | $94,151 | |||||

| Stock Awards | $1,650,164 | — | |||||

| Non-Equity Incentive Plan Compensation | $818,022 | $0 | |||||

Change in Pension Value and Nonqualified Deferred Compensation Earnings (1) | $144,501 | 11,313 | |||||

| All Other Compensation | $41,847 | $18,404 | |||||

| TOTAL | $3,298,304 | $123,868 | |||||

| CEO Pay to Median Employee Pay Ratio | 27 | : | 1 | ||||

| (1) These amounts are attributable to a change in the value of each individual’s defined benefit pension account balance and do not represent earned or paid compensation. Pension values are dependent on many variables including years of service, earnings, and actuarial assumptions. | |||||||

| The primary pay components for our executive officers in 2019 were: | |||

| ● | Base Salary; | ||

| ● | Annual performance-based cash incentive awards; and | ||

| ● | Long-term performance-based equity incentive awards in the form of performance units and ERRP restricted share units. | ||

NorthWestern Energy | Proxy Statement | Page 22 |

| Compensation Discussion and Analysis |

| The Compensation Committee considers adjustments to base salaries for executive officers on an annual basis. For 2019, the Compensation Committee felt that an increase to the base salaries of our executive officers in line with the increases generally provided to our employees was reasonable in light of the company’s operating results | ||||||||

| in 2018. To remain competitive with the market, the Compensation Committee also considered the effect of such increased salaries for our executive officers in relation to the median of our 2019 peer group. One named executive officer received a further increase to align with the market median. The table to the right sets forth the base salaries for our named executive officers. The base salary adjustments for 2019 were effective April 1, 2019. | ||||||||

| Annualized Base Salary | Increase (%) | |||||||

| 2018 | 2019 | |||||||

| Name | ($) | ($) | ||||||

| Robert C. Rowe | 630,315 | 649,224 | 3.0 | |||||

| Brian B. Bird | 435,978 | 449,057 | 3.0 | |||||

| Heather H. Grahame | 399,543 | 423,516 | 6.0 | |||||

| Curtis T. Pohl | 296,249 | 305,136 | 3.0 | |||||

| Bobbi L. Schroeppel | 279,101 | 287,474 | 3.0 | |||||

| Although base salary is included as an expense we recover from customers in our rates approved by our regulators, our recent Montana general electric rate case which established new rates used base salary figures from 2017, instead of the 2018 and 2019 base salary figures listed above. | ||||||||

| (1) | (2) | (3) | (4) | |||||

Base Salary | x | Individual Target Incentive (% of Base Salary) | x | Plan Funding Percentage (performance vs. metrics) | x | Individual Performance Multiple | = | Individual Payout |

| $649,224 | x | 100% | x | 126% | x | 1 | = | $818,022 |

NorthWestern Energy | Proxy Statement | Page 23 |

| Compensation Discussion and Analysis |

| The table to the right sets forth the 2019 annual incentive target opportunity for our named executive officers. In 2019, the Compensation Committee adjusted the target incentive opportunity for our chief financial officer and our general counsel, increasing their opportunity, respectively, to 60 percent from 55 percent, and to 55 percent from 50 percent in 2018, to align the incentive opportunity with the market. | 2019 | |||||||

| Name | Base Salary ($) | Target Incentive Opportunity (% of base salary) | Target Incentive Opportunity ($) | |||||

| Robert C. Rowe | 649,224 | 100% | 649,224 | |||||

| Brian B. Bird | 449,057 | 60% | 269,434 | |||||

| Heather H. Grahame | 423,516 | 55% | 232,934 | |||||

| Curtis T. Pohl | 305,136 | 40% | 122,054 | |||||

| Bobbi L. Schroeppel | 287,474 | 40% | 114,990 | |||||

| For our executives, the funding (as a percentage of target) under the annual incentive plan has ranged from 80 percent to 136 percent for the five previous years, as set forth in the table to the right. | Historical Funding of Annual Cash Incentive (as a percentage of target) | |||||

| 2014 | 2015 (1) | 2016 | 2017 | 2018 | ||

| 125% | 80% | 113% | 99% | 136% | ||

| (1) Due to a work-related fatality in 2015, the funding level of the annual cash incentive for executives was 80% (for non-executive employees, the plan was funded at 88%). | ||||||

NorthWestern Energy | Proxy Statement | Page 24 |

| Compensation Discussion and Analysis |

| In order for any awards under the 2019 annual incentive plan to be earned and paid out, the company must attain at least 90 percent of the budgeted net income target, which coincides with the threshold net income target for the plan. This metric for determining performance against our financial goal is derived from our audited financial statements. However, the Compensation Committee, in its discretion, may consider certain items or events as unusual when determining performance against the metric and make what it deems to be appropriate adjustments. There were no adjustments in 2019. In addition, the 2019 annual incentive plan provided that the lost-time incident rate portion of the safety metric would be forfeited in the event of a work-related fatality, unless the Compensation Committee determined that no actions on the part of the employee or the Company contributed to the incident. | Annual Incentive Plan Metrics | |

| ||

| 2019 | |||||||||||||||||||||||

| Annual Incentive Plan Information | |||||||||||||||||||||||

| Performance Measures | Weight (% of Total Plan Payout) | Performance Level | Target % Achieved | Final Funding % of Total | |||||||||||||||||||

| Threshold | Target | Maximum | Actual Achieved | ||||||||||||||||||||

Financial (55%) (1) | |||||||||||||||||||||||

| Net Income ($ in millions) | 55 | % | $155.9 | $ | 172.9 | $ | 190.2 | $202.1 | 150.0 | % | 82.5 | ||||||||||||

| Safety (15%) (2) | |||||||||||||||||||||||

| Lost Time Incident Rate | 5 | % | 0.65 | 0.50 | 0.27 | 0.58 | 73.3 | % | 3.7 | ||||||||||||||

| Total Recordable Incident Rate | 5 | % | 1.90 | 1.60 | 1.30 | 1.87 | 52.2 | % | 2.6 | ||||||||||||||

| Safety Training Completion | 5 | % | 95.0 | % | 97.0 | % | 99.0 | % | 99.7 | % | 150.0 | % | 7.5 | ||||||||||

| Reliability (15%) (3) | |||||||||||||||||||||||

| SAIDI (excluding major event days) | 5.0 | % | 119.00 | 105.00 | 89.00 | 103.22 | 105.6 | % | 5.3 | ||||||||||||||

| SAIDI (including major event days) | 5.0 | % | 178.00 | 126.00 | 101.00 | 110.43 | 131.1 | % | 6.6 | ||||||||||||||

| Gas – Leaks per 100 Miles of Main | 2.5 | % | 7.40 | 5.60 | 3.50 | 8.80 | — | % | — | ||||||||||||||

| Gas – Damages per 1000 Locates | 2.5 | % | 2.40 | 2.00 | 1.65 | 3.10 | — | % | — | ||||||||||||||

| Customer Satisfaction (15%) (4) | |||||||||||||||||||||||

J.D. Power Residential Electric and Gas Survey Performance Ranking | 5 | % | 680.00 | 712.00 | 716.00 | 718.90 | 150.0 | % | 7.5 | ||||||||||||||

Operational Performance – Customer Survey by Flynn Wright | 5 | % | 34.83 | 38.71 | 42.58 | 38.94 | 103.0 | % | 5.1 | ||||||||||||||

Reputational Perceptions – Customer Survey by Flynn Wright | 5 | % | 34.14 | 37.93 | 41.72 | 38.09 | 102.1 | % | 5.1 | ||||||||||||||

| TOTAL FUNDING PERCENTAGE | 126.0 | % | |||||||||||||||||||||

| (1) | Financial. The net income target is based upon the Board approved budget for the plan year, and the actual achieved is determined by what is reported in our annual report on Form 10-K for the plan year. |

| (2) | Safety. Safety performance regarding Lost Time Incident Rate and Total Recordable Incident Rate is calculated according to Occupational Safety and Health Administration (OSHA) standards. OSHA specifically defines what workplace injuries and illnesses should be recorded and, of those recorded, which must be considered lost time incidents. The threshold level for the safety measures represents our five-year average performance for these metrics, which is significantly above our Edison Electric Institute (EEI) peer group average; the target level is significantly above our peer group average and represents a 15 percent improvement over our five-year average performance for lost time incident rate and total recordable incident rate; and the maximum represents first quartile performance for our EEI peer group and a significant improvement over historical company performance. Safety Training Completion includes completion of assigned safety training for all employees through an internal education portal, and is calculated by dividing the difference of total courses assigned less total courses overdue by the total courses assigned. |

NorthWestern Energy | Proxy Statement | Page 25 |

| Compensation Discussion and Analysis |

| (3) | Reliability. SAIDI (excluding major event days). System Average Interruption Duration Index (SAIDI) is a system reliability index used by us and participating Institute of Electrical and Electronic Engineers, Inc. (IEEE), utilities to measure the duration of interruptions on a utility’s electric system. SAIDI indicates the total duration of interruption for the average customer during a predefined period of time. The threshold level for SAIDI, excluding major event days, represents a 10 percent improvement over the difference between the five-year average performance for IEEE medium-sized utilities and maximum; the target level represents a 10 percent improvement over the difference between the company’s five-year average results and the maximum level; and the maximum level is the five-year average of first quartile performance of IEEE medium-sized utilities. |

| (4) | Customer Satisfaction. J.D. Power. One customer satisfaction metric is measured by the broadly utilized J.D. Power residential electric and gas customer satisfaction surveys and studies, which include the following components: communications, corporate citizenship, billing and payment, price, power quality and reliability (electric) or field service (gas) and customer service. The threshold level represents the company’s five-year average; the target level is an improvement of one point over our best ever score, which we achieved in 2018; and the maximum level is a five point improvement over our 2018 best ever score. |

| 2019 | |||||||||||||

| Name | Base Salary ($) | Target Cash Incentive, as % of Base Salary | Funding Percentage (%) | Individual Performance Multiple | Actual Cash Incentive, as % of Base Salary | Cash Incentive Award ($) | |||||||

| Robert C. Rowe | 649,224 | 100% | 126% | 1.0 | 126.0% | 818,022 | |||||||

| Brian B. Bird | 449,057 | 60% | 126% | 1.0 | 75.6% | 339,487 | |||||||

| Heather H. Grahame | 423,516 | 55% | 126% | 1.0 | 69.3% | 293,497 | |||||||

| Curtis T. Pohl | 305,136 | 40% | 126% | 1.0 | 50.4% | 153,789 | |||||||

| Bobbi L. Schroeppel | 287,474 | 40% | 126% | 1.0 | 50.4% | 144,887 | |||||||

| Clawback of Annual Cash Incentive Awards | ||

| Although we have not adopted a formal clawback policy, the annual cash incentive awards are specifically made subject to any formal clawback policy that we may adopt in the future. | ||

NorthWestern Energy | Proxy Statement | Page 26 |

| Compensation Discussion and Analysis |

| Historical Funding of LTIP (as a percentage of target) | ||||

| 2013-2015 | 2014-2016 | 2015-2017 | 2016-2018 | 2017-2019 |

| 167.3% | 108.3% | 44.9% | 94.3% | 122.2% |

NorthWestern Energy | Proxy Statement | Page 27 |

| Compensation Discussion and Analysis |

| The target equity opportunities (value at target and number of shares) for the 2019 grants of LTIP performance units are shown in the table to the right. The table also compares the target opportunities (expressed as a percentage of base salary) applicable to the 2018 and 2019 awards. | Target LTIP Performance Unit Opportunity for 2019 | ||||||||||

| 2018 | 2019 | 2019 | 2019 | ||||||||

| Name | Base Salary (%) | Base Salary (%) | Value at Target ($) | LTIP Stock Awards (1) | |||||||

| Robert C. Rowe | 200% | 200% | 1,260,630 | 20,868 | |||||||

| Brian B. Bird | 100% | 100% | 435,978 | 7,217 | |||||||

| Heather H. Grahame | 90% | 90% | 359,589 | 5,952 | |||||||

| Curtis T. Pohl | 60% | 60% | 177,749 | 2,942 | |||||||

| Bobbi L. Schroeppel | 50% | 50% | 139,551 | 2,310 | |||||||

| (1) Based on a weighted average grant date fair value of $60.41, which was calculated using the closing stock price of $64.98 on February 11, 2019, less the present value of expected dividends | |||||||||||

| Performance Measures — 2019-2021 | Threshold | Target | Maximum | |||||||

| Financial Goals – 50% | ||||||||||

| ROAE | 8.35 | % | 8.80 | % | 9.25 | % | ||||

| Simple Average EPS Growth | 1.7 | % | 3.2 | % | 4.7 | % | ||||

| TSR – 50% | ||||||||||

| Relative Average vs. Peers | 13th | 6th | 1st | |||||||

NorthWestern Energy | Proxy Statement | Page 28 |

| Compensation Discussion and Analysis |

| 2019 Target ERRP Opportunity | ||||||||||

| Name | 2019 Base Salary ($) | Award % of Base Salary (%) | Value at Grant Date ($) | ERRP Stock Awards (#) (1) | ||||||

| Robert C. Rowe | 649,224 | 60% | 389,534 | 6,414 | ||||||

| Brian B. Bird | 449,057 | 25% | 112,264 | 1,849 | ||||||

| Heather H. Grahame | 423,516 | 20% | 84,703 | 1,395 | ||||||

| Curtis T. Pohl | 305,136 | 20% | 61,027 | 1,005 | ||||||

| Bobbi L. Schroeppel | 287,474 | 15% | 43,121 | 710 | ||||||

| (1) | Based on a grant date fair value of $60.73, which was calculated using the closing stock price of $72.20 on December 18, 2019, less the present value of expected dividends, calculated using a 1.74 percent five-year Treasury rate and assuming quarterly dividends of $0.60 for the five-year vesting period, based on announced planned dividend of $2.40 per share for 2019. |

NorthWestern Energy | Proxy Statement | Page 29 |

| Compensation Discussion and Analysis |

| Performance Measures — 2017-2019 | Threshold | Target | Maximum | Actual | |||||||||

| Financial Goals – 50% | |||||||||||||

| ROAE | 9.0 | % | 9.6 | % | 10.2 | % | 10.0 | % | |||||

| Simple Average EPS Growth | 0.4 | % | 2.4 | % | 4.4 | % | 6.0 | % | |||||

| Market Goal – 50% | |||||||||||||

| Relative TSR Average vs. Peers | 13th | 6th | 1st | 8th | |||||||||

| Based on the Compensation Committee’s calculation of these performance measures, the 2017 LTIP performance unit grants vested at 122.2 percent. The table to | Performance Measures — 2017-2019 | Result | Weight | Vesting | |||||||

| Financial Goals – ROAE and Simple Average EPS Growth | 184.3 | % | 50 | % | 92.2 | % | |||||

| Market Goal – TSR | 60.0 | % | 50 | % | 30.0 | % | |||||

| TOTAL | 122.2 | % | |||||||||

| the right summarizes the performance results with respect to each of the performance measures applicable to the 2017 LTIP performance unit grants and the corresponding contributions to the vesting percentage. | |||||||||||

| Vesting of 2017 Performance Unit Grants | ||||||||

| Name | Units at Grant Date (#) | Vesting Percentage (%) | Units upon Vesting (#) | |||||

| Robert C. Rowe | 24,821 | 122.2% | 30,331 | |||||

| Brian B. Bird | 8,584 | 122.2% | 10,490 | |||||

| Heather H. Grahame | 6,013 | 122.2% | 7,348 | |||||

| Curtis T. Pohl | 3,500 | 122.2% | 4,277 | |||||

| Bobbi L. Schroeppel | 2,689 | 122.2% | 3,286 | |||||

NorthWestern Energy | Proxy Statement | Page 30 |

| Compensation Discussion and Analysis |

Net Income (millions) | |||||

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| $120.7 | $151.2 | $162.7 | $172.7 | $197.0 | $202.1 |

| As a result of achieving the financial performance metric, the 2014 ERRP restricted share unit grants vested on December 31, 2019. In accordance with the terms of the grants, the vested restricted share units have been credited to an account for each executive officer similar to a deferred compensation account. Executives are not entitled to | ||||||

payout of any of the vested units in such account until the executive leaves the company, and following such departure, each unit will be paid out as a share of common stock of the company in five equal annual installments. The table to the right indicates the number of 2014 ERRP restricted share units which vested on December 31, 2019, for each of our named executive officers. | ||||||

| Name | 2014 ERRP Restricted Share Units Vested (#) | |||||

| Robert C. Rowe | 6,410 | |||||

| Brian B. Bird | 2,103 | |||||

| Heather H. Grahame | 1,531 | |||||

| Curtis T. Pohl | 1,205 | |||||

| Bobbi L. Schroeppel | 834 | |||||

NorthWestern Energy | Proxy Statement | Page 31 |

| Compensation Discussion and Analysis |

Compensation Committee Report The Compensation Committee reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the proxy statement and incorporated by reference into the Annual Report on Form 10-K for the year ended December 31, 2019. Compensation Committee Dana J. Dykhouse, Chair Anthony T. Clark Julia L. Johnson Mahvash Yazdi | ||

NorthWestern Energy | Proxy Statement | Page 32 |

| Name and Principal Position | Year | Salary ($) (1) | Bonus ($) | Stock Awards ($) (1) (2) | Non-Equity Incentive Plan Compensation ($) (1) (3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (1) (4) | All Other Compen- sation ($) (5) | Total ($) (1) | |||||||||||||||||

| Robert C. Rowe | |||||||||||||||||||||||||

| President and Chief Executive Officer | 2019 | 643,770 | — | 1,650,164 | 818,022 | 144,501 | 41,847 | 3,298,304 | |||||||||||||||||

| 2018 | 625,019 | — | 1,602,080 | 857,228 | 34,793 | 46,811 | 3,165,931 | ||||||||||||||||||

| 2017 | 607,232 | — | 1,497,280 | 605,836 | 94,609 | 43,322 | 2,848,279 | ||||||||||||||||||

| Brian B. Bird | |||||||||||||||||||||||||

| Chief Financial Officer | 2019 | 445,284 | — | 548,242 | 339,487 | 31,861 | 57,387 | 1,422,261 | |||||||||||||||||

| 2018 | 432,315 | — | 532,315 | 326,112 | 5,939 | 52,676 | 1,349,357 | ||||||||||||||||||

| 2017 | 420,012 | — | 517,798 | 209,524 | 22,378 | 54,923 | 1,224,635 | ||||||||||||||||||

| Heather H. Grahame | |||||||||||||||||||||||||

| General Counsel and Vice President - Regulatory & Federal Gov't Affairs | 2019 | 416,601 | — | 444,292 | 293,497 | — | 51,505 | 1,205,895 | |||||||||||||||||

| 2018 | 391,204 | — | 413,461 | 271,689 | — | 55,210 | 1,131,564 | ||||||||||||||||||

| 2017 | 367,773 | — | 362,718 | 165,117 | — | 49,527 | 945,135 | ||||||||||||||||||

| Curtis T. Pohl | |||||||||||||||||||||||||

| Vice President - Distribution | 2019 | 302,572 | — | 238,776 | 153,789 | 59,131 | 53,608 | 807,876 | |||||||||||||||||

| 2018 | 293,760 | — | 231,817 | 161,159 | — | 52,910 | 739,646 | ||||||||||||||||||

| 2017 | 285,399 | — | 225,507 | 113,898 | 38,024 | 49,257 | 712,085 | ||||||||||||||||||

| Bobbi L. Schroeppel | |||||||||||||||||||||||||

| Vice President - Customer Care, Communications and HR | 2019 | 285,059 | — | 182,672 | 144,887 | 39,441 | 56,915 | 708,974 | |||||||||||||||||

| 2018 | 275,267 | — | 174,755 | 151,831 | — | 52,214 | 654,067 | ||||||||||||||||||

| 2017 | 263,577 | — | 168,940 | 92,103 | 24,602 | 53,984 | 603,206 | ||||||||||||||||||

| (1) | As a regulated utility, the amounts we pay for salary and non-equity incentive plan compensation are included in the rates we charge our customers; while stock awards, change in pension value and nonqualified deferred compensation earnings are excluded from those rates. Although we recently concluded a Montana general electric rate case in which our regulators established our new rates, the salary and non-equity incentive plan compensation amounts for 2017 were included in that rate case instead of the higher 2018 and 2019 amounts. |

| (2) | These values reflect the grant date fair value of these awards as calculated utilizing the provisions of Accounting Standards Codification 718, Stock Compensation, and do not represent earned or paid compensation as the shares are subject to performance and vesting conditions. The values in the table above assume payout at target (100 percent) based on grant date fair value. The exact number of shares issued will vary from zero to 200 percent of the target award, depending on actual company performance relative to the performance goals. See Note 15 to the consolidated financial statements in our 2019 Annual Report on Form 10-K for further information regarding assumptions underlying the valuation of equity awards. The value of awards granted in 2019 for each named executive officer assuming a maximum payout based on grant date fair value would be $2,910,794 for Mr. Rowe; $984,220 for Mr. Bird; $803,881 for Ms. Grahame; $416,525 for Mr. Pohl; and $322,223 for Ms. Schroeppel. |

| (3) | The “Non-Equity Incentive Plan Compensation” column reflects cash incentive awards earned pursuant to our annual incentive plan as previously described. These awards are earned during the year reflected and paid in the following fiscal year. |

| (4) | These amounts are attributable to a change in the value of each individual’s defined benefit pension account balances and do not represent earned or paid compensation. Pension values are dependent on many variables including years of service, earnings and actuarial assumptions. Our pension plans were closed prior to Ms. Grahame joining the company; therefore, she is not a participant in a pension plan. |

| (5) | The table to the right identifies the items included in the “All Other Compensation” column for 2019. Employee benefits include employer contributions, as applicable, for health benefits (medical, dental, vision, employee assistance plan and health savings account), group term life and 401(k) plan, which are generally available to all employees on a nondiscriminatory basis. Life insurance | Health Benefits | Life Insurance | 401(k) Contributions | Other Income | Total All Other Compensation | |||||||||||||||||

| Robert C. Rowe | $ | 22,373 | $ | 5,547 | $ | 11,200 | $ | 2,727 | $ | 41,847 | |||||||||||||

| Brian B. Bird | 24,161 | 2,516 | 28,000 | 2,710 | 57,387 | ||||||||||||||||||

| Heather H. Grahame | 17,253 | 3,452 | 30,800 | — | 51,505 | ||||||||||||||||||

| Curtis T. Pohl | 17,411 | 5,397 | 30,800 | — | 53,608 | ||||||||||||||||||

| Bobbi L. Schroeppel | 24,161 | 2,044 | 28,000 | 2,710 | 56,915 | ||||||||||||||||||

| also includes imputed income consistent with IRS guidelines for coverage amounts in excess of $50,000 for each of the named executive officers. Mr. Rowe’s other income includes vacation sold back to the company at a rate of 75 percent. Mr. Bird’s and Ms. Schroeppel’s other income for 2019 includes imputed income related to executive physicals. | |||||||||||||||||||||||

NorthWestern Energy | Proxy Statement | Page 33 |

| Executive Pay |

| Name | Grant Date | Estimated Future Payouts Under Non-equity Incentive Plan Awards (1) | Estimated Future Payouts Under Equity Incentive Plan Awards (1) (2) | All Other Stock Awards: Number of Shares of Stock or Units (#) | Grant Date Fair Value of Stock Awards (3) ($) | ||||||||||||||||||||||

| Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||||||||||||||||||||

| Robert C. Rowe | |||||||||||||||||||||||||||

| Annual Cash Incentive | — | 324,612 | 649,224 | 973,836 | — | — | — | — | — | ||||||||||||||||||

| Performance Units | 2/11/2019 | — | — | — | — | 20,868 | 41,736 | — | 1,260,630 | ||||||||||||||||||

| Restricted Share Units | 12/18/2019 | — | — | — | — | 6,414 | 6,414 | — | 389,534 | ||||||||||||||||||

| Brian B. Bird | |||||||||||||||||||||||||||

| Annual Cash Incentive | — | 134,717 | 269,434 | 404,151 | — | — | — | — | — | ||||||||||||||||||

| Performance Units | 2/11/2019 | — | — | — | — | 7,217 | 14,434 | — | 435,978 | ||||||||||||||||||

| Restricted Share Units | 12/18/2019 | — | — | — | — | 1,849 | 1,849 | — | 112,264 | ||||||||||||||||||

| Heather H. Grahame | |||||||||||||||||||||||||||

| Annual Cash Incentive | — | 116,467 | 232,934 | 349,401 | — | — | — | — | — | ||||||||||||||||||

| Performance Units | 2/11/2019 | — | — | — | — | 5,952 | 11,904 | — | 359,589 | ||||||||||||||||||

| Restricted Share Units | 12/18/2019 | — | — | — | — | 1,395 | 1,395 | — | 84,703 | ||||||||||||||||||

| Curtis T. Pohl | |||||||||||||||||||||||||||

| Annual Cash Incentive | — | 61,027 | 122,054 | 183,081 | — | — | — | — | — | ||||||||||||||||||

| Performance Units | 2/11/2019 | — | — | — | — | 2,942 | 5,884 | — | 177,749 | ||||||||||||||||||

| Restricted Share Units | 12/18/2019 | — | — | — | — | 1,005 | 1,005 | — | 61,027 | ||||||||||||||||||

| Bobbi L. Schroeppel | |||||||||||||||||||||||||||

| Annual Cash Incentive | — | 57,495 | 114,990 | 172,484 | — | — | — | — | — | ||||||||||||||||||

| Performance Units | 2/11/2019 | — | — | — | — | 2,310 | 4,620 | — | 139,551 | ||||||||||||||||||

| Restricted Share Units | 12/18/2019 | — | — | — | — | 710 | 710 | — | 43,121 | ||||||||||||||||||

| (1) | As a regulated utility, the amounts we pay for non-equity incentive plan awards are included in the rates we charge our customers; while all equity incentive plan awards are excluded from those rates. In addition, although we recently concluded a Montana general electric rate case in which our regulators established our new rates, the non-equity incentive plan awards that were included in that rate case were based on 2017 figures instead of the 2019 and 2018 amounts disclosed in this proxy statement. |

| (2) | Reflects possible payout range of 2019 performance units and restricted share units awards. The performance units granted on February 11, 2019, have a weighted average grant date fair value of $60.41. The restricted share units granted on December 18, 2019, have a weighted average grant date fair value of $60.73. |

| (3) | These values reflect the grant date fair value of these awards as calculated utilizing the provisions of Accounting Standards Codification 718, Stock Compensation, and do not represent earned or paid compensation as the shares are subject to performance and vesting conditions. The values in the table above reflect grant date fair value assuming payment at target. See Note 15 to the consolidated financial statements in our 2019 Annual Report on Form 10-K for further information regarding assumptions underlying the valuation of equity awards. |