- NWE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

8-K Filing

NorthWestern (NWE) 8-KRegulation FD Disclosure

Filed: 15 Nov 05, 12:00am

Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

Third Quarter 2005 Update

November 2005

NEW STRENGTH. NEW STRATEGY. NEW ENERGY.

Forward-Looking Statement

During the course of this presentation today, we will be discussing certain subjects including those pertaining to our strategy, and our discussions may contain forward-looking information. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. These factors that may affect our results are listed in certain of our press releases and disclosed in the company’s public filings with the SEC.

2

NorthWestern Energy Today

[GRAPHIC]

• Serving 617,000 electric and natural gas customers in Montana, South Dakota and Nebraska

• Approximately 1,350 employees

• Listed on NASDAQ: NWEC

• Approximately $1.1 billion market capitalization

3

[GRAPHIC]

• Regulated operations

• Electric utility provides 52% of revenues and 63% of gross margin

• Natural gas utility provides 28% of revenues and 22% of gross margin

• Unregulated operations

• Electric operations include 30% share of Colstrip Unit 4 and Milltown Hydro

• Electric operations provide 8% of revenues and 13% of gross margin

• Natural gas operations provide 12% of revenues and 2% gross margin

4

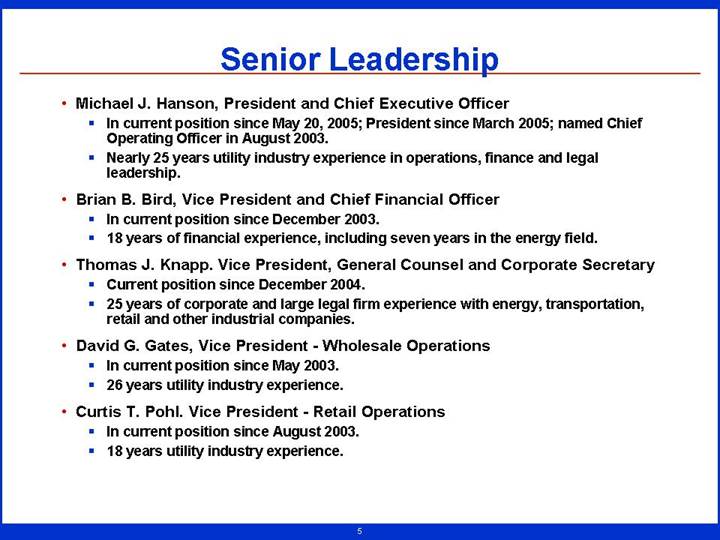

Senior Leadership

• Michael J. Hanson, President and Chief Executive Officer

• In current position since May 20, 2005; President since March 2005; named Chief Operating Officer in August 2003.

• Nearly 25 years utility industry experience in operations, finance and legal leadership.

• Brian B. Bird, Vice President and Chief Financial Officer

• In current position since December 2003.

• 18 years of financial experience, including seven years in the energy field.

• Thomas J. Knapp. Vice President, General Counsel and Corporate Secretary

• Current position since December 2004.

• 25 years of corporate and large legal firm experience with energy, transportation, retail and other industrial companies.

• David G. Gates, Vice President - Wholesale Operations

• In current position since May 2003.

• 26 years utility industry experience.

• Curtis T. Pohl. Vice President - Retail Operations

• In current position since August 2003.

• 18 years utility industry experience.

5

• Patrick R. Corcoran, Vice President - Governmental and Regulatory Affairs

• In current position since 2001.

• 26 years utility industry experience

• Bobbi L. Schroeppel, Vice President - Customer Care and Communications

• In current position since June 2002.

• 11 years utility industry experience.

• Bart A. Thielbar, Vice President - Information Technology

• In current position since June 2002.

• 12 years IT management experience.

• Gregory G. A. Trandem, Vice President - Administrative Services

• In current position since January 2003.

• 28 years utility industry experience

6

Third Quarter 2005 Highlights

• Finalized settlement with PPL

• Nearly all bankruptcy claims have been settled

• Magten only significant claim remaining

• Sold last Blue Dot operation location

• Continuing work on Jackrabbit line and substations to meet demand for increasing loads in high-growth areas of Montana

• ServiceOne™ award winner for second year in a row

7

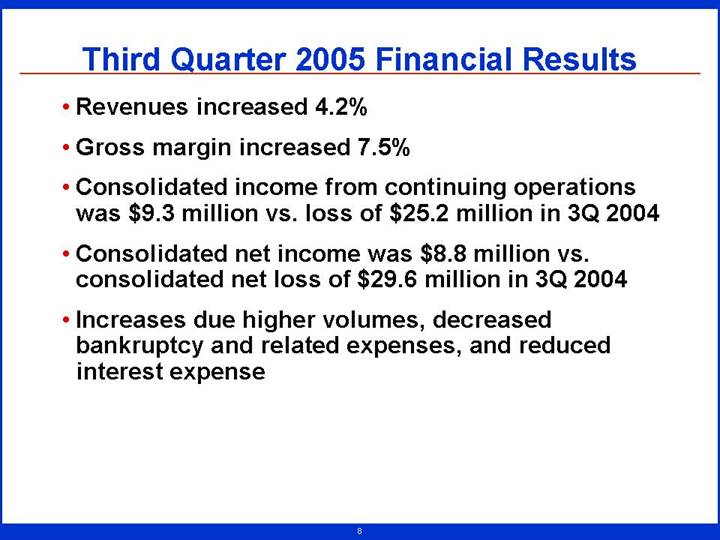

Third Quarter 2005 Financial Results

• Revenues increased 4.2%

• Gross margin increased 7.5%

• Consolidated income from continuing operations was $9.3 million vs. loss of $25.2 million in 3Q 2004

• Consolidated net income was $8.8 million vs. consolidated net loss of $29.6 million in 3Q 2004

• Increases due higher volumes, decreased bankruptcy and related expenses, and reduced interest expense

8

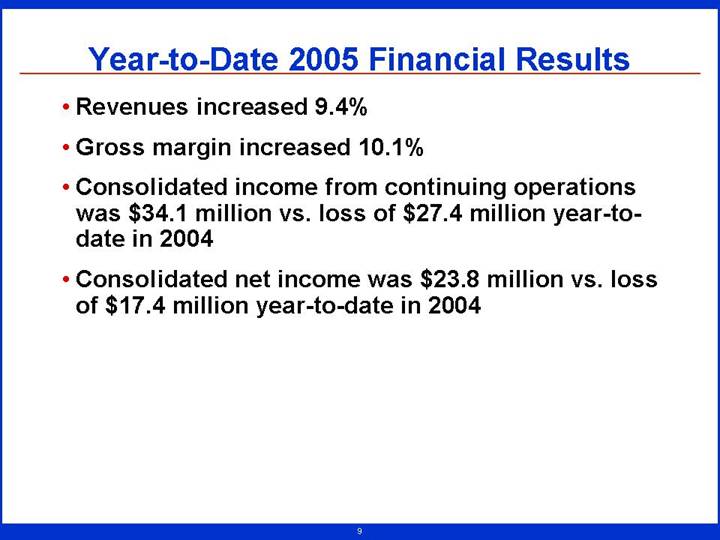

Year-to-Date 2005 Financial Results

• Revenues increased 9.4%

• Gross margin increased 10.1%

• Consolidated income from continuing operations was $34.1 million vs. loss of $27.4 million year-to-date in 2004

• Consolidated net income was $23.8 million vs. loss of $17.4 million year-to-date in 2004

9

Balance Sheet at September 30, 2005

• Unrestricted cash was $20.3 million vs. $17.1 million at year-end 2004

• Increase in open credit from suppliers

• Company has secured lines of credit from energy suppliers at approximately 1.5 times expected commodity purchases for winter season

• Long-term debt was $737.4 million vs. $836.9 million at year-end 2004

• Long-term debt to total capitalization ratio is approximately 51%

10

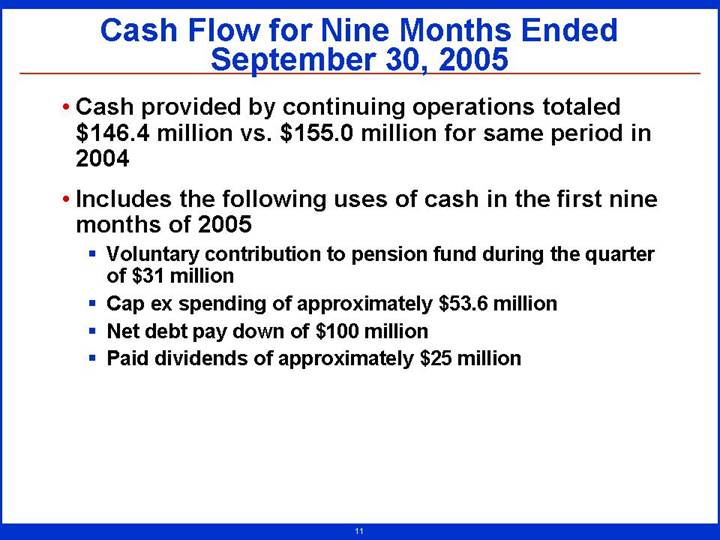

Cash Flow for Nine Months Ended September 30, 2005

• Cash provided by continuing operations totaled $146.4 million vs. $155.0 million for same period in 2004

• Includes the following uses of cash in the first nine months of 2005

• Voluntary contribution to pension fund during the quarter of $31 million

• Cap ex spending of approximately $53.6 million

• Net debt pay down of $100 million

• Paid dividends of approximately $25 million

11

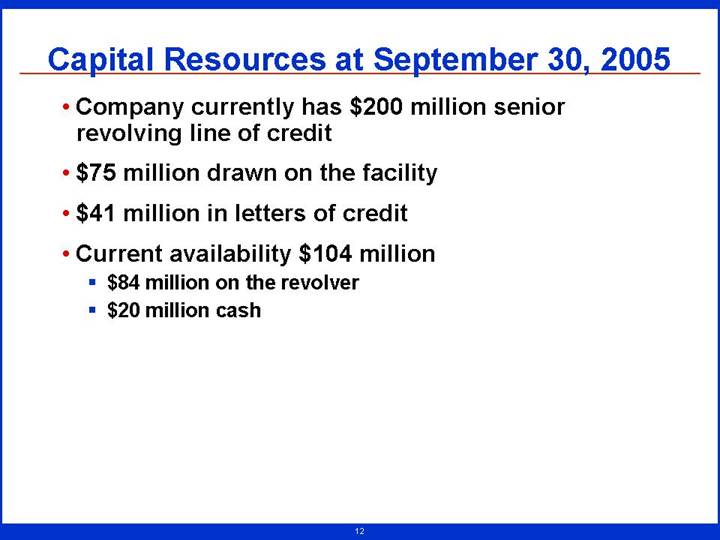

Capital Resources at September 30, 2005

• Company currently has $200 million senior revolving line of credit

• $75 million drawn on the facility

• $41 million in letters of credit

• Current availability $104 million

• $84 million on the revolver

• $20 million cash

12

Status of Noncore Asset Sales

• Netexit Bankrupcty

• Company received in September an initial $20 million distribution as a creditor

• Anticipates receiving additional $20 million by end of 2005

• Montana First Megawatts

• Continue work to sell equipment

• Anticipate receiving approximately $20 million from sale of generation equipment during first quarter of 2006

• Remaining non-equipment assets, including the land, also for sale

13

Share Repurchase Program

• For up to $75 million, or approximately 7% of outstanding shares of common stock

• Anticipate using cash from asset sales and 2006 cash flow from operations to fund program

• Intend to maintain debt to capitalization levels at approximately 50%

14

Other Opportunities for Value Creation

• Buy down Qualifying Facility contract liability

• Buy out Colstrip 4 lease

• Invest in utility transmission and distribution assets to grow earnings and cash flow

15

Earnings Guidance

• Reaffirmed 2005 guidance of $1.30 to $1.45 per share on continuing operations (basic)

• Expects to be on the high end of the range

• Projecting earnings from continuing operations of $1.70 to $1.90 per share (basic)

• Expect cash flow provided from continuing operations for 2006 in the range of $175 million to $200 million

• Key bridges from 2005 recurring EPS to 2006

• Improved interest expense

• Improved margins

• OA&G expenses anticipated to increase slightly due to increases in labor + property taxes in Montana

• Does not include impact of share repurchase program

16

Dividend Growth

• Quarterly dividend increased to 31 cents per share from previous amount 25 cents per share

• Dividend payable on Dec. 31 (Dec. 15 record date)

• Annualized rate of $1.24 per share

• 60% - 70% payout

• Board will continue to review dividend policy to insure competitive return to shareholders

17

Credit Ratings

• Fitch

• Secured debt: BBB-

• Corporate rating: BB+

• Positive outlook

• Standard & Poors

• Secured debt: BB+

• Corporate rating: BB+

• Negative outlook (based on uncertainty of MPPI proposal)

• Moody’s

• Secured debt: Ba1

• Corporate rating: Ba2

• Positive outlook

18

[GRAPHIC]

[LOGO]

Questions

19