UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03894

T. Rowe Price Short-Term Bond Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about Short-Term Bond Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short-Term Bond Fund - Z Class | $0 | 0.00% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by a rally in rates and credit spreads near the end of 2023.

The fund’s overweight to investment-grade corporate bonds and corresponding underweight to U.S. Treasuries aided performance relative to its style-specific benchmark, the Bloomberg 1–3 Year U.S. Government/Credit Bond Index, as corporate credit spreads tightened. Out-of-benchmark allocations to residential mortgage-backed securities, asset-backed securities (ABS), and commercial mortgage-backed securities also contributed as the securitized sectors benefited from the rally in U.S. Treasury yields and strong investor demand.

Allocations along the yield curve slightly hindered relative performance. An overweight to the five-year key rate detracted as the yield on the five-year U.S. Treasury note ended the period higher.

The fund seeks to provide a high level of income with minimal fluctuation in principal value and liquidity by investing in a diversified portfolio. The fund’s allocation to investment-grade corporate bonds decreased over the reporting period but continued to represent its largest absolute and relative positions. We focused on additions in securitized sectors, notably ABS, and our allocation in those sectors ended higher.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. The use of derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives—specifically, interest rate derivatives—detracted from absolute performance.

How has the fund performed?

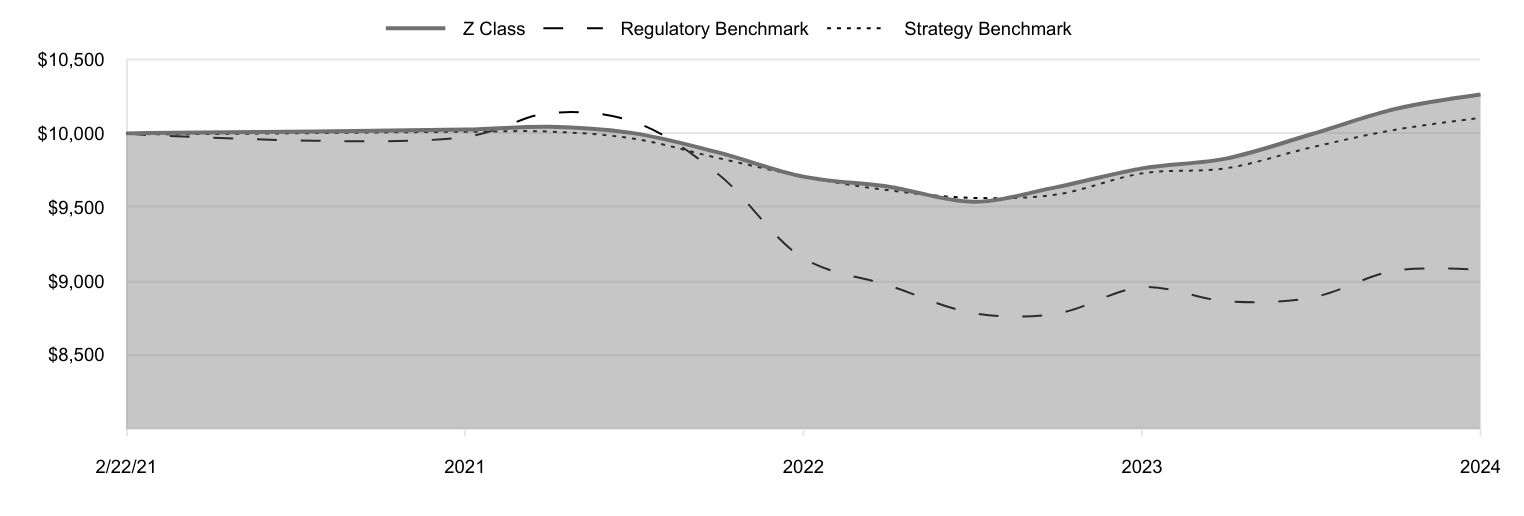

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2/22/21 | 10,000 | 10,000 | 10,000 |

| 2/28/21 | 10,003 | 9,989 | 9,995 |

| 5/31/21 | 10,026 | 9,975 | 10,011 |

| 8/31/21 | 10,045 | 10,138 | 10,012 |

| 11/30/21 | 10,000 | 10,077 | 9,963 |

| 2/28/22 | 9,871 | 9,725 | 9,833 |

| 5/31/22 | 9,707 | 9,154 | 9,707 |

| 8/31/22 | 9,639 | 8,970 | 9,614 |

| 11/30/22 | 9,537 | 8,783 | 9,563 |

| 2/28/23 | 9,636 | 8,779 | 9,586 |

| 5/31/23 | 9,763 | 8,958 | 9,729 |

| 8/31/23 | 9,831 | 8,863 | 9,765 |

| 11/30/23 | 9,994 | 8,887 | 9,905 |

| 2/29/24 | 10,166 | 9,071 | 10,025 |

| 5/31/24 | 10,263 | 9,075 | 10,105 |

202405-3565004, 202407-3567301

Average Annual Total Returns

| 1 Year | Since Inception 2/22/2021 |

|---|

| Short-Term Bond Fund (Z Class) | 5.12% | 0.80% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | |

| Bloomberg 1-3 Year U.S. Government/Credit Bond Index (Strategy Benchmark) | 3.86 | 0.32 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $4,686,925 |

| Number of Portfolio Holdings | 881 |

| Investment Advisory Fees Paid (000s) | $12,879 |

| Portfolio Turnover Rate | 92.3% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 15.9% |

| AA Rated | 9.7 |

| A Rated | 20.7 |

| BBB Rated | 25.1 |

| BB Rated and Below | 0.1 |

| Not Rated | 2.7 |

| U.S. Government Agency Securities | 4.5 |

| U.S. Treasury Securities | 20.9 |

| Reserves | 0.4 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 19.9% |

| Federal National Mortgage Assn. | 2.6 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Government National Mortgage Assn. | 1.0 |

| AbbVie | 0.8 |

| Crown Castle | 0.8 |

| Federal Home Loan Mortgage | 0.8 |

| JPMorgan Chase | 0.8 |

| CarMax Auto Owner Trust | 0.8 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short-Term Bond Fund

Z Class (TRZOX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about Short-Term Bond Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short-Term Bond Fund - Investor Class | $48 | 0.47% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by a rally in rates and credit spreads near the end of 2023.

The fund’s overweight to investment-grade corporate bonds and corresponding underweight to U.S. Treasuries aided performance relative to its style-specific benchmark, the Bloomberg 1–3 Year U.S. Government/Credit Bond Index, as corporate credit spreads tightened. Out-of-benchmark allocations to residential mortgage-backed securities, asset-backed securities (ABS), and commercial mortgage-backed securities also contributed as the securitized sectors benefited from the rally in U.S. Treasury yields and strong investor demand.

Allocations along the yield curve slightly hindered relative performance. An overweight to the five-year key rate detracted as the yield on the five-year U.S. Treasury note ended the period higher.

The fund seeks to provide a high level of income with minimal fluctuation in principal value and liquidity by investing in a diversified portfolio. The fund’s allocation to investment-grade corporate bonds decreased over the reporting period but continued to represent its largest absolute and relative positions. We focused on additions in securitized sectors, notably ABS, and our allocation in those sectors ended higher.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. The use of derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives—specifically, interest rate derivatives—detracted from absolute performance.

How has the fund performed?

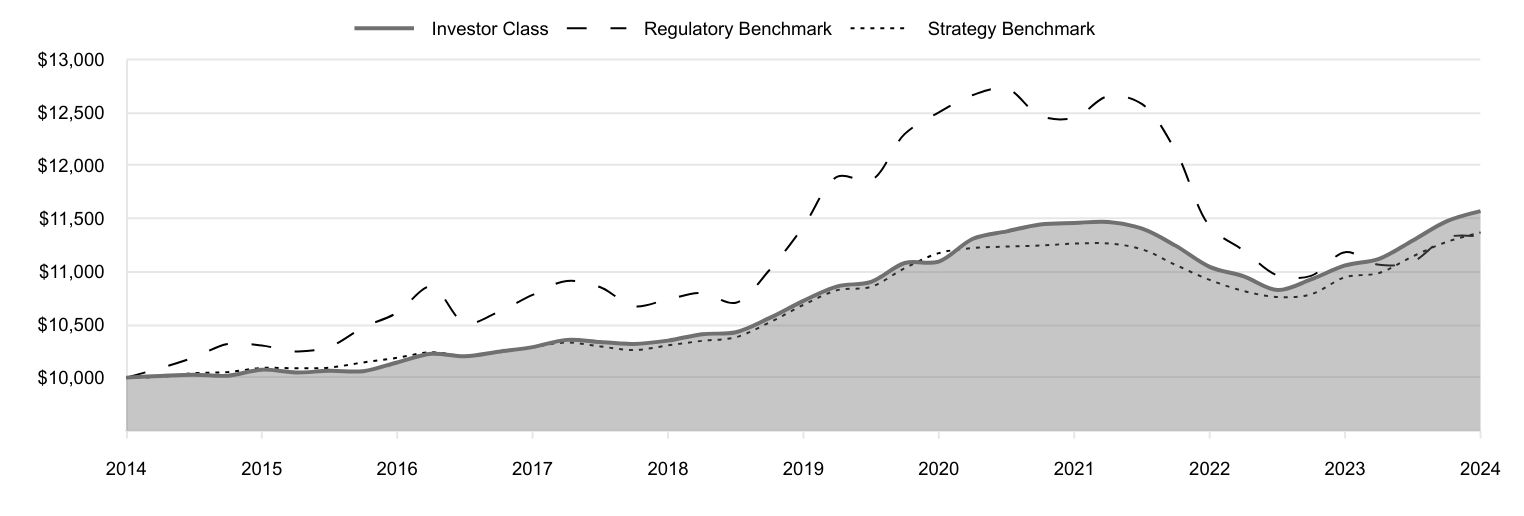

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

| 2014 | 10,016 | 10,090 | 10,007 |

| 2014 | 10,028 | 10,192 | 10,042 |

| 2015 | 10,018 | 10,318 | 10,052 |

| 2015 | 10,075 | 10,303 | 10,091 |

| 2015 | 10,048 | 10,247 | 10,088 |

| 2015 | 10,065 | 10,291 | 10,095 |

| 2016 | 10,061 | 10,473 | 10,143 |

| 2016 | 10,143 | 10,612 | 10,187 |

| 2016 | 10,225 | 10,859 | 10,239 |

| 2016 | 10,201 | 10,514 | 10,204 |

| 2017 | 10,244 | 10,621 | 10,247 |

| 2017 | 10,288 | 10,780 | 10,288 |

| 2017 | 10,356 | 10,912 | 10,331 |

| 2017 | 10,336 | 10,852 | 10,294 |

| 2018 | 10,318 | 10,674 | 10,260 |

| 2018 | 10,349 | 10,739 | 10,304 |

| 2018 | 10,410 | 10,798 | 10,347 |

| 2018 | 10,428 | 10,707 | 10,381 |

| 2019 | 10,561 | 11,013 | 10,519 |

| 2019 | 10,724 | 11,426 | 10,686 |

| 2019 | 10,861 | 11,896 | 10,825 |

| 2019 | 10,903 | 11,862 | 10,857 |

| 2020 | 11,081 | 12,299 | 11,033 |

| 2020 | 11,095 | 12,502 | 11,174 |

| 2020 | 11,310 | 12,666 | 11,222 |

| 2020 | 11,380 | 12,726 | 11,236 |

| 2021 | 11,445 | 12,470 | 11,246 |

| 2021 | 11,459 | 12,452 | 11,264 |

| 2021 | 11,468 | 12,655 | 11,265 |

| 2021 | 11,405 | 12,579 | 11,210 |

| 2022 | 11,245 | 12,140 | 11,064 |

| 2022 | 11,045 | 11,428 | 10,922 |

| 2022 | 10,955 | 11,198 | 10,817 |

| 2022 | 10,826 | 10,964 | 10,760 |

| 2023 | 10,926 | 10,960 | 10,786 |

| 2023 | 11,058 | 11,183 | 10,947 |

| 2023 | 11,121 | 11,064 | 10,987 |

| 2023 | 11,293 | 11,094 | 11,144 |

| 2024 | 11,474 | 11,324 | 11,280 |

| 2024 | 11,570 | 11,329 | 11,369 |

202405-3565004, 202407-3567301

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Short-Term Bond Fund (Investor Class) | 4.63% | 1.53% | 1.47% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 1.26 |

| Bloomberg 1-3 Year U.S. Government/Credit Bond Index (Strategy Benchmark) | 3.86 | 1.25 | 1.29 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $4,686,925 |

| Number of Portfolio Holdings | 881 |

| Investment Advisory Fees Paid (000s) | $12,879 |

| Portfolio Turnover Rate | 92.3% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 15.9% |

| AA Rated | 9.7 |

| A Rated | 20.7 |

| BBB Rated | 25.1 |

| BB Rated and Below | 0.1 |

| Not Rated | 2.7 |

| U.S. Government Agency Securities | 4.5 |

| U.S. Treasury Securities | 20.9 |

| Reserves | 0.4 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 19.9% |

| Federal National Mortgage Assn. | 2.6 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Government National Mortgage Assn. | 1.0 |

| AbbVie | 0.8 |

| Crown Castle | 0.8 |

| Federal Home Loan Mortgage | 0.8 |

| JPMorgan Chase | 0.8 |

| CarMax Auto Owner Trust | 0.8 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short-Term Bond Fund

Investor Class (PRWBX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about Short-Term Bond Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short-Term Bond Fund - Advisor Class | $80 | 0.78% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by a rally in rates and credit spreads near the end of 2023.

The fund’s overweight to investment-grade corporate bonds and corresponding underweight to U.S. Treasuries aided performance relative to its style-specific benchmark, the Bloomberg 1–3 Year U.S. Government/Credit Bond Index, as corporate credit spreads tightened. Out-of-benchmark allocations to residential mortgage-backed securities, asset-backed securities (ABS), and commercial mortgage-backed securities also contributed as the securitized sectors benefited from the rally in U.S. Treasury yields and strong investor demand.

Allocations along the yield curve slightly hindered relative performance. An overweight to the five-year key rate detracted as the yield on the five-year U.S. Treasury note ended the period higher.

The fund seeks to provide a high level of income with minimal fluctuation in principal value and liquidity by investing in a diversified portfolio. The fund’s allocation to investment-grade corporate bonds decreased over the reporting period but continued to represent its largest absolute and relative positions. We focused on additions in securitized sectors, notably ABS, and our allocation in those sectors ended higher.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. The use of derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives—specifically, interest rate derivatives—detracted from absolute performance.

How has the fund performed?

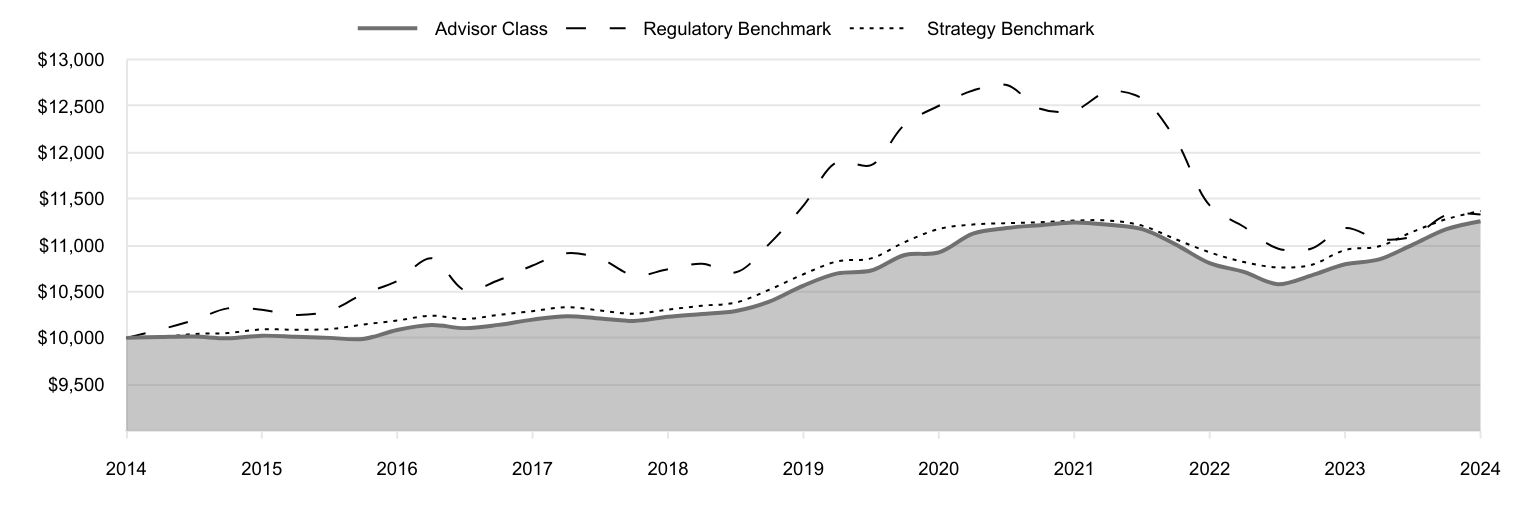

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 | 10,000 |

| 2014 | 10,009 | 10,090 | 10,007 |

| 2014 | 10,014 | 10,192 | 10,042 |

| 2015 | 9,996 | 10,318 | 10,052 |

| 2015 | 10,024 | 10,303 | 10,091 |

| 2015 | 10,012 | 10,247 | 10,088 |

| 2015 | 10,000 | 10,291 | 10,095 |

| 2016 | 9,988 | 10,473 | 10,143 |

| 2016 | 10,085 | 10,612 | 10,187 |

| 2016 | 10,138 | 10,859 | 10,239 |

| 2016 | 10,105 | 10,514 | 10,204 |

| 2017 | 10,140 | 10,621 | 10,247 |

| 2017 | 10,197 | 10,780 | 10,288 |

| 2017 | 10,234 | 10,912 | 10,331 |

| 2017 | 10,208 | 10,852 | 10,294 |

| 2018 | 10,183 | 10,674 | 10,260 |

| 2018 | 10,227 | 10,739 | 10,304 |

| 2018 | 10,257 | 10,798 | 10,347 |

| 2018 | 10,289 | 10,707 | 10,381 |

| 2019 | 10,390 | 11,013 | 10,519 |

| 2019 | 10,564 | 11,426 | 10,686 |

| 2019 | 10,695 | 11,896 | 10,825 |

| 2019 | 10,726 | 11,862 | 10,857 |

| 2020 | 10,893 | 12,299 | 11,033 |

| 2020 | 10,921 | 12,502 | 11,174 |

| 2020 | 11,124 | 12,666 | 11,222 |

| 2020 | 11,184 | 12,726 | 11,236 |

| 2021 | 11,215 | 12,470 | 11,246 |

| 2021 | 11,243 | 12,452 | 11,264 |

| 2021 | 11,219 | 12,655 | 11,265 |

| 2021 | 11,172 | 12,579 | 11,210 |

| 2022 | 11,008 | 12,140 | 11,064 |

| 2022 | 10,805 | 11,428 | 10,922 |

| 2022 | 10,711 | 11,198 | 10,817 |

| 2022 | 10,579 | 10,964 | 10,760 |

| 2023 | 10,672 | 10,960 | 10,786 |

| 2023 | 10,793 | 11,183 | 10,947 |

| 2023 | 10,846 | 11,064 | 10,987 |

| 2023 | 11,005 | 11,094 | 11,144 |

| 2024 | 11,172 | 11,324 | 11,280 |

| 2024 | 11,257 | 11,329 | 11,369 |

202405-3565004, 202407-3567301

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Short-Term Bond Fund (Advisor Class) | 4.30% | 1.28% | 1.19% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 1.26 |

| Bloomberg 1-3 Year U.S. Government/Credit Bond Index (Strategy Benchmark) | 3.86 | 1.25 | 1.29 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $4,686,925 |

| Number of Portfolio Holdings | 881 |

| Investment Advisory Fees Paid (000s) | $12,879 |

| Portfolio Turnover Rate | 92.3% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 15.9% |

| AA Rated | 9.7 |

| A Rated | 20.7 |

| BBB Rated | 25.1 |

| BB Rated and Below | 0.1 |

| Not Rated | 2.7 |

| U.S. Government Agency Securities | 4.5 |

| U.S. Treasury Securities | 20.9 |

| Reserves | 0.4 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 19.9% |

| Federal National Mortgage Assn. | 2.6 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Government National Mortgage Assn. | 1.0 |

| AbbVie | 0.8 |

| Crown Castle | 0.8 |

| Federal Home Loan Mortgage | 0.8 |

| JPMorgan Chase | 0.8 |

| CarMax Auto Owner Trust | 0.8 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short-Term Bond Fund

Advisor Class (PASHX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

This annual shareholder report contains important information about Short-Term Bond Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short-Term Bond Fund - I Class | $35 | 0.34% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by a rally in rates and credit spreads near the end of 2023.

The fund’s overweight to investment-grade corporate bonds and corresponding underweight to U.S. Treasuries aided performance relative to its style-specific benchmark, the Bloomberg 1–3 Year U.S. Government/Credit Bond Index, as corporate credit spreads tightened. Out-of-benchmark allocations to residential mortgage-backed securities, asset-backed securities (ABS), and commercial mortgage-backed securities also contributed as the securitized sectors benefited from the rally in U.S. Treasury yields and strong investor demand.

Allocations along the yield curve slightly hindered relative performance. An overweight to the five-year key rate detracted as the yield on the five-year U.S. Treasury note ended the period higher.

The fund seeks to provide a high level of income with minimal fluctuation in principal value and liquidity by investing in a diversified portfolio. The fund’s allocation to investment-grade corporate bonds decreased over the reporting period but continued to represent its largest absolute and relative positions. We focused on additions in securitized sectors, notably ABS, and our allocation in those sectors ended higher.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. The use of derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives—specifically, interest rate derivatives—detracted from absolute performance.

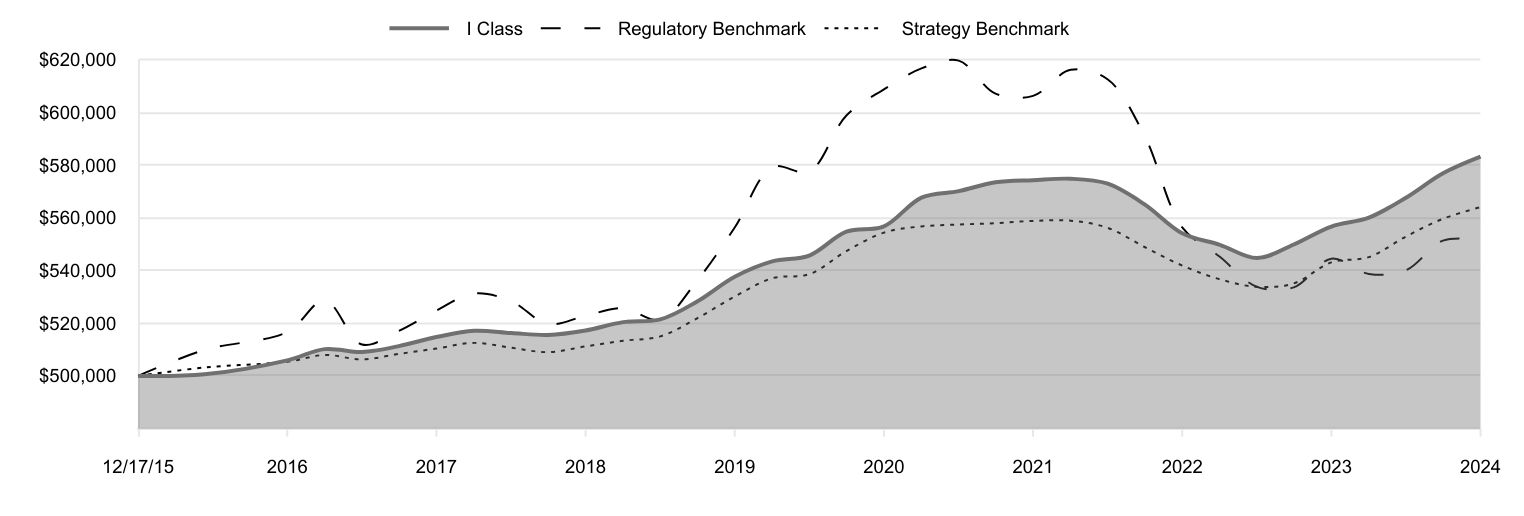

How has the fund performed?

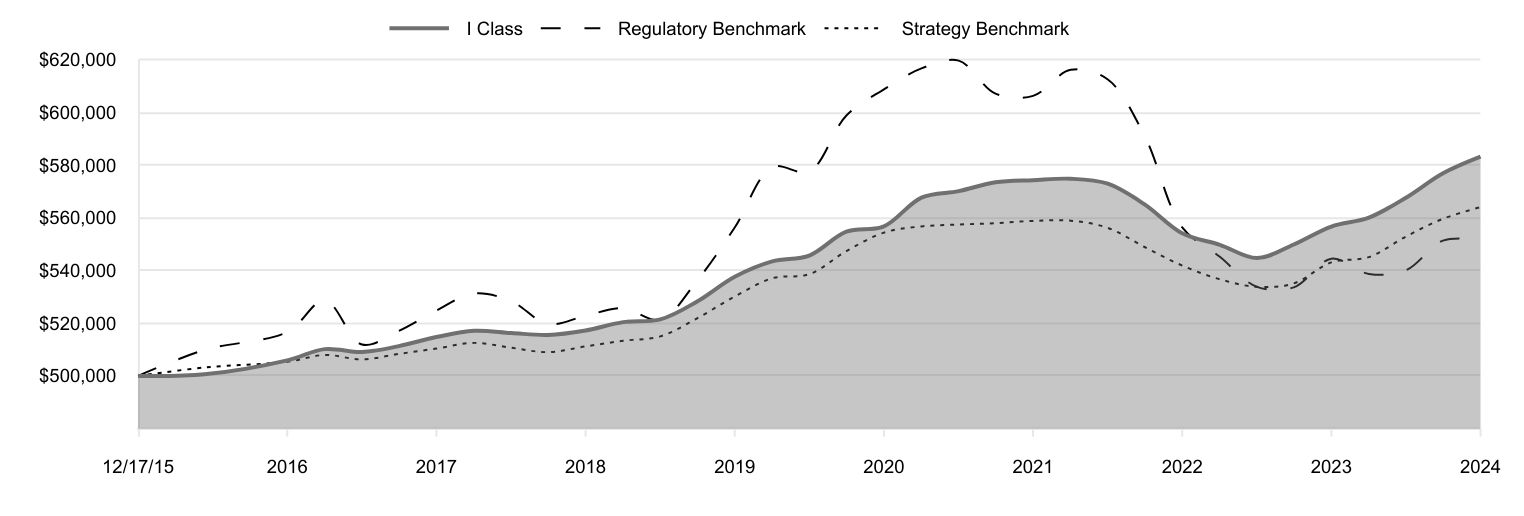

Cumulative Returns of a Hypothetical $500,000 Investment as of May 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/17/15 | 500,000 | 500,000 | 500,000 |

| 2/29/16 | 500,608 | 509,869 | 503,216 |

| 5/31/16 | 505,905 | 516,654 | 505,374 |

| 8/31/16 | 510,175 | 528,657 | 507,963 |

| 11/30/16 | 509,081 | 511,904 | 506,252 |

| 2/28/17 | 511,307 | 517,084 | 508,347 |

| 5/31/17 | 514,749 | 524,810 | 510,397 |

| 8/31/17 | 517,127 | 531,261 | 512,539 |

| 11/30/17 | 516,283 | 528,358 | 510,683 |

| 2/28/18 | 515,529 | 519,696 | 509,027 |

| 5/31/18 | 517,220 | 522,844 | 511,194 |

| 8/31/18 | 520,411 | 525,686 | 513,327 |

| 11/30/18 | 521,440 | 521,267 | 515,007 |

| 2/28/19 | 528,222 | 536,169 | 521,852 |

| 5/31/19 | 537,641 | 556,308 | 530,120 |

| 8/31/19 | 543,484 | 579,161 | 537,040 |

| 11/30/19 | 545,662 | 577,518 | 538,611 |

| 2/29/20 | 554,699 | 598,808 | 547,343 |

| 5/31/20 | 556,714 | 608,687 | 554,359 |

| 8/31/20 | 567,639 | 616,653 | 556,720 |

| 11/30/20 | 570,104 | 619,583 | 557,419 |

| 2/28/21 | 573,436 | 607,093 | 557,939 |

| 5/31/21 | 574,251 | 606,223 | 558,793 |

| 8/31/21 | 574,793 | 616,133 | 558,889 |

| 11/30/21 | 572,938 | 612,437 | 556,141 |

| 2/28/22 | 565,064 | 591,041 | 548,904 |

| 5/31/22 | 554,083 | 556,379 | 541,862 |

| 8/31/22 | 549,733 | 545,179 | 536,653 |

| 11/30/22 | 544,691 | 533,802 | 533,800 |

| 2/28/23 | 549,860 | 533,580 | 535,102 |

| 5/31/23 | 556,668 | 544,457 | 543,074 |

| 8/31/23 | 560,035 | 538,674 | 545,066 |

| 11/30/23 | 567,593 | 540,100 | 552,879 |

| 2/29/24 | 576,866 | 551,334 | 559,612 |

| 5/31/24 | 583,173 | 551,565 | 564,038 |

202405-3565004, 202407-3567301

Average Annual Total Returns

| 1 Year | 5 Years | Since Inception 12/17/2015 |

|---|

| Short-Term Bond Fund (I Class) | 4.76% | 1.64% | 1.84% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | | 1.17 |

| Bloomberg 1-3 Year U.S. Government/Credit Bond Index (Strategy Benchmark) | 3.86 | 1.25 | 1.44 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $4,686,925 |

| Number of Portfolio Holdings | 881 |

| Investment Advisory Fees Paid (000s) | $12,879 |

| Portfolio Turnover Rate | 92.3% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 15.9% |

| AA Rated | 9.7 |

| A Rated | 20.7 |

| BBB Rated | 25.1 |

| BB Rated and Below | 0.1 |

| Not Rated | 2.7 |

| U.S. Government Agency Securities | 4.5 |

| U.S. Treasury Securities | 20.9 |

| Reserves | 0.4 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 19.9% |

| Federal National Mortgage Assn. | 2.6 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Government National Mortgage Assn. | 1.0 |

| AbbVie | 0.8 |

| Crown Castle | 0.8 |

| Federal Home Loan Mortgage | 0.8 |

| JPMorgan Chase | 0.8 |

| CarMax Auto Owner Trust | 0.8 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short-Term Bond Fund

I Class (TBSIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | 2024 | | | | | | 2023 | | | |

Audit Fees | | $ | 33,841 | | | | | | | $ | 33,192 | |

Audit-Related Fees | | | - | | | | | | | | - | |

Tax Fees | | | - | | | | | | | | - | |

All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

PRWBX

Short-Term

Bond

Fund

–

.

PASHX

Short-Term

Bond

Fund–

.

Advisor Class

TBSIX

Short-Term

Bond

Fund–

.

I Class

TRZOX

Short-Term

Bond

Fund–

.

Z Class

T.

ROWE

PRICE

Short-Term

Bond

Fund

Go

Paperless

Going

paperless

offers

a

host

of

benefits,

which

include:

Timely

delivery

of

important

documents

Convenient

access

to

your

documents

anytime,

anywhere

Strong

security

protocols

to

safeguard

sensitive

data

Waive

your

account

service

fee

by

going

paperless.*

To

Enroll:

˃

If

you

invest

directly

with

T.

Rowe

Price,

go

to

troweprice.com/paperless

.

If

you

invest

through

a

financial

intermediary

such

as

an

investment

advisor,

a

bank,

or

a

brokerage

firm,

please

contact

that

organization

and

ask

if

it

can

provide

electronic

documentation.

Log

in

to

your

account

at

troweprice.com

for

more

information.

*

An

account

service

fee

will

be

charged

annually

for

each

T.

Rowe

Price

mutual

fund

account

unless

you

meet

criteria

for

a

fee

waiver.

Go

to

troweprice.com/personal-investing/

help/fees-and-minimums.html

to

learn

more

about

this

account

service

fee,

including

other

ways

to

waive

it.

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

4.50

$

4.61

$

4.84

$

4.76

$

4.71

Investment

activities

Net

investment

income

(1)(2)

0.16

0.11

0.06

0.08

0.11

Net

realized

and

unrealized

gain/loss

0.04

(0.11)

(0.23)

0.08

0.05

Total

from

investment

activities

0.20

—

(0.17)

0.16

0.16

Distributions

Net

investment

income

(0.16)

(0.11)

(0.06)

(0.06)

(0.11)

Tax

return

of

capital

—

—

—

(0.02)

—

Total

distributions

(0.16)

(0.11)

(0.06)

(0.08)

(0.11)

NET

ASSET

VALUE

End

of

period

$

4.54

$

4.50

$

4.61

$

4.84

$

4.76

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

4.63%

0.11%

(3.61)%

3.28%

3.45%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.47%

0.46%

0.44%

0.44%

0.44%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.47%

0.46%

0.44%

0.44%

0.44%

Net

investment

income

3.62%

2.51%

1.16%

1.56%

2.35%

Portfolio

turnover

rate

92.3%

50.6%

70.1%

49.4%

70.2%

Net

assets,

end

of

period

(in

millions)

$1,329

$1,524

$1,856

$3,588

$4,298

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

Advisor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

4.51

$

4.62

$

4.85

$

4.77

$

4.71

Investment

activities

Net

investment

income

(1)(2)

0.15

0.10

0.04

0.06

0.10

Net

realized

and

unrealized

gain/loss

0.04

(0.11)

(0.23)

0.08

0.06

Total

from

investment

activities

0.19

(0.01)

(3)

(0.19)

0.14

0.16

Distributions

Net

investment

income

(0.15)

(0.10)

(0.04)

(0.04)

(0.10)

Tax

return

of

capital

—

—

—

(0.02)

—

Total

distributions

(0.15)

(0.10)

(0.04)

(0.06)

(0.10)

NET

ASSET

VALUE

End

of

period

$

4.55

$

4.51

$

4.62

$

4.85

$

4.77

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(4)

4.30%

(0.11)%

(3.89)%

2.95%

3.38%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.78%

0.70%

0.74%

0.76%

0.73%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.78%

0.70%

0.74%

0.76%

0.73%

Net

investment

income

3.31%

2.26%

0.87%

1.24%

2.06%

Portfolio

turnover

rate

92.3%

50.6%

70.1%

49.4%

70.2%

Net

assets,

end

of

period

(in

thousands)

$6,947

$8,050

$9,706

$22,646

$27,362

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

results

of

operations

because

of

the

timing

of

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

NET

ASSET

VALUE

Beginning

of

period

$

4.51

$

4.61

$

4.84

$

4.77

$

4.72

Investment

activities

Net

investment

income

(1)(2)

0.17

0.12

0.06

0.08

0.12

Net

realized

and

unrealized

gain/loss

0.04

(0.10)

(0.23)

0.07

0.05

Total

from

investment

activities

0.21

0.02

(0.17)

0.15

0.17

Distributions

Net

investment

income

(0.17)

(0.12)

(0.06)

(0.06)

(0.12)

Tax

return

of

capital

—

—

—

(0.02)

—

Total

distributions

(0.17)

(0.12)

(0.06)

(0.08)

(0.12)

NET

ASSET

VALUE

End

of

period

$

4.55

$

4.51

$

4.61

$

4.84

$

4.77

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

5/31/24

5/31/23

5/31/22

5/31/21

5/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

4.76%

0.47%

(3.51)%

3.15%

3.55%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.34%

0.33%

0.34%

0.36%

0.35%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.34%

0.33%

0.34%

0.36%

0.35%

Net

investment

income

3.77%

2.66%

1.31%

1.56%

2.43%

Portfolio

turnover

rate

92.3%

50.6%

70.1%

49.4%

70.2%

Net

assets,

end

of

period

(in

millions)

$3,041

$2,971

$3,183

$2,228

$933

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

Z

Class

(1)

..

Year

..

..

Ended

.

2/22/21

(1)

Through

5/31/21

5/31/24

5/31/23

5/31/22

NET

ASSET

VALUE

Beginning

of

period

$

4.50

$

4.61

$

4.84

$

4.85

Investment

activities

Net

investment

income

(2)(3)

0.19

0.13

0.08

0.02

Net

realized

and

unrealized

gain/loss

0.04

(0.11)

(0.23)

(0.01)

(4)

Total

from

investment

activities

0.23

0.02

(0.15)

0.01

Distributions

Net

investment

income

(0.19)

(0.13)

(0.08)

—

(5)

Tax

return

of

capital

—

—

—

(0.02)

Total

distributions

(0.19)

(0.13)

(0.08)

(0.02)

NET

ASSET

VALUE

End

of

period

$

4.54

$

4.50

$

4.61

$

4.84

T.

ROWE

PRICE

Short-Term

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

2/22/21

(1)

Through

5/31/21

5/31/24

5/31/23

5/31/22

Ratios/Supplemental

Data

Total

return

(3)(6)

5.12%

0.58%

(3.18)%

0.26%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.31%

0.31%

0.32%

0.34%

(7)

Net

expenses

after

waivers/payments

by

Price

Associates

0.00%

0.00%

0.00%

0.00%

(7)

Net

investment

income

4.19%

2.95%

1.62%

1.69%

(7)

Portfolio

turnover

rate

92.3%

50.6%

70.1%

49.4%

Net

assets,

end

of

period

(in

thousands)

$310,323

$150,111

$201,043

$244,089

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(5)

Amounts

round

to

less

than

$0.01

per

share.

(6)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(7)

Annualized

T.

ROWE

PRICE

Short-Term

Bond

Fund

May

31,

2024

Par/Shares

$

Value

(Amounts

in

000s)

‡

ASSET-BACKED

SECURITIES

18.7%

Car

Loan

5.5%

Ally

Auto

Receivables

Trust

Series

2023-A,

Class

B

6.01%,

1/17/34 (1)

1,052

1,053

Ally

Auto

Receivables

Trust

Series

2023-A,

Class

C

6.08%,

1/17/34 (1)

1,947

1,957

AmeriCredit

Automobile

Receivables

Trust

Series

2020-1,

Class

D

1.80%,

12/18/25

13,509

13,440

AmeriCredit

Automobile

Receivables

Trust

Series

2021-1,

Class

C

0.89%,

10/19/26

6,385

6,213

AmeriCredit

Automobile

Receivables

Trust

Series

2021-1,

Class

D

1.21%,

12/18/26

3,945

3,766

AmeriCredit

Automobile

Receivables

Trust

Series

2021-2,

Class

D

1.29%,

6/18/27

8,770

8,168

Avis

Budget

Rental

Car

Funding

AESOP

Series

2019-2A,

Class

B

3.55%,

9/22/25 (1)

2,843

2,831

Avis

Budget

Rental

Car

Funding

AESOP

Series

2020-1A,

Class

A

2.33%,

8/20/26 (1)

3,950

3,818

Avis

Budget

Rental

Car

Funding

AESOP

Series

2022-5A,

Class

C

6.24%,

4/20/27 (1)

2,065

2,052

Avis

Budget

Rental

Car

Funding

AESOP

Series

2023-2A,

Class

C

6.18%,

10/20/27 (1)

1,455

1,441

Bayview

Opportunity

Master

Fund

VII

Series

2024-CAR1,

Class

A,

FRN

SOFR30A

+

1.10%,

6.424%,

12/26/31 (1)

2,961

2,970

CarMax

Auto

Owner

Trust

Series

2020-4,

Class

D

1.75%,

4/15/27

4,290

4,190

CarMax

Auto

Owner

Trust

Series

2023-3,

Class

B

5.47%,

2/15/29

1,595

1,593

CarMax

Auto

Owner

Trust

Series

2023-3,

Class

C

5.61%,

2/15/29

5,070

5,054

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

CarMax

Auto

Owner

Trust

Series

2023-3,

Class

D

6.44%,

12/16/30

2,515

2,536

CarMax

Auto

Owner

Trust

Series

2023-4,

Class

B

6.39%,

5/15/29

8,020

8,232

CarMax

Auto

Owner

Trust

Series

2023-4,

Class

C

6.58%,

5/15/29

8,020

8,218

CarMax

Auto

Owner

Trust

Series

2024-1,

Class

A4

4.94%,

8/15/29

1,845

1,829

CarMax

Auto

Owner

Trust

Series

2024-1,

Class

C

5.47%,

8/15/29

3,605

3,588

CarMax

Auto

Owner

Trust

Series

2024-2,

Class

D

6.42%,

10/15/30

400

403

Carvana

Auto

Receivables

Trust

Series

2022-N1,

Class

C

3.32%,

12/11/28 (1)

315

304

Carvana

Auto

Receivables

Trust

Series

2022-P1,

Class

A4

3.52%,

2/10/28

12,850

12,369

Enterprise

Fleet

Financing

Series

2023-2,

Class

A2

5.56%,

4/22/30 (1)

10,354

10,335

Exeter

Automobile

Receivables

Trust

Series

2022-4A,

Class

D

5.98%,

12/15/28

4,100

4,081

Exeter

Automobile

Receivables

Trust

Series

2022-5A,

Class

C

6.51%,

12/15/27

12,400

12,437

Exeter

Automobile

Receivables

Trust

Series

2023-1A,

Class

D

6.69%,

6/15/29

485

490

Ford

Credit

Auto

Lease

Trust

Series

2022-A,

Class

C

4.18%,

10/15/25

13,100

13,020

Ford

Credit

Auto

Lease

Trust

Series

2023-B,

Class

B

6.20%,

2/15/27

1,290

1,301

Ford

Credit

Auto

Lease

Trust

Series

2023-B,

Class

C

6.43%,

4/15/27

2,440

2,474

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

Ford

Credit

Auto

Owner

Trust

Series

2020-1,

Class

B

2.29%,

8/15/31 (1)

5,140

5,015

Ford

Credit

Auto

Owner

Trust

Series

2020-2,

Class

C

1.74%,

4/15/33 (1)

4,600

4,333

Ford

Credit

Auto

Owner

Trust

Series

2023-A,

Class

B

5.07%,

1/15/29

2,655

2,634

Ford

Credit

Floorplan

Master

Owner

Trust

Series

2023-1,

Class

C

5.75%,

5/15/28 (1)

2,985

2,963

Ford

Credit

Floorplan

Master

Owner

Trust

Series

2023-1,

Class

D

6.62%,

5/15/28 (1)

5,293

5,311

Ford

Credit

Floorplan

Master

Owner

Trust

Series

2024-1,

Class

B

5.48%,

4/15/29 (1)

3,375

3,372

GM

Financial

Automobile

Leasing

Trust

Series

2022-3,

Class

C

5.13%,

8/20/26

10,120

10,035

GM

Financial

Automobile

Leasing

Trust

Series

2023-1,

Class

C

5.76%,

1/20/27

2,405

2,404

GM

Financial

Automobile

Leasing

Trust

Series

2024-2,

Class

B

5.56%,

5/22/28

7,165

7,180

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series

2024-1,

Class

A

5.59%,

4/25/29 (1)

1,100

1,100

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series

2024-1,

Class

B

5.79%,

4/25/29 (1)

625

625

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series

2024-1,

Class

C

6.13%,

4/25/29 (1)

980

980

Navistar

Financial

Dealer

Note

Master

Owner

Trust

II

Series

2023-1,

Class

A

6.18%,

8/25/28 (1)

3,325

3,344

Santander

Bank

Series

2021-1A,

Class

B

1.833%,

12/15/31 (1)

247

244

Santander

Bank

Auto

Credit-Linked

Notes

Series

2022-B,

Class

A2

5.587%,

8/16/32 (1)

1,676

1,672

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

Santander

Bank

Auto

Credit-Linked

Notes

Series

2022-B,

Class

C

5.916%,

8/16/32 (1)

806

805

Santander

Bank

Auto

Credit-Linked

Notes

Series

2022-C,

Class

A2

6.024%,

12/15/32 (1)

1,272

1,277

Santander

Bank

Auto

Credit-Linked

Notes

Series

2022-C,

Class

B

6.451%,

12/15/32 (1)

1,140

1,142

Santander

Bank

Auto

Credit-Linked

Notes

Series

2023-B,

Class

A2

5.644%,

12/15/33 (1)

1,251

1,247

Santander

Bank

Auto

Credit-Linked

Notes

Series

2023-B,

Class

C

5.933%,

12/15/33 (1)

2,565

2,559

Santander

Bank

Auto

Credit-Linked

Notes

Series

2023-B,

Class

D

6.663%,

12/15/33 (1)

4,150

4,148

Santander

Consumer

Auto

Receivables

Trust

Series

2021-BA,

Class

C

3.09%,

3/15/29 (1)

2,860

2,779

Santander

Drive

Auto

Receivables

Trust

Series

2020-4,

Class

E

2.85%,

4/17/28 (1)

11,230

10,894

Santander

Drive

Auto

Receivables

Trust

Series

2021-4,

Class

D

1.67%,

10/15/27

9,480

9,082

Santander

Retail

Auto

Lease

Trust

Series

2021-C,

Class

C

1.11%,

3/20/26 (1)

84

83

SBNA

Auto

Lease

Trust

Series

2024-A,

Class

A3

5.39%,

11/20/26 (1)

1,795

1,791

SBNA

Auto

Lease

Trust

Series

2024-A,

Class

A4

5.24%,

1/22/29 (1)

1,715

1,708

SBNA

Auto

Lease

Trust

Series

2024-B,

Class

A4

5.55%,

12/20/28 (1)

6,630

6,643

SFS

Auto

Receivables

Securitization

Trust

Series

2024-1A,

Class

A3

4.95%,

5/21/29 (1)

2,000

1,981

SFS

Auto

Receivables

Securitization

Trust

Series

2024-1A,

Class

C

5.51%,

1/20/32 (1)

655

648

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

SFS

Auto

Receivables

Securitization

Trust

Series

2024-2A,

Class

A4

5.26%,

8/20/30 (1)

1,820

1,815

U.S.

Bank

Series

2023-1,

Class

B

6.789%,

8/25/32 (1)

314

315

Wheels

Fleet

Lease

Funding

1

Series

2024-1A,

Class

A1

5.49%,

2/18/39 (1)

7,930

7,916

World

Omni

Auto

Receivables

Trust

Series

2022-A,

Class

C

2.55%,

9/15/28

4,240

4,011

World

Omni

Select

Auto

Trust

Series

2020-A,

Class

C

1.25%,

10/15/26

3,591

3,556

255,775

Other

Asset-Backed

Securities

11.7%

AllegroX

Series

2018-3A,

Class

B1R,

CLO,

FRN

3M

TSFR

+

1.85%,

7.177%,

10/16/31 (1)

15,245

15,268

Amur

Equipment

Finance

Receivables

XIII

Series

2024-1A,

Class

A2

5.38%,

1/21/31 (1)

2,155

2,146

Amur

Equipment

Finance

Receivables

XIII

Series

2024-1A,

Class

C

5.55%,

1/21/31 (1)

1,515

1,506

Apidos

XVIII

Series

2018-18A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.15%,

6.475%,

10/22/30 (1)

9,313

9,317

Apidos

Xxv

Series

2016-25A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.15%,

6.475%,

10/20/31 (1)

11,389

11,402

Atrium

XIII

Series

13A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.15%,

6.476%,

11/21/30 (1)

11,301

11,306

Auxilior

Term

Funding

Series

2023-1A,

Class

A2

6.18%,

12/15/28 (1)

6,900

6,920

Ballyrock

Series

2021-1A,

Class

A1,

CLO,

FRN

3M

TSFR

+

1.322%,

6.65%,

4/15/34 (1)

2,280

2,285

Barings

Series

2018-4A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.80%,

7.129%,

10/15/30 (1)

9,285

9,308

BlueMountain

Series

2016-3A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.20%,

6.522%,

11/15/30 (1)

11,524

11,540

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

BRE

Grand

Islander

Timeshare

Issuer

Series

2019-A,

Class

A

3.28%,

9/26/33 (1)

1,128

1,084

Cedar

Funding

XIV

Series

2021-14A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.362%,

6.69%,

7/15/33 (1)

10,480

10,499

CIFC

Funding

Series

2021-4A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.312%,

6.64%,

7/15/33 (1)

15,375

15,403

CNH

Equipment

Trust

Series

2024-B,

Class

A3

5.19%,

9/17/29

2,980

2,979

CNH

Equipment

Trust

Series

2024-B,

Class

A4

5.23%,

11/17/31

2,630

2,632

CyrusOne

Data

Centers

Issuer

I

Series

2024-1A,

Class

A2

4.76%,

3/22/49 (1)

1,380

1,305

CyrusOne

Data

Centers

Issuer

I

Series

2024-2A,

Class

A2

4.50%,

5/20/49 (1)

11,760

10,826

Dell

Equipment

Finance

Trust

Series

2023-3,

Class

D

6.75%,

10/22/29 (1)

820

832

Dell

Equipment

Finance

Trust

Series

2024-1,

Class

A3

5.39%,

3/22/30 (1)

1,215

1,216

Dell

Equipment

Finance

Trust

Series

2024-1,

Class

D

6.12%,

9/23/30 (1)

1,185

1,186

DLLAA

Series

2023-1A,

Class

A3

5.64%,

2/22/28 (1)

4,710

4,728

DLLST

Series

2024-1A,

Class

A3

5.05%,

8/20/27 (1)

1,720

1,704

DLLST

Series

2024-1A,

Class

A4

4.93%,

4/22/30 (1)

465

459

Driven

Brands

Funding

Series

2018-1A,

Class

A2

4.739%,

4/20/48 (1)

10,498

10,337

Driven

Brands

Funding

Series

2019-1A,

Class

A2

4.641%,

4/20/49 (1)

1,587

1,540

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

Driven

Brands

Funding

Series

2019-2A,

Class

A2

3.981%,

10/20/49 (1)

2,989

2,838

Dryden

Series

2020-86A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.362%,

6.679%,

7/17/34 (1)

9,145

9,154

Elara

HGV

Timeshare

Issuer

Series

2019-A,

Class

A

2.61%,

1/25/34 (1)

1,638

1,564

Elara

HGV

Timeshare

Issuer

Series

2023-A,

Class

A

6.16%,

2/25/38 (1)

1,819

1,830

Elara

HGV

Timeshare

Issuer

Series

2023-A,

Class

C

7.30%,

2/25/38 (1)

2,469

2,489

FirstKey

Homes

Trust

Series

2020-SFR1,

Class

C

1.941%,

8/17/37 (1)

6,850

6,497

FirstKey

Homes

Trust

Series

2020-SFR2,

Class

D

1.968%,

10/19/37 (1)

7,535

7,078

FOCUS

Brands

Funding

Series

2017-1A,

Class

A2II

5.093%,

4/30/47 (1)

6,110

5,896

Hardee's

Funding

Series

2018-1A,

Class

A23

5.71%,

6/20/48 (1)

3,041

2,873

Hardee's

Funding

Series

2020-1A,

Class

A2

3.981%,

12/20/50 (1)

8,054

7,223

Hardee's

Funding

Series

2021-1A,

Class

A2

2.865%,

6/20/51 (1)

2,110

1,790

Hilton

Grand

Vacations

Trust

Series

2019-AA,

Class

A

2.34%,

7/25/33 (1)

445

426

Hilton

Grand

Vacations

Trust

Series

2019-AA,

Class

B

2.54%,

7/25/33 (1)

916

877

Hilton

Grand

Vacations

Trust

Series

2020-AA,

Class

A

2.74%,

2/25/39 (1)

649

617

Hilton

Grand

Vacations

Trust

Series

2022-1D,

Class

A

3.61%,

6/20/34 (1)

1,351

1,293

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares

$

Value

(Amounts

in

000s)

Hilton

Grand

Vacations

Trust

Series

2023-1A,

Class

B

6.11%,

1/25/38 (1)

7,375

7,391

Hilton

Grand

Vacations

Trust

Series

2023-1A,

Class

C

6.94%,

1/25/38 (1)

1,375

1,392

HPEFS

Equipment

Trust

Series

2021-2A,

Class

D

1.29%,

3/20/29 (1)

3,915

3,869

HPEFS

Equipment

Trust

Series

2023-1A,

Class

B

5.73%,

4/20/28 (1)

6,910

6,910

HPEFS

Equipment

Trust

Series

2023-1A,

Class

C

5.91%,

4/20/28 (1)

4,315

4,316

HPEFS

Equipment

Trust

Series

2023-2A,

Class

C

6.48%,

1/21/31 (1)

1,440

1,454

HPEFS

Equipment

Trust

Series

2023-2A,

Class

D

6.97%,

7/21/31 (1)

3,042

3,087

HPEFS

Equipment

Trust

Series

2024-1A,

Class

C

5.33%,

5/20/31 (1)

8,335

8,253

Madison

Park

Funding

XXIII

Series

2017-23A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.232%,

6.556%,

7/27/31 (1)

10,380

10,369

Madison

Park

Funding

XXIII

Series

2017-23A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.812%,

7.136%,

7/27/31 (1)

7,810

7,833

Madison

Park

Funding

XXIV

Series

2016-24A,

Class

CR2,

CLO,

FRN

3M

TSFR

+

2.05%,

7.377%,

10/20/29 (1)

5,240

5,240

Madison

Park

Funding

XXIX

Series

2018-29A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.80%,

7.127%,

10/18/30 (1)

12,700

12,684

Madison

Park

Funding

XXXIII

Series

2019-33A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.29%,

6.619%,

10/15/32 (1)

13,845

13,866

Madison

Park

Funding

XXXV

Series

2019-35A,

Class

CR,

CLO,

FRN

3M

TSFR

+

2.162%,

7.486%,

4/20/32 (1)

745

741

Magnetite

XXV

Series

2020-25A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.462%,

6.785%,

1/25/32 (1)

7,884

7,903

T.

ROWE

PRICE

Short-Term

Bond

Fund

Par/Shares