UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03894

T. Rowe Price Short-Term Bond Fund, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

May 31, 2024

Short Duration Income Fund

This annual shareholder report contains important information about Short Duration Income Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short Duration Income Fund - I Class | $31 | 0.30% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by declining interest rates and tighter credit spreads near the end of 2023. Corporate bonds and securitized credit generated positive excess returns during the rally and the broader reporting period.

The fund’s out-of-benchmark allocations to emerging markets debt and securitized sectors—asset-backed securities (ABS), collateralized loan obligations (CLOs), commercial mortgage-backed securities, and residential mortgage-backed securities—aided relative performance versus its style-specific benchmark, the Bloomberg 1–3 Year U.S. Corporate Bond Index. Security selection among investment-grade and high yield corporate bonds further added to relative gains. Additionally, the portfolio’s slightly shorter-than-benchmark average duration position helped relative performance as U.S. Treasury note and bond yields ended the period higher.

Out-of-benchmark holdings of U.S. Treasuries hindered performance relative to the fund’s style-specific benchmark, as corporate credit spreads tightened.

The fund’s allocation to corporate debt decreased but continued to represent the portfolio’s largest absolute position. As corporate bond valuations tightened early in the period, we focused on additions in ABS. We also added CLOs during the period as spreads tightened elsewhere in fixed income markets.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. Derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives, particularly Treasury futures, detracted modestly from absolute performance.

How has the fund performed?

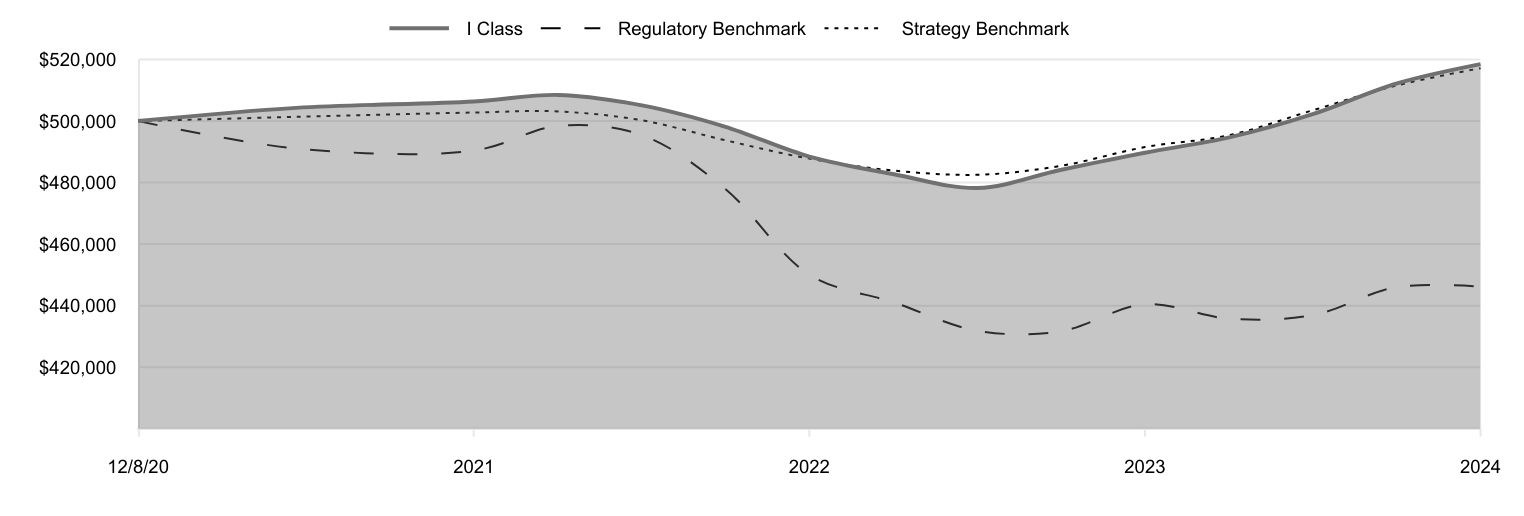

Cumulative Returns of a Hypothetical $500,000 Investment as of May 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/8/20 | 500,000 | 500,000 | 500,000 |

| 2/28/21 | 504,292 | 491,107 | 501,375 |

| 5/31/21 | 506,334 | 490,403 | 502,782 |

| 8/31/21 | 508,512 | 498,419 | 503,129 |

| 11/30/21 | 505,104 | 495,429 | 500,247 |

| 2/28/22 | 498,217 | 478,121 | 493,805 |

| 5/31/22 | 488,450 | 450,082 | 487,789 |

| 8/31/22 | 482,725 | 441,022 | 483,898 |

| 11/30/22 | 478,221 | 431,818 | 482,548 |

| 2/28/23 | 484,094 | 431,639 | 485,408 |

| 5/31/23 | 489,706 | 440,437 | 491,543 |

| 8/31/23 | 494,685 | 435,759 | 495,415 |

| 11/30/23 | 502,230 | 436,913 | 503,510 |

| 2/29/24 | 512,176 | 446,000 | 511,526 |

| 5/31/24 | 518,523 | 446,187 | 517,174 |

202405-3565004, 202407-3567307

Average Annual Total Returns

| 1 Year | Since Inception 12/8/2020 |

|---|

| Short Duration Income Fund (I Class) | 5.88% | 1.05% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | |

| Bloomberg 1-3 Year U.S. Corporate Bond Index (Strategy Benchmark) | 5.21 | 0.98 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $54,942 |

| Number of Portfolio Holdings | 381 |

| Investment Advisory Fees Paid (000s) | $(165) |

| Portfolio Turnover Rate | 88.7% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 18.5% |

| AA Rated | 10.2 |

| A Rated | 17.9 |

| BBB Rated | 23.0 |

| BB Rated and Below | 6.9 |

| Not Rated | 5.7 |

| U.S. Treasury Securities | 14.3 |

| U.S. Government Agency Securities | 4.1 |

| Reserves | -0.6 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 13.3% |

| Federal National Mortgage Assn. | 2.0 |

| Federal Home Loan Banks | 1.2 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Octane Receivables Trust | 1.0 |

| UMBS | 1.0 |

| Crown Castle | 1.0 |

| VF | 0.9 |

| Ford Credit Auto Lease Trust | 0.9 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short Duration Income Fund

I Class (TSIDX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

May 31, 2024

Short Duration Income Fund

This annual shareholder report contains important information about Short Duration Income Fund (the "fund") for the period of June 1, 2023 to May 31, 2024. You can find the fund’s prospectus, financial information on Form N-CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1-800-638-5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Short Duration Income Fund - Investor Class | $42 | 0.41% |

What drove fund performance during the past 12 months?

The shorter-maturity U.S. investment-grade bond market generated positive returns over the 12-month period ended May 31, 2024, largely lifted by declining interest rates and tighter credit spreads near the end of 2023. Corporate bonds and securitized credit generated positive excess returns during the rally and the broader reporting period.

The fund’s out-of-benchmark allocations to emerging markets debt and securitized sectors—asset-backed securities (ABS), collateralized loan obligations (CLOs), commercial mortgage-backed securities, and residential mortgage-backed securities—aided relative performance versus its style-specific benchmark, the Bloomberg 1–3 Year U.S. Corporate Bond Index. Security selection among investment-grade and high yield corporate bonds further added to relative gains. Additionally, the portfolio’s slightly shorter-than-benchmark average duration position helped relative performance as U.S. Treasury note and bond yields ended the period higher.

Out-of-benchmark holdings of U.S. Treasuries hindered performance relative to the fund’s style-specific benchmark, as corporate credit spreads tightened.

The fund’s allocation to corporate debt decreased but continued to represent the portfolio’s largest absolute position. As corporate bond valuations tightened early in the period, we focused on additions in ABS. We also added CLOs during the period as spreads tightened elsewhere in fixed income markets.

While we are primarily a cash bond manager, we occasionally employ the limited use of derivatives in our strategy for hedging purposes. Derivatives may include futures and options, as well as credit default and interest rate swaps. During the reporting period, our use of derivatives, particularly Treasury futures, detracted modestly from absolute performance.

How has the fund performed?

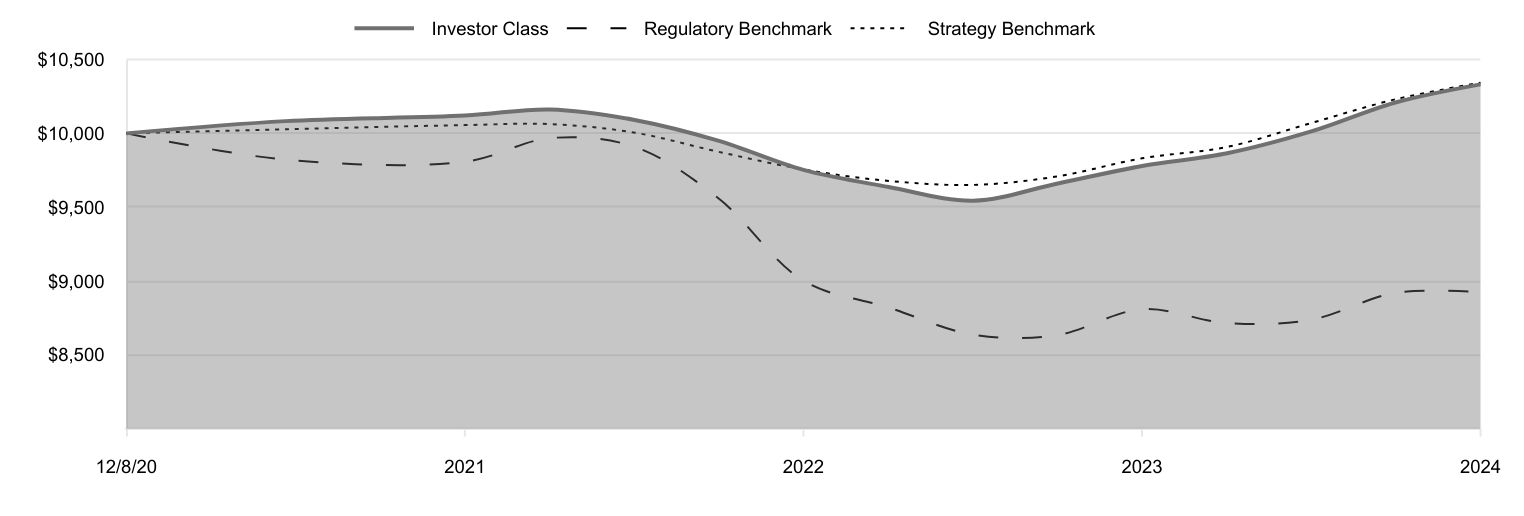

Cumulative Returns of a Hypothetical $10,000 Investment as of May 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 12/8/20 | 10,000 | 10,000 | 10,000 |

| 2/28/21 | 10,083 | 9,822 | 10,028 |

| 5/31/21 | 10,121 | 9,808 | 10,056 |

| 8/31/21 | 10,162 | 9,968 | 10,063 |

| 11/30/21 | 10,091 | 9,909 | 10,005 |

| 2/28/22 | 9,951 | 9,562 | 9,876 |

| 5/31/22 | 9,753 | 9,002 | 9,756 |

| 8/31/22 | 9,637 | 8,820 | 9,678 |

| 11/30/22 | 9,544 | 8,636 | 9,651 |

| 2/28/23 | 9,659 | 8,633 | 9,708 |

| 5/31/23 | 9,779 | 8,809 | 9,831 |

| 8/31/23 | 9,865 | 8,715 | 9,908 |

| 11/30/23 | 10,013 | 8,738 | 10,070 |

| 2/29/24 | 10,209 | 8,920 | 10,231 |

| 5/31/24 | 10,332 | 8,924 | 10,343 |

202405-3565004, 202407-3567307

Average Annual Total Returns

| 1 Year | Since Inception 12/8/2020 |

|---|

| Short Duration Income Fund (Investor Class) | 5.66% | 0.95% |

| Bloomberg U.S. Aggregate Bond Index (Regulatory Benchmark) | 1.31 | |

| Bloomberg 1-3 Year U.S. Corporate Bond Index (Strategy Benchmark) | 5.21 | 0.98 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any. Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares. The fund’s past performance is not a good predictor of the fund’s future performance. Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

| Total Net Assets (000s) | $54,942 |

| Number of Portfolio Holdings | 381 |

| Investment Advisory Fees Paid (000s) | $(165) |

| Portfolio Turnover Rate | 88.7% |

What did the fund invest in?

Credit Quality Allocation* (as a % of Net Assets)

| AAA Rated | 18.5% |

| AA Rated | 10.2 |

| A Rated | 17.9 |

| BBB Rated | 23.0 |

| BB Rated and Below | 6.9 |

| Not Rated | 5.7 |

| U.S. Treasury Securities | 14.3 |

| U.S. Government Agency Securities | 4.1 |

| Reserves | -0.6 |

*Credit ratings for the securities held in the Fund are provided by Moody’s, Standard & Poor’s, and Fitch and are converted to the Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of D represents the lowest rated securities. If the ratings agencies differ, the highest rating is applied to the security. If a rating is not available, the security is classified as Not Rated. The rating of the underlying investment vehicle is used to determine the creditworthiness of credit default swaps and sovereign securities. The Fund is not rated by any agency.

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes | 13.3% |

| Federal National Mortgage Assn. | 2.0 |

| Federal Home Loan Banks | 1.2 |

| U.S. Treasury Inflation-Indexed Notes | 1.0 |

| Octane Receivables Trust | 1.0 |

| UMBS | 1.0 |

| Crown Castle | 1.0 |

| VF | 0.9 |

| Ford Credit Auto Lease Trust | 0.9 |

| Verus Securitization Trust | 0.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Short Duration Income Fund

Investor Class (TSDLX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | | | 2024 | | | 2023 | |

| | Audit Fees | | | $33,841 | | | | $33,192 | |

| | Audit-Related Fees | | | - | | | | - | |

| | Tax Fees | | | - | | | | - | |

| | All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,230,000 and $1,521,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TSDLX

Short

Duration

Income

Fund

–

.

TSIDX

Short

Duration

Income

Fund–

.

I Class

T.

ROWE

PRICE

Short

Duration

Income

Fund

Go

Paperless

Going

paperless

offers

a

host

of

benefits,

which

include:

Timely

delivery

of

important

documents

Convenient

access

to

your

documents

anytime,

anywhere

Strong

security

protocols

to

safeguard

sensitive

data

Waive

your

account

service

fee

by

going

paperless.*

To

Enroll:

˃

If

you

invest

directly

with

T.

Rowe

Price,

go

to

troweprice.com/paperless

.

If

you

invest

through

a

financial

intermediary

such

as

an

investment

advisor,

a

bank,

or

a

brokerage

firm,

please

contact

that

organization

and

ask

if

it

can

provide

electronic

documentation.

Log

in

to

your

account

at

troweprice.com

for

more

information.

*

An

account

service

fee

will

be

charged

annually

for

each

T.

Rowe

Price

mutual

fund

account

unless

you

meet

criteria

for

a

fee

waiver.

Go

to

troweprice.com/personal-investing/

help/fees-and-minimums.html

to

learn

more

about

this

account

service

fee,

including

other

ways

to

waive

it.

T.

ROWE

PRICE

Short

Duration

Income

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

(1)

..

Year

..

..

Ended

.

12/8/20

(1)

Through

5/31/21

5/31/24

5/31/23

5/31/22

NET

ASSET

VALUE

Beginning

of

period

$

9.23

$

9.51

$

10.05

$

10.00

Investment

activities

Net

investment

income

(2)(3)

0.44

0.31

0.17

0.07

Net

realized

and

unrealized

gain/loss

0.07

(0.29)

(0.53)

0.05

Total

from

investment

activities

0.51

0.02

(0.36)

0.12

Distributions

Net

investment

income

(0.44)

(0.30)

(0.17)

(0.07)

Net

realized

gain

—

—

(0.01)

—

Total

distributions

(0.44)

(0.30)

(0.18)

(0.07)

NET

ASSET

VALUE

End

of

period

$

9.30

$

9.23

$

9.51

$

10.05

Ratios/Supplemental

Data

Total

return

(3)(4)

5.66%

0.26%

(3.64)%

1.21%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.01%

1.05%

0.97%

1.32%

(5)

Net

expenses

after

waivers/payments

by

Price

Associates

0.41%

0.40%

0.40%

0.40%

(5)

Net

investment

income

4.76%

3.30%

1.72%

1.47%

(5)

Portfolio

turnover

rate

88.7%

96.9%

60.1%

24.7%

Net

assets,

end

of

period

(in

thousands)

$33,978

$29,420

$31,100

$42,912

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Short

Duration

Income

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

(1)

..

Year

..

..

Ended

.

12/8/20

(1)

Through

5/31/21

5/31/24

5/31/23

5/31/22

NET

ASSET

VALUE

Beginning

of

period

$

9.22

$

9.51

$

10.05

$

10.00

Investment

activities

Net

investment

income

(2)(3)

0.45

0.32

0.19

0.07

Net

realized

and

unrealized

gain/loss

0.08

(0.30)

(0.54)

0.06

Total

from

investment

activities

0.53

0.02

(0.35)

0.13

Distributions

Net

investment

income

(0.45)

(0.31)

(0.18)

(0.08)

Net

realized

gain

—

—

(0.01)

—

Total

distributions

(0.45)

(0.31)

(0.19)

(0.08)

NET

ASSET

VALUE

End

of

period

$

9.30

$

9.22

$

9.51

$

10.05

Ratios/Supplemental

Data

Total

return

(3)(4)

5.88%

0.26%

(3.53)%

1.27%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.94%

0.97%

0.93%

1.49%

(5)

Net

expenses

after

waivers/payments

by

Price

Associates

0.30%

0.30%

0.29%

0.29%

(5)

Net

investment

income

4.86%

3.41%

1.98%

1.57%

(5)

Portfolio

turnover

rate

88.7%

96.9%

60.1%

24.7%

Net

assets,

end

of

period

(in

thousands)

$20,964

$18,914

$17,250

$251

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Short

Duration

Income

Fund

May

31,

2024

Par/Shares

$

Value

(Amounts

in

000s)

‡

ASSET-BACKED

SECURITIES

28.5%

Car

Loan

9.1%

Ally

Auto

Receivables

Trust

Series 2023-A,

Class

B

6.01%,

1/17/34 (1)

81

81

AmeriCredit

Automobile

Receivables

Trust

Series 2020-2,

Class

D

2.13%,

3/18/26

120

118

Avis

Budget

Rental

Car

Funding

AESOP

Series 2019-3A,

Class

B

2.65%,

3/20/26 (1)

150

147

Avis

Budget

Rental

Car

Funding

AESOP

Series 2020-1A,

Class

B

2.68%,

8/20/26 (1)

100

96

Avis

Budget

Rental

Car

Funding

AESOP

Series 2022-5A,

Class

C

6.24%,

4/20/27 (1)

100

99

Avis

Budget

Rental

Car

Funding

AESOP

Series 2023-2A,

Class

C

6.18%,

10/20/27 (1)

100

99

Bayview

Opportunity

Master

Fund

VII

Series 2024-CAR1,

Class

C,

FRN

SOFR30A

+

1.50%,

6.824%,

12/26/31 (1)

233

233

CarMax

Auto

Owner

Trust

Series 2020-3,

Class

C

1.69%,

4/15/26

50

50

CarMax

Auto

Owner

Trust

Series 2022-4,

Class

D

8.08%,

4/16/29

200

208

CarMax

Auto

Owner

Trust

Series 2023-1,

Class

A2A

5.23%,

1/15/26

52

52

CarMax

Auto

Owner

Trust

Series 2023-2,

Class

D

6.55%,

10/15/29

135

137

Enterprise

Fleet

Financing

Series 2021-2,

Class

A2

0.48%,

5/20/27 (1)

7

6

Enterprise

Fleet

Financing

Series 2021-3,

Class

A2

0.77%,

8/20/27 (1)

10

10

Enterprise

Fleet

Financing

Series 2022-2,

Class

A2

4.65%,

5/21/29 (1)

30

30

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Enterprise

Fleet

Financing

Series 2023-2,

Class

A2

5.56%,

4/22/30 (1)

221

221

Exeter

Automobile

Receivables

Trust

Series 2022-1A,

Class

C

2.56%,

6/15/28

177

175

Exeter

Automobile

Receivables

Trust

Series 2022-4A,

Class

D

5.98%,

12/15/28

45

45

Exeter

Automobile

Receivables

Trust

Series 2023-1A,

Class

A3

5.58%,

4/15/26

25

25

Ford

Credit

Auto

Lease

Trust

Series 2022-A,

Class

C

4.18%,

10/15/25

255

253

Ford

Credit

Auto

Lease

Trust

Series 2023-A,

Class

C

5.54%,

12/15/26

230

229

Ford

Credit

Floorplan

Master

Owner

Trust

Series 2023-1,

Class

D

6.62%,

5/15/28 (1)

145

145

Ford

Credit

Floorplan

Master

Owner

Trust

Series 2024-1,

Class

B

5.48%,

4/15/29 (1)

100

100

GM

Financial

Automobile

Leasing

Trust

Series 2022-2,

Class

C

4.33%,

5/20/26

85

84

GM

Financial

Automobile

Leasing

Trust

Series 2022-3,

Class

C

5.13%,

8/20/26

245

243

GM

Financial

Automobile

Leasing

Trust

Series 2024-2,

Class

B

5.56%,

5/22/28

125

125

GM

Financial

Consumer

Automobile

Receivables

Trust

Series 2020-3,

Class

C

1.37%,

1/16/26

30

30

GM

Financial

Consumer

Automobile

Receivables

Trust

Series 2020-4,

Class

C

1.05%,

5/18/26

50

49

GM

Financial

Consumer

Automobile

Receivables

Trust

Series 2023-1,

Class

B

5.03%,

9/18/28

35

35

GM

Financial

Consumer

Automobile

Receivables

Trust

Series 2023-3,

Class

C

5.92%,

2/16/29

45

46

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

GMF

Floorplan

Owner

Revolving

Trust

Series 2023-1,

Class

B

5.73%,

6/15/28 (1)

230

230

JPMorgan

Chase

Bank

Series 2021-2,

Class

D

1.138%,

12/26/28 (1)

39

38

Navistar

Financial

Dealer

Note

Master

Owner

Trust

Series 2024-1,

Class

C

6.13%,

4/25/29 (1)

35

35

Navistar

Financial

Dealer

Note

Master

Owner

Trust

II

Series 2023-1,

Class

A

6.18%,

8/25/28 (1)

173

174

Nissan

Auto

Lease

Trust

Series 2023-A,

Class

A2A

5.10%,

3/17/25

26

26

Santander

Bank

-

SBCLN

Series 2021-1A,

Class

C

3.268%,

12/15/31 (1)

67

66

Santander

Bank

Auto

Credit-Linked

Notes

Series 2023-B,

Class

D

6.663%,

12/15/33 (1)

250

250

Santander

Consumer

Auto

Receivables

Trust

Series 2021-AA,

Class

D

1.57%,

1/15/27 (1)

100

95

Santander

Consumer

Auto

Receivables

Trust

Series 2021-CA,

Class

C

2.97%,

6/15/28 (1)

118

115

Santander

Retail

Auto

Lease

Trust

Series 2021-C,

Class

D

1.39%,

8/20/26 (1)

350

349

Santander

Retail

Auto

Lease

Trust

Series 2022-B,

Class

A3

3.28%,

11/20/25 (1)

43

43

Santander

Retail

Auto

Lease

Trust

Series 2022-B,

Class

B

3.85%,

3/22/27 (1)

30

30

U.S.

Bank

Series 2023-1,

Class

B

6.789%,

8/25/32 (1)

194

195

Wheels

Fleet

Lease

Funding

1

Series 2024-1A,

Class

A1

5.49%,

2/18/39 (1)

100

100

World

Omni

Auto

Receivables

Trust

Series 2020-C,

Class

C

1.39%,

5/17/27

85

84

5,001

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Other

Asset-Backed

Securities

18.4%

Allegro

IX

Series 2018-3A,

Class

B1R,

CLO,

FRN

3M

TSFR

+

1.85%,

7.177%,

10/16/31 (1)

250

250

Amur

Equipment

Finance

Receivables

IX

Series 2021-1A,

Class

D

2.30%,

11/22/27 (1)

260

254

Amur

Equipment

Finance

Receivables

X

Series 2022-1A,

Class

C

2.37%,

4/20/28 (1)

150

143

Amur

Equipment

Finance

Receivables

XI

Series 2022-2A,

Class

A2

5.30%,

6/21/28 (1)

59

59

Amur

Equipment

Finance

Receivables

XIII

Series 2024-1A,

Class

B

5.37%,

1/21/31 (1)

100

99

Apidos

Xxv

Series 2016-25A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.15%,

6.475%,

10/20/31 (1)

234

235

Barings

Series 2018-4A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.80%,

7.129%,

10/15/30 (1)

250

251

BlueMountain

Series 2016-3A,

Class

A1R2,

CLO,

FRN

3M

TSFR

+

1.20%,

6.522%,

11/15/30 (1)

232

232

CIFC

Funding

Series 2021-4A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.312%,

6.64%,

7/15/33 (1)

250

250

CyrusOne

Data

Centers

Issuer

I

Series 2024-1A,

Class

A2

4.76%,

3/22/49 (1)

30

28

CyrusOne

Data

Centers

Issuer

I

Series 2024-2A,

Class

A2

4.50%,

5/20/49 (1)

135

124

DB

Master

Finance

Series 2019-1A,

Class

A2II

4.021%,

5/20/49 (1)

90

87

Dell

Equipment

Finance

Trust

Series 2024-1,

Class

D

6.12%,

9/23/30 (1)

100

100

DLLAD

Series 2023-1A,

Class

A2

5.19%,

4/20/26 (1)

66

66

DLLAD

Series 2023-1A,

Class

A3

4.79%,

1/20/28 (1)

52

51

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Driven

Brands

Funding

Series 2019-2A,

Class

A2

3.981%,

10/20/49 (1)

96

91

Elara

HGV

Timeshare

Issuer

Series 2019-A,

Class

A

2.61%,

1/25/34 (1)

48

46

FirstKey

Homes

Trust

Series 2020-SFR2,

Class

D

1.968%,

10/19/37 (1)

225

211

FOCUS

Brands

Funding

Series 2017-1A,

Class

A2II

5.093%,

4/30/47 (1)

93

90

Hardee's

Funding

Series 2020-1A,

Class

A2

3.981%,

12/20/50 (1)

242

217

Hilton

Grand

Vacations

Trust

Series 2018-AA,

Class

C

4.00%,

2/25/32 (1)

72

70

Hilton

Grand

Vacations

Trust

Series 2019-AA,

Class

B

2.54%,

7/25/33 (1)

61

58

Hilton

Grand

Vacations

Trust

Series 2023-1A,

Class

C

6.94%,

1/25/38 (1)

77

78

Home

Partners

of

America

Trust

Series 2022-1,

Class

D

4.73%,

4/17/39 (1)

96

90

HPEFS

Equipment

Trust

Series 2023-2A,

Class

D

6.97%,

7/21/31 (1)

100

101

Madison

Park

Funding

XXIV

Series 2016-24A,

Class

CR2,

CLO,

FRN

3M

TSFR

+

2.05%,

7.377%,

10/20/29 (1)

250

250

Madison

Park

Funding

XXIX

Series 2018-29A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.80%,

7.127%,

10/18/30 (1)

250

250

Marble

Point

XII

Series 2018-1A,

Class

A,

CLO,

FRN

3M

TSFR

+

1.272%,

6.599%,

7/16/31 (1)

205

205

Marble

Point

XIV

Series 2018-2A,

Class

A12R,

CLO,

FRN

3M

TSFR

+

1.20%,

6.525%,

1/20/32 (1)

246

247

MMAF

Equipment

Finance

Series 2020-A,

Class

A3

0.97%,

4/9/27 (1)

93

89

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

MVW

Series 2021-1WA,

Class

C

1.94%,

1/22/41 (1)

38

35

MVW

Series 2021-2A,

Class

C

2.23%,

5/20/39 (1)

97

89

MVW

Series 2023-1A,

Class

C

6.54%,

10/20/40 (1)

146

145

Northwoods

Capital

XIV-B

Series 2018-14BA,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.25%,

6.574%,

11/13/31 (1)

250

251

Oaktree

Series 2022-2A,

Class

A1R,

CLO,

FRN

3M

TSFR

+

1.55%,

6.879%,

7/15/33 (1)

250

250

OCP

Series 2014-7A,

Class

A1RR,

CLO,

FRN

3M

TSFR

+

1.382%,

6.706%,

7/20/29 (1)

126

126

OCP

Series 2017-13A,

Class

A2R,

CLO,

FRN

3M

TSFR

+

1.812%,

7.14%,

7/15/30 (1)

250

250

Octagon

Investment

Partners

29

Series 2016-1A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.442%,

6.765%,

1/24/33 (1)

250

250

Octagon

Investment

Partners

39

Series 2018-3A,

Class

AR,

CLO,

FRN

3M

TSFR

+

1.15%,

6.475%,

10/20/30 (1)

229

230

Octane

Receivables

Trust

Series 2021-2A,

Class

A

1.21%,

9/20/28 (1)

17

17

Octane

Receivables

Trust

Series 2022-1A,

Class

B

4.90%,

5/22/28 (1)

150

148

Octane

Receivables

Trust

Series 2022-2A,

Class

A

5.11%,

2/22/28 (1)

37

37

Octane

Receivables

Trust

Series 2022-2A,

Class

C

6.29%,

7/20/28 (1)

200

200

Octane

Receivables

Trust

Series 2023-1A,

Class

A

5.87%,

5/21/29 (1)

48

48

Octane

Receivables

Trust

Series 2024-1A,

Class

A2

5.68%,

5/20/30 (1)

100

100

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

OZLM

Funding

II

Series 2012-2A,

Class

A1A2,

CLO,

FRN

3M

TSFR

+

1.20%,

6.53%,

7/30/31 (1)

214

215

Planet

Fitness

Master

Issuer

Series 2018-1A,

Class

A2II

4.666%,

9/5/48 (1)

194

190

Post

Road

Equipment

Finance

Series 2024-1A,

Class

C

5.81%,

10/15/30 (1)

100

100

Progress

Residential

Trust

Series 2020-SFR2,

Class

A

2.078%,

6/17/37 (1)

199

192

Romark

Series 2018-2A,

Class

A2R,

CLO,

FRN

3M

TSFR

+

1.65%,

7/25/31 (1)(2)

250

250

Sabey

Data

Center

Issuer

Series 2020-1,

Class

A2

3.812%,

4/20/45 (1)

35

34

Sabey

Data

Center

Issuer

Series 2021-1,

Class

A2

1.881%,

6/20/46 (1)

100

91

SCF

Equipment

Leasing

Series 2023-1A,

Class

A3

6.17%,

5/20/32 (1)

235

239

SEB

Funding

Series 2024-1A,

Class

A2

7.386%,

4/30/54 (1)

85

85

Sierra

Timeshare

Receivables

Funding

Series 2019-3A,

Class

A

2.34%,

8/20/36 (1)

13

12

Sierra

Timeshare

Receivables

Funding

Series 2020-2A,

Class

B

2.32%,

7/20/37 (1)

64

62

Sierra

Timeshare

Receivables

Funding

Series 2021-1A,

Class

B

1.34%,

11/20/37 (1)

59

56

Sierra

Timeshare

Receivables

Funding

Series 2021-1A,

Class

C

1.79%,

11/20/37 (1)

20

19

Sierra

Timeshare

Receivables

Funding

Series 2021-2A,

Class

A

1.35%,

9/20/38 (1)

62

59

Symphony

Static

I

Series 2021-1A,

Class

C,

CLO,

FRN

3M

TSFR

+

2.112%,

7.435%,

10/25/29 (1)

250

250

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Symphony

XXIII

Series 2020-23A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.862%,

7.19%,

1/15/34 (1)

250

250

TCI-Flatiron

Series 2018-1A,

Class

BR,

CLO,

FRN

3M

TSFR

+

1.662%,

6.986%,

1/29/32 (1)

250

250

THL

Credit

Wind

River

Series 2015-1A,

Class

A1R3,

CLO,

FRN

3M

TSFR

+

1.20%,

6.525%,

10/20/30 (1)

201

202

TIAA

Series 2016-1A,

Class

ARR,

CLO,

FRN

3M

TSFR

+

1.25%,

6.575%,

7/20/31 (1)

250

251

Tricon

Residential

Trust

Series 2024-SFR2,

Class

A

4.75%,

6/17/40 (1)

100

97

Trinitas

VI

Series 2017-6A,

Class

ARRR,

CLO,

FRN

3M

TSFR

+

1.33%,

1/25/34 (1)(2)

250

250

Verdant

Receivables

Series 2023-1A,

Class

A2

6.24%,

1/13/31 (1)

93

93

Verdant

Receivables

Series 2024-1A,

Class

A2

5.68%,

12/12/31 (1)

100

100

Voya

Series 2018-3A,

Class

BR2,

CLO,

FRN

3M

TSFR

+

1.80%,

7.129%,

10/15/31 (1)

250

250

10,095

Student

Loan

1.0%

Navient

Private

Education

Loan

Trust

Series 2020-A,

Class

A2A

2.46%,

11/15/68 (1)

52

49

Navient

Private

Education

Refi

Loan

Trust

Series 2019-A,

Class

A2A

3.42%,

1/15/43 (1)

26

25

Navient

Private

Education

Refi

Loan

Trust

Series 2019-D,

Class

A2A

3.01%,

12/15/59 (1)

69

66

Navient

Private

Education

Refi

Loan

Trust

Series 2019-GA,

Class

A

2.40%,

10/15/68 (1)

47

44

SMB

Private

Education

Loan

Trust

Series 2016-C,

Class

A2A

2.34%,

9/15/34 (1)

6

6

SMB

Private

Education

Loan

Trust

Series 2017-B,

Class

B

3.50%,

12/16/41 (1)

150

140

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

SMB

Private

Education

Loan

Trust

Series 2020-A,

Class

A2A

2.23%,

9/15/37 (1)

96

90

SMB

Private

Education

Loan

Trust

Series 2021-A,

Class

A2A1,

FRN

1M

TSFR

+

0.844%,

6.161%,

1/15/53 (1)

142

140

560

Total

Asset-Backed

Securities

(Cost

$15,680)

15,656

BANK

LOANS

1.1%

(3)

Capital

Goods

0.4%

LTI

Holdings,

FRN,

1M

TSFR

+

3.50%,

8.944%,

9/6/25

212

208

208

Communications

0.3%

Altice

France,

FRN,

1M

USD

LIBOR

+

4.00%,

9.584%,

8/14/26

80

64

Clear

Channel

International,

7.50%,

4/1/27 (4)

20

20

CSC

Holdings,

FRN,

1M

USD

LIBOR

+

2.50%,

7.931%,

4/15/27

80

62

146

Consumer

Non-Cyclical

0.2%

Bausch

+

Lomb,

FRN,

1M

TSFR

+

3.25%,

8.67%,

5/10/27

129

128

128

Insurance

0.2%

Asurion,

FRN,

1M

TSFR

+

3.25%,

8.694%,

12/23/26

135

134

134

Total

Bank

Loans

(Cost

$641)

616

CORPORATE

BONDS

36.5%

Banking

10.7%

American

Express,

VR,

5.645%,

4/23/27 (5)

200

201

Banco

de

Bogota,

6.25%,

5/12/26

200

198

Banco

Santander,

2.746%,

5/28/25

200

194

Banco

Santander

Mexico

Institucion

de

Banca

Multiple

Grupo

Financiero

Santand,

5.375%,

4/17/25

150

149

Bank

of

America,

VR,

5.08%,

1/20/27 (5)

150

149

Bank

of

Montreal,

5.30%,

6/5/26

200

200

Bank

of

the

Philippine

Islands,

2.50%,

9/10/24

200

198

Banque

Federative

du

Credit

Mutuel,

4.935%,

1/26/26 (1)

200

198

Barclays,

VR,

5.304%,

8/9/26 (5)

200

199

Barclays,

VR,

7.325%,

11/2/26 (5)

200

203

CaixaBank,

VR,

6.208%,

1/18/29 (1)(5)

200

203

Capital

One

Financial,

VR,

5.70%,

2/1/30 (5)

35

35

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Capital

One

Financial,

VR,

6.312%,

6/8/29 (5)

225

229

Danske

Bank,

VR,

5.427%,

3/1/28 (1)(5)

200

200

Fifth

Third

Bancorp,

2.375%,

1/28/25

25

24

Fifth

Third

Bank,

VR,

5.852%,

10/27/25 (5)

250

249

HDFC

Bank,

5.686%,

3/2/26

200

200

HSBC

Holdings,

VR,

5.597%,

5/17/28 (5)

200

201

Huntington

National

Bank,

VR,

5.699%,

11/18/25 (5)

250

249

JPMorgan

Chase,

VR,

5.04%,

1/23/28 (5)

95

94

Lloyds

Banking

Group,

4.50%,

11/4/24

200

198

Lloyds

Banking

Group,

VR,

5.462%,

1/5/28 (5)

200

199

NatWest

Group,

VR,

7.472%,

11/10/26 (5)

200

205

PNC

Financial

Services

Group,

VR,

4.758%,

1/26/27 (5)

120

119

PNC

Financial

Services

Group,

VR,

5.30%,

1/21/28 (5)

30

30

PNC

Financial

Services

Group,

VR,

5.671%,

10/28/25 (5)

135

135

Santander

Holdings

USA,

VR,

6.124%,

5/31/27 (5)

20

20

Societe

Generale,

2.625%,

10/16/24 (1)

200

198

Societe

Generale,

VR,

5.519%,

1/19/28 (1)(5)

200

197

Standard

Chartered,

VR,

5.688%,

5/14/28 (1)(5)

200

199

Standard

Chartered,

VR,

6.17%,

1/9/27 (1)(5)

200

201

Truist

Financial,

VR,

6.047%,

6/8/27 (5)

200

201

U.S.

Bancorp,

VR,

5.384%,

1/23/30 (5)

30

30

UBS

Group,

VR,

4.488%,

5/12/26 (1)(5)

200

198

Wells

Fargo,

VR,

4.54%,

8/15/26 (5)

150

148

5,851

Basic

Industry

1.7%

Celanese

U.S.

Holdings,

6.05%,

3/15/25

42

42

Indorama

Ventures

Global

Services,

4.375%,

9/12/24

200

197

LG

Chem,

4.375%,

7/14/25

200

197

Nutrien,

4.90%,

3/27/28

50

49

POSCO,

5.625%,

1/17/26 (1)

200

200

Sasol

Financing

USA,

4.375%,

9/18/26

260

244

Westlake,

0.875%,

8/15/24

25

25

954

Brokerage

Asset

Managers

Exchanges

0.5%

LPL

Holdings,

5.70%,

5/20/27

50

50

LPL

Holdings,

6.75%,

11/17/28

45

47

LSEGA

Financing,

1.375%,

4/6/26 (1)

200

186

283

Capital

Goods

0.9%

BAE

Systems,

5.00%,

3/26/27 (1)

200

198

Boeing,

6.259%,

5/1/27 (1)

55

55

Carrier

Global,

5.80%,

11/30/25

70

71

Owens

Corning,

5.50%,

6/15/27

50

50

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Regal

Rexnord,

6.05%,

2/15/26

75

75

Republic

Services,

4.875%,

4/1/29

20

20

469

Communications

3.0%

American

Tower,

3.55%,

7/15/27

200

190

Axian

Telecom,

7.375%,

2/16/27

200

195

Clear

Channel

Outdoor

Holdings,

5.125%,

8/15/27 (1)

30

28

Crown

Castle,

5.00%,

1/11/28

175

172

Crown

Castle,

5.60%,

6/1/29

105

106

PT

Tower

Bersama

Infrastructure,

4.25%,

1/21/25

200

197

Sable

International

Finance,

5.75%,

9/7/27 (1)

200

191

SBA

Tower

Trust,

6.599%,

1/15/28 (1)

115

117

Take-Two

Interactive

Software,

5.00%,

3/28/26

150

149

Townsquare

Media,

6.875%,

2/1/26 (1)

165

161

Warnermedia

Holdings,

3.755%,

3/15/27

155

147

1,653

Consumer

Cyclical

4.1%

Advance

Auto

Parts,

5.90%,

3/9/26

140

140

Allied

Universal

Holdco,

6.625%,

7/15/26 (1)

6

6

Carnival,

7.625%,

3/1/26 (1)

145

146

CEC

Entertainment,

6.75%,

5/1/26 (1)

75

74

Daimler

Truck

Finance

North

America,

5.00%,

1/15/27 (1)

150

149

Daimler

Truck

Finance

North

America,

5.15%,

1/16/26 (1)

150

149

Ford

Motor

Credit,

5.125%,

6/16/25

200

198

Ford

Motor

Credit,

6.798%,

11/7/28

200

207

General

Motors

Financial,

5.40%,

4/6/26

155

154

General

Motors

Financial,

5.40%,

5/8/27

80

80

General

Motors

Financial,

5.55%,

7/15/29

45

45

Hyundai

Capital

America,

5.50%,

3/30/26 (1)

80

80

Hyundai

Capital

America,

5.65%,

6/26/26 (1)

200

200

Hyundai

Capital

America,

6.25%,

11/3/25 (1)

50

50

Life

Time,

5.75%,

1/15/26 (1)

76

75

Marriott

International,

4.90%,

4/15/29

21

21

O'Reilly

Automotive,

5.75%,

11/20/26

30

30

Tapestry,

7.05%,

11/27/25

20

20

VF,

2.40%,

4/23/25

150

145

VF,

2.80%,

4/23/27

100

91

Volkswagen

Group

of

America

Finance,

6.00%,

11/16/26 (1)

200

202

2,262

Consumer

Non-Cyclical

2.7%

Brunswick,

0.85%,

8/18/24

115

114

Campbell

Soup,

5.20%,

3/19/27

60

60

CHS,

8.00%,

3/15/26 (1)

59

59

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

CSL

Finance,

3.85%,

4/27/27 (1)

25

24

HCA,

5.25%,

4/15/25

200

199

Hikma

Finance

USA,

3.25%,

7/9/25

200

193

Icon

Investments

Six,

5.809%,

5/8/27

200

202

IQVIA,

6.25%,

2/1/29

65

66

Legacy

LifePoint

Health,

4.375%,

2/15/27 (1)

140

132

Mattel,

5.875%,

12/15/27 (1)

150

149

Solventum,

5.45%,

2/25/27 (1)

105

105

Teva

Pharmaceutical

Finance

Netherlands

III,

3.15%,

10/1/26

185

172

1,475

Electric

2.2%

AES,

3.30%,

7/15/25 (1)

100

97

American

Electric

Power,

5.20%,

1/15/29

105

104

American

Electric

Power,

5.699%,

8/15/25

90

90

Constellation

Energy

Generation,

3.25%,

6/1/25

200

195

DTE

Energy,

STEP,

4.22%,

11/1/24

65

64

Engie

Energia

Chile,

4.50%,

1/29/25

200

199

NRG

Energy,

3.75%,

6/15/24 (1)

150

150

Pacific

Gas

&

Electric,

3.50%,

6/15/25

100

98

PacifiCorp,

5.10%,

2/15/29

30

30

Southern,

STEP,

4.475%,

8/1/24

125

125

Vistra

Operations,

5.125%,

5/13/25 (1)

58

58

1,210

Energy

2.5%

Columbia

Pipelines

Holding,

6.055%,

8/15/26 (1)

5

5

Continental

Resources,

3.80%,

6/1/24

50

50

Crescent

Energy

Finance,

9.25%,

2/15/28 (1)

120

127

Diamondback

Energy,

5.20%,

4/18/27

40

40

Enbridge,

5.90%,

11/15/26

60

61

Enbridge,

6.00%,

11/15/28

50

51

Energy

Transfer,

2.90%,

5/15/25

100

97

GS

Caltex,

1.625%,

7/27/25

200

191

Medco

Oak

Tree,

7.375%,

5/14/26

200

202

ONEOK,

5.55%,

11/1/26

60

60

Southwestern

Energy,

8.375%,

9/15/28

175

180

TER

Finance

Jersey,

Series 21,

Zero

Coupon,

1/2/25 (1)(4)

100

96

Williams,

5.30%,

8/15/28

200

200

1,360

Finance

Companies

1.4%

AerCap

Ireland

Capital,

1.65%,

10/29/24

215

211

AerCap

Ireland

Capital,

6.10%,

1/15/27

150

152

Avolon

Holdings

Funding,

3.95%,

7/1/24 (1)

100

100

Avolon

Holdings

Funding,

6.375%,

5/4/28 (1)

115

117

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

GATX,

5.40%,

3/15/27

40

40

Navient,

5.00%,

3/15/27

85

81

OneMain

Finance,

3.50%,

1/15/27

85

78

779

Financial

Other

0.7%

Emaar

Sukuk,

3.635%,

9/15/26

200

191

EMG

SUKUK,

4.564%,

6/18/24

200

200

391

Industrial

Other

0.7%

Albion

Financing

1,

6.125%,

10/15/26 (1)

200

198

Bidvest

Group

U.K.,

3.625%,

9/23/26

200

186

384

Insurance

2.7%

Athene

Global

Funding,

1.716%,

1/7/25 (1)

225

219

Athene

Global

Funding,

5.684%,

2/23/26 (1)

230

229

CNO

Global

Funding,

1.65%,

1/6/25 (1)

150

146

CNO

Global

Funding,

1.75%,

10/7/26 (1)

150

137

Corebridge

Financial,

3.65%,

4/5/27

200

191

Corebridge

Global

Funding,

5.20%,

1/12/29 (1)

40

40

Humana,

1.35%,

2/3/27

70

63

Humana,

5.75%,

3/1/28

25

25

Jackson

National

Life

Global

Funding,

5.50%,

1/9/26 (1)

175

174

Jackson

National

Life

Global

Funding,

5.60%,

4/10/26 (1)

250

250

1,474

Natural

Gas

0.4%

Engie,

5.25%,

4/10/29 (1)

200

199

NiSource,

5.25%,

3/30/28

25

25

224

Real

Estate

Investment

Trusts

0.6%

MPT

Operating

Partnership,

5.00%,

10/15/27 (6)

95

77

MPT

Operating

Partnership,

5.25%,

8/1/26 (6)

115

104

Park

Intermediate

Holdings,

7.50%,

6/1/25 (1)

95

95

Service

Properties

Trust,

4.75%,

10/1/26

69

65

341

Technology

1.4%

Atlassian,

5.25%,

5/15/29

40

40

CA

Magnum

Holdings,

5.375%,

10/31/26

200

191

Foundry

JV

Holdco,

5.90%,

1/25/30 (1)

200

203

Micron

Technology,

5.375%,

4/15/28

150

150

SK

Hynix,

6.25%,

1/17/26 (1)

200

202

786

Transportation

0.3%

Penske

Truck

Leasing,

5.35%,

1/12/27 (1)

40

40

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Penske

Truck

Leasing,

5.75%,

5/24/26 (1)

105

105

145

Total

Corporate

Bonds

(Cost

$20,088)

20,041

FOREIGN

GOVERNMENT

OBLIGATIONS

&

MUNICIPALITIES

2.5%

Government

Sponsored

0.4%

MEGlobal

Canada,

5.00%,

5/18/25

200

198

198

Owned

No

Guarantee

2.1%

Axiata,

4.357%,

3/24/26

200

196

Bank

Mandiri

Persero,

5.50%,

4/4/26

200

200

Bank

Negara

Indonesia

Persero,

3.75%,

3/30/26

200

192

DAE

Funding,

1.55%,

8/1/24

200

198

QNB

Finance,

1.375%,

1/26/26

200

187

State

Bank

of

India,

1.80%,

7/13/26

200

185

1,158

Total

Foreign

Government

Obligations

&

Municipalities

(Cost

$1,373)

1,356

NON-U.S.

GOVERNMENT

MORTGAGE-BACKED

SECURITIES

8.8%

Collateralized

Mortgage

Obligations

3.6%

Barclays

Mortgage

Loan

Trust

Series 2021-NQM1,

Class

A3,

CMO,

ARM

2.189%,

9/25/51 (1)

62

54

Bellemeade

Re

Series 2022-1,

Class

M1B,

CMO,

ARM

SOFR30A

+

2.15%,

7.474%,

1/26/32 (1)

300

302

COLT

Mortgage

Loan

Trust

Series 2020-3,

Class

A1,

CMO,

ARM

1.506%,

4/27/65 (1)

12

11

Connecticut

Avenue

Securities

Trust

Series 2021-R01,

Class

1M2,

CMO,

ARM

SOFR30A

+

1.55%,

6.874%,

10/25/41 (1)

194

195

Deephaven

Residential

Mortgage

Trust

Series 2021-1,

Class

A3,

CMO,

ARM

1.128%,

5/25/65 (1)

21

20

Flagstar

Mortgage

Trust

Series 2019-1INV,

Class

A11,

CMO,

ARM

1M

TSFR

+

1.064%,

5.50%,

10/25/49 (1)

15

14

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Flagstar

Mortgage

Trust

Series 2020-1INV,

Class

A11,

CMO,

ARM

1M

TSFR

+

0.964%,

6.00%,

3/25/50 (1)

27

25

Freddie

Mac

Whole

Loan

Securities

Trust

Series 2017-SC02,

Class

M1,

CMO,

ARM

3.869%,

5/25/47 (1)

160

153

JPMorgan

Mortgage

Trust

Series 2019-INV2,

Class

A3,

CMO,

ARM

3.50%,

2/25/50 (1)

76

68

New

Residential

Mortgage

Loan

Trust

Series 2021-NQ1R,

Class

A3,

CMO,

ARM

1.198%,

7/25/55 (1)

50

44

OBX

Trust

Series 2019-EXP3,

Class

1A9,

CMO,

ARM

3.50%,

10/25/59 (1)

114

101

OBX

Trust

Series 2019-INV1,

Class

A3,

CMO,

ARM

4.50%,

11/25/48 (1)

25

24

OBX

Trust

Series 2019-INV2,

Class

A25,

CMO,

ARM

4.00%,

5/27/49 (1)

41

37

OBX

Trust

Series 2020-EXP1,

Class

2A1B,

CMO,

ARM

1M

TSFR

+

0.864%,

6.189%,

2/25/60 (1)

68

65

OBX

Trust

Series 2023-NQM10,

Class

A2,

CMO,

STEP

6.92%,

10/25/63 (1)

91

92

Radnor

RE

Series 2021-2,

Class

M1A,

CMO,

ARM

SOFR30A

+

1.85%,

7.174%,

11/25/31 (1)

10

10

Starwood

Mortgage

Residential

Trust

Series 2020-INV1,

Class

A3,

CMO,

ARM

1.593%,

11/25/55 (1)

19

17

Structured

Agency

Credit

Risk

Debt

Notes

Series 2021-DNA5,

Class

M2,

CMO,

ARM

SOFR30A

+

1.65%,

6.974%,

1/25/34 (1)

55

55

Structured

Agency

Credit

Risk

Debt

Notes

Series 2023-HQA3,

Class

A1,

CMO,

ARM

SOFR30A

+

1.85%,

7.174%,

11/25/43 (1)

98

99

Structured

Agency

Credit

Risk

Debt

Notes

Series 2024-HQA1,

Class

A1,

CMO,

ARM

SOFR30A

+

1.25%,

6.574%,

3/25/44 (1)

148

148

Verus

Securitization

Trust

Series 2019-4,

Class

A1,

CMO,

STEP

3.642%,

11/25/59 (1)

6

6

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Verus

Securitization

Trust

Series 2019-INV3,

Class

A3,

CMO,

ARM

4.10%,

11/25/59 (1)

76

73

Verus

Securitization

Trust

Series 2020-1,

Class

A3,

CMO,

STEP

3.724%,

1/25/60 (1)

62

60

Verus

Securitization

Trust

Series 2021-2,

Class

A3,

CMO,

ARM

1.545%,

2/25/66 (1)

124

108

Verus

Securitization

Trust

Series 2023-8,

Class

A2,

CMO,

STEP

6.664%,

12/25/68 (1)

104

104

Verus

Securitization

Trust

Series 2023-INV3,

Class

A2,

CMO,

ARM

7.33%,

11/25/68 (1)

110

111

1,996

Commercial

Mortgage-Backed

Securities

5.1%

Alen

Mortgage

Trust

Series 2021-ACEN,

Class

A,

ARM

1M

TSFR

+

1.264%,

6.581%,

4/15/34 (1)

100

91

BANK

Series 2019-BN23,

Class

A1

1.975%,

12/15/52

1

1

Benchmark

Mortgage

Trust

Series 2024-V6,

Class

A1

5.568%,

10/15/28

97

97

BFLD

Series 2019-DPLO,

Class

D,

ARM

1M

TSFR

+

1.954%,

7.271%,

10/15/34 (1)

100

100

BX

Commercial

Mortgage

Trust

Series 2024-MDHS,

Class

B,

ARM

1M

TSFR

+

1.841%,

7.191%,

5/15/41 (1)

200

200

BX

Trust

Series 2021-ARIA,

Class

C,

ARM

1M

TSFR

+

1.76%,

7.077%,

10/15/36 (1)

160

158

CD

Mortgage

Trust

Series 2016-CD1,

Class

B,

ARM

3.077%,

8/10/49

100

76

Citigroup

Commercial

Mortgage

Trust

Series 2013-375P,

Class

B,

ARM

3.518%,

5/10/35 (1)

150

144

Citigroup

Commercial

Mortgage

Trust

Series 2016-C1,

Class

AS

3.514%,

5/10/49

200

189

Cold

Storage

Trust

Series 2020-ICE5,

Class

A,

ARM

1M

TSFR

+

1.014%,

6.334%,

11/15/37 (1)

98

98

T.

ROWE

PRICE

Short

Duration

Income

Fund

Par/Shares

$

Value

(Amounts

in

000s)

‡

Cold

Storage

Trust

Series 2020-ICE5,

Class

C,

ARM

1M

TSFR

+

1.764%,

7.084%,

11/15/37 (1)

147

147

Commercial

Mortgage

Trust

Series 2014-UBS2,

Class

B

4.701%,

3/10/47

17

16

Commercial

Mortgage

Trust

Series 2017-PANW,

Class

D,

ARM

3.935%,

10/10/29 (1)

109

97

Eleven

Madison

Mortgage

Trust

Series 2015-11MD,

Class

A,

ARM

3.555%,

9/10/35 (1)

170

162

Federal

Home

Loan

Mortgage

Multifamily

Structured

PTC

Series K060,

Class

A1

2.958%,

7/25/26

71

69

Federal

Home

Loan

Mortgage

Multifamily

Structured

PTC

Series K084,

Class

A2,

ARM

3.78%,

10/25/28

250

239

Federal

Home

Loan

Mortgage

Multifamily

Structured

PTC

Series K085,

Class

A2,

ARM

4.06%,

10/25/28

106

102

HILT

Commercial

Mortgage

Trust

Series 2024-ORL,

Class

C,

ARM

1M

TSFR

+

2.44%,

7.74%,

5/15/37 (1)

105

105

JPMorgan

Chase

Commercial

Mortgage

Securities

Trust

Series 2018-WPT,

Class

BFL,

ARM

1M

TSFR

+

1.489%,

6.812%,

7/5/33 (1)

59

52

JPMorgan

Chase

Commercial

Mortgage

Securities

Trust

Series 2020-609M,

Class

B,

ARM

1M

TSFR

+

2.134%,

7.451%,

10/15/33 (1)

100

93

LSTAR

Commercial

Mortgage

Trust

Series 2015-3,

Class

B,

ARM

3.117%,

4/20/48 (1)

92

90

MARQ

Trust

Series 2024-HOU,

Class

B,

ARM

1M

TSFR

+

2.091%,

7.41%,

6/15/29 (1)

100

100

MED

Commercial

Mortgage

Trust

Series 2024-MOB,

Class

A,

ARM

1M

TSFR

+

1.592%,

6.908%,

5/15/41 (1)

100

100

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

Series 2015-C24,

Class

AS,

ARM

4.036%,