Privi Privile leg ged ed and and Conf Confiden idential tial Dr Draft aft – – Sub Subje ject ct to to Mate Material rial Chang Change e – – For For Discussion P Discussion Pur urposes poses Onl Only y Exhibit (c)(3)(A) DISCUSSION MATERIALS July 8, 2022

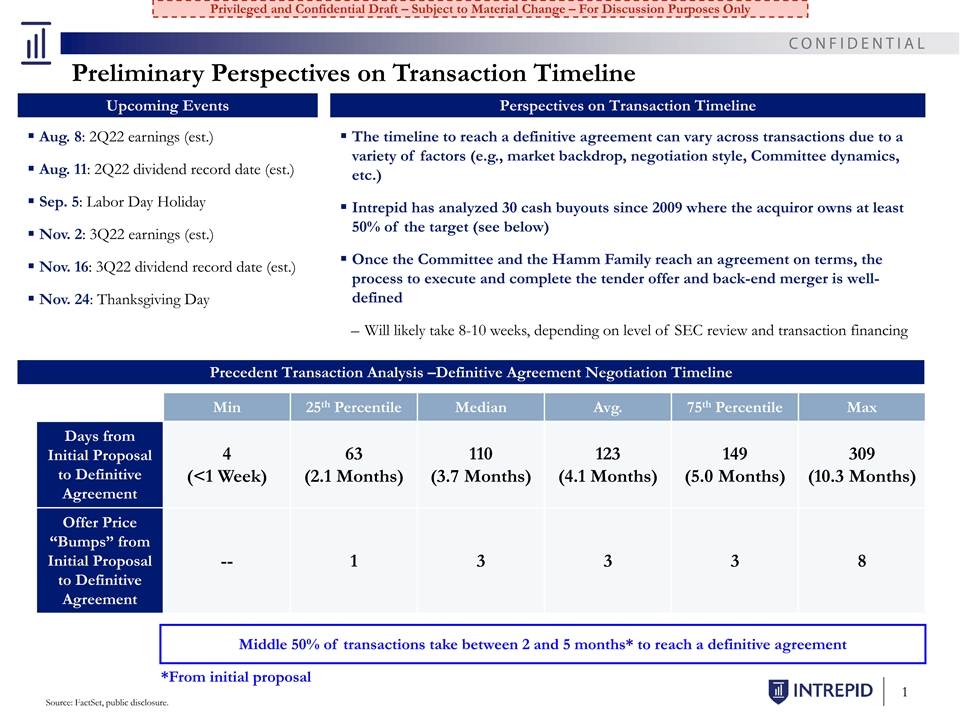

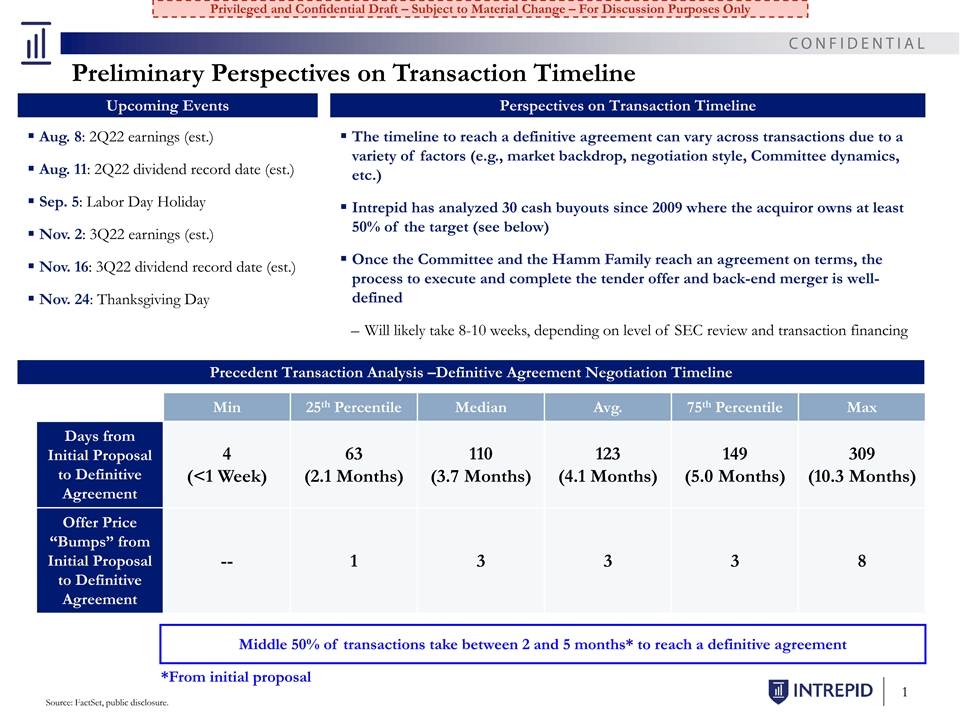

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Preliminary Perspectives on Transaction Timeline Upcoming Events Perspectives on Transaction Timeline ▪ Aug. 8: 2Q22 earnings (est.)▪ The timeline to reach a definitive agreement can vary across transactions due to a variety of factors (e.g., market backdrop, negotiation style, Committee dynamics, ▪ Aug. 11: 2Q22 dividend record date (est.) etc.) ▪ Sep. 5: Labor Day Holiday ▪ Intrepid has analyzed 30 cash buyouts since 2009 where the acquiror owns at least 50% of the target (see below) ▪ Nov. 2: 3Q22 earnings (est.) ▪ Once the Committee and the Hamm Family reach an agreement on terms, the ▪ Nov. 16: 3Q22 dividend record date (est.) process to execute and complete the tender offer and back-end merger is well- defined ▪ Nov. 24: Thanksgiving Day – Will likely take 8-10 weeks, depending on level of SEC review and transaction financing Precedent Transaction Analysis –Definitive Agreement Negotiation Timeline th th Min 25 Percentile Median Avg. 75 Percentile Max Days from Initial Proposal 4 63 110 123 149 309 to Definitive (<1 Week) (2.1 Months) (3.7 Months) (4.1 Months) (5.0 Months) (10.3 Months) Agreement Offer Price “Bumps” from Initial Proposal -- 1 3 3 3 8 to Definitive Agreement Middle 50% of transactions take between 2 and 5 months* to reach a definitive agreement *From initial proposal 1 Source: FactSet, public disclosure.

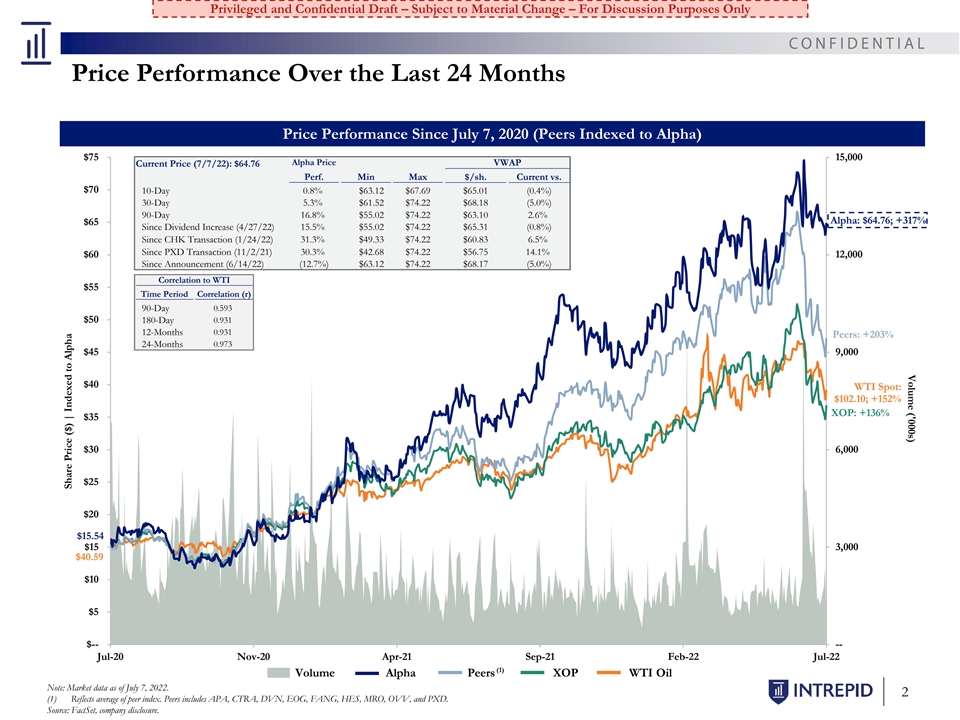

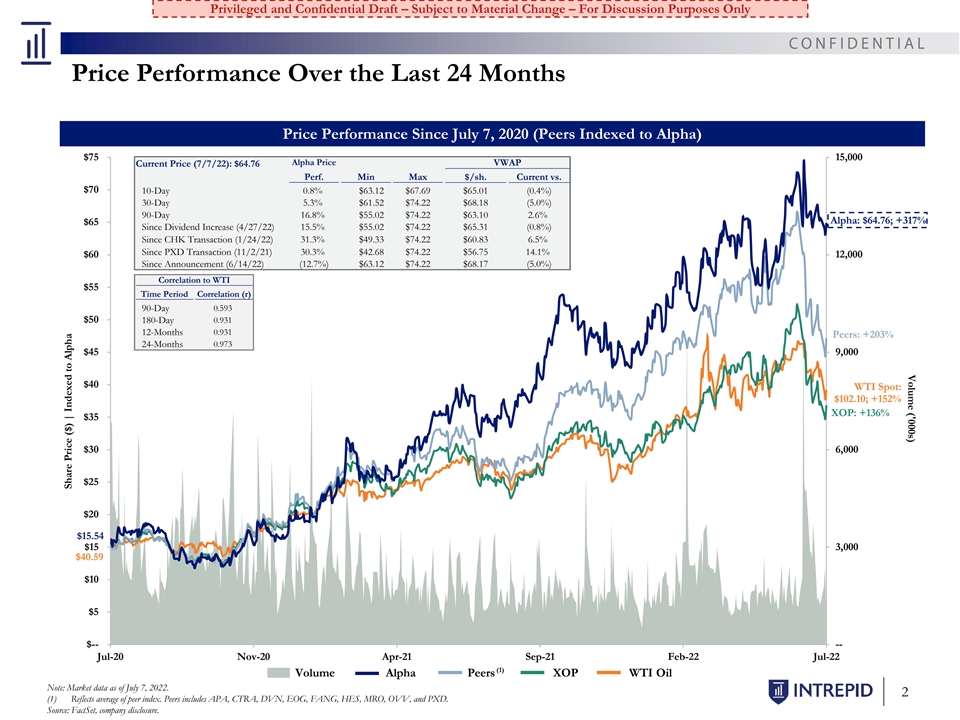

Volume ('000s) Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Price Performance Over the Last 24 Months Price Performance Since July 7, 2020 (Peers Indexed to Alpha) $75 15,000 Alpha Price VWAP Current Price (7/7/22): $64.76 Perf. Min Max $/sh. Current vs. $70 10-Day 0.8% $63.12 $67.69 $65.01 (0.4%) 30-Day 5.3% $61.52 $74.22 $68.18 (5.0%) 90-Day 16.8% $55.02 $74.22 $63.10 2.6% Alpha: $64.76; +317% $65 Since Dividend Increase (4/27/22) 15.5% $55.02 $74.22 $65.31 (0.8%) Since CHK Transaction (1/24/22) 31.3% $49.33 $74.22 $60.83 6.5% Since PXD Transaction (11/2/21) 30.3% $42.68 $74.22 $56.75 14.1% $60 12,000 Since Announcement (6/14/22) (12.7%) $63.12 $74.22 $68.17 (5.0%) Correlation to WTI $55 Time Period Correlation (r) 0.593 90-Day $50 0.931 180-Day 0.931 12-Months Peers: +203% 0.973 24-Months $45 9,000 $40 WTI Spot: $102.10; +152% XOP: +136% $35 $30 6,000 $25 $20 $15.54 $15 3,000 $40.59 $10 $5 $-- -- Jul-20 Nov-20 Apr-21 Sep-21 Feb-22 Jul-22 (1) Volume Alpha Peers XOP WTI Oil Note: Market data as of July 7, 2022. 2 (1) Reflects average of peer index. Peers includes APA, CTRA, DVN, EOG, FANG, HES, MRO, OVV, and PXD. Source: FactSet, company disclosure. Share Price ($) | Indexed to Alpha

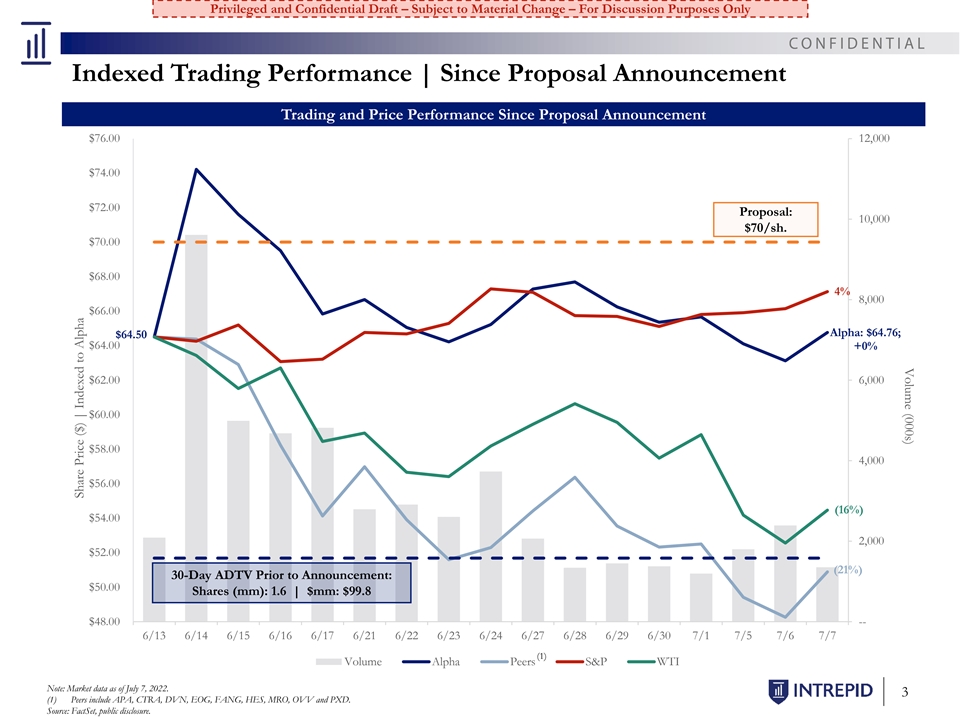

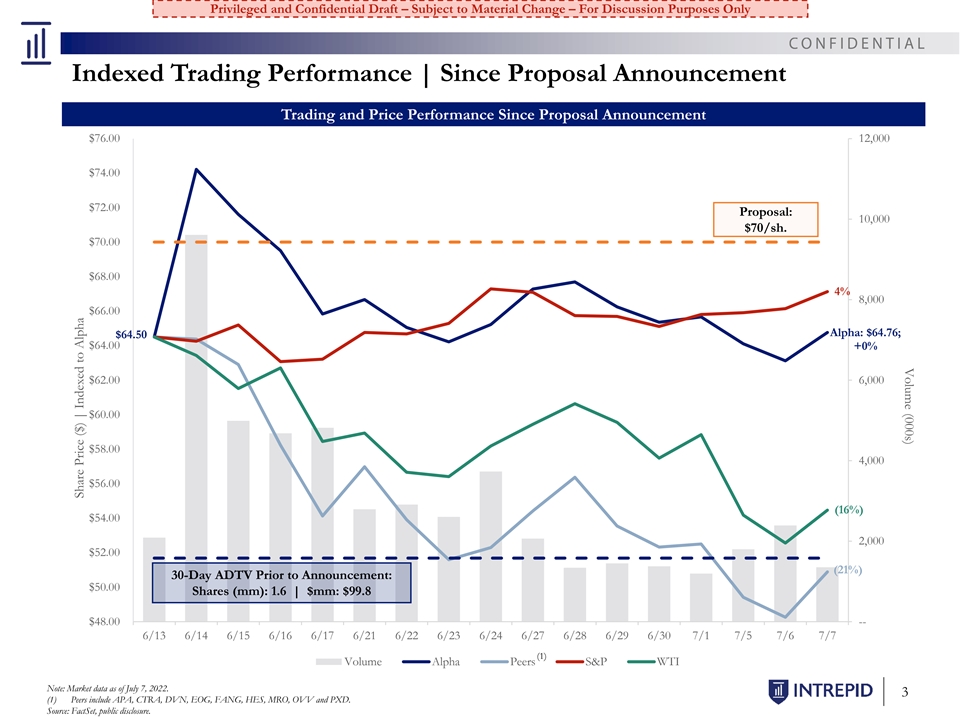

Volume (000s) Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Indexed Trading Performance | Since Proposal Announcement Trading and Price Performance Since Proposal Announcement $76.00 12,000 $74.00 $72.00 Proposal: 10,000 $70/sh. $70.00 $68.00 4% 8,000 $66.00 Alpha: $64.76; $64.50 $64.00 +0% $62.00 6,000 $60.00 $58.00 4,000 $56.00 (16%) $54.00 2,000 $52.00 (21%) 30-Day ADTV Prior to Announcement: $50.00 Shares (mm): 1.6 | $mm: $99.8 $48.00 -- 6/13 6/14 6/15 6/16 6/17 6/21 6/22 6/23 6/24 6/27 6/28 6/29 6/30 7/1 7/5 7/6 7/7 (1) Volume Alpha Peers S&P WTI Note: Market data as of July 7, 2022. 3 (1) Peers include APA, CTRA, DVN, EOG, FANG, HES, MRO, OVV and PXD. Source: FactSet, public disclosure. Share Price ($) | Indexed to Alpha

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Trading Performance | Since Proposal Announcement Trading and Price Performance Since Proposal Announcement 4.1% 0.4% (15.6%) (17.1%) (17.8%) (19.0%) (20.8%) (21.1%) (21.3%) Peer Median: (21.3%) (22.1%) (22.5%) (23.1%) (24.0%) (24.3%) Alpha PXD HES CTRA EOG FANG DVN MRO OVV APA S&P 500 WTI Oil Peer Avg. XOP 4 Note: Market data as of July 7, 2022. Source: FactSet, public disclosure.

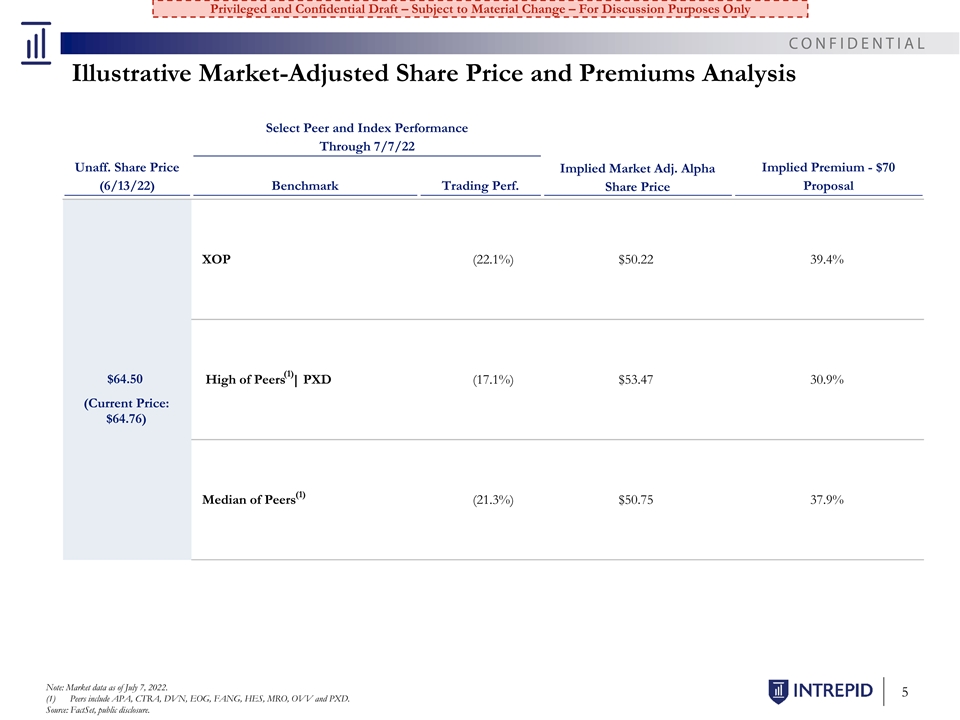

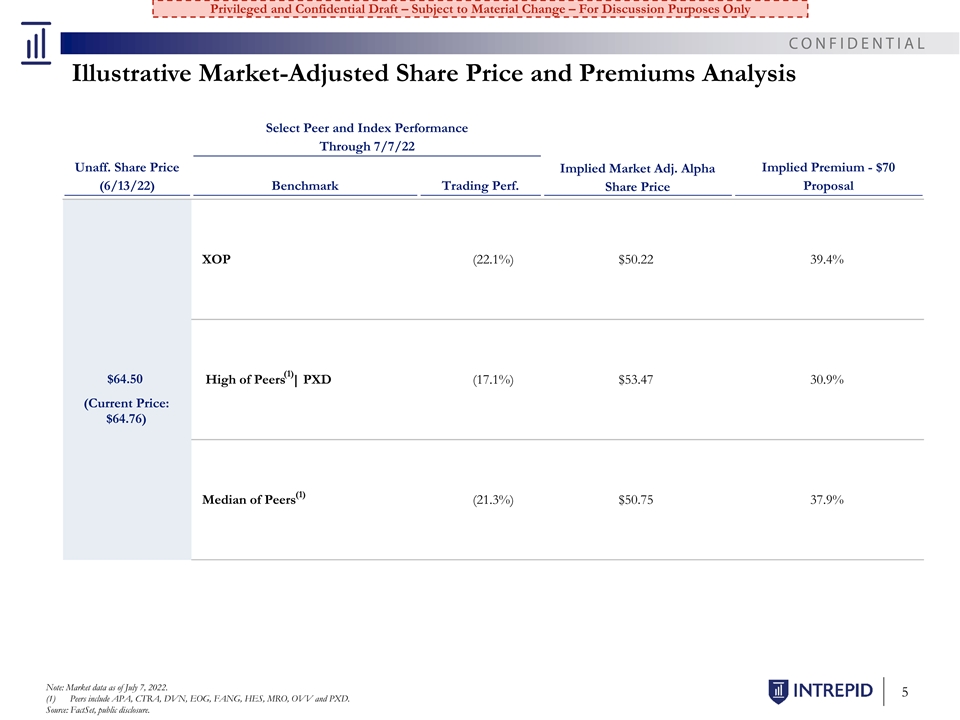

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Illustrative Market-Adjusted Share Price and Premiums Analysis Select Peer and Index Performance Through 7/7/22 Unaff. Share Price Implied Premium - $70 Implied Market Adj. Alpha (6/13/22) Benchmark Trading Perf. Share Price Proposal XOP (22.1%) $50.22 39.4% (1) $64.50 High of Peers | PXD (17.1%) $53.47 30.9% (Current Price: $64.76) (1) Median of Peers (21.3%) $50.75 37.9% Note: Market data as of July 7, 2022. 5 (1) Peers include APA, CTRA, DVN, EOG, FANG, HES, MRO, OVV and PXD. Source: FactSet, public disclosure.

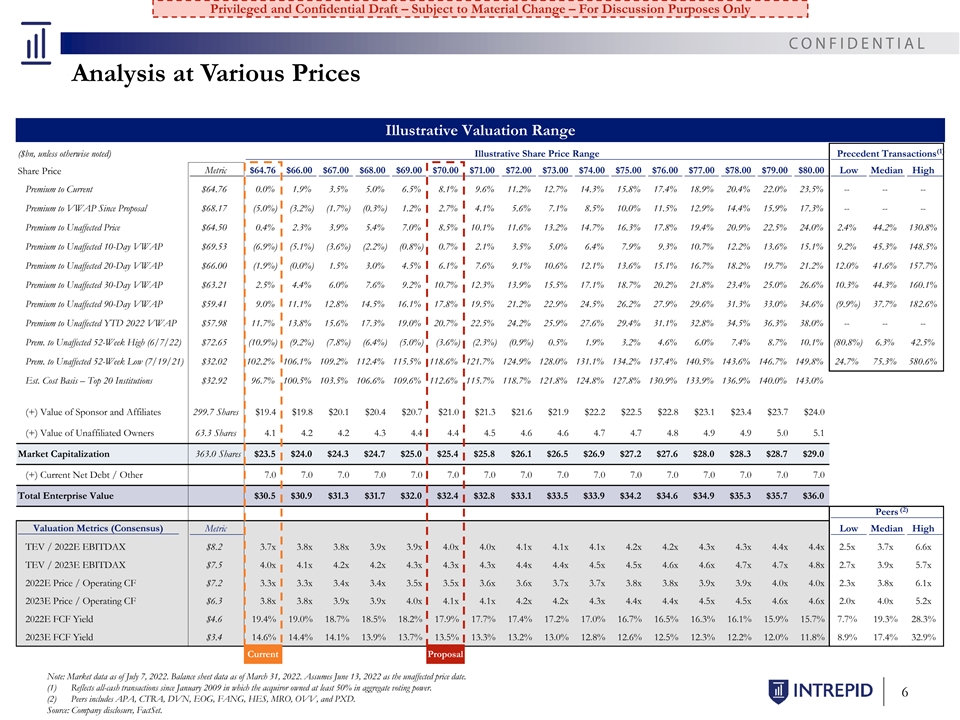

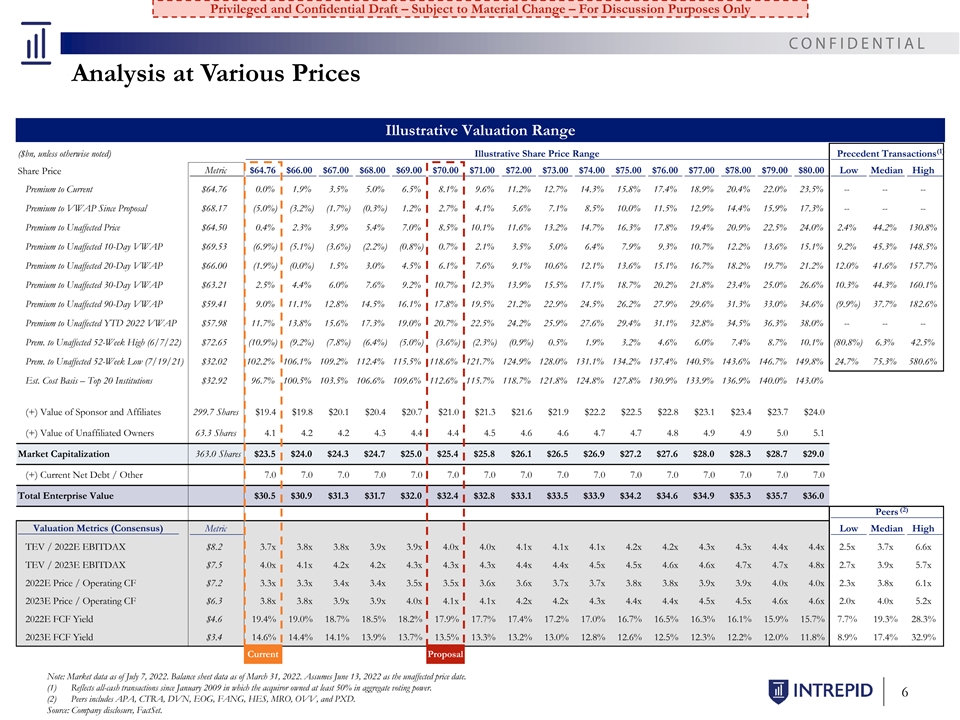

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Analysis at Various Prices Illustrative Valuation Range (1) ($bn, unless otherwise noted) Illustrative Share Price Range Precedent Transactions Metric $64.76 $66.00 $67.00 $68.00 $69.00 $70.00 $71.00 $72.00 $73.00 $74.00 $75.00 $76.00 $77.00 $78.00 $79.00 $80.00 Low Median High Share Price Premium to Current $64.76 0.0% 1.9% 3.5% 5.0% 6.5% 8.1% 9.6% 11.2% 12.7% 14.3% 15.8% 17.4% 18.9% 20.4% 22.0% 23.5% -- -- -- Premium to VWAP Since Proposal $68.17 (5.0%) (3.2%) (1.7%) (0.3%) 1.2% 2.7% 4.1% 5.6% 7.1% 8.5% 10.0% 11.5% 12.9% 14.4% 15.9% 17.3% -- -- -- Premium to Unaffected Price $64.50 0.4% 2.3% 3.9% 5.4% 7.0% 8.5% 10.1% 11.6% 13.2% 14.7% 16.3% 17.8% 19.4% 20.9% 22.5% 24.0% 2.4% 44.2% 130.8% Premium to Unaffected 10-Day VWAP $69.53 (6.9%) (5.1%) (3.6%) (2.2%) (0.8%) 0.7% 2.1% 3.5% 5.0% 6.4% 7.9% 9.3% 10.7% 12.2% 13.6% 15.1% 9.2% 45.3% 148.5% Premium to Unaffected 20-Day VWAP $66.00 (1.9%) (0.0%) 1.5% 3.0% 4.5% 6.1% 7.6% 9.1% 10.6% 12.1% 13.6% 15.1% 16.7% 18.2% 19.7% 21.2% 12.0% 41.6% 157.7% Premium to Unaffected 30-Day VWAP $63.21 2.5% 4.4% 6.0% 7.6% 9.2% 10.7% 12.3% 13.9% 15.5% 17.1% 18.7% 20.2% 21.8% 23.4% 25.0% 26.6% 10.3% 44.3% 160.1% Premium to Unaffected 90-Day VWAP $59.41 9.0% 11.1% 12.8% 14.5% 16.1% 17.8% 19.5% 21.2% 22.9% 24.5% 26.2% 27.9% 29.6% 31.3% 33.0% 34.6% (9.9%) 37.7% 182.6% Premium to Unaffected YTD 2022 VWAP $57.98 11.7% 13.8% 15.6% 17.3% 19.0% 20.7% 22.5% 24.2% 25.9% 27.6% 29.4% 31.1% 32.8% 34.5% 36.3% 38.0% -- -- -- Prem. to Unaffected 52-Week High (6/7/22) $72.65 (10.9%) (9.2%) (7.8%) (6.4%) (5.0%) (3.6%) (2.3%) (0.9%) 0.5% 1.9% 3.2% 4.6% 6.0% 7.4% 8.7% 10.1% (80.8%) 6.3% 42.5% Prem. to Unaffected 52-Week Low (7/19/21) $32.02 102.2% 106.1% 109.2% 112.4% 115.5% 118.6% 121.7% 124.9% 128.0% 131.1% 134.2% 137.4% 140.5% 143.6% 146.7% 149.8% 24.7% 75.3% 580.6% Est. Cost Basis – Top 20 Institutions $32.92 96.7% 100.5% 103.5% 106.6% 109.6% 112.6% 115.7% 118.7% 121.8% 124.8% 127.8% 130.9% 133.9% 136.9% 140.0% 143.0% (+) Value of Sponsor and Affiliates 299.7 Shares $19.4 $19.8 $20.1 $20.4 $20.7 $21.0 $21.3 $21.6 $21.9 $22.2 $22.5 $22.8 $23.1 $23.4 $23.7 $24.0 (+) Value of Unaffiliated Owners 63.3 Shares 4.1 4.2 4.2 4.3 4.4 4.4 4.5 4.6 4.6 4.7 4.7 4.8 4.9 4.9 5.0 5.1 Market Capitalization 363.0 Shares $23.5 $24.0 $24.3 $24.7 $25.0 $25.4 $25.8 $26.1 $26.5 $26.9 $27.2 $27.6 $28.0 $28.3 $28.7 $29.0 (+) Current Net Debt / Other 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 7.0 Total Enterprise Value $30.5 $30.9 $31.3 $31.7 $32.0 $32.4 $32.8 $33.1 $33.5 $33.9 $34.2 $34.6 $34.9 $35.3 $35.7 $36.0 (2) Peers Valuation Metrics (Consensus) Metric Low Median High TEV / 2022E EBITDAX $8.2 3.7x 3.8x 3.8x 3.9x 3.9x 4.0x 4.0x 4.1x 4.1x 4.1x 4.2x 4.2x 4.3x 4.3x 4.4x 4.4x 2.5x 3.7x 6.6x TEV / 2023E EBITDAX $7.5 4.0x 4.1x 4.2x 4.2x 4.3x 4.3x 4.3x 4.4x 4.4x 4.5x 4.5x 4.6x 4.6x 4.7x 4.7x 4.8x 2.7x 3.9x 5.7x 2022E Price / Operating CF $7.2 3.3x 3.3x 3.4x 3.4x 3.5x 3.5x 3.6x 3.6x 3.7x 3.7x 3.8x 3.8x 3.9x 3.9x 4.0x 4.0x 2.3x 3.8x 6.1x 2023E Price / Operating CF $6.3 3.8x 3.8x 3.9x 3.9x 4.0x 4.1x 4.1x 4.2x 4.2x 4.3x 4.4x 4.4x 4.5x 4.5x 4.6x 4.6x 2.0x 4.0x 5.2x 2022E FCF Yield $4.6 19.4% 19.0% 18.7% 18.5% 18.2% 17.9% 17.7% 17.4% 17.2% 17.0% 16.7% 16.5% 16.3% 16.1% 15.9% 15.7% 7.7% 19.3% 28.3% 2023E FCF Yield $3.4 14.6% 14.4% 14.1% 13.9% 13.7% 13.5% 13.3% 13.2% 13.0% 12.8% 12.6% 12.5% 12.3% 12.2% 12.0% 11.8% 8.9% 17.4% 32.9% Current Proposal Note: Market data as of July 7, 2022. Balance sheet data as of March 31, 2022. Assumes June 13, 2022 as the unaffected price date. (1) Reflects all-cash transactions since January 2009 in which the acquiror owned at least 50% in aggregate voting power. 6 (2) Peers includes APA, CTRA, DVN, EOG, FANG, HES, MRO, OVV, and PXD. Source: Company disclosure, FactSet.

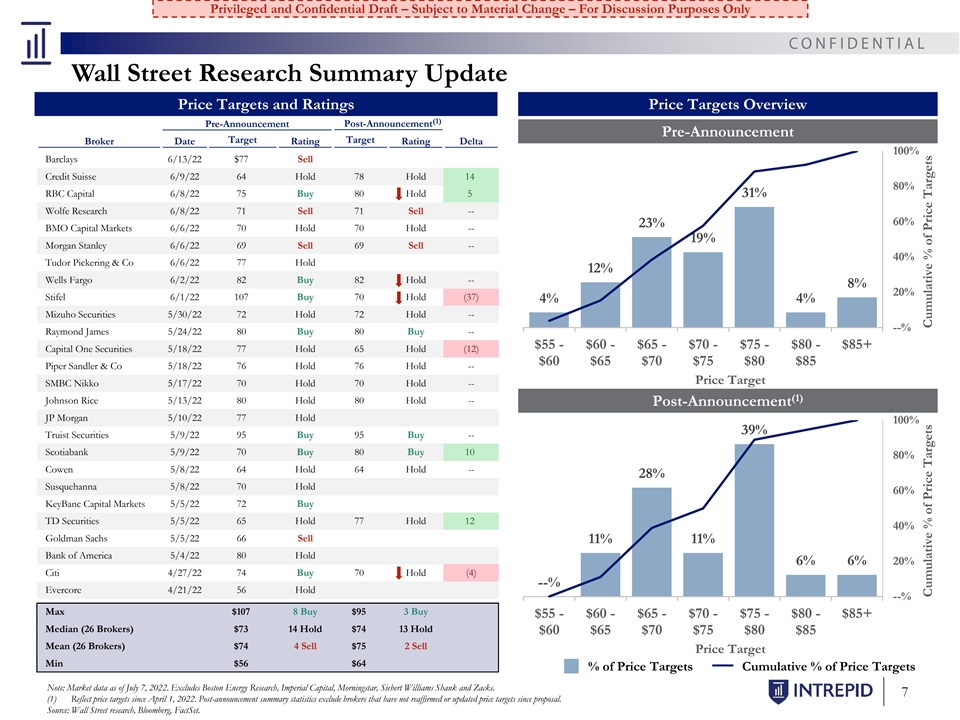

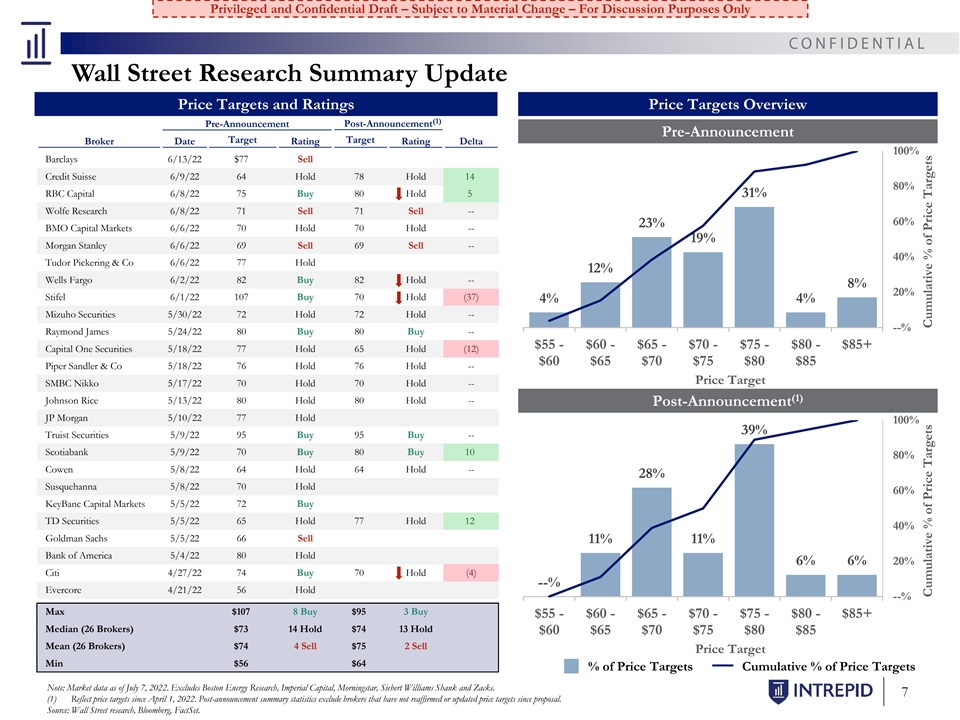

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Wall Street Research Summary Update Price Targets and Ratings Price Targets Overview (1) Pre-Announcement Post-Announcement Pre-Announcement Target Target Broker Date Rating Rating Delta 100% Barclays 6/13/22 $77 Sell Credit Suisse 6/9/22 64 Hold 78 Hold 14 80% RBC Capital 6/8/22 75 Buy 80 Hold 5 31% Wolfe Research 6/8/22 71 Sell 71 Sell -- 60% 23% BMO Capital Markets 6/6/22 70 Hold 70 Hold -- 19% Morgan Stanley 6/6/22 69 Sell 69 Sell -- 40% Tudor Pickering & Co 6/6/22 77 Hold 12% Wells Fargo 6/2/22 82 Buy 82 Hold -- 8% 20% Stifel 6/1/22 107 Buy 70 Hold (37) 4% 4% Mizuho Securities 5/30/22 72 Hold 72 Hold -- --% Raymond James 5/24/22 80 Buy 80 Buy -- $55 - $60 - $65 - $70 - $75 - $80 - $85+ Capital One Securities 5/18/22 77 Hold 65 Hold (12) $60 $65 $70 $75 $80 $85 Piper Sandler & Co 5/18/22 76 Hold 76 Hold -- Price Target SMBC Nikko 5/17/22 70 Hold 70 Hold -- (1) Johnson Rice 5/13/22 80 Hold 80 Hold -- Post-Announcement JP Morgan 5/10/22 77 Hold 100% 39% Truist Securities 5/9/22 95 Buy 95 Buy -- Scotiabank 5/9/22 70 Buy 80 Buy 10 80% Cowen 5/8/22 64 Hold 64 Hold -- 28% Susquehanna 5/8/22 70 Hold 60% KeyBanc Capital Markets 5/5/22 72 Buy TD Securities 5/5/22 65 Hold 77 Hold 12 40% Goldman Sachs 5/5/22 66 Sell 11% 11% Bank of America 5/4/22 80 Hold 6% 6% 20% Citi 4/27/22 74 Buy 70 Hold (4) --% Evercore 4/21/22 56 Hold --% Max $107 8 Buy $95 3 Buy $55 - $60 - $65 - $70 - $75 - $80 - $85+ Median (26 Brokers) $73 14 Hold $74 13 Hold $60 $65 $70 $75 $80 $85 Mean (26 Brokers) $74 4 Sell $75 2 Sell Price Target Min $56 $64 % of Price Targets Cumulative % of Price Targets Note: Market data as of July 7, 2022. Excludes Boston Energy Research, Imperial Capital, Morningstar, Siebert Williams Shank and Zacks. 7 (1) Reflect price targets since April 1, 2022. Post-announcement summary statistics exclude brokers that have not reaffirmed or updated price targets since proposal. Source: Wall Street research, Bloomberg, FactSet. Cumulative % of Price Targets Cumulative % of Price Targets

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Select Research Analyst Commentary Since Announcement Select Commentary | Broker Research “Mr. [Sponsor] contends that the public equity markets are not “Although we estimate a 'fair value' of $82/sh for [Alpha] stock at our properly valuing the industry, but we would expect minority $70/bbl 'mid-cycle' oil view, we also don't expect a bidding war for shareholders may have the same contention… We have no questions of [Alpha] shares as indicated by the closing price. Thus, we see the Mr. [Sponsor]’s intentions, we do think [Alpha] minority shareholders are potential for downward pressure on shares in the near term ” likely to demand higher compensation for their shares in the current environment where short-cycle supply is constrained from responding to price signals” $82 | Hold June 14, 2022 $76 | Hold June 14, 2022 “Although there was a period of low premium, largely papered M&A in the “The offer price is in-line with our net asset value estimate of $73/sh at energy space during 2019-2020 partially driven by a need to remain above a current strip prices… the implied 2022 EV/EBITDA multiple of 3.5x is certain market capitalization to remain institutionally relevant, premiums a modest 9% discount vs peers, we think this is warranted given have increased over the last year and half as commodity prices differences in asset & inventory quality. In addition, the implied 2022 continued to raise…We believe a deal sweetener is a distinct possibility FCF yield at the offer price of 18% is slightly below peers (19%). That said, since the announced premium falls towards the low-end of the range shares traded through the offer price, implying some expectation that the bid for recent transactions” could be revised higher.” $65 | Hold June 14, 2022 June 14, 2022 $69 | Underweight “We believe the transaction goes through as the offer price represents “We believe investors will likely want a higher valuation more in line with ‘a reasonable premium’ and a price the stock has only closed above eight peers, implying a higher price of ~$78/share.” times since 2015.” June 14, 2022 $78 | Hold June 14, 2022 $70 | Hold “We think it will take a higher price for existing shareholder given the current elevated commodity price environment.” “Would not be surprised if a process ultimately resulted in a sale… June 14, 2022 $75 | Buy … We think it will be worth watching what activity level a potential outside bidder would determine for the assets versus what the current owner will run.” “[Alpha] has always been closely held and consummating a full take-private has been mentioned previously…and is not fully surprising.” $95 | Buy June 14, 2022 $64 | Hold June 14, 2022 8 Note: Broker ratings and price targets reflect those at the time of the report, not current ratings and price targets. Source: Wall Street research, Bloomberg, FactSet.

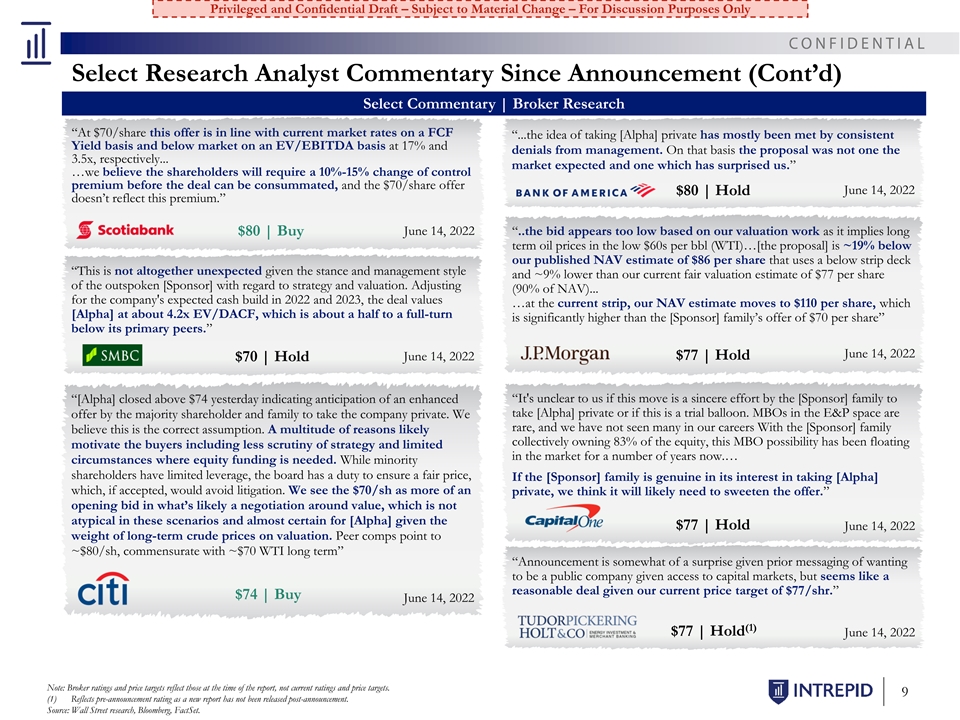

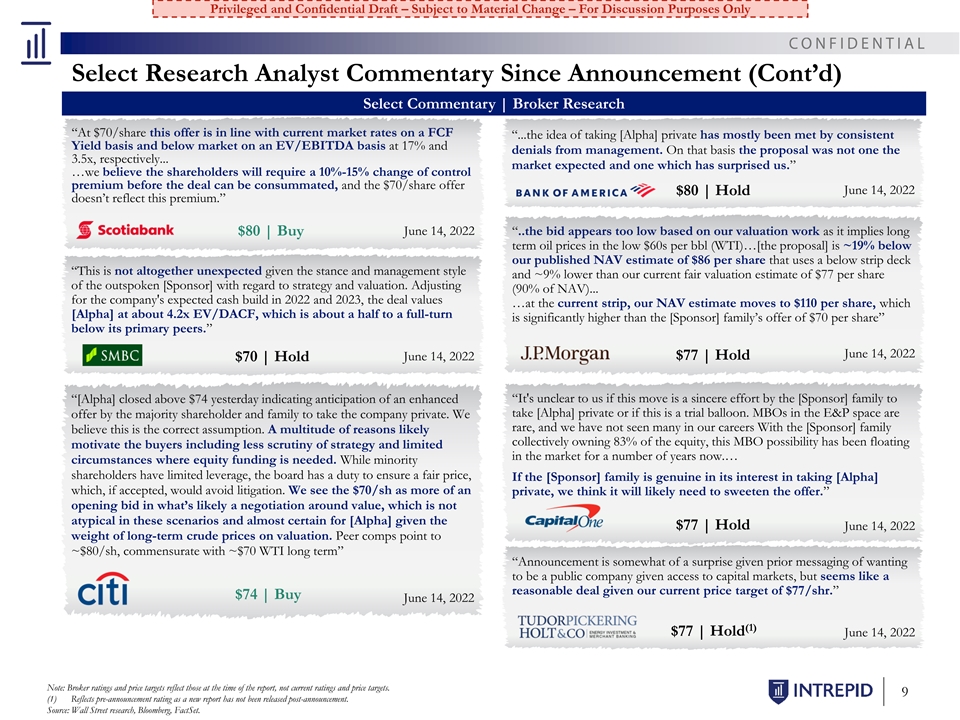

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Select Research Analyst Commentary Since Announcement (Cont’d) Select Commentary | Broker Research “At $70/share this offer is in line with current market rates on a FCF “...the idea of taking [Alpha] private has mostly been met by consistent Yield basis and below market on an EV/EBITDA basis at 17% and denials from management. On that basis the proposal was not one the 3.5x, respectively... market expected and one which has surprised us.” …we believe the shareholders will require a 10%-15% change of control premium before the deal can be consummated, and the $70/share offer June 14, 2022 $80 | Hold doesn’t reflect this premium.” June 14, 2022 “..the bid appears too low based on our valuation work as it implies long $80 | Buy term oil prices in the low $60s per bbl (WTI)…[the proposal] is ~19% below our published NAV estimate of $86 per share that uses a below strip deck “This is not altogether unexpected given the stance and management style and ~9% lower than our current fair valuation estimate of $77 per share of the outspoken [Sponsor] with regard to strategy and valuation. Adjusting (90% of NAV)... for the company's expected cash build in 2022 and 2023, the deal values …at the current strip, our NAV estimate moves to $110 per share, which [Alpha] at about 4.2x EV/DACF, which is about a half to a full-turn is significantly higher than the [Sponsor] family’s offer of $70 per share” below its primary peers.” June 14, 2022 June 14, 2022 $77 | Hold $70 | Hold “[Alpha] closed above $74 yesterday indicating anticipation of an enhanced “It's unclear to us if this move is a sincere effort by the [Sponsor] family to take [Alpha] private or if this is a trial balloon. MBOs in the E&P space are offer by the majority shareholder and family to take the company private. We rare, and we have not seen many in our careers With the [Sponsor] family believe this is the correct assumption. A multitude of reasons likely collectively owning 83% of the equity, this MBO possibility has been floating motivate the buyers including less scrutiny of strategy and limited in the market for a number of years now.… circumstances where equity funding is needed. While minority shareholders have limited leverage, the board has a duty to ensure a fair price, If the [Sponsor] family is genuine in its interest in taking [Alpha] which, if accepted, would avoid litigation. We see the $70/sh as more of an private, we think it will likely need to sweeten the offer.” opening bid in what’s likely a negotiation around value, which is not atypical in these scenarios and almost certain for [Alpha] given the $77 | Hold June 14, 2022 weight of long-term crude prices on valuation. Peer comps point to ~$80/sh, commensurate with ~$70 WTI long term” “Announcement is somewhat of a surprise given prior messaging of wanting to be a public company given access to capital markets, but seems like a reasonable deal given our current price target of $77/shr.” $74 | Buy June 14, 2022 (1) $77 | Hold June 14, 2022 Note: Broker ratings and price targets reflect those at the time of the report, not current ratings and price targets. 9 (1) Reflects pre-announcement rating as a new report has not been released post-announcement. Source: Wall Street research, Bloomberg, FactSet.

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Select Research Analyst Commentary Since Announcement (Cont’d) Select Commentary | Credit Ratings “(BBB-/Stable) nonbinding take-private offer from the [Sponsor] family “Long-Term Issuer Default Ratings (IDR) of ‘BBB’ and senior unsecured would not impact our ratings or outlook on the company… while the ratings of ‘BBB’ are currently unaffected by an announced potential deal financing has not been disclosed yet, we expect the company’s financial privatization of the company… the risk of privatization alone is viewed metrics would remain appropriate for an investment-grade company and well as neutral in [Alpha’s] IDR… Fitch would be looking for [Alpha] to above our downgrade trigger under a scenario in which the transaction operate with similar financial policies, capital structure, as well as, maintain is 100% debt-funded and the debt is consolidated into the balance similar debt market access as it currently does, which are consistent with our sheet.” base case assumptions, in order for the rating to remain unchanged.” June 14, 2022 June 14, 2022 “Given that [Alpha]'s shares were trading above $70/share as recently as last week and are trading over $73/share as of mid-morning on June 14, 2022, we think the $70 offer could be subject to revision higher as part of the negotiating process… our view is that the rating agencies do not often give E&P companies the benefit of the doubt when it comes to leveraging transactions that rely heavily on high commodity prices to reduce debt (although OXY in 2019 was an example when this did happen). With S&P signaling that it expects [Alpha] to remain investment grade, and Fitch's rating at mid-BBB, we view the odds of falling out of the index as low, even if we see risk to the Baa3 rating at Moody's, which has tended to be more conservative with E&P sector ratings.” June 14, 2022 Select Commentary | Other “[Alpha] used to track very closely with the price of crude, peaking at $71.79 “The offer at a minimum should be $100, but the company is worth north with crude oil at $79.76. Today, the spread between crude and the share of that… at $110 [a barrel] oil, it’s worth $110 or more. At $120 [a barrel], it price of [Alpha] has massively widened at a time when investors would begins to look like stealing” normally be falling all over each other to buy these stocks. Hence, [Sponsor]’s willingness to borrow against the copious free cashflow of [Alpha] to buy out minority shareholders for what historically looks like a June 14, 2022 song. “Taking [Alpha] Resources private is significant, but not surprising… while it is only a proposed offer at this stage, the chances of realization are high… valuation represents a 12% discount to our US$80/Bbl high case scenario. June 28, 2022 June 15, 2022 10 Source: Wall Street research, Bloomberg, FactSet.

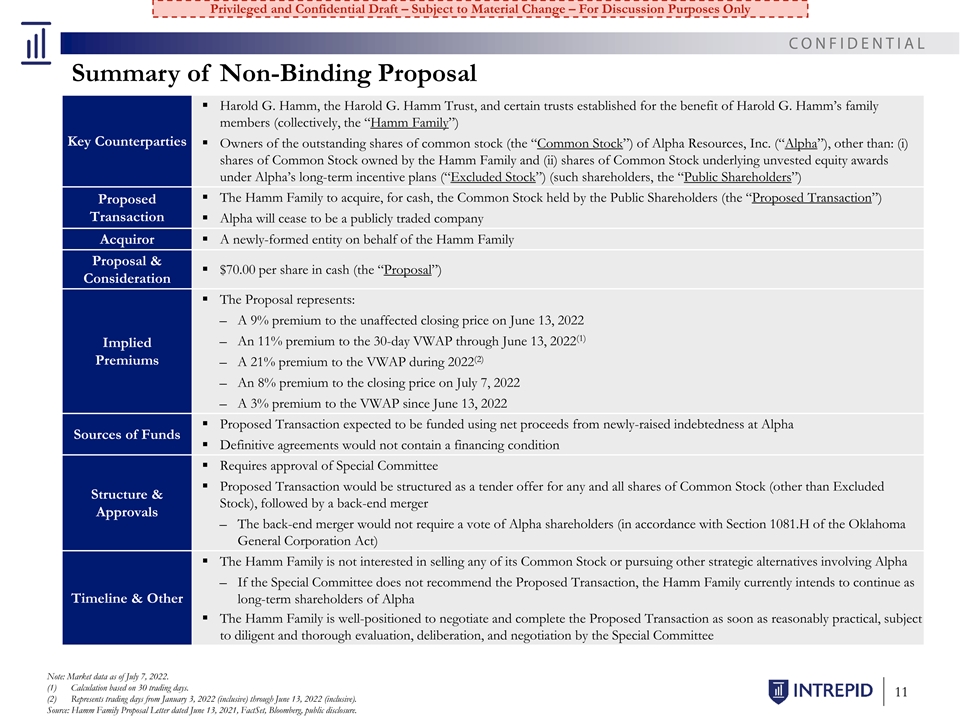

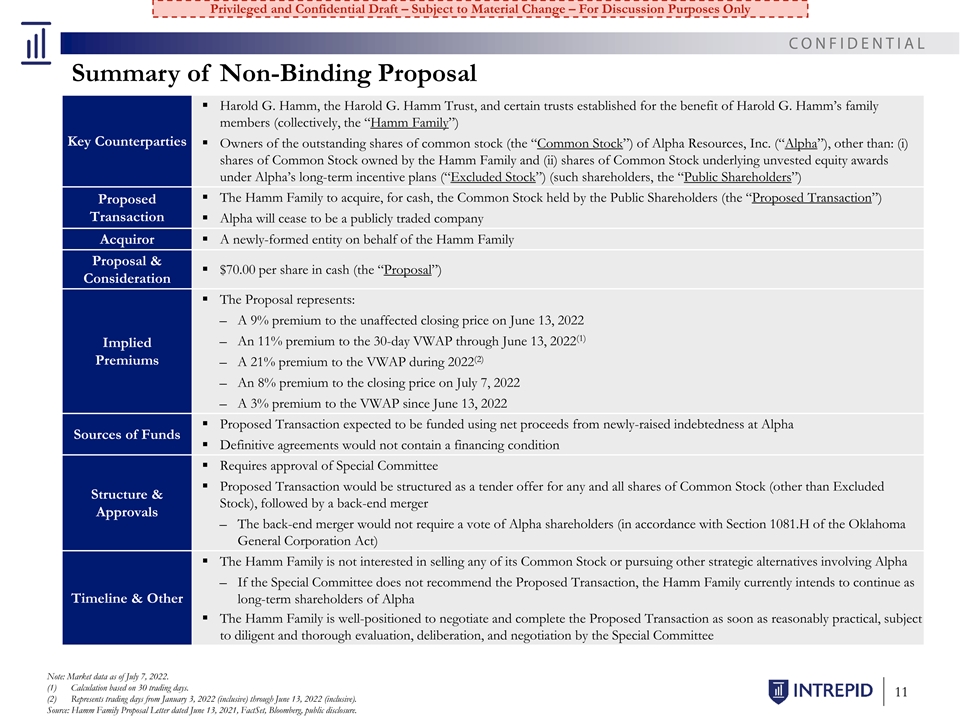

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Summary of Non-Binding Proposal ▪ Harold G. Hamm, the Harold G. Hamm Trust, and certain trusts established for the benefit of Harold G. Hamm’s family members (collectively, the “Hamm Family”) Key Counterparties ▪ Owners of the outstanding shares of common stock (the “Common Stock”) of Alpha Resources, Inc. (“Alpha”), other than: (i) shares of Common Stock owned by the Hamm Family and (ii) shares of Common Stock underlying unvested equity awards under Alpha’s long-term incentive plans (“Excluded Stock”) (such shareholders, the “Public Shareholders”) ▪ The Hamm Family to acquire, for cash, the Common Stock held by the Public Shareholders (the “Proposed Transaction”) Proposed Transaction ▪ Alpha will cease to be a publicly traded company Acquiror▪ A newly-formed entity on behalf of the Hamm Family Proposal & ▪ $70.00 per share in cash (the “Proposal”) Consideration ▪ The Proposal represents: – A 9% premium to the unaffected closing price on June 13, 2022 (1) – An 11% premium to the 30-day VWAP through June 13, 2022 Implied (2) Premiums – A 21% premium to the VWAP during 2022 – An 8% premium to the closing price on July 7, 2022 – A 3% premium to the VWAP since June 13, 2022 ▪ Proposed Transaction expected to be funded using net proceeds from newly-raised indebtedness at Alpha Sources of Funds ▪ Definitive agreements would not contain a financing condition ▪ Requires approval of Special Committee ▪ Proposed Transaction would be structured as a tender offer for any and all shares of Common Stock (other than Excluded Structure & Stock), followed by a back-end merger Approvals – The back-end merger would not require a vote of Alpha shareholders (in accordance with Section 1081.H of the Oklahoma General Corporation Act) ▪ The Hamm Family is not interested in selling any of its Common Stock or pursuing other strategic alternatives involving Alpha – If the Special Committee does not recommend the Proposed Transaction, the Hamm Family currently intends to continue as Timeline & Other long-term shareholders of Alpha ▪ The Hamm Family is well-positioned to negotiate and complete the Proposed Transaction as soon as reasonably practical, subject to diligent and thorough evaluation, deliberation, and negotiation by the Special Committee Note: Market data as of July 7, 2022. (1) Calculation based on 30 trading days. 11 (2) Represents trading days from January 3, 2022 (inclusive) through June 13, 2022 (inclusive). Source: Hamm Family Proposal Letter dated June 13, 2021, FactSet, Bloomberg, public disclosure.

Privileged and Confidential Draft – Subject to Material Change – For Discussion Purposes Only Disclaimer This document has been prepared by Intrepid Partners, L.L.C. (“Intrepid”), member FINRA and SIPC, for informational purposes only. You should not rely upon or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. This document and any oral information provided in connection with this document, as well as any information derived by you from the information contained herein, is confidential and is for the intended recipient and cannot be redistributed, reproduced, disclosed or transmitted without prior written permission from Intrepid. If you are not the intended recipient of this document, please delete and destroy all copies immediately. Prices shown in this document are indicative only and Intrepid is not offering to buy or sell, or soliciting offers to buy or sell any financial instrument. This document is “as is”. Unless otherwise specified, the source for all graphs, charts, and other information is Intrepid. Intrepid’s databases are derived from various internal and external sources. Intrepid’s use of any information from external sources does not imply that it has independently verified or necessarily agrees with any of such information, and Intrepid has assumed and relied upon the accuracy and completeness of such information for purposes of this document. Neither Intrepid nor any of its affiliates or agents represents or warrants, expressly or impliedly, that the information provided herein, or any oral information provided in connection herewith, or any data it generates, is accurate or complete, and it should not be relied upon as such. Intrepid and its affiliates and agents expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. Any data on past performance, modeling or back-testing or any other information contained herein is no indication as to future performance. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any modeling or back-testing or any other information contained herein. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have changed since the issuance of this document. All opinions, terms and estimates contained herein are preliminary and are based on financial, economic, market and other conditions prevailing as of the date hereof and are subject to change. Intrepid assumes no obligation or responsibility to update any of the information contained in this document to reflect any such changes. The value of any investment may fluctuate as a result of market changes. The information herein is not intended to predict actual results and no assurances are given with respect thereto. Nothing herein shall be deemed to constitute investment, legal, tax, financial, accounting or other advice. Intrepid and/or its affiliated companies may make a market or deal as principal in the securities mentioned in this document or in options or other derivatives based thereon. Intrepid may be on the opposite side of any orders executed for securities or financial instruments that are related to or the subject of this material. In addition, Intrepid, its affiliated companies, shareholders, directors, officers, and/or employees, including persons involved in preparation or issuance of this material, may from time to time have long or short positions in such securities or financial instruments, or in options, futures, or other derivative instruments based thereon. Intrepid and its affiliates and their respective officers, directors, partners and employees, including persons involved in the preparation or issuance of this document, may from time to time act as manager, co-manager, arranger or underwriter of an offering or otherwise, in the capacity of principal or agent, transact in, hold or act as market-maker or advisor, broker or commercial and/or investment banker in relation to the securities, instruments or related derivatives which are the subject of this document. This document does not constitute nor does it form part of an offer to sell or purchase, or the solicitation of an offer to sell or purchase, any securities or instruments or an offer or recommendation to enter into any transaction described herein nor does this document constitute an offer or commitment to provide, syndicate, arrange or underwrite any financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of financial opinion or recommendation by Intrepid or any of its affiliates. This document is not a research report nor should it be construed as such. IRS Circular 230 Disclosure: Intrepid and its affiliates do not provide tax advice. Please note that (i) any discussion of U.S. tax matters contained in this communication (including any attachments) cannot be used by you for the purpose of avoiding tax penalties; (ii) this communication was written to support the promotion or marketing of the matters addressed herein; and (iii) you should seek advice based on your particular circumstances from an independent tax advisor. No action has been made or will be taken that would permit a public offering of the securities described herein in any jurisdiction in which action for that purpose is required. No offers, sales, resales, or delivery of the securities described herein or distribution of any offering material relating to such securities may be made in or from any jurisdiction except in circumstances which will result in compliance with any applicable laws and regulations and which will not impose any obligation on Intrepid or any of its affiliates. This document does not disclose all the risks and other significant issues related to an investment in the securities described herein. Prior to transacting, potential investors should ensure that they fully understand the terms of the relevant securities and any applicable risks. The information contained herein is not intended to be distributed to any prospective or actual investors and, accordingly, may not be shown or given to any person other than the recipient, and is not to be forwarded to any other person (including any retail investor or customer), copied or otherwise reproduced or distributed to any such person in any manner whatsoever. Failure to comply with this directive can result in a violation of the Securities Act of 1933, as amended.