UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

610 Market Street

Philadelphia, PA 19106

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Delaware Tax-Free Minnesota Fund

Class A: DEFFX

Annual shareholder report | August 31, 2024

This annual shareholder report contains important information about Delaware Tax-Free Minnesota Fund (Fund) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $86 | 0.83% |

Management’s discussion of Fund performance

Performance highlights

Delaware Tax-Free Minnesota Fund (Class A) returned 7.10% (excluding sales charge) for the 12 months ended August 31, 2024. During the same period, the Bloomberg Municipal Bond Index, the Fund's broad-based securities market index, returned 6.09%.

Top contributors to performance:

Municipal yields fell over the fiscal year against a backdrop of slowing inflation and anticipation that the US Federal Reserve (Fed) would eventually cut rates. As a result, the longer end of the curve outperformed.

Lower-investment-grade and below-investment-grade segments drove performance. The catalyst was a strong technical backdrop of diminutive high yield issuance coupled with inflows to municipal mutual funds, particularly high yield funds.

Key contributors to performance included:

Overweight to the long bond (22+ years) segment of the curve

Overweight to BBB-rated credit

Significant out-of-benchmark allocation to below-investment-grade securities

Top detractors from performance:

The front end of the curve – which is, by its nature, shorter in duration – detracted from performance over the fiscal year, as this maturity segment lagged relative to the intermediate and long ends of the curve.

Key detractors from performance included:

Modest out-of-benchmark allocation to the front end (0-1 year) of the curve

Allocation to pre-refunded bonds, predominantly on the front end of the curve

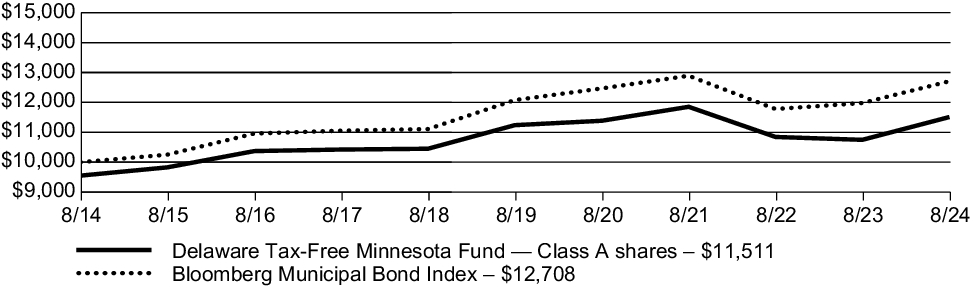

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index for the same period and the deduction of the maximum applicable sales charge for Class A shares.

Growth of $10,000 investment

For the period August 31, 2014, through August 31, 2024

| Average annual total returns (as of August 31, 2024) | 1 year | 5 year | 10 year |

| Delaware Tax-Free Minnesota Fund (Class A) – including sales charge | 2.23 | % | -0.46 | % | 1.42 | % |

| Delaware Tax-Free Minnesota Fund (Class A) – excluding sales charge | 7.10 | % | 0.47 | % | 1.89 | % |

| Bloomberg Municipal Bond Index | 6.09 | % | 1.02 | % | 2.43 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

Fund statistics (as of August 31, 2024)

| Fund net assets | $550,892,137 |

| Total number of portfolio holdings | 321 |

| Total advisory fees paid | $2,058,623 |

| Portfolio turnover rate | 27% |

Fund holdings (as of August 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Healthcare Revenue Bonds | 32.29% |

| Education Revenue Bonds | 19.95% |

| Local General Obligation Bonds | 18.18% |

| Transportation Revenue Bonds | 7.71% |

| Electric Revenue Bonds | 6.20% |

Industrial Development Revenue/Pollution Control

Revenue Bonds | 3.57% |

| State General Obligation Bonds | 3.27% |

| Special Tax Revenue Bonds | 3.06% |

| Housing Revenue Bonds | 1.98% |

| Lease Revenue Bonds | 1.88% |

| Pre-Refunded Bond | 0.15% |

| |

| |

| |

State and territory allocation

| Minnesota | 94.70% |

| Puerto Rico | 3.54% |

For the fiscal year ended August 31, 2024, the Fund introduced a new fee waiver for Class A shares of 0.81% (excluding certain items).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 31, 2024, at delawarefunds.com/literature or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Tax-Free Minnesota Fund

Class C: DMOCX

Annual shareholder report | August 31, 2024

This annual shareholder report contains important information about Delaware Tax-Free Minnesota Fund (Fund) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $163 | 1.58% |

Management’s discussion of Fund performance

Performance highlights

Delaware Tax-Free Minnesota Fund (Class C) returned 6.39% (excluding sales charge) for the 12 months ended August 31, 2024. During the same period, the Bloomberg Municipal Bond Index, the Fund's broad-based securities market index, returned 6.09%.

Top contributors to performance:

Municipal yields fell over the fiscal year against a backdrop of slowing inflation and anticipation that the US Federal Reserve (Fed) would eventually cut rates. As a result, the longer end of the curve outperformed.

Lower-investment-grade and below-investment-grade segments drove performance. The catalyst was a strong technical backdrop of diminutive high yield issuance coupled with inflows to municipal mutual funds, particularly high yield funds.

Key contributors to performance included:

Overweight to the long bond (22+ years) segment of the curve

Overweight to BBB-rated credit

Significant out-of-benchmark allocation to below-investment-grade securities

Top detractors from performance:

The front end of the curve – which is, by its nature, shorter in duration – detracted from performance over the fiscal year, as this maturity segment lagged relative to the intermediate and long ends of the curve.

Key detractors from performance included:

Modest out-of-benchmark allocation to the front end (0-1 year) of the curve

Allocation to pre-refunded bonds, predominantly on the front end of the curve

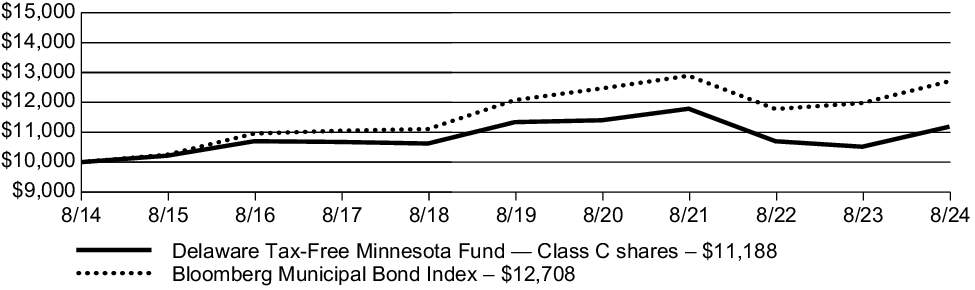

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index for the same period.

Growth of $10,000 investment

For the period August 31, 2014, through August 31, 2024

| Average annual total returns (as of August 31, 2024) | 1 year | 5 year | 10 year |

| Delaware Tax-Free Minnesota Fund (Class C) – including sales charge | 5.39 | % | -0.28 | % | 1.13 | % |

| Delaware Tax-Free Minnesota Fund (Class C) – excluding sales charge | 6.39 | % | -0.28 | % | 1.13 | % |

| Bloomberg Municipal Bond Index | 6.09 | % | 1.02 | % | 2.43 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

Fund statistics (as of August 31, 2024)

| Fund net assets | $550,892,137 |

| Total number of portfolio holdings | 321 |

| Total advisory fees paid | $2,058,623 |

| Portfolio turnover rate | 27% |

Fund holdings (as of August 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Healthcare Revenue Bonds | 32.29% |

| Education Revenue Bonds | 19.95% |

| Local General Obligation Bonds | 18.18% |

| Transportation Revenue Bonds | 7.71% |

| Electric Revenue Bonds | 6.20% |

Industrial Development Revenue/Pollution Control

Revenue Bonds | 3.57% |

| State General Obligation Bonds | 3.27% |

| Special Tax Revenue Bonds | 3.06% |

| Housing Revenue Bonds | 1.98% |

| Lease Revenue Bonds | 1.88% |

| Pre-Refunded Bond | 0.15% |

| |

| |

| |

State and territory allocation

| Minnesota | 94.70% |

| Puerto Rico | 3.54% |

For the fiscal year ended August 31, 2024, the Fund introduced a new fee waiver for Class C shares of 1.56% (excluding certain items).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 31, 2024, at delawarefunds.com/literature or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Delaware Tax-Free Minnesota Fund

Institutional Class: DMNIX

Annual shareholder report | August 31, 2024

This annual shareholder report contains important information about Delaware Tax-Free Minnesota Fund (Fund) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last 12 months?

(Based on a hypothetical $10,000 investment)

| Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $60 | 0.58% |

Management’s discussion of Fund performance

Performance highlights

Delaware Tax-Free Minnesota Fund (Institutional Class) returned 7.37% (excluding sales charge) for the 12 months ended August 31, 2024. During the same period, the Bloomberg Municipal Bond Index, the Fund's broad-based securities market index, returned 6.09%.

Top contributors to performance:

Municipal yields fell over the fiscal year against a backdrop of slowing inflation and anticipation that the US Federal Reserve (Fed) would eventually cut rates. As a result, the longer end of the curve outperformed.

Lower-investment-grade and below-investment-grade segments drove performance. The catalyst was a strong technical backdrop of diminutive high yield issuance coupled with inflows to municipal mutual funds, particularly high yield funds.

Key contributors to performance included:

Overweight to the long bond (22+ years) segment of the curve

Overweight to BBB-rated credit

Significant out-of-benchmark allocation to below-investment-grade securities

Top detractors from performance:

The front end of the curve – which is, by its nature, shorter in duration – detracted from performance over the fiscal year, as this maturity segment lagged relative to the intermediate and long ends of the curve.

Key detractors from performance included:

Modest out-of-benchmark allocation to the front end (0-1 year) of the curve

Allocation to pre-refunded bonds, predominantly on the front end of the curve

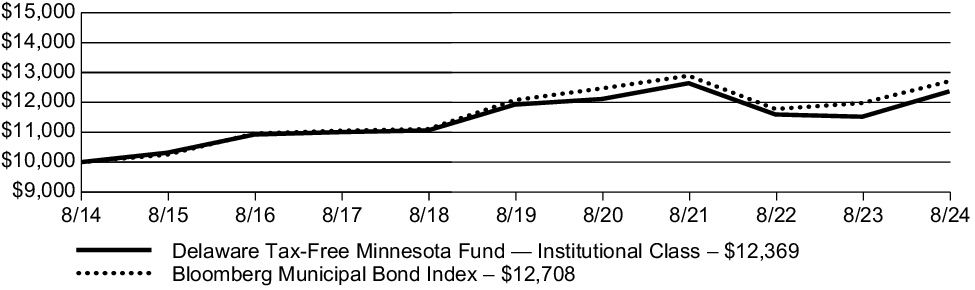

Fund performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the Class. It also assumes a $10,000 initial investment at the beginning of the first full fiscal year in a broad-based securities market index for the same period.

Growth of $10,000 investment

For the period August 31, 2014, through August 31, 2024

| Average annual total returns (as of August 31, 2024) | 1 year | 5 year | 10 year |

| Delaware Tax-Free Minnesota Fund (Institutional Class) – including sales charge | 7.37 | % | 0.72 | % | 2.15 | % |

| Delaware Tax-Free Minnesota Fund (Institutional Class) – excluding sales charge | 7.37 | % | 0.72 | % | 2.15 | % |

| Bloomberg Municipal Bond Index | 6.09 | % | 1.02 | % | 2.43 | % |

Keep in mind that the Fund's past performance is not a good predictor of how the Fund will perform in the future.

Visit delawarefunds.com/performance for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance results reflect any expense caps in effect during these periods. All results shown assume reinvestment of distributions.

Fund statistics (as of August 31, 2024)

| Fund net assets | $550,892,137 |

| Total number of portfolio holdings | 321 |

| Total advisory fees paid | $2,058,623 |

| Portfolio turnover rate | 27% |

Fund holdings (as of August 31, 2024)

The tables below show the investment makeup of the Fund, with each category representing a percentage of the total net assets of the Fund.

| Healthcare Revenue Bonds | 32.29% |

| Education Revenue Bonds | 19.95% |

| Local General Obligation Bonds | 18.18% |

| Transportation Revenue Bonds | 7.71% |

| Electric Revenue Bonds | 6.20% |

Industrial Development Revenue/Pollution Control

Revenue Bonds | 3.57% |

| State General Obligation Bonds | 3.27% |

| Special Tax Revenue Bonds | 3.06% |

| Housing Revenue Bonds | 1.98% |

| Lease Revenue Bonds | 1.88% |

| Pre-Refunded Bond | 0.15% |

| |

| |

| |

State and territory allocation

| Minnesota | 94.70% |

| Puerto Rico | 3.54% |

For the fiscal year ended August 31, 2024, the Fund introduced a new fee waiver for Institutional Class shares of 0.56% (excluding certain items).

This is a summary of certain changes to the Fund since the beginning of the reporting period. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 31, 2024, at delawarefunds.com/literature or upon request at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Availability of additional information

You can find additional information about the Fund, such as the prospectus, financial information, holdings, and proxy voting information, at delawarefunds.com/literature. You can also request this information by contacting us at 800 523-1918, weekdays from 8:30am to 6:00pm ET.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports, and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800 523-1918 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For more information, please scan the QR code at left to navigate to additional hosted material at delawarefunds.com/literature.

Item 2. Code of Ethics.

| | (a) | The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. A copy of the registrant’s Code of Business Ethics has been posted on the Delaware Funds by Macquarie® Internet Web site at www.delawarefunds.com. Any amendments to the Code of Business Ethics, and information on any waiver from its provisions granted by the registrant, will also be posted on this Web site within five business days of such amendment or waiver and will remain on the Web site for at least 12 months. |

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that certain members of the registrant’s Audit Committee are audit committee financial experts, as defined below. For purposes of this item, an “audit committee financial expert” is a person who has the following attributes:

a. An understanding of generally accepted accounting principles and financial statements;

b. The ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves;

c. Experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities;

d. An understanding of internal controls and procedures for financial reporting; and

e. An understanding of audit committee functions.

An “audit committee financial expert” shall have acquired such attributes through:

a. Education and experience as a principal financial officer, principal accounting officer, controller, public accountant, or auditor or experience in one or more positions that involve the performance of similar functions;

b. Experience actively supervising a principal financial officer, principal accounting officer, controller, public accountant, auditor, or person performing similar functions;

c. Experience overseeing or assessing the performance of companies or public accountants with respect to the preparation, auditing, or evaluation of financial statements; or

d. Other relevant experience.

The registrant’s Board of Trustees has also determined that each member of the registrant’s Audit Committee is independent. In order to be “independent” for purposes of this item, the Audit Committee member may not, other than in his or her capacity as a member of the Board of Trustees or any committee thereof, (i) accept directly or indirectly any consulting, advisory or other compensatory fee from the issuer; or (ii) be an “interested person” of the registrant as defined in Section 2(a)(19) of the Investment Company Act of 1940.

The names of the audit committee financial experts on the registrant’s Audit Committee are set forth below:

H. Jeffrey Dobbs

Frances Sevilla-Sacasa, Chair

Christianna Wood

Item 4. Principal Accountant Fees and Services.

Audit Fees

| | (a) | The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years are $43,000 for 2024 and $38,887 for 2023. |

Audit-Related Fees

| | (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item are $1,362,878 for 2024 and $1,362,878 for 2023. |

Tax Fees

| | (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are $5,797 for 2024 and $5,297 for 2023. |

All Other Fees

| | (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $0 for 2024 and $0 for 2023. |

| (e)(1) | The registrant’s Audit Committee has established pre-approval policies and procedures as permitted by Rule 2-01(c)(7)(i)(B) of Regulation S-X (the “Pre-Approval Policy”) with respect to services provided by the registrant’s independent auditors. Pursuant to the Pre-Approval Policy, the Audit Committee has pre-approved the services set forth in the table below with respect to the registrant up to the specified fee limits. Certain fee limits are based on aggregate fees to the registrant and other registrants within the Delaware Funds by Macquarie. |

| | |

Service | | Range of Fees |

| Audit Services | | |

| |

| Statutory audits or financial audits for new Funds | | up to $50,000 per Fund |

| |

| Services associated with SEC registration statements (e.g., Form N-1A, Form N-14, etc.), periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings (e.g., comfort letters for closed-end Fund offerings, consents), and assistance in responding to SEC comment letters | | up to $10,000 per Fund |

| |

| Consultations by Fund management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, or other regulatory or standard-setting bodies (Note: Under SEC rules, some consultations may be considered “audit-related services” rather than “audit services”) | | up to $25,000 in the aggregate |

| |

| Audit-Related Services | | |

| |

| Consultations by Fund management as to the accounting or disclosure treatment of transactions or events and /or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, or other regulatory or standard-setting bodies (Note: Under SEC rules, some consultations may be considered “audit services” rather than “audit-related services”) | | up to $25,000 in the aggregate |

| |

| Tax Services | | |

| |

| U.S. federal, state and local and international tax planning and advice (e.g., consulting on statutory, regulatory or administrative developments, evaluation of Funds’ tax compliance function, etc.) | | up to $25,000 in the aggregate |

| |

| U.S. federal, state and local tax compliance (e.g., excise distribution reviews, etc.) | | up to $5,000 per Fund |

| |

| Review of federal, state, local and international income, franchise and other tax returns | | up to $5,000 per Fund |

Under the Pre-Approval Policy, the Audit Committee has also pre-approved the services set forth in the table below with respect to the registrant’s investment adviser and other entities controlling, controlled by or under common control with the investment adviser that provide ongoing services to the registrant (the “Control Affiliates”) up to the specified fee limit. This fee limit is based on aggregate fees to the investment adviser and its Control Affiliates.

| | |

Service | | Range of Fees |

| Non-Audit Services | | |

| |

| Services associated with periodic reports and other documents filed with the SEC and assistance in responding to SEC comment letters | | up to $10,000 in the aggregate |

The Pre-Approval Policy requires the registrant’s independent auditors to report to the Audit Committee at each of its regular meetings regarding all services initiated since the last such report was rendered, including those services authorized by the Pre-Approval Policy.

| (e)(2) | The percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X are as follows: |

(b) 0%

(c) 0%

(d) 0%

| | (g) | The aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant was $17,300,000 for 2024 and $24,428,000 for 2023. |

| | (h) | The audit committee of the registrant’s board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Financial Statements filed under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

| (a) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file its most recent annual or semi-annual financial statements required, and for the periods specified, by Regulation S-X. |

The annual financial statements are attached herewith.

| (b) | An open-end management investment company registered on Form N-1A [17 CFR 239.15A and 17 CFR 274.11A] must file the information required by Item 13 of Form N-1A. |

The Financial Highlights are attached herewith.

Fixed income mutual funds

Delaware Minnesota High-Yield Municipal Bond Fund

Delaware Tax-Free Minnesota Fund

Financial statements and other information

For the year ended August 31, 2024

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus.

Form N-PORT and proxy voting information

Each Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT. Each Fund’s Form N-PORT, as well as a description of the policies and procedures that the Funds use to determine how to vote proxies (if any) relating to portfolio securities, are available without charge (i) upon request, by calling 800 523-1918; and (ii) on the SEC’s website at sec.gov. In addition, a description of the policies and procedures that the Funds use to determine how to vote proxies (if any) relating to portfolio securities and the Schedule of Investments included in the Funds’ most recent Form N-PORT are available without charge on the Funds’ website at delawarefunds.com/literature.

Information (if any) regarding how the Funds voted proxies relating to portfolio securities during the most recently disclosed 12-month period ended June 30 is available without charge (i) through the Funds' website at delawarefunds.com/proxy; and (ii) on the SEC’s website at sec.gov.

Schedules of investments

| Delaware Minnesota High-Yield Municipal Bond Fund | August 31, 2024 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds — 98.01% |

| Education Revenue Bonds — 26.71% |

| City of Bethel, Minnesota Charter School Lease Revenue | | | |

| (Spectrum High School Project) | | | |

| Series A 4.00% 7/1/32 | | 840,000 | $ 837,724 |

| Series A 4.00% 7/1/37 | | 850,000 | 814,478 |

| Series A 4.25% 7/1/47 | | 750,000 | 684,375 |

| Series A 4.375% 7/1/52 | | 250,000 | 226,990 |

City of Brooklyn Park, Minnesota Charter School Lease

Revenue | | | |

(Prairie Seeds Academy Project)

Series A 5.00% 3/1/39 | | 1,270,000 | 1,246,886 |

City of Cologne, Minnesota Charter School Lease

Revenue | | | |

| (Cologne Academy Project) | | | |

| Series A 5.00% 7/1/29 | | 270,000 | 270,105 |

| Series A 5.00% 7/1/34 | | 350,000 | 350,081 |

| Series A 5.00% 7/1/45 | | 360,000 | 358,589 |

| City of Deephaven, Minnesota Charter School Revenue | | | |

(Eagle Ridge Academy Project)

Series A 5.50% 7/1/50 | | 1,000,000 | 1,005,130 |

City of Forest Lake, Minnesota Charter School Lease

Revenue | | | |

| (Lakes International Language Academy Project) | | | |

| Series A 4.50% 8/1/26 | | 245,000 | 245,051 |

| Series A 5.375% 8/1/50 | | 975,000 | 991,117 |

| Series A 5.75% 8/1/44 | | 585,000 | 585,351 |

City of Ham Lake, Minnesota Charter School Lease

Revenue | | | |

| (DaVinci Academy Project) | | | |

| Series A 5.00% 7/1/36 | | 235,000 | 230,768 |

| Series A 5.00% 7/1/47 | | 710,000 | 647,761 |

(Parnassus Preparatory School Project)

Series A 5.00% 11/1/47 | | 650,000 | 651,378 |

| City of Hugo, Minnesota Charter School Lease Revenue | | | |

| (Noble Academy Project) | | | |

| Series A 5.00% 7/1/34 | | 1,000,000 | 1,000,410 |

| Series A 5.00% 7/1/44 | | 495,000 | 494,995 |

City of Minneapolis, Minnesota Charter School Lease

Revenue | | | |

(Cyber Village Academy Project)

Series A 5.50% 6/1/57 | | 1,400,000 | 1,338,582 |

| (Hiawatha Academies Project) | | | |

| Series A 144A 5.375% 7/1/42 # | | 690,000 | 691,470 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

City of Minneapolis, Minnesota Charter School Lease

Revenue | | | |

| (Hiawatha Academies Project) |

| Series A 144A 5.50% 7/1/52 # | | 1,130,000 | $ 1,123,525 |

| Series A 144A 5.50% 7/1/57 # | | 880,000 | 869,378 |

| City of Minneapolis, Minnesota Student Housing Revenue | | | |

| (Riverton Community Housing Project) | | | |

| 144A 4.75% 8/1/43 # | | 750,000 | 731,678 |

| 144A 5.00% 8/1/53 # | | 570,000 | 570,074 |

| 5.25% 8/1/39 | | 800,000 | 800,320 |

City of Otsego, Minnesota Charter School Lease

Revenue | | | |

(Kaleidoscope Charter School Project)

Series A 5.00% 9/1/44 | | 1,435,000 | 1,346,963 |

City of St. Cloud, Minnesota Charter School Lease

Revenue | | | |

(Stride Academy Project)

Series A 5.00% 4/1/46 | | 750,000 | 639,712 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Charter School Lease Revenue | | | |

(Academia Cesar Chavez School Project)

Series A 5.25% 7/1/50 | | 1,750,000 | 1,595,667 |

(Great River School Project)

Series A 144A 5.50% 7/1/52 # | | 265,000 | 267,528 |

| (Hmong College Preparatory Academy Project) | | | |

| Series A 5.00% 9/1/43 | | 1,000,000 | 1,011,860 |

| Series A 5.00% 9/1/55 | | 1,000,000 | 995,310 |

| Series A 5.75% 9/1/46 | | 500,000 | 508,550 |

| Series A 6.00% 9/1/51 | | 3,500,000 | 3,568,285 |

(Nova Classical Academy Project)

Series A 4.125% 9/1/47 | | 1,250,000 | 1,128,425 |

(Twin Cities Academy Project)

Series A 5.375% 7/1/50 | | 1,500,000 | 1,503,900 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Health Care Facilities Revenue | | | |

(Great River School Project)

Series A 144A 4.75% 7/1/29 # | | 300,000 | 303,141 |

(Nova Classical Academy Project)

Series A 4.00% 9/1/36 | | 1,620,000 | 1,570,379 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Revenue | | | |

(Hmong College Preparatory Academy Project)

Series A 5.00% 9/1/40 | | 715,000 | 726,090 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

City of Woodbury, Minnesota Charter School Lease

Revenue | | | |

(MSA Building Company)

Series A 4.00% 12/1/50 | | 450,000 | $ 374,243 |

| (Woodbury Leadership Academy Project) | | | |

| 4.00% 7/1/41 | | 890,000 | 752,450 |

| Series A 4.00% 7/1/51 | | 1,140,000 | 875,201 |

| Series A 4.00% 7/1/56 | | 575,000 | 428,093 |

| Duluth Housing & Redevelopment Authority Revenue | | | |

| (Duluth Public Schools Academy Project) | | | |

| Series A 5.00% 11/1/38 | | 700,000 | 664,503 |

| Series A 5.00% 11/1/48 | | 1,700,000 | 1,500,199 |

| Minnesota Higher Education Facilities Authority Revenue | | | |

| (Bethel University) | | | |

| 5.00% 5/1/37 | | 1,250,000 | 1,215,638 |

| 5.00% 5/1/47 | | 3,000,000 | 2,734,380 |

(Carleton College)

4.00% 3/1/47 | | 1,500,000 | 1,483,695 |

(Green Bonds)

Series A 5.00% 10/1/32 | | 500,000 | 550,815 |

(Gustavus Adolphus College)

5.00% 10/1/47 | | 2,350,000 | 2,388,023 |

| (Macalester College) | | | |

| 3.00% 3/1/40 | | 365,000 | 324,485 |

| 3.00% 3/1/43 | | 325,000 | 274,066 |

| 4.00% 3/1/48 | | 600,000 | 582,486 |

| (Minneapolis College of Art & Design) | | | |

| 4.00% 5/1/25 | | 200,000 | 200,020 |

| 4.00% 5/1/26 | | 100,000 | 100,007 |

| (St. Catherine University) | | | |

| 5.00% 10/1/52 | | 750,000 | 751,928 |

| Series A 4.00% 10/1/38 | | 920,000 | 882,823 |

| Series A 5.00% 10/1/45 | | 1,670,000 | 1,684,596 |

(St. Olaf College)

4.00% 10/1/46 | | 935,000 | 904,070 |

| (Trustees of the Hamline University of Minnesota) | | | |

| Series B 5.00% 10/1/37 | | 300,000 | 303,810 |

| Series B 5.00% 10/1/39 | | 1,000,000 | 1,008,090 |

| Series B 5.00% 10/1/47 | | 1,055,000 | 1,057,669 |

| (University of St. Thomas) | | | |

| 4.00% 10/1/37 | | 300,000 | 305,028 |

| 4.00% 10/1/44 | | 100,000 | 96,796 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

| Minnesota Higher Education Facilities Authority Revenue | | | |

| (University of St. Thomas) |

| 5.00% 10/1/34 | | 450,000 | $ 485,235 |

| 5.00% 10/1/40 | | 915,000 | 966,999 |

| Series A 4.125% 10/1/53 | | 1,325,000 | 1,305,377 |

| Series A 5.00% 10/1/49 | | 1,250,000 | 1,338,837 |

| Minnesota Office of Higher Education Revenue | | | |

(Senior Supplemental Student Loan Program)

4.00% 11/1/42 (AMT) | | 250,000 | 241,460 |

St. Paul, Minnesota Independent School District No.

625 Revenue | | | |

| Series A 5.00% 2/1/43 | | 1,000,000 | 1,118,770 |

| University of Minnesota Revenue | | | |

| Series A 5.00% 9/1/42 | | 900,000 | 927,414 |

| | 59,759,232 |

| Electric Revenue Bonds — 1.20% |

| Hutchinson Utilities Commission Revenue | | | |

| Series A 5.00% 12/1/26 | | 360,000 | 360,508 |

| Puerto Rico Electric Power Authority Revenue | | | |

| Series A 5.05% 7/1/42 ‡ | | 165,000 | 89,100 |

| Series AAA 5.25% 7/1/25 ‡ | | 95,000 | 51,300 |

| Series CCC 5.25% 7/1/27 ‡ | | 650,000 | 351,000 |

| Series WW 5.00% 7/1/28 ‡ | | 585,000 | 315,900 |

| Series XX 4.75% 7/1/26 ‡ | | 105,000 | 56,700 |

| Series XX 5.25% 7/1/40 ‡ | | 295,000 | 159,300 |

| Series XX 5.75% 7/1/36 ‡ | | 370,000 | 199,800 |

| Series ZZ 4.75% 7/1/27 ‡ | | 85,000 | 45,900 |

| Series ZZ 5.25% 7/1/25 ‡ | | 130,000 | 69,875 |

| Southern Minnesota Municipal Power Agency Revenue | | | |

| Series A 5.00% 1/1/46 | | 400,000 | 407,136 |

Western Minnesota Municipal Power Agency Supply

Revenue | | | |

(Red Rock Hydroelectric Project)

Series A 5.00% 1/1/49 | | 555,000 | 573,270 |

| | 2,679,789 |

| Healthcare Revenue Bonds — 38.07% |

City of Anoka, Minnesota Healthcare & Housing Facilities

Revenue | | | |

(The Homestead at Anoka Project)

5.125% 11/1/49 | | 400,000 | 366,436 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

| City of Apple Valley, Minnesota Senior Housing Revenue | | | |

| (PHS Senior Housing, Inc. Orchard Path Project) | | | |

| 4.50% 9/1/53 | | 840,000 | $ 795,732 |

| 5.00% 9/1/43 | | 1,000,000 | 1,003,550 |

| 5.00% 9/1/58 | | 1,175,000 | 1,176,234 |

| City of Apple Valley, Minnesota Senior Living Revenue | | | |

| (Senior Living LLC Project) | | | |

| Fourth Tier Series D 7.00% 1/1/37 | | 490,000 | 312,890 |

| Fourth Tier Series D 7.25% 1/1/52 | | 1,495,000 | 841,864 |

| Second Tier Series B 5.00% 1/1/47 | | 535,000 | 320,738 |

City of Bethel, Minnesota Housing & Health Care

Facilities Revenue | | | |

(Benedictine Health System – St. Peter Communities Project)

Series A 5.50% 12/1/48 | | 1,280,000 | 1,239,923 |

| (Ecumen Obligated Group) | | | |

| Series A 6.125% 3/1/44 | | 1,100,000 | 1,134,716 |

| Series A 6.125% 3/1/49 | | 300,000 | 303,981 |

| City of Bethel, Minnesota Senior Housing Revenue | | | |

(The Lodge at the Lakes at Stillwater Project)

5.25% 6/1/58 | | 1,475,000 | 1,305,906 |

City of Brooklyn Center, Minnesota Multifamily Housing

Revenue | | | |

(Sanctuary at Brooklyn Center Project)

Series A 5.50% 11/1/35 ‡ | | 639,031 | 383,419 |

| City of Center, Minnesota Health Care Facilities Revenue | | | |

(Hazelden Betty Ford Foundation Project)

4.50% 11/1/34 | | 1,000,000 | 1,000,810 |

City of Chatfield, Minnesota Healthcare & Housing

Facilities Revenue | | | |

| (Chosen Valley Care Center Project) | | | |

| 4.00% 9/1/39 | | 250,000 | 213,645 |

| 5.00% 9/1/52 | | 1,500,000 | 1,299,585 |

City of Crookston, Minnesota Health Care Facilities

Revenue | | | |

(Riverview Health Project)

5.00% 5/1/51 | | 1,025,000 | 628,571 |

City of Glencoe, Minnesota Health Care Facilities

Revenue | | | |

(Glencoe Regional Health Services Project)

4.00% 4/1/31 | | 185,000 | 182,258 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

City of Hayward, Minnesota Health Care Facilities

Revenue | | | |

(American Baptist Homes Midwest Obligated Group)

5.375% 8/1/34 | | 750,000 | $ 666,833 |

(St. John's Lutheran Home of Albert Lea Project)

Series A 5.375% 10/1/44 | | 90,000 | 54,900 |

City of Maple Grove, Minnesota Health Care Facilities

Revenue | | | |

| (Maple Grove Hospital Corporation) | | | |

| 4.00% 5/1/37 | | 1,625,000 | 1,546,675 |

| 5.00% 5/1/29 | | 500,000 | 517,075 |

(North Memorial Health Care)

4.00% 9/1/35 | | 300,000 | 291,243 |

City of Maple Plain, Minnesota Senior Housing & Health

Care Revenue | | | |

(Haven Homes Incorporate Project)

5.00% 7/1/49 | | 1,000,000 | 958,760 |

City of Minneapolis, Minnesota Health Care System

Revenue | | | |

(Allina Health System)

4.00% 11/15/40 | | 1,000,000 | 991,620 |

| (Fairview Health Services) | | | |

| Series A 4.00% 11/15/48 | | 2,855,000 | 2,596,594 |

| Series A 5.00% 11/15/32 | | 1,250,000 | 1,262,775 |

| Series A 5.00% 11/15/33 | | 1,400,000 | 1,457,064 |

| Series A 5.00% 11/15/44 | | 1,000,000 | 1,000,890 |

| Series A 5.00% 11/15/49 | | 1,000,000 | 1,010,000 |

City of Minneapolis, Minnesota Senior Housing &

Healthcare Revenue | | | |

(Ecumen-Abiitan Mill City Project)

5.375% 11/1/50 | | 1,700,000 | 1,616,343 |

| City of Morris, Minnesota Health Care Facilities Revenue | | | |

| (Farmington Health Services) | | | |

| 4.10% 8/1/44 | | 500,000 | 395,360 |

| 4.20% 8/1/49 | | 1,500,000 | 1,153,110 |

City of Rochester, Minnesota Health Care & Housing

Revenue | | | |

(The Homestead at Rochester Project)

Series A 6.875% 12/1/48 | | 1,200,000 | 1,200,192 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

City of Rochester, Minnesota Health Care Facilities

Revenue | | | |

| (Mayo Clinic) | | | |

| 4.00% 11/15/39 | | 3,500,000 | $ 3,635,275 |

| 5.00% 11/15/57 | | 5,175,000 | 5,562,245 |

| Series B 5.00% 11/15/33 | | 500,000 | 587,945 |

City of Sartell, Minnesota Health Care & Housing

Facilities Revenue | | | |

| (Country Manor Campus LLC Project) | | | |

| 5.30% 9/1/37 | | 600,000 | 600,126 |

| Series A 5.00% 9/1/32 | | 1,000,000 | 1,009,950 |

| Series A 5.00% 9/1/35 | | 350,000 | 352,607 |

City of Sauk Rapids, Minnesota Health Care Housing

Facilities Revenue | | | |

(Good Shepherd Lutheran Home)

5.125% 1/1/39 | | 825,000 | 738,631 |

City of Shakopee, Minnesota Health Care Facilities

Revenue | | | |

| (St. Francis Regional Medical Center) | | | |

| 4.00% 9/1/31 | | 130,000 | 127,154 |

| 5.00% 9/1/34 | | 105,000 | 105,037 |

| City of St. Cloud, Minnesota Health Care Revenue | | | |

| (Centracare Health System Project) | | | |

| 4.00% 5/1/49 | | 2,250,000 | 2,118,442 |

| Series A 5.00% 5/1/46 | | 2,630,000 | 2,656,353 |

City of St. Joseph, Minnesota Senior Housing &

Healthcare Revenue | | | |

(Woodcrest Country Manor Project)

5.00% 7/1/55 | | 1,000,000 | 896,170 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Health Care Facilities Revenue | | | |

(Episcopal Homes Obligated Group)

Series A 4.00% 11/1/42 | | 700,000 | 603,491 |

| (Fairview Health Services) | | | |

| Series A 4.00% 11/15/43 | | 1,550,000 | 1,432,743 |

| Series A 5.00% 11/15/47 | | 2,360,000 | 2,394,786 |

| (HealthPartners Obligated Group Project) | | | |

| Series A 5.00% 7/1/30 | | 1,000,000 | 1,011,730 |

| Series A 5.00% 7/1/33 | | 1,000,000 | 1,010,290 |

(Marian Center Project)

Series A 5.375% 5/1/43 | | 1,000,000 | 918,740 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Revenue | | | |

(Amherst H. Wilder Foundation Project)

Series A 5.00% 12/1/36 | | 1,000,000 | $ 1,053,010 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Senior Housing & Health Care Revenue | | | |

(Episcopal Homes Project)

5.125% 5/1/48 | | 2,000,000 | 1,757,280 |

City of Victoria, Minnesota Health Care Facilities

Revenue | | | |

(Augustana Emerald Care Project)

5.00% 8/1/39 | | 1,500,000 | 1,333,095 |

| City of Wayzata, Minnesota Senior Housing Revenue | | | |

| (Folkestone Senior Living Community) | | | |

| 3.75% 8/1/37 | | 500,000 | 482,575 |

| 4.00% 8/1/38 | | 500,000 | 490,560 |

| 4.00% 8/1/39 | | 400,000 | 389,456 |

| 4.00% 8/1/44 | | 700,000 | 656,012 |

| 5.00% 8/1/35 | | 150,000 | 152,671 |

| 5.00% 8/1/54 | | 1,250,000 | 1,257,175 |

City of West St. Paul, Minnesota Rochester Health Care

& Housing Revenue | | | |

(Walker Westwood Ridge Campus Project)

5.00% 11/1/49 | | 1,500,000 | 1,437,750 |

Dakota County Community Development Agency Senior

Housing Revenue | | | |

(Walker Highview Hills Project)

Series A 144A 5.00% 8/1/51 # | | 1,995,000 | 1,945,903 |

Deephaven, Minnesota Housing & Healthcare Facility

Revenue | | | |

| (St. Therese Senior Living Project) | | | |

| Series A 5.00% 4/1/38 | | 335,000 | 314,833 |

| Series A 5.00% 4/1/40 | | 315,000 | 289,973 |

| Series A 5.00% 4/1/48 | | 185,000 | 159,100 |

| Duluth Economic Development Authority Revenue | | | |

| (Benedictine Health System) | | | |

| Series A 4.00% 7/1/31 | | 1,500,000 | 1,431,585 |

| Series A 4.00% 7/1/41 | | 930,000 | 780,800 |

| (Essentia Health Obligated Group) | | | |

| Series A 4.25% 2/15/43 | | 400,000 | 391,600 |

| Series A 5.00% 2/15/53 | | 1,590,000 | 1,617,205 |

| Series A 5.00% 2/15/58 | | 6,940,000 | 7,053,330 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

| Duluth Economic Development Authority Revenue | | | |

| (Essentia Health Obligated Group) |

| Series A 5.25% 2/15/58 | | 2,000,000 | $ 2,053,620 |

| (St. Luke’s Hospital of Duluth Obligated Group) | | | |

| Series A 4.00% 6/15/33 | | 380,000 | 398,594 |

| Series A 4.00% 6/15/38 | | 400,000 | 412,752 |

| Series B 5.25% 6/15/52 | | 1,000,000 | 1,081,610 |

Minnesota Agricultural & Economic Development Board

Healthcare Facilities Revenue | | | |

| (Health Partners Obligated Group) | | | |

| 4.00% 1/1/49 | | 2,050,000 | 1,983,457 |

| 5.25% 1/1/54 | | 1,150,000 | 1,257,168 |

| | 85,172,521 |

| Housing Revenue Bonds — 2.97% |

| City of Bethel, Minnesota Senior Housing Revenue | | | |

(Birchwood Landing at the Lakes at Stillwater Project)

5.00% 5/1/54 | | 1,000,000 | 932,720 |

| City of Stillwater, Minnesota Multifamily Housing Revenue | | | |

(Orleans Homes Project)

5.50% 2/1/42 (AMT) | | 750,000 | 734,340 |

Minnesota Housing Finance Agency Residential Housing

Finance Revenue | | | |

(Social Bonds)

Series F 2.40% 7/1/46 | | 1,250,000 | 869,975 |

| Minnesota Housing Finance Agency Revenue | | | |

| Series A1 4.90% 8/1/66 | | 350,000 | 352,884 |

| Series D 5.50% 7/1/53 | | 970,000 | 1,036,600 |

| Series I 2.20% 1/1/51 | | 635,000 | 407,683 |

| Series O 4.45% 7/1/38 | | 1,000,000 | 1,029,850 |

Northwest Multi-County Housing & Redevelopment

Authority Revenue | | | |

(Pooled Housing Program)

5.50% 7/1/45 | | 1,275,000 | 1,275,000 |

| | 6,639,052 |

| Industrial Development Revenue/Pollution ControlRevenue Bonds — 3.26% |

| City of Cottonwood, Minnesota Revenue | | | |

(Extreme Holdings LLC Project)

Series A 144A 5.00% 12/1/50 (AMT) # | | 1,210,000 | 1,021,482 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Industrial Development Revenue/Pollution ControlRevenue Bonds (continued) |

| Minnesota Municipal Gas Agency Revenue | | | |

(Minnesota Community Energy)

Sub-Series A 4.00% 12/1/52 • | | 1,000,000 | $ 1,010,140 |

St. Paul, Minnesota Port Authority Solid Waste Disposal

Revenue | | | |

(Gerdau St. Paul Steel Mill Project)

Series 7 144A 4.50% 10/1/37 (AMT) # | | 5,350,000 | 5,266,647 |

| | 7,298,269 |

| Lease Revenue Bonds — 1.40% |

Chaska, Minnesota Economic Development Authority

Revenue | | | |

(Minnesota Lease Obligation)

Series A 4.125% 2/1/54 | | 1,250,000 | 1,208,050 |

City of New London, Economic Development Authority

Revenue | | | |

| (SWWC Service Cooperative Lease With Option to Purchase Project) | | | |

| 5.00% 2/1/38 | | 880,000 | 895,954 |

| Series A 4.50% 2/1/33 | | 345,000 | 351,317 |

| Hibbing Independent School District No. 701 Revenue | | | |

| Series A 3.00% 3/1/41 | | 500,000 | 434,405 |

| Minnesota Housing Finance Agency Revenue | | | |

(State Appropriation)

5.00% 8/1/31 | | 250,000 | 250,380 |

| | 3,140,106 |

| Local General Obligation Bonds — 10.63% |

| Anoka-Hennepin Independent School District No. 11 | | | |

| (Minnesota School District Credit Enhancement Program) | | | |

| Series A 3.00% 2/1/43 | | 500,000 | 428,030 |

| Series A 3.00% 2/1/45 | | 750,000 | 623,700 |

| Cass Lake-Bena Independent School District No. 115 | | | |

| (Minnesota School District Credit Enhancement Program) | | | |

| Series A 4.00% 2/1/41 | | 375,000 | 380,175 |

| Series A 4.00% 2/1/42 | | 925,000 | 935,878 |

| Series A 4.00% 2/1/43 | | 800,000 | 808,136 |

| City of Blaine, Minnesota | | | |

| Series A 4.00% 2/1/39 | | 1,165,000 | 1,222,225 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Local General Obligation Bonds (continued) |

| City of Minneapolis, Minnesota | | | |

| (Green Bonds) | | | |

| 3.00% 12/1/37 | | 1,300,000 | $ 1,195,610 |

| 3.00% 12/1/38 | | 1,970,000 | 1,777,984 |

| 3.00% 12/1/42 | | 1,000,000 | 857,670 |

| City of Rosemount, Minnesota | | | |

| Series A 4.00% 2/1/53 | | 2,930,000 | 2,812,624 |

| City of Virginia, Minnesota | | | |

| Series A 4.00% 2/1/38 (AGM) | | 1,000,000 | 1,009,180 |

Dilworth Glyndon Felton Independent School

District No. 2164 | | | |

| Series A 3.00% 2/1/41 | | 225,000 | 194,983 |

| Elk River Independent School District No. 728 | | | |

| Series A 3.00% 2/1/40 | | 530,000 | 471,811 |

| Gibbon, Minnesota Independent School District No. 2365 | | | |

| Series A 4.125% 2/1/52 | | 1,250,000 | 1,232,400 |

Goodridge, Minnesota Independent School District No.

561 | | | |

| Series A 4.00% 2/1/37 | | 1,170,000 | 1,217,607 |

| Metropolitan Council General Obligation Wastewater | | | |

| (Minneapolis-St. Paul Metropolitan Area) | | | |

| Series C 4.00% 3/1/41 | | 600,000 | 613,530 |

| Series C 4.00% 3/1/43 | | 575,000 | 582,044 |

| Ramsey County, Minnesota | | | |

| Series B 4.00% 2/1/42 | | 500,000 | 515,400 |

| Rice County, Minnesota | | | |

(State Credit Enhancement Program)

Series A-1 4.00% 2/1/52 | | 1,500,000 | 1,446,195 |

Rosemount-Apple Valley-Eagan Independent School

District No. 196 | | | |

| Series A 4.00% 2/1/44 | | 1,070,000 | 1,056,069 |

| St. Peter Independent School District No. 508, Minnesota | | | |

| Series A 4.00% 2/1/44 | | 150,000 | 149,268 |

| Series A 4.00% 2/1/45 | | 325,000 | 322,277 |

| Series A 5.00% 2/1/42 | | 420,000 | 453,583 |

| Stillwater Independent School District No. 834 | | | |

(Minnesota School District Credit Enhancement Program)

Series A 4.00% 2/1/41 | | 435,000 | 442,382 |

| Washington County, Minnesota | | | |

| Series A 5.00% 2/1/43 | | 1,000,000 | 1,122,180 |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Local General Obligation Bonds (continued) |

| Westonka Independent School District No. 277 | | | |

(Minnesota School District Credit Enhancement Program)

Series A 4.00% 2/1/44 | | 1,035,000 | $ 1,028,386 |

| White Bear Lake Independent School District No. 624 | | | |

| Series A 3.00% 2/1/42 | | 1,000,000 | 873,330 |

| | 23,772,657 |

| Pre-Refunded Bonds — 0.57% |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Hospital Facility Revenue | | | |

| (Healtheast Care System Project) | | | |

| Series A 5.00% 11/15/29-25 § | | 275,000 | 282,043 |

| Series A 5.00% 11/15/30-25 § | | 205,000 | 210,250 |

| Duluth Independent School District No. 709 | | | |

| Series A 4.20% 3/1/34-27 § | | 750,000 | 776,137 |

| | 1,268,430 |

| Special Tax Revenue Bonds — 3.49% |

| City of Minneapolis, Minnesota Tax Increment Revenue | | | |

(Village of St. Anthony Falls Project)

4.00% 3/1/27 | | 650,000 | 650,078 |

| Commonwealth of Puerto Rico Revenue | | | |

| (Subordinate) | | | |

| 1.724% 11/1/51 • | | 138,275 | 88,669 |

| 3.029% 11/1/43 • | | 1,634,344 | 1,035,766 |

| Puerto Rico Sales Tax Financing Revenue | | | |

| (Restructured) | | | |

| Series A-1 4.75% 7/1/53 | | 1,505,000 | 1,493,697 |

| Series A-1 5.398% 7/1/51 ^ | | 6,809,000 | 1,670,997 |

| Series A-2 4.536% 7/1/53 | | 3,000,000 | 2,877,750 |

| | 7,816,957 |

| State General Obligation Bonds — 3.28% |

| Commonwealth of Puerto Rico Revenue | | | |

| (Restructured) | | | |

| Series A-1 4.00% 7/1/37 | | 1,070,000 | 1,046,813 |

| Series A-1 4.00% 7/1/46 | | 1,000,000 | 928,530 |

| Minnesota State | | | |

| Series A 4.00% 9/1/38 | | 550,000 | 579,447 |

| Series A 5.00% 8/1/40 | | 750,000 | 822,278 |

| Series A 5.00% 8/1/41 | | 1,000,000 | 1,122,890 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| State General Obligation Bonds (continued) |

| Minnesota State | | | |

| Series A 5.00% 8/1/44 | | 2,500,000 | $ 2,834,925 |

| | 7,334,883 |

| Transportation Revenue Bonds — 6.43% |

Minneapolis-St. Paul Metropolitan Airports Commission

Revenue | | | |

| (Private Activity) | | | |

| Series A 4.00% 1/1/54 | | 1,500,000 | 1,441,515 |

| Series B 5.00% 1/1/32 (AMT) | | 330,000 | 350,246 |

| Series B 5.00% 1/1/39 (AMT) | | 500,000 | 521,160 |

| Series B 5.00% 1/1/49 (AMT) | | 600,000 | 612,780 |

| Series B 5.25% 1/1/42 (AMT) | | 2,910,000 | 3,211,709 |

| Series B 5.25% 1/1/47 (AMT) | | 500,000 | 534,805 |

| Series B 5.25% 1/1/49 (AMT) | | 1,000,000 | 1,083,280 |

(Senior)

Series C 5.00% 1/1/46 | | 185,000 | 189,599 |

| (Subordinate) | | | |

| Series A 5.00% 1/1/44 | | 4,000,000 | 4,215,760 |

| Series B 5.00% 1/1/44 (AMT) | | 2,150,000 | 2,213,317 |

| | 14,374,171 |

| Total Municipal Bonds (cost $224,162,982) | 219,256,067 |

|

|

|

| Short-Term Investments — 0.89% |

| Variable Rate Demand Note — 0.89%¤ |

City of Minneapolis, Minnesota Health Care System

Revenue | | | |

(Fairview Health Services) Series C 3.80% 11/15/48

(LOC - Wells Fargo Bank, N.A.) | | 2,000,000 | 2,000,000 |

| Total Short-Term Investments (cost $2,000,000) | 2,000,000 |

Total Value of Securities—98.90%

(cost $226,162,982) | | | $221,256,067 |

| ° | Principal amount shown is stated in USD unless noted that the security is denominated in another currency. |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At August 31, 2024, the aggregate value of Rule 144A securities was $12,790,826, which represents 5.72% of the Fund’s net assets. See Note 10 in “Notes to financial statements.” |

| ‡ | Non-income producing security. Security is currently in default. |

Schedules of investments

Delaware Minnesota High-Yield Municipal Bond Fund

| • | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at August 31, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their descriptions. The reference rate descriptions (i.e. SOFR01M, SOFR03M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

| § | Pre-refunded bonds. Municipal bonds that are generally backed or secured by US Treasury bonds. For pre-refunded bonds, the stated maturity is followed by the year in which the bond will be pre-refunded. See Note 10 in “Notes to financial statements.” |

| ^ | Zero-coupon security. The rate shown is the effective yield at the time of purchase. |

| ¤ | Tax-exempt obligations that contain a floating or variable interest rate adjustment formula and an unconditional right of demand to receive payment of the unpaid principal balance plus accrued interest upon a short notice period (generally up to 30 days) prior to specified dates either from the issuer or by drawing on a bank letter of credit, a guarantee, or insurance issued with respect to such instrument. Each rate shown is as of August 31, 2024. |

| Summary of abbreviations: |

| AGM – Insured by Assured Guaranty Municipal Corporation |

| AMT – Subject to Alternative Minimum Tax |

| LLC – Limited Liability Corporation |

| LOC – Letter of Credit |

| N.A. – National Association |

| SOFR01M – Secured Overnight Financing Rate 1 Month |

| SOFR03M – Secured Overnight Financing Rate 3 Month |

| USD – US Dollar |

See accompanying notes, which are an integral part of the financial statements.

Schedules of investments

| Delaware Tax-Free Minnesota Fund | August 31, 2024 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds — 98.24% |

| Education Revenue Bonds — 19.95% |

| City of Bethel, Minnesota Charter School Lease Revenue | | | |

| (Spectrum High School Project) | | | |

| Series A 4.00% 7/1/32 | | 425,000 | $ 423,848 |

| Series A 4.25% 7/1/47 | | 1,550,000 | 1,414,375 |

| Series A 4.375% 7/1/52 | | 1,250,000 | 1,134,950 |

City of Brooklyn Park, Minnesota Charter School Lease

Revenue | | | |

| (Prairie Seeds Academy Project) | | | |

| Series A 5.00% 3/1/34 | | 2,395,000 | 2,394,760 |

| Series A 5.00% 3/1/39 | | 385,000 | 377,993 |

City of Cologne, Minnesota Charter School Lease

Revenue | | | |

| (Cologne Academy Project) | | | |

| Series A 5.00% 7/1/29 | | 305,000 | 305,119 |

| Series A 5.00% 7/1/34 | | 150,000 | 150,035 |

| Series A 5.00% 7/1/45 | | 1,705,000 | 1,698,316 |

| City of Deephaven, Minnesota Charter School Revenue | | | |

| (Eagle Ridge Academy Project) | | | |

| Series A 5.25% 7/1/40 | | 500,000 | 503,345 |

| Series A 5.50% 7/1/50 | | 2,000,000 | 2,010,260 |

City of Forest Lake, Minnesota Charter School Lease

Revenue | | | |

| (Lakes International Language Academy Project) | | | |

| Series A 5.25% 8/1/43 | | 400,000 | 408,300 |

| Series A 5.375% 8/1/50 | | 2,290,000 | 2,327,854 |

| Series A 5.50% 8/1/36 | | 1,000,000 | 1,000,810 |

| Series A 5.75% 8/1/44 | | 1,895,000 | 1,896,137 |

City of Ham Lake, Minnesota Charter School Lease

Revenue | | | |

| (DaVinci Academy Project) | | | |

| Series A 5.00% 7/1/36 | | 765,000 | 751,222 |

| Series A 5.00% 7/1/47 | | 2,290,000 | 2,089,259 |

| City of Hugo, Minnesota Charter School Lease Revenue | | | |

(Noble Academy Project)

Series A 5.00% 7/1/44 | | 2,545,000 | 2,544,975 |

City of Minneapolis, Minnesota Charter School Lease

Revenue | | | |

| (Cyber Village Academy Project) | | | |

| Series A 5.25% 6/1/42 | | 1,000,000 | 970,710 |

| Series A 5.50% 6/1/57 | | 500,000 | 478,065 |

| (Hiawatha Academies Project) | | | |

| Series A 144A 5.00% 7/1/32 # | | 800,000 | 822,368 |

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

City of Minneapolis, Minnesota Charter School Lease

Revenue | | | |

| (Hiawatha Academies Project) |

| Series A 144A 5.375% 7/1/42 # | | 880,000 | $ 881,874 |

| Series A 144A 5.50% 7/1/52 # | | 1,440,000 | 1,431,749 |

| Series A 144A 5.50% 7/1/57 # | | 1,120,000 | 1,106,482 |

| City of Minneapolis, Minnesota Student Housing Revenue | | | |

| (Riverton Community Housing Project) | | | |

| 5.25% 8/1/39 | | 250,000 | 250,100 |

| 5.50% 8/1/49 | | 3,250,000 | 3,250,877 |

City of Otsego, Minnesota Charter School Lease

Revenue | | | |

| (Kaleidoscope Charter School) | | | |

| Series A 5.00% 9/1/34 | | 520,000 | 519,959 |

| Series A 5.00% 9/1/44 | | 1,565,000 | 1,468,987 |

City of St. Cloud, Minnesota Charter School Lease

Revenue | | | |

(Stride Academy Project)

Series A 5.00% 4/1/46 | | 875,000 | 746,331 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Charter School Lease Revenue | | | |

(Academia Cesar Chavez School Project)

Series A 5.25% 7/1/50 | | 3,110,000 | 2,835,729 |

(Great River School Project)

Series A 144A 5.50% 7/1/52 # | | 735,000 | 742,012 |

| (Hmong College Preparatory Academy Project) | | | |

| Series A 5.00% 9/1/55 | | 1,000,000 | 995,310 |

| Series A 5.75% 9/1/46 | | 1,000,000 | 1,017,100 |

(Nova Classical Academy Project)

Series A 4.125% 9/1/47 | | 1,750,000 | 1,579,795 |

(Twin Cities Academy Project)

Series A 5.30% 7/1/45 | | 1,700,000 | 1,704,369 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Health Care Facilities Revenue | | | |

| (Great River School Project) | | | |

| Series A 144A 4.75% 7/1/29 # | | 100,000 | 101,047 |

| Series A 144A 5.25% 7/1/33 # | | 140,000 | 143,346 |

(Nova Classical Academy Project)

Series A 4.00% 9/1/36 | | 150,000 | 145,405 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Revenue | | | |

(Hmong College Preparatory Academy Project)

Series A 5.00% 9/1/40 | | 375,000 | $ 380,816 |

City of Woodbury, Minnesota Charter School Lease

Revenue | | | |

(Woodbury Leadership Academy Project)

Series A 4.00% 7/1/51 | | 1,500,000 | 1,151,580 |

| Duluth Housing & Redevelopment Authority Revenue | | | |

| (Duluth Public Schools Academy Project) | | | |

| Series A 5.00% 11/1/38 | | 400,000 | 379,716 |

| Series A 5.00% 11/1/48 | | 3,355,000 | 2,960,687 |

| Minnesota Higher Education Facilities Authority Revenue | | | |

(Bethel University)

5.00% 5/1/37 | | 1,500,000 | 1,458,765 |

| (Carleton College) | | | |

| 4.00% 3/1/35 | | 1,000,000 | 1,012,770 |

| 4.00% 3/1/36 | | 415,000 | 419,399 |

| 4.00% 3/1/47 | | 3,775,000 | 3,733,966 |

| 5.00% 3/1/53 | | 2,900,000 | 3,096,591 |

(College of St. Benedict)

Series 8-K 4.00% 3/1/43 | | 1,000,000 | 911,020 |

| (College of St. Scholastica) | | | |

| 4.00% 12/1/33 | | 500,000 | 489,470 |

| 4.00% 12/1/34 | | 500,000 | 486,515 |

| 4.00% 12/1/40 | | 1,200,000 | 1,094,448 |

(Gustavus Adolphus College)

5.00% 10/1/47 | | 6,850,000 | 6,960,833 |

(Macalester College)

4.00% 3/1/42 | | 735,000 | 736,691 |

| (St. Catherine University) | | | |

| 5.00% 10/1/52 | | 2,250,000 | 2,255,782 |

| Series A 4.00% 10/1/36 | | 925,000 | 900,691 |

| Series A 5.00% 10/1/32 | | 715,000 | 744,687 |

| Series A 5.00% 10/1/45 | | 4,155,000 | 4,191,315 |

| (St. John's University) | | | |

| Series 8-I 5.00% 10/1/32 | | 500,000 | 509,390 |

| Series 8-I 5.00% 10/1/33 | | 250,000 | 254,660 |

| (St. Olaf College) | | | |

| 3.00% 10/1/38 | | 1,000,000 | 904,950 |

| 3.00% 10/1/41 | | 1,000,000 | 875,060 |

| 4.00% 10/1/46 | | 565,000 | 546,310 |

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Education Revenue Bonds (continued) |

| Minnesota Higher Education Facilities Authority Revenue | | | |

| (St. Olaf College) |

| 4.00% 10/1/50 | | 700,000 | $ 662,683 |

| Series 8-G 5.00% 12/1/32 | | 795,000 | 814,008 |

| (Trustees of the Hamline University of Minnesota) | | | |

| Series B 5.00% 10/1/37 | | 955,000 | 967,128 |

| Series B 5.00% 10/1/38 | | 1,000,000 | 1,010,810 |

| Series B 5.00% 10/1/39 | | 940,000 | 947,605 |

| Series B 5.00% 10/1/40 | | 625,000 | 629,325 |

| Series B 5.00% 10/1/47 | | 1,060,000 | 1,062,682 |

| (University of St. Thomas) | | | |

| 4.00% 10/1/44 | | 545,000 | 527,538 |

| 5.00% 10/1/33 | | 750,000 | 811,943 |

| 5.00% 10/1/34 | | 800,000 | 862,640 |

| 5.00% 10/1/40 | | 1,595,000 | 1,685,644 |

| Series 7-U 4.00% 4/1/26 | | 1,000,000 | 1,000,520 |

| Series A 4.00% 10/1/34 | | 400,000 | 405,616 |

| Series A 4.00% 10/1/36 | | 500,000 | 504,980 |

| Series A 4.125% 10/1/53 | | 1,000,000 | 985,190 |

| Series A 5.00% 10/1/49 | | 2,475,000 | 2,650,898 |

(University of St. Thomas) (Green Bonds)

Series A 5.00% 10/1/35 | | 1,720,000 | 1,885,412 |

| Minnesota Office of Higher Education Revenue | | | |

| (Senior Supplemental Student Loan Program) | | | |

| 2.65% 11/1/38 (AMT) | | 645,000 | 574,972 |

| 4.00% 11/1/42 (AMT) | | 1,500,000 | 1,448,760 |

| St. Paul, Minnesota Independent School District No. 625 | | | |

| Series A 5.00% 2/1/43 | | 2,100,000 | 2,349,417 |

| University of Minnesota Revenue | | | |

| Series A 5.00% 4/1/34 | | 2,115,000 | 2,187,693 |

| Series A 5.00% 9/1/42 | | 2,100,000 | 2,163,966 |

| Series A 5.00% 11/1/42 | | 2,000,000 | 2,172,620 |

| Series A 5.00% 1/1/43 | | 1,250,000 | 1,410,050 |

| Series A 5.00% 1/1/44 | | 1,000,000 | 1,123,840 |

| | 109,925,225 |

| Electric Revenue Bonds — 6.20% |

| Central Minnesota Municipal Power Agency Revenue | | | |

(Brookings SouthEast Twin Cities Transmission Project)

3.00% 1/1/38 (AGM) | | 300,000 | 271,269 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Electric Revenue Bonds (continued) |

| City of Chaska, Minnesota Electric Revenue | | | |

| (Generating Facilities) | | | |

| Series A 5.00% 10/1/28 | | 250,000 | $ 256,163 |

| Series A 5.00% 10/1/30 | | 1,150,000 | 1,177,611 |

| City of Rochester, Minnesota Electric Utility Revenue | | | |

| Series A 5.00% 12/1/47 | | 3,660,000 | 3,751,170 |

City of St. Paul, Minnesota Housing & Redevelopment

Authority Revenue | | | |

| Series A 4.00% 10/1/30 | | 1,910,000 | 1,963,270 |

| Series A 4.00% 10/1/33 | | 365,000 | 370,968 |

| Minnesota Municipal Power Agency Electric Revenue | | | |

| 5.00% 10/1/30 | | 500,000 | 500,810 |

| 5.00% 10/1/33 | | 1,205,000 | 1,206,807 |

| 5.00% 10/1/47 | | 2,000,000 | 2,044,100 |

| Series A 5.00% 10/1/30 | | 1,300,000 | 1,302,106 |

| Series A 5.00% 10/1/34 | | 750,000 | 751,103 |

| Series A 5.00% 10/1/35 | | 1,525,000 | 1,527,150 |

| Puerto Rico Electric Power Authority Revenue | | | |

| Series A 5.05% 7/1/42 ‡ | | 430,000 | 232,200 |

| Series AAA 5.25% 7/1/25 ‡ | | 250,000 | 135,000 |

| Series CCC 5.25% 7/1/27 ‡ | | 1,875,000 | 1,012,500 |

| Series WW 5.25% 7/1/33 ‡ | | 1,250,000 | 675,000 |

| Series XX 4.75% 7/1/26 ‡ | | 260,000 | 140,400 |

| Series XX 5.75% 7/1/36 ‡ | | 925,000 | 499,500 |

| Series ZZ 4.75% 7/1/27 ‡ | | 210,000 | 113,400 |

| Series ZZ 5.25% 7/1/25 ‡ | | 350,000 | 188,125 |

Sauk Centre Public Utilities Commission Electric

Revenue | | | |

| Series A 4.50% 12/1/53 (AGM) | | 875,000 | 878,080 |

| Southern Minnesota Municipal Power Agency Revenue | | | |

| Series A 5.00% 1/1/42 | | 3,815,000 | 3,995,717 |

| Series A 5.00% 1/1/46 | | 3,685,000 | 3,750,740 |

(Capital Appreciation)

Series A 4.438% 1/1/25 (NATL) ^ | | 5,000,000 | 4,938,550 |

Western Minnesota Municipal Power Agency Supply

Revenue | | | |

| Series A 5.00% 1/1/30 | | 1,000,000 | 1,119,430 |

(Red Rock Hydroelectric Project)

Series A 5.00% 1/1/49 | | 1,300,000 | 1,342,796 |

| | 34,143,965 |

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds — 32.29% |

City of Anoka, Minnesota Healthcare & Housing Facilities

Revenue | | | |

| (The Homestead at Anoka Project) | | | |

| 5.125% 11/1/49 | | 1,100,000 | $ 1,007,699 |

| 5.375% 11/1/34 | | 590,000 | 590,018 |

| City of Apple Valley, Minnesota Senior Housing Revenue | | | |

| (PHS Apple Valley Senior Housing Orchard Path Phase II Project) | | | |

| 4.00% 9/1/51 | | 500,000 | 438,450 |

| 4.00% 9/1/61 | | 700,000 | 580,482 |

| (PHS Senior Housing, Inc. Orchard Path Project) | | | |

| 4.50% 9/1/53 | | 1,000,000 | 947,300 |

| 5.00% 9/1/58 | | 1,605,000 | 1,606,685 |

| City of Apple Valley, Minnesota Senior Living Revenue | | | |

| (Senior Living LLC Project) | | | |

| Fourth Tier Series D 7.00% 1/1/37 | | 1,585,000 | 1,012,102 |

| Fourth Tier Series D 7.25% 1/1/52 | | 2,580,000 | 1,452,849 |

| Second Tier Series B 5.00% 1/1/47 | | 1,640,000 | 983,196 |

| Second Tier Series B 5.25% 1/1/37 | | 480,000 | 353,861 |

| Third Tier Series C 4.25% 1/1/27 | | 285,000 | 249,364 |

| Third Tier Series C 5.00% 1/1/32 | | 400,000 | 285,820 |

City of Bethel, Minnesota Housing & Health Care

Facilities Revenue | | | |

(Benedictine Health System – St. Peter Communities Project)

Series A 5.50% 12/1/48 | | 2,600,000 | 2,518,594 |

(Ecumen Obligated Group)

Series A 6.125% 3/1/49 | | 1,100,000 | 1,114,597 |

| City of Bethel, Minnesota Senior Housing Revenue | | | |

| (The Lodge at the Lakes at Stillwater Project) | | | |

| 5.00% 6/1/38 | | 700,000 | 676,970 |

| 5.00% 6/1/48 | | 1,000,000 | 888,050 |

| 5.00% 6/1/53 | | 2,450,000 | 2,119,078 |

| City of Center, Minnesota Health Care Facilities Revenue | | | |

| (Hazelden Betty Ford Foundation Project) | | | |

| 4.00% 11/1/34 | | 500,000 | 501,595 |

| 4.00% 11/1/41 | | 2,000,000 | 1,913,540 |

| 4.50% 11/1/34 | | 1,700,000 | 1,701,377 |

| 5.00% 11/1/24 | | 600,000 | 601,440 |

| 5.00% 11/1/26 | | 500,000 | 501,080 |

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

City of Chatfield, Minnesota Healthcare & Housing

Facilities Revenue | | | |

| (Chosen Valley Care Center Project) | | | |

| 4.00% 9/1/34 | | 100,000 | $ 91,396 |

| 4.00% 9/1/39 | | 100,000 | 85,458 |

| 5.00% 9/1/44 | | 500,000 | 456,880 |

City of Crookston, Minnesota Health Care Facilities

Revenue | | | |

| (Riverview Health Project) | | | |

| 5.00% 5/1/38 | | 500,000 | 358,805 |

| 5.00% 5/1/44 | | 1,500,000 | 987,660 |

| 5.00% 5/1/51 | | 1,585,000 | 971,985 |

City of Glencoe, Minnesota Health Care Facilities

Revenue | | | |

| (Glencoe Regional Health Services Project) | | | |

| 4.00% 4/1/25 | | 660,000 | 658,990 |

| 4.00% 4/1/26 | | 270,000 | 269,997 |

| 4.00% 4/1/31 | | 60,000 | 59,111 |

City of Hayward, Minnesota Health Care Facilities

Revenue | | | |

| (American Baptist Homes Midwest Obligated Group) | | | |

| 5.375% 8/1/34 | | 660,000 | 586,813 |

| 5.75% 2/1/44 | | 500,000 | 412,560 |

(St. John's Lutheran Home of Albert Lea Project)

Series A 5.375% 10/1/44 | | 400,000 | 244,000 |

City of Maple Grove, Minnesota Health Care Facilities

Revenue | | | |

| (Maple Grove Hospital Corporation) | | | |

| 4.00% 5/1/37 | | 2,500,000 | 2,379,500 |

| 5.00% 5/1/27 | | 1,400,000 | 1,452,136 |

| 5.00% 5/1/28 | | 1,000,000 | 1,035,480 |

| 5.00% 5/1/29 | | 1,000,000 | 1,034,150 |

| 5.00% 5/1/30 | | 850,000 | 877,506 |

| 5.00% 5/1/32 | | 825,000 | 847,910 |

| (North Memorial Health Care) | | | |

| 4.00% 9/1/35 | | 350,000 | 339,783 |

| 5.00% 9/1/31 | | 1,320,000 | 1,332,778 |

| 5.00% 9/1/32 | | 1,000,000 | 1,009,210 |

City of Maple Plain, Minnesota Senior Housing & Health

Care Revenue | | | |

(Haven Homes Project)

5.00% 7/1/54 | | 3,500,000 | 3,288,425 |

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | Principal

amount° | Value (US $) |

| Municipal Bonds (continued) |

| Healthcare Revenue Bonds (continued) |

City of Minneapolis, Minnesota Health Care System

Revenue | | | |

| (Allina Health System) | | | |

| 4.00% 11/15/38 | | 2,000,000 | $ 2,012,220 |

| 4.00% 11/15/40 | | 3,750,000 | 3,718,575 |

| (Fairview Health Services) | | | |

| Series A 4.00% 11/15/48 | | 6,790,000 | 6,175,437 |

| Series A 5.00% 11/15/32 | | 750,000 | 757,665 |

| Series A 5.00% 11/15/33 | | 860,000 | 895,054 |

| Series A 5.00% 11/15/35 | | 500,000 | 518,080 |

| Series A 5.00% 11/15/44 | | 1,000,000 | 1,000,890 |

| Series A 5.00% 11/15/49 | | 6,115,000 | 6,176,150 |

City of Minneapolis, Minnesota Senior Housing &

Healthcare Revenue | | | |

| (Ecumen-Abiitan Mill City Project) | | | |

| 5.00% 11/1/35 | | 1,030,000 | 988,213 |

| 5.25% 11/1/45 | | 1,950,000 | 1,840,469 |

| 5.375% 11/1/50 | | 655,000 | 622,767 |

City of Rochester, Minnesota Health Care & Housing

Revenue | | | |

(The Homestead at Rochester Project)

Series A 6.875% 12/1/48 | | 3,520,000 | 3,520,563 |

City of Rochester, Minnesota Health Care Facilities

Revenue | | | |

| (Mayo Clinic) | | | |

| 4.00% 11/15/39 | | 11,450,000 | 11,892,542 |

| 5.00% 11/15/57 | | 7,250,000 | 7,792,518 |

| Series B 5.00% 11/15/33 | | 1,900,000 | 2,234,191 |

City of Sartell, Minnesota Health Care & Housing

Facilities Revenue | | | |

(Country Manor Campus LLC Project)

5.30% 9/1/37 | | 1,200,000 | 1,200,252 |