Item 1. Reports to Stockholders

Annual report

Fixed income mutual funds

Delaware Tax-Free Minnesota Fund

Delaware Tax-Free Minnesota Intermediate Fund

Delaware Minnesota High-Yield Municipal Bond Fund

August 31, 2016

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and their summary prospectuses, which may be obtained by visiting delawareinvestments.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawareinvestments.com/edelivery.

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Tax-Free Minnesota Fund, Delaware Tax-Free Minnesota Intermediate Fund, and Delaware Minnesota High-Yield Municipal Bond Fund at delawareinvestments.com/literature.

Manage your investments online

| ● | | 24-hour access to your account information |

| ● | | Check your account balance and recent transactions |

| ● | | Request statements or literature |

| ● | | Make purchases and redemptions |

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment and funds management services.

Neither Delaware Investments nor its affiliates referred to in this document are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL), a subsidiary of Macquarie Group Limited and an affiliate of Delaware Investments. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Funds are governed by U.S. laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of Aug. 31, 2016, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Funds’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2016 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| | |

| Portfolio management review |

| Delaware Investments® Minnesota Municipal Bond Funds | | September 6, 2016 |

| | | | | | | | |

| Performance preview (for the year ended August 31, 2016) | | | | | | |

Delaware Tax-Free Minnesota Fund (Institutional Class shares) | | | 1-year return | | | | +5.87% | |

Delaware Tax-Free Minnesota Fund (Class A shares) | | | 1-year return | | | | +5.52% | |

Bloomberg Barclays Municipal Bond Index1 (benchmark) | | | 1-year return | | | | +6.88% | |

Lipper Minnesota Municipal Debt Funds Average | | | 1-year return | | | | +5.44% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Minnesota Fund, please see the table on page 5.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Minnesota Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Minnesota (double tax-exempt) or a city in Minnesota (triple tax-exempt).

Please see page 8 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Tax-Free Minnesota Intermediate Fund (Institutional Class shares) | | | 1-year return | | | | +5.22% | |

Delaware Tax-Free Minnesota Intermediate Fund (Class A shares) | | | 1-year return | | | | +4.98% | |

Bloomberg Barclays 3–15 Year Blend Municipal Bond Index2 (benchmark) | | | 1-year return | | | | +5.97% | |

Lipper Other States Intermediate Municipal Debt Funds Average | | | 1-year return | | | | +4.74% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Tax-Free Minnesota Intermediate Fund, please see the table on page 9.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Other States Intermediate Municipal Debt Funds Average compares funds that invest in municipal debt issues with dollar-weighted average maturities of 5 to 10 years and are exempt from taxation on a specified city or state basis.

Please see page 12 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

| | | | | | | | |

Delaware Minnesota High-Yield Municipal Bond Fund (Institutional Class shares) | | | 1-year return | | | | +6.28% | |

Delaware Minnesota High-Yield Municipal Bond Fund (Class A shares) | | | 1-year return | | | | +6.12% | |

Bloomberg Barclays Municipal Bond Index1 (benchmark) | | | 1-year return | | | | +6.88% | |

Lipper Minnesota Municipal Debt Funds Average | | | 1-year return | | | | +5.44% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Minnesota High-Yield Municipal Bond Fund, please see the table on page 13.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

The Lipper Minnesota Municipal Debt Funds Average compares funds that limit assets to those securities that are exempt from taxation in Minnesota (double tax-exempt) or a city in Minnesota (triple tax-exempt).

Please see page 16 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

1 Formerly known as the Barclays Municipal Bond Index.

2Formerly known as the Barclays 3–15 Year Blend Municipal Bond Index.

1

Portfolio management review

Delaware Investments® Minnesota Municipal Bond Funds

Economic backdrop

Back in September 2015, at the start of the Funds’ fiscal year ended Aug. 31, 2016, many investors were anticipating relatively strong U.S. economic growth. Accordingly, the U.S. Federal Reserve was widely expected to begin raising its target short-term interest rate for the first time in nine years. The Fed eventually did so at its December 2015 meeting, increasing the federal funds rate by 0.25 percentage points.

It soon became clear, however, that the U.S. economy was growing at a relatively sluggish pace — one factor behind the Fed’s decision to leave rates alone for the remainder of the Funds’ fiscal year. Although U.S. gross domestic product (GDP) expanded by a moderate rate of 2.0% in the third quarter of 2015, it slowed to an annual pace of just 0.9% growth in the fourth quarter, and 0.8% and an estimated 1.1% in the first and second quarters of 2016, respectively (source: U.S. Commerce Department).

Investor concern also extended beyond the United States and included worries about Chinese economic growth, new financial challenges in Europe, and, in June, U.K. voters’ decision to leave the European Union. This vote, dubbed Brexit, led to significant short-term market volatility, although markets quickly recovered.

Municipal bond market conditions

Against this backdrop, interest rates unexpectedly fell for much of the fiscal year — beneficial for municipal bond and other fixed income investors. This was particularly true in the first half of calendar year 2016, as concerns rose about the global economy, weak commodity prices, and the Fed’s apparent unwillingness to raise rates further.

Continuing a trend of several years, tax-exempt bonds with longer maturity dates tended to outpace those with shorter maturities. Also, lower-rated, higher yielding issues again generally

surpassed their investment grade counterparts, performing particularly well in this environment.

The following table shows municipal bond returns, by maturity and credit quality, for the 12 months ended Aug. 31, 2016:

| | | | |

Maturity | | | |

| |

5 years | | | 4.01 | % |

10 years | | | 7.34 | % |

22+ years | | | 10.46 | % |

Credit quality | | | |

| |

AAA | | | 5.59 | % |

AA | | | 6.20 | % |

A | | | 8.51 | % |

BBB | | | 8.83 | % |

Source: Bloomberg

Other positive factors included the continued favorable balance between supply and demand of municipal debt, and the healthy credit environment for many state and local municipal borrowers.

Tobacco was the strongest-performing sector in the municipal bond marketplace, as these lower-rated, higher yielding securities benefited from issuers’ generally improved credit quality and strong investor demand for yield. Other bond categories dominated by lower-rated issuers also fared well, including transportation and healthcare. Higher-quality categories, including state general obligation bonds, produced positive returns that nevertheless lagged the overall municipal bond market.

Sticking to our strategy

For all three Funds in this report, our management approach remained consistent, as it does in every market environment. With our bottom-up investment strategy, we evaluate potential bond holdings one by one. Working with our municipal credit analysts, we conduct thorough research to determine which bonds we believe offer the most

2

favorable apparent trade-off between their credit risk and income generation.

In general, we emphasize bonds with lower-investment-grade or below-investment-grade credit ratings, where we believe our credit research capabilities can provide us potentially more meaningful insights. During the fiscal period, both Delaware Tax-Free Minnesota Fund and Delaware Tax-Free Minnesota Intermediate Fund had substantial allocations to bonds with credit ratings of A and BBB, the two lowest rating tiers among investment grade bonds.

Both Funds also had exposure to high yield bonds — rated below BBB. Up to 20% of these two Funds’ net assets can be invested in high yield municipal debt. When making use of this basket of investments, we focused on securities that provided a combination of what we believed to be attractive income and credit characteristics.

Delaware Minnesota High-Yield Municipal Bond Fund has significantly more flexibility to invest in lower-rated issues, reflecting its high-yield mandate. As of fiscal year end, 31.8% of the Fund’s portfolio was held in below-investment-grade bonds, down from 33.4% 12 months earlier.

As we normally do, we maintained a neutral duration, or sensitivity to interest rate changes, within the Funds, roughly on par with that of their respective benchmarks. We preferred to seek to add value through credit selection rather than interest rate management.

During the fiscal period, we took advantage of opportunities to add the types of higher yielding, lower-rated bonds we often favor. In states with smaller amounts of tax-exempt bond issuance, such as Minnesota, it can be challenging to find enough lower-rated bonds to add to the portfolios. To keep the Funds fully invested, we typically purchase higher-quality, in-state bonds as placeholders while we wait for what we view as attractive lower-rated, longer-dated issues to emerge. We made use of this strategy while

researching potentially better-yielding long-term investment opportunities — a process that was ongoing as the fiscal year concluded.

The purchases we made in the Funds were largely financed through bond calls and maturities, as well as the proceeds of new share purchases by investors. We were reluctant to sell many of the Funds’ bond holdings, however, as many of these older issues offered higher income and were better long-term investments, in our view.

Within the Funds

Given the market trends of slow growth, economic uncertainty, and low yields, we believe all three Funds were well positioned for the fiscal year, with healthy exposure to longer-dated, lower-rated credits. Many of the Funds’ strongest-performing bonds had one or both of these characteristics.

In Delaware Tax-Free Minnesota Fund, Delaware Tax-Free Minnesota Intermediate Fund, and Delaware Minnesota High-Yield Municipal Bond Fund, for example, we benefited from a position in St. Paul Housing and Redevelopment Authority hospital revenue bonds for the HealthEast Care System. These bonds, rated BBB- by Standard & Poor’s (S&P) and Fitch, had a 2030 maturity date and a 5% coupon, which helped them gain 16% in value for the fiscal year.

Meanwhile, an allocation to bonds for Academia Cesar Chavez School, a charter school in St. Paul helped both Delaware Tax-Free Minnesota Fund and Delaware Tax-Free Minnesota Intermediate Fund. These below-investment-grade bonds, which rose 14%, also benefited from their long maturity date and 5.25% coupon.

Similarly, Delaware Minnesota High-Yield Municipal Bond Fund saw particularly strong performance from its bonds for the Eagle Ridge Academy charter school in Minnetonka. As with the Cesar Chavez bonds, they benefited from their

3

Portfolio management review

Delaware Investments® Minnesota Municipal Bond Funds

relatively long maturities and below-investment-grade rating, which resulted in a return of more than 20%.

In contrast, the poor performance of St. Paul corporate-backed solid waste bonds for Gerdau Steel, a Brazilian steel company, hampered all three Funds. These lower-investment-grade bonds with a 2037 maturity date struggled because of the twin headwinds of declining steel prices and Brazil’s economic weakness and political turmoil. That said, as Gerdau successfully restructured some of its debt, the bonds bounced back strongly over time, finishing the fiscal year with only a modest decline.

Additionally, in keeping with the market trends we outlined earlier, all three Funds saw limited performance from bonds with short maturity or call dates, high credit quality, or both. In Delaware Tax-Free Minnesota Fund, for example, single-family housing bonds produced marginal performance despite a strong market environment, as the securities had been advance refunded, giving them a short duration and high credit quality.

Similarly, in Delaware Tax-Free Minnesota Intermediate Fund, Minneapolis general obligation bonds, which combined a 2023 maturity date with the top credit rating of AAA, were very modest gainers. And short-dated higher education bonds issued for St. Olaf College were relative underperformers for Delaware Minnesota High-Yield Municipal Bond Fund.

Minnesota economic backdrop

The state has a fundamentally sound economy and is not dependent on any one sector. Employment is diverse, with a mix of manufacturing, services, and trade similar to the U.S.. Other relevant notes:

| ● | | July 2016 nonfarm employment of 2.9 million was up 1.5% from a year earlier. |

| ● | | The state’s unemployment rate of 3.9% in July 2016 was well below the 4.9% national average. |

| ● | | Over the past five years, the state’s per capita personal income levels have consistently been above the national average. |

| ● | | Fiscal year 2016 General Fund revenues are estimated to total $20.9 billion, 1.1% above projections and 2.7% above fiscal year 2015 collections. |

| ● | | Income tax revenues were in line with budget estimates, sales tax collections were 0.4% below budget, and corporate tax receipts were 11.1% higher than budget. |

| ● | | In February 2016, the state projected a fiscal year 2016-2017 General Fund budgetary balance of $900 million, 2.2% of the state’s operating budget forecast. |

Data: bls.gov, bea.gov, ncsl.org, Minnesota Management and Budget.

4

| | |

| Performance summaries | | |

| Delaware Tax-Free Minnesota Fund | | August 31, 2016 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| | | | | | | | |

| Fund and benchmark performance1, 2 | | Average annual total returns through August 31, 2016 |

| | | | |

| | | 1 year | | 5 years | | 10 years | | Lifetime |

Class A (Est. Feb. 27, 1984) | | | | | | | | |

Excluding sales charge | | +5.52% | | +4.61% | | +4.45% | | +6.52% |

Including sales charge | | +0.80% | | +3.65% | | +3.97% | | +6.37% |

Class C (Est. May 4, 1994) | | | | | | | | |

Excluding sales charge | | +4.73% | | +3.83% | | +3.66% | | +4.36% |

Including sales charge | | +3.73% | | +3.83% | | +3.66% | | +4.36% |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | |

Excluding sales charge | | +5.87% | | n/a | | n/a | | +6.34% |

Including sales charge | | +5.87% | | n/a | | n/a | | +6.34% |

Bloomberg Barclays Municipal Bond Index | | +6.88% | | +4.80% | | +4.87% | | +6.32%* |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 6. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

5

Performance summaries

Delaware Tax-Free Minnesota Fund

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local taxes and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Bond ratings are determined by a nationally recognized statistical rating organization.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

Per Standard & Poor’s credit rating agency, bonds rated AA and A are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in the higher-rated AAA category, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.60% of the Fund’s average daily net assets during the period from Sept. 1, 2015 through Aug. 31, 2016.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| | | | | | |

| Fund expense ratios | | Class A | | Class C | | Institutional Class |

Total annual operating expenses | | 0.95% | | 1.70% | | 0.70% |

(without fee waivers) | | | | | | |

Net expenses | | 0.85% | | 1.60% | | 0.60% |

(including fee waivers, if any) | | | | | | |

Type of waiver | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2014, through Dec. 29, 2016.

6

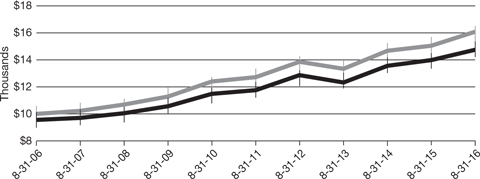

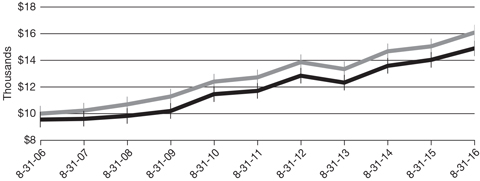

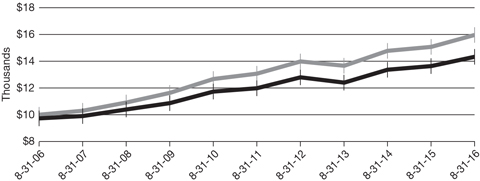

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2006, through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Aug. 31, 2006, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index | | | $10,000 | | | | $16,093 | |

Delaware Tax-Free Minnesota Fund — Class A shares Delaware Tax-Free Minnesota Fund — Class A shares | | | $9,550 | | | | $14,755 | |

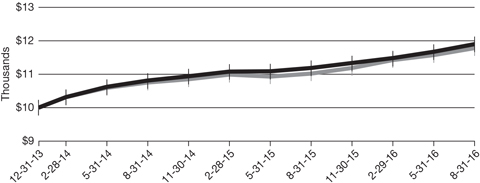

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Dec. 31, 2013, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Delaware Tax-Free Minnesota Fund — Institutional Class shares Delaware Tax-Free Minnesota Fund — Institutional Class shares | | | $10,000 | | | | $11,780 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index | | | $10,000 | | | | $11,776 | |

7

Performance summaries

Delaware Tax-Free Minnesota Fund

1 The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2006, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2006.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the

periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 5 through 8.

The Bloomberg Barclays Municipal Bond Index (formerly known as the Barclays Municipal Bond Index) measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | | | |

| | | Nasdaq symbols | | CUSIPs | | | | |

Class A | | DEFFX | | 928918101 | | | | |

Class C | | DMOCX | | 928918408 | | | | |

Institutional Class | | DMNIX | | 928918705 | | | | |

8

| | |

| Performance summaries | | |

| Delaware Tax-Free Minnesota Intermediate Fund | | August 31, 2016 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| | | | | | | | |

| Fund and benchmark performance1, 2 | | Average annual total returns through August 31, 2016 |

| | | | |

| | | 1 year | | 5 years | | 10 years | | Lifetime |

Class A (Est. Oct. 27, 1985) | | | | | | | | |

Excluding sales charge | | +4.98% | | +3.66% | | +3.96% | | +4.95% |

Including sales charge | | +2.06% | | +3.09% | | +3.67% | | +4.86% |

Class C (Est. May 4, 1994) | | | | | | | | |

Excluding sales charge | | +4.17% | | +2.78% | | +3.09% | | +3.54% |

Including sales charge | | +3.17% | | +2.78% | | +3.09% | | +3.54% |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | |

Excluding sales charge | | +5.22% | | n/a | | n/a | | +4.97% |

Including sales charge | | +5.22% | | n/a | | n/a | | +4.97% |

Bloomberg Barclays 3–15 Year Blend | | | | | | | | |

Municipal Bond Index | | +5.97% | | +4.08% | | +4.79% | | +5.21%* |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 10. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

Class A shares are sold with a maximum front-end sales charge of 2.75%, and have an annual distribution and service fee of 0.25% of average daily net assets. This fee has been contractually limited to 0.15% of average daily net assets from Sept. 1, 2015, through Aug. 31, 2016.** Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

**The aggregate contractual waiver period covering this report is from

Dec. 29, 2014 through Dec. 29, 2016.

9

Performance summaries

Delaware Tax-Free Minnesota Intermediate Fund

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local taxes and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Bond ratings are determined by a nationally recognized statistical rating organization.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

Per Standard & Poor’s credit rating agency, bonds rated AA and A are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in the higher-rated AAA category, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.69% of the Fund’s average daily net assets during the period from Sept. 1, 2015 through Aug. 31, 2016.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| | | | | | |

| Fund expense ratios | | Class A | | Class C | | Institutional Class |

Total annual operating expenses | | 0.97% | | 1.72% | | 0.72% |

(without fee waivers) | | | | | | |

Net expenses | | 0.84% | | 1.69% | | 0.69% |

(including fee waivers, if any) | | | | | | |

Type of waiver | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2014, through Dec. 29, 2016.

10

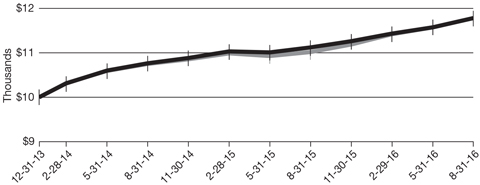

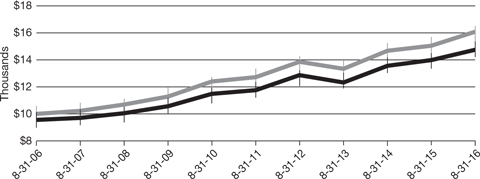

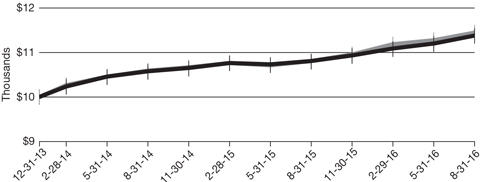

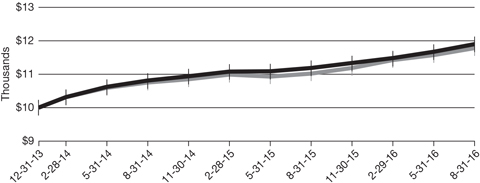

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2006, through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Aug. 31, 2006, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Bloomberg Barclays 3–15 Year Blend Municipal Bond Index Bloomberg Barclays 3–15 Year Blend Municipal Bond Index | | | $10,000 | | | | $15,969 | |

Delaware Tax-Free Minnesota Intermediate Fund — Class A shares Delaware Tax-Free Minnesota Intermediate Fund — Class A shares | | | $9,725 | | | | $14,335 | |

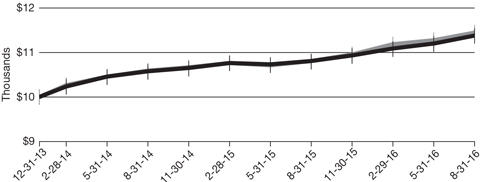

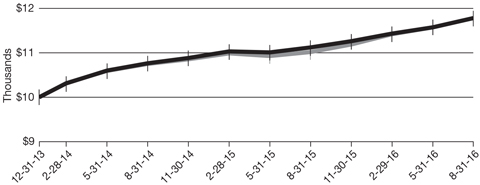

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Dec. 31, 2013, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Bloomberg Barclays 3–15 Year Blend Municipal Bond Index Bloomberg Barclays 3–15 Year Blend Municipal Bond Index | | | $10,000 | | | | $11,450 | |

Delaware Tax-Free Minnesota Intermediate Fund — Institutional Class shares Delaware Tax-Free Minnesota Intermediate Fund — Institutional Class shares | | | $10,000 | | | | $11,380 | |

11

Performance summaries

Delaware Tax-Free Minnesota Intermediate Fund

1 The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2006, and includes the effect of a 2.75% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays 3–15 Year Blend Municipal Bond Index as of Aug. 31, 2006.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays 3–15 Year Blend Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the

periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 10. Please note additional details on pages 9 through 12.

The Bloomberg Barclays 3–15 Year Blend Municipal Bond Index (formerly known as the Barclays 3–15 Year Blend Municipal Bond Index) measures the total return performance of investment grade, U.S. tax-exempt bonds with maturities from 2 to 17 years.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DXCCX | | 928930106 | | |

Class C | | DVSCX | | 928930205 | | |

Institutional Class | | DMIIX | | 92910U109 | | |

12

Performance summaries

| | |

| Delaware Minnesota High-Yield Municipal Bond Fund | | August 31, 2016 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fund and benchmark performance1, 2 | | Average annual total returns through August 31, 2016 | |

| | | | | | | |

| | | 1 year | | | | | | 5 years | | | | | | 10 years | | | | | | Lifetime | |

Class A (Est. June 4, 1996) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +6.12% | | | | | | | | +4.94% | | | | | | | | +4.55% | | | | | | | | +5.36% | |

Including sales charge | | | +1.35% | | | | | | | | +3.98% | | | | | | | | +4.07% | | | | | | | | +5.13% | |

Class C (Est. June 7, 1996) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +5.22% | | | | | | | | +4.15% | | | | | | | | +3.77% | | | | | | | | +4.58% | |

Including sales charge | | | +4.22% | | | | | | | | +4.15% | | | | | | | | +3.77% | | | | | | | | +4.58% | |

Institutional Class (Est. Dec. 31, 2013) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +6.28% | | | | | | | | n/a | | | | | | | | n/a | | | | | | | | +6.74% | |

Including sales charge | | | +6.28% | | | | | | | | n/a | | | | | | | | n/a | | | | | | | | +6.74% | |

Bloomberg Barclays Municipal Bond Index | | | +6.88% | | | | | | | | +4.80% | | | | | | | | +4.87% | | | | | | | | +6.32%* | |

*The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 14. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

Class A shares are sold with a maximum front-end sales charge of 4.50%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares,

excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

13

Performance summaries

Delaware Minnesota High-Yield Municipal Bond Fund

High yielding, non-investment-grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

Funds that invest primarily in one state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to state or local taxes and/or the federal alternative minimum tax (AMT) that applies to certain investors. Capital gains, if any, are taxable.

Bond ratings are determined by a nationally recognized statistical rating organization.

Duration number will change as market conditions change. Therefore, duration should not be solely relied upon to indicate a municipal bond fund’s potential volatility.

Per Standard & Poor’s credit rating agency, bonds rated AA and A are more susceptible to the adverse effects of changes in circumstances and economic conditions than those in the higher-rated AAA category, but the obligor’s capacity to meet its financial commitment on the obligation is still strong. Bonds rated BBB exhibit adequate protection parameters, although adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments. Bonds rated BB, B, and CCC are regarded as having significant speculative characteristics, with BB indicating the least degree of speculation of the three.

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, inverse floater program expenses, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.64% of the Fund’s average daily net assets during the period from Sept. 1, 2015 through Aug. 31, 2016.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | | | Class C | | | | Institutional Class |

Total annual operating expenses | | 0.99% | | | | 1.74% | | | | 0.74% |

(without fee waivers) | | | | | | | | | | |

Net expenses | | 0.89% | | | | 1.64% | | | | 0.64% |

(including fee waivers, if any) | | | | | | | | | | |

Type of waiver | | Contractual | | | | Contractual | | | | Contractual |

*The aggregate contractual waiver period covering this report is from Dec. 29, 2014, through Dec. 29, 2016.

14

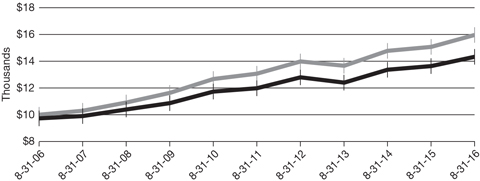

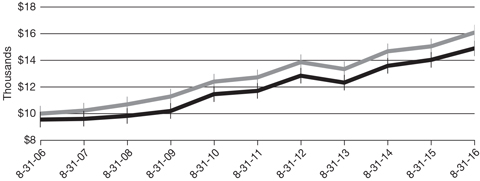

Performance of a $10,000 investment1

Class A shares

Average annual total returns from Aug. 31, 2006, through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Aug. 31, 2006, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index | | | $10,000 | | | | $16,093 | |

Delaware Minnesota High-Yield Municipal Bond Fund — Class A shares Delaware Minnesota High-Yield Municipal Bond Fund — Class A shares | | | $9,550 | | | | $14,902 | |

Institutional Class shares

Average annual total returns from Dec. 31, 2013 (inception date) through Aug. 31, 2016

| | | | | | | | | | |

| For period beginning Dec. 31, 2013, through Aug. 31, 2016 | | Starting value | | | Ending value | |

Delaware Minnesota High-Yield Municipal Bond Fund — Institutional Class shares Delaware Minnesota High-Yield Municipal Bond Fund — Institutional Class shares | | | $10,000 | | | | $11,898 | |

Bloomberg Barclays Municipal Bond Index Bloomberg Barclays Municipal Bond Index | | | $10,000 | | | | $11,776 | |

15

Performance summaries

Delaware Minnesota High-Yield Municipal Bond Fund

1 The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on Aug. 31, 2006, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Aug. 31, 2006.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Dec. 31, 2013, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the Bloomberg Barclays Municipal Bond Index as of Dec. 31, 2013.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the

periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 14. Please note additional details on pages 13 through 16.

The Bloomberg Barclays Municipal Bond Index (formerly known as the Barclays Municipal Bond Index) measures the total return performance of the long-term, investment grade tax-exempt bond market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DVMHX | | 928928316 | | |

Class C | | DVMMX | | 928928282 | | |

Institutional Class | | DMHIX | | 928928175 | | |

16

Disclosure of Fund expenses

For the six-month period from March 1, 2016 to August 31, 2016 (Unaudited)

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from March 1, 2016 to Aug. 31, 2016.

Actual expenses

The first section of the tables shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

17

Disclosure of Fund expenses

For the six-month period from March 1, 2016 to August 31, 2016 (Unaudited)

Delaware Tax-Free Minnesota Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/16 | | Ending

Account Value

8/31/16 | | Annualized

Expense Ratio | | Expenses

Paid During Period

3/1/16 to 8/31/16* |

Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $1,028.60 | | | | | 0.85 | % | | | | $4.33 | |

Class C | | | | 1,000.00 | | | | | 1,024.60 | | | | | 1.60 | % | | | | 8.14 | |

Institutional Class | | | | 1,000.00 | | | | | 1,029.80 | | | | | 0.60 | % | | | | 3.06 | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $1,020.86 | | | | | 0.85 | % | | | | $4.32 | |

Class C | | | | 1,000.00 | | | | | 1,017.09 | | | | | 1.60 | % | | | | 8.11 | |

Institutional Class | | | | 1,000.00 | | | | | 1,022.12 | | | | | 0.60 | % | | | | 3.05 | |

Delaware Tax-Free Minnesota Intermediate Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/16 | | Ending

Account Value

8/31/16 | | Annualized

Expense Ratio | | Expenses

Paid During Period

3/1/16 to 8/31/16* |

Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

Class A | | | $ | 1,000.00 | | | | $ | 1,024.20 | | | | | 0.84 | % | | | $ | 4.27 | |

Class C | | | | 1,000.00 | | | | | 1,020.70 | | | | | 1.69 | % | | | | 8.58 | |

Institutional Class | | | | 1,000.00 | | | | | 1,025.90 | | | | | 0.69 | % | | | | 3.51 | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | �� | | | | |

Class A | | | $ | 1,000.00 | | | | $ | 1,020.91 | | | | | 0.84 | % | | | $ | 4.27 | |

Class C | | | | 1,000.00 | | | | | 1,016.64 | | | | | 1.69 | % | | | | 8.57 | |

Institutional Class | | | | 1,000.00 | | | | | 1,021.67 | | | | | 0.69 | % | | | | 3.51 | |

18

Delaware Minnesota High-Yield Municipal Bond Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

3/1/16 | | Ending

Account Value

8/31/16 | | Annualized

Expense Ratio | | Expenses

Paid During Period

3/1/16 to 8/31/16* |

Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

Class A | | | $ | 1,000.00 | | | | $ | 1,034.80 | | | | | 0.89 | % | | | $ | 4.55 | |

Class C | | | | 1,000.00 | | | | | 1,029.90 | | | | | 1.64 | % | | | | 8.37 | |

Institutional Class | | | | 1,000.00 | | | | | 1,035.10 | | | | | 0.64 | % | | | | 3.27 | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | | | | | |

Class A | | | $ | 1,000.00 | | | | $ | 1,020.66 | | | | | 0.89 | % | | | $ | 4.52 | |

Class C | | | | 1,000.00 | | | | | 1,016.89 | | | | | 1.64 | % | | | | 8.31 | |

Institutional Class | | | | 1,000.00 | | | | | 1,021.92 | | | | | 0.64 | % | | | | 3.25 | |

| * | “Expenses Paid During Period” are equal to the relevant Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

†Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

19

| | |

| Security type / sector / territory allocations |

| Delaware Tax-Free Minnesota Fund | | As of August 31, 2016 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials.

| | | | | |

| Security type / sector | | Percentage of net assets |

Municipal Bonds* | | | | 99.43 | % |

Corporate-Backed Revenue Bonds | | | | 1.94 | % |

Education Revenue Bonds | | | | 13.96 | % |

Electric Revenue Bonds | | | | 5.93 | % |

Healthcare Revenue Bonds | | | | 26.82 | % |

Housing Revenue Bonds | | | | 1.74 | % |

Lease Revenue Bonds | | | | 2.97 | % |

Local General Obligation Bonds | | | | 9.35 | % |

Pre-Refunded/Escrowed to Maturity Bonds | | | | 18.34 | % |

Special Tax Revenue Bonds | | | | 3.17 | % |

State General Obligation Bonds | | | | 8.59 | % |

Transportation Revenue Bonds | | | | 3.47 | % |

Water & Sewer Revenue Bonds | | | | 3.15 | % |

Short-Term Investments | | | | 0.45 | % |

Total Value of Securities | | | | 99.88 | % |

Receivables and Other Assets Net of Liabilities | | | | 0.12 | % |

Total Net Assets | | | | 100.00 | % |

* As of the date of this report, Delaware Tax-Free Minnesota Fund held bonds issued by or on behalf of territories and the states of the United States as follows:

| | | | | |

| State / territory | | Percentage of net assets |

Guam | | | | 0.33 | % |

Minnesota | | | | 99.17 | % |

U.S. Virgin Islands | | | | 0.38 | % |

Total Value of Securities | | | | 99.88 | % |

20

| | |

| Security type / sector / territory allocations |

| Delaware Tax-Free Minnesota Intermediate Fund | | As of August 31, 2016 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials.

| | | | | |

| Security type / sector | | Percentage of net assets |

Municipal Bonds* | | | | 99.51 | % |

Corporate-Backed Revenue Bonds | | | | 1.33 | % |

Education Revenue Bonds | | | | 17.40 | % |

Electric Revenue Bonds | | | | 7.59 | % |

Healthcare Revenue Bonds | | | | 29.06 | % |

Housing Revenue Bonds | | | | 0.39 | % |

Lease Revenue Bonds | | | | 5.39 | % |

Local General Obligation Bonds | | | | 8.20 | % |

Pre-Refunded Bonds | | | | 13.54 | % |

Special Tax Revenue Bonds | | | | 2.79 | % |

State General Obligation Bonds | | | | 6.11 | % |

Transportation Revenue Bonds | | | | 4.92 | % |

Water & Sewer Revenue Bonds | | | | 2.79 | % |

Short-Term Investments | | | | 0.50 | % |

Total Value of Securities | | | | 100.01 | % |

Liabilities Net of Receivables and Other Assets | | | | (0.01 | %) |

Total Net Assets | | | | 100.00 | % |

* As of the date of this report, Delaware Tax-Free Minnesota Intermediate Fund held bonds issued by or on behalf of territories and the states of the United States as follows:

| | | | | |

| State / territory | | Percentage of net assets |

Guam | | | | 0.34 | % |

Minnesota | | | | 99.67 | % |

Total Value of Securities | | | | 100.01 | % |

21

| | |

| Security type / sector/ territory allocations |

| Delaware Minnesota High-Yield Municipal Bond Fund | | As of August 31, 2016 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials.

| | | | | |

| Security type / sector | | Percentage of net assets |

Municipal Bonds* | | | | 98.71 | % |

Corporate-Backed Revenue Bonds | | | | 1.52 | % |

Education Revenue Bonds | | | | 20.05 | % |

Electric Revenue Bonds | | | | 7.87 | % |

Healthcare Revenue Bonds | | | | 29.12 | % |

Housing Revenue Bonds | | | | 2.09 | % |

Lease Revenue Bonds | | | | 3.04 | % |

Local General Obligation Bonds | | | | 11.90 | % |

Pre-Refunded Bonds | | | | 10.21 | % |

Special Tax Revenue Bonds | | | | 5.25 | % |

State General Obligation Bonds | | | | 4.41 | % |

Transportation Revenue Bonds | | | | 1.95 | % |

Water & Sewer Revenue Bonds | | | | 1.30 | % |

Short-Term Investments | | | | 2.37 | % |

Total Value of Securities | | | | 101.08 | % |

Liabilities Net of Receivables and Other Assets | | | | (1.08 | %) |

Total Net Assets | | | | 100.00 | % |

* As of the date of this report, Delaware Minnesota High-Yield Municipal Bond Fund held bonds issued by or on behalf of territories and the states of the United States as follows:

| | | | | |

| State / territory | | Percentage of net assets |

Guam | | | | 0.32 | % |

Minnesota | | | | 100.76 | % |

Total Value of Securities | | | | 101.08 | % |

22

| | |

| Schedules of investments | | |

| Delaware Tax-Free Minnesota Fund | | August 31, 2016 |

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds – 99.43% | | | | | | | | |

| |

Corporate-Backed Revenue Bonds – 1.94% | | | | | | | | |

Laurentian Energy Authority I Cogeneration Revenue | | | | | | | | |

Series A 5.00% 12/1/21 | | | 8,000,000 | | | $ | 8,002,800 | |

St. Paul Port Authority Solid Waste Disposal Revenue | | | | | | | | |

(Gerdau St. Paul Steel Mill Project) Series 7 144A 4.50% 10/1/37 (AMT)# | | | 3,790,000 | | | | 3,430,897 | |

| | | | | | | | |

| | | | | | | 11,433,697 | |

| | | | | | | | |

Education Revenue Bonds – 13.96% | | | | | | | | |

Baytown Township Lease Revenue | | | | | | | | |

(St. Croix Preparatory Academy Project) Series A 4.25% 8/1/46 | | | 150,000 | | | | 152,425 | |

Brooklyn Park Charter School Lease | | | | | | | | |

(Prairie Seeds Academy Project) | | | | | | | | |

Series A 5.00% 3/1/34 | | | 2,260,000 | | | | 2,403,081 | |

Series A 5.00% 3/1/39 | | | 385,000 | | | | 406,826 | |

Cologne Charter School Lease Revenue | | | | | | | | |

(Cologne Academy Project) | | | | | | | | |

Series A 5.00% 7/1/34 | | | 250,000 | | | | 275,785 | |

Series A 5.00% 7/1/45 | | | 1,390,000 | | | | 1,518,408 | |

Deephaven Charter School Lease Revenue | | | | | | | | |

(Eagle Ridge Academy Project) Series A 5.50% 7/1/50 | | | 2,000,000 | | | | 2,193,200 | |

Duluth Housing & Redevelopment Authority Revenue | | | | | | | | |

(Public School Academy) Series A 5.875% 11/1/40 | | | 3,500,000 | | | | 3,747,800 | |

Forest Lake Charter School Revenue Fund | | | | | | | | |

(Forest Lake International Language Academy) | | | | | | | | |

Series A 5.50% 8/1/36 | | | 580,000 | | | | 636,921 | |

Series A 5.75% 8/1/44 | | | 1,190,000 | | | | 1,322,161 | |

Ham Lake Charter School Lease Revenue | | | | | | | | |

(Davinci Academy Project) | | | | | | | | |

Series A 5.00% 7/1/36 | | | 765,000 | | | | 813,210 | |

Series A 5.00% 7/1/47 | | | 2,290,000 | | | | 2,404,340 | |

Hugo Charter School Lease Revenue | | | | | | | | |

(Noble Academy Project) | | | | | | | | |

Series A 5.00% 7/1/34 | | | 580,000 | | | | 612,254 | |

Series A 5.00% 7/1/44 | | | 1,770,000 | | | | 1,851,562 | |

Minneapolis Charter School Lease Revenue | | | | | | | | |

(Hiawatha Academies Project) | | | | | | | | |

Series A 5.00% 7/1/31 | | | 885,000 | | | | 951,844 | |

Series A 5.00% 7/1/47 | | | 2,300,000 | | | | 2,377,648 | |

Minneapolis Student Housing Revenue | | | | | | | | |

(Riverton Community Housing Project) | | | | | | | | |

5.25% 8/1/39 | | | 470,000 | | | | 498,379 | |

5.50% 8/1/49 | | | 2,260,000 | | | | 2,412,821 | |

23

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Education Revenue Bonds (continued) | | | | | | | | |

Minnesota Colleges & Universities Revenue Fund | | | | | | | | |

Series A 5.00% 10/1/28 | | | 8,900,000 | | | $ | 9,637,365 | |

Minnesota Higher Education Facilities Authority Revenue | | | | | | | | |

(Bethel University) Series 6-R 5.50% 5/1/37 | | | 2,500,000 | | | | 2,535,525 | |

(Carleton College) | | | | | | | | |

Series 6-T 5.00% 1/1/28 | | | 1,000,000 | | | | 1,052,010 | |

Series 7-D 5.00% 3/1/30 | | | 1,500,000 | | | | 1,647,075 | |

(College of St. Benedict) Series 8-K 4.00% 3/1/43 | | | 1,000,000 | | | | 1,089,040 | |

(St. Catherine University) | | | | | | | | |

Series 7-Q 5.00% 10/1/21 | | | 1,300,000 | | | | 1,498,107 | |

Series 7-Q 5.00% 10/1/23 | | | 350,000 | | | | 410,403 | |

Series 7-Q 5.00% 10/1/24 | | | 475,000 | | | | 560,856 | |

Series 7-Q 5.00% 10/1/27 | | | 200,000 | | | | 233,704 | |

(St. John’s University) | | | | | | | | |

Series 8-I 5.00% 10/1/32 | | | 500,000 | | | | 612,380 | |

Series 8-I 5.00% 10/1/33 | | | 250,000 | | | | 305,500 | |

(St. Olaf College) | | | | | | | | |

Series 8-G 5.00% 12/1/31 | | | 670,000 | | | | 829,380 | |

Series 8-G 5.00% 12/1/32 | | | 670,000 | | | | 826,847 | |

Series 8-N 4.00% 10/1/33 | | | 1,765,000 | | | | 2,022,496 | |

Series 8-N 4.00% 10/1/35 | | | 500,000 | | | | 569,110 | |

(St. Scholastica College) Series 7-J 6.30% 12/1/40 | | | 1,800,000 | | | | 2,027,772 | |

(University of St. Thomas) | | | | | | | | |

Series 7-A 5.00% 10/1/39 | | | 2,000,000 | | | | 2,225,660 | |

Series 7-U 5.00% 4/1/23 | | | 550,000 | | | | 672,369 | |

Series 8-L 5.00% 4/1/35 | | | 750,000 | | | | 911,745 | |

Otsego Charter School Lease Revenue | | | | | | | | |

(Kaleidoscope Charter School) | | | | | | | | |

Series A 5.00% 9/1/34 | | | 765,000 | | | | 821,809 | |

Series A 5.00% 9/1/44 | | | 1,500,000 | | | | 1,591,290 | |

Rice County Educational Facilities Revenue | | | | | | | | |

(Shattuck-St. Mary’s School) Series A 144A 5.00% 8/1/22 # | | | 2,855,000 | | | | 3,094,706 | |

St. Cloud Charter School Lease Revenue | | | | | | | | |

(Stride Academy Project) Series A 5.00% 4/1/46 | | | 875,000 | | | | 897,155 | |

St. Paul Housing & Redevelopment Authority Charter School Lease Revenue | | | | | | | | |

(Academia Cesar Chavez School Project) Series A 5.25% 7/1/50 | | | 2,000,000 | | | | 2,029,500 | |

(Twin Cities Academy Project) Series A 5.30% 7/1/45 | | | 1,440,000 | | | | 1,517,962 | |

University of Minnesota | | | | | | | | |

Series A 5.00% 4/1/34 | | | 925,000 | | | | 1,169,579 | |

24

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Education Revenue Bonds (continued) | | | | | | | | |

University of Minnesota | | | | | | | | |

Series A 5.00% 4/1/35 | | | 3,175,000 | | | $ | 3,998,722 | |

Series A 5.00% 4/1/36 | | | 2,650,000 | | | | 3,326,995 | |

Series A 5.25% 12/1/28 | | | 1,000,000 | | | | 1,177,610 | |

Series A 5.25% 12/1/29 | | | 1,850,000 | | | | 2,176,877 | |

Series D 5.00% 12/1/27 | | | 1,000,000 | | | | 1,186,040 | |

State Supported Stadium Debt Series A 5.00% 8/1/26 | | | 3,760,000 | | | | 4,812,386 | |

| | | | | | | | |

| | | | | | | 82,046,640 | |

| | | | | | | | |

Electric Revenue Bonds – 5.93% | | | | | | | | |

Chaska Electric Revenue | | | | | | | | |

(Generating Facilities) Series A 5.00% 10/1/30 | | | 1,150,000 | | | | 1,427,691 | |

Hutchinson Utilities Commission Revenue | | | | | | | | |

Series A 4.00% 12/1/21 | | | 700,000 | | | | 791,098 | |

Minnesota Municipal Power Agency Electric Revenue | | | | | | | | |

4.00% 10/1/41 | | | 1,000,000 | | | | 1,121,570 | |

5.00% 10/1/29 | | | 395,000 | | | | 483,448 | |

5.00% 10/1/30 | | | 500,000 | | | | 609,765 | |

5.00% 10/1/33 | | | 1,205,000 | | | | 1,455,568 | |

5.00% 10/1/36 | | | 100,000 | | | | 122,859 | |

Series A 5.00% 10/1/30 | | | 1,060,000 | | | | 1,292,702 | |

Series A 5.00% 10/1/34 | | | 750,000 | | | | 903,487 | |

Series A 5.00% 10/1/35 | | | 1,525,000 | | | | 1,830,854 | |

Northern Municipal Power Agency Electric System Revenue | | | | | | | | |

5.00% 1/1/27 | | | 540,000 | | | | 686,772 | |

5.00% 1/1/30 | | | 520,000 | | | | 647,691 | |

Series A 5.00% 1/1/25 | | | 125,000 | | | | 151,000 | |

Series A 5.00% 1/1/26 | | | 425,000 | | | | 510,561 | |

Series A 5.00% 1/1/31 | | | 520,000 | | | | 608,977 | |

Rochester Electric Utility Revenue | | | | | | | | |

Series B 5.00% 12/1/27 | | | 295,000 | | | | 365,768 | |

Series B 5.00% 12/1/28 | | | 275,000 | | | | 341,129 | |

Series B 5.00% 12/1/31 | | | 1,365,000 | | | | 1,683,564 | |

Series B 5.00% 12/1/33 | | | 300,000 | | | | 368,631 | |

Southern Minnesota Municipal Power Agency Revenue | | | | | | | | |

Series A 5.00% 1/1/41 | | | 1,310,000 | | | | 1,595,698 | |

Series A 5.00% 1/1/46 | | | 2,000,000 | | | | 2,423,120 | |

Capital Appreciation Series A 6.70% 1/1/25 (NATL)^ | | | 5,000,000 | | | | 4,322,450 | |

Western Minnesota Municipal Power Agency Revenue | | | | | | | | |

Series A 5.00% 1/1/33 | | | 1,000,000 | | | | 1,208,960 | |

25

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Electric Revenue Bonds (continued) | | | | | | | | |

Western Minnesota Municipal Power Agency Revenue | | | | | | | | |

Series A 5.00% 1/1/34 | | | 4,000,000 | | | $ | 4,820,680 | |

Series A 5.00% 1/1/40 | | | 1,250,000 | | | | 1,492,337 | |

Series A 5.00% 1/1/46 | | | 3,000,000 | | | | 3,568,170 | |

| | | | | | | | |

| | | | | | | 34,834,550 | |

| | | | | | | | |

Healthcare Revenue Bonds – 26.82% | | | | | | | | |

Alexandria Senior Housing Revenue | | | | | | | | |

(Knute Nelson Senior Living) | | | | | | | | |

6.00% 7/1/35 | | | 1,500,000 | | | | 1,546,785 | |

6.20% 7/1/45 | | | 2,000,000 | | | | 2,068,320 | |

Anoka Health Care Facilities Revenue | | | | | | | | |

(Homestead Anoka Project) | | | | | | | | |

Series A 7.00% 11/1/40 | | | 1,000,000 | | | | 1,120,820 | |

Series A 7.00% 11/1/46 | | | 1,220,000 | | | | 1,355,274 | |

Anoka Healthcare & Housing Facilities Revenue | | | | | | | | |

(Homestead Anoka Project) | | | | | | | | |

5.125% 11/1/49 | | | 1,100,000 | | | | 1,174,019 | |

5.375% 11/1/34 | | | 320,000 | | | | 351,430 | |

Anoka Housing Facilities Revenue | | | | | | | | |

(Senior Homestead Anoka Project) Series B 6.875% 11/1/34 | | | 2,015,000 | | | | 2,178,013 | |

Breckenridge Catholic Health Initiatives | | | | | | | | |

Series A 5.00% 5/1/30 | | | 2,385,000 | | | | 2,393,514 | |

Center City Health Care Facilities Revenue | | | | | | | | |

(Hazelden Betty Ford Foundation Project) | | | | | | | | |

5.00% 11/1/26 | | | 500,000 | | | | 618,355 | |

5.00% 11/1/44 | | | 500,000 | | | | 585,960 | |

Dakota County Community Development Agency Senior Housing Revenue | | | | | | | | |

(Walker Highview Hills Project) | | | | | | | | |

Series A 144A 5.00% 8/1/36 # | | | 280,000 | | | | 292,438 | |

Series A 5.00% 8/1/46 | | | 2,380,000 | | | | 2,473,129 | |

Deephaven Housing & Healthcare Revenue | | | | | | | | |

(St. Therese Senior Living Project) | | | | | | | | |

Series A 5.00% 4/1/38 | | | 730,000 | | | | 773,158 | |

Series A 5.00% 4/1/40 | | | 705,000 | | | | 745,848 | |

Series A 5.00% 4/1/48 | | | 315,000 | | | | 330,385 | |

Duluth Economic Development Authority | | | | | | | | |

(St. Luke’s Hospital Authority Obligation Group) | | | | | | | | |

5.75% 6/15/32 | | | 1,850,000 | | | | 2,109,981 | |

6.00% 6/15/39 | | | 3,570,000 | | | | 4,098,289 | |

26

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Healthcare Revenue Bonds (continued) | | | | | | | | |

Fergus Falls Health Care Facilities Revenue | | | | | | | | |

(Lake Region Health Care) | | | | | | | | |

5.15% 8/1/35 | | | 1,250,000 | | | $ | 1,270,000 | |

5.40% 8/1/40 | | | 1,000,000 | | | | 1,019,510 | |

Glencoe Health Care Facilities Revenue | | | | | | | | |

(Glencoe Regional Health Services Project) | | | | | | | | |

4.00% 4/1/24 | | | 500,000 | | | | 547,175 | |

4.00% 4/1/25 | | | 660,000 | | | | 721,552 | |

4.00% 4/1/31 | | | 60,000 | | | | 64,290 | |

Hayward Health Care Facilities Revenue | | | | | | | | |

(American Baptist Homes Midwest Obligated Group) | | | | | | | | |

5.375% 8/1/34 | | | 660,000 | | | | 701,105 | |

5.75% 2/1/44 | | | 500,000 | | | | 534,350 | |

(St. John’s Lutheran Home of Albert Lea) 5.375% 10/1/44 | | | 1,570,000 | | | | 1,665,990 | |

Maple Grove Health Care Facilities Revenue | | | | | | | | |

(North Memorial Health Care) | | | | | | | | |

5.00% 9/1/31 | | | 1,000,000 | | | | 1,202,600 | |

5.00% 9/1/32 | | | 1,000,000 | | | | 1,196,360 | |

Maple Grove Health Care System Revenue | | | | | | | | |

(Maple Grove Hospital) | | | | | | | | |

5.25% 5/1/28 | | | 4,500,000 | | | | 4,616,325 | |

5.25% 5/1/37 | | | 2,950,000 | | | | 3,020,859 | |

Minneapolis Health Care System Revenue | | | | | | | | |

(Fairview Health Services) | | | | | | | | |

Series A 5.00% 11/15/33 | | | 500,000 | | | | 607,015 | |

Series A 5.00% 11/15/34 | | | 500,000 | | | | 603,800 | |

Series A 5.00% 11/15/44 | | | 1,000,000 | | | | 1,188,560 | |

Series B Unrefunded Balance 6.50% 11/15/38 (AGC) | | | 965,000 | | | | 1,075,550 | |

Minneapolis Senior Housing & Healthcare Revenue | | | | | | | | |

(Ecumen Mill City Quarter) | | | | | | | | |

5.00% 11/1/35 | | | 500,000 | | | | 525,690 | |

5.25% 11/1/45 | | | 1,950,000 | | | | 2,058,576 | |

5.375% 11/1/50 | | | 455,000 | | | | 473,296 | |

Minneapolis – St. Paul Housing & Redevelopment Authority Health Care Revenue | | | | | | | | |

(Children’s Hospital Clinics) Series A 5.25% 8/15/35 | | | 2,085,000 | | | | 2,397,604 | |

Minnesota Agricultural & Economic Development Board Revenue | | | | | | | | |

(Essentia Remarketing) Series C-1 5.00% 2/15/30 (AGC) | | | 5,725,000 | | | | 6,378,852 | |

27

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Healthcare Revenue Bonds (continued) | | | | | | | | |

Minnesota Agricultural & Economic Development Board Revenue | | | | | | | | |

(Essentia Remarketing) | | | | | | | | |

Series C-1 5.25% 2/15/23 (AGC) | | | 5,000,000 | | | $ | 5,709,000 | |

Series C-1 5.50% 2/15/25 (AGC) | | | 5,120,000 | | | | 5,857,638 | |

Northfield Hospital & Skilled Nursing Revenue | | | | | | | | |

5.375% 11/1/26 | | | 3,785,000 | | | | 3,813,198 | |

Red Wing Senior Housing | | | | | | | | |

(Deer Crest Project) | | | | | | | | |

Series A 5.00% 11/1/27 | | | 430,000 | | | | 466,877 | |

Series A 5.00% 11/1/32 | | | 330,000 | | | | 355,073 | |

Series A 5.00% 11/1/42 | | | 1,250,000 | | | | 1,334,875 | |

Rochester Health Care & Housing Revenue | | | | | | | | |

(Samaritan Bethany) Series A 7.375% 12/1/41 | | | 5,220,000 | | | | 5,850,367 | |

(The Homestead at Rochester Project) Series A 6.875% 12/1/48 | | | 2,980,000 | | | | 3,508,414 | |

Rochester Health Care Facilities Revenue | | | | | | | | |

(Mayo Clinic) 4.00% 11/15/41 | | | 4,515,000 | | | | 4,918,054 | |

Series D Remarketing 5.00% 11/15/38 | | | 6,405,000 | | | | 7,261,989 | |

(Olmsted Medical Center Project) | | | | | | | | |

5.00% 7/1/24 | | | 295,000 | | | | 358,505 | |

5.00% 7/1/33 | | | 650,000 | | | | 761,039 | |

5.875% 7/1/30 | | | 1,850,000 | | | | 2,144,372 | |

Sartell Health Care Facilities Revenue | | | | | | | | |

(Country Manor Campus Project) | | | | | | | | |

Series A 5.25% 9/1/27 | | | 1,280,000 | | | | 1,405,734 | |

Series A 5.30% 9/1/37 | | | 1,200,000 | | | | 1,310,652 | |

Series A 6.375% 9/1/42 | | | 2,435,000 | | | | 2,464,877 | |

Sauk Rapids Health Care Housing Facilities Revenue | | | | | | | | |

(Good Shepherd Lutheran Home) 5.125% 1/1/39 | | | 1,350,000 | | | | 1,411,560 | |

Shakopee Health Care Facilities Revenue | | | | | | | | |

(St. Francis Regional Medical Center) | | | | | | | | |

4.00% 9/1/31 | | | 915,000 | | | | 1,012,914 | |

5.00% 9/1/24 | | | 575,000 | | | | 717,905 | |

5.00% 9/1/25 | | | 750,000 | | | | 930,698 | |

5.00% 9/1/26 | | | 575,000 | | | | 709,188 | |

5.00% 9/1/27 | | | 405,000 | | | | 497,376 | |

5.00% 9/1/28 | | | 425,000 | | | | 517,246 | |

5.00% 9/1/29 | | | 425,000 | | | | 514,339 | |

5.00% 9/1/34 | | | 730,000 | | | | 865,364 | |

28

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Healthcare Revenue Bonds (continued) | | | | | | | | |

St. Cloud Health Care Revenue | | | | | | | | |

(Centracare Health System Project) | | | | | | | | |

Series A 4.00% 5/1/37 | | | 1,100,000 | | | $ | 1,228,359 | |

Series A 5.00% 5/1/46 | | | 7,715,000 | | | | 9,387,843 | |

Series A Unrefunded Balance 5.125% 5/1/30 | | | 740,000 | | | | 838,879 | |

St. Paul Housing & Redevelopment Authority Health Care Facilities Revenue | | | | | | | | |

(Allina Health System) Series A-1 5.25% 11/15/29 | | | 5,605,000 | | | | 6,351,978 | |

(Health Partners Obligation Group Project) | | | | | | | | |

5.00% 7/1/29 | | | 2,200,000 | | | | 2,707,914 | |

5.00% 7/1/32 | | | 2,500,000 | | | | 3,051,250 | |

5.00% 7/1/33 | | | 1,260,000 | | | | 1,532,198 | |

St. Paul Housing & Redevelopment Authority Hospital Facility Revenue | | | | | | | | |

(Healtheast Care System Project) | | | | | | | | |

Series A 5.00% 11/15/29 | | | 910,000 | | | | 1,102,783 | |

Series A 5.00% 11/15/30 | | | 670,000 | | | | 810,935 | |

St. Paul Housing & Redevelopment Authority Housing & Health Care Facilities Revenue | | | | | | | | |

(Senior Carondelet Village Project) Series A 6.00% 8/1/42 | | | 3,075,000 | | | | 3,157,717 | |

(Senior Episcopal Homes Project) 5.125% 5/1/48 | | | 3,100,000 | | | | 3,332,283 | |

St. Paul Housing & Redevelopment Authority Multifamily Housing Revenue | | | | | | | | |

(Marian Center Project) | | | | | | | | |

Series A 5.30% 11/1/30 | | | 500,000 | | | | 500,660 | |

Series A 5.375% 5/1/43 | | | 500,000 | | | | 500,570 | |

Wayzata Senior Housing Revenue | | | | | | | | |

(Folkestone Senior Living Community) | | | | | | | | |

Series A 5.50% 11/1/32 | | | 1,050,000 | | | | 1,143,807 | |

Series A 5.75% 11/1/39 | | | 2,365,000 | | | | 2,565,765 | |

Series A 6.00% 5/1/47 | | | 3,685,000 | | | | 4,016,134 | |

Winona Health Care Facilities Revenue | | | | | | | | |

(Winona Health Obligation) | | | | | | | | |

4.50% 7/1/25 | | | 850,000 | | | | 932,000 | |

4.65% 7/1/26 | | | 540,000 | | | | 593,568 | |

Woodbury Housing & Redevelopment Authority Revenue | | | | | | | | |

(St. Therese of Woodbury) | | | | | | | | |

5.00% 12/1/34 | | | 500,000 | | | | 539,550 | |

5.125% 12/1/44 | | | 1,605,000 | | | | 1,727,799 | |

5.25% 12/1/49 | | | 750,000 | | | | 815,843 | |

| | | | | | | | |

| | | | | | | 157,619,866 | |

| | | | | | | | |

29

Schedules of investments

Delaware Tax-Free Minnesota Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Municipal Bonds (continued) | | | | | | | | |

| |

Housing Revenue Bonds – 1.74% | | | | | | | | |

Minnesota Housing Finance Agency | | | | | | | | |

(Residential Housing) Series L 5.10% 7/1/38 (AMT) | | | 6,735,000 | | | $ | 6,778,845 | |

Minnesota Housing Finance Agency Homeownership | | | | | | | | |

Finance (Non-Agency Mortgage-Backed Securities Program) Series D 4.70% 1/1/31 (GNMA) (FNMA) (FHLMC) | | | 1,880,000 | | | | 2,065,349 | |

Northwest Multi-County Housing & Redevelopment Authority | | | | | | | | |

(Pooled Housing Program) 5.50% 7/1/45 | | | 1,330,000 | | | | 1,379,676 | |

| | | | | | | | |

| | | | | | | 10,223,870 | |

| | | | | | | | |

Lease Revenue Bonds – 2.97% | | | | | | | | |

Minnesota General Fund Revenue Appropriations | | | | | | | | |

Series A 5.00% 6/1/38 | | | 1,250,000 | | | | 1,505,788 | |