UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-03916

Name of Registrant: | | Vanguard Specialized Funds |

Address of Registrant: | | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| | |

Name and address of agent for service: | | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: January 31

Date of reporting period: February 1, 2018—January 31, 2019

Item 1: Reports to Shareholders

Annual Report | January 31, 2019 Vanguard Energy Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

A Note From Our Chairman | 1 |

Your Fund’s Performance at a Glance | 2 |

Advisors’ Report | 3 |

About Your Fund’s Expenses | 7 |

Performance Summary | 9 |

Financial Statements | 12 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

It’s important to be prepared for that turbulence, whenever it appears. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

February 19, 2019

1

Your Fund’s Performance at a Glance

· For the 12 months ended January 31, 2019, Vanguard Energy Fund returned –11.48% for Investor Shares and –11.40% for Admiral Shares. The results lagged the –8.01% return of the fund’s benchmark, the MSCI ACWI Energy Index.

· The broad stock market returned about –2%. Volatility returned as investors faced slowing global economic growth, rising U.S. interest rates, and heightened geopolitical uncertainty.

· The fund’s advisors seek long-term capital appreciation through multicapitalization exposure to global energy stocks, with a focus on oil and natural gas producers, service companies, and refiners.

· The fund’s negative return reflected the decline of oil prices over the period. The fund’s oil and gas exploration and production holdings significantly hurt performance.

· For the ten years ended January 31, 2019, the fund posted an average annual return of about 5%, 2 percentage points ahead of its spliced benchmark index.

Market Barometer | | | | | | | |

| | Average Annual Total Returns | |

| | Periods Ended January 31, 2019 | |

| | One Year | | Three Years | | Five Years | |

Stocks | | | | | | | |

Russell 1000 Index (Large-caps) | | -2.17% | | 14.14% | | 10.68% | |

Russell 2000 Index (Small-caps) | | -3.52 | | 14.71 | | 7.26 | |

Russell 3000 Index (Broad U.S. market) | | -2.26 | | 14.19 | | 10.41 | |

FTSE All-World ex US Index (International) | | -12.52 | | 9.68 | | 3.47 | |

| | | | | | | |

Bonds | | | | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | | | | | |

(Broad taxable market) | | 2.25% | | 1.95% | | 2.44% | |

Bloomberg Barclays Municipal Bond Index | | | | | | | |

(Broad tax-exempt market) | | 3.26 | | 2.15 | | 3.57 | |

FTSE Three-Month U.S. Treasury Bill Index | | 1.96 | | 1.05 | | 0.63 | |

| | | | | | | |

CPI | | | | | | | |

Consumer Price Index | | 1.55% | | 2.04% | | 1.48% | |

2

Advisors’ Report

For the 12 months ended January 31, 2019, Vanguard Energy Fund returned –11.48% for Investor Shares and –11.40% for Admiral Shares. It trailed the –8.01% return of its benchmark, the MSCI ACWI Energy Index. Your fund is managed by two advisors, a strategy that enhances fund diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies are presented in the table below. The advisors also have provided a discussion of the investment environment that existed during the year and of how their portfolio positioning reflects this assessment. These reports were prepared on February 19, 2019.

Wellington Management Company LLP

Portfolio Manager:

Gregory LeBlanc, CFA,

Senior Managing Director,

Global Industry Analyst

The investment environment

Global equities fell during the 12-month period. Global energy stocks, as measured by the fund’s benchmark, returned –8.01%,

Vanguard Energy Fund Investment Advisors

| | Fund Assets Managed | | |

Investment Advisor | | % | | $ Million | | Investment Strategy |

Wellington Management Company LLP | | 93 | | 7,327 | | Emphasizes long-term total-return opportunities from the various energy subsectors: international oils, foreign integrated oils and foreign producers, North American producers, oil services and equipment, midstream and utilities, and refining and marketing. |

Vanguard Quantitative Equity Group | | 5 | | 397 | | Employs a quantitative fundamental management approach using models that assess valuation, management decisions, market sentiment, and earnings and balance-sheet quality of companies as compared with their peers. |

Cash Investments | | 2 | | 147 | | These short-term reserves are invested by Vanguard in equity index products to simulate investments in stock. Each advisor may also maintain a modest cash position. |

3

trailing the –6.98% return of the broader market, as measured by the MSCI All Country World Index.

Energy markets fell early in the period amid high volatility, particularly during the lead-up to the June OPEC meeting, as investors grew increasingly nervous about the impact of a potential production increase. Oil prices recovered through mid-2018, as the market’s focus shifted to OPEC’s shrinking spare capacity amid supply disruptions from Libya, Venezuela, and Iran. Oil prices continued to strengthen during the third quarter of 2018, surging above $75 per barrel (for West Texas Intermediate, or WTI) in October given tight inventories, sustained demand, and heightened geopolitical tensions that could threaten future supply. Despite increased output from Saudi Arabia and Russia, renewed economic sanctions on Iran and decreased output from Venezuela further reduced oil production capacity globally.

The trend reversed, however, and prices plummeted during the final months of 2018. Prices fell to $42 per barrel in December as sanctions reduced Iran’s exports less than expected. The equity market also sold off in December, as investors grew increasingly concerned about trade tensions, rising interest rates, and the potential for slowing global growth as we near the end of a decade-long bull market.

Amid oil price volatility and increased macroeconomic uncertainty, energy equities declined alongside most other asset classes. Energy equities surged during the final month of the fiscal year, however, as adherence to OPEC production cuts drove an uptick in global oil prices.

The fund’s positioning

With the recent volatility, oil prices have declined to extreme levels, encouraging production restraint from OPEC and Canada. We believe a reduction in global supply could trigger a near-term boost in oil prices. Price differentials between Permian oil and WTI have also started to narrow as additional pipeline capacity comes online in the Permian Basin.

Heading into the new fiscal year, we remain optimistic about the positive macro backdrop for oil. There are early signals from OPEC that it will adhere to production cuts and indications from U.S. producers that they will adjust their budgets to limit supply growth in favor of free-cash-flow generation. We also see room for sentiment to improve in 2019 given the industry’s move to a more balanced business model and a growing focus on capital return. For this reason, we continue to believe there are enhanced opportunities for upside potential in energy equities given lower valuation and current sentiment.

Though we remain cautiously optimistic about oil prices in the near term, we continue to monitor a list of cyclical concerns that could affect energy equity prices. As global financial conditions tighten and fiscal impulse fades, we’re increasingly concerned about a downshift in global growth. Additionally, the potential effects of a trade war are beginning to weigh on global demand and are likely to

4

further slow the global economy, adding uncertainty to capital markets and company investment decisions. Accordingly, as we head into the new fiscal year, we will continue to pay close attention to global growth signals, trade talks, geopolitical tensions, U.S. shale activity, and OPEC adherence to production cuts.

Our successes and shortfalls

Security selection detracted most from the fund’s performance for the period, particularly among upstream producers. A relative overweight to this subindustry also hurt results, as did an underweight to the integrated oils subindustry.

Exploration and production companies Pioneer Natural Resources, Alta Mesa Resources, and Newfield Exploration were among the largest detractors. Both Alta Mesa and Newfield Exploration were weighed down early in the period because of inconsistent well results that failed to meet investor expectations within the SCOOP and STACK basins, in Oklahoma.

One of the more notable developments in the energy sector during the period was the stark underperformance of Permian oil producers relative to other U.S. producers, among them our holdings Pioneer Natural Resources and Diamondback Energy.

Here, price differentials caused by infrastructure bottlenecks and corresponding takeaway capacity constraints led Permian producers to sell oil at prices below WTI levels. Accordingly, we believe that the Permian companies in our portfolio stand to benefit from the closing of that pricing gap as we head into the new fiscal year. Our view on this has strengthened recently as several new pipeline projects have been announced or started over the last few months.

By contrast, the portfolio benefited from selection among utilities companies. The fund’s position in Sempra Energy was among the largest contributors for the fiscal year. The company’s stock price rose sharply in June after activist investors called for broad structural changes that focused on improving core operations and selling or spinning off peripheral Latin American utilities and U.S. liquefied natural gas businesses.

Lukoil was the largest contributor to relative results over the period. Shares of Lukoil notably outperformed other energy equities in the final months of the fiscal year, boosted by strong third-quarter earnings results. Highlights of the results were impressive top-line and sales volume growth, as well as free-cash-flow figures that beat consensus estimates. Shares also rose sharply in January 2019 as global oil prices rebounded.

Vanguard Quantitative Equity Group

Portfolio Managers:

James P. Stetler

Binbin Guo, Principal, Head of Alpha Equity Investments

5

The investment environment

Energy stocks experienced significant volatility over the past 12 months. Although crude oil prices topped $75 per barrel in October 2018—their highest point since 2014—they bottomed out at about $42 in December before rebounding above $50 in January.

The decline in oil prices can be attributed to the muted impact of the Trump administration’s sanctions on Iran. Because of the temporary waivers granted to Iran’s largest customers—including China, India, and Japan—Iran’s oil production was only modestly curbed. At the same time, production in Saudi Arabia and the United States has been increasing faster than expected. In 2019, a new round of supply cuts by OPEC and its allies lifted oil prices.

Investment objective and strategy

Although it’s important to understand how our overall performance is affected by the macroeconomic factors we’ve described, our approach to investing focuses on specific fundamentals—not on technical analysis of stock price movements. We compare all stocks in our investment universe within the same industry groups in order to identify those with characteristics that we believe will outperform over the long run.

To do this, we use a strict quantitative process that systematically focuses on several key fundamental factors. We believe that attractive stocks exhibit four key themes: (1) high quality—healthy balance sheets and consistent cash-flow generation; (2) sound management decisions—investment policies that favor internal over external funding; (3) strong market sentiment—market confirmation of our view; and (4) reasonable valuation— avoidance of overpriced stocks. Using these results, we construct our portfolio with the goal of maximizing expected return and minimizing exposure to risks that our research indicates do not improve returns.

Our successes and shortfalls

For the 12 months, our sentiment and quality models boosted relative performance most, followed by our valuation model. Our management decisions model did not perform as expected.

Our selections in integrated oil and gas companies held up better than those in the benchmark. Our underweighting of equipment and services and stock selection in exploration and production also helped relative performance. Our underweighting of and selection in storage and transportation detracted from relative performance.

We also benefited from our holdings in the United States and, to a lesser extent, Finland and Turkey. Our holdings in Japan, China, and India limited relative performance.

Our most successful overweightings included those to Grupa Lotos, Petróleo Brasileiro, and Neste. We also benefited from underweight allocations to Halliburton and Schlumberger. Our results were restrained by overweight positions in GCL-Poly Energy, Cosmo Energy, and Hindustan Petroleum and underweighting of Andeavor.

6

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

7

Six Months Ended January 31, 2019 | | | |

Energy Fund | Beginning

Account Value

7/31/2018 | Ending

Account Value

1/31/2019 | Expenses

Paid During

Period |

Based on Actual Fund Return | | | |

Investor Shares | $1,000.00 | $844.41 | $1.63 |

Admiral™ Shares | 1,000.00 | 844.86 | 1.26 |

Based on Hypothetical 5% Yearly Return | | | |

Investor Shares | $1,000.00 | $1,023.44 | $1.79 |

Admiral Shares | 1,000.00 | 1,023.84 | 1.38 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.35% for Investor Shares and 0.27% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

8

Energy Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

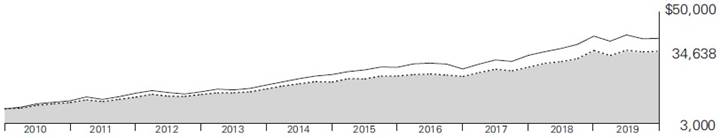

Cumulative Performance: January 31, 2009, Through January 31, 2019

Initial Investment of $10,000

| | | | Average Annual Total Returns | | |

| | | | Periods Ended January 31, 2019 | | |

| | | | | | | | | | Final Value |

| | | | One | | Five | | Ten | | of a $10,000 |

| | | | Year | | Years | | Years | | Investment |

| | Energy Fund Investor Shares | | -11.48% | | -2.24% | | 5.07% | | $16,399 |

| | Spliced Energy Index | | -8.01 | | -1.24 | | 3.11 | | 13,579 |

| | Dow Jones U.S. Total Stock Market Float Adjusted Index | | -2.32 | | 10.36 | | 15.14 | | 40,951 |

Spliced Energy Index: S&P 500 Index through November 30, 2000; S&P Energy Sector Index through May 31, 2010; MSCI All Country World Energy Index thereafter.

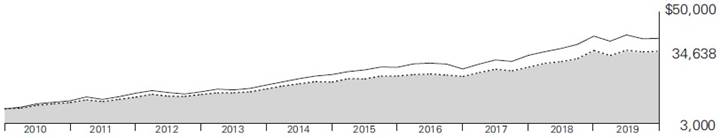

| | | | | | | | | | Final Value |

| | | | One | | Five | | Ten | | of a $50,000 |

| | | | Year | | Years | | Years | | Investment |

Energy Fund Admiral Shares | | -11.40% | | -2.17% | | 5.14% | | $82,550 |

Spliced Energy Index | | -8.01 | | -1.24 | | 3.11 | | 67,897 |

Dow Jones U.S. Total Stock Market Float Adjusted Index | | -2.32 | | 10.36 | | 15.14 | | 204,756 |

See Financial Highlights for dividend and capital gains information.

9

Energy Fund

Average Annual Total Returns: Periods Ended December 31, 2018

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | Inception Date | | One Year | | Five Years | | Ten Years |

Investor Shares | | 5/23/1984 | | -17.15% | | -5.20% | | 3.66% |

Admiral Shares | | 11/12/2001 | | -17.08 | | -5.13 | | 3.73 |

10

Energy Fund

Sector Diversification

As of January 31, 2019

Integrated Oil & Gas | | 43.6 | % |

Oil & Gas Drilling | | 0.4 | |

Oil & Gas Equipment & Services | | 5.0 | |

Oil & Gas Exploration & Production | | 30.1 | |

Oil & Gas Refining & Marketing | | 10.0 | |

Oil & Gas Storage & Transportation | | 4.7 | |

Utilities | | 4.5 | |

Other | | 1.7 | |

The table reflects the fund’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

11

Energy Fund

Financial Statements

Statement of Net Assets

As of January 31, 2019

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov.

| | | | | Market |

| | | | | Value· |

| | | Shares | | ($000) |

Common Stocks (96.4%)1 | | | | |

United States (60.7%) | | | | |

Electric Utilities (1.4%) | | | | |

| Avangrid Inc. | | 1,142,339 | | 56,968 |

| NextEra Energy Inc. | | 155,200 | | 27,778 |

| OGE Energy Corp. | | 405,664 | | 16,612 |

* | PG&E Corp. | | 453,379 | | 5,894 |

| | | | | 107,252 |

Energy Equipment & Services (4.4%) | | | | |

| Schlumberger Ltd. | | 3,092,193 | | 136,706 |

| Halliburton Co. | | 3,220,321 | | 100,989 |

* | ProPetro Holding Corp. | | 3,967,742 | | 64,833 |

| Patterson-UTI Energy Inc. | | 2,203,980 | | 26,734 |

| Baker Hughes a GE Co. Class A | | 811,525 | | 19,128 |

^ | Liberty Oilfield Services Inc. Class A | | 113,577 | | 1,728 |

| | | | 350,118 |

Multi-Utilities (1.3%) | | | | |

| Sempra Energy | | 856,956 | | 100,247 |

| | | | | |

Oil, Gas & Consumable Fuels (52.4%) | | | | |

| Integrated Oil & Gas (17.9%) | | | | |

| Exxon Mobil Corp. | | 9,013,151 | | 660,484 |

| Chevron Corp. | | 5,042,049 | | 578,071 |

| Occidental Petroleum Corp. | | 2,544,213 | | 169,902 |

| | | | | |

| Oil & Gas Exploration & Production (24.3%) | | | | |

| Diamondback Energy Inc. | | 2,639,137 | | 272,148 |

| EOG Resources Inc. | | 2,496,047 | | 247,608 |

| Pioneer Natural Resources Co. | | 1,677,765 | | 238,780 |

* | Concho Resources Inc. | | 1,344,033 | | 161,069 |

| ConocoPhillips | | 1,873,002 | | 126,783 |

| Cabot Oil & Gas Corp. | | 4,391,678 | | 109,572 |

| Anadarko Petroleum Corp. | | 2,180,861 | | 103,220 |

| Hess Corp. | | 1,524,895 | | 82,344 |

* | WPX Energy Inc. | | 5,708,074 | | 69,981 |

| Noble Energy Inc. | | 2,665,338 | | 59,544 |

* | PDC Energy Inc. | | 1,639,141 | | 53,387 |

| Devon Energy Corp. | | 1,901,767 | | 50,682 |

| Viper Energy Partners LP | | 1,517,954 | | 48,134 |

* | Callon Petroleum Co. | | 5,331,112 | | 43,395 |

* | SRC Energy Inc. | | 7,711,699 | | 37,942 |

| EQT Corp. | | 1,809,038 | | 35,222 |

* | Parsley Energy Inc. Class A | | 1,824,386 | | 33,897 |

* | Kosmos Energy Ltd. | | 6,023,835 | | 30,902 |

| Marathon Oil Corp. | | 1,869,653 | | 29,522 |

*,^ | Jagged Peak Energy Inc. | | 2,728,852 | | 28,735 |

* | Centennial Resource Development Inc. Class A | | 1,807,412 | | 23,804 |

* | Magnolia Oil & Gas Corp. | | 969,604 | | 11,674 |

* | Extraction Oil & Gas Inc. | | 966,854 | | 3,809 |

| Cimarex Energy Co. | | 41,574 | | 3,132 |

| Murphy Oil Corp. | | 101,903 | | 2,787 |

| Range Resources Corp. | | 217,506 | | 2,399 |

* | Antero Resources Corp. | | 54,747 | | 551 |

| | | | | |

| Oil & Gas Refining & Marketing (8.0%) | | | | |

| Marathon Petroleum Corp. | | 4,411,169 | | 292,284 |

| Valero Energy Corp. | | 2,734,233 | | 240,120 |

| Phillips 66 | | 997,166 | | 95,140 |

| HollyFrontier Corp. | | 61,855 | | 3,485 |

| | | | | |

| Oil & Gas Storage & Transportation (2.2%) | | | | |

| Kinder Morgan Inc. | | 4,633,169 | | 83,860 |

| Targa Resources Corp. | | 1,399,841 | | 60,207 |

* | Scorpio Tankers Inc. | | 1,247,050 | | 23,357 |

12

Energy Fund

| | | | | Market |

| | | | | Value· |

| | | Shares | | ($000) |

* | Equitrans Midstream Corp. | | 122,021 | | 2,541 |

| Williams Cos. Inc. | | 91,748 | | 2,471 |

| ONEOK Inc. | | 25,641 | | 1,646 |

| | | | | 4,124,591 |

Other (0.6%) | | | | |

2 | Vanguard Energy ETF | | 578,000 | | 49,789 |

| | | | | |

Semiconductors & Semiconductor Equipment (0.6%) | | | | |

* | First Solar Inc. | | 872,611 | | 44,145 |

Total United States | | | | 4,776,142 |

International (35.7%) | | | | |

Australia (0.0%) | | | | |

| Woodside Petroleum Ltd. | | 46,975 | | 1,175 |

| | | | | |

Austria (0.1%) | | | | |

| OMV AG | | 60,368 | | 3,002 |

| | | | | |

Brazil (1.3%) | | | | |

| Petroleo Brasileiro SA ADR | | 5,837,992 | | 95,159 |

| Petroleo Brasileiro SA | | 424,762 | | 3,446 |

| Petroleo Brasileiro SA Preference Shares | | 278,000 | | 1,953 |

| | | | | 100,558 |

Canada (6.1%) | | | | |

| Encana Corp. | | 23,136,301 | | 159,178 |

| TransCanada Corp. (New York Shares) | | 3,568,452 | | 151,731 |

| Suncor Energy Inc. | | 4,194,751 | | 135,574 |

| Enbridge Inc. (New York Shares) | | 293,248 | | 10,739 |

| Enbridge Inc. | | 219,205 | | 8,010 |

| Canadian Natural Resources Ltd. | | 242,839 | | 6,518 |

| Suncor Energy Inc. (New York Shares) | | 169,750 | | 5,475 |

| TransCanada Corp. | | 78,170 | | 3,324 |

| Husky Energy Inc. | | 217,335 | | 2,579 |

| | | | | 483,128 |

China (1.9%) | | | | |

| CNOOC Ltd. ADR | | 600,375 | | 100,437 |

| China Petroleum & Chemical Corp. ADR | | 349,351 | | 29,153 |

| CNOOC Ltd. | | 3,634,717 | | 6,075 |

| China Petroleum & Chemical Corp. | | 6,387,600 | | 5,341 |

| PetroChina Co. Ltd. | | 6,254,000 | | 4,037 |

| China Longyuan Power Group Corp. Ltd. | | 3,503,000 | | 2,622 |

| Kunlun Energy Co. Ltd. | | 2,284,000 | | 2,440 |

| Huaneng Renewables Corp. Ltd. | | 7,920,000 | | 2,284 |

| | | | | 152,389 |

Colombia (0.0%) | | | | |

| Ecopetrol SA ADR | | 147,255 | | 2,776 |

| | | | | |

Finland (0.1%) | | | | |

| Neste Oyj | | 45,695 | | 4,187 |

| | | | | |

France (4.7%) | | | | |

| TOTAL SA ADR | | 6,478,920 | | 354,591 |

| TOTAL SA | | 324,780 | | 17,805 |

| | | | | 372,396 |

Germany (0.3%) | | | | |

| E.ON SE | | 2,300,575 | | 25,574 |

| | | | | |

Greece (0.1%) | | | | |

| Motor Oil Hellas Corinth Refineries SA | | 81,604 | | 2,035 |

| Hellenic Petroleum SA | | 182,941 | | 1,610 |

| | | | | 3,645 |

Hungary (0.0%) | | | | |

| MOL Hungarian Oil & Gas plc | | 223,936 | | 2,687 |

| | | | | |

India (2.1%) | | | | |

| Reliance Industries Ltd. | | 6,024,313 | | 104,354 |

| Power Grid Corp. of India Ltd. | | 23,257,433 | | 61,797 |

| | | | | 166,151 |

Israel (0.1%) | | | | |

* | Oil Refineries Ltd. | | 4,681,224 | | 2,281 |

| Paz Oil Co. Ltd. | | 6,661 | | 996 |

| | | | | 3,277 |

Italy (2.6%) | | | | |

| Eni SPA ADR | | 4,157,727 | | 140,864 |

| Tenaris SA ADR | | 2,224,928 | | 55,556 |

| Eni SPA | | 497,401 | | 8,434 |

| | | | | 204,854 |

Japan (0.8%) | | | | |

| Inpex Corp. | | 5,459,579 | | 52,480 |

| JXTG Holdings Inc. | | 849,600 | | 4,640 |

| Cosmo Energy Holdings Co. Ltd. | | 100,000 | | 2,264 |

| Showa Shell Sekiyu KK | | 27,300 | | 407 |

| | | | | 59,791 |

Malaysia (0.0%) | | | | |

* | Bumi Armada Bhd. | | 16,550,600 | | 810 |

13

Energy Fund

| | | | | Market |

| | | | | Value· |

| | | Shares | | ($000) |

Norway (0.6%) | | | | |

| Equinor ASA ADR | | 1,935,907 | | 44,100 |

| Equinor ASA | | 237,392 | | 5,428 |

| | | | | 49,528 |

Poland (0.0%) | | | | |

| Grupa Lotos SA | | 104,705 | | 2,618 |

| Polskie Gornictwo Naftowe i Gazownictwo SA | | 120,465 | | 247 |

| | | | | 2,865 |

Portugal (0.6%) | | | | |

| Galp Energia SGPS SA | | 3,124,149 | | 48,814 |

| | | | | |

Russia (3.7%) | | | | |

| Lukoil PJSC ADR | | 2,621,201 | | 210,476 |

| Rosneft Oil Co. PJSC GDR | | 9,322,203 | | 58,294 |

| Gazprom PJSC | | 2,433,814 | | 6,064 |

| Rosneft Oil Co. PJSC | | 500,900 | | 3,150 |

| Tatneft PJSC ADR | | 41,974 | | 3,085 |

| AK Transneft OAO Preference Shares | | 1,088 | | 2,909 |

| LUKOIL PJSC | | 23,865 | | 1,924 |

| Tatneft PJSC | | 155,950 | | 1,922 |

| Surgutneftegas OAO Preference Shares | | 2,172,300 | | 1,345 |

| Novatek PJSC GDR | | 2,457 | | 451 |

| | | | | 289,620 |

South Korea (0.0%) | | | | |

| GS Holdings Corp. | | 48,367 | | 2,367 |

| | | | | |

Spain (1.1%) | | | | |

* | Iberdrola SA (Madrid Shares) | | 5,449,150 | | 45,040 |

* | Repsol SA | | 2,342,230 | | 41,114 |

* | Iberdrola SA | | 121,092 | | 998 |

| | | | | 87,152 |

Sweden (0.7%) | | | | |

| Lundin Petroleum AB | | 1,626,099 | | 52,012 |

| | | | | |

Thailand (0.1%) | | | | |

| PTT PCL (Foreign) | | 1,955,500 | | 3,045 |

* | PTT Exploration and Production PCL (Local) | | 747,400 | | 2,952 |

* | PTT PCL | | 1,566,100 | | 2,439 |

| | | | | 8,436 |

Turkey (0.0 %) | | | | |

| Tupras Turkiye Petrol Rafinerileri AS | | 106,029 | | 2,853 |

| | | | | |

United Kingdom (8.7%) | | | | |

| Royal Dutch Shell plc ADR | | 5,473,567 | | 337,883 |

| BP plc ADR | | 6,896,320 | | 283,577 |

| BP plc | | 3,119,841 | | 21,312 |

| Royal Dutch Shell plc Class B | | 472,247 | | 14,663 |

| Royal Dutch Shell plc Class A | | 381,491 | | 11,798 |

| Royal Dutch Shell plc Class A (XLON) | | 307,003 | | 9,517 |

| Petrofac Ltd. | | 308,868 | | 2,226 |

| | | | | 680,976 |

Total International | | | | 2,811,023 |

Total Common Stocks (Cost $5,188,938) | | | | 7,587,165 |

Temporary Cash Investments (3.3%)1 | | | | |

Money Market Fund (0.6%) | | | | |

3,4 | Vanguard Market Liquidity Fund, 2.572% | | 463,653 | | 46,365 |

| | | | | |

| | | Face | | |

| | | Amount | | |

| | | ($000) | | |

Repurchase Agreements (2.6%) | | | | |

| RBS Securities, Inc. 2.550%, 2/1/19 (Dated 1/31/19, Repurchase Value $90,706,000, collateralized by U.S. Treasury Note/Bond 1.500%–2.750%, 8/15/26–8/15/47, with a value of $92,514,000) | | 90,700 | | 90,700 |

| Societe Generale 2.530%, 2/1/19 (Dated 1/31/19, Repurchase Value $119,508,000, collateralized by U.S. Treasury Note/Bond 0.000%–4.375%, 10/10/19–5/15/48, with a value of $121,890,000) | | 119,500 | | 119,500 |

| | | | | 210,200 |

U.S. Government and Agency Obligations (0.1%) | | | | |

5 | United States Treasury Bill, 2.292%–2.314%, 2/28/19 | | 700 | | 699 |

| United States Treasury Bill, 2.439%, 4/11/19 | | 2,000 | | 1,991 |

5 | United States Treasury Bill, 2.479%, 5/9/19 | | 3,500 | | 3,478 |

| | | | | 6,168 |

Total Temporary Cash Investments (Cost $262,726) | | | | 262,733 |

Total Investments (99.7%) (Cost $5,451,664) | | | | 7,849,898 |

14

Energy Fund

| | | | | Amount |

| | | | | ($000) |

Other Assets and Liabilities (0.3%) | | | | |

Other Assets | | | | |

Investment in Vanguard | | | | 394 |

Receivables for Investment Securities Sold | | | | 70,972 |

Receivables for Accrued Income | | | | 3,897 |

Receivables for Capital Shares Issued | | | | 3,351 |

Variation Margin Receivable—Futures Contracts | | | | 233 |

Other Assets | | | | 17 |

Total Other Assets | | | | 78,864 |

Liabilities | | | | |

Payables for Investment Securities Purchased | | | | (12,052) |

Payables to Investment Advisor | | | | (1,644) |

Collateral for Securities on Loan | | | | (20,893) |

Payables for Capital Shares Redeemed | | | | (4,713) |

Payables to Vanguard | | | | (14,936) |

Other Liabilities | | | | (3,445) |

Total Liabilities | | | | (57,683) |

Net Assets (100%) | | | | 7,871,079 |

At January 31, 2019, net assets consisted of:

| | | | | Amount |

| | | | | ($000) |

Paid-in Capital | | | | 6,250,054 |

Total Distributable Earnings (Loss) | | | | 1,621,025 |

Net Assets | | | | 7,871,079 |

| | | | | Amount |

| | | | | ($000) |

Investor Shares—Net Assets | | | | |

Applicable to 47,322,338 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | | 2,264,590 |

Net Asset Value Per Share—Investor Shares | | | | $47.85 |

| | | | |

Admiral Shares—Net Assets | | | | |

Applicable to 62,455,794 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | | 5,606,489 |

Net Asset Value Per Share—Admiral Shares | | | | $89.77 |

· See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $19,987,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 97.6% and 2.1%, respectively, of net assets.

2 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

4 Includes $20,893,000 of collateral received for securities on loan.

5 Securities with a value of $1,690,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

Derivative Financial Instruments Outstanding as of Period End |

Futures Contracts | | | | | | | | | |

| | | | | | | | | ($000) |

| | | | | | | | Value and |

| | | | Number of | | | | Unrealized |

| | | | Long (Short) | | Notional | | Appreciation |

| | Expiration | | Contracts | | Amount | | (Depreciation) |

Long Futures Contracts | | | | | | | | |

E-mini S&P 500 Index | | March 2019 | | 736 | | 99,526 | | 1,888 |

See accompanying Notes, which are an integral part of the Financial Statements.

15

Energy Fund

Statement of Operations

| | Year Ended | |

| | January 31, 2019 | |

| | ($000 | ) |

Investment Income | | | |

Income | | | |

Dividends—Unaffiliated Issuers1 | | 240,429 | |

Dividends—Affiliated Issuers | | 1,493 | |

Interest—Unaffiliated Issuers | | 4,776 | |

Interest—Affiliated Issuers | | 1,778 | |

Securities Lending—Net | | 1,765 | |

Total Income | | 250,241 | |

Expenses | | | |

Investment Advisory Fees—Note B | | | |

Basic Fee | | 13,149 | |

Performance Adjustment | | (1,054 | ) |

The Vanguard Group—Note C | | | |

Management and Administrative—Investor Shares | | 5,368 | |

Management and Administrative—Admiral Shares | | 8,471 | |

Marketing and Distribution—Investor Shares | | 398 | |

Marketing and Distribution—Admiral Shares | | 355 | |

Custodian Fees | | 949 | |

Auditing Fees | | 34 | |

Shareholders’ Reports—Investor Shares | | 78 | |

Shareholders’ Reports—Admiral Shares | | 47 | |

Trustees’ Fees and Expenses | | 14 | |

Total Expenses | | 27,809 | |

Net Investment Income | | 222,432 | |

Realized Net Gain (Loss) | | | |

Investment Securities Sold—Unaffiliated Issuers | | 102,663 | |

Investment Securities Sold—Affiliated Issuers | | (37 | ) |

Futures Contracts | | (15,132 | ) |

Foreign Currencies | | (151 | ) |

Realized Net Gain (Loss) | | 87,343 | |

Change in Unrealized Appreciation (Depreciation) | | | |

Investment Securities—Unaffiliated Issuers2 | | (1,349,579 | ) |

Investment Securities—Affiliated Issuers | | (9,185 | ) |

Futures Contracts | | (1,616 | ) |

Foreign Currencies | | (52 | ) |

Change in Unrealized Appreciation (Depreciation) | | (1,360,432 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | (1,050,657 | ) |

1 Dividends are net of foreign withholding taxes of $14,006,000.

2 The change in unrealized appreciation (depreciation) is net of deferred foreign capital gains taxes of $2,500,000.

See accompanying Notes, which are an integral part of the Financial Statements.

16

Energy Fund

Statement of Changes in Net Assets

| | Year Ended January 31, | |

| | 2019 | | 2018 | |

| | ($000 | ) | ($000 | ) |

Increase (Decrease) in Net Assets | | | | | |

Operations | | | | | |

Net Investment Income | | 222,432 | | 279,233 | |

Realized Net Gain (Loss) | | 87,343 | | 74,710 | |

Change in Unrealized Appreciation (Depreciation) | | (1,360,432 | ) | 400,546 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | (1,050,657 | ) | 754,489 | |

Distributions | | | | | |

Net Investment Income | | | | | |

Investor Shares | | (60,363 | ) | (84,836 | ) |

Admiral Shares | | (153,140 | ) | (197,679 | ) |

Realized Capital Gain | | | | | |

Investor Shares | | — | | — | |

Admiral Shares | | — | | — | |

Total Distributions | | (213,503 | ) | (282,515 | ) |

Capital Share Transactions | | | | | |

Investor Shares | | (338,483 | ) | (619,766 | ) |

Admiral Shares | | (290,002 | ) | (771,839 | ) |

Net Increase (Decrease) from Capital Share Transactions | | (628,485 | ) | (1,391,605 | ) |

Total Increase (Decrease) | | (1,892,645 | ) | (919,631 | ) |

Net Assets | | | | | |

Beginning of Period | | 9,763,724 | | 10,683,355 | |

End of Period | | 7,871,079 | | 9,763,724 | |

See accompanying Notes, which are an integral part of the Financial Statements.

17

Energy Fund

Financial Highlights

Investor Shares

For a Share Outstanding Throughout Each Period | | Year Ended January 31, | |

| 2019 | | 2018 | | 2017 | | 2016 | | 2015 | |

Net Asset Value, Beginning of Period | | $55.62 | | $52.70 | | $40.43 | | $51.53 | | $63.85 | |

Investment Operations | | | | | | | | | | | |

Net Investment Income | | 1.300 | 1 | 1.477 | 1,2 | .982 | | 1.096 | | 1.276 | |

Net Realized and Unrealized Gain (Loss) on Investments | | (7.788 | ) | 3.035 | | 12.275 | | (11.118 | ) | (9.436 | ) |

Total from Investment Operations | | (6.488 | ) | 4.512 | | 13.257 | | (10.022 | ) | (8.160 | ) |

Distributions | | | | | | | | | | | |

Dividends from Net Investment Income | | (1.282 | ) | (1.592 | ) | (.987 | ) | (1.078 | ) | (1.206 | ) |

Distributions from Realized Capital Gains | | — | | — | | — | | — | | (2.954 | ) |

Total Distributions | | (1.282 | ) | (1.592 | ) | (.987 | ) | (1.078 | ) | (4.160 | ) |

Net Asset Value, End of Period | | $47.85 | | $55.62 | | $52.70 | | $40.43 | | $51.53 | |

| | | | | | | | | | | |

Total Return3 | | -11.48% | | 8.75% | | 32.73% | | -19.53% | | -13.16% | |

| | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | |

Net Assets, End of Period (Millions) | | $2,265 | | $2,968 | | $3,452 | | $2,693 | | $3,334 | |

Ratio of Total Expenses to Average Net Assets4 | | 0.37% | | 0.38% | | 0.41% | | 0.37% | | 0.37% | |

Ratio of Net Investment Income to Average Net Assets | | 2.42% | | 2.86%2 | | 1.97% | | 2.20% | | 1.84% | |

Portfolio Turnover Rate | | 31% | | 24% | | 29% | | 23% | | 31% | |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.342 and 0.67%, respectively, from income received as a result of the General Electric Co. and Baker Hughes Inc. merger in July 2017.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

4 Includes performance-based investment advisory fee increases (decreases) of (0.01%), 0.00%, 0.03%, 0.03%, and 0.03%.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Energy Fund

Financial Highlights

Admiral Shares

For a Share Outstanding Throughout Each Period | | Year Ended January 31, | |

| 2019 | | 2018 | | 2017 | | 2016 | | 2015 | |

Net Asset Value, Beginning of Period | | $104.35 | | $98.88 | | $75.85 | | $96.69 | | $119.83 | |

Investment Operations | | | | | | | | | | | |

Net Investment Income | | 2.511 | 1 | 2.815 | 1,2 | 1.918 | | 2.113 | | 2.479 | |

Net Realized and Unrealized Gain (Loss) on Investments | | (14.600 | ) | 5.730 | | 23.035 | | (20.872 | ) | (17.726 | ) |

Total from Investment Operations | | (12.089 | ) | 8.545 | | 24.953 | | (18.759 | ) | (15.247 | ) |

Distributions | | | | | | | | | | | |

Dividends from Net Investment Income | | (2.491 | ) | (3.075 | ) | (1.923 | ) | (2.081 | ) | (2.351 | ) |

Distributions from Realized Capital Gains | | — | | — | | — | | — | | (5.542 | ) |

Total Distributions | | (2.491 | ) | (3.075 | ) | (1.923 | ) | (2.081 | ) | (7.893 | ) |

Net Asset Value, End of Period | | $89.77 | | $104.35 | | $98.88 | | $75.85 | | $96.69 | |

| | | | | | | | | | | |

Total Return3 | | -11.40% | | 8.84% | | 32.83% | | -19.48% | | -13.11% | |

| | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | |

Net Assets, End of Period (Millions) | | $5,606 | | $6,796 | | $7,231 | | $5,428 | | $6,569 | |

Ratio of Total Expenses to Average Net Assets4 | | 0.29% | | 0.30% | | 0.33% | | 0.31% | | 0.31% | |

Ratio of Net Investment Income to Average Net Assets | | 2.50% | | 2.94%2 | | 2.05% | | 2.26% | | 1.90% | |

Portfolio Turnover Rate | | 31% | | 24% | | 29% | | 23% | | 31% | |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.643 and 0.67%, respectively, from income received as a result of the General Electric Co. and Baker Hughes Inc. merger in July 2017.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

4 Includes performance-based investment advisory fee increases (decreases) of (0.01%), 0.00%, 0.03%, 0.03%, and 0.03%.

See accompanying Notes, which are an integral part of the Financial Statements.

19

Energy Fund

Notes to Financial Statements

Vanguard Energy Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers two classes of shares: Investor Shares and Admiral Shares. Each of the share classes has different eligibility and minimum purchase requirements, and is designed for different types of investors.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin

20

Energy Fund

requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended January 31, 2019, the fund’s average investments in long and short futures contracts represented 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

4. Repurchase Agreements: The fund enters into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature, and in the absence of a default, such collateral cannot be repledged, resold, or rehypothecated. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any repurchase agreements with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

5. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (January 31, 2016–2019), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

6. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

7. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market

21

Energy Fund

Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

8. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at January 31, 2019, or at any time during the period then ended.

9. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Taxes on foreign dividends and capital gains have been provided for in accordance with the fund’s understanding of the applicable countries’ tax rules and rates. Foreign capital gains tax is accrued daily based upon net unrealized gains. The fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings within these countries. Such tax reclaims received during the year, if any, are included in dividend income. No other amounts for additional tax reclaims are reflected in the financial statements due to the uncertainty as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. The investment advisory firm Wellington Management Company LLP provides investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee is subject to quarterly adjustments based on performance relative to the MSCI ACWI Energy Index for the preceding three years.

Vanguard provides investment advisory services to a portion of the fund as described below; the fund paid Vanguard advisory fees of $721,000 for the year ended January 31, 2019.

22

Energy Fund

For the year ended January 31, 2019, the aggregate investment advisory fee paid to all advisors represented an effective annual basic rate of 0.15% of the fund’s average net assets, before a decrease of $1,054,000 (0.01%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At January 31, 2019, the fund had contributed to Vanguard capital in the amount of $394,000, representing 0.01% of the fund’s net assets and 0.16% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments as of January 31, 2019, based on the inputs used to value them:

Investments | | Level 1

($000 | ) | Level 2

($000 | ) | Level 3

($000 | ) |

Common Stocks—United States | | 4,776,142 | | — | | — | |

Common Stocks—International | | 1,927,224 | | 883,799 | | — | |

Temporary Cash Investments | | 46,365 | | 216,368 | | — | |

Futures Contracts—Assets1 | | 233 | | — | | — | |

Total | | 6,749,964 | | 1,100,167 | | — | |

1 Represents variation margin on the last day of the reporting period.

23

Energy Fund

E. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for foreign currency transactions, passive foreign investment companies, and tax expense on capital gains were reclassified between the following accounts:

| | Amount

($000 | ) |

Paid-in Capital | | — | |

Total Distributable Earnings (Loss) | | — | |

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the tax deferral of losses on wash sales, the realization of unrealized gains or losses on certain futures contracts, and unrealized gains on passive foreign investment companies. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| | Amount

($000 | ) |

Undistributed Ordinary Income | | 211 | |

Undistributed Long-Term Gains | | — | |

Capital Loss Carryforwards (Non-expiring)* | | (752,159 | ) |

Net Unrealized Gains (Losses) | | 2,387,157 | |

* The fund used capital loss carryforwards of $87,030,000 to offset taxable capital gains realized during the year ended January 31, 2019, reducing the amount of capital gains that would otherwise be available to distribute to shareholders.

As of January 31, 2019, gross unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

| | Amount

($000 | ) |

Tax Cost | | 5,462,737 | |

Gross Unrealized Appreciation | | 2,590,307 | |

Gross Unrealized Depreciation | | (203,147 | ) |

Net Unrealized Appreciation (Depreciation) | | 2,387,160 | |

F. During the year ended January 31, 2019, the fund purchased $2,644,575,000 of investment securities and sold $3,147,538,000 of investment securities, other than temporary cash investments.

24

Energy Fund

G. Capital share transactions for each class of shares were:

| | Year Ended January 31, | |

| | | | 2019 | | | | 2018 | |

| | Amount | | Shares | | Amount | | Shares | |

| | ($000 | ) | (000 | ) | ($000 | ) | (000 | ) |

Investor Shares | | | | | | | | | |

Issued | | 369,497 | | 6,945 | | 425,153 | | 8,257 | |

Issued in Lieu of Cash Distributions | | 56,497 | | 1,272 | | 79,692 | | 1,521 | |

Redeemed | | (764,477 | ) | (14,260 | ) | (1,124,611 | ) | (21,913 | ) |

Net Increase (Decrease)—Investor Shares | | (338,483 | ) | (6,043 | ) | (619,766 | ) | (12,135 | ) |

Admiral Shares | | | | | | | | | |

Issued | | 921,133 | | 9,349 | | 954,935 | | 9,930 | |

Issued in Lieu of Cash Distributions | | 139,594 | | 1,675 | | 180,333 | | 1,835 | |

Redeemed | | (1,350,729 | ) | (13,691 | ) | (1,907,107 | ) | (19,772 | ) |

Net Increase (Decrease)—Admiral Shares | | (290,002 | ) | (2,667 | ) | (771,839 | ) | (8,007 | ) |

H. Transactions during the period in investments where the issuer is another member of The Vanguard Group were as follows:

| | | | | | Current Period Transactions | | |

| Jan. 31, | | Proceeds | Realized | | | | | Jan. 31, |

| 2018 | | from | Net | Change in | | Capital Gain | | 2019 |

| Market | Purchases | Securities | Gain | Unrealized | | Distributions | | Market |

| Value | at Cost | Sold | (Loss) | App. (Dep.) | Income | Received | | Value |

| ($000) | ($000) | ($000) | ($000) | ($000) | ($000) | ($000 | ) | ($000) |

Vanguard Energy ETF | 58,996 | — | — | — | (9,207) | 1,493 | — | | 49,789 |

Vanguard Market Liquidity Fund | 192,265 | NA1 | NA1 | (37) | 22 | 1,778 | — | | 46,365 |

Total | 251,261 | | | (37) | (9,185) | 3,271 | — | | 96,154 |

1 Not applicable—purchases and sales are for temporary cash investment purposes.

I. Management has determined that no events or transactions occurred subsequent to January 31, 2019, that would require recognition or disclosure in these financial statements.

25

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Specialized Funds and Shareholders of Vanguard Energy Fund

Opinion on the Financial Statements

We have audited the accompanying statement of net assets of Vanguard Energy Fund (one of the funds constituting Vanguard Specialized Funds, referred to hereafter as the “Fund”) as of January 31, 2019, the related statement of operations for the year ended January 31, 2019, the statement of changes in net assets for each of the two years in the period ended January 31, 2019, including the related notes, and the financial highlights for each of the five years in the period ended January 31, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of January 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended January 31, 2019 and the financial highlights for each of the five years in the period ended January 31, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of January 31, 2019 by correspondence with the custodians and brokers and by agreement to the underlying ownership records of the transfer agent; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

March 14, 2019

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

26

Special 2018 tax information (unaudited) for Vanguard Energy Fund

This information for the fiscal year ended January 31, 2019, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $213,503,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 60.1% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

27

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 212 Vanguard funds.

Information for each trustee and executive officer of the fund appears below. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

Interested Trustee1

Mortimer J. Buckley

Born in 1969. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: chairman of the board (January 2019–present) of Vanguard and of each of the investment companies served by Vanguard; chief executive officer (January 2018–present) of Vanguard; chief executive officer, president, and trustee (January 2018–present) of each of the investment companies served by Vanguard; president and director (2017–present) of Vanguard; and president (February 2018–present) of Vanguard Marketing Corporation. Chief investment officer (2013–2017), managing director (2002–2017), head of the Retail Investor Group (2006–2012), and chief information officer (2001–2006) of Vanguard. Chairman of the board (2011–2017) and trustee (2009–2007) of the Children’s Hospital of Philadelphia; trustee (2018–present) of The Shipley School.

Independent Trustees

Emerson U. Fullwood

Born in 1948. Trustee since January 2008. Principal occupation(s) during the past five years and other experience: executive chief staff and marketing officer for North America and corporate vice president (retired 2008) of Xerox Corporation (document management products and services). Former president of the Worldwide Channels Group, Latin America, and Worldwide Customer Service and executive chief staff officer of Developing Markets of Xerox. Executive in residence and 2009–2010 Distinguished Minett Professor at the Rochester Institute of Technology. Director of SPX FLOW, Inc. (multi-industry manufacturing). Director of the University of Rochester Medical Center, the Monroe Community College Foundation, the United Way of Rochester, North Carolina A&T University, and Roberts Wesleyan College. Trustee of the University of Rochester.

Amy Gutmann

Born in 1949. Trustee since June 2006. Principal occupation(s) during the past five years and other experience: president (2004–present) of the University of Pennsylvania. Christopher H. Browne Distinguished Professor of Political Science, School of Arts and Sciences, and professor of communication, Annenberg School for Communication, with secondary faculty appointments in the Department of Philosophy, School of Arts and Sciences, and at the Graduate School of Education, University of Pennsylvania. Trustee of the National Constitution Center.

F. Joseph Loughrey

Born in 1949. Trustee since October 2009. Principal occupation(s) during the past five years and other experience: president and chief operating officer (retired 2009) and vice chairman of the board (2008–2009) of Cummins Inc. (industrial machinery). Chairman of the board of Hillenbrand, Inc. (specialized consumer services), and the Lumina Foundation.

1 Mr. Buckley is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

Director of the V Foundation and Oxfam America. Member of the advisory council for the College of Arts and Letters and chair of the advisory board to the Kellogg Institute for International Studies, both at the University of Notre Dame.

Mark Loughridge

Born in 1953. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: senior vice president and chief financial officer (retired 2013) of IBM (information technology services). Fiduciary member of IBM’s Retirement Plan Committee (2004–2013), senior vice president and general manager (2002–2004) of IBM Global Financing, vice president and controller (1998–2002) of IBM, and a variety of other prior management roles at IBM. Member of the Council on Chicago Booth.

Scott C. Malpass

Born in 1962. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: chief investment officer (1989–present) and vice president (1996–present) of the University of Notre Dame. Assistant professor of finance at the Mendoza College of Business, University of Notre Dame, and member of the Notre Dame 403(b) Investment Committee. Chairman of the board of TIFF Advisory Services, Inc. Member of the board of Catholic Investment Services, Inc. (investment advisors), the board of advisors for Spruceview Capital Partners, and the board of superintendence of the Institute for the Works of Religion.

Deanna Mulligan

Born in 1963. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: president (2010–present) and chief executive officer (2011–present) of The Guardian Life Insurance Company of America. Chief operating officer (2010–2011) and executive vice president (2008–2010) of Individual Life and Disability of The Guardian Life Insurance Company of America. Member of the board of The Guardian Life Insurance Company of America, the American Council of Life Insurers, the Partnership for New York City (business leadership), and the Committee Encouraging Corporate Philanthropy. Trustee of the Economic Club of New York and the Bruce Museum (arts and science). Member of the Advisory Council for the Stanford Graduate School of Business.

André F. Perold

Born in 1952. Trustee since December 2004. Principal occupation(s) during the past five years and other experience: George Gund Professor of Finance and Banking, Emeritus at the Harvard Business School (retired 2011). Chief investment officer and co-managing partner of HighVista Strategies LLC (private investment firm). Board of advisors and investment committee member of the Museum of Fine Arts Boston. Board member (2018–present) of RIT Capital Partners (investment firm); investment committee member of Partners Health Care System.

Sarah Bloom Raskin