Exhibit 99.1

TABLE OF CONTENTS

| | | | |

Consolidated Financial Highlights | | | 4 | |

| |

Message to the Shareholders | | | 5 | |

| |

Executive Management and Board of Directors | | | 8 | |

| |

Officers | | | 9 | |

| |

Shareholder Information | | | 12 | |

2014 ANNUAL REPORT HIGHLIGHTS 3

CONSOLIDATED FINANCIAL HIGHLIGHTS(dollars in thousands, except per share data)

HIGHLIGHTS

| | | | | | | | | | | | |

| | | 2014 | | | 2013 | | | % Change | |

| | | |

FOR THE YEAR | | | | | | | | | | | | |

Interest and Dividend Income | | $ | 86,882 | | | $ | 71,416 | | | | 21.7 | % |

Interest Expense | | | 12,287 | | | | 12,212 | | | | 0.6 | % |

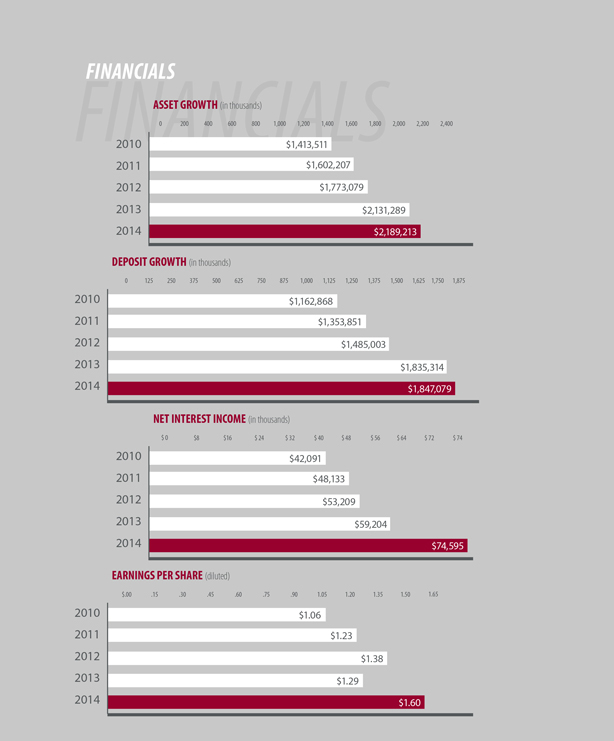

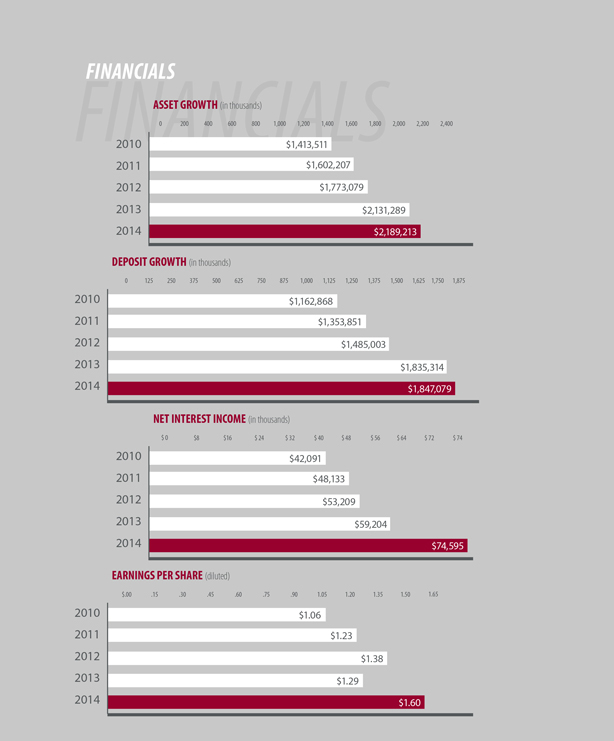

Net Interest Income | | | 74,595 | | | | 59,204 | | | | 26.0 | % |

Non-interest Income | | | 14,321 | | | | 13,766 | | | | 4.0 | % |

Non-interest Expense | | | 52,688 | | | | 43,813 | | | | 20.3 | % |

Net Income | | | 23,074 | | | | 16,679 | | | | 38.3 | % |

| | | |

Net Income Return on: | | | | | | | | | | | | |

Average Assets | | | 1.07 | % | | | 0.88 | % | | | 21.6 | % |

Average Equity | | | 12.76 | % | | | 11.38 | % | | | 12.1 | % |

| | | |

AT YEAR END | | | | | | | | | | | | |

| | | |

Assets | | $ | 2,189,213 | | | $ | 2,131,289 | | | | 2.7 | % |

Loans, net of unearned | | | 1,355,289 | | | | 1,295,363 | | | | 4.6 | % |

Deposits | | | 1,847,079 | | | | 1,835,314 | | | | 0.6 | % |

Shareholders’ Equity | | | 188,548 | | | | 164,911 | | | | 14.3 | % |

| | | |

PER SHARE DATA | | | | | | | | | | | | |

| | | |

Net Income, diluted | | $ | 1.60 | | | $ | 1.29 | | | | 24.0 | % |

Dividends | | | 0.66 | | | | 0.66 | | | | 0.0 | % |

Book Value | | | 13.09 | | | | 11.43 | | | | 14.5 | % |

Market Value | | | 18.50 | | | | 19.00 | | | | (2.6 | %) |

4 CNB FINANCIAL CORPORATION

MESSAGE TO THE SHAREHOLDERS

To Our Shareholders, Customers, Employees & Friends:

CNB Financial Corporation has once again achieved double-digit growth in earnings. Net income for 2014 rose 38% over 2013 to $23.1 million. Prior to 2013, which included acquisition costs of $2.4 million, the Corporation had four consecutive years of double-digit increases. The overall philosophy that community bank earnings are based on solid core deposits has been the primary driver of this achievement. During the last five years, deposits have increased $890 million, or 93%.

Along with solid earnings, asset quality also improved during the year. The ratio of non-performing assets to total assets was 0.47% at December 31, 2014, a level that has not been achieved since September 2008. In addition, the ratio of classified assets to capital declined substantially during 2014 while achieving a nominal ratio of net chargeoffs to average loans of 0.21%. All of CNB’s asset quality metrics are very favorable to allow the Corporation to grow into the future.

Loan growth for 2014 was 4.6% and was achieved with a key focus placed on reducing the level of classified assets. The Corporation’s markets are recovering well, and even expanding, after the lengthy recent recession. Liquidity is strong with a loan to deposit ratio of 73%, and investment portfolio provides consistent cash flows to fund future loan growth.

In 2014, deposit customers became more confident in the local and US economies. There has been a spending expansion by our business customers as orders have increased and equipment replacement and building expansions have begun. Customers have also started investing money back into the markets through stocks, bonds and mutual funds. As deposits across our market area grew over the last five years, there was an underlying assumption that confidence would be restored and spending would once again occur, thereby reducing the deposit base of financial institutions. CNB has fared well as many of the deposit customers gained are true relationships with core operating accounts.

2014 ANNUAL REPORT HIGHLIGHTS 5

6 CNB FINANCIAL CORPORATION

Message to the Shareholders continued…

One key focus for 2014, as mentioned earlier, was to improve asset quality. That was not the only initiative. Perhaps the most significant focus was to integrate the FCBank acquisition. Much has occurred in Ohio for the Corporation during the first 15 months following the acquisition with very positive results. The FCBank team is almost entirely in place and has done an excellent job retaining many of the existing customers while creating many new relationships. A new office in Dublin, Ohio opened in July housing our commercial lending and private banking groups. In addition, CNB Bank and ERIEBANK each opened new loan production offices during the year in Hollidaysburg, PA and Ashtabula, OH, respectively. Both have been very well received in each market. ERIEBANK also constructed and opened, in January 2015, its eighth office, located in the northwest area of the city of Erie, PA.

CNB’s Board, management, and team look forward to 2015 with a clean balance sheet, an improving economy, and a capacity for expanding customer relationships. Your confidence and ownership has been a real strength for this Corporation.

|

|

| Joseph B. Bower, Jr. |

| President and Chief Executive Officer |

2014 ANNUAL REPORT HIGHLIGHTS 7

EXECUTIVE MANAGEMENT & BOARD OF DIRECTORS

| | | | |

| Corporate Officers, CNB Financial Corporation | | |

| | |

| Joseph B. Bower, Jr. | | Brian W. Wingard | | |

| President & Chief Executive Officer | | Treasurer & Principal Financial Officer | | |

| | |

| Richard L. Greslick, Jr. | | Vincent C. Turiano | | |

| Secretary | | Assistant Secretary | | |

| | |

| Executive Officers, CNB Bank | | | | |

| | |

Joseph B. Bower, Jr. President & Chief Executive Officer Mark D. Breakey Senior Executive Vice President & Chief Credit Officer Richard L. Greslick, Jr. Senior Executive Vice President, Chief Operating Officer | | Mary Ann Conaway Executive Vice President, Human Resources Joseph E. Dell, Jr. Executive Vice President & Chief Lending Officer | | Leanne D. Kassab

Executive Vice President, Customer Experience Vincent C. Turiano Executive Vice President, Wealth Officer Brian W. Wingard Executive Vice President &

Chief Financial Officer |

| |

| |

| |

| |

| |

| |

| |

| | |

| Board of Directors | | | | |

| | |

CNB Financial Corporation and CNB Bank Dennis L. Merrey Chairman of the Board Retired, Formerly President, Clearfield Powdered Metals, Inc. (Manufacturer) Joseph B. Bower, Jr. President and Chief Executive Officer, CNB Financial Corporation; President & Chief Executive Officer, CNB Bank William F. Falger Retired, Formerly President & Chief Executive Officer, CNB Financial Corporation, CNB Bank Richard L. Greslick, Jr. Senior Executive Vice President & Chief Operating Officer, CNB Bank; Secretary, CNB Financial Corporation R. Duane Hord President of Hord Livestock Company, Inc. (Agriculture) | | Robert W. Montler President & Chief Executive Officer, Lee Industries and Keystone Process Equipment (Manufacturer) Joel E. Peterson President, Clearfield Wholesale Paper (Wholesaler) Deborah Dick Pontzer Economic Development & Workforce Specialist, Office of Congressman Glenn Thompson Jeffrey S. Powell President, J.J. Powell, Inc. (Petroleum Distributor) James B. Ryan Retired, Formerly Vice President of Sales, Marketing, Windfall Products, Inc. (Manufacturer) Nick Scott, Jr. Vice President & Owner, Scott Enterprises (Hospitality Industry) | | Richard B. Seager

President and Chief Executive Officer, Beacon Light Behavioral Health Systems

(Health Services) Peter F. Smith Attorney at Law Director Emeritus L. E. Soult, Jr. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

8 CNB FINANCIAL CORPORATION

OFFICERS

Administrative Services

Timothy A. Bracken

Vice President, Controller

Edward H. Proud

Vice President, Information Systems

Susan M. Warrick

Vice President, Operations

Donna J. Collins

Vice President, Regulation & Examination

Thomas J. Ammerman, Jr.

Assistant Vice President, Security

Shannon L. Irwin

Assistant Vice President, Human Resources

Paul A. McDermott

Assistant Vice President, Facilities

Carolyn B. Smeal

Assistant Vice President, Operations

Becky Coleman

Operations Officer

Carol J. Cossick

Assistant Controller

Thomas W. Grice

Network Administration Officer

Amy B. Potter

Marketing Officer

Dennis J. Sloppy

Information Systems Officer

B.J. Sterndale

Training Officer

Brenda L. Terry

Banking Officer

Branch Division

Mary A. Baker

Assistant Vice President, Northern Cambria Office

Vickie L. Baker

Assistant Vice President,

Regional Branch Administration, Bradford Main Office

Susan J. Shimmel

Assistant Vice President, Clearfield Old Town Road Office

Deborah Peak

Banking Officer, Indiana

Larry A. Putt

Banking Officer, Clearfield

Nadine J. Rodgers

Banking Officer, Indiana

Mary Ann Roney

Banking Officer, Bradford

Gregory R. Williams

Banking Officer, Clearfield

Tyler A. Kirkwood

Regional Branch Administration, Clearfield Industrial Park Road Office

Lori Curtis

Community Office Manager, Philipsburg Plaza Office

Denise J. Greene

Community Office Manager, DuBois Office

Lynette Hebel

Community Office Manager, Karthaus and Kylertown Offices

Caroline Henry

Community Office Manager, Philipsburg Presqueisle Street Office

Alesia McElwee

Community Office Manager, Clearfield Main Office

Douglas M. Shaffer

Community Office Manager, Punxsutawney Office

Lori D. Shimel

Community Office Manager, Houtzdale and Madera Offices

Pam Synder

Community Office Manager, Kane Office

Lending Division

Jeffrey W. Alabran

Senior Vice President, Commercial Banking, Indiana

Gregory M. Dixon

Vice President, Commercial Banking, Clearfield

Michael E. Haines

Vice President, Commercial Banking, St. Marys

Robin L. Hay

Vice President, Commercial Banking, Clearfield

Karen R. Pfingstler

Vice President, Commercial Banking, DuBois

Timothy C. Nagle

Vice President,

Market Executive, Blair County

Matthew Q. Raptosh

Vice President,

Commercial Lending, Philipsburg

Michael C. Sutika

Vice President,

Commercial Banking, Clearfield

Joseph H. Yaros

Vice President,

Commercial Banking, Bradford

David W. Ogden

Vice President, Credit Administration

Eileen F. Ryan

Vice President, Mortgage Lending

Ruth Anne Ryan-Catalano

Vice President, Retail Banking

C. Brett Stewart

Vice President,

Commercial Banking, Indiana

Christopher L. Stott

Vice President, Retail Lending

James C. Davidson

Assistant Vice President, Private Banking

Michael Mignogna

Assistant Vice President, Business Development Officer, Blair County

Autumn F. Farley

Commercial Loan Portfolio Manager & Support Lending Officer

Cory Johnston

Assistant Vice President, Credit Administration

Katie A. Penoyer

Commercial Banking Officer

Wealth & Asset Management Services

Craig C. Ball

Vice President, Wealth & Asset Management

Eric A. Johnson

Vice President, Wealth & Asset Management

Glenn R. Pentz

Vice President, Wealth & Asset Management

Andrew Roman

Vice President, Wealth & Asset Management

Calvin R. Thomas, Jr.

Vice President, Wealth & Asset Management

Shawn Amblod

Assistant Vice President, Wealth & Asset Management

R. Michael Love

Assistant Vice President, Wealth & Asset Management

Andrew D. Franson

Wealth & Asset Operations Officer

2014 ANNUAL REPORT HIGHLIGHTS 9

OFFICERS & AFFILIATES

ERIEBANK, a Division of CNB Bank

David J. Zimmer

President

Steven M. Cappellino

Senior Vice President,

Commercial Banking, Meadville Office

Donald W. Damon

Senior Vice President, Private Banking

William L. DeLuca, Jr.

Senior Vice President,

Commercial Banking

David Bogardus

Vice President,

Commercial Banking, Ashtabula

Betsy Bort

Vice President, Commercial Banking

Scott O. Calhoun

Vice President, Commercial Banking

Joshua P. Miller

Vice President, ERIEBANK Investment Advisors

Larry Morton

Vice President, ERIEBANK Investment Advisors

John M. Schulze

Vice President, Commercial Banking

William J. Vitron, Jr.

Vice President, ERIEBANK Investment Advisors

Chrystal M. Fairbanks

Assistant Vice President,

Commercial Banking, Ashtabula

Katie J. Jones

Assistant Vice President, Regional Retail Administrator, Harborcreek Office

Carla M. LaGuardia

Assistant Vice President, Commercial Banking, West 12th Street Office

James Miale

Assistant Vice President, Commercial Banking, Meadville Office

Gregory Noon

Assistant Vice President, Commercial Banking, Warren Office

Paul D. Sallie

Assistant Vice President, Private Banking

Jaclyn R. Italiani

Community Office Manager,

Downtown Office

Debra Masone

Community Office Manager,

Vernon Office

Erin Mehler

Community Office Manager, Interchange Office

Helicia E. Sonney

Community Office Manager, Asbury Office

Theresa L. Swanson

Community Office Manager, Warren Office

Mary J. Taormina

Community Office Manager, Meadville Office

Abby L. Williams

Community Office Manager, West 12th Street Office

Kelly S. Buck

Private Banking Officer

Russell Daniels

Commercial Lending Officer

Allison Hodas

Cash Management Officer

Julie L. Martin

Operations Officer

Timothy Roberts

Commercial Lending Officer

ERIEBANK Regional Board of Directors

Joseph B. Bower, Jr.

President and Chief Executive Officer, CNB Financial Corporation, CNB Bank

Mark D. Breakey

Senior Executive Vice President & Chief Credit Officer, CNB Bank

Gary L. Clark

Managing Partner,

Stonebank Management, LLC (Consulting)

Jane M. Earll

Esquire, (Senator, Retired)

David K. Galey

Vice President of Administration, Greenleaf Corporation (Manufacturer)

James E. Gehrlein

Chairman, Enterprise Loan Fund of Develop Erie (Community Development)

Richard L. Greslick, Jr.

Senior Executive Vice President & Chief Operating Officer, CNB Bank; Secretary, CNB Financial Corporation

Charles Hagerty

Vice President, Northern Tier Markets, UPMC Health Plan (Health Services)

Thomas Kennedy

President, Professional Development Associates, Inc. (Real Estate Developer)

Charles H. Reams

President, C. H. Reams & Associates, Inc. (Insurance)

Nick Scott, Jr.

Vice President & Owner, Scott Enterprises (Hospitality Industry)

James E. Spoden

Esquire, MacDonald Illig Jones &

Britton, LLP (Law Office)

David J. Zimmer

President, ERIEBANK

10 CNB FINANCIAL CORPORATION

FCBank, a Division of CNB Bank

J. Andrew Dale

President

Kimberly S. Emerson

Vice President, Private Banking

Terrance E. Hamm

Vice President, Commercial Banking

Robert N. Hatch

Vice President, Commercial Banking

Stephen R. Lust

Vice President, Regional Retail Sales Manager

Jeffrey C. Perkins

Vice President, Private Banking

Dean J. Vande Water

Vice President, Commercial Relationship Manager

Brian C. Bach

Assistant Vice President, Agriculture Lending

Donna M. Conley

Assistant Vice President, Lending

William R. Diehl

Assistant Vice President, Dublin Office

Elizabeth M. Ricketts

Assistant Vice President,

Regional Branch Administration

Annette D. Lester

Community Office Manager, Cardington Office

Clara J. McClung

Community Office Manager, Worthington Office

Brian A. McFarland

Community Office Manager,

Upper Arlington Office

Elaine M. Wilson

Community Office Manager, Fredericktown Office

Teri A. Slate

Community Office Manager, Shiloh Office

Jared Butler

Network Adminstrator, Facilities Officer

Michelle P. Muchow

Banking Officer, Dublin Office

J. Ralph Parker

Senior Credit Officer

Toni M. Ridge

Banking Officer, Bucyrus North Office

Travis M. Smith

Operations Officer

Ashley Snyder

Agricultural Lending Officer

FCBank, Regional Board of Directors

Joseph B. Bower, Jr.

President and Chief Executive Officer, CNB Financial Corporation, CNB Bank

Mark D. Breakey

Senior Executive Vice President & Chief Credt Officer, CNB Bank

Patrick J. Drouhard

Retired, Superintentdent, Cardington-Lincoln School District (Education)

Richard L. Greslick, Jr.

Executive Vice President and Chief Operating Officer, CNB Bank; Secretary, CNB Financial Corporation

R. Duane Hord

President, Hord Livestock, Inc. (Agriculture)

Patrick Hord

CEO, Hord Livestock, Inc. (Agriculture)

Lawrence A. Morrison

CPA and Partner, Kleshinski, Morrison & Morris, LLP (Accounting)

David Royer

Vice President of Finance & Development, Continental Real Estate Companies (Real Estate Developer)

J. Randall Schoedinger

CEO, Schoedinger Funeral and Cremation Services

J. Andrew Dale

President, Chairman

Holiday Financial Services Corporation, a Subsidiary of CNB Financial Corporation

BOARD OF DIRECTORS

Joseph B. Bower, Jr.

Chairman

Richard L. Greslick, Jr.

Secretary

Christopher L. Stott

Director

Brian W. Wingard

Director

CORPORATE OFFICERS

Christopher L. Stott

Chairman

Joseph P. Strouse

President

CNB Securities Corporation, a Subsidiary of CNB Financial Corporation, Wilmington, DE

BOARD OF DIRECTORS

Timothy A. Bracken

Director

Glenn R. Pentz

Director

Donald R. McLamb, Jr.

Wilmington Trust SP Services, Inc.

CORPORATE OFFICERS

Brian W. Wingard

President

Donald R. McLamb, Jr.

Treasurer, Wilmington Trust SP Services, Inc.

Elizabeth F. Bothner

Secretary, Wilmington Trust SP Services, Inc.

|

2014 ANNUAL REPORT HIGHLIGHTS 11 |

SHAREHOLDER INFORMATION

Annual Meeting

The Annual Meeting of the Shareholders of CNB Financial Corporation will be held Tuesday, April 21, 2015 at 2:00 p.m. at the Clearfield, PA campus of Lock Haven University located at 201 University Drive, Clearfield, PA 16830.

Corporate Address

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

(814) 765-9621

Stock Transfer Agent & Registrar

Computershare

P.O. Box 30170

College Station, TX 77842

(800) 368-5948

Form 10-K

Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to:

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

ATTN: Shareholder Relations

Quarterly Share Data

For information regarding the Corporation’s quarterly share data, please refer to Item 5 in the 2014 Form 10-K.

Market Makers

The following firm has chosen to make a market in the stock of the Corporation. Inquiries concerning their services should be directed to:

Boenning & Scattergood, Inc.

1700 Market Street, Ste 1420

Philadelphia, PA 19103

(800) 842-8928

12 CNB FINANCIAL CORPORATION

Corporate Profile

CNB Financial Corporation is a leader in providing integrated financial solutions which create value for both consumers and businesses. These solutions encompass checking, savings, time and deposit accounts, Private Banking, loans and lines of credit (real estate, commercial, industrial, residential and consumer), credit cards, cash management, online banking, electronic check deposit, merchant credit card processing, on-site banker and accounts receivable handling. In addition, the Corporation provides wealth and asset management services, retirement plans and other employee benefit plans.

CNB Bank

A subsidiary of CNB Financial Corporation, CNB is a regional independent community bank in North Central Pennsylvania with approximately 400 employees who make customer service more responsive and reliable. For over 150 years, the Bank has strived to be more customer-driven than its competitors and to build long-term customer relationships by being reliable and competitively priced.

CNB continually seeks innovative ways to execute a personal, quality-driven customer service strategy and prides itself being first-to-market for many of these innovations. To satisfy customers’ financial needs and expectations, it offers a variety of delivery channels, which includes 21 full-service offices, one loan production office, 19 ATMs, telephone banking (1-866-224-7314), Internet banking (www.BankCNB.com), mobile banking, and a centralized customer service center (1-800-492-3221).

ERIEBANK

Headquartered in Erie, Pennsylvania, ERIEBANK is a division of CNB Bank. Presently, there are a total of eight full service offices in Pennsylvania, which house its commercial, retail and Private Banking divisions. Five of those offices are in Erie, two in Meadville, and one in Warren, Pennsylvania. ERIEBANK also has one loan production office in Ashtabula, Ohio. In addition, ERIEBANK Investment Advisors provides wealth and asset management services, retirement plans and other employee benefit plans.

FCBANK

FCBank, a division of CNB Bank, is headquartered in Bucyrus, Ohio with nine full service offices in the communities of Bucyrus, Shiloh, Mt. Hope, Cardington, Fredericktown, Worthington, Dublin, and Upper Arlington. FCBank is driven by a strong focus on meeting the financial heeds of businesses and individuals in a way only a community bank can deliver. FCBank offers commercial, retail, and Private Banking services.

Holiday Financial Services

Holiday Financial Services, a subsidiary of CNB Financial Corporation, is a consumer loan company, currently has thirteen conveniently located offices in State College, Bradford, Clearfield, Hollidaysburg, Erie, Northern Cambria, Ridgway, Johnstown, Ebensburg, DuBois, Indiana, Clarion, and Huntingdon, Pennsylvania.

2014 ANNUAL REPORT HIGHLIGHTS 13

The common stock of the Corporation trades on the NASDAQ Global Select Market under the symbol CCNE.

14 CNB FINANCIAL CORPORATION