As filed with the Securities and Exchange Commission on January 11, 2019

1933 Act Registration No. [_____]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. ☐ Post-Effective Amendment No. ☐

(Check appropriate box or boxes)

Neuberger Berman Advisers Management Trust

(Exact name of Registrant as specified in charter)

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 476-8800

Joseph V. Amato

Chief Executive Officer and President

Neuberger Berman Advisers Management Trust

c/o Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

(Name and Address of Agent for Service)

With copies to:

Arthur C. Delibert, Esq.

K&L Gates LLP

1601 K Street, N.W.

Washington, D.C. 20006-1601

(Names and Addresses of Agents for Service of Process)

Approximate Date of Proposed Public Offering: As soon as practicable after this registration statement goes effective under the Securities Act of 1933, as amended.

Title of Securities being registered: Class I Shares and Class S Shares of Sustainable Equity Portfolio.

No filing fee is due because of Registrant’s reliance on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing will go effective on February 11, 2019 pursuant to Rule 488.

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST

FORM N-14

CONTENTS OF REGISTRATION STATEMENT ON FORM N-14

This Registration Statement consists of the following papers and documents:

Cover Sheet

Contents of Registration Statement on Form N-14

Letter to Shareholders

Part A – Information Statement and Prospectus

Part B – Statement of Additional Information

Part C – Other Information

Signature Page

Exhibits

NEUBERGER BERMAN ADVISERS MANAGEMENT TRUST

Guardian Portfolio

Large Cap Value Portfolio

1290 Avenue of the Americas

New York, New York 10104-0002

February 11, 2019

Dear Valued Contractholder:

On December 13, 2018, the Board of Trustees (the “Board”) of the Neuberger Berman Advisers Management Trust (the “Trust”) approved two separate reorganizations of Guardian Portfolio and Large Cap Value Portfolio (each, a “Merging Portfolio”) into Sustainable Equity Portfolio (the “Surviving Portfolio,” and together with the Merging Portfolios, the “Portfolios” or “Funds”) (each a “Reorganization”). Each Reorganization is independent of the other, and the Reorganization of either Merging Portfolio may proceed even if the Reorganization of the other Merging Portfolio is postponed or cancelled. All Portfolios are series of the Trust:

Merging Portfolio will be reorganized into the corresponding Class of Surviving Portfolio as follows: |

| Guardian Portfolio – Class I | à | Sustainable Equity Portfolio – Class I |

| Guardian Portfolio – Class S | à | Sustainable Equity Portfolio – Class S |

| Large Cap Value Portfolio – Class I | à | Sustainable Equity Portfolio – Class I |

Each Reorganization will take effect on or about April 30, 2019. No shareholder vote is required for either of the Reorganizations. We are not asking you for a proxy, and you are requested not to send us a proxy. Shares of each Portfolio are held directly by insurance companies or qualified plans that offer the Portfolio to contractholders as an investment vehicle. You are receiving this letter because, as of February [ ], 2019, you were the indirect holder of one of the Merging Portfolios through your ownership of a variable annuity contract or qualified plan. At the time of each Reorganization, contractholders who are shareholders of a Merging Portfolio (indirectly through a separate account) automatically will become shareholders (again, indirectly through that separate account) of the corresponding Class of the Surviving Portfolio, receiving shares of the corresponding Class of the Surviving Portfolio having an aggregate net asset value equal to the contractholder’s shares in the Merging Portfolio.

Each Portfolio is managed by Neuberger Berman Investment Advisers LLC (“NBIA” or the “Manager”) and all have similar investment objectives and principal risks and identical fundamental investment limitations. (Fundamental investment limitations are those that cannot be changed without a vote of the shareholders.) However, there are differences in the principal risks, investment policies and strategies of the Portfolios and these differences are outlined herein. Accordingly, each Reorganization will result in no material changes to the Merging Portfolio’s investment objective or fundamental investment limitations, though certain of its principal risks, investment policies and strategies will change. Although each Portfolio has similar investment objectives, the Surviving

Portfolio invests at least 80% of its net assets in equity securities selected in accordance with the Portfolio’s environmental, social and governance (“ESG”) criteria and is subject to risks associated with investing according to the ESG criteria. The attached Combined Prospectus and Information Statement contains further information regarding each Reorganization and the Surviving Portfolio. Please read it carefully.

The Board believes that each Reorganization will benefit the Merging Portfolio and its contractholders as a result of the Surviving Portfolio’s larger asset base and the elimination of the smaller investment options that are less viable than the investment options available to the Surviving Portfolio. The Surviving Portfolio currently has a lower contractual expense cap for Class I and Class S shares than the corresponding Class of each Merging Portfolio. While the amount of the contractual expense cap is higher for Class I shares of each Merging Portfolio, since the contractual expense cap of Class I shares of each Merging Portfolio excludes NBIA’s compensation, which is not excluded in the Class I contractual expense cap of the Surviving Portfolio, the Class I contractual expense cap of the Surviving Portfolio will be lower than the Class I contractual expense cap of each Merging Portfolio. NBIA has contractually agreed to limit each Portfolio’s total annual operating expenses through December 31, 2021. Currently, the Surviving Portfolio operates above its contractual expense cap for Class S shares and below its contractual expense cap for Class I shares. Each Class of the Surviving Portfolio’s total annual fund operating expenses after any fee waiver and/or expense reimbursement (“Net Expenses”) are lower than the corresponding Class of each Merging Portfolio’s Net Expenses. Further, no Reorganization is expected to result directly in any adverse tax consequences or changes in account values for shareholders or contractholders. No sales load, commission or other fee will be imposed on shareholders in connection with the tax-free exchange of their shares. Detailed information regarding each Reorganization is contained in the enclosed materials. If you have any questions regarding a Reorganization, please call the Manager toll-free at 800-366-6264 or 800-877-9700.

Sincerely,

/s/ Joseph V. Amato

Joseph V. Amato

President and Chief Executive Officer

Neuberger Berman Advisers Management Trust

IMPORTANT NOTICE REGARDING CHANGE IN INVESTMENT OBJECTIVE

AND INVESTMENT POLICY OR STRATEGY

Effective as of the closing of each Reorganization, shareholders of each Merging Portfolio will become shareholders of the Surviving Portfolio with the investment objective, investment strategies and investment policies of the Surviving Portfolio. The chart below outlines any differences between each Merging Portfolio’s current investment objective and any 80% investment policy or other material investment strategy (as articulated in the Portfolio’s principal investment strategy):

Merging Portfolio | Merging Portfolio Investment Objective(s) | Merging Portfolio 80% Policy or Material Investment Strategy | Surviving Portfolio Investment Objective | Surviving Portfolio 80% Policy and Material Investment Strategy |

Guardian Portfolio | Long-term growth of capital; current income is a secondary goal | To pursue its goals, the Fund invests mainly in common stocks of companies across all market capitalizations. Compares its performance to the S&P 500® Index. | Long-term growth of capital by investing primarily in securities of companies that meet the Fund’s environmental, social and governance (ESG) criteria. | To pursue its goal, the Fund seeks to invest primarily in common stocks of mid- to large-capitalization companies that meet the Fund’s quality oriented financial and ESG criteria. The Fund normally invests at least 80% of its net assets in equity securities selected in accordance with its ESG criteria. Compares its performance to the S&P 500® Index. |

Large Cap Value Portfolio | Long-term growth of capital | To pursue its goal, the Fund normally invests at least 80% of its net assets in equity securities of large-capitalization companies, which it defines as those with a market capitalization within the market capitalization range of the Russell 1000 Value Index at the time of purchase. Compares its performance to the Russell 1000® Value Index. |

Questions and Answers

Q. What is happening? Why did I get this document?

A. The Board of Trustees (the “Board”) of Neuberger Berman Advisers Management Trust (the “Trust”), has approved two separate reorganizations of Guardian Portfolio and Large Cap Value Portfolio (each, a “Merging Portfolio”) into Sustainable Equity Portfolio (the “Surviving Portfolio”) (each a “Reorganization”). Each Reorganization is independent of the other, and the Reorganization of either Merging Portfolio may proceed even if the Reorganization of the other Merging Portfolio is postponed or cancelled. Each Merging Portfolio and the Surviving Portfolio (collectively, the “Portfolios” or “Funds”) are each a series of the Trust. Please see below for more information comparing the Portfolios’ investment objectives, strategies and policies.

You are receiving this document because, as of February [ ], 2019, you were the indirect holder of one of the Merging Portfolios through your ownership of a variable annuity contract or qualified plan. Pursuant to a Plan of Reorganization and Dissolution adopted by the Board, upon closing of a Reorganization, your shares of the participating Merging Portfolio (which you own indirectly through a separate account) will convert to shares of the corresponding Class of the Surviving Portfolio with an aggregate net asset value (“NAV”) equal to those Merging Portfolio shares as of the close of business on the day of the closing of the Reorganization, which currently is expected to take place on or about April 30, 2019 (“Effective Date”). (For convenience, shares you own indirectly through a separate account are referred to below as though you owned them directly.)

Q. What is this document?

A. This document is a Combined Prospectus and Information Statement (“Information Statement”) for each Merging Portfolio and the Surviving Portfolio. This Information Statement contains information the shareholders of each Merging Portfolio should know prior to the Reorganization. You should retain this document for future reference.

Q. What are the Reorganizations?

A. Each Reorganization discussed in this Information Statement will reorganize a Merging Portfolio into the Surviving Portfolio on or about the Effective Date. The Portfolios have similar investment objectives and risks and identical fundamental investment limitations. However, there are differences in investment policies and strategies of the Portfolios. Accordingly, the Reorganization will result in no material changes to the Merging Portfolio’s investment objective, risks, or fundamental investment limitations, though its investment policies and strategies will change. Although each Portfolio has similar investment objectives, the Surviving Portfolio invests at least 80% of its net assets in equity securities selected in accordance with the Fund’s environmental, social and governance (“ESG”) criteria and is subject to risks associated with investing according to the ESG criteria. Please see below for more information comparing the investment objectives, strategies, policies and risks of the Portfolios.

Q. Why did the Board Approve Each Reorganization?

A. NBIA recommended to the Board that each Merging Portfolio be merged with the Surviving Portfolio. After considering the terms and conditions of each Reorganization, the investment objectives, strategies and principal risks of each Portfolio, fees and expenses,

including the total annual expense ratios, of each Portfolio, and the relative performance of each Portfolio, the Board believes that reorganizing each Merging Portfolio into the Surviving Portfolio is in the best interests of each Portfolio and that the interests of each Portfolio's shareholders will not be diluted as a result of any reorganization. In reaching this conclusion, the Board determined that reorganizing each Merging Portfolio into the Surviving Portfolio, which also is managed by NBIA and has a similar investment objective and identical fundamental investment limitations as those of the Surviving Portfolio, offers potential benefits to shareholders. These potential benefits include permitting shareholders to pursue similar investment goals in a larger combined fund with a more viable long-term future that has a comparable long-term performance record to that of each Merging Portfolio and is expected to have a lower total annual expense ratio than each Merging Portfolio.

Q. How will this affect me as a shareholder?

A. Shareholders of each Merging Portfolio will become shareholders of the Surviving Portfolio on the Effective Date. No sales charges or other fees, other than those described below, will be imposed in connection with any Reorganization. In addition, the Portfolios’ procedures for purchasing, redeeming and exchanging shares are identical.

If you own Class I shares or Class S shares, as applicable, of a Merging Portfolio, you will receive Class I shares or Class S shares, respectively, of the Surviving Portfolio. Class I shares and Class S shares do not have either a front-end sales charge or a contingent deferred sales charge (“CDSC”).

Q. After the Reorganization of my Portfolio, will I own the same number of shares?

A. The aggregate value of your investment will not change as a result of the Reorganization. It is likely, however, that the number of shares you own will change because your shares will be exchanged at the NAV per share of the Surviving Portfolio, which is likely to be different from the NAV per share of your Merging Portfolio.

Q. Do the Portfolio Managers who manage each Merging Portfolio also manage the Surviving Portfolio?

A. No. Ingrid S. Dyott and Sajjad S. Ladiwala are the portfolio managers of the Surviving Portfolio. Each Merging Portfolio has different portfolio managers.

Q. Will my expenses increase pursuant to the Reorganization of my Portfolio?

A. No. Currently, each Class of the Surviving Portfolio’s total annual fund operating expenses after fee waiver and/or expense reimbursement (“Net Expenses”) are lower than the corresponding Class of each Merging Portfolio’s Net Expenses.

Q. What are the tax consequences of the Reorganizations?

A. Each Reorganization is expected to be a tax-free transaction for federal income tax purposes.

Q. Can I still purchase shares of a Merging Portfolio until its Reorganization?

A. You may continue to purchase shares of a Merging Portfolio through April 26, 2019. As a result of each Reorganization, effective April 26, 2019, the Merging Portfolios will no longer accept purchases or exchanges of shares.

Q. What if I want to exchange my shares into another Neuberger Berman Portfolio prior to the Reorganization of my Portfolio?

A. You may exchange shares in each Merging Portfolio to another Neuberger Berman Portfolio prior to the Reorganization subject to the availability of another Neuberger Berman Portfolio in your insurance product or plan and further subject to any limitations in the prospectus for your variable contract or your qualified plan documentation. Additional information about your options for transferring your investment will be provided to you by your insurance company or other applicable financial intermediary.

Q. Who is paying the costs of each Reorganization?

A. NBIA will pay the costs associated with each Reorganization, including the costs of filing, printing and distributing disclosure documents, and legal and accounting fees, but excluding any brokerage costs, which will be paid by the Portfolio that incurs them. The Surviving Portfolio will pay any fees payable to governmental authorities for the registration or qualification of the Surviving Portfolio shares distributable to each Merging Portfolio’s shareholders pursuant to the Reorganization and all related transfer agency costs. Such fees and costs are not expected to be material to the operation of the Surviving Portfolio.

If you have any questions, please call the Neuberger Berman Family of Portfolios toll-free at 800-366-6264 or 800-877-9700.

Combined Prospectus and Information Statement

February 11, 2019

Reorganization of the Assets and Liabilities of each of the

GUARDIAN PORTFOLIO

LARGE CAP VALUE PORTFOLIO

each a series of Neuberger Berman Advisers Management Trust

By and in Exchange for Shares of and Assumption of Liabilities by the

SUSTAINABLE EQUITY PORTFOLIO,

a series of Neuberger Berman Advisers Management Trust

1290 Avenue of the Americas

New York, New York 10104-0002

800-366-6264

800-877-9700

This Combined Prospectus and Information Statement (“Information Statement”) contains information you should know about a Plan of Reorganization and Dissolution (“Plan”) adopted by the Board of Trustees (“Board”) of Neuberger Berman Advisers Management Trust (“Trust”) relating to two separate reorganizations of Guardian Portfolio and Large Cap Value Portfolio (each, a “Merging Portfolio”) into Sustainable Equity Portfolio (the “Surviving Portfolio”) (each a “Reorganization”). The Merging Portfolios and the Surviving Portfolio (collectively, the “Portfolios”) are series of the Trust. The Trust is a Delaware statutory trust and is a registered, open-end management investment company. The investment objective of Guardian Portfolio is to seek long-term growth of capital; current income is a secondary goal. The investment objective of Large Cap Value Portfolio is to seek long-term growth of capital. The investment objective of the Surviving Portfolio is to seek long-term growth of capital by investing primarily in securities of companies that meet the Portfolio’s environmental, social and governance (“ESG”) criteria. You should carefully read this Information Statement, which contains important information you should know, and keep it for future reference.

Upon completion of the Reorganization of your Merging Portfolio you, as the owner of a variable annuity contract and/or a variable life insurance policy issued by an insurance company that participates in that Merging Portfolio through the investment divisions of a separate account or accounts established by that company (each, a “Separate Account”), will become a shareholder of the Surviving Portfolio through that Separate Account. (For convenience, shares you own indirectly through a Separate Account are referred to throughout this Information Statement as though you owned them directly.) You will receive shares of the Surviving Portfolio with an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shares of your Merging Portfolio that you hold as of the close of business on the day of the closing of the Reorganization, which is expected to be April 30, 2019 (“Effective Date”). The shares of the Surviving Portfolio that you receive will be of the same class as the shares of the Merging Portfolio that you currently hold. When each Reorganization is completed, the respective Merging Portfolio will be liquidated and dissolved.

This Combined Prospectus and Information Statement sets forth important information that you should know regarding each Reorganization. You should read and retain this Combined Prospectus and Information Statement for future reference. The following documents have been

filed with the Securities and Exchange Commission (“SEC”) and are incorporated by reference into this Information Statement:

| 1. | The registration statement for the Trust (File Nos. 811-04255 and 002-88566) contains a prospectus for each Merging Portfolio dated May 1, 2018. You should review the prospectus for your respective Merging Portfolio. |

| 2. | The combined Statement of Additional Information for the Portfolios dated May 1, 2018, as amended January 2, 2019. |

| 3. | The audited financial statements included in your respective Merging Portfolio’s Annual Report to shareholders for the fiscal year ended December 31, 2017, and the unaudited financial statements and financial highlights included in the corresponding Semi-Annual Reports to shareholders of such Portfolios for the six-month period ended June 30, 2018. |

Each Portfolio previously sent its Annual Report and Semi-Annual Report to its shareholders. For a free copy of these reports or any of the other documents listed above, you may call 800-366-6264 or 800-877-9700, send an email to fundinquiries@nb.com, or write to a Portfolio at:

Neuberger Berman Investment Advisers LLC

1290 Avenue of the Americas

New York, New York 10104-0002

800-366-6264

800-877-9700

You also may obtain many of these documents by accessing the Internet site for the Portfolios at www.nb.com. Text-only versions of all the Portfolios’ documents can be viewed online or downloaded from the EDGAR database on the SEC’s Internet site at www.sec.gov. The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, it must file certain reports and other information with the SEC. You can review and copy information regarding the Portfolios by visiting the SEC’s Public Reference Room, Room 1580, 100 F Street NE, Washington, D.C. 20549. You can obtain copies, upon payment of a duplicating fee, by sending an e-mail request to publicinfo@sec.gov or by writing the Public Reference Room at the address above. Information on the operations of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

The SEC has not approved or disapproved these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

Shares of each Portfolio are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal.

No person has been authorized to give any information or to make any representation other than those in this Information Statement, and, if given or made, such other information or representation must not be relied upon as having been authorized by any Portfolio or the Trust.

TABLE OF CONTENTS

| ABOUT EACH REORGANIZATION | 8 |

| | Summary | 8 |

| | Considerations Regarding each Reorganization | 9 |

| | Comparison of Investment Objectives, Strategies and Policies and Information about Adviser/Subadviser and Portfolio Managers | 11 |

| | Comparison of Fundamental Investment Limitations and Non-Fundamental Policies | 12 |

| | Comparison of Principal Risks | 16 |

| | Comparison of Fees and Expenses | 21 |

| | Example of Portfolio Expenses | 23 |

| | Comparative Performance Information | 26 |

| | Capitalization | 29 |

| | Information Regarding the Plan of Reorganization and Dissolution | 30 |

| | Reasons for the Reorganizations | 31 |

| | Description of the Securities to be Issued | 33 |

| | Federal Income Tax Considerations | 33 |

| OTHER INFORMATION | 41 |

| | Investment Adviser, Subadviser, and Portfolio Managers | 41 |

| | Legal Matters | 42 |

| | Control Persons | 42 |

| | Experts | 43 |

| | Additional Information | 43 |

| FINANCIAL HIGHLIGHTS | 43 |

| APPENDIX A PLAN OF REORGANIZATION AND DISSOLUTION | A-1 |

| APPENDIX B FINANCIAL HIGHLIGHTS | B-1 |

ABOUT EACH REORGANIZATION

Summary

The following is a summary of certain information relating to each Reorganization and is qualified in its entirety by reference to the more complete information contained elsewhere in the Information Statement. Due primarily to concerns over asset levels and limited prospects for future growth, Neuberger Berman Investment Advisers LLC (“NBIA” or the “Manager”), the investment manager of each Portfolio, recommended to the Board of Trustees of the Trust, the separate reorganization of each Merging Portfolio into the Surviving Portfolio.

After careful consideration of a number of factors, the Board of Trustees, including the Trustees who are not “interested persons” (within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”)) of the Trust (the “Board”), voted unanimously to approve the reorganization of each Merging Portfolio into the Surviving Portfolio and the Plan with respect to each Reorganization. In each Reorganization, the Surviving Portfolio would acquire all of the assets of each Merging Portfolio in exchange solely for the assumption of all the liabilities of the Merging Portfolio and the issuance of shares of the Surviving Portfolio to be distributed pro rata by the Merging Portfolio to its shareholders in complete liquidation and dissolution of the Merging Portfolio. As a result of each Reorganization, each shareholder of a Merging Portfolio would become the owner of the Surviving Portfolio’s shares having a total aggregate value equal to the total aggregate value of his or her holdings in the Merging Portfolio on the Effective Date. Each Reorganization is independent of the other, and the Reorganization of either Merging Portfolio may proceed even if the Reorganization of the other Merging Portfolio is postponed or cancelled.

The Surviving Portfolio offers both Class I and Class S shares. Guardian Portfolio offers both Class I and Class S shares and Large Cap Value Portfolio offers only Class I shares. Each Merging Portfolio shareholder would receive shares of the same class of the Surviving Portfolio having the same aggregate value as such shareholder currently owns. Each Merging Portfolio’s respective class of shares has the same purchase, distribution, exchange and redemption procedures as the corresponding class of shares of the Surviving Portfolio.

The Board has concluded that each Reorganization would be in the best interests of each Merging Portfolio and its existing shareholders and that the interests of each Merging Portfolio’s shareholders would not be diluted as a result of the transactions contemplated by each Reorganization. Among other things, each Reorganization would give each Merging Portfolio’s shareholders the opportunity to participate in a larger Portfolio, with a similar investment objective and investment risks (although with certain differing investment risks, strategies and policies as outlined herein). The Surviving Portfolio currently has a lower contractual expense cap for Class I and Class S shares than the corresponding Class of each Merging Portfolio. NBIA has agreed to maintain the Surviving Portfolio’s current contractual expense caps until December 31, 2021. Currently, the Surviving Portfolio is operating above its contractual expense cap for Class S shares and below its contractual expense cap for Class I shares and its net annual operating expenses (“Net Expenses”) are lower than each Merging Portfolio’s Net Expenses after fee waiver and/or expense reimbursement.

As a condition to each Reorganization, the Trust will receive an opinion of counsel that the Reorganization will be considered a tax-free reorganization under applicable provisions of the

Internal Revenue Code of 1986, as amended (the “Code”), so that neither the Merging Portfolio participating therein nor the Surviving Portfolio or their shareholders will recognize any gain or loss as a result of the Reorganization. See “Federal Income Tax Considerations” below for further information.

Considerations Regarding each Reorganization

Please note the following information regarding each Reorganization:

| · | The Surviving Portfolio pursues a similar investment objective as each Merging Portfolio. The investment objective of Guardian Portfolio is to seek long-term growth of capital; current income is a secondary goal. The investment objective of Large Cap Value Portfolio is to seek long-term growth of capital. The Surviving Portfolio’s investment objective is to seek long-term growth of capital by investing primarily in securities of companies that meet the Portfolio’s ESG criteria. Each Portfolio may invest in equity securities of mid- to large-capitalization companies and Guardian Portfolio may also invest in equity securities of small-capitalization companies. |

| · | The Surviving Portfolio has similar investment objectives and principal risks and identical fundamental investment limitations as each Merging Portfolio, but different investment strategies and policies. Accordingly, each Reorganization will result in no material changes to each Merging Portfolio’s investment objective or principal risks and no material changes to its fundamental investment limitations, though certain of its principal risks, investment strategies and policies will change. The Surviving Portfolio is subject to risks associated with investing according to its ESG criteria. See “Comparison of Investment Objectives, Strategies and Policies” below for further information. |

| · | Guardian Portfolio and the Surviving Portfolio each compares its performance to the S&P 500® Index. Large Cap Value Portfolio compares its performance to the Russell 1000® Value Index. Upon completion of each Reorganization, the Surviving Portfolio will continue to compare its performance to the S&P 500® Index. See “Description of Indices” below for further information. |

| · | NBIA is each Portfolio’s investment adviser. Ingrid S. Dyott and Sajjad S. Ladiwala are the portfolio managers of the Surviving Portfolio. Charles Kantor and Marc Regenbaum are the portfolio managers of Guardian Portfolio and Eli M. Salzmann is the portfolio manager for Large Cap Value Portfolio. |

| · | NBIA has reviewed the Portfolios’ current portfolio holdings and determined that each Merging Portfolio’s holdings generally are compatible with the Surviving Portfolio’s investment objective and policies. As a result, NBIA believes that all or substantially all of each Merging Portfolio’s assets could be transferred to and held by the Surviving Portfolio. See “Comparison of Investment Objectives, Strategies and Policies” below for further information. |

| · | The Class I shares and Class S shares of the Surviving Portfolio outperformed the corresponding class of shares of Guardian Portfolio for each of the one-year, five- |

| | year and ten-year periods and underperformed the corresponding class of shares of Guardian Portfolio for the three-year and since inception periods. The Class I shares of the Surviving Portfolio and Class I shares of Large Cap Value Portfolio had similar performance for the five-year and ten-year periods and the Class I shares of the Surviving Portfolio underperformed the corresponding class of shares of Large Cap Value Portfolio for the one-year, three-year, and since inception periods. The following table provides each Portfolio’s performance record for these periods. |

AVERAGE ANNUAL TOTAL RETURNS

(For the periods ended December 31, 2018)

| Portfolio Name | Class | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception |

| SURVIVING PORTFOLIO | | | | | | |

| Sustainable Equity Portfolio | I | -5.73% | 7.04% | 6.15% | 12.41% | 6.69%1 |

S&P 500® Index | | -4.38% | 9.26% | 8.49% | 13.12% | 5.67% |

| | | | | | | |

| Sustainable Equity Portfolio | S | -5.94% | 6.80% | 5.92% | 12.22% | 6.58%1 |

S&P 500® Index | | -4.38% | 9.26% | 8.49% | 13.12% | 5.67% |

| |

| MERGING PORTFOLIOS | | | | | | |

| Guardian Portfolio | I | -7.61% | 8.00% | 5.47% | 11.83% | 7.37%2 |

S&P 500® Index | | -4.38% | 9.26% | 8.49% | 13.12% | 6.87% |

| | | | | | | |

| Guardian Portfolio | S | -7.60% | 7.82% | 5.30% | 11.67% | 7.22%2 |

S&P 500® Index | | -4.38% | 9.26% | 8.49% | 13.12% | 6.87% |

| |

| Large Cap Value Portfolio | I | -1.04% | 12.63% | 6.72% | 12.98% | 8.21%3 |

Russell 1000® Value Index | | -8.27% | 6.95% | 5.95% | 11.18% | 8.96% |

1 The inception dates of Sustainable Equity Portfolio Class I and Class S shares are 2/18/99 and 5/1/06, respectively. Performance shown prior to May 1, 2006 for Sustainable Equity Portfolio Class S shares is that of Sustainable Equity Portfolio Class I shares, which has lower expenses and correspondingly higher returns than Class S shares.

2 The inception dates of Guardian Portfolio Class I and Class S shares are 11/3/97 and 8/2/02, respectively. Performance shown prior to August 2, 2002 for Guardian Portfolio Class S shares is that of Guardian Portfolio Class I shares, which has lower expenses and correspondingly higher returns than Class S shares.

3 The inception date of Large Cap Value Portfolio Class I shares is 3/22/94.

| · | The Surviving Portfolio currently has a lower contractual expense cap for Class I and Class S shares than the corresponding Class of each Merging Portfolio. While the amount of the contractual expense cap is higher for Class I shares of each Merging Portfolio, since the contractual expense cap of Class I shares of each Merging Portfolio excludes NBIA’s compensation, which is not excluded in the Class I contractual expense cap of the Surviving Portfolio, the Class I contractual expense cap of the Surviving Portfolio will be lower than the Class I contractual expense cap of each Merging Portfolio. NBIA has contractually |

| | agreed to limit each Portfolio’s total annual operating expenses through December 31, 2021. |

| · | Currently, the Surviving Portfolio operates above its contractual expense cap for Class S shares and below its contractual expense cap for Class I shares and its Net Expenses are lower than each Merging Portfolio’s Net Expenses after fee waiver and/or expense reimbursement. The interests of each Portfolio’s shareholders would not be diluted by any Reorganization, because each Reorganization would be effected on the basis of each Portfolio’s NAV. |

| · | NBIA will pay the costs associated with each Reorganization, including the costs of filing, printing and distributing disclosure documents, and legal and accounting fees, but excluding any brokerage costs, which will be paid by the Portfolio that incurs them. The Surviving Portfolio will pay any fees payable to governmental authorities for the registration or qualification of the Surviving Portfolio shares distributable to each Merging Portfolio’s shareholders pursuant to the Reorganization and all related transfer agency costs. Such fees and costs are not expected to be material to the operation of the Surviving Portfolio. |

| · | Each Reorganization is expected to be a tax-free transaction. |

| · | An alternative to each Reorganization is the liquidation of each Merging Portfolio. |

Comparison of Investment Objectives, Strategies and Policies and Information about

Adviser and Portfolio Managers

Each Merging Portfolio and the Surviving Portfolio have similar investment objectives but pursue these objectives via different strategies. Accordingly, the Reorganizations will result in no material changes to any Merging Portfolio’s investment objective or principal risks, though certain of its principal risks and investment strategies and policies will change. The Portfolios’ investment objectives, strategies and policies are described below. Each Portfolio may change its investment objectives without shareholder approval, although each portfolio does not currently intend to do so. The investment strategy described below does not reflect the complete strategies of each Portfolio, for more information please see the “Surviving Portfolio’s Principal Investment Strategy” below and the Principal Investment Strategies section of the prospectus for your Merging Portfolio.

NBIA, the investment adviser of each Merging Portfolio, has reviewed each Merging Portfolio’s current portfolio holdings and determined that those holdings generally are compatible with the Surviving Portfolio’s investment objective and policies. As a result, NBIA believes that all or substantially all of each Merging Portfolio’s assets could be transferred to and held by the Surviving Portfolio. Nevertheless, in executing the Surviving Portfolio’s investment strategy, the portfolio manager may determine to sell some or a substantial portion of the assets of a Merging Portfolio after the completion of its Reorganization.

| | MERGING PORTFOLIOS | | SURVIVING PORTFOLIO |

| | GUARDIAN | LARGE CAP VALUE | | SUSTAINABLE EQUITY |

| Investment Objective | Long-term growth of capital; current income is a secondary goal | Long-term growth of capital | Long-term growth of capital by investing primarily in securities of companies that meet the Fund’s ESG criteria. |

| Investment Strategy | Invests mainly in common stocks of companies across all market capitalizations. May invest in stocks of foreign companies and use options. Compares its performance to the S&P 500® Index. | Normally invests at least 80% of its net assets in equity securities of large-capitalization companies (defined as those with a total market cap within the market cap range of the Russell 1000 Value Index). May invest in stocks of foreign companies and use options. Compares its performance to the Russell 1000® Value Index. | Seeks to invest primarily in common stocks of mid- to large-capitalization companies that meet the Fund’s quality oriented financial and ESG criteria. Normally invests at least 80% of its net assets in equity securities (mid- to large-capitalization companies) selected in accordance with the Fund’s ESG criteria. May invest in stocks of foreign companies. Compares its performance to the S&P 500® Index. |

Investment Adviser | Neuberger Berman Investment Advisers LLC | Neuberger Berman Investment Advisers LLC | Neuberger Berman Investment Advisers LLC |

| Portfolio Managers | Charles Kantor Marc Regenbaum | Eli M. Salzmann | Ingrid S. Dyott Sajjad S. Ladiwala |

Surviving Portfolio’s Principal Investment Strategy

To pursue its goal, the Surviving Portfolio seeks to invest primarily in common stocks of mid- to large-capitalization companies that meet the Fund’s quality oriented financial and ESG criteria. The Fund seeks to reduce risk by investing across many different industries.

The Portfolio Managers employ a research driven and valuation sensitive approach to stock selection, with a focus on long term sustainability. This sustainable investment approach seeks to identify high quality, well-positioned companies with leadership that is focused on ESG as defined by best in class operating practices. As part of their focus on quality, the Portfolio Managers look for solid balance sheets, strong management teams with a track record of success, good cash flow, the prospect for above-average earnings growth and the sustainability of those earnings, as well as the company’s business model, over the long term. They seek to purchase the stock of businesses that they believe to be well positioned and undervalued by the market. Among companies that meet these criteria, the Portfolio Managers look for those that show leadership in environmental, social and governance considerations, including progressive workplace practices and community relations.

In addition, the Portfolio Managers typically look at a company’s record in public health and the nature of its products. The Portfolio Managers judge firms on their corporate citizenship overall, considering their accomplishments as well as their goals. While these judgments are inevitably subjective, the Fund endeavors to avoid companies that derive revenue from gambling or the production of alcohol, tobacco, weapons, or nuclear power. The Fund also does not invest in any

company that derives its total revenue primarily from non-consumer sales to the military. Please see the Statement of Additional Information for a detailed description of the Fund’s ESG criteria.

Although the Fund invests primarily in domestic stocks, it may also invest in stocks of foreign companies. The Portfolio Managers follow a disciplined selling strategy and may sell a stock when it reaches a target price, if a company’s business fails to perform as expected, or when other opportunities appear more attractive.

As a sustainable fund, the Fund is required by the federal securities laws to have a policy, which it cannot change without providing investors at least 60 days’ written notice, of investing at least 80% of its net assets in equity securities selected in accordance with its ESG criteria. The 80% test is applied at the time the Fund invests; later percentage changes caused by a change in Fund assets, market values or company circumstances will not require the Fund to dispose of a holding. In practice, the Portfolio Managers intend to hold only securities selected in accordance with the Fund’s ESG criteria.

Valuation Sensitive Investing. In addition to employing traditional value criteria – that is, looking for value among companies whose stock prices are below their historical average, based on earnings, cash flow, or other financial measures – the Portfolio Managers may buy a company’s shares if they look more fully priced based on Wall Street consensus estimates of earnings, but still inexpensive relative to the Portfolio Managers’ estimates. The Portfolio Managers look for these companies to rise in price as they outperform Wall Street’s expectations, because they believe some aspects of the business have not been fully appreciated or appropriately priced by other investors.

Comparison of Fundamental Investment Limitations and Non-Fundamental Policies

The fundamental investment limitations for each Portfolio are the same. The table below summarizes the Portfolios’ fundamental investment limitations and non-fundamental policies. The fundamental investment limitations of each Portfolio may not be changed without a vote of the majority of the outstanding securities of the Portfolio. The Portfolios’ investment limitations and policies may be found in their combined Statement of Additional Information (“SAI”). Except with respect to borrowing money, if a percentage limitation is adhered to at the time of the investment, a later increase or decrease in the percentage resulting from any change in value of net assets will not result in a violation of such restriction.

In addition to the policies noted below, the Surviving Portfolio has a non-fundamental policy that it shall normally invest at least 80% of its net assets, plus 80% of any borrowings for investment purposes, in equity securities selected in accordance with its ESG criteria. The Surviving Portfolio will not alter this policy without providing at least 60 days’ prior notice to shareholders. In addition, the Surviving Portfolio has a non-fundamental policy that it may not purchase securities of issuers that derive more than 5% of their total revenue from the production of alcohol, tobacco, weapons, or nuclear power and may not purchase securities of issuers deriving more than 5% of total revenue from gambling. Large Cap Value Portfolio, one of the Merging Portfolios, has a non-fundamental policy that it shall normally invest at least 80% of its net assets, plus 80% of any borrowings for investment purposes, in equity securities of large-capitalization companies. The Large Cap Value Portfolio will not alter this policy without providing at least 60 days’ prior notice to shareholders.

| Investment Restriction | All Portfolios |

| FUNDAMENTAL LIMITATIONS |

| Borrowing | Each Fund may not borrow money, except that a Fund may (i) borrow money from banks for temporary or emergency purposes and not for leveraging or investment and (ii) enter into reverse repurchase agreements for any purpose; provided that (i) and (ii) in combination do not exceed 33-1/3% of the value of its total assets (including the amount borrowed) less liabilities (other than borrowings). If at any time borrowings exceed 33-1/3% of the value of a Fund’s total assets, the Fund will reduce its borrowings within three days (excluding Sundays and holidays) to the extent necessary to comply with the 33-1/3% limitation. |

| Commodities | Each Fund may not purchase physical commodities or contracts thereon, unless acquired as a result of the ownership of securities or instruments, but this restriction shall not prohibit a Fund from purchasing futures contracts or options (including options on futures and foreign currencies and forward contracts but excluding options or futures contracts on physical commodities) or from investing in securities of any kind. |

| Diversification | Each Fund may not, with respect to 75% of the value of its total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government, or any of its agencies or instrumentalities (“U.S. Government and Agency Securities”), or securities issued by other investment companies) if, as a result, (i) more than 5% of the value of the Fund’s total assets would be invested in the securities of that issuer or (ii) the Fund would hold more than 10% of the outstanding voting securities of that issuer. |

| Industry Concentration | Each Fund may not purchase any security if, as a result, 25% or more of its total assets (taken at current value) would be invested in the securities of issuers having their principal business activities in the same industry. This limitation does not apply to purchases of (i) securities issued or guaranteed by the U.S. Government and Agency Securities, or (ii) investments by all Funds (except Large Cap Value Portfolio) in certificates of deposit or bankers’ acceptances issued by domestic branches of U.S. banks. |

| Lending | Each Fund may not lend any security or make any other loan if, as a result, more than 33-1/3% of its total assets (taken at current value) would be lent to other parties, except in accordance with its investment objective, policies, and limitations, (i) through the purchase of a portion of an issue of debt securities or (ii) by |

| Investment Restriction | All Portfolios |

| | engaging in repurchase agreements. |

| Real Estate | Each Fund may not purchase real estate unless acquired as a result of the ownership of securities or instruments, but this restriction shall not prohibit a Fund from purchasing securities issued by entities or investment vehicles that own or deal in real estate or interests therein, or instruments secured by real estate or interests therein. |

| Senior Securities | Each Fund may not issue senior securities, except as permitted under the 1940 Act. |

| Underwriting | Each Fund may not underwrite securities of other issuers, except to the extent that a Fund, in disposing of portfolio securities, may be deemed to be an underwriter within the meaning of the Securities Act of 1933, as amended (“1933 Act”). |

| Investment through a Master/Feeder Structure | Notwithstanding any other investment policy, each Fund may invest all of its net investable assets (cash, securities and receivables relating to securities) in an open-end management investment company having substantially the same investment objective, policies and limitations as the Fund. Currently, the Funds do not utilize this policy. Rather, each Fund invests directly in securities. |

| NON-FUNDAMENTAL POLICIES |

| Borrowing | Each Fund may not purchase securities if outstanding borrowings, including any reverse repurchase agreements, exceed 5% of its total assets. |

| Lending | Except for the purchase of debt securities and engaging in repurchase agreements, each Fund may not make any loans other than securities loans. |

| Margin Transactions | Each Fund may not purchase securities on margin from brokers or other lenders except that a Fund may obtain such short-term credits as are necessary for the clearance of securities transactions. For all Funds, margin payments in connection with derivatives transactions and short sales shall not constitute the purchase of securities on margin and shall not be deemed to violate the foregoing limitation. |

| Illiquid Securities | Each Fund may not purchase any security if, as a result, more than |

| Investment Restriction | All Portfolios |

| | 15% of its net assets would be invested in illiquid securities. Generally, illiquid securities include securities that cannot be expected to be sold or disposed of within seven days in the ordinary course of business for approximately the amount at which the Fund has valued the securities, such as repurchase agreements maturing in more than seven days. |

| Investment by a Fund of Funds | If shares of a Fund are purchased by another fund in reliance on Section 12(d)(1)(G) of the 1940 Act, for so long as shares of the Fund are held by such fund, the Fund will not purchase securities of registered open-end investment companies or registered unit investment trusts in reliance on Section 12(d)(1)(F) or Section 12(d)(1)(G) of the 1940 Act. |

| Foreign Securities | The Funds may not invest more than 20% of the value of their total assets in securities denominated in foreign currency. This policy does not limit investment in American Depository Receipts (“ADRs”) and similar instruments denominated in U.S. dollars, where the underlying security may be denominated in a foreign currency. |

Pledging (Guardian Portfolio only) | Guardian Portfolio may not pledge or hypothecate any of its assets, except that the Fund may pledge or hypothecate up to 5% of its total assets in connection with its entry into any agreement or arrangement pursuant to which a bank furnishes a letter of credit to collateralize a capital commitment made by the Fund to a mutual insurance company of which the Fund is a member. Large Cap Value Portfolio and the Surviving Portfolio are not subject to any restrictions on their ability to pledge or hypothecate assets and may do so in connection with permitted borrowings. |

Comparison of Principal Risks

The principal risks of investing in the Surviving Portfolio and each Merging Portfolio are listed in the chart below and summarized in the text following the chart. The Portfolios are subject to substantially similar principal risks in most cases. The Surviving Portfolio is subject to ESG Criteria Risk but is not subject to the following risks that one or both of the Merging Portfolios have: Catalyst Risk, High Portfolio Turnover Risk, or Options Risk. Historically, most of each Portfolios’ performance has depended on what happened in the markets. The markets’ behavior can be difficult to predict, particularly in the short term. There can be no guarantee that a Portfolio will achieve its goal. A Portfolio may take temporary defensive and cash management positions; in such a case, it will not be pursuing its principal investment strategies.

| | Guardian | | Sustainable Equity | Sustainable Equity After Reorganization (pro forma) |

| | Class I | Class S | | Class I | Class S | Class I | Class S |

Annual Fund Operating Expenses | | | | | | |

| Management fees | 0.85 | 0.85 | 0.84 | 0.84 | 0.84 | 0.84 |

| Distribution (12b-1 fees) | None | 0.25 | None | 0.25 | None | 0.25 |

| Other expenses | 0.35 | 0.35 | 0.10 | 0.10 | 0.10 | 0.10 |

| Total annual operating expenses | 1.20 | 1.45 | | 0.94 | 1.19 | 0.94 | 1.19 |

| Fee Waiver and/or expense reimbursement | | 0.19 | | 0.01 | | 0.02 |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 1.261 | | 1.182 | | 1.17 |

1 NBIA has contractually undertaken to waive and/or reimburse certain fees and expenses of Class S so that total annual operating expenses (excluding interest, taxes, transaction costs, brokerage commissions, dividend and interest expenses relating to short sales, acquired fund fees and expenses and extraordinary expenses, if any) (“annual operating expenses”) are limited to 1.25% of average net assets. This undertaking lasts until 12/31/2021 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that Class S will repay the Manager for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses to exceed 1.25% of its average net assets. Any such repayment must be made within three years after the year in which the Manager incurred the expense.

2 NBIA has contractually undertaken to waive and/or reimburse certain fees and expenses of Class S so that total annual operating expenses (excluding interest, taxes, transaction costs, brokerage commissions, dividend and interest expenses relating to short sales, acquired fund fees and expenses and extraordinary expenses, if any) (“annual operating expenses”) are limited to 1.17% of average net assets. This undertaking lasts until 12/31/2021 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that Class S will repay the Manager for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses to exceed 1.17% of its average net assets. Any such repayment must be made within three years after the year in which the Manager incurred the expense.

| | Large Cap Value | | Sustainable Equity | Sustainable Equity After Reorganization (pro forma) |

| | Class I | | Class I | Class I | Class S |

Annual Fund Operating Expenses | | | | |

| Management fees | 0.85 | 0.84 | 0.84 | 0.84 |

| Distribution (12b-1 fees) | None | None | None | 0.25 |

| Other expenses | 0.26 | 0.10 | 0.10 | 0.10 |

| Acquired fund fees and expenses | 0.01 | – | – | – |

| Total annual operating expenses | 1.12 | 0.94 | 0.94 | 1.19 |

| Fee Waiver and/or expense reimbursement | | | | 0.01 |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | | | 1.18 |

| | Guardian | Large Cap Value | | Sustainable Equity | Sustainable Equity Assuming Consummation of Both Reorganizations (pro forma) |

| | Class I | Class S | Class I | | Class I | Class S | Class I | Class S |

Annual Fund Operating Expenses | | | | | | | |

| Management fees | 0.85 | 0.85 | 0.85 | 0.84 | 0.84 | 0.83 | 0.83 |

| Distribution (12b-1 fees) | None | 0.25 | None | None | 0.25 | None | 0.25 |

| Other expenses | 0.35 | 0.35 | 0.26 | 0.10 | 0.10 | 0.10 | 0.10 |

| Acquired fund fees and expenses | – | – | 0.01 | – | – | – | – |

| Total annual operating expenses | 1.20 | 1.45 | 1.12 | 0.94 | 1.19 | 0.93 | 1.18 |

| Fee Waiver and/or expense reimbursement | | 0.19 | | | 0.01 | | 0.01 |

| Total annual operating expenses after fee waiver and/or expense reimbursement | | 1.261 | | | 1.182 | | 1.17 |

1 NBIA has contractually undertaken to waive and/or reimburse certain fees and expenses of Class S so that total annual operating expenses (excluding interest, taxes, transaction costs, brokerage commissions, dividend and interest expenses relating to short sales, acquired fund fees and expenses and extraordinary expenses, if any) (“annual operating expenses”) are limited to 1.25% of average net assets. This undertaking lasts until 12/31/2021 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that Class S will repay the Manager for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses to exceed 1.25% of its average net assets. Any such repayment must be made within three years after the year in which the Manager incurred the expense.

2 NBIA has contractually undertaken to waive and/or reimburse certain fees and expenses of Class S so that total annual operating expenses (excluding interest, taxes, transaction costs, brokerage commissions, dividend and interest expenses relating to short sales, acquired fund fees and expenses and extraordinary expenses, if any) (“annual operating expenses”) are limited to 1.17% of average net assets. This undertaking lasts until 12/31/2021 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that Class S will repay the Manager for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses to exceed 1.17% of its average net assets. Any such repayment must be made within three years after the year in which the Manager incurred the expense.

Example of Portfolio Expenses

This example can help you compare costs between each Merging Portfolio and the Surviving Portfolio and the pro forma costs for the Surviving Portfolio after giving effect to the Reorganization. The example assumes that you invested $10,000 for the periods shown, that you earned a hypothetical 5% total return each year, and that the Portfolios’ expenses were those in the

table above. Your costs would be the same whether you sold your shares or continued to hold them at the end of each period. Actual performance and expenses may be higher or lower. These examples do not take into account any fees or expenses that your insurance company or other financial intermediary may impose.

Reorganization of Guardian Portfolio into Sustainable Equity Portfolio including Pro Formas

| Year 1 |

| | Guardian | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $122 | $96 | $96 |

| Class S | $128 | $120 | $119 |

| Year 3 |

| | Guardian | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $381 | $300 | $300 |

| Class S | $400 | $375 | $372 |

| Year 5 |

| | Guardian | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $660 | $520 | $520 |

| Class S | $735 | $651 | $648 |

| Year 10 |

| | Guardian | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $1,455 | $1,155 | $1,155 |

| Class S | $1,683 | $1,440 | $1,438 |

Reorganization of Large Cap Value Portfolio into Sustainable Equity Portfolio including Pro Formas

| Year 1 |

| | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $114 | $96 | $96 |

| Class S | - | $120 | $120 |

| Year 3 |

| | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $356 | $300 | $300 |

| Class S | - | $375 | $375 |

| Year 5 |

| | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $617 | $520 | $520 |

| Class S | - | $651 | $651 |

| Year 10 |

| | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $1,363 | $1,155 | $1,155 |

| Class S | - | $1,440 | $1,440 |

Assuming Consummation of Both Reorganizations including Pro Formas

| Year 1 |

| | Guardian | Large Cap Value | Sustainable Equity | Sustainable E quity (pro forma) |

| Class I | $122 | $114 | $96 | $95 |

| Class S | $128 | - | $120 | $119 |

| Year 3 |

| | Guardian | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $381 | $356 | $300 | $296 |

| Class S | $400 | - | $375 | $372 |

| Year 5 |

| | Guardian | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $660 | $617 | $520 | $515 |

| Class S | $735 | - | $651 | $646 |

| Year 10 |

| | Guardian | Large Cap Value | Sustainable Equity | Sustainable Equity (pro forma) |

| Class I | $1,455 | $1,363 | $1,155 | $1,143 |

| Class S | $1,683 | - | $1,440 | $1,429 |

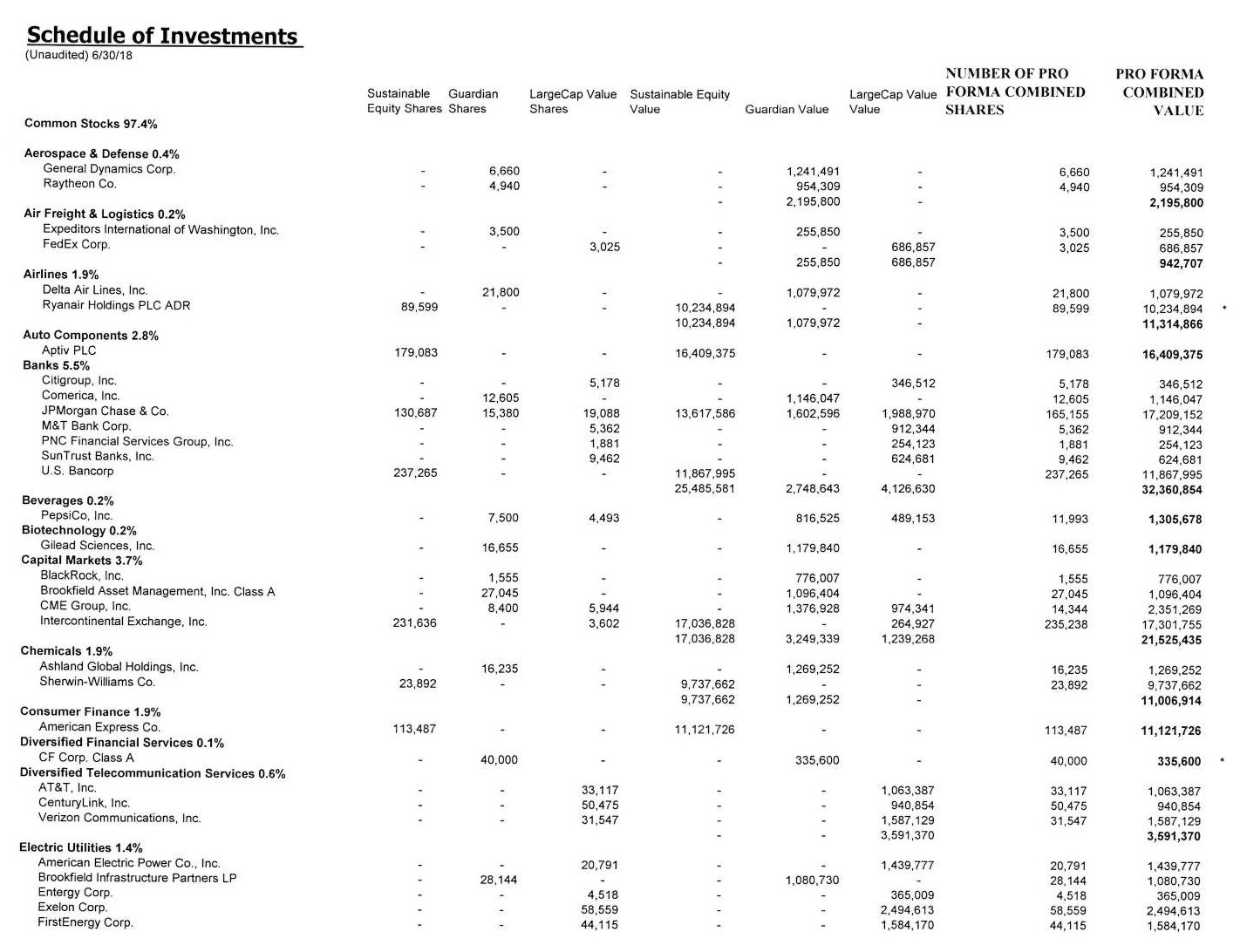

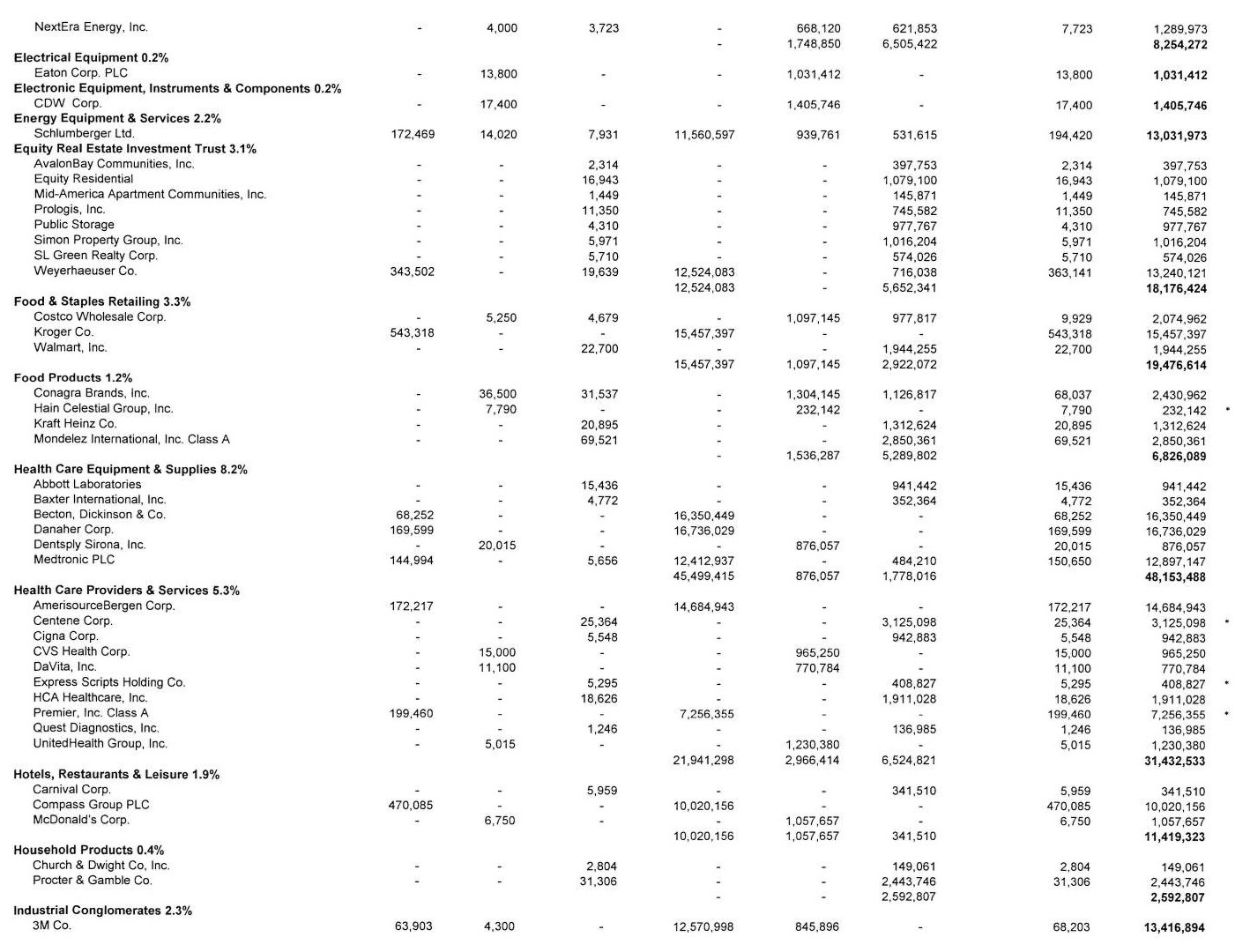

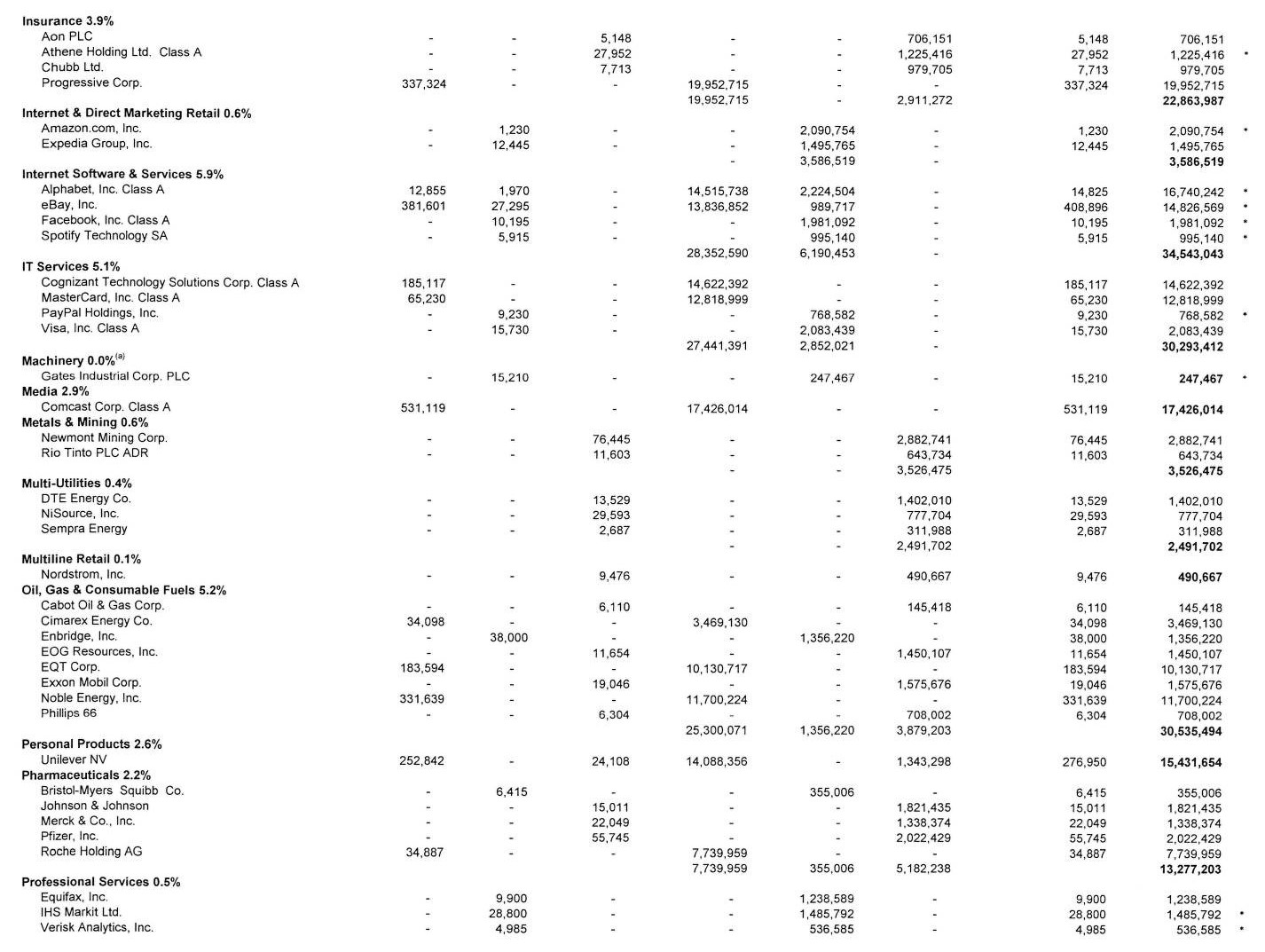

Comparative Performance Information

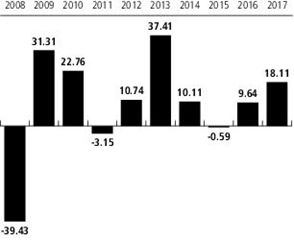

The bar chart and table for each Portfolio below provide an indication of the risks of investing in the Portfolios. Each bar chart shows how a Portfolio’s performance has varied from year to year. The table next to the bar chart shows what the returns would equal if you averaged out actual performance over various lengths of time and compares the returns with the returns of a broad-based market index for each Portfolio. The performance information does not reflect variable contract or qualified plan fees and expenses. If such fees and expenses were reflected, returns would be less than those shown. Please refer to the prospectus for your variable contract or your qualified plan documentation for information on their separate fees and expenses. Past performance is not a prediction of future results.

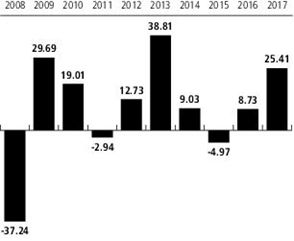

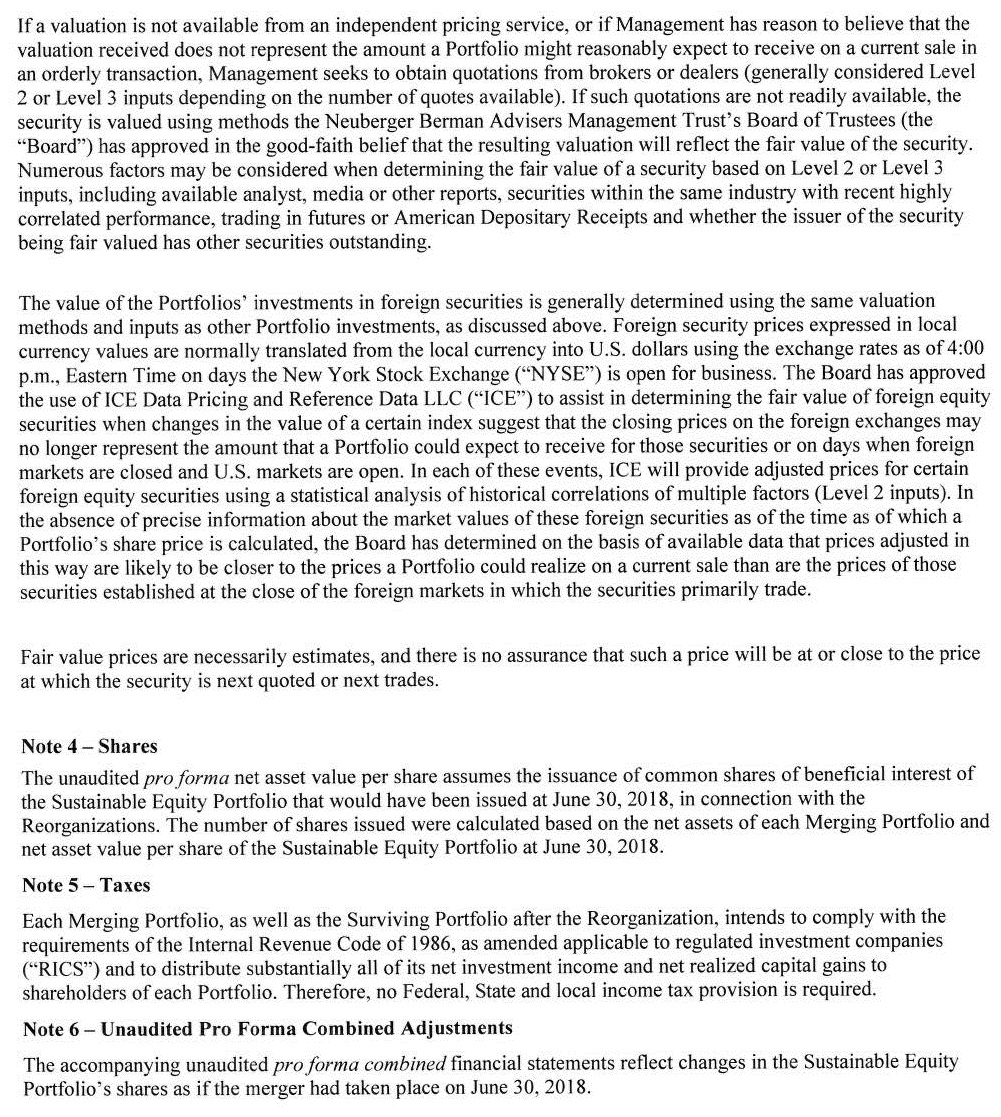

Guardian Portfolio - Class I

YEAR-BY-YEAR % RETURNS

AS OF 12/31 EACH YEAR* | |

| |

Best quarter: Q2 '09, 15.50% Worst quarter: Q4 '08, -25.53% | |

AVERAGE ANNUAL TOTAL % RETURNS

AS OF 12/31/17* | |

| | 1 Year | 5 Years | 10 Years | |

| Guardian Portfolio (Class I) | 25.41 | 14.42 | 7.59 | |

S&P 500® Index

(reflects no deduction for fees, expenses or taxes) | 21.83 | 15.79 | 8.50 | |

| | * | Returns would have been lower if Neuberger Berman Investment Advisers LLC had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. |

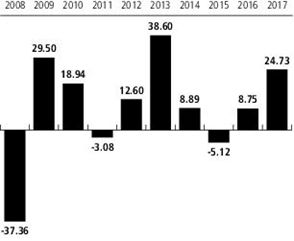

Guardian Portfolio - Class S

YEAR-BY-YEAR % RETURNS

AS OF 12/31 EACH YEAR* | |

| |

Best quarter: Q2 '09, 15.52% Worst quarter: Q4 '08, -25.57% | |

AVERAGE ANNUAL TOTAL % RETURNS

AS OF 12/31/17* | |

| | 1 Year | 5 Years | 10 Years | |

| Guardian Portfolio (Class S) | 24.73 | 14.20 | 7.42 | |

S&P 500® Index

(reflects no deduction for fees, expenses or taxes) | 21.83 | 15.79 | 8.50 | |

| | * | Returns would have been lower if Neuberger Berman Investment Advisers LLC had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. |

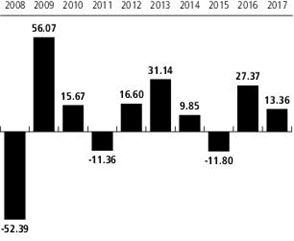

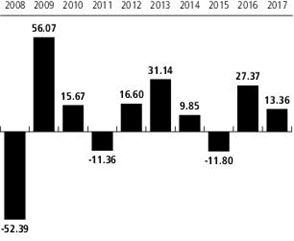

Large Cap Value Portfolio - Class I

YEAR-BY-YEAR % RETURNS

AS OF 12/31 EACH YEAR* | |

| |

Best quarter: Q2 '09, 28.06% Worst quarter: Q4 '08, -33.46% | |

AVERAGE ANNUAL TOTAL % RETURNS

AS OF 12/31/17* | |

| | 1 Year | 5 Years | 10 Years | |

| Large Cap Value Portfolio (Class I) | 13.36 | 12.90 | 5.00 | |

Russell 1000® Value Index

(reflects no deduction for fees, expenses or taxes) | 13.66 | 14.04 | 7.10 | |

| | * | Returns would have been lower if Neuberger Berman Investment Advisers LLC had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. |

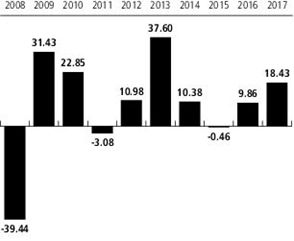

Sustainable Equity Portfolio - Class I

YEAR-BY-YEAR % RETURNS

AS OF 12/31 EACH YEAR* | |

| |

Best quarter: Q2 '09, 15.74% Worst quarter: Q4 '08, -27.01% | |

AVERAGE ANNUAL TOTAL % RETURNS

AS OF 12/31/17* | |

| | 1 Year | 5 Years | 10 Years | |

| Sustainable Equity Portfolio (Class I) | 18.43 | 14.49 | 7.54 | |

S&P 500® Index

(reflects no deduction for fees, expenses or taxes) | 21.83 | 15.79 | 8.50 | |

| | * | Returns would have been lower if Neuberger Berman Investment Advisers LLC had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. |

Sustainable Equity Portfolio - Class S

YEAR-BY-YEAR % RETURNS

AS OF 12/31 EACH YEAR* | |

| |

Best quarter: Q2 '09, 15.84% Worst quarter: Q4 '08, -26.95% | |

AVERAGE ANNUAL TOTAL % RETURNS

AS OF 12/31/17* | |

| | 1 Year | 5 Years | 10 Years | |

| Sustainable Equity Portfolio (Class S) | 18.11 | 14.26 | 7.39 | |

S&P 500® Index

(reflects no deduction for fees, expenses or taxes) | 21.83 | 15.79 | 8.50 | |

| | * | Returns would have been lower if Neuberger Berman Investment Advisers LLC had not reimbursed certain expenses and/or waived a portion of the investment management fees during certain of the periods shown. |

Descriptions of Indices

The S&P 500® Index is a float-adjusted market capitalization-weighted index that focuses on the large-cap segment of the U.S. equity market, and includes a significant portion of the total value of the market.

The Russell 1000® Value Index is a float-adjusted market capitalization-weighted index that measures the performance of the large-cap value segment of the U.S. equity market. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth rates. The index is rebalanced annually in June.

Guardian Portfolio and the Surviving Portfolio each compares its performance to the S&P 500® Index. Large Cap Value Portfolio compares its performance to the Russell 1000® Value Index. Upon completion of each Reorganization, the Surviving Portfolio will continue to compare its performance to the S&P 500® Index.

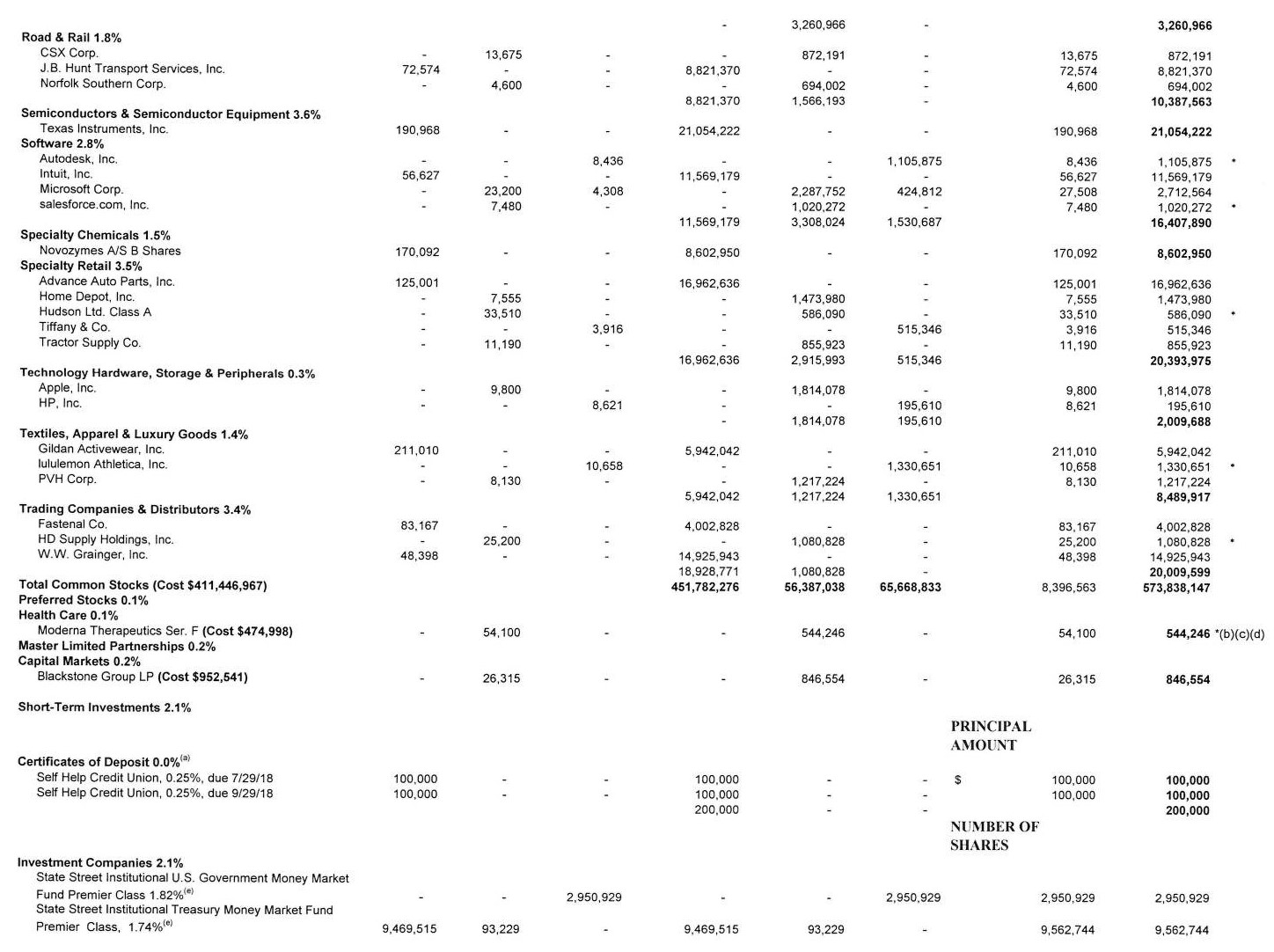

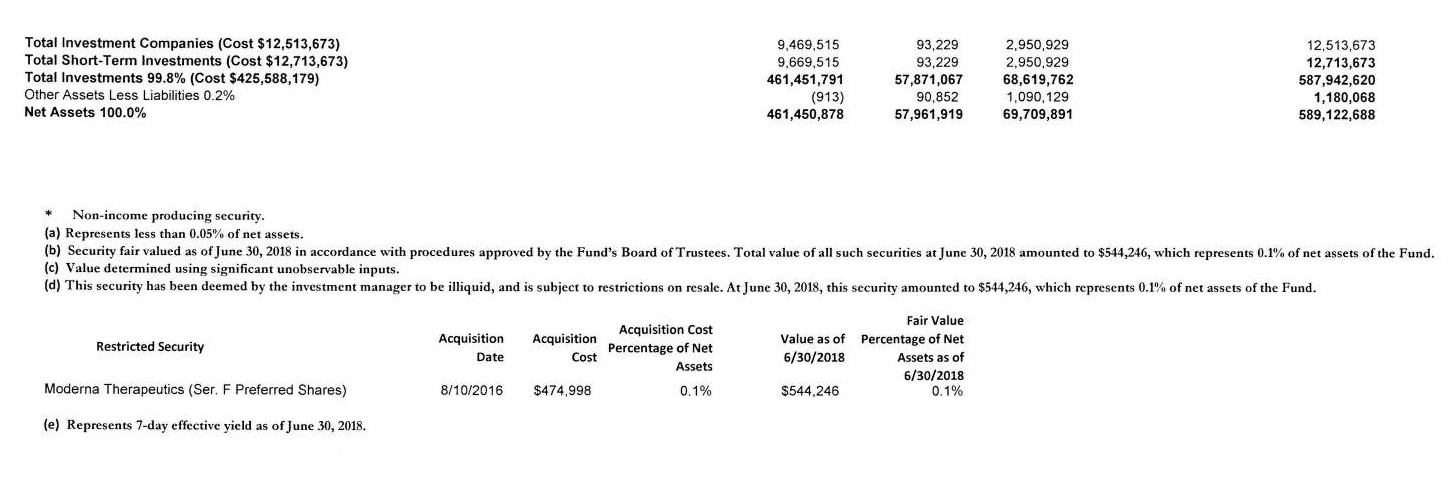

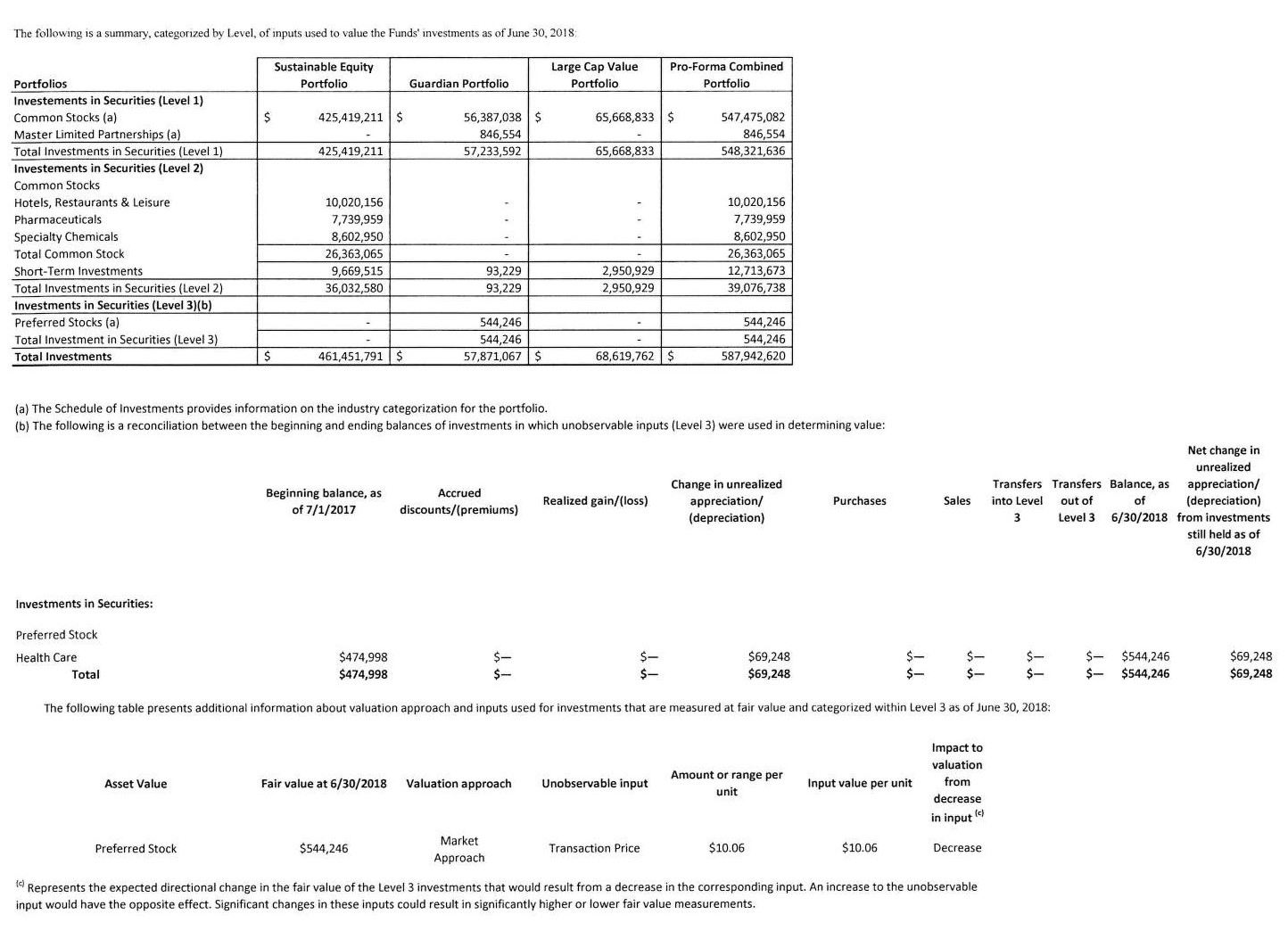

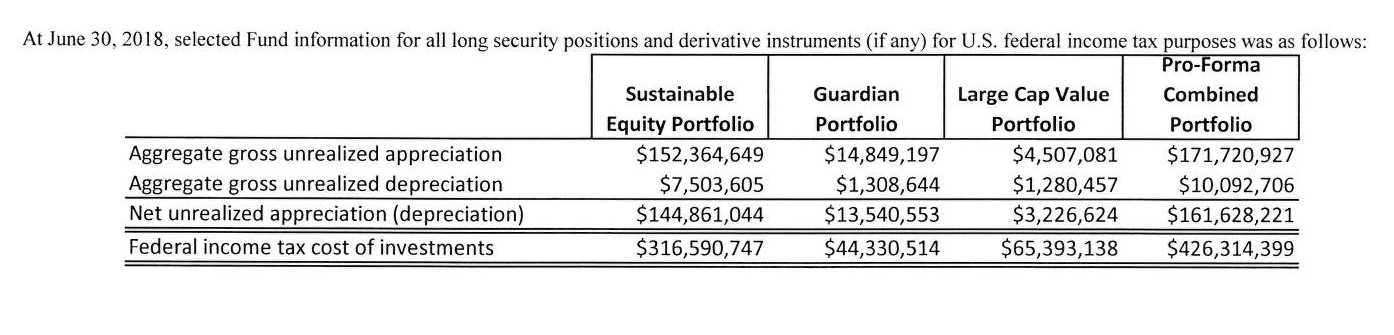

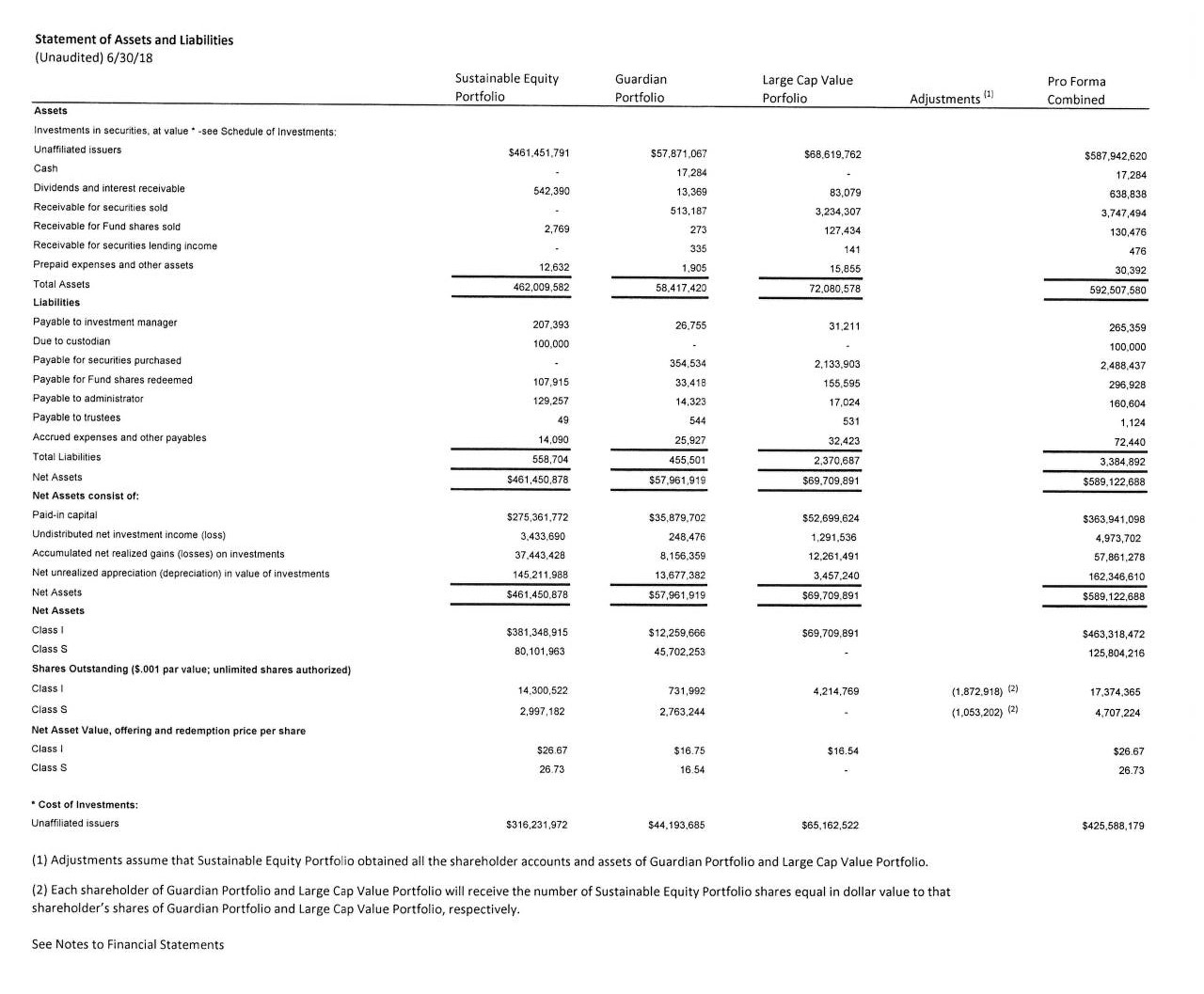

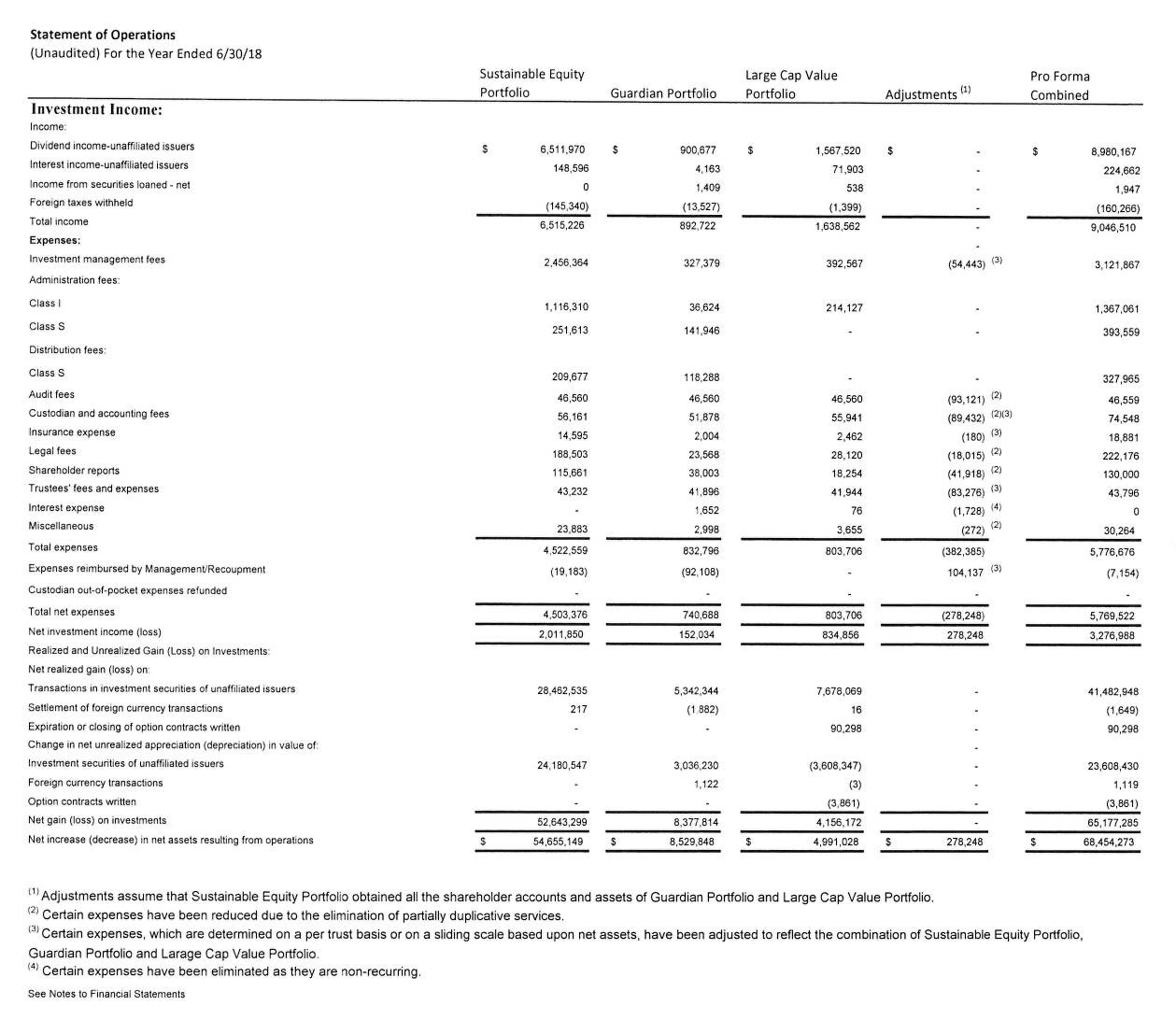

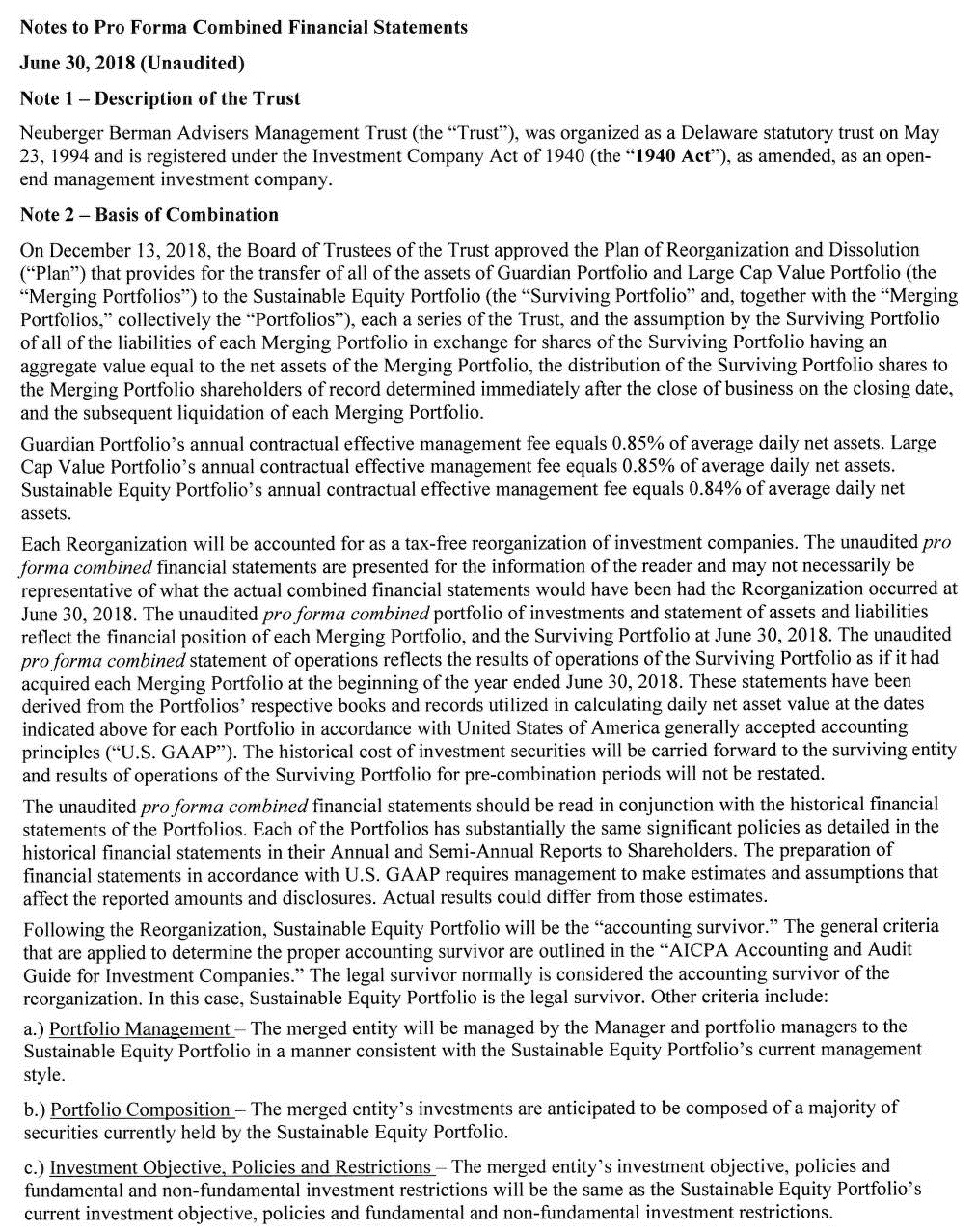

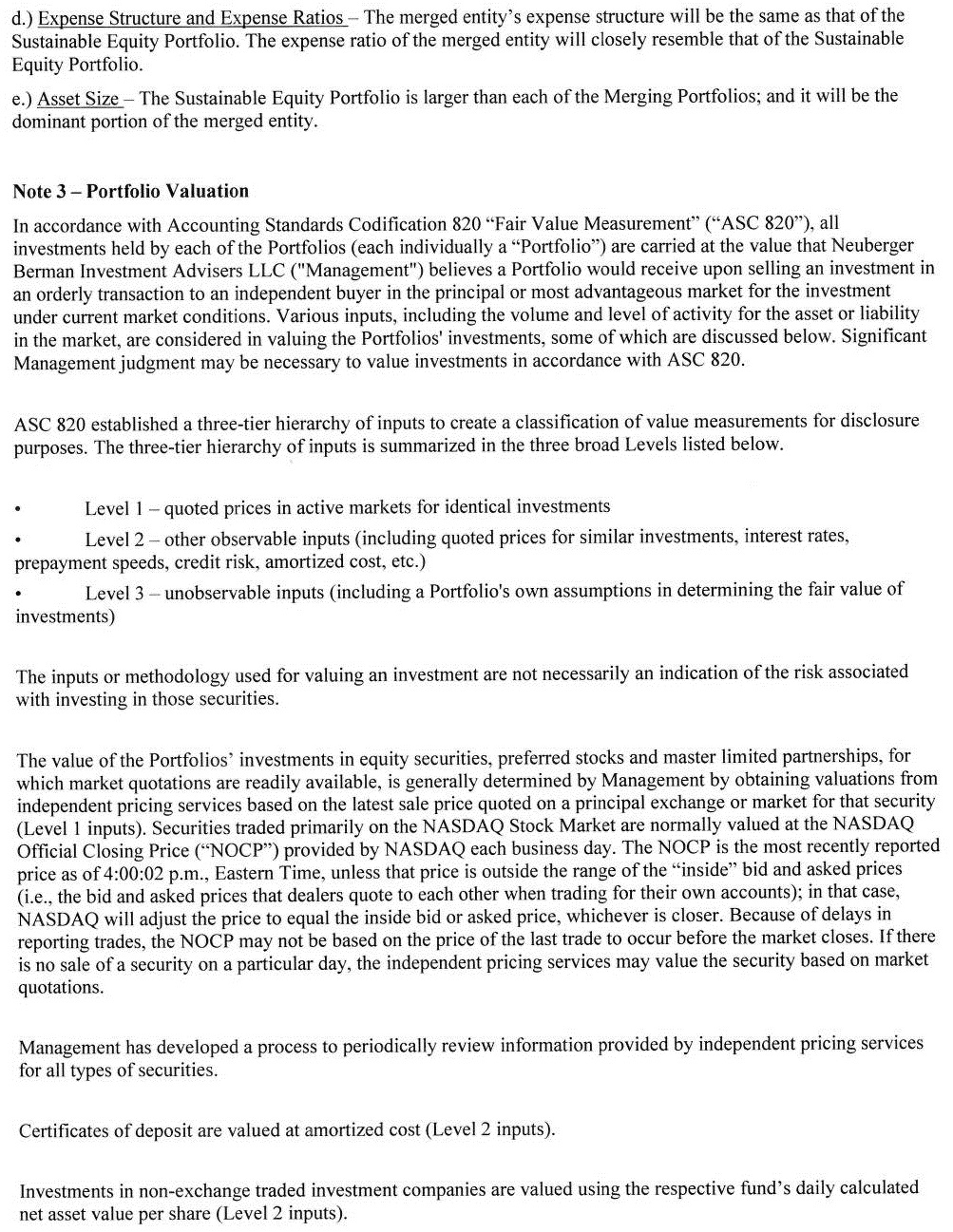

Capitalization

The following table sets forth the capitalization of each Merging Portfolio and the Surviving Portfolio as of June 30, 2018 and of the Surviving Portfolio on a pro forma combined basis as of that date, giving effect to each Reorganization.

| | Net Assets | Net Asset Value Per Share | Shares Outstanding |

| Guardian – Class I | 12,259,666 | 16.75 | 731,992 |

| Guardian – Class S | 45,702,253 | 16.54 | 2,763,244 |

| Sustainable Equity – Class I | 381,348,915 | 26.67 | 14,300,522 |

| Sustainable Equity – Class S | 80,101,963 | 26.73 | 2,997,182 |

Sustainable Equity After Reorganization (pro forma) – Class I | 393,608,581 | 26.67 | 14,760,257 |

Sustainable Equity After Reorganization (pro forma) – Class S | 125,804,216 | 26.73 | 4,707,224 |

| |

| Large Cap Value – Class I | 69,709,891 | 16.54 | 4,214,769 |

| Sustainable Equity – Class I | 381,348,915 | 26.67 | 14,300,522 |

Sustainable Equity After Reorganization (pro forma) – Class I | 451,058,806 | 26.67 | 16,914,630 |

| |

Sustainable Equity Assuming Consummation of Both Reorganizations (pro forma) – Class I | 463,318,472 | 26.67 | 17,374,365 |

Sustainable Equity Assuming Consummation of Both Reorganizations (pro forma) – Class S | 125,804,216 | 26.73 | 4,707,224 |

| | | | |

Information Regarding the Plan of Reorganization and Dissolution

The terms and conditions under which each Reorganization will be consummated are set forth in the Plan, a copy of the form of which is attached as Appendix A to this Information Statement. Significant provisions of the Plan are summarized below; however, this summary is qualified in its entirety by reference to the Plan itself.

The Plan provides for each Reorganization to occur on or about April 30, 2019. The Plan provides that pursuant to each Reorganization, all of the assets of a Merging Portfolio will be transferred to the Surviving Portfolio at the close of business (or other time determined by the Trust) on the Effective Date (the “Effective Time”). In exchange for that transfer of assets, the Surviving Portfolio will simultaneously (a) issue to the Merging Portfolio a number of full and fractional Surviving Portfolio shares, by class, equal in value to the aggregate NAV of the Merging Portfolio outstanding at the Effective Time and (b) assume all of the liabilities of the Merging Portfolio.

Following that exchange, the Merging Portfolio will distribute all of the Surviving Portfolio shares proportionately to its shareholders of record (i.e., one or more Separate Accounts) at the Effective Time (each, a “Separate Account Shareholder”), by class, in complete liquidation of the Merging Portfolio. That distribution will be accomplished by the Trust’s transfer agent’s opening accounts on the Surviving Portfolio’s share transfer books in the names of the Separate

Account Shareholders (other than Separate Account Shareholders that already have the Surviving Portfolio share accounts) and transferring those Surviving Portfolio shares to those newly opened and existing accounts. Pursuant to that transfer, each Separate Account Shareholder’s account will be credited with the respective pro rata number of full and fractional (rounded to the third decimal place) Surviving Portfolio shares due to that Separate Account Shareholder. The account for each Separate Account Shareholder that holds any Merging Portfolio Class I shares will be credited with the respective pro rata number of the Surviving Portfolio Class I shares due that Separate Account Shareholder and the account for each Separate Account Shareholder that holds any Merging Portfolio Class S shares will be credited with the respective pro rata number of the Surviving Portfolio Class S shares due that Separate Account Shareholder. The aggregate NAV of the Surviving Portfolio shares to be so credited to each Separate Account Shareholder’s account will equal the aggregate NAV of the Merging Portfolio shares that Separate Account Shareholder owned at the Effective Time. All issued and outstanding shares of each Merging Portfolio, including any represented by certificates, will simultaneously be canceled on the Merging Portfolio’s share transfer books. The Surviving Portfolio will not issue certificates representing the Surviving Portfolio shares issued in connection with any Reorganization.

After the Effective Time, each Merging Portfolio will not conduct any business except in connection with its dissolution. As soon as reasonably practicable after distribution of the Surviving Portfolio shares described above, but in all events within six months after the Effective Time, each Merging Portfolio will be terminated as a series of the Trust and any further actions will be taken in connection therewith as required by applicable law.

The Plan may be terminated or delayed, and any Reorganization may be abandoned or postponed by the Board at any time before the Effective Time, if circumstances develop that, in its opinion, make proceeding with the Reorganization inadvisable for either Portfolio to each Reorganization. The completion of each Reorganization also is subject to various conditions, including completion of all filings with, and receipt of any necessary approvals from, the SEC, delivery of a legal opinion regarding the federal tax consequences of the Reorganization and other customary corporate and securities matters. Subject to the satisfaction of those conditions, each respective Reorganization will take place at the Effective Time. Each Reorganization is independent of the other, and the Reorganization of either Merging Portfolio may proceed even if the Reorganization of the other Merging Portfolio is postponed or cancelled.

No sales charges will be imposed by any Portfolio in connection with the receipt of the Surviving Portfolio shares by shareholders of a Merging Portfolio.

As provided in the Plan, expenses solely and directly related to each Reorganization (as determined in accordance with guidelines set by the Internal Revenue Service) will be paid by NBIA, the investment manager of each Portfolio, excluding any brokerage costs, which will be paid by the respective Portfolio that incurs them. Further, the Surviving Portfolio will pay any fees payable to governmental authorities for the registration or qualification of the Surviving Portfolio shares distributable to Merging Portfolio shareholders pursuant to each Reorganization and all related transfer agency costs. Such fees and costs are not expected to be material to the operation of the Surviving Portfolio.

Reasons for the Reorganizations

The Board met on December 13, 2018 to consider information in connection with the Reorganizations. In determining whether to approve each Reorganization and the Plan, the Board, including the Independent Trustees, with the advice and assistance of independent legal counsel, inquired into and considered a number of matters, including: (1) the terms and conditions of the Reorganization; (2) the compatibility of the investment programs of each Merging Portfolio and the Surviving Portfolio; (3) the expense ratios of each Portfolio on a comparative basis; (4) the relative historical performance record of the Portfolios; (5) the historical asset levels of each Merging Portfolio and its prospects for future growth; (6) the continuity of advisory and portfolio management, distribution and shareholder services provided by the Reorganization; (7) that NBIA will bear costs of the Reorganization (excluding any brokerage costs) and the Surviving Portfolio will pay any fees payable to governmental authorities for the registration or qualification of the Surviving Portfolio shares distributable to the Merging Portfolio’s shareholders pursuant to the Reorganization and related transfer agency costs; (8) the benefits to NBIA as a result of the Reorganization, as NBIA is expected to experience savings on the amount of expenses required to be reimbursed pursuant to each Portfolio’s current contractual expense limitation arrangement once the Portfolios are merged; (9) the differences in the investment strategies for the Portfolios, including that the Surviving Portfolio invests 80% of its net assets in equity securities selected in accordance with its ESG criteria; and (10) the non-recognition of any gain or loss for federal income tax purposes to each Merging Portfolio or its shareholders as a result of the Reorganization. The Board did not assign specific weights to any or all of these factors, but it did consider all of them in determining, in its business judgment, to approve the Reorganization and Plan.

At the meeting, representatives of NBIA discussed the rationale for the Reorganizations. NBIA’s representatives explained that the Reorganization of each Merging Portfolio would eliminate certain smaller investment portfolios that are less viable than other portfolios in the complex and create one product with meaningful assets under management, lower expenses and a more viable long-term future. NBIA’s representatives also noted that each Merging Portfolio and the Surviving Portfolio have similar investment objectives, but employ different investment strategies and policies to meet those objectives.

NBIA’s representatives noted that the Surviving Portfolio is operating above its contractual expense cap for Class S shares and operating below its contractual expense cap for Class I shares and the Surviving Portfolio’s Net Expenses for each class are lower than the Net Expenses of the corresponding share class of each Merging Portfolio after fee waiver and/or expense reimbursement. The Surviving Portfolio currently has a lower contractual expense cap for Class I and Class S shares than the corresponding Class of each Merging Portfolio. NBIA has agreed to maintain the Surviving Portfolio’s contractual expense caps until December 31, 2021.

NBIA explained that alternatives to the Reorganizations were considered, including liquidating and terminating the Merging Portfolios, but that it was determined that the more beneficial course of action for shareholders would be to merge the Merging Portfolios.

NBIA then reviewed with the Board the terms and conditions of the Plan, noting that the Reorganizations were expected to be tax-free to each Merging Portfolio and its shareholders. NBIA noted that the interests of the shareholders would not be diluted by the Reorganizations because they would be effected on the basis of each Merging Portfolio’s NAV. NBIA further noted that the Plan provides that NBIA will pay the costs associated with each Reorganization,

excluding any brokerage costs, which will be paid by the Portfolio that incurs them. It was noted that the Surviving Portfolio will pay any fees owed to governmental authorities for the registration or qualification of the Surviving Portfolio shares distributable to the Merging Portfolio shareholders and all related transfer agency costs. NBIA noted that such fees and costs are not expected to be material to the operation of the Surviving Portfolio. They then recommended that the Board approve each Reorganization.

Article X, Section 4 of the Trust’s Amended and Restated Trust Instrument (“Trust Instrument”) permits the Board to merge portfolios without shareholder approval so long as the Board determines that continuation of the portfolio is not in the best interests of the Trust, the portfolio or its shareholders as a result of factors or events adversely affecting the ability of the portfolio to conduct its business and operations in an economically viable manner.

In reaching the decision to approve each Reorganization and the Plan, the Board, including the Independent Trustees, concluded that the participation of each Merging Portfolio in the Reorganizations would be in the best interests of the Merging Portfolio and that the interests of the shareholders of the Merging Portfolio would not be diluted as a result of the Reorganization. The Board’s conclusion was based on a number of factors, including those discussed above and under the section of this Information Statement entitled “Considerations Regarding the Reorganizations.”

On the basis of the information provided to the Board and the Board’s evaluation of that information, the Board voted unanimously to approve each Reorganization and the Plan.

Description of the Securities to be Issued