UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 3940 |

| |

| Strategic Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 5/31 | |

Date of reporting period: | 5/31/15 | |

| | |

| | | | | | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect the other series of the Registrant, which have different fiscal year ends and, therefore, different N-CSR reporting requirements. Separate N-CSR Forms will be filed for these series, as appropriate.

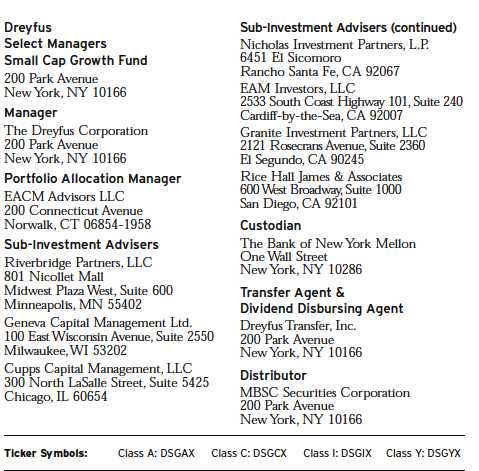

Dreyfus Select Managers Small Cap Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus |

| Select Managers |

| Small Cap Growth Fund |

ANNUAL REPORT May 31, 2015

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 24 | Statement of Assets and Liabilities |

| 25 | Statement of Operations |

| 26 | Statement of Changes in Net Assets |

| 28 | Financial Highlights |

| 32 | Notes to Financial Statements |

| 43 | Report of Independent Registered Public Accounting Firm |

| 44 | Important Tax Information |

| 45 | Board Members Information |

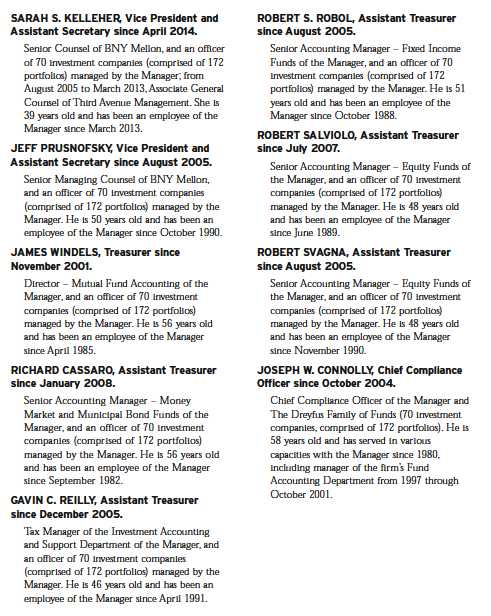

| 48 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

Select Managers

Small Cap Growth Fund

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Select Managers Small Cap Growth Fund, covering the 12-month period from June 1, 2014, through May 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

The U.S. stock market encountered bouts of heightened volatility on its way to setting a series of new record highs during the reporting period. Stock prices were driven broadly higher over the second half of 2014 as U.S. corporate fundamentals benefited from a sustained economic recovery, which was fueled by strengthening labor markets, intensifying manufacturing activity, and greater consumer and business confidence. Gains moderated over the first five months of 2015, when investors worried that persistent economic weakness in overseas markets and a strengthening U.S. dollar might derail growth in the United States.

We remain optimistic regarding the long-term outlook for the U.S. economy. We believe the domestic economic recovery has resumed after a winter soft patch, energy prices have begun to rebound, foreign currencies recently have strengthened, and aggressively accommodative monetary policies from the world’s major central banks seem likely to address global economic weakness.While stocks stand to benefit from these conditions, valuations appear to have risen toward fair levels. Moreover, we believe expectations of domestic rate hikes and recently mixed corporate financial reports may have created uncertainty as to the pace of future gains.As always, we urge you to discuss these observations with your financial advisor, who can help you assess their implications for your investment portfolio.

Thank you for your continued confidence and support.

J. Charles Cardona

President

The Dreyfus Corporation

June 15, 2015

2

DISCUSSION OF FUND PERFORMANCE

For the reporting period of June 1, 2014, through May 31, 2015, as provided by Keith L. Stransky and Robert B. Mayerick, Portfolio Allocation Managers, EACM Advisors LLC

Fund and Market Performance Overview

For the 12-month period ended May 31, 2015, Dreyfus Select Managers Small Cap Growth Fund’s Class A, Class C, Class I, and Class Y shares produced total returns of 14.30%, 13.49%, 14.69%, and 14.66%, respectively.1 In comparison, the Russell 2000® Growth Index (the “Index”), the fund’s benchmark, returned 17.73% for the same period.2

Stocks advanced strongly in a recovering U.S. economy over the reporting period’s first half before posting more modest gains during the second half.The fund lagged its benchmark, mainly due to shortfalls in the information technology and consumer discretionary sectors.

The Fund’s Investment Approach

The fund seeks long-term capital appreciation.To pursue its goal, the fund normally invests at least 80% of its assets in the stocks of small-cap companies.

The fund uses a “multi-manager” approach by selecting one or more sub-advisers to manage its assets. We seek sub-advisers that complement one another’s style of investing. We monitor and evaluate the performance of the sub-advisers and will make corresponding recommendations to Dreyfus and the fund’s Board.

The fund’s assets are currently under the day-to-day portfolio management of seven sub-advisers, each of whom acts independently and uses their own methodology to select investments.At the end of the reporting period, 7% of the fund’s assets are under the management of Riverbridge Partners, LLC, which employs a bottom-up approach to stock selection and focuses on companies that are building their earnings power and intrinsic value over long periods of time. Approximately 9% of the fund’s assets are under the management of Geneva Capital Management LLC, which employs bottom-up fundamental analysis supplemented by top-down considerations to identify companies that perform well over long periods of time. Approximately 14% of the fund’s assets are under the management of Cupps Capital Management, LLC,

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

which employs a proprietary investment framework to evaluate the attractiveness of stocks. Nicholas Investment Partners, L.P., which employs quantitative/qualitative analysis to identify companies experiencing positive change in seeking above-expected growth, manages 19% of the fund’s assets. EAM Investors, LLC, which manages 21% of the fund’s assets, chooses investments through bottom-up fundamental analysis using a blend of a quantitative discovery process and a qualitative analysis process. Approximately 12% of assets are managed by Granite Investment Partners, LLC, which seeks attractively valued small-cap companies with catalysts for growth, and another 18% of assets are managed by Rice Hall James & Associates, which seeks growing companies whose value, in the manager’s view, has not yet been fully appreciated in the marketplace.These percentages are expected to increase over time, within ranges described in the prospectus.

Stocks Digested Gains in 2015 after Strong 2014 Rally

The U.S. economy rebounded strongly over the first half of the reporting period, supported by a strengthening labor market, low interest rates, and improved confidence among consumers and businesses.The economic expansion proved more uneven over the second half due to severe winter weather, a labor slowdown in West Coast ports, and economic weakness in international markets. Massive quantitative easing programs in overseas markets caused the U.S. dollar to appreciate sharply against most foreign currencies, hampering revenues for American exporters. Meanwhile, sharply lower oil prices generated challenges for energy producers.

Consequently, equity markets achieved most of the reporting period’s gains during 2014. In contrast, broad measures of U.S. stock market performance repeatedly vacillated between gains and losses in early 2015 before stronger economic data supported moderately higher stock prices in the spring.

The Fund Participates in Market Gains

Although the fund participated substantially in the benchmark’s gains over the reporting period, its relative performance was undermined by a handful of disappointments in the information technology sector. For example, 3-D printing specialist Stratasys declined sharply after reducing its earnings forecast in light of slowing organic growth, rising costs, and a recent acquisition. Cloud-based software developer Actua was hurt by lower-than-expected capital expenditures by its customers. In the consumer discretionary sector,

4

radio broadcaster Cumulus Media encountered slowing advertising trends and rising programming costs, and restaurant chain Chuy’s Holdings reduced future guidance due to higher-than-anticipated new-store opening costs.

The fund produced better relative performance among individual stocks in other areas. Most notably, pharmaceutical developer Receptos more than quadrupled in value after announcing positive results from clinical trials of a new ulcerative colitis drug, and medical devices maker ABIOMED more than doubled after receiving regulatory approval of a new mechanical circulatory support device for heart failure patients.

A Constructive Investment Posture

The U.S. economic recovery has resumed, we believe stocks of fast-growing small-cap companies should see increased investor demand, mergers-and-acquisitions activity has intensified, and U.S.-centric small-cap companies should continue to be insulated from global economic uncertainty. Therefore, as of the reporting period’s end, the fund’s sub-advisers generally have maintained constructive investment postures, including an emphasis on more economically sensitive and faster growing industry groups.

June 15, 2015

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period. Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The prices of small company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories.They also tend to be less liquid than larger company stocks.

|

| 1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the |

| maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed |

| on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past |

| performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain |

| fund expenses by The Dreyfus Corporation pursuant to an undertaking in effect through October 1, 2015, at which |

| time it may be extended, terminated, or modified. Had these expenses not been absorbed, the fund’s Class A and C |

| returns would have been lower. |

| 2 SOURCE: LIPPER INC. — The Russell 2000 Growth Index is an unmanaged index, which measures the |

| performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. |

| The total return figure cited for this index assumes change in security prices and reinvestment of dividends, but does |

| not reflect the costs of managing a mutual fund. Investors cannot invest directly in any index. |

The Fund 5

FUND PERFORMANCE

| |

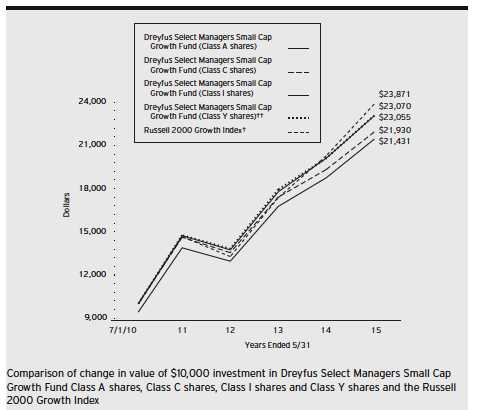

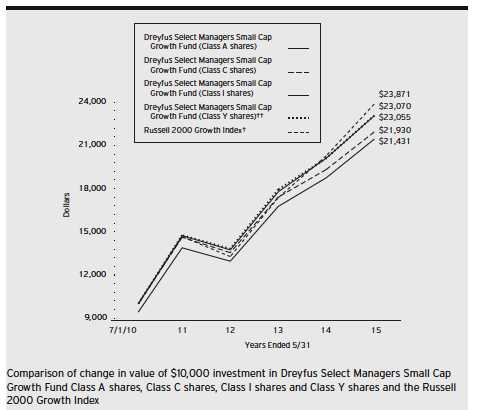

| † | Source: Lipper Inc. |

| †† | The total return figures presented for ClassY shares of the fund reflect the performance of the fund’s Class A shares |

| | for the period prior to 7/1/13 (the inception date for ClassY shares), adjusted to reflect the applicable sales load for |

| | Class A shares. |

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Select Managers Small Cap Growth Fund on 7/1/10 (inception date) to a $10,000 investment made in the Russell 2000 Growth Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested. The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is an unmanaged index, which measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

| Average Annual Total Returns as of 5/31/15 | | | | |

| | Inception | | | From | |

| | Date | 1 | Year | Inception | |

| Class A shares | | | | | |

| with maximum sales charge (5.75%) | 7/1/10 | 7.71 | % | 16.76 | % |

| without sales charge | 7/1/10 | 14.30 | % | 18.17 | % |

| Class C shares | | | | | |

| with applicable redemption charge † | 7/1/10 | 12.49 | % | 17.31 | % |

| without redemption | 7/1/10 | 13.49 | % | 17.31 | % |

| Class I shares | 7/1/10 | 14.69 | % | 18.52 | % |

| Class Y shares | 7/1/13 | 14.66 | % | 18.50 | %†† |

| Russell 2000 Growth Index | 6/30/10 | 17.73 | % | 19.36 | %††† |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

| |

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | date of purchase. |

| †† | The total return performance figures presented for ClassY shares of the fund reflect the performance of the fund’s |

| | Class A shares for the period prior to 7/1/13 (the inception date for ClassY shares), adjusted to reflect the |

| | applicable sales load for Class A shares. |

| ††† | For comparative purposes, the value of the Index as of 6/30/10 is used as the beginning value on 7/1/10. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Select Managers Small Cap Growth Fund from December 1, 2014 to May 31, 2015. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended May 31, 2015

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Y |

| Expenses paid per $1,000† | $ | 6.67 | $ | 10.58 | $ | 5.12 | $ | 5.02 |

| Ending value (after expenses) | $ | 1,073.70 | $ | 1,070.20 | $ | 1,075.60 | $ | 1,075.70 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended May 31, 2015

| | | | | | | | |

| | | Class A | | Class C | | Class I | | Class Y |

| Expenses paid per $1,000† | $ | 6.49 | $ | 10.30 | $ | 4.99 | $ | 4.89 |

| Ending value (after expenses) | $ | 1,018.50 | $ | 1,014.71 | $ | 1,020.00 | $ | 1,020.09 |

|

| † Expenses are equal to the fund’s annualized expense ratio of 1.29% for Class A, 2.05% for Class C, .99% for |

| Class I and .97% for ClassY, multiplied by the average account value over the period, multiplied by 182/365 (to |

| reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

May 31, 2015

| | | |

| Common Stocks—98.0% | Shares | | Value ($) |

| Automobiles & Components—1.4% | | | |

| American Axle & Manufacturing Holdings | 33,073 | a | 830,463 |

| Dorman Products | 27,358 | a,b | 1,276,525 |

| Drew Industries | 18,041 | | 1,107,717 |

| Gentex | 65,500 | | 1,125,290 |

| Gentherm | 63,483 | a | 3,254,139 |

| Remy International | 56,766 | | 1,254,529 |

| | | | 8,848,663 |

| Banks—2.9% | | | |

| Bank of the Ozarks | 115,890 | | 5,095,683 |

| BBCN Bancorp | 79,707 | | 1,147,781 |

| BofI Holding | 51,970 | a | 4,893,496 |

| Boston Private Financial Holdings | 93,086 | | 1,167,298 |

| Central Pacific Financial | 51,496 | | 1,206,036 |

| HomeStreet | 37,903 | a | 873,285 |

| LendingTree | 26,707 | a | 1,582,657 |

| Radian Group | 68,461 | b | 1,226,821 |

| Texas Capital Bancshares | 19,916 | a | 1,083,430 |

| | | | 18,276,487 |

| Capital Goods—6.5% | | | |

| AAON | 22,690 | | 537,072 |

| Acuity Brands | 15,323 | | 2,704,356 |

| Aerojet Rocketdyne Holdings | 38,439 | a | 797,609 |

| Apogee Enterprises | 48,439 | | 2,602,628 |

| Astronics | 29,290 | a | 2,047,078 |

| Barnes Group | 26,395 | | 1,062,663 |

| Beacon Roofing Supply | 57,178 | a | 1,793,102 |

| Builders FirstSource | 83,158 | a | 1,021,180 |

| CaesarStone Sdot-Yam | 16,570 | | 1,024,357 |

| CIRCOR International | 13,697 | | 730,324 |

| Comfort Systems USA | 40,820 | | 916,409 |

| Donaldson | 25,856 | b | 922,025 |

| Dycom Industries | 19,483 | a | 1,121,831 |

| Encore Wire | 30,029 | | 1,311,667 |

| Esterline Technologies | 18,673 | a | 2,019,858 |

| Graham | 24,404 | | 542,501 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Capital Goods (continued) | | | |

| H&E Equipment Services | 42,196 | | 921,139 |

| HEICO | 12,155 | b | 696,481 |

| Hexcel | 17,129 | | 843,432 |

| John Bean Technologies | 27,697 | | 1,040,576 |

| Kadant | 16,936 | | 797,686 |

| Levy Acquisition | 58,126 | a | 938,735 |

| Middleby | 15,929 | a | 1,731,482 |

| MYR Group | 27,143 | a | 803,433 |

| Patrick Industries | 10,481 | a,b | 626,764 |

| Ply Gem Holdings | 79,871 | a | 986,407 |

| Proto Labs | 27,930 | a,b | 1,932,198 |

| RBC Bearings | 16,274 | a | 1,140,482 |

| Rush Enterprises, Cl. A | 40,429 | a | 1,074,198 |

| Sparton | 38,746 | a | 1,027,156 |

| TASER International | 29,064 | a,b | 917,841 |

| The Greenbrier Companies | 23,470 | b | 1,413,598 |

| Trex | 12,822 | a | 648,793 |

| Tutor Perini | 42,070 | a | 881,787 |

| Woodward | 11,686 | | 595,285 |

| | | | 40,172,133 |

| Commercial & Professional Services—5.0% | | | |

| ABM Industries | 26,600 | | 862,904 |

| Acacia Research | 77,936 | b | 795,727 |

| Advisory Board | 83,991 | a | 4,264,223 |

| CEB | 49,768 | | 4,209,875 |

| Exponent | 6,523 | | 555,238 |

| Franklin Covey | 24,508 | a | 489,915 |

| FTI Consulting | 29,094 | a | 1,143,394 |

| Healthcare Services Group | 62,289 | | 1,881,751 |

| Huron Consulting Group | 43,182 | a | 2,776,603 |

| InnerWorkings | 41,180 | a | 261,905 |

| Insperity | 15,572 | | 819,399 |

| Interface | 43,332 | | 932,938 |

| MiX Telematics, ADR | 51,988 | a,b | 400,308 |

| Mobile Mini | 18,542 | | 735,747 |

| Paylocity Holding | 34,898 | a | 1,168,385 |

10

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Commercial & Professional Services (continued) | | | |

| Resources Connection | 78,502 | | 1,231,696 |

| Ritchie Brothers Auctioneers | 43,638 | b | 1,233,210 |

| Rollins | 56,866 | | 1,411,414 |

| Steelcase, Cl. A | 161,379 | | 2,775,719 |

| Team | 16,837 | a | 670,113 |

| Tetra Tech | 95,207 | | 2,490,615 |

| | | | 31,111,079 |

| Consumer Durables & Apparel—2.6% | | | |

| Arctic Cat | 30,023 | | 993,161 |

| Callaway Golf | 118,034 | | 1,114,241 |

| G-III Apparel Group | 82,968 | a | 4,717,561 |

| Libbey | 21,228 | | 838,506 |

| Nautilus | 29,456 | a | 622,111 |

| Performance Sports Group | 66,210 | a | 1,303,013 |

| Ryland Group | 8,315 | | 349,812 |

| Sequential Brands Group | 68,326 | a,b | 954,514 |

| Skechers USA, Cl. A | 35,741 | a | 3,783,900 |

| Steven Madden | 15,258 | a | 576,447 |

| Universal Electronics | 20,416 | a | 1,057,957 |

| | | | 16,311,223 |

| Consumer Services—7.0% | | | |

| 2U | 37,410 | a,b | 1,038,502 |

| Bravo Brio Restaurant Group | 117,875 | a | 1,579,525 |

| Bright Horizons Family Solutions | 21,178 | a | 1,178,979 |

| Buffalo Wild Wings | 13,919 | a,b | 2,125,014 |

| Century Casinos | 130,825 | a | 799,341 |

| Cheesecake Factory | 65,557 | | 3,380,775 |

| Chegg | 130,702 | a,b | 994,642 |

| Chuy’s Holdings | 24,745 | a | 643,123 |

| ClubCorp Holdings | 89,832 | | 2,041,882 |

| Dave & Buster’s Entertainment | 25,888 | | 818,837 |

| Diamond Resorts International | 72,342 | a,b | 2,249,836 |

| Fiesta Restaurant Group | 26,761 | a | 1,245,189 |

| Grand Canyon Education | 30,308 | a | 1,294,455 |

| Intrawest Resorts Holdings | 103,049 | a | 1,294,295 |

| Jack in the Box | 9,815 | | 852,040 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Consumer Services (continued) | | | |

| Kona Grill | 24,180 | a | 491,338 |

| La Quinta Holdings | 131,098 | a | 3,259,096 |

| LifeLock | 250,163 | a | 3,807,481 |

| Noodles & Company | 28,541 | a | 414,415 |

| Panera Bread, Cl. A | 3,235 | a,b | 588,770 |

| Popeyes Louisiana Kitchen | 34,506 | a | 1,918,879 |

| Potbelly | 78,857 | a,b | 1,107,941 |

| Red Robin Gourmet Burgers | 32,575 | a | 2,716,429 |

| Scientific Games, Cl. A | 79,980 | a,b | 1,217,296 |

| Six Flags Entertainment | 16,925 | | 826,956 |

| Sonic | 25,379 | | 764,923 |

| Texas Roadhouse | 37,995 | | 1,330,585 |

| Vail Resorts | 34,947 | | 3,625,401 |

| | | | 43,605,945 |

| Diversified Financials—2.4% | | | |

| Affiliated Managers Group | 2,644 | a | 591,357 |

| Financial Engines | 27,005 | b | 1,158,514 |

| GAMCO Investors, Cl. A | 10,927 | b | 753,854 |

| Hercules Technology Growth Capital | 63,906 | b | 819,914 |

| HFF, Cl. A | 52,104 | | 2,096,665 |

| Interactive Brokers Group, Cl. A | 52,376 | | 1,869,823 |

| MarketAxess Holdings | 20,570 | | 1,819,416 |

| On Deck Capital | 19,465 | b | 295,479 |

| PRA Group | 46,271 | a,b | 2,626,342 |

| Springleaf Holdings | 24,852 | a | 1,180,967 |

| WisdomTree Investments | 66,464 | b | 1,419,671 |

| | | | 14,632,002 |

| Energy—1.3% | | | |

| Bonanza Creek Energy | 15,601 | a | 324,189 |

| Callon Petroleum | 110,538 | a | 868,829 |

| Diamondback Energy | 21,009 | a | 1,634,710 |

| Dril-Quip | 8,071 | a | 610,006 |

| Gulfport Energy | 32,571 | a | 1,405,765 |

| Matador Resources | 41,090 | a | 1,131,619 |

| Patterson-UTI Energy | 28,625 | | 578,225 |

| PDC Energy | 15,344 | a | 915,116 |

12

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Energy (continued) | | | |

| Synergy Resources | 50,290 | a | 578,838 |

| | | | 8,047,297 |

| Exchange-Traded Funds—.2% | | | |

| iShares Russell 2000 ETF | 11,958 | b | 1,481,477 |

| Food & Staples Retailing—1.2% | | | |

| Diplomat Pharmacy | 68,893 | b | 2,662,714 |

| Fresh Market | 102,222 | a,b | 3,245,549 |

| United Natural Foods | 18,538 | a | 1,243,344 |

| | | | 7,151,607 |

| Food, Beverage & Tobacco—1.4% | | | |

| Cal-Maine Foods | 16,882 | | 957,041 |

| Farmer Brothers | 32,568 | a | 799,544 |

| Hain Celestial Group | 43,762 | a | 2,768,822 |

| J&J Snack Foods | 11,201 | | 1,207,468 |

| John B. Sanfilippo & Son | 16,249 | | 822,362 |

| Pinnacle Foods | 21,055 | | 887,468 |

| SunOpta | 113,323 | a,b | 1,149,095 |

| | | | 8,591,800 |

| Health Care Equipment & Services—9.8% | | | |

| AAC Holdings | 46,124 | b | 1,792,378 |

| Abaxis | 11,163 | | 592,867 |

| ABIOMED | 72,991 | a | 4,359,023 |

| Acadia Healthcare | 58,818 | a | 4,360,767 |

| AMN Healthcare Services | 35,732 | a | 950,114 |

| AmSurg | 14,879 | a | 1,001,952 |

| AngioDynamics | 88,736 | a | 1,424,213 |

| athenahealth | 8,524 | a,b | 993,898 |

| AtriCure | 49,818 | a | 1,142,825 |

| Avinger | 42,140 | b | 492,195 |

| Bio-Reference Laboratories | 121,415 | a | 4,033,406 |

| Cantel Medical | 29,417 | | 1,369,655 |

| Chemed | 8,845 | | 1,098,461 |

| DexCom | 24,714 | a | 1,772,488 |

| ExamWorks Group | 17,550 | a,b | 717,444 |

| Globus Medical, Cl. A | 22,420 | a | 581,575 |

| Health Net | 10,763 | a | 669,889 |

The Fund 13

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Health Care Equipment & Services (continued) | | | |

| HealthStream | 16,494 | a | 467,935 |

| Hill-Rom Holdings | 15,879 | | 818,721 |

| Insulet | 33,589 | a | 949,561 |

| Intersect ENT | 28,182 | | 669,041 |

| IPC Healthcare | 29,746 | a | 1,468,560 |

| K2M Group Holdings | 74,569 | | 1,949,233 |

| LDR Holding | 71,552 | a | 2,899,286 |

| Masimo | 27,517 | a | 965,847 |

| Medidata Solutions | 64,871 | a | 3,763,167 |

| MEDNAX | 15,320 | a | 1,090,478 |

| Merit Medical Systems | 42,168 | a | 866,974 |

| Molina Healthcare | 11,793 | a | 857,823 |

| Neogen | 43,151 | a | 2,016,877 |

| Nevro | 52,248 | | 2,655,766 |

| Novadaq Technologies | 31,200 | a,b | 312,312 |

| NuVasive | 56,668 | a | 2,864,568 |

| Quidel | 28,675 | a | 621,387 |

| Spectranetics | 55,937 | a | 1,388,916 |

| Team Health Holdings | 30,392 | a | 1,777,325 |

| Teleflex | 14,214 | | 1,829,910 |

| Trinity Biotech, ADR | 58,580 | | 1,013,434 |

| U.S. Physical Therapy | 17,573 | | 876,190 |

| Zeltiq Aesthetics | 60,869 | a,b | 1,671,463 |

| | | | 61,147,924 |

| Household & Personal Products—.3% | | | |

| Inter Parfums | 34,156 | | 1,141,835 |

| Medifast | 26,130 | a | 841,125 |

| | | | 1,982,960 |

| Insurance—.2% | | | |

| Stewart Information Services | 32,718 | | 1,229,215 |

| Materials—3.0% | | | |

| Balchem | 18,505 | | 1,044,792 |

| Berry Plastics Group | 53,824 | a | 1,801,489 |

| Chemtura | 27,918 | a | 775,004 |

| Cytec Industries | 29,868 | | 1,806,715 |

| Eagle Materials | 10,536 | | 879,545 |

14

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Materials (continued) | | | |

| Globe Specialty Metals | 51,866 | | 1,002,570 |

| Graphic Packaging Holding | 57,943 | | 825,108 |

| Headwaters | 48,007 | a | 911,173 |

| Intrepid Potash | 77,042 | a | 895,228 |

| Kaiser Aluminum | 13,519 | | 1,096,796 |

| LSB Industries | 49,516 | a | 2,105,915 |

| PolyOne | 14,184 | | 551,616 |

| Scotts Miracle-Gro, Cl. A | 11,840 | | 725,318 |

| Senomyx | 227,105 | a,b | 1,287,685 |

| Sensient Technologies | 29,624 | | 2,005,545 |

| US Concrete | 28,816 | a | 1,088,957 |

| | | | 18,803,456 |

| Media—1.6% | | | |

| Cinemark Holdings | 14,415 | | 584,240 |

| Gray Television | 81,542 | a | 1,301,410 |

| Journal Media Group | 1 | | 6 |

| MDC Partners, Cl. A | 203,725 | | 4,318,970 |

| New Media Investment Group | 30,221 | | 665,466 |

| Rentrak | 23,732 | a,b | 1,611,640 |

| Scholastic | 35,249 | | 1,566,818 |

| | | | 10,048,550 |

| Pharmaceuticals, Biotech & | | | |

| Life Sciences—12.9% | | | |

| ACADIA Pharmaceuticals | 13,128 | a,b | 540,874 |

| Aegerion Pharmaceuticals | 25,612 | a,b | 498,922 |

| Agenus | 153,057 | a | 1,252,006 |

| Agios Phamaceuticals | 4,445 | a,b | 542,379 |

| Albany Molecular Research | 62,355 | a,b | 1,256,453 |

| Alder Biopharmaceuticals | 12,658 | | 538,218 |

| Alnylam Pharmaceuticals | 4,992 | a | 654,401 |

| AMAG Pharmaceuticals | 13,856 | a,b | 964,100 |

| Amicus Therapeutics | 87,045 | a | 1,071,524 |

| Anacor Pharmaceuticals | 9,135 | a | 650,595 |

| Atara Biotherapeutics | 6,545 | b | 277,246 |

| Avalanche Biotechnologies | 7,437 | | 277,251 |

| Bio-Rad Laboratories, Cl. A | 6,272 | a | 905,489 |

The Fund 15

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Pharmaceuticals, Biotech & | | | |

| Life Sciences (continued) | | | |

| Bio-Techne | 21,985 | | 2,225,981 |

| BioSpecifics Technologies | 13,245 | a | 630,992 |

| Bluebird Bio | 12,361 | a | 2,401,124 |

| Cambrex | 21,344 | a | 854,187 |

| Celldex Therapeutics | 6,435 | a,b | 185,778 |

| Cempra Holdings | 18,862 | a | 692,424 |

| Cepheid | 71,233 | a | 3,929,925 |

| Chimerix | 20,720 | a | 867,132 |

| Clovis Oncology | 34,422 | a,b | 3,181,970 |

| Dyax | 61,210 | a | 1,612,272 |

| Dynavax Technologies | 72,996 | a,b | 1,662,119 |

| Eagle Pharmaceuticals | 25,954 | a | 1,885,039 |

| Esperion Therapeutics | 27,048 | a,b | 2,907,931 |

| Exact Sciences | 142,277 | a,b | 3,842,902 |

| Flex Pharma | 13,879 | b | 247,740 |

| Fluidigm | 33,976 | a,b | 803,193 |

| Halozyme Therapeutics | 55,272 | a,b | 958,969 |

| Horizon Pharma | 81,237 | a | 2,634,516 |

| IGI Laboratories | 77,995 | a,b | 506,967 |

| INC Research Holdings, Cl. A | 20,575 | | 711,689 |

| Insmed | 10,972 | a | 240,726 |

| Keryx Biopharmaceuticals | 171,479 | a,b | 1,783,382 |

| KYTHERA Biopharmaceuticals | 34,011 | a,b | 1,713,134 |

| Ligand Pharmaceuticals | 48,119 | a,b | 4,239,766 |

| Loxo Oncology | 18,689 | | 230,622 |

| Merrimack Pharmaceuticals | 69,674 | a,b | 822,153 |

| Momenta Pharmaceuticals | 43,760 | a | 868,636 |

| NanoString Technologies | 49,266 | a | 691,695 |

| Nektar Therapeutics | 177,708 | a,b | 2,043,642 |

| NeoGenomics | 49,828 | a | 265,583 |

| Neothetics | 3,244 | b | 19,464 |

| Novavax | 108,088 | a | 972,792 |

| Orexigen Therapeutics | 122,393 | a,b | 599,726 |

| Pacira Pharmaceuticals | 22,039 | a,b | 1,723,670 |

| PAREXEL International | 20,937 | a | 1,391,682 |

16

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Pharmaceuticals, Biotech & | | | |

| Life Sciences (continued) | | | |

| Pfenex | 21,328 | | 404,805 |

| Portola Pharmaceuticals | 14,271 | a | 596,813 |

| Progenics Pharmaceuticals | 127,085 | a | 715,489 |

| Prothena PLC | 21,878 | a | 862,868 |

| PTC Therapeutics | 27,501 | a | 1,597,533 |

| Puma Biotechnology | 3,102 | a,b | 606,286 |

| Radius Health | 11,277 | a,b | 543,777 |

| Receptos | 18,467 | a | 3,045,023 |

| Relypsa | 23,211 | a | 853,933 |

| Repligen | 52,782 | a | 2,151,395 |

| SAGE Therapeutics | 25,205 | b | 1,887,099 |

| Spark Therapeutics | 3,774 | b | 277,917 |

| TESARO | 10,356 | a,b | 608,519 |

| Tetraphase Pharmaceuticals | 39,382 | a | 1,688,700 |

| TG Therapeutics | 53,328 | a,b | 839,383 |

| TherapeuticsMD | 72,495 | a | 513,265 |

| Ultragenyx Pharmaceutical | 12,260 | a | 1,066,620 |

| UNIQURE | 29,661 | a,b | 852,457 |

| ZIOPHARM Oncology | 75,025 | a,b | 711,237 |

| ZS Pharma | 13,511 | | 790,394 |

| | | | 80,392,494 |

| Real Estate—1.6% | | | |

| Alexander & Baldwin | 26,048 | | 1,069,791 |

| CyrusOne | 30,254 | c | 976,297 |

| Howard Hughes | 13,606 | a | 2,004,028 |

| Marcus & Millichap | 60,523 | a | 2,839,134 |

| RE/MAX Holdings, Cl. A | 46,079 | | 1,541,343 |

| Ryman Hospitality Properties | 13,707 | | 755,393 |

| Summit Hotel Properties | 57,124 | c | 763,177 |

| | | | 9,949,163 |

| Retailing—5.7% | | | |

| Ascena Retail Group | 56,354 | a | 832,912 |

| Boot Barn Holdings | 36,108 | | 883,202 |

| Burlington Stores | 43,950 | a | 2,319,241 |

| Core-Mark Holding Company | 48,683 | | 2,614,764 |

The Fund 17

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Retailing (continued) | | | |

| CST Brands | 27,776 | | 1,104,651 |

| DSW, Cl. A | 22,833 | | 791,163 |

| Express | 47,623 | a | 840,070 |

| Five Below | 22,675 | a,b | 753,944 |

| Hibbett Sports | 13,332 | a | 620,605 |

| Kirkland’s | 32,200 | a | 845,894 |

| LKQ | 17,395 | a | 496,975 |

| MarineMax | 87,174 | a | 2,085,202 |

| Monro Muffler Brake | 48,789 | | 2,879,038 |

| Pier 1 Imports | 73,487 | b | 934,020 |

| Pool | 56,976 | | 3,776,369 |

| Restoration Hardware Holdings | 25,882 | a | 2,354,227 |

| Select Comfort | 57,699 | a | 1,797,323 |

| Shutterfly | 100,158 | a | 4,657,347 |

| The Container Store Group | 52,125 | a,b | 957,015 |

| Tile Shop Holdings | 94,352 | a,b | 1,176,570 |

| TravelCenters of America | 40,114 | a | 631,394 |

| Vitamin Shoppe | 13,439 | a | 533,528 |

| Wayfair, Cl. A | 42,409 | b | 1,267,605 |

| | | | 35,153,059 |

| Semiconductors & Semiconductor | | | |

| Equipment—4.9% | | | |

| Advanced Energy Industries | 31,061 | a | 885,860 |

| Applied Optoelectronics | 47,472 | a,b | 847,850 |

| Cabot Microelectronics | 19,095 | a | 881,807 |

| Canadian Solar | 33,050 | a,b | 1,079,413 |

| Cavium | 72,661 | a | 5,113,155 |

| CEVA | 91,835 | a | 1,886,291 |

| Cirrus Logic | 28,610 | a | 1,080,027 |

| Entegris | 62,324 | a | 868,173 |

| FormFactor | 216,001 | a | 2,010,970 |

| Inphi | 52,625 | a | 1,259,842 |

| Integrated Device Technology | 188,984 | a | 4,470,416 |

| MaxLinear, Cl. A | 86,027 | a | 861,991 |

| Mellanox Technologies | 26,865 | a | 1,351,847 |

| ON Semiconductor | 80,562 | a | 1,068,252 |

18

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Semiconductors & Semiconductor | | | |

| Equipment (continued) | | | |

| Power Integrations | 25,929 | | 1,316,156 |

| Rudolph Technologies | 62,516 | a | 796,454 |

| Sigma Designs | 97,877 | a | 838,806 |

| Silicon Laboratories | 16,187 | a | 897,407 |

| SolarEdge Technologies | 20,947 | b | 784,256 |

| SunEdison | 34,881 | a,b | 1,045,384 |

| Tower Semiconductor | 81,000 | a,b | 1,249,830 |

| | | | 30,594,187 |

| Software & Services—19.5% | | | |

| ACI Worldwide | 115,919 | a | 2,760,031 |

| Actua | 195,871 | a | 2,489,520 |

| Acxiom | 61,711 | a | 1,022,551 |

| Aspen Technology | 33,360 | a | 1,427,808 |

| Attunity | 91,511 | a | 1,264,682 |

| Barracuda Networks | 39,656 | a | 1,560,067 |

| Benefitfocus | 34,397 | a,b | 1,234,164 |

| Blackbaud | 21,990 | | 1,127,207 |

| Bottomline Technologies | 25,871 | a | 681,183 |

| BroadSoft | 49,182 | a | 1,795,634 |

| Callidus Software | 141,503 | a | 2,026,322 |

| Cass Information Systems | 11,864 | | 591,539 |

| ChannelAdvisor | 17,453 | a | 195,648 |

| Cimpress | 36,916 | a,b | 3,038,925 |

| comScore | 53,582 | a | 3,031,670 |

| Constant Contact | 125,005 | a | 3,407,636 |

| CoStar Group | 7,477 | a | 1,562,020 |

| Criteo, ADR | 110,445 | a | 5,304,673 |

| Cvent | 25,448 | a,b | 670,809 |

| Cyber-Ark Software | 47,782 | b | 2,971,563 |

| Dealertrack Technologies | 57,541 | a | 2,399,460 |

| Demandware | 42,309 | a | 2,635,005 |

| Descartes Systems Group | 120,083 | a | 1,830,065 |

| Ebix | 20,978 | b | 746,817 |

| Ellie Mae | 16,117 | a | 1,018,917 |

| Envestnet | 65,600 | a | 2,873,936 |

The Fund 19

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Software & Services (continued) | | | |

| FactSet Research Systems | 5,170 | | 853,929 |

| Fair Isaac | 17,018 | | 1,492,819 |

| Gigamon | 34,896 | a | 1,073,401 |

| GrubHub | 38,102 | a | 1,536,273 |

| GTT Communications | 71,835 | a | 1,582,525 |

| Guidewire Software | 11,743 | a | 568,948 |

| Hortonworks | 79,897 | b | 2,098,894 |

| HubSpot | 21,366 | | 1,085,393 |

| Imperva | 38,783 | a | 2,358,394 |

| Infoblox | 33,628 | a | 873,992 |

| Interactive Intelligence Group | 51,349 | a | 2,219,817 |

| Intralinks Holdings | 124,394 | a | 1,322,308 |

| j2 Global | 53,209 | | 3,533,609 |

| LogMeIn | 34,887 | a | 2,214,278 |

| Luxoft Holdings | 20,382 | a | 1,091,048 |

| Manhattan Associates | 20,817 | a | 1,141,812 |

| Marketo | 27,649 | a,b | 824,770 |

| MAXIMUS | 35,597 | | 2,326,976 |

| Monotype Imaging Holdings | 18,680 | | 484,559 |

| NetSuite | 9,416 | a | 879,643 |

| NeuStar, Cl. A | 50,610 | a,b | 1,382,665 |

| Paycom Software | 90,563 | a | 3,147,970 |

| Pegasystems | 35,193 | | 769,319 |

| Points International | 44,222 | a,b | 634,143 |

| Proofpoint | 34,125 | a,b | 2,017,811 |

| PROS Holdings | 16,843 | a | 324,228 |

| PTC | 20,427 | a | 843,022 |

| Q2 Holdings | 35,500 | a | 841,705 |

| QLIK Technologies | 24,060 | a | 870,250 |

| Qualys | 41,423 | a | 1,686,745 |

| Reis | 45,092 | | 979,398 |

| SciQuest | 42,076 | a | 642,080 |

| SeaChange International | 156,041 | a | 1,054,837 |

20

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Software & Services (continued) | | | |

| SPS Commerce | 42,741 | a | 2,779,020 |

| Stamps.com | 64,153 | a | 4,316,855 |

| Tableau Software, Cl. A | 11,029 | a | 1,248,593 |

| Textura | 41,917 | a,b | 1,220,204 |

| Tyler Technologies | 13,667 | a | 1,660,267 |

| Ultimate Software Group | 33,750 | a | 5,460,412 |

| Verint Systems | 47,059 | a | 3,043,306 |

| WEX | 19,414 | a | 2,201,353 |

| Wix.com | 47,377 | a,b | 1,180,161 |

| WNS Holdings, ADR | 77,500 | a | 2,045,225 |

| Xoom | 42,733 | a,b | 803,808 |

| Zix | 138,331 | a | 634,939 |

| | | | 121,019,556 |

| Technology Hardware | | | |

| & Equipment—2.9% | | | |

| Aerohive Networks | 64,284 | a | 464,130 |

| Belden | 16,295 | | 1,375,624 |

| Ciena | 37,513 | a | 904,814 |

| Cognex | 22,636 | | 1,142,439 |

| CommScope Holding | 30,122 | a | 938,903 |

| Digi International | 41,790 | a | 416,228 |

| Electronics For Imaging | 27,816 | a | 1,202,486 |

| Immersion | 75,750 | a | 915,817 |

| Infinera | 94,329 | a | 1,946,951 |

| IPG Photonics | 20,879 | a,b | 1,980,164 |

| Ituran Location and Control | 17,255 | | 401,179 |

| National Instruments | 44,187 | | 1,321,633 |

| QLogic | 56,291 | a | 873,636 |

| RealD | 63,075 | a | 796,006 |

| Stratasys | 7,551 | a,b | 268,514 |

| Super Micro Computer | 46,678 | a | 1,561,846 |

| Universal Display | 24,919 | a,b | 1,338,399 |

| | | | 17,848,769 |

The Fund 21

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Telecommunication Services—.6% | | | |

| Boingo Wireless | 201,858 | a,b | 1,814,704 |

| RingCentral, Cl. A | 60,397 | a | 1,032,185 |

| Vonage Holdings | 155,665 | a | 725,399 |

| | | | 3,572,288 |

| Transportation—2.7% | | | |

| Allegiant Travel | 7,359 | | 1,158,822 |

| Controladora Vuela Compania de | | | |

| Aviacion, ADR | 99,499 | a | 1,187,023 |

| Covenant Transport, Cl. A | 23,895 | a | 738,594 |

| Echo Global Logistics | 149,898 | a | 4,823,718 |

| Forward Air | 10,295 | | 534,002 |

| Genesee & Wyoming, Cl. A | 9,852 | a | 811,214 |

| Hub Group, Cl. A | 10,255 | a | 435,017 |

| JetBlue Airways | 55,780 | a,b | 1,124,525 |

| Marten Transport | 82,973 | | 1,881,827 |

| Old Dominion Freight Line | 12,383 | a | 842,168 |

| XPO Logistics | 70,447 | a,b | 3,463,174 |

| | | | 17,000,084 |

| Utilities—.4% | | | |

| American States Water | 36,607 | | 1,406,807 |

| Vivint Solar | 64,932 | b | 935,021 |

| | | | 2,341,828 |

| Total Common Stocks | | | |

| (cost $499,599,750) | | | 609,313,246 |

22

| | | | |

| Investment of Cash Collateral | | | | |

| for Securities Loaned—10.0% | Shares | | Value ($) | |

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash | | | | |

| Advantage Fund | | | | |

| (cost $61,998,999) | 61,998,999 | d | 61,998,999 | |

| |

| Total Investments (cost $561,598,749) | 108.0 | % | 671,312,245 | |

| Liabilities, Less Cash and Receivables | (8.0 | %) | (49,674,222 | ) |

| Net Assets | 100.0 | % | 621,638,023 | |

ADR—American Depository Receipts

ETF—Exchange-Traded Fund

|

| a Non-income producing security. |

| b Security, or portion thereof, on loan.At May 31, 2015, the value of the fund’s securities on loan was $88,718,246 |

| and the value of the collateral held by the fund was $92,353,350, consisting of cash collateral of $61,998,999 and |

| U.S. Government & Agency securities valued at $30,354,351. |

| c Investment in real estate investment trust. |

| d Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| Value (%) | | Value (%) |

| Software & Services | 19.5 | Consumer Durables & Apparel | 2.6 |

| Pharmaceuticals, Biotech & Life Sciences | 12.9 | Diversified Financials | 2.4 |

| Money Market Investment | 10.0 | Media | 1.6 |

| Health Care Equipment & Services | 9.8 | Real Estate | 1.6 |

| Consumer Services | 7.0 | Automobiles & Components | 1.4 |

| Capital Goods | 6.5 | Food, Beverage & Tobacco | 1.4 |

| Retailing | 5.7 | Energy | 1.3 |

| Commercial & Professional Services | 5.0 | Food & Staples Retailing | 1.2 |

| Semiconductors & | | Telecommunication Services | .6 |

| Semiconductor Equipment | 4.9 | Utilities | .4 |

| Materials | 3.0 | Household & Personal Products | .3 |

| Banks | 2.9 | Exchange-Traded Funds | .2 |

| Technology Hardware & Equipment | 2.9 | Insurance | .2 |

| Transportation | 2.7 | | 108.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

The Fund 23

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2015

| | | |

| | Cost | Value | |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments (including | | | |

| securities on loan, valued at $88,718,246)—Note 1(b): | | | |

| Unaffiliated issuers | 499,599,750 | 609,313,246 | |

| Affiliated issuers | 61,998,999 | 61,998,999 | |

| Cash | | 14,097,966 | |

| Receivable for investment securities sold | | 11,589,368 | |

| Receivable for shares of Common Stock subscribed | | 455,027 | |

| Dividends and securities lending income receivable | | 285,695 | |

| Prepaid expenses | | 22,323 | |

| | | 697,762,624 | |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 523,348 | |

| Liability for securities on loan—Note 1(b) | | 61,998,999 | |

| Payable for investment securities purchased | | 13,228,911 | |

| Payable for shares of Common Stock redeemed | | 278,246 | |

| Accrued expenses | | 95,097 | |

| | | 76,124,601 | |

| Net Assets ($) | | 621,638,023 | |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | 488,394,564 | |

| Accumulated investment (loss)—net | | (790,734 | ) |

| Accumulated net realized gain (loss) on investments | | 24,320,697 | |

| Accumulated net unrealized appreciation | | | |

| (depreciation) on investments | | 109,713,496 | |

| Net Assets ($) | | 621,638,023 | |

| | | | |

| Net Asset Value Per Share | | | | |

| | Class A | Class C | Class I | Class Y |

| Net Assets ($) | 4,833,977 | 267,686 | 23,881,730 | 592,654,630 |

| Shares Outstanding | 194,586 | 11,222 | 945,754 | 23,489,106 |

| Net Asset Value Per Share ($) | 24.84 | 23.85 | 25.25 | 25.23 |

| |

| See notes to financial statements. | | | | |

24

STATEMENT OF OPERATIONS

Year Ended May 31, 2015

| | |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $33,154 foreign taxes withheld at source) | 2,292,910 | |

| Income from securities lending—Note 1(b) | 826,546 | |

| Total Income | 3,119,456 | |

| Expenses: | | |

| Management fee—Note 3(a) | 4,755,856 | |

| Custodian fees—Note 3(c) | 118,013 | |

| Registration fees | 71,605 | |

| Professional fees | 63,542 | |

| Directors’ fees and expenses—Note 3(d) | 42,181 | |

| Shareholder servicing costs—Note 3(c) | 22,765 | |

| Prospectus and shareholders’ reports | 18,639 | |

| Loan commitment fees—Note 2 | 5,888 | |

| Distribution fees—Note 3(b) | 2,495 | |

| Miscellaneous | 46,558 | |

| Total Expenses | 5,147,542 | |

| Less—reduction in expenses due to undertaking—Note 3(a) | (7,357 | ) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (8 | ) |

| Net Expenses | 5,140,177 | |

| Investment (Loss)—Net | (2,020,721 | ) |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | 49,113,495 | |

| Net unrealized appreciation (depreciation) on investments | 27,576,978 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 76,690,473 | |

| Net Increase in Net Assets Resulting from Operations | 74,669,752 | |

| See notes to financial statements. | | |

The Fund 25

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | | | Year Ended May 31, | |

| | 2015 | | 2014 | a |

| Operations ($): | | | | |

| Investment (loss)—net | (2,020,721 | ) | (2,048,531 | ) |

| Net realized gain (loss) on investments | 49,113,495 | | 40,328,441 | |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 27,576,978 | | 4,034,369 | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 74,669,752 | | 42,314,279 | |

| Dividends to Shareholders from ($): | | | | |

| Net realized gain on investments: | | | | |

| Class A | (255,540 | ) | (117,849 | ) |

| Class C | (24,962 | ) | (11,167 | ) |

| Class I | (1,796,475 | ) | (22,586,266 | ) |

| Class Y | (39,214,656 | ) | (57 | ) |

| Total Dividends | (41,291,633 | ) | (22,715,339 | ) |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A | 2,328,567 | | 5,361,188 | |

| Class C | 49,219 | | 457,590 | |

| Class I | 18,738,044 | | 119,283,672 | |

| Class Y | 620,463,504 | | 982,102 | |

| Dividends reinvested: | | | | |

| Class A | 252,253 | | 115,639 | |

| Class C | 24,962 | | 10,992 | |

| Class I | 1,690,443 | | 11,988,560 | |

| Class Y | 20,039,114 | | — | |

| Cost of shares redeemed: | | | | |

| Class A | (2,806,296 | ) | (1,074,701 | ) |

| Class C | (254,251 | ) | (42,049 | ) |

| Class I | (474,966,106 | ) | (60,071,260 | ) |

| Class Y | (57,309,024 | ) | (4,825 | ) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | 128,250,429 | | 77,006,908 | |

| Total Increase (Decrease) in Net Assets | 161,628,548 | | 96,605,848 | |

| Net Assets ($): | | | | |

| Beginning of Period | 460,009,475 | | 363,403,627 | |

| End of Period | 621,638,023 | | 460,009,475 | |

| Undistributed investment (loss)—net | (790,734 | ) | — | |

26

| | | | |

| | | | Year Ended May 31, | |

| | 2015 | | 2014 | a |

| Capital Share Transactions: | | | | |

| Class A | | | | |

| Shares sold | 100,109 | | 209,944 | |

| Shares issued for dividends reinvested | 10,753 | | 4,614 | |

| Shares redeemed | (117,675 | ) | (43,311 | ) |

| Net Increase (Decrease) in Shares Outstanding | (6,813 | ) | 171,247 | |

| Class C | | | | |

| Shares sold | 2,134 | | 18,615 | |

| Shares issued for dividends reinvested | 1,104 | | 450 | |

| Shares redeemed | (10,818 | ) | (1,720 | ) |

| Net Increase (Decrease) in Shares Outstanding | (7,580 | ) | 17,345 | |

| Class Ib | | | | |

| Shares sold | 760,915 | | 4,719,753 | |

| Shares issued for dividends reinvested | 70,998 | | 473,295 | |

| Shares redeemed | (18,932,546 | ) | (2,372,287 | ) |

| Net Increase (Decrease) in Shares Outstanding | (18,100,633 | ) | 2,820,761 | |

| Class Yb | | | | |

| Shares sold | 24,964,010 | | 41,048 | |

| Shares issued for dividends reinvested | 842,334 | | — | |

| Shares redeemed | (2,358,089 | ) | (197 | ) |

| Net Increase (Decrease) in Shares Outstanding | 23,448,255 | | 40,851 | |

|

| a Effective July 1, 2013, the fund commenced offering ClassY shares. |

| b During the period ended May 31, 2015, 17,848,095 Class I shares representing $448,344,147 were exchanged |

| for 17,862,317 ClassY shares. |

See notes to financial statements.

The Fund 27

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | Year Ended May 31, | | | |

| Class A Shares | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 23.55 | | 22.16 | | 17.13 | | 18.36 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—netb | (.17 | ) | (.19 | ) | (.11 | ) | (.13 | ) | (.15 | ) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 3.42 | | 2.90 | | 5.14 | | (1.10 | ) | 6.06 | |

| Total from Investment Operations | 3.25 | | 2.71 | | 5.03 | | (1.23 | ) | 5.91 | |

| Distributions: | | | | | | | | | | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | (1.96 | ) | (1.32 | ) | — | | — | | (.05 | ) |

| Net asset value, end of period | 24.84 | | 23.55 | | 22.16 | | 17.13 | | 18.36 | |

| Total Return (%)c | 14.30 | | 11.87 | | 29.36 | | (6.70 | ) | 47.31 | d |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.32 | | 1.38 | | 1.34 | | 1.43 | | 2.95 | e |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.30 | | 1.30 | | 1.33 | | 1.34 | | 1.40 | e |

| Ratio of net investment (loss) | | | | | | | | | | |

| to average net assets | (.71 | ) | (.75 | ) | (.56 | ) | (.78 | ) | (1.03 | )e |

| Portfolio Turnover Rate | 148.55 | | 121.33 | | 111.48 | | 107.62 | | 70.41 | d |

| Net Assets, end of period ($ x 1,000) | 4,834 | | 4,742 | | 668 | | 430 | | 758 | |

| |

| a | From July 1, 2010 (commencement of operations) to May 31, 2011. |

| b | Based on average shares outstanding. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

See notes to financial statements.

28

| | | | | | | | | | |

| | | | Year Ended May 31, | | | |

| Class C Shares | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 22.85 | | 21.70 | | 16.89 | | 18.22 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—netb | (.35 | ) | (.36 | ) | (.23 | ) | (.26 | ) | (.26 | ) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 3.31 | | 2.83 | | 5.04 | | (1.07 | ) | 6.03 | |

| Total from Investment Operations | 2.96 | | 2.47 | | 4.81 | | (1.33 | ) | 5.77 | |

| Distributions: | | | | | | | | | | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | (1.96 | ) | (1.32 | ) | — | | — | | (.05 | ) |

| Net asset value, end of period | 23.85 | | 22.85 | | 21.70 | | 16.89 | | 18.22 | |

| Total Return (%)c | 13.49 | | 10.99 | | 28.48 | | (7.30 | ) | 46.19 | d |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 2.34 | | 2.34 | | 2.25 | | 2.16 | | 3.73 | e |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 2.05 | | 2.03 | | 2.02 | | 2.07 | | 2.15 | e |

| Ratio of net investment (loss) | | | | | | | | | | |

| to average net assets | (1.48 | ) | (1.48 | ) | (1.28 | ) | (1.56 | ) | (1.77 | )e |

| Portfolio Turnover Rate | 148.55 | | 121.33 | | 111.48 | | 107.62 | | 70.41 | d |

| Net Assets, end of period ($ x 1,000) | 268 | | 430 | | 32 | | 47 | | 214 | |

| |

| a | From July 1, 2010 (commencement of operations) to May 31, 2011. |

| b | Based on average shares outstanding. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

See notes to financial statements.

The Fund 29

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | Year Ended May 31, | | | |

| Class I Shares | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | a |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 23.83 | | 22.35 | | 17.22 | | 18.40 | | 12.50 | |

| Investment Operations: | | | | | | | | | | |

| Investment (loss)—netb | (.10 | ) | (.12 | ) | (.05 | ) | (.06 | ) | (.13 | ) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 3.48 | | 2.92 | | 5.18 | | (1.12 | ) | 6.08 | |

| Total from Investment Operations | 3.38 | | 2.80 | | 5.13 | | (1.18 | ) | 5.95 | |

| Distributions: | | | | | | | | | | |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | (1.96 | ) | (1.32 | ) | — | | — | | (.05 | ) |

| Net asset value, end of period | 25.25 | | 23.83 | | 22.35 | | 17.22 | | 18.40 | |

| Total Return (%) | 14.69 | | 12.18 | | 29.79 | | (6.41 | ) | 47.63 | c |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | .97 | | .98 | | .99 | | 1.03 | | 1.77 | d |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | .97 | | .98 | | .99 | | 1.02 | | 1.15 | d |

| Ratio of net investment (loss) | | | | | | | | | | |

| to average net assets | (.53 | ) | (.45 | ) | (.25 | ) | (.34 | ) | (.84 | )d |

| Portfolio Turnover Rate | 148.55 | | 121.33 | | 111.48 | | 107.62 | | 70.41 | c |

| Net Assets, end of period ($ x 1,000) | 23,882 | | 453,865 | | 362,704 | | 189,191 | | 111,480 | |

| |

| a | From July 1, 2010 (commencement of operations) to May 31, 2011. |

| b | Based on average shares outstanding. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

30

| | | | |

| | | | Year Ended May 31, | |

| Class Y Shares | 2015 | | 2014 | a |

| Per Share Data ($): | | | | |

| Net asset value, beginning of period | 23.81 | | 23.06 | |

| Investment Operations: | | | | |

| Investment (loss)—netb | (.09 | ) | (.02 | ) |

| Net realized and unrealized | | | | |

| gain (loss) on investments | 3.47 | | 2.09 | |

| Total from Investment Operations | 3.38 | | 2.07 | |

| Distributions: | | | | |

| Dividends from net realized gain on investments | (1.96 | ) | (1.32 | ) |

| Net asset value, end of period | 25.23 | | 23.81 | |

| Total Return (%) | 14.66 | | 8.68 | c |

| Ratios/Supplemental Data (%): | | | | |

| Ratio of total expenses to average net assets | .97 | | 1.16 | d |

| Ratio of net expenses to average net assets | .97 | | 1.04 | d |

| Ratio of net investment (loss) to average net assets | (.36 | ) | (.08 | )d |

| Portfolio Turnover Rate | 148.55 | | 121.33 | |

| Net Assets, end of period ($ x 1,000) | 592,655 | | 973 | |

| |

| a | From July 1, 2013 (commencement of initial offering) to May 31, 2014. |

| b | Based on average shares outstanding. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

The Fund 31

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Select Managers Small Cap Growth Fund (the “fund”) is a separate non-diversified series of Strategic Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering ten series, including the fund. The fund’s investment objective is to seek capital appreciation.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. EACM Advisors LLC (“EACM”), a wholly-owned subsidiary of BNY Mellon and an affiliate of Dreyfus, serves as the fund’s portfolio allocation manager. Riverbridge Partners, LLC (“Riverbridge”), Geneva Capital Management Ltd. (“Geneva”), Cupps Capital Management, LLC (“CCM”), Nicholas Investment Partners, L.P. (“Nicholas”), EAM Investors, LLC (“EAM”), Granite Investment Partners, LLC (“Granite”) and Rice Hall James & Associates (“Rice Hall”), serve as the fund’s sub-investment advisers, each managing an allocated portion of the fund’s portfolio.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue 325 million shares of $.001 par value Common Stock.The fund currently offers four classes of shares: Class A (75 million shares authorized), Class C (75 million shares authorized), Class I (75 million shares authorized) and Class Y (100 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I and Class Y shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency

32

costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered

34

investment companies that are not traded on an exchange are valued at their net asset value.All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Director’s (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

The Fund 35

NOTES TO FINANCIAL STATEMENTS (continued)

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of May 31, 2015 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Domestic | | | | |

| Common Stocks† | 575,514,377 | — | — | 575,514,377 |

| Equity Securities— | | | | |

| Foreign | | | | |

| Common Stocks† | 32,317,392 | — | — | 32,317,392 |

| Exchange-Traded | | | | |

| Funds | 1,481,477 | — | — | 1,481,477 |

| Mutual Funds | 61,998,999 | — | — | 61,998,999 |

† See Statement of Investments for additional detailed categorizations.

At May 31, 2015, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral

36

is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities.The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. During the period ended May 31, 2015, The Bank of New York Mellon earned $210,570 from lending portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended May 31, 2015 were as follows:

| | | | | |

| Affiliated | | | | | |

| Investment | Value | | | Value | Net |

| Company | 5/31/2014($) | Purchases ($) | Sales ($) | 5/31/2015 ($) | Assets (%) |

| Dreyfus | | | | | |

| Institutional | | | | | |

| Cash | | | | | |

| Advantage | | | | | |

| Fund | 27,274,600 | 315,163,188 | 280,438,789 | 61,998,999 | 10.0 |

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

The Fund 37

NOTES TO FINANCIAL STATEMENTS (continued)

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended May 31, 2015, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended May 31, 2015, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended May 31, 2015 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At May 31, 2015, the components of accumulated earnings on a tax basis were as follows: undistributed capital gains $30,093,402 and unrealized appreciation $103,940,791. In addition, the fund deferred for tax purposes late year ordinary losses of $790,734 to the first day of the following fiscal year.

The tax character of distributions paid to shareholders during the fiscal periods ended May 31, 2015 and May 31, 2014 were as follows: ordinary income $2,410,710 and $8,801,203, and long-term capital gains $38,880,923 and $13,914,136, respectively.

During the period ended May 31, 2015, as a result of permanent book to tax differences, primarily due to the tax treatment for net operating losses, the fund increased accumulated undistributed investment income-net by $1,229,987 and decreased paid-in capital by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $430 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York

38

Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 8, 2014, the unsecured credit facility with Citibank , N.A. was $265 million.In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended May 31, 2015, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at the annual rate of .90% of the value of the fund’s average daily net assets and is payable monthly. Dreyfus had contractually agreed, from June 1, 2014 through November 30, 2014, to waive receipt of its fees and/or assume the direct expenses of Class Y shares, so that the expenses of Class Y shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) did not exceed 1.05% of the value of the fund’s average daily net assets. Dreyfus has also contractually agreed, from June 1, 2014 through October 1, 2015, to waive receipt of its fees and/or assume the direct expenses of Class A, Class C and Class I shares and from December 1, 2014 through October 1, 2015, to waive receipt of its fees and/or assume the direct expenses of Class Y shares, so that the expenses of none of the classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees and certain expenses as described above) exceed 1.05%, 1.05%, 1.05% and .98% of the value of the respective class’ average daily net assets.The reduction in expenses, pursuant to the undertaking, amounted to $7,357 during the period ended May 31, 2015.

Pursuant to a Portfolio Allocation Agreement between Dreyfus and EACM, Dreyfus pays EACM a monthly fee at an annual percentage of the value of the fund’s average daily net assets.

The Fund 39

NOTES TO FINANCIAL STATEMENTS (continued)

Pursuant to separate sub-investment advisory agreements between Dreyfus and Riverbridge, Geneva, CCM, Nicholas, EAM, Granite and Rice Hall, each serves as the fund’s sub-investment adviser responsible for the day-to-day management of a portion of the fund’s portfolio. Dreyfus pays each sub-investment advisor a monthly fee at an annual percentage of the value of the fund’s average daily net assets. Dreyfus has obtained an exemptive order from the SEC (the “Order”), upon which the fund may rely, to use a manager of managers approach that permits Dreyfus, subject to certain conditions and approval by the Board, to enter into and materially amend sub-investment advisory agreements with one or more sub-investment advisers who are either unaffiliated with Dreyfus or are wholly-owned subsidiaries (as defined under the Act) of Dreyfus’ ultimate parent company, BNY Mellon, without obtaining shareholder approval. The Order also allows the fund to disclose the sub-investment advisory fee paid by Dreyfus to any unaffiliated sub-investment advisers in the aggregate with other unaffiliated sub-investment adviser in documents filed with the SEC and provided to shareholders. In addition, pursuant to the Order, it is not necessary to disclose the sub-investment advisory fee payable by Dreyfus separately to a sub-investment adviser that is a wholly-owned subsidiary of BNY Mellon in documents filed with the SEC and provided to shareholders; such fees are to be aggregated with fees payable to Dreyfus. Dreyfus has ultimate responsibility (subject to oversight by the Board) to supervise any sub-investment adviser and recommend the hiring, termination, and replacement of any sub-investment adviser to the Board.

During the period ended May 31, 2015, the Distributor retained $261 from commissions earned on sales of the fund’s Class A shares.