UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-03940 | |||||

| BNY Mellon Strategic Funds, Inc. | ||||||

| (Exact name of Registrant as specified in charter) | ||||||

c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | ||||||

| (Address of principal executive offices) (Zip code) | ||||||

Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant's telephone number, including area code: | (212) 922-6400 | |||||

Date of fiscal year end:

| 05/31 | |||||

| Date of reporting period: | 05/31/22

| |||||

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Select Managers Small Cap Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Select Managers Small Cap Growth Fund

ANNUAL REPORT May 31, 2022 |

|

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from June 1, 2021, through May 31, 2022, as provided by portfolio allocation manager Elena Goncharova

Market and Fund Performance Overview

For the 12-month period ended May 31, 2022, BNY Mellon Select Managers Small Cap Growth Fund’s (the “fund”) Class A, Class C, Class I and Class Y shares at NAV produced total returns of −20.28%, −20.84%, −20.01% and −20.00%, respectively.1 In comparison, the Russell 2000® Growth Index (the “Index”), the fund’s benchmark, returned −25.71% for the same period.2

Small-cap growth stocks lost ground over the reporting period as markets began to take into account rising inflation and interest rates. The fund outperformed the Index due to both favorable asset allocation and stock selection decisions.

The Fund’s Investment Approach

The fund seeks capital appreciation. To pursue its goal, the fund normally invests at least 80% of its assets in the stocks of small-cap companies. The fund’s portfolio is constructed to have a growth tilt.

The fund uses a “multi-manager” approach by selecting various sub-advisers to manage its assets. We may hire, terminate or replace sub-advisers and modify material terms and conditions of sub-advisory arrangements without shareholder approval.

The fund’s assets are currently allocated to six sub-advisers, each acting independently and using its own methodology to select portfolio investments. At the end of the reporting period, 13% of the fund’s assets were under the management of Redwood Investments, LLC, which employs a blend of quantitative and qualitative research to build growth and core equity portfolios; approximately 18% of the fund’s assets were under the management of Geneva Capital Management, which employs bottom-up fundamental analysis supplemented by top-down considerations to identify companies with a consistent, sustainable record of growth; approximately 13% of the fund’s assets were under the management of Nicholas Investment Partners, L.P., which uses a bottom-up approach to security selection, combining rigorous fundamental analysis with the discipline and objectivity of quantitative analytics; EAM Investors, LLC, which managed 21% of the fund’s assets, chooses investments through bottom-up fundamental analysis using a blend of a quantitative discovery process and a qualitative analysis process; approximately 10% of the fund’s assets were managed by Granite Investment Partners, LLC, which seeks attractively valued, small-cap companies with catalysts for growth; and 25% of the fund’s assets were managed by Rice Hall James & Associates LLC, which seeks growing companies with high earnings growth, high or improving returns on invested capital and sustainable competitive advantages. The percentages of the fund’s assets allocated to the various sub-advisers can change over time, within ranges described in the prospectus.

Market Hindered by Inflation, Rising Rates

The reporting period was marked by on-and-off recovery from the pandemic, rising concerns about inflation and a shift in policy stance by the Federal Reserve (the “Fed”) from accommodation to tightening. This shift as well as other concerns, including Russia’s invasion of Ukraine and rising prospects of recession, contributed to an increase in volatility.

The spread of the COVID-19 delta variant during the period led the Centers for Disease Control and Prevention (“CDC”) to recommend that indoor mask mandates be reimposed. COVID-19 policies in certain countries led to supply-chain bottlenecks that resulted in shortages of certain

2

products, such as computer chips, which slowed production in other industries, including auto manufacturing.

But the delta variant also injected some uncertainty into the outlook for the ongoing recovery. Although the U.S. economy grew by an annualized rate of 6.7% in the second quarter of 2021, pandemic-related uncertainties, combined with supply-chain issues, caused many economists to reduce their forecasts for the balance of the year. Around the end of the year, the omicron COVID-19 variant led many countries to enact precautionary restrictions, adding uncertainty to the economic outlook heading into 2022.

The reporting period was also marked by a pivot on monetary policy, driven by stronger-than-expected inflation. As late as its September 2021 meeting, the Fed was still not noticeably concerned about pricing pressures, though it did raise its inflation forecast from 3.4% to 4.2% for 2021 and from 2.1% to 2.2% for 2022. Nonetheless, the Fed’s “dot plot” indicated that voting members of the Federal Open Market Committee were split on forecasting a tightening of monetary policy during 2022.

In the fourth quarter of 2021, continuing supply-chain disruptions and rising energy prices helped pushed the Consumer Price Index (“CPI”) to 6.8%, the highest reading since 1982, and high enough to prompt a change in the Fed’s stance. Having begun tapering its bond purchases by $15 billion a month in November 2021, the Fed swiftly accelerated the pace to $30 billion a month later. The new hawkish stance was also reflected at the December 2021 Fed meeting and in a new “dot plot” suggesting that three rate hikes were likely in 2022, followed by three more in in 2023 and another two in 2024. But in retrospect, the Fed seemed behind the curve as its inflation estimate for 2022 was revised up to only 2.6% from 2.2%.

Inflation continued to rise in the first quarter of 2022, and major central banks continued to tighten their policies. As a result, government bonds weakened significantly, with the 10-year U.S. Treasury yield rising by 83 basis points (bps) to 2.34% during the quarter. Credit markets generally declined even more than government bonds, as spreads widened, adding to the higher yields on underlying government bonds.

In March 2022, responding to persistent and higher-than-expected inflation, the Fed raised interest rates for the first time since 2018. As expected, the federal funds target rate was raised by 0.25% to 0.50%. Headline consumer price inflation approached 8.0% year over year early in 2022, the highest in 40 years, and enough to prompt the Fed to indicate that it intends to provide a steady stream of rate increases throughout 2022, and likely beyond. The surge in Treasury yields reflected the ongoing news regarding ever-higher inflation.

Geopolitical events also roiled markets early in 2022. The invasion of Ukraine and the sanctions imposed on Russia led to further spikes in energy and commodity prices. With the two countries being major producers of wheat and corn, those prices, as well as other industrial commodities, rose during the quarter. While Russian authorities may have expected to swiftly achieve their objective, their military advances slowed, leading to expectations that the conflict could persist for months.

Asset Allocation and Security Selection Benefited Performance

The fund’s relative performance versus the Index was mainly the result of favorable asset allocation and stock selections by the fund’s underlying portfolio managers. Positioning in the health care and industrial sectors were the primary drivers of relative performance. Our large underweight to the health care sector was advantageous as this sector was the worst-performing one in the Index. An overweight to the industrial sector was also beneficial. Our cash position,

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

which remained between 2% and 3% of the portfolio, added to performance as well. Stock selection also was beneficial, especially in the health care sector, where we were able to avoid many stocks that posted large losses. We also owned stocks in this sector that were beneficial, including Cytokinetics and Intra-Cellular Therapies, two drug makers.

On a less positive note, the fund’s stock selections in the industrial sector hampered performance. While certain holdings in the construction-related industries performed well early in the period, they subsequently lagged, hampering the fund’s returns. In the industrial machinery industry, our position in Kornit Digital, which does custom printing for the apparel and textile industries, was especially detrimental.

Positioned for Uncertainty

We are anticipating a period of uncertainty as the Fed’s efforts to combat inflation proceed over the coming months. The Fed will need to proceed carefully to halt inflation without putting the economy into recession. One positive feature of the current economic environment is the job market, which appears healthy enough to allow the Fed to continue to implement interest-rate increases. On the other hand, some signs indicate that consumer spending may be weakening, potentially hindering the broader economy. On balance, we are positioned neutrally as to the likely result of the Fed’s policy.

June 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Return figures provided reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an undertaking in effect through September 30, 2022, at which time it may be extended, terminated or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — The Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Russell 2000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set, and that the represented companies continue to reflect growth characteristics. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The prices of small company stocks tend to be more volatile than the prices of large company stocks, mainly because these companies have less established and more volatile earnings histories. They also tend to be less liquid than larger company stocks.

Investing in foreign denominated and/or domiciled securities involves special risks, including changes in currency exchange rates, political, economic, and social instability, limited company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries.

Multi-manager risk means each sub-adviser makes investment decisions independently, and it is possible that the investment styles of the sub-advisers may not complement one another. Consequently, the fund’s exposure to a given stock, industry or investment style could be greater or smaller than if the fund had a single adviser.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be and should not be interpreted as recommendations.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

4

FUND PERFORMANCE (Unaudited)

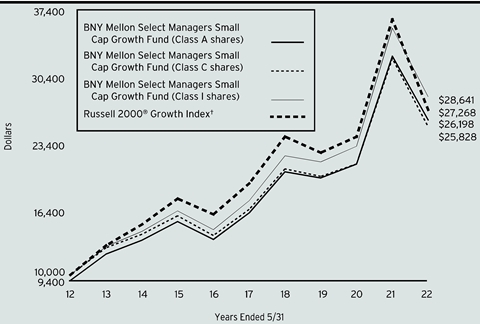

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Select Managers Small Cap Growth Fund with a hypothetical investment of $10,000 in the Russell 2000® Growth Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in Class A shares, Class C shares and Class I shares of BNY Mellon Select Managers Small Cap Growth Fund on 5/31/12 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect growth characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Select Managers Small Cap Growth Fund with a hypothetical investment of $1,000,000 in the Russell 2000® Growth Index (the “Index”).

† Source: Lipper Inc.

†† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales load for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Select Managers Small Cap Growth Fund on 5/31/12 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses of the fund’s Class Y shares. The Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher growth earning potential as defined by Russell’s leading style methodology. The Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The Index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set and that the represented companies continue to reflect growth characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

Average Annual Total Returns as of 5/31/2022 | ||||

Inception Date | 1 Year | 5 Years | 10 Years | |

Class A shares | ||||

with maximum sales charge (5.75%) | 7/1/10 | -24.87% | 8.40% | 10.11% |

without sales charge | 7/1/10 | -20.28% | 9.70% | 10.77% |

Class C shares | ||||

with applicable redemption charge† | 7/1/10 | -21.48% | 8.91% | 9.95% |

without redemption | 7/1/10 | -20.84% | 8.91% | 9.95% |

Class I shares | 7/1/10 | -20.01% | 10.02% | 11.10% |

Class Y shares | 7/1/13 | -20.00% | 10.06% | 11.18%†† |

Russell 2000® Growth Index | 6/30/10 | -25.71% | 6.87% | 10.55% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales load for Class A shares.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund's performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Select Managers Small Cap Growth Fund from December 1, 2021 to May 31, 2022. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment |

| |||||

Assume actual returns for the six months ended May 31, 2022 |

| |||||

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y |

|

Expenses paid per $1,000† | $5.76 | $9.07 | $4.48 | $4.30 |

| |

Ending value (after expenses) | $778.20 | $775.50 | $779.60 | $779.50 |

| |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment |

| |||||

Assuming a hypothetical 5% annualized return for the six months ended May 31, 2022 |

| |||||

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class Y |

|

Expenses paid per $1,000† | $6.54 | $10.30 | $5.09 | $4.89 |

| |

Ending value (after expenses) | $1,018.45 | $1,014.71 | $1,019.90 | $1,020.09 |

| |

† | Expenses are equal to the fund’s annualized expense ratio of 1.30% for Class A, 2.05% for Class C, 1.01% for Class I and .97% for Class Y, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). | |||||

8

STATEMENT OF INVESTMENTS

May 31, 2022

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% | |||||||

Automobiles & Components - 2.3% | |||||||

Dana | 21,427 | 354,831 | |||||

Dorman Products | 13,194 | a | 1,333,254 | ||||

Fox Factory Holding | 48,146 | a | 3,948,935 | ||||

LCI Industries | 18,371 | 2,195,702 | |||||

Visteon | 16,987 | a | 1,906,111 | ||||

9,738,833 | |||||||

Banks - 3.2% | |||||||

Axos Financial | 102,332 | a | 3,955,132 | ||||

Bank OZK | 25,389 | 1,052,882 | |||||

Central Pacific Financial | 7,680 | 185,395 | |||||

Eastern Bankshares | 50,303 | 979,399 | |||||

Federal Agricultural Mortgage, Cl. C | 6,429 | 675,109 | |||||

First Financial Bankshares | 21,853 | 901,218 | |||||

Heritage Commerce | 81,178 | 931,112 | |||||

Mr. Cooper Group | 10,042 | a | 435,421 | ||||

National Bank Holdings, Cl. A | 24,958 | 1,017,038 | |||||

Pacific Premier Bancorp | 29,764 | 969,116 | |||||

ServisFirst Bancshares | 5,724 | 477,153 | |||||

Texas Capital Bancshares | 17,061 | a | 964,458 | ||||

The Bancorp | 15,052 | a | 313,533 | ||||

Wintrust Financial | 9,203 | 804,250 | |||||

13,661,216 | |||||||

Capital Goods - 11.6% | |||||||

AAON | 27,915 | 1,495,686 | |||||

AAR | 15,169 | a | 731,449 | ||||

AeroVironment | 13,910 | a | 1,279,164 | ||||

Alamo Group | 8,733 | 1,027,263 | |||||

Ameresco, Cl. A | 14,855 | a,b | 872,286 | ||||

Arcosa | 17,172 | 907,884 | |||||

Armstrong World Industries | 18,211 | 1,520,618 | |||||

Barnes Group | 16,813 | 605,772 | |||||

Beacon Roofing Supply | 23,172 | a | 1,422,993 | ||||

Chart Industries | 7,369 | a | 1,296,060 | ||||

Construction Partners, Cl. A | 62,515 | a | 1,437,220 | ||||

Curtiss-Wright | 3,336 | 473,645 | |||||

Donaldson | 18,419 | 962,945 | |||||

Dycom Industries | 10,370 | a | 965,551 | ||||

Energy Recovery | 12,196 | a | 246,481 | ||||

ESCO Technologies | 22,184 | 1,459,929 | |||||

Evoqua Water Technologies | 44,631 | a | 1,588,417 | ||||

Fluor | 83,480 | a,b | 2,356,641 | ||||

9

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Capital Goods - 11.6% (continued) | |||||||

Griffon | 20,893 | 670,039 | |||||

H&E Equipment Services | 33,507 | 1,194,525 | |||||

Hudson Technologies | 79,178 | a | 791,780 | ||||

Kornit Digital | 31,188 | a | 1,308,960 | ||||

Kratos Defense & Security Solutions | 54,785 | a | 790,000 | ||||

Masonite International | 31,311 | a | 2,875,289 | ||||

MSC Industrial Direct, Cl. A | 4,409 | 374,456 | |||||

NV5 Global | 5,876 | a | 723,806 | ||||

PGT Innovations | 45,633 | a | 917,223 | ||||

RADA Electronic Industries | 82,903 | a | 998,152 | ||||

RBC Bearings | 13,924 | a | 2,595,294 | ||||

Regal Rexnord | 5,965 | 745,327 | |||||

Rush Enterprises, Cl. A | 26,136 | 1,332,413 | |||||

Simpson Manufacturing | 19,196 | 2,079,887 | |||||

SiteOne Landscape Supply | 12,970 | a,b | 1,741,482 | ||||

Titan International | 42,676 | a | 777,130 | ||||

Trex | 29,628 | a | 1,887,896 | ||||

Triton International | 7,678 | 489,626 | |||||

Univar Solutions | 63,686 | a | 1,956,434 | ||||

Veritiv | 4,638 | a | 674,133 | ||||

Watts Water Technologies, Cl. A | 4,856 | 635,310 | |||||

WESCO International | 4,225 | a | 530,575 | ||||

WillScot Mobile Mini Holdings | 62,516 | a | 2,233,697 | ||||

48,973,438 | |||||||

Commercial & Professional Services - 4.1% | |||||||

ABM Industries | 13,446 | 650,114 | |||||

CACI International, Cl. A | 6,225 | a | 1,745,303 | ||||

Casella Waste Systems, Cl. A | 15,065 | a | 1,078,353 | ||||

CBIZ | 37,590 | a | 1,539,686 | ||||

CoreCivic | 54,791 | a | 705,160 | ||||

Exponent | 35,122 | 3,174,678 | |||||

Franklin Covey | 11,058 | a | 423,632 | ||||

FTI Consulting | 9,561 | a | 1,606,248 | ||||

Huron Consulting Group | 10,823 | a | 648,514 | ||||

IAA | 29,719 | a | 1,159,933 | ||||

KBR | 19,537 | 972,161 | |||||

Montrose Environmental Group | 24,091 | a | 975,926 | ||||

RCM Technologies | 27,180 | a | 597,416 | ||||

The Brink's Company | 21,426 | 1,303,344 | |||||

Willdan Group | 23,341 | a | 621,804 | ||||

17,202,272 | |||||||

Consumer Durables & Apparel - .7% | |||||||

Clarus | 52,635 | 1,153,233 | |||||

10

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Consumer Durables & Apparel - .7% (continued) | |||||||

Mattel | 30,036 | a | 754,504 | ||||

Skyline Champion | 18,277 | a | 971,057 | ||||

2,878,794 | |||||||

Consumer Services - 4.5% | |||||||

Boyd Gaming | 34,933 | 2,053,012 | |||||

Bright Horizons Family Solutions | 15,013 | a | 1,359,427 | ||||

Century Casinos | 70,459 | a | 615,812 | ||||

Chuy's Holdings | 27,101 | a | 612,212 | ||||

Dutch Bros, CI. A | 20,778 | a,b | 780,214 | ||||

European Wax Center, Cl. A | 43,812 | a | 1,161,018 | ||||

H&R Block | 20,461 | 721,046 | |||||

Hilton Grand Vacations | 36,150 | a | 1,653,862 | ||||

Jack in the Box | 5,541 | b | 378,450 | ||||

Strategic Education | 11,691 | 769,502 | |||||

Stride | 90,255 | a | 3,529,873 | ||||

Texas Roadhouse | 42,561 | 3,318,481 | |||||

Udemy | 36,717 | a | 541,576 | ||||

Vail Resorts | 5,264 | 1,327,633 | |||||

18,822,118 | |||||||

Diversified Financials - 1.3% | |||||||

A-Mark Precious Metals | 8,786 | 668,000 | |||||

Donnelley Financial Solutions | 65,650 | a | 2,042,371 | ||||

PJT Partners, Cl. A | 25,590 | 1,940,746 | |||||

StoneX Group | 8,873 | a | 666,096 | ||||

5,317,213 | |||||||

Energy - 7.0% | |||||||

Antero Resources | 18,168 | a | 779,044 | ||||

Cactus, Cl. A | 12,589 | 659,915 | |||||

California Resources | 13,883 | 606,271 | |||||

Chesapeake Energy | 24,553 | b | 2,390,971 | ||||

Comstock Resources | 39,524 | a | 762,813 | ||||

Delek US Holdings | 22,558 | a | 657,791 | ||||

Earthstone Energy, Cl. A | 37,098 | a | 668,506 | ||||

Enviva | 14,096 | 1,097,937 | |||||

Helmerich & Payne | 44,209 | 2,225,923 | |||||

HF Sinclair | 13,548 | 665,207 | |||||

International Seaways | 30,904 | b | 745,714 | ||||

Magnolia Oil & Gas, CI. A | 29,714 | b | 820,404 | ||||

Matador Resources | 30,608 | 1,864,027 | |||||

Murphy Oil | 17,113 | 725,933 | |||||

New Fortress Energy | 16,381 | b | 763,191 | ||||

Nextier Oilfield Solutions | 88,517 | a | 964,835 | ||||

Northern Oil & Gas | 28,250 | 923,492 | |||||

11

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Energy - 7.0% (continued) | |||||||

Oasis Petroleum | 3,854 | 611,745 | |||||

Ovintiv | 13,346 | 747,243 | |||||

Patterson-UTI Energy | 37,138 | 708,593 | |||||

PBF Energy, Cl. A | 23,470 | a | 779,204 | ||||

PDC Energy | 8,695 | 688,122 | |||||

Range Resources | 20,016 | a | 679,543 | ||||

Ranger Oil, Cl. A | 31,219 | a | 1,336,485 | ||||

Scorpio Tankers | 27,363 | 904,347 | |||||

Select Energy Services, Cl. A | 73,516 | a | 622,681 | ||||

Southwestern Energy | 123,584 | a | 1,127,086 | ||||

Teekay Tankers, Cl. A | 29,867 | a | 616,754 | ||||

Tellurian | 102,826 | a,b | 490,480 | ||||

TETRA Technologies | 109,315 | a | 548,761 | ||||

U.S. Silica Holdings | 25,874 | a | 457,452 | ||||

Uranium Energy | 96,819 | a,b | 369,849 | ||||

Vertex Energy Inc | 65,136 | a,b | 911,253 | ||||

Whiting Petroleum | 7,686 | 679,904 | |||||

29,601,476 | |||||||

Food & Staples Retailing - 1.3% | |||||||

BJ's Wholesale Club Holdings | 43,933 | a | 2,542,403 | ||||

Grocery Outlet Holding | 38,427 | a,b | 1,469,832 | ||||

Performance Food Group | 29,802 | a | 1,291,619 | ||||

Sprouts Farmers Market | 10,652 | a | 288,563 | ||||

5,592,417 | |||||||

Food, Beverage & Tobacco - 1.8% | |||||||

Freshpet | 14,446 | a | 1,039,679 | ||||

Hostess Brands | 39,699 | a | 843,604 | ||||

J&J Snack Foods | 10,937 | 1,402,342 | |||||

MGP Ingredients | 15,588 | 1,509,854 | |||||

Post Holdings | 7,986 | a | 656,689 | ||||

The Hain Celestial Group | 29,683 | a | 782,147 | ||||

The Simply Good Foods Company | 16,594 | a | 663,096 | ||||

TreeHouse Foods | 19,349 | a | 795,631 | ||||

7,693,042 | |||||||

Health Care Equipment & Services - 9.0% | |||||||

Acadia Healthcare | 10,308 | a | 733,620 | ||||

AMN Healthcare Services | 14,335 | a | 1,389,061 | ||||

Axonics | 23,733 | a | 1,186,650 | ||||

BioLife Solutions | 39,659 | a | 544,121 | ||||

Certara | 32,213 | a | 654,568 | ||||

CryoPort | 71,466 | a | 1,818,810 | ||||

Cutera | 19,811 | a,b | 891,297 | ||||

Establishment Labs Holdings | 9,986 | a,b | 616,136 | ||||

12

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Health Care Equipment & Services - 9.0% (continued) | |||||||

Evolent Health, Cl. A | 15,785 | a | 444,032 | ||||

Figs, Cl. A | 21,604 | a | 192,276 | ||||

Globus Medical, Cl. A | 35,776 | a | 2,382,682 | ||||

HealthEquity | 48,680 | a | 3,046,394 | ||||

HealthStream | 38,816 | a | 790,682 | ||||

Inari Medical | 14,738 | a | 969,760 | ||||

Inmode | 27,036 | a | 724,835 | ||||

Inspire Medical Systems | 6,971 | a | 1,232,682 | ||||

Insulet | 1,914 | a | 408,601 | ||||

iRhythm Technologies | 5,962 | a | 839,748 | ||||

Lantheus Holdings | 18,041 | a | 1,236,169 | ||||

LeMaitre Vascular | 22,904 | b | 1,047,171 | ||||

LHC Group | 15,325 | a | 2,554,064 | ||||

Masimo | 7,755 | a | 1,089,035 | ||||

MEDNAX | 29,659 | a | 573,012 | ||||

Neogen | 41,722 | a,b | 1,103,964 | ||||

Omnicell | 35,629 | a | 3,960,520 | ||||

OptimizeRx | 21,700 | a,b | 555,086 | ||||

Option Care Health | 24,403 | a | 740,875 | ||||

PetIQ | 33,364 | a | 572,526 | ||||

Premier, Cl. A | 59,233 | 2,215,907 | |||||

Shockwave Medical | 2,409 | 395,582 | |||||

STAAR Surgical | 24,053 | a | 1,586,055 | ||||

Tandem Diabetes Care | 12,746 | a | 868,895 | ||||

TransMedics Group | 19,513 | a | 569,194 | ||||

37,934,010 | |||||||

Household & Personal Products - 1.3% | |||||||

Inter Parfums | 21,192 | 1,563,970 | |||||

Medifast | 15,782 | 2,631,648 | |||||

Veru | 44,175 | a,b | 571,624 | ||||

WD-40 | 4,593 | b | 867,112 | ||||

5,634,354 | |||||||

Insurance - 1.9% | |||||||

Assurant | 3,877 | 685,027 | |||||

Goosehead Insurance, Cl. A | 12,077 | 625,347 | |||||

Kinsale Capital Group | 24,696 | 5,430,156 | |||||

Palomar Holdings | 8,854 | a | 550,276 | ||||

Unum Group | 18,198 | a | 663,317 | ||||

7,954,123 | |||||||

Materials - 5.8% | |||||||

AdvanSix | 12,923 | 598,723 | |||||

Allegheny Technologies | 27,153 | a | 746,707 | ||||

Aspen Aerogels | 22,167 | a | 388,366 | ||||

13

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Materials - 5.8% (continued) | |||||||

Balchem | 18,370 | 2,285,779 | |||||

Cabot | 12,991 | 982,250 | |||||

Commercial Metals | 17,709 | 703,579 | |||||

Element Solutions | 85,744 | 1,825,490 | |||||

Graphic Packaging Holding | 31,176 | 693,978 | |||||

Ingevity | 24,727 | a | 1,722,977 | ||||

Kaiser Aluminum | 13,701 | 1,399,831 | |||||

Livent | 87,621 | a,b | 2,785,472 | ||||

LSB Industries | 32,177 | a | 647,402 | ||||

Materion | 13,558 | 1,111,485 | |||||

Methanex | 35,459 | b | 1,753,448 | ||||

MP Materials | 20,475 | a | 807,329 | ||||

Ranpak Holdings | 95,496 | a | 1,189,880 | ||||

Reliance Steel & Aluminum | 4,257 | 827,561 | |||||

Silgan Holdings | 9,850 | 431,528 | |||||

SunCoke Energy | 58,306 | 471,696 | |||||

Sylvamo | 13,042 | 661,751 | |||||

The Chemours Company | 17,387 | 749,206 | |||||

TimkenSteel | 34,887 | a | 805,890 | ||||

Warrior Met Coal | 20,091 | 675,459 | |||||

24,265,787 | |||||||

Media & Entertainment - 2.3% | |||||||

Lions Gate Entertainment, Cl. A | 74,583 | a,b | 762,984 | ||||

Nexstar Media Group, Cl. A | 3,166 | 554,747 | |||||

TechTarget | 37,715 | a | 2,681,159 | ||||

World Wrestling Entertainment, Cl. A | 47,456 | b | 3,168,637 | ||||

Ziff Davis | 32,470 | a | 2,478,760 | ||||

9,646,287 | |||||||

Pharmaceuticals Biotechnology & Life Sciences - 9.4% | |||||||

ACADIA Pharmaceuticals | 20,858 | a | 336,857 | ||||

Aerie Pharmaceuticals | 79,571 | a,b | 412,178 | ||||

Albireo Pharma | 26,582 | a | 529,779 | ||||

Alpha Teknova | 18,663 | a | 142,772 | ||||

Amicus Therapeutics | 43,204 | a | 329,214 | ||||

Amphastar Pharmaceuticals | 17,846 | a | 662,800 | ||||

Apellis Pharmaceuticals | 4,500 | a | 186,525 | ||||

argenx, ADR | 3,118 | a,b | 964,397 | ||||

Ascendis Pharma, ADR | 10,180 | a,b | 860,312 | ||||

Avid Bioservices | 99,805 | a,b | 1,334,393 | ||||

Azenta | 19,304 | 1,479,459 | |||||

Biohaven Pharmaceutical Holding | 15,853 | a | 2,278,551 | ||||

Bio-Techne | 6,461 | 2,388,825 | |||||

CareDx | 21,678 | a | 545,202 | ||||

14

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Pharmaceuticals Biotechnology & Life Sciences - 9.4% (continued) | |||||||

Catalyst Pharmaceuticals | 85,773 | a | 617,566 | ||||

Chinook Therapeutics Inc | 20,035 | a | 304,131 | ||||

Collegium Pharmaceutical | 12,824 | a,b | 200,311 | ||||

CTI BioPharma Corp | 136,975 | a | 743,774 | ||||

Cytokinetics | 18,351 | a,b | 732,205 | ||||

Emergent BioSolutions | 15,470 | a | 509,891 | ||||

Evolus | 52,394 | a | 675,883 | ||||

Fate Therapeutics | 12,085 | a | 279,163 | ||||

Global Blood Therapeutics | 15,662 | a,b | 390,610 | ||||

Halozyme Therapeutics | 94,280 | a | 4,334,994 | ||||

Insmed | 14,326 | a | 269,615 | ||||

Instil Bio | 11,388 | a,b | 68,385 | ||||

Intra-Cellular Therapies | 30,561 | a | 1,754,202 | ||||

Iovance Biotherapeutics | 58,088 | a | 392,094 | ||||

IVERIC bio | 28,562 | a | 298,187 | ||||

Karuna Therapeutics | 1,808 | a,b | 188,611 | ||||

Karyopharm Therapeutics | 52,576 | a,b | 330,177 | ||||

Kiniksa Pharmaceuticals, CI. A | 36,498 | a | 279,575 | ||||

Krystal Biotech | 8,231 | a,b | 484,641 | ||||

LAVA Therapeutics | 17,267 | a | 52,492 | ||||

Ligand Pharmaceuticals | 14,737 | a | 1,310,267 | ||||

Medpace Holdings | 17,719 | a | 2,538,069 | ||||

Mirum Pharmaceuticals | 23,515 | a | 550,016 | ||||

Neurocrine Biosciences | 9,991 | a | 934,059 | ||||

Nkarta | 28,641 | a,b | 413,290 | ||||

Optinose | 36,686 | a | 75,390 | ||||

Pacira Biosciences | 17,963 | a | 1,136,160 | ||||

Prestige Consumer Healthcare | 46,244 | a | 2,581,340 | ||||

Prometheus Biosciences | 11,321 | a | 295,025 | ||||

PTC Therapeutics | 29,121 | a | 855,284 | ||||

Puma Biotechnology | 15,098 | a | 29,290 | ||||

Repligen | 2,492 | a | 409,859 | ||||

Revance Therapeutics | 42,319 | a,b | 578,924 | ||||

SomaLogic | 46,389 | a | 278,334 | ||||

Supernus Pharmaceuticals | 30,529 | a | 850,843 | ||||

Twist Bioscience | 8,769 | a,b | 298,497 | ||||

Ultragenyx Pharmaceutical | 3,843 | a | 180,237 | ||||

United Therapeutics | 2,943 | a | 677,891 | ||||

VistaGen Therapeutics | 135,059 | a | 155,318 | ||||

39,505,864 | |||||||

Real Estate - 2.0% | |||||||

American Assets Trust | 22,519 | c | 767,898 | ||||

15

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Real Estate - 2.0% (continued) | |||||||

DigitalBridge Group | 205,882 | a,c | 1,239,410 | ||||

Farmland Partners | 46,239 | c | 694,510 | ||||

Independence Realty Trust | 19,168 | c | 450,640 | ||||

Innovative Industrial Properties | 5,741 | c | 763,840 | ||||

NexPoint Residential Trust | 6,089 | c | 447,420 | ||||

Retail Opportunity Investments | 66,453 | c | 1,200,806 | ||||

Ryman Hospitality Properties | 8,037 | a,c | 717,624 | ||||

Tanger Factory Outlet Centers | 49,505 | b,c | 866,833 | ||||

Terreno Realty | 13,986 | c | 849,090 | ||||

The St. Joe Company | 12,682 | 640,314 | |||||

8,638,385 | |||||||

Retailing - 3.3% | |||||||

Asbury Automotive Group | 7,788 | a | 1,410,796 | ||||

Boot Barn Holdings | 10,311 | a | 832,098 | ||||

Caleres | 22,267 | 633,719 | |||||

Dick's Sporting Goods | 3,156 | b | 256,362 | ||||

Funko, Cl. A | 30,301 | a | 617,231 | ||||

Leslie's | 118,226 | a,b | 2,295,948 | ||||

Murphy USA | 3,241 | 807,398 | |||||

Ollie's Bargain Outlet Holdings | 19,149 | a | 899,429 | ||||

Overstock.com | 45,454 | a | 1,408,619 | ||||

Penske Automotive Group | 5,438 | b | 626,131 | ||||

Points.com | 8,641 | a | 213,173 | ||||

Pool | 2,964 | 1,181,510 | |||||

Shutterstock | 18,072 | 1,087,934 | |||||

Signet Jewelers | 16,835 | 1,003,366 | |||||

Sleep Number | 11,502 | a | 528,287 | ||||

13,802,001 | |||||||

Semiconductors & Semiconductor Equipment - 4.5% | |||||||

Axcelis Technologies | 7,815 | a | 484,999 | ||||

CEVA | 30,349 | a | 1,094,688 | ||||

Credo Technology Group Holding Ltd | 54,217 | a,b | 554,640 | ||||

Lattice Semiconductor | 23,470 | a | 1,220,909 | ||||

Monolithic Power Systems | 2,986 | 1,344,865 | |||||

Onto Innovation | 52,368 | a | 4,209,340 | ||||

Photronics | 31,438 | a | 683,462 | ||||

Rambus | 26,291 | a | 659,904 | ||||

Semtech | 54,816 | a | 3,513,158 | ||||

Silicon Motion Technology, ADR | 25,961 | 2,344,538 | |||||

SiTime | 6,232 | a | 1,327,416 | ||||

Synaptics | 9,828 | a | 1,455,723 | ||||

18,893,642 | |||||||

16

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Software & Services - 12.7% | |||||||

ACI Worldwide | 100,369 | a | 2,673,830 | ||||

Agilysys | 29,513 | a | 1,206,196 | ||||

Alarm.com Holdings | 32,741 | a | 2,070,213 | ||||

Amdocs | 7,421 | 644,811 | |||||

Bill.com Holdings | 7,587 | a | 897,087 | ||||

Blackbaud | 18,292 | a | 1,164,286 | ||||

BlackLine | 21,649 | a | 1,585,140 | ||||

Box, Cl. A | 30,820 | a | 804,710 | ||||

Cerence | 9,098 | a | 288,952 | ||||

Consensus Cloud Solutions | 9,987 | a | 479,676 | ||||

CSG Systems International | 10,901 | 677,933 | |||||

Digital Turbine | 42,132 | a | 1,071,417 | ||||

DigitalOcean Holdings | 24,632 | a,b | 1,203,273 | ||||

Domo, Cl. B | 14,409 | a | 459,359 | ||||

Elastic | 8,161 | a | 503,126 | ||||

Envestnet | 27,555 | a,b | 1,835,714 | ||||

Euronet Worldwide | 24,142 | a | 2,925,045 | ||||

Evo Payments, Cl. A | 49,710 | a | 1,145,815 | ||||

ExlService Holdings | 27,683 | a | 3,936,245 | ||||

Fair Isaac | 6,714 | a | 2,749,719 | ||||

Five9 | 6,225 | a | 602,020 | ||||

I3 Verticals, Cl. A | 47,317 | a | 1,103,432 | ||||

International Money Express Inc | 35,123 | a | 724,236 | ||||

Limelight Networks | 127,059 | a | 459,954 | ||||

MAXIMUS | 17,422 | 1,130,514 | |||||

Perficient | 30,760 | a | 3,011,712 | ||||

Q2 Holdings | 19,810 | a | 1,044,581 | ||||

Qualys | 12,983 | a | 1,696,619 | ||||

Rackspace Technology | 130,858 | a,b | 1,207,819 | ||||

Rapid7 | 9,155 | a | 648,815 | ||||

SolarWinds | 9,764 | 113,653 | |||||

Sprout Social, Cl. A | 25,690 | a | 1,308,392 | ||||

SPS Commerce | 8,251 | a | 883,187 | ||||

Switch, Cl. A | 25,115 | 847,631 | |||||

Tenable Holdings | 9,563 | a | 481,019 | ||||

The Descartes Systems Group | 59,900 | a | 3,555,066 | ||||

Tyler Technologies | 2,462 | a | 876,029 | ||||

Varonis Systems | 7,276 | a | 240,617 | ||||

Verra Mobility | 63,433 | a | 1,011,756 | ||||

Wix.com | 6,002 | a | 378,186 | ||||

WNS Holdings, ADR | 45,949 | a | 3,343,709 | ||||

Workiva | 10,296 | a | 751,711 | ||||

53,743,205 | |||||||

17

STATEMENT OF INVESTMENTS (continued)

Description | Shares | Value ($) | |||||

Common Stocks - 96.6% (continued) | |||||||

Technology Hardware & Equipment - 3.8% | |||||||

908 Devices | 10,355 | a,b | 144,142 | ||||

Arlo Technologies | 113,818 | a | 805,831 | ||||

Avnet | 14,121 | 684,162 | |||||

Belden | 22,166 | 1,276,318 | |||||

Calix | 37,930 | a | 1,401,134 | ||||

Cambium Networks | 32,630 | a | 466,283 | ||||

Clearfield | 16,837 | a | 1,040,527 | ||||

CTS | 15,181 | 617,411 | |||||

ePlus | 30,747 | a | 1,744,585 | ||||

Ituran Location & Control | 7,147 | 179,104 | |||||

NETSCOUT Systems | 18,166 | a | 623,639 | ||||

Novanta | 16,697 | a | 2,053,063 | ||||

PAR Technology | 20,100 | a,b | 755,358 | ||||

Radware | 51,447 | a | 1,241,416 | ||||

Rogers | 3,831 | a | 1,016,671 | ||||

Sanmina | 14,700 | a | 645,183 | ||||

ScanSource | 15,053 | a | 583,153 | ||||

Super Micro Computer | 12,173 | a | 609,380 | ||||

15,887,360 | |||||||

Telecommunication Services - .1% | |||||||

Gogo | 31,347 | a | 635,090 | ||||

Transportation - 2.5% | |||||||

Air Transport Services Group | 70,902 | a | 2,142,658 | ||||

Allegiant Travel | 9,370 | a | 1,400,346 | ||||

Eagle Bulk Shipping | 9,147 | b | 670,109 | ||||

Genco Shipping & Trading | 19,342 | 488,385 | |||||

GXO Logistics | 8,349 | a | 453,100 | ||||

Marten Transport | 142,586 | 2,503,810 | |||||

Saia | 5,512 | a | 1,089,116 | ||||

TFI International | 10,771 | 883,761 | |||||

XPO Logistics | 16,177 | a | 864,499 | ||||

10,495,784 | |||||||

Utilities - .2% | |||||||

California Water Service Group | 17,222 | 924,305 | |||||

Total Common Stocks (cost $336,929,157) | 407,441,016 | ||||||

Exchange-Traded Funds - .3% | |||||||

Registered Investment Companies - .3% | |||||||

iShares Russell 2000 Growth ETF | 4,747 | 1,046,571 | |||||

18

Description | 1-Day | Shares | Value ($) | ||||

Investment Companies - 3.5% | |||||||

Registered Investment Companies - 3.5% | |||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 0.80 | 14,691,745 | d | 14,691,745 | |||

Investment of Cash Collateral for Securities Loaned - 2.0% | |||||||

Registered Investment Companies - 2.0% | |||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares | 0.80 | 8,481,909 | d | 8,481,909 | |||

Total Investments (cost $361,109,961) | 102.4% | 431,661,241 | |||||

Liabilities, Less Cash and Receivables | (2.4%) | (10,074,496) | |||||

Net Assets | 100.0% | 421,586,745 | |||||

ADR—American Depository Receipt

ETF—Exchange-Traded Fund

a Non-income producing security.

b Security, or portion thereof, on loan. At May 31, 2022, the value of the fund’s securities on loan was $34,358,801 and the value of the collateral was $36,798,566, consisting of cash collateral of $8,481,909 and U.S. Government & Agency securities valued at $28,316,657. In addition, the value of collateral may include pending sales that are also on loan.

c Investment in real estate investment trust within the United States.

d Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

Portfolio Summary (Unaudited) † | Value (%) |

Information Technology | 20.9 |

Health Care | 18.4 |

Industrials | 18.2 |

Consumer Discretionary | 10.7 |

Energy | 7.0 |

Financials | 6.4 |

Materials | 5.8 |

Investment Companies | 5.8 |

Consumer Staples | 4.5 |

Communication Services | 2.4 |

Real Estate | 2.1 |

Utilities | .2 |

102.4 |

† Based on net assets.

See notes to financial statements.

19

STATEMENT OF INVESTMENTS (continued)

Affiliated Issuers | ||||||

Description | Value ($) 5/31/2021 | Purchases ($)† | Sales ($) | Value ($) 5/31/2022 | Dividends/ | |

Registered Investment Companies - 3.5% | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 3.5% | 19,191,519 | 431,815,132 | (436,314,906) | 14,691,745 | 23,277 | |

Investment of Cash Collateral for Securities Loaned - 2.0% | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares - 2.0% | 7,000,373 | 117,596,021 | (116,114,485) | 8,481,909 | 204,080 | †† |

Total - 5.5% | 26,191,892 | 549,411,153 | (552,429,391) | 23,173,654 | 227,357 | |

† Includes reinvested dividends/distributions.

†† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

20

STATEMENT OF ASSETS AND LIABILITIES

May 31, 2022

|

|

|

|

|

|

|

|

|

| Cost |

| Value |

|

Assets ($): |

|

|

|

| ||

Investments in securities—See Statement of Investments |

|

|

| |||

Unaffiliated issuers | 337,936,307 |

| 408,487,587 |

| ||

Affiliated issuers |

| 23,173,654 |

| 23,173,654 |

| |

Receivable for investment securities sold |

| 1,897,986 |

| |||

Dividends and securities lending income receivable |

| 230,213 |

| |||

Receivable for shares of Common Stock subscribed |

| 44,000 |

| |||

Tax reclaim receivable—Note 1(b) |

| 3,729 |

| |||

Prepaid expenses |

|

|

|

| 46,903 |

|

|

|

|

|

| 433,884,072 |

|

Liabilities ($): |

|

|

|

| ||

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) |

| 353,929 |

| |||

Liability for securities on loan—Note 1(c) |

| 8,481,909 |

| |||

Payable for investment securities purchased |

| 1,736,279 |

| |||

Payable for shares of Common Stock redeemed |

| 1,629,800 |

| |||

Directors’ fees and expenses payable |

| 8,971 |

| |||

Other accrued expenses |

|

|

|

| 86,439 |

|

|

|

|

|

| 12,297,327 |

|

Net Assets ($) |

|

| 421,586,745 |

| ||

Composition of Net Assets ($): |

|

|

|

| ||

Paid-in capital |

|

|

|

| 337,464,405 |

|

Total distributable earnings (loss) |

|

|

|

| 84,122,340 |

|

Net Assets ($) |

|

| 421,586,745 |

| ||

Net Asset Value Per Share | Class A | Class C | Class I | Class Y |

|

Net Assets ($) | 1,580,552 | 232,438 | 13,564,488 | 406,209,267 |

|

Shares Outstanding | 71,606 | 12,352 | 578,535 | 17,275,967 |

|

Net Asset Value Per Share ($) | 22.07 | 18.82 | 23.45 | 23.51 |

|

|

|

|

|

|

|

See notes to financial statements. |

|

|

|

|

|

21

STATEMENT OF OPERATIONS

Year Ended May 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

Income: |

|

|

|

| ||

Cash dividends (net of $9,527 foreign taxes withheld at source): |

| |||||

Unaffiliated issuers |

|

| 3,599,628 |

| ||

Affiliated issuers |

|

| 23,277 |

| ||

Income from securities lending—Note 1(c) |

|

| 204,080 |

| ||

Interest |

|

| 2,115 |

| ||

Total Income |

|

| 3,829,100 |

| ||

Expenses: |

|

|

|

| ||

Management fee—Note 3(a) |

|

| 6,022,413 |

| ||

Professional fees |

|

| 98,433 |

| ||

Registration fees |

|

| 67,509 |

| ||

Custodian fees—Note 3(c) |

|

| 54,188 |

| ||

Directors’ fees and expenses—Note 3(d) |

|

| 50,810 |

| ||

Chief Compliance Officer fees—Note 3(c) |

|

| 36,786 |

| ||

Shareholder servicing costs—Note 3(c) |

|

| 17,769 |

| ||

Loan commitment fees—Note 2 |

|

| 10,200 |

| ||

Prospectus and shareholders’ reports |

|

| 9,419 |

| ||

Distribution fees—Note 3(b) |

|

| 2,301 |

| ||

Miscellaneous |

|

| 40,478 |

| ||

Total Expenses |

|

| 6,410,306 |

| ||

Less—reduction in expenses due to undertaking—Note 3(a) |

|

| (1,491) |

| ||

Net Expenses |

|

| 6,408,815 |

| ||

Net Investment (Loss) |

|

| (2,579,715) |

| ||

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

Net realized gain (loss) on investments | 40,696,884 |

| ||||

Net change in unrealized appreciation (depreciation) on investments | (162,171,451) |

| ||||

Net Realized and Unrealized Gain (Loss) on Investments |

|

| (121,474,567) |

| ||

Net (Decrease) in Net Assets Resulting from Operations |

| (124,054,282) |

| |||

|

|

|

|

|

|

|

See notes to financial statements. | ||||||

22

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

| Year Ended May 31, | |||||

|

|

|

| 2022 |

| 2021 |

| ||

Operations ($): |

|

|

|

|

|

|

|

| |

Net investment (loss) |

|

| (2,579,715) |

|

|

| (3,063,354) |

| |

Net realized gain (loss) on investments |

| 40,696,884 |

|

|

| 153,795,273 |

| ||

Net change in unrealized appreciation |

| (162,171,451) |

|

|

| 103,798,676 |

| ||

Net Increase (Decrease) in Net Assets | (124,054,282) |

|

|

| 254,530,595 |

| |||

Distributions ($): |

| ||||||||

Distributions to shareholders: |

|

|

|

|

|

|

|

| |

Class A |

|

| (332,673) |

|

|

| (131,718) |

| |

Class C |

|

| (70,262) |

|

|

| (26,197) |

| |

Class I |

|

| (3,161,020) |

|

|

| (1,045,357) |

| |

Class Y |

|

| (112,382,784) |

|

|

| (48,153,829) |

| |

Total Distributions |

|

| (115,946,739) |

|

|

| (49,357,101) |

| |

Capital Stock Transactions ($): |

| ||||||||

Net proceeds from shares sold: |

|

|

|

|

|

|

|

| |

Class A |

|

| 314,626 |

|

|

| 334,206 |

| |

Class C |

|

| 100,100 |

|

|

| 7,150 |

| |

Class I |

|

| 14,107,360 |

|

|

| 12,084,948 |

| |

Class Y |

|

| 54,228,948 |

|

|

| 133,815,728 |

| |

Distributions reinvested: |

|

|

|

|

|

|

|

| |

Class A |

|

| 332,673 |

|

|

| 131,718 |

| |

Class C |

|

| 68,374 |

|

|

| 25,345 |

| |

Class I |

|

| 2,456,946 |

|

|

| 811,542 |

| |

Class Y |

|

| 50,024,995 |

|

|

| 21,548,837 |

| |

Cost of shares redeemed: |

|

|

|

|

|

|

|

| |

Class A |

|

| (331,163) |

|

|

| (335,637) |

| |

Class C |

|

| (78,344) |

|

|

| (291,221) |

| |

Class I |

|

| (14,099,945) |

|

|

| (7,687,411) |

| |

Class Y |

|

| (193,744,784) |

|

|

| (90,817,009) |

| |

Increase (Decrease) in Net Assets | (86,620,214) |

|

|

| 69,628,196 |

| |||

Total Increase (Decrease) in Net Assets | (326,621,235) |

|

|

| 274,801,690 |

| |||

Net Assets ($): |

| ||||||||

Beginning of Period |

|

| 748,207,980 |

|

|

| 473,406,290 |

| |

End of Period |

|

| 421,586,745 |

|

|

| 748,207,980 |

| |

23

STATEMENT OF CHANGES IN NET ASSETS (continued)

|

|

|

| Year Ended May 31, | |||||

|

|

|

| 2022 |

| 2021 |

| ||

Capital Share Transactions (Shares): |

| ||||||||

Class Aa,b |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 11,465 |

|

|

| 11,032 |

| |

Shares issued for distributions reinvested |

|

| 12,132 |

|

|

| 4,278 |

| |

Shares redeemed |

|

| (12,041) |

|

|

| (11,380) |

| |

Net Increase (Decrease) in Shares Outstanding | 11,556 |

|

|

| 3,930 |

| |||

Class Ca |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 3,072 |

|

|

| 281 |

| |

Shares issued for distributions reinvested |

|

| 2,915 |

|

|

| 928 |

| |

Shares redeemed |

|

| (3,628) |

|

|

| (12,870) |

| |

Net Increase (Decrease) in Shares Outstanding | 2,359 |

|

|

| (11,661) |

| |||

Class Ib |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 445,197 |

|

|

| 382,577 |

| |

Shares issued for distributions reinvested |

|

| 84,460 |

|

|

| 25,164 |

| |

Shares redeemed |

|

| (469,657) |

|

|

| (247,604) |

| |

Net Increase (Decrease) in Shares Outstanding | 60,000 |

|

|

| 160,137 |

| |||

Class Yb |

|

|

|

|

|

|

|

| |

Shares sold |

|

| 1,735,389 |

|

|

| 4,371,820 |

| |

Shares issued for distributions reinvested |

|

| 1,715,534 |

|

|

| 666,941 |

| |

Shares redeemed |

|

| (6,994,218) |

|

|

| (2,985,307) |

| |

Net Increase (Decrease) in Shares Outstanding | (3,543,295) |

|

|

| 2,053,454 |

| |||

|

|

|

|

|

|

|

|

|

|

a | During the period ended May 31, 2022, 194 Class C shares representing $5,247 were automatically converted to 169 Class A shares and during the period ended May 31, 2021, 788 Class C shares representing $22,425 were automatically converted to 699 Class A shares. | ||||||||

b | During the period ended May 31, 2022, 414,308 Class Y shares representing $13,133,764 were exchanged for 415,311 Class I shares, 1,331 Class A shares representing $28,076 were exchanged for 1,253 Class I shares and 1,696 Class Y shares representing $48,480 were exchanged for 1,804 Class A shares. During the period ended May 31, 2021, 330,551 Class Y shares representing $10,495,865 were exchanged for 331,131 Class I shares. | ||||||||

See notes to financial statements. | |||||||||

24

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

Year Ended May 31, | ||||||

Class A Shares | 2022 | 2021 | 2020 | 2019 | 2018 | |

Per Share Data ($): | ||||||

Net asset value, beginning of period | 33.26 | 23.63 | 23.18 | 28.94 | 24.54 | |

Investment Operations: | ||||||

Net investment (loss)a | (.21) | (.25) | (.16) | (.18) | (.15) | |

Net realized and unrealized | (5.45) | 12.38 | 1.87 | (1.28) | 6.36 | |

Total from Investment Operations | (5.66) | 12.13 | 1.71 | (1.46) | 6.21 | |

Distributions: | ||||||

Dividends from net realized | (5.53) | (2.50) | (1.26) | (4.30) | (1.81) | |

Net asset value, end of period | 22.07 | 33.26 | 23.63 | 23.18 | 28.94 | |

Total Return (%)b | (20.28) | 52.22 | 7.19 | (3.11) | 26.05 | |

Ratios/Supplemental Data (%): | ||||||

Ratio of total expenses | 1.35 | 1.37 | 1.39 | 1.40 | 1.29 | |

Ratio of net expenses | 1.30 | 1.30 | 1.30 | 1.30 | 1.28 | |

Ratio of net investment (loss) | (.72) | (.82) | (.68) | (.68) | (.56) | |

Portfolio Turnover Rate | 98.16 | 112.92 | 105.26 | 101.14 | 95.50 | |

Net Assets, end of period ($ x 1,000) | 1,581 | 1,998 | 1,326 | 1,630 | 2,090 | |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

25

FINANCIAL HIGHLIGHTS (continued)

Year Ended May 31, | ||||||

Class C Shares | 2022 | 2021 | 2020 | 2019 | 2018 | |

Per Share Data ($): | ||||||

Net asset value, beginning of period | 29.38 | 21.24 | 21.10 | 26.95 | 23.13 | |

Investment Operations: | ||||||

Net investment (loss)a | (.37) | (.40) | (.31) | (.35) | (.33) | |

Net realized and unrealized | (4.66) | 11.04 | 1.71 | (1.20) | 5.96 | |

Total from Investment Operations | (5.03) | 10.64 | 1.40 | (1.55) | 5.63 | |

Distributions: | ||||||

Dividends from net realized | (5.53) | (2.50) | (1.26) | (4.30) | (1.81) | |

Net asset value, end of period | 18.82 | 29.38 | 21.24 | 21.10 | 26.95 | |

Total Return (%)b | (20.84) | 50.99 | 6.41 | (3.71) | 25.11 | |

Ratios/Supplemental Data (%): | ||||||

Ratio of total expenses | 2.22 | 2.31 | 2.16 | 2.33 | 2.23 | |

Ratio of net expenses | 2.05 | 2.05 | 2.05 | 2.05 | 2.05 | |

Ratio of net investment (loss) | (1.47) | (1.56) | (1.43) | (1.43) | (1.37) | |

Portfolio Turnover Rate | 98.16 | 112.92 | 105.26 | 101.14 | 95.50 | |

Net Assets, end of period ($ x 1,000) | 232 | 294 | 460 | 479 | 587 | |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

26

Year Ended May 31, | ||||||

Class I Shares | 2022 | 2021 | 2020 | 2019 | 2018 | |

Per Share Data ($): | ||||||

Net asset value, beginning of period | 34.89 | 24.63 | 24.05 | 29.76 | 25.12 | |

Investment Operations: | ||||||

Net investment (loss)a | (.13) | (.16) | (.09) | (.10) | (.07) | |

Net realized and unrealized | (5.78) | 12.92 | 1.93 | (1.31) | 6.52 | |

Total from Investment Operations | (5.91) | 12.76 | 1.84 | (1.41) | 6.45 | |

Distributions: | ||||||

Dividends from net realized | (5.53) | (2.50) | (1.26) | (4.30) | (1.81) | |

Net asset value, end of period | 23.45 | 34.89 | 24.63 | 24.05 | 29.76 | |

Total Return (%) | (20.01) | 52.63 | 7.52 | (2.88) | 26.42 | |

Ratios/Supplemental Data (%): | ||||||

Ratio of total expenses | .99 | 1.00 | 1.01 | .98 | .99 | |

Ratio of net expenses | .99 | 1.00 | 1.01 | .98 | .98 | |

Ratio of net investment (loss) | (.41) | (.52) | (.37) | (.35) | (.26) | |

Portfolio Turnover Rate | 98.16 | 112.92 | 105.26 | 101.14 | 95.50 | |

Net Assets, end of period ($ x 1,000) | 13,564 | 18,091 | 8,826 | 12,949 | 16,532 | |

a Based on average shares outstanding.

See notes to financial statements.

27

FINANCIAL HIGHLIGHTS (continued)

Year Ended May 31, | ||||||

Class Y Shares | 2022 | 2021 | 2020 | 2019 | 2018 | |

Per Share Data ($): | ||||||

Net asset value, beginning of period | 34.96 | 24.66 | 24.07 | 29.77 | 25.12 | |

Investment Operations: | ||||||

Net investment (loss)a | (.12) | (.15) | (.08) | (.09) | (.06) | |

Net realized and unrealized | (5.80) | 12.95 | 1.93 | (1.31) | 6.52 | |

Total from Investment Operations | (5.92) | 12.80 | 1.85 | (1.40) | 6.46 | |

Distributions: | ||||||

Dividends from net realized | (5.53) | (2.50) | (1.26) | (4.30) | (1.81) | |

Net asset value, end of period | 23.51 | 34.96 | 24.66 | 24.07 | 29.77 | |

Total Return (%) | (20.00) | 52.73 | 7.56 | (2.84) | 26.46 | |

Ratios/Supplemental Data (%): | ||||||

Ratio of total expenses | .96 | .96 | .97 | .95 | .95 | |

Ratio of net expenses | .96 | .96 | .97 | .95 | .94 | |

Ratio of net investment (loss) | (.38) | (.48) | (.34) | (.34) | (.21) | |

Portfolio Turnover Rate | 98.16 | 112.92 | 105.26 | 101.14 | 95.50 | |

Net Assets, end of period ($ x 1,000) | 406,209 | 727,826 | 462,795 | 519,312 | 798,000 | |

a Based on average shares outstanding.

See notes to financial statements.

28

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Select Managers Small Cap Growth Fund (the “fund”) is a separate diversified series of BNY Mellon Strategic Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering six series, including the fund. The fund’s investment objective is to seek capital appreciation. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser and the fund’s portfolio allocation manager. Geneva Capital Management LLC (“Geneva”), Nicholas Investment Partners, L.P. (“Nicholas”), EAM Investors, LLC (“EAM”), Granite Investment Partners, LLC (“Granite”), Rice Hall James & Associates, LLC (“Rice Hall”) and Redwood Investments, LLC (“Redwood”), serve as the fund’s sub-advisers (collectively the “Sub-Advisers”), each managing an allocated portion of the fund’s portfolio.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 425 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (75 million shares authorized), Class C (75 million shares authorized), Class I (75 million shares authorized) and Class Y (200 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC.

29

NOTES TO FINANCIAL STATEMENTS (continued)

Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

30

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for

31

NOTES TO FINANCIAL STATEMENTS (continued)

example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of May 31, 2022 in valuing the fund’s investments:

Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | Level 3-Significant Unobservable Inputs | Total | |||

Assets ($) | ||||||

Investments in Securities:† | ||||||

Equity Securities - Common Stocks | 407,441,016 | - | - | 407,441,016 | ||

Exchange-Traded Funds | 1,046,571 | - | - | 1,046,571 | ||

Investment Companies | 23,173,654 | - | - | 23,173,654 | ||

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of May 31, 2022, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and

32

amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with BNY Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, BNY Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended May 31, 2022, BNY Mellon earned $27,811 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.