UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03942

LORD ABBETT MUNICIPAL INCOME FUND, INC.

(Exact name of Registrant as specified in charter)

| 90 Hudson Street, Jersey City, NJ 07302 | |

| (Address of principal executive offices) (Zip code) | |

Thomas R. Phillips, Esq., Vice President & Assistant Secretary

| 90 Hudson Street, Jersey City, NJ 07302 | |

| (Name and address of agent for service) | |

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 9/30

Date of reporting period: 9/30/2013

| Item 1: | Report(s) to Shareholders. |

2 0 1 3

L O R D A B B E T T

A N N U A L

R E P O R T

Lord Abbett

Municipal Income Fund

Short Duration Tax Free Fund

Intermediate Tax Free Fund

AMT Free Municipal Bond Fund

National Tax Free Income Fund

High Yield Municipal Bond Fund

California Tax Free Income Fund

New Jersey Tax Free Income Fund

New York Tax Free Income Fund

For the fiscal year ended September 30, 2013

Table of Contents

Lord Abbett Municipal Income Fund

Annual Report

For the fiscal year ended September 30, 2013

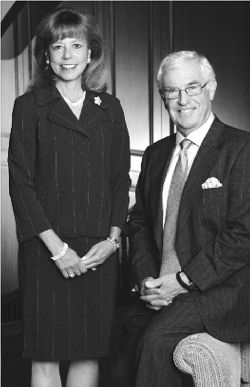

Daria L. Foster, Director, President and Chief Executive Officer of the Lord Abbett Funds and E. Thayer Bigelow, Independent Chairman of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended September 30, 2013. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Funds, please visit our Website at www.lordabbett.com, where you also can access quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Daria L. Foster

Director, President and Chief Executive Officer

Municipal Bond Market Review

The municipal bond market for the 12-month period experienced a high degree of volatility. After a relatively calm first six months, municipal bonds suffered erratic investor demand. Historically, the municipal and Treasury markets have tended to move in tandem; however, municipal bonds recently underperformed particularly in longer securities, and their yields are currently above those of Treasury securities across most maturities.

Municipal bond issuance for the calendar year-to-date period ended August 31, 2013, totaled approximately $229 billion, a more than 10% decrease in

1

issuance compared with the year-ago period. As interest rates increased, refunding issuance declined approximately 20% as municipalities could no longer gain the same economic advantage from refunding outstanding bonds.

Municipal bond outflows intensified during the second half of the period. The municipal yield curve steepened as investors became concerned that the U.S. Federal Reserve might eventually slow its pace of asset purchases of Treasury and mortgage-backed securities, even though the Federal Open Market Committee decided, in September 2013, that it would refrain from doing so for the time being.

Despite numerous negative headlines regarding a few large municipalities, municipal bond defaults have remained exceedingly rare within the investment-grade segment of the market. There were, admittedly, pockets of distress in the municipal bond market, but the general trend has been one of an improving credit profile supported by appreciating home prices and rising state and local tax revenues. This prompted Moody’s to revise their U.S. states sector outlook to “stable” after five years of “negative” outlooks. Unemployment began the period at 7.8% before dropping to 7.3% by August, the lowest level since December of 2008.

The table below shows each Fund’s performance relative to its benchmark for the year ended September 30, 2013.

| | Class A Shares

@ NAV

9/30/2013

12-Mo.

Return | | Lipper

Funds

Average1 | | Barclays

Muni Bond

Index2 | | Barclays

1-15 Yr.

Muni Bond

Index3 | | Barclays

High Yield

Muni Bond

Index4 | | Barclays

Muni Bond

Short

1-5

Yr. Index5 | |

| Short Duration Tax Free Fund | | -0.28 | % | | -0.07 | % | | — | | | — | | | — | | | 0.57 | % | |

| Intermediate Tax Free Fund | | -1.99 | | | -1.97 | | | — | | | -0.95 | % | | — | | | — | | |

| AMT Free Municipal Bond Fund | | -4.88 | | | -3.44 | | | -2.21 | % | | — | | | — | | | — | | |

| National Tax Free Fund | | -4.40 | | | -3.44 | | | -2.21 | | | — | | | — | | | — | | |

| High Yield Municipal Bond Fund | | -4.11 | | | -4.50 | | | — | | | — | | | -1.54 | % | | — | | |

| California Tax Free Fund | | -2.51 | | | -2.98 | | | -2.21 | | | — | | | — | | | — | | |

| New Jersey Tax Free Fund | | -4.85 | | | -4.46 | | | -2.21 | | | — | | | — | | | — | | |

| New York Tax Free Fund | | -3.80 | | | -4.61 | | | -2.21 | | | — | | | — | | | — | | |

Short Duration Tax Free Fund

The Short Duration Tax Free Fund underperformed its benchmark, the Barclays Municipal Bond Short 1-5 Year Index,5 during the 12-month period. The Fund’s bonds with maturities longer than five years underperformed, as rising interest rates negatively affected most longer bond maturities. The Fund’s exposure to bonds shorter than five years performed better as demand was strong

2

from investors seeking to avoid any interest rate risk. The Fund’s overweight to bonds rated ‘BBB’ and lower detracted from relative performance. Among the sectors, electric revenue bonds detracted the most from absolute performance, while government lease appropriation obligations was the Fund’s best contributing sector.

Intermediate Tax Free Fund

The Intermediate Tax Free Fund underperformed its benchmark, the Barclays 1-15 Year Municipal Bond Index,3 during the 12-month period. The Fund’s exposure to longer-maturity bonds detracted from absolute performance, as rising interest rates negatively affected most longer bond maturities along the yield curve. The Fund’s exposure to shorter-maturity bonds contributed the most to absolute performance as demand was strong from investors seeking to avoid any interest rate risk. Furthermore, the Fund’s overweight to lower-quality bonds detracted from relative performance, as demand remained stronger for higher-quality securities relative to lower-quality securities. Among the sectors, state general obligation bonds were among the performance laggards, while tobacco bonds provided the strongest returns on an absolute basis.

AMT Free Municipal Bond Fund

The AMT Free Municipal Bond Fund underperformed its benchmark, the Barclays Municipal Bond Index,2 during the 12-month period. The Fund’s exposure to longer-maturity bonds detracted from absolute performance, as rising interest rates negatively affected longer-maturity bonds. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance, as demand was strong from investors seeking to avoid any interest rate risk. Furthermore, the Fund’s exposure to lower-quality bonds detracted from absolute performance, as demand remained stronger for higher-quality securities relative to lower-quality securities. Among the sectors, state general obligation bonds were among the performance laggards, while tobacco bonds provided the strongest returns on an absolute basis.

National Tax Free Fund

The National Tax Free Fund underperformed its benchmark, the Barclays Municipal Bond Index,2 during the 12-month period. The Fund’s exposure to longer-maturity bonds detracted from absolute performance, as rising interest rates negatively affected longer-maturity bonds. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance, as demand was strong from investors seeking to avoid interest rate risk. Furthermore, the Fund’s overweight to bonds rated ‘BBB’ and lower detracted from relative performance, as demand remained stronger for higher-quality securities relative to lower-quality securities. Among the sectors, state general obligation bonds were among the

3

performance laggards, while tobacco bonds provided the strongest returns on an absolute basis.

High Yield Municipal Bond Fund

The High Yield Municipal Bond Fund underperformed its benchmark, the Barclays High Yield Municipal Bond Index,4 during the 12-month period. The Fund’s exposure to longer-maturity bonds detracted from absolute performance, as rising interest rates negatively affected longer-maturity bonds. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance, as demand was strong from investors seeking to avoid any interest rate risk. Furthermore, the Fund’s exposure to bonds rated ‘BBB’ detracted from absolute performance, as demand remained stronger for higher-quality securities relative to lower-quality securities. Among the sectors, state general obligation bonds were among the performance laggards, while tobacco bonds provided the strongest contribution to returns on an absolute basis.

California Tax Free Fund

The California Tax Free Fund underperformed its benchmark, the Barclays Municipal Bond Index,2 during the 12-month period. The Fund’s exposure to bonds in the 20- to 24-year range and to bonds rated ‘BBB’ detracted from absolute performance. Long bonds were most negatively impacted by rising interest rates across most fixed income markets while lower quality bonds faced significantly reduced demand. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance, as demand was strong from investors who sought to avoid any interest rate risk. Within the sectors, state general obligation bonds were among the performance laggards, while special tax bonds contributed the most to absolute performance.

General obligation debt issued by the State of California was rated ‘A1’ by Moody’s and ‘A’ by Standard & Poor’s, as of September 30, 2013. During the period, California’s bonds were upgraded to ‘A’ from ‘A-’ by Standard & Poor’s. In-state demand for California bonds remained strong due to approved tax increases from the end of 2012 that helped strengthen the state budget.

Although California’s unemployment rate is higher than the unemployment rate in most other states, it boasts a gross domestic product (GDP) of $2 trillion. The state’s economy continues to have the benefit of a well-educated work force and above-average share of jobs in the professional/business services, and information industries, due in part to the state’s leadership in technology and film.

New Jersey Tax Free Fund

The Fund underperformed its benchmark, the Barclays Municipal Bond Index,2 during the 12-month period. The Fund’s exposure to bonds longer than 16 years detracted from absolute performance as long bonds were most negatively impacted by rising

4

interest rates in most fixed income markets. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance as demand was strong from investors seeking to avoid any interest rate risk. Furthermore, the Fund’s exposure to bonds rated ‘BBB’ detracted from absolute performance. Within the sectors, government lease appropriation bonds were among the performance laggards, while airline bonds contributed the most to absolute performance.

General obligation debt issued by the State of New Jersey was rated ‘Aa3’ by Moody’s and ‘AA-’ by Standard & Poor’s, as of September 30, 2013. Standard & Poor’s maintained its “negative” outlook due to the state’s overly optimistic revenue targets.

New Jersey’s unemployment rate remains elevated. As of August 2013, the Bureau of Labor Statistics reported the unemployment rate at 8.5% for the state, well above the 7.3% national average. New Jersey’s high investment-grade ratings do, however, reflect a strong economic base and high wealth levels.

New York Tax Free Fund

The Fund underperformed its benchmark, the Barclays Municipal Bond Index,2 during the 12-month period. The Fund’s exposure to bonds in the 20- to 24-year range and to bonds rated ‘BBB’ detracted from absolute performance. Long bonds were most negatively impacted by rising interest rates across most fixed income markets while lower quality bonds faced significantly reduced demand. The Fund’s exposure to shorter-maturity bonds contributed to absolute performance, as demand was strong from investors seeking to avoid any interest rate risk. Within the sectors, electric revenue bonds were among the performance laggards, while tobacco bonds were among the best performing sectors on an absolute basis.

General obligation debt issued by the State of New York was rated ‘Aa2’ by Moody’s and ‘AA’ by Standard & Poor’s, as of September 30, 2013.

As of September 30, 2013, New York’s unemployment rate lagged the unemployment rates in most other states. The Bureau of Labor Statistics reported the unemployment rate at 7.6% for the state, slightly above the 7.3% national average. New York is one of nine states to have regained all of the private sector jobs lost during the recession.

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

5

1 The Lipper Funds Average: Lipper, Inc. is a nationally recognized organization that reports on mutual fund total return performance, calculates fund rankings and is a global leader in benchmarking and classifying mutual funds. Peer averages are based on universes of funds with similar investment objectives. Peer group averages include reinvested dividends and capital gains, if any, and exclude sales charges.

2 The Barclays Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. The index is a broad measure of the municipal bond market with maturities of at least one year. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, S&P, Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. Bonds must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date after December 31, 1990, and must be at least one year from their maturity date.

3 The Barclays 1-15 Year Municipal Bond Index is the 1-15 year component of the Municipal Bond index. The Barclays Municipal Bond Index is a rules-based, market value-weighted index engineered for the long-term tax-exempt bond market. The index is a broad measure of the municipal bond market with maturities of at least one year. To be included in the index, bonds must be rated investment grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, Standard & Poor’s, and Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date after December 31, 1990, and must be at least one year from their maturity date.

4 The Barclays High Yield Municipal Bond Index is an unmanaged index consisting of noninvestment-grade, unrated or below Ba1 bonds. The Barclays High Yield Municipal Bond Index is a subset of the Barclays Municipal Bond Index; a rules-based, market value-weighted index engineered for the long-term tax-exempt bond market.

5 The Barclays Municipal Bond Short 1-5 Year Index is the Muni Short 1-5 year component of the Municipal Bond index. The Barclays Municipal Bond Index is a rules-based, market value-weighted index engineered for the long-term tax-exempt bond market. The index is a broad measure of the municipal bond market with maturities of at least one year. To be included in the index, bonds must be rated investment-grade (Baa3/BBB- or higher) by at least two of the following ratings agencies: Moody’s, Standard & Poor’s, or Fitch. If only two of the three agencies rate the security, the lower rating is used to determine index eligibility. If only one of the three agencies rates a security, the rating must be investment-grade. They must have an outstanding par value of at least $7 million and be issued as part of a transaction of at least $75 million. The bonds must be fixed rate, have a dated-date after December 31, 1990, and must be at least one year from their maturity date.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers several classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense reimbursements, the Funds’ returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio holdings of the Funds as of September 30, 2013. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities.

6

Because the Funds’ portfolios are actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’ portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

7

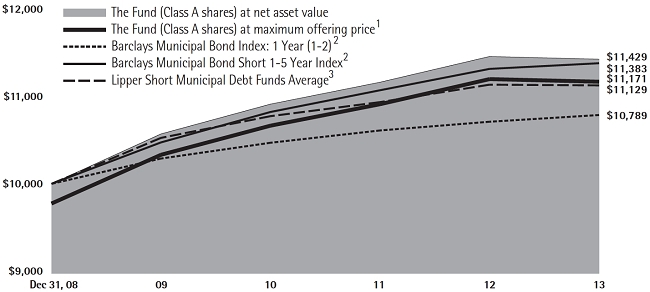

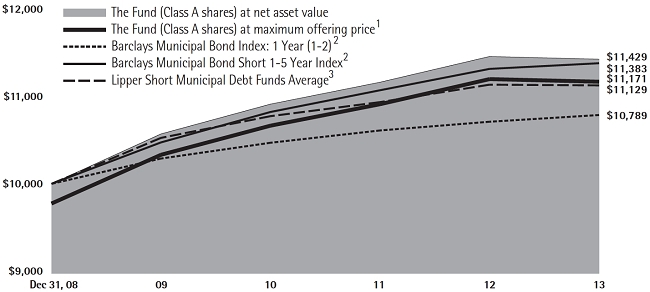

Short Duration Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index: 1 Year (1-2), Barclays Municipal Bond Short 1-5 Year Index and the Lipper Short Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. Because the Fund believes that the Barclays Municipal Bond Short 1-5 Year Index is more accurately reflective of the Fund’s investment strategies than the Barclays Municipal Bond Index: 1 Year (1-2), the Fund is adding the Barclays Municipal Bond Short 1-5 Year Index to this annual report and will delete the Barclays Municipal Bond Index: 1 Year (1-2) from its next annual report. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | Life of Class |

| Class A4 | | | -2.53 | % | | | 2.36 | % |

| Class C5 | | | -1.92 | % | | | 2.10 | % |

| Class F6 | | | -0.18 | % | | | 2.95 | % |

| Class I7 | | | -0.08 | % | | | 3.05 | % |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class C | | Class F | | Class I | |

| 0.97% | | 0.34% | | 1.08% | | 1.16% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for period shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return. Class A shares commenced operations on December 12, 2008. Performance for the Class began December 31, 2008.

5 Class C shares commenced operations on December 12, 2008. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for the Class began December 31, 2008. Performance for other periods is at net asset value.

6 Class F shares commenced operations on December 12, 2008. Performance for the Class began December 31, 2008. Performance is at net asset value.

7 Class I shares commenced operations on December 12, 2008. Performance for the Class began December 31, 2008. Performance is at net asset value.

8

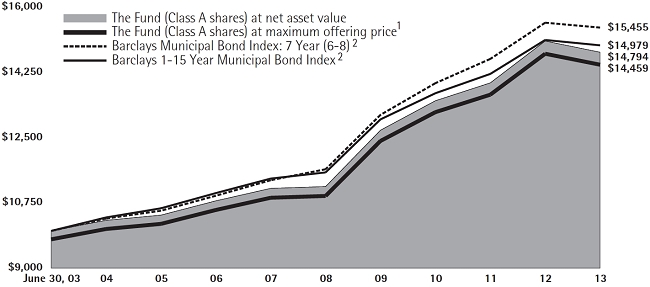

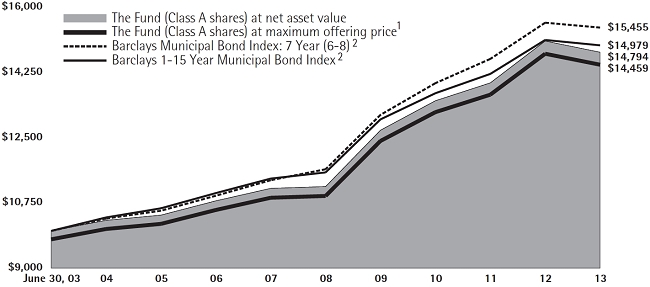

Intermediate Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index: 7 Year (6-8) and the Barclays 1-15 Year Municipal Bond Index assuming reinvestment of all dividends and distributions. Because the Fund believes that the Barclays 1-15 Year Municipal Bond Index is more accurately reflective of the Fund’s investment strategies than the Barclays Municipal Bond Index: 7 Year (6-8), the Fund is adding the Barclays 1-15 Year Municipal Bond Index to this annual report and will delete the Barclays Municipal Bond Index: 7 Year (6-8) from its next annual report. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A3 | | -4.17% | | 5.25% | | 3.76% | | — |

| Class B4 | | -7.55% | | 4.58% | | 3.36% | | — |

| Class C5 | | -3.61% | | 5.01% | | 3.25% | | — |

| Class F6 | | -1.89% | | 5.85% | | — | | 4.94% |

| Class I7 | | -1.89% | | — | | — | | 5.37% |

| Class P8 | | -2.32% | | 5.50% | | 3.78% | | — |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class B | | Class C | | Class F | | Class I | | Class P | |

| 2.92% | | 2.20% | | 2.34% | | 3.08% | | 3.18% | | 2.75% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return. The Class A share inception date is June 30, 2003.

4 Class B shares were first offered on June 30, 2003. Performance reflects the deduction of CDSC of 5% for 1 year, 2% for 5 years and 0% for the life of the Class. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.)

5 Class C shares were first offered on June 30, 2003. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations and performance for the Class began on January 31, 2011. Performance is at net asset value.

8 Class P shares were first offered on June 30, 2003. Performance is at net asset value.

9

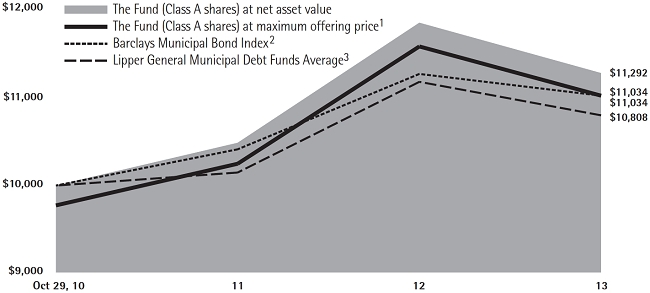

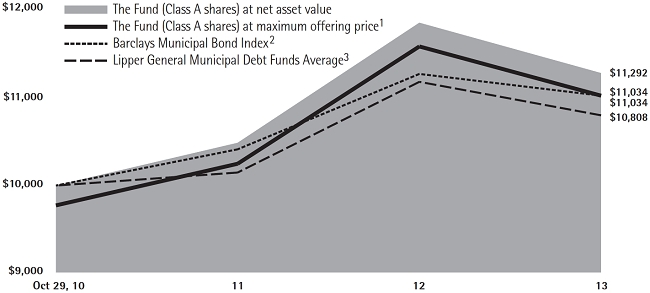

AMT Free Municipal Bond Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index and the Lipper General Municipal Debt Funds Average assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | Life of Class |

| Class A4 | | -7.03% | | 3.43% |

| Class C5 | | -6.44% | | 3.43% |

| Class F6 | | -4.78% | | 4.34% |

| Class I7 | | -4.65% | | 4.49% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class C | | Class F | | Class I | |

| 4.37% | | 3.76% | | 4.65% | | 4.57% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for period shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return. Class A shares commenced operations on October 26, 2010. Performance for the Class began October 29, 2010.

5 Class C shares Commenced operations on October 26, 2010. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for the Class began October 29, 2010. Performance for other periods is at net asset value.

6 Class F shares commenced operations on October 26, 2010. Performance for the Class began October 29, 2010. Performance is at net asset value.

7 Class I shares commenced operations on October 26, 2010. Performance for the Class began October 29, 2010. Performance is at net asset value.

10

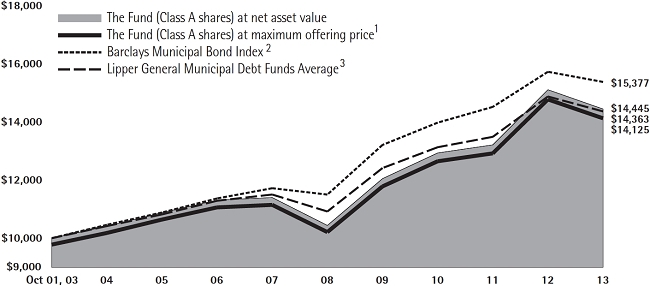

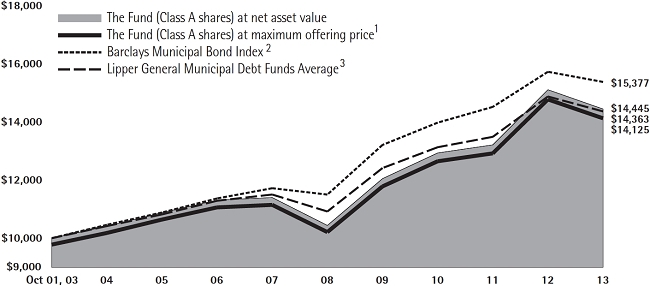

National Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index and the Lipper General Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A4 | | -6.59% | | 6.23% | | 3.51% | | — |

| Class B5 | | -9.80% | | 5.52% | | 3.14% | | — |

| Class C6 | | -5.94% | | 5.99% | | 3.07% | | — |

| Class F7 | | -4.31% | | 6.79% | | — | | 4.11% |

| Class I8 | | -4.23% | | — | | — | | 4.81% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class B | | Class C | | Class F | | Class I | |

| 4.37% | | 3.68% | | 3.83% | | 4.56% | | 4.66% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return.

5 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for 10 years. Class B sharess automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

6 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

7 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

8 Class I shares commenced operations and performance for the Class began on July 26, 2010. Performance is at net asset value.

11

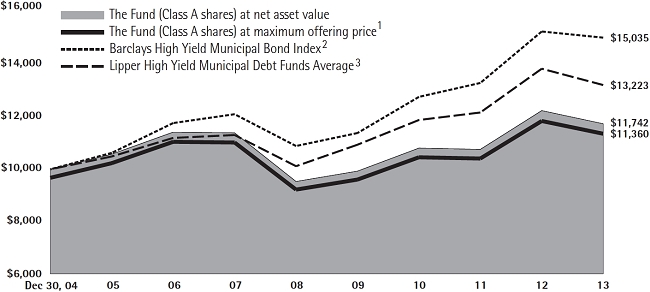

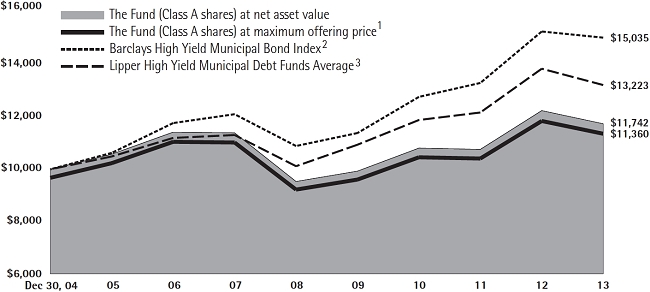

High Yield Municipal Bond Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays High Yield Municipal Bond Index and the Lipper High Yield Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | Life of Class |

| Class A4 | | -6.23% | | 3.79% | | 1.47% |

| Class C5 | | -5.55% | | 3.59% | | 1.32% |

| Class F6 | | -4.01% | | 4.35% | | 0.61% |

| Class I7 | | -3.92% | | — | | 3.81% |

| Class P8 | | -4.29% | | 4.04% | | 1.73% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class C | | Class F | | Class I | | Class P | |

| 5.33% | | 4.83% | | 5.56% | | 5.60% | | 5.24% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged indexes does not reflect any fees or expenses. The performance of the indexes is not necessarily representative of the Fund's performance. Indexes and average are calculated from December 31, 2004 to September 30, 2013.

3 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

4 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using SEC required uniform method to compute such return. The Class A inception date is December 30, 2004.

5 Class C shares were first offered on December 30, 2004. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations and performance for the Class began on July 26, 2010. Performance is at net asset value.

8 Class P shares were first offered on December 30, 2004. Performance is at net asset value.

12

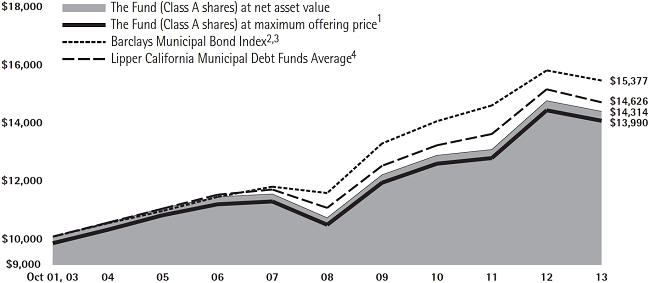

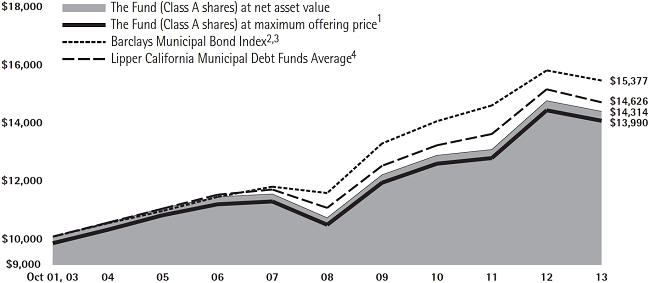

California Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index and the Lipper California Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A5 | | -4.73% | | 5.60% | | 3.41% | | — |

| Class C6 | | -4.09% | | 5.39% | | 2.99% | | — |

| Class F7 | | -2.42% | | 6.20% | | — | | 3.86% |

| Class I8 | | -2.40% | | — | | — | | 7.91% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class C | | Class F | | Class I | |

| 3.84% | | 3.28% | | 4.12% | | 4.02% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

4 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

5 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return.

6 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

7 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

8 Class I shares commenced operations and performance for the Class began on January 31, 2011. Performance is at net asset value.

13

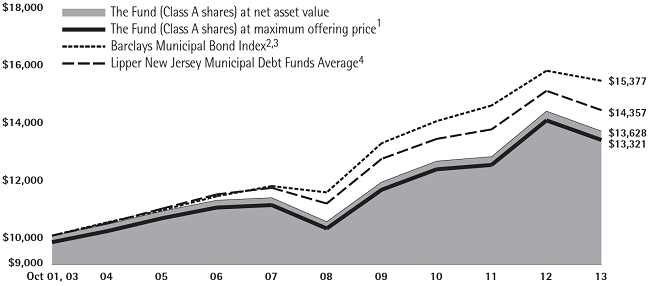

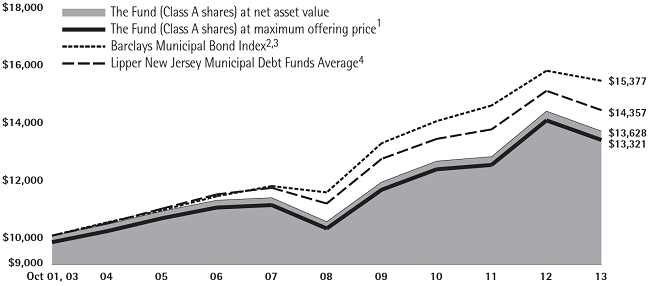

New Jersey Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index and the Lipper New Jersey Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The performance of the other class will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A5 | | -7.05% | | 4.92% | | 2.91% | | — |

| Class F6 | | -4.76% | | 5.49% | | — | | 3.24% |

| Class I7 | | -4.63% | | — | | — | | 6.32% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class F | | Class I | |

| 3.95% | | 4.26% | | 4.15% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

4 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

5 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations and performance for the Class began on January 31, 2011. Performance is at net asset value.

14

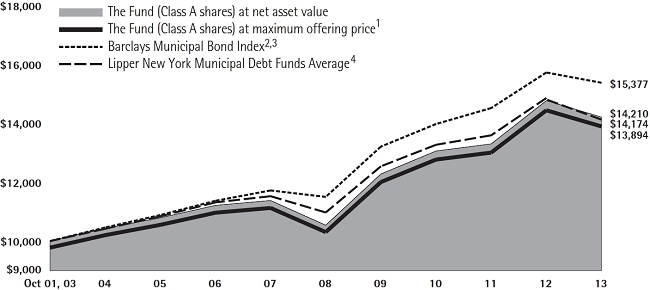

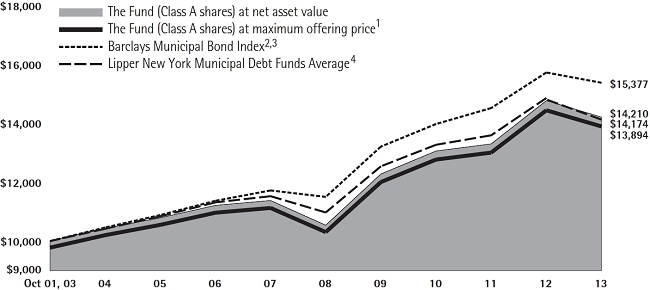

New York Tax Free Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares to the same investment in the Barclays Municipal Bond Index and the Lipper New York Municipal Debt Funds Average, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund's returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended September 30, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A5 | | -5.95% | | 5.68% | | 3.34% | | — |

| Class C6 | | -5.36% | | 5.48% | | 2.91% | | — |

| Class F7 | | -3.70% | | 6.26% | | — | | 3.89% |

| Class I8 | | -3.60% | | — | | — | | 6.10% |

Standardized Yield for the Period Ended September 30, 2013

| Class A | | Class C | | Class F | | Class I | |

| 3.79% | | 3.22% | | 4.06% | | 3.97% | |

1 Reflects the deduction of the maximum initial sales charge of 2.25%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund's performance.

3 The Index is composed of municipal bonds from many states while the Fund is a single-state municipal bond portfolio.

4 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

5 Total return, which is the percent change in value, after deduction of the maximum initial sales charge of 2.25% applicable to Class A shares, with all dividends and distributions reinvested for periods shown ended September 30, 2013, is calculated using the SEC required uniform method to compute such return.

6 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

7 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

8 Class I shares commenced operations and performance for the Class began on January 30, 2011. Performance is at net asset value.

15

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2013 through September 30, 2013).

Actual Expenses

For each class of each Fund, the first line of the table on the following pages provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 4/1/13 – 9/30/13” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following pages provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

16

Short Duration Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 991.60 | | | $ | 3.15 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.89 | | | $ | 3.19 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 988.40 | | | $ | 6.43 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,018.59 | | | $ | 6.53 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 992.10 | | | $ | 2.65 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.39 | | | $ | 2.69 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 992.60 | | | $ | 2.15 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.91 | | | $ | 2.18 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.63% for Class A, 1.29% for Class C, 0.53% for Class F and 0.43% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 9.52 | % |

| AA+ | | | 8.59 | % |

| AA | | | 16.47 | % |

| AA- | | | 16.85 | % |

| A+ | | | 12.95 | % |

| A | | | 10.32 | % |

| A- | | | 6.47 | % |

| BBB+ | | | 4.42 | % |

| BBB | | | 6.62 | % |

| Credit Rating: | | |

| S&P or Moody’s(a) | | %* |

| BBB- | | | 1.77 | % |

| BB+ | | | 1.49 | % |

| BB | | | 0.40 | % |

| BB- | | | 0.27 | % |

| B+ | | | 0.26 | % |

| B3 | | | 0.10 | % |

| NR | | | 3.50 | % |

| Total | | | 100.00 | % |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

17

Intermediate Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 965.60 | | | $ | 3.40 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.59 | | | $ | 3.50 | |

| Class B | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 961.70 | | | $ | 7.33 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.58 | | | $ | 7.54 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 963.20 | | | $ | 6.74 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,018.20 | | | $ | 6.93 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 967.00 | | | $ | 2.91 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.09 | | | $ | 2.99 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 966.60 | | | $ | 2.42 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.61 | | | $ | 2.48 | |

| Class P | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 964.40 | | | $ | 4.58 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,020.39 | | | $ | 4.71 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.69% for Class A, 1.49% for Class B, 1.37% for C, 0.59% for Class F, 0.49% for Class I and 0.93% for Class P) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 6.56 | % |

| AA+ | | | 5.96 | % |

| AA | | | 10.44 | % |

| AA- | | | 11.77 | % |

| A+ | | | 17.61 | % |

| A | | | 11.17 | % |

| A- | | | 8.54 | % |

| BBB+ | | | 4.32 | % |

| BBB | | | 5.79 | % |

| BBB- | | | 5.89 | % |

| | | |

| Credit Rating: | | |

| S&P or Moody’s(a) | | %* |

| BB+ | | | 2.00 | % |

| BB | | | 0.85 | % |

| BB- | | | 0.71 | % |

| B+ | | | 0.87 | % |

| B | | | 1.87 | % |

| B- | | | 1.80 | % |

| NR | | | 3.85 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| | | | | |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

18

AMT Free Municipal Bond Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 931.10 | | | $ | 2.90 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.05 | | | $ | 3.04 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 927.70 | | | $ | 6.43 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,018.38 | | | $ | 6.73 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 931.60 | | | $ | 2.42 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.55 | | | $ | 2.54 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 931.90 | | | $ | 1.94 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,023.03 | | | $ | 2.03 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.60% for Class A, 1.33% for Class C, 0.50% for Class F and 0.40% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 0.56 | % |

| AA+ | | | 0.78 | % |

| AA | | | 6.41 | % |

| AA- | | | 13.55 | % |

| A+ | | | 14.33 | % |

| A | | | 14.37 | % |

| A- | | | 11.86 | % |

| BBB+ | | | 4.79 | % |

| BBB | | | 10.53 | % |

| BBB- | | | 8.44 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BB+ | | | 5.25 | % |

| BB | | | 1.48 | % |

| BB- | | | 0.51 | % |

| B+ | | | 0.70 | % |

| B | | | 0.88 | % |

| B- | | | 1.77 | % |

| CC | | | 0.06 | % |

| NR | | | 3.73 | % |

| Total | | | 100.00 | % |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

19

National Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 933.40 | | | $ | 3.78 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.16 | | | $ | 3.95 | |

| Class B | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 929.20 | | | $ | 7.64 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.14 | | | $ | 7.99 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 930.40 | | | $ | 6.97 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.85 | | | $ | 7.28 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 933.80 | | | $ | 3.30 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.66 | | | $ | 3.45 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 934.30 | | | $ | 2.81 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.17 | | | $ | 2.94 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.78% for Class A, 1.58% for Class B, 1.44% for Class C, 0.68% for Class F and 0.58% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 2.23 | % |

| AA+ | | | 5.52 | % |

| AA | | | 10.29 | % |

| AA- | | | 12.80 | % |

| A+ | | | 15.39 | % |

| A | | | 7.56 | % |

| A- | | | 10.79 | % |

| BBB+ | | | 5.12 | % |

| BBB | | | 6.98 | % |

| BBB- | | | 6.95 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BB+ | | | 2.91 | % |

| BB | | | 1.80 | % |

| BB- | | | 1.21 | % |

| B+ | | | 0.59 | % |

| B | | | 1.95 | % |

| B- | | | 1.38 | % |

| CC | | | 0.32 | % |

| NR | | | 6.21 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| | |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

20

High Yield Municipal Bond Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 914.90 | | | $ | 4.22 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,020.67 | | | $ | 4.46 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 912.80 | | | $ | 7.34 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.41 | | | $ | 7.74 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 916.20 | | | $ | 3.70 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.18 | | | $ | 3.90 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 916.70 | | | $ | 3.22 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.68 | | | $ | 3.40 | |

| Class P | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 914.80 | | | $ | 5.33 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.58 | | | $ | 5.62 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.88% for Class A, 1.53% for Class C, 0.77% for Class F, 0.67% for Class I and 1.11% for Class P) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 0.59 | % |

| AA+ | | | 1.54 | % |

| AA | | | 3.96 | % |

| AA- | | | 1.07 | % |

| A+ | | | 0.56 | % |

| A | | | 2.83 | % |

| A- | | | 3.44 | % |

| BBB+ | | | 3.37 | % |

| BBB | | | 5.39 | % |

| BBB- | | | 9.98 | % |

| BB+ | | | 7.32 | % |

| BB | | | 5.37 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BB- | | | 3.27 | % |

| B+ | | | 1.61 | % |

| B | | | 8.83 | % |

| B- | | | 7.71 | % |

| CCC | | | 0.95 | % |

| CC | | | 0.02 | % |

| C | | | 0.00 | %** |

| D | | | 0.24 | % |

| NR | | | 31.95 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| | |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

21

California Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 953.80 | | | $ | 4.07 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,020.91 | | | $ | 4.20 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 949.80 | | | $ | 7.28 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.60 | | | $ | 7.54 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 954.30 | | | $ | 3.58 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.42 | | | $ | 3.70 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 953.90 | | | $ | 3.13 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.87 | | | $ | 3.24 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.83% for Class A, 1.49% for Class C, 0.73% for Class F and 0.64% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 2.01 | % |

| AA+ | | | 3.05 | % |

| AA | | | 10.87 | % |

| AA- | | | 17.78 | % |

| A+ | | | 18.86 | % |

| A | | | 17.33 | % |

| A- | | | 8.13 | % |

| BBB+ | | | 2.67 | % |

| BBB | | | 4.50 | % |

| BBB- | | | 3.57 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BB+ | | | 2.47 | % |

| BB | | | 1.43 | % |

| BB- | | | 0.38 | % |

| B+ | | | 0.19 | % |

| B | | | 1.42 | % |

| B- | | | 1.70 | % |

| NR | | | 3.64 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

22

New Jersey Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 939.30 | | | $ | 4.04 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,020.89 | | | $ | 4.20 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 939.70 | | | $ | 3.55 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.40 | | | $ | 3.70 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 940.40 | | | $ | 3.02 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.94 | | | $ | 3.14 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.83% for Class A, 0.73% for Class F and 0.62% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 4.53 | % |

| AA+ | | | 3.11 | % |

| AA | | | 2.81 | % |

| AA- | | | 13.79 | % |

| A+ | | | 29.10 | % |

| A | | | 10.46 | % |

| A- | | | 4.29 | % |

| BBB+ | | | 9.45 | % |

| BBB | | | 2.72 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BBB- | | | 6.89 | % |

| BB+ | | | 0.60 | % |

| Ba2 | | | 1.04 | % |

| B+ | | | 2.82 | % |

| B | | | 3.88 | % |

| NR | | | 4.51 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

23

New York Tax Free Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 4/1/13 | | 9/30/13 | | 4/1/13 -

9/30/13 |

| Class A | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 949.00 | | | $ | 3.86 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.10 | | | $ | 4.00 | |

| Class C | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 946.60 | | | $ | 7.08 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,017.78 | | | $ | 7.33 | |

| Class F | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 949.50 | | | $ | 3.37 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.60 | | | $ | 3.50 | |

| Class I | | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 950.80 | | | $ | 2.89 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,022.10 | | | $ | 2.99 | |

| † | For each class of the Fund, net expenses (including interest expense) are equal to the annualized expense ratio for such class (0.79% for Class A, 1.45% for Class C, 0.69% for Class F and 0.59% for Class I) multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Credit Rating

September 30, 2013

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| AAA | | | 12.64 | % |

| AA+ | | | 4.92 | % |

| AA | | | 11.53 | % |

| AA- | | | 24.34 | % |

| A+ | | | 3.92 | % |

| A | | | 7.11 | % |

| A- | | | 10.38 | % |

| BBB+ | | | 3.50 | % |

| BBB | | | 2.69 | % |

| BBB- | | | 7.76 | % |

| | | | |

| Credit Rating: | | | |

| S&P or Moody’s(a) | | %* |

| BB+ | | | 2.39 | % |

| BB | | | 1.66 | % |

| BB- | | | 0.62 | % |

| B+ | | | 0.71 | % |

| B | | | 0.64 | % |

| B- | | | 0.72 | % |

| NR | | | 4.47 | % |

| Money Market Mutual Fund | | | 0.00 | %** |

| Total | | | 100.00 | % |

| (a) | Certain investments have been rated by Fitch IBCA. |

| * | Represents percent of total investments. |

| ** | Amount is less than 0.01%. |

24

Schedule of Investments

SHORT DURATION TAX FREE FUND September 30, 2013

| Investments | | Interest

Rate | | Maturity

Date | | Credit

Rating:

S&P or

Moody’s(a) | | Principal

Amount

(000) | | | Fair

Value | |

| MUNICIPAL BONDS 82.27% | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Corporate-Backed 5.71% | | | | | | | | | | | | | | | | |

| Beaver Co IDA—FirstEnergy Rmkt | | | 2.50 | % | | 12/1/2041 | | BBB- | | $ | 10,000 | | | $ | 9,658,900 | |

| Beaver Co IDA—FirstEnergy Rmkt | | | 2.70 | % | | 4/1/2035 | | BBB- | | | 12,000 | | | | 11,555,280 | |

| Burke Co Dev—GA Power | | | 0.319 | % | # | 1/1/2024 | | AA- | | | 13,400 | | | | 11,976,263 | |

| Burke Co Dev—GA Power | | | 1.75 | % | | 12/1/2049 | | A | | | 15,000 | | | | 15,090,300 | |

| Burke Co Dev—GA Power | | | 2.40 | % | | 1/1/2040 | | A | | | 6,505 | | | | 6,194,647 | |

| Burke Co Dev—GA Transmission | | | 1.25 | % | | 1/1/2052 | | AA- | | | 7,250 | | | | 7,306,768 | |

| CA Poll Ctl—Waste Mgmt | | | 2.00 | % | | 2/1/2019 | | BBB | | | 4,000 | | | | 4,049,120 | |

| Charles City Co EDA—Waste Mgmt | | | 3.125 | % | | 2/1/2029 | | BBB | | | 5,000 | | | | 5,129,350 | |

| Citizens Property Insurance Corp | | | 4.25 | % | | 6/1/2017 | | A+ | | | 2,690 | | | | 2,927,419 | |

| Citizens Property Insurance Corp | | | 5.00 | % | | 6/1/2015 | | A+ | | | 15,275 | | | | 16,315,533 | |

| Citizens Property Insurance Corp | | | 5.00 | % | | 6/1/2018 | | A+ | | | 8,000 | | | | 9,051,360 | |

| Citizens Property Insurance Corp | | | 5.50 | % | | 6/1/2017 | | A+ | | | 3,365 | | | | 3,828,495 | |

| Coconino Co Poll Ctl—AZ Pub Svc | | | 5.50 | % | | 6/1/2034 | | BBB+ | | | 2,000 | | | | 2,064,140 | |

| Farmington Poll Ctl—So Cal Edison | | | 2.875 | % | | 4/1/2029 | | A1 | | | 7,500 | | | | 7,721,625 | |

| Gloucester Co Impt Auth—Waste Mgmt | | | 2.125 | % | | 12/1/2029 | | BBB | | | 4,500 | | | | 4,438,890 | |

| Gulf Coast Waste Disp—US Steel | | | 5.75 | % | | 9/1/2017 | | BB- | | | 6,850 | | | | 7,066,871 | |

| Mobile Indl Poll Ctl—AL Power Co Rmkt | | | 1.65 | % | | 6/1/2034 | | A | | | 3,000 | | | | 3,015,120 | |

| Navajo Co Poll Ctl—AZ Pub Svc | | | 1.25 | % | | 6/1/2034 | | Baa1 | | | 6,000 | | | | 6,024,360 | |

| NY Env Facs—Waste Mgmt | | | 2.75 | % | | 7/1/2017 | | BBB | | | 1,000 | | | | 1,009,930 | |

| St Charles Parish—Valero Energy | | | 4.00 | % | | 12/1/2040 | | BBB | | | 2,000 | | | | 1,995,280 | |

| Valdez Marine Term—BP Rmkt | | | 5.00 | % | | 1/1/2018 | | A | | | 10,000 | | | | 11,332,400 | |

| Total | | | | | | | | | | | | | | | 147,752,051 | |

| | | | | | | | | | | | | | | | | |

| Education 6.18% | | | | | | | | | | | | | | | | |

| AZ Brd Regents COP—Univ of AZ | | | 4.00 | % | | 6/1/2017 | | AA- | | | 2,050 | | | | 2,249,547 | |

| AZ Brd Regents COP—Univ of AZ | | | 4.00 | % | | 6/1/2018 | | AA- | | | 2,140 | | | | 2,366,712 | |

| AZ Brd Regents COP—Univ of AZ | | | 5.00 | % | | 6/1/2017 | | AA- | | | 5,750 | | | | 6,514,750 | |

| AZ Brd Regents COP—Univ of AZ | | | 5.00 | % | | 6/1/2018 | | AA- | | | 3,215 | | | | 3,699,340 | |

| CA State Univ Sys | | | 5.00 | % | | 11/1/2020 | | Aa2 | | | 5,000 | | | | 5,916,450 | |

| Cleveland State Univ | | | 5.00 | % | | 6/1/2018 | | A+ | | | 1,000 | | | | 1,142,910 | |

| Cleveland State Univ | | | 5.00 | % | | 6/1/2019 | | A+ | | | 1,265 | | | | 1,453,257 | |

| Curators Univ Sys | | | 5.00 | % | | 11/1/2019 | | AA+ | | | 5,000 | | | | 5,904,550 | |

| Harris Co Cultural Ed—Baylor Clg / Med | | | 1.12 | % | # | 11/15/2045 | | A- | | | 10,000 | | | | 10,011,300 | |

| Hudson Co BAN | | | 1.00 | % | | 12/6/2013 | | NR | | | 25,000 | | | | 25,030,000 | |

| IL Ed Facs—Univ of Chicago | | | 1.875 | % | | 7/1/2036 | | Aa1 | | | 5,250 | | | | 5,341,140 | |

| MA DFA—Boston Univ | | | 2.875 | % | | 10/1/2014 | | A1 | | | 1,595 | | | | 1,637,858 | |

| | See Notes to Financial Statements. | 25 |

Schedule of Investments (continued)

SHORT DURATION TAX FREE FUND September 30, 2013

| Investments | | Interest

Rate | | Maturity

Date | | Credit

Rating:

S&P or

Moody’s(a) | | Principal

Amount

(000) | | | Fair

Value | |

| Education (continued) | | | | | | | | | | | | | | | | |

| MA Hlth & Ed—Amherst Clg | | | 1.70 | % | | 11/1/2038 | | Aaa | | $ | 4,850 | | | $ | 4,921,586 | |

| NC Cap Facs—High Point Univ | | | 4.00 | % | | 5/1/2016 | | BBB+ | | | 1,770 | | | | 1,835,862 | |

| NC Cap Facs—High Point Univ | | | 4.00 | % | | 5/1/2017 | | BBB+ | | | 2,785 | | | | 2,901,831 | |

| NC Cap Facs—High Point Univ | | | 5.00 | % | | 5/1/2018 | | BBB+ | | | 1,640 | | | | 1,774,906 | |

| NJ Ed Facs—Univ Med & Dent | | | 5.50 | % | | 12/1/2013 | | NR | | | 1,000 | | | | 1,008,630 | |

| NY Dorm—CUNY (NPFGC)(FGIC) | | | 5.00 | % | | 7/1/2015 | | AA- | | | 1,565 | | | | 1,687,446 | |

| NY Dorm—St Johns Univ ETM (NPFGC) | | | 5.00 | % | | 7/1/2014 | | A | | | 2,000 | | | | 2,071,520 | |

| NY Dorm—St Lawrence Univ | | | 5.00 | % | | 7/1/2014 | | A2 | | | 4,000 | | | | 4,143,040 | |

| NYC Cultural—Julliard Sch(b) | | | 2.10 | % | | 4/1/2036 | | AA | | | 14,000 | | | | 14,388,780 | |

| PR Indl Tourist—Inter American Univ | | | 4.00 | % | | 10/1/2014 | | A- | | | 500 | | | | 506,925 | |

| PR Indl Tourist—Inter American Univ | | | 5.00 | % | | 10/1/2015 | | A- | | | 800 | | | | 821,992 | |

| PR Indl Tourist—Inter American Univ | | | 5.00 | % | | 10/1/2016 | | A- | | | 1,000 | | | | 1,029,380 | |

| PR Indl Tourist—Inter American Univ | | | 5.00 | % | | 10/1/2018 | | A- | | | 2,500 | | | | 2,564,350 | |

| SC Ed Facs Auth—Furman Univ | | | 4.00 | % | | 10/1/2015 | | A1 | | | 1,000 | | | | 1,057,460 | |

| Univ of Delaware | | | 0.70 | % | | 11/1/2037 | | AA+ | | | 8,175 | | | | 8,094,149 | |

| Univ of North Carolina—Chapel Hill | | | 0.872 | % | # | 12/1/2041 | | Aaa | | | 25,000 | | | | 25,077,750 | |

| Univ of Texas | | | 4.00 | % | | 8/15/2014 | | AAA | | | 1,000 | | | | 1,032,890 | |

| Univ of Texas | | | 5.00 | % | | 7/1/2014 | | AAA | | | 1,400 | | | | 1,449,966 | |

| Univ Sys of MD | | | 1.25 | % | | 7/1/2023 | | AA+ | | | 8,100 | | | | 7,866,153 | |

| Wayne State Univ | | | 5.00 | % | | 11/15/2015 | | Aa2 | | | 3,975 | | | | 4,304,527 | |

| Total | | | | | | | | | | | | | | | 159,806,957 | |

| | | | | | | | | | | | | | | | | |

| General Obligation 17.36% | | | | | | | | | | | | | | | | |

| AK Muni Bond Bank | | | 3.00 | % | | 3/1/2014 | | Aa2 | | | 1,000 | | | | 1,011,580 | |

| Bedford Park GO (AG) | | | 5.00 | % | | 12/1/2013 | | AA- | | | 1,275 | | | | 1,283,045 | |

| CA State GO | | | 5.00 | % | | 9/1/2018 | | A1 | | | 3,750 | | | | 4,384,613 | |

| CA State GO | | | 5.00 | % | | 9/1/2018 | | A1 | | | 7,500 | | | | 8,769,225 | |

| CA State GO | | | 5.00 | % | | 9/1/2018 | | A1 | | | 8,050 | | | | 9,412,301 | |

| CA State GO | | | 5.00 | % | | 11/1/2018 | | A1 | | | 12,150 | | | | 14,234,454 | |

| CA State GO | | | 5.00 | % | | 9/1/2020 | | A1 | | | 10,000 | | | | 11,821,100 | |

| CA State GO | | | 5.00 | % | | 10/1/2018 | | A1 | | | 6,595 | | | | 7,719,052 | |

| CA State GO | | | 5.50 | % | | 4/1/2019 | | A1 | | | 8,715 | | | | 10,430,025 | |

| CA State GO | | | 6.00 | % | | 4/1/2019 | | A1 | | | 2,500 | | | | 3,057,225 | |

| Carmel Sch Bld Corp (AGM) | | | 4.75 | % | | 7/15/2019 | | AA | | | 6,105 | | | | 6,668,369 | |

| Centennial Auth (AG) | | | 5.00 | % | | 9/1/2014 | | Aa2 | | | 3,460 | | | | 3,579,059 | |

| Chicago Brd Ed | | | 5.00 | % | | 12/1/2014 | | A+ | | | 2,255 | | | | 2,378,551 | |

| Chicago GO | | | 5.25 | % | | 1/1/2022 | | A+ | | | 5,135 | | | | 5,328,127 | |

| Chicago GO (AGM) | | | 5.00 | % | | 1/1/2017 | | AA- | | | 9,000 | | | | 9,341,280 | |

| 26 | See Notes to Financial Statements. |

Schedule of Investments (continued)

SHORT DURATION TAX FREE FUND September 30, 2013

| Investments | | Interest

Rate | | Maturity

Date | | Credit

Rating:

S&P or

Moody’s(a) | | Principal

Amount

(000) | | | Fair

Value | |

| General Obligation (continued) | | | | | | | | | | | | | | | | |

| Clark Co Sch Dist Ltd Tax | | | 5.00 | % | | 6/15/2016 | | AA- | | $ | 7,500 | | | $ | 8,297,100 | |

| Cook Co GO | | | 5.00 | % | | 11/15/2017 | | AA | | | 5,010 | | | | 5,611,551 | |

| Cook Co GO (AMBAC) | | | 5.00 | % | | 11/15/2014 | | AA | | | 1,000 | | | | 1,036,870 | |

| Cook Co Sch Dist #99—Cicero (AGM) | | | 5.00 | % | | 12/1/2014 | | Aa3 | | | 1,690 | | | | 1,768,230 | |

| CT State GO | | | 5.00 | % | | 8/15/2021 | | AA | | | 5,000 | | | | 5,914,950 | |

| CT State GO (SIFMA) | | | 0.99 | % | # | 5/15/2018 | | AA | | | 4,000 | | | | 4,015,720 | |

| Cumberland Co COP | | | 4.00 | % | | 12/1/2014 | | AA | | | 3,500 | | | | 3,637,865 | |

| Detroit—State Aid GO | | | 5.00 | % | | 11/1/2015 | | AA | | | 6,775 | | | | 7,090,444 | |

| Douglas Co Sch Dist #206— Eastmont (NPFGC) | | | 5.00 | % | | 12/1/2014 | | Aa1 | | | 1,000 | | | | 1,049,030 | |

| Douglas Co SD | | | 4.00 | % | | 11/15/2018 | | Aa1 | | | 5,085 | | | | 5,690,166 | |

| FL St Dept Trans | | | 5.00 | % | | 7/1/2020 | | AAA | | | 9,330 | | | | 11,055,210 | |

| Frederick Co GO | | | 4.00 | % | | 8/1/2018 | | AA+ | | | 6,820 | | | | 7,621,214 | |

| Guam GO | | | 5.75 | % | | 11/15/2014 | | B+ | | | 1,740 | | | | 1,767,388 | |

| Hawaii Co GO (AMBAC) | | | 5.00 | % | | 7/15/2014 | | Aa2 | | | 1,750 | | | | 1,815,713 | |

| HI State GO | | | 5.00 | % | | 11/1/2021 | | AA | | | 5,000 | | | | 5,945,300 | |

| Honolulu City & Co GO (NPFGC) | | | 5.00 | % | | 7/1/2014 | | Aa1 | | | 2,475 | | | | 2,563,704 | |

| Houston GO | | | 5.00 | % | | 3/1/2018 | | AA | | | 7,365 | | | | 8,526,019 | |

| IL State GO | | | 5.00 | % | | 8/1/2016 | | A- | | | 7,000 | | | | 7,651,210 | |

| IL State GO | | | 5.00 | % | | 10/1/2017 | | A- | | | 4,575 | | | | 4,590,463 | |

| IL State GO | | | 5.00 | % | | 7/1/2017 | | A- | | | 6,000 | | | | 6,616,380 | |

| IL State GO (AGM) | | | 5.50 | % | | 5/1/2016 | | AA- | | | 7,000 | | | | 7,697,830 | |

| Kane Cook & Du Page Co Sch Dist #46 | | | 4.00 | % | | 1/1/2015 | | AA- | | | 9,450 | | | | 9,845,293 | |

| Kansas City MO GO | | | 4.00 | % | | 2/1/2018 | | AA | | | 9,000 | | | | 9,975,150 | |

| Katy ISD PSF GTD | | | 0.772 | % | # | 8/15/2036 | | AAA | | | 20,000 | | | | 20,089,600 | |

| Madison Co CUSD #2—Triad (NPFGC) | | | 5.25 | % | | 1/1/2015 | | A+ | | | 2,035 | | | | 2,111,740 | |

| Maricopa Co Sch Dist #11—Peoria USD (AGM) | | | 5.00 | % | | 7/1/2014 | | AA- | | | 70 | | | | 72,487 | |

| Miami Dade Co GO | | | 4.25 | % | | 10/1/2017 | | Aa2 | | | 6,320 | | | | 7,027,777 | |

| MN State GO | | | 5.00 | % | | 8/1/2014 | | AA+ | | | 1,200 | | | | 1,247,820 | |

| MS Dev Bank—Marshall Co | | | 5.00 | % | | 1/1/2018 | | AA- | | | 2,225 | | | | 2,522,438 | |

| Newark BAN | | | 2.00 | % | | 12/11/2013 | | NR | | | 3,360 | | | | 3,364,234 | |

| NJ State GO | | | 5.00 | % | | 6/1/2019 | | AA- | | | 13,400 | | | | 15,705,604 | |

| NYC GO | | | 5.00 | % | | 8/1/2019 | | AA | | | 5,585 | | | | 6,525,626 | |

| NYC GO | | | 5.00 | % | | 8/1/2017 | | AA | | | 5,890 | | | | 6,741,458 | |

| NYC GO | | | 5.00 | % | | 8/1/2021 | | AA | | | 7,410 | | | | 8,713,641 | |

| NYC GO(c) | | | 5.00 | % | | 8/1/2019 | | AA | | | 14,885 | | | | 17,391,932 | |

| NYC GO | | | 5.00 | % | | 8/1/2018 | | AA | | | 10,000 | | | | 11,603,700 | |

| | See Notes to Financial Statements. | 27 |

Schedule of Investments (continued)

SHORT DURATION TAX FREE FUND September 30, 2013

| Investments | | Interest