UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

--------

FORM N-CSR

--------

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBERS 811-3967

FIRST INVESTORS INCOME FUNDS

(Exact name of registrant as specified in charter)

110 Wall Street

New York, NY 10005

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

First Investors Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

1-732-855-2712

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: SEPTEMBER 30, 2007

DATE OF REPORTING PERIOD: SEPTEMBER 30, 2007

Item 1. Reports to Stockholders

The Annual Report to Stockholders follows

FOREWORD

This report is for the information of the shareholders of the Funds. It is the Funds’ practice to mail only one copy of their annual and semi-annual reports to all family members who reside in the same household. Additional copies of the reports will be mailed if requested by any shareholder in writing or by calling 1-800-423-4026. The Funds will ensure that separate reports are sent to any shareholder who subsequently changes his or her mailing address.

The views expressed in the portfolio manager letters reflect those views of the portfolio managers only through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Fund, including information about its Trustees.

Portfolio Managers’ Letter

TOTAL RETURN FUND

Dear Investor:

This is the annual report for the First Investors Total Return Fund for the fiscal year ended September 30, 2007. During the period, the Fund’s return on a net asset value basis was 11.7% for Class A shares and 10.9% for Class B shares, including dividends of 29.8 cents per share on Class A shares and 18.9 cents per share on Class B shares, and capital gains distributions of 10.2 cents per share for both Class A and Class B shares.

The Fund’s strategy remains to allocate its portfolio among stocks, bonds and cash equivalents, with at least 50% in stocks and at least 25% in bonds. Given the solid rise in equity prices during the fiscal year, the Fund benefited from its 59.9% average allocation to equity investments. The Fund also held, on average, a 35.3% allocation to fixed income securities and a 4.8% allocation to cash equivalents.

The performance of the equity portion of the portfolio was largely the result of the Fund’s investments in the industrials, technology, materials, energy and consumer staples sectors. Overall stock selection benefited most notably in the industrials, materials and consumer staples sectors.

Notable individual performers within the industrials sector included Precision Castparts, which benefited from increased demand for complex metal components and castings used in aerospace and industrial machines, 3M, the large-cap maker of “Scotch Tape” as well as other industrial, consumer and technology products, and Honeywell International, which benefited from increased global demand for its aerospace, automotive, power and control technology products. Within the materials sector, shares of specialty chemical producer Celanese benefited from increased worldwide demand for chemical feedstocks ethylene and propylene. Within the consumer staples sector, shares of small-cap personal products maker Chattem were strong as their acquisition of well known brand products from Johnson & Johnson, such as Kaopectate, ACT, Cortizone-10 and Balmex, added more in earnings than was originally anticipated.

The Fund continued to benefit from strong merger and acquisition activity among its holdings, as both strategic acquirers and private equity firms remained very active. During the fiscal year, eleven of our holdings received merger offers, which are either closed or still pending. The most notable contributors were the takeovers of First Data and Dollar General by the investment group KKR, Biomet by an investment consortium led by the Blackstone Group, Paxar by Avery Dennison and Triad Hospitals by Community Health Systems. The Fund has three deals waiting for completion as of the reporting date: the purchase of Clear Channel Communications by Bain Capital, the purchase of regional bank USB Holdings by KeyCorp and the pending merger of TransOcean and Global Santa Fe.

Portfolio Managers’ Letter (continued)

TOTAL RETURN FUND

The Fund maintained a diverse allocation strategy, which at the end of the reporting period was 57% large cap, 16% mid cap and 27% small cap, according to Lipper’s market capitalization ranges. While the large- and mid-cap components delivered satisfactory results, performance in the small-cap area was weaker as stock selection detracted particularly during the more volatile second half of the year.

During the review period, the Fund maintained a fixed income allocation of 35.3% of total assets, in addition to a 4.8% cash position. The fixed income investments were primarily allocated among high grade corporate bonds, U.S. government notes and mortgage-backed securities. The Fund had no investments in subprime mortgage-backed securities.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Sincerely,

Edwin D. Miska

Portfolio Manager and

Director of Equities, First Investors Management Company, Inc.

Clark D. Wagner

Portfolio Manager and

Director of Fixed Income, First Investors Management Company, Inc.

November 1, 2007

Understanding Your Fund’s Expenses

FIRST INVESTORS EQUITY FUNDS

FIRST INVESTORS INCOME FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only), a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, April 1, 2007, and held for the entire six-month period ended September 30, 2007. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for Class A and Class B shares, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Fund Expenses

TOTAL RETURN FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/07) | (9/30/07) | (4/1/07-9/30/07)* |

|

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,037.76 | $6.69 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.50 | $6.63 |

|

| |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,034.67 | $10.25 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,014.99 | $10.15 |

|

* Expenses are equal to the annualized expense ratio of 1.31% for Class A shares and 2.01% for

Class B shares, multiplied by the average account value over the period, multiplied by 183/365

(to reflect the one-half year period).

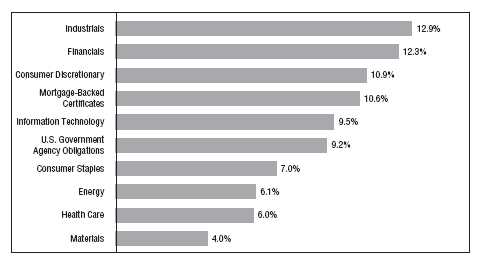

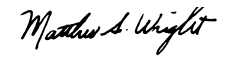

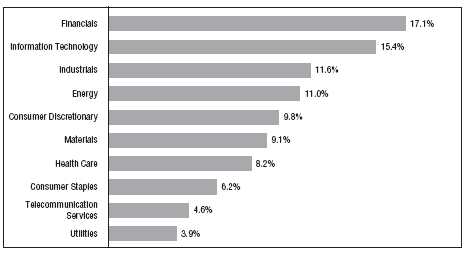

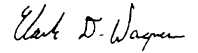

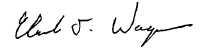

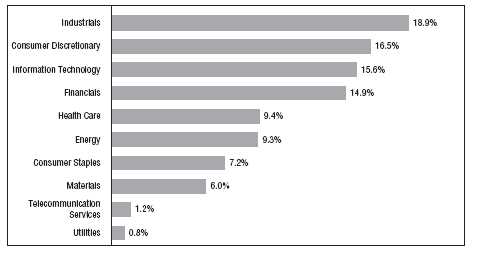

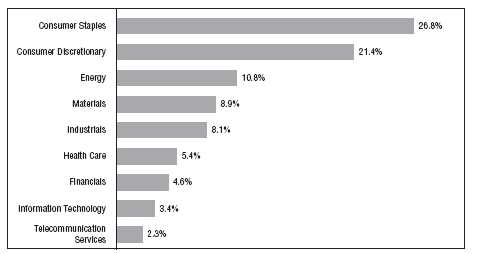

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2007,

and are based on the total value of investments.

4

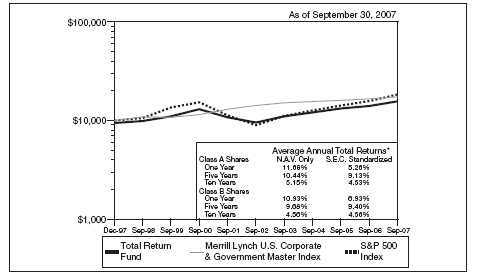

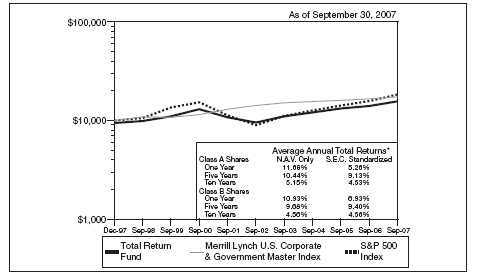

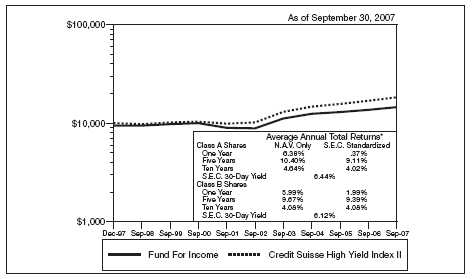

Cumulative Performance Information

TOTAL RETURN FUND

Comparison of change in value of $10,000 investment in the First Investors Total Return

Fund (Class A shares), the Merrill Lynch U.S. Corporate & Government Master Index and the

Standard & Poor's 500 Index.

The graph compares a $10,000 investment in the First Investors Total Return Fund (Class A shares) beginning 12/31/97 with theoretical investments in the Merrill Lynch Corporate & Government Master Index and the Standard & Poor’s 500 Index (the “Indices”). The Merrill Lynch U.S. Corporate & Government Master Index is unmanaged and tracks the performance of U.S. dollar-denominated investment grade U.S. Government and corporate public debt issued in the U.S. domestic bond market, excluding collateralized products such as mortgage pass-through and assets backed securities. Qualifying bonds have at least one year to maturity, a fixed coupon schedule and minimum amount outstanding of $1 billion for U.S. Treasuries and $150 million for all other securities. The Standard & Poor’s 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad dome stic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in these Indices. In addition, the Indices do not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/07) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75% (prior to 6/17/02, the maximum sales charge was 6.25%) . The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for Five Years and Ten Years would have been 9.01% and 4.37%, respectively. The Class B “S.E.C. Standardized” Average Annual Total Return for Five Years and Ten Years would have been 9.27% and 4.40%, respectively. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Merrill Lynch U.S. Corporate & Government Master Index figures are from Merrill Lynch & Co., Standard & Poor’s 500 Index figures are from Standard & Poor's and all other figures are from First Investors Management Company, Inc.

5

Portfolio of Investments

TOTAL RETURN FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | COMMON STOCKS—58.8% | | |

| | | | |

| | | Consumer Discretionary—9.7% | | |

| 81,800 | | bebe stores, inc. | $ | 1,196,734 |

| 62,100 | | Brown Shoe Company, Inc. | | 1,204,740 |

| 32,100 | * | Carter’s, Inc. | | 640,395 |

| 51,900 | | CBS Corporation – Class “B” | | 1,634,850 |

| 60,900 | * | CEC Entertainment, Inc. | | 1,636,383 |

| 40,000 | | Cinemark Holdings, Inc. | | 742,400 |

| 49,600 | | Clear Channel Communications, Inc. | | 1,857,024 |

| 26,100 | * | Eddie Bauer Holdings, Inc. | | 224,460 |

| 83,600 | | Foot Locker, Inc. | | 1,281,588 |

| 13,100 | | Genuine Parts Company | | 655,000 |

| 49,700 | | H&R Block, Inc. | | 1,052,646 |

| 62,200 | | Home Depot, Inc. | | 2,017,768 |

| 14,300 | | J.C. Penney Company, Inc. | | 906,191 |

| 40,000 | | Journal Register Company | | 96,000 |

| 30,200 | | Kenneth Cole Productions, Inc. – Class “A” | | 584,974 |

| 40,200 | | Leggett & Platt, Inc. | | 770,232 |

| 55,500 | * | Lincoln Educational Services Corporation | | 723,720 |

| 56,400 | | McDonald’s Corporation | | 3,072,108 |

| 102,700 | * | Morgans Hotel Group Company | | 2,233,725 |

| 57,700 | | Movado Group, Inc. | | 1,841,784 |

| 65,200 | | Newell Rubbermaid, Inc. | | 1,879,064 |

| 22,400 | | Orient-Express Hotels, Ltd. | | 1,148,448 |

| 12,900 | | Polo Ralph Lauren Corporation – Class “A” | | 1,002,975 |

| 71,100 | * | Quiksilver, Inc. | | 1,016,730 |

| 66,300 | | Ruby Tuesday, Inc. | | 1,215,942 |

| 17,500 | | Sherwin-Williams Company | | 1,149,925 |

| 28,500 | * | Skechers U.S.A., Inc. – Class “A” | | 629,850 |

| 53,900 | | Staples, Inc. | | 1,158,311 |

| 26,800 | * | Steiner Leisure, Ltd. | | 1,163,120 |

| 29,550 | * | Viacom, Inc. – Class “B” | | 1,151,564 |

| 79,200 | | Westwood One, Inc. | | 217,800 |

| 56,460 | | Wyndham Worldwide Corporation | | 1,849,630 |

|

| | | | | 37,956,081 |

|

| | | Consumer Staples—4.3% | | |

| 41,200 | | Altria Group, Inc. | | 2,864,636 |

| 34,200 | | Avon Products, Inc. | | 1,283,526 |

| 15,500 | * | Chattem, Inc. | | 1,093,060 |

| 18,100 | | Coca-Cola Company | | 1,040,207 |

| 58,200 | | CVS Caremark Corporation | | 2,306,466 |

|

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Consumer Staples (continued) | | |

| 28,549 | | Kraft Foods, Inc. – Class “A” | $ | 985,226 |

| 123,200 | | Nu Skin Enterprises, Inc. – Class “A” | | 1,990,912 |

| 13,400 | | PepsiCo, Inc. | | 981,684 |

| 20,800 | | Procter & Gamble Company | | 1,463,072 |

| 22,824 | | Tootsie Roll Industries, Inc. | | 605,521 |

| 39,600 | | Wal-Mart Stores, Inc. | | 1,728,540 |

| 8,475 | | WD-40 Company | | 289,337 |

|

| | | | | 16,632,187 |

|

| | | Energy—5.4% | | |

| 15,400 | | Anadarko Petroleum Corporation | | 827,750 |

| 65,900 | * | Cal Dive International, Inc. | | 988,500 |

| 12,950 | | Chesapeake Energy Corporation | | 456,617 |

| 23,200 | | ConocoPhillips | | 2,036,264 |

| 29,900 | | ExxonMobil Corporation | | 2,767,544 |

| 1,897 | | Hugoton Royalty Trust | | 44,845 |

| 8,386 | | Marathon Oil Corporation | | 478,170 |

| 41,400 | | Noble Corporation | | 2,030,670 |

| 19,900 | * | North American Energy Partners, Inc. | | 343,474 |

| 32,700 | | Sasol, Ltd. (ADR) | | 1,405,773 |

| 38,800 | | Suncor Energy, Inc. | | 3,678,628 |

| 18,200 | * | Swift Energy Company | | 744,744 |

| 23,400 | * | Transocean, Inc. | | 2,645,370 |

| 20,200 | | World Fuel Services Corporation | | 824,362 |

| 31,066 | | XTO Energy, Inc. | | 1,921,121 |

|

| | | | | 21,193,832 |

|

| | | Financials—8.8% | | |

| 13,600 | | American Express Company | | 807,432 |

| 28,900 | | American International Group, Inc. | | 1,955,085 |

| 2,580 | | Ameriprise Financial, Inc. | | 162,824 |

| 34,100 | | Astoria Financial Corporation | | 904,673 |

| 39,200 | | Bank of America Corporation | | 1,970,584 |

| 40,000 | | Brookline Bancorp, Inc. | | 463,600 |

| 17,092 | | Capital One Financial Corporation | | 1,135,421 |

| 35,300 | | Citigroup, Inc. | | 1,647,451 |

| 52,300 | | Colonial BancGroup, Inc. | | 1,130,726 |

| 26,550 | * | Discover Financial Services | | 552,240 |

| 64,350 | * | First Mercury Financial Corporation | | 1,384,168 |

| 13,024 | | Hartford Financial Services Group, Inc. | | 1,205,371 |

|

Portfolio of Investments (continued)

TOTAL RETURN FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Financials (continued) | | |

| 47,200 | | JPMorgan Chase & Company | $ | 2,162,704 |

| 16,800 | | Lehman Brothers Holdings, Inc. | | 1,037,064 |

| 16,900 | | Merrill Lynch & Company, Inc. | | 1,204,632 |

| 23,900 | | Morgan Stanley | | 1,505,700 |

| 53,500 | | New York Community Bancorp, Inc. | | 1,019,175 |

| 71,100 | | NewAlliance Bancshares, Inc. | | 1,043,748 |

| 13,100 | | Plum Creek Timber Company, Inc. (REIT) | | 586,356 |

| 34,800 | | South Financial Group, Inc. | | 791,352 |

| 58,775 | | Sovereign Bancorp, Inc. | | 1,001,526 |

| 67,700 | | Sunstone Hotel Investors, Inc. | | 1,735,828 |

| 19,600 | | SunTrust Banks, Inc. | | 1,483,132 |

| 52,500 | | U.S. Bancorp | | 1,707,825 |

| 53,845 | | U.S.B. Holding Company, Inc. | | 1,250,819 |

| 26,000 | | Wachovia Corporation | | 1,303,900 |

| 34,300 | | Washington Mutual, Inc. | | 1,211,133 |

| 16,300 | | Webster Financial Corporation | | 686,556 |

| 36,500 | | Wells Fargo & Company | | 1,300,130 |

|

| | | | | 34,351,155 |

|

| | | Health Care—5.6% | | |

| 42,400 | | Abbott Laboratories | | 2,273,488 |

| 18,500 | | Aetna, Inc. | | 1,003,995 |

| 12,300 | * | Amgen, Inc. | | 695,811 |

| 5,800 | | Baxter International, Inc. | | 326,424 |

| 12,675 | * | Covidien, Ltd. | | 526,013 |

| 5,200 | * | Genentech, Inc. | | 405,704 |

| 45,900 | | Johnson & Johnson | | 3,015,630 |

| 13,400 | * | Laboratory Corporation of America Holdings | | 1,048,282 |

| 19,400 | | Medtronic, Inc. | | 1,094,354 |

| 21,200 | | Merck & Company, Inc. | | 1,095,828 |

| 112,280 | | Pfizer, Inc. | | 2,743,000 |

| 32,600 | | Sanofi-Aventis (ADR) | | 1,382,892 |

| 32,900 | * | St. Jude Medical, Inc. | | 1,449,903 |

| 25,600 | * | Thermo Fisher Scientific, Inc. | | 1,477,632 |

| 23,000 | * | TriZetto Group, Inc. | | 402,730 |

| 14,350 | | UnitedHealth Group, Inc. | | 694,970 |

| 46,700 | | Wyeth | | 2,080,485 |

|

| | | | | 21,717,141 |

|

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Industrials—11.1% | | |

| 40,200 | | 3M Company | $ | 3,761,916 |

| 27,000 | * | AAR Corporation | | 819,180 |

| 22,500 | | Alexander & Baldwin, Inc. | | 1,127,925 |

| 95,704 | * | Altra Holdings, Inc. | | 1,595,386 |

| 31,700 | * | Armstrong World Industries, Inc. | | 1,286,703 |

| 13,600 | | Avery Dennison Corporation | | 775,472 |

| 62,000 | | Barnes Group, Inc. | | 1,979,040 |

| 25,450 | * | BE Aerospace, Inc. | | 1,056,938 |

| 21,600 | | Burlington Northern Santa Fe Corporation | | 1,753,272 |

| 26,000 | | Caterpillar, Inc. | | 2,039,180 |

| 36,500 | * | Gardner Denver, Inc. | | 1,423,500 |

| 66,600 | | General Electric Company | | 2,757,240 |

| 10,500 | * | Genlyte Group, Inc. | | 674,730 |

| 38,800 | | Harsco Corporation | | 2,299,676 |

| 51,800 | | Honeywell International, Inc. | | 3,080,546 |

| 9,000 | | Hubbell, Inc. – Class “B” | | 514,080 |

| 31,900 | | Illinois Tool Works, Inc. | | 1,902,516 |

| 74,100 | | Knoll, Inc. | | 1,314,534 |

| 14,300 | | Lockheed Martin Corporation | | 1,551,407 |

| 25,700 | * | Mobile Mini, Inc. | | 620,912 |

| 12,800 | * | Navigant Consulting, Inc. | | 162,048 |

| 23,600 | | Northrop Grumman Corporation | | 1,840,800 |

| 41,000 | * | PGT, Inc. | | 325,130 |

| 27,000 | * | Pinnacle Airlines Corporation | | 432,540 |

| 14,100 | | Precision Castparts Corporation | | 2,086,518 |

| 13,000 | | Steelcase, Inc. – Class “A” | | 233,740 |

| 64,500 | | TAL International Group, Inc. | | 1,617,015 |

| 12,675 | | Tyco International, Ltd. | | 562,010 |

| 44,900 | | United Technologies Corporation | | 3,613,552 |

|

| | | | | 43,207,506 |

|

| | | Information Technology—9.2% | | |

| 7,900 | * | CACI International, Inc. – Class “A” | | 403,611 |

| 105,600 | * | Cisco Systems, Inc. | | 3,496,416 |

| 38,800 | * | Electronics for Imaging, Inc. | | 1,042,168 |

| 96,900 | * | EMC Corporation | | 2,015,520 |

| 79,400 | * | Entrust, Inc. | | 169,122 |

| 38,600 | | Harris Corporation | | 2,230,694 |

| 42,900 | | Hewlett-Packard Company | | 2,135,991 |

| 48,500 | | Intel Corporation | | 1,254,210 |

| 30,800 | | International Business Machines Corporation | | 3,628,240 |

|

Portfolio of Investments (continued)

TOTAL RETURN FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Information Technology (continued) | | |

| 92,900 | | Microsoft Corporation | $ | 2,736,834 |

| 72,100 | | Motorola, Inc. | | 1,336,013 |

| 50,500 | * | NCI, Inc. – Class “A” | | 955,460 |

| 52,200 | | Nokia Corporation – Class “A” (ADR) | | 1,979,946 |

| 89,400 | * | Parametric Technology Corporation | | 1,557,348 |

| 35,600 | | QUALCOMM, Inc. | | 1,504,456 |

| 161,500 | * | Silicon Image, Inc. | | 831,725 |

| 75,800 | * | SMART Modular Technologies (WWH), Inc. | | 541,970 |

| 52,500 | * | Symantec Corporation | | 1,017,450 |

| 106,500 | * | TIBCO Software, Inc. | | 787,035 |

| 12,675 | | Tyco Electronics, Ltd. | | 449,075 |

| 13,500 | * | ValueClick, Inc. | | 303,210 |

| 36,000 | * | Varian Semiconductor Equipment Associates, Inc. | | 1,926,720 |

| 19,300 | * | VeriSign, Inc. | | 651,182 |

| 31,476 | | Western Union Company | | 660,052 |

| 22,000 | * | Wright Express Corporation | | 802,780 |

| 52,300 | | Xilinx, Inc. | | 1,367,122 |

|

| | | | | 35,784,350 |

|

| | | Materials—3.5% | | |

| 7,800 | | Ashland, Inc. | | 469,638 |

| 52,600 | | Celanese Corporation – Series “A” | | 2,050,348 |

| 21,900 | | Dow Chemical Company | | 943,014 |

| 20,900 | | Freeport-McMoRan Copper & Gold, Inc. | | 2,192,201 |

| 32,500 | | Lubrizol Corporation | | 2,114,450 |

| 14,400 | | PPG Industries, Inc. | | 1,087,920 |

| 16,800 | | Praxair, Inc. | | 1,407,168 |

| 52,200 | | RPM International, Inc. | | 1,250,190 |

| 13,000 | | Scotts Miracle-Gro Company – Class “A” | | 555,750 |

| 30,250 | | Temple-Inland, Inc. | | 1,592,057 |

|

| | | | | 13,662,736 |

|

| | | Telecommunication Services—.7% | | |

| 43,200 | | AT&T, Inc. | | 1,827,792 |

| 19,600 | | Verizon Communications, Inc. | | 867,888 |

|

| | | | | 2,695,680 |

|

| | | | |

| Shares or | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

|

| |

| | | Utilities—.5% | | |

| 30,200 | | Atmos Energy Corporation | $ | 855,264 |

| 19,500 | | Consolidated Edison, Inc. | | 902,850 |

|

| | | | | 1,758,114 |

|

| Total Value of Common Stocks (cost $164,509,642) | | 228,958,782 |

|

| | | CORPORATE BONDS—12.4% | | |

| | | | |

| | | Aerospace/Defense—.3% | | |

| $ 500M | | Boeing Co., 7.25%, 2025 | | 574,967 |

| 500M | | Precision Castparts Corp., 5.6%, 2013 | | 510,800 |

|

| | | | | 1,085,767 |

|

| | | Automotive—.1% | | |

| 500M | | Daimler Chrysler NA Holdings Corp., 5.75%, 2009 | | 505,422 |

|

| | | Chemicals—.2% | | |

| 900M | | Praxair, Inc., 5.375%, 2016 | | 884,757 |

|

| | | Consumer Non-Durables—.2% | | |

| 700M | | Newell Rubbermaid, Inc., 6.75%, 2012 | | 726,974 |

|

| | | Energy—.6% | | |

| 500M | | ConocoPhillips, 5.625%, 2016 | | 498,938 |

| 500M | | Kinder Morgan Finance Co., 5.35%, 2011 | | 489,133 |

| 1,000M | | Northern Border Pipeline Co., 7.1%, 2011 | | 1,051,475 |

| 419M | | Pacific Energy Partners LP, 7.125%, 2014 | | 430,076 |

|

| | | | | 2,469,622 |

|

| | | Financial Services—1.9% | | |

| 950M | | Citigroup, Inc., 6%, 2033 | | 928,535 |

| 1,000M | | Endurance Specialty Holdings, Ltd., 7%, 2034 | | 930,209 |

| 310M | | GATX Financial Corp., 5.5%, 2012 | | 309,051 |

| 1,000M | | Goldman Sachs Group, Inc., 6.45%, 2036 | | 978,871 |

| 500M | | Hibernia Corp., 5.35%, 2014 | | 481,287 |

| 760M | | Independence Community Bank Corp., 4.9%, 2010 | | 741,737 |

| 500M | | JPMorgan Chase & Co., 5.25%, 2015 | | 484,180 |

| 765M | | Marshall & Ilsley Bank, 5.2%, 2017 | | 731,200 |

| 500M | | MetLife, Inc., 6.4%, 2036 | | 476,947 |

| 1,000M | | Nationsbank Corp., 7.8%, 2016 | | 1,122,350 |

| 335M | | Washington Mutual Bank, 5.95%, 2013 | | 331,086 |

|

| | | | | 7,515,453 |

|

| |

11 |

Portfolio of Investments (continued)

TOTAL RETURN FUND

September 30, 2007

| | | | |

| Principal | | | | |

| Amount | | Security | | Value |

|

| |

| | | Financials—1.3% | | |

| $ 500M | | Caterpillar Financial Services Corp., 5.85%, 2017 | $ | 505,495 |

| 927M | | Ford Motor Credit Co., 9.75%, 2010 | | 946,309 |

| 500M | | General Electric Capital Corp., 5.625%, 2017 | | 500,806 |

| 1,000M | | General Motors Acceptance Corp., 7.75%, 2010 | | 992,376 |

| 625M | | Health Care Property Investors, Inc., 6%, 2017 | | 597,924 |

| 1,000M | | International Lease Finance Corp., 5.625%, 2013 | | 992,720 |

| 500M | | Siemens Financieringsmaatschappij NV, 5.75%, 2016 † | | 505,108 |

|

| | | | | 5,040,738 |

|

| | | Food/Beverage/Tobacco—1.0% | | |

| 1,000M | | Altria Group, Inc., 7%, 2013 | | 1,088,079 |

| 500M | | Anheuser-Busch Cos., Inc., 4.375%, 2013 | | 476,236 |

| 200M | | Bottling Group, LLC , 5%, 2013 | | 196,701 |

| 1,170M | | Bunge Limited Finance Corp., 5.875%, 2013 | | 1,160,961 |

| 1,000M | | Coca-Cola Enterprises, Inc., 7.125%, 2017 | | 1,111,160 |

|

| | | | | 4,033,137 |

|

| | | Food/Drug—.2% | | |

| 700M | | Kroger Co., 6.75%, 2012 | | 736,817 |

|

| | | Gaming/Leisure—.4% | | |

| 700M | | International Speedway Corp., 4.2%, 2009 | | 692,084 |

| 750M | | MGM Mirage, Inc., 8.5%, 2010 | | 787,500 |

|

| | | | | 1,479,584 |

|

| | | Health Care—.4% | | |

| 500M | | Abbott Laboratories, 5.875%, 2016 | | 505,347 |

| 336M | | Baxter International, Inc., 5.9%, 2016 | | 339,339 |

| 800M | | Wyeth, 6.95%, 2011 | | 839,082 |

|

| | | | | 1,683,768 |

|

| | | Information Technology—.3% | | |

| 1,000M | | International Business Machines Corp., 7%, 2025 | | 1,105,244 |

|

| | | Manufacturing—.5% | | |

| 1,000M | | Caterpillar, Inc., 6.05%, 2036 | | 1,004,680 |

| 1,000M | | Crane Co., 6.55%, 2036 | | 985,207 |

|

| | | | | 1,989,887 |

|

| | | | |

| Principal | | | | |

| Amount | | Security | | Value |

|

| |

| | | Media-Broadcasting—.4% | | |

| $ 750M | | Comcast Cable Communications, Inc., 7.125%, 2013 | $ | 799,280 |

| 800M | | Cox Communications, Inc., 5.5%, 2015 | | 773,166 |

|

| | | | | 1,572,446 |

|

| | | Media-Diversified—1.1% | | |

| | | AOL Time Warner, Inc.: | | |

| 750M | | 6.75%, 2011 | | 780,154 |

| 1,000M | | 6.875%, 2012 | | 1,050,308 |

| 500M | | News America, Inc., 5.3%, 2014 | | 487,149 |

| 705M | | Viacom, Inc., 8.625%, 2012 | | 788,514 |

| 1,000M | | Walt Disney Co., 5.7%, 2011 | | 1,015,133 |

|

| | | | | 4,121,258 |

|

| | | Metals/Mining—.4% | | |

| 1,000M | | Alcoa, Inc., 6%, 2012 | | 1,020,853 |

| 500M | | Vale Overseas, Ltd., 6.875%, 2036 | | 517,633 |

|

| | | | | 1,538,486 |

|

| | | Real Estate Investment Trusts—.2% | | |

| 700M | | Mack-Cali Realty LP, 7.75%, 2011 | | 750,103 |

|

| | | Retail-General Merchandise—.4% | | |

| 500M | | Lowe’s Companies, Inc., 5.6%, 2012 | | 505,443 |

| 1,200M | | Wal-Mart Stores, Inc., 5.8%, 2018 | | 1,210,639 |

|

| | | | | 1,716,082 |

|

| | | Telecommunications—.8% | | |

| 800M | | GTE Corp., 6.84%, 2018 | | 854,853 |

| 600M | | SBC Communications, Inc., 6.25%, 2011 | | 617,888 |

| 600M | | Verizon New York, Inc., 6.875%, 2012 | | 632,652 |

| 1,000M | | Vodafone AirTouch PLC, 7.75%, 2010 | | 1,056,392 |

|

| | | | | 3,161,785 |

|

| | | Transportation—.6% | | |

| 500M | | Burlington Northern Santa Fe Corp., 4.3%, 2013 | | 472,096 |

| 500M | | Canadian Pacific Railroad Co., 5.95%, 2037 | | 463,212 |

| 335M | | FedEx Corp., 5.5%, 2009 | | 338,895 |

| 1,000M | | Union Pacific Corp., 7.375%, 2009 | | 1,044,965 |

|

| | | | | 2,319,168 |

|

Portfolio of Investments (continued)

TOTAL RETURN FUND

September 30, 2007

| | | | |

| Principal | | | | |

| Amount | | Security | | Value |

|

| |

| | | Utilities—.8% | | |

| $ 1,000M | | Carolina Power & Light, Inc., 5.15%, 2015 | $ | 970,738 |

| 350M | | Entergy Gulf States, Inc., 5.25%, 2015 | | 330,410 |

| 1,000M | | Great River Energy Co., 5.829%, 2017 † | | 1,024,152 |

| 900M | | Public Service Electric & Gas Co., 6.75%, 2016 | | 964,184 |

|

| | | | | 3,289,484 |

|

| | | Waste Management—.3% | | |

| 1,000M | | Waste Management, Inc., 6.875%, 2009 | | 1,034,003 |

|

| Total Value of Corporate Bonds (cost $49,041,842) | | 48,759,985 |

|

| | | MORTGAGE-BACKED CERTIFICATES—10.6% | | |

| | | Fannie Mae—10.0% | | |

| 12,223M | | 5.5%, 4/1/2033—3/1/2037 | | 11,996,150 |

| 18,916M | | 6%, 5/1/2036—8/1/2037 | | 18,950,269 |

| 5,722M | | 6.5%, 11/1/2033—7/1/2037 | | 5,834,370 |

| 1,881M | | 7%, 3/1/2032—8/1/2032 | | 1,975,191 |

|

| | | | | 38,755,980 |

|

| | | Freddie Mac—.6% | | |

| 2,295M | | 6%, 9/1/2032—10/1/2035 | | 2,302,690 |

|

| Total Value of Mortgage-Backed Certificates (cost $41,214,243) | | 41,058,670 |

|

| | U.S. GOVERNMENT AGENCY OBLIGATIONS—9.2% | | |

| | | Fannie Mae: | | |

| 2,000M | | 6%, 2012 | | 2,005,018 |

| 5,000M | | 5.4%, 2013 | | 5,000,485 |

| 4,000M | | 6%, 2014 | | 4,009,964 |

| 5,000M | | 6%, 2015 | | 5,001,370 |

| 4,000M | | 6%, 2016 | | 4,001,604 |

| 1,000M | | 6%, 2016 | | 1,001,869 |

| 1,000M | | 6.5%, 2017 | | 1,002,502 |

| | | Federal Farm Credit Bank: | | |

| 4,650M | | 4.94%, 2012 | | 4,636,134 |

| 3,000M | | 5.33%, 2013 | | 2,999,982 |

| 5,000M | | Federal Home Loan Bank, 6%, 2013 | | 5,044,690 |

| 1,000M | | Freddie Mac, 6%, 2017 | | 1,019,083 |

|

| Total Value of U.S. Government Agency Obligations (cost $35,620,587) | | 35,722,701 |

|

| | | | | |

| Principal | | | | | |

| Amount | | Security | | | Value |

|

| |

| | | U.S. GOVERNMENT OBLIGATIONS—3.2% | |

| | | U.S. Treasury Notes: | | | |

| $ 5,000M | | 4.5%, 2012 | | $ | 5,062,110 |

| 7,000M | | 5.375%, 2031 | | | 7,495,474 |

|

| Total Value of U.S. Government Obligations (cost $12,419,736) | 12,557,584 |

|

| | | MUNICIPAL BONDS—.8% | | | |

| 3,000M | | Tobacco Settlement Fin. Auth., West Virginia, Series “A”, | |

| | | 7.467%, 2047 (cost $3,000,000) | | | 2,953,470 |

|

| | | PASS THROUGH CERTIFICATES—.2% | |

| | | Transportation | | | |

| 613M | | Continental Airlines, Inc., 8.388%, 2020 (cost $640,188) | 611,594 |

|

| | | SHORT-TERM CORPORATE NOTES—4.5% | |

| | | General Electric Capital Corp.: | | | |

| 11,100M | | 4.72%, 10/10/07 | | | 11,083,983 |

| 1,000M | | 4.74%, 10/15/07 | | | 997,893 |

| 3,500M | | 5.24%, 10/23/07 | | | 3,487,730 |

| 2,000M | | New Jersey Natural Gas Co., 4.75%, 10/9/07 | | | 1,997,359 |

|

| Total Value of Short-Term Corporate Notes (cost $17,566,965) | 17,566,965 |

|

| Total Value of Investments (cost $324,013,203) | 99.7 | % | 388,189,751 |

| Other Assets, Less Liabilities | . 3 | | 1,279,596 |

|

| Net Assets | | | 100.0 | % | $389,469,347 |

|

* Non-income producing

† Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4).

Summary of Abbreviations:

ADR American Depositary Receipts

REIT Real Estate Investment Trusts

| |

| See notes to financial statements | 15 |

Portfolio Manager’s Letter

VALUE FUND

Dear Investor:

This is the annual report for the First Investors Value Fund for the fiscal year ended September 30, 2007. During the period, the Fund’s return on a net asset value basis was 11.4% for Class A shares and 10.6% for Class B shares, including dividends of 10.0 cents per share on Class A shares and 4.4 cents per share on Class B shares.

Although the Fund benefited from positive returns across all major economic sectors, the energy sector was the leading sector for the Fund. The Fund’s biggest individual contributors to performance were Marathon Oil, Chevron and McDonald’s.

The Fund benefited from an underweight position in health care stocks, which lagged broad market returns. Stock selection in the financials sector was also beneficial to the Fund. Within this sector, performance was driven by A.G. Edwards, a brokerage firm that agreed to be acquired by Wachovia, and Brookfield Asset Management, an asset management company with substantial real estate and power generation assets.

While the Fund lagged the S&P 500 Index, this was primarily due to the fact that the Fund employs a multi-cap strategy. As a result, the Fund held small-cap stocks, which as a class did not perform as well as mid- and large-cap stocks. The S&P 500 is predominantly made up of large- and mid-cap stocks.

On a relative basis, the Fund’s sector allocation in the energy, information technology and consumer discretionary sectors hurt performance. The Fund was underweight in energy and information technology, two top-performing sectors, and overweight in consumer discretionary, a weaker performing sector. In addition, stock selection in the industrials, materials and utilities sectors had a negative impact. The two poorest performing stocks were Talbot’s, a women’s apparel retailer and Lee Enterprises, a newspaper publisher. The Fund’s cash position was also a drag on performance.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Sincerely,

Matthew S. Wright

Portfolio Manager

November 1, 2007

Fund Expenses

VALUE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will

help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for

a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/07) | (9/30/07) | (4/1/07-9/30/07)* |

|

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,024.96 | $6.70 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.45 | $6.68 |

|

| |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,020.55 | $10.23 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,014.94 | $10.20 |

|

* Expenses are equal to the annualized expense ratio of 1.32% for Class A shares and 2.02%

for Class B shares, multiplied by the average account value over the period, multiplied by

183/365 (to reflect the one-half year period).

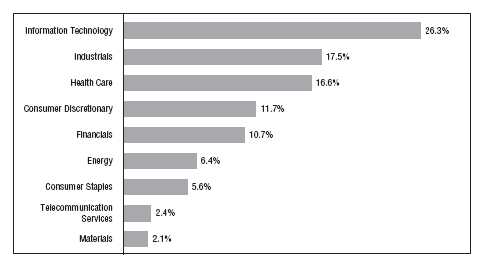

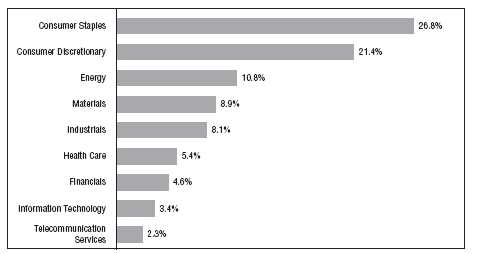

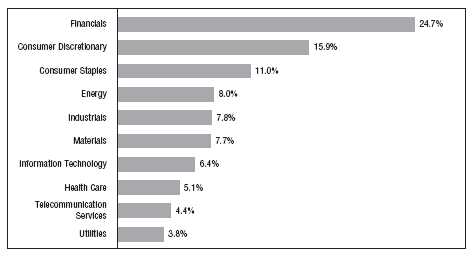

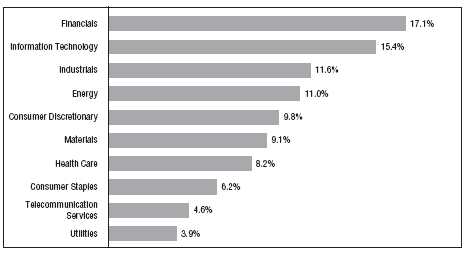

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2007, and are based on the total value of investments.

Cumulative Performance Information

VALUE FUND

Comparison of change in value of $10,000 investment in the First Investors Value Fund

(Class A shares) and the Standard & Poor's 500 Index.

The graph compares a $10,000 investment in the First Investors Value Fund (Class A shares) beginning 10/31/97 with a theoretical investment in the Standard & Poor’s 500 Index (the “Index”). The Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/07) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A ���S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75% (prior to 6/17/02 the maximum sales charge was 6.25%) . The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or l ess than the original cost. Standard & Poor’s 500 Index figures are from Standard & Poor’s and all other figures are from First Investors Management Company, Inc.

18

Portfolio of Investments

VALUE FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | COMMON STOCKS—93.6% | | |

| | | Consumer Discretionary—15.9% | | |

| 10,500 | | Autoliv, Inc. | $ | 627,375 |

| 123,600 | | bebe stores, inc. | | 1,808,268 |

| 24,500 | | Best Buy Company, Inc. | | 1,127,490 |

| 58,900 | | Bob Evans Farms, Inc. | | 1,777,602 |

| 48,900 | | Carnival Corporation | | 2,368,227 |

| 34,300 | | CBS Corporation – Class “B” | | 1,080,450 |

| 80,300 | | Cinemark Holdings, Inc. | | 1,490,368 |

| 102,500 | | Clear Channel Communications, Inc. | | 3,837,600 |

| 107,100 | | Family Dollar Stores, Inc. | | 2,844,576 |

| 46,000 | | Gannett Company, Inc. | | 2,010,200 |

| 46,000 | | Genuine Parts Company | | 2,300,000 |

| 62,000 | | H&R Block, Inc. | | 1,313,160 |

| 14,825 | * | Hanesbrands, Inc. | | 415,990 |

| 99,900 | | Haverty Furniture Companies, Inc. | | 876,123 |

| 89,000 | | Home Depot, Inc. | | 2,887,160 |

| 24,700 | | J.C. Penney Company, Inc. | | 1,565,239 |

| 57,600 | | Jones Apparel Group, Inc. | | 1,217,088 |

| 61,200 | | Kenneth Cole Productions, Inc. – Class “A” | | 1,185,444 |

| 118,600 | | Lee Enterprises, Inc. | | 1,846,602 |

| 118,300 | | Leggett & Platt, Inc. | | 2,266,628 |

| 31,600 | | Liz Claiborne, Inc. | | 1,084,828 |

| 16,400 | | Magna International, Inc. – Class “A” | | 1,579,484 |

| 75,100 | | Marine Products Corporation | | 636,848 |

| 102,600 | | McDonald’s Corporation | | 5,588,622 |

| 111,100 | | Modine Manufacturing Company | | 2,957,482 |

| 101,700 | | New York Times Company – Class “A” | | 2,009,592 |

| 42,500 | | Newell Rubbermaid, Inc. | | 1,224,850 |

| 102,600 | | Pearson PLC (ADR) | | 1,586,196 |

| 100,100 | | Ruby Tuesday, Inc. | | 1,835,834 |

| 50,000 | | Staples, Inc. | | 1,074,500 |

| 132,000 | | Stein Mart, Inc. | | 1,004,520 |

| 118,100 | | Talbots, Inc. | | 2,125,800 |

| 61,700 | | Tiffany & Company | | 3,229,995 |

| 170,800 | | Time Warner, Inc. | | 3,135,888 |

| 32,901 | | Tribune Company | | 898,855 |

| 123,700 | | Walt Disney Company | | 4,254,043 |

| 32,920 | | Wyndham Worldwide Corporation | | 1,078,459 |

|

| | | | | 70,151,386 |

|

Portfolio of Investments (continued)

VALUE FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Consumer Staples—11.0% | | |

| 88,800 | | Anheuser-Busch Companies, Inc. | $ | 4,439,112 |

| 76,400 | | Avon Products, Inc. | | 2,867,292 |

| 66,000 | | B&G Foods, Inc. – Class “A” | | 844,800 |

| 86,600 | | Coca-Cola Company | | 4,976,902 |

| 59,400 | | ConAgra Foods, Inc. | | 1,552,122 |

| 34,141 | | Del Monte Foods Company | | 358,481 |

| 45,200 | | Diageo PLC (ADR) | | 3,965,396 |

| 34,100 | | Estee Lauder Companies, Inc. – Class “A” | | 1,447,886 |

| 41,400 | | Fomento Economico Mexicano SA de CV (ADR) | | 1,548,360 |

| 53,600 | | H.J. Heinz Company | | 2,476,320 |

| 71,300 | | Hershey Company | | 3,309,033 |

| 47,100 | | Kimberly-Clark Corporation | | 3,309,246 |

| 133,700 | | Kraft Foods, Inc. – Class “A” | | 4,613,987 |

| 19,900 | | Pepsi Bottling Group, Inc. | | 739,683 |

| 46,800 | | Ruddick Corporation | | 1,569,672 |

| 148,200 | | Sara Lee Corporation | | 2,473,458 |

| 50,625 | | Tasty Baking Company | | 510,806 |

| 106,700 | | Topps Company, Inc. | | 1,033,923 |

| 37,100 | | UST, Inc. | | 1,840,160 |

| 100,900 | | Wal-Mart Stores, Inc. | | 4,404,285 |

|

| | | | | 48,280,924 |

|

| | | Energy—8.0% | | |

| 53,900 | | Anadarko Petroleum Corporation | | 2,897,125 |

| 45,300 | | BP PLC (ADR) | | 3,141,555 |

| 65,917 | | Chevron Corporation | | 6,168,513 |

| 54,400 | | ConocoPhillips | | 4,774,688 |

| 36,100 | | Diamond Offshore Drilling, Inc. | | 4,089,769 |

| 8,100 | | Hess Corporation | | 538,893 |

| 101,600 | | Marathon Oil Corporation | | 5,793,232 |

| 54,100 | | Royal Dutch Shell PLC – Class “A” (ADR) | | 4,445,938 |

| 57,600 | | Tidewater, Inc. | | 3,619,584 |

|

| | | | | 35,469,297 |

|

| | | Financials—24.1% | | |

| 44,000 | | A.G. Edwards, Inc. | | 3,736,040 |

| 19,600 | | ACE, Ltd. | | 1,187,172 |

| 28,500 | | Allstate Corporation | | 1,629,915 |

| 31,000 | | American International Group, Inc. | | 2,097,150 |

| 51,600 | | Aon Corporation | | 2,312,196 |

|

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Financials (continued) | | |

| 45,000 | | Aspen Insurance Holdings, Ltd. | $ | 1,255,950 |

| 35,000 | | Assured Guaranty, Ltd. | | 950,950 |

| 166,200 | | Bank Mutual Corporation | | 1,959,498 |

| 94,266 | | Bank of America Corporation | | 4,738,752 |

| 104,528 | | Bank of New York Mellon Corporation | | 4,613,866 |

| 147,375 | | Brookfield Asset Management, Inc. – Class “A” | | 5,673,938 |

| 96,200 | | Brookline Bancorp, Inc. | | 1,114,958 |

| 25,903 | | Capital One Financial Corporation | | 1,720,736 |

| 43,456 | | Chubb Corporation | | 2,330,980 |

| 54,047 | | Cincinnati Financial Corporation | | 2,340,776 |

| 93,600 | | Citigroup, Inc. | | 4,368,312 |

| 44,800 | | Comerica, Inc. | | 2,297,344 |

| 45,300 | * | Discover Financial Services | | 942,240 |

| 41,400 | | EMC Insurance Group, Inc. | | 1,075,986 |

| 39,149 | | Erie Indemnity Company – Class “A” | | 2,393,178 |

| 21,000 | | FBL Financial Group, Inc. – Class “A” | | 829,290 |

| 85,900 | | First Potomac Realty Trust (REIT) | | 1,872,620 |

| 91,300 | | Hudson City Bancorp, Inc. | | 1,404,194 |

| 102,800 | | Invesco PLC (ADR) | | 2,806,440 |

| 102,100 | | JPMorgan Chase & Company | | 4,678,222 |

| 48,600 | | KeyCorp | | 1,571,238 |

| 44,074 | | Lincoln National Corporation | | 2,907,562 |

| 41,900 | | Merrill Lynch & Company, Inc. | | 2,986,632 |

| 53,600 | | Morgan Stanley | | 3,376,800 |

| 119,200 | | NewAlliance Bancshares, Inc. | | 1,749,856 |

| 33,900 | | One Liberty Properties, Inc. (REIT) | | 659,355 |

| 100,000 | | People’s United Financial, Inc. | | 1,728,000 |

| 55,800 | | Plum Creek Timber Company, Inc. (REIT) | | 2,497,608 |

| 31,500 | | PMI Group, Inc. | | 1,030,050 |

| 48,800 | | PNC Financial Services Group, Inc. | | 3,323,280 |

| 96,500 | | Progressive Corporation | | 1,873,065 |

| 51,000 | | Protective Life Corporation | | 2,164,440 |

| 115,117 | | Regions Financial Corporation | | 3,393,649 |

| 34,400 | | St. Joe Company | | 1,156,184 |

| 43,893 | | State Street Corporation | | 2,991,747 |

| 36,700 | | SunTrust Banks, Inc. | | 2,777,089 |

| 116,400 | | U-Store-It Trust (REIT) | | 1,536,480 |

| 44,200 | | Wachovia Corporation | | 2,216,630 |

| 54,000 | | Waddell & Reed Financial, Inc. – Class “A” | | 1,459,620 |

| 9,000 | | Washington Mutual, Inc. | | 317,790 |

|

Portfolio of Investments (continued)

VALUE FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Financials (continued) | | |

| 96,300 | | Wells Fargo & Company | $ | 3,430,206 |

| 97,300 | | Westfield Financial, Inc. | | 944,783 |

|

| | | | | 106,422,767 |

|

| | | Health Care—5.1% | | |

| 74,800 | | Abbott Laboratories | | 4,010,776 |

| 23,875 | * | Covidien, Ltd. | | 990,813 |

| 49,100 | | GlaxoSmithKline PLC (ADR) | | 2,612,120 |

| 90,800 | | Johnson & Johnson | | 5,965,560 |

| 32,100 | | Novartis AG (ADR) | | 1,764,216 |

| 179,500 | | Pfizer, Inc. | | 4,385,185 |

| 81,700 | | Schering-Plough Corporation | | 2,584,171 |

|

| | | | | 22,312,841 |

|

| | | Industrials—7.8% | | |

| 26,000 | | 3M Company | | 2,433,080 |

| 2,600 | | Alexander & Baldwin, Inc. | | 130,338 |

| 38,600 | | Avery Dennison Corporation | | 2,200,972 |

| 57,200 | | Dover Corporation | | 2,914,340 |

| 87,200 | | Federal Signal Corporation | | 1,339,392 |

| 41,300 | | General Dynamics Corporation | | 3,488,611 |

| 69,000 | | Honeywell International, Inc. | | 4,103,430 |

| 17,800 | | Hubbell, Inc. – Class “B” | | 1,016,736 |

| 21,000 | | Illinois Tool Works, Inc. | | 1,252,440 |

| 32,422 | | Lawson Products, Inc. | | 1,128,610 |

| 86,200 | | Masco Corporation | | 1,997,254 |

| 39,600 | | Norfolk Southern Corporation | | 2,055,636 |

| 59,600 | | Pitney Bowes, Inc. | | 2,707,032 |

| 7,500 | | SPX Corporation | | 694,200 |

| 23,875 | | Tyco International, Ltd. | | 1,058,618 |

| 47,400 | | United Parcel Service, Inc. – Class “B” | | 3,559,740 |

| 139,600 | | Werner Enterprises, Inc. | | 2,394,140 |

|

| | | | | 34,474,569 |

|

| | | Information Technology—6.4% | | |

| 46,000 | | Automatic Data Processing, Inc. | | 2,112,780 |

| 45,700 | | AVX Corporation | | 735,770 |

| 33,765 | | Bel Fuse, Inc. – Class “B” | | 1,170,295 |

| 19,100 | | Broadridge Financial Solutions, Inc. | | 361,945 |

| 30,200 | | Fair Isaac Corporation | | 1,090,522 |

|

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Information Technology (continued) | | |

| 76,400 | | Hewlett-Packard Company | $ | 3,803,956 |

| 65,000 | | Intel Corporation | | 1,680,900 |

| 12,200 | | International Business Machines Corporation | | 1,437,160 |

| 159,100 | | Methode Electronics, Inc. | | 2,394,455 |

| 120,500 | | Microsoft Corporation | | 3,549,930 |

| 54,600 | | Molex, Inc. | | 1,470,378 |

| 130,700 | | Motorola, Inc. | | 2,421,871 |

| 76,000 | | Nokia Corporation – Class “A” (ADR) | | 2,882,680 |

| 91,600 | * | Planar Systems, Inc. | | 614,636 |

| 34,000 | | Texas Instruments, Inc. | | 1,244,060 |

| 32,775 | | Tyco Electronics, Ltd. | | 1,161,218 |

|

| | | | | 28,132,556 |

|

| | | Materials—7.7% | | |

| 36,400 | | Air Products & Chemicals, Inc. | | 3,558,464 |

| 44,400 | | Albemarle Corporation | | 1,962,480 |

| 63,200 | | Alcoa, Inc. | | 2,472,384 |

| 20,400 | | Bemis Company, Inc. | | 593,844 |

| 124,330 | | Chemtura Corporation | | 1,105,294 |

| 56,600 | | Compass Minerals International, Inc. | | 1,926,664 |

| 103,300 | | Dow Chemical Company | | 4,448,098 |

| 79,200 | | DuPont (E.I.) de Nemours & Company | | 3,925,152 |

| 32,000 | | Glatfelter | | 474,880 |

| 106,200 | | Louisiana-Pacific Corporation | | 1,802,214 |

| 61,700 | | Lubrizol Corporation | | 4,014,202 |

| 60,100 | | MeadWestvaco Corporation | | 1,774,753 |

| 73,830 | | Myers Industries, Inc. | | 1,463,311 |

| 144,800 | | Sappi, Ltd. (ADR) | | 2,215,440 |

| 66,600 | | Sonoco Products Company | | 2,009,988 |

| 45,223 | | Tronox, Inc. – Class “B” | | 408,364 |

|

| | | | | 34,155,532 |

|

| | | Telecommunication Services—4.1% | | |

| 9,651 | | ALLTEL Corporation | | 672,482 |

| 135,430 | | AT&T, Inc. | | 5,730,043 |

| 55,200 | | D&E Communications, Inc. | | 784,944 |

| 4,120 | | Embarq Corporation | | 229,072 |

| 50,900 | | Nippon Telegraph and Telephone Corporation (ADR) | | 1,184,443 |

| 142,600 | | Sprint Nextel Corporation | | 2,709,400 |

| 24,000 | | Telephone & Data Systems, Inc. | | 1,602,000 |

|

Portfolio of Investments (continued)

VALUE FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Telecommunication Services (continued) | | |

| 30,000 | | Telephone & Data Systems, Inc. – Special Shares | $ | 1,860,000 |

| 73,828 | | Verizon Communications, Inc. | | 3,269,104 |

| 9,978 | | Windstream Corporation | | 140,889 |

|

| | | | | 18,182,377 |

|

| | | Utilities—3.5% | | |

| 29,250 | | American States Water Company | | 1,140,750 |

| 41,400 | | FPL Group, Inc. | | 2,520,431 |

| 84,250 | | MDU Resources Group, Inc. | | 2,345,520 |

| 85,800 | | NiSource, Inc. | | 1,642,211 |

| 37,700 | | Northwest Natural Gas Company | | 1,722,890 |

| 40,200 | | ONEOK, Inc. | | 1,905,480 |

| 51,200 | | Southwest Gas Corporation | | 1,448,448 |

| 48,700 | | United Utilities PLC (ADR) | | 1,389,075 |

| 50,300 | | Vectren Corporation | | 1,372,686 |

|

| | | | | 15,487,491 |

|

| Total Value of Common Stocks (cost $308,539,111) | | 413,069,740 |

|

| | | PREFERRED STOCKS—.6% | | |

| | | Financials—.2% | | |

| 44,000 | | Citigroup Capital XVI, 6.45%, 2066 – Series “W” | | 1,030,040 |

|

| | | Telecommunication Services—.2% | | |

| 44,800 | | AT&T, Inc., 6.375%, 2056 | | 1,067,136 |

|

| | | Utilities—.2% | | |

| 31,600 | | Entergy Louisiana, LLC, 7.6%, 2032 | | 790,632 |

|

| Total Value of Preferred Stocks (cost $3,035,047) | | 2,887,808 |

|

| | | CONVERTIBLE PREFERRED STOCKS—.4% | | |

| | | Financials | | |

| 56,900 | | Lehman Brothers Holdings, Inc., 6.25%, 2007 – Series “GIS” | | |

| | | (cost $1,446,983) | | 1,536,300 |

|

| | | | | |

| Principal | | | | | |

| Amount | | Security | | | Value |

|

| |

| | | CORPORATE BONDS—.1% | | | |

| | | Utilities | | | |

| $ 500M | | Union Electric Co., 6.75%, 2008 (cost $499,872) | $ | 502,954 |

|

| | | SHORT-TERM CORPORATE NOTES—5.2% | | |

| 19,700M | | General Electric Capital Corp., 4.72%, 10/10/07 | | 19,671,573 |

| 3,100M | | New Jersey Natural Gas Co., 4.75%, 10/12/07 | | 3,094,681 |

|

| Total Value of Short-Term Corporate Notes (cost $22,766,254) | | 22,766,254 |

|

| Total Value of Investments (cost $336,287,267) | 99.9 | % | 440,763,056 |

| Other Assets, Less Liabilities | .1 | | 450,768 |

|

| Net Assets | | | 100.0 | % | $441,213,824 |

|

* Non-income producing

Summary of Abbreviations:

ADR American Depositary Receipts

REIT Real Estate Investment Trust

| |

| See notes to financial statements | 25 |

Portfolio Managers’ Letter

BLUE CHIP FUND

Dear Investor:

This is the annual report for the First Investors Blue Chip Fund for the fiscal year ended September 30, 2007. During the period, the Fund’s return on a net asset value basis was 14.8% for Class A shares and 14.0% for Class B shares, including dividends of 13.0 cents per share on Class A shares.

Although the Fund benefited from positive returns across all major economic sectors, the energy sector was the leading sector for the Fund. The biggest individual contributors to results within the energy sector were ExxonMobil, Chevron and Schlumberger.

The information technology, telecommunications services and industrials sectors also turned in strong performances. Nokia and International Business Machines were the top contributing holdings in technology. The telecommunications services sector was led by shares of AT&T and Verizon Communications. General Electric and United Technologies boosted performance in the industrials sector.

The financials sector generated the weakest returns for the Fund as deterioration in the housing market affected some of our holdings. Capital One Financial and Washington Mutual were among our worst performing financial stocks. Aside from financials, performance in the health care sector lagged in large part due to the Fund’s holdings in Amgen and Pfizer.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Sincerely,

| |

Matthew S. Wright

Portfolio Manager | Constance Unger

Assistant Portfolio Manager |

November 1, 2007

Fund Expenses

BLUE CHIP FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/07) | (9/30/07) | (4/1/07-9/30/07)* |

|

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,088.06 | $7.17 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.20 | $6.93 |

|

| |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,083.98 | $10.81 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,014.69 | $10.45 |

|

* Expenses are equal to the annualized expense ratio of 1.37% for Class A shares and 2.07%

for Class B shares, multiplied by the average account value over the period, multiplied by

183/365 (to reflect the one-half year period).

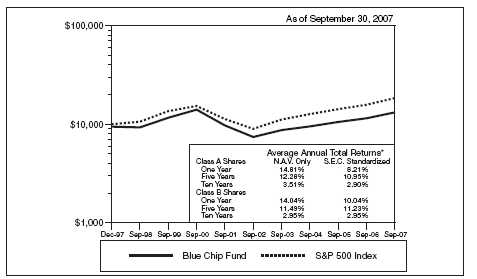

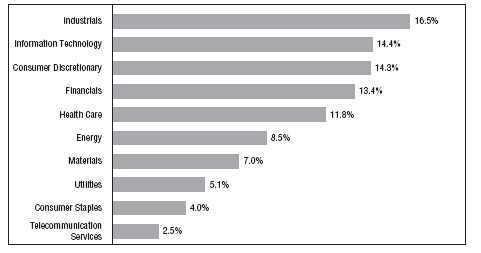

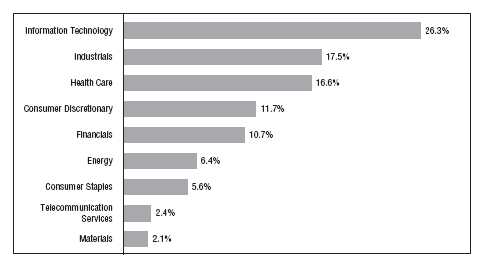

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2007,

and are based on the total value of investments.

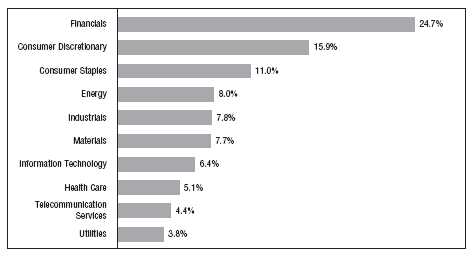

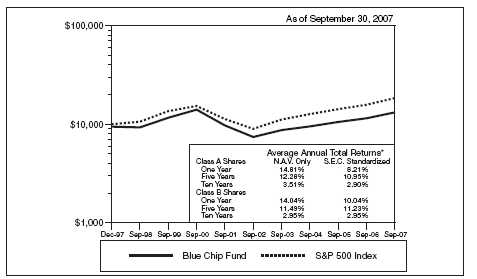

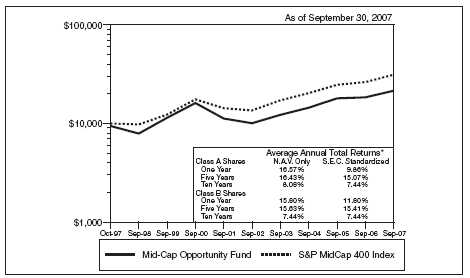

Cumulative Performance Information

BLUE CHIP FUND

Comparison of change in value of $10,000 investment in the First Investors Blue Chip Fund

(Class A shares) and the Standard & Poor’s 500 Index.

The graph compares a $10,000 investment in the First Investors Blue Chip Fund (Class A shares) beginning 12/31/97 with a theoretical investment in the Standard & Poor’s 500 Index (the “Index”). The Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of such stocks, which represent all major industries. It is not possible to invest directly in this Index. In addition, the Index does not reflect fees and expenses associated with the active management of a mutual fund portfolio. For purposes of the graph and the accompanying table, unless otherwise indicated, it has been assumed that the maximum sales charge was deducted from the initial $10,000 investment in the Fund and all dividends and distributions were reinvested. Class B shares performance may be greater than or less than that shown in the line graph above for Class A shares based on differences in sales loads and fees paid by shareholders investing in the different classes.

* Average Annual Total Return figures (for the periods ended 9/30/07) include the reinvestment of all dividends and distributions. “N.A.V. Only” returns are calculated without sales charges. The Class A “S.E.C. Standardized” returns shown are based on the maximum sales charge of 5.75% (prior to 6/17/02, the maximum sales charge was 6.25%) . The Class B “S.E.C. Standardized” returns are adjusted for the applicable deferred sales charge (maximum of 4% in the first year). During the periods shown, some of the expenses of the Fund were waived or assumed. If such expenses had been paid by the Fund, the Class A “S.E.C. Standardized” Average Annual Total Return for Five Years and Ten Years would have been 10.89% and 2.83%, respectively. The Class B “S.E.C. Standardized” Average Annual Total Return for Five Years and Ten Years would have been 11.16% and 2.88%, respectively. Results represent past performance and do not indicate future results. The graph and the returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Standard & Poor’s 500 Index figures are from Standard & Poor's and all other figures are from First Investors Management Company, Inc.

28

Portfolio of Investments

BLUE CHIP FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | COMMON STOCKS—98.4% | | |

| | | Consumer Discretionary—9.3% | | |

| 41,200 | | Best Buy Company, Inc. | $ | 1,896,024 |

| 45,100 | | Carnival Corporation | | 2,184,193 |

| 89,295 | | CBS Corporation – Class “B” | | 2,812,792 |

| 56,800 | | Clear Channel Communications, Inc. | | 2,126,592 |

| 47,394 | * | Comcast Corporation – Class “A” | | 1,145,987 |

| 84,350 | * | Comcast Corporation – Special Class “A” | | 2,021,026 |

| 57,200 | | H&R Block, Inc. | | 1,211,496 |

| 27,300 | | Hilton Hotels Corporation | | 1,269,177 |

| 151,500 | | Home Depot, Inc. | | 4,914,660 |

| 14,700 | * | Kohl’s Corporation | | 842,751 |

| 107,400 | | Lowe’s Companies, Inc. | | 3,009,348 |

| 77,300 | | McDonald’s Corporation | | 4,210,531 |

| 162,400 | | News Corporation – Class “A” | | 3,571,176 |

| 34,000 | | NIKE, Inc. – Class “B” | | 1,994,440 |

| 58,700 | | Staples, Inc. | | 1,261,463 |

| 63,500 | | Target Corporation | | 4,036,695 |

| 283,300 | | Time Warner, Inc. | | 5,201,388 |

| 17,042 | | Tribune Company | | 465,587 |

| 70,600 | * | Viacom, Inc. – Class “B” | | 2,751,282 |

| 147,000 | | Walt Disney Company | | 5,055,330 |

| 30,920 | | Wyndham Worldwide Corporation | | 1,012,939 |

|

| | | | | 52,994,877 |

|

| | | Consumer Staples—12.1% | | |

| 81,600 | | Altria Group, Inc. | | 5,673,648 |

| 75,800 | | Anheuser-Busch Companies, Inc. | | 3,789,242 |

| 85,600 | | Avon Products, Inc. | | 3,212,568 |

| 156,900 | | Coca-Cola Company | | 9,017,043 |

| 27,000 | | Colgate-Palmolive Company | | 1,925,640 |

| 36,800 | | Costco Wholesale Corporation | | 2,258,416 |

| 98,700 | | CVS Caremark Corporation | | 3,911,481 |

| 36,400 | | General Mills, Inc. | | 2,111,564 |

| 28,800 | | Hershey Company | | 1,336,608 |

| 61,800 | | Kimberly-Clark Corporation | | 4,342,068 |

| 117,824 | | Kraft Foods, Inc. – Class “A” | | 4,066,106 |

| 106,900 | | PepsiCo, Inc. | | 7,831,494 |

| 140,940 | | Procter & Gamble Company | | 9,913,720 |

| 51,800 | | Walgreen Company | | 2,447,032 |

| 161,730 | | Wal-Mart Stores, Inc. | | 7,059,514 |

|

| | | | | 68,896,144 |

|

Portfolio of Investments (continued)

BLUE CHIP FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Energy—12.0% | | |

| 17,800 | | BP PLC (ADR) | $ | 1,234,430 |

| 153,100 | | Chevron Corporation | | 14,327,098 |

| 89,870 | | ConocoPhillips | | 7,887,890 |

| 239,000 | | ExxonMobil Corporation | | 22,121,840 |

| 105,790 | | Halliburton Company | | 4,062,336 |

| 17,500 | | Hess Corporation | | 1,164,275 |

| 84,200 | | Schlumberger, Ltd. | | 8,841,000 |

| 80,350 | | Spectra Energy Corporation | | 1,966,968 |

| 46,100 | * | Transocean, Inc. | | 5,211,605 |

| 29,200 | | Valero Energy Corporation | | 1,961,656 |

|

| | | | | 68,779,098 |

|

| | | Financials—18.5% | | |

| 49,200 | | ACE, Ltd. | | 2,980,044 |

| 31,200 | | Allstate Corporation | | 1,784,328 |

| 98,500 | | American Express Company | | 5,847,945 |

| 158,600 | | American International Group, Inc. | | 10,729,290 |

| 17,900 | | Ameriprise Financial, Inc. | | 1,129,669 |

| 206,666 | | Bank of America Corporation | | 10,389,100 |

| 158,487 | | Bank of New York Mellon Corporation | | 6,995,616 |

| 850 | * | Berkshire Hathaway, Inc. – Class “B” | | 3,359,200 |

| 48,600 | | Capital One Financial Corporation | | 3,228,498 |

| 37,300 | | Chubb Corporation | | 2,000,772 |

| 278,500 | | Citigroup, Inc. | | 12,997,595 |

| 58,750 | * | Discover Financial Services | | 1,222,000 |

| 28,600 | | Fannie Mae | | 1,739,166 |

| 44,500 | | Freddie Mac | | 2,625,945 |

| 187,968 | | JPMorgan Chase & Company | | 8,612,694 |

| 20,500 | | Lehman Brothers Holdings, Inc. | | 1,265,465 |

| 44,500 | | Marsh & McLennan Companies, Inc. | | 1,134,750 |

| 53,300 | | Merrill Lynch & Company, Inc. | | 3,799,224 |

| 70,700 | | Morgan Stanley | | 4,454,100 |

| 20,000 | | PNC Financial Services Group, Inc. | | 1,362,000 |

| 73,000 | | Progressive Corporation | | 1,416,930 |

| 22,500 | | SunTrust Banks, Inc. | | 1,702,575 |

| 41,000 | | Travelers Companies, Inc. | | 2,063,940 |

| 64,500 | | U.S. Bancorp | | 2,098,185 |

| 83,600 | | Wachovia Corporation | | 4,192,540 |

| 62,000 | | Washington Mutual, Inc. | | 2,189,220 |

| 117,400 | | Wells Fargo & Company | | 4,181,788 |

|

| | | | | 105,502,579 |

|

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Health Care—11.8% | | |

| 107,000 | | Abbott Laboratories | $ | 5,737,340 |

| 33,200 | | Aetna, Inc. | | 1,801,764 |

| 82,700 | * | Amgen, Inc. | | 4,678,339 |

| 34,600 | | Baxter International, Inc. | | 1,947,288 |

| 136,300 | | Bristol-Myers Squibb Company | | 3,928,166 |

| 41,225 | * | Covidien, Ltd. | | 1,710,838 |

| 12,100 | * | Genentech, Inc. | | 944,042 |

| 184,800 | | Johnson & Johnson | | 12,141,360 |

| 90,700 | | Medtronic, Inc. | | 5,116,387 |

| 71,200 | | Merck & Company, Inc. | | 3,680,328 |

| 80,300 | | Novartis AG (ADR) | | 4,413,288 |

| 403,560 | | Pfizer, Inc. | | 9,858,971 |

| 31,700 | * | St. Jude Medical, Inc. | | 1,397,019 |

| 64,200 | | Teva Pharmaceutical Industries, Ltd. (ADR) | | 2,854,974 |

| 87,800 | | UnitedHealth Group, Inc. | | 4,252,154 |

| 66,100 | | Wyeth | | 2,944,755 |

|

| | | | | 67,407,013 |

|

| | | Industrials—11.4% | | |

| 56,100 | | 3M Company | | 5,249,838 |

| 33,400 | | Boeing Company | | 3,506,666 |

| 38,900 | | Caterpillar, Inc. | | 3,050,927 |

| 45,600 | | Dover Corporation | | 2,323,320 |

| 84,200 | | Emerson Electric Company | | 4,481,124 |

| 454,200 | | General Electric Company | | 18,803,880 |

| 44,600 | | Honeywell International, Inc. | | 2,652,362 |

| 32,400 | | Illinois Tool Works, Inc. | | 1,932,336 |

| 24,800 | | ITT Corporation | | 1,684,664 |

| 33,700 | | Lockheed Martin Corporation | | 3,656,113 |

| 74,700 | | Masco Corporation | | 1,730,799 |

| 34,500 | | Northrop Grumman Corporation | | 2,691,000 |

| 41,225 | | Tyco International, Ltd. | | 1,827,916 |

| 46,600 | | United Parcel Service, Inc. – Class “B” | | 3,499,660 |

| 102,700 | | United Technologies Corporation | | 8,265,296 |

|

| | | | | 65,355,901 |

|

| | | Information Technology—16.8% | | |

| 36,320 | | Accenture, Ltd. – Class “A” | | 1,461,880 |

| 38,000 | | Analog Devices, Inc. | | 1,374,080 |

| 17,400 | * | Apple, Inc. | | 2,671,596 |

|

Portfolio of Investments (continued)

BLUE CHIP FUND

September 30, 2007

| | | | |

| Shares | | Security | | Value |

|

| |

| | | Information Technology (continued) | | |

| 72,100 | | Applied Materials, Inc. | $ | 1,492,470 |

| 30,000 | | Automatic Data Processing, Inc. | | 1,377,900 |

| 272,200 | * | Cisco Systems, Inc. | | 9,012,542 |

| 92,000 | | Corning, Inc. | | 2,267,800 |

| 183,700 | * | Dell, Inc. | | 5,070,120 |

| 31,500 | * | eBay, Inc. | | 1,229,130 |

| 226,625 | * | EMC Corporation | | 4,713,800 |

| 100,900 | | Hewlett-Packard Company | | 5,023,811 |

| 320,200 | | Intel Corporation | | 8,280,372 |

| 70,100 | | International Business Machines Corporation | | 8,257,780 |

| 42,800 | | Maxim Integrated Products, Inc. | | 1,256,180 |

| 555,945 | | Microsoft Corporation | | 16,378,140 |

| 160,100 | | Motorola, Inc. | | 2,966,653 |

| 167,000 | | Nokia Corporation – Class “A” (ADR) | | 6,334,310 |

| 183,300 | * | Oracle Corporation | | 3,968,445 |

| 57,970 | | QUALCOMM, Inc. | | 2,449,812 |

| 109,900 | | Texas Instruments, Inc. | | 4,021,241 |

| 50,225 | | Tyco Electronics, Ltd. | | 1,779,472 |

| 103,200 | | Western Union Company | | 2,164,104 |

| 55,300 | * | Xerox Corporation | | 958,902 |

| 65,300 | * | Yahoo!, Inc. | | 1,752,652 |

|

| | | | | 96,263,192 |

|

| | | Materials—2.7% | | |

| 58,600 | | Alcoa, Inc. | | 2,292,432 |

| 39,649 | * | Cemex SA de CV (ADR) | | 1,186,298 |

| 96,900 | | Dow Chemical Company | | 4,172,514 |

| 55,900 | | DuPont (E.I.) de Nemours & Company | | 2,770,404 |

| 72,700 | | International Paper Company | | 2,607,749 |

| 21,300 | | Newmont Mining Corporation | | 952,749 |

| 7,600 | | PPG Industries, Inc. | | 574,180 |

| 11,100 | | Weyerhaeuser Company | | 802,530 |

|

| | | | | 15,358,856 |

|

| | | Telecommunication Services—2.9% | | |

| 164,700 | | AT&T, Inc. | | 6,968,457 |

| 206,366 | | Sprint Nextel Corporation | | 3,920,954 |

| 129,700 | | Verizon Communications, Inc. | | 5,743,116 |

|

| | | | | 16,632,527 |

|

32

| | | | | |

| Shares or | | | | | |

| Principal | | | | | |

| Amount | | Security | | | Value |

|

| |

| | | Utilities—.9% | | | |

| 177,700 | | Duke Energy Corporation | | $ | 3,321,213 |

| 31,200 | | FPL Group, Inc. | | | 1,899,456 |

|

| | | | | | 5,220,669 |

|

| Total Value of Common Stocks (cost $370,180,273) | | | 562,410,856 |

|

| | | SHORT-TERM CORPORATE NOTES—1.8% | | |

| $ 5,000M | | General Electric Capital Corp., 4.72%, 10/10/07 | | 4,992,785 |

| 3,200M | | New Jersey Natural Gas Co., 4.75%, 10/12/07 | | 3,194,509 |

| 2,000M | | Toyota Motor Credit Corp., 5.26%, 10/12/07 | | | 1,996,192 |

|

| Total Value of Short-Term Corporate Notes (cost $10,183,486) | | 10,183,486 |

|

| Total Value of Investments (cost $380,363,759) | 100.2 | % | 572,594,342 |

| Excess of Liabilities Over Other Assets | (.2 | ) | (829,803) |

|

| Net Assets | | | 100.0 | % | $571,764,539 |

|

* Non-income producing

Summary of Abbreviations:

ADR American Depositary Receipts

| |

| See notes to financial statements | 33 |

Portfolio Manager’s Letter

GROWTH & INCOME FUND

Dear Investor:

This is the annual report for the First Investors Growth & Income Fund for the fiscal year ended September 30, 2007. During the period, the Fund’s return on a net asset value basis was 16.8% for Class A shares and 16.0% for Class B shares, including dividends of 7.1 cents per share on Class A shares, 0.4 cents per shares on B shares, and capital gains distributions of 23.5 cents per share for both Class A and Class B shares.

The Fund’s performance was driven by solid performance of the equity markets, better than expected corporate earnings results, and significant merger and acquisition activity among the Fund’s holdings. Overall stock selection benefited investments most notably in the industrials, materials and consumer staples sectors. Overweight positions in the industrials and materials areas also contributed positively.

Notable performers within the industrials sector included Precision Castparts, which benefited from increased demand for complex metal components and castings used in aerospace and industrial machines, 3M, the large-cap maker of “Scotch Tape” as well as other industrial, consumer and technology products, and Honeywell International, which benefited from increased global demand for its aerospace, automotive, power and control technology products. Within the materials sector, shares of specialty chemical producer Celanese benefited from increased worldwide demand for chemical feedstocks: ethylene and propylene. Within consumer staples, shares of small-cap personal products maker Chattem were strong as their acquisition of well known brand products from Johnson & Johnson, such as Kaopectate, ACT, Cortizone-10 and Balmex, added more in earnings than was originally anticipated.

The Fund continued to benefit from strong merger and acquisition activity among its holdings, as both strategic acquirers and private equity firms remained very active. During the fiscal year, eleven of our holdings received merger offers, which are either closed or still pending. The most notable contributors were the takeovers of First Data and Dollar General by the investment group KKR, Biomet by an investment consortium led by the Blackstone Group, Paxar by Avery Dennison and Triad Hospitals by Community Health Systems. The Fund has three deals waiting for completion as of the reporting date: the purchase of Clear Channel Communications by Bain Capital, the purchase of regional bank institution USB Holdings by KeyCorp and the pending merger of TransOcean and Global Santa Fe.

The Fund has maintained a diverse allocation strategy, which at the end of the reporting period was 57% large cap, 16% mid cap and 27% small cap, according to Lipper’s market capitalization ranges. While the large- and mid-cap components delivered satisfactory results, performance in the small-cap area was weaker as stock selection detracted particularly during the more volatile second half of the year.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Sincerely,

Edwin D. Miska

Portfolio Manager and

Director of Equities, First Investors Management Company, Inc.

November 1, 2007

Fund Expenses

GROWTH & INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help

you in comparing these costs with costs of other mutual funds. Please refer to page 3 for a detailed

explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (4/1/07) | (9/30/07) | (4/1/07-9/30/07)* |

|

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,051.58 | $6.69 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.55 | $6.58 |

|

| |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,047.84 | $10.27 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.04 | $10.10 |

|

* Expenses are equal to the annualized expense ratio of 1.30% for Class A shares and 2.00% for

Class B shares, multiplied by the average account value over the period, multiplied by 183/365

(to reflect the one-half year period).

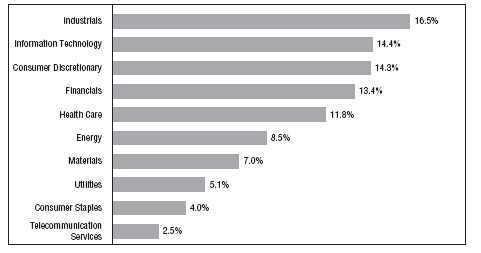

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of September 30, 2007,

and are based on the total value of investments.

36

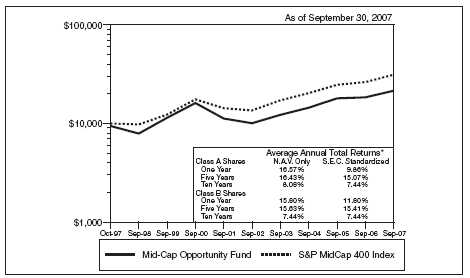

Cumulative Performance Information

GROWTH & INCOME FUND

Comparison of change in value of $10,000 investment in the First Investors Growth & Income

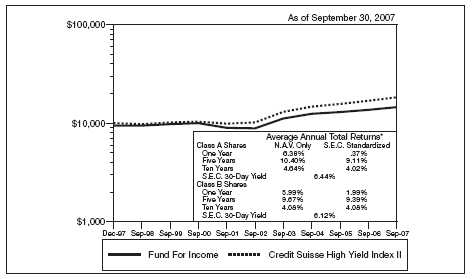

Fund (Class A shares) and the Standard & Poor’s 500 Index.