|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBERS 811-3967 |

| |

| FIRST INVESTORS INCOME FUNDS |

| (Exact name of registrant as specified in charter) |

| |

| 110 Wall Street |

| New York, NY 10005 |

| (Address of principal executive offices) (Zip code) |

| |

| Joseph I. Benedek |

| First Investors Management Company, Inc. |

| Raritan Plaza I |

| Edison, NJ 08837-3620 |

| 1-732-855-2712 |

| (Name and address of agent for service) |

| |

| REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: |

| 1-212-858-8000 |

| |

| DATE OF FISCAL YEAR END: SEPTEMBER 30, 2009 |

| |

| DATE OF REPORTING PERIOD: MARCH 31, 2009 |

| |

| Item 1. | Reports to Stockholders |

| | The semi-annual report to stockholders follows |

FOREWORD

This report is for the information of the shareholders of the Funds. It is the Funds’ practice to mail only one copy of their annual and semi-annual reports to all family members who reside in the same household. Additional copies of the reports will be mailed if requested by any shareholder in writing or by calling 1-800-423-4026. The Funds will ensure that separate reports are sent to any shareholder who subsequently changes his or her mailing address.

The views expressed in the Market Overview letter reflect those views of the Director of Equities and Director of Fixed Income of First Investors Management Company, Inc. through the end of the period covered. Any such views are subject to change at any time based upon market or other conditions and we disclaim any responsibility to update such views. These views may not be relied on as investment advice.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 110 Wall Street, New York, NY 10005, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. See Note 9 in the Notes to Financial Statements for information regarding the Cash Management Fund’s participation in the U.S. Department of the Treasury Temporary Guarantee Program for Money Market Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

Market Overview

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

Dear Investor:

The reporting period was defined by the global economic crisis. Policymakers responded in force, and as such, events in Washington, D.C. drove much of the market’s movement during the period. Under the Bush administration, the $700 billion Troubled Asset Relief Program (“TARP”) was signed into law, becoming one of the largest economic interventions in the country’s history. The Obama administration followed up with a fiscal stimulus plan and the announcement and implementation of its Financial Stability Plan. The Federal Reserve (the “Fed”) also entered unprecedented territory, cutting its target federal funds rate to historic lows — between zero and 25 basis points — and announcing a plan to pump more than $1 trillion into the economy.

Despite these actions, economic woes persisted, and in some cases, intensified during the period. Consumers were fearful, and pulled back sharply on spending. The U.S. economy shrank at a 6.3% pace in the fourth quarter of 2008, and 6.1% in the first quarter of this year. In March, the unemployment rate rose to 8.5%, the highest level in over 25 years.

Bond market returns in the aggregate were positive: the Merrill Lynch Broad Market Index was up 4.2% for the two quarters. But returns by sector varied, from 7.4% in the Treasury sector to –13.5% in the high yield (i.e., below investment grade) bond market. High quality bonds benefited from the substantial decline in benchmark U.S. Treasury rates. Specifically, the two-year U.S. Treasury note yield fell from 2.0% to 0.8%, and the ten-year note yield fell from 3.8% to 2.7%.

High quality mortgage-backed bonds returned 6.6%. The market benefited from the ongoing purchases of Fannie Mae, Freddie Mac, and Ginnie Mae mortgage-backed securities by the Fed and the Treasury. The government’s commitment to support the mortgage-backed market was underlined by the Fed’s announcement in March that it would increase its purchase program from $500 billion to $1.25 trillion and extend the program through 2009. The investment grade corporate bond market returned 0.1% as the slowing economy and concern about financial issuers affected performance. High yield corporate bonds (sometimes referred to as “high risk” or “junk” bonds) returned –13.5%, reflecting the very weak economy.

Market Overview (continued)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

The tax-exempt bond market returned 4.3%. Virtually all of the return occurred in January, which was the best month in the thirty-year history of Merrill Lynch’s Municipal Master Index. The market benefited from substantial demand from individuals, both through direct purchases and mutual funds, as well as from total return investors who viewed municipal bonds as attractive relative to other sectors of the bond market.

In the money markets, the actions by the Fed and the Treasury Department to restore liquidity following the Lehman bankruptcy were successful. As the period ended, the money markets were functioning normally, with yields at very low levels as a result of the Fed’s rate cuts.

In the equities markets, the reporting period was marked by record-setting lows and continued extreme volatility. In the U.S., all segments of the market posted steep losses: large-cap stocks, as measured by the S&P 500 Index, were down 30.5%; mid-cap stocks, as measured by the S&P MidCap 400 Index, fell 32.8%; and small-cap stocks, as measured by the Russell 2000 Index, lost 37.8%. Performance was not much better in international markets, as the MSCI EAFE Index, an index that measures performance in developed markets, excluding the U.S., was down 32.0% in U.S. dollars.

There were some reasons for cautious optimism by equity investors during the period. March saw a sharp turnaround in the form of a 20% rally in the Dow Jones Industrial Average (the “Dow”) over a span of three weeks. This sharp rebound marked the Dow’s fastest rise from a bear market low since 1938. Signs of an economic bottom may be beginning to appear. There was an unexpected lift in home sales during the period, as prices became more affordable to families and renters who had previously been priced out of the market. More unexpected, yet positive, news came from a few heavyweights in the financial sector when Citigroup, JP Morgan Chase, and Bank of America all announced that they were profitable in January and February 2009. However, overall the sector continued to struggle: financials fell 24% worldwide during the period. It remains to be seen if this rally will be the one to break the current bear market trend. There may be several such rebounds befor e a final capitulation marks the end of a bear market.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

Edwin D. Miska

Director of Equities

First Investors Management Company, Inc.

Clark D. Wagner

Director of Fixed Income

First Investors Management Company, Inc.

May 1, 2009

This Market Overview is not part of the Funds’ financial report and is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus. The Market Overview reflects conditions through the end of the period as stated on the cover. Market conditions are subject to change. This Market Overview may not be relied upon as investment advice or an indication of current or future trading intent on behalf of any Fund.

There are a variety of risks associated with investing in mutual funds. For stock funds, the risks include market risk (the risk that the entire stock market will decline because of an event such as a deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock funds, such as small-cap, global and international funds. For bond funds, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, longer-term bonds fluctuate more than shorter-term bonds in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. You should consult your prospectus for a precise explanation of the risks associated w ith your fund.

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only), a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, October 1, 2008, and held for the entire six-month period ended March 31, 2009. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for Class A and Class B shares, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,004.61 | $3.90 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,021.04 | $3.93 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,001.40 | $7.09 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,017.80 | $7.14 |

* Expenses are equal to the annualized expense ratio of .78% for Class A shares and 1.42% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived.

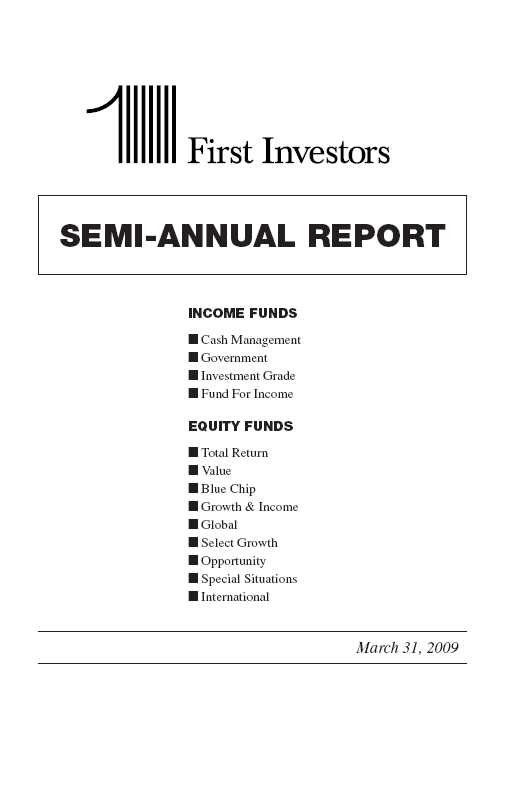

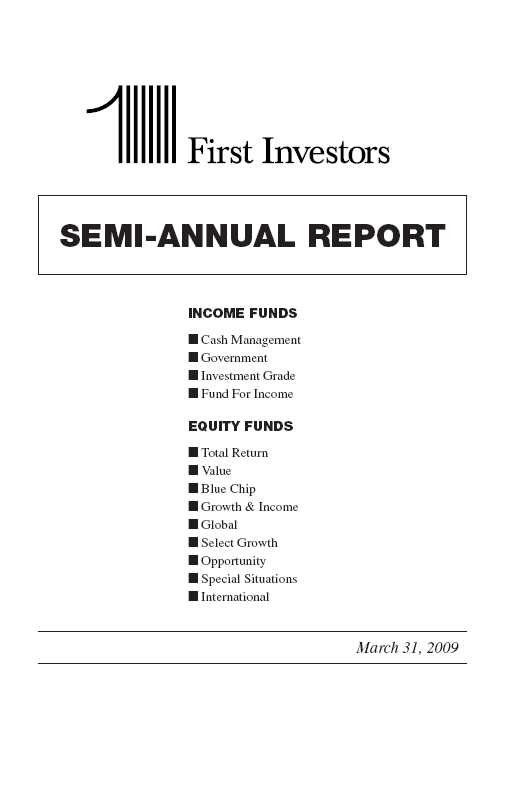

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total value of investments.

Portfolio of Investments

CASH MANAGEMENT FUND

March 31, 2009

| | | | | |

| |

| Principal | | | Interest | | |

| Amount | | Security | Rate | * | Value |

| | | CORPORATE NOTES—71.7% | | | |

| $ 1,200M | | 3M Co., 11/6/09 | 1.07 | % | $1,228,737 |

| | | Abbott Laboratories: | | | |

| 7,000M | | 4/7/09 (a) | 0.35 | | 6,999,591 |

| 2,000M | | 5/15/09 | 2.86 | | 2,006,020 |

| 800M | | 5/15/09 | 2.80 | | 802,399 |

| 585M | | Atlantic Richfield Co., 4/15/09 | 1.07 | | 586,053 |

| 6,000M | | Becton Dickinson & Co., 4/6/09 | 0.25 | | 5,999,792 |

| 4,400M | | BP Capital Markets PLC, 3/15/10 | 1.55 | | 4,537,307 |

| 2,000M | | Chevron Funding Corp., 4/24/09 | 0.28 | | 1,999,642 |

| 3,000M | | Citigroup Funding Inc., 5/6/09 | 0.30 | | 2,999,125 |

| 8,000M | | Coca-Cola Co., 4/14/09 (a) | 0.37 | | 7,998,931 |

| 2,605M | | DuPont (E.I.) de Nemours & Co., 10/15/09 | 1.55 | | 2,678,903 |

| 2,350M | | Electric Data Systems Corp., 10/15/09 | 1.41 | | 2,421,832 |

| 8,000M | | Emerson Electric Co., 6/18/09 (a) | 0.28 | | 7,995,146 |

| 8,500M | | Fannie Mae, 4/3/09 | 0.33 | | 8,499,844 |

| | | Freddie Mac: | | | |

| 5,000M | | 4/24/09 | 0.32 | | 4,998,977 |

| 1,500M | | 5/11/09 | 0.26 | | 1,499,567 |

| 6,700M | | 5/11/09 | 0.37 | | 6,697,244 |

| 9,500M | | 5/13/09 | 0.40 | | 9,495,563 |

| | | General Electric Capital Corp.: | | | |

| 2,276M | | 4/1/09 | 2.80 | | 2,276,000 |

| 1,000M | | 9/1/09 | 2.25 | | 1,007,705 |

| 2,000M | | 9/15/09 | 2.59 | | 2,018,237 |

| | | Illinois Tool Works, Inc.: | | | |

| 2,500M | | 4/6/09 (a) | 0.38 | | 2,499,868 |

| 8,000M | | 5/8/09 (a) | 0.42 | | 7,996,544 |

| | | International Business Machines Corp.: | | | |

| 500M | | 6/1/09 | 1.50 | | 502,386 |

| 2,675M | | 9/15/09 | 1.46 | | 2,709,624 |

| 3,095M | | John Deere Capital Corp., 7/15/09 | 1.40 | | 3,121,638 |

| 2,900M | | Johnson & Johnson, 6/8/09 (a) | 0.33 | | 2,898,192 |

| 7,000M | | Kimberly-Clark Worldwide, 5/1/09 (a) | 0.32 | | 6,998,133 |

| 3,700M | | Northwest Natural Gas Co., 5/14/09 (a) | 0.65 | | 3,697,124 |

| 7,000M | | PepsiCo, Inc., 4/16/09 (a) | 0.19 | | 6,999,446 |

| 4,000M | | Pfizer, Inc., 6/5/09 (a) | 0.35 | | 3,997,472 |

| | | Pitney Bowes Credit Corp.: | | | |

| 5,000M | | 9/15/09 | 1.80 | | 1,622,937 |

| 1,585M | | 9/15/09 | 3.17 | | 5,151,401 |

| 800M | | 9/15/09 | 1.27 | | 826,084 |

| | | | | |

| |

| Principal | | | Interest | | |

| Amount | | Security | Rate | * | Value |

| | | CORPORATE NOTES (continued) | | | |

| | | Procter & Gamble Co.: | | | |

| $ 345M | | 8/10/09 | 2.50 | % | $ 352,363 |

| 1,500M | | 9/15/09 | 0.99 | | 1,539,774 |

| 2,000M | | Procter & Gamble International Finance, 7/6/09 | 5.30 | | 2,016,717 |

| 4,500M | | SBC Communications, Inc., 9/15/09 | 1.70 | | 4,548,671 |

| 4,000M | | Toyota Motor Credit Corp., 4/23/09 | 0.40 | | 3,999,022 |

| 2,000M | | United Technologies Corp., 6/1/09 | 1.13 | | 2,017,930 |

| 960M | | Vastar Resources, Inc., 4/1/09 | 0.90 | | 960,000 |

| | | Wal-Mart Stores, Inc.: | | | |

| 3,000M | | 8/10/09 | 2.27 | | 3,049,423 |

| 2,500M | | 8/10/09 | 2.50 | | 2,538,879 |

| 2,000M | | 8/10/09 | 1.46 | | 2,038,802 |

| 1,500M | | 8/10/09 | 1.90 | | 1,526,593 |

| Total Value of Corporate Notes (cost $158,355,638) | | | 158,355,638 |

| | | FLOATING RATE NOTES—19.7% | | | |

| 1,500M | | AstraZeneca PLC, 9/11/09 | 1.61 | | 1,502,909 |

| 1,500M | | BP Capital Markets PLC, 3/17/10 | 1.53 | | 1,502,005 |

| 5,000M | | Federal Home Loan Bank, 10/13/09 | 1.19 | | 5,004,400 |

| | | Freddie Mac: | | | |

| 2,250M | | 10/8/09 | 0.46 | | 2,247,943 |

| 4,000M | | 1/8/10 | 0.61 | | 4,001,533 |

| 6,750M | | IBM International Group Capital, LLC, 7/29/09 | 1.52 | | 6,752,019 |

| 4,210M | | Monongallia Health Systems, 7/1/40 | 1.00 | | 4,210,000 |

| 700M | | Port Blakely Community WA Rev., 2/15/21 | 0.95 | | 700,000 |

| 2,880M | | Procter & Gamble Co., 3/9/10 | 1.46 | | 2,886,422 |

| 3,500M | | Procter & Gamble International Finance, 7/6/09 (b) | 1.42 | | 3,501,205 |

| 3,000M | | Toyota Motor Credit Corp., 1/29/10 | 2.43 | | 3,000,000 |

| 3,175M | | University of Oklahoma Hospital Rev., 8/15/21 | 0.85 | | 3,175,000 |

| 5,000M | | Walt Disney Co., 9/10/09 | 1.39 | | 5,001,294 |

| Total Value of Floating Rate Notes (cost $43,484,730) | | | 43,484,730 |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

March 31, 2009

| | | | | | | |

| |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—4.7% | | | | | |

| | | Federal Home Loan Bank: | | | | | |

| $ 3,500M | | 4/30/09 | | | 2.63 | % | $ 3,500,000 |

| 1,250M | | 12/15/09 (c) | | | 1.55 | | 1,250,000 |

| 1,500M | | 1/6/10 | | | 0.93 | | 1,529,186 |

| 2,000M | | 1/26/10 | | | 1.00 | | 1,997,866 |

| 2,000M | | Freddie Mac, 2/5/10 | | | 1.05 | | 2,000,000 |

| Total Value of U.S. Government Agency Obligations (cost $10,277,052) | | 10,277,052 |

| | | BANKERS’ ACCEPTANCES—2.3% | | | | | |

| 5,000M | | Bank of America NA, 4/20/09 (cost $4,998,468) | | 0.58 | | 4,998,468 |

| | | U.S. GOVERNMENT OBLIGATIONS—.9% | | | | |

| 2,000M | | U.S. Treasury Bills, 6/25/09 (cost $1,998,963) | | | 0.22 | | 1,998,963 |

| Total Value of Investments (cost $219,114,851)** | 99.3 | % | | | 219,114,851 |

| Other Assets, Less Liabilities | .7 | | | | 1,642,554 |

| Net Assets | | 100.0 | % | | | $220,757,405 |

* The interest rates shown are the effective rates at the time of purchase by the Fund. The interest rates shown on floating rate notes are adjusted periodically; the rates shown are the rates in effect at March 31, 2009.

** Aggregate cost for federal income tax purposes is the same.

(a) Security exempt from registration under Secton 4(2) of the Securities Act of 1933 (see Note 4).

(b) Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 4).

(c) Denotes a step bond (a zero coupon bond that converts to a fixed interest rate at a designated date).

| |

| 8 | See notes to financial statements |

Fund Expenses (unaudited)

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,058.36 | $5.64 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.45 | $5.54 |

| |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,054.70 | $9.22 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.95 | $9.05 |

* Expenses are equal to the annualized expense ratio of 1.10% for Class A shares and 1.80% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived.

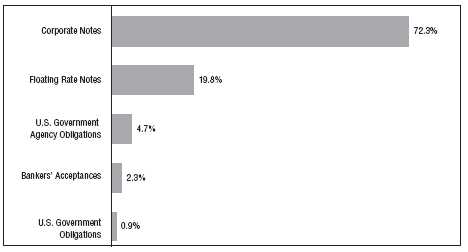

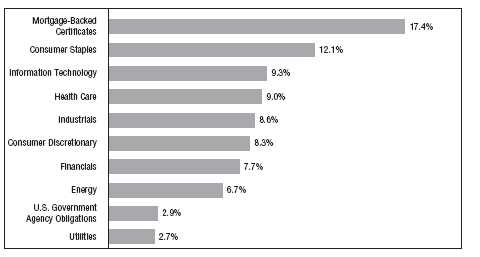

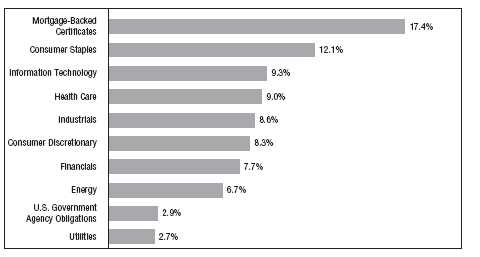

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total value of investments.

Portfolio of Investments

GOVERNMENT FUND

March 31, 2009

| | | | | | | |

| |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | MORTGAGE-BACKED CERTIFICATES—100.7% | | | | |

| | | Fannie Mae—7.6% | | | | | |

| $ 9,675M | | 5.5%, 7/1/2033 – 12/1/2035 | | | | | $ 10,082,044 |

| 10,722M | | 6%, 1/1/2036 – 12/1/2037 | | | | | 11,214,226 |

| | | | | | | | 21,296,270 |

| | | Government National Mortgage Association I | | | | |

| | | Program—93.1% | | | | | |

| 8,500M | | 4.5%, 4/20/2039 | | | | | 8,696,562 |

| 53,858M | | 5%, 5/15/2033 – 4/20/2039 | | | | | 56,008,153 |

| 85,028M | | 5.5%, 3/15/2033 – 2/15/2039 | | | | | 88,791,398 |

| 73,554M | | 6%, 3/15/2031 – 12/15/2038 | | | | | 77,231,054 |

| 23,443M | | 6.5%, 10/15/2028 – 12/15/2038 | | | | | 24,936,312 |

| 3,849M | | 7%, 4/15/2032 – 4/15/2034 | | | | | 4,125,360 |

| 1,346M | | 7.5%, 7/15/2023 – 6/15/2034 | | | | | 1,446,470 |

| | | | | | | | 261,235,309 |

| Total Value of Mortgage-Backed Certificates (cost $274,249,504) | | | | 282,531,579 |

| | | SHORT-TERM INVESTMENTS—2.5% | | | | |

| | | Money Market Fund | | | | | |

| 7,028M | | First Investors Cash Reserve Fund, 0.59% (cost $7,028,000)* | | | | 7,028,000 |

| Total Value of Investments (cost $281,277,504) | 103.2 | % | | | 289,559,579 |

| Excess of Liabilities Over Other Assets | (3.2 | ) | | | (8,949,952) |

| Net Assets | | | 100.0 | % | | | $280,609,627 |

* Affiliated unregistered money market fund available only to First Investors funds and certain accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at March 31, 2009 (see Note 2).

| |

| 10 | See notes to financial statements |

Fund Expenses (unaudited)

INVESTMENT GRADE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | `Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $989.26 | $5.46 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.45 | $5.54 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $985.89 | $8.91 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.95 | $9.05 |

* Expenses are equal to the annualized expense ratio of 1.10% for Class A shares and 1.80% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived.

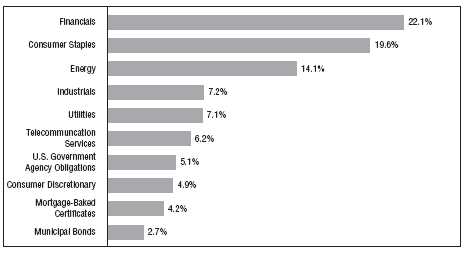

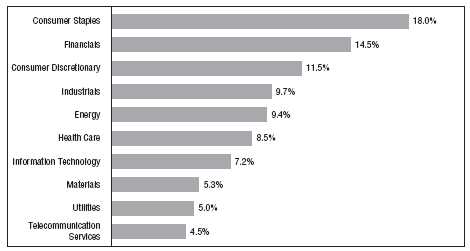

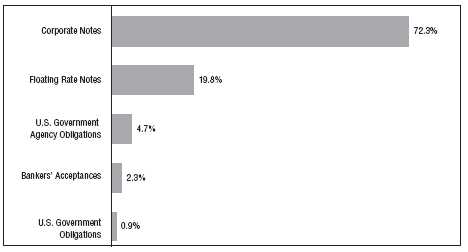

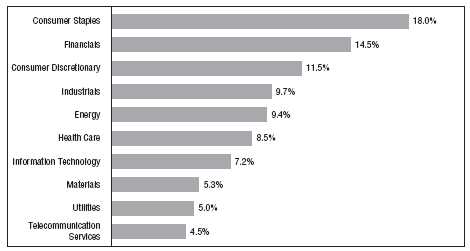

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total value of investments.

Portfolio of Investments

INVESTMENT GRADE FUND

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | CORPORATE BONDS—80.4% | |

| | | Automotive—3.4% | |

| $ 10,301M | | Daimler Chrysler NA Holdings Corp., 6.5%, 2013 | $ 9,342,255 |

| | | Chemicals—1.2% | |

| 1,700M | | Air Products & Chemicals, Inc., 4.125%, 2010 | 1,701,511 |

| 1,700M | | Cabot Corp., 5.25%, 2013 (a) | 1,641,986 |

| | | | 3,343,497 |

| | | Consumer Durables—.5% | |

| 1,650M | | Black & Decker Corp., 5.75%, 2016 | 1,486,600 |

| | | Consumer Non-Durables—1.0% | |

| 1,600M | | Newell Rubbermaid, Inc., 6.75%, 2012 | 1,533,627 |

| 1,060M | | Procter & Gamble Co., 4.6%, 2014 | 1,123,013 |

| | | | 2,656,640 |

| | | Energy—12.9% | |

| 2,700M | | Canadian Natural Resources, Ltd., 5.9%, 2018 | 2,422,607 |

| 2,250M | | ConocoPhillips, 5.75%, 2019 | 2,269,134 |

| 800M | | Halliburton Co., 7.45%, 2039 | 803,306 |

| 850M | | Kinder Morgan Finance Co., 5.35%, 2011 | 816,000 |

| 2,800M | | Nabors Industries, Inc., 6.15%, 2018 | 2,194,130 |

| | | Nexen, Inc.: | |

| 2,000M | | 5.05%, 2013 | 1,843,888 |

| 1,800M | | 6.4%, 2037 | 1,280,029 |

| 2,000M | | Northern Border Pipeline Co., 7.1%, 2011 | 2,005,888 |

| 2,150M | | Pacific Energy Partners LP, 7.125%, 2014 | 1,993,906 |

| 7,200M | | Rockies Express Pipeline, 6.25%, 2013 (a) | 7,071,005 |

| 5,800M | | Spectra Energy Capital, LLC, 6.2%, 2018 | 5,362,425 |

| 4,400M | | Suncor Energy, Inc., 6.85%, 2039 | 3,334,043 |

| 3,600M | | TransOcean, Inc., 6%, 2018 | 3,397,367 |

| 900M | | Valero Energy Corp., 10.5%, 2039 | 929,786 |

| | | | 35,723,514 |

| | | Financial Services—7.7% | |

| 5,040M | | Amvescap PLC, 5.375%, 2013 | 3,647,871 |

| 2,700M | | Citigroup, Inc., 5.5%, 2013 | 2,374,207 |

| 7,460M | | CoBank, ACB, 7.875%, 2018 (a) | 7,292,240 |

| 1,800M | | Compass Bank, 6.4%, 2017 | 1,671,872 |

| 625M | | Greenpoint Bank, 9.25%, 2010 | 601,391 |

| | | | |

| |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financial Services (continued) | | |

| $ 2,420M | | Hibernia Corp., 5.35%, 2014 | | $ 1,724,141 |

| 2,900M | | Royal Bank of Scotland Group PLC, 5%, 2014 | | 1,833,090 |

| | | SunTrust Bank, Inc.: | | |

| 1,600M | | 7.25%, 2018 | | 1,542,864 |

| 3,000M | | 5.853%, 2049 | | 750,321 |

| | | | | 21,437,997 |

| | | Financials—8.0% | | |

| | | American General Finance Corp.: | | |

| 875M | | 8.125%, 2009 | | 672,748 |

| 1,800M | | 6.9%, 2017 | | 631,580 |

| 1,500M | | Bear Stearns Cos., Inc., 7.25%, 2018 | | 1,551,589 |

| 1,170M | | ERAC USA Finance Enterprise Co., 8%, 2011 (a) | | 1,060,156 |

| 2,363M | | Ford Motor Credit Co., 9.75%, 2010 | | 1,944,508 |

| | | Goldman Sachs Group, Inc.: | | |

| 500M | | 6.15%, 2018 | | 457,472 |

| 1,600M | | 6.45%, 2036 | | 1,014,032 |

| 2,750M | | 6.75%, 2037 | | 1,864,453 |

| 3,600M | | HSBC Finance Corp., 4.75%, 2010 | | 3,372,422 |

| 6,700M | | Merrill Lynch & Co., 5.45%, 2013 | | 5,496,908 |

| | | Morgan Stanley: | | |

| 1,425M | | 5.3%, 2013 | | 1,371,409 |

| 1,100M | | 6.625%, 2018 | | 1,050,595 |

| 2,300M | | UBS AG, 5.875%, 2016 | | 1,793,809 |

| | | | | 22,281,681 |

| | | Food/Beverage/Tobacco—5.4% | | |

| 4,600M | | Altria Group, Inc., 10.2%, 2039 | | 4,710,207 |

| 1,980M | | Bunge Limited Finance Corp., 5.875%, 2013 | | 1,766,105 |

| 1,900M | | Cargill, Inc., 6%, 2017 (a) | | 1,788,023 |

| 1,949M | | ConAgra Foods, Inc., 6.75%, 2011 | | 2,062,227 |

| 4,600M | | Philip Morris International, Inc., 5.65%, 2018 | | 4,578,642 |

| | | | | 14,905,204 |

| | | Food/Drug—1.0% | | |

| 2,000M | | Kroger Co., 6.75%, 2012 | | 2,117,506 |

| 700M | | Safeway, Inc., 6.5%, 2011 | | 734,428 |

| | | | | 2,851,934 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Health Care—2.4% | |

| $ 2,400M | | Novartis, 5.125%, 2019 | $ 2,441,462 |

| 4,000M | | Pfizer, Inc., 5.35%, 2015 | 4,225,556 |

| | | | 6,667,018 |

| | | Industrials—.6% | |

| 2,365M | | Harley-Davidson Funding Corp., 6.8%, 2018 (a) | 1,536,777 |

| | | Information Technology—1.2% | |

| 1,600M | | Cisco Systems, Inc., 4.95%, 2019 | 1,577,221 |

| 1,750M | | Xerox Corp., 6.875%, 2011 | 1,670,858 |

| | | | 3,248,079 |

| | | Manufacturing—2.9% | |

| 1,750M | | Briggs & Stratton Corp., 8.875%, 2011 | 1,723,750 |

| 2,500M | | Crane Co., 6.55%, 2036 | 1,869,987 |

| | | John Deere Capital Corp.: | |

| 2,800M | | 5.5%, 2017 | 2,657,586 |

| 272M | | 5.35%, 2018 | 252,767 |

| 1,550M | | United Technologies Corp., 6.125%, 2019 | 1,671,715 |

| | | | 8,175,805 |

| | | Media-Broadcasting—2.7% | |

| 2,600M | | Comcast Cable Communications, Inc., 7.125%, 2013 | 2,708,519 |

| | | Cox Communications, Inc.: | |

| 2,000M | | 4.625%, 2013 | 1,820,460 |

| 3,100M | | 8.375%, 2039 (a) | 2,916,185 |

| | | | 7,445,164 |

| | | Media-Diversified—11.5% | |

| 3,208M | | Dun & Bradstreet Corp., 6%, 2013 | 3,275,743 |

| | | McGraw-Hill Cos., Inc.: | |

| 1,800M | | 5.9%, 2017 | 1,576,519 |

| 2,300M | | 6.55%, 2037 | 1,611,451 |

| 6,900M | | News America, Inc., 5.3%, 2014 | 6,493,666 |

| 4,500M | | Thomson Reuters Corp., 5.95%, 2013 | 4,399,542 |

| | | Time Warner Cable, Inc.: | |

| 4,430M | | 6.2%, 2013 | 4,316,503 |

| 2,700M | | 6.75%, 2018 | 2,538,743 |

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Media-Diversified (continued) | |

| | | Time Warner, Inc.: | |

| $ 3,550M | | 6.875%, 2012 | $ 3,615,671 |

| 1,000M | | 9.125%, 2013 | 1,051,367 |

| 2,800M | | Walt Disney Co., 4.5%, 2013 | 2,864,739 |

| | | | 31,743,944 |

| | | Metals/Mining—.5% | |

| 1,300M | | Alcoa, Inc., 6%, 2012 | 1,133,834 |

| 803M | | ArcelorMittal, 6.125%, 2018 | 581,859 |

| | | | 1,715,693 |

| | | Real Estate Investment Trusts—.6% | |

| 200M | | AvalonBay Communities, Inc., 6.625%, 2011 | 194,551 |

| 1,350M | | Duke Weeks Realty Corp., 7.75%, 2009 | 1,329,256 |

| | | | 1,523,807 |

| | | Retail—.4% | |

| 1,000M | | McDonald’s Corp., 5%, 2019 | 1,042,094 |

| | | Telecommunications—5.2% | |

| 3,000M | | AT&T, Inc., 5.8%, 2019 | 2,942,235 |

| 6,100M | | Deutsche Telekom International Finance BV, 5.875%, 2013 | 6,210,556 |

| 1,359M | | GTE Corp., 6.84%, 2018 | 1,348,059 |

| 2,000M | | SBC Communications, Inc., 6.25%, 2011 | 2,089,946 |

| 1,725M | | Sprint Capital Corp., 6.375%, 2009 | 1,725,000 |

| | | | 14,315,796 |

| | | Transportation—1.7% | |

| 4,397M | | Burlington Northern Santa Fe Corp., 4.3%, 2013 | 4,261,520 |

| 300M | | Union Pacific Railroad, 7.28%, 2011 | 310,038 |

| | | | 4,571,558 |

| | | Utilities—7.8% | |

| 1,800M | | Consumers Energy Co., 6.875%, 2018 | 1,886,992 |

| 8,250M | | E. ON International Finance BV, 5.8%, 2018 (a) | 8,129,146 |

| 2,100M | | Electricite de France, 6.95%, 2039 (a) | 2,087,938 |

| 2,650M | | Entergy Gulf States, Inc., 5.25%, 2015 | 2,397,797 |

| 655M | | Great River Energy Co., 5.829%, 2017 (a) | 676,859 |

| 1,400M | | OGE Energy Corp., 5%, 2014 | 1,323,710 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

March 31, 2009

| | | | |

| |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Utilities (continued) | | |

| $ 775M | | PSI Energy, Inc., 8.85%, 2022 | | $ 938,110 |

| 1,510M | | Public Service Electric & Gas Co., 6.75%, 2016 | | 1,649,539 |

| 2,575M | | Trans-Canada Pipelines, Ltd., 7.625%, 2039 | | 2,553,594 |

| | | | | 21,643,685 |

| | | Waste Management—.9% | | |

| 500M | | Allied Waste NA, Inc., 5.75%, 2011 | | 488,337 |

| 2,000M | | Waste Management, Inc., 6.875%, 2009 | | 2,004,794 |

| | | | | 2,493,131 |

| | | Wireless Communications—.9% | | |

| 2,400M | | Verizon Wireless Capital, 5.55%, 2014 (a) | | 2,404,522 |

| Total Value of Corporate Bonds (cost $237,466,925) | | 222,556,395 |

| | | U.S. GOVERNMENT AGENCY | | |

| | | OBLIGATIONS—5.0% | | |

| 4,500M | | Fannie Mae, 4.02%, 2015 | | 4,633,974 |

| 5,500M | | Federal Farm Credit Bank, 5.37%, 2018 | | 5,517,930 |

| 1,000M | | Federal Home Loan Bank, 7.23%, 2015 | | 1,078,521 |

| 2,500M | | Freddie Mac, 6%, 2017 | | 2,529,545 |

| Total Value of U.S. Government Agency Obligations (cost $13,384,819) | | 13,759,970 |

| | | FLOATING RATE NOTES(b)—4.1% | | |

| | | Financial Services—1.0% | | |

| 4,800M | | Wachovia Bank, 1.65%, 2016 | | 2,875,930 |

| | | Financial—3.1% | | |

| 2,300M | | General Electric Capital Corp., 1.614%, 2026 | | 1,089,137 |

| 4,500M | | Goldman Sachs Group, Inc., 1.522%, 2015 | | 3,171,641 |

| 2,800M | | HSBC Finance Corp., 1.691%, 2016 | | 1,531,928 |

| 3,800M | | Morgan Stanley, 1.574%, 2015 | | 2,703,882 |

| | | | | 8,496,588 |

| Total Value of Floating Rate Notes (cost $11,324,055) | | 11,372,518 |

| | | | | |

| |

| Principal | | | | | |

| Amount | | Security | | | Value |

| | | MORTGAGE-BACKED CERTIFICATES—4.1% | | |

| | | Fannie Mae | | | |

| $ 8,764M | | 5.5%, 8/1/2038 – 10/1/2038 | | | $ 9,106,464 |

| 2,144M | | 6%, 11/1/2038 | | | 2,242,184 |

| Total Value of Mortgage-Backed Certificates (cost $11,022,158) | | 11,348,648 |

| | | MUNICIPAL BONDS—2.7% | | | |

| 2,250M | | Massachusetts Bay Trans. Auth. MA Rev., 5.25%, 2034 | | 2,301,120 |

| 1,800M | | Platte Riv. Pwr. Auth. CO, 5%, 2024 | | | 1,892,484 |

| 1,730M | | Tobacco Settlement Fin. Auth. WV, Series “A”, 7.467%, 2047 | | 899,946 |

| 2,250M | | Triborough Brdg. & Tunl. Auth. NY Rev. Bonds, 5.25%, 2034 | | 2,280,398 |

| Total Value of Municipal Bonds (cost $8,079,375) | | | 7,373,948 |

| | | U.S. GOVERNMENT OBLIGATIONS—.4% | | |

| 953M | | FDA Queens LP, 6.99%, 2017 (cost $1,023,770) (a) | | 1,126,877 |

| | | PASS THROUGH CERTIFICATES—.3% | | |

| | | Transportation | | | |

| 458M | | American Airlines, Inc., 7.377%, 2019 | | | 219,624 |

| 1,161M | | Continental Airlines, Inc., 8.388%, 2020 | | | 742,961 |

| Total Value of Pass Through Certificates (cost $1,618,846) | | | 962,585 |

| | | SHORT-TERM INVESTMENTS—.8% | | | |

| | | Money Market Fund | | | |

| 2,115M | | First Investors Cash Reserve Fund, 0.59% (cost $2,115,000) (c) | | 2,115,000 |

| Total Value of Investments (cost $286,034,948) | 97.8 | % | 270,615,941 |

| Other Assets, Less Liabilities | 2.2 | | 6,220,342 |

| |

| Net Assets | | | 100.0 | % | $ 276,836,283 |

(a) Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 4).

(b) Interest rates on floating rate notes are determined and reset periodically by the issuer and are the rates in effect on March 31, 2009.

(c) Affiliated unregistered money market fund available only to First Investors funds and certain accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at March 31, 2009 (see Note 2).

| |

| See notes to financial statements | 17 |

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $826.87 | $6.47 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,017.85 | $7.14 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $822.34 | $9.63 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,014.31 | $10.65 |

* Expenses are equal to the annualized expense ratio of 1.42% for Class A shares and 2.12% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived.

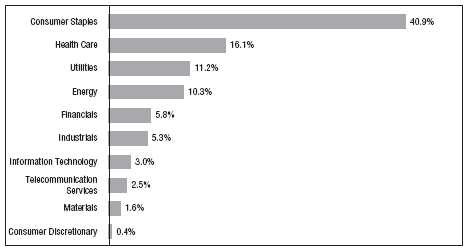

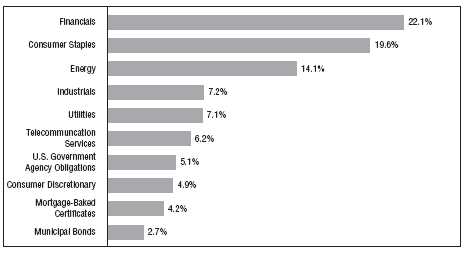

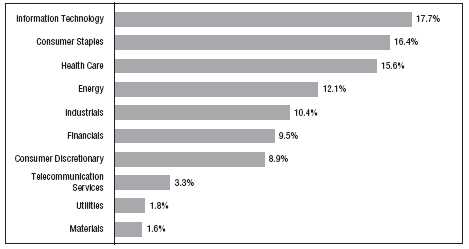

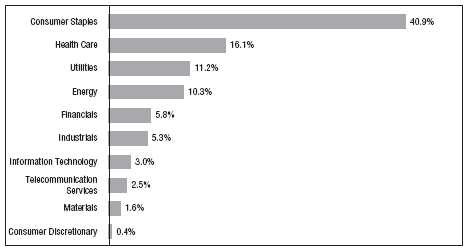

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total value of investments.

Portfolio of Investments

FUND FOR INCOME

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | CORPORATE BONDS—87.9% | |

| | | Aerospace/Defense—4.3% | |

| $ 4,775M | | Alliant Techsystems, Inc., 6.75%, 2016 | $ 4,560,125 |

| 5,508M | | DynCorp International, LLC, 9.5%, 2013 | 5,191,290 |

| 1,747M | | GenCorp, Inc., 9.5%, 2013 | 1,266,575 |

| 4,375M | | L-3 Communications Corp., 7.625%, 2012 | 4,402,344 |

| | | | 15,420,334 |

| | | Automotive—3.2% | |

| 2,700M | | Accuride Corp., 8.5%, 2015 (a) | 587,250 |

| | Asbury Automotive Group, Inc.: | |

| 5,400M | | 8%, 2014 | 2,646,000 |

| 2,000M | | 7.625%, 2017 | 950,000 |

| 6,975M | | Avis Budget Car Rental, LLC, 7.75%, 2016 | 1,778,625 |

| | | General Motors Corp.: | |

| 3,500M | | 7.7%, 2016 (a) | 437,500 |

| 3,500M | | 8.375%, 2033 (a) | 437,500 |

| 500M | | Tenneco Automotive, Inc., 8.625%, 2014 | 95,000 |

| 6,575M | | United Auto Group, Inc., 7.75%, 2016 | 3,320,375 |

| 3,600M | | United Components, Inc., 9.375%, 2013 | 1,422,000 |

| | | | 11,674,250 |

| | | Chemicals—4.2% | |

| | | Huntsman, LLC: | |

| 1,636M | | 11.625%, 2010 | 1,623,730 |

| 4,515M | | 11.5%, 2012 | 3,544,275 |

| 4,800M | | Newmarket Corp., 7.125%, 2016 | 3,828,000 |

| 4,500M | | Terra Capital, Inc., 7%, 2017 | 4,162,500 |

| 3,075M | | Westlake Chemical Corp., 6.625%, 2016 | 2,167,875 |

| | | | 15,326,380 |

| | | Consumer Non-Durables—1.5% | |

| 3,815M | | GFSI, Inc., 10.5%, 2011 (b)(c) | 2,880,325 |

| 3,125M | | Levi Strauss & Co., 9.75%, 2015 | 2,703,125 |

| | | | 5,583,450 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Energy—12.9% | |

| $ 5,275M | | Basic Energy Services, Inc., 7.125%, 2016 | $ 3,085,875 |

| 3,600M | | Calfrac Holdings, 7.75%, 2015 (b) | 1,728,000 |

| | | Chesapeake Energy Corp.: | |

| 1,800M | | 7.5%, 2014 | 1,633,500 |

| 8,850M | | 6.625%, 2016 | 7,411,875 |

| 4,500M | | Cimarex Energy Co., 7.125%, 2017 | 3,645,000 |

| | | Compagnie Generale de Geophysique: | |

| 4,350M | | 7.5%, 2015 | 3,458,250 |

| 2,900M | | 7.75%, 2017 | 2,233,000 |

| 4,375M | | Complete Production Services, Inc., 8%, 2016 | 2,800,000 |

| 4,400M | | Connacher Oil & Gas, Ltd., 10.25%, 2015 (b) | 1,408,000 |

| 5,900M | | Delta Petroleum Corp., 7%, 2015 | 1,917,500 |

| 3,100M | | Hilcorp Energy I, LP, 9%, 2016 (b) | 2,309,500 |

| 3,501M | | National Oilwell Varco, Inc., 6.125%, 2015 | 3,059,883 |

| 950M | | Pacific Energy Partners LP, 7.125%, 2014 | 881,028 |

| | | Petroplus Finance, Ltd.: | |

| 900M | | 6.75%, 2014 (b) | 670,500 |

| 3,950M | | 7%, 2017 (b) | 2,863,750 |

| 2,625M | | Plains Exploration & Production Co., 7.625%, 2018 | 2,139,375 |

| 3,600M | | Stallion Oilfield Services, Ltd., 9.75%, 2015 (b) | 468,000 |

| 2,600M | | Stewart & Stevenson, LLC, 10%, 2014 | 1,976,000 |

| 3,490M | | Tesoro Corp., 6.25%, 2012 | 3,062,475 |

| | | | 46,751,511 |

| | | Food/Beverage/Tobacco—4.1% | |

| 9,000M | | Constellation Brands, Inc. , 7.25%, 2016 | 8,595,000 |

| | | Land O’Lakes, Inc.: | |

| 1,800M | | 9%, 2010 | 1,811,250 |

| 775M | | 8.75%, 2011 | 771,125 |

| 4,125M | | Southern States Cooperative, Inc., 10.5%, 2010 (b) | 3,691,875 |

| | | | 14,869,250 |

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Food/Drug—2.2% | |

| $ 8,300M | | Ingles Markets, Inc., 8.875%, 2011 | $ 8,134,000 |

| | | Forest Products/Containers—1.3% | |

| 2,150M | | Jefferson Smurfit Corp., 8.25%, 2012 (d) | 279,500 |

| 4,400M | | Sappi Papier Holding, AG, 6.75%, 2012 (b) | 2,474,393 |

| 2,000M | | Tekni-Plex, Inc., 8.75%, 2013 (a) | 990,000 |

| 3,275M | | Verso Paper Holdings, LLC, 4.92%, 2014 (c) | 966,125 |

| | | | 4,710,018 |

| | | Gaming/Leisure—4.7% | |

| 4,250M | | Circus & Eldorado/Silver Legacy, 10.125%, 2012 | 2,783,750 |

| 2,513M | | Isle of Capri Casinos, Inc., 7%, 2014 | 1,495,235 |

| 5,220M | | Mandalay Resort Group, 6.375%, 2011 | 1,853,100 |

| 6,960M | | MGM Mirage, Inc., 6.625%, 2015 | 2,505,600 |

| 1,800M | | Pinnacle Entertainment, Inc., 7.5%, 2015 | 1,125,000 |

| 8,445M | | Speedway Motorsports, Inc., 6.75%, 2013 | 7,114,913 |

| | | | 16,877,598 |

| | | Health Care—9.7% | |

| | | Alliance Imaging, Inc.: | |

| 900M | | 7.25%, 2012 | 868,500 |

| 3,150M | | 7.25%, 2012 | 3,039,750 |

| 4,375M | | Community Health Systems, 8.875%, 2015 | 4,156,250 |

| 1,000M | | Cooper Companies, Inc., 7.125%, 2015 | 907,500 |

| 4,350M | | DaVita, Inc., 7.25%, 2015 | 4,203,187 |

| 3,480M | | Fisher Scientific International, Inc., 6.125%, 2015 | 3,460,749 |

| 4,400M | | Genesis Health Ventures, Inc., 9.75%, 2011 (d)(e) | 2,750 |

| 5,700M | | HCA, Inc., 6.75%, 2013 | 4,289,250 |

| 4,000M | | Omnicare, Inc., 6.875%, 2015 | 3,600,000 |

| 3,025M | | Res-Care, Inc., 7.75%, 2013 | 2,684,687 |

| | | Tenet Healthcare Corp.: | |

| 3,450M | | 7.375%, 2013 | 2,760,000 |

| 2,250M | | 9.25%, 2015 | 1,743,750 |

| 4,500M | | Universal Hospital Services, Inc., 5.943%, 2015 (c) | 3,285,000 |

| | | | 35,001,373 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Housing—.9% | |

| $ 2,180M | | Beazer Homes USA, Inc., 6.875%, 2015 | $ 479,600 |

| 6,100M | | Builders FirstSource, Inc., 5.484%, 2012 (c) | 884,500 |

| 900M | | NTK Holdings, Inc., 0%—10.75%, 2014 (a)(f) | 58,500 |

| 3,500M | | Realogy Corp., 12.375%, 2015 | 612,500 |

| | | William Lyon Homes, Inc.: | |

| 4,500M | | 7.625%, 2012 | 787,500 |

| 2,700M | | 10.75%, 2013 | 472,500 |

| | | | 3,295,100 |

| | | Information Technology—3.4% | |

| 7,650M | | Belden CDT, Inc., 7%, 2017 | 6,311,250 |

| 3,000M | | Exodus Communications, Inc., 10.75%, 2009 (d)(e) | 1,875 |

| 5,250M | | Freescale Semiconductor, Inc., 9.125%, 2014 | 420,000 |

| | | Iron Mountain, Inc.: | |

| 1,000M | | 8.625%, 2013 | 1,005,000 |

| 1,000M | | 6.625%, 2016 | 930,000 |

| 1,500M | | 8%, 2020 | 1,402,500 |

| | | Sanmina – SCI Corp.: | |

| 875M | | 4.07%, 2014 (b)(c) | 485,625 |

| 1,300M | | 8.125%, 2016 | 461,500 |

| | | Xerox Corp.: | |

| 500M | | 6.4%, 2016 | 381,728 |

| 1,000M | | 6.75%, 2017 | 764,821 |

| | | | 12,164,299 |

| | | Investment/Finance Companies—1.8% | |

| 7,300M | | LaBranche & Co., Inc., 11%, 2012 | 6,615,625 |

| | | Manufacturing—2.7% | |

| 2,740M | | Case New Holland, Inc., 7.125%, 2014 | 2,027,600 |

| | | ESCO Corp.: | |

| 250M | | 5.195%, 2013 (b)(c) | 158,750 |

| 2,000M | | 8.625%, 2013 (b) | 1,530,000 |

| 2,500M | | Itron, Inc., 7.75%, 2012 | 2,253,125 |

| 4,500M | | Terex Corp., 8%, 2017 | 3,667,500 |

| | | | 9,636,975 |

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Media-Broadcasting—1.9% | |

| $ 5,250M | | Block Communications, Inc., 8.25%, 2015 (b) | $ 3,924,375 |

| 4,400M | | LBI Media, Inc., 8.5%, 2017 (b) | 1,210,000 |

| 3,196M | | Nexstar Finance Holding, LLC, 11.375%, 2013 | 1,166,505 |

| 1,357M | | Sinclair Broadcasting Group, Inc., 8%, 2012 | 742,958 |

| | | Young Broadcasting, Inc.: | |

| 2,920M | | 10%, 2011 (d) | 321 |

| 4,900M | | 8.75%, 2014 (d) | 539 |

| | | | 7,044,698 |

| | | Media-Cable TV—8.1% | |

| 6,250M | | Atlantic Broadband Finance, LLC, 9.375%, 2014 | 4,968,750 |

| 6,900M | | Cablevision Systems Corp., 8%, 2012 | 6,744,750 |

| | | Charter Communications Holdings, LLC: | |

| 8,250M | | 11.75%, 2011 (d) | 92,812 |

| 2,000M | | 8%, 2012 (b)(d) | 1,840,000 |

| 5,444M | | 10%, 2015 (d) | 61,245 |

| 1,875M | | CSC Holdings, Inc., 8.5%, 2014 (b) | 1,856,250 |

| 6,940M | | Echostar DBS Corp., 6.375%, 2011 | 6,714,450 |

| | | Mediacom LLC/Mediacom Capital Corp.: | |

| 4,000M | | 7.875%, 2011 | 3,820,000 |

| 2,000M | | 9.5%, 2013 | 1,880,000 |

| | | Quebecor Media, Inc.: | |

| 800M | | 7.75%, 2016 | 612,000 |

| 1,000M | | 7.75%, 2016 | 765,000 |

| | | | 29,355,257 |

| | | Media-Diversified—2.6% | |

| | | Cenveo, Inc.: | |

| 5,200M | | 7.875%, 2013 | 2,730,000 |

| 500M | | 10.5%, 2016 (b) | 283,125 |

| 2,000M | | Deluxe Corp., 7.375%, 2015 | 1,490,000 |

| 7,875M | | Idearc, Inc., 8%, 2016 (d) | 246,094 |

| | | MediaNews Group, Inc.: | |

| 2,625M | | 6.875%, 2013 | 72,187 |

| 3,100M | | 6.375%, 2014 | 85,250 |

| 6,450M | | R.H. Donnelley Corp., 8.875%, 2017 | 387,000 |

| 4,700M | | Universal City Development Partners, Ltd., 11.75%, 2010 | 4,042,000 |

| 250M | | Universal City Florida Holding Co., 5.92%, 2010 (c) | 88,750 |

| | | | 9,424,406 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Metals/Mining—1.8% | |

| $ 500M | | Freeport-McMoRan Copper & Gold, Inc., 8.375%, 2017 | $ 468,159 |

| 1,750M | | Metals USA, Inc., 11.125%, 2015 | 1,058,750 |

| 6,010M | | Russell Metals, Inc., 6.375%, 2014 | 4,868,100 |

| | | | 6,395,009 |

| | | Retail-General Merchandise—1.4% | |

| 2,900M | | GSC Holdings Corp., 8%, 2012 | 2,943,500 |

| 6,100M | | Neiman Marcus Group, Inc., 10.375%, 2015 (a) | 1,982,500 |

| | | | 4,926,000 |

| | | Services—6.0% | |

| | | Allied Waste NA, Inc.: | |

| 1,800M | | 7.875%, 2013 | 1,792,528 |

| 6,000M | | 7.375%, 2014 | 5,690,844 |

| 5,250M | | 6.875%, 2017 | 4,784,708 |

| 4,700M | | Ashtead Capital, Inc., 9%, 2016 (b) | 2,702,500 |

| 3,950M | | First Data Corp., 9.875%, 2015 | 2,330,500 |

| | | United Rentals, Inc.: | |

| 2,863M | | 6.5%, 2012 | 2,304,715 |

| 4,350M | | 7%, 2014 | 2,218,500 |

| | | | 21,824,295 |

| | | Telecommunications—2.9% | |

| 5,250M | | Citizens Communications Co., 7.125%, 2019 | 4,147,500 |

| 3,500M | | Qwest Communications International, Inc., 7.5%, 2014 | 3,045,000 |

| 3,500M | | Windstream Corp., 8.625%, 2016 | 3,456,250 |

| | | | 10,648,750 |

| | | Transportation—.0% | |

| 500M | | Titan Petrochemicals Group, Ltd., 8.5%, 2012 (b) | 62,500 |

| | | Utilities—2.7% | |

| 5,250M | | Dynergy Holdings, Inc., 7.75%, 2019 | 3,438,750 |

| 500M | | El Paso Corp., 8.25%, 2016 | 470,000 |

| 2,600M | | Energy Future Holdings Corp., 10.875%, 2017 | 1,690,000 |

| 4,625M | | NRG Energy, Inc., 7.375%, 2017 | 4,312,813 |

| | | | 9,911,563 |

| | | |

| |

| Principal | | | |

| Amount | | | |

| or Shares | | Security | Value |

| | | Wireless Communications—3.6% | |

| $ 3,500M | | Metro PCS Wireless, Inc., 9.25%, 2014 (b) | $ 3,395,000 |

| 8,000M | | Nextel Communications, Inc., 5.95%, 2014 | 4,480,000 |

| 5,200M | | Rogers Wireless, Inc., 6.375%, 2014 | 5,269,867 |

| | | | 13,144,867 |

| Total Value of Corporate Bonds (cost $493,106,177) | 318,797,508 |

| | | COMMON STOCKS—1.0% | |

| | | Automotive—.0% | |

| 37,387 | * | Safelite Glass Corporation – Class “B” (b)(e) | 23,180 |

| 2,523 | * | Safelite Realty Corporation (e) | 25 |

| | | | 23,205 |

| | | Chemicals—.2% | |

| 182,350 | * | Texas Petrochemicals Corporation (e) | 638,225 |

| | | Consumer Staples—.4% | |

| 60,249 | | Time Warner Cable, Inc. | 1,494,175 |

| | | Media-Broadcasting—.1% | |

| 325,000 | | Sinclair Broadcasting Group, Inc. | 334,750 |

| | | Telecommunications—.3% | |

| 175,000 | | Frontier Communications Corporation | 1,256,500 |

| 8 | * | Viatel Holding (Bermuda), Ltd. (e) | 29 |

| 18,224 | * | World Access, Inc. | 15 |

| | | | 1,256,544 |

| Total Value of Common Stocks (cost $18,420,986) | 3,746,899 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2009

| | | | | |

| |

| Principal | | | | | |

| Amount | | | | | |

| or Warrants | | Security | | | Value |

| | | AUCTION RATE SECURITIES (g)—1.0% | | |

| $2,300M | | New York State Twy. Auth. Svc. Contract Rev., 0.838%, 2021 (e) | | $2,131,341 |

| 1,725M | | Winter Park, FL Elec. Rev., 0.891%, 2034 (e) | | | 1,425,747 |

| Total Value of Auction Rate Securities (cost $4,025,000) | | | 3,557,088 |

| | | WARRANTS—.0% | | | |

| | | Telecommunication Services | | | |

| 3,500 | * | GT Group Telecom, Inc. (expiring 2/1/10) (cost $316,222) (b)(e) | | — |

| | | SHORT-TERM INVESTMENTS—7.0% | | | |

| | | Money Market Fund | | | |

| $25,360M | | First Investors Cash Reserve Fund, 0.59% (cost $25,360,000) (h) | | 25,360,000 |

| | | REPURCHASE AGREEMENT (i)—1.1% | | | |

| 3,828M | | Barclays Bank PLC, .2%, dated 3/31/09, to be repurchased | | |

| | | at $3,828,021 on 4/1/09 (collateralized by Fannie Mae, | | |

| | | 5.125%, 4/15/11, valued at $3,926,501) (cost $3,828,000) | | 3,828,000 |

| Total Value of Investments (cost $545,056,385) | 98.0 | % | 355,289,495 |

| Other Assets, Less Liabilities | 2.0 | | 7,033,443 |

| Net Assets | | 100.0 | % | $362,322,938 |

* Non-income producing

(a) Loaned security; a portion or all of the security is on loan as of March 31, 2009 (see Note 1G).

(b) Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 4).

(c) Interest rates on adjustable rate bonds are determined and reset periodically by the indentures. The interest rates shown are the rated in effect on March 31, 2009.

(d) In default as to principal and/or interest payment

(e) Securities valued at fair value (see Note 1A).

(f) Denotes a step bond (a zero coupon bond that converts to a fixed interest rate at a designated date).

(g) The interest rates shown are the rates that were in effect on March 31, 2009. While interest rates on auction rate securities are normally determined and reset periodically by the issuer, the auctions on these securities have failed. Therefore, the rates are those that are stipulated under the auction procedures when there are no sufficient clearing bids on an auction date.

(h) Affiliated unregistered money market fund available only to First Investors funds and certain accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at March 31, 2009 (see Note 2).

(i) Collateral for securities on loan.

| |

| 26 | See notes to financial statements |

Fund Expenses (unaudited)

TOTAL RETURN FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $839.80 | $6.70 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,017.65 | $7.34 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $837.29 | $9.89 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,014.16 | $10.85 |

* Expenses are equal to the annualized expense ratio of 1.46% for Class A shares and 2.16% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

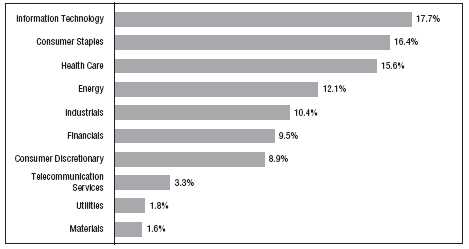

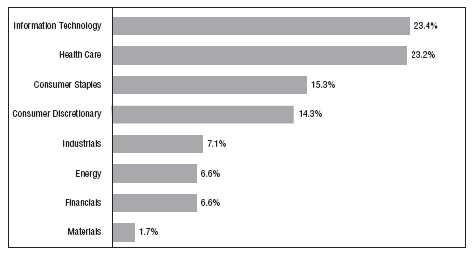

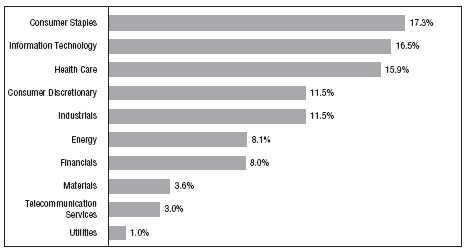

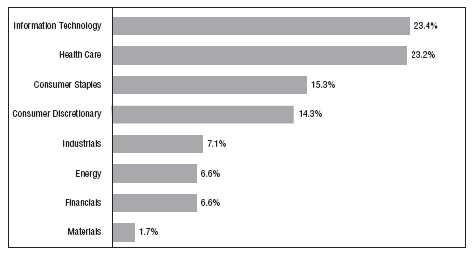

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total market value of investments.

Portfolio of Investments

TOTAL RETURN FUND

March 31, 2009

| | | |

| |

| Shares | | Security | Value |

| | | COMMON STOCKS—52.8% | |

| | | Consumer Discretionary—6.1% | |

| 29,800 | | BorgWarner, Inc. | $ 604,940 |

| 69,000 | | Brown Shoe Company, Inc. | 258,750 |

| 53,100 | | CBS Corporation – Class “B” | 203,904 |

| 61,600 | * | CEC Entertainment, Inc. | 1,594,208 |

| 45,200 | * | Coach, Inc. | 754,840 |

| 26,800 | * | Eddie Bauer Holdings, Inc. | 11,524 |

| 23,500 | | Genuine Parts Company | 701,710 |

| 65,700 | | H&R Block, Inc. | 1,195,083 |

| 66,400 | | Home Depot, Inc. | 1,564,384 |

| 74,800 | * | Jack in the Box, Inc. | 1,742,092 |

| 82,500 | * | Lincoln Educational Services Corporation | 1,511,400 |

| 29,800 | | Luxottica Group SpA (ADR) | 458,920 |

| 34,900 | | McDonald’s Corporation | 1,904,493 |

| 135,300 | * | Morgans Hotel Group Company | 420,783 |

| 27,400 | | Newell Rubbermaid, Inc. | 174,812 |

| 13,200 | | Polo Ralph Lauren Corporation – Class “A” | 557,700 |

| 67,500 | * | Ruby Tuesday, Inc. | 197,100 |

| 49,700 | | Staples, Inc. | 900,067 |

| 31,700 | * | Steiner Leisure, Ltd. | 773,797 |

| 198,300 | | Stewart Enterprises, Inc – Class “A” | 642,492 |

| 71,660 | | Wyndham Worldwide Corporation | 300,972 |

| | | | 16,473,971 |

| | | Consumer Staples—9.8% | |

| 128,500 | | Altria Group, Inc. | 2,058,570 |

| 33,900 | | Avon Products, Inc. | 651,897 |

| 30,500 | * | Chattem, Inc. | 1,709,525 |

| 27,400 | | Coca-Cola Company | 1,204,230 |

| 101,700 | | CVS Caremark Corporation | 2,795,733 |

| 46,900 | * | Dean Foods Company | 847,952 |

| 35,449 | | Kraft Foods, Inc. – Class “A” | 790,158 |

| 55,200 | | McCormick & Company, Inc. | 1,632,264 |

| 188,100 | | Nu Skin Enterprises, Inc. – Class “A” | 1,973,169 |

| 34,200 | | PepsiCo, Inc. | 1,760,616 |

| 76,300 | | Philip Morris International, Inc. | 2,714,754 |

| 25,600 | | Procter & Gamble Company | 1,205,504 |

| 97,100 | | Safeway, Inc. | 1,960,449 |

| | | |

| |

| Shares | | Security | Value |

| | | Consumer Staples (continued) | |

| 14,541 | | Tootsie Roll Industries, Inc. | $ 315,820 |

| 84,700 | | Walgreen Company | 2,198,812 |

| 48,700 | | Wal-Mart Stores, Inc. | 2,537,270 |

| | | | 26,356,723 |

| | | Energy—4.4% | |

| 19,700 | | Anadarko Petroleum Corporation | 766,133 |

| 67,500 | * | Cal Dive International, Inc. | 456,975 |

| 29,900 | | ConocoPhillips | 1,170,884 |

| 34,000 | | ExxonMobil Corporation | 2,315,400 |

| 1,897 | | Hugoton Royalty Trust | 18,135 |

| 25,986 | | Marathon Oil Corporation | 683,172 |

| 48,800 | | Noble Corporation | 1,175,592 |

| 24,300 | | Sasol, Ltd. (ADR) | 703,485 |

| 67,400 | | Suncor Energy, Inc. | 1,496,954 |

| 14,470 | * | Transocean, Inc. | 851,415 |

| 21,000 | | World Fuel Services Corporation | 664,230 |

| 52,500 | | XTO Energy, Inc. | 1,607,550 |

| | | | 11,909,925 |

| | | Financials—4.1% | |

| 17,200 | | American Express Company | 234,436 |

| 29,100 | | Astoria Financial Corporation | 267,429 |

| 16,797 | | Bank of America Corporation | 114,556 |

| 48,600 | | Brookline Bancorp, Inc. | 461,700 |

| 20,692 | | Capital One Financial Corporation | 253,270 |

| 16,400 | | Citigroup, Inc. | 41,492 |

| 26,550 | | Discover Financial Services | 167,530 |

| 181,500 | | Financial Select Sector SPDR Fund (ETF) | 1,599,015 |

| 53,750 | * | First Mercury Financial Corporation | 776,150 |

| 13,324 | | Hartford Financial Services Group, Inc. | 104,593 |

| 48,200 | | Hudson City Bancorp, Inc. | 563,458 |

| 57,900 | | JPMorgan Chase & Company | 1,538,982 |

| 24,499 | | KeyCorp | 192,807 |

| 46,100 | | Morgan Stanley | 1,049,697 |

| 67,800 | | New York Community Bancorp, Inc. | 757,326 |

| 88,200 | | NewAlliance Bancshares, Inc. | 1,035,468 |

| 39,400 | | SPDR KBW Regional Banking ETF | 757,268 |

| 99,272 | | Sunstone Hotel Investors, Inc. (REIT) | 261,085 |

Portfolio of Investments (continued)

TOTAL RETURN FUND

March 31, 2009

| | | |

| |

| Shares | | Security | Value |

| | | Financials (continued) | |

| 33,300 | | U.S. Bancorp | $ 486,513 |

| 16,700 | | Webster Financial Corporation | 70,975 |

| 28,700 | | Wells Fargo & Company | 408,688 |

| | | | 11,142,438 |

| | | Health Care—8.9% | |

| 47,500 | | Abbott Laboratories | 2,265,750 |

| 15,100 | * | Amgen, Inc. | 747,752 |

| 18,500 | | Baxter International, Inc. | 947,570 |

| 28,800 | | Becton, Dickinson & Company | 1,936,512 |

| 17,500 | * | Cephalon, Inc. | 1,191,750 |

| 23,700 | * | Genzyme Corporation | 1,407,543 |

| 57,800 | | Johnson & Johnson | 3,040,280 |

| 15,500 | * | Laboratory Corporation of America Holdings | 906,595 |

| 45,100 | | Medtronic, Inc. | 1,329,097 |

| 33,600 | | Merck & Company, Inc. | 898,800 |

| 45,800 | | Perrigo Company | 1,137,214 |

| 134,680 | | Pfizer, Inc. | 1,834,342 |

| 72,900 | * | PSS World Medical, Inc. | 1,046,115 |

| 33,700 | | Sanofi-Aventis (ADR) | 941,241 |

| 16,200 | * | St. Jude Medical, Inc. | 588,546 |

| 27,500 | * | Thermo Fisher Scientific, Inc. | 980,925 |

| 62,900 | | Wyeth | 2,707,216 |

| | | | 23,907,248 |

| | | Industrials—6.2% | |

| 26,400 | | 3M Company | 1,312,608 |

| 69,300 | * | AAR Corporation | 869,022 |

| 27,600 | | Alexander & Baldwin, Inc. | 525,228 |

| 35,504 | * | Altra Holdings, Inc. | 137,756 |

| 50,000 | * | Armstrong World Industries, Inc. | 550,500 |

| 12,600 | | Barnes Group, Inc. | 134,694 |

| 25,450 | * | BE Aerospace, Inc. | 220,652 |

| 9,500 | | Burlington Northern Santa Fe Corporation | 571,425 |

| 55,600 | | Chicago Bridge & Iron Company NV – NY Shares | 348,612 |

| 39,000 | * | Esterline Technologies Corporation | 787,410 |

| 77,200 | | General Electric Company | 780,492 |

| 25,500 | | Harsco Corporation | 565,335 |

| 46,100 | | Honeywell International, Inc. | 1,284,346 |

| 41,300 | | IDEX Corporation | 903,231 |

| 20,300 | | Lockheed Martin Corporation | 1,401,309 |

| | | |

| |

| Shares | | Security | Value |

| | | Industrials (continued) | |

| 59,700 | * | Mobile Mini, Inc. | $ 687,744 |

| 25,400 | | Northrop Grumman Corporation | 1,108,456 |

| 39,230 | * | PGT, Inc. | 54,530 |

| 27,000 | * | Pinnacle Airlines Corporation | 37,530 |

| 25,400 | | Raytheon Company | 989,076 |

| 18,510 | | Republic Services, Inc. | 317,446 |

| 93,300 | | TAL International Group, Inc. | 682,956 |

| 59,200 | | Textainer Group Holdings, Ltd. | 399,600 |

| 32,975 | | Tyco International, Ltd. | 644,991 |

| 28,700 | | United Technologies Corporation | 1,233,526 |

| | | | 16,548,475 |

| | | Information Technology—9.1% | |

| 25,400 | * | CACI International, Inc. – Class “A” | 926,846 |

| 64,600 | * | Cisco Systems, Inc. | 1,083,342 |

| 37,400 | * | Electronics for Imaging, Inc. | 366,520 |

| 116,600 | * | EMC Corporation | 1,329,240 |

| 79,400 | * | Entrust, Inc. | 119,894 |

| 62,500 | | Harris Corporation | 1,808,750 |

| 43,900 | | Hewlett-Packard Company | 1,407,434 |

| 58,400 | | Intel Corporation | 878,920 |

| 36,000 | | International Business Machines Corporation | 3,488,040 |

| 91,500 | * | Macrovision Solutions Corporation | 1,627,785 |

| 132,200 | | Microsoft Corporation | 2,428,514 |

| 21,950 | * | NCI, Inc. – Class “A” | 570,700 |

| 90,900 | | Nokia Corporation – Class “A” (ADR) | 1,060,803 |

| 69,500 | * | Parametric Technology Corporation | 693,610 |

| 52,900 | | QUALCOMM, Inc. | 2,058,339 |

| 52,675 | * | SRA International, Inc. – Class “A” | 774,322 |

| 134,400 | * | Symantec Corporation | 2,007,936 |

| 115,200 | * | TIBCO Software, Inc. | 676,224 |

| 66,076 | | Western Union Company | 830,575 |

| 17,600 | | Xilinx, Inc. | 337,216 |

| | | | 24,475,010 |

Portfolio of Investments (continued)

TOTAL RETURN FUND

March 31, 2009

| | | |

| |

| Shares or | | | |

| Principal | | | |

| Amount | | Security | Value |

| | | Materials—1.9% | |

| 18,500 | | Agrium, Inc. | $ 662,115 |

| 58,100 | | Celanese Corporation – Series “A” | 776,797 |

| 23,100 | | Freeport-McMoRan Copper & Gold, Inc. | 880,341 |

| 12,600 | | PPG Industries, Inc. | 464,940 |

| 17,000 | | Praxair, Inc. | 1,143,930 |

| 73,700 | | RPM International, Inc. | 938,201 |

| 41,550 | | Temple-Inland, Inc. | 223,124 |

| | | | 5,089,448 |

| | | Telecommunication Services—1.7% | |

| 79,300 | | AT&T, Inc. | 1,998,360 |

| 87,600 | | Verizon Communications, Inc. | 2,645,520 |

| | | | 4,643,880 |

| | | Utilities—.6% | |

| 38,100 | | Atmos Energy Corporation | 880,872 |

| 15,700 | | Consolidated Edison, Inc. | 621,877 |

| | | | 1,502,749 |

| Total Value of Common Stocks (cost $178,285,302) | 142,049,867 |

| | | MORTGAGE-BACKED CERTIFICATES—17.3% | |

| | | Fannie Mae—16.4% | |

| $ 1,729M | | 5%, 7/1/2033 | 1,789,839 |

| 13,772M | | 5.5%, 4/1/2033 – 5/1/2037 | 14,345,261 |

| 20,481M | | 6%, 5/1/2036 – 7/1/2038 | 21,426,364 |

| 4,630M | | 6.5%, 11/1/2033 – 7/1/2037 | 4,894,006 |

| 1,559M | | 7%, 3/1/2032 – 8/1/2032 | 1,692,466 |

| | | | 44,147,936 |

| | | Freddie Mac—.9% | |

| 2,293M | | 6%, 9/1/2032 – 9/1/2037 | 2,403,185 |

| Total Value of Mortgage-Backed Certificates (cost $44,667,831) | 46,551,121 |

| | | CORPORATE BONDS—16.2% | |

| | | Consumer Non-Durables—.2% | |

| 700M | | Newell Rubbermaid, Inc., 6.75%, 2012 | 670,962 |

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Energy—1.9% | |

| $ 1,000M | | Canadian Natural Resources, Ltd., 5.9%, 2018 | $ 897,262 |

| 500M | | ConocoPhillips, 5.75%, 2019 | 504,252 |

| 130M | | Halliburton Co., 7.45%, 2039 | 130,537 |

| 500M | | Kinder Morgan Finance Co., 5.35%, 2011 | 480,000 |

| 1,000M | | Nexen, Inc., 6.4%, 2037 | 711,127 |

| 1,000M | | Northern Border Pipeline Co., 7.1%, 2011 | 1,002,944 |

| 1,000M | | Pacific Energy Partners LP, 7.125%, 2014 | 927,398 |

| 500M | | Spectra Energy Capital, LLC, 6.2%, 2018 | 462,278 |

| | | | 5,115,798 |

| | | Financial Services—1.3% | |

| 1,000M | | CoBank, ACB, 7.875%, 2018 (a) | 977,512 |

| 1,000M | | Fifth Third Bancorp, 5.45%, 2017 | 745,829 |

| 500M | | Hibernia Corp., 5.35%, 2014 | 356,227 |

| 1,000M | | Nationsbank Corp., 7.8%, 2016 | 643,054 |

| 1,000M | | Prudential Financial, Inc., 6%, 2017 | 661,401 |

| | | | 3,384,023 |

| | | Financials—2.3% | |

| 1,000M | | American General Finance Corp., 6.9%, 2017 | 350,878 |

| 1,000M | | Bear Stearns Cos., Inc., 7.25%, 2018 | 1,034,393 |

| 1,000M | | Caterpillar Financial Services Corp., 5.85%, 2017 | 870,225 |

| 927M | | Ford Motor Credit Co., 9.75%, 2010 | 762,826 |

| 850M | | General Motors Acceptance Corp., LLC, 7.75%, 2010 (a) | 714,221 |

| 1,000M | | Goldman Sachs Group, Inc., 6.45%, 2036 | 633,770 |

| 1,000M | | HSBC Finance Corp., 4.75%, 2010 | 936,784 |

| 1,000M | | Merrill Lynch & Co., 5.45%, 2013 | 820,434 |

| | | | 6,123,531 |

| | | Food/Beverage/Tobacco—1.9% | |

| 1,000M | | Altria Group, Inc., 10.2%, 2039 | 1,023,958 |

| 1,170M | | Bunge Limited Finance Corp., 5.875%, 2013 | 1,043,607 |

| 900M | | Cargill, Inc., 6%, 2017 (a) | 846,959 |

| 1,000M | | Coca-Cola Enterprises, Inc., 7.125%, 2017 | 1,094,371 |

| 1,000M | | Philip Morris International, Inc., 5.65%, 2018 | 995,357 |

| | | | 5,004,252 |

| | | Food/Drug—.3% | |

| 700M | | Kroger Co., 6.75%, 2012 | 741,127 |

Portfolio of Investments (continued)

TOTAL RETURN FUND

March 31, 2009

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Health Care—.4% | |

| $ 400M | | Novartis, 5.125%, 2019 | $ 406,910 |

| 650M | | Pfizer, Inc., 5.35%, 2015 | 686,653 |

| | | | 1,093,563 |

| | | Information Technology—.1% | |

| 275M | | Cisco Systems, Inc., 4.95%, 2019 | 271,085 |

| | | Manufacturing—1.0% | |

| 1,000M | | Crane Co., 6.55%, 2036 | 747,995 |

| 1,000M | | John Deere Capital Corp., 5.35%, 2018 | 929,289 |

| 1,000M | | United Technologies Corp., 6.125%, 2019 | 1,078,526 |

| | | | 2,755,810 |

| | | Manufacturing-Diversified—.4% | |

| 1,200M | | General Electric Co., 5.25%, 2017 | 1,111,657 |

| | | Media-Broadcasting—.7% | |

| 750M | | Comcast Cable Communications, Inc., 7.125%, 2013 | 781,303 |

| | | Cox Communications, Inc.: | |

| 800M | | 5.5%, 2015 | 709,821 |

| 500M | | 8.375%, 2039 (a) | 470,353 |

| | | | 1,961,477 |

| | | Media-Diversified—1.2% | |

| | | AOL Time Warner, Inc.: | |

| 750M | | 6.75%, 2011 | 761,553 |

| 1,000M | | 6.875%, 2012 | 1,018,499 |

| 1,000M | | McGraw-Hill Cos., Inc., 5.9%, 2017 | 875,844 |

| 500M | | News America, Inc., 5.3%, 2014 | 470,556 |

| | | | 3,126,452 |

| | | Metals/Mining—.5% | |

| 1,000M | | Alcoa, Inc., 6%, 2012 | 872,180 |

| 500M | | ArcelorMittal, 6.125%, 2018 | 362,303 |

| | | | 1,234,483 |

| | | |

| |

| Principal | | | |

| Amount | | Security | Value |

| | | Telecommunications—.9% | |

| $ 500M | | AT&T, Inc., 5.8%, 2019 | $ 490,372 |

| 800M | | GTE Corp., 6.84%, 2018 | 793,559 |

| 600M | | SBC Communications, Inc., 6.25%, 2011 | 626,984 |

| 400M | | Verizon Wireless Capital, 5.55%, 2014 (a) | 400,754 |

| | | | 2,311,669 |

| | | Transportation—.2% | |

| 500M | | Burlington Northern Santa Fe Corp., 4.3%, 2013 | 484,594 |

| | | Utilities—2.5% | |

| 1,000M | | Consolidated Edison Co. of New York, 7.125%, 2018 | 1,065,540 |

| 2,000M | | E. ON International Finance BV, 5.8%, 2018 (a) | 1,970,702 |

| 600M | | Electricite de France, 6.95%, 2039 (a) | 596,554 |

| 350M | | Entergy Gulf States, Inc., 5.25%, 2015 | 316,690 |

| 873M | | Great River Energy, 5.829%, 2017 (a) | 902,478 |

| 900M | | Public Service Electric & Gas Co., 6.75%, 2016 | 983,169 |

| 1,000M | | Trans-Canada Pipelines, Ltd., 7.625%, 2039 | 991,687 |

| | | | 6,826,820 |

| | | Waste Management—.4% | |

| 1,000M | | Waste Management, Inc., 6.875%, 2009 | 1,002,397 |

| Total Value of Corporate Bonds (cost $47,505,413) | 43,219,700 |

| | | U.S. GOVERNMENT AGENCY | |

| | | OBLIGATIONS—2.8% | |

| 1,000M | | Fannie Mae, 5.5%, 2018 | 1,001,100 |

| 2,000M | | Federal Farm Credit Bank, 5.37%, 2018 | 2,006,520 |

| 1,000M | | Freddie Mac, 6%, 2017 | 1,011,818 |

| | | Tennessee Valley Authority: | |

| 1,450M | | 4.375%, 2015 | 1,544,816 |

| 2,000M | | 4.5%, 2018 | 2,074,764 |

| Total Value of U.S. Government Agency Obligations (cost $7,548,651) | 7,639,018 |

| | | MUNICIPAL BONDS—2.5% | |

| 3,000M | | Kentucky State Ppty. & Bldgs, 5.375%, 2023 | 3,162,960 |

| 2,500M | | Massachusetts Bay Trans. Auth. MA Rev., 5.25%, 2034 | 2,556,800 |

| 1,965M | | Tobacco Settlement Fin. Auth., WV, Series “A”, 7.467%, 2047 | 1,022,193 |

| Total Value of Municipal Bonds (cost $7,376,767) | 6,741,953 |

Portfolio of Investments (continued)

TOTAL RETURN FUND

March 31, 2009

| | | | | |

| |

| Principal | | | | | |

| Amount | | | | | |

| or Shares | | Security | | | Value |

| | | U.S. GOVERNMENT FDIC GUARANTEED | | |

| | | DEBT—1.9% | | | |

| | | Financials | | | |

| $ 1,500M | | Bank of America NA, 1.361%, 2010 | | | $ 1,502,073 |

| 1,000M | | JPMorgan Chase & Co., 1.331%, 2011 | | | 1,002,107 |

| 2,500M | | Regions Bank, 2.75%, 2010 | | | 2,558,333 |

| Total Value of U.S. Government FDIC Guaranteed Debt (cost $5,028,684) | | 5,062,513 |

| | | PASS THROUGH CERTIFICATES—.1% | | |

| | | Transportation | | | |

| 578M | | Continental Airlines, Inc., 8.388%, 2020 (cost $596,102) | | 369,972 |

| | | PREFERRED STOCKS—.0% | | | |

| | | Financials | | | |

| 150,000 | | Preferred Blocker, Inc., 9%, 2011 (cost $146,737) (a) | | 29,873 |

| | | SHORT-TERM CORPORATE NOTES—5.9% | | |

| | | Money Market Fund | | | |

| $15,840M | | First Investors Cash Reserve Fund, .59% (cost $15,840,000) (b) | | 15,840,000 |

| Total Value of Investments (cost $306,995,487) | 99.5 | % | 267,504,017 |

| Other Assets, Less Liabilities | .5 | | 1,466,595 |

| Net Assets | | | 100.0 | % | $268,970,612 |

* Non-income producing

(a) Security exempt from registration under Rule 144A of Securities Act of 1933 (see Note 4).

(b) Affiliated unregistered money market fund available only to First Investors funds and certain accounts managed by First Investors Management Company, Inc. Rate shown is the 7-day yield at March 31, 2009 (see Note 2).

Summary of Abbreviations:

ADR American Depositary Receipts

ETF Exchange Traded Fund

REIT Real Estate Investment Trust

| |

| 36 | See notes to financial statements |

Fund Expenses (unaudited)

VALUE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/08) | (3/31/09) | (10/1/08–3/31/09)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $716.53 | $6.46 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,017,40 | $7.59 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $714.21 | $9.45 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,013.91 | $11.10 |

* Expenses are equal to the annualized expense ratio of 1.51% for Class A shares and 2.21% for Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

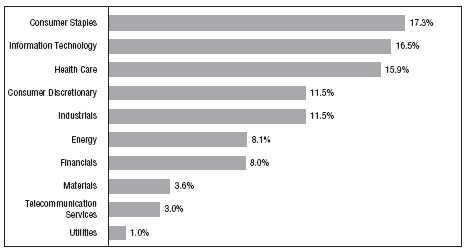

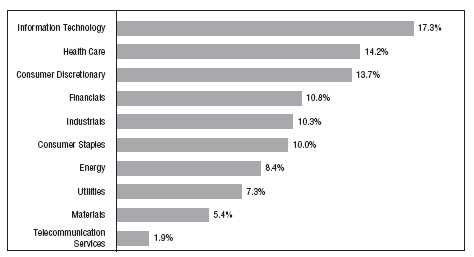

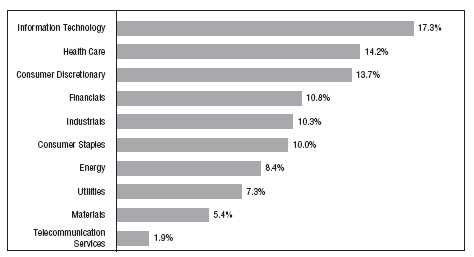

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2009, and are based on the total value of investments.

Portfolio of Investments

VALUE FUND

March 31, 2009

| | | |

| |

| Shares | | Security | Value |

| | | COMMON STOCKS—92.3% | |

| | | Consumer Discretionary—11.5% | |

| 24,500 | | Best Buy Company, Inc. | $ 930,020 |

| 46,700 | | Bob Evans Farms, Inc. | 1,047,014 |

| 55,800 | | Carnival Corporation | 1,205,280 |

| 56,100 | | CBS Corporation – Class “B” | 215,424 |

| 78,900 | | Cinemark Holdings, Inc. | 740,871 |

| 95,500 | | Family Dollar Stores, Inc. | 3,186,835 |

| 62,200 | | Genuine Parts Company | 1,857,292 |

| 60,600 | | H&R Block, Inc. | 1,102,314 |

| 80,900 | | Home Depot, Inc. | 1,906,004 |

| 29,700 | | J.C. Penney Company, Inc. | 596,079 |

| 93,100 | | Leggett & Platt, Inc. | 1,209,369 |

| 96,400 | | Lowe’s Companies, Inc. | 1,759,300 |

| 32,800 | | Marine Products Corporation | 139,072 |

| 56,400 | | McDonald’s Corporation | 3,077,748 |

| 55,700 | | Newell Rubbermaid, Inc. | 355,366 |

| 125,800 | | Pearson PLC (ADR) | 1,259,258 |

| 112,400 | * | Ruby Tuesday, Inc. | 328,208 |

| 78,000 | | Staples, Inc. | 1,412,580 |

| 72,800 | | Tiffany & Company | 1,569,568 |

| 16,701 | | Time Warner Cable, Inc. | 414,173 |

| 66,533 | | Time Warner, Inc. | 1,284,093 |

| 131,500 | | Walt Disney Company | 2,388,040 |

| 39,220 | | Wyndham Worldwide Corporation | 164,724 |

| | | | 28,148,632 |

| | | Consumer Staples—18.0% | |

| 77,200 | | Avon Products, Inc. | 1,484,556 |

| 95,700 | | Coca-Cola Company | 4,206,015 |

| 15,800 | | Colgate-Palmolive Company | 931,884 |

| 65,400 | | ConAgra Foods, Inc. | 1,103,298 |

| 35,700 | | Costco Wholesale Corporation | 1,653,624 |

| 53,100 | | CVS Caremark Corporation | 1,459,719 |

| 48,200 | | Diageo PLC (ADR) | 2,156,950 |

| 33,000 | | Estee Lauder Companies, Inc. – Class “A” | 813,450 |

| 58,600 | | H.J. Heinz Company | 1,937,316 |

| 91,100 | | Hershey Corporation | 3,165,725 |

| 63,600 | | Kimberly-Clark Corporation | 2,932,596 |

| 169,700 | | Kraft Foods, Inc. – Class “A” | 3,782,613 |

| 54,000 | | McCormick & Company, Inc. | 1,596,780 |

| 71,000 | | PepsiAmericas, Inc. | 1,224,750 |

| | | |

| |

| Shares | | Security | Value |

| | | Consumer Staples (continued) | |

| 51,400 | | PepsiCo, Inc. | $ 2,646,072 |

| 81,000 | | Philip Morris International, Inc. | 2,881,980 |

| 37,400 | | Ruddick Corporation | 839,630 |

| 37,200 | | Safeway, Inc. | 751,068 |

| 176,700 | | Sara Lee Corporation | 1,427,736 |

| 78,300 | | Walgreen Company | 2,032,668 |

| 97,400 | | Wal-Mart Stores, Inc. | 5,074,540 |

| | | | 44,102,970 |

| | | Energy—9.3% | |

| 54,400 | | Anadarko Petroleum Corporation | 2,115,616 |

| 53,800 | | BP PLC (ADR) | 2,157,380 |

| 60,417 | | Chevron Corporation | 4,062,439 |

| 64,700 | | ConocoPhillips | 2,533,652 |

| 30,800 | | Diamond Offshore Drilling, Inc. | 1,936,088 |

| 23,200 | | ExxonMobil Corporation | 1,579,920 |

| 23,200 | | Hess Corporation | 1,257,440 |

| 106,600 | | Marathon Oil Corporation | 2,802,514 |

| 56,100 | | Royal Dutch Shell PLC – Class “A” (ADR) | 2,485,230 |

| 53,900 | | Tidewater, Inc. | 2,001,307 |

| | | | 22,931,586 |

| | | Financials—14.4% | |

| 21,700 | | ACE, Ltd. | 876,680 |

| 39,500 | | Allstate Corporation | 756,425 |

| 44,300 | | Aon Corporation | 1,808,326 |

| 29,000 | | Aspen Insurance Holdings, Ltd. | 651,340 |

| 157,200 | | Bank Mutual Corporation | 1,424,232 |

| 130,887 | | Bank of America Corporation | 892,649 |

| 93,028 | | Bank of New York Mellon Corporation | 2,628,041 |

| 51,521 | | Brookfield Asset Management, Inc. – Class “A” | 709,959 |

| 25,903 | | Capital One Financial Corporation | 317,053 |

| 46,456 | | Chubb Corporation | 1,966,018 |