|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| -------- |

| |

| FORM N-CSR |

| -------- |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT |

| INVESTMENT COMPANIES |

| |

| INVESTMENT COMPANY ACT FILE NUMBER 811-3967 |

FIRST INVESTORS INCOME FUNDS

(Exact name of registrant as specified in charter)

55 Broadway

New York, NY 10006

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

First Investors Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: 1-212-858-8000

DATE OF FISCAL YEAR END: SEPTEMBER 30

DATE OF REPORTING PERIOD: MARCH 31, 2013

Item 1. Reports to Stockholders

The semi-annual report to stockholders follows

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Administrative Data Management Corp., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: First Investors Corporation, 55 Broadway, New York, NY 10006, or by visiting our website at www.firstinvestors.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

Market Overview

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

Dear Investor:

During the six-month reporting period ending March 31, 2013, the U.S. economy continued to improve at a slow but steady pace, with positive readings on housing, manufacturing and unemployment. In particular, growth accelerated from an anemic 0.4% in the fourth quarter of 2012 to 2.5% in the first quarter of 2013, as the unemployment rate fell to a four-year low of 7.5%.

Inflation remained subdued as the Consumer Price Index – excluding the volatile food and energy components – remained under 2%. While concerns about November’s presidential election quickly turned into worries over the impact of the “fiscal cliff,” the crisis was averted when President Obama and the Congress struck a deal on New Year’s Day. Lastly, the financial markets were underpinned by the Federal Reserve’s (“the Fed’s”) continuation of its very accommodative monetary policy.

Bond Markets

The low interest rate environment continued during the review period, as benchmark U.S. Treasury yields moved in a relatively narrow range. Yields reached their lows in mid-November due to concerns over the fiscal cliff. After the fiscal cliff was avoided, yields gradually moved to 11-month highs in March in response to stronger-than-expected economic data, only to retrace much of the move because of concern over the bailout of Cyprus. The ten-year Treasury note yield ended the review period at 1.85%, up from 1.63%. The two-year Treasury note yield, which is anchored by the Fed’s commitment to keep short-term rates very low, moved from 0.23% to 0.24%.

The broad bond market gained 0.2% during the reporting period, according to the Bank of America Merrill Lynch US Broad Market Index. Riskier sectors had the best returns, as high yield bonds gained 6.2%. Investment grade corporate bonds advanced 1.3%, while high-quality mortgage-backed and Treasury securities had returns of -0.3% and -0.4%, respectively. Municipal bonds gained 1.0% for the quarter, despite a very weak December when investors became concerned that the fiscal cliff deal would include a cap on the value of their tax exemption (which did not occur). Money market rates remained close to zero, reflecting the Fed’s commitment to keep short-term interest rates at an exceptionally low level.

Equity Markets

Equities posted positive results during the reporting period. Stocks ended 2012 with a flourish, as the S&P 500 Index concluded the calendar year up 16.0%, on a total return basis. Issues such as the U.S. presidential election in November and the impending year-end fiscal cliff of tax hikes and budget cuts weighed on investors’ minds, but did not derail a strong market rally. Strong corporate profit growth and positive economic news lifted the markets during the first half of the reporting period with stocks having gained in excess of 10%. Overall economic news flow had a positive bias,

Market Overview (continued)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

as notable headlines included a rise in consumer spending, higher retail sales, lower unemployment and increased factory orders. New housing and existing home sales also surprised positively. However, economic growth remained below optimal levels, and was highly subject to swings in sentiment, forcing the Fed to remain active in supporting monetary stimulus.

By the end of the reporting period, a review of the markets had every sector but one posting positive absolute results. The S&P 500 Index gained an additional 10.6% through March 31. Investors favored shares exhibiting earnings and sales growth and share price momentum. Factors such as positive earnings surprise, share repurchase, lower valuation and low price-to-sales led performers. Returns were best in: financials, health care, consumer discretionary and industrials sectors. The worst-performing sectors were technology, telecom and energy. Markets favored smaller-cap size, particularly among mid-caps, which were the strongest category by size. Among styles, “value” outperformed “growth” with the highest returns within smaller-cap sizes.

Thank you for placing your trust in First Investors. As always, we appreciate the opportunity to serve your investment needs.

This Market Overview is not part of the Funds’ financial report and is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors in the Funds, unless preceded or accompanied by an effective prospectus. The Market Overview reflects conditions through the end of the period as stated on the cover. Market conditions are subject to change. This Market Overview may not be relied upon as investment advice or as an indication of current or future trading intent on behalf of any Fund.

There are a variety of risks associated with investing in mutual funds. For stock funds, the risks include market risk (the risk that the entire stock market will decline because of an event such as deterioration in the economy or a rise in interest rates), as well as special risks associated with investing in certain types of stock funds, such as small-cap, global and international funds. For bond funds, the risks include interest rate risk and credit risk. Interest rate risk is the risk that bonds will decrease in value as interest rates rise. As a general matter, longer-term bonds fluctuate more than shorter-term bonds in reaction to changes in interest rates. Credit risk is the risk that bonds will decline in value as the result of a decline in the credit rating of the bonds or the economy as a whole, or that the issuer will be unable to pay interest and/or principal when due. There are also special risks associated with investing in certain types of bond funds, including liquidity risk and prepayment and extension risk. You should consult your prospectus for a precise explanation of the risks associated with your Fund.

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only) and a contingent deferred sales charge on redemptions (on Class B shares only); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, October 1, 2012, and held for the entire six-month period ended March 31, 2013. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for Class A and Class B shares, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Fund Expenses (unaudited)

CASH MANAGEMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/12) | (3/31/13) | (10/1/12–3/31/13)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,000.00 | $0.65 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,024.28 | $0.66 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,000.00 | $0.65 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,024.28 | $0.66 |

| |

| * | Expenses are equal to the annualized expense ratio of .13% for Class A shares and .13% for Class B |

| shares, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the |

| one-half year period). Expenses paid during the period are net of expenses waived and/or assumed. |

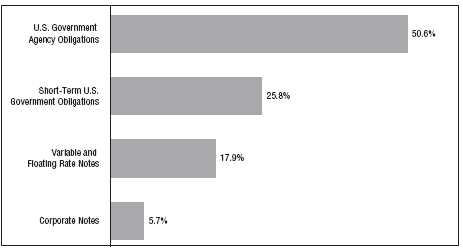

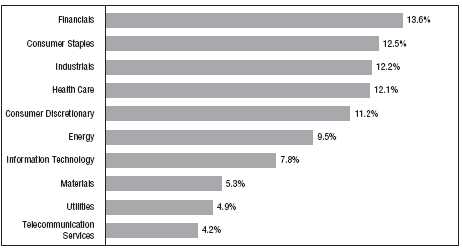

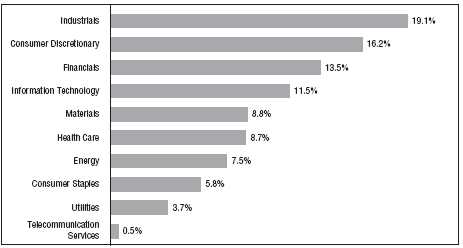

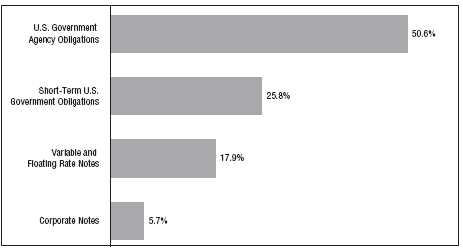

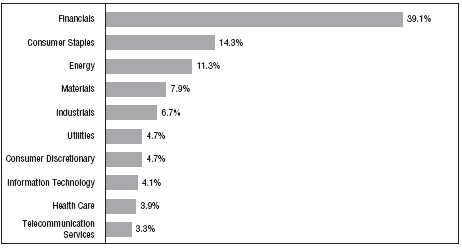

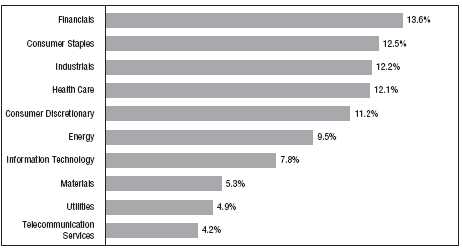

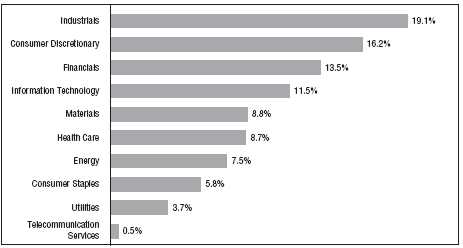

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2013, and are based on the total value of investments.

Portfolio of Investments

CASH MANAGEMENT FUND

March 31, 2013

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—50.3% | | | | | |

| $ 6,500M | | Fannie Mae, 8/1/2013 | | | 0.12 | % | $ 6,497,467 |

| | | Federal Home Loan Bank: | | | | | |

| 8,600M | | 4/17/13 | | | 0.10 | | 8,599,637 |

| 6,400M | | 4/19/13 | | | 0.08 | | 6,399,760 |

| 3,000M | | 4/26/13 | | | 0.09 | | 2,999,812 |

| 5,500M | | 6/7/13 | | | 0.11 | | 5,498,874 |

| | | Freddie Mac: | | | | | |

| 5,500M | | 4/4/13 | | | 0.11 | | 5,499,950 |

| 1,400M | | 4/15/13 | | | 0.10 | | 1,399,948 |

| 12,000M | | 4/22/13 | | | 0.08 | | 11,999,440 |

| 2,100M | | 4/23/13 | | | 0.08 | | 2,099,897 |

| 7,258M | | 6/3/13 | | | 0.12 | | 7,256,476 |

| 2,720M | | 7/1/13 | | | 0.11 | | 2,719,244 |

| 6,500M | | 7/1/13 | | | 0.14 | | 6,497,699 |

| 3,500M | | 7/15/13 | | | 0.13 | | 3,544,585 |

| Total Value of U.S. Government Agency Obligations (cost $71,012,789) | | 71,012,789 |

| | | VARIABLE AND FLOATING RATE NOTES—17.9% | | |

| | | Federal Farm Credit Bank: | | | | | |

| 3,000M | | 9/16/13 | | | 0.37 | | 3,002,795 |

| 1,000M | | 10/15/13 | | | 0.26 | | 1,000,491 |

| | | Federal Home Loan Bank: | | | | | |

| 2,800M | | 7/25/13 | | | 0.14 | | 2,799,910 |

| 1,850M | | 11/8/13 | | | 0.21 | | 1,850,227 |

| 5,000M | | 12/20/13 | | | 0.22 | | 5,001,460 |

| 5,700M | | Mississippi Business Finance Corp. | | | | | |

| | | (Chevron USA, Inc.), 12/1/2030 | | | 0.14 | | 5,700,000 |

| 5,835M | | Valdez, Alaska Marine Terminal Rev. | | | | | |

| | | (Exxon Pipeline Co., Project B), 12/1/2033 | | | 0.13 | | 5,835,000 |

| Total Value of Variable and Floating Rate Notes (cost $25,189,883) | | | | | 25,189,883 |

| | | CORPORATE NOTES—5.7% | | | | | |

| 4,000M | | Abbott Laboratories, 5/16/2013 (a) | | | 0.13 | | 3,999,350 |

| 4,000M | | Coca-Cola Co., 8/2/2013 (a) | | | 0.16 | | 3,997,813 |

| Total Value of Corporate Notes (cost $7,997,163) | | | | | 7,997,163 |

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | Interest | | |

| Amount | | Security | | | Rate | * | Value |

| | | SHORT-TERM U.S. GOVERNMENT | | | | | |

| | | OBLIGATIONS—25.7% | | | | | |

| | | U.S. Treasury Bills: | | | | | |

| $ 9,000M | | 4/4/13 | | | 0.08 | % | $ 8,999,938 |

| 3,000M | | 5/9/13 | | | 0.08 | | 2,999,753 |

| 2,500M | | 5/9/13 | | | 0.08 | | 2,499,786 |

| 5,000M | | 5/16/13 | | | 0.12 | | 4,999,247 |

| 7,000M | | 6/13/13 | | | 0.09 | | 6,998,679 |

| 6,000M | | 7/18/13 | | | 0.11 | | 5,998,110 |

| 3,700M | | 7/25/13 | | | 0.11 | | 3,698,694 |

| Total Value of Short-Term U.S. Government Obligations (cost $36,194,207) | | 36,194,207 |

| Total Value of Investments (cost $140,394,042)** | 99.6 | % | | | 140,394,042 |

| Other Assets, Less Liabilities | .4 | | | | 633,097 |

| Net Assets | | | 100.0 | % | | | $141,027,139 |

| |

| * | The interest rates shown are the effective rates at the time of purchase by the Fund. The interest |

| rates shown on variable and floating rate notes are adjusted periodically; the rates shown are the |

| rates in effect at March 31, 2013. |

| |

| ** | Aggregate cost for federal income tax purposes is the same. |

| |

| (a) | Security exempt from registration under Section 4(2) of the Securities Act of 1933 (see Note 4). |

Portfolio of Investments (continued)

CASH MANAGEMENT FUND

March 31, 2013

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2013:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | $ | — | | $ | 71,012,789 | | $ | — | | $ | 71,012,789 |

| Variable and Floating Rate Notes: | | | | | | | | | | | | |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 13,654,883 | | | — | | | 13,654,883 |

| Corporate Notes | | | — | | | 5,835,000 | | | — | | | 5,835,000 |

| Municipal Bonds | | | — | | | 5,700,000 | | | — | | | 5,700,000 |

| Corporate Notes | | | — | | | 7,997,163 | | | — | | | 7,997,163 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 36,194,207 | | | — | | | 36,194,207 |

| Total Investments in Securities | | $ | — | | $ | 140,394,042 | | $ | — | | $ | 140,394,042 |

There were no transfers into or from Level 1 or Level 2 by the Fund during the year ended March 31, 2013. Transfers, if any, between Levels are recognized at the end of the reporting period.

| | |

| 8 | See notes to financial statements | |

Fund Expenses (unaudited)

GOVERNMENT FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/12) | (3/31/13) | (10/1/12–3/31/13)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $994.06 | $5.52 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.40 | $5.59 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $991.57 | $8.99 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.90 | $9.10 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.11% for Class A shares and 1.81% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to |

| reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

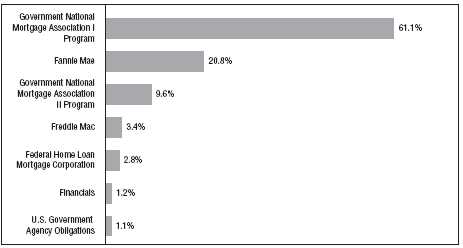

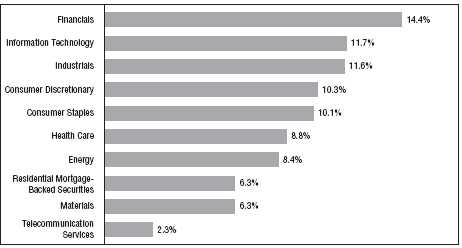

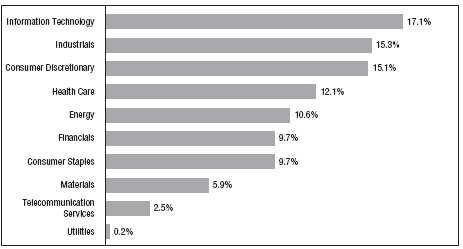

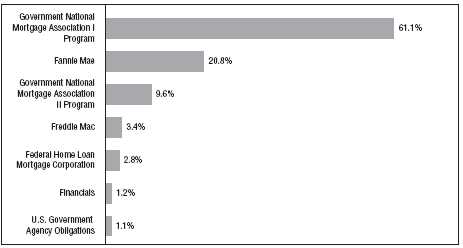

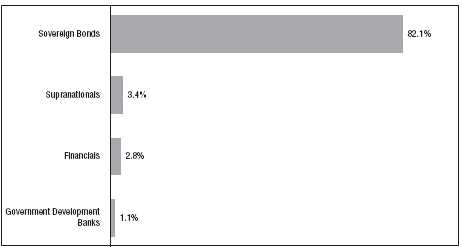

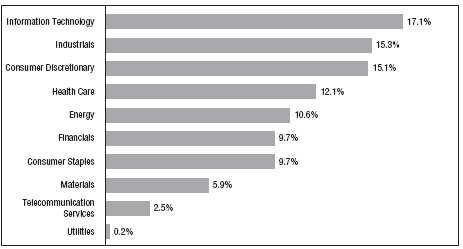

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2013, and are based on the total value of investments.

Portfolio of Investments

GOVERNMENT FUND

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | RESIDENTIAL MORTGAGE-BACKED | | |

| | | SECURITIES—95.3% | | |

| | | Fannie Mae—20.0% | | |

| $ 9,766M | | 2.5%, 11/1/2027 – 12/1/2027 | | $ 10,145,154 |

| 7,923M | | 3%, 1/1/2043 | | 8,183,356 |

| 11,190M | | 3.5%, 8/1/2026 – 10/1/2042 | | 11,878,569 |

| 23,217M | | 4%, 12/1/2040 – 10/1/2041 (a) | | 25,198,506 |

| 8,484M | | 4.5%, 11/1/2040 – 8/1/2041 (a) | | 9,206,680 |

| 5,697M | | 5%, 8/1/2039 – 11/1/2039 | | 6,305,085 |

| 5,069M | | 5.5%, 7/1/2033 – 10/1/2039 | | 5,624,612 |

| | | | | 76,541,962 |

| | | Federal Home Loan Mortgage Corporation—1.4% | | |

| 5,071M | | FHLMC, 3%, 8/15/2039 | | 5,341,537 |

| | | Freddie Mac—3.4% | | |

| 4,889M | | 2.5%, 1/1/2028 | | 5,072,617 |

| 7,308M | | 4%, 11/1/2040 (a) | | 7,867,321 |

| | | | | 12,939,938 |

| | | Government National Mortgage Association I | | |

| | | Program—61.0% | | |

| 22,490M | | 3%, 11/15/2042 – 12/15/2042 | | 23,580,777 |

| 13,695M | | 4%, 7/15/2040 – 1/15/2042 | | 15,124,445 |

| 60,724M | | 4.5%, 9/15/2033 – 7/15/2041 | | 67,048,685 |

| 54,140M | | 5%, 6/15/2033 – 6/15/2040 | | 59,894,872 |

| 29,147M | | 5.5%, 3/15/2033 – 10/15/2039 | | 32,713,764 |

| 26,151M | | 6%, 3/15/2031 – 5/15/2040 | | 29,729,071 |

| 2,017M | | 6.5%, 6/15/2034 – 3/15/2038 | | 2,307,780 |

| 2,867M | | 7%, 6/15/2023 – 4/15/2034 | | 3,253,319 |

| | | | | 233,652,713 |

| | | Government National Mortgage Association II | | |

| | | Program—9.5% | | |

| 13,119M | | 3.5%, 1/20/2041 – 10/20/2042 | | 14,051,788 |

| 20,811M | | 4%, 3/20/2040 – 7/20/2042 | | 22,569,503 |

| | | | | 36,621,291 |

| Total Value of Residential Mortgage-Backed Securities (cost $353,927,560) | | 365,097,441 |

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | COMMERCIAL MORTGAGE-BACKED | | | | |

| | | SECURITIES—2.1% | | | | | |

| | | Fannie Mae DUS—.8% | | | | | |

| $ 2,991M | | 2.27%, 1/1/2023 | | | | | $ 2,999,243 |

| | | Federal Home Loan Mortgage Corporation—1.3% | | | | |

| 5,000M | | FHLMC Multifamily Structured Pass Thru, 2.13%, 1/25/2019 | | | | 5,205,295 |

| Total Value of Commercial Mortgage-Backed Securities (cost $8,161,527) | | | | 8,204,538 |

| | | CORPORATE BONDS—1.2% | | | | | |

| | | Financials | | | | | |

| 4,500M | | Excalibur One 77B, LLC, 1.491%, 1/1/2025 (cost $4,476,397) | | | | 4,477,343 |

| | | U.S. GOVERNMENT AGENCY | | | | | |

| | | OBLIGATIONS—1.2% | | | | | |

| 4,400M | | Federal Home Loan Bank, 1%, 2/15/2028 (cost $4,394,200) | | | | 4,397,021 |

| Total Value of Investments (cost $370,959,684) | 99.8 | % | | | 382,176,343 |

| Other Assets, Less Liabilities | .2 | | | | 792,224 |

| Net Assets | | | 100.0 | % | | | $382,968,567 |

| |

| (a) | A portion or all of the security purchased on a when-issued or delayed delivery basis |

| (see Note 1G). |

Portfolio of Investments (continued)

GOVERNMENT FUND

March 31, 2013

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2013:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Residential Mortgage-Backed | | | | | | | | | | | | |

| Securities | | $ | — | | $ | 365,097,441 | | $ | — | | $ | 365,097,441 |

| Commercial Mortgage-Backed | | | | | | | | | | | | |

| Securities | | | — | | | 8,204,538 | | | — | | | 8,204,538 |

| Corporate Bonds | | | — | | | 4,477,343 | | | — | | | 4,477,343 |

| U.S. Government Agency | | | | | | | | | | | | |

| Obligations | | | — | | | 4,397,021 | | | — | | | 4,397,021 |

| Total Investments in Securities* | | $ | — | | $ | 382,176,343 | | $ | — | | $ | 382,176,343 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for the portfolio. |

| |

| There were no transfers into or from Level 1 or Level 2 by the Fund during the period ended |

| March 31, 2013. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| 12 | See notes to financial statements | |

Fund Expenses (unaudited)

INVESTMENT GRADE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/12) | (3/31/13) | (10/1/12–3/31/13)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,013.50 | $5.42 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,019.54 | $5.44 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,013.44 | $8.94 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,016.05 | $8.95 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.08% for Class A shares and 1.78% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to |

| reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

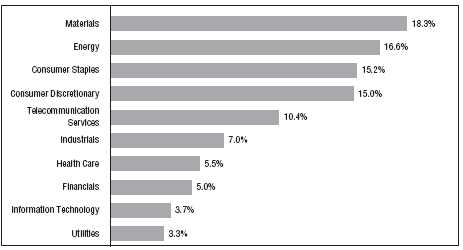

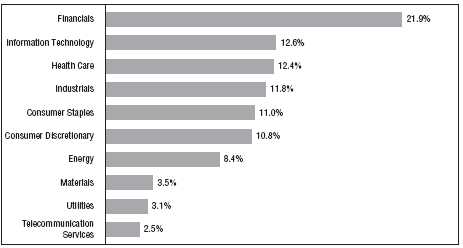

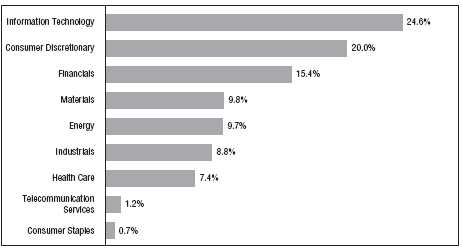

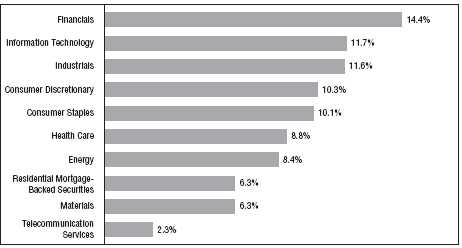

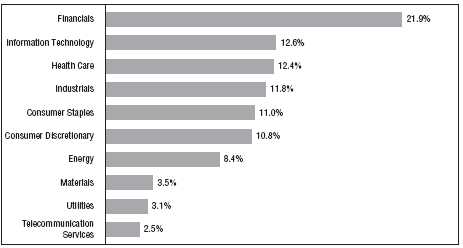

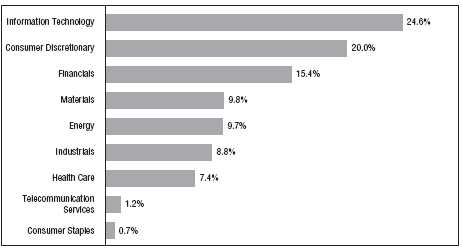

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2013, and are based on the total value of investments.

Portfolio of Investments

INVESTMENT GRADE FUND

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—98.2% | | |

| | | Aerospace/Defense—.3% | | |

| $1,800M | | BAE Systems Holdings, Inc., 4.95%, 6/1/2014 (a) | | $ 1,877,123 |

| | | Agriculture—.6% | | |

| 2,725M | | Cargill, Inc., 6%, 11/27/2017 (a) | | 3,250,723 |

| | | Automotive—.7% | | |

| 4,000M | | Daimler Finance NA, LLC, 2.95%, 1/11/2017 (a) | | 4,199,856 |

| | | Chemicals—1.7% | | |

| 4,000M | | CF Industries, Inc., 7.125%, 5/1/2020 | | 4,963,140 |

| 4,000M | | Dow Chemical Co., 4.25%, 11/15/2020 | | 4,407,080 |

| | | | | 9,370,220 |

| | | Consumer Durables—1.1% | | |

| 2,300M | | Newell Rubbermaid, Inc., 4.7%, 8/15/2020 | | 2,555,992 |

| 3,000M | | Stanley Black & Decker, 5.2%, 9/1/2040 | | 3,377,307 |

| | | | | 5,933,299 |

| | | Energy—11.1% | | |

| 4,000M | | Canadian Oil Sands, Ltd., 7.75%, 5/15/2019 (a) | | 5,048,248 |

| 4,800M | | DCP Midstream, LLC, 9.75%, 3/15/2019 (a) | | 6,328,997 |

| 5,000M | | Enbridge Energy Partners, LP, 4.2%, 9/15/2021 | | 5,278,770 |

| 5,000M | | Kinder Morgan Energy Partners, LP, 3.45%, 2/15/2023 | | 5,063,835 |

| 1,716M | | Maritime & Northeast Pipeline, LLC, 7.5%, 5/31/2014 (a) | | 1,789,622 |

| 4,000M | | Nabors Industries, Inc., 6.15%, 2/15/2018 | | 4,552,824 |

| 4,000M | | ONEOK Partners, LP, 3.375%, 10/1/2022 | | 3,981,012 |

| 5,000M | | Petrobras International Finance Co., 5.375%, 1/27/2021 | | 5,419,965 |

| 4,100M | | Reliance Holdings USA, Inc., 4.5%, 10/19/2020 (a) | | 4,304,770 |

| 5,800M | | Spectra Energy Capital, LLC, 6.2%, 4/15/2018 | | 7,013,412 |

| 4,400M | | Suncor Energy, Inc., 6.85%, 6/1/2039 | | 5,827,510 |

| 2,700M | | Valero Energy Corp., 9.375%, 3/15/2019 | | 3,688,011 |

| 4,000M | | Weatherford International, Inc., 6.35%, 6/15/2017 | | 4,591,264 |

| | | | | 62,888,240 |

| | | Financial Services—13.8% | | |

| 2,250M | | Aflac, Inc., 8.5%, 5/15/2019 | | 3,044,707 |

| 6,000M | | American Express Co., 7%, 3/19/2018 | | 7,500,258 |

| | | American International Group, Inc.: | | |

| 3,100M | | 4.875%, 9/15/2016 | | 3,452,479 |

| 3,200M | | 8.25%, 8/15/2018 | | 4,155,024 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| |

| | | Financial Services (continued) | | |

| $3,800M | | Berkshire Hathaway, Inc., 3.4%, 1/31/2022 | | $ 4,012,431 |

| 4,000M | | BlackRock, Inc., 5%, 12/10/2019 | | 4,752,908 |

| 3,510M | | CoBank, ACB, 7.875%, 4/16/2018 (a) | | 4,458,472 |

| 1,800M | | Compass Bank, 6.4%, 10/1/2017 | | 1,958,353 |

| 5,750M | | ERAC USA Finance Co., 4.5%, 8/16/2021 (a) | | 6,346,384 |

| 6,200M | | Ford Motor Credit Co., LLC, 5%, 5/15/2018 | | 6,844,242 |

| | | General Electric Capital Corp.: | | |

| 2,000M | | 5.625%, 9/15/2017 | | 2,346,302 |

| 4,700M | | 5.3%, 2/11/2021 | | 5,396,770 |

| 4,000M | | Glencore Funding, LLC, 6%, 4/15/2014 (a) | | 4,191,008 |

| 3,800M | | Harley-Davidson Funding Corp., 5.75%, 12/15/2014 (a) | | 4,107,412 |

| 4,000M | | Liberty Mutual Group, Inc., 4.95%, 5/1/2022 (a) | | 4,394,088 |

| 4,000M | | Protective Life Corp., 7.375%, 10/15/2019 | | 4,916,540 |

| | | Prudential Financial, Inc.: | | |

| 2,300M | | 6%, 12/1/2017 | | 2,747,028 |

| 3,000M | | 5.625%, 6/15/2043 | | 3,120,000 |

| | | | | 77,744,406 |

| | | Financials—18.8% | | |

| | | Bank of America Corp.: | | |

| 2,900M | | 5.65%, 5/1/2018 | | 3,358,502 |

| 1,800M | | 5%, 5/13/2021 | | 2,021,045 |

| 2,500M | | 5.7%, 1/24/2022 | | 2,933,543 |

| 6,000M | | Barclays Bank, PLC, 5.125%, 1/8/2020 | | 6,912,192 |

| 3,168M | | Bear Stearns Cos., Inc., 7.25%, 2/1/2018 | | 3,941,226 |

| | | Citigroup, Inc.: | | |

| 3,400M | | 5%, 9/15/2014 | | 3,571,357 |

| 6,800M | | 6.125%, 11/21/2017 | | 8,048,398 |

| 2,000M | | 4.5%, 1/14/2022 | | 2,227,704 |

| 4,000M | | Fifth Third Bancorp, 3.5%, 3/15/2022 | | 4,175,640 |

| | | Goldman Sachs Group, Inc.: | | |

| 6,000M | | 6.15%, 4/1/2018 | | 7,077,948 |

| 1,900M | | 5.75%, 1/24/2022 | | 2,213,078 |

| 3,000M | | 3.625%, 1/22/2023 | | 3,027,300 |

| 1,600M | | 6.125%, 2/15/2033 | | 1,845,880 |

| 2,750M | | 6.75%, 10/1/2037 | | 3,091,341 |

| | | JPMorgan Chase & Co.: | | |

| 6,000M | | 6%, 1/15/2018 | | 7,137,684 |

| 2,000M | | 4.5%, 1/24/2022 | | 2,195,862 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Financials (continued) | | |

| | | Merrill Lynch & Co., Inc.: | | |

| $2,000M | | 5%, 1/15/2015 | | $ 2,128,490 |

| 4,600M | | 6.4%, 8/28/2017 | | 5,404,264 |

| | | Morgan Stanley: | | |

| 5,800M | | 5.95%, 12/28/2017 | | 6,721,980 |

| 5,000M | | 6.625%, 4/1/2018 | | 5,983,505 |

| 6,000M | | SunTrust Banks, Inc., 6%, 9/11/2017 | | 7,090,062 |

| 2,928M | | UBS AG, 4.875%, 8/4/2020 | | 3,396,907 |

| | | Wells Fargo & Co.: | | |

| 5,800M | | 4.6%, 4/1/2021 | | 6,635,154 |

| 1,800M | | 3.5%, 3/8/2022 | | 1,895,429 |

| 3,000M | | 3.45%, 2/13/2023 | | 3,026,439 |

| | | | | 106,060,930 |

| | | Food/Beverage/Tobacco—7.7% | | |

| 4,000M | | Altria Group, Inc., 9.7%, 11/10/2018 | | 5,573,080 |

| 4,000M | | Anheuser-Busch InBev Worldwide, Inc., 5.375%, 1/15/2020 | | 4,831,376 |

| 2,700M | | Bottling Group, LLC, 5.125%, 1/15/2019 | | 3,194,176 |

| 3,000M | | Bunge Ltd., Finance Corp., 3.2%, 6/15/2017 | | 3,106,221 |

| 4,165M | | Corn Products International, Inc., 4.625%, 11/1/2020 | | 4,646,332 |

| 4,000M | | Dr. Pepper Snapple Group, Inc., 6.82%, 5/1/2018 | | 5,018,796 |

| 4,000M | | Lorillard Tobacco Co., 6.875%, 5/1/2020 | | 4,858,188 |

| 3,000M | | Mead Johnson Nutrition Co., 4.9%, 11/1/2019 | | 3,414,648 |

| 4,000M | | Philip Morris International, Inc., 5.65%, 5/16/2018 | | 4,808,440 |

| 4,000M | | SABMiller Holdings, Inc., 3.75%, 1/15/2022 (a) | | 4,289,440 |

| | | | | 43,740,697 |

| | | Food/Drug—.8% | | |

| 4,000M | | Safeway, Inc., 4.75%, 12/1/2021 | | 4,313,552 |

| | | Forest Products/Containers—.5% | | |

| 2,200M | | International Paper Co., 9.375%, 5/15/2019 | | 3,027,248 |

| | | Gaming/Leisure—.7% | | |

| 4,000M | | Marriott International, Inc., 3.25%, 9/15/2022 | | 4,024,140 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care—3.8% | | |

| $4,000M | | Biogen IDEC, Inc., 6.875%, 3/1/2018 | | $ 4,901,424 |

| 4,050M | | Express Scripts Holding Co., 4.75%, 11/15/2021 | | 4,606,272 |

| 4,000M | | Laboratory Corp. of America Holdings, 3.75%, 8/23/2022 | | 4,114,268 |

| 4,000M | | Mylan, Inc., 3.125%, 1/15/2023 (a) | | 3,946,948 |

| 2,400M | | Novartis Securities Investment, Ltd., 5.125%, 2/10/2019 | | 2,869,342 |

| 1,000M | | Roche Holdings, Inc., 6%, 3/1/2019 (a) | | 1,245,293 |

| | | | | 21,683,547 |

| | | Information Technology—4.0% | | |

| 4,000M | | Corning, Inc., 4.75%, 3/15/2042 | | 4,092,140 |

| 4,000M | | Harris Corp., 4.4%, 12/15/2020 | | 4,392,708 |

| 5,000M | | Motorola Solutions, Inc., 6%, 11/15/2017 | | 5,858,395 |

| 4,000M | | Pitney Bowes, Inc., 5.75%, 9/15/2017 | | 4,371,260 |

| 4,000M | | Symantec Corp., 3.95%, 6/15/2022 | | 4,117,392 |

| | | | | 22,831,895 |

| | | Manufacturing—3.7% | | |

| 3,000M | | CRH America, Inc., 8.125%, 7/15/2018 | | 3,732,552 |

| 2,700M | | General Electric Co., 5.25%, 12/6/2017 | | 3,166,088 |

| 4,000M | | Ingersoll-Rand Global Holdings Co., Ltd., 6.875%, 8/15/2018 | | 4,833,404 |

| 3,200M | | Johnson Controls, Inc., 5%, 3/30/2020 | | 3,647,699 |

| 2,725M | | Tyco Electronics Group SA, 6.55%, 10/1/2017 | | 3,261,890 |

| 2,500M | | Tyco Flow Control International, Ltd., 3.15%, 9/15/2022 (a) | | 2,462,945 |

| | | | | 21,104,578 |

| | | Media-Broadcasting—3.4% | | |

| 3,950M | | British Sky Broadcasting Group, PLC, 9.5%, 11/15/2018 (a) | | 5,404,694 |

| 6,500M | | Comcast Corp., 4.25%, 1/15/2033 | | 6,564,851 |

| 3,000M | | DirecTV Holdings, LLC, 3.8%, 3/15/2022 | | 3,072,312 |

| 3,000M | | Time Warner Entertainment Co., LP, 8.375%, 3/15/2023 | | 4,109,031 |

| | | | | 19,150,888 |

| | | Media-Diversified—1.6% | | |

| | | McGraw-Hill Cos., Inc.: | | |

| 1,800M | | 5.9%, 11/15/2017 | | 2,033,449 |

| 2,300M | | 6.55%, 11/15/2037 | | 2,426,268 |

| 4,000M | | Vivendi SA, 6.625%, 4/4/2018 (a) | | 4,682,672 |

| | | | | 9,142,389 |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Metals/Mining—5.0% | | |

| $5,000M | | Alcoa, Inc., 6.15%, 8/15/2020 | | $ 5,451,900 |

| 4,000M | | ArcelorMittal, 6.125%, 6/1/2018 | | 4,324,796 |

| 3,800M | | Newmont Mining Corp., 5.125%, 10/1/2019 | | 4,399,477 |

| 5,000M | | Rio Tinto Finance USA, Ltd., 3.75%, 9/20/2021 | | 5,276,895 |

| 4,000M | | Vale Overseas, Ltd., 5.625%, 9/15/2019 | | 4,530,268 |

| 4,000M | | Xstrata Canada Financial Corp., 4.95%, 11/15/2021 (a) | | 4,309,560 |

| | | | | 28,292,896 |

| | | Real Estate Investment Trusts—5.9% | | |

| 5,000M | | Boston Properties, LP, 5.875%, 10/15/2019 | | 6,024,680 |

| 5,000M | | Digital Realty Trust, LP, 5.25%, 3/15/2021 | | 5,553,465 |

| 5,000M | | HCP, Inc., 5.375%, 2/1/2021 | | 5,817,475 |

| 4,000M | | ProLogis, LP, 6.625%, 5/15/2018 | | 4,815,448 |

| 2,000M | | Realty Income Corp., 3.25%, 10/15/2022 | | 1,962,294 |

| 4,000M | | Simon Property Group, LP, 5.75%, 12/1/2015 | | 4,469,268 |

| 4,000M | | Ventas Realty, LP, 4.75%, 6/1/2021 | | 4,452,760 |

| | | | | 33,095,390 |

| | | Retail-General Merchandise—2.1% | | |

| 6,000M | | GAP, Inc., 5.95%, 4/12/2021 | | 6,869,844 |

| 4,000M | | Home Depot, Inc., 5.875%, 12/16/2036 | | 4,988,908 |

| | | | | 11,858,752 |

| | | Telecommunications—3.7% | | |

| 3,700M | | BellSouth Corp., 6.55%, 6/15/2034 | | 4,387,231 |

| 1,200M | | BellSouth Telecommunications, 6.375%, 6/1/2028 | | 1,455,036 |

| 3,000M | | Deutsche Telekom International Finance BV, 4.875%, 3/6/2042 (a) | | 3,023,148 |

| 3,300M | | GTE Corp., 6.84%, 4/15/2018 | | 4,082,542 |

| 3,000M | | Rogers Communications, Inc., 3%, 3/15/2023 | | 3,016,923 |

| 4,045M | | Verizon New York, Inc., 7.375%, 4/1/2032 | | 5,095,919 |

| | | | | 21,060,799 |

| | | Transportation—2.5% | | |

| 3,000M | | Burlington Northern Santa Fe, LLC, 3%, 3/15/2023 | | 3,029,286 |

| 3,000M | | Con-way, Inc., 7.25%, 1/15/2018 | | 3,537,636 |

| 3,200M | | GATX Corp., 4.75%, 6/15/2022 | | 3,399,757 |

| 4,000M | | Penske Truck Leasing Co., LP, 4.875%, 7/11/2022 (a) | | 4,226,128 |

| | | | | 14,192,807 |

| | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | Utilities—4.7% | | | | | |

| $3,000M | | E.ON International Finance BV, 5.8%, 4/30/2018 (a) | | | | $ 3,593,250 |

| 1,900M | | Electricite de France SA, 6.5%, 1/26/2019 (a) | | | | 2,322,602 |

| 3,240M | | Entergy Arkansas, Inc., 3.75%, 2/15/2021 | | | | | 3,548,383 |

| 4,000M | | Exelon Generation Co., LLC, 5.2%, 10/1/2019 | | | | 4,533,440 |

| | | Great River Energy Co.: | | | | | |

| 496M | | 5.829%, 7/1/2017 (a) | | | | | 538,951 |

| 3,652M | | 4.478%, 7/1/2030 (a) | | | | | 4,025,903 |

| 3,000M | | Ohio Power Co., 5.375%, 10/1/2021 | | | | | 3,617,148 |

| 2,881M | | Sempra Energy, 9.8%, 2/15/2019 | | | | | 4,054,549 |

| | | | | | | | 26,234,226 |

| Total Value of Corporate Bonds (cost $504,779,708) | 98.2 | % | | | 555,078,601 |

| Other Assets, Less Liabilities | 1.8 | | | | 10,154,339 |

| Net Assets | | | 100.0 | % | | | $565,232,940 |

| |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

Portfolio of Investments (continued)

INVESTMENT GRADE FUND

March 31, 2013

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2013:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Corporate Bonds* | | $ | — | | $ | 555,078,601 | | $ | — | | $ | 555,078,601 |

| |

| * | The Portfolio of Investments provides information on the industry categorization for corporate bonds. |

| |

| There were no transfers into or from Level 1 or Level 2 by the Fund during the period ended |

| March 31, 2013. Transfers, if any, between Levels are recognized at the end of the reporting period. |

| | |

| 20 | See notes to financial statements | |

Fund Expenses (unaudited)

INTERNATIONAL OPPORTUNITIES BOND FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| | | | |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/12) | (3/31/13) | (10/1/12–3/31/13)* |

| Expense Example | | | |

| Actual | $1,000.00 | $1,015.73 | $6.53 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.45 | $6.54 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.30% for Class A shares multiplied by the |

| average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| Expenses paid during the period are net of expenses waived and/or assumed. |

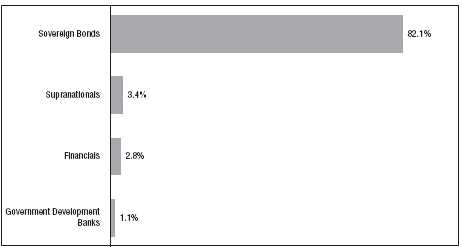

Portfolio Composition

BY SECTOR

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2013, and are based on the total value of investments.

Portfolio of Investments

INTERNATIONAL OPPORTUNITIES BOND FUND

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | SOVEREIGN BONDS—80.3% | | |

| | | United Kingdom—16.1% | | |

| | | United Kingdom Gilt: | | |

| 2,865M | GBP | 4.25%, 3/7/2036 | | $ 5,291,939 |

| 4,430M | GBP | 2.25%, 3/7/2014 | | 6,853,581 |

| | | | | 12,145,520 |

| | | Mexico—14.8% | | |

| | | United Mexican States: | | |

| 236M | MXN | 7%, 6/19/2014 | | 1,988,405 |

| 453M | MXN | 8.5%, 5/31/2029 | | 4,835,363 |

| 249M | MXN | 8.5%, 11/18/2038 | | 2,724,610 |

| 185M | MXN | 9.5%, 12/18/2014 | | 1,632,170 |

| | | | | 11,180,548 |

| | | Australia—10.5% | | |

| 2,680M | AUD | New South Wales Treasury Corp., 6%, 4/1/2016 | | 3,007,454 |

| | | Queensland Treasury Corp.: | | |

| 2,155M | AUD | 6.25%, 2/21/2020 | | 2,521,817 |

| 735M | AUD | 6%, 7/21/2022 | | 855,020 |

| 1,365M | AUD | Treasury Corp. of Victoria, 5.75%, 11/15/2016 | | 1,537,289 |

| | | | | 7,921,580 |

| | | Italy—8.3% | | |

| 4,990M | EUR | Italy Buoni Poliennali Del Tesoro, 5%, 8/1/2039 | | 6,285,326 |

| | | Poland—6.1% | | |

| | | Republic of Poland: | | |

| 14,110M | PLN | 5%, 10/24/2013 | | 4,385,920 |

| 680M | PLN | 5.25%, 10/25/2020 | | 231,179 |

| | | | | 4,617,099 |

| | | South Korea—4.4% | | |

| | | Republic of Korea: | | |

| 556,000M | KRW | 3%, 12/10/2013 | | 501,519 |

| 2,725,000M | KRW | 5.75%, 9/10/2018 | | 2,850,165 |

| | | | | 3,351,684 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | New Zealand—4.1% | | |

| | | New Zealand Government Bonds: | | |

| 1,690M | NZD | 5%, 3/15/2019 | | $ 1,566,983 |

| 1,590M | NZD | 5.5%, 4/15/2023 | | 1,557,148 |

| | | | | 3,124,131 |

| | | Malaysia—4.1% | | |

| | | Federation of Malaysia: | | |

| 8,240M | MYR | 3.741%, 2/27/2015 | | 2,695,881 |

| 1,300M | MYR | 3.172%, 7/15/2016 | | 421,409 |

| | | | | 3,117,290 |

| | | Turkey—3.4% | | |

| 4,480M | TRY | Republic of Turkey, 9%, 3/5/2014 | | 2,550,097 |

| | | Hungary—3.3% | | |

| | | Hungary Government Bond: | | |

| 505,000M | HUF | 5.5%, 2/12/2016 | | 2,162,134 |

| 69,000M | HUF | 7.5%, 11/12/2020 | | 317,712 |

| | | | | 2,479,846 |

| | | South Africa—3.3% | | |

| | | Republic of South Africa: | | |

| 7,685M | ZAR | 6.75%, 3/31/2021 | | 849,657 |

| 18,270M | ZAR | 6.5%, 2/28/2041 | | 1,618,660 |

| | | | | 2,468,317 |

| | | Ireland—1.9% | | |

| | | Republic of Ireland: | | |

| 450M | EUR | 4.5%, 4/18/2020 | | 606,083 |

| 575M | EUR | 5%, 10/18/2020 | | 797,882 |

| | | | | 1,403,965 |

| Total Value of Sovereign Bonds (cost $60,334,128) | | 60,645,403 |

Portfolio of Investments (continued)

INTERNATIONAL OPPORTUNITIES BOND FUND

March 31, 2013

| | | | | | | |

| |

| | | | | | | | |

| | | | | | | | |

| Principal | | | | | | | |

| Amount | | Security | | | | | Value |

| | | CORPORATE BONDS—7.1% | | | | | |

| | | Germany—2.7% | | | | | |

| | | Financials | | | | | |

| 1,735M | AUD | Kreditanstalt fuer Wiederaufbau, 6.25%, 12/4/2019 (a) | | | | $ 2,033,446 |

| | | United States—1.8% | | | | | |

| | | Supranationals | | | | | |

| 2,800M | BRL | Inter-American Development Bank, 5.25%, 7/19/2016 | | | | 1,342,753 |

| | | Canada—1.1% | | | | | |

| | | Government Development Banks | | | | | |

| 1,677M | BRL | Export Development Canada, 5.125%, 7/31/2014 (b) | | | | 823,966 |

| | | Philippines—0.8% | | | | | |

| | | Supranationals | | | | | |

| 1,272M | BRL | Asian Development Bank, 5.25%, 9/25/2015 | | | | 620,939 |

| | | Luxembourg—0.7% | | | | | |

| | | Supranationals | | | | | |

| 1,150M | BRL | European Investment Bank, 6%, 1/25/2016 (b)(c) | | | | 565,248 |

| Total Value of Corporate Bonds (cost $5,485,069) | | | | | 5,386,352 |

| | | SHORT-TERM U.S. GOVERNMENT | | | | |

| | | OBLIGATIONS—10.4% | | | | | |

| | | U.S. Treasury Bills: | | | | | |

| $5,115M | USD | 0.105%, 11/14/2013 | | | | | 5,111,614 |

| 2,750M | USD | 0.13%, 11/14/2013 | | | | | 2,747,693 |

| Total Value of Short-Term U.S. Government Obligations (cost $7,859,307) | | | | 7,859,307 |

| Total Value of Investments (cost $73,678,504) | 97.8 | % | | | 73,891,062 |

| Other Assets, Less Liabilities | 2.2 | | | | 1,642,417 |

| Net Assets | | | 100.0 | % | | | $75,533,479 |

| |

| (a) | The Federal Republic of Germany guarantees all existing and future obligations of Kreditanstalt |

| fuer Wiederaufbau (“KFW”) in respect of money borrowed, bonds issued, and derivative trans- |

| actions entered into by KFW, as well as third party obligations that are expressly guaranteed |

| by KFW. |

| |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

| |

| (c) | A portion or all of the security purchased on a when-issued or delayed delivery basis |

| (see Note 1G). |

| |

| Abbreviations: |

| AUD | Australian Dollar |

| BRL | Brazilian Real |

| EUR | Euro |

| GBP | British Pound |

| HUF | Hungarian Forint |

| KRW | South Korean Won |

| MXN | Mexican Peso |

| MYR | Malaysian Ringgit |

| NZD | New Zealand Dollar |

| PLN | Polish Zloty |

| TRY | Turkish Lira |

| USD | United States Dollar |

| ZAR | South African Rand |

Accounting Standards Codification (“ASC”) 820 established a three-tier hierarchy of inputs to establish a classification of fair value measurements for disclosure purposes. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| Level 1 — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Portfolio of Investments (continued)

INTERNATIONAL OPPORTUNITIES BOND FUND

March 31, 2013

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2013:

| | | | | | | | | | | | |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Sovereign Bonds | | | | | | | | | | | | |

| United Kingdom | | $ | — | | $ | 12,145,520 | | $ | — | | $ | 12,145,520 |

| Mexico | | | — | | | 11,180,548 | | | — | | | 11,180,548 |

| Australia | | | — | | | 7,921,580 | | | — | | | 7,921,580 |

| Italy | | | — | | | 6,285,326 | | | — | | | 6,285,326 |

| Poland | | | — | | | 4,617,099 | | | — | | | 4,617,099 |

| South Korea | | | — | | | 3,351,684 | | | — | | | 3,351,684 |

| New Zealand | | | — | | | 3,124,131 | | | — | | | 3,124,131 |

| Malaysia | | | — | | | 3,117,290 | | | — | | | 3,117,290 |

| Turkey | | | — | | | 2,550,097 | | | — | | | 2,550,097 |

| Hungary | | | — | | | 2,479,846 | | | — | | | 2,479,846 |

| South Africa | | | — | | | 2,468,317 | | | — | | | 2,468,317 |

| Ireland | | | — | | | 1,403,965 | | | — | | | 1,403,965 |

| Corporate Bonds | | | | | | | | | | | | |

| Germany | | | — | | | 2,033,446 | | | — | | | 2,033,446 |

| United States | | | — | | | 1,342,753 | | | — | | | 1,342,753 |

| Canada | | | — | | | 823,966 | | | — | | | 823,966 |

| Philippines | | | — | | | 620,939 | | | — | | | 620,939 |

| Luxembourg | | | — | | | 565,248 | | | — | | | 565,248 |

| Short-Term U.S. Government | | | | | | | | | | | | |

| Obligations | | | — | | | 7,859,307 | | | — | | | 7,859,307 |

| Total Investments in Securities | | $ | — | | $ | 73,891,062 | | $ | — | | $ | 73,891,062 |

| Other Financial Instruments* | | $ | — | | $ | (90,369) | | $ | — | | $ | (90,369) |

| |

| * | Other financial instruments are foreign exchange contracts and are considered derivative instruments, |

| which are valued at the net unrealized depreciation on the instruments. |

| |

| During the period ended March 31, 2013, there were no transfers between Level 1 investments and |

| Level 2 investments that had a material impact to the Fund. Transfers, if any, between Levels are |

| recognized at the end of the reporting period. |

| | |

| 26 | See notes to financial statements | |

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 4 for a detailed explanation of the information presented in these examples.

| | | |

| |

| | Beginning | Ending | |

| | Account | Account | Expenses Paid |

| | Value | Value | During Period |

| | (10/1/12) | (3/31/13) | (10/1/12–3/31/13)* |

| Expense Example – Class A Shares | | | |

| Actual | $1,000.00 | $1,053.13 | $6.40 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,018.70 | $6.29 |

| Expense Example – Class B Shares | | | |

| Actual | $1,000.00 | $1,053.98 | $9.99 |

| Hypothetical | | | |

| (5% annual return before expenses) | $1,000.00 | $1,015.21 | $9.80 |

| |

| * | Expenses are equal to the annualized expense ratio of 1.25% for Class A shares and 1.95% for |

| Class B shares, multiplied by the average account value over the period, multiplied by 182/365 (to |

| reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

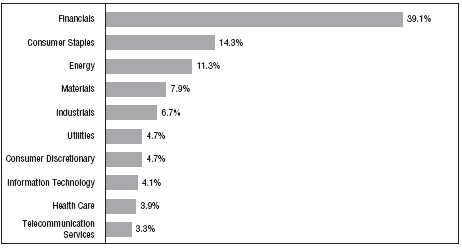

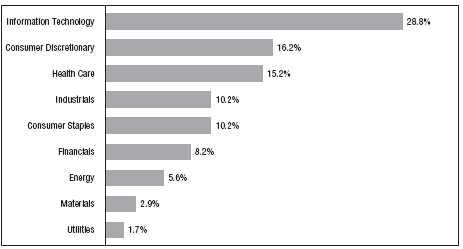

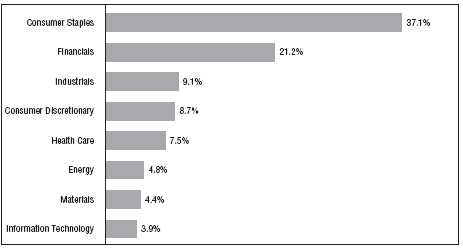

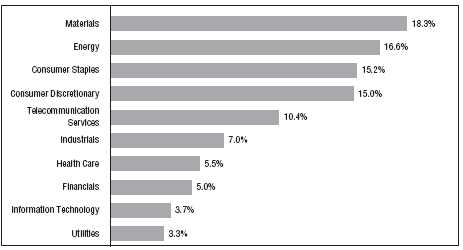

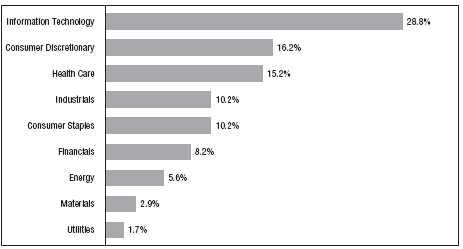

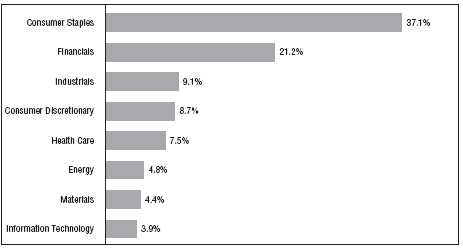

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2013, and are based on the total value of investments.

Portfolio of Investments

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | CORPORATE BONDS—89.0% | | |

| | | Aerospace/Defense—.5% | | |

| $ 2,875M | | Meccanica Holdings USA, Inc., 6.25%, 7/15/2019 (a) | | $ 2,965,640 |

| | | Automotive—3.0% | | |

| | | American Axle & Manufacturing, Inc.: | | |

| 2,250M | | 6.625%, 10/15/2022 | | 2,340,000 |

| 2,350M | | 6.25%, 3/15/2021 | | 2,420,500 |

| 3,000M | | Cooper Tire & Rubber Co., 8%, 12/15/2019 | | 3,472,500 |

| 2,825M | | Cooper-Standard Automotive, Inc., 8.5%, 5/1/2018 | | 3,093,375 |

| 1,925M | | Exide Technologies, 8.625%, 2/1/2018 | | 1,662,720 |

| 2,100M | | Oshkosh Corp., 8.5%, 3/1/2020 | | 2,362,500 |

| | | Schaeffler Finance BV: | | |

| 1,725M | | 7.75%, 2/15/2017 (a) | | 1,951,406 |

| 1,900M | | 8.5%, 2/15/2019 (a) | | 2,170,750 |

| | | | | 19,473,751 |

| | | Building Materials—1.8% | | |

| | | Building Materials Corp.: | | |

| 3,625M | | 6.875%, 8/15/2018 (a) | | 3,905,937 |

| 1,375M | | 7.5%, 3/15/2020 (a) | | 1,509,062 |

| 1,325M | | Cemex Finance, LLC, 9.375%, 10/12/2022 (a) | | 1,546,937 |

| | | Cemex SAB de CV: | | |

| 1,350M | | 9.5%, 6/15/2018 (a) | | 1,576,125 |

| 525M | | 5.875%, 3/25/2019 (a) | | 531,562 |

| 2,150M | | Texas Industries, Inc., 9.25%, 8/15/2020 | | 2,359,625 |

| | | | | 11,429,248 |

| | | Chemicals—3.4% | | |

| 2,950M | | Ferro Corp., 7.875%, 8/15/2018 | | 3,090,125 |

| 1,625M | | Huntsman International, LLC, 8.625%, 3/15/2020 | | 1,824,063 |

| 2,575M | | Orion Engineered Carbons Bondco GmbH, 9.625%, 6/15/2018 (a) | | 2,877,563 |

| 2,475M | | PolyOne Corp., 7.375%, 9/15/2020 | | 2,747,250 |

| 3,650M | | Rhodia SA, 6.875%, 9/15/2020 (a) | | 4,134,804 |

| 4,175M | | TPC Group, Inc., 8.75%, 12/15/2020 (a) | | 4,368,094 |

| 3,000M | | US Coatings Acquisition, Inc., 7.375%, 5/1/2021 (a) | | 3,168,750 |

| | | | | 22,210,649 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Consumer Non-Durables—2.5% | | |

| $ 1,650M | | Hanesbrands, Inc., 6.375%, 12/15/2020 | | $ 1,804,687 |

| | | Levi Strauss & Co.: | | |

| 925M | | 7.625%, 5/15/2020 | | 1,022,125 |

| 2,625M | | 6.875%, 5/1/2022 | | 2,887,500 |

| 1,125M | | Libbey Glass, Inc., 6.875%, 5/15/2020 | | 1,219,219 |

| 3,025M | | Phillips Van-Heusen Corp., 7.375%, 5/15/2020 | | 3,388,000 |

| 3,600M | | Reynolds Group Issuer, Inc., 5.75%, 10/15/2020 | | 3,676,500 |

| | | Spectrum Brands Escrow Corp.: | | |

| 825M | | 6.375%, 11/15/2020 (a) | | 887,906 |

| 1,075M | | 6.625%, 11/15/2022 (a) | | 1,169,063 |

| | | | | 16,055,000 |

| | | Energy—16.2% | | |

| | | AmeriGas Finance, LLC: | | |

| 500M | | 6.75%, 5/20/2020 | | 546,250 |

| 1,325M | | 7%, 5/20/2022 | | 1,447,562 |

| 1,300M | | Antero Resources Finance Corp., 6%, 12/1/2020 (a) | | 1,365,000 |

| 3,150M | | Atlas Pipeline Partners, LP, 5.875%, 8/1/2023 (a) | | 3,150,000 |

| | | Basic Energy Services, Inc.: | | |

| 1,025M | | 7.75%, 2/15/2019 | | 1,053,187 |

| 2,100M | | 7.75%, 10/15/2022 | | 2,173,500 |

| | | Berry Petroleum Co.: | | |

| 675M | | 6.75%, 11/1/2020 | | 732,375 |

| 2,275M | | 6.375%, 9/15/2022 | | 2,428,562 |

| 2,650M | | Calumet Specialty Products Partners, LP, 9.625%, 8/1/2020 (a) | | 3,001,125 |

| | | Chesapeake Energy Corp.: | | |

| 1,525M | | 7.25%, 12/15/2018 | | 1,738,500 |

| 275M | | 6.875%, 11/15/2020 | | 301,125 |

| 2,750M | | 6.625%, 8/15/2020 | | 3,018,125 |

| 1,225M | | 5.75%, 3/15/2023 (d) | | 1,244,906 |

| | | Concho Resources, Inc.: | | |

| 2,300M | | 8.625%, 10/1/2017 | | 2,478,250 |

| 1,275M | | 5.5%, 4/1/2023 | | 1,329,187 |

| | | Consol Energy, Inc.: | | |

| 1,875M | | 8%, 4/1/2017 | | 2,029,687 |

| 3,825M | | 8.25%, 4/1/2020 | | 4,255,312 |

| 700M | | Crosstex Energy, LP, 8.875%, 2/15/2018 | | 761,250 |

| 2,500M | | Eagle Rock Energy Partners, LP, 8.375%, 6/1/2019 | | 2,650,000 |

| 2,750M | | El Paso Corp., 6.5%, 9/15/2020 | | 3,051,958 |

| 3,426M | | Expro Finance Luxembourg SCA, 8.5%, 12/15/2016 (a) | | 3,648,690 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy (continued) | | |

| | | Ferrellgas Partners, LP: | | |

| $ 3,450M | | 9.125%, 10/1/2017 | | $ 3,717,375 |

| 1,363M | | 8.625%, 6/15/2020 | | 1,390,260 |

| 1,900M | | Forest Oil Corp., 7.25%, 6/15/2019 | | 1,909,500 |

| | | Genesis Energy, LP: | | |

| 3,375M | | 7.875%, 12/15/2018 | | 3,720,937 |

| 600M | | 5.75%, 2/15/2021 (a) | | 620,625 |

| 1,700M | | Inergy Midstream, LP, 6%, 12/15/2020 (a) | | 1,776,500 |

| 2,850M | | Legacy Reserves, LP, 8%, 12/1/2020 (a) | | 2,964,000 |

| | | Linn Energy, LLC: | | |

| 1,100M | | 6.25%, 11/1/2019 (a) | | 1,130,250 |

| 475M | | 6.5%, 5/15/2019 | | 499,344 |

| 1,975M | | 7.75%, 2/1/2021 | | 2,128,063 |

| 1,225M | | 8.625%, 4/15/2020 | | 1,356,688 |

| 3,100M | | Murray Energy Corp., 10.25%, 10/15/2015 (a) | | 3,127,125 |

| | | Newfield Exploration Co.: | | |

| 450M | | 7.125%, 5/15/2018 | | 469,688 |

| 1,100M | | 5.75%, 1/30/2022 | | 1,182,500 |

| | | Offshore Group Investment, Ltd.: | | |

| 525M | | 7.5%, 11/1/2019 (a) | | 559,125 |

| 1,075M | | 7.125%, 4/1/2023 (a) | | 1,101,875 |

| | | Penn Virginia Resource Partners, LP: | | |

| 2,100M | | 8.25%, 4/15/2018 | | 2,236,500 |

| 1,000M | | 8.375%, 6/1/2020 | | 1,055,000 |

| 1,525M | | Petrohawk Energy Corp., 10.5%, 8/1/2014 | | 1,613,090 |

| 475M | | PetroLogistics, LP, 6.25%, 4/1/2020 (a) | | 480,344 |

| | | Plains Exploration & Production Co.: | | |

| 1,125M | | 6.125%, 6/15/2019 | | 1,237,500 |

| 600M | | 6.5%, 11/15/2020 | | 666,000 |

| | | Quicksilver Resources, Inc.: | | |

| 975M | | 8.25%, 8/1/2015 | | 964,031 |

| 2,100M | | 9.125%, 8/15/2019 | | 1,942,500 |

| 2,300M | | Rain CII Carbon, LLC, 8.25%, 1/15/2021 (a) | | 2,495,500 |

| 1,725M | | Range Resources Corp., 5%, 3/15/2023 (a) | | 1,768,125 |

| 3,200M | | Samson Investment Co., 9.75%, 2/15/2020 (a) | | 3,416,000 |

| 5,200M | | SandRidge Energy, Inc., 7.5%, 2/15/2023 | | 5,421,000 |

| 1,125M | | SESI, LLC, 6.375%, 5/1/2019 | | 1,215,000 |

| | | SM Energy Co.: | | |

| 600M | | 6.625%, 2/15/2019 | | 646,500 |

| 1,175M | | 6.5%, 11/15/2021 | | 1,289,563 |

| 1,150M | | 6.5%, 1/1/2023 | | 1,265,000 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Energy (continued) | | |

| | | Suburban Propane Partners, LP: | | |

| $ 2,089M | | 7.5%, 10/1/2018 | | $ 2,277,010 |

| 603M | | 7.375%, 8/1/2021 | | 667,823 |

| 1,300M | | Tesoro Logistics, LP, 5.875%, 10/1/2020 (a) | | 1,378,000 |

| 2,075M | | Unit Corp., 6.625%, 5/15/2021 | | 2,183,938 |

| | | | | 104,276,830 |

| | | Financials—3.9% | | |

| | | Algeco Scotsman Global Finance, PLC: | | |

| 1,650M | | 8.5%, 10/15/2018 (a) | | 1,777,875 |

| 800M | | 10.75%, 10/15/2019 (a) | | 832,000 |

| | | Ally Financial, Inc.: | | |

| 5,175M | | 6.25%, 12/1/2017 | | 5,806,624 |

| 4,400M | | 8%, 3/15/2020 | | 5,478,000 |

| 675M | | CNH Capital, LLC, 6.25%, 11/1/2016 | | 749,250 |

| | | International Lease Finance Corp.: | | |

| 2,975M | | 8.625%, 9/15/2015 | | 3,395,219 |

| 4,275M | | 8.75%, 3/15/2017 | | 5,049,844 |

| 1,500M | | 8.25%, 12/15/2020 | | 1,841,250 |

| | | | | 24,930,062 |

| | | Food/Beverage/Tobacco—.3% | | |

| 550M | | Chiquita Brands International, Inc., 7.875%, 2/1/2021 (a) | | 578,187 |

| 1,125M | | Vector Group, Ltd., 7.75%, 2/15/2021 (a) | | 1,186,875 |

| | | | | 1,765,062 |

| | | Food/Drug—1.0% | | |

| 3,600M | | NBTY, Inc., 9%, 10/1/2018 | | 4,041,000 |

| 2,450M | | Tops Holding Corp., 8.875%, 12/15/2017 (a) | | 2,701,125 |

| | | | | 6,742,125 |

| | | Forest Products/Containers—3.2% | | |

| | | Ardagh Packaging Finance, PLC: | | |

| 2,050M | | 7.375%, 10/15/2017 (a) | | 2,254,094 |

| 3,500M | | 7%, 11/15/2020 (a) | | 3,605,000 |

| 2,450M | | Ball Corp., 7.375%, 9/1/2019 | | 2,725,625 |

| 2,375M | | Clearwater Paper Corp., 7.125%, 11/1/2018 | | 2,594,687 |

| 1,925M | | CROWN Americas, LLC, 4.5%, 1/15/2023 (a) | | 1,876,875 |

| 2,200M | | Greif, Inc., 7.75%, 8/1/2019 | | 2,574,000 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Forest Products/Containers (continued) | | |

| | | Sealed Air Corp.: | | |

| $ 1,500M | | 8.125%, 9/15/2019 (a) | | $ 1,704,375 |

| 600M | | 8.375%, 9/15/2021 (a) | | 690,000 |

| 2,150M | | Tekni-Plex, Inc., 9.75%, 6/1/2019 (a) | | 2,386,500 |

| | | | | 20,411,156 |

| | | Gaming/Leisure—.6% | | |

| 1,950M | | National CineMedia, LLC, 7.875%, 7/15/2021 | | 2,181,563 |

| 1,675M | | Six Flags Entertainment Corp., 5.25%, 1/15/2021 (a) | | 1,681,281 |

| | | | | 3,862,844 |

| | | Health Care—5.3% | | |

| 850M | | Aviv Healthcare Properties, LP, 7.75%, 2/15/2019 | | 918,000 |

| 1,249M | | Biomet, Inc., 6.5%, 8/1/2020 (a) | | 1,330,185 |

| | | Community Health Systems, Inc.: | | |

| 3,175M | | 8%, 11/15/2019 | | 3,532,187 |

| 1,750M | | 7.125%, 7/15/2020 | | 1,900,937 |

| | | DaVita, Inc.: | | |

| 1,425M | | 6.375%, 11/1/2018 | | 1,519,406 |

| 1,025M | | 5.75%, 8/15/2022 | | 1,069,844 |

| 1,150M | | Fresenius Medical Care US Finance II, Inc., 5.625%, 7/31/2019 (a) | | 1,267,875 |

| 4,400M | | Genesis Health Ventures, Inc., 9.75%, 6/15/2005 (b)(c) | | 2,750 |

| | | HCA, Inc.: | | |

| 375M | | 6.375%, 1/15/2015 | | 402,656 |

| 2,075M | | 8%, 10/1/2018 | | 2,432,937 |

| 675M | | 8.5%, 4/15/2019 | | 746,719 |

| 475M | | 7.25%, 9/15/2020 | | 526,656 |

| 1,050M | | 6.25%, 2/15/2021 | | 1,122,188 |

| 1,950M | | 7.75%, 5/15/2021 | | 2,177,906 |

| 1,525M | | 7.5%, 2/15/2022 | | 1,757,562 |

| | | HealthSouth Corp.: | | |

| 411M | | 7.25%, 10/1/2018 | | 444,908 |

| 725M | | 8.125%, 2/15/2020 | | 802,938 |

| 945M | | 7.75%, 9/15/2022 | | 1,032,413 |

| | | Universal Hospital Services, Inc.: | | |

| 525M | | 7.625%, 8/15/2020 (a) | | 567,000 |

| 1,975M | | 7.625%, 8/15/2020 | | 2,135,469 |

| 675M | | Valeant Pharmaceuticals International, Inc., 6.375%, 10/15/2020 (a) | | 713,391 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Health Care (continued) | | |

| | | Vanguard Health Holding Co. II, LLC: | | |

| $ 2,250M | | 8%, 2/1/2018 | | $ 2,404,688 |

| 1,325M | | 7.75%, 2/1/2019 | | 1,424,375 |

| 3,450M | | VPI Escrow Corp., 6.375%, 10/15/2020 (a) | | 3,652,688 |

| | | | | 33,885,678 |

| | | Information Technology—2.6% | | |

| 2,500M | | Advanced Micro Devices, Inc., 7.5%, 8/15/2022 (a) | | 2,281,250 |

| 2,000M | | Audatex North America, Inc., 6.75%, 6/15/2018 (a) | | 2,155,000 |

| 1,475M | | CyrusOne, LP, 6.375%, 11/15/2022 (a) | | 1,552,437 |

| | | Equinix, Inc.: | | |

| 1,875M | | 8.125%, 3/1/2018 | | 2,073,047 |

| 1,250M | | 7%, 7/15/2021 | | 1,392,187 |

| 2,400M | | Fidelity National Information Services, Inc., 7.875%, 7/15/2020 | | 2,718,000 |

| | | Hewlett-Packard Co.: | | |

| 550M | | 4.3%, 6/1/2021 | | 559,296 |

| 425M | | 4.375%, 9/15/2021 | | 434,060 |

| 1,825M | | Lender Processing Services, Inc., 5.75%, 4/15/2023 | | 1,911,688 |

| 2,100M | | MEMC Electronic Materials, Inc., 7.75%, 4/1/2019 | | 1,953,000 |

| | | | | 17,029,965 |

| | | Manufacturing—3.9% | | |

| 1,550M | | Amsted Industries, 8.125%, 3/15/2018 (a) | | 1,674,000 |

| | | Bombardier, Inc.: | | |

| 2,425M | | 7.5%, 3/15/2018 (a) | | 2,779,656 |

| 2,575M | | 7.75%, 3/15/2020 (a) | | 2,974,125 |

| 1,500M | | 6.125%, 1/15/2023 (a) | | 1,563,750 |

| 3,850M | | Case New Holland, Inc., 7.875%, 12/1/2017 | | 4,523,750 |

| 2,450M | | Dematic SA, 7.75%, 12/15/2020 (a) | | 2,560,250 |

| 3,350M | | Edgen Murray Corp., 8.75%, 11/1/2020 (a) | | 3,492,375 |

| 1,550M | | EDP Finance BV, 6%, 2/2/2018 (a) | | 1,639,125 |

| | | Rexel SA: | | |

| 3,075M | | 6.125%, 12/15/2019 (a) | | 3,251,813 |

| 975M | | 5.25%, 6/15/2020 (a)(d) | | 992,063 |

| | | | | 25,450,907 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Media-Broadcasting—2.9% | | |

| $ 2,450M | | Allbritton Communication Co., 8%, 5/15/2018 | | $ 2,664,375 |

| | | Belo Corp.: | | |

| 725M | | 7.75%, 6/1/2027 | | 775,750 |

| 150M | | 7.25%, 9/15/2027 | | 155,250 |

| 2,825M | | Block Communications, Inc., 7.25%, 2/1/2020 (a) | | 3,086,312 |

| | | Nexstar Broadcasting, Inc.: | | |

| 2,475M | | 8.875%, 4/15/2017 | | 2,734,875 |

| 3,175M | | 6.875%, 11/15/2020 (a) | | 3,365,500 |

| | | Sinclair Television Group, Inc.: | | |

| 4,000M | | 9.25%, 11/1/2017 (a) | | 4,355,000 |

| 1,825M | | 5.375%, 4/1/2021 (a)(d) | | 1,820,438 |

| | | | | 18,957,500 |

| | | Media-Cable TV—6.7% | | |

| | | Cablevision Systems Corp.: | | |

| 2,750M | | 8.625%, 9/15/2017 | | 3,217,500 |

| 500M | | 7.75%, 4/15/2018 | | 563,125 |

| | | CCO Holdings, LLC: | | |

| 1,200M | | 7.25%, 10/30/2017 | | 1,297,500 |

| 1,700M | | 7.875%, 4/30/2018 | | 1,812,625 |

| 1,150M | | 7%, 1/15/2019 | | 1,244,875 |

| 1,175M | | 7.375%, 6/1/2020 | | 1,308,656 |

| 650M | | 5.25%, 3/15/2021 (a) | | 649,187 |

| 875M | | 5.125%, 2/15/2023 | | 853,125 |

| | | Cequel Communications Holdings I, LLC: | | |

| 1,900M | | 8.625%, 11/15/2017 (a) | | 2,035,375 |

| 1,625M | | 6.375%, 9/15/2020 (a) | | 1,694,062 |

| | | Clear Channel Worldwide Holdings, Inc.: | | |

| 200M | | 7.625%, 3/15/2020 Series “A” | | 207,750 |

| 2,850M | | 7.625%, 3/15/2020 Series “B” | | 2,988,937 |

| 1,025M | | 6.5%, 11/15/2022 Series “A” (a) | | 1,073,687 |

| 2,375M | | 6.5%, 11/15/2022 Series “B” (a) | | 2,517,500 |

| | | DISH DBS Corp.: | | |

| 3,900M | | 7.875%, 9/1/2019 | | 4,641,000 |

| 950M | | 5%, 3/15/2023 (a) | | 939,312 |

| 1,800M | | Echostar DBS Corp., 7.125%, 2/1/2016 | | 2,009,250 |

| 3,025M | | Gray Television, Inc., 7.5%, 10/1/2020 | | 3,244,312 |

| 1,625M | | Harron Communications, LP, 9.125%, 4/1/2020 (a) | | 1,811,875 |

| 1,200M | | Lynx II Corp., 6.375%, 4/15/2023 (a) | | 1,263,000 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Media-Cable TV (continued) | | |

| $ 3,025M | | Nara Cable Funding, Ltd., 8.875%, 12/1/2018 (a) | | $ 3,183,813 |

| 450M | | Quebecor Media, Inc., 5.75%, 1/15/2023 (a) | | 461,250 |

| 3,850M | | UPC Holding BV, 9.875%, 4/15/2018 (a) | | 4,316,813 |

| | | | | 43,334,529 |

| | | Media-Diversified—1.5% | | |

| 2,882M | | Entravision Communications Corp., 8.75%, 8/1/2017 | | 3,134,175 |

| 2,750M | | Griffey Intermediate, Inc., 7%, 10/15/2020 (a) | | 2,818,750 |

| 3,625M | | Lamar Media Corp., 7.875%, 4/15/2018 | | 3,964,844 |

| | | | | 9,917,769 |

| | | Metals/Mining—8.5% | | |

| 2,475M | | Alcoa, Inc., 6.15%, 8/15/2020 | | 2,698,690 |

| 1,625M | | Aleris International, Inc., 7.875%, 11/1/2020 | | 1,738,750 |

| | | ArcelorMittal: | | |

| 475M | | 5%, 2/25/2017 | | 497,526 |

| 1,175M | | 6.125%, 6/1/2018 | | 1,270,409 |

| 5,306M | | 10.35%, 6/1/2019 | | 6,708,381 |

| 1,450M | | 6.75%, 2/25/2022 | | 1,587,331 |

| | | Arch Coal, Inc.: | | |

| 325M | | 7%, 6/15/2019 | | 294,937 |

| 2,775M | | 7.25%, 10/1/2020 | | 2,511,375 |

| 2,950M | | 7.25%, 6/15/2021 | | 2,662,375 |

| 1,650M | | Coeur d’Alene Mines Corp., 7.875%, 2/1/2021 (a) | | 1,751,062 |

| | | FMG Resources (August 2006) Property, Ltd.: | | |

| 1,250M | | 6.375%, 2/1/2016 (a) | | 1,292,187 |

| 975M | | 6%, 4/1/2017 (a) | | 1,006,687 |

| 2,275M | | 6.875%, 2/1/2018 (a) | | 2,400,125 |

| 1,525M | | 8.25%, 11/1/2019 (a) | | 1,652,719 |

| 850M | | 6.875%, 4/1/2022 (a) | | 893,562 |

| 3,125M | | JMC Steel Group, 8.25%, 3/15/2018 (a) | | 3,328,125 |

| 1,000M | | Kaiser Aluminum Corp., 8.25%, 6/1/2020 | | 1,125,000 |

| 2,975M | | Molycorp, Inc., 10%, 6/1/2020 | | 2,945,250 |

| | | Novelis, Inc.: | | |

| 5,425M | | 8.375%, 12/15/2017 | | 5,967,500 |

| 400M | | 8.75%, 12/15/2020 | | 453,000 |

| | | Peabody Energy Corp.: | | |

| 2,050M | | 6%, 11/15/2018 | | 2,185,813 |

| 1,700M | | 6.5%, 9/15/2020 | | 1,819,000 |

| 2,525M | | 6.25%, 11/15/2021 | | 2,638,625 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Metals/Mining (continued) | | |

| | | Steel Dynamics, Inc.: | | |

| $ 1,200M | | 6.125%, 8/15/2019 (a) | | $ 1,302,000 |

| 675M | | 6.375%, 8/15/2022 (a) | | 732,375 |

| | | United States Steel Corp.: | | |

| 550M | | 7%, 2/1/2018 | | 594,000 |

| 1,275M | | 7.375%, 4/1/2020 | | 1,341,938 |

| 425M | | 6.875%, 4/1/2021 | | 438,813 |

| 900M | | 7.5%, 3/15/2022 | | 947,250 |

| | | | | 54,784,805 |

| | | Real Estate Investment Trusts—.6% | | |

| | | Omega Healthcare Investors, Inc.: | | |

| 100M | | 7.5%, 2/15/2020 | | 111,500 |

| 1,800M | | 6.75%, 10/15/2022 | | 1,993,500 |

| 1,400M | | Taylor Morrison Communities, Inc., 7.75%, 4/15/2020 (a) | | 1,508,500 |

| | | | | 3,613,500 |

| | | Retail-General Merchandise—3.3% | | |

| 1,150M | | ARAMARK Corp., 5.75%, 3/15/2020 (a) | | 1,181,625 |

| 2,063M | | CKE Restaurants, Inc., 11.375%, 7/15/2018 | | 2,403,395 |

| 2,125M | | Landry’s, Inc., 9.375%, 5/1/2020 (a) | | 2,300,313 |

| 2,050M | | Limited Brands, Inc., 8.5%, 6/15/2019 | | 2,526,625 |

| 1,675M | | Michaels Stores, Inc., 7.75%, 11/1/2018 | | 1,838,313 |

| 1,975M | | Monitronics International, Inc., 9.125%, 4/1/2020 | | 2,098,438 |

| 4,485M | | Needle Merger Sub Corp., 8.125%, 3/15/2019 (a) | | 4,709,250 |

| 2,250M | | Party City Holdings, Inc., 8.875%, 8/1/2020 (a) | | 2,480,625 |

| 1,525M | | Sally Holdings, LLC, 6.875%, 11/15/2019 | | 1,696,563 |

| | | | | 21,235,147 |

| | | Services—3.2% | | |

| 3,150M | | 313 Group, Inc., 6.375%, 12/1/2019 (a) | | 3,142,125 |

| 2,850M | | Brickman Group Holdings, Inc., 9.125%, 11/1/2018 (a) | | 3,113,625 |

| 2,050M | | CoreLogic, Inc., 7.25%, 6/1/2021 | | 2,275,500 |

| 1,550M | | Covanta Holding Corp., 6.375%, 10/1/2022 | | 1,694,785 |

| 1,700M | | H&E Equipment Services, Inc., 7%, 9/1/2022 (a) | | 1,878,500 |

| 1,525M | | Iron Mountain, Inc., 7.75%, 10/1/2019 | | 1,702,281 |

| 1,450M | | Live Nation Entertainment, Inc., 7%, 9/1/2020 (a) | | 1,566,000 |

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Services (continued) | | |

| | | PHH Corp.: | | |

| $ 825M | | 9.25%, 3/1/2016 | | $ 967,313 |

| 1,350M | | 7.375%, 9/1/2019 | | 1,532,250 |

| 2,375M | | Reliance Intermediate Holdings, LP, 9.5%, 12/15/2019 (a) | | 2,660,000 |

| | | | | 20,532,379 |

| | | Telecommunications—6.6% | | |

| | | CenturyLink, Inc.: | | |

| 275M | | 5.625%, 4/1/2020 | | 281,591 |

| 1,500M | | 5.8%, 3/15/2022 | | 1,521,383 |

| | | Citizens Communications Co.: | | |

| 5,500M | | 7.125%, 3/15/2019 | | 5,967,500 |

| 2,175M | | 9%, 8/15/2031 | | 2,256,562 |

| | | Frontier Communications Corp.: | | |

| 100M | | 8.5%, 4/15/2020 | | 113,750 |

| 275M | | 7.625%, 4/15/2024 (d) | | 283,594 |

| 2,525M | | GCI, Inc., 8.625%, 11/15/2019 | | 2,676,500 |

| 5,850M | | Inmarsat Finance, PLC, 7.375%, 12/1/2017 (a) | | 6,259,500 |

| | | Intelsat Jackson Holdings SA: | | |

| 3,850M | | 8.5%, 11/1/2019 | | 4,326,438 |

| 975M | | 7.25%, 10/15/2020 | | 1,074,938 |

| 800M | | PAETEC Holding Corp., 9.875%, 12/1/2018 | | 922,000 |

| 1,125M | | Qwest Communications International, Inc., 7.125%, 4/1/2018 | | 1,174,219 |

| 425M | | Qwest Corp., 6.5%, 6/1/2017 | | 492,134 |

| | | Sprint Capital Corp.: | | |

| 2,000M | | 6.9%, 5/1/2019 | | 2,205,000 |

| 3,125M | | 6.875%, 11/15/2028 | | 3,210,938 |

| 1,700M | | Telesat Canada, 6%, 5/15/2017 (a) | | 1,785,000 |

| | | Wind Acquisition Finance SA: | | |

| 750M | | 11.75%, 7/15/2017 (a) | | 798,750 |

| 2,175M | | 7.25%, 2/15/2018 (a) | | 2,275,594 |

| | | Windstream Corp.: | | |

| 1,725M | | 7.875%, 11/1/2017 | | 1,979,438 |

| 1,775M | | 7.75%, 10/15/2020 | | 1,934,750 |

| 875M | | 6.375%, 8/1/2023 (a) | | 872,813 |

| | | | | 42,412,392 |

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2013

| | | | |

| |

| | | | | |

| | | | | |

| Principal | | | | |

| Amount | | Security | | Value |

| | | Transportation—1.0% | | |

| $ 1,900M | | Aircastle, Ltd., 6.25%, 12/1/2019 | | $ 2,085,250 |

| | | Navios Maritime Holdings: | | |

| 1,825M | | 8.875%, 11/1/2017 | | 1,872,906 |

| 2,550M | | 8.125%, 2/15/2019 | | 2,320,500 |

| | | | | 6,278,656 |

| | | Utilities—3.2% | | |

| | | AES Corp.: | | |

| 875M | | 9.75%, 4/15/2016 | | 1,047,812 |

| 800M | | 8%, 10/15/2017 | | 945,000 |

| 1,275M | | 7.375%, 7/1/2021 | | 1,485,375 |

| 3,275M | | Atlantic Power Corp., 9%, 11/15/2018 | | 3,438,750 |

| 2,600M | | Calpine Construction Finance Co., LP, 8%, 6/1/2016 (a) | | 2,739,750 |

| 331M | | Calpine Corp., 7.875%, 7/31/2020 (a) | | 364,100 |

| 1,248M | | Indiantown Cogeneration Utilities, LP, 9.77%, 12/15/2020 | | 1,387,510 |

| 3,475M | | Intergen NV, 9%, 6/30/2017 (a) | | 3,431,563 |