UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

INVESTMENT COMPANY ACT FILE NUMBER 811-3967

FIRST INVESTORS INCOME FUNDS

(Exact name of registrant as specified in charter)

40 Wall Street

New York, NY 10005

(Address of principal executive offices) (Zip code)

Joseph I. Benedek

Foresters Investment Management Company, Inc.

Raritan Plaza I

Edison, NJ 08837-3620

(Name and address of agent for service)

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

1-212-858-8000

DATE OF FISCAL YEAR END: SEPTEMBER 30

DATE OF REPORTING PERIOD: MARCH 31, 2018

Item 1. Reports to Stockholders

The semi-annual report to stockholders follows

FOREWORD

This report is for the information of the shareholders of the Funds. It is the policy of each Fund described in this report to mail only one copy of a Fund’s prospectus, annual report, semi-annual report and proxy statements to all shareholders who share the same mailing address and share the same last name and have invested in a Fund covered by the same document. You are deemed to consent to this policy unless you specifically revoke this policy and request that separate copies of such documents be mailed to you. In such case, you will begin to receive your own copies within 30 days after our receipt of the revocation. You may request that separate copies of these disclosure documents be mailed to you by writing to us at: Foresters Investor Services, Inc., Raritan Plaza I, Edison, NJ 08837-3620 or calling us at 1-800-423-4026.

You may obtain a free prospectus for any of the Funds by contacting your representative, calling 1-800-423-4026, writing to us at the following address: Foresters Financial Services, Inc., 40 Wall Street, New York, NY 10005, or by visiting our website at www.foresters.com. You should consider the investment objectives, risks, charges and expenses of a Fund carefully before investing. The prospectus contains this and other information about the Fund, and should be read carefully before investing.

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the Government Cash Management Fund seeks to preserve a net asset value at $1.00 per share, it is possible to lose money by investing in it, just as it is possible to lose money by investing in any of the other Funds. Past performance is no guarantee of future results. There is no guarantee that a Fund’s investment objective will be achieved.

A Statement of Additional Information (“SAI”) for any of the Funds may also be obtained, without charge, upon request by calling 1-800-423-4026, writing to us at our address or by visiting our website listed above. The SAI contains more detailed information about the Funds, including information about its Trustees.

Foresters FinancialTM and ForestersTM are the trade names and trademarks of The Independent Order of Foresters (Foresters), a fraternal benefit society, 789 Don Mills Road, Toronto, Canada M3C 1T9 and its subsidiaries.

Understanding Your Fund’s Expenses (unaudited)

FIRST INVESTORS INCOME FUNDS

FIRST INVESTORS EQUITY FUNDS

As a mutual fund shareholder, you incur two types of costs: (1) transaction costs, including a sales charge (load) on purchase payments (on Class A shares only) and a contingent deferred sales charge on redemptions (on Class B shares and, under certain circumstances when a Class A load was waived, on Class A shares); and (2) ongoing costs, including advisory fees; distribution and service fees (12b-1) (on Class A and Class B shares only); and other expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 in each Fund at the beginning of the period, October 1, 2017, and held for the entire six-month period ended March 31, 2018. The calculations assume that no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses Example:

These amounts help you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To estimate the expenses you paid on your account during this period, simply divide your ending account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period”.

Hypothetical Expenses Example:

These amounts provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares of a Fund, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transaction costs, such as front-end or contingent deferred sales charges (loads) or account fees that are charged to certain types of accounts, such as an annual custodial fee of $15 for certain IRA accounts and certain other retirement accounts or an annual custodial fee of $30 for 403(b) custodial accounts (subject to exceptions and certain waivers as described in the Funds’ Statement of Additional Information). Therefore, the hypothetical expenses example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these costs were included, your costs would have been higher.

1

Fund Expenses (unaudited)

BALANCED INCOME FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

Expense Example | Annualized

Expense

Ratio | Beginning

Account Value

(10/1/17) | Ending

Account Value

(3/31/18) | Expenses Paid

During Period

(10/1/17–3/31/18)* |

Class A Shares | 1.15% | | | |

Actual | | $1,000.00 | $1,000.43 | $5.74 |

Hypothetical** | | $1,000.00 | $1,019.20 | $5.79 |

Advisor Class Shares | 0.82% | | | |

Actual | | $1,000.00 | $1,004.11 | $4.10 |

Hypothetical** | | $1,000.00 | $1,020.84 | $4.13 |

Institutional Class Shares | 0.69% | | | |

Actual | | $1,000.00 | $1,005.86 | $3.45 |

Hypothetical** | | $1,000.00 | $1,021.49 | $3.48 |

* | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived and/or assumed. |

** | Assumed rate of return of 5% before expenses |

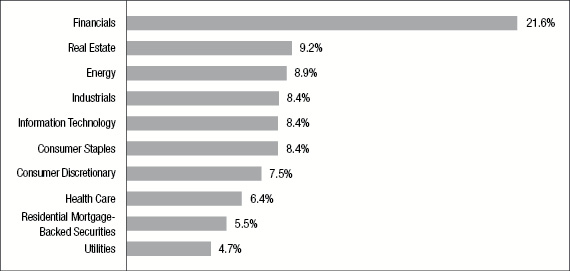

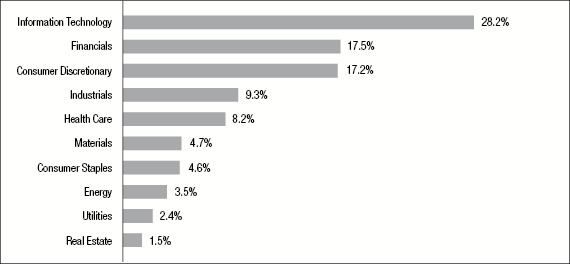

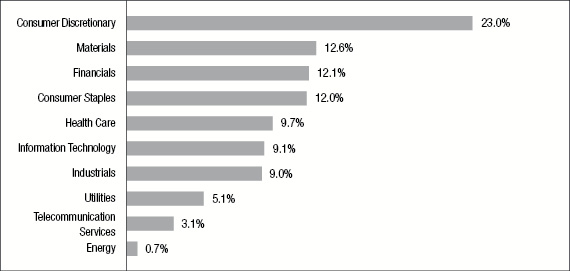

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2018, and are based on the total market value of investments.

2

Portfolio of Investments

BALANCED INCOME FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | CORPORATE BONDS—50.0% | | | | |

| | | | | Aerospace/Defense—.5% | | | | |

| $ | 25 | M | | Bombardier, Inc., 8.75%, 12/1/2021 (a) | | $ | 27,531 | |

| | 200 | M | | Rolls-Royce, PLC, 3.625%, 10/14/2025 (a) | | | 201,123 | |

| | 25 | M | | TransDigm, Inc., 6.5%, 5/15/2025 | | | 25,313 | |

| | | | | | | | 253,967 | |

| | | | | Automotive—1.2% | | | | |

| | 25 | M | | American Axle & Manufacturing, Inc., 6.25%, 4/1/2025 | | | 25,031 | |

| | 25 | M | | Asbury Automotive Group, Inc., 6%, 12/15/2024 | | | 25,562 | |

| | 25 | M | | Cooper Standard Automotive, Inc., 5.625%, 11/15/2026 (a) | | | 25,000 | |

| | 55 | M | | Dana Holding Corp., 5.5%, 12/15/2024 | | | 56,100 | |

| | 500 | M | | O’Reilly Automotive, Inc., 3.55%, 3/15/2026 | | | 489,840 | |

| | | | | | | | 621,533 | |

| | | | | Building Materials—.1%t | | | | |

| | 25 | M | | Building Materials Corp., 5.375%, 11/15/2024 (a) | | | 25,437 | |

| | 25 | M | | Griffon Corp., 5.25%, 3/1/2022 | | | 25,195 | |

| | | | | | | | 50,632 | |

| | | | | Chemicals—1.5% | | | | |

| | 200 | M | | Agrium, Inc., 3.375%, 3/15/2025 | | | 194,456 | |

| | 25 | M | | Blue Cube Spinco, Inc., 10%, 10/15/2025 | | | 29,500 | |

| | 25 | M | | Chemours Co., 6.625%, 5/15/2023 | | | 26,344 | |

| | 25 | M | | CVR Partners, LP, 9.25%, 6/15/2023 (a) | | | 26,711 | |

| | 500 | M | | Dow Chemical Co., 3.5%, 10/1/2024 | | | 496,174 | |

| | 25 | M | | Rain CII Carbon, LLC, 7.25%, 4/1/2025 (a) | | | 26,500 | |

| | 30 | M | | Rayonier AM Products, Inc., 5.5%, 6/1/2024 (a) | | | 29,550 | |

| | | | | | | | 829,235 | |

| | | | | Consumer Non-Durables—.1% | | | | |

| | 25 | M | | Reynolds Group Holdings, Inc., 5.125%, 7/15/2023 (a) | | | 25,274 | |

| | | | | Energy—5.9% | | | | |

| | 25 | M | | Blue Racer Midstream, LLC, 6.125%, 11/15/2022 (a) | | | 25,562 | |

| | 500 | M | | BP Capital Markets, PLC, 3.216%, 11/28/2023 | | | 496,026 | |

3

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Energy (continued) | | | | |

| $ | 50 | M | | Endeavor Energy Resources, LP, 5.75%, 1/30/2028 (a) | | $ | 50,000 | |

| | 500 | M | | Enterprise Products Operating, 7.55%, 4/15/2038 | | | 677,301 | |

| | 30 | M | | Exterran Partners, LP, 6%, 10/1/2022 | | | 29,925 | |

| | 25 | M | | Global Partners, LP, 6.25%, 7/15/2022 | | | 25,000 | |

| | 500 | M | | Kinder Morgan Energy Partners, LP, 3.45%, 2/15/2023 | | | 491,755 | |

| | 500 | M | | Magellan Midstream Partners, LP, 5%, 3/1/2026 | | | 537,536 | |

| | 25 | M | | Matador Resources Co., 6.875%, 4/15/2023 | | | 26,063 | |

| | 25 | M | | Murphy Oil Corp., 6.875%, 8/15/2024 | | | 26,125 | |

| | 25 | M | | NGPL Pipeco, LLC, 4.875%, 8/15/2027 (a) | | | 24,719 | |

| | 25 | M | | Oasis Petroleum, Inc., 6.875%, 1/15/2023 | | | 25,406 | |

| | 25 | M | | Parkland Fuel Corp., 6%, 4/1/2026 (a) | | | 25,188 | |

| | 25 | M | | PDC Energy, Inc., 6.125%, 9/15/2024 | | | 25,625 | |

| | 25 | M | | SESI, LLC, 7.75%, 9/15/2024 (a) | | | 25,938 | |

| | 500 | M | | Valero Energy Corp., 6.625%, 6/15/2037 | | | 633,176 | |

| | 25 | M | | Whiting Petroleum Corp., 5.75%, 3/15/2021 | | | 25,312 | |

| | 30 | M | | WPX Energy, Inc., 5.25%, 9/15/2024 | | | 29,700 | |

| | | | | | | | 3,200,357 | |

| | | | | Financial Services—7.1% | | | | |

| | 500 | M | | American International Group, Inc., 3.75%, 7/10/2025 | | | 493,118 | |

| | 200 | M | | Assured Guaranty U.S. Holding, Inc., 5%, 7/1/2024 | | | 213,487 | |

| | 1,000 | M | | Brookfield Finance, Inc., 4%, 4/1/2024 | | | 1,008,664 | |

| | 500 | M | | Ford Motor Credit Co., LLC, 8.125%, 1/15/2020 | | | 541,529 | |

| | 300 | M | | GE Capital International Funding Services, Ltd., 4.418%, 11/15/2035 | | | 293,797 | |

| | 500 | M | | General Motors Financial Co., Inc., 5.25%, 3/1/2026 | | | 528,935 | |

| | 250 | M | | Key Bank NA, 3.4%, 5/20/2026 | | | 242,029 | |

| | 500 | M | | Travelers Cos., Inc., 4.05%, 3/7/2048 | | | 505,992 | |

| | | | | | | | 3,827,551 | |

| | | | | Financials—9.2% | | | | |

| | 25 | M | | Ally Financial, Inc., 8%, 11/1/2031 | | | 30,625 | |

| | | | | Bank of America Corp.: | | | | |

| | 500 | M | | 4.1%, 7/24/2023 | | | 516,521 | |

| | 400 | M | | 5.875%, 2/7/2042 | | | 500,047 | |

4

Principal

Amount | | | Security | | Value | |

| $ | 400 | M | | Capital One Financial Corp., 3.75%, 4/24/2024 | | $ | 397,610 | |

| | 500 | M | | Citigroup, Inc., 4.3%, 11/20/2026 | | | 501,168 | |

| | 25 | M | | DAE Funding, LLC, 5%, 8/1/2024 (a) | | | 23,719 | |

| | 500 | M | | Deutsche Bank AG, 3.7%, 5/30/2024 | | | 483,301 | |

| | 500 | M | | Goldman Sachs Group, Inc., 3.625%, 1/22/2023 | | | 502,275 | |

| | | | | Icahn Enterprises, LP: | | | | |

| | 25 | M | | 6.25%, 2/1/2022 | | | 25,500 | |

| | 25 | M | | 6.75%, 2/1/2024 | | | 25,531 | |

| | 400 | M | | JPMorgan Chase & Co., 6.4%, 5/15/2038 | | | 521,981 | |

| | 25 | M | | Ladder Capital Finance Holdings, LLLP, 5.25%, 10/1/2025 (a) | | | 23,750 | |

| | 25 | M | | LPL Holdings, Inc., 5.75%, 9/15/2025 (a) | | | 24,743 | |

| | | | | Morgan Stanley: | | | | |

| | 100 | M | | 5.5%, 7/28/2021 | | | 106,887 | |

| | 500 | M | | 4%, 7/23/2025 | | | 505,132 | |

| | 25 | M | | Springleaf Finance Corp., 7.75%, 10/1/2021 | | | 27,156 | |

| | | | | U.S. Bancorp: | | | | |

| | 200 | M | | 3.6%, 9/11/2024 | | | 200,658 | |

| | 200 | M | | 3.1%, 4/27/2026 | | | 191,136 | |

| | 300 | M | | Wells Fargo & Co., 5.606%, 1/15/2044 | | | 344,714 | |

| | | | | | | | 4,952,454 | |

| | | | | Food/Beverage/Tobacco—1.8% | | | | |

| | | | | Anheuser-Busch InBev Finance, Inc.: | | | | |

| | 100 | M | | 3.65%, 2/1/2026 | | | 99,573 | |

| | 200 | M | | 4.7%, 2/1/2036 | | | 212,247 | |

| | 100 | M | | 4.9%, 2/1/2046 | | | 108,269 | |

| | 500 | M | | Dr. Pepper Snapple Group, Inc., 3.43%, 6/15/2027 | | | 479,801 | |

| | 25 | M | | Pilgrim’s Pride Corp., 5.75%, 3/15/2025 (a) | | | 24,340 | |

| | 25 | M | | Post Holdings, Inc., 5.75%, 3/1/2027 (a) | | | 24,938 | |

| | | | | | | | 949,168 | |

| | | | | Forest Products/Containers—.9% | | | | |

| | 450 | M | | Packaging Corp. of America, 3.4%, 12/15/2027 | | | 431,356 | |

5

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Forest Products/Containers (continued) | | | | |

| $ | 25 | M | | Sealed Air Corp., 6.875%, 7/15/2033 (a) | | $ | 27,875 | |

| | | | | | | | 459,231 | |

| | | | | Gaming/Leisure—.1% | | | | |

| | 25 | M | | CRC Escrow Issuer, LLC, 5.25%, 10/15/2025 (a) | | | 24,029 | |

| | 25 | M | | Golden Nugget, Inc., 6.75%, 10/15/2024 (a) | | | 25,187 | |

| | 25 | M | | IRB Holding Corp., 6.75%, 2/15/2026 (a) | | | 24,565 | |

| | 25 | M | | Viking Cruises, Ltd., 6.25%, 5/15/2025 (a) | | | 25,125 | |

| | | | | | | | 98,906 | |

| | | | | Health Care—1.2% | | | | |

| | 25 | M | | Centene Corp., 5.625%, 2/15/2021 | | | 25,750 | |

| | 25 | M | | CHS/Community Health Systems, Inc., 6.25%, 3/31/2023 | | | 23,156 | |

| | 400 | M | | CVS Health Corp., 3.875%, 7/20/2025 | | | 397,152 | |

| | 25 | M | | DaVita, Inc., 5.125%, 7/15/2024 | | | 24,453 | |

| | 25 | M | | HCA, Inc., 6.25%, 2/15/2021 | | | 26,313 | |

| | 25 | M | | HealthSouth Corp., 5.75%, 11/1/2024 | | | 25,531 | |

| | 25 | M | | LifePoint Health, Inc., 5.875%, 12/1/2023 | | | 25,336 | |

| | 25 | M | | Mallinckrodt Finance SB, 5.75%, 8/1/2022 (a) | | | 21,500 | |

| | 25 | M | | Molina Healthcare, Inc., 4.875%, 6/15/2025 (a) | | | 23,438 | |

| | 25 | M | | Universal Hospital Services, Inc., 7.625%, 8/15/2020 | | | 25,313 | |

| | | | | Valeant Pharmaceuticals International, Inc.: | | | | |

| | 25 | M | | 6.5%, 3/15/2022 (a) | | | 25,906 | |

| | 25 | M | | 7.25%, 7/15/2022 (a) | | | 25,094 | |

| | | | | | | | 668,942 | |

| | | | | Information Technology—2.3% | | | | |

| | 25 | M | | Alliance Data Systems Corp., 5.375%, 8/1/2022 (a) | | | 25,125 | |

| | 500 | M | | Apple, Inc., 2.5%, 2/9/2025 | | | 474,495 | |

| | 25 | M | | CommScope Technologies, LLC, 6%, 6/15/2025 (a) | | | 26,138 | |

| | 300 | M | | Corning, Inc., 7.25%, 8/15/2036 | | | 366,605 | |

| | 300 | M | | Microsoft Corp., 3.45%, 8/8/2036 | | | 293,194 | |

| | 25 | M | | Rackspace Hosting, Inc., 8.625%, 11/15/2024 (a) | | | 24,750 | |

6

Principal

Amount | | | Security | | Value | |

| $ | 25 | M | | Solera, LLC, 10.5%, 3/1/2024 (a) | | $ | 27,938 | |

| | | | | | | | 1,238,245 | |

| | | | | Manufacturing—.1% | | | | |

| | 25 | M | | ATS Automation Tooling Systems, Inc., 6.5%, 6/15/2023 (a) | | | 26,187 | |

| | 25 | M | | Grinding Media, Inc., 7.375%, 12/15/2023 (a) | | | 26,313 | |

| | | | | | | | 52,500 | |

| | | | | Media-Broadcasting—1.1% | | | | |

| | 500 | M | | Comcast Corp., 4.25%, 1/15/2033 | | | 518,904 | |

| | 25 | M | | Nexstar Broadcasting, Inc., 5.625%, 8/1/2024 (a) | | | 24,555 | |

| | 25 | M | | Sirius XM Radio, Inc., 6%, 7/15/2024 (a) | | | 25,766 | |

| | | | | | | | 569,225 | |

| | | | | Media-Cable TV—.4% | | | | |

| | | | | CCO Holdings, LLC: | | | | |

| | 25 | M | | 5.125%, 2/15/2023 | | | 25,225 | |

| | 25 | M | | 5.875%, 4/1/2024 (a) | | | 25,500 | |

| | 25 | M | | Clear Channel Worldwide Holdings, Inc. - Series “A”, 6.5%, 11/15/2022 | | | 25,500 | |

| | 50 | M | | CSC Holdings, LLC, 6.75%, 11/15/2021 | | | 52,187 | |

| | 25 | M | | DISH DBS Corp., 5%, 3/15/2023 | | | 22,563 | |

| | 25 | M | | Gray Television, Inc., 5.875%, 7/15/2026 (a) | | | 24,375 | |

| | 25 | M | | Midcontinent Communications & Finance Corp., 6.875%, 8/15/2023 (a) | | | 26,406 | |

| | 25 | M | | Radiate Holdco, LLC, 6.875%, 2/15/2023 (a) | | | 24,313 | |

| | | | | | | | 226,069 | |

| | | | | Media-Diversified—.5% | | | | |

| | 25 | M | | Outdoor Americas Capital, LLC, 5.875%, 3/15/2025 | | | 25,437 | |

| | 200 | M | | Time Warner, Inc., 3.6%, 7/15/2025 | | | 194,925 | |

| | 25 | M | | Tribune Media Co., 5.875%, 7/15/2022 | | | 25,469 | |

| | | | | | | | 245,831 | |

7

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Metals/Mining—.3% | | | | |

| $ | 25 | M | | Big River Steel, LLC, 7.25%, 9/1/2025 (a) | | $ | 26,000 | |

| | 25 | M | | Cleveland-Cliffs Inc., 4.875%, 1/15/2024 (a) | | | 24,313 | |

| | 25 | M | | Commercial Metals Co., 4.875%, 5/15/2023 | | | 24,996 | |

| | 25 | M | | HudBay Minerals, Inc., 7.25%, 1/15/2023 (a) | | | 26,063 | |

| | 25 | M | | Novelis, Inc., 5.875%, 9/30/2026 (a) | | | 24,563 | |

| | 30 | M | | SunCoke Energy Partners, LP, 7.5%, 6/15/2025 (a) | | | 31,050 | |

| | | | | | | | 156,985 | |

| | | | | Real Estate—6.6% | | | | |

| | 300 | M | | Alexandria Real Estate Equities, Inc., 3.95%, 1/15/2028 | | | 293,573 | |

| | 450 | M | | Boston Properties, LP, 2.75%, 10/1/2026 | | | 410,404 | |

| | 211 | M | | Digital Realty Trust, LP, 4.75%, 10/1/2025 | | | 220,622 | |

| | 25 | M | | Equinix, Inc., 5.375%, 4/1/2023 | | | 25,656 | |

| | 200 | M | | ERP Operating, LP, 3.375%, 6/1/2025 | | | 197,659 | |

| | 300 | M | | Essex Portfolio, LP, 3.875%, 5/1/2024 | | | 302,212 | |

| | 30 | M | | Geo Group, Inc., 5.875%, 10/15/2024 | | | 29,850 | |

| | 25 | M | | Greystar Real Estate Partners, 5.75%, 12/1/2025 (a) | | | 25,000 | |

| | 50 | M | | Iron Mountain, Inc., 5.75%, 8/15/2024 | | | 48,688 | |

| | 500 | M | | Realty Income Corp., 3.25%, 10/15/2022 | | | 496,580 | |

| | 200 | M | | Simon Property Group, LP, 3.375%, 10/1/2024 | | | 197,569 | |

| | 500 | M | | Tanger Properties, LP, 3.125%, 9/1/2026 | | | 459,332 | |

| | 300 | M | | Vornado Realty, LP, 3.5%, 1/15/2025 | | | 289,275 | |

| | | | | Welltower, Inc.: | | | | |

| | 400 | M | | 4%, 6/1/2025 | | | 400,296 | |

| | 140 | M | | 4.25%, 4/1/2026 | | | 141,972 | |

| | | | | | | | 3,538,688 | |

| | | | | Retail-General Merchandise—2.5% | | | | |

| | | | | Amazon.com, Inc.: | | | | |

| | 200 | M | | 4.8%, 12/5/2034 | | | 222,193 | |

| | 400 | M | | 4.05%, 8/22/2047 (a) | | | 402,023 | |

| | 25 | M | | AmeriGas Partners, LP, 5.5%, 5/20/2025 | | | 24,250 | |

| | 500 | M | | Home Depot, Inc., 5.875%, 12/16/2036 | | | 643,728 | |

8

Principal

Amount | | | Security | | Value | |

| $ | 25 | M | | J.C. Penney Co., Inc., 8.625%, 3/15/2025 | | $ | 23,563 | |

| | 25 | M | | KFC Holding Co., LLC, 5%, 6/1/2024 (a) | | | 24,906 | |

| | | | | | | | 1,340,663 | |

| | | | | Services—.1% | | | | |

| | 50 | M | | AECOM, 5.125%, 3/15/2027 | | | 48,285 | |

| | 25 | M | | United Rentals, Inc., 4.625%, 10/15/2025 | | | 24,375 | |

| | | | | | | | 72,660 | |

| | | | | Telecommunications—1.2% | | | | |

| | 200 | M | | AT&T, Inc., 5.15%, 3/15/2042 | | | 206,767 | |

| | 25 | M | | CenturyLink, Inc., 5.8%, 3/15/2022 | | | 24,531 | |

| | 25 | M | | Cincinnati Bell, Inc., 7%, 7/15/2024 (a) | | | 22,500 | |

| | 50 | M | | GCI, Inc., 6.875%, 4/15/2025 | | | 52,625 | |

| | 25 | M | | Sprint Capital Corp., 6.875%, 11/15/2028 | | | 23,375 | |

| | 300 | M | | Verizon Communications, Inc., 4.272%, 1/15/2036 | | | 288,058 | |

| | 25 | M | | Zayo Group, LLC, 6.375%, 5/15/2025 | | | 25,969 | |

| | | | | | | | 643,825 | |

| | | | | Transportation—2.1% | | | | |

| | 25 | M | | BCD Acquisition, Inc., 9.625%, 9/15/2023 (a) | | | 27,125 | |

| | | | | Burlington Northern Santa Fe, LLC: | | | | |

| | 100 | M | | 7%, 12/15/2025 | | | 123,122 | |

| | 400 | M | | 5.15%, 9/1/2043 | | | 464,025 | |

| | 200 | M | | Cummins, Inc., 4.875%, 10/1/2043 | | | 226,442 | |

| | 300 | M | | Southwest Airlines Co., 3%, 11/15/2026 | | | 282,732 | |

| | 25 | M | | XPO Logistics, Inc., 6.5%, 6/15/2022 (a) | | | 25,875 | |

| | | | | | | | 1,149,321 | |

| | | | | Utilities—2.9% | | | | |

| | 25 | M | | Calpine Corp., 5.25%, 6/1/2026 (a) | | | 24,219 | |

| | 25 | M | | Cheniere Corpus Christi Holdings, 5.875%, 3/31/2025 | | | 26,250 | |

| | 500 | M | | Commonwealth Edison Co., 5.9%, 3/15/2036 | | | 616,484 | |

| | 30 | M | | DCP Midstream, LP, 7.375%, 12/29/2049† | | | 29,944 | |

| | 200 | M | | Duke Energy Progress, Inc., 4.15%, 12/1/2044 | | | 205,832 | |

9

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

Principal

Amount

or Shares | | | Security | | Value | |

| | | | | Utilities (continued) | | | | |

| $ | 500 | M | | Entergy Arkansas, Inc., 4.95%, 12/15/2044 | | $ | 512,914 | |

| | 25 | M | | NRG Yield Operating, LLC, 5%, 9/15/2026 | | | 24,688 | |

| | 100 | M | | Oklahoma Gas & Electric Co., 4%, 12/15/2044 | | | 100,978 | |

| | | | | | | | 1,541,309 | |

| | | | | Waste Management—.1% | | | | |

| | 25 | M | | Covanta Holding Corp., 5.875%, 3/1/2024 | | | 24,563 | |

| | 25 | M | | GFL Environmental, Inc., 5.375%, 3/1/2023 (a) | | | 24,625 | |

| | | | | | | | 49,188 | |

| | | | | Wireless Communications—.2% | | | | |

| | 25 | M | | Intelsat Jackson Holdings SA, 8%, 2/15/2024 (a) | | | 26,344 | |

| | 25 | M | | Level 3 Financing, Inc., 5.375%, 1/15/2024 | | | 24,422 | |

| | 25 | M | | Sprint Communications, Inc., 6%, 11/15/2022 | | | 24,594 | |

| | 25 | M | | T-Mobile USA, Inc., 6%, 3/1/2023 | | | 26,063 | |

| | | | | | | | 101,423 | |

| | Total Value of Corporate Bonds (cost $27,480,658) | | | 26,863,182 | |

| | | | | COMMON STOCKS—37.5% | | | | |

| | | | | Consumer Discretionary—3.0% | | | | |

| | 4,400 | | | Acushnet Holdings Corp. | | | 101,596 | |

| | 400 | | | CBS Corp. - Class “B” | | | 20,556 | |

| | 7,600 | | | DSW, Inc. - Class “A” | | | 170,696 | |

| | 3,400 | | | Ford Motor Co. | | | 37,672 | |

| | 3,700 | | | L Brands, Inc. | | | 141,377 | |

| | 2,400 | | | Meredith Corp. | | | 129,120 | |

| | 3,900 | | | Nordstrom, Inc. | | | 188,799 | |

| | 4,900 | | | Tapestry, Inc. | | | 257,789 | |

| | 4,400 | | | Tupperware Brands Corp. | | | 212,872 | |

| | 450 | | | Whirlpool Corp. | | | 68,899 | |

| | 2,300 | | | Wyndham Worldwide Corp. | | | 263,189 | |

| | | | | | | | 1,592,565 | |

10

| Shares | | | Security | | Value | |

| | | | | Consumer Staples—5.0% | | | | |

| | 7,800 | | | Altria Group, Inc. | | $ | 486,096 | |

| | 6,000 | | | B&G Foods, Inc. | | | 142,200 | |

| | 5,200 | | | Coca-Cola Co. | | | 225,836 | |

| | 9,100 | | | Koninklijke Ahold Delhaize NV (ADR) | | | 215,852 | |

| | 3,600 | | | PepsiCo, Inc. | | | 392,940 | |

| | 5,600 | | | Philip Morris International, Inc. | | | 556,640 | |

| | 2,350 | | | Procter & Gamble Co. | | | 186,308 | |

| | 3,700 | | | Sysco Corp. | | | 221,852 | |

| | 3,200 | | | Wal-Mart Stores, Inc. | | | 284,704 | |

| | | | | | | | 2,712,428 | |

| | | | | Energy—2.8% | | | | |

| | 1,700 | | | Chevron Corp. | | | 193,868 | |

| | 2,350 | | | ExxonMobil Corp. | | | 175,333 | |

| | 3,400 | | | Marathon Petroleum Corp. | | | 248,574 | |

| | 1,400 | | | Occidental Petroleum Corp. | | | 90,944 | |

| | 4,000 | | | PBF Energy, Inc. - Class “A” | | | 135,600 | |

| | 1,600 | | | Phillips 66 | | | 153,472 | |

| | 2,800 | | | Royal Dutch Shell, PLC - Class “A” (ADR) | | | 178,668 | |

| | 2,000 | | | Schlumberger, Ltd. | | | 129,560 | |

| | 5,300 | | | Suncor Energy, Inc. | | | 183,062 | |

| | | | | | | | 1,489,081 | |

| | | | | Financials—4.8% | | | | |

| | 2,300 | | | Ameriprise Financial, Inc. | | | 340,262 | |

| | 3,500 | | | Berkshire Hills Bancorp, Inc. | | | 132,825 | |

| | 1,300 | | | Chubb, Ltd. | | | 177,801 | |

| | 4,200 | | | Discover Financial Services | | | 302,106 | |

| | 3,300 | | | Hamilton Lane, Inc. - Class “A” | | | 122,859 | |

| | 3,600 | | | JPMorgan Chase & Co. | | | 395,892 | |

| | 4,500 | | | MetLife, Inc. | | | 206,505 | |

| | 1,500 | | | PNC Financial Services Group, Inc. | | | 226,860 | |

| | 4,800 | | | U.S. Bancorp | | | 242,400 | |

| | 9,800 | | | Waddell & Reed Financial, Inc. - Class “A” | | | 198,058 | |

11

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

| Shares | | | Security | | Value | |

| | | | | Financials (continued) | | | | |

| | 4,000 | | | Wells Fargo & Co. | | $ | 209,640 | |

| | | | | | | | 2,555,208 | |

| | | | | Health Care—5.0% | | | | |

| | 6,200 | | | Abbott Laboratories | | | 371,504 | |

| | 6,100 | | | AbbVie, Inc. | | | 577,365 | |

| | 7,300 | | | GlaxoSmithKline, PLC (ADR) | | | 285,211 | |

| | 3,700 | | | Johnson & Johnson | | | 474,155 | |

| | 6,700 | | | Koninklijke Philips NV (ADR) | | | 256,677 | |

| | 4,800 | | | Merck & Co., Inc. | | | 261,456 | |

| | 13,400 | | | Pfizer, Inc. | | | 475,566 | |

| | | | | | | | 2,701,934 | |

| | | | | Industrials—4.6% | | | | |

| | 2,100 | | | 3M Co. | | | 460,992 | |

| | 9,300 | | | General Electric Co. | | | 125,364 | |

| | 2,600 | | | Honeywell International, Inc. | | | 375,726 | |

| | 5,664 | | | Johnson Controls International, PLC | | | 199,599 | |

| | 1,650 | | | Lockheed Martin Corp. | | | 557,584 | |

| | 3,900 | | | Mobile Mini, Inc. | | | 169,650 | |

| | 13,300 | | | Triton International, Ltd. | | | 406,980 | |

| | 1,600 | | | United Technologies Corp. | | | 201,312 | |

| | | | | | | | 2,497,207 | |

| | | | | Information Technology—5.9% | | | | |

| | 3,800 | | | Apple, Inc. | | | 637,564 | |

| | 10,900 | | | Cisco Systems, Inc. | | | 467,501 | |

| | 5,600 | | | Intel Corp. | | | 291,648 | |

| | 7,200 | | | Maxim Integrated Products, Inc. | | | 433,584 | |

| | 8,100 | | | Microsoft Corp. | | | 739,287 | |

| | 5,600 | | | QUALCOMM, Inc. | | | 310,296 | |

| | 9,100 | | | Travelport Worldwide, Ltd. | | | 148,694 | |

| | 1,300 | | | Western Digital Corp. | | | 119,951 | |

| | | | | | | | 3,148,525 | |

12

| Shares | | | Security | | Value | |

| | | | | Materials—1.0% | | | | |

| | 4,600 | | | International Paper Co. | | $ | 245,778 | |

| | 1,350 | | | Praxair, Inc. | | | 194,805 | |

| | 2,200 | | | RPM International, Inc. | | | 104,874 | |

| | | | | | | | 545,457 | |

| | | | | Real Estate—2.4% | | | | |

| | 4,900 | | | Americold Realty Trust (REIT) | | | 93,492 | |

| | 13,000 | | | Brixmor Property Group, Inc. (REIT) | | | 198,250 | |

| | 5,000 | | | Chesapeake Lodging Trust (REIT) | | | 139,050 | |

| | 1,200 | | | Federal Realty Investment Trust (REIT) | | | 139,332 | |

| | 6,500 | | | GGP, Inc. (REIT) | | | 132,990 | |

| | 8,304 | | | RLJ Lodging Trust (REIT) | | | 161,430 | |

| | 10,400 | | | Tanger Factory Outlet Centers, Inc. (REIT) | | | 228,800 | |

| | 6,000 | | | Urstadt Biddle Properties, Inc. - Class “A” (REIT) | | | 115,800 | |

| | 9,400 | | | Whitestone REIT (REIT) | | | 97,666 | |

| | | | | | | | 1,306,810 | |

| | | | | Telecommunication Services—1.3% | | | | |

| | 10,300 | | | AT&T, Inc. | | | 367,195 | |

| | 6,800 | | | Verizon Communications, Inc. | | | 325,176 | |

| | | | | | | | 692,371 | |

| | | | | Utilities—1.7% | | | | |

| | 3,200 | | | Black Hills Corp. | | | 173,760 | |

| | 3,800 | | | Duke Energy Corp. | | | 294,386 | |

| | 3,800 | | | Exelon Corp. | | | 148,238 | |

| | 6,400 | | | NiSource, Inc. | | | 153,024 | |

| | 2,500 | | | WEC Energy Group, Inc. | | | 156,750 | |

| | | | | | | | 926,158 | |

| | Total Value of Common Stocks (cost $18,277,019) | | | 20,167,744 | |

13

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

Principal

Amount | | | Security | | | Value | |

| | | | | RESIDENTIAL MORTGAGE-BACKED SECURITIES—5.4% | | | | | |

| | | | | Fannie Mae | | | | | |

| $ | 224 | M | | 3%, 5/1/2029 | | | $ | 225,097 | |

| | 900 | M | | 3.5%, 9/1/2045 - 11/1/2046 | | | | 903,502 | |

| | 925 | M | | 4%, 11/1/2045 - 7/1/2046 | | | | 951,860 | |

| | 747 | M | | 4.5%, 1/1/2047 - 2/1/2048 (b) | | | | 785,780 | |

| | 56 | M | | 5%, 8/1/2039 | | | | 60,652 | |

| | Total Value of Residential Mortgage-Backed Securities (cost $2,980,699) | | | | 2,926,891 | |

| | | | | PASS-THROUGH CERTIFICATES—.9% | | | | | |

| | | | | Transportation | | | | | |

| | 500 | M | | American Airlines 17-2 AA PTT, 3.35%, 10/15/2029 (cost $504,010) (a) | | | | 486,114 | |

| | | | | SHORT-TERM U.S. GOVERNMENT AGENCY OBLIGATIONS—4.7% | | | | | |

| | | | | Federal Home Loan Bank: | | | | | |

| | 1,000 | M | | 1.53%, 4/5/2018 | | | | 999,862 | |

| | 1,000 | M | | 1.54%, 4/11/2018 | | | | 999,587 | |

| | 500 | M | | 1.56%, 4/12/2018 | | | | 499,771 | |

| | Total Value of Short-Term U.S. Government Agency Obligations (cost $2,499,163) | | | | 2,499,220 | |

| | Total Value of Investments (cost $51,741,549) | 98.5% | | | 52,943,151 | |

| | Other Assets, Less Liabilities | 1.5 | | | 819,013 | |

| | Net Assets | 100.0% | | $ | 53,762,164 | |

(a) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

(b) | A portion or all of the security purchased on a when-issued or delayed delivery basis. |

† | Interest rates are determined and reset periodically. The interest rates above are the rates in effect at March 31, 2018. |

14

Summary of Abbreviations:

ADR | American Depositary Receipts |

LLLP | Limited Liability Limited Partnership |

REIT | Real Estate Investment Trust |

Futures contracts outstanding at March 31, 2018:

| Number of

Contracts | | Type | | | Expiration | | | | Notional

Amounts | | | | Value at

March 31, 2018 | | | | Unrealized Depreciation | |

| | (5) | | 5 Year U.S. Treasury Note | | | June 2018 | | | $ | (569,180 | ) | | $ | (572,369 | ) | | $ | (3,189 | ) |

| | (19) | | 10 Year U.S. Treasury Note | | | June 2018 | | | | (2,275,844 | ) | | | (2,301,913 | ) | | | (26,069 | ) |

| | (7) | | U.S. Treasury Long Bond | | | June 2018 | | | | (997,828 | ) | | | (1,026,464 | ) | | | (28,636 | ) |

| | (Premium received $394) | | | | | | | | | | | | | | $ | (57,894 | ) |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| | Level 1 | — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| | Level 2 | — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | Level 3 | — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

15

Portfolio of Investments (continued)

BALANCED INCOME FUND

March 31, 2018

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2018:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Corporate Bonds | | $ | — | | | $ | 26,863,182 | | | $ | — | | | $ | 26,863,182 | |

| Common Stocks | | | 20,167,744 | | | | — | | | | — | | | | 20,167,744 | |

| Residential Mortgage-Backed Securities | | | — | | | | 2,926,891 | | | | — | | | | 2,926,891 | |

| Pass-Through Certificates | | | — | | | | 486,114 | | | | — | | | | 486,114 | |

| Short-Term U.S. Government Agency Obligations | | | — | | | | 2,499,220 | | | | — | | | | 2,499,220 | |

| Total Investments in Securities* | | $ | 20,167,744 | | | $ | 32,775,407 | | | $ | — | | | $ | 52,943,151 | |

| | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | |

| Futures Contracts | | $ | (57,500 | ) | | $ | — | | | $ | — | | | $ | (57,500 | ) |

* | The Portfolio of Investments provides information on the industry categorization for corporate bonds, common stocks and pass-through certificates. |

There were no transfers into or from Level 1 and Level 2 by the Fund during the period ended March 31, 2018. Transfers, if any, between Levels are recognized at the end of the reporting period.

See notes to financial statements

16

Fund Expenses (unaudited)

FLOATING RATE FUND

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

Expense Example | Annualized

Expense

Ratio | Beginning

Account Value

(10/1/17) | Ending

Account Value

(3/31/18) | Expenses Paid

During Period

(10/1/17–3/31/18)* |

Class A Shares | 1.10% | | | |

Actual | | $1,000.00 | $1,017.01 | $5.53 |

Hypothetical** | | $1,000.00 | $1,019.45 | $5.54 |

Advisor Class Shares | 0.90% | | | |

Actual | | $1,000.00 | $1,016.96 | $4.53 |

Hypothetical** | | $1,000.00 | $1,020.44 | $4.53 |

Institutional Class Shares | 0.70% | | | |

Actual | | $1,000.00 | $1,018.78 | $3.52 |

Hypothetical** | | $1,000.00 | $1,021.44 | $3.53 |

* | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived and/or assumed. |

** | Assumed rate of return of 5% before expenses |

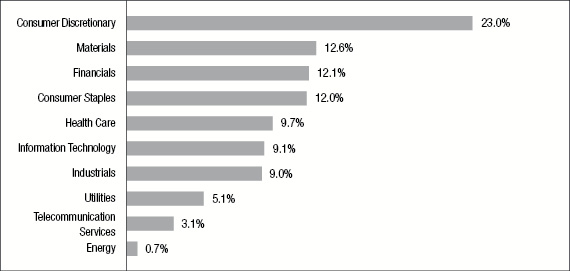

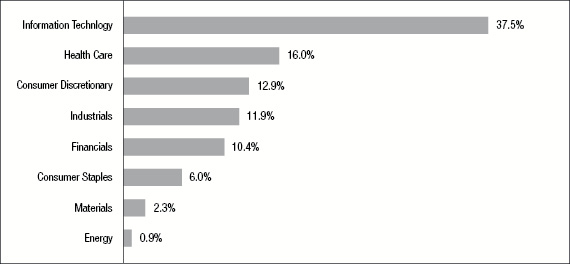

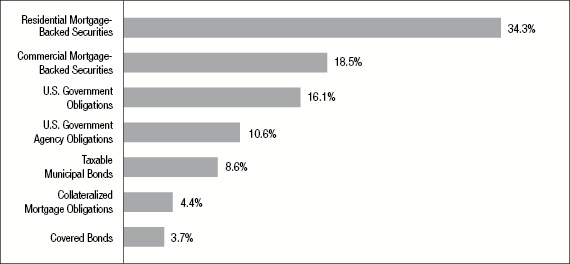

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2018, and are based on the total market value of investments.

17

Portfolio of Investments

FLOATING RATE FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | LOAN PARTICIPATIONS†—91.3% | | | | |

| | | | | Aerospace/Defense—.8% | | | | |

| | | | | TransDigm, Inc.: | | | | |

| $ | 1,342 | M | | 4.3980%, 8/22/2024 | | $ | 1,347,859 | |

| | 344 | M | | 4.6269%, 5/14/2022 | | | 345,906 | |

| | | | | | | | 1,693,765 | |

| | | | | Automotive—4.9% | | | | |

| | | | | Dexko Global, Inc.: | | | | |

| | 2,985 | M | | 5.802%, 7/24/2024 | | | 3,015,791 | |

| | 500 | M | | 10.552%, 7/24/2025 | | | 505,158 | |

| | 340 | M | | Horizon Global, 5%, 2/16/2024 | | | 336,600 | |

| | 771 | M | | Innovative XC, 6.58%, 11/29/2022 | | | 781,708 | |

| | 1,586 | M | | Key Safety Systems, Inc., 6.28%, 8/29/2021 | | | 1,588,429 | |

| | 1,250 | M | | Navistar International Corp., 5.21%, 11/6/2024 | | | 1,258,075 | |

| | 1,067 | M | | Superior Industries International, Inc., 6.3769%, 5/22/2024 | | | 1,079,596 | |

| | | | | Truck Hero, Inc.: | | | | |

| | 1,092 | M | | 6.2225%, 4/22/2024 | | | 1,100,391 | |

| | 500 | M | | 10.4725%, 4/21/2025 | | | 503,958 | |

| | | | | | | | 10,169,706 | |

| | | | | Chemicals—5.4% | | | | |

| | 1,493 | M | | Archroma Finance Sarl, 5.9702%, 8/12/2024 | | | 1,496,231 | |

| | 2,993 | M | | Avantor Performance Materials Holdings, Inc., 5.8769%, 11/21/2024 | | | 3,027,811 | |

| | 2,483 | M | | ColourOz Investment, 4.7413%, 9/7/2021 | | | 2,346,703 | |

| | | | | Invictus U.S. Newco, LLC: | | | | |

| | 500 | M | | 3%, 2/14/2025 | | | 504,500 | |

| | 1,000 | M | | 6.75%, 2/13/2026 | | | 1,017,915 | |

| | 656 | M | | Methanol Holdings Trinidad, Ltd., 5.3769%, 6/30/2022 | | | 658,899 | |

| | 1,347 | M | | PQ Group Holdings, Inc., 4.2907%, 2/8/2025 | | | 1,352,934 | |

| | 945 | M | | Venator Finance Sarl, 4.8769%, 8/8/2024 | | | 950,567 | |

| | | | | | | | 11,355,560 | |

18

Principal

Amount | | | Security | | Value | |

| | | | | Consumer Durables—1.2% | | | | |

| | | | | TGP Holdings III, LLC: | | | | |

| $ | 122 | M | | 4.25%, 9/25/2024 (a) | | $ | 123,288 | |

| | 181 | M | | 6%, 9/25/2024 (a) | | | 182,885 | |

| | 2,198 | M | | 7.3020%, 9/25/2024 (a) | | | 2,219,152 | |

| | | | | | | | 2,525,325 | |

| | | | | Consumer Non-Durables—1.5% | | | | |

| | 299 | M | | Belron International, Ltd, 4.2935%, 11/7/2024 | | | 301,494 | |

| | 1,575 | M | | Kronos Acquisiton Intermediate, Inc., 5.875%, 5/15/2023 | | | 1,592,057 | |

| | 1,217 | M | | Reynolds Group Holdings, Inc., 4.6269%, 2/5/2023 | | | 1,224,794 | |

| | | | | | | | 3,118,345 | |

| | | | | Energy—.8% | | | | |

| | 450 | M | | California Resources Corp., 6.5721%, 12/31/2022 | | | 457,033 | |

| | 1,287 | M | | Foresight Energy, LLC, 7.6269%, 3/28/2022 | | | 1,260,719 | |

| | | | | | | | 1,717,752 | |

| | | | | Financial Services—5.7% | | | | |

| | 2,722 | M | | Alliant Holdings Intermediate,LLC, 5.1269%, 8/12/2022 | | | 2,740,528 | |

| | 1,835 | M | | EIG Investors Corp., 5.9563%, 2/9/2023 | | | 1,850,541 | |

| | 2,722 | M | | NFP Corp., 4.8769%, 1/8/2024 | | | 2,736,057 | |

| | 4,552 | M | | USI Holdings Corp., 5.302%, 5/16/2024 | | | 4,566,920 | |

| | | | | | | | 11,894,046 | |

| | | | | Financials—4.9% | | | | |

| | 498 | M | | Acrisure, LLC, 5.9913%, 11/22/2023 | | | 504,754 | |

| | 1,990 | M | | AssuredPartners, Inc., 5.3769%, 10/22/2024 | | | 1,997,462 | |

| | 1,318 | M | | Canyon Valor Cos., Inc., 5.1269%, 6/16/2023 | | | 1,330,847 | |

| | 249 | M | | Edelman Financial Services, LLC, 5.9702%, 11/11/2024 | | | 252,063 | |

| | | | | Jaguar Holding Co. I, LLC: | | | | |

| | 960 | M | | 4.802%, 8/18/2022 | | | 964,266 | |

| | 871 | M | | 4.37688%, 8/18/2022 | | | 874,925 | |

| | 1,500 | M | | PI U.K. Holdco II, LLC, 5.3583%, 1/3/2025 | | | 1,508,437 | |

| | 1,750 | M | | Sigma Bidco BV, 3%, 3/6/2025 | | | 1,751,094 | |

19

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Financials (continued) | | | | |

| $ | 1,085 | M | | VFH Parent, LLC, 4.9447%, 12/30/2021 | | $ | 1,096,520 | |

| | | | | | | | 10,280,368 | |

| | | | | Food/Beverage/Tobacco—1.5% | | | | |

| | 1,562 | M | | Chobani, LLC, 5.3769%, 10/10/2023 (a) | | | 1,571,612 | |

| | 1,000 | M | | Refresco Group NV, 2.75%, 12/13/2024 | | | 998,125 | |

| | 525 | M | | Utz Quality Foods, LLC, 5.3538%, 11/21/2024 | | | 530,988 | |

| | | | | | | | 3,100,725 | |

| | | | | Forest Products/Containers—2.4% | | | | |

| | 1,737 | M | | BWay Holding Co., 4.9580%, 4/3/2024 | | | 1,748,095 | |

| | 3,270 | M | | Coveris Holdings SA, 5.582789%, 6/29/2022 | | | 3,288,903 | |

| | | | | | | | 5,036,998 | |

| | | | | Gaming/Leisure—11.5% | | | | |

| | | | | AMC Entertainment Holdings, Inc.: | | | | |

| | 867 | M | | 4.0266%, 12/15/2022 | | | 870,571 | |

| | 371 | M | | 4.0266%, 12/15/2023 | | | 372,256 | |

| | 3,990 | M | | Caesars Entertainment Operating Co., Inc., 4.6269%, 12/23/2024 | | | 4,019,675 | |

| | 2,978 | M | | Cyan Blue Holdco 2, Ltd., 5.052%, 8/23/2024 | | | 2,981,259 | |

| | 2,500 | M | | Dorna Sports SL, 3.25%, 4/12/2024 | | | 2,484,375 | |

| | 3,865 | M | | Golden Nugget, Inc., 4.9788%, 10/4/2023 | | | 3,902,120 | |

| | 1,300 | M | | La Quinta Intermediate Holdings, LLC, 4.4702%, 4/14/2021 | | | 1,304,836 | |

| | | | | Landry’s, Inc.: | | | | |

| | 650 | M | | 5.03893%, 10/4/2023 | | | 655,960 | |

| | 456 | M | | 4.90006%, 10/4/2023 | | | 460,229 | |

| | 1,454 | M | | Live Nation Entertainment, Inc., 3.4375%, 10/31/2023 | | | 1,466,684 | |

| | 2,400 | M | | Scientific Games International, 2.75%, 8/14/2024 | | | 2,411,256 | |

| | 860 | M | | Seminole Hard Rock Entertainment, Inc., 4.4434%, 5/14/2020 | | | 867,111 | |

| | | | | WorldStrides Lakeland Tours: | | | | |

| | 162 | M | | 4%, 12/16/2024 | | | 164,348 | |

| | 1,971 | M | | 6.1245%, 12/16/2024 | | | 1,995,649 | |

| | | | | | | | 23,956,329 | |

20

Principal

Amount | | | Security | | Value | |

| | | | | Health Care—8.7% | | | | |

| | | | | Air Medical Group Holdings, Inc.: | | | | |

| $ | 1,315 | M | | 4.9362%, 4/28/2022 | | $ | 1,322,304 | |

| | 175 | M | | 6.015%, 3/14/2025 | | | 176,472 | |

| | 1,100 | M | | Air Methods Corp., 5.802%, 4/22/2024 | | | 1,105,637 | |

| | 250 | M | | Albany Molecular Research, Inc., 8.8769%, 8/30/2025 | | | 251,875 | |

| | 1,985 | M | | American Renal Holdings, Inc., 5.1269%, 6/21/2024 | | | 1,990,578 | |

| | 900 | M | | Amneal Pharmaceuticals, LLC, 3.5%, 3/21/2025 (a) | | | 903,375 | |

| | 375 | M | | Concentra Operating Corp., 4.53%, 6/1/2022 | | | 378,202 | |

| | 607 | M | | Envision Healthcare Corp., 4.88%, 12/01/2023 | | | 610,361 | |

| | 1,496 | M | | Equian Buyer Corp., 5.1539%, 5/20/2024 | | | 1,506,054 | |

| | 987 | M | | ExamWorks Group, Inc., 5.1269%, 7/27/2023 | | | 996,095 | |

| | 993 | M | | Geronimo Intermediate Parent, Inc., 5.1269%, 6/22/2023 | | | 1,001,810 | |

| | | | | Mallinckrodt International Finance SA: | | | | |

| | 462 | M | | 5.203%, 9/24/2024 | | | 460,902 | |

| | 500 | M | | 4.82%, 2/24/2025 | | | 501,615 | |

| | 469 | M | | MPH Acquisition Holdings, LLC, 5.052%, 6/7/2023 | | | 471,415 | |

| | 188 | M | | Onex Carestream Finance, LP, 5.8769%, 6/7/2019 | | | 189,733 | |

| | 348 | M | | Parexel International Corp., 4.6269%, 9/27/2024 | | | 348,905 | |

| | | | | PetVet Care Centers, LLC: | | | | |

| | 1,500 | M | | 4.5266%, 1/31/2025 | | | 1,490,003 | |

| | 500 | M | | 8.0266%, 1/31/2026 | | | 502,500 | |

| | 750 | M | | PharMerica Corp., 5.2113%, 12/6/2024 | | | 753,518 | |

| | 1,485 | M | | Sterigenics-Nordion Holdings, LLC, 4.8769%, 5/15/2022 | | | 1,489,641 | |

| | 820 | M | | U.S. Anesthesia Partners Inc., 4.8769%, 6/23/2024 | | | 824,672 | |

| | 756 | M | | Valeant Pharmaceuticals International, Inc., 5.24%, 4/1/2022 | | | 765,002 | |

| | | | | | | | 18,040,669 | |

| | | | | Information Technology—9.1% | | | | |

| | 1,671 | M | | Avast Holdings BV, 5.052%, 9/30/2023 | | | 1,682,380 | |

| | 866 | M | | Change Heathcare Holdings, Inc., 4.6269%, 3/1/2024 | | | 869,295 | |

| | 970 | M | | Digicel International Finance, Ltd., 5.02%, 5/27/2024 | | | 967,324 | |

| | 3,275 | M | | DigiCert Holdings, Inc., 6.5223%, 10/31/2024 | | | 3,315,527 | |

| | 740 | M | | Hyland Software, Inc., 5.1269%, 7/1/2022 | | | 747,166 | |

| | 1,995 | M | | ION Trading Technologies, Ltd., 5.052%, 11/21/2024 | | | 1,980,038 | |

21

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Information Technology (continued) | | | | |

| $ | 2,313 | M | | Project Leopard Holdings, Inc., 5.8769%, 7/7/2023 | | $ | 2,331,469 | |

| | 1,450 | M | | Quest Software U.S. Holdings, Inc., 7.2723%, 10/31/2022 | | | 1,479,712 | |

| | 723 | M | | Redtop Acquisitions, Ltd., 5.02225%, 12/3/2020 | | | 724,724 | |

| | 1,995 | M | | Solarwinds, Inc., 4.8769%, 2/5/2024 | | | 2,006,232 | |

| | 2,275 | M | | SS&C Technologies Holdings, Inc, 2.5%, 2/28/2025 | | | 2,290,322 | |

| | 606 | M | | Western Digital Corp., 3.8769%, 4/29/2023 | | | 609,705 | |

| | | | | | | | 19,003,894 | |

| | | | | Manufacturing—7.5% | | | | |

| | 2,000 | M | | Altran Technologies SA, 4.5721%, 1/31/2025 | | | 2,015,830 | |

| | 2,200 | M | | AMG Advanced Metallurgical, 3%, 2/3/2025 | | | 2,222,000 | |

| | 3,473 | M | | Brand Energy & Infrastructure Services, Inc., 6.0012%, 6/21/2024 | | | 3,507,619 | |

| | 997 | M | | Engineered Machinery Holdings, Inc., 5.552%, 7/19/2024 | | | 999,061 | |

| | 1,350 | M | | Filtration Group Corp., 3.5%, 3/27/2025 (a) | | | 1,360,125 | |

| | 992 | M | | Gardner Denver, Inc., 5.052%, 7/30/2024 | | | 998,345 | |

| | 1,500 | M | | GrafTech International, Ltd., 5.2396%, 2/12/2025 | | | 1,501,876 | |

| | 2,474 | M | | HII Holding Corp., 5.12688%, 12/20/2019 | | | 2,268,261 | |

| | 750 | M | | NCI Building Systems, Inc., 3.8769%, 2/7/2025 | | | 750,938 | |

| | | | | | | | 15,624,055 | |

| | | | | Media-Broadcasting—4.4% | | | | |

| | 1,216 | M | | Altice Financing SA, 4.4702%, 7/15/2025 | | | 1,196,815 | |

| | 1,340 | M | | Altice U.S. Finance I Corp., 4.5223%, 6/22/2025 | | | 1,293,535 | |

| | 124 | M | | CBS Radio, Inc., 4.6225%, 11/18/2024 | | | 125,289 | |

| | 272 | M | | Mission Broadcasting, Inc., 4.1642%, 1/17/2024 (a) | | | 273,388 | |

| | 2,140 | M | | Nexstar Broadcasting, Inc., 4.1642%, 1/17/2024 (a) | | | 2,150,196 | |

| | 4,000 | M | | Sinclair Broadcasting Group, 2.5%, 12/12/2024 | | | 4,022,500 | |

| | | | | | | | 9,061,723 | |

| | | | | Media-Cable TV—5.0% | | | | |

| | 3,775 | M | | Atlantic Broadband Finance, LLC, 4.25188%, 8/11/2024 | | | 3,780,908 | |

| | | | | CSC Holdings, LLC: | | | | |

| | 1,857 | M | | 4.0364%, 7/17/2025 | | | 1,857,255 | |

| | 250 | M | | 4.2766%, 1/25/2026 | | | 250,820 | |

22

Principal

Amount | | | Security | | Value | |

| $ | 741 | M | | Gray Television, Inc., 3.9201%, 2/07/2024 | | $ | 745,254 | |

| | 1,739 | M | | Midcontinent Communications, Inc., 3.9896%, 12/31/2023 | | | 1,751,567 | |

| | 1,493 | M | | Raycom TV Broadcasting, LLC, 3.8707%, 8/23/2024 | | | 1,496,231 | |

| | 600 | M | | Ziggo Secured Finance Partnership, 4.2766%, 4/15/2025 | | | 596,502 | |

| | | | | | | | 10,478,537 | |

| | | | | Media-Diversified—.2% | | | | |

| | 462 | M | | Tribune Media Co., 4.8769%, 1/26/2024 | | | 463,159 | |

| | | | | Metals/Mining—2.4% | | | | |

| | 1,238 | M | | Arch Coal, Inc., 5.1269%, 3/7/2024 | | | 1,240,594 | |

| | 1,368 | M | | Big River Steel, LLC, 7.302%, 8/23/2023 | | | 1,390,357 | |

| | 1,397 | M | | MRC Global (U.S.), Inc., 5.3869%, 9/20/2024 | | | 1,405,228 | |

| | 846 | M | | TMS International Corp., 4.6269%, 8/14/2024 | | | 849,699 | |

| | | | | | | | 4,885,878 | |

| | | | | Retail-General Merchandise—4.5% | | | | |

| | 1,437 | M | | 1011778 B.C., ULC, 4.2937%, 2/16/2024 | | | 1,440,135 | |

| | 1,290 | M | | BJ’s Wholesale Club, Inc., 5.1905%, 2/3/2024 | | | 1,290,734 | |

| | 907 | M | | CNT Holdings III Corp., 5.13%, 1/22/2023 | | | 881,656 | |

| | 1,519 | M | | Harbor Freight Tools USA, Inc., 4.3769%, 8/18/2023 | | | 1,522,676 | |

| | 1,037 | M | | Party City Holdings, Inc., 4.4874%, 8/19/2022 | | | 1,042,124 | |

| | 1,995 | M | | Staples, Inc., 5.787%, 9/12/2024 | | | 1,979,040 | |

| | 1,147 | M | | Varsity Brands, 5.3769%, 12/7/2024 | | | 1,158,493 | |

| | | | | | | | 9,314,858 | |

| | | | | Services—.7% | | | | |

| | 531 | M | | GW Honos Security Corp., 5.5106%, 5/24/2024 | | | 537,143 | |

| | 936 | M | | Monitronics International, Inc., 7.802%, 9/30/2022 | | | 914,593 | |

| | | | | | | | 1,451,736 | |

| | | | | Telecommunications—.8% | | | | |

| | 1,675 | M | | Cincinnati Bell, Inc., 5.4447%, 10/2/2024 | | | 1,689,656 | |

| | | | | Utilities—4.9% | | | | |

| | 2,864 | M | | Calpine Corp., 4.81%, 1/15/2024 | | | 2,875,363 | |

23

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Utilities (continued) | | | | |

| $ | 1,570 | M | | Charah, LLC, 8.1864%, 10/25/2024 | | $ | 1,588,644 | |

| | 1,993 | M | | Dayton Power & Light Co., 3.88%, 8/24/2022 | | | 2,005,279 | |

| | 1,496 | M | | ExGen Renewables I, LLC, 4.99%, 11/28/2024 | | | 1,514,961 | |

| | | | | HD Supply, Inc.: | | | | |

| | 626 | M | | 4.552%, 8/13/2021 | | | 631,184 | |

| | 543 | M | | 4.802%, 10/17/2023 | | | 547,445 | |

| | 1,062 | M | | Talen Energy Supply, LLC, 5.8769%, 7/15/2023 | | | 1,045,666 | |

| | | | | | | | 10,208,542 | |

| | | | | Waste Management—.5% | | | | |

| | 1,000 | M | | Gopher Resource, LLC, 5.4784%, 3/6/2025 | | | 1,009,690 | |

| | | | | Wireless Communications—2.0% | | | | |

| | 1,000 | M | | Intelsat Jackson Holdings SA, 5.7063%, 11/27/2023 | | | 1,001,980 | |

| | 1,436 | M | | Sprint Communications, Inc., 4.4375%, 2/2/2024 | | | 1,437,474 | |

| | 1,689 | M | | Telesat Canada, 5.31%, 11/17/2023 | | | 1,700,098 | |

| | | | | | | | 4,139,552 | |

| | Total Value of Loan Participations (cost $188,712,569) | | | 190,220,868 | |

| | | | | CORPORATE BONDS—5.0% | | | | |

| | | | | Aerospace/Defense—.2% | | | | |

| | 325 | M | | Bombardier, Inc., 8.75%, 12/1/2021 (b) | | | 357,906 | |

| | | | | Energy—.5% | | | | |

| | 750 | M | | Oasis Petroleum, Inc., 6.5%, 11/1/2021 | | | 763,125 | |

| | 271 | M | | Precision Drilling Corp., 6.5%, 12/15/2021 | | | 274,388 | |

| | | | | | | | 1,037,513 | |

| | | | | Financials—.7% | | | | |

| | | | | DAE Funding, LLC: | | | | |

| | 300 | M | | 4%, 8/1/2020 (b) | | | 293,250 | |

| | 350 | M | | 4.5%, 8/1/2022 (b) | | | 332,937 | |

| | 850 | M | | Icahn Enterprises, LP, 6.25%, 2/1/2022 | | | 867,000 | |

| | | | | | | | 1,493,187 | |

24

Principal

Amount | | | Security | | Value | |

| | | | | Forest Products/Containers—1.0% | | | | |

| $ | 1,000 | M | | Ardagh Holdings USA, Inc., 7.25%, 5/15/2024 (b) | | $ | 1,067,500 | |

| | 900 | M | | BWAY Holding Co., 5.5%, 4/15/2024 (b) | | | 907,875 | |

| | | | | | | | 1,975,375 | |

| | | | | Health Care—.8% | | | | |

| | 800 | M | | Centene Corp., 5.625%, 2/15/2021 | | | 824,000 | |

| | 450 | M | | Endo Finance, LLC, 7.25%, 1/15/2022 (b) | | | 392,625 | |

| | 450 | M | | Molina Healthcare, Inc., 5.375%, 11/15/2022 | | | 446,625 | |

| | | | | | | | 1,663,250 | |

| | | | | Media-Cable TV—.9% | | | | |

| | 750 | M | | CSC Holdings, LLC, 10.125%, 1/15/2023 (b) | | | 834,375 | |

| | 500 | M | | DISH DBS Corp., 7.875%, 9/1/2019 | | | 523,750 | |

| | 425 | M | | Numericable Group SA, 6.25%, 5/15/2024 (b) | | | 402,156 | |

| | | | | | | | 1,760,281 | |

| | | | | Metals/Mining—.2% | | | | |

| | 100 | M | | Aleris International, Inc., 9.5%, 4/1/2021 (b) | | | 104,375 | |

| | 325 | M | | Teck Resources, Ltd., 8.5%, 6/1/2024 (b) | | | 361,953 | |

| | | | | | | | 466,328 | |

| | | | | Services—.2% | | | | |

| | 450 | M | | Cimpress NV, 7%, 4/1/2022 (b) | | | 471,375 | |

| | | | | Telecommunications—.3% | | | | |

| | 650 | M | | GCI, Inc., 6.875%, 4/15/2025 | | | 684,125 | |

| | | | | Utilities—.2% | | | | |

| | 430 | M | | Calpine Corp., 6%, 1/15/2022 (b) | | | 442,534 | |

| | Total Value of Corporate Bonds (cost $10,476,103) | | | 10,351,874 | |

25

Portfolio of Investments (continued)

FLOATING RATE FUND

March 31, 2018

| | Principal Amount | | Security | | | Value | |

| | | | SHORT-TERM CORPORATE NOTES—3.6% | | | | | |

| $ | 7,500M | | Federal Home Loan Bank, 1.7%, 4/26/2018 (cost $7,491,139) | | | $ | 7,491,750 | |

| | Total Value of Investments (cost $206,679,811) | 99.9% | | | 208,064,492 | |

| | Other Assets, Less Liabilities | .1 | | | 145,965 | |

| | Net Assets | 100.0% | | $ | 208,210,457 | |

(a) | A portion or all of the security purchased on a when-issued or delayed delivery basis. |

(b) | Security exempt from registration under Rule 144A of the Securities Act of 1933 (see Note 4). |

† | Interest rates are determined and reset periodically. The interest rates above are the rates in effect at March 31, 2018. |

Summary of Abbreviations:

ULC | Unlimited Liability Corporation |

The Fund’s assets and liabilities are classified into the following three levels based on the inputs used to value the assets and liabilities:

| | Level 1 | — Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| | Level 2 | — Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | Level 3 | — Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumption about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The inputs methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

See notes to financial statements

26

The following is a summary, by category of Level, of inputs used to value the Fund’s investments as of March 31, 2018:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Loan Participations | | $ | — | | | $ | 190,220,868 | | | $ | — | | | $ | 190,220,868 | |

| Corporate Bonds | | | — | | | | 10,351,874 | | | | — | | | | 10,351,874 | |

| Short-Term U.S. Government Agency Obligations | | | — | | | | 7,491,750 | | | | — | | | | 7,491,750 | |

| Total Investments in Securities* | | $ | — | | | $ | 208,064,492 | | | $ | — | | | $ | 208,064,492 | |

* | The Portfolio of Investments provides information on the industry categorization of loan participations and corporate bonds. |

There were no transfers into or from Level 1 and Level 2 by the Fund for the period ended March 31, 2018. Transfers, if any, between Levels are recognized at the end of the reporting period.

See notes to financial statements

27

Fund Expenses (unaudited)

FUND FOR INCOME

The examples below show the ongoing costs (in dollars) of investing in your Fund and will help you in comparing these costs with costs of other mutual funds. Please refer to page 6 for a detailed explanation of the information presented in these examples.

Expense Example | Annualized

Expense

Ratio | Beginning

Account Value

(10/1/17) | Ending

Account Value

(3/31/18) | Expenses Paid

During Period (10/1/17–3/31/18)* |

Class A Shares | 1.21% | | | |

Actual | | $1,000.00 | $ 992.72 | $ 6.01 |

Hypothetical** | | $1,000.00 | $ 1,018.90 | $ 6.09 |

Class B Shares | 2.02% | | | |

Actual | | $1,000.00 | $ 950.13 | $ 9.82 |

Hypothetical** | | $1,000.00 | $ 1,014.86 | $ 10.15 |

Advisor Class Shares | 0.95% | | | |

Actual | | $1,000.00 | $ 994.05 | $ 4.72 |

Hypothetical** | | $1,000.00 | $ 1,020.19 | $ 4.78 |

Institutional Class Shares | 0.79% | | | |

Actual | | $1,000.00 | $ 994.89 | $ 3.93 |

Hypothetical** | | $1,000.00 | $ 1,020.99 | $ 3.98 |

* | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Expenses paid during the period are net of expenses waived. |

** | Assumed rate of return of 5% before expenses |

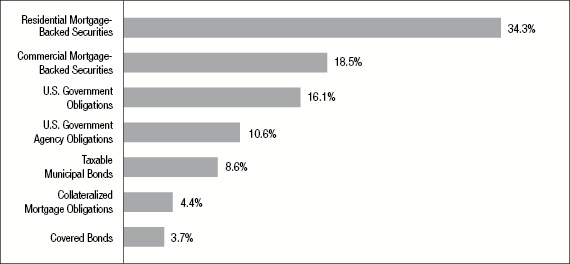

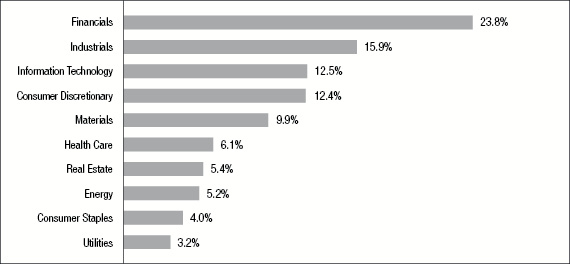

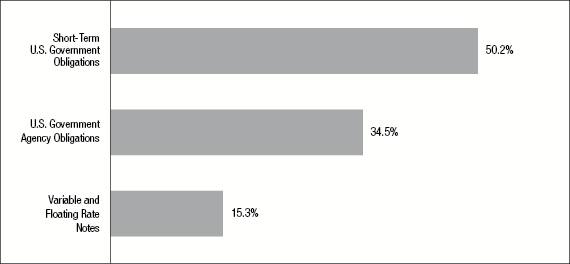

Portfolio Composition

TOP TEN SECTORS

Portfolio holdings and allocations are subject to change. Percentages are as of March 31, 2018, and are based on the total market value of investments.

28

Portfolio of Investments

FUND FOR INCOME

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | CORPORATE BONDS—90.4% | | | | |

| | | | | Aerospace/Defense—2.6% | | | | |

| | | | | Bombardier, Inc.: | | | | |

| $ | 2,600 | M | | 8.75%, 12/1/2021 (a) | | $ | 2,863,250 | |

| | 1,950 | M | | 7.5%, 12/1/2024 (a) | | | 2,023,125 | |

| | 1,200 | M | | 7.5%, 3/15/2025 (a) | | | 1,237,500 | |

| | 3,275 | M | | KLX, Inc., 5.875%, 12/1/2022 (a) | | | 3,386,514 | |

| | | | | Meccanica Holdings USA, Inc.: | | | | |

| | 1,871 | M | | 7.375%, 7/15/2039 (a) | | | 2,291,975 | |

| | 750 | M | | 6.25%, 1/15/2040 (a) | | | 832,500 | |

| | | | | TransDigm, Inc.: | | | | |

| | 1,650 | M | | 5.5%, 10/15/2020 | | | 1,662,375 | |

| | 3,225 | M | | 6.375%, 6/15/2026 | | | 3,257,250 | |

| | | | | | | | 17,554,489 | |

| | | | | Automotive—2.7% | | | | |

| | 3,500 | M | | Adient Global Holdings, Ltd., 4.875%, 8/15/2026 (a) | | | 3,325,000 | |

| | 1,475 | M | | American Axle & Manufacturing, Inc., 6.25%, 4/1/2025 | | | 1,476,844 | |

| | 1,725 | M | | Asbury Automotive Group, Inc., 6%, 12/15/2024 | | | 1,763,813 | |

| | 1,700 | M | | Avis Budget Group, Inc., 6.375%, 4/1/2024 (a) | | | 1,725,500 | |

| | 1,675 | M | | Cooper Standard Automotive, Inc., 5.625%, 11/15/2026 (a) | | | 1,675,000 | |

| | 1,000 | M | | Dana Financing Luxembourg Sarl, 6.5%, 6/1/2026 (a) | | | 1,042,500 | |

| | | | | Dana Holding Corp.: | | | | |

| | 2,000 | M | | 6%, 9/15/2023 | | | 2,077,000 | |

| | 700 | M | | 5.5%, 12/15/2024 | | | 714,000 | |

| | 1,425 | M | | Group 1 Automotive, Inc., 5.25%, 12/15/2023 (a) | | | 1,432,125 | |

| | 1,650 | M | | Hertz Corp., 7.625%, 6/1/2022 (a) | | | 1,678,875 | |

| | 1,675 | M | | Meritor, Inc., 6.25%, 2/15/2024 | | | 1,748,281 | |

| | | | | | | | 18,658,938 | |

| | | | | Building Materials—1.2% | | | | |

| | 3,250 | M | | Building Materials Corp., 5.375%, 11/15/2024 (a) | | | 3,306,875 | |

| | 3,425 | M | | Griffon Corp., 5.25%, 3/1/2022 | | | 3,451,715 | |

| | 1,200 | M | | New Enterprise Stone & Lime Co., 6.25%, 3/15/2026 (a) | | | 1,204,500 | |

| | | | | | | | 7,963,090 | |

29

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Chemicals—2.6% | | | | |

| $ | 1,200 | M | | A. Schulman, Inc., 6.875%, 6/1/2023 | | $ | 1,272,000 | |

| | 1,800 | M | | Blue Cube Spinco, Inc., 10%, 10/15/2025 | | | 2,124,000 | |

| | 1,850 | M | | CF Industries, Inc., 4.95%, 6/1/2043 | | | 1,621,063 | |

| | 1,625 | M | | Chemours Co., 6.625%, 5/15/2023 | | | 1,712,344 | |

| | 1,950 | M | | CVR Partners, LP, 9.25%, 6/15/2023 (a) | | | 2,083,478 | |

| | 1,600 | M | | PQ Corp., 6.75%, 11/15/2022 (a) | | | 1,688,000 | |

| | 4,300 | M | | Rain CII Carbon, LLC, 7.25%, 4/1/2025 (a) | | | 4,558,000 | |

| | 2,475 | M | | Rayonier AM Products, Inc., 5.5%, 6/1/2024 (a) | | | 2,437,875 | |

| | | | | | | | 17,496,760 | |

| | | | | Consumer Non-Durables—1.2% | | | | |

| | 1,600 | M | | First Quality Finance Co., 4.625%, 5/15/2021 (a) | | | 1,600,000 | |

| | 3,575 | M | | Kronos Acquisition, Inc., 9%, 8/15/2023 (a) | | | 3,405,188 | |

| | 1,525 | M | | Reynolds Group Holdings, Inc., 5.125%, 7/15/2023 (a) | | | 1,541,699 | |

| | 1,375 | M | | Standard Industries, Inc., 5.5%, 2/15/2023 (a) | | | 1,426,562 | |

| | | | | | | | 7,973,449 | |

| | | | | Energy—12.5% | | | | |

| | | | | Andeavor Logistics, LP: | | | | |

| | 725 | M | | 5.2%, 12/1/2047 | | | 716,488 | |

| | 1,700 | M | | 6.875%, 12/29/2049 | | | 1,711,050 | |

| | | | | Antero Resources Corp.: | | | | |

| | 950 | M | | 5.375%, 11/1/2021 | | | 970,187 | |

| | 475 | M | | 5.125%, 12/1/2022 | | | 480,937 | |

| | 1,725 | M | | Baytex Energy Corp., 5.125%, 6/1/2021 (a) | | | 1,621,500 | |

| | 1,475 | M | | Berry Petroleum Co., 7%, 2/15/2026 (a) | | | 1,490,192 | |

| | 1,375 | M | | Blue Racer Midstream, LLC, 6.125%, 11/15/2022 (a) | | | 1,405,938 | |

| | 850 | M | | Callon Petroleum Co., 6.125%, 10/1/2024 | | | 873,630 | |

| | | | | Carrizo Oil & Gas, Inc.: | | | | |

| | 500 | M | | 6.25%, 4/15/2023 | | | 502,500 | |

| | 600 | M | | 8.25%, 7/15/2025 | | | 631,500 | |

| | 2,175 | M | | Chesapeake Energy Corp., 8%, 1/15/2025 (a) | | | 2,109,750 | |

| | 925 | M | | CONSOL Energy, Inc., 5.875%, 4/15/2022 | | | 933,094 | |

30

Principal

Amount | | | Security | | Value | |

| | | | | Consolidated Energy Finance SA: | | | | |

| $ | 1,700 | M | | 6.75%, 10/15/2019 (a) | | $ | 1,721,250 | |

| | 1,400 | M | | 6.875%, 6/15/2025 (a) | | | 1,470,000 | |

| | | | | Continental Resources, Inc.: | | | | |

| | 1,775 | M | | 3.8%, 6/1/2024 | | | 1,715,094 | |

| | 1,950 | M | | 4.375%, 1/15/2028 (a) | | | 1,903,687 | |

| | | | | Crestwood Midstream Partners, LP: | | | | |

| | 2,175 | M | | 6.25%, 4/1/2023 | | | 2,202,187 | |

| | 1,375 | M | | 5.75%, 4/1/2025 | | | 1,368,125 | |

| | 1,825 | M | | CSI Compressco, LP, 7.5%, 4/1/2025 (a) | | | 1,847,812 | |

| | | | | DCP Midstream Operating, LP: | | | | |

| | 2,250 | M | | 5.35%, 3/15/2020 (a) | | | 2,323,125 | |

| | 1,575 | M | | 7.375%, 12/29/2049 † | | | 1,572,047 | |

| | 1,775 | M | | Delek Logistics Partners, LP, 6.75%, 5/15/2025 (a) | | | 1,801,625 | |

| | | | | Diamondback Energy, Inc.: | | | | |

| | 500 | M | | 4.75%, 11/1/2024 | | | 496,250 | |

| | 775 | M | | 5.375%, 5/31/2025 (a) | | | 787,981 | |

| | | | | Endeavor Energy Resources, LP: | | | | |

| | 1,825 | M | | 5.5%, 1/30/2026 (a) | | | 1,820,437 | |

| | 1,475 | M | | 5.75%, 1/30/2028 (a) | | | 1,475,000 | |

| | 2,767 | M | | Exterran Partners, LP, 6%, 10/1/2022 | | | 2,760,083 | |

| | 975 | M | | Forum Energy Technologies, Inc., 6.25%, 10/1/2021 | | | 970,125 | |

| | | | | Genesis Energy, LP: | | | | |

| | 1,400 | M | | 6.75%, 8/1/2022 | | | 1,443,750 | |

| | 500 | M | | 5.625%, 6/15/2024 | | | 473,750 | |

| | 1,875 | M | | Global Partners, LP, 6.25%, 7/15/2022 | | | 1,875,000 | |

| | 1,150 | M | | Gulfport Energy Corp., 6.375%, 5/15/2025 | | | 1,105,437 | |

| | 1,300 | M | | Laredo Petroleum, Inc., 5.625%, 1/15/2022 | | | 1,296,750 | |

| | 1,825 | M | | Matador Resources Co., 6.875%, 4/15/2023 | | | 1,902,563 | |

| | | | | Murphy Oil Corp.: | | | | |

| | 1,425 | M | | 4.7%, 12/1/2022 | | | 1,382,250 | |

| | 1,100 | M | | 5.75%, 8/15/2025 | | | 1,086,250 | |

| | 700 | M | | 5.875%, 12/1/2042 | | | 644,000 | |

| | 1,850 | M | | Nabors Industries, Inc., 5.75%, 2/1/2025 (a) | | | 1,748,250 | |

| | 1,675 | M | | Newfield Exploration Co., 5.375%, 1/1/2026 | | | 1,737,812 | |

31

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Energy (continued) | | | | |

| $ | 1,725 | M | | NGPL Pipeco, LLC, 4.875%, 8/15/2027 (a) | | $ | 1,705,594 | |

| | 1,750 | M | | Oasis Petroleum, Inc., 6.875%, 1/15/2023 | | | 1,778,438 | |

| | 1,650 | M | | Parkland Fuel Corp., 6%, 4/1/2026 (a) | | | 1,662,375 | |

| | | | | Parsley Energy, LLC: | | | | |

| | 425 | M | | 6.25%, 6/1/2024 (a) | | | 441,469 | |

| | 1,775 | M | | 5.25%, 8/15/2025 (a) | | | 1,768,344 | |

| | 300 | M | | 5.625%, 10/15/2027 (a) | | | 300,750 | |

| | | | | PDC Energy, Inc.: | | | | |

| | 1,250 | M | | 6.125%, 9/15/2024 | | | 1,281,250 | |

| | 675 | M | | 5.75%, 5/15/2026 (a) | | | 664,031 | |

| | | | | Precision Drilling Corp.: | | | | |

| | 1,148 | M | | 6.5%, 12/15/2021 | | | 1,162,350 | |

| | 950 | M | | 7.125%, 1/15/2026 (a) | | | 942,875 | |

| | 1,350 | M | | QEP Resources, Inc., 6.875%, 3/1/2021 | | | 1,437,750 | |

| | 350 | M | | Range Resources Corp., 4.875%, 5/15/2025 | | | 326,375 | |

| | 700 | M | | RSP Permian, Inc., 5.25%, 1/15/2025 | | | 727,125 | |

| | 575 | M | | SESI, LLC, 7.75%, 9/15/2024 (a) | | | 596,563 | |

| | 1,025 | M | | SM Energy Co., 5%, 1/15/2024 | | | 955,812 | |

| | | | | Southwestern Energy Co.: | | | | |

| | 1,000 | M | | 7.5%, 4/1/2026 | | | 1,015,000 | |

| | 1,250 | M | | 7.75%, 10/1/2027 | | | 1,278,125 | |

| | 700 | M | | Suburban Propane Partners, LP, 5.875%, 3/1/2027 | | | 666,750 | |

| | 1,125 | M | | Sunoco, LP, 5.875%, 3/15/2028 (a) | | | 1,089,844 | |

| | | | | Targa Resources Partners, LP: | | | | |

| | 900 | M | | 5.25%, 5/1/2023 | | | 909,000 | |

| | 2,800 | M | | 4.25%, 11/15/2023 | | | 2,698,500 | |

| | 325 | M | | TransMontaigne Partners, LP, 6.125%, 2/15/2026 | | | 327,438 | |

| | 375 | M | | Unit Corp., 6.625%, 5/15/2021 | | | 376,875 | |

| | | | | Weatherford Bermuda, PLC: | | | | |

| | 600 | M | | 4.5%, 4/15/2022 | | | 493,500 | |

| | 625 | M | | 6.5%, 8/1/2036 | | | 446,875 | |

| | 2,375 | M | | Whiting Petroleum Corp., 6.25%, 4/1/2023 | | | 2,410,625 | |

| | 3,150 | M | | WPX Energy, Inc., 6%, 1/15/2022 | | | 3,252,375 | |

| | | | | | | | 85,093,414 | |

32

Principal

Amount | | | Security | | Value | |

| | | | | Financials—6.9% | | | | |

| $ | 2,225 | M | | Ally Financial, Inc., 8%, 11/1/2031 | | $ | 2,725,625 | |

| | 1,925 | M | | Arch Merger Sub, Inc., 8.5%, 9/15/2025 (a) | | | 1,785,437 | |

| | 1,825 | M | | Argos Merger Sub, Inc., 7.125%, 3/15/2023 (a) | | | 1,044,812 | |

| | 1,200 | M | | AssuredPartners, Inc., 7%, 8/15/2025 (a) | | | 1,188,000 | |

| | 1,525 | M | | Credit Suisse Group AG, 7.5%, 12/11/2023 (a) | | | 1,654,779 | |

| | 2,575 | M | | CSTN Merger Sub, Inc., 6.75%, 8/15/2024 (a) | | | 2,564,571 | |

| | 3,600 | M | | DAE Funding, LLC, 5%, 8/1/2024 (a) | | | 3,415,500 | |

| | | | | Icahn Enterprises, LP: | | | | |

| | 2,225 | M | | 6.25%, 2/1/2022 | | | 2,269,500 | |

| | 1,450 | M | | 6.75%, 2/1/2024 | | | 1,480,813 | |

| | 1,000 | M | | 6.375%, 12/15/2025 | | | 1,007,500 | |

| | | | | Intesa Sanpaolo SpA: | | | | |

| | 3,425 | M | | 5.017%, 6/26/2024 (a) | | | 3,382,708 | |

| | 1,675 | M | | 5.71%, 1/15/2026 (a) | | | 1,683,589 | |

| | | | | Ladder Capital Finance Holdings, LLLP: | | | | |

| | 325 | M | | 5.875%, 8/1/2021 (a) | | | 331,893 | |

| | 1,350 | M | | 5.25%, 3/15/2022 (a) | | | 1,353,375 | |

| | 2,700 | M | | 5.25%, 10/1/2025 (a) | | | 2,565,000 | |

| | 2,425 | M | | LPL Holdings, Inc., 5.75%, 9/15/2025 (a) | | | 2,400,023 | |

| | 2,650 | M | | Navient Corp., 5.875%, 3/25/2021 | | | 2,719,563 | |

| | 2,550 | M | | Royal Bank of Scotland Group, PLC, 8.625%, 8/15/2021 | | | 2,776,312 | |

| | 1,600 | M | | Societe Generale SA, 7.375%, 9/13/2071 (a) | | | 1,706,000 | |

| | | | | Springleaf Finance Corp.: | | | | |

| | 1,225 | M | | 7.75%, 10/1/2021 | | | 1,330,656 | |

| | 1,450 | M | | 5.625%, 3/15/2023 | | | 1,426,438 | |

| | 1,600 | M | | 6.875%, 3/15/2025 | | | 1,610,000 | |

| | 4,325 | M | | UniCredit SpA, 5.861%, 6/19/2032 (a) | | | 4,401,596 | |

| | | | | | | | 46,823,690 | |

| | | | | Food/Beverage/Tobacco—1.8% | | | | |

| | 1,225 | M | | Barry Callebault Services SA, 5.5%, 6/15/2023 (a) | | | 1,311,975 | |

| | 2,050 | M | | JBS USA LUX SA, 6.75%, 2/15/2028 (a) | | | 1,970,562 | |

| | 625 | M | | Lamb Weston Holdings, Inc., 4.875%, 11/1/2026 (a) | | | 621,094 | |

33

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Food/Beverage/Tobacco (continued) | | | | |

| | | | | Pilgrim’s Pride Corp.: | | | | |

| $ | 250 | M | | 5.75%, 3/15/2025 (a) | | $ | 243,403 | |

| | 2,075 | M | | 5.875%, 9/30/2027 (a) | | | 1,960,460 | |

| | | | | Post Holdings, Inc.: | | | | |

| | 1,725 | M | | 5.5%, 3/1/2025 (a) | | | 1,703,438 | |

| | 2,800 | M | | 5.75%, 3/1/2027 (a) | | | 2,793,000 | |

| | 1,300 | M | | Simmons Foods, Inc., 5.75%, 11/1/2024 (a) | | | 1,181,375 | |

| | 350 | M | | Vector Group, Ltd., 6.125%, 2/1/2025 (a) | | | 350,875 | |

| | | | | | | | 12,136,182 | |

| | | | | Forest Products/Containers—2.5% | | | | |

| | | | | Ardagh Holdings USA, Inc.: | | | | |

| | 525 | M | | 4.625%, 5/15/2023 (a) | | | 528,937 | |

| | 4,750 | M | | 7.25%, 5/15/2024 (a) | | | 5,070,625 | |

| | | | | BWAY Holding Co.: | | | | |

| | 1,725 | M | | 5.5%, 4/15/2024 (a) | | | 1,740,094 | |

| | 2,825 | M | | 7.25%, 4/15/2025 (a) | | | 2,888,562 | |

| | 2,000 | M | | Crown Americas, LLC, 4.25%, 9/30/2026 | | | 1,855,000 | |

| | | | | Mercer International, Inc.: | | | | |

| | 350 | M | | 7.75%, 12/1/2022 | | | 372,312 | |

| | 1,175 | M | | 6.5%, 2/1/2024 | | | 1,233,750 | |

| | 525 | M | | 5.5%, 1/15/2026 (a) | | | 522,375 | |

| | 2,175 | M | | Sealed Air Corp., 6.875%, 7/15/2033 (a) | | | 2,425,125 | |

| | | | | | | | 16,636,780 | |

| | | | | Gaming/Leisure—3.1% | | | | |

| | 2,300 | M | | Boyd Gaming Corp., 6.875%, 5/15/2023 | | | 2,435,125 | |

| | 3,100 | M | | CRC Escrow Issuer, LLC, 5.25%, 10/15/2025 (a) | | | 2,979,658 | |

| | | | | Golden Nugget, Inc.: | | | | |

| | 1,425 | M | | 8.75%, 10/1/2025 (a) | | | 1,482,000 | |

| | 1,875 | M | | 6.75%, 10/15/2024 (a) | | | 1,889,044 | |

| | 3,750 | M | | IRB Holding Corp., 6.75%, 2/15/2026 (a) | | | 3,684,750 | |

| | 575 | M | | Lions Gate Entertainment Corp., 5.875%, 11/1/2024 (a) | | | 599,437 | |

| | 1,650 | M | | National CineMedia, LLC, 6%, 4/15/2022 | | | 1,674,750 | |

| | 1,125 | M | | Silversea Cruise Finance, Ltd., 7.25%, 2/1/2025 (a) | | | 1,195,313 | |

34

Principal

Amount | | | Security | | Value | |

| | | | | Viking Cruises, Ltd.: | | | | |

| $ | 3,325 | M | | 6.25%, 5/15/2025 (a) | | $ | 3,341,625 | |

| | 1,500 | M | | 5.875%, 9/15/2027 (a) | | | 1,425,000 | |

| | | | | | | | 20,706,702 | |

| | | | | Health Care—6.8% | | | | |

| | 2,725 | M | | Centene Corp., 6.125%, 2/15/2024 | | | 2,842,720 | |

| | | | | CHS/Community Health Systems, Inc.: | | | | |

| | 1,125 | M | | 7.125%, 7/15/2020 | | | 922,500 | |

| | 950 | M | | 5.125%, 8/1/2021 | | | 888,250 | |

| | 2,450 | M | | 6.25%, 3/31/2023 | | | 2,269,313 | |

| | 5,575 | M | | DaVita, Inc., 5.125%, 7/15/2024 | | | 5,453,047 | |

| | | | | Endo Finance, LLC: | | | | |

| | 725 | M | | 7.25%, 1/15/2022 (a) | | | 632,562 | |

| | 1,575 | M | | 6%, 7/15/2023 (a) | | | 1,197,000 | |

| | 375 | M | | 6%, 2/1/2025 (a) | | | 270,937 | |

| | | | | HCA, Inc.: | | | | |

| | 3,600 | M | | 6.25%, 2/15/2021 | | | 3,789,000 | |

| | 1,800 | M | | 5.875%, 5/1/2023 | | | 1,867,500 | |

| | | | | HealthSouth Corp.: | | | | |

| | 1,150 | M | | 5.125%, 3/15/2023 | | | 1,170,125 | |

| | 1,325 | M | | 5.75%, 11/1/2024 | | | 1,353,156 | |

| | 300 | M | | inVentiv Group Holdings, Inc., 7.5%, 10/1/2024 (a) | | | 320,250 | |

| | | | | LifePoint Health, Inc.: | | | | |

| | 2,900 | M | | 5.875%, 12/1/2023 | | | 2,939,005 | |

| | 1,175 | M | | 5.375%, 5/1/2024 | | | 1,152,969 | |

| | | | | Mallinckrodt Finance SB: | | | | |

| | 2,575 | M | | 5.75%, 8/1/2022 (a) | | | 2,214,500 | |

| | 1,025 | M | | 5.5%, 4/15/2025 (a) | | | 800,781 | |

| | | | | Molina Healthcare, Inc.: | | | | |

| | 2,925 | M | | 5.375%, 11/15/2022 | | | 2,903,062 | |

| | 1,750 | M | | 4.875%, 6/15/2025 (a) | | | 1,640,625 | |

| | 775 | M | | MPH Operating Partnership, LP, 7.125%, 6/1/2024 (a) | | | 802,125 | |

| | 1,775 | M | | Polaris Intermediate Corp., 8.5%, 12/1/2022 (a) | | | 1,814,955 | |

35

Portfolio of Investments (continued)

FUND FOR INCOME

March 31, 2018

Principal

Amount | | | Security | | Value | |

| | | | | Health Care (continued) | | | | |

| $ | 850 | M | | RegionalCare Hospital Partners Holdings, Inc., 8.25%, 5/1/2023 (a) | | $ | 888,250 | |

| | 1,534 | M | | Universal Hospital Services, Inc., 7.625%, 8/15/2020 | | | 1,553,175 | |

| | | | | Valeant Pharmaceuticals International, Inc.: | | | | |

| | 400 | M | | 6.5%, 3/15/2022 (a) | | | 414,500 | |

| | 1,925 | M | | 7.25%, 7/15/2022 (a) | | | 1,932,219 | |

| | 800 | M | | 7%, 3/15/2024 (a) | | | 837,000 | |

| | 2,150 | M | | 6.125%, 4/15/2025 (a) | | | 1,863,513 | |

| | 1,900 | M | | 9%, 12/15/2025 (a) | | | 1,895,250 | |

| | | | | | | | 46,628,289 | |

| | | | | Home Building—.2% | | | | |

| | 1,650 | M | | William Lyon Homes, Inc., 6%, 9/1/2023 (a) | | | 1,652,063 | |

| | | | | Information Technology—4.2% | | | | |

| | 3,850 | M | | Alliance Data Systems Corp., 5.375%, 8/1/2022 (a) | | | 3,869,250 | |

| | 1,650 | M | | CDW, LLC, 5%, 9/1/2025 | | | 1,650,000 | |

| | 1,625 | M | | CommScope Technologies, LLC, 6%, 6/15/2025 (a) | | | 1,698,938 | |

| | | | | Diamond 1 Finance Corp.: | | | | |

| | 1,525 | M | | 5.875%, 6/15/2021 (a) | | | 1,570,750 | |

| | 1,200 | M | | 6.02%, 6/15/2026 (a) | | | 1,294,357 | |

| | 1,325 | M | | Equinix, Inc., 5.875%, 1/15/2026 | | | 1,384,625 | |

| | 825 | M | | Match Group, Inc., 6.375%, 6/1/2024 | | | 880,687 | |

| | | | | NCR Corp.: | | | | |

| | 600 | M | | 4.625%, 2/15/2021 | | | 598,500 | |

| | 525 | M | | 5.875%, 12/15/2021 | | | 536,156 | |

| | 1,375 | M | | Nuance Communications, Inc., 6%, 7/1/2024 | | | 1,416,250 | |

| | 1,000 | M | | NXP BV, 3.875%, 9/1/2022 (a) | | | 995,000 | |

| | 1,300 | M | | Open Text Corp., 5.625%, 1/15/2023 (a) | | | 1,353,625 | |

| | 3,850 | M | | Rackspace Hosting, Inc., 8.625%, 11/15/2024 (a) | | | 3,811,500 | |

| | 1,800 | M | | Radiate Holdco, LLC, 6.625%, 2/15/2025 (a) | | | 1,660,500 | |

| | 1,225 | M | | Sensata Technologies U.K. Financing Co., 6.25%, 2/15/2026 (a) | | | 1,293,539 | |

| | 3,975 | M | | Solera, LLC, 10.5%, 3/1/2024 (a) | | | 4,442,063 | |

| | | | | | | | 28,455,740 | |

36

Principal