UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under Rule 14a-12 |

|

| NV ENERGY, INC. |

| (Name of registrant as specified in its charter) |

|

|

| (Name of person(s) filing proxy statement, if other than the registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

March 27, 2013

To Our Stockholders:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2013 Annual Meeting of the stockholders of NV Energy, Inc. The Annual Meeting will be held on Wednesday, May 8, 2013, at 8:00 a.m., Pacific Time, at The Smith Center for the Performing Arts, 361 Symphony Park Avenue, Las Vegas, Nevada, 89106. A map of the Annual Meeting location is included in our proxy materials.

The matters to be acted upon at the meeting are described in our proxy materials, which are being furnished to our stockholders over the Internet. In addition, we will discuss the Company’s 2012 financial results and outlook. During the meeting, you and other stockholders will have the opportunity to ask questions and comment on the Company’s operations. Our directors and officers also will be available to visit with you before and after the formal meeting.

Your views are very important to the Company. Whether or not you are able to attend the Annual Meeting, we encourage you to review our Annual Report and the proxy materials, and to vote your shares. You may vote in person or by proxy at the meeting, or by Internet, telephone or mail.

We greatly appreciate the interest expressed by our stockholders. We are pleased that in the past so many of you have voted your shares, and we hope that you will do so again this year. We urge you to execute and return your proxy as soon as possible.

Sincerely,

Michael W. Yackira

President and Chief Executive Officer

NV Energy, Inc.

NV ENERGY, INC.

6226 W. Sahara Avenue

Las Vegas, Nevada 89146

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 8, 2013

March 27, 2013

The 2013 Annual Meeting of the stockholders of NV Energy, Inc. (the “Annual Meeting”) will be held at 8:00 a.m., Pacific Time, on Wednesday, May 8, 2013, at The Smith Center for the Performing Arts, 361 Symphony Park Avenue, Las Vegas, Nevada, 89106, for the following purposes:

| | 1. | To elect as director 10 nominees named in the proxy statement to serve one-year terms, and until their successors are elected and qualified. |

| | 2. | To approve our executive compensation on an advisory basis. |

| | 3. | To approve the 2013 Long-Term Incentive Plan. |

| | 4. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our 2013 fiscal year. |

| | 5. | To take action on such other business as may properly come before the meeting, and any adjournments or postponements thereof. |

Stockholders of record of NV Energy common stock at the close of business on March 11, 2013, will be entitled to vote at the meeting, and any adjournments thereof.

We are using the Internet as the primary means of furnishing proxy materials to our stockholders. You may read, print and download our annual report for fiscal year 2012 (the “Annual Report”) and proxy materials at the investor section of our website atwww.nvenergy.com.

Beginning March 27, 2013, we will send a notice card by mail with instructions on how to use the Internet to access our proxy materials and Annual Report, and how to vote online. The notice card further explains how to request a paper copy of the proxy materials and the Annual Report, if desired. Alternatively, if you have selected this as a preference in the past, you may have received these materials via e-mail. Your e-mail contains links to our proxy materials and Annual Report, and instructions on how to vote online.

You are cordially invited to attend the Annual Meeting in person. Whether you plan to attend the meeting or not, please read the accompanying proxy statement and then vote your shares as early as possible. You can change your vote and revoke your proxy at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement.

On behalf of the Board of Directors

Paul J. Kaleta

Corporate Secretary

NV Energy, Inc.

TABLE OF CONTENTS

NV ENERGY, INC.

6226 West Sahara Avenue

Las Vegas, NV 89146

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

This proxy statement pertains to the 2013 annual meeting of stockholders of NV Energy, Inc. (the “Annual Meeting”). The Annual Meeting will be held on Wednesday, May 8, 2013, at 8:00 a.m. (Pacific Time) at The Smith Center for the Performing Arts, 361 Symphony Park Avenue, Las Vegas, Nevada, 89106.

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of NV Energy, Inc. (the “Company,” “NVE” or “NV Energy”) for use at the Annual Meeting and any adjournment thereof. Stockholders of record at the close of business on March 11, 2013 (the “Record Date”) are entitled to vote at the Annual Meeting, either in person or by proxy. The number of outstanding shares of our common stock entitled to vote at the Annual Meeting is 235,515,172.

We distribute our proxy materials and our annual report to stockholders for 2012 primarily over the Internet. Most stockholders are mailed only a Notice of Internet Availability of Proxy Materials (“Notice”). The Notice explains how to access our materials atwww.ProxyVote.com. We expect to mail the Notice on March 27, 2013.

At the Annual Meeting, stockholders of record will vote on the proposals noted below. You may vote by telephone, by mail, or via the Internet atwww.ProxyVote.com before 11:59 p.m. (Eastern Time) on May 7, 2013, or in person at the meeting.

The Board recommends that you vote for each of the director nominees in Proposal 1, and in favor of Proposals 2, 3 and 4.

| | | | | | | | |

Proposal | | Board

Recommendation | | Voting Required for Approval | | Page No. |

1. | | To elect as director 10 nominees named in the proxy statement to serve one-year terms and until their successors are elected and qualified. | | FOR | | A majority of the votes cast with respect to each nominee | | 2 |

2. | | To approve our executive compensation on an advisory basis. | | FOR | | A majority of the votes cast with respect to the proposal | | 10 |

3. | | To approve our 2013 Long-Term Incentive Plan. | | FOR | | A majority of the votes cast with respect to the proposal | | 12 |

4. | | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2013. | | FOR | | A majority of the votes cast with respect to the proposal | | 26 |

If you return your proxy with instructions and do not revoke it, the proxy will be voted in accordance with your instructions. If you return your proxy and leave a voting instruction blank, the matter will be voted in accordance with the Board’s recommendation, except for situations involving “broker non-votes” as described later in this proxy statement under “Voting Matters.”

If you have any questions about the Annual Meeting, our proxy materials, our annual report or your ownership of our common stock, please see “Other Annual Meeting Information” later in this proxy statement.

1

PROPOSAL ONE

ELECTION OF DIRECTORS

Our Board consists of ten directors. If elected, each of our director nominees will serve until the 2014 annual meeting and until a successor has been elected and qualified. Each nominee has consented to serve, if elected. If any nominee becomes unavailable for election or service, the persons named on the proxy card as proxies may vote for another nominee selected by the Board, or the Board may reduce the number of directors.

The Company’s bylaws contain a majority voting standard for uncontested elections of directors. Under our bylaws, an “uncontested” election is an election in which the number of nominees for director is not greater than the number to be elected. In an uncontested election, a nominee must be elected by a majority of the votes cast, in person or by proxy, with respect to the election of that nominee. A “majority” means that the number of votes cast “FOR” a nominee’s election exceeds the number of shares voted “AGAINST” that nominee’s election. We will not count as either “FOR” or “AGAINST” any shares that are voted as abstentions, nor will we take into account broker non-votes. If an incumbent director is not re-elected in an uncontested election, the director must submit an offer to resign. The Board will then consider the criteria set forth in our bylaws and will act on the offer within 120 days following certification of the stockholder vote. We will publicly disclose the Board’s decision and, if the resignation is not accepted, the reasons for that decision.

In a “contested” election, the number of nominees for director exceeds the number to be elected and directors will be elected by a plurality of the votes represented at the meeting. A “plurality” means that the open seats on the Board will be filled by the nominees who received the most affirmative votes, regardless of whether those nominees received a majority of votes cast with respect to their election.

At our 2013 Annual Meeting, the election of directors is considered to be uncontested because we have not been notified of any other nominees as required by our bylaws. Therefore, to be elected, each nominee must receive a majority of votes cast with respect to that nominee.

Nominees for Director

As discussed in greater detail in the “Corporate Governance Matters” section of this proxy statement, beginning on page 4:

| | • | | each nominee, except Mr. Yackira, is “independent” under the New York Stock Exchange (“NYSE”) listing standards; |

| | • | | each nominee attended at least 75% of the aggregate of all meetings of the Board and committees on which he or she served during 2012; and |

| | • | | each nominee is in compliance with our director stock ownership guidelines. |

Joseph B. Anderson, Jr., 70, is chairman and chief executive officer of TAG Holdings, LLC, a holding company for manufacturing and service-based enterprises. He has held these positions since 2002. He also serves as a director of Meritor, Inc., Quaker Chemical Corporation, Rite Aid Corporation and Valassis Communications, Inc. Mr. Anderson served initially as vice chair and then chairman of the Manufacturing Council of the U.S. Department of Commerce from September 2010 until September 2012. He has been a director of NV Energy since 2005, and currently chairs our Compensation Committee.

The Board believes Mr. Anderson should serve as a director because of his global business and financial expertise, business acumen, and experience gained over many years as an executive officer and director of public and private companies, in addition to his demonstrated leadership experience on diversity matters.

Glenn C. Christenson, 63, has been managing director of Velstand Investments, LLC, a private investment management company, since 2004. He retired in 2007 as executive vice president and chief financial officer of Station Casinos, Inc., a gaming entertainment company, after 17 years with the company. Prior to that, Mr. Christenson was a partner of the firm now known as Deloitte & Touche LLP. He served as a director of First American Financial Corporation from 2008 until 2011, and as director of Tropicana Entertainment, Inc. during 2010. Mr. Christenson is a Certified Public Accountant. He has been a director of NV Energy since 2007, and currently chairs our Audit Committee.

2

The Board believes Mr. Christenson should serve as a director because of his financial and risk management expertise, and his years of experience as the chief financial officer of a public company, together with his prior experience as an audit partner of Deloitte & Touche LLP.

Susan F. Clark, 64, is an attorney and shareholder of Radey Thomas Yon & Clark, P.A., a Florida-based law firm, where she specializes in energy and telecommunications law and utility regulation. She has held this position since 2003. She served as a commissioner of the Florida Public Service Commission for nine years until 2000, as a director of the National Association of Regulatory Utility Commissioners for three years until 2000, and as a director of the Electric Power Research Institute for four years until 2006. She has been a director of NV Energy since 2008.

The Board believes Ms. Clark should serve as a director because of her experience as a public utility regulator, her deep industry knowledge and her extensive background as a lawyer focusing on utility-related issues.

Stephen E. Frank, 71, retired in 2002 as chairman, president and chief executive officer of Southern California Edison, a regulated investor-owned utility. He also serves as a director of Northrop Grumman Corporation. In the past, he served as a director of various publicly-traded utilities, including Edison International (1995 to 2002), FPL Group, Inc. (now known as NextEra) (1990 to 1995) and Puget Energy, Inc. (2004 to 2008). He served as a director of Washington Mutual, Inc. (now known as WMI Holdings Corp.) from 1997 until March 2012. Mr. Frank was honored as an outstanding director by Outstanding Directors Exchange in 2008. He has been a director of NV Energy since 2009.

The Board believes Mr. Frank should serve as a director because of his extensive experience as an officer and director of public utilities in the Western U.S. and elsewhere, and his service on the boards of other public companies with nationwide scope, together with his financial and risk management expertise.

Brian J. Kennedy, 69, is president and chief executive officer of Argonaut LLC, a private equity group. He has served in that role since 2007. Prior to that, Mr. Kennedy was president and chief executive officer of Meridian Gold, Inc., from 1996 to 2006, and a director of the company from 2006 to 2007. He has been a director of NV Energy since 2007.

The Board believes Mr. Kennedy should serve as a director because of his financial expertise, business acumen, knowledge and experience gained over many years as an executive officer and director of publicly-traded companies, together with his Nevada business and customer experience.

Maureen T. Mullarkey, 53, has been a member of Blue Heron Investments, LLC, a private investment firm, since 2011. She retired in 2007 as executive vice president and chief financial officer of International Game Technology, a supplier of gaming equipment and technology, after 19 years with the company. Ms. Mullarkey served as an Entrepreneur in Residence with The Nevada Institute for Renewable Energy Commercialization from 2009 until 2011. She has been a director of NV Energy since 2008.

The Board believes Ms. Mullarkey should serve as a director because of her years of experience as the chief financial officer of a public company and her Nevada business experience, together with her renewable energy-related experience.

John F. O’Reilly,67, is an attorney and member of the O’Reilly Law Group LLC, a Nevada-based law firm, with which he has practiced since 1999. Mr. O’Reilly served as a director of Herbst Gaming, Inc., from 2004 to 2010. His past experience includes auditing and tax accounting at the firm now known as Ernst & Young. He has been a director of NV Energy since 1999 and a director of Nevada Power Company since 1995. Mr. O’Reilly currently chairs our Finance Committee.

The Board believes Mr. O’Reilly should serve as a director because of his diverse and extensive experience as an auditor, businessman and attorney, and his knowledge of the utility regulatory process and the State of Nevada.

Philip G. Satre, 63, retired in 2005 as chairman of Harrah’s Entertainment, Inc., a gaming entertainment company, having previously served as its chief executive officer from 1994 to 2003. He currently serves as a

3

director of International Game Technology and Nordstrom, Inc., and also served as a director of Rite Aid Corporation from 2005 until 2011. Mr. Satre was honored as an outstanding director by Outstanding Directors Exchange in 2010. He has been a director of NV Energy since 2005, and our non-executive chairman since 2008.

The Board believes Mr. Satre should serve as a director because of his nationwide business and financial expertise, business acumen, and experience gained over many years as an executive officer, chairman and director of public companies, in addition to his Nevada business experience.

Donald D. Snyder, 65, has been dean of the University of Nevada, Las Vegas, Harrah College of Hotel Administration, since 2010. Mr. Snyder retired in 2005 after more than eight years as president and director of Boyd Gaming Corporation. He currently serves as a director of Tutor Perini Corporation and Western Alliance Bancorporation. Mr. Snyder has been a director of NV Energy since 2005, and currently chairs our Nominating and Governance Committee.

The Board believes Mr. Snyder should serve as a director because of his financial and banking expertise and business acumen, his broad experience gained over many years as an executive officer and director of banks and public companies, and his Nevada business experience.

Michael W. Yackira, 61, is our chief executive officer. Mr. Yackira joined NV Energy in 2003 and served as chief financial officer, chief operating officer and president before being named chief executive officer in 2007. He formerly served as chief financial officer of FPL Group, Inc. (now known as NextEra) from 1995 to 1998, and as president of FPL Energy LLC from 1998 to 2000. Mr. Yackira is a Certified Public Accountant. He has been a director of NV Energy since 2007.

The Board believes Mr. Yackira should serve as a director because of his knowledge of the Company as its chief executive officer, as well as his many years of accounting, operations, renewable energy, finance and regulatory experience in the utility industry.

Our Board recommends that you vote “FOR” the election of each nominee listed in this Proposal. Proxies will be voted “FOR” each nominee unless you have otherwise specified in the proxy.

CORPORATE GOVERNANCE MATTERS

Leadership Structure

In 2007, our Board separated the roles of chief executive officer and chairman of the board in recognition of the differing responsibilities of those positions. The non-executive chairman sets the final agenda for and presides at meetings of the Board as it sets the strategic direction for the Company, while the chief executive officer is responsible for performance of the Company in executing its business strategy and for day-to-day leadership. The Board believes this structure creates a balance in leadership and accountability, and generally enhances the independence of the Board.

Under our Governance Guidelines (available on our website atwww.nvenergy.com), the non-executive chair of the Board serves for a three-year term, subject to annual review and ratification. Mr. Satre currently is chairman of our Board.

Board Structure and Composition

Our Board is not classified, meaning that all directors stand for election every year and are nominated to serve one-year terms. The Board consists of ten directors, nine of whom are independent. The Board considers its size, structure and composition annually in connection with the director nomination process, and believes the current arrangements are appropriate.

Director Qualifications and Diversity

The Board, acting through the Nominating and Governance Committee, is responsible for assembling for stockholder consideration a group of nominees collectively having the experience, qualifications, attributes, and

4

skills appropriate for functioning effectively as a board of directors. The committee regularly reviews the composition of the Board in light of the Board’s size, the Company’s changing requirements, the Board’s assessment of its performance, and the input of stockholders and other key constituencies.

Although the Board has not established a formal policy or absolute prerequisites for directors, in selecting nominees the committee looks for certain characteristics such as integrity, strong professional reputation and record of achievement, constructive and collegial personal attributes, race and gender diversity, and the ability and commitment to devote sufficient time and energy to board service. The committee also seeks a balanced mix of local experience, which we believe is especially important for a utility, and national public company or industry experience.

In addition, the committee seeks to include on the Board a complementary mix of individuals with diverse backgrounds and qualities that reflect the broad set of challenges that the Board confronts. These backgrounds and qualities may include, among others, industry experience, technical experience, regulatory experience, risk management experience, knowledge of the Company’s customers and communities, and relevant leadership experience. The committee further takes into account the financial literacy, expertise and independence requirements set forth in applicable stock exchange and Securities and Exchange Commission (“SEC”) rules. At least one, and preferably several, members of the Audit Committee and the Board are to meet the criteria for an “Audit Committee Financial Expert” as defined by SEC rules.

The committee also considers candidates suggested by stockholders. To be considered, suggestions must be submitted in writing to the committee in care of the Corporate Secretary, NV Energy, Inc., P.O. Box 98910, Las Vegas, NV 89151. The Corporate Secretary will submit any such suggestion to the committee before the committee recommends to the Board nominees for the next annual meeting of stockholders.

Director Education

Our Nominating and Governance Committee oversees an ongoing program for new director orientation and director education. The program includes education on the electric and natural gas utility industry, information relevant to the role and duties of public company directors, and sessions specific to Company strategies, operations, policies and practices.

Director Independence

Under our Governance Guidelines, a majority of our directors must qualify as “independent” directors in accordance with applicable SEC and NYSE rules. The Board has determined that all of our directors are independent, except our chief executive officer, Mr. Yackira. There are no family relationships among our directors, and no director serves as a director, officer or employee of a competitor of the Company.

The matters described below were specifically considered by our Board in determining the independence of two of our directors, Mr. Snyder and Mr. O’Reilly, as indicated.

The Smith Center for Performing Arts

Mr. Snyder has been chairman of the board of The Smith Center for the Performing Arts since 1996. This is an unpaid position with a Las Vegas non-profit, cultural organization. In 2012, our charitable foundation paid The Smith Center the last of five $200,000 annual installments toward the cost of constructing a performance hall in downtown Las Vegas, and the first of five $100,000 annual installments to reserve a dedicated box in the performance hall. These amounts represented about one-tenth of one percent (0.1%) of The Smith Center’s most recently reported annual gross revenue of $290.7 million.

Our Board reviewed the donations and determined, based on the particular facts and circumstances (including the size and nature of the donations, and the fact that Mr. Snyder does not receive any remuneration from The Smith Center) that the donations did not constitute a material relationship that would affect the independence of Mr. Snyder. Mr. Snyder abstained from the Board’s review and decision-making process.

5

University of Nevada, Las Vegas (“UNLV”)

Mr. Snyder and Mr. O’Reilly are among the 56 volunteer trustees of the UNLV Foundation, a charitable organization that raises private support for educational purposes relating to UNLV. Mr. O’Reilly serves as chairman of the board of the UNLV Foundation. Furthermore, Mr. Snyder is employed as dean of the Harrah College of Hotel Administration at UNLV, a non-executive position. In 2012, our charitable foundation donated $250,000 to UNLV toward development of an undergraduate program in renewable energy resources, and $95,000 to support other programs. In addition, UNLV and the Company entered into $243,000 in transactions for research services related to the NV Energize “smart meter” project and energy efficiency programs, and the Company paid UNLV $100,000 under an agreement to sponsor the “Governor’s Series” of contests between UNLV and the University of Nevada, Reno. Based on UNLV’s most-recently reported annual gross revenue of $321.9 million, the Company’s $688,000 aggregate in transactions with UNLV amounted to approximately two-tenths of one percent (0.2%) of UNLV’s gross revenue.

Our Board reviewed the donations to and transactions with UNLV and determined, based on the particular facts and circumstances (including the size and nature of the donations and transactions, the fact that all transactions were conducted at arms’ length, the fact that Mr. Snyder and Mr. O’Reilly do not receive any remuneration from the UNLV Foundation, the fact that Mr. Snyder’s position at UNLV is a non-executive position with one of seven UNLV colleges, and the fact that no donations were made to the Harrah College), that the donations and the transactions did not constitute a material relationship that would affect the independence of Mr. Snyder or Mr. O’Reilly. Messrs. Snyder and O’Reilly abstained from the Board’s review and decision-making process.

Director Stock Ownership Guidelines

Our director stock ownership guidelines require that directors maintain ownership of shares of our common stock with an aggregate market value at least five times the maximum cash portion of the annual director retainer. For 2012, the maximum cash portion of the annual director retainer was $60,000. At December 31, 2012, all directors were in compliance with our stock ownership guidelines.

Directors’ Role in Risk Oversight

Management assesses and reports quarterly to the Audit Committee regarding the risk factors and cautionary language contained in the Company’s SEC filings. Our chief risk officer also regularly reports to the Board on the Company’s enterprise risk management activities.

To further establish a framework for risk oversight, pursuant to Board policy the Company has formed the Enterprise Risk Oversight Committee (“EROC”). The voting members of EROC include seven senior officers and our chief accounting officer, who collectively are responsible for ensuring that adequate risk assessment and control policies and procedures are in place and followed. The EROC reports quarterly to the Audit Committee.

In addition, the Company’s internal audit group conducts an annual risk assessment and prepares an audit plan that is updated throughout the year with changes approved by the Audit Committee. Finally, the Board receives reports directly from management regarding various strategic, financial and operational risks facing the Company.

We believe this approach to risk oversight ensures that the subject of risk management receives regular attention at the Audit Committee level, while providing the full Board with appropriate opportunities to consider the significant risks facing the Company, and efforts to address those risks.

Stockholder Communications

The Board will give appropriate attention to written communications from stockholders and other interested parties, and will respond if and as appropriate. Absent unusual circumstances or unless otherwise contemplated by committee charters, the chair of the Nominating and Governance Committee will be primarily responsible for monitoring communications from stockholders. Communications or summaries of communications will be forwarded to all directors if they relate to substantive matters and include suggestions or comments that the chair

6

considers to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to personal grievances and matters as to which we tend to receive repetitive or duplicative communications.

Stockholders and other interested parties may communicate directly with the Company’s non-management directors as a group, or with any individual director, by addressing such communications to the desired recipients and sending it in care of the Corporate Secretary, NV Energy, Inc., P.O. Box 98910, Las Vegas, NV 89151, and marking such communications as “confidential.”

Other Governance Practices and Responsiveness to Stockholders

Say-on-Pay. At our 2012 annual meeting, of the shares voting or abstaining on our “say-on-pay” proposal, 97.8% were voted in favor, 2.0% were voted against and 0.2% abstained from voting. We considered this as evidence of broad-based support for our compensation program and decisions as described in the 2012 proxy statement, and as grounds for maintaining a similar approach for 2013.

Political Activity. In 2012, our Board continued its practice of annually reviewing the Company’s political activity, including political contributions and lobbying expenditures. All contributions and expenditures are made and reported in accordance with applicable law, and the Company does not contribute to political action committees that are not legally required to report their contributors.

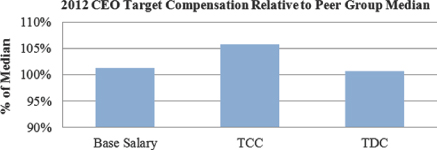

Investor Outreach. In December 2012 and January 2013, our Corporate Secretary met or spoke with representatives of ten of our largest institutional shareholders regarding our executive compensation and corporate governance policies and practices. The investors generally provided positive feedback and recommended no significant changes in our compensation or governance policies or practices.

Clawback Policy. Effective January 1, 2013, our Board adopted an incentive compensation recovery policy, commonly known as a “clawback” policy. In general, it is the policy of the Board that the Company should, to the extent permitted by governing law, require reimbursement of a portion of any incentive award paid to any current or former Section 16 officer where (i) the payment was predicated upon the achievement of certain financial results that were subsequently the subject of a restatement, and (ii) a lower payment would have been made to the officer based upon the restated financial results. The Compensation Committee will have the discretion to enforce and interpret the policy, and the requirements of the policy will be incorporated in all new award agreements.

Code of Ethics

Our Board has adopted a code of conduct, called “The Power of Integrity,” which applies to all of our employees, executive officers and directors. We have an additional code of ethics that specifically applies to our chief executive, financial and accounting officers. Both codes may be viewed on our website atwww.nvenergy.com.

BOARD OF DIRECTORS AND COMMITTEE MATTERS

Board Committees

The Board has established four standing committees – the Audit Committee, the Compensation Committee, the Finance Committee, and the Nominating and Governance Committee. Each standing committee has a written charter, which is posted on our website atwww.nvenergy.com. These charters, as well as the membership and structure of the committees, satisfy all applicable requirements of the SEC and NYSE.

Board and Committee Meetings

In 2012, the Board held nine meetings, the Audit Committee held six meetings, the Compensation Committee held five meetings, the Finance Committee held six meetings, and the Nominating and Governance Committee held four meetings. Each director attended at least 75% of the aggregate of all meetings of the Board and committees on which he or she served.

7

In 2012, the independent directors held regularly scheduled executive sessions without management present and, in addition, met in executive session from time to time during Board meetings. Our non-executive chairman presided over these sessions.

It is the Company’s policy for all directors to attend our annual meeting of stockholders. In 2012, nine directors attended the annual meeting. One director, Mr. Anderson, was unable to attend due to an unavoidable conflict with his duties as chairman of the Manufacturing Council of the U.S. Department of Commerce.

Committee Membership

Our directors served on the following committees in 2012:

| | | | | | | | |

Director | | Audit

Committee | | Compensation

Committee | | Finance

Committee | | Nominating and Governance

Committee |

Mr. Anderson | | | | Chair | | | | X |

Mr. Christenson | | Chair | | X | | | | |

Ms. Clark | | | | X | | X | | |

Mr. Frank | | X | | X | | | | |

Mr. Kennedy | | X | | | | | | X |

Ms. Mullarkey | | X | | | | X | | |

Mr. O’Reilly | | X | | | | Chair | | |

Mr. Satre | | | | | | X | | X |

Mr. Snyder | | | | X | | | | Chair |

Mr. Yackira | | | | | | X | | |

Audit Committee

The Audit Committee is comprised of five directors, all of whom our Board has determined are independent under applicable requirements of the SEC and NYSE. Our Board has further determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined by SEC rules, and is “financially literate” and has “accounting and related financial management expertise” within the meaning of the NYSE listing standards.

Our Audit Committee’s primary duties are described in detail in its charter and are directed toward assisting the Board in fulfilling its oversight responsibilities with respect to:

| | • | | the integrity of our financial statements and related disclosures; |

| | • | | our compliance with legal and regulatory requirements that may have a material impact on our financial statements; |

| | • | | the qualifications and independence of our independent auditor; |

| | • | | the performance of our independent auditor and our internal auditing department; and |

The Audit Committee also is responsible for preparing the report that is set forth below and for the appointment, compensation, retention and oversight of our independent auditor.

Report of the Audit Committee

The Audit Committee has reviewed and discussed our audited consolidated financial statements for the fiscal year-ended December 31, 2012 with NV Energy’s management and has also discussed with our independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T.

8

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee regarding independence, and has discussed with the independent accountants their independence from our Company and our subsidiaries.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in NV Energy’s Annual Report on Form 10-K for the year-ended December 31, 2012, for filing with the SEC.

AUDIT COMMITTEE

Glenn C. Christenson, Chair

Stephen E. Frank

Brian J. Kennedy

Maureen T. Mullarkey

John F. O’Reilly

Compensation Committee

The Compensation Committee is comprised of five directors, all of whom our Board has determined (i) are independent under the NYSE listing standards, (ii) meet the definition of “non-employee director” in the SEC rules promulgated under section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, and (iii) meet the definition of “outside director” for purposes of section 162(m) of the Internal Revenue Code of 1986 (the “Code”), as amended. In determining the independence of the committee members, the Board considered all relevant factors including those specified in recently-adopted NYSE listing standards further to the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Our Compensation Committee’s primary duties are described in detail in its charter and most importantly are directed toward oversight of:

| | • | | the chief executive officer’s performance and compensation; |

| | • | | the compensation of other senior officers; |

| | • | | our compensation and benefit plans, in general; |

| | • | | our non-employee director compensation; and |

| | • | | the executive compensation disclosures in our proxy statement. |

In fulfilling its obligations, our Compensation Committee has obtained the advice and assistance from compensation consulting firm Frederic W. Cook & Co, Inc. (“F.W. Cook”). The Compensation Committee assessed the independence of F.W. Cook pursuant to applicable SEC and NYSE standards and concluded that F.W. Cook’s work for the Compensation Committee does not raise any conflict of interest, and no material relationship exists that would impair the independence of F.W. Cook or the relevant individual consultants.

Compensation Committee Interlocks and Insider Participation

During 2012, no Compensation Committee member was an officer or employee of NV Energy, was a former officer or employee of NV Energy, or had any relationships with NV Energy that require disclosure under the SEC rules and regulations. None of our executive officers served as a director or member of the compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

Finance Committee

The Finance Committee is comprised of five directors. Its primary duties are to review and recommend to the Board action on budget, financing, insurance, dividend, and real estate matters.

9

Nominating and Governance Committee

The Nominating and Governance Committee is comprised of four directors, all of whom our Board has determined are independent under applicable requirements of the SEC and NYSE. Its primary duties are to ensure that we have effective corporate governance policies and practices, and an effective board of directors. The Committee’s specific duties are described in detail in its charter and include, most prominently, oversight of:

| | • | | the size, composition, qualifications, membership and performance of our Board and its committees; |

| | • | | chief executive officer and executive management elections and succession; |

| | • | | our corporate governance structure, guidelines, policies and practices; |

| | • | | related party transactions and ethics and compliance matters; and |

| | • | | our sustainability report. |

Review, Approval or Ratification of Transactions with Related Parties

Our Nominating and Governance Committee is responsible for implementing our Policy and Procedure Governing Related Party Transactions, as adopted by the Board. This written policy provides that the committee will review any contemplated transaction, arrangement or relationship with the Company or its subsidiaries where (1) any of the following has a material interest: a director, director nominee, executive officer, 5% stockholder, or any of their immediate family members, or any entity in which any of the foregoing persons is employed or is a partner or principal or in a similar position or in which such person has a 10% beneficial ownership interest (each, a “Related Party”), and (2) the aggregate amount involved exceeds $50,000 in any calendar year. The committee or its chair, to whom authority has been delegated under certain circumstances, will review the transactions and may approve only those transactions it finds to be in the best interests of the Company and its stockholders, or not inconsistent therewith. Factors to be considered include:

| | • | | the extent of the Related Party’s interest in the transaction; |

| | • | | the benefits to the Company; |

| | • | | the availability of other sources of comparable products or services; |

| | • | | whether the terms of the transaction are no less favorable than terms generally available in unaffiliated transactions under like circumstances; |

| | • | | the aggregate value of the transaction; and |

| | • | | the effect on a director’s independence. |

The policy further provides that certain transactions are deemed pre-approved. Generally, those transactions fall within categories that would not require disclosure as a related party transaction under applicable SEC rules. In 2012, there were no transactions for which the policy was not followed.

PROPOSAL TWO

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with SEC rules and the results of voting at our 2011 annual meeting, our stockholders annually will vote on an advisory basis whether to endorse our executive compensation program. Because the vote is advisory it will not be binding on our Board, but will be considered by the Board when establishing future compensation arrangements. The frequency of such votes will be revisited by our stockholders at the 2017 annual meeting or at an earlier time if our Board deems it appropriate.

At our 2012 annual meeting, of the shares voting or abstaining on our “say-on-pay” proposal, 97.8% were voted in favor, 2.0% were voted against and 0.2% abstained from voting. We considered these results as evidence of broad-based support for our compensation program and decisions as described in the 2012 proxy statement, and as grounds for maintaining a similar approach for 2013.

10

As discussed in the Compensation Discussion and Analysis (“CD&A”) beginning on page 27 of this proxy statement, we believe our executive compensation program reflects a pay-for-performance philosophy that is strongly aligned with the interests of our stockholders and our customers. We use incentive compensation plans that reward success in achieving the Company’s customer service, operational and financial objectives, while encouraging prudent risk management and long-term sustainable growth in stockholder value. We believe that the pay-for-performance philosophy as embodied in our compensation practices has contributed to the Company’s success.

Further points to consider on this proposal include:

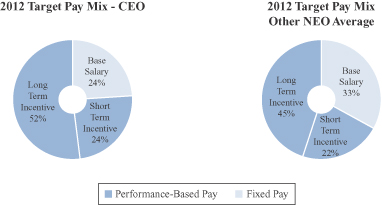

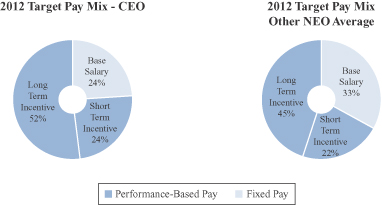

| | • | | Our executive compensation program is heavily weighted toward incentive pay that depends on achieving our goals. The majority of each executive officer’s compensation depends on the Company achieving successful results over one-year and three-year periods and, as such, is “at-risk” of being reduced if the Company does not perform well. |

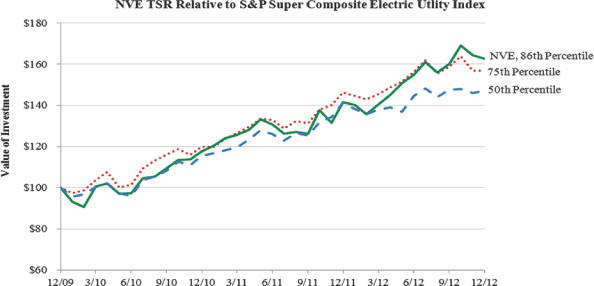

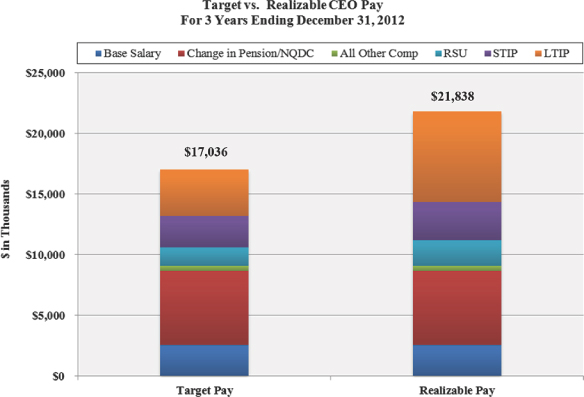

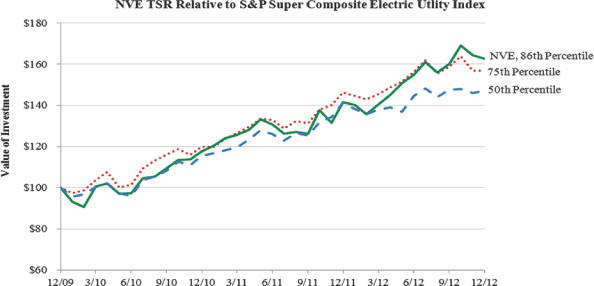

| | • | | We ranked in the 86th percentile for total shareholder return relative to industry peers as reflected in the S&P Super Composite Electric Utility Index for the three-year performance period ended December 31, 2012. To correspond with this successful performance, our Named Executive Officers earned 150% of their target Performance Units granted in 2010 under the Long-Term Incentive Plan (“LTIP”). |

| | • | | For the same three-year performance period, our annual company performance goal score under the Short-Term Incentive Plan (“STIP”) averaged 117%, indicating that the annual company performance goals established by the Board were met and exceeded, on average. As a result, our Named Executive Officers earned 117% of their target Performance Shares granted in 2010 under the LTIP. |

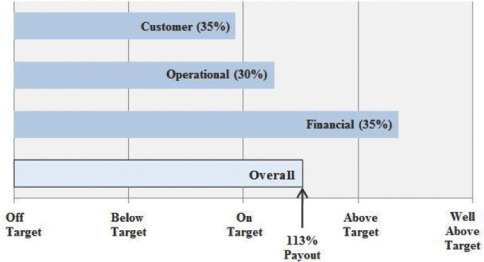

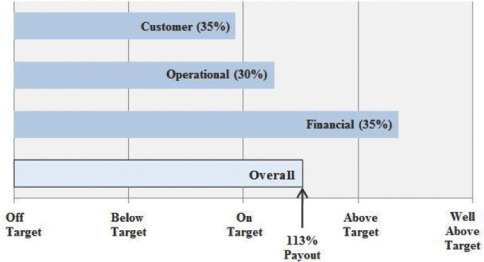

| | • | | For 2012, we achieved overall performance results which exceeded our target. Our Named Executive Officers accordingly earned from 113% to 116% of their 2012 target opportunity under the STIP, taking into account their respective achievement of individual performance objectives. |

| | • | | We have upper limits on payouts of STIP and LTIP awards of 150% of target, and the Compensation Committee has never adjusted awards above those limits. We have a floor of 0% for the same payouts. Notably, in 2008 and 2009 no Performance Units vested under the LTIP and the Board did not authorize any relief to offset the negative impact on Named Executive Officer compensation in those years. |

| | • | | We encourage long-term stock ownership by our executives. The stock ownership requirement for our chief executive officer is five times base salary, with a requirement to retain 100% of net shares realized from equity compensation until this ownership level is met. The requirement for other Named Executive Officers is three times base salary, with a requirement to retain 50% of net shares realized until the ownership level is met. All hedging of our stock is prohibited. |

| | • | | Our LTIP specifically prohibits the repricing of stock options. This policy is affirmed in our Corporate Governance Guidelines (available on our website atwww.nvenergy.com). |

| | • | | We have no tax gross-ups for change in control payments, and our change in control policy requires a second trigger before awards granted to officers can vest following a change in control. |

For these reasons, and the reasons discussed in our Compensation Discussion and Analysis beginning on page 27, our Board recommends that you vote “FOR” the resolution:

“Resolved, that the stockholders of NV Energy, Inc., approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as described in the Compensation Discussion and Analysis and the compensation tables (together with the accompanying narrative disclosure) in this proxy statement.”

11

PROPOSAL THREE

APPROVAL OF THE NV ENERGY, INC 2013 LONG TERM INCENTIVE PLAN

The Board is requesting that the stockholders approve the NV Energy, Inc. 2013 Executive Long Term Incentive Plan (the “2013 LTIP”). The 2004 LTIP (as defined below) is scheduled to terminate at the end of 2013. If this proposal is approved, the 2004 LTIP will no longer be used for the granting of new awards.

Subject to certain adjustments provided in the 2013 LTIP as described below, the total number of shares available for grant under the 2013 LTIP will be 8,707,154, which is a net increase of 6,250,000 new shares added to the 2,457,154 shares which remain available for issuance under the 2004 LTIP as of December 31, 2012. The number of shares available for grant will be reduced by one share for every share granted under the 2013 LTIP, plus one share for each share subject to awards granted under the 2004 LTIP on or after January 1, 2013 and prior to stockholder approval of the 2013 LTIP.

We have been able to manage our equity award program so that it has had only a limited impact on stockholder dilution. When the 2004 LTIP was originally approved by stockholders in May 2004, the total number of shares of NV Energy common stock authorized for issuance under the plan was 7,750,000, equivalent at that time to approximately 6.61% of outstanding shares. No shares have been added to the 2004 LTIP since its initial approval. If the 2013 LTIP is approved, there will be a net increase of 6,250,000 shares that may be issued as equity awards to executives over what is currently available under the 2004 LTIP. That increase is the equivalent of approximately 2.66% of currently outstanding shares, and the total shares available under the 2013 LTIP would be the equivalent of approximately 3.70% of currently outstanding shares. The average rate at which shares were granted over the past three years as a percentage of the weighted average shares outstanding in those same years was 0.41%.

The following table sets forth certain information about the 2013 LTIP and the 2004 LTIP as of December 31, 2012:

| | | | |

Number of shares authorized for future grant under the 2013 LTIP after stockholder approval (1) | | | 8,707,154 | |

Number of shares relating to outstanding stock options at December 31, 2012 under the 2004 LTIP | | | 356,437 | |

Number of shares at December 31, 2012 relating to outstanding restricted stock unit, performance unit and performance share awards under the 2004 LTIP (2) | | | 2,520,690 | |

Weighted average remaining term of outstanding options | | | 4.15 years | |

Weighted average exercise price of outstanding options | | | $ 17.90 | |

(1) | Grants of stock-based awards will count against the authorization as one share for every one share granted. The authorization will also be reduced by the number of shares granted under the 2004 LTIP between January 1, 2013 and the date of stockholder approval, and shares subject to awards under the 2004 LTIP that expire or are forfeited after December 31, 2012 will again be available for grant under the 2013 LTIP. |

(2) | Of the total 2,520,690 shares reflected in this row, 1,923,549 of such shares relate to outstanding performance awards at December 31, 2012. |

On March 11, 2013, the last reported sale price of NV Energy’s common stock on the NYSE was $20.15.

General

As we describe in the CD&A, long-term equity incentive compensation is critical to our ability to attract and retain highly-skilled executives. In recent years, we have issued performance units, performance shares and restricted stock units pursuant to the Amended and Restated NV Energy, Inc. 2004 Executive Long Term Incentive Plan, which was most recently amended and restated January 1, 2011 (the “2004 LTIP”). Because the 2004 LTIP is scheduled to expire on December 31, 2013, there will be no other equity plan available for awards to executives of the Company after that date. Accordingly, the Board, acting upon recommendation of the Compensation Committee, approved the 2013 LTIP on February 7, 2013, subject to stockholder approval at the Company’s 2013 Annual Meeting.

12

The 2013 LTIP will supersede and replace the 2004 LTIP;provided,however, that the 2004 LTIP will remain in effect until all awards granted under that plan have been exercised, forfeited, canceled or have otherwise expired or terminated. No awards will be granted under the 2004 LTIP on or after the date on which the 2013 LTIP is approved by the Company’s stockholders.

In determining the number of shares to authorize for the 2013 LTIP, the Board considered a number of factors, including the need to replenish the number of shares available for equity incentive awards in order to attract and retain talented executives, the rate at which equity awards have been made in recent years and the projected need for additional shares, the input of the independent compensation consultant, F.W. Cook, the fact that no additional shares have been requested for executive equity awards since 2004, and the number of shares remaining under the 2004 LTIP.

Like the 2004 LTIP, the purpose of the 2013 LTIP is to promote the success and enhance the value of the Company by linking the personal interests of participants to those of Company stockholders, customers, and employees by providing participants with an incentive for outstanding performance. The 2013 LTIP is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of participants upon whose judgment, interest, and special effort the successful conduct of its operation is largely dependent. The 2013 LTIP emphasizes pay-for-performance by tying reward opportunities to carefully determined and articulated performance goals at corporate, business unit, and individual levels. To further these objectives, the 2013 LTIP provides for the grant of options, stock appreciation rights (“SARs”), restricted stock, restricted stock units, performance units, performance shares, performance cash, stock grants, stock units and dividend equivalent rights.

Consistent with the 2004 LTIP, the 2013 LTIP contains a number of provisions that we believe reflect best practices for equity incentive compensation plans, including the following:

| | • | | Expressly prohibits the Compensation Committee from repricing stock options and SARs without prior stockholder approval. |

| | • | | An express requirement that all options and SARs be granted at an exercise price that is at least equal to the fair market value of a share of stock on the date of grant. |

| | • | | Precludes the payment of dividend equivalent rights for any dividend equivalent right granted in connection with any restricted stock unit award that vests based on the achievement of performance goals, or with respect to a performance share or performance unit award, unless and until such award vests or is earned by satisfaction of the applicable performance goals. |

| | • | | The award agreement for any award granted pursuant to the 2013 LTIP will provide for the recapture or clawback of all or any portion of the award to comply with applicable law in effect on the date of the award agreement, including but not limited to, the final rules issued under the Dodd-Frank Wall Street Reform and Consumer Protection Act and with any Company request or demand for recapture or clawback. |

| | • | | By accepting an award granted pursuant to the 2013 LTIP, each participant agrees to comply with the Company’s stock ownership guidelines. |

Section 162(m) of the Code

The 2013 LTIP is designed to help the Company comply with the rules relating to its ability to deduct in full for federal income tax purposes the compensation recognized by its executive officers in connection with certain types of awards. Section 162(m) of the Internal Revenue Code (the “Code”) generally denies a corporate tax deduction for annual compensation exceeding $1 million paid to the principal executive officer or any of the three other most highly compensated executive officers of a publicly held company other than the principal financial officer. However, qualified performance-based compensation is excluded from this limit. To enable compensation in connection with stock options, stock appreciation rights, certain restricted stock and restricted stock unit awards, performance units, performance shares, performance cash, stock grants, stock units and dividend equivalent rights granted under the 2013 LTIP that are intended to qualify as “performance-based”

13

within the meaning of Section 162(m) of the Code, the stockholders are being asked to approve certain material terms of the 2013 LTIP. By approving the 2013 LTIP, the stockholders will be specifically approving, among other things:

| | • | | the eligibility requirements for participation in the 2013 LTIP; |

| | • | | the maximum numbers of shares for which stock-based awards may be granted to an employee in any fiscal year; |

| | • | | the maximum dollar amount that a participant may receive under a cash-based award for each fiscal year contained in the performance period; and |

| | • | | the performance criteria that may be used by the Compensation Committee to establish the performance goals applicable to the grant or vesting of awards other than stock options and stock appreciation rights that are intended to result in qualified performance-based compensation. |

While we believe that compensation provided by such awards under the 2013 LTIP generally should be deductible by the Company for federal income tax purposes, under certain circumstances, such as a change in control of the Company, compensation paid in settlement of certain awards intended to qualify as performance-based may not actually qualify as performance-based. In addition, because the Compensation Committee does not believe that compensation decisions should be constrained necessarily by how much compensation is deductible, the 2013 LTIP also authorizes the Compensation Committee to grant awards to executives which would not qualify as “performance-based” compensation under Section 162(m) of the Code. Section 162(m) (including a list of the performance criteria) is further discussed below under the heading “Performance Based Compensation Awards.”

Summary of the Material Provisions of the 2013 LTIP

A summary of the 2013 LTIP’s principal provisions is set forth below. The summary is qualified by reference to the full text of the 2013 LTIP, a copy of which is attached as Exhibit A to this Proxy Statement. Defined terms not otherwise defined in this summary shall have the meanings assigned in the 2013 LTIP.

Administration of the 2013 LTIP

The 2013 LTIP will be administered by the Compensation Committee of the Board (the “Committee”). The Committee shall consist of not less than two members of the Board who are: (i) “independent directors” as defined in the NYSE Listing Standards; (ii) “non-employee directors” within the meaning of Rule 16b-3 of the Exchange Act; and (iii) “outside directors” within the meaning of Section 162(m) of the Code, in each case, as each such rule or regulation is in effect from time to time. The Committee’s powers are fully described in Article 2 of the 2013 LTIP and include, but are not limited to, designating participants to receive awards, determining the size and types of awards, and determining the other terms and conditions of each award.

To the extent not inconsistent with applicable law or the rules and regulations of the principal U.S. national securities exchange on which the Company’s common stock is traded, the Committee may:

| | • | | delegate to a committee of one or more directors of the Company any of the authority of the Committee under the Plan, including the right to grant, cancel or suspend awards, and |

| | • | | authorize one or more executive officers to do one or more of the following with respect to employees who are not directors or executive officers of the Company: |

| | ¡ | | designate employees to be recipients of awards, |

| | ¡ | | determine the number of Shares subject to such awards to be received by such employees, and |

| | ¡ | | cancel or suspend awards to such employees; provided that (i) any resolution of the Committee authorizing such officer(s) must specify the total number of shares subject to awards that such officer(s) may so award, and (ii) the Committee may not authorize any officer to designate himself or herself as the recipient of an award. |

14

The Committee may adopt such other rules and procedures as it deems appropriate for purposes of administering the 2013 LTIP.

Shares Available for Grant

The total number of shares available for grant under the 2013 LTIP is 8,707,154. The number of shares available for grant will be reduced by one share for each share subject to awards granted under the 2013 LTIP, plus one share for each share subject to awards granted under the 2004 LTIP on or after January 1, 2013 and prior to stockholder approval of the 2013 LTIP. The number of shares reserved for grants pursuant to the 2013 LTIP is subject to adjustment in the event of certain changes in capital structure as described below under “Adjustment Provisions.”

For purposes of calculating the number of shares available for grant under the 2013 LTIP, the following share counting rules apply:

| | • | | Shares tendered or withheld to pay the exercise price of an option or other award or to satisfy a tax withholding obligation arising in connection with any award, under the 2013 LTIP or with respect to an award under the 2004 LTIP after December 31, 2012, will be available for grant under the 2013 LTIP on a one-for-one basis. |

| | • | | If any award granted under the 2013 LTIP, or any award outstanding under the 2004 LTIP after December 31, 2012, is forfeited, expires or otherwise terminates without the issuance of shares, or is settled for cash (in whole or in part) or otherwise does not result in the issuance of all or a portion of the shares subject to such award (including on payment in shares on exercise of a stock appreciation right), the shares subject to such award shall again become available for grant under the 2013 LTIP on a one-for-one basis. |

As of the date of this proxy statement, the following transactions would affect the number of shares available for grant under the 2013 LTIP. In February 2013, the Board made annual equity grants under the 2004 LTIP relating to an aggregate of 549,066 shares. Since January 1, 2013, an aggregate of 377,760 shares were tendered or withheld to pay the exercise price or to satisfy withholding tax obligations of awards made under the 2004 LTIP, and awards relating to 10,875 shares previously granted under the 2004 LTIP were forfeited, expired or otherwise terminated. The net effect of the foregoing transactions will be to reduce by 160,431 the number of shares available for grant under the 2013 LTIP.

Limits on Awards

To enable compensation provided in connection with certain types of awards intended to qualify as “performance-based” within the meaning of Section 162(m) of the Code, the 2013 LTIP establishes a limit on the maximum aggregate number of shares or dollar value for which such awards may be granted to an employee in any fiscal year which are intended to qualify as performance-based awards under Section 162(m) of the Code, as follows:

Subject to the Adjustment Provisions described below, no participant may be granted (i) options or stock appreciation rights during any calendar year with respect to more than 2,000,000 shares, and (ii) awards (other than options or stock appreciation rights) during any calendar year that are intended to comply with the performance-based exception under Section 162(m) of the Code and are denominated in shares under which more than 1,000,000 shares may be earned for each 12 months in the vesting period or performance period. During any calendar year no participant may be granted an award intended to satisfy the requirements of the performance-based compensation exception to the limitations imposed by Section 162(m) of the Code denominated in cash under which more than $5,000,000 may be earned for each 12 months in the performance period. Each of the limitations described in this paragraph will be multiplied by two with respect to awards granted to a participant during the first calendar year in which the participant commences employment with the Company and its subsidiaries. If an award is cancelled, the cancelled award will continue to be counted toward the applicable limitation described in this paragraph.

15

In addition to the annual limits described above, the maximum aggregate number of shares available for grant under the 2013 LTIP as incentive stock options is the same number as the total number of shares available for grant under the 2013 LTIP.

Eligibility and Participation

Persons eligible to participate in the 2013 LTIP include all full-time or part-time employees of the Company and its subsidiaries, including those members of the Board of the Company and its subsidiaries who are also employees. Awards (other than incentive stock options) also may be granted to prospective employees, but no portion of any such award will vest or become effective prior to the date on which the individual begins to provide services to the Company or any subsidiary. As of January 22, 2013, the Company and its subsidiaries had 2,699 employees who would have been eligible to participate in the 2013 LTIP.

Awards under the 2013 LTIP

The following types of awards may be granted under the 2013 LTIP:

Stock Options.The Committee may grant incentive stock options (“ISOs”), nonqualified stock options (“NQSOs”), or any combination thereof. ISOs will only be granted to participants who are full-time or part-time employees of the Company or of the Company’s subsidiaries. The option price for all stock options granted shall be at least equal to 100% (110% for an ISO granted to a 10% or more shareholder) of the fair market value of a share of the Company’s stock on the date of grant. Options shall expire at such times as the Committee shall determine;provided,however, that no option may be exercisable later than the tenth anniversary (the fifth anniversary in case of an ISO granted to a 10% or more shareholder) of the grant date. Without prior stockholder approval, an option may not be amended or modified to reduce the exercise price after the grant date or surrendered in consideration of or exchanged for cash, other awards or a new option having an exercise price below that of the option being surrendered or exchanged, except in connection with an adjustment pursuant to a change in the Company’s capital structure and pursuant to the plan, as described below.

Options shall be exercisable at such times and subject to such restrictions and conditions as the Committee shall determine. The exercise price for any option shall be payable in cash, a promissory note (other than for executive officers), any net-issuance or cashless exercise arrangement, or any other property acceptable to the Committee (including broker-assisted “cashless exercise” arrangements).

The 2013 LTIP specifies each participant’s rights with respect to ISOs and NQSOs in the event of a termination of employment. Generally, unless otherwise provided in the award agreement, the following rules apply to NQSOs: (i) if a participant incurs a termination of employment (as defined in the 2013 LTIP), all unvested NQSOs are forfeited; (ii) if a participant incurs a termination of employment on account of death, disability (as defined in the 2013 LTIP), or retirement (as defined in the 2013 LTIP), all vested NQSOs remain exercisable until the earlier of the option’s expiration date or 12 months after termination of employment; and (iii) if a participant incurs a termination of employment for any reason other than death, disability or retirement, all vested NQSOs shall lapse (and no longer be exercisable) as of the end of the 90th day following the date of the participant’s termination of employment. The term of a NQSO shall be extended if on the last business day of the term the exercise is prohibited by applicable law or the shares may not be purchased or sold due to the “black-out period” of a Company policy or a “lock-up” agreement undertaken in connection with the issuance of securities by the Company. The extension shall continue for a period of 30 days following the end of the legal prohibition, blackout period or lock-up agreement.

Incentive stock options lapse upon the end of the three month period following the participant’s termination of employment, except in the case of death or disability in which ISOs may be exercised until the earlier of the scheduled expiration of the ISO or 12 months after the death or disability.

Stock Appreciation Rights.The Committee may grant freestanding SARs, tandem SARs, or any combination thereof. The base value of a freestanding SAR shall equal 100% of the fair market value of a share of stock on the grant date. The base value of a tandem SAR shall equal 100% of the fair market value of one share of stock on the grant date of the option related to the tandem SAR. SARs shall expire at such times as the

16

Committee shall determine;provided,however, that no SAR may be exercisable later than the tenth anniversary of the grant date. Without prior stockholder approval, a SAR may not be amended or modified to reduce the base value after the grant date or surrendered in consideration of or exchanged for cash, other awards or a new SAR having a base value below that of the SAR being surrendered or exchanged, except in connection with an adjustment pursuant to a change in the Company’s capital structure and pursuant to the plan, as described below.

SARs shall be exercisable at such times and subject to such restrictions as the Committee shall determine. Upon the exercise of a SAR, a participant shall be entitled to receive a payment in an amount determined by multiplying: (i) the difference between the fair market value of one share as of the date of exercise over the base value fixed by the Committee at the grant date; by (ii) the number of shares with respect to which the SAR is exercised. Payment shall be made at the time and in the manner specified by the Committee. The permissible manners of payment include cash, shares of equivalent value, or any combination thereof.

The 2013 LTIP specifies each participant’s rights with respect to SARs in the event of a termination of employment. Generally, unless otherwise provided in the award agreement, the following rules apply to SARs: (i) if a participant incurs a termination of employment all unvested SARs are forfeited; (ii) if a participant incurs a termination of employment on account of death, disability, or retirement, all vested SARs remain exercisable until the earlier of the SAR’s expiration date or 12 months after termination of employment; and (iii) if a participant incurs a termination of employment for any reason other than death, disability or retirement, all vested SARs shall lapse (and no longer be exercisable) as of the end of the 90th day following the date of the participant’s termination of employment. The term of a SAR shall be extended if on the last business day of the term the exercise is prohibited by applicable law or the shares may not be purchased or sold due to the “black-out period” of a Company policy or a “lock-up” agreement undertaken in connection with the issuance of securities by the Company. The extension shall continue for a period of 30 days following the end of the legal prohibition, blackout period or lock-up agreement.

Restricted Stock.The Committee may grant restricted stock awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A restricted stock award gives the participant the right to receive a specified number of shares of stock at a purchase price, if any, determined by the Committee. Except as otherwise provided in the award agreement, participants holding shares of restricted stock may exercise full voting rights with respect to those shares during the period of restriction.

The 2013 LTIP specifies each participant’s rights with respect to restricted stock in the event of a termination of employment. Generally, unless otherwise provided in the award agreement, the following rules apply to restricted stock awards. If a participant incurs a termination of employment on account of death, disability, or retirement, any time-based or other restrictions shall lapse and the participant shall receive a prorated payment. For restricted stock subject to time-based restrictions only, the prorated payment shall be determined by multiplying the number of shares of restricted stock the participant would have received had the participant continued employment through the end of the period of restriction by a fraction, the numerator of which is the number of whole months of the participant’s employment during the period of restriction and the denominator of which is the number of months in the period of restriction. For restricted stock subject to both time-based and performance-based restrictions, the prorated payment shall be determined by multiplying the number of shares of restricted stock earned during the period of restriction (based upon the level of achievement of the performance-based restrictions as determined at the end of the period) by a fraction, the numerator of which is the number of whole months of the participant’s employment during the restriction period and the denominator of which is the total number of months in the period of restriction. If a participant incurs a termination of employment for any reason other than death, disability or retirement during a period of restriction, all unvested restricted stock awards shall be forfeited.

Restricted Stock Units.The Committee may grant restricted stock unit awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A restricted stock unit award gives the participant the right to receive a specified number of shares of stock, or a cash payment, equal to the fair market value (determined as of a specified date) of a specified number of shares of stock. Participants shall not have any voting rights with respect to shares underlying a restricted stock unit award.

17

The 2013 LTIP specifies each participant’s rights with respect to restricted stock units in the event of a termination of employment. Generally, unless otherwise provided in the award agreement, the following rules apply to restricted stock unit awards. If a participant incurs a termination of employment on account of death, disability, or retirement, any time-based or other restrictions shall lapse and the participant shall receive a prorated payment. For restricted stock units subject to time-based restrictions only, the prorated payment shall be determined by multiplying the number of restricted stock units the participant would have received had the participant continued employment through the end of the period of restriction by a fraction, the numerator of which is the number of whole months of the participant’s employment during the period of restriction and the denominator of which is the number of months in the period of restriction. For restricted stock units subject to both time-based and performance-based restrictions, the prorated payment shall be determined by multiplying the number of restricted stock units earned during the period of restriction (based upon the level of achievement of the performance-based restrictions as determined at the end of the period) by a fraction, the numerator of which is the number of whole months of the participant’s employment during the restriction period and the denominator of which is the total number of months in the period of restriction. If a participant incurs a termination of employment for any reason other than death, disability or retirement during a period of restriction, all unvested restricted stock unit awards shall be forfeited.

Stock Grant Awards.The Committee may grant stock grant awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A stock grant award gives the participant the right to receive (or purchase at such price as determined by the Committee) shares of stock, free of any vesting restrictions. The purchase price, if any, for a stock grant award shall be payable in cash or in any other form of consideration acceptable to the Committee. A stock grant award may be granted or sold in respect of any legal consideration.

Stock Unit Awards.The Committee may grant stock unit awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A stock unit award gives the participant the right to receive shares of stock, or a cash payment equal to the fair market value of a designated number of shares, in the future, free of any vesting restrictions. A stock unit award may be granted or sold in respect of any legal consideration.

Performance Units.The Committee may grant performance unit awards upon such terms and conditions, and at any time, and from time to time, as the Committee shall determine. A performance unit award gives the participant the right to receive a specified number of shares of stock, or a cash payment equal to the fair market value (determined as of a specified date) of a specified number of shares, depending on the satisfaction of one or more performance goals for a particular performance period. The achievement of the performance goals for a particular performance period will determine the ultimate value of the performance unit award. Unless otherwise provided in the award agreement, payment for a performance unit award shall be made in a single lump sum payment in cash, shares of stock, or a combination thereof, within 70 days following the end of the applicable performance period.