SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | | |

| | | |

| Check the appropriate box: | | |

| [ ] | | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 |

| [ ] | | Confidential, For Use of the

Commission Only (as permitted

by Rule 14a-6(e)(2)) | | |

| [X] | | Definitive Proxy Statement | |

| [ ] | | Definitive Additional Materials | |

| | NV ENERGY, INC. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | 2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | 4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | 5) | | Total fee paid: |

| | | | | |

| [ ] | | Fee paid previously with preliminary materials: |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | 1) | | Amount previously paid: |

| | | | | |

| | | 2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | 3) | | Filing Party: |

| | | | | |

| | | 4) | | Date Filed: |

| | | | | |

Michael W. Yackira

President and Chief

Executive Officer

March 21, 2011

To Our Stockholders:

On behalf of the Board of Directors, I am pleased to invite you to attend the 2011 Annual Meeting of the Stockholders of NV Energy, Inc. The Annual Meeting will be held on Tuesday, May 3, 2011 at 8:00 a.m. Pacific Time at NV Energy’s Southern Operations Center (Beltway Complex), located at 7155 Lindell Rd., Las Vegas, NV 89118. The formal notice of the Annual Meeting is set forth on the next page. A map of the Annual Meeting location can be found at the end of the attached proxy statement.

The matters to be acted upon at the meeting are described in the attached proxy statement. During the meeting, you and other stockholders will have the opportunity to ask questions and comment on the Company’s operations. Board members, officers, and other employees of the Company will be available to visit with you before and after the formal meeting to answer whatever questions you may have. In addition to the matters set forth herein, we will also discuss 2010 financial results. Refreshments will be provided before and after the meeting.

Your views and opinions are very important to the Company. Whether or not you are able to be present at the Annual Meeting, we would appreciate it if you would please review the enclosed proxy statement and the Annual Report. Regardless of the number of shares you own, please promptly vote your shares by Internet, telephone or mail.

We greatly appreciate the interest expressed by our stockholders, and we are pleased that in the past so many of you have voted your shares either in person or by proxy. We hope that you will continue to do so and urge you to execute and return your proxy as soon as possible.

As our primary distribution method, we are furnishing proxy materials to our stockholders over the Internet. You may read, print and download our Annual Report and proxy statement at the investor section of our website at www.nvenergy.com (select “About our Company”; then “Investor Relations”).

| Sincerely, |

| |

|

NV ENERGY, INC.

6226 W. Sahara Avenue

Las Vegas, Nevada 89146

__________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 3, 2011

__________________________________

To our Stockholders:

The 2011 Annual Meeting of Stockholders of NV Energy, Inc. (“Annual Meeting”) will be held at NV Energy’s Southern Operations Center (Beltway Complex), located at 7155 Lindell Rd., Las Vegas, NV 89118 at 8:00 a.m., Pacific Time. At the meeting, stockholders of NV Energy, Inc. (“Company”) will consider and vote on the following matters:

| | 1. | | Elect to the Board of Directors the six nominees who are named in the attached proxy statement to serve until the Annual Meeting in 2012, and until their successors are elected and qualified; |

| | |

| | 2. | | An advisory vote on the Company’s executive compensation; |

| | |

| | 3. | | An advisory vote on the frequency of stockholder voting on the Company’s executive compensation; |

| | |

| | 4. | | Approval of certain amendments to and material terms of performance goals of the Company’s Amended and Restated Executive Long-Term Incentive Plan; |

| | |

| | 5. | | Approval of amendment of Articles of Incorporation to reduce super-majority vote required to amend Article on Director elections and removals; |

| | |

| | 6. | | Approval of amendment of Articles of Incorporation to reduce super-majority votes in “fair price” provision; |

| | |

| | 7. | | Ratify the selection of the Company’s independent registered public accounting firm; |

| | |

| | 8. | | Consider a stockholder proposal relating to majority voting for Directors to be included in the By- Laws; |

| | |

| | 9. | | Consider a stockholder proposal to amend the By-Laws to allow 15% of stockholders to call a special meeting; |

| | |

| | 10. | | Consider a stockholder proposal to adopt a policy requiring executives to hold equity compensation through termination of employment; and |

| | |

| | 11. | | Transact such other business as may properly come before the meeting, and any or all adjournments thereof. |

Stockholders of record of common stock at the close of business on March 8, 2011, will be entitled to vote by proxy or in person at the meeting, and any or all adjournments thereof.

As our primary distribution method, we are furnishing proxy materials to our stockholders over the Internet. You may read, print and download our Annual Report and proxy statement at the investor section of our website at www.nvenergy.com. On March 21, 2011, we sent you a notice card by mail with instructions on how to access our proxy materials and Annual Report on the Internet and how to vote online. The notice further explains how to request a paper copy of the proxy materials and the Annual Report, if desired. Alternatively, if you have selected this as a preference in the past, you may have received your annual materials via email. Your email contains links to our proxy materials and annual report on the Internet and instructions how to vote online.

You are cordially invited to attend the Annual Meeting in person. Whether you plan to attend the meeting or not, please read the accompanying proxy statement and then vote your shares as early as possible. You can change your vote and revoke your proxy at any time before the polls close at the meeting by following the procedures described in the accompanying proxy statement.

| On Behalf of the Board of Directors |

|

| PAUL J. KALETA, |

| Corporate Secretary |

Las Vegas, Nevada

March 21, 2011

TABLE OF CONTENTS

| GENERAL | 1 |

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 1 |

| PROPOSAL NUMBER ONE – ELECTION OF DIRECTORS | 6 |

| PROPOSAL NUMBER TWO – ADVISORY VOTE ON THE COMPANY’S EXECUTIVE | |

| COMPENSATION | 14 |

| PROPOSAL NUMBER THREE – ADVISORY VOTE ON FREQUENCY OF THE VOTE ON | |

| EXECUTIVE COMPENSATION | 17 |

| PROPOSAL NUMBER FOUR – APPROVAL OF CERTAIN AMENDMENTS TO AND | |

| MATERIAL PERFORMANCE GOALS OF THE RESTATED EXECUTIVE LONG-TERM | |

| INCENTIVE PLAN | 18 |

| PROPOSAL NUMBER FIVE – AMENDMENT OF ARTICLES OF INCORPORATION TO | |

| REDUCE SUPER-MAJORITY VOTE REQUIRED FOR AMENDING ARTICLE ON | |

| DIRECTOR ELECTIONS AND REMOVALS | 27 |

| PROPOSAL NUMBER SIX – AMENDMENT OF ARTICLES OF INCORPORATION TO | |

| REDUCE SUPER-MAJORITY VOTE REQUIREMENTS IN THE “FAIR PRICE” | |

| PROVISIONS | 29 |

| PROPOSAL NUMBER SEVEN – RATIFICATION OF THE SELECTION | |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 29 |

| PROPOSAL NUMBER EIGHT – STOCKHOLDER PROPOSAL FOR MAJORITY VOTING | |

| FOR DIRECTORS TO BE INCLUDED IN COMPANY’S BY-LAWS | 30 |

| PROPOSAL NUMBER NINE – STOCKHOLDER PROPOSAL TO AMEND BY-LAWS TO | |

| ALLOW 15% OF STOCKHOLDERS TO CALL SPECIAL MEETING | 31 |

| PROPOSAL NUMBER TEN – STOCKHOLDER PROPOSAL TO ADOPT POLICY | |

| REQUIRING SENIOR EXECUTIVES TO HOLD EQUITY COMPENSATION THROUGH | |

| TERMINATION OF EMPLOYMENT | 33 |

| BOARD AND GOVERNANCE MATTERS | 34 |

| BOARD COMMITTEES | 36 |

| EMPLOYEE COMPENSATION | 37 |

| EXECUTIVE COMPENSATION | 39 |

| EQUITY COMPENSATION PLAN INFORMATION | 80 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 81 |

| SECTION 16 BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 83 |

| AUDIT COMMITTEE REPORT | 83 |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 84 |

| COMPENSATION COMMITTEE REPORT | 84 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 85 |

| INDEPENDENT PUBLIC ACCOUNTANTS | 87 |

| COMMUNICATIONS WITH DIRECTORS | 88 |

| OTHER MATTERS | 88 |

NV ENERGY, INC.

6226 W. Sahara Avenue

Las Vegas, NV 89146

________________________

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

________________________

GENERAL

This proxy statement contains information about the 2011 Annual Meeting of Stockholders of NV Energy, Inc. (the “Annual Meeting”). The Annual Meeting will be held on Tuesday, May 3, 2011 at 8:00 a.m. Pacific Time at NV Energy’s Southern Operations Center (Beltway Complex), located at 7155 Lindell Road, Las Vegas, NV 89118.

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of NV Energy, Inc. (the “Company”) for use at the Annual Meeting and any adjournment thereof. All returned proxies that are not revoked will be voted in accordance with your instructions. If you return your proxy and leave blank a voting instruction, the matter will be voted in accordance with the Board’s recommendation. References in this proxy statement to the “Company,” “NVE,” “we,” “us,” or “our” refer to NV Energy, Inc. References in this proxy statement to “NVE North,” or “NVE South,” refer to the Northern and Southern service territories of our regulated utility subsidiaries (or “Utilities”).

We make our proxy materials and our Annual Report to Stockholders for 2010 available on the Internet as our primary distribution method. Most stockholders will be mailed only a Notice of Internet Availability of Proxy Materials (the “Notice”). We expect to mail the Notice on March 21, 2011. Hard copies of annual meeting materials can be specifically requested. The Notice specifies how to access proxy materials on the Internet and how to submit your proxy vote.

You can request a hard copy of the proxy statement, our Annual Report to Stockholders (the “Annual Report”) and/or our Annual Report on Form 10-K for 2010, by contacting:

Broadridge Financial Solutions

51 Mercedes Way

Edgewood, NY 11717

Telephone: (800) 579-1639

Internet: www.materials.proxyvote.com/67073Y

If you have any questions about the Annual Meeting, the content of our proxy materials, our Annual Report or about your ownership of our common stock, please contact the NVE Shareholder Relations Department at:

NV Energy, Inc.

6226 W. Sahara Avenue MS51

Las Vegas, NV 89146

Attn: Shareholder Relations

Telephone: (800) 662-7575

ANNUAL MEETING AND VOTING INFORMATION

Who can vote?

Stockholders of record at the close of business on March 8, 2011 (the “Record Date”) are entitled to vote at the Annual Meeting. The number of outstanding shares of our common stock entitled to vote at the Annual Meeting is 235,665,136.

What matters are before the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the matters outlined below. In determining how to vote, please consider the detailed information regarding each proposal as discussed on the referenced pages in this proxy statement. The Board of Directors recommends that you vote for each of the Director nominees in Proposal 1, in favor of Proposals 2 through 7 and against Proposals 8 through 10.

| | | Discussion | Board | |

| | Proposal | on pages | Recommendation | Voting required for approval |

| 1 | Elect to the Board of Directors the six nominees who are named in this proxy statement to serve until the Annual Meeting in 2012, and until their successors are elected and qualified. | 6 through 14 | FOR | Plurality of the votes cast by stockholders present, in person or by proxy, at the Annual Meeting. See below for a description of the Company’s policy which requires a Director to tender his or her resignation if a greater number of votes is withheld than cast for that particular nominee. |

| 2 | Advisory vote on NVE’s executive compensation.

| 14 through 17 | FOR “1 year” frequency | A majority of the votes cast with respect to this proposal. |

| 3 | Advisory vote on the frequency of stockholder voting on NVE’s executive compensation.

| 17 through 18 | FOR | The option that receives the highest number of votes cast. |

| 4 | Approval of certain amendments to and material terms of performance goals of Restated Long-Term Incentive Plan

| 18 through 27 | FOR | A majority of the votes cast with respect to this proposal. |

| 5 | Amendment of Articles of Incorporation to reduce super-majority vote required for amending article on Director elections and removals.

| 27 through 28 | FOR | A majority of shares entitled to vote at the Annual Meeting. |

| 6 | Amendment of Articles of Incorporation to reduce super-majority requirements in the “fair price” provisions.

| 29 through 29 | FOR | Two-thirds of votes entitled to vote at the Annual Meeting. |

| 7 | Ratification of selection of the Company’s independent registered public accounting firm.

| 29 through 30 | FOR | A majority of the votes cast with respect to this proposal. |

| 8 | Stockholder proposal for majority voting for Directors to be included in Company’s By-Laws.

| 30 through 31 | AGAINST | A majority of the votes cast with respect to this proposal. |

| 9 | Stockholder proposal to amend By-Laws to allow 15% of stockholders to call special meeting.

| 31 through 32 | AGAINST | A majority of votes cast with respect to this proposal. |

| 10 | Stockholder proposal to adopt policy requiring senior executives to hold equity compensation through termination of employment.

| 33 through 34 | AGAINST | A majority of votes cast with respect to this proposal. |

2

What happens if a Director receives a greater number of votes “withheld” than votes “for” such Director?

As noted above, a plurality of votes cast by stockholders present, in person or by proxy, at the Annual Meeting is required for the election of our Directors. “Plurality” means that the nominees receiving the largest number of votes cast are elected as Directors up to the maximum number of Directors who are nominated to be elected at the meeting. Under the policy adopted by the Board of Directors on February 19, 2010, if a Director nominee in an uncontested election receives a greater number of votes “withheld” from his or her election than votes “for” such election, the Director must promptly tender a resignation from the Board of Directors. The Board of Directors will then decide whether to accept the resignation within 120 days following certification of the stockholder vote (based on the recommendation of the Nominating and Governance Committee, which is comprised exclusively of independent Directors). We will publicly disclose the Board’s decision and its reasoning with regard to the offered resignation.

Will any other business be conducted at the Annual Meeting or will other matters be voted on?

The Board of Directors does not know of any other matters that may come before the Annual Meeting. If any matter properly comes before the Annual Meeting, the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote, or otherwise act, at the Annual Meeting with respect to that matter or proposal.

How can I vote?

You may vote by proxy, or at the Annual Meeting in person. Detailed voting instructions can be found on the Notice or e-mail sent on March 21, 2011, and they are also included in the proxy card at the end of this proxy statement.

If you are a stockholder of record, you may vote by proxy through the Internet, by telephone or by mail. Please help us save time and postage costs and vote via the Internet at www.ProxyVote.com before 11:59 p.m. Eastern Time on May 2, 2011. Consistent with the requirements imposed by the Securities and Exchange Commission, stockholder privacy is strictly enforced through a cookie-free and secure website, hosted by Broadridge Financial Solutions.

If you attend the Annual Meeting in person, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot. Ballots will be available at the meeting. Whether you plan to attend the meeting or not, we encourage you to vote by proxy as soon as possible.

You may revoke your proxy at any time prior to voting at the Annual Meeting by giving written notice to the Corporate Secretary of the Company, by submitting a later-dated proxy, or by revoking it in person at the Annual Meeting. Your attendance at the Annual Meeting in itself will not revoke your proxy.

If the shares you own are held in “street name” by a bank or brokerage firm, your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. Your bank or brokerage firm will provide you with information about voting. Many banks and brokerage firms offer the option of voting over the Internet or by telephone.

If your shares are held in “street name” and you wish to attend the Annual Meeting in person, then you must bring an account statement or letter from your brokerage firm or bank showing that you are the beneficial owner of the shares as of the Record Date to be admitted to the Annual Meeting. To be able to vote your shares held in “street name” at the Annual Meeting, you will need to bring a proxy card provided by your brokerage firm or bank.

If my shares are held in “street name,” what will happen if I do not give voting instructions to my bank or brokerage firm?

Banks, brokers, or other nominees that hold shares in “street name” on behalf of a customer may vote only on certain “routine” Annual Meeting matters in the absence of instructions from the customer. Of the ten matters before the meeting this year, only the ratification of the selection of the independent accounting firm is considered a routine matter that can be voted by a bank or brokerage firm absent customer instructions. For

3

all remaining matters, the bank or broker may return blank voting instructions to us, resulting in a “non-vote” which will have the same effect as voting against Proposals 5 and 6, but will not have any effect with respect to the other Proposals.

Who will bear the costs of soliciting these proxies?

We will bear the costs of solicitation of proxies. Banks and brokers will be requested to forward proxy soliciting material to the beneficial owners of shares of our common stock. We will reimburse banks and brokers for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials. Proxies may be solicited via e-mail, via personal interview, by telephone, by facsimile or electronic medium. Morrow & Co., LLC, 470 West Avenue, Stamford, CT 06902, will assist the Company in the solicitation of proxies at an estimated cost of $13,000, plus expenses.

How do we distribute our proxy materials?

We make our proxy materials and our Annual Report to Stockholders for 2010 available on the Internet as our primary distribution method. Most stockholders will be mailed only a Notice of Internet Availability of Proxy Materials (the “Notice”). The Notice specifies how to access proxy materials on the Internet at www.ProxyVote.com and how to submit your proxy vote.

You can request a hard copy of the proxy statement, our Annual Report and/or our Annual Report on Form 10-K for 2010, by contacting:

Broadridge Financial Solutions

51 Mercedes Way

Edgewood, NY 11717

Telephone: (800) 579-1639

Internet: www. materials.proxyvote.com/67073Y

Banks, brokers and other nominee record holders will often engage in the practice of "householding" notices of Internet availability, proxy statements and annual reports. This means that only one copy of notices of Internet availability, proxy statements or annual reports is sent to multiple registered stockholders that share the same address unless they have requested otherwise. You can request to subscribe or unsubscribe from "householding" practices, by contacting Broadridge at:

Broadridge Financial Solutions

Householding Department

51 Mercedes Way

Edgewood, NY 11717

Telephone: (800) 542-1061

What constitutes a quorum?

For business to be conducted at the Annual Meeting with respect to a particular matter, a quorum must be present for that particular matter. For each of the proposals described in this proxy statement, a quorum consists of the holders of a majority of the shares entitled to vote at the Annual Meeting, or at least 117,832,569 shares of our common stock.

Shares of common stock represented in person and proxy (including broker “non-votes” and shares that abstain or do not vote with respect to one or more matters to be voted upon) will be counted for the purpose of determining whether a quorum exists. A share, once represented for any purpose at the Annual Meeting, is deemed present for quorum purposes for the remainder of the meeting and for any adjournment of the meeting, unless (1) the stockholder attends solely to object to the procedural or substantive grounds for calling the Annual Meeting and does not vote the shares or otherwise consent to be deemed present, or (2) in the case of adjournment, a new record date is or will be set for that adjourned meeting.

4

How will proxies be voted?

All proxies will be voted in accordance with the instructions they contain. With the exception of broker “non-votes,” if no instruction is specified on a proxy, it will be voted for the nominees for Director in Proposal 1, in favor of Proposals 2 and 4 through 7, voted in accordance with the Board recommendation for Proposal 3, and voted against Proposals 8 through 10 set forth in the notice of the Annual Meeting.

How will votes be counted?

Abstentions and broker “non-votes” will not be counted as votes in favor of a proposal, and will also not be counted as votes cast or shares voting on such proposal. Accordingly, abstentions and broker “non-votes” will have the same effect as voting against Proposals 5 and 6, but will not have any effect with respect to the other Proposals.

The votes will be tabulated by Broadridge Financial Solutions, the inspector of elections appointed for the meeting. Each share of common stock will be counted as one vote.

Where can I find the voting results?

We will report the voting results on a Form 8-K to be filed within four business days after the Annual Meeting.

How and when may I submit a stockholder proposal for the 2012 annual meeting?

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy materials

Stockholders of the Company may submit proposals on matters appropriate for stockholder action at meetings of the Company’s stockholders in accordance with Rule 14a-8 of the Securities Exchange Act of 1934, or the Exchange Act. To be submitted for inclusion in next year’s proxy statement, stockholder proposals must satisfy all applicable requirements of Rule 14a-8 and be received at our principal executive offices no later than the close of business on Tuesday, November 22, 2011.

Requirements for stockholder proposals to be brought before the 2012 annual meeting

Our bylaws require that any stockholder proposal that is not submitted for inclusion in next year’s proxy statement under SEC Rule 14a-8, but is instead sought to be presented directly at the 2012 annual meeting of Stockholders, must be received at our principal executive offices not later than 120 days prior to the first anniversary of the 2011 Annual Meeting. As a result, proposals, including Director nominations, submitted pursuant to these provisions of our bylaws must be received no later than the close of business on Wednesday, January 4, 2012.

Furthermore, any proposal presented by a stockholder at the Annual Meeting for which the Company has not been provided with notice on or before January 4, 2012, may be voted on pursuant to the discretionary authority granted to the persons named in the proxy solicited by the Board of Directors for that meeting.

Stockholder proposals should be sent to:

Paul J. Kaleta

Corporate Secretary

NV Energy, Inc.

P.O. Box 98910

Las Vegas, NV 89151

5

PROPOSAL NUMBER ONE

ELECTION OF DIRECTORS

There are currently 10 members of our Board of Directors. All Directors elected after NVE’s Annual Meeting of Stockholders on April 30, 2009 are elected to serve one-year terms, expiring at the next annual meeting of stockholders. Directors elected prior to or on April 30, 2009, serve three-year terms expiring at the 2011 and 2012 annual meetings of stockholders.

The Board has determined that all Directors, except Michael W. Yackira, our Chief Executive Officer (CEO), meet the independence requirements and thus qualify as “independent directors” under the New York Stock Exchange’s Listing Standards (the “NYSE Listing Standards”). All Directors are expected to personally attend the Annual Meeting to meet and converse with stockholders in attendance.

Upon the recommendation of our Nominating and Governance Committee, the Board has nominated Joseph B. Anderson, Jr., Glenn C. Christenson, Brian J. Kennedy, John F. O’Reilly, Philip G. Satre, and Michael W. Yackira for election to one year terms expiring at the annual meeting in 2012. Each of these Directors has consented to serve, if elected, for the one-year term. For each nominee, you can vote to elect the nominee, or alternatively withhold your vote. If any of the nominees shall become unable or unwilling to serve, all proxies voted in favor of a candidate may be applied to the election of a substitute nominee designated by our Board of Directors, or the Board may reduce the number of Directors. A plurality of votes cast by stockholders present, in person or by proxy, at the Annual Meeting is required for the election of Directors. “Plurality” means that the nominees receiving the largest number of votes cast are elected as Directors up to the maximum number of Directors who are nominated to be elected at the meeting. At the Annual Meeting, the maximum number of Directors to be elected is six. Proxies may not be voted for more than the six persons.

Our Board has adopted a policy that provides that if any nominee for Director in an uncontested election receives a greater number of votes “withheld” from his or her election than votes “for” such election, the nominee must offer his or her resignation to the Board promptly after the voting results are certified. The Nominating and Governance Committee, comprised entirely of independent Directors and which will specifically exclude any Director who is required to offer his or her own resignation, will consider the tendered resignation and make a recommendation, taking into account all factors deemed relevant, including, without limitation, the underlying reasons why stockholders withheld votes from such Director (if ascertainable) and whether such underlying reasons are curable, the length of service and qualifications of the Director whose resignation has been tendered, the Director's contributions to the Company, whether by accepting such resignation the Company will no longer be in compliance with any applicable law, rule, regulation or governing document, and whether or not accepting the resignation is in the best interests of the Company and its stockholders. Our Board will act upon this Committee’s recommendation within 120 days following certification of the stockholder vote and will consider the factors considered by the Committee and such additional information and factors as the Board believes to be relevant. We will publicly disclose the Board’s decision with regard to any resignation offered under these circumstances including the reasons for not accepting a resignation offer.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE NOMINEES, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE IN THE PROXY.

The following is a listing of all the current Directors of NVE, and its wholly owned subsidiaries, Nevada Power Company (“NPC”) d/b/a NV Energy and Sierra Pacific Power Company (“SPPC”) d/b/a NV Energy, and their ages, as well as information about positions they have held with us, their principal occupations and business experience during the past five years, and the names of other publicly-held companies of which they serve as directors, or have served at any time during the last five years, as well as any additional relevant skills, qualifications, attributes, or expertise that qualify them to serve on the Board of Directors. There are no family relationships among them. The Company, in determining the composition of our Board, seeks a balanced mix of local experience, which we believe is specifically relevant for a utility, and nationwide public company experience, among other factors of experience. As a utility company with its operations predominantly

6

in Nevada, we believe it is critically important for the Company and its local Directors to be involved in and otherwise support local community and charitable organizations. We believe that each Director has an excellent local or national reputation and is recognized as a community or national leader.

Nominees for election to the Board for a One-Year Term

| Name of Director | | Principal Occupation and Directorships | Director |

| And Nominee | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Joseph B. Anderson, Jr. | 68 | Mr. Anderson has been the chairman and CEO of TAG Holdings, LLC, a parent corporation for various manufacturing and service-based enterprises, since 2002. Mr. Anderson currently serves as a director for the following publicly-held companies: Rite Aid Corporation, Quaker Chemical Corporation, ArvinMeritor, Inc. and Valassis Communications, Inc. Other relevant experience includes directorships and Audit, Compensation, Nominating & Governing, Environmental & Social Responsibility Committee positions at various other publicly-held companies since 1992, including at RR Donnelley Corporation, profit and loss responsibilities at General Motors Company in the early ‘90s, and majority ownership stakes in various companies (six currently). Mr. Anderson serves as a director of the National Recreation Foundation. Mr. Anderson is Vice Chair of the Manufacturing Council of the Department of Commerce. Mr. Anderson graduated from the United States Military Academy with a Bachelor of Science Degree in Math and Engineering. He subsequently received two master degrees from the University of California, Los Angeles. He attended the Army’s Command and General Staff College and also is a graduate of the Harvard Advanced Management Program. Mr. Anderson was elected as a Director of NVE, NPC and SPPC in February 2005.

The Board believes that Mr. Anderson should serve as a Director of the Company because of his financial experience and business acumen, knowledge and experience gained over many years and as an owner, executive officer and director of public and private companies, together with his leadership experience with regard to business and diversity matters. | 2005 |

7

| Name of Director | | Principal Occupation and Directorships | Director |

| And Nominee | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Glenn C. Christenson | 61 | Mr. Christenson has been a managing director of Velstand Investments, LLC, a private investment management company, since 2004. In March 2007, Mr. Christenson retired as executive vice president and chief financial officer of Station Casinos, Inc., a gaming entertainment company, where he was employed for 17 years. Previously, he was a partner of the international accounting firm of Deloitte Haskins & Sells (now Deloitte & Touche LLP) for 17 years, three years of which he served as lead audit partner for the hospitality industry and two years of which he was in charge of the Nevada audit practice. He is a director of the First American Financial Corporation, a public company. In the past, he has served as a director for the Nevada Community Bank from 2001 to 2005. He served on the board of trustees of the Las Vegas Convention and Visitors Authority from 2005 to 2007. He serves as chairman of the National Center for Responsible Gaming, the Nevada State College Foundation and the Nevada Development Authority. Mr. Christenson holds an undergraduate degree in business administration from Wittenberg University and an MBA in finance from The Ohio State University. He has been a CPA since 1975. Mr. Christenson was elected as a Director of NVE, NPC and SPPC in May 2007.

The Board believes that Mr. Christenson should serve as a Director of the Company based on his years of experience as the chief financial officer of a public company, responsible for corporate finance, financial reporting, risk management, accounting and tax information systems, and investor relations, together with his work as an audit partner for Deloitte & Touche. | 2007 |

8

| Name of Director | | Principal Occupation and Directorships | Director |

| And Nominee | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Brian J. Kennedy | 67 | Mr. Kennedy has been chairman of Argonaut Gold, Inc., a Canadian public company, since December 2009. He has served as president and CEO of Argonaut LLC, a private equity group, since 2007. He further served as chairman and a director of Meridian Gold, Inc., a publicly-held mining company, until 2007, after having served as its president and CEO from 1996 to 2006. He also served as president and chief operating officer and director of publicly-held FMC Gold Company from 1987 to 1996. He further serves as a director of a private exploration company, Western Exploration and Development, Ltd. Mr. Kennedy is a trustee of three non-profit corporations: the Nevada Museum of Art, the Community Foundation of Western Nevada and the Kennedy Foundation. Mr. Kennedy is a graduate of the U.S. Naval Academy and holds an MBA degree from Harvard University. Mr. Kennedy was elected as a Director of NVE, SPPC and NPC in February 2007.

The Board believes that Mr. Kennedy should serve as a Director of the Company based on his financial expertise and business acumen, knowledge and experience gained over many years as an executive officer, chairman and director of publicly traded companies. | 2007 |

| | | | |

| John F. O’Reilly | 65 | Mr. O’Reilly is chairman and CEO of the law firm O’Reilly Law Group LLC and John F. O’Reilly APC, and holds board and officer positions in various family-owned business entities and investments. He serves as a member of the community board of Wells Fargo Bank Nevada, N.A. and served as a director of Herbst Gaming, Inc. until December 31, 2010. Other relevant prior experience includes: auditing and tax accounting at Arthur Andersen and Ernst & Ernst (now Ernst & Young); serving as a chairman/CEO and board member of a public company in the early 1990’s; and over 40 years of experience as a business transaction attorney and litigator in Nevada. Mr. O’Reilly also serves as an officer, director, trustee or member on various local organizations, including the UNLV Foundation, the Nevada Development Authority, the Henderson Chamber of Commerce, and Vision 2020 …Today, Inc. Mr. O’Reilly has a law degree from St. Louis University (cum laude) and a Bachelor of Science degree with an accounting major and an MBA degree (cum laude) from the University of Nevada, Las Vegas. Mr. O’Reilly has been a Director of NPC since 1995 and a Director of NVE and SPPC since July 1999. The Board believes Mr. O’Reilly should serve as a Director of the Company as a result of his diverse and extensive experience as a businessman including tax, auditing and financial experience, and as an attorney including his many years of experience with the Company, the regulatory process and the State of Nevada. | 1999 |

9

| Name of Director | | Principal Occupation and Directorships | Director |

| And Nominee | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Philip G. Satre | 61 | Mr. Satre retired January 1, 2005, as chairman of Harrah’s Entertainment, Inc., a gaming entertainment company. Previously he was CEO of Harrah’s Entertainment from 1993 to 2003 and served as a director from 1988 through 2004. He is a director of the following public companies: Nordstrom Inc.; Rite Aid Corporation; and chairman of International Game Technology. Mr. Satre served as a director of Tabcorp Holdings (Australia) from 1999 to 2008. He also is a director of the National Center for Responsible Gaming, and chairman of the board of trustees of the National World War II Museum. Mr. Satre is a graduate of Stanford University with a Bachelor of Arts degree in psychology and a law degree from the University of California at Davis. Mr. Satre was elected as a Director of NVE, SPPC and NPC in January 2005 and appointed as Non-Executive Chairman of the Board of NVE in August 2008.

The Board believes that Mr. Satre should serve as a Director of the Company because of his financial expertise and business acumen, knowledge and experience gained over many years as an executive officer, chairman and director of public companies. | 2005 |

| | | | |

| Michael W. Yackira | 59 | Mr. Yackira was elected to his current position as CEO of NVE effective August 2007. He was previously the Company’s president and chief operating officer from February 2007 until August 2007. Prior to that, he served as executive vice president and chief financial officer from December 2003 to February 2007. Prior to that, he was Executive Vice President, Strategy and Policy, from January 2003 to December 2003. Previously, Mr. Yackira served as vice president and CFO of Mars Music, Inc. from 2001 to 2002. Prior to that, he was with Florida-based FPL Group, Inc. from 1989 to 2000 where he held positions as president of FPL Energy, Vice President, Finance and CFO of FPL Group and Senior Vice President, Market and Regulatory Services, among other positions. Mr. Yackira also serves as a director of the Edison Electric Institute, the Nevada Development Authority, The Council for a Better Nevada and the Nevada Cancer Institute. Mr. Yackira served as a director of the Las Vegas Chamber of Commerce from November 2008 to December 2010. He served as a director of United Way from 2003 to 2009. He served as a director of the American Heart Association from 2006 to 2008. He also served as a director of Salvation Army from 2005 to 2006. Mr. Yackira holds a Bachelor of Science degree in accounting from Lehman College, City University of New York. Mr. Yackira is a Certified Public Accountant (CPA). Mr. Yackira was elected a Director of NVE, NPC and SPPC in February 2007.

The Board believes that Mr. Yackira should serve as a Director of the Company because of his knowledge of the Company as its chief executive officer, as well as his many years of accounting, operations, renewable energy, finance and regulatory experience in the utility industry, and his experience in other industries. | 2007 |

10

Directors whose terms expire in 2012

| | | Principal Occupation and Directorships | Director |

| Name of Director | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Susan F. Clark | 62 | Ms. Clark is an attorney and shareholder of Radey Thomas Yon & Clark, P.A. since 2003. Her primary area of practice is in energy and telecommunications law and utility regulation. Prior to that Ms. Clark practiced law with the law firm of Katz, Kutter, Alderman, Bryant and Yon from 2000 to 2003. Prior to that, Ms. Clark was employed with the Florida Public Service Commission from 1980 to 2000, where she served nine years as a commissioner from 1991 to 2000, including two years as commission chair from 1995 to 1996 and as general counsel from 1988 to 1991. Ms. Clark served as a director of the National Association of Regulatory Utility Commissioners (NARUC) from 1997 to 2000 and as a director of the Electric Power Research Institute (EPRI) from 2002 to 2006. In addition, Ms. Clark served on the board of the Brogan Museum of Art & Science from 2000 to 2008, including two years as president from 2003 to 2005. Ms. Clark holds a law degree from the University of Florida and a bachelor of arts in political science from the University of Florida. She has been a member of the Florida bar since 1974. Ms. Clark was elected a Director of NVE, NPC and SPPC in October 2008.

The Board believes that Ms. Clark should serve as a Director of the Company because of her extensive experience as a public utility regulator, her deep industry knowledge and her extensive background as a lawyer focusing on utility-related issues. | 2008 |

11

| | | Principal Occupation and Directorships | Director |

| Name of Director | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Stephen E. Frank | 69 | Mr. Frank retired in 2002 as chairman, president and CEO of Southern California Edison. He is chairman and director of Washington Mutual, Inc. and a director of Northrop Grumman Corp., both publicly-held companies. He also is a director of Aegis Insurance Services, Limited, a mutual insurance company. In past years, he has served as a director of various publicly traded companies, including Puget Energy, Inc. from 2004 to 2008, Intermec Inc. from 1997 to 2006, LNR Property Corporation from 2000 to 2005 and Edison International from 1995 to 2002. He served as director of FPL Group from 1990 until 1995. Other management positions held during his career included president and chief operating officer of Florida Power and Light Company, executive vice president and CFO of TRW Inc. and vice president, controller and treasurer of GTE Corporation. Mr. Frank serves as a director for the Los Angeles Philharmonic Association and St. Mary’s Health Foundation. He is a trustee of the Reno Philharmonic Association. Mr. Frank served as a director on the Reno/Tahoe Open Foundation until late 2010. He holds a bachelor’s degree from Dartmouth College, an MBA in finance from the University of Michigan and he completed the Advanced Management Program at Harvard Business School. He is a member of the advisory board of the College of Science, University of Nevada-Reno. Mr. Frank was elected a Director of NVE, NPC and SPPC in February 2009. The Board believes that Mr. Frank should serve as a Director of the Company because of his extensive involvement as an executive officer and director with several public utilities, including in the Western United States, and his service on the boards of other public companies, together with his financial and risk management expertise. | 2009 |

12

| | | Principal Occupation and Directorships | Director |

| Name of Director | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Maureen T. Mullarkey | 51 | Ms. Mullarkey retired in 2007 as executive vice president and chief financial officer of International Game Technology (IGT), a supplier of gaming equipment and technology. At IGT, she held various management positions, including CFO, senior vice president and treasurer, and gained over ten years of experience in areas of corporate finance, accounting, tax, investor relations, information systems, risk management and insurance. Ms. Mullarkey is currently an Entrepreneur in Residence (EIR) with The Nevada Institute for Renewable Energy Commercialization (NIREC). Ms. Mullarkey serves as a director of Renown Health System, and the Nevada Museum of Art. Ms. Mullarkey served as a director on the Desert Research Institute and as an advisory board member of the Community Foundation of Western Nevada until 2010. Ms. Mullarkey holds an MBA degree from the University of Nevada, Reno and a Bachelor of Science from the University of Texas, Austin. Ms. Mullarkey was elected a Director of NVE, NPC and SPPC in April 2008.

The Board believes that Ms. Mullarkey should serve as a Director of the Company based on her years of experience as the chief financial officer of a public company, responsible for corporate finance, financial reporting, risk management, accounting and tax, investor relations and information systems, together with her renewable energy related experience at NIREC. | 2008 |

13

| | | Principal Occupation and Directorships | Director |

| Name of Director | Age | During Last 5 Years; Other Qualifications | Since |

| | | | |

| Donald D. Snyder | 63 | Mr. Snyder retired in March 2005 after more than eight years as president and director of Boyd Gaming Corporation, a publicly traded gaming entertainment company. Mr. Snyder began his banking career immediately following college, rising from the management training program at First Interstate Bancorp’s subsidiary bank in California to chairman and CEO of its subsidiary bank in Nevada over the course of his 22 years with the organization. Mr. Snyder is a co-founder of Bank West of Nevada, now known as Bank of Nevada. He serves as chairman of the board (a non-executive position) of Bank of Nevada and has served as a director of the bank’s parent, Western Alliance Bancorporation (a publicly traded multi-bank holding company), since 1996. He further serves as a director for Tutor Perini Corporation, a public company. He is also a board member of privately-held Switch Communications Group, LLC. He is chairman of the board of The Smith Center for the Performing Arts, a not-for-profit organization. He serves on numerous other not-for-profit organizations, including Nathan Adelson Hospice, and the University of Nevada-Las Vegas Foundation. Mr. Snyder accepted an appointment effective July 1, 2010, as Interim Dean of the Harrah College of Hotel Administration at the University of Nevada, Las Vegas. Mr. Snyder is a cum laude graduate of the University of Wyoming with a Bachelor of Science degree in Business Administration. He also completed the Graduate School of Credit and Financial Management program at Stanford University and has received an honorary doctor of laws degree from the University of Nevada, Las Vegas. Mr. Snyder was elected a Director of NVE, NPC and SPPC in November 2005.

The Board believes that Mr. Snyder should serve as a Director of the Company because of his financial and banking expertise and business acumen, knowledge and experience gained over many years as an executive officer and director of banks and public companies. | 2005 |

Certain Legal Proceedings

Mr. Yackira was the Chief Financial Officer of Mars Music, Inc. from February 2001 until June 2002. In September 2002, subsequent to Mr. Yackira’s departure, Mars Music, Inc. filed for bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of Florida. The final decree in this proceeding was issued in November 2005.

PROPOSAL NUMBER TWO

APPROVAL OF AN ADVISORY VOTE ON THE

COMPANY’S EXECUTIVE COMPENSATION

We believe that NV Energy’s executive compensation programs and policies reflect a pay-for-performance culture that is strongly aligned with the interests of our stockholders and our customers. The Compensation Committee of the Board is committed to utilizing incentive compensation programs that reward success in achieving the Company’s financial, customer service, and operational objectives (e.g, cost of service, reliability, safety, use of sustainable energy and overall environmental performance) that encourage prudent

14

risk management, and long-term sustainable growth of shareholder value. In accordance with the rules of the Securities and Exchange Commission (or SEC), the Board is providing NV Energy’s shareholders with an opportunity to endorse or not endorse our executive compensation program, commonly known as a “Say-on-Pay” proposal.

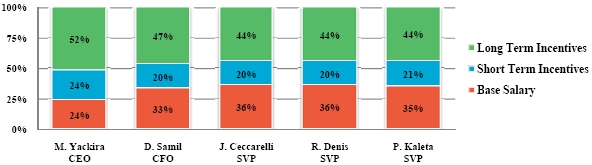

Strong Emphasis on Incentive Pay

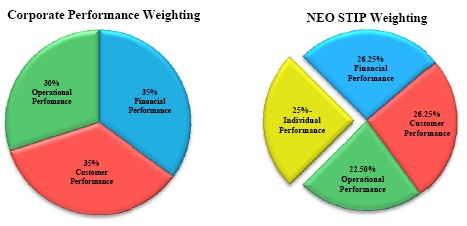

Our compensation program is heavily weighted toward incentive pay and highly dependent on achieving corporate performance goals, and to some extent individual performance goals. The majority of each executive officer’s compensation depends on achievement of successful results over a three-year term (long-term incentives) and certain annual goals (short-term incentives). The compensation program was designed in a manner that we believe delivers appropriate recognition in compensation for contributing to current business results, while at the same time motivating and retaining executives to enhance long-term sustainable business results. The program further reflects that NVE does business in a highly-regulated industry that continues to stand in the middle of national energy and environmental policy debates and is increasingly characterized by emerging technologies. NVE follows a compensation strategy appropriate for such an industry and designed to manage risk by employing a balanced portfolio of performance and market driven compensation components designed to optimize stockholder and customer interests and thereby ensure sustainable business success and value-creation. This compensation strategy supports the Company's vision to be the premier provider of energy in Nevada and is further aligned with NVE's mission to provide energy, products and services that enable our customers to manage their energy needs while delivering industry-leading returns for our investors.

The chart below indicates the percentage of target pay for each Named Executive Officer (NEO) that is performance based. It excludes a one-time restricted stock units award to Ms. Samil made upon the commencement of her employment.

2010 Target Total Direct Compensation Components

Track Record of Pay-for-Performance

As evidence of our commitment to a pay-for-performance culture, the following actions were taken over the past two years:

In both 2008 and 2009, we made no payouts under our Long-Term Incentive Program (LTIP) because we did not meet our performance targets, and we did not provide any relief in the form of increased other compensation to offset the zero payout.

In 2009, no base pay merit increases were awarded to any of our named executive officers (NEOs) due to overall economic conditions.

2010 Compensation Program

At the start of 2010, Performance Units were granted to our CEO and other NEOs under the LTIP, with vesting based on the favorable three-year performance of NVE stock relative to its industry peers measured at year-end 2012 (weighted at 66.67% of long-term grants).

15

In addition, in 2010, Performance Shares were granted to the NEOs under the LTIP, the vesting of which remains contingent upon three-year Corporate Performance Goal achievement measured at year-end 2012 (weighted at 33.33% of long-term grants).

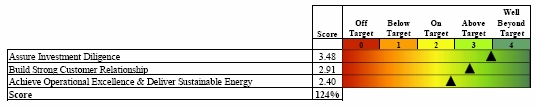

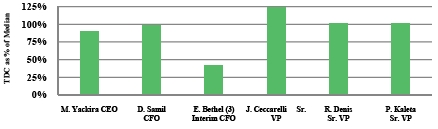

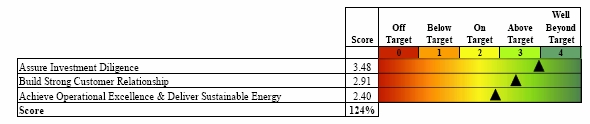

Our NEOs were offered an opportunity to earn cash compensation in addition to base salary under the Short-Term Incentive Plan (STIP), made contingent on the favorable performance of 2010 Corporate Performance Goals (weighted at 75% of STIP), and accomplishment of Individual Performance Objectives set for 2010 (weighted at 25% of STIP). NVE achieved an Above Target 2010 Corporate Performance Goal overall score, which resulted in a payout of 124% of target. The Compensation Committee determined that our CEO and other NEOs were at or above target for their Individual Performance Objectives for 2010.

Performance under Long-Term Incentive Plan Grants

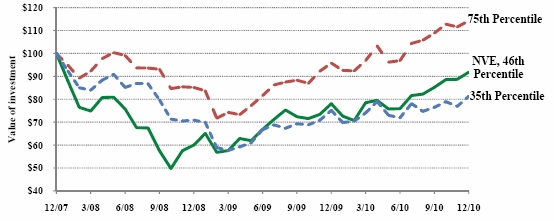

| | Ø | | Performance Units: For the three-year period ended December 31, 2010, NVE ranked in the 46th percentile relative to its peers in the S&P Super Composite Utility Index. As a result, 86.67 % of our CEO and other NEOs targeted Performance Units granted in 2008 vested under the LTIP. |

| | | | |

| | Ø | | Performance Shares: For the three-year period ended December 31, 2010, NVE achieved an above target average Corporate Performance Goal score. As a result, 101.60% of our NEOs targeted Performance Shares granted in 2008 vested under the LTIP. |

Performance under Short-Term Incentive Plan

Summary of Compensation Best Practices

Our Compensation Committee is advised by an independent compensation consultant on best practices in executive compensation and is provided with market information to assist in designing our compensation program and in making compensation decisions.

We increased our CEO’s stock ownership requirements in 2010 from two to five times his base salary and required him to retain 100 percent of net shares realized from option exercises and stock vesting until this ownership level is met. The requirement for other NEOs was doubled to three times base salary, and a retention requirement imposed for them of 50 percent of net shares.

We abolished cash perquisites for our NEOs in 2010.

We have absolute upper limits on LTIP awards, and the Committee has never adjusted awards above those limits.

We encourage a long-term orientation by our executives by using three-year minimum vesting requirements for performance units, performances shares and restricted stock units.

Our LTIP expressly prohibits option repricing.

We have no tax gross-ups for change-in-control payments, and our change-in-control policy requires a second trigger before awards granted to officers can vest following a change-in-control.

We eliminated tax gross-ups on executive life insurance premiums in 2010 and decreased the coverage level to three times annual base salary, subject to a cap of $1,750,000.

We have a company-wide prohibition against hedging transactions involving NVE stock.

We encourage you to review the details of our long-term and short-term incentive programs, which are described more fully in the “Compensation Discussion and Analysis (CD&A)” beginning on page 39.

16

The Company will continue to link executive compensation awards to annual and longer-term business performance to demonstrate our commitment to a pay-for-performance compensation philosophy.

For the reasons discussed above, the Board recommends that shareholders vote in favor of the following “Say-on-Pay” resolution:

“Resolved, that the stockholders of NV Energy, Inc. approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as described in the Compensation Discussion and Analysis and the compensation tables (together with the accompanying narrative disclosure) in this Proxy Statement.”

Because your vote is advisory, it will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE ADVISORY VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION.

PROPOSAL NUMBER THREE

ADVISORY VOTE ON FREQUENCY OF THE VOTE ON EXECUTIVE COMPENSATION

A separate proposal will be presented at the Annual Meeting asking stockholders to approve, on an advisory basis, the frequency of the stockholder vote on the compensation of our named executive officers.

Stockholders are being asked to vote on whether the advisory vote on the compensation of our named executive officers should occur every one, two or three years. You will also have the choice to abstain from voting on this proposal.

After careful consideration of this proposal, our Board of Directors has determined that an advisory vote on executive compensation that occurs every year is the most appropriate alternative for NV Energy, and therefore our Board of Directors recommends that you vote for holding the advisory vote on executive compensation every year.

In reaching this recommendation, our Board of Directors concluded that an annual advisory vote on executive compensation will allow our stockholders to provide us with timely input on our compensation philosophy, policies and practices. Such an approach is consistent with our overall policy of seeking input from, and engaging in discussions with, our stockholders on corporate governance and compensation matters. While our compensation programs and policies are designed to enhance long-term growth and performance, and the single largest element of our executive compensation consists of long-term incentives with three-year performance periods, our Compensation Committee nevertheless conducts an in-depth review of the compensation program on an annual basis and decides upon salary levels, short-term incentives and possible equity award grants. Our Board of Directors believes it will be helpful for the Compensation Committee, as part of this annual process, to know if there are current stockholder concerns with respect to elements of our compensation program so those may be factored into its decisions.

17

Stockholders are being asked to vote on the following resolution:

“Resolved, that the stockholders of NV Energy, Inc. determine, on an advisory basis, that the frequency with which the stockholders of the Company shall have an advisory vote on the compensation of the Company’s Named Executive Officers as set forth in the Company’s proxy statement is:

Choice 1 – 1 year frequency;

Choice 2 – 2 year frequency;

Choice 3 – 3 year frequency; or

Choice 4 – abstain from voting.”

The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. However, because this vote is advisory and not binding on the Board of Directors or the Company, the Board may decide that it is in the best interests of our stockholders to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE OPTION OF “1 YEAR” AS THE FREQUENCY WITH WHICH STOCKHOLDERS ARE PROVIDED AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

PROPOSAL NUMBER FOUR

APPROVAL OF CERTAIN AMENDMENTS TO

AND MATERIAL TERMS OF PERFORMANCE GOALS

OF THE RESTATED EXECUTIVE LONG TERM INCENTIVE PLAN

The Company's Executive Long-Term Incentive Plan (the "LTIP") was originally adopted by stockholders in 1994, and subsequently amended by stockholders in 2001 to increase the number of shares available for grant. In 2004, stockholders approved a renewal of the Company's LTIP, authorizing 7,750,000 shares of Common Stock to be available for grant. In 2008, the Board of Directors amended and restated the LTIP, and the stockholders approved the material terms of the performance goals that may be included in awards under the LTIP. In December 2010, the Board approved Amendment No. 1 to the Amended and Restated LTIP, and in February 2011, the Board approved a further amendment and restatement of the LTIP (the “Restated LTIP”) and directed that those provisions of the Restated LTIP that required stockholder approval under applicable stock exchange rules or tax laws be submitted for approval at the Annual Meeting. This Proposal Four seeks that approval. No additional shares are being requested for the Restated LTIP under this Proposal.

The purpose of the Restated LTIP is to promote the success and enhance the value of the Company by aligning participants' personal interests with those of the Company's stockholders by rewarding outstanding performance. Additionally, the Restated LTIP is intended to emphasize pay-for-performance by tying reward opportunities to carefully determined and articulated performance goals at corporate and individual levels. The Restated LTIP is also intended to provide flexibility in the Company's ability to motivate, attract and retain the services of individuals upon whose judgment, interest and special effort the Company is dependent.

The Restated LTIP is administered by the Compensation Committee (the "Committee") and is a comprehensive incentive plan that provides for the grant of nonqualified stock options, incentive stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance shares and other equity-based awards payable in cash to eligible participants, which includes officers and key employees of Company, as determined by the Committee. The eligible participants under the Restated LTIP are the same as under the LTIP as approved by stockholders in 2004 and 2008. As of February 4, 2011, there were 111 officers and key employees that received 2011 grants under the Restated LTIP.

The Restated LTIP contains a number of provisions that we believe reflect best practices for incentive compensation plans, including the following:

18

it expressly prohibits the Committee from repricing stock options;

it provides for minimum vesting periods for time-based awards and minimum performance periods for performance-based awards;

it contains caps on aggregate grants of restricted stock and restricted stock units;

it does not provide for discounted awards; and

if dividend rights are approved by the stockholders under this proposal, such rights will only be allowed in connection with full-value awards and may not be paid on unvested or forfeited awards.

The specific provisions of the Restated LTIP for which we are seeking stockholder approval are the following:

provisions allowing the inclusion of dividend equivalent rights in connections with certain awards, which can be paid only if the underlying awards are earned and paid;

share and dollar sublimits on awards that may be made to any participant in any calendar years; and

material terms of performance goals that may be included in awards under the Restated LTIP.

Performance Goals

The payment of any award under the Restated LTIP or the lapse of any period of restriction relating to any such award may be conditioned upon (i) the achievement of an objective performance goal (ii) over a specified performance period, in each case as established by the Committee at the time of the grant of the award. The Committee can choose from one or more of the below listed permitted performance goals when establishing short-term or long-term incentives. The performance goals permitted by the Restated LTIP, which are applied to the Company, a subsidiary, an affiliate or a business unit and which are in all material respects the same as those approved by stockholders in 2008, are the following:

total stockholder return;

total stockholder return as compared to total return of a publicly available index;

net income;

pretax earnings;

funds from operations;

earnings before interest expense, taxes, depreciation and amortization;

operating margin;

earnings per share;

return on equity, capital, assets or investment;

operating earnings;

working capital and/or liquidity;

completion of capital projects;

expense and/or liability containment;

operating expenditures;

operational safety metrics;

energy supply, conservation and environmental performance;

- customer satisfaction metrics;

- service levels and reliability;

19

- shareholder profile metrics;

- ethics;

- public affairs and marketing metrics;

- ratio of debt to stockholders equity;

- workforce-related metrics;

- internal financial reporting and accounts payable metrics; and

- revenue.

A performance goal, or any component thereof, may be established by the Committee on an absolute or relative basis, and if on a relative basis, may be compared to a market index, a group of other companies, or any combination thereof. The achievement of a specified period of service may also be deemed a performance goal. The specific targets with respect to any performance goals will be determined in the Committee's discretion. Before paying an award or permitting the lapse of any restriction on an award under the Restated Plan, the Committee is required to certify in writing that the performance goal has been satisfied. In the event of death, disability or retirement of a participant, a prorated payment of the award will be made following the end of the performance period if the applicable performance goals have been met.

Award Sub-limits

Awards under the Restated Plan are subject to annual limits. Such limits apply to grants of awards in any one given calendar year to any participant as follows:

| Type of Award | | Maximum Aggregate Number |

| | | of Shares of Common Stock |

| Options | | 500,000 |

| Stock Appreciation Rights | | 500,000 |

| Restricted Stock | | 500,000 |

| Restricted Stock Units | | 500,000 |

| Performance Units | | 500,000 |

| Performance Shares | | 500,000 |

Additionally, the maximum aggregate amount of cash payments pursuant to performance units or other equity-based awards payable in cash under the Restated Plan that may be made in any one calendar year to any participant is $5,000,000.

Under the LTIP as approved by stockholders in 2008, the annual sublimit per category of award was 45,000 and the maximum amount of cash payments was $900,000. These sublimits have been increased by the Board of Directors and are being submitted for stockholder approval pursuant to this Proposal. If the stockholders do not approve the new sublimits, then from and after the Annual Meeting, the sublimits of the LTIP as approved in 2008 will apply to future awards.

The total number of shares authorized for issuance under the Restated LTIP is the same as originally approved in 2004, and no additional shares are being requested.

Awards conditioned on the enumerated performance goals, subject to the annual limits and which otherwise comply with the procedural requirements of the Restated LTIP, are intended to qualify as "performance-based compensation" within the meaning of Section 162(m) of the Code and related regulations and rulings. Under Section 162(m), federal income tax deductions may be disallowed to the extent that total compensation paid to a "covered employee" exceeds $1,000,000 in any one year (covered employees generally are the Company's named executive officers, as that term is used in this proxy statement other than the Corporate Senior Vice President, Chief Financial Officer). For compensation to be considered "performance-based" and thus not subject to the deduction limitations, Section 162(m) requires that, among other things, the material terms of the performance goals under which compensation may be paid must be disclosed to and

20

approved by the Company's stockholders. For purposes of Section 162(m) of the Code, the material terms of the performance goals of the Restated LTIP include: (i) the employees eligible to receive compensation, (ii) a description of the business criteria on which the performance goal is based and (iii) the maximum amount of compensation that can be paid. Stockholder approval of this Proposal Four constitutes approval of each of these aspects of the Restated LTIP for purposes of the approval requirements of Section 162(m) of the Code.

Dividend Equivalent Rights

The Restated LTIP provides that, subject to stockholder approval pursuant to this Proposal Four, the Committee may grant dividend equivalent rights to any participant under the Restated LTIP as a component of an award of Restricted Stock Units, Restricted Stock, Performance Units or Performance Shares. The terms and conditions of the dividend equivalent rights will be specified in the applicable award agreement. Dividend equivalents credited to the holder of a dividend equivalent right shall be reinvested in additional shares, which may thereafter accrue additional equivalents. Any such reinvestment shall be at fair market value on the date of reinvestment or such other price as may then apply under a dividend reinvestment plan sponsored by the Company, if any. Dividend equivalent rights may be settled in cash or shares or a combination thereof, in a single installment or installments. A dividend equivalent right granted as a component of an award of Restricted Stock Units, Restricted Stock, Performance Units or Performance Shares shall provide that such dividend equivalent right shall be settled upon settlement or payment of, or lapse of restrictions on, such other award, and such dividend equivalent right shall expire or be forfeited or annulled under the same conditions as such other award.

Except as may otherwise be provided by the Committee either in the award agreement or, in writing after the award is issued, a grantee’s rights in all dividend equivalent rights granted as a component of an award of Restricted Stock Units, Restricted Stock, Performance Units or Performance Shares that has not vested shall automatically terminate upon the grantee’s termination of employment (or cessation of service relationship) with the Company and its Subsidiaries for any reason.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ABOVE AMENDMENTS TO AND MATERIAL TERMS OF PERFORMANCE GOALS OF THE RESTATED LTIP, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

Other Changes to LTIP Previously Adopted by the Board of Directors

The Board of Directors also approved, and the Restated LTIP includes, the following changes, which are not subject to stockholder approval pursuant to this Proposal Four.

Ability to Issue Restricted Stock Units. The Committee has the power to award Restricted Stock Units, which are subject to the same general terms and conditions as Restricted Stock, except that holders of Restricted Stock Units are not issued stock at the time of the award and have no voting rights with respect to shares subject to the Restricted Stock Units prior to the payment of the shares. Restricted Stock Units are aggregated with Restricted Stock for purposes of the Restated LTIP’s limitation that such awards may not exceed over the life of the Restated LTIP 30 percent of all shares available for grant under the plan nor exceed over the life of the Restated LTIP for any individual 25 percent of all shares available for grant under the plan.

Settlement of Performance Shares in Stock Only. The Committee may only settle earned Performance Share awards by delivery of shares of stock of the Company, and the number of shares is determined at the close of the applicable performance period, unless otherwise provided in the award agreement.

Ability to Specify Treatment of Awards in Change in Control Situations. The Committee is authorized to determine how to treat awards in the context of a merger or acquisition, including stating in the award agreements that they are subject to the Company’s Change in Control Policy. Under the Company’s Change in Control Policy, a “change in control” is deemed to occur if (i) a person becomes the beneficial owner of securities representing 40 % of the combined voting power of the Company’s then outstanding securities, subject to certain exclusions, (ii) individuals constituting the Board of Directors as of January 1, 2011 cease to constitute a majority of the Board, other than new Directors whose appointment or

21

election was approved or recommended by at least two-thirds of the Directors then still in office who were either Directors on such date or were so approved or recommended, (iii) the consummation of a merger or consolidation, other than certain transactions which would result in at least 66-2/3% of the combined voting power remaining with the same beneficial owners as before the transaction or certain recapitalization transactions in which no person becomes the beneficial owner of 40% or more of the combined voting power of the Company, (iv) a complete liquidation or dissolution of the Company or sale of all or substantially all of its assets, or (v) consummation of a sale of a majority of the stock of the Company or adoption of a plan for the complete liquidation or dissolution or sale of all or substantially all the assets of the Company.

Deferral of Receipt of Awards. The Committee is authorized to provide in award agreements that the participant may defer receipt of payment of an earned award. The Restated LTIP also provides that it is the Company’s intention that all awards made under the plan comply with and be interpreted in accordance with Section 409A of the Internal Revenue Code, including any applicable exemptions thereunder.

Summary of Material Provisions of the Restated LTIP

The following is a summary of the material provisions of the Restated LTIP (including but not limited to the material terms of the performance goals), which is qualified in its entirety by reference to the Restated LTIP, a copy of which is attached as Exhibit A to this Proxy Statement. Defined terms not otherwise defined in this summary shall have the meaning ascribed to such terms in the Restated LTIP.

Administration of the Plan

The Restated LTIP is administered by the Compensation Committee of the Company's Board of Directors (which consists exclusively of outside Directors meeting the independence requirements of the NYSE). Additionally, the Committee is and will be comprised solely of Directors qualified to administer the Restated LTIP pursuant to Rule 16b-3 of the Securities Exchange Act of 1934 (the "Exchange Act") and Section 162(m) of the Code.

Shares Subject to the Plan Over a 10-Year Period

The Restated LTIP authorizes the grant over 10 years of up to 7,750,000 shares of the Company's Common Stock, in the form of grants more fully described below and subject to whatever limitations in the types of grants which may presently exist or be adopted or imposed by requirements of the SEC or the NYSE. This is the same number of shares approved by stockholders in 2004. There has been no increase. Of the 7,750,000 shares authorized, 3,638,731 shares are available for grant as of December 31, 2010.

If any corporate transaction occurs which causes a change in the Company's capitalization, the Committee shall make such adjustments to the number and class of shares delivered, and the number and class and/or price of shares subject to outstanding awards granted, under the Restated LTIP as appropriate and equitable to prevent dilution or enlargements of participants' rights.

Eligibility and Participation

Employees eligible to participate in the Restated LTIP include officers and key employees of the Company and its subsidiaries, as determined by the Committee, including employees who are members of the Board, but excluding Directors who are not Employees.

Amendment and Termination of the Plan

In no event may any award under the Restated LTIP be granted on or after January 1, 2014. The Board may amend, modify or terminate the Restated LTIP at any time; provided that no amendment requiring shareholder approval for the Restated LTIP to continue to comply with Rule 16b-3 under the Exchange Act or the listing standards of the NYSE shall be effective unless approved by stockholders. No amendment without shareholder approval shall be permitted to increase the number of shares authorized for issuance under the Restated LTIP, except in cases of recapitalization of the Company.

22

The Committee may amend any outstanding award, without the approval or consent of the participant, if such amendment is necessary or appropriate to conform the award to, or otherwise satisfy legal requirements (including without limitation the provides of Sections 162(m) and 409A of the Code or the regulations or rulings promulgated there under). Such an amendment can be made prospectively or retroactively. Additionally, without the approval or consent of the participant, the Committee may make adjustment in the terms and conditions of an award in recognition of unusual or nonrecurring events affecting the Company or the financial statements of the Company in order to prevent dilution or enlargement of the benefits intended to be made available pursuant to the award and the Restated LTIP to the extent, in the case of awards intended to be qualified performance-based compensation under Section 162(m) of the Code, such adjustment would be consistent with Section 162(m). No other termination, amendment or modification to the Restated LTIP or an award may be made, without the written consent of the applicable participant, if it would adversely affect in any material way any award previously granted.

Awards under the Restated LTIP