UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2006

Commission file number: 1-9972

HOOPER HOLMES, INC.

(Exact name of Registrant as specified in its charter)

New York | 22-1659359 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

170 Mt.Airy Road | |

Basking Ridge, NJ | 07920 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (908) 766-5000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock ($.04 par value per share) | American Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | * | Accelerated Filer | x | Non-Accelerated Filer | * | |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

The aggregate market value of the shares of common stock held by non-affiliates of the Registrant (64,149,850 shares), based on the closing price of these shares on June 30, 2006 (the last business day of the registrant’s most recently completed second fiscal quarter) on the American Stock Exchange, was $195,657,042.

The number of shares outstanding of the Registrant’s common stock as of February 28, 2007 was 68,018,879.

PART I |

| | | |

| | Cautionary Statement Regarding Forward-Looking Statements | 3 |

| Item 1 | Business | 4 |

| Item 1A | Risk Factors | 12 |

| Item 1B | Unresolved Staff Comments | 16 |

| Item 2 | Properties | 16 |

| Item 3 | Legal Proceedings | 16 |

| Item 4 | Submission of Matters to a Vote of Security Holders | 16 |

| | | |

PART II |

| | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters | |

| | and Issuer Purchases of Equity Securities | 17 |

| Item 6 | Selected Financial Data | 19 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| Item 7A | Quantitative and Qualitative Disclosures about Market Risk | 42 |

| Item 8 | Financial Statements and Supplementary Data | 43 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 74 |

| Item 9A | Controls and Procedures | 74 |

| Item 9B | Other Information | 76 |

| | | |

PART III |

| | | |

| Item 10 | Directors and Executive Officers of the Registrant | 76 |

| Item 11 | Executive Compensation | 76 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 76 |

| Item 13 | Certain Relationships and Related Transactions | 76 |

| Item 14 | Principal Accountant Fees and Services | 76 |

| | | |

PART IV |

| | | |

| Item 15 | Exhibits and Financial Statement Schedules | 77 |

| | Schedule II - Valuation and Qualifying Accounts | 80 |

| | Signatures | 81 |

FORM 10K

PART 1

Cautionary Statement Regarding Forward-Looking Statements

This annual report on Form 10-K (particularly Items 1, 1A and 7) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. We intend that such forward-looking statements be subject to the safe harbors created by this legislation.

In some cases, you can identify forward-looking statements by our use of terms such as “anticipate,” “believe,” “continue,” “could,” “should,” “estimate,” “expect,” “forecast,” “intend,” “goal,” “may,” “will,” “plan,” “seek” and variations of these words or similar expressions.

Forward-looking statements are based on management’s current assumptions, estimates and expectations of future events. We cannot guarantee that these assumptions and estimates are accurate or that the expectations will be realized. All of these forward-looking statements are subject to risks and uncertainties. Some of the factors that could cause our actual results to differ materially from those projected in any such forward-looking statements include, without limitation:

| | · | our ability to implement the strategic plans in connection with management’s recently completed strategic review of all aspects of the Company’s operations; |

| | · | our ability to effect several expense management initiatives, including (i) aligning our costs with existing, and possibly declining, levels of revenues, (ii) making better use of our assets, particularly our branch offices and branch office personnel within our Portamedic paramedical examination business, and (iii) generating cost efficiencies through an enhanced information technology platform; |

| | · | our meeting or exceeding our customers’ expectations with respect to the quality and timeliness of our services on a consistent basis; |

| | · | our ability to enhance and expand our technology and network infrastructure; |

| | · | our ability to finance our operations; and |

| | · | our ability to anticipate key trends and developments affecting our businesses, and proactively position ourselves to seize opportunities presented by these trends and developments. |

The section of this annual report under the caption “Risk Factors” addresses some of the important risk factors that are affecting or may affect our business, results of operations and financial condition. These risk factors are not necessarily all of the factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors not identified could also have material adverse effects on our future results.

The forward-looking statements included in this annual report are made as of the date of this report. Other than as required by law, we expressly disclaim any intent or obligation to update any forward-looking statements to reflect events or circumstances that subsequently occur or of which we hereafter become aware. Unless otherwise indicated, all references to a year reflect our fiscal year that ends December 31.

ITEM 1

Business Description

Hooper Holmes, Inc. and its subsidiaries currently engage in businesses that are managed as two separate divisions: the Health Information Division and the Claims Evaluation Division.

Our Health Information Division (HID) provides medical-related risk assessment information to life and health insurance carriers, information that is integral to such carriers’ underwriting decisions. These services include:

| | · | performing paramedical and medical examinations of individual insurance policy applicants - mainly life insurance policy applicants - throughout the United States (under the Portamedic brand name) and in the United Kingdom (under the Medicals Direct brand name); |

| | · | completing telephone interviews of applicants and collecting applicants’ medical records; |

| | · | testing the blood, urine and other specimens obtained in connection with a portion of the paramedical examinations we coordinate, as well as specimens provided by third-party health information service providers; and |

| | · | underwriting life insurance policies on an outsourced basis for life insurance companies. |

We believe our network of branch and contract affiliate offices - through which we coordinate the activities of over 9,000 paramedical examiners - is the most extensive in our industry, enabling us to provide timely examinations of insurance applicants located anywhere in the United States.

Our Claims Evaluation Division (CED) provides medical claims evaluation services to property and casualty (P&C) insurance carriers, law firms, self-insureds and third party administrators for use in processing personal injury accident claims. The core activity of this business consists of arranging for independent medical exams (IMEs). An IME is a medical examination by a doctor (other than a claimant’s physician) for the purpose of rendering an objective opinion regarding the nature, origin, treatment and causal relationship of an injury. We provide our claims evaluation services in connection with automobile, liability, disability and workers’ compensation claims.

Our Claims Evaluation Division has been built through four acquisitions, the first of which was completed in November 2002. In early 2006, we merged the acquired companies - D&D Associates, Medimax, Allegiance Health and Michigan Evaluation Group - into Hooper Evaluations, Inc., a wholly owned direct subsidiary of Hooper Holmes, Inc. However, we continue to use the D&D Associates and Michigan Evaluation Group names for marketing purposes. The CED’s business activities and revenues are generated nationally with core market concentration.

The following table provides the Company’s revenues for each of the three most recent completed fiscal years, broken down by division and, in the case of the Health Information Division, further broken down by service activity:

| | | | | | |

(in millions) | 2006 | % Change | 2005 | % Change | 2004 |

| Health Information Division: | | | | | |

| Service Activity: | | | | | |

| Paramedical Exams/Tele-interviewing | $222.0 | -5.3% | $234.4 | -5.1% | $247.0 |

| Outsourced Underwriting | 20.6 | -17.1% | 24.8 | 54.2% | 16.1 |

| Lab Services | 17.9 | -6.6% | 19.2 | 14.5% | 16.7 |

| Other | 2.1 | -38.2% | 3.4 | - | 3.4 |

| | | | | | |

| Total HID | $262.6 | -6.8% | $281.8 | -0.5% | $283.2 |

| Claims Evaluation Division | 31.3 | -18.7% | 38.5 | -11.5% | 43.5 |

| Total | $293.9 | -8.3% | $320.3 | -2.0% | $326.7 |

Our Strategy

During 2006, we restructured our senior management team through a combination of our best internal talent, augmented by external hires to obtain new and necessary skills. These changes included a new chief executive officer (January, 2006), a new chief financial officer (May, 2006), and several other key positions.

In the first quarter of 2006, we initiated an extensive review of all aspects of the Company’s business, including an assessment of our organization’s strengths and challenges. As a result of this review, we formulated a turnaround program to address the continuation of negative financial trends we have been experiencing. The Company is pursuing the financial and other goals of our turnaround program in three phases: expense management, revenue enhancement and growth investment.

Details regarding the implementation of our turnaround program, including the expected financial impact of the program, are presented in Part II, Item 7, under our “Management Discussion and Analysis of Financial Condition and Results of Operations”.

Financial Information About Operating Segments

Financial information relating to our two segments is incorporated herein by reference to Note 5 of the Notes to Consolidated Financial Statements included under Item 8 of this report.

Our Services

Underwriting decisions are based on statistical probabilities of mortality and morbidity, such that insurance companies generally require quantitative data reflecting an applicant’s general health. The businesses that comprise our Health Information Division gather and provide that data.

Health Information Division

Paramedical and Medical Examinations

Our Portamedic business performs paramedical and medical examinations of insurance policy applicants. Our extensive branch office network, which is augmented by additional offices of our contract affiliates (i.e., independently owned and operated businesses), enables us to provide such examinations throughout the United States. Our branch offices recruit, monitor and manage our network of paramedical examiners.

Through our wholly-owned subsidiary, Medicals Direct Group, we also provide paramedical examinations in the United Kingdom, referred to in the U.K. as “screenings.”

A paramedical exam typically consists of questions about an applicant’s medical history, measurements of the applicant’s height and weight, blood pressure and pulse. Blood and urine specimens are also collected, to be tested by a laboratory. Insurance carriers have different guidelines for determining when a more complete medical examination is required and the scope of such examination. The likelihood that a more complete medical examination will be required of an applicant is influenced by the applicant’s age and the amount of insurance being sought. In general, insurance carriers insist upon more stringent underwriting requirements as the age of the applicant and amount of coverage increases.

Almost all of our paramedical examiners are registered nurses, licensed practitioner nurses, emergency medical technicians (EMTs), phlebotomists or other medically trained professionals. Many work on a part-time basis. Also, the paramedical examiners have the ability to work for more than one of the national paramedical examination arrangers/suppliers.

When a medical examination beyond the capability of a paramedical examiner is required, we contract with physicians who are licensed and in good standing and practice in the specialty area approved by the insurance company. These physicians provide services such as medical exams, treadmill electrocardiograms (ECGs or EKGs), X-rays, etc.

Infolink Tele-Underwriting Services

We conduct telephone interviews (which we refer as to tele-interviews or tele-underwriting) on behalf of our insurance company customers. We conduct such interviews from our call centers located in Overland Park, Kansas, Harlan, Iowa and Allentown, PA. A tele-interview enables us to gather much of the medical information needed in connection with the life insurance application process in a more-time efficient manner compared to the alternative of a paramedical examiner gathering such information while conducting a paramedical exam. As a result, the paramedical examiner can focus on the actual examination of the applicant.

A tele-interview provides two potential benefits to the insurance company:

| | (1) | It can reduce the underwriting cycle time in several respects: |

| | · | if an insurance agent or broker sends an application directly to one of our call centers at the same time he or she submits the application to the insurance company’s central office, we can typically conduct a tele-interview within one to four days, depending on the applicant’s availability; |

| | · | the person in our call center conducting a tele-interview can pull up on his or her computer screen, from our extensive library of insurance company-specific forms (which vary depending on the applicant’s state of residence), the appropriate underwriting questionnaire. The applicant’s answers to the base questions in the questionnaire, and any additional questions that are asked based on the applicant’s responses to the base questions, are input on a real-time basis. Our tele-interviews are quite effective as data-collection tools, allowing us to drill down into existing medical conditions and ask the “right” questions. The completed, typewritten reports are far less likely to contain errors, such as incomplete responses or unanswered questions. The greater quality control reduces the likelihood that the carrier will determine that the applicant must be re-contacted to obtain additional or clarifying information; |

| | · | the interviewer can electronically send a request to one of our attending physician statement (APS) centers to order the applicant’s medical records either on a same- or next-day basis, as opposed to after the paramedical examination; and |

| | · | the interviewer can also schedule the paramedical exam during the interview, at which point one of our branch offices promptly coordinates to make the necessary arrangements. |

Reducing the underwriting cycle time is key for the insurance agents and brokers, and the insurance companies they work with, because it reduces the likelihood of the applicant not pursuing the policy.

| | (2) | It can reduce the insurance company’s costs in the following respects. |

| | · | the tele-interview allows insurance companies to avoid the cost of certain application work if, for example, it is clear that the applicant will not meet the underwriting standards; and |

| | · | our lower internal costs in handling the APS retrieval through one of our three processing centers (a high-volume business that lends itself to a factory-type environment) enables us to pass along cost savings as we are able to negotiate national contracts which may lower average medical facility fees to our insurance company customers. |

Cost containment has become increasingly important in the life insurance industry, in part because of the shift that has occurred from higher-margin whole life products to products with reduced margins, such as term insurance, annuities and other retirement products.

Lab Services

Our wholly-owned subsidiary, Heritage Labs International, LLC., processes the blood and urine specimens obtained in connection with a portion of the paramedical examinations handled by Portamedic, as well as the specimens provided by third-party health information service providers. Most insurance carriers use more than one lab. Heritage Labs’ laboratory provides testing services which consist of certain specimen profiles designed to provide insurance companies with specific information of relevance to the assessment of the applicant’s health profile, such as:

| | · | the presence of antibodies or antigens to the human immunodeficiency virus (HIV); |

| | · | cholesterol and related lipids; |

| | · | liver or kidney disorders; |

| | · | the presence of antibodies to hepatitis; |

| | · | prostate specific antigen; |

| | · | tobacco/nicotine use; and |

| | · | the use of certain medications, cocaine and other drugs. |

Heritage Labs’ laboratory currently operates at approximately 65% of capacity. We are exploring business opportunities, including opportunities in the wellness and disease management markets, to utilize the additional capacity of our laboratory.

Outsourced Underwriting

We made our initial entry into the outsourced underwriting business through the acquisition of Medicals Direct Group, which provides outsourced underwriting services in connection with life insurance policies that are underwritten in the United Kingdom. We built on this platform in 2004 by acquiring Mid-America Agency Services, Inc. (MAAS), an insurance services organization based in Omaha, Nebraska that provides underwriting services to the insurance underwriting industry on an outsourced basis, without the mortality and morbidity risks, using professionals who are trained in medical, non-medical and financial aspects of underwriting.

At various times during the calendar year, the level of insurance application activity can vary significantly. It is costly for carriers to maintain an underwriting staff sufficient to handle the peak periods on a year-round basis. To date, MAAS’s outsourced underwriting services have been utilized extensively by one primary customer, and more recently by other customers, to deal with overflow and regular new business processing activity.

Claims Evaluation Division

Claims Evaluation Services

Our Claims Evaluation Division provides medical claims evaluation services to insurance adjusters for use in processing personal injury accident claims, primarily on behalf of property and casualty insurance carriers. While we also serve disability insurance carriers, revenues from these carriers have not been significant. We provide our claims evaluation services primarily in connection with automobile claims and workers’ compensation claims, with a small volume of services rendered in connection with general liability claims and, on the life and health insurance side of the insurance industry, private disability claims.

Our claims evaluation services encompass arranging:

| | · | independent medical examinations (IMEs); |

| | · | peer reviews (i.e., an analysis of a prior treatment performed by a doctor in the same specialty to determine the appropriateness of the treatment); |

| | · | file reviews (i.e., the review of a claim file for purposes other than to review the appropriateness and necessity of the treatment); |

| | · | radiology reviews (i.e., the review of imaging studies, such as X-rays and MRIs, to confirm previous readings and interpretations of diagnostic studies); |

| | · | functional capacity evaluations (i.e., an extensive set of tests done by a licensed therapist designed to test the ability to perform specific job tasks and activities of daily living); and |

| | · | other ancillary services that assist in processing claims. |

The administration of the above services must be performed efficiently and effectively, working within the parameters of applicable law, regulations and customer protocols. Customer service success is measured by the overall accuracy, timeliness and quality of these services. Managing and maintaining a credentialed provider network available to provide these services is critical. Our Claims Evaluation Division’s provider panel includes practitioners of multiple specialties in 46 states.

Customers

Health Information Division

The businesses that comprise our Health Information Division provide risk assessment services to over 700 life insurance companies in the United States, including most of the top 100 insurance companies in the United States, and virtually all of the roughly 50 life insurance companies operating in the United Kingdom.

Although no single customer represented more than 10% of the Health Information Division’s total revenue in 2006, the division’s three largest customers represented 7%, 6% and 5%, respectively. The division’s top 10 customers represented approximately 39% of division revenues in 2006.

We have written agreements with certain carrier customers, with terms of between one and three years.

Claims Evaluation Division

Our Claims Evaluation Division’s customer base includes property & casualty insurance companies, third party administrators, employers and other self-insured entities, law firms and public sector entities.

The CED’s largest 5 clients accounted for approximately 63% of the division’s revenues in 2006.

We typically enter into oral and written agreements with our Claims Evaluation Division’s customers. Service standards are addressed on a case-by case basis with our customers.

Sales and Marketing

Health Information Division

Our core Portamedic business requires a two-step sales process, notwithstanding the greater proportion of life insurance sold through what we refer to as the alternative distribution channel (i.e., sales through direct mail, telephone and the Internet directly to the public). First, our Portamedic corporate sales representatives must negotiate with the national office of a life insurance carrier to get on its list of approved outside risk assessment service providers. Second, our field sales personnel must sell to the carrier’s local agents and to the community of independent brokers and agents that sell that carrier’s products.

To more effectively address sales at the national carrier level, we have recently augmented our corporate sales team. We also have a sales team whose primary focus is the alternative distribution channel. Success at the local level requires establishing, maintaining and nurturing relationships with the agents and brokers. In 2006, we increased the number of field sales personnel in our HID division and implemented new sales incentive programs.

Claims Evaluation Division

The Claims Evaluation Division markets its claims evaluation services to insurance claims adjusters working generally in four distinct lines of insurance: automobile, workers’ compensation, disability and general liability. The division’s target customers include the entities that handle such claims. The sales process occurs at three levels: the national/regional contracting level, the claims processing center or branch level, and the local claims office/individual adjuster level. Individual adjusters have historically had significant discretion in the choice of outside claims evaluation service vendors.

The Claims Evaluation Division has a full-time sales staff dedicated to soliciting business from prospective customers and generating revenue growth from existing customers. Their responsibilities include developing and maintaining customer contact.

Information Technology

In 2006, we completed several major upgrades of our information technology (IT) infrastructure and applications, including:

| | · | new branch office software applications that automate operations previously performed manually, which will improve the quality and timeliness of our paramedical examination network. The new applications (i) improve accuracy and timeliness of services to be provided based on individual carrier requirements, (ii) provide rules-based outcomes of processes based on carrier and broker requirements, (iii) allow paramedical examiners to log on and manage their work flow remotely, and (iv) allow carriers/brokers to view the work flow remotely; and |

| | · | development of a new data center, with high-speed (T-1) connections to all of our offices, and storage area networks. |

Competition

Health Information Division

Our core Portamedic business is the largest of the four national firms, whose businesses encompass arranging paramedical examinations, providing specimen analysis, conducting interviews of insurance applicants and medical records collection for the life insurance industry. The other three firms are ExamOne, a subsidiary of Quest Diagnostics Incorporated, Examination Management Services, Inc. (EMSI) and American Para Professional Systems, Inc. (APPS). In addition, a significant number of regional and local firms also compete in this industry. Although we have exclusive relationships with certain of our carrier customers, most customers generally use two or more risk assessment service providers.

Our Heritage Labs subsidiary is one of three national laboratories, the others being LabOne and the privately-held Clinical Reference Laboratory (CRL). LabOne and CRL both focus on activities beyond the testing of blood, urine and oral fluid specimens for the life and health insurance industries.

In management’s view, the principal competitive factors in the medical-related risk assessment services market are (i) the ability to further the cost containment objectives of insurance carriers, (ii) the ability to further reduce underwriting cycle time, and (iii) the efforts made to establish, maintain and nurture relationships with the agents and brokers that determine which company they will use to provide risk assessment services.

Claims Evaluation Division

The outsourced medical claims management services industry is relatively fragmented. Management believes that the Claims Evaluation Division may be one of the leading providers of IMEs in the Northeast and Midwest regions of the United States. Our competition includes numerous businesses that provide services on a regional, local or, in some cases, customer-specific basis. Certain competitors that are publicly held offer services beyond medical evaluative services.

Government Regulation

The businesses that comprise our Health Information Division, in particular, our paramedical examination and lab businesses are subject to federal and state regulation. The paramedical examiners we utilize are subject to licensing and certification requirements and regulations with respect to the drawing of blood and needle disposal. We are subject to federal and state regulation relating to the transportation, handling and disposal of the various specimens obtained in the course of a paramedical or medical examination. The Food and Drug Administration governs certain aspects of Heritage Labs’ business, including the manufacture of specimen collection kits. In addition, certain aspects of the risk assessment services we provide may be subject to certain provisions of the Health Information Portability and Accountability Act of 1996 (“HIPAA”) relating to the privacy of protected health information.

The business conducted by our Claims Evaluation Division is regulated or affected by the laws and regulations of the states in which we operate and, to a lesser extent, federal laws and regulations. Many states require entities that provide some of the services we provide, such as medical review services, to be registered with or licensed by the state. These laws typically establish minimum standards for qualifications of personnel, confidentiality and internal quality control. In addition, because workers’ compensation claims, automobile insurance claims and general liability claims are generally governed by state law, the demand for most of the division’s services is affected by the insurance laws of the various states in which we conduct business. These state regulatory regimes and other laws frequently change. The changes may create a greater or lesser demand for some or all of our services or require us to develop new or modified services to meet the needs of our customers and compete effectively with other providers of claims evaluation services.

The CED’s business may also be indirectly subject to certain regulations promulgated under HIPAA. These regulations establish standards relating to the privacy and security of protected health information, which is individually identifiable health information, such as an individual’s medical records. These regulations are designed to protect the confidentiality, integrity and availability of health information through restrictions on the use and disclosure of the information, and through required implementation of safeguards to secure electronically maintained protected health information. We believe that we comply with these privacy and security standards to the extent that we are required to do so by contract with our customers.

Employees

We employ approximately 3,000 persons in our Health Information Division and 150 persons in our Claims Evaluation Division. In addition to approximately 120 personnel in the corporate headquarters in Basking Ridge, New Jersey, our Health Information Division employs a field staff that receives and processes the orders for the division’s services. In our Claims Evaluation Division, our employees are based in the regional operations centers and perform administrative, scheduling, quality reviews and marketing-related functions.

General Information

Hooper Holmes, Inc. is a New York corporation. Our principal executive offices are located at 170 Mt. Airy Road, Basking Ridge, New Jersey 07920. Our telephone number is (908) 766-5000. Our website address is www.hooperholmes.com. We have included our website address as an inactive textual reference only. The information on our website is not incorporated by reference into this annual report on Form 10-K. We make available through our website our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, Forms 3, 4 and 5 filings, and all amendments to these reports and filings as soon as reasonably practicable after such material is electronically filed with the SEC. These documents may also be accessed through the SEC’s website at www.sec.gov.

Risks Related to the Company Generally

If we are unable to implement the plans outlined in our September 2006 strategic review, we may not realize the anticipated financial improvements.

In September 2006, we completed a strategic review which resulted in detailed plans to implement expense management initiatives, along with related incremental revenue opportunities. The implementation period for these plans is expected to cover eight quarters. These plans, when fully implemented, are expected to result in approximately $17.5 million of additional operating income on an annual basis.

If we are unable to complete some, or all, of the strategic review detailed plans, we may not realize the additional operating income expected as a result of their implementation.

If the Company is unable to comply with the terms of its Loan & Security Agreement with CitiCapital Commercial Corporation dated October 10, 2006, the Company may not have sufficient cash to meet its operating and capital requirement needs.

On October 10, 2006, the Company entered into a three year Loan and Security Agreement with CitiCapital Commercial Corporation. The agreement requires the Company to adhere to certain financial covenants, which are fully discussed in Note 9 to the consolidated financial statements contained in this annual report on Form 10-K. The amount of available borrowings under this facility is limited to 90% of eligible receivables, plus 65% of the fair market value of the Company’s headquarters, not to exceed $25 million in aggregate. The agreement contains one financial covenant whereby the Company must maintain a fixed charge coverage ratio of 1:1, if the available borrowing base, less amounts outstanding under the credit facility, is less than $10 million. The borrowing base at December 31, 2006 was $19.2 million. If the Company fails to comply with this financial covenant, the Company’s ability to borrow under this facility could be limited and have a negative effect on the Company’s ability to finance its operations.

If we cannot maintain and upgrade our information technology platform so that our customers are able to readily access critical data related to their underwriting decisions or processing of claims, the competitiveness of our businesses will suffer.

In each of our businesses, the speed with which we make information available to our customers is critical. As a result, we are dependent on our information technology platform and our ability to store, retrieve, process, manage and enable timely customer access to the health-related and other data we gather on behalf of our customers. Disruption of the operation of our IT systems for any extended period of time, loss of stored data, programming errors or other system failures could cause customers to turn elsewhere to address their service needs. In addition, we must continue to enhance our IT systems to keep pace with our competitors’ service and product enhancements.

Acquisitions, alliances or other investments present many risks, and we may not realize the anticipated financial and strategic goals of any of our acquisitions or other investments.

As part of our business strategy, we have pursued acquisitions and other strategic investments that will complement our existing services and leverage our existing capabilities. There is no guarantee that these activities will be profitable, or that we will continue to offset the decline in operating results of our Portamedic business through these types of activities. Any such acquisition or other investment involves a number of risks, including:

| | · | we may find that the acquired company or assets do not further our business strategy, or that we overpaid for the company or assets, or that economic conditions have changed, all of which may result in a future impairment charge; |

| | · | we may have difficulty integrating the operations (including IT systems) and personnel of an acquired business and may have difficulty retaining its customers and/or key personnel; |

| | · | our ongoing business and management’s attention may be disrupted or diverted by transition or integration issues and the complexity of managing diverse locations; and |

| | · | we may have difficulty maintaining uniform standards, controls, procedures and policies across locations. |

An ill-advised acquisition, business alliance or other investment could hurt our business, results of operations and financial condition or cash flows, particularly in the case of a significant acquisition or multiple acquisitions in a short period of time. From time to time, we may enter into negotiations for acquisitions or other investments that are not ultimately consummated. Such negotiations could result in significant diversion of management’s time from our business as well as significant out-of-pocket costs.

The consideration that we pay in connection with an acquisition or other investment could affect our financial condition. If we were to proceed with one or more significant acquisitions or other investments in which the consideration included cash, we could be required to use a substantial portion of our available cash to consummate such acquisitions. To the extent we issue shares of stock or other rights to purchase stock, including options or other rights, our then-existing shareholders may experience dilution in their share ownership in our company and their earnings per share may decrease. In addition, acquisitions or other investments may result in the incurrence of debt, large one-time write-offs and restructuring charges. They may also result in goodwill and other intangible assets that are subject to impairment tests, which could result in future impairment charges. Any of these factors may decrease our operating results and weaken our financial condition.

Risks Related to Our Health Information Division

We expect that the market for our life insurance risk assessment services will continue to contract.

Each of our paramedical examination, tele-underwriting, attending physician statement (APS) retrieval, lab specimen testing and outsourced underwriting businesses is directly influenced by the level of life insurance application activity in the United States and in the United Kingdom. Based on available data, life insurance application activity in North America has declined in each of the last four years. The data are consistent with the fundamental changes that reportedly have been occurring within the life insurance industry over a number of years, changes that have resulted in the slow decline of the market for life insurance. We do not foresee a change in this trend.

Our paramedical examination, lab specimen testing and APS retrieval businesses are also affected by decisions of life insurance carriers as to the policy amount thresholds, and the age of applicants and other criteria for which life insurance carriers require such services. In general, a raising of these thresholds and other criteria has a negative effect on the demand for our services.

We may experience unintended negative consequences as a result of the elimination of geographic overlaps among some of our Portamedic branch offices.

During 2006 and continuing into 2007, we will eliminate the geographic overlap that exists among some of our branch offices. The restructuring of Portamedic’s branch structure is motivated by the objective of lowering the division’s operating costs and improving efficiencies. However, the elimination of certain offices could have unintended negative consequences, including a loss of locally generated business and/or loss of employees. Further, we may not realize the anticipated levels of cost improvements, greater efficiencies and improved synergies from this restructuring.

Improper actions by our paramedical examiners or our physician practitioners could cause us to lose business and result in claims against us or our incurring expenses to indemnify our life insurance carrier customers.

In the first quarter of 2006, a life insurance company client informed us that, after investigation, the client determined that it issued certain life insurance policies that were procured by fraudulent means employed by insurance applicants, the client’s agents, the Company’s sub-contracted examiners and others. As of the date of filing this Form 10-K, no claim has been asserted against the Company by the client, nor has the client produced any evidence pertaining to the matter. The service agreement between the Company and the client contains certain indemnification provisions which may be applicable. While the Company believes it is probable that the client will assert a claim against the Company for partial indemnification, it also believes that the Company has meritorious defenses to any such claim. However, the risk exists in this situation (and in other instances where allegations of wrongdoing are made regarding our paramedical examiners or physician practitioners) that the client relationship may be damaged, such that we experience a drop-off in the volume of business from the client or the loss of the client’s business.

We have experienced downward pricing pressure from our life insurance carrier customers, which has hurt our operating margins and otherwise adversely affected our operating results.

For the past several years, we have experienced downward pricing pressure from our life insurance carrier customers. We attribute this pressure to the carriers’ efforts to address cost items in a more rigorous manner in an attempt to maintain their profitability and level of return to their investors and other stakeholders.

With price having become the primary basis of competition in the paramedical examination business, we have experienced declines in our average revenue per exam. This has been a significant factor in the decline in revenues derived by our core paramedical examination business in each of the last three years, and the related declines in operating margins and cash flow from operating activities. Although the Company recently instituted increased pricing for certain customers in response to improved levels of service, price increases may not be widely accepted by our customers and may not be sufficient to reverse past pricing declines.

Our Health Information Division’s ten largest customers represented approximately 39% of division revenues in 2006. The loss of a significant volume of business from any of these customers could be expected to result in a material reduction in our revenues and negatively affect our cash flows from operating activities.

In 2006, our Health Information Division’s top 10 customers represented, in the aggregate, approximately 39% of the division’s revenues (excluding UK volume). The loss of a significant volume of business from any of these customers could be expected to result in a material reduction in our revenues and negatively affect our cash flows from operating activities.

Heritage Labs’ failure to provide accurate laboratory test results may result in claims against us.

Our Heritage Labs subsidiary processes the blood, urine and other specimens obtained in connection with a portion of our paramedical examinations, as well as specimens provided by third-party health information service providers. Our insurance company clients and these third-party health information service providers rely on the accuracy of the test results and other data in connection with their insurance underwriting, treatment and other decisions. In addition, federal and state laws regulate the disclosure of specimen test results and other nonpublic medical-related personal information. If Heritage Labs does not provide accurate test results or does not protect the confidentiality of such results in accordance with applicable laws, we could face significant liability.

Our classification of most of our paramedical examiners outside of the States of California, Montana and Oregon as independent contractors, rather than employees, exposes us to possible litigation and legal liability.

We classify most of our paramedical examiners outside the States of California, Montana and Oregon as independent contractors, making such examiners personally responsible for their employment taxes and workers’ compensation. In the past, some state agencies have claimed that we improperly classified our examiners as independent contractors, rather than employees, for purposes of state unemployment tax laws and that we were, therefore, liable for arrears of taxes or for penalties for failure to comply with these laws. Should any jurisdictions in which we conduct operations determine that our paramedical examiners are employees, we may be exposed to liability, as well as increased operating costs.

Risks Related to Our Claims Evaluation Division

There are signs that the outsourced medical claims management market in the United States may be contracting, which may limit the potential growth of our Claims Evaluation Division’s business.

Our management perceives that the outsourced medical claims management market in the United States, including the market for the Claims Evaluation Division’s claims evaluation services, may be contracting. There are a number of factors that may be contributing to the trend including the decrease in manufacturing employment levels in the United States and the associated decline in the rates of workplace injuries and, in turn, workers’ compensation claims, the reported decline in the number of people injured in automobile accidents in the United States, and changes in state laws and regulations that, in general encourage the use of managed care techniques in handling workers’ compensation and automobile-related personal injury insurance claims.

Our Claims Evaluation Division’s business is being affected by increased customer procurement demands, driven primarily by heightened federal laws and regulations, that are increasing operating costs.

Our Claims Evaluation division’s business is being affected by increased customer procurement demands. These demands are being primarily driven by heightened compliance and security standards being imposed at the federal and state levels. Compliance with these demands entails higher operating costs, which has contributed to reduced margins and profitability.

Our Claims Evaluation Division has a significant degree of customer concentration, such that the loss of any one of its larger customers would have a material effect on its operating results.

Our Claims Evaluation Division’s 5 largest clients accounted for 63% of the division’s revenues in 2006. The loss of any of these customers would likely result in a reduction in the Claims Evaluation Division’s revenues and profitability, and that reduction may be material.

The nature of the claims evaluation services we provide exposes us to possible litigation and liability.

Through our network of physician practitioners, our Claims Evaluation Division provides assessments of the appropriateness of healthcare providers’ medical treatment plans. The nature of this work is such that we could be exposed to claims for adverse medical consequences. The Claims Evaluation Division does not grant or deny claims for payment of benefits and, to date, has not been made a defendant in any litigation relating to any such decision. However, this does not preclude future exposure to claims that may arise or result from the decisions of our customers. We maintain professional liability insurance and such other coverage as we believe appropriate, but such insurance may prove insufficient.

Our Claims Evaluation Division could be negatively affected by changes in what is a fragmented, but highly competitive market.

The market for claims evaluation services market is fragmented, but competitive. We compete with many smaller vendors who generally provide such services on a local level, particularly companies with established relationships with one or more local insurance company claims adjusters. We also compete with larger companies that offer a broader selection of complementary services. Changes in the competitive landscape, including the performance by our property and casualty carrier customers of a greater degree of claims evaluation services in-house, could negatively affect our business.

If any of the members of our physician panel were to be found to lack proper credentials or be determined to be less than “independent”, the damage to our reputation and business could be considerable.

The nature of the Claims Evaluation Division’s business is such that the proper credentialing and “independence” of each member of the division’s panel of physicians that perform IMEs has been, and remains, of paramount importance. Even though our credentialing process is accredited by URAC, there remains an exposure to liability resulting from improper conduct during an examination encounter even with the most rigorous of credentialing processes.

ITEM 1B | Unresolved Staff Comments |

Not applicable.

We own a five building complex located at 170 Mt. Airy Road, Basking Ridge, New Jersey approximately 45 miles southwest of New York City. Of approximately 53,000 total square feet of office space, we maintain our operations in approximately 45,000 square feet and the balance is leased or available for lease to several tenants. Management believes that this arrangement provides for our foreseeable expansion needs.

Our asset-based lending agreement with CitiCapital Commercial Corporation includes a provision using fair value of our office building as collateral.

We lease our regional operations centers and field offices under a number of operating leases with varying terms and expirations, typically three years in duration. We also lease 9,200 sq feet in Allentown, PA for a business continuity and operations center.

On January 25, 2005 Sylvia Gayed, one of the Company’s examiners in California, filed a class-action lawsuit against the Company in the Superior Court of California, Los Angeles County, alleging violations of California’s wage and hour laws. The complaint alleged that the Company failed to pay overtime wages, provide meal and rest periods and reimbursement for expenses incurred by examiners in performing examinations. We currently employ approximately 400 examiners in California and have employed in excess of 1,400 examiners in California over the past 60 months. Following mediation on December 6, 2006, the parties reached a settlement, pursuant to which the Company will pay the sum of $1.2 million to the class members in full settlement of this lawsuit.

ITEM 4 | Submission Of Matters To A Vote Of Security Holders |

No matters were submitted to a vote of securities holders during the fourth quarter of the fiscal year covered by this report.

PART II

ITEM 5 Market For The Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities

Market Information

Our common stock is traded on the American Stock Exchange (AMEX) under the symbol “HH.” Options of our common stock are also traded on the AMEX.

Common Stock Price Range

The following table shows, for the periods indicated, the high and low closing sales prices per share of our common stock based on published financial sources: (dollars)

| | 2006 | 2005 |

| Quarter | High | Low | High | Low |

| First | 3.80 | 2.24 | 5.95 | 3.51 |

| Second | 3.25 | 2.50 | 4.45 | 3.22 |

| Third | 3.85 | 2.71 | 4.36 | 3.86 |

| Fourth | 3.65 | 2.92 | 3.87 | 2.50 |

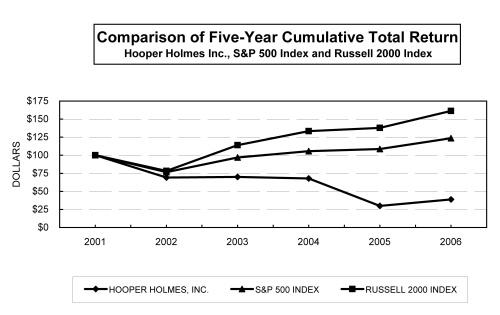

The following graph shows a comparison of cumulative total returns for an investment in our common stock, the [S&P 500 Composite Index] and the [Russell 2000 Index]. It covers the period commencing December 31, 2001 and ending December 31, 2006. The graph assumes that the value for the investment in our common stock and in each index was $100 on December 31, 2001 and that all dividends were reinvested. This graph is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and the graph shall not be deemed to be incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934.

Holders

According to the records of our transfer agent, Registrar and Transfer Company, Cranford, NJ, as of February 15, 2007, there were 1,025 holders of record of our common stock.

Dividends

No dividends were paid in 2006, as directed by a resolution of the Board of Directors. In 2005, the Company paid quarterly dividends per share as follows: (dollars)

| Quarter | 2005 |

| First | .015 |

| Second | .015 |

| Third | .015 |

| Fourth | .015 |

As mentioned above, our Board of Directors suspended the payment of cash dividends on the Company’s common stock in 2006. Furthermore, we are precluded from declaring or making any dividend payments or other distributions of assets with respect to any class of our equity securities under the terms of our Loan and Security Agreement with CitiCapital Commercial Corporation.

Recent Sales of Unregistered Securities

Stock Grants to Non-Employee Directors

On January 28, 2003, our Board of Directors authorized the issuance of shares of the Company’s common stock to the then non-employee directors of the Company for future services. Such resolution provided for the issuance of 5,000 shares to each of these directors on each of January 31, 2005, 2004 and 2003. Accordingly, we have issued an aggregate of 90,000 shares of our common stock to the six non-employee directors who served on the Board during this time. All of these shares issued are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933 (the “Securities Act”). These share issuances were exempt from registration pursuant to Section 4(2) of the Securities Act as “transactions not involving a public offering.” No underwriter participated in these transactions, nor was any commission paid.

Each of the stock award agreements memorializing the share issuances to each of the non-employee directors provides that the shares may not be sold or transferred by the director until four years from the date of issue, and then only if covered by an effective registration statement or an exemption from registration under the Securities Act. In January 2006, the Board adopted a resolution removing all contractual restrictions with respect to any such shares held by a director who retires from the Board and is not removed with cause.

Purchase of Equity Securities by the Issuer and Affiliated Purchaser

On May 30, 2000, the Board of Directors authorized the repurchase in any calendar year of up to 2,500,000 shares of the Company’s common stock for an aggregate purchase price not to exceed $25.0 million. On April 27, 2005 the Board of Directors amended its earlier resolution limiting the repurchases to between 1.0 and 1.5 million shares of the Company’s common stock in any calendar year. Shares may be repurchased in open market purchases or through privately negotiated transactions. Under the terms of our credit agreement with CitiCapital Commercial Corporation, we are not permitted to purchase any shares of our common stock. We did not purchase any shares in 2006 or in 2004; we purchased 30,800 shares in 2005.

ITEM 6 | Selected Financial Data |

The following table of selected financial data should be read in conjunction with our consolidated financial statements and related notes, the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other financial information appearing elsewhere in this annual report. The statement of operations data set forth below for each of the years in the three year periods ended December 31, 2006, and the balance sheet data as of December 31, 2006 and 2005, have been derived from, and are qualified by reference to, our consolidated financial statements appearing elsewhere in this annual report. The statement of operations data for the years ended December 31, 2003 and 2002, and the balance sheet data as of December 31, 2004, 2003 and 2002, are derived from the Company’s consolidated financial statements that are not included in this annual report.

| | | For the years ended December 31, | |

(in thousands except for share data) | | 2006 | | 2005 | (c) | 2004 | | 2003 | | 2002 | |

| Statement of operations data: | | | | | | | | | | | |

| Revenues | | $ | 293,862 | | $ | 320,346 | | $ | 326,651 | | $ | 300,182 | | $ | 260,317 | |

| Operating income (loss) | | | (55,672 | )(a) | | (134,319 | )(b) | | 17,581 | | | 26,794 | | | 21,872 | |

| Interest expense | | | 421 | | | 524 | | | 632 | | | 386 | | | 113 | |

| Net income (loss) | | | (85,181 | ) | | (96,623 | ) | | 10,015 | | | 15,847 | | | 14,293 | |

| Basic earnings (loss) per share | | | (1.28 | ) | | (1.47 | ) | | .15 | | | .24 | | | .22 | |

| Diluted earnings (loss) per share | | $ | (1.28 | ) | $ | (1.47 | ) | $ | .15 | | $ | .24 | | $ | .21 | |

| Cash dividends per share | | | - | | $ | .06 | | $ | .06 | | $ | .05 | | $ | .04 | |

| Weighted average shares - basic | | | 66,804,605 | | | 65,513,451 | | | 64,996,778 | | | 64,733,346 | | | 64,868,163 | |

| Weighted average shares - diluted | | | 66,804,605 | | | 65,513,451 | | | 66,534,421 | | | 66,598,604 | | | 67,229,119 | |

| Balance Sheet Data (as of December 31): | | | | | | | | | | | | | | | | |

| Working capital | | $ | 19,998 | | $ | 33,772 | | $ | 38,296 | | $ | 53,378 | | $ | 59,173 | |

| Total assets | | | 84,897 | | | 162,331 | | | 275,109 | | | 256,019 | | | 236,953 | |

| Current maturities of long-term debt | | | - | | | 1,000 | | | 1,067 | | | 1,028 | | | 173 | |

| Long-term debt, less current maturities | | | - | | | - | | | 1,000 | | | 2,000 | | | 3,314 | |

| Total long-term debt | | | - | | | 1,000 | | | 2,067 | | | 3,028 | | | 3,487 | |

| Stockholders’ equity | | $ | 48,808 | | $ | 128,902 | | $ | 227,959 | | $ | 219,876 | | $ | 206,211 | |

(a) Includes goodwill and long-lived asset impairment charges of $36.2 million and $1.8 million, respectively, along with special charges totaling $10.5 million.

(b) | Includes goodwill and long-lived asset impairment charges of $115.6 million and $18.0 million, respectively, along with special charges totaling $6.6 million. |

(c) | Certain reclassifications have been made to conform to the 2006 presentation. |

ITEM 7 Management Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis contains forward-looking statements. See page 3 of this annual report on Form 10-K for information regarding our use of forward-looking statements in this annual report. This discussion and analysis should be read in conjunction with our audited consolidated financial statements and related notes included in Item 8 of this annual report.

Overview

Hooper Holmes, Inc. and its subsidiaries currently engage in businesses that are managed as two separate divisions: the Health Information Division and the Claims Evaluation Division.

Our Health Information Division (HID) provides medical-related risk assessment information to life and health insurance carriers, information that is integral to such carriers’ underwriting decisions. These services include:

| | · | arranging paramedical and medical examinations of individual insurance policy applicants - mainly life insurance policy applicants - throughout the United States (under the Portamedic brand name) and in the United Kingdom (under the Medicals Direct brand name); |

| | · | performing telephone interviews of applicants and collecting applicants’ medical records; |

| | · | testing the blood, urine and other specimens obtained in connection with a portion of the paramedical examinations we coordinate, as well as specimens provided by third-party health information service providers; and |

| | · | underwriting life insurance policies on an outsourced basis for life insurance companies. |

Our Health Information Division accounted for 89.3%, 88.0% and 86.7% of our total revenues in 2006, 2005 and 2004, respectively. Our core Portamedic paramedical examination business accounted for 60.1% of our HID revenue and 53.7% of our total revenue in 2006. In 2005 and 2004, Portamedic accounted for 61.0% and 66.7% of HID revenues and 53.7% and 57.9% of our total revenues, respectively.

Our Claims Evaluation Division (CED) provides medical claims evaluation services to property and casualty (P&C) insurance carriers, law firms, self-insureds and third party administrators for use in processing personal injury accident claims. The core activity of this business consists of arranging for independent medical exams (IMEs). An IME is a medical examination by a doctor (other than a claimant’s physician) for the purpose of rendering an objective opinion regarding the nature, origin, treatment and causal relationship of an injury. We provide our claims evaluation services in connection with automobile, liability, disability and workers’ compensation claims.

Our Claims Evaluation Division accounted for 10.7%, 12.0% and 13.3% of our total revenues in 2006, 2005 and 2004, respectively.

Status of Our Strategic Review and Turnaround Program

In the first quarter of 2006, our management team initiated an extensive review of all aspects of the Company’s business. The review was undertaken to assess our organizational strengths and challenges and to help plot a future course of action.

As a result of our review, management formulated a turnaround program to address the continuation of the negative financial trends we have been experiencing, particularly in our core Portamedic business. Management anticipates that the Company will pursue the financial and other goals of this program in three phases:

Phase 1 - Expense Management

Phase 2 - Revenue Enhancement

Phase 3 - Growth Investment

Expense Management

In May 2006, the Company began a strategic review process which divided the Company into teams, each with specific accountability and responsibility. The process was led by an executive team, with support from external consultants, EHS Partners. Although the strategic review’s primary focus was expense management, there were also incremental revenue opportunities identified during this first phase of our turnaround program.

The Company’s strategic review was completed in September, 2006, at which time detailed plans were formulated to implement expense management initiatives identified during the review, along with the related incremental revenue opportunities. The implementation period is expected to cover eight quarters, with the majority of the initiatives to be completed by December 31, 2007. The two year implementation period reflects management’s decision to move in a careful, methodical manner in order to protect existing revenues and our ability to deliver client service. Management recognizes that our wholly-owned branches, dedicated Portamedic examiners, customer service representatives and branch managers are essential to our success.

Management’s plans, when fully implemented, are expected to result in approximately $17.5 million of additional operating income on an annual basis, comprised of $11.5 million in annual cost reductions and approximately $6.0 million of additional operating income from new revenue initiatives. The expected impact on gross margin of these plans is an increase of approximately $12.7 million, with an expected SG&A expense reduction of $4.8 million. For calendar year 2007, management expects the plan initiatives should generate approximately $6.8 million in cost reductions and $3.5 million of additional operating income from revenue initiatives.

The expense management initiatives currently being implemented focus on:

| · | aligning costs with revenues to improve operating margins; |

| · | improving utilization of Company assets, including a balancing of branch office volumes and operating costs, while eliminating geographic overlap among our branch offices; |

| · | improving our information technology platform to generate cost efficiencies; |

| · | consolidation of our regional service centers; and |

| · | enhancing operational controls on a Company-wide basis with a focus on reducing costs. |

The financial benefit of these expense management initiatives should begin to have a positive impact in our first quarter 2007 financial results.

Revenue Enhancement

The focus of Phase 2 of our turnaround program, which began in the first quarter of 2007, will be to reverse the decline in revenues and profitability we are experiencing in each of our two divisions and pursue opportunities for revenue enhancement. As noted previously, although the focus of Phase 1 was primarily expense management, there were also revenue enhancement initiatives identified. Additional initiatives will be identified during Phase 2 which are expected to increase revenues. These initiatives, including the revenue enhancement opportunities already implemented, consist of:

| | · | seeking opportunities to grow and expand our current services by delivering new and increased value to our customers. The life insurance market in the United States continues to decline based on the reduction in life insurance activity. In order to stabilize and ultimately grow our Portamedic market share in a flat or declining market, we need to deliver higher levels of service, speed and quality, which we believe are critical metrics to our customers’ success; |

| | · | increasing the number of local sales and marketing people calling upon local insurance agents in our Portamedic business. While we have national contracts with a large number of leading insurance carriers, the majority of our Portamedic business is generated locally through our branch offices and the local insurance agents and brokers they serve. We are also increasing the sales force in our other businesses, including Heritage Labs, MAAS and the Claims Evaluation Division. In addition, sales incentive plans have been implemented in 2007 for all sales personnel of the Company; |

| | · | introducing new products and services which address the critical business needs of new and existing customers and, as a result, provide additional revenue opportunities for our Company; and |

| | · | obtaining price increases from customers in response to improved service levels provided by the Company, along with charging for ancillary services not currently charged for, but in conformance with industry standards (e.g. cancellation fees, etc.). |

We believe that the revenue enhancement initiatives described above should help stabilize revenue declines experienced by our Company over the past several years.

Growth Investment

The final phase of our turnaround program is growth investment. Beginning in the second half of 2007, with the benefits of our reduced cost structure, we plan to pursue a phase of organic growth. This phase will include our development of an optimal growth strategy which focuses on our core capabilities. We believe that the wellness and disease management markets present a major opportunity to leverage our core capabilities, primarily our ability to deliver medical examinations at any location in the U.S., along with the related lab testing and fulfillment services. As health care premiums continue to rise (approximately 11% annually in the last 15 years), wellness and disease management programs have developed into a large market which continues to grow at approximately 20% per annum. Most major corporations are turning to the wellness market for services and methodologies to control and reduce health-care costs (i.e., identify and mitigate employee health risks, before the risks result in an expensive medical claim).

We believe that our core capabilities represent a significant asset to current and potential wellness customers, including the ability to schedule medical screenings for large groups of employees, manufacture the necessary collection kits, conduct group screenings at any location and analyze and transmit the related medical data.

In addition to the wellness market, we will continue to leverage our core skills to extend our current services into new growth markets. All organic and acquisition opportunities identified during this phase will be screened for growth potential, profitability and risk.

Conversely, we continually evaluate each of our current business units based on their growth potential, expected return on equity and strategic importance to our turnaround program, in order to ensure we are investing only in those businesses which we believe offer the greatest potential sustainable return to our shareholders.

Key Factors and Industry Trends Affecting Our Businesses

Our revenue, profitability and cash flows are directly affected by the demand for our services, the prices we can charge for the services we provide, the relative volume of the higher-margin services we provide relative to services with lower margins, and our efforts to grow our business and manage our operating and other expenses. In the periods covered by the consolidated financial statements included in this annual report, the businesses that comprise our Health Information Division and our Claims Evaluation Division have been influenced by several key factors or trends, discussed below.

Health Information Division

Decline in Life Insurance Application Activity

We believe that the level of life insurance application activity in the United States and in the United Kingdom had a significant effect on the businesses that comprise our Health Information Division. In general, the lower the level of application activity, the lower the demand for our paramedical examination, tele-underwriting, lab specimen testing and outsourced underwriting services.

Based on data available from the Medical Information Bureau Group, Inc. (MIB), a clearinghouse of policy application information based in Westwood, Massachusetts that is owned by participants in the insurance industry, it appears that life insurance application activity in North America has declined during each of the last four years. The MIB Life Index is the life insurance industry’s timeliest measure of application activity across the United States and Canada. The index is based on the number of searches member company underwriters perform on the MIB database. Since the vast majority of individually underwritten life insurance policies in North America include a MIB search as a routine underwriting requirement, the MIB Life Index provides what our management believes is a reliable proxy for new application activity. The MIB data suggest a decline in application activity of 3.8% in 2006, 3.4% in 2005, 2.3% in 2004 and 4.1% in 2003. Our volume of paramedical examinations performed in 2006 has declined at a higher rate: 8.3% in 2006 and 3.8% in 2005.

The MIB data is consistent with a fundamental change that has been occurring within the life insurance industry over a number of years, that is the reported shift in consumers’ preferences away from individual life insurance and toward other wealth accumulation and investment products, such as annuities and mutual funds.

We also believe that we have lost market share for the services we provide to the insurance industry from 2003 through mid-2006. In an attempt to reverse this loss, management has implemented several initiatives, including the hiring of additional salespersons in the fourth quarter of 2006, along with implementing sales incentive plans for all sales personnel of the Company.

Pricing Pressure from Life Insurance Carriers

For the past several years, we have experienced downward pricing pressure from our life insurance carrier customers. We attribute this pressure to the carriers’ efforts to address cost issues in a more rigorous manner in an attempt to maintain their profitability and level of return to their stakeholders.

As discussed in Item 1. “Business - Sales and Marketing - Health Information Division,” our core Portamedic business must negotiate with the headquarters offices of life insurance carriers to get on their lists of approved outside risk assessment service providers. In the past, those negotiations have increasingly focused on pricing levels as carriers have focused on lowering their costs. However, as we improve our levels of service, speed and quality, we believe we can offer improved value to certain customers, which should help mitigate past pricing declines.

In addition, we anticipate that life insurance carriers’ cost containment objectives will serve to increase the level of interest and demand for tele-interviewing/underwriting and for outsourced underwriting services, both of which we believe further those objectives. Accordingly, we see our businesses that provide those services as having growth potential.

Claims Evaluation Division

Contraction of the Outsourced Claims Management Market in the United States

Our management perceives that the outsourced medical claims management market in the United States, including the market for the Claims Evaluation Division’s claims evaluation services, may be contracting. There are a number of factors that may be contributing to this trend, including:

| | · | the decrease in manufacturing employment levels in the United States and the associated decline in the rates of workplace injuries and, in turn, workers’ compensation claims; |

| | · | the reported decline in the number of people injured in automobile accidents in the United States; and |

| | · | changes in state laws and regulations that, in general, encourage the use of managed care techniques in handling workers’ compensation and automobile-related personal injury insurance claims. Managed care laws generally channel claimants into provider networks and suggest treatment protocols and other constraints on the activity of the physician practitioners in such networks. |

In addition to the factors cited above, the market for claims evaluation services in New York (where a significant portion of the CED’s revenues were derived in the periods covered by the consolidated financial statements included in this annual report) has been adversely affected by the implementation of regulatory changes (for example, shortening the period of time for filing a personal injury and property claim) and efforts to curb auto injury insurance fraud.

Write-Down of Long-Lived Assets and Goodwill

In the fourth quarter of 2006, the Company's management initiated our annual testing for impairment of goodwill, in accordance with applicable accounting pronouncements. We also deemed it appropriate to test for impairment of long-lived assets, since certain impairment indicators were present. During the course of the testing process, we considered a number of events and circumstances that constitute impairment indicators under the literature, including:

| | · | a preliminary expectation that the operating loss in the fourth quarter of 2006 was going to be greater than our fourth quarter forecast; |

| | · | the completion of our 2007 operating budget that reflected an assumption that some of the negative trends adversely affecting the Company's results (discussed above) would continue to a greater extent than our previous forecasts for 2007 and thereafter: and |

| | · | notification during the fourth quarter of a further decline in projected revenue for 2007 from a major customer within the MAAS business. |

Upon completion of the impairment tests, we recorded non-cash impairment charges to long-lived assets and goodwill of $1.8 million and $36.2 million, respectively. For more information regarding these impairment charges, see the discussion under "Results of Operations - Impairment of Long-Lived Assets and Goodwill."

Key Financial and Other Metrics Monitored by Management

In our periodic reports filed with the SEC, we provide certain financial information and metrics about our businesses and each of our two segments, information that our management uses in evaluating the Company’s performance and financial condition. Our objective in providing this information is to help our shareholders and investors generally understand our overall performance and assess the profitability of our businesses and our prospects for future net cash flows.

In 2006, our management primarily focused on tracking our actual results relative to our forecasts and budgets, and measuring the degree of success of efforts to align our costs with lower revenue levels.

With respect to our Health Information Division, our management monitors the following metrics:

| | · | the MIB Life Index data, which, as discussed previously, serves as a proxy for the level of life insurance application activity and indirectly serves to give us a sense of changes in our market share; |

| | · | the number of paramedical examinations and screenings performed by Portamedic and Medicals Direct, respectively; |

| | · | the average revenue per paramedical examination; |

| | · | time service performance, from examination order to completion; |

| | · | the number of tele-interviewing/underwriting reports we generate; |

| | · | the number of specimens tested by our Heritage Labs subsidiary; |