UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2008

Commission file number: 001-09972

HOOPER HOLMES, INC.

(Exact name of Registrant as specified in its charter)

| New York | 22-1659359 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 170 Mt. Airy Road | |

| Basking Ridge, NJ | 07920 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (908) 766-5000

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock ($.04 par value per share) | NYSE Amex |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of Section 15(d) of the Act.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer | * | Accelerated Filer | * | Non-Accelerated Filer | * | Smaller Reporting Company | x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

The aggregate market value of the shares of common stock held by non-affiliates of the Registrant (66,293,962 shares), based on the closing price of these shares on June 30, 2008 (the last business day of the registrant’s most recently completed second fiscal quarter) on the American Stock Exchange, was $67,619,841.

The number of shares outstanding of the Registrant’s common stock as of February 28, 2009 was 68,674,587.

Documents Incorporated by Reference

Items 10, 11, 12, 13 and 14 of Part III incorporate by reference information from the Registrant’s proxy statement to be filed with the Securities and Exchange Commission in connection with the solicitation of proxies for the Registrant’s Annual Meeting of Shareholders to be held on May 19, 2009.

| PART I |

| | | |

| | Cautionary Statement Regarding Forward-Looking Statements | |

| Item 1 | Business | 5 |

| Item 1A | Risk Factors | 14 |

| Item 1B | Unresolved Staff Comments | 18 |

| Item 2 | Properties | 18 |

| Item 3 | Legal Proceedings | 18 |

| Item 4 | Submission of Matters to a Vote of Security Holders | 19 |

| | | |

| PART II |

| | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters | 19 |

| | and Issuer Purchases of Equity Securities | |

| Item 6 | Selected Financial Data | 22 |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 23 |

| Item 7A | Quantitative and Qualitative Disclosures about Market Risk | 45 |

| Item 8 | Financial Statements and Supplementary Data | 45 |

| Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 76 |

| Item 9A | Controls and Procedures | 76 |

| Item 9B | Other Information | 77 |

| | | |

| PART III |

| | | |

| Item 10 | Directors, Executive Officers and Corporate Governance | 77 |

| Item 11 | Executive Compensation | 77 |

| Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 77 |

| Item 13 | Certain Relationships and Related Transactions | 77 |

| Item 14 | Principal Accountant Fees and Services | 77 |

| | | |

| PART IV |

| | | |

| Item 15 | Exhibits and Financial Statement Schedules | 78 |

| | Schedule II – Valuation and Qualifying Accounts | |

| | Signatures | |

FORM 10K

PART 1

In this report, the terms “Hooper Holmes,” “Company,” “we,” “us” and “our” refer to Hooper Holmes, Inc. and its subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended, including, but not limited to, statements about our plans, strategies and prospects under the headings “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this annual report. When used in this Report, the words “expects,” “anticipates,” “believes,” “estimates,” “plans,” “intends,” “could,” “will,” “may” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include statements as to our operating results, revenues, sources of revenues, cost of revenues, gross margins, net and operating losses, our new IT system, our new imaging platform, our expansion of managed scheduling, and the expansion of certain business units. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expected. These risks and uncertainties include, but are not limited to risks related to customer concerns about our financial health, our limited or negative cash flows, our liquidity, future claims arising from the sale of our business, declines in our business, our competitive disadvantage, our ability to successfully implement cost reduction initiatives, as well as risks discussed in Item 1A- Risk Factors, below. Investors should consider these factors before deciding to make or maintain an investment in our securities. The forward-looking statements included in this annual report are based on information available to us as of the date of this annual report. We expressly disclaim any intent or obligation to update any forward-looking statements to reflect subsequent events or circumstances.

Overview

We are a publicly-traded company whose shares of common stock are listed on the NYSE Amex Exchange (AMEX). Our corporate headquarters are located in Basking Ridge, New Jersey.

Our Company history spans over 100 years. Over the last 40 years, our business focus has been on providing health risk assessment services, described more fully below under the caption “Description of Services.” Effective upon the sale of the Claims Evaluation Division (CED) in June 2008, we operate within one reportable operating segment: the Health Information Division.

Our Health Information Division (HID) consists of the following lines of business:

| · | Portamedic – performs paramedical and medical examinations of individuals seeking insurance coverage, mainly life insurance; |

| · | Infolink – conducts telephone interviews of individuals seeking life insurance coverage, and retrieves the medical records of such individuals, to gather much of the medical information needed in connection with the application process; |

| · | Health & Wellness – established in 2007, conducts wellness screenings for health management companies, including wellness companies, disease management organizations and health plans; |

| · | Heritage Labs – performs tests of blood, urine and/or oral fluid specimens, primarily generated in connection with the paramedical exams and wellness screenings performed by our Portamedic and Health & Wellness business units, and assembles and sells specimen collection kits; and |

| · | Underwriting Solutions – provides risk management solutions and underwriting services to reinsurance companies and insurance carriers in the life, health and annuity insurance industry. |

The table below provides a breakdown of our revenues by line of business for each of the three most recently completed fiscal years. Historical financial information presented in this annual report reflects our former Claims Evaluation division (“CED”), sold in June 2008, and our United Kingdom based subsidiary, Medicals Direct Group (“MDG”), sold in October 2007, as discontinued operations. Accordingly, except where specific discussion of MDG and/or CED is made, all financial information presented in this annual report excludes CED and MDG for all periods presented.

| | For the Years Ended December 31, | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Portamedic | | $ | 140,720 | | | | 71.0 | % | | $ | 148,035 | | | | 71.0 | % | | $ | 161,494 | | | | 72.1 | % |

| Infolink | | | 24,983 | | | | 12.6 | % | | | 28,089 | | | | 13.5 | % | | | 32,098 | | | | 14.3 | % |

| Heritage Labs | | | 15,738 | | | | 7.9 | % | | | 17,445 | | | | 8.4 | % | | | 17,860 | | | | 8.0 | % |

| Health & Wellness | | | 7,587 | | | | 3.8 | % | | | 5,007 | | | | 2.4 | % | | | - | | | | - | |

| | | 12,092 | | | | 6.1 | % | | | 13,437 | | | | 6.4 | % | | | 15,962 | | | | 7.1 | % |

| Subtotal | | | 201,120 | | | | - | | | | 212,013 | | | | - | | | | 227,414 | | | | - | |

Intercompany eliminations (a) | | | (2,887 | ) | | | -1.5 | % | | | (3,381 | ) | | | -1.6 | % | | | (3,507 | ) | | | -1.6 | % |

| | $ | 198,233 | | | | 100.0 | % | | $ | 208,632 | | | | 100.0 | % | | $ | 223,907 | | | | 100.0 | % |

| | (a) represents intercompany sales from Heritage Labs to Portamedic |

Description of Services

Portamedic

In the insurance industry, underwriting decisions are based on statistical probabilities of mortality (death) and morbidity (illness or disease), such that insurance companies generally require quantitative data reflecting an insurance applicant’s general health. We assist insurance companies, their affiliated agents, independent agents and brokers, in gathering this data.

We perform paramedical and medical examinations of applicants for insurance, primarily life insurance, throughout the United States under the Portamedic trade name, the results of which are used by our clients in processing applications for insurance. We provide our paramedical examination services through a network of paramedical examiners, consisting largely of phlebotomists, registered nurses, licensed practitioner nurses, emergency medical technicians (EMTs), and other medically trained professionals. A paramedical exam typically consists of asking questions about an applicant’s medical history, taking measurements of the applicant’s height and weight, blood pressure and pulse. Blood and urine specimens are also collected, to be tested by a laboratory – in many cases, our Heritage Labs laboratory.

When our customers require a medical examination beyond the capacity of a paramedical examiner, we contract with physicians who are licensed and in good standing and practice in the relevant specialty area. Insurance companies have different guidelines for determining when a more complete medical examination is required and the scope of such examination. The likelihood that an insurance company will require a more complete examination of an applicant is primarily influenced by the applicant’s age and the amount of insurance coverage he or she is seeking. In general, insurance companies insist upon more stringent underwriting standards as the age of the applicant and amount of coverage increase.

Infolink

Under the Infolink tradename, we conduct personal health interviews over the telephone (during which we gather information about an insurance applicant’s health, as well as financial and employment history) and provide medical records collection services, including obtaining Attending Physician Statements (“APS”), for our customers. We provide our Portamedic, tele-interview and APS services to the same customer base (large insurance companies). The tele-interviews are conducted from our call center located in Lenexa, Kansas.

Our tele-interview services provide a number of benefits to our customers, as well as to our paramedical examiners and insurance applicants:

| · | Tele-interviews tend to reduce the underwriting cycle time (i.e., the time from submission of the application to the time the insurance policy is issued). Reducing the underwriting cycle time is critical for insurance agents and brokers, and the insurance companies they work with, because it reduces the likelihood of an applicant not pursuing the policy. |

| · | Tele-interviews can reduce our insurance company customers’ costs, for example, by eliminating the need for certain application work with respect to applicants who, based on information elicited during the tele-interview, clearly do not meet the insurer’s underwriting standards. Cost containment has become increasingly important in the life insurance industry, in part because of the shift that has occurred from higher-margin whole life insurance products to products with reduced margins, such as term life insurance, annuities and other retirement products. |

| · | Tele-interviews enable us to gather much of the medical information needed in connection with the life insurance application process in a more time-efficient manner compared to the alternative of a paramedical examiner gathering such information while conducting a paramedical exam of an applicant. As a result, the paramedical examiner can focus on the actual examination of an applicant, making the examination – and the entire application process – more time efficient for an applicant. |

Health & Wellness

We formed our Health & Wellness business in 2007 in an effort to leverage our existing assets and services in a market that, unlike our core Portamedic paramedical examination business, is experiencing growth: the health and care management market. See the discussion under the caption “Market Conditions and Strategic Initiatives” below.

Our Health & Wellness business conducts biometric screenings for health and care management companies including wellness companies, disease management organizations and health plans. The results of the biometric screenings are used by our customers to measure the populations they manage, identify risks in those populations, target interventional programs, and measure the results of their health and care management programs.

Our Health & Wellness services include:

| · | scheduling of individual and group screenings; |

| · | provision and fulfillment of needed supplies (e.g., examination kits, blood pressure cuffs, stadiometers, scales, centrifuges, etc.) at screening events; |

| · | end-to-end event management; |

| · | biometric screenings (e.g., height, weight, body mass index, the taking of a person’s hip, waist and neck measurements, as well as his or her pulse and blood pressure) and blood draws via venipuncture or fingerstick – all performed by certain of our paramedical examiners; |

| · | lab testing of blood specimens – utilizing our Heritage Labs laboratory; and |

| · | data processing and transmission. |

Heritage Labs

Heritage Labs performs tests of blood, urine and/or oral fluid specimens, the results of which are used primarily in connection with the life insurance underwriting process and, to a lesser extent, in the health insurance underwriting process. Most blood and urine samples are collected by paramedical examiners during the course of a paramedical exam; oral fluid samples are generally collected by insurance agents.

Approximately 75-80% of the total volumes of specimens that Heritage Labs tests in its lab are originated through the paramedical exams coordinated by our Portamedic business. This percentage has been fairly constant over the past several years. As a result, Heritage Labs’ business is affected by the market trends and conditions influencing our Portamedic business. The other specimens Heritage Labs tests are generated by third-party health information service providers.

Heritage Labs performs a defined group of standard tests (referred to as “panels”) on the specimens tested, as well as a secondary level of additional reflex tests that can be used to supplement the basic panels. Heritage Labs provides testing services that consist of certain specimen profiles designed to provide its customers with specific information of relevance to the assessment of a person’s health profile, such as:

| · | the presence of antibodies to the human immunodeficiency virus (HIV); |

| · | cholesterol and related lipids; |

| · | liver or kidney disorders; |

| · | the presence of antibodies to hepatitis; |

| · | prostate specific antigens; |

| · | tobacco/nicotine use; and |

| · | the use of certain medications, cocaine and other drugs. |

In addition to performing lab testing services, Heritage Labs assembles blood/urine kits, urine-only kits and oral fluid kits. The kits are primarily sold to paramedical examination companies, including our Portamedic business, which then bill their insurance company customers for the kits they use. Heritage Labs also assembles kits for a number of other companies.

Heritage Labs markets a line of self-collected finger stick test kits under the trade name “Appraise.” The kits are used for the testing of, among other things, glycosylated (glycated) hemoglobin (hemoglobin A1c), which has been implicated in diabetes and damage to, or disease of, the kidneys and non-inflammatory damage to the retina of the eye. Disease management companies use these kits to help monitor the diabetics in their populations.

Underwriting Solutions

Our Underwriting Solutions business provides risk management consultative support and underwriting services to reinsurance companies and to insurance carriers active in the life, annuity and health insurance markets. Underwriting Solutions’ services include:

| · | Full underwriting: We assess health and lifestyle data associated with a prospective insured and then make a determination about insurability and appropriate rate class consistent with the customer’s product pricing, risk tolerances and reinsurance treaties. |

| · | Simplified underwriting: We review information about a proposed insured’s general health to determine insurability for products having predetermined benefit limits. This service provides for limited medical and non-medical data collection when compared to fully underwritten applications. |

| · | PILs: Our Physicians Information Line (PIL) service comprises the use of health care professionals to conduct an in-depth interview with a proposed insured’s physician about a single disease state or multiple impairments. Insurance carriers also use PILs to assess a proposed insured’s cognitive state. |

| · | Impaired risk underwriting services. This service focuses on proposed insureds looking to purchase life insurance or long-term care insurance who have known health or lifestyle conditions that may make them uninsurable. We gather information, review medical records and review lab test results to assess the degree of impairment, project life expectancy and make recommendations about insurability and at what rate class. Often a report or summary is presented to one or more insurance carriers or reinsurance companies who have shown a willingness to extend coverage to consumers with the same or similar conditions as the proposed insured. |

| · | Telephone interviews of insurance applicants: Our licensed insurance agents interact over the telephone with consumers predisposed to purchase insurance coverage. They help consumers select appropriate coverage, take information sufficient to complete an application and authenticate the purchase. The application goes to our underwriters for simplified underwriting. Insurance carriers rely on this service to support ongoing business development campaigns involving third-party endorsements including financial institutions and associations. |

| · | Underwriting audits: Underwriting Solutions conducts underwriting audits for direct writers of life insurance and reinsurance companies. |

| · | Product Planning. We work with insurance companies to design applications for insurance that seek information from a proposed insured commensurate with product design and pricing. Carriers look to us to validate pricing assumptions relative to risk preferences. |

Market Conditions and Strategic Initiatives

Our operating results for the past several years (discussed more fully in the Management’s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this annual report) reflect, in part, the challenging market conditions we have experienced in our businesses.

Portamedic

Our Portamedic business, which accounted for 71% of our total revenues in 2008, has been adversely affected by the decline in life insurance application activity in the United States. We believe this is the result of the reported shift in consumers’ preferences away from individual life insurance towards other wealth accumulation and investment products, such as annuities and mutual funds, along with the weakening U.S. economy in 2008 and its negative impact on the market for life insurance products. We have historically relied on the MIB Life Index, the life insurance industry’s timeliest measure of application activity across the United States and Canada, to gauge the degree of the decline. However, as discussed immediately below, there are other contributing factors.

In early 2006, we initiated a three-phase turnaround program to address the negative financial trends we have been experiencing. In our Portamedic business, we closed a number of our branch offices to further the objectives of the first phase of the turnaround program: expense management. The branch offices closed were chosen based on perceived overlap in branch office territories, profitability considerations and/or management/personnel issues. Our management assumed that the branch closures would not result in any significant loss of Portamedic unit volumes. In fact, the closure of these branch offices resulted in a decline in unit volumes, highlighting the importance of the relationships between our branch office personnel and the insurance agents and brokers in the surrounding vicinity. In many instances, the closure of these branch offices resulted in the agents and brokers seeking another paramedical examination company to fulfill their orders for paramedical examination and ancillary services.

In 2007, we lost the national approval of one significant insurance company customer, and experienced reduced business from other insurers. These losses reflect the intensely competitive nature of the paramedical examination business. Our branch office network provides us with certain competitive advantages (e.g., stronger relationships with local insurance agents and brokers, the ability to perform a paramedical exam anywhere in the United States), but it can also put us at a competitive disadvantage – for example, from a pricing standpoint – vis-à-vis those competitors whose business model relies entirely on independent contractor personnel for fulfillment of paramedical examination orders. Portamedic’s branch office network is such that a higher proportion of our costs are fixed relative to our competitors, where a greater proportion of their costs are variable (i.e., directly linked to the level of paramedical examination volumes). With many of our paramedical examiners working for multiple vendors, differentiating our services can be a challenge, making pricing the primary basis of competition for certain insurance companies. As a result, we have, on occasion, entered into contracts with insurance companies that result in realizing very low – and, in a few instances, negative - margins for our services.

To address these market conditions, we have taken (or are in the process of taking) a number of steps to better differentiate our services. This includes:

Introduction of new services. The Company has introduced its National Broker & General Agency service program which includes specialized training of our field sales reps to market to this specific distribution channel. To serve these customers, we have implemented new case management services which link our ordering and imaging systems to many agency management tools.

In an effort to improve the speed, accuracy and consistency of services provided to our Portamedic/Infolink customers, we decided in December 2008 to begin the development of a new customer service order tracking IT system. In utilizing our current IT system, we license the software and, as such, have difficulties in quickly implementing improvements and enhancements to the software. Our new IT system is expected to eliminate these difficulties and to operate at a significantly lower cost and cash outlay relative to our existing system.

In 2007, we introduced our Mature Assessment service, targeted at the growing market for life insurance among the elderly. This service entails asking questions during the examination process intended to test applicants’ cognitive abilities, as well as additional testing of lab specimens.

In 2008, we introduced a new quality/imaging platform for all paramedical exam reports on a trial basis. This platform assists us in reviewing the accuracy and legibility of examination reports. This new imaging platform, which we plan to extend throughout Portamedic, is expected to improve our quality of service to customers.

We expect to continue to expand managed scheduling across the Portamedic business. Currently, many of our examiners schedule their own appointments with applicants, and it may take 6 to 7 days to schedule an examination. In those markets where we have introduced managed scheduling, we have reduced the time required to schedule an examination to as little as 3 to 4 days.

Changes in fee arrangements with our paramedical examiners. In January 2008, we revised the fee-based arrangements we had in place with our paramedical examiners, such that examiners now get paid on the basis of a schedule of payments for each service rather than a percentage of the dollar amount of what we bill our clients for the individual orders. We believe there are several benefits to be derived from this change. For one, examiners can more readily understand what they will get paid. Also, the new fee arrangements may help us reduce the level of examiner turnover, an industry-wide issue, as the fee schedule includes a tiered system under which our best examiners will get higher fees and be compensated for special skills (e.g., foreign language proficiency, being able to conduct an EKG).

Sales and Marketing

Portamedic

Our Portamedic business generally requires a two-step sales process. First, our corporate sale representatives negotiate with the national office of a life insurance company to get on its list of approved outside risk assessment service providers. Second, our field sales personnel must sell to the insurance company’s local agents and to the community of independent brokers and agents that sell the insurer’s products. Success at the local level requires establishing, maintaining and nurturing relationships with the agents and brokers. We have taken steps to coordinate localized marketing campaigns, develop on-line sales training programs for new sales personnel, and otherwise provide better support for local field sales personnel. We also utilize a pay-for-performance program for our sales personnel, with the incentive compensation potentially payable under the program being tied solely to the development of local business.

Health & Wellness

Our Health & Wellness business markets its services to health and care management organizations, wellness companies and health plans. We offer an end-to-end biometric screening solution that we believe offers our customers:

| | (1) | the ability to engage more individuals via our national network of examiners; |

| | (2) | the ability to collect more health risk information earlier in the health and care management process; and |

| | (3) | the ability to implement integrated screening solutions via venipucture and fingerstick blood draws and self-collection test kits. |

We believe our unique set of services allows our customers to uncover risks, stratify populations, target interventional programs, and measure improvement in health.

Heritage Labs has historically relied heavily on our Portamedic sales representatives to market its lab testing services in addition to its own sales staff. In 2008, Heritage Labs increased its sales staff by adding a Vice President of Sales with an insurance industry background, as well as a Medical Director, to improve Heritage Labs’ sales and marketing efforts.

Underwriting Solutions

In 2008, our Underwriting Solutions business was primarily marketed by one individual sales resource. In December 2008, we appointed a new President of Underwriting Solutions with significant experience and industry knowledge in the life, health and annuity insurance and in the reinsurance markets. We expect to expand our presence in the marketplace and anticipate increasing business development resources across the country. In addition, we plan to increase market awareness through joint initiatives with leading insurance marketing organizations.

Information Technology

Information technology systems are used extensively in virtually all aspects of our business. We have made substantial investments in our IT systems, believing that IT capability is or can be a competitive differentiator.

In an effort to improve the speed, accuracy and consistency of services provided to our Portamedic/Infolink customers, we decided in December 2008 to begin the development of a new customer service order tracking IT system. In utilizing our current IT system, we license the software and, as such, have difficulties in quickly implementing improvements and enhancements to the software. Our new IT system is expected to eliminate these difficulties and to operate at a significantly lower cost and cash outlay relative to our existing system.

Our Health & Wellness business owns its IT system, which is separate from the Company’s Portamedic system.

Our IT systems may be vulnerable to damage from a variety of causes, including telecommunications or network failures, human acts and natural disasters. Moreover, despite the security measures we have taken, our systems may be subject to physical or electronic break-in attempts, computer viruses and similar disruptive problems. System failures could adversely affect our reputation and result in the loss of customers.

Competition

Portamedic

We believe that our Portamedic business is the largest of the four national firms, as measured by market share, whose businesses encompass arranging paramedical examinations, providing specimen analysis, conducting interviews of insurance applicants and collecting medical records for life insurers. In addition, a significant number of regional and local firms also compete in this industry. Although we have exclusive relationships with certain of our insurance carrier customers, most customers use two or more risk assessment service providers. As discussed under market conditions and strategic initiatives, above, pricing is a primary basis of competition for the business of certain of these insurance carriers.

Health & Wellness

Our Health & Wellness business cites several competitive differentiators in its sales and marketing efforts, including:

| · | its complete ownership of every phase of the wellness screening process, including an internal lab testing capability through Heritage Labs; |

| · | its ability to screen both individuals and groups of all sizes; |

| · | its ability to conduct screenings via venipuncture, fingerstick or self-collection blood draws; |

| · | its ability to conduct screenings in every jurisdiction in the United States; |

| · | its fulfillment capability, in the form of Heritage Labs being an FDA-approved Class I and II medical device and specimen collection kit assembler; and |

| · | its wellness examiner certification process through “Hooper Holmes University,” an online training program. |

Our Health & Wellness business needs to continually refine and enhance its value proposition to maintain its advantage and capitalize on the evolving nature of the wellness market.

Heritage Labs

There are two other major laboratories providing testing services to the life and health industries. We estimate that Heritage Labs is the smallest of the three, measured by market share. With the smallest market share, we believe there is room to grow and capture additional market share. Most large insurance companies tend to use more than one lab, while many small or medium-sized companies may use only a single lab.

Underwriting Solutions

There are several companies that compete with Underwriting Solutions. While competing for market share, we believe we are the only provider of full underwriting, simplified underwriting, PILs and impaired risk and related services. We believe that this gives us a competitive advantage in the market. In addition, we endeavor to maintain a qualified workforce made up of approximately 54 underwriters, four physicians, nurses and other health care professionals. We perceive the most significant barrier to entry into the underwriting business to be the current scarcity of qualified insurance underwriters.

Governmental Regulation

The businesses within our Health Information Division, in particular, our paramedical examination, health & wellness and lab businesses, are subject to federal and state regulation. The paramedical examiners we utilize in many instances, are subject to licensing and certification requirements and regulations with respect to the drawing of blood and needle disposal. We are subject to federal and state regulations relating to the transportation, handling and disposal of the various specimens obtained in the course of a paramedical examination, medical examination or wellness screening. The FDA governs certain aspects of Heritage Labs’ business, including the assembly of specimen collection kits. In addition, certain aspects of the risk assessment services we provide may be subject to certain provisions of the Health Information Portability and Accountability Act of 1996 (“HIPAA”) relating to the privacy of protected health information.

Employees

We employ approximately 2,150 persons in our Health Information Division, including approximately 80 personnel in our corporate headquarters in Basking Ridge, New Jersey.

General Information

Hooper Holmes, Inc. is a New York corporation. Our principal executive offices are located at 170 Mt. Airy Road, Basking Ridge, New Jersey 07920. Our telephone number is (908) 766-5000. Our website address is www.hooperholmes.com. We have included our website address as an inactive textual reference only. The information on our website is not incorporated by reference into this annual report.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document that we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-732-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding companies that file electronically with the SEC. The SEC’s website is www.sec.gov. We also make available, free of charge, through our website, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statements, the Form 3, 4 and 5 filings of our directors and executive officers, and all amendments to these reports and filings, as soon as reasonably practicable after such material is electronically filed with the SEC.

You should carefully consider all the information included in this annual report, particularly the following risk factors, before deciding to invest in our shares of common stock. The risk factors set forth below are not the only risks we face. Additional risks not presently known to or understood by us may also negatively affect our business, results of operations and/or financial condition.

Customer concerns about our financial health may result in the loss of customers or a portion of their business, or cause prospective customers not to engage us.

Customer concerns about our financial health, stemming from the decline in our operating results over the past several years and the associated drop in our stock price, may result in the loss of customers or a portion of their business. Concerns about our financial health may also prompt prospective customers not to engage us or make it more challenging for us to compete for their business.

Limited or negative cash flow from operations in 2009 may limit our ability to make the desired level of investment in our businesses.

While we do not believe we are facing any immediate or near-term liquidity crisis, we experienced a revenue decline in 2008 and anticipate that this will continue in 2009 due to the downturn in the economy and its negative impact on our customers. We were able to lower our cost of operations as a percentage of revenues and reduced our selling, general and administrative (SG&A) expense in 2008. However, if we continue to experience the rates of decline in our consolidated revenues that we have experienced for the past several years, it will become increasingly difficult to generate cash from operations and invest in our businesses at optimal levels.

Our liquidity may be adversely affected by the terms of our Loan and Security Agreement.

If we experience negative cash flows from operations, we may need to borrow under our Loan and Security Agreement. We have an available borrowing base of $15.0 million under this facility as of March 9, 2009. The Loan and Security Agreement contains a financial covenant that requires us to maintain a fixed charge coverage ratio (as defined in the Loan and Security Agreement), on a trailing 12-month basis, of no less than 1.1 to 1.0 as of January 31, 2010 and as of the end of each of our fiscal quarters thereafter. As of December 31, 2008, our fixed charge coverage ratio measured on a trailing twelve month period was 0.6 to 1.0. As such, we would fail this financial covenant and therefore we would be prohibited from further borrowings under our Loan and Security Agreement after January 31, 2010. It is possible that, if we continue to experience losses from operations, we would not be able to borrow under our Loan and Security Agreement, and our liquidity would be adversely affected.

Future claims arising from the sale of two business units (Discontinued Operations) could negatively impact our results of operations.

We sold our Medicals Direct business in 2007 and our Claims Evaluation business in 2008. In regard to these sales, we retained certain potential liabilities pertaining to periods prior to the sale of each unit. For example, we have recorded a liability of approximately $1.4 million as of December 31, 2008 for certain potential tax exposures related to the MDG business. In addition, we have recorded a liability of $0.3 million as of December 31, 2008 for a potential liability on a long-term lease for the CED business. If additional claims are identified related to our two discontinued operations (MDG and CED) in the future, this may result in additional cost and cash payments by us which could negatively impact our results of operations and financial condition.

The lack of coverage of our stock by the financial analyst community may reduce the volume of trading in shares of our common stock and could negatively affect our stock price.

As our stock price has dropped, the financial analysts who followed our stock dropped their coverage. The lack of analyst coverage may lead to a reduced volume of trading in shares of our common stock. A concern about the liquidity of the market for our shares could negatively affect our stock price.

We continue to experience declines in Portamedic unit volumes.

We have experienced period-over-period declines in Portamedic unit volumes for the past several years, with the rate of decline exceeding the rate of overall market contraction, as reflected by the MIB Life Index data. The decline in unit volumes has often exceeded our budgeted forecasts. In February 2008, our Board appointed Roy H. Bubbs as President and Chief Executive Officer in view of his extensive background in the life insurance industry and track record of success in sales-related functions. Mr. Bubbs has taken a number of steps to strengthen our field sales personnel, streamline our sales tracking systems, improve sales training, and focus sales incentives on increases in paramedical exams completed (i.e., unit goals). However, we cannot be sure that these initiatives will prove sufficient to stop the decline in Portamedic unit volumes. In fact, our continuing focus on profitable revenue may lead us to terminate certain accounts when our contractual obligations expire, resulting in an acceleration of the rate of decline in Portamedic unit volumes.

In a market where price has increasingly become the sole or principal basis of competition, our Portamedic branch office network may put us in a position of being at a competitive disadvantage.

Through much of its history, our Portamedic business has benefited from our branch office network, which we believe to be the most extensive in our industry. Our branch office personnel are critical to building and nurturing the relationships with the insurance agents and brokers in the surrounding geographic area, from whom we receive a significant volume of our paramedical exam orders. The importance of these relationships was reinforced for us in 2007 when we closed a limited number of our branch offices and subsequently experienced a decline in unit volumes from the insurance agents and brokers in the areas surrounding these branch offices.

Prior to 2007, we experienced downward pricing pressure from our life insurance carrier customers. We attribute this pressure to their efforts to address cost items in a more rigorous manner in an attempt to maintain their profitability and level of return to their investors and other stakeholders. In 2007 and 2008, we had some success in increasing our price levels to some extent, largely as a result of making improvements in our levels of service. The price increases contributed to an increase in our average revenue per paramedical exam and improved operating margins. Nonetheless, pricing represents the primary basis of competition for the business of certain insurance companies. With our Portamedic branch office network, a higher proportion of our costs are fixed costs compared with our competitors who do not operate such a network.

Our Health & Wellness business would be adversely affected if health and wellness interventional programs are determined not to have a sufficient return on investment.

Based on published information from industry analysts, no standard methodology exists yet for measuring whether disease management and/or wellness programs produce cost savings and, if so, how much. If a methodology is established and health insurance companies, employers and other payers then determine that health and wellness interventional programs do not provide the anticipated return on investment, this may adversely affect the health management industry. This, in turn, could adversely affect our Health & Wellness business.

Each of our business units derives a significant percentage of its revenues from a limited number of customers, such that a loss of some or all of the business of one or more customers over a short period of time could have a material adverse effect on our results of operations.

Each of our business units, including our core Portamedic business, derives a significant percentage of its revenues from a limited number of customers. Losing some or all of the business of one or more of these customers can result in a significant reduction in the revenues of the applicable business unit. For example, in 2007, Heritage Labs was unsuccessful in its bid to retain the business of its largest customer, from which it derived roughly $4 million in revenues annually, representing over 20% of its revenues in 2007. In 2006, our Underwriting Solutions business was advised by its largest customer that the customer intended to pursue a multi-vendor policy for fulfillment of its underwriting needs. In such cases, we face significant challenges in the short term in replacing the lost revenues. Further, the loss of business from key customers can negatively affect our cash flows from operations.

A number of circumstances could prompt our loss of one or more key customers or a substantial portion of its or their business. For example, many organizations in the insurance industry have consolidated; if one of our customers were to be acquired by or merged into another company for whom we do not provide services, we could lose the acquired company’s business. Additionally, we could lose one or more significant customers due to competitive pricing pressures or other reasons.

Continued weakness in the economy in general, or the financial health of the life insurance industry in particular, could have a material adverse effect on our results of operations.

We derive a significant percentage of our revenues from customers in the life insurance industry. If the condition of the U.S. economy continues to weaken, demand for life insurance products may decline more steeply, generating less business for our Company. If some of our life insurance company customers fail or curtail operations as a result of economic conditions in the life insurance industry, it would also generate less business for our Company. Either event would negatively affect our cash flows from operations.

The reductions in our cost structure and capital expenditures that we plan may not succeed in offsetting the decline in revenues we are experiencing.

To offset the declines in revenues we have experienced, and expect to experience in 2009, we have taken actions to decrease our cost structure and reduce the level of capital expenditures. If we are unable to implement these actions as quickly or completely as we plan, our cash flows from operations would be negatively affected.

If we cannot maintain and upgrade our information technology platform so that we can meet critical customer requirements, the competitiveness of our businesses will suffer.

In each of our businesses, the speed with which we make information available to our customers is critical. As a result, we are dependent on our information technology platforms and our ability to store, retrieve, process, manage and enable timely customer access to the health-related and other data we gather on behalf of our customers. Disruption of the operation of our IT systems for any extended period of time, loss of stored data, programming errors or other system failures could cause customers to turn elsewhere to address their service needs.

In addition, we must continue to enhance our IT systems – potentially at substantial cost – to keep pace with our competitors’ service and product enhancements. In December 2008, the Company decided to begin developing a new Portamedic/Infolink customer service order tracking system. In utilizing our current IT system, we license the system software and, as such, have difficulties in getting improvements or enhancements to the software and also find that it requires significant cash outlay. If we are not able to identify and acquire new technology resources to develop and support this new order tracking system, the competitiveness of our business could suffer.

Allegations of improper actions by our paramedical examiners or our physician practitioners could result in claims against us and/or our incurring expenses to indemnify our clients.

Allegations of improper actions by our paramedical examiners or our physician practitioners could result in claims against us, require us to indemnify our clients for any harm they may suffer, or damage our relationships with important clients. For example, in the first quarter of 2006 a life insurance company client informed us that, after investigation, it had determined that it issued certain life insurance policies that were procured by fraudulent means employed by insurance applicants, the client’s agents, the Company’s sub-contracted examiners and others. We have since reached an agreement under which we paid $0.5 million to the client to resolve the matter.

Allegations of our failure to provide accurate health-related risk assessment analyses of that data may result in claims against us.

Our clients rely on the accuracy of the medical data we gather on their behalf – whether derived from a Portamedic paramedical exam, an Infolink tele-interview, a Health & Wellness screening, a Heritage Labs specimen test, or our Underwriting Solutions underwriting resources – in connection with their insurance underwriting, interventional programs, patient treatment and other decisions. As a result, we face exposure to claims that may arise or result from the decisions of our customers based on allegedly inaccurate data and/or faulty analysis of such data. We maintain professional liability insurance and such other coverage as we believe appropriate, but such insurance may prove insufficient. Regardless of insurance, any such claims could damage our relationships with important clients.

Our operations and reputation may be harmed if we do not adequately secure information.

Federal and state laws regulate the disclosure of specimen test results and other nonpublic medical-related personal information. If we do not protect the confidentiality of such results in accordance with applicable laws, we could face significant liability, and/or damage to our relationship with clients.

Our classification of most of our paramedical examiners outside of the States of California, Montana and Oregon as independent contractors, rather than employees, exposes us to possible litigation and legal liability.

In the past, some state agencies have claimed that we improperly classified our examiners as independent contractors for purposes of state unemployment or workers compensation tax laws and that we were therefore liable for taxes in arrears, or for penalties for failure to comply with such state agencies’ interpretations of the laws. In some states, our classification of examiners has been upheld and in others it has not. However, there are no assurances that we will not be subject to similar claims in other states in the future.

Allegations of our failure to register certain securities could result in claims against us.

The issuance in 2007 of an aggregate of 81,508 shares (at an aggregate purchase price of approximately $0.2 million) pursuant to the 2004 Employee Stock Purchase Plan occurred prior to the filing with the SEC of a registration statement in respect of those shares. As a result, the Company may have potential liability, to the purchasers of those shares, for rescission of the sale.

Our operations could be adversely affected by the effects of a natural disaster or an act of terrorism.

Our operations – in particular, that of Heritage Labs’ laboratory, would be adversely affected in the event of a natural disaster, such as a tornado or hurricane, or an act of terrorism. While Heritage Labs has a back-up lab facility available (also located in Kansas), and a disaster recovery plan, damage to its primary laboratory or to its available back-up lab facility could nonetheless disrupt its ability to provide its testing services, which could have a material adverse effect on its operations and business.

| Unresolved Staff Comments |

Not applicable.

Our corporate headquarters consists of a five building complex located at 170 Mt. Airy Road, Basking Ridge, New Jersey approximately 45 miles southwest of New York City. Of approximately 53,000 total square feet of office space, we maintain our operations in approximately 45,000 square feet and the balance is leased or available for lease to several tenants. We have pledged our corporate headquarters as collateral under our asset-based lending facility provided by TD Bank, N.A.

We lease our regional operations centers, and our approximately 100 Portamedic branch offices, with the term of such leases typically being three years.

We also lease 9,200 square feet in Allentown, PA for a business continuity and customer service operations center.

We believe that, in general, our facilities are suitable and adequate for our current and anticipated future levels of operations and are adequately maintained. We believe that if we were unable to renew a lease on any of our facilities, we could find alternative space at competitive market rates and relocate our operations to such new location without material disruption to our business.

On January 25, 2005, one of the Company’s examiners in California filed a class-action lawsuit against the Company in the Superior Court of California, Los Angeles County, alleging violations of California’s wage and hour laws. Following mediation on December 6, 2006, the parties reached a settlement, pursuant to which the Company agreed to pay the sum of $1.2 million to the class members in full settlement of this lawsuit. The court granted final approval of the settlement on July 16, 2007. Payment of $0.7 million was made on October 3, 2007, and the balance of the settlement was paid in March 2008.

In 2006, a life insurance company client informed the Company of its belief that certain life insurance policies that it issued were procured by fraudulent means employed by insurance applicants, the client’s agents, the Company’s sub-contracted examiners, and others. On December 14, 2007, the client filed a Demand for Arbitration, in which it alleged damages in excess of $5.0 million. The Company believed it had strong defenses to the client’s claim, but in order to avoid the time and expense of litigation, the Company agreed to pay the client $0.5 million. The Company made this payment in May 2008.

On February 28, 2008, a physician, John McGee, M.D., filed suit in the United States District Court for the Eastern District of New York in which he alleged, among other things, that an insurance company and numerous other named and unnamed defendants including Hooper Evaluations, Inc. (which was part of the CED the Company sold in June 2008), violated various laws, including the Racketeer Influenced Corrupt Organization Act, in connection with the arranging of independent medical examinations. The substance of the claim appears to be that the plaintiff physician was denied compensation for medical services allegedly rendered to persons claiming to have been injured in automobile accidents, after independent medical examinations arranged by the defendant insurance company indicated no basis for those services. It is not yet possible to estimate the size of the alleged claim against the defendants as a whole, or the CED in particular. The Company believes the plaintiff’s claims are without merit and intends to defend itself vigorously in this matter. The Company, along with the other defendants, moved to dismiss the case, and these motions are pending. The Company retained liability for this litigation following the sale of substantially all of the assets and liabilities of the CED.

On April 3, 2008, Gregory Sundahl and Jesse Sundahl, individually and on behalf of all others similarly situated, filed suit in the United States District Court for the Eastern District of New York in which they alleged, among other things, that an insurance company and numerous other named and unnamed defendants including Hooper Evaluations, Inc. (which was part of the CED the Company sold in June 2008), violated various laws, including the Racketeer Influenced Corrupt Organization Act, in connection with the arranging of independent medical examinations. This suit was filed by the same lawyer that filed the McGee case described above, and contains similar allegations, but on behalf of the patients who were allegedly injured in automobile accidents whose medical services were not paid for based on the results of independent medical examinations. It is not yet possible to estimate the size of the alleged claim against the defendants as a whole, or CED in particular. The Company believes the plaintiff’s claims are without merit and intends to defend itself vigorously in this matter. The Company, along with the other defendants, moved to dismiss the case, and these motions are pending. The Company has retained liability for this litigation following the sale of substantially all of the assets and liabilities of the CED.

We are a party to (or an indemnitor of) a number of other legal claims and actions arising in the ordinary course of our business. We maintain various liability insurance coverages (e.g., general liability and professional liability) for such claims. In the opinion of management, we have substantial legal defenses and or insurance coverage with respect to these pending legal matters. Accordingly, none of these actions is expected to have a material adverse effect on our liquidity, or our consolidated financial position.

| Submission Of Matters To A Vote Of Security Holders |

No matters were submitted to a vote of securities holders during the fourth quarter of the fiscal year covered by this report.

PART II

| ITEM 5 | Market For The Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities |

Market Information

Our common stock is traded on the AMEX under the symbol “HH.” Options of our common stock are also traded on the AMEX.

Common Stock Price Range

The following table shows, for the periods indicated, the high and low sales prices per share of our common stock based on published financial sources: (dollars)

| | | 2008 | | | 2007 | |

| | | | | | | | | | | | |

| First | | | 1.76 | | | | 0.55 | | | | 4.83 | | | | 3.02 | |

| Second | | | 1.10 | | | | 0.63 | | | | 4.86 | | | | 2.80 | |

| Third | | | 1.69 | | | | 0.93 | | | | 3.35 | | | | 1.80 | |

| | | 1.30 | | | | 0.17 | | | | 2.38 | | | | 1.35 | |

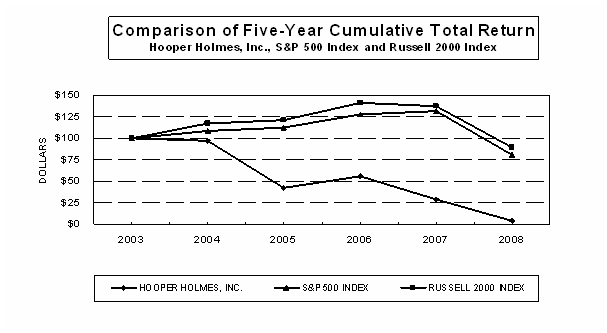

The following graph shows a comparison of cumulative total returns for an investment in our common stock, versus both the S&P 500 Composite Index and the Russell 2000 Index. It covers the period commencing December 31, 2003 and ending December 31, 2008. The graph assumes that the value for the investment in our common stock and in each index was $100 on December 31, 2003 and that all dividends were reinvested. This graph is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and the graph shall not be deemed to be incorporated by reference into any prior or subsequent filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934. The Company does not believe that an appropriate, published industry or line of business index is available.

| | | For the years ended December 31, | |

| | | | | | | | | | | | | | | | | | | |

| Hooper Holmes, Inc. | | $ | 100 | | | $ | 96.76 | | | $ | 42.66 | | | $ | 55.38 | | | $ | 28.78 | | | $ | 4.18 | |

| S&P 500 Composite Index | | $ | 100 | | | $ | 108.99 | | | $ | 112.26 | | | $ | 127.55 | | | $ | 132.06 | | | $ | 81.23 | |

| Russell 2000 Index | | $ | 100 | | | $ | 117.00 | | | $ | 120.89 | | | $ | 141.43 | | | $ | 137.55 | | | $ | 89.68 | |

Holders

According to the records of our transfer agent, Registrar and Transfer Company, Cranford, NJ, as of February 15, 2009, there were 1,072 holders of record of our common stock.

Dividends

No dividends were paid in 2008, 2007 or 2006.

In 2006, our Board of Directors suspended the payment of cash dividends on the Company’s common stock. Furthermore, we were precluded from declaring or making any dividend payments or other distributions of assets with respect to any class of our equity securities under the terms of our Revolving Credit Facility with CitiCapital Commercial Corporation which terminated on March 9, 2009, and continue to be precluded from declaring or making any dividend payments under our new Loan and Security Agreement with TD Bank, N.A., which was effective March 9, 2009 (See Note 8 to our consolidated financial statements).

Recent Sales of Unregistered Securities

On April 25, 2007, the Company’s shareholders approved the Hooper Holmes, Inc. 2007 Non-Employee Director Restricted Stock Plan (the “2007 Plan”).

On June 1, 2007, we issued an aggregate of 45,000 shares of our common stock to the eight non-employee directors who served on the Board as of June 1, 2007. On June 1, 2008, we issued 40,000 shares to the seven non-employee directors as of June 1, 2008. These share issuances were exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”) as “transactions not involving a public offering.” No underwriter participated in these transactions, nor was any commission paid.

In the third quarter of 2007, the Company became aware that it did not file with the SEC a registration statement on Form S-8 to register the shares of its common stock issuable under either the Hooper Holmes, Inc. 2002 Stock Option Plan (the "2002 Stock Option Plan") or the Hooper Holmes, Inc. Stock Purchase Plan (2004) (the "2004 Employee Stock Purchase Plan") at the time such plans were approved by the Company’s shareholders in May 2002 and May 2003, respectively. In 2007 the Company filed with the SEC a registration statement on Form S-8 (the "Registration Statement") covering shares that remain issuable under these plans. In May 2007, pursuant to the 2002 Stock Option Plan, we issued 45,000 shares of common stock upon the exercise of options with an exercise price of $3.46 per share for a total consideration of approximately $0.2 million. We believe that the acquisition of the shares upon exercise of these options was exempt from registration under Section 4(2) of the Securities Act. No underwriter participated in these transactions, nor was any commission paid.

In March 2007, we issued an aggregate of 81,508 shares pursuant to the 2004 Employee Stock Purchase Plan at a per share purchase price of $2.70. The aggregate purchase price of these shares was approximately $0.2 million. The issuances of shares upon exercise of purchase rights granted under the 2004 Employee Stock Purchase Plan, which occurred prior to the filing of the Registration Statement, may not have been exempt from registration under the Securities Act and applicable state securities laws and regulations. As a result, the Company may have potential liability to those employees (and, in some cases, now former employees) to whom the Company issued its shares upon the exercise of purchase rights granted under the plans. The Company may also have potential liability with respect to shares issued under the 2002 Stock Option Plan if the acquisition of shares under the plan is not exempt from registration under Section 4(2) of the Securities Act.

Purchase of Equity Securities by the Issuer and Affiliated Purchaser

We did not repurchase any shares of our common stock during the fourth quarter of our fiscal year ended December 31, 2008.

The following table of selected financial data should be read in conjunction with our consolidated financial statements and related notes, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other financial information appearing elsewhere in this annual report. The statement of operations data set forth below for each of the years in the three year periods ended December 31, 2008, and the balance sheet data as of December 31, 2008 and 2007, have been derived from, and are qualified by reference to, our consolidated financial statements appearing elsewhere in this annual report. The statement of operations data for the years ended December 31, 2005 and 2004, and the balance sheet data as of December 31, 2006, 2005 and 2004, are derived from the Company’s consolidated financial statements that are not included in this annual report.

(in thousands except for share data) | | | | | | | | | | | | | | | | | | | |

| Statement of operations data: | | | | | | | | | | | | | | | | | | | |

| Revenues | | $ | 198,233 | | | | $ | 208,632 | | | | $ | 223,907 | | | | $ | 239,657 | | | | $ | 242,841 | |

| Operating (loss) income from continuing operations | | | (1,428 | ) | (a) | | | (10,390 | ) | (b) | | | (49,970 | ) | (d) | | | (80,606 | ) | (f) | | | 11,309 | |

| Interest expense | | | 3 | | | | | 181 | | | | | 138 | | | | | 230 | | | | | 174 | |

| (Loss) income from continuing operations | | | (1,559 | ) | | | | (10,506 | ) | | | | (79,043 | ) | | | | (41,089 | ) | | | | 6,520 | |

| (Loss) income from discontinued operations | | | (326 | ) | (g) | | | 3,199 | | (c) | | | (7,048 | ) | (e) | | | (55,712 | ) | (h) | | | 3,495 | |

| Net (loss) income | | | (1,885 | ) | | | | (7,307 | ) | | | | (86,091 | ) | | | | (96,801 | ) | | | | 10,015 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | | |

| Continuing operations | | | (0.02 | ) | | | | (0.15 | ) | | | | (1.18 | ) | | | | (0.63 | ) | | | | 0.10 | |

| Discontinued operations | | | - | | | | | 0. 05 | | | | | (0.11 | ) | | | | (0.85 | ) | | | | 0.05 | |

| | | (0.03 | ) | | | | (0.11 | ) | | | | (1.29 | ) | | | | (1.48 | ) | | | | 0.15 | |

| | | - | | | | | - | | | | | - | | | | $ | 0.06 | | | | $ | 0.06 | |

Weighted average shares – basic and diluted | | | 68,957,975 | | | | | 68,476,194 | | | | | 66,804,605 | | | | | 65,513,451 | | | | | 64,996,778 | |

| Balance sheet data (as of December 31): | | | | | | | | | | | | | | | | | | | | | | | | |

Working capital(i) | | $ | 23,981 | | | | $ | 24,850 | | | | $ | 31,913 | | | | $ | 50,600 | | | | $ | 114,042 | |

| Total assets | | | 59,269 | | | | | 66,625 | | | | | 85,668 | | | | | 162,567 | | | | | 275,108 | |

| Current maturities of long-term debt | | | - | | | | | - | | | | | - | | | | | 1,000 | | | | | 1,000 | |

| Long-term debt, less current maturities | | | - | | | | | - | | | | | - | | | | | - | | | | | 1,000 | |

| Total long-term debt | | | - | | | | | - | | | | | - | | | | | 1,000 | | | | | 2,000 | |

| | $ | 40,768 | | | | $ | 41,909 | | | | $ | 47,969 | | | | $ | 128,727 | | | | $ | 227,959 | |

| (a) | Includes restructuring and other charges totaling $1.6 million. |

| (b) | Includes restructuring and other charges totaling $4.7 million. |

| (c) | Includes goodwill and intangible asset impairment charges of $5.7 million and $0.6 million, respectively, and a $9.2 million net gain on the sale of MDG. |

| (d) | Includes goodwill and intangible asset impairment charges of $29.9 million and $1.8 million, respectively, along with restructuring and other charges totaling $10.3 million. |

| (e) | Includes a goodwill impairment charge of $6.3 million and restructuring and other charges totaling $0.2 million. |

| (f) | Includes goodwill and intangible asset impairment charges of $76.1 million and $0.7 million, respectively, along with restructuring and other charges totaling $6.3 million. |

| (g) | Includes a $0.9 million net gain on the sale of the CED. |

| (h) | Includes goodwill and impairment charges of $39.5 million and $17.3 million, respectively, along with restructuring and other charges totaling $0.3 million. |

| (i) | Working capital includes the net assets and liabilities of discontinued operations for the years 2007-2004, including assets and liabilities of $6.3 million and $1.7 million in 2007, $26.8 million and $10.3 million in 2006, $30.3 million and $8.7 million in 2005, and $97.0 million and $15.5 million in 2004, respectively. |

ITEM 7 &# 160; Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis contains forward-looking statements. See page 4 of this annual report on Form 10-K for information regarding our use of forward-looking statements in this annual report. This discussion and analysis should be read in conjunction with our audited consolidated financial statements and related notes included in Item 8 of this annual report.

Overview

As discussed in greater detail in Item 1 (“Business”), we currently engage in several lines of business that are managed as one division: the Health Information Division.

Our Health Information Division (HID) consists of the following lines of business:

| · | Portamedic – performs paramedical and medical examinations of individuals seeking insurance coverage, mainly life insurance; |

| · | Infolink – conducts telephone interviews of individuals seeking life insurance coverage, and retrieves the medical records of such individuals, to gather much of the medical information needed in connection with the application process; |

| · | Health & Wellness – established in 2007, conducts wellness screenings for health management companies, including wellness companies, disease management organizations and health plans; |

| · | Heritage Labs – performs tests of blood, urine and/or oral fluid specimens, primarily generated in connection with the paramedical exams and wellness screenings performed by our Portamedic and Health & Wellness business units, and assembles and sells specimen collection kits; and |

| · | Underwriting Solutions – provides risk management solutions and underwriting services to reinsurance companies and insurance carriers in the life, health and annuity insurance industry. |

Our core Portamedic paramedical examination business accounted for approximately 71%, 71% and 72% of our total consolidated revenues in 2008, 2007 and 2006, respectively.

Basis of Presentation of Management’s Discussion and Analysis

On June 30, 2008, we sold substantially all of the assets and liabilities of our Claims Evaluation Division (CED), through which we provided claims evaluation services. We completed the sale for an aggregate sales price of $5.6 million. Upon closing the transaction, we received cash payments totaling $5.1 million and a $0.5 million note receivable due in six equal monthly installments beginning July 31, 2008. For the year ended December 31, 2008, we recognized a net gain on the sale of approximately $0.9 million.

On October 7, 2007, we sold our United Kingdom-based subsidiary, Medicals Direct Group (MDG), through which we provided medical-related risk assessment services in the United Kingdom. We completed the sale for an aggregate purchase price of $15.3 million. Upon closing the transaction, we received a cash payment of $12.8 million, net of $1.2 million in closing adjustments. In addition, we incurred $1.0 million of expenses related to the sale. For the year ended December 31, 2007, we recognized a net gain on the sale of approximately $9.2 million.

Our decision to sell the CED and MDG was based on several factors, including their limited ability to significantly contribute to our long-term specific goals. See Note 4 to our consolidated financial statements included in this annual report for further discussion of our sale of CED and MDG. Except where specific discussion of CED and MDG is made, our discussion of our results of operations and financial condition excludes CED and MDG for all periods presented.

2008 Highlights and Business Outlook for 2009

Leadership Changes

On February 5, 2008, the Board of Directors appointed Roy H. Bubbs to serve as the President and CEO. Previously, Mr. Bubbs had served as a member of the Board since being elected to the Board by the Company’s shareholders at the May 2007 annual shareholders’ meeting.

Mr. Bubbs has been in the financial services industry for 37 years. As President of MONY Partners he created the brokerage division for the MONY Group, leading strategy, infrastructure, operations and business plan implementation. His experience in expanding distribution channels, instituting new technology platforms and developing new product portfolios enabled MONY to generate significant growth. Prior to joining MONY, Mr. Bubbs was Senior Vice President for Manulife, US, where his responsibilities included developing and implementing a multiple distribution channel strategy to reinvigorate insurance sales and eliminate distribution expense losses. For the first 24 years of his career, Mr. Bubbs was with Cigna, where he served as an agent, agency manager and senior executive. As Senior Vice President, he was responsible for half of Cigna’s career agency sales force. He also ran the distribution and field service unit for Cigna’s Pension Division and built the Annuity Division.

In addition during 2008, the Company appointed new Presidents in two of its businesses. Richard Whitbeck was appointed President of our Portamedic business in September 2008 and Marcus Mears was named President of our Underwriting Solutions business in December 2008.

2008 Consolidated Financial Performance

For the year ended December 31, 2008, consolidated revenues totaled $198.2 million, representing a decline of approximately 5% from the prior year. After making progress in reducing our revenue decline during the first nine months of 2008, the trend reversed in the fourth quarter of 2008 due to revenue declines resulting from the downturn in the economy and its negative impact on the customers we serve (i.e. life insurance industry). We expect the economic downturn to continue in 2009, along with its negative impact on our consolidated revenues. As a result, we have taken actions to decrease our cost structure and reduce capital expenditures. These actions include headcount reductions, wage and hiring freezes, the elimination of our 401k company match and a reduction in general operating expenses.

Although revenues declined in 2008, our gross margin improved to 25.2%, an improvement of 200 basis points over the comparable prior year period, resulting primarily from increased pricing, productivity gains and cost reductions. In addition, we reduced our selling, general and administrative expenses to $49.8 million, representing a reduction of $4.2 million, or approximately 8% from the prior year. As a result, our loss from continuing operations totaled $1.6 million for the year ended December 31, 2008, including restructuring and other charges of approximately $1.6 million. This represents a significant reduction from the prior year loss from continuing operations of $10.5 million, including restructuring and other charges of approximately $4.7 million.

Portamedic/Infolink

For the year ended December 31, 2008, Portamedic revenues decreased approximately 5% in comparison to the prior year, with Infolink revenues declining 11% compared to the prior year. We continue to believe that achieving acceptable profitability levels will require top-line revenue growth, including the reversal of past revenue declines. Although we have approvals from over 90% of the insurance carriers in the marketplace, the number of paramedical examinations we complete on life insurance applicants continues to decline. The rate of decline in the number of paramedical examinations completed by our Portamedic business increased to approximately 12% in the fourth quarter of 2008 compared to the corresponding period of 2007, a rate of decline that exceeded our 9% decline experienced in the first nine months of 2008. The decline in completed examinations in the fourth quarter was primarily attributable to the economic downturn which accelerated during the quarter and its negative impact on the number of consumers seeking to purchase life insurance. The rate of decline in completed examinations for the full year 2008 was 10% compared to 2007, and 12% for 2007 compared to 2006. We must achieve greater success in turning carrier approvals into unit sales at the local agent, corporate and brokerage levels. We continue to take steps to strengthen our local sales force: we are hiring more sales representatives, streamlining our sales tracking systems, improving sales training, and focusing sales incentives on increases in paramedical exams completed (i.e. unit goals).

The market for our Portamedic/Infolink services has steadily declined. For example, according to the MIB Life Index, in 2007 there were approximately nine million applications for life insurance completed in the United States, compared to approximately 17 million applications in 1985. Notwithstanding the rate of decline in applications submitted, we believe that the market continues to offer attractive opportunities to a company that can sell its services effectively and distinguish itself from its competitors.

We are taking the following steps to increase our marketshare and improve top-line revenue :

| · | In September 2008, we appointed a new President of Portamedic with more than 25 years experience as a senior executive in the insurance industry. |