UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Hooper Holmes Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Hooper Holmes, Inc., to be held on Tuesday, May 20, 2003 at 11:00 a.m. local time, at the Company’s headquarters, 170 Mt. Airy Road, Basking Ridge, New Jersey.

The Notice of Annual Meeting and Proxy Statement which follow describe the business to be conducted at the meeting. There will also be a brief report on the current status of our business.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the Notice of Annual Meeting and Proxy Statement, please complete, sign, date and return your proxy in the envelope provided.

On behalf of the Officers and Directors of Hooper Holmes, Inc., I wish to thank you for your interest in the Company and I hope that you will be able to attend our Meeting.

| For the Board of Directors, |

| |

|

|

|

|

| James M. McNamee

Chairman, President and Chief Executive Officer |

April 17, 2003

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held May 20, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting (the “Annual Meeting”) of Shareholders of Hooper Holmes, Inc., a New York corporation (the “Company”), will be held on Tuesday, May 20, 2003 at 11:00 a.m. local time, at the Company’s headquarters, 170 Mt. Airy Road, Basking Ridge, New Jersey, for the following purposes:

| 1. | To elect directors. |

| | |

| 2. | To consider and act upon a proposal to approve the 2004 Employee Stock Purchase Plan. |

| | |

| 3. | To ratify the selection of the firm of KPMG LLP as auditors for the 2003 fiscal year. |

| | |

| 4. | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

Holders of record of the Company’s common stock, par value $.04 per share (the “Common Stock”), as of the close of business on April 4, 2003, the record date fixed by the Board of Directors for such purpose (the “Record Date”), are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof.

| BY ORDER OF THE BOARD OF DIRECTORS, |

| |

|

|

|

|

| Robert William Jewett

Secretary |

April 17, 2003

Please sign the enclosed proxy and return it promptly in the envelope enclosed which requires no postage if mailed in the United States.

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

PROXY STATEMENT

INTRODUCTION

The enclosed proxy is solicited by the Board of Directors of Hooper Holmes, Inc., (the “Company”) for use at the Annual Meeting of Shareholders to be held on May 20, 2003.

An Annual Report to Shareholders containing the financial statements for the fiscal year ended December 31, 2002 is enclosed with this proxy statement. This proxy statement and form of proxy were first sent to shareholders on or about the date stated in the accompanying Notice of Annual Meeting of Shareholders.

Only shareholders of record as of the Record Date are entitled to vote at the meeting and any adjournments thereof. As of that date, 64,810,423 shares of Common Stock of the Company were issued and outstanding. Each share outstanding as of the Record Date will be entitled to one vote, and shareholders may vote in person or by proxy. Execution of a proxy will not in any way affect a shareholder’s right to attend the meeting and vote in person. Any shareholder giving a proxy has the right to revoke it at any time before it is voted by providing written notice to the Secretary of the Company or by submitting another proxy bearing a later date. In addition, shareholders attending the meeting may revoke their proxies at any time prior to the time such proxies are exercised.

The presence in person or by proxy of the holders of a majority of the votes entitled to be cast at the meeting will constitute a quorum. Abstentions and withhold-authority votes all count for the purpose of determining a quorum, but broker non-votes do not. Directors who receive a plurality of the votes cast at the meeting will be elected. The 2004 Employee Stock Purchase Plan and the selection of auditors will be approved if a majority of the votes cast at the meeting are in favor. Votes cast for directors, the 2004 Employee Stock Purchase Plan and auditors include votes for or against, but do not include broker non-votes, abstentions or withheld-authority votes.

All properly executed proxies returned in time to be cast at the meeting, if no contrary instruction is indicated, will be voted FOR the election of all directors nominated herein, FOR approval of the 2004 Employee Stock Purchase Plan and FOR the ratification of the auditors.

The solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally and by telephone or telegraph by regular employees of the Company, without any additional remuneration and at minimal cost. The cost of soliciting the proxies will be borne by the Company.

1

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors consists of seven members divided into three classes, one class with three members and two classes with two members each. At each Annual Meeting of Shareholders, one class of directors is elected to serve for a three-year term or until their successors are elected and have qualified. The class of directors to be elected at this Annual Meeting will serve until the 2006 Annual Meeting.

Any shareholder submitting a proxy has the right to withhold authority to vote for any individual nominee to the Board of Directors by writing that nominee’s name in the space provided on the proxy. Shares represented by all proxies received by the Company and not so marked as to withhold authority to vote for any individual director or for all directors nominated will be voted FOR the election of the nominees named below. The Company knows of no reason why any such nominee should be unable to serve, but in the event that any nominee shall be unavailable or unable to serve as a director, the proxy holders will vote for substitute nominees in the exercise of their best judgment, but may not vote for more than two persons.

Nominees for Directors (Term expires 2006)

The nominees for directors and further information with respect to each nominee are set forth below.

Quentin J. Kennedy

Mr. Kennedy, age 69, was Executive Vice President, Secretary, Treasurer and Director of Federal Paper Board Company in Montvale, New Jersey until his retirement in 1996. Mr. Kennedy has been a director of the Company since 1991. He is a member of the Executive Committee and the Executive Compensation Committee.

John E. Nolan

Mr. Nolan, age 75, is a partner in the law firm of Steptoe & Johnson LLP in Washington, D.C. and has been engaged in the practice of law since 1956. He has been a director of the Company since 1971, and is a member of the Audit Committee and the Executive Committee. Mr. Nolan is also a director of Iomega Corporation.

Directors Continuing in Office

The directors whose terms expire at the Annual Meetings in 2004 and 2005 and further information with respect to each continuing director are set forth below.

James M. McNamee

Mr. McNamee, age 58, has served as Chairman of the Board of Directors of the Company since 1996 and as President and Chief Executive Officer of the Company since 1984. He has been an employee of the Company since 1968 and a director since 1984. Mr. McNamee is a member of the Executive Committee and the Nominating and Corporate Governance Committee. (Term expires at the Annual Meeting in 2004.)

Kenneth R. Rossano

Mr. Rossano, age 68, is a private investor. From 1992 to 1999, he was a Senior Vice President of Cassidy & Associates in Boston, Massachusetts. He has been a director of the Company since 1967, and is a member of the Executive Committee and the Nominating and Corporate Governance Committee. Mr. Rossano is also a director of Active International, Inc and Chairman of the Katherine Gibbs School of Boston. (Term expires at the Annual Meeting in 2004.)

2

G. Earle Wight

Mr. Wight, age 69, was Senior Vice President of the Company from 1985 until his retirement in 2002. He has been a director of the Company since 1966. Mr. Wight is a member of the Nominating and Corporate Governance Committee. (Term expires at the Annual Meeting in 2004.)

Benjamin A. Currier

Mr. Currier, age 69, was Senior Vice President of Operations for Security Life of Denver Insurance Company, a subsidiary of ING/Barings, in Denver, Colorado prior to his retirement in 1997. He has been a director of the Company since 1996, and is a member of the Audit Committee and the Executive Compensation Committee. (Term expires at the Annual Meeting in 2005.)

Elaine L. Rigolosi

Dr. Rigolosi, Ed.D, J.D., age 58, is Professor in the Department of Organization and Leadership at Teachers College, Columbia University. She has been associated with Columbia University since 1976, and has maintained a private consulting practice in management for health care organizations since 1974. Dr. Rigolosi has been a director of the Company since 1989, and is a member of the Audit Committee and the Executive Compensation Committee. (Term expires at the Annual Meeting in 2005.)

3

Certain Relationships and Related Transactions

Messrs. G. Earle Wight and Kenneth R. Rossano, directors of the Company, are brothers-in-law.

Mr. John E. Nolan, a director of the Company, is a partner in the law firm of Steptoe & Johnson LLP, which performs legal services for the Company.

Compensation of Directors

Each outside director of the Company will receive an annual retainer of $16,000 in 2003 plus a $2,000 fee for each regular or special meeting attended, a $1,000 fee for each telephone meeting attended, a $1,000 fee for each committee meeting attended and a $500 fee for each telephone committee meeting attended. Each outside director will also receive 5,000 shares of the Company’s Common Stock on January 31, 2003, 2004 and 2005. Additionally, each committee Chairperson will receive an annual retainer of $4,000. In accordance with the 1997 Director Option Plan, each outside director received stock options to purchase 200,000 shares of common stock pursuant to the Plan. Directors who are employees of the Company do not receive stock options pursuant to the Plan nor do they receive director fees. Directors are also reimbursed for out-of-pocket expenses incurred in attending Board and committee meetings.

The Company has entered into supplemental indemnity agreements with its executive officers and directors. The indemnity agreements require the Company to indemnify each such person for all expenses actually and reasonably incurred in defending or settling an action to which such person is a party or threatened to be made a party or is otherwise involved because of his or her status as an officer or director of the Company. If the action is brought by or in the right of the Company, the indemnification must be made only if such person acted in good faith, for a purpose reasonably believed to be in the best interest of the Company (or, in the case of service to another entity, not opposed to the interest of the Company).

Committees of the Board

The Board of Directors has an Audit Committee, an Executive Committee, a Nominating and Corporate Governance Committee and an Executive Compensation Committee.

The Audit Committee acts as principal liaison between the Board of Directors and the independent auditors employed by the Company and reviews the annual financial statements and the Company’s internal accounting systems and controls. The Committee also recommends to the Board of Directors the selection of independent auditors to be employed by the Company.

The Executive Committee exercises the authority of the Board of Directors in certain corporate matters between meetings and exercises specific powers and authority as may from time to time be lawfully delegated to it by the Board of Directors.

The Nominating and Corporate Governance Committee nominates individuals for election or re-election to the Board of Directors. It will consider nominations recommended by shareholders who submit written recommendations to the Nominating Committee in care of the Secretary of the Company. The committee name was changed from the Nominating Committee to the Nominating and Corporate Governance Committee late in 2002 to reflect that it also oversees and reviews corporate regulatory compliance.

4

The Executive Compensation Committee, among other matters, annually reviews and determines the compensation of the Chief Executive Officer of the Company and, upon his recommendation, the compensation of the other elected officers and senior management of the Company and annually reviews and recommends to the Board of Directors the compensation and allowances for the Company’s outside directors. The Committee also prepares a report to shareholders (contained in this Proxy Statement) which discusses the Company’s compensation policies for the executive officers, the Committee’s bases for determining the compensation of the Chief Executive Officer for the past fiscal year, and the relationship between compensation and the Company’s performance for the past fiscal year. The Executive Compensation Committee also administers the 1992 Stock Option Plan, the 1994 Stock Option Plan, the 1997 Stock Option Plan, the 1997 Director Option Plan, the 1999 Stock Option Plan and the 2002 Stock Option Plan and determines the amount and terms of the options granted under the plans. The Committee also administers the 1993 Employee Stock Purchase Plan and, if approved by the shareholders, will administer the 2004 Employee Stock Purchase Plan.

The Board of Directors held four regular meetings and two special meetings during the fiscal year ended December 31, 2002. The Audit Committee met eight times, the Executive Committee met six times, the Executive Compensation Committee met six times, and the Nominating and Corporate Governance Committee did not meet in 2002. The full Board of Directors nominated the nominees. All directors attended at least 75% of the total number of meetings of the Board of Directors and the committees to which they belong.

Report of the Audit Committee

On behalf of the Company’s Board of Directors, the Audit Committee (Committee) oversees a comprehensive system of internal controls to ensure the integrity of financial reports and compliance with laws, regulations and corporate policies. The Committee consists entirely of directors who meet the independence requirements of the American Stock Exchange. The Board of Directors has adopted the Committee charter attached to this Proxy Statement.

KPMG LLP, the Company’s independent auditors, issued their unqualified report, dated February 26, 2003, on the Company’s consolidated financial statements. Consistent with its oversight responsibility, the Committee has reviewed and discussed with management and the independent auditors the audited consolidated financial statements for the year ended December 31, 2002.

The Committee has also discussed with KPMG LLP matters required to be discussed by AICPA Statement on Auditing Standards No. 61, “Communication with Audit Committees.” The Committee has also received the letter from KPMG LLP required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” has discussed with the independent auditors their independence in relation to the Company and its management, and has considered whether KPMG LLP’s provision of non-audit services is compatible with maintaining the auditors’ independence.

Based on these reviews and discussions, the Committee has recommended to the Board of Directors that the Company’s audited financial statements for the year ended December 31, 2002, be included in the Company’s Annual Report on Form 10-K for the fiscal year then ended.

| Submitted by, | |

| AUDIT COMMITTEE | |

| | |

| | |

|

| |

| John E. Nolan, Chair

Benjamin A. Currier

Elaine L. Rigolosi | |

5

Compensation Committee Interlocks and Insider Participation

For 2002, Dr. Elaine L. Rigolosi and Messrs. Quentin J. Kennedy and Benjamin A. Currier served on the Executive Compensation Committee.

Executive Officers

Set forth below are the executive officers of the Company who are not Directors. Executive officers serve at the pleasure of the Board of Directors.

Mario L. Cavezza

Mr. Cavezza, age 55, has served as Senior Vice President, Administrative Services Group of the Company since January 2003. He was Senior Vice President and General Manager of Operations of the Company from 2000 until January 2003, and was Senior Vice President and Regional Manager of the Company’s Northern Region from 1997 until 2000. He has been an employee of the Company since 1968.

David J. Goldberg

Mr. Goldberg, age 46, has served as Senior Vice President and Chief Marketing Officer of the Company since January 2003. He was Senior Vice President of Sales and Marketing of the Company from 1997 until 2003. He has been an employee of the Company since 1979.

Robert William Jewett

Mr. Jewett, age 50, has served as Senior Vice President and General Counsel of the Company since 1991 and as Secretary since 1983. He has been an employee of the Company since 1981.

Steven A. Kariotis

Mr. Kariotis, age 46, has served as Senior Vice President and General Manager, Diversified Business Unit of the Company since September 2002. He was Senior Vice President and Regional Manager of the Company’s Northern Region from 2001 until September 2002. He was Vice President and Regional Manager from 2000 to 2001 and Vice President and Zone Manager of the Company’s Great Lakes Zone from 1988 to 2000. He has been an employee of the Company since 1982.

Fred Lash

Mr. Lash, age 57, has served as Senior Vice President of the Company since 1993, as Chief Financial Officer since 1989 and as Treasurer since 1987. He has been an employee of the Company since 1987.

Joseph A. Marone, Jr.

Mr. Marone, age 47, has served as Vice President of the Company since 1999 and as Controller since 1992. He has been an employee of the Company since 1990.

Raymond A. Sinclair

Mr. Sinclair, age 56, has served as Senior Vice President and Regional Manager of the Company’s Southern Region since 1990. He has been an employee of the Company since 1976.

Alexander Warren

Mr. Warren, age 57, has served as Senior Vice President and General Manager, Health Information Business Unit of the Company since January 2003. He was Senior Vice President and Regional Manager

6

of the Company’s Western Region from 1991 until January 2003. He has been an employee of the Company since 1982.

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of March 1, 2003, the beneficial ownership of the Company’s issued and outstanding Common Stock (on the basis of 64,754,923 shares outstanding on that date), including the stock ownership of each person who, to the Company’s knowledge, owns over 5% of the Company’s outstanding Common Stock, each of the directors of the Company, each executive officer named in the Summary Compensation Table which follows, and the directors and officers of the Company as a group, and the percentage which the shares owned constitute of the total shares outstanding.

Name and Position of Beneficial Owners | | Amount & Nature

of Beneficial

Ownership of

Common Stock (1) | | Percent of Class

(based on # of

shares outstanding

3/01/03) | |

| |

| |

| |

| Kayne Anderson Rudnick Investment Management, LLC | | 4,254,751 | (2) | 6.60 | % |

| | 1800 Avenue of the Stars, Second Floor | | | | | |

| | Los Angeles, CA 90067 | | | | | |

| Merrill Lynch & Co., Inc. | | 3,499,246 | (3) | 5.42 | % |

| | World Financial Center, North Tower | | | | | |

| | 250 Vesey Street | | | | | |

| | New York, NY 10381 | | | | | |

| Putnam, LLC | | 3,497,540 | (4) | 5.40 | % |

| | One Post Office Square | | | | | |

| | Boston, MA 02109 | | | | | |

Directors | | | | | |

| G. Earle Wight | | 896,348 | (5) | 1.38 | % |

| Kenneth R. Rossano | | 1,482,752 | (6) | 2.29 | % |

| James M. McNamee | | 3,150,129 | (7) | 4.86 | % |

| Quentin J. Kennedy | | 228,000 | (8) | | * |

| Elaine L. Rigolosi | | 168,400 | (9) | | * |

| Benjamin A. Currier | | 121,520 | (10) | | * |

| John E. Nolan | | 240,000 | (8) | | * |

Other Most Highly Paid Executive Officers | | | | | |

| Mario L. Cavezza | | 192,204 | (11) | | * |

| David J. Goldberg | | 160,166 | (12) | | * |

| Fred Lash | | 476,836 | (13) | | * |

| Alexander Warren | | 188,403 | (14) | | * |

| All officers and directors as a group (15 total) | | 7,985,221 | (15) | 12.33 | % |

| | | | | | |

* Less than 1%

(1) | Includes shares, if any, held by or for a spouse or minor children or as a trustee. Unless otherwise indicated, the director or 5% stockholder possesses sole investment and voting power in respect of these shares. |

7

(2) | Kayne Anderson Rudnick Investment Management, LLC (“Kayne Anderson”), a registered investment advisor, filed a statement on Schedule 13G dated January 20, 2003, disclosing that it benefitcially owned 4,254,751 shares of Common Stock of the Company, representing 6.60% of the Common Stock outstanding. On Schedule 13G, Kayne Anderson certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| | |

(3) | Merrill Lynch & Co., Inc. (“Merrill”), a registered investment advisor and parent holding company, filed a statement on Schedule 13G dated January 8, 2003, disclosing that on December 31, 2002, it beneficially owned 3,499,246 shares of Common Stock of the Company, representing 5.42% of the Common Stock outstanding. On Schedule 13G, Merrill certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such purpose or effect. |

| | |

(4) | Putnam, LLC (“Putnam”), a parent holding company on behalf of itself and Putnam Investment Management, LLC and the Putnam Advisory Company, LLC, registered investment advisors, filed a statement on Schedule 13G dated February 6, 2003, disclosing that on December 31, 2002, it beneficially owned 3,497,540 shares of Common Stock of the Company, representing 5.40% of the Common Stock outstanding. On Schedule 13G, Putnam certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| |

(5) | Includes 513,344 shares held by the Lucile K. Wight Trust, of which Mr. Wight is trustee with sole voting and dispositive power, and 345,460 shares held by 874367 Ontario, Inc., a corporation of which Mr. Wight and his spouse Sonia are the controlling shareholders. |

| |

(6) | Includes 222,976 shares held by Mr. Rossano’s spouse, Cynthia, and 967,680 shares held by The Cynthia W. Rossano 1991 Trust, of which Mr. and Mrs. Rossano are trustees with sole voting and dispositive power. Also includes 200,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(7) | Includes 1,284,329 shares held by Mr. McNamee and his spouse Patricia as joint tenants, and 140,800 shares held by Mr. McNamee’s spouse, Patricia. Also includes 1,725,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(8) | Includes 200,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(9) | Includes 3,600 shares held by Ms. Rigolosi’s spouse, Robert. Also includes 160,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(10) | Includes 100,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(11) | Includes 185,900 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(12) | Includes 133,200 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(13) | Includes 2,400 shares held by Mr. Lash and his spouse, Suzanne, as joint tenants. Also includes 447,900 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(14) | Includes 170,600 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| |

(15) | Includes shares owned individually by each officer and director in the group as well as shares indirectly owned by such persons as trustee of various trusts; however, where more than one officer or director is a trustee of the same trust, the total number of shares owned by such trust is counted only once in determining the amount owned by all officers and directors as a group. Also includes 4,170,150 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

8

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors of the Company and persons who beneficially own more than ten percent of the Company’s Common Stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”) and the American Stock Exchange. Based solely on a review of reports and written representations furnished to the Company, the Company believes that all Section 16(a) filing requirements applicable to its executive officers, directors and ten percent shareholders were complied with on a timely basis, except for one Form 4 reporting a stock sale by Mr. G. Earle Wight.

Compensation of Executive Officers

The following table provides certain summary information concerning compensation paid or accrued for the last three completed fiscal years to or on behalf of the Company’s Chief Executive Officer and the four other most highly paid executive officers of the Company whose total annual salary and bonus exceeded $100,000 in 2002.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | Long term compensation | | | | |

| | | | | | | | | | |

| | | | |

| | | | | Annual compensation | | Awards | | Payouts | | | | |

| | | | |

| |

| |

| | | | |

Name and principal position | | | Year | | | Salary

($) | | | Bonus

($)(1) | | | Securities

underlying

options

(#)(2) | | | LTIP

payouts

($)(3) | | | All other

compensation

($)(4) | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| James M. McNamee | | | 2002 | | | 635,000 | | | — | | | 100,000 | | | — | | | 113,480 | |

| Chairman, President and | | | 2001 | | | 575,000 | | | 523,800 | �� | | 325,000 | | | 29,880 | | | 117,931 | |

| | Chief Executive Officer | | | 2000 | | | 500,000 | | | 641,200 | | | — | | | 316,160 | | | 113,131 | |

| Fred Lash | | | 2002 | | | 223,000 | | | 210,000 | | | 30,000 | | | — | | | 36,833 | |

| Senior Vice President, | | | 2001 | | | 212,000 | | | 125,000 | | | 75,000 | | | — | | | 36,708 | |

| | Chief Financial Officer and Treasurer | | | 2000 | | | 200,000 | | | 110,000 | | | — | | | — | | | 36,483 | |

| Mario L. Cavezza | | | 2002 | | | 187,500 | | | 35,000 | | | 25,000 | | | — | | | 36,953 | |

| Senior Vice President | | | 2001 | | | 174,375 | | | 80,000 | | | 80,000 | | | — | | | 36,828 | |

| | | | 2000 | | | 144,103 | | | 75,000 | | | — | | | — | | | 24,603 | |

| David J. Goldberg | | | 2002 | | | 183,750 | | | 70,000 | | | 20,000 | | | — | | | 14,048 | |

| Senior Vice President | | | 2001 | | | 165,000 | | | 62,500 | | | 65,000 | | | — | | | 13,973 | |

| | | | 2000 | | | 134,520 | | | 60,000 | | | — | | | — | | | 12,198 | |

| Alexander Warren | | | 2002 | | | 145,000 | | | 50,000 | | | 20,000 | | | — | | | 27,088 | |

| Senior Vice President | | | 2001 | | | 135,080 | | | 72,500 | | | 65,000 | | | — | | | 26,963 | |

| | | | 2000 | | | 118,080 | | | 70,000 | | | — | | | — | | | 26,647 | |

| | | | | | | | | | | | | | | | | | | | |

(1) | For Mr. McNamee, includes stock awards with a fair market value on the award date of $298,800 and $291,200 in 2001 and 2000 respectively. Perquisites fall below the thresholds required for disclosure and, accordingly, have been omitted. |

| |

(2) | Includes the effect of a two for one stock split in 2000. |

| |

(3) | Represents the fair market value on the award date of the stock bonus awarded to Mr. McNamee under the CEO Compensation Plan, which provided the potential for annual stock bonuses. The plan did not apply in 2002. |

9

(4) | The amounts disclosed in this column include: |

| | |

| (a) | Company contributions of the following amounts in 2002, 2001 and 2000 respectively, under the Company’s Salary Reduction Plan, a defined contribution plan on behalf of Mr. McNamee ($2,750, $2,625 and $2,400), Mr. Lash ($2,750, $2,625 and $2,400), Mr. Cavezza ($2,750, $2,625 and $2,400), Mr. Goldberg ($2,750, $2,625 and $2,400) and Mr. Warren ($2,750, $2,625 and $2,309). |

| | |

| (b) | Payment by the Company in 2002, 2001 and 2000 respectively of premiums on whole-life insurance policies in the following annual amounts for Mr. McNamee ($106,155, $110,731 and $106,156), Mr. Lash ($34,083, $34,083 and $34,083), Mr. Cavezza ($34,203, $34,203 and $22,203), Mr. Goldberg ($11,298, $11,348 and $9,798) and Mr. Warren ($24,338, $24,338, $24,338). |

| | |

| (c) | Payment by the Company in 2002, 2001 and 2000 of premiums on a disability insurance policy for Mr. McNamee of $4,575 per year. |

Option Grants in Last Fiscal Year

OPTION GRANTS IN LAST FISCAL YEAR

Individual grants | | | | | | | |

| | | | | | | |

Name | | | Number of

securities underlying

options

granted (#)(1) | | | % of total

options granted

to employees in

fiscal year | | Exercise

price ($/Sh) | | | Expiration

date | | | Grant date

present

value ($)(3) | |

| | |

| | |

| |

| | |

| | |

| |

| James M. McNamee | | | 100,000 | (2) | | 8.8 | % | | 6.180 | | | 7/30/12 | | | 330,000 | |

| Chairman, President and | | | | | | | | | | | | | | | | |

| | Chief Executive Officer | | | | | | | | | | | | | | | | |

| Mario L. Cavezza | | | 25,000 | (2) | | 2.2 | % | | 6.180 | | | 7/30/12 | | | 82,500 | |

| Senior Vice President | | | | | | | | | | | | | | | | |

| David J. Goldberg | | | 20,000 | (2) | | 1.8 | % | | 6.180 | | | 7/30/12 | | | 66,000 | |

| Senior Vice President | | | | | | | | | | | | | | | | |

| Fred Lash | | | 30,000 | (2) | | 2.6 | % | | 6.180 | | | 7/30/12 | | | 99,000 | |

| Senior Vice President, | | | | | | | | | | | | | | | | |

| | Chief Financial Officer and Treasurer | | | | | | | | | | | | | | | | |

| Alexander Warren | | | 20,000 | (2) | | 1.8 | % | | 6.180 | | | 7/30/12 | | | 66,000 | |

| Senior Vice President | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(1) | The 2002 Stock Option Plan grants become exercisable commencing 24 months after the grant date and 25% become exercisable on each successive anniversary of that date, with full vesting occurring on the fourth anniversary date. The options terminate upon termination of employment for any reason other than death, disability or retirement. Further, to be eligible to exercise the options, an optionee must remain in the employment of the Company for a period of 24 months from the date of grant (or retirement or total disability, if earlier). Options that are not fully vested and exercisable as of the date the optionee terminates employment because of death, disability or retirement, or as of the date |

10

| of an actual or threatened change in control of the Company, become vested and exercisable in full on such date. Similarly, the vesting of options may be accelerated in connection with certain mergers, consolidations, sales or transfers by the Company of substantially all of its assets. |

| |

(2) | These options were granted under the 2002 Stock Option Plan on July 30, 2002. |

| |

(3) | The valuation calculations are solely for purposes of compliance with the rules and regulations promulgated under the Exchange Act, and are not intended to forecast possible future appreciation, if any, of the Corporation’s stock price. The grant date present value for the options expiring on July 30, 2012 is derived by using the Black-Scholes option pricing model with the following assumptions: the average dividend yield for the year ended December 31, 2002 of .57%; volatility of the Common Stock for the year ended December 31, 2002 of 48.04%; an annualized risk-free interest rate of 1.75% and an option term of 10 years. This valuation model was not adjusted for risk of forfeiture or the vesting restrictions for the options expiring on July 30, 2012 which became 25% exercisable after two years and 25% in each of 3 successive years. This valuation model does not necessarily represent the fair market value of individual options. At the expiration date, the options will have no actual value unless, and only to the extent that, the price of the Common Stock appreciates from the grant date to the exercise date. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides certain information on options exercised in 2002 and the value of unexercised options at December 31, 2002.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION VALUES

| | | | | | Number of securities

underlying

unexercised options

at FY-end (#)(2) | | Value of

unexercised

in-the-money

options at

FY-end ($)(3) | |

| | | | | |

| |

| |

Name | | Shares

acquired

on exercise(#) | | Value

realized ($)(1) | | Exercisable/

Unexercisable | | Exercisable/

Unexercisable | |

| |

| |

| |

| |

| |

| James M. McNamee | | 1,270,000 | | | 6,662,120 | | 1,645,000/570,000 | | 5,968,625/73,575 | |

| Fred Lash | | 0 | | | 0 | | 425,400/150,000 | | 1,607,619/24,525 | |

| Mario L. Cavezza | | 0 | | | 0 | | 163,400/140,000 | | 487,176/24,525 | |

| David J. Goldberg | | 0 | | | 0 | | 115,200/118,000 | | 263,409/19,620 | |

| Alexander Warren | | 0 | | | 0 | | 150,600/120,000 | | 402,759/24,525 | |

| | | | | | | | | | | |

(1) | Amount represents the difference between the exercise price and the fair market value on the date of exercise, multiplied by the number of options exercised. |

| |

(2) | Includes the effect of two for one stock splits of the Company’s Common Stock in 1997, 1999 and 2000. |

| |

(3) | Amount represents the difference between the exercise price and the fair market value on December 31, 2002 ($6.14), multiplied by the number of options exercisable and unexercisable. |

11

Equity Compensation Plans

The following table provides information as of December 31, 2002 regarding equity compensation plans of the Company pursuant to which equity securities of the Company are authorized for issuance:

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | | (a) Number of

Securities to be Issued

upon Exercise of

Outstanding Options

Warrants and Rights | | (b) Weighted-Average

Exercise price of

Outstanding Options,

Warrants and Rights ($) | | (c) Number of

Securities Remaining

Available for Future

Issuance under Equity

Compensation Plans

(Excluding Securities

Reflected in Column (a)) | |

| |

| |

| |

| |

| Equity compensation plans approved by security holders (1) | | 9,283,350 | | | 6.18 | | 2,293,250 | |

| Equity compensation plans not approved by security holders (2) | | 0 | | | | | 0 | |

| Total | | 9,283,350 | | | 6.18 | | 2,293,250 | |

| | | | | | | | | |

(1) | Consists of the 1992, 1994, 1997, 1999 and 2002 Employee Stock Option Plans, the 1997 CEO Option Plan and the 1997 Director Option Plan. |

| |

(2) | As of December 31, 2002, there were no equity compensation plans not approved by security holders. |

Report of the Executive Compensation Committee

| The report of the Executive Compensation Committee below shall not be deemed to be filed under, or incorporated by reference into any filing under, the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this Report by reference. |

The Company’s Executive Compensation Committee for 2002 was comprised of three directors who are not present or former employees of the Company. The Committee establishes compensation policies for the Chief Executive Officer (CEO) and other executive officers and administers the Company’s programs for cash compensation and stock awards, bonuses and options.

Essentially, the Committee believes that executive compensation should be largely determined by management’s performance in the shareholders’ interests. This usually means earnings. Sustained growth in earnings will ultimately be reflected in increased shareholder value and positioning the Company for future growth in revenues and earnings is an important management function.

The Committee believes that employee stock ownership effectively aligns employees with the interests

12

of stockholders and looks to stock options to provide an opportunity for employee stock ownership. The Committee further believes that compensation is important to attract talented individuals to the Company, to retain them and to provide incentive. In addition, the CEO has been entitled to stock awards and stock bonuses (or cash payments in lieu of stock awards or stock bonuses) under the CEO Compensation Plans that have been in effect since 1990.

Each year the Committee also reviews and determines the compensation of the other executive officers. In furtherance of the Company’s policy to provide incentives and to reward performance, compensation is based on specific criteria developed through the Company’s experience, including attainment of revenue and expense objectives, planning and organizational development and personal leadership. The weight accorded each of these factors is within the Committee’s discretion and may depend on the Company’s performance during the year.

The following information regarding stock options and stock awards is presented after giving effect to two for one stock splits effected on August 22, 1997, January 8, 1999, and April 12, 2000.

In accordance with past CEO Compensation Plans, awards for Mr. McNamee have been based on continuing satisfactory performance measured against management objectives established by the Board. These objectives include corporate growth and development, profitability, total return to shareholders and management team development. For 2002, to recognize his leadership in putting the Company’s 2002 revenues and gross profit back on a positive growth track and to more closely align his interests with that of shareholders, Mr. McNamee was granted options to purchase 100,000 shares at $6.18 per share and on March 20, 2003, options to purchase 300,000 shares at $5.02 per share. However, he received no stock award this year compared to stock awards of 36,000 shares in 2001 and 28,000 shares in 2000. In addition, stock and cash bonuses for Mr. McNamee have been given in past years, and have been based on sustained increases in earnings per share. For 2002, Mr. McNamee did not receive either a stock bonus or a cash bonus. He received stock bonuses of $225,000 in 2001 and $350,000 in 2000.

For 1999 through 2001 the Committee developed a CEO Compensation Plan utilizing the stock award and stock bonus principals that were established in the earlier CEO Plans. In addition, the 1996-98 Plan, in order to provide incentive for the Company to achieve earnings and share price goals over the life of the Plan, provided for a special 800,000 share option (100,000 shares pre-split) for the CEO, which was granted in 1997. This option is a variation of the Company’s regular options that become exercisable 20% during the first year and an additional 20% each of the next four years. It provides, however, that the entire 800,000 share option may be exercised if the Company’s earnings exceed $.175 a share for 1998 and the stock price is at or above $3.75 per share for any period of thirty consecutive days in the first six months of 1999. The earnings and stock price requirements have been met and the options are now exercisable at $2.14 per share which was the fair market value on April 9, 1997, the date the option was approved by the Board. This option has been adjusted for the 1997, 1999 and 2000 stock splits. This option was submitted to shareholders and approved at the 1997 annual meeting.

13

Section 162(m) of the Internal Revenue Code, enacted in 1993 and effective for taxable years beginning after January 1, 1994, generally limits to $1 million per individual per year the federal income tax deduction for compensation paid by a publicly-held company to certain executive officers. Compensation that qualifies as performance-based compensation for purposes of this section is not subject to the $1 million deduction limitation. The Executive Compensation Committee will continue to evaluate this provision but presently intends to qualify compensation as performance-based to the extent feasible and in the best interest of the Company.

| EXECUTIVE COMPENSATION COMMITTEE | |

| | |

| | |

|

| |

| Quentin J. Kennedy, Chair

Elaine L. Rigolosi

Benjamin A. Currier | |

14

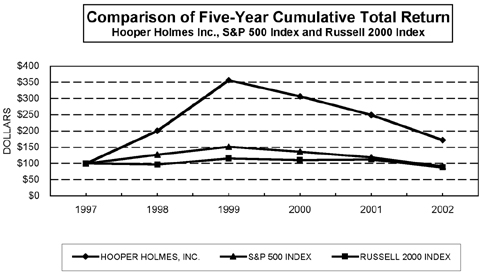

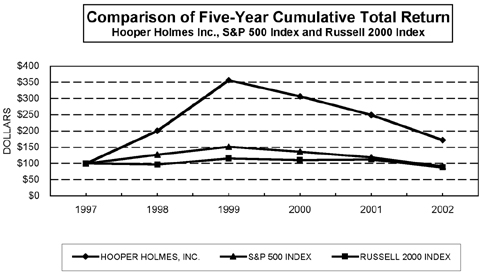

Stock Price Performance Graph

The Stock Price Performance Graph below shall not be deemed to be filed under, or incorporated by reference into any filing under, the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this graph by reference.

The following graph compares the cumulative total shareholder return (assuming dividends are reinvested) on the Company’s Common Stock for the last five years with the cumulative total return (assuming dividends are reinvested) of the Standard & Poor’s 500 Stock Index and the Russell 2000 Index. The Russell 2000 Index was selected because it represents companies with similar market capitalization to the Company. The shareholder return shown on this graph is not necessarily indicative of future performance.

ASSUMES $100 INVESTED ON DEC. 31, 1997

ASSUMES DIVIDENDS REINVESTED

FISCAL YEAR ENDING DEC. 31, 2002

15

Employment Contracts and Change-in-Control Arrangements

In 1990, the Company entered into an employee retention agreement, as amended (the “Agreement”) with Mr. McNamee entitling him to certain benefits if his employment is terminated within two years of a “change of control”, as defined in the Agreement. Following a change of control, Mr. McNamee is entitled to retain the same position, duties and compensation as he had prior to the change of control for a period of two years after the date of the change of control. After a change in control has occurred, if Mr. McNamee’s employment is terminated by the Company or by Mr. McNamee within two years of the date of the change of control (other than as a result of his death, disability or for cause, as defined in the Agreement), Mr. McNamee is entitled to receive a lump sum payment in cash equal to the aggregate of (a) to the extent unpaid, his highest base salary through the date of termination (as defined in the Agreement), (b) a pro rata portion of his recent bonus (as defined in the Agreement, generally to be the highest annual guaranteed bonus to which he was entitled during the last two full fiscal years prior to the date of the change of control), (c) twice the sum of his highest base salary and recent bonus, and (d) all amounts of compensation previously deferred (with accrued interest thereon) and unpaid and any accrued vacation pay not yet paid by the Company. In addition, he will be entitled to receive during the two year period after the change of control, all benefits payable to him (or his family) under welfare benefit programs (such as medical, dental, disability and life insurance programs) equivalent to those most favorable immediately preceding the date of the change of control. In the event that Mr. McNamee would be subject to an excise tax, then he is entitled to receive an additional payment such that after Mr. McNamee pays such excise taxes, including any excise tax imposed on any portion of such additional payment, Mr. McNamee will retain additional payments equal to the excise taxes imposed.

The Company has entered into employee retention agreements (“Agreement”) with each of the other Executive Officers of the Company, entitling them to certain benefits if their employment is terminated within two years of a change in control, as defined in the Agreement. Following a change in control, each Executive Officer is entitled to retain the same position, duties and compensation as he had prior to the change of control for a period of one or two years after the date of the change in control. After a change in control has occurred, if the Executive Officer’s employment is terminated by the Company or by the Executive Officer within two years of the date of the change in control (other than as a result of his death, disability or for cause as defined in the Agreement), the Executive Officer is entitled to receive a lump sum payment in cash equal to the aggregate of (a) to the extent unpaid, his highest base salary through the date of termination (as defined in the Agreement), (b) a pro rata portion of his recent bonus (as defined in the Agreement, generally to be the highest guaranteed bonus to which he was entitled during the last three full fiscal years prior to the date of the change of control), (c) twice the sum of his highest base salary and recent bonus, and (d) all amounts of compensation previously deferred (with accrued interest thereon) and unpaid and any accrued vacation pay not yet paid by the Company. In addition, the Executive Officer will be entitled to receive during the two year period after the change in control, all benefits payable to him (or his family) under welfare benefit programs (such as medical, dental, disability and life insurance programs) equivalent to those most favorable immediately preceding the date of the change in control. In the event that the Executive Officer would be subject to an excise tax, then he is entitled to receive an additional payment such that after the Executive Officer pays such excise taxes, including any excise tax imposed on any portion of such additional payment, he will retain additional payments equal to the excise taxes imposed.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES IDENTIFIED HEREIN.

16

ITEM 2—PROPOSAL FOR APPROVAL OF THE 2004 EMPLOYEE STOCK PURCHASE PLAN

INTRODUCTION

The Executive Compensation Committee recommended that the Company establish a new employee stock purchase plan and the Board approved resolutions adopting the Hooper Holmes, Inc. 2004 Employee Stock Purchase Plan (the “2004 Plan”), subject to approval by the Company’s shareholders. Unless terminated earlier by the Board of Directors, the 2004 Plan will terminate December 31, 2013. The purpose of the 2004 Plan is to permit all full-time and part-time employees of the Company and certain of its subsidiaries, with at least one year of employment, to purchase shares of the Company’s common stock at a 5% discount, to induce such employees to remain in the employ of the Company, to attract talented individuals to join the Company, to motivate such employees to exert their best efforts on behalf of the Company, and to encourage such employees to secure or increase their stock ownership in the Company.

The aggregate number of shares of the Company’s common stock available for purchase under the 2004 Plan is 2,000,000. The Plan is intended to satisfy the requirements of Section 423 of the U.S. Internal Revenue Code (the “Code”).

Because benefits under the 2004 Plan will depend on employee elections and the fair market value of the Company’s common stock, it is not possible to determine the benefits that will be received by eligible participants if the 2004 Plan is approved by our shareholders. A summary of the 2004 Plan is set forth below. This summary is qualified in its entirety by the full text of the 2004 Plan, which is attached hereto.

PURCHASE OF SHARES OF COMPANY COMMON STOCK

The stock purchased by employees under the 2004 Plan shall be, in the discretion of the Committee, either authorized but unissued shares of the common stock of the Company (“Common Stock”) or shares of Common Stock held in the treasury of the Company or any Subsidiary, including shares purchased in the open market or otherwise. Subject to adjustment by the Committee in the event an adjustment is required in order to preserve the benefits or potential benefits intended to be made available under the 2004 Plan, the total number of shares of Common Stock which may be sold under the 2004 Plan shall not exceed in the aggregate 2,000,000 shares.

Each agreement shall prescribe the method or methods pursuant to which the purchase price of shares shall be paid by the employee.

STOCK PURCHASE PRICE

The purchase price per share purchased under the 2004 Plan shall be 95% of the fair market value of a share of Common Stock based on the closing price as reported on the American Stock Exchange on the grant date.

FEDERAL TAX TREATMENT

The following discussion is a summary of the general U.S. federal income tax rules applicable to purchases under the 2004 Plan. However, employees should consult their own tax advisors since a taxpayer’s particular situation may be such that some variation of the rules described below will apply. If a plan participant does not dispose of shares purchased under the 2004 Plan during the two-year period following the beginning of the offering period, he or she will not recognize any income on the date of grant or exercise of the right. When the stock is disposed of after the required holding period, the plan

17

participant will realize ordinary income equal to the lesser of (a) the difference between the fair market value of the stock at the end of the offering period and the purchased price paid at the end of the offering period, or (b) the difference between the fair market value of the stock on the date of its sale and the purchase price paid at the end of the offering period. Any further gain (or loss) will be taxed as a capital gain.

If a plan participant sells his or her shares before the expiration of the two-year holding period, he or she would realize ordinary income equal to the difference between the discounted price paid and the Common Stock fair market value on the date the right was exercised (the purchase date).

ADMINISTRATION

The 2004 Plan will be administered by the Executive Compensation Committee of the Board of Directors (or other committee that satisfies the requirements for non-employee directors set forth in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended) (the “Committee”). The Committee shall have full power and authority to construe and interpret the 2004 Plan and may from time to time adopt such rules and regulations for carrying out the 2004 Plan as it may deem best. Decisions of the Committee shall be final, conclusive and binding upon all parties, including the Company, its shareholders and its employees.

ELIGIBILITY

All full-time and part-time employees of the Company (or certain of its subsidiaries) with at least 1 year of employment, are eligible to receive awards under the 2004 Plan. The subsidiaries of the Company which shall be Participating Subsidiaries will be designated by the Committee from time to time. Currently, approximately 2,000 employees would be eligible to participate in the 2004 Plan.

ENROLLMENT AND PARTICIPATION

From time to time, the Committee shall announce an offering of Common Stock pursuant to the 2004 Plan and the terms and conditions under which eligible employees may enter into agreements for the purchase of the Common Stock so offered. Each agreement shall provide that an employee may elect to purchase pursuant to the terms of the agreement a number of shares of Common Stock determined by the Committee but in no event greater than the number of shares allowable for the 2004 Plan to qualify under Section 423 of the Internal Revenue Code.

No employee may elect to purchase a number of shares of Common Stock greater than the number of shares of Common Stock with a fair market value on the grant date, equal to 10% of the employee’s aggregate compensation, as reported for such employee on form W-2 for the previous calendar year by the Company, the Participating Subsidiaries or any corporation, the employment by which will be considered to be employment by the Company or a Participating Subsidiary.

No employee may elect to purchase under agreements in any single calendar year, a number of shares of Common Stock which, together with all other shares in the Company and Subsidiaries which the employee may be entitled to purchase in such year pursuant to an agreement and under any other employee stock purchase plan, as defined in Section 423 of the Internal Revenue Code, has an aggregate fair market value (measured in each case on the grant date) in excess of $25,000.

TERMINATION OF AGREEMENT BY EMPLOYEE

An employee who has entered into an agreement may, to the extent permitted by the agreement, terminate the employee’s agreement in its entirety by written notice of such termination delivered in the manner

18

and within the time period set forth in the agreement. If there are any funds, including interest, then on deposit pursuant to the agreement, such funds shall be paid to the employee.

TERMINATION OF EMPLOYMENT AND CHANGE IN CONTROL

Each agreement shall specify the applicable rules in respect of the effect of the death, retirement or other termination of employment of the employee and the effect, if any, of a change in control of the Company.

AUTOMATIC TERMINATION

Except as otherwise determined by the Committee, each agreement will automatically terminate if on the last business day before the purchase date the closing price for Common Stock as reported on the American Stock Exchange is 10% or more below the purchase price.

AMENDMENT OR TERMINATION OF THE PLAN BY THE BOARD OF DIRECTORS

The Board of Directors may from time to time alter, amend, suspend, or terminate the 2004 Plan or alter, amend, suspend or terminate any and all agreements; provided however, that no such action of the Board of Directors may, without the approval of the shareholders, make any amendment for which shareholder approval is necessary to comply with any tax or regulatory requirement, including for this purpose any approval requirement which is a prerequisite for exemptive relief under Section 16(b) of the Securities Exchange Act.

ADJUSTMENTS

The number and kind of shares offered under the 2004 Plan, the number and kind of shares subject to outstanding agreements, and the purchase price with respect to any of the foregoing may be adjusted proportionately by the Committee, in its sole discretion, in the event that the Committee determines that any stock dividend, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, consolidation, exchange of shares, warrants or rights offering to purchase Common Stock, or other similar corporate event affects the Common Stock such that an adjustment is required in order to preserve the benefits or potential benefits intended to be made available under the 2004 Plan.

RIGHTS NOT TRANSFERABLE

The rights of any plan participant under the 2004 Plan are not transferable by voluntary or involuntary assignment or by operation of law, or in any manner other than by beneficiary designation or by the laws of descent and distribution.

NO RIGHTS AS AN EMPLOYEE

Nothing in the 2004 Plan or in any right granted under the 2004 Plan shall confer upon a plan participant any right to continued employment by the Company or by any participating subsidiary of the company for any period of specific duration or interfere with or otherwise restrict in any way the rights of the Company or any participating subsidiary to terminate his or her employment at any time for any reason, with or without cause.

NO RIGHTS AS A SHAREHOLDER

A plan participant will not have any rights as a shareholder with respect to any shares of Company common stock that he or she may have a right to purchase under the 2004 Plan until such shares have been purchased on the purchase date.

19

GOVERNING LAW

The 2004 Plan and all Agreements shall be construed in accordance with and governed by the law of the State of New York, without giving effect to any conflict of laws rule or principle that might require the application of the law of another jurisdiction.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE 2004 PLAN.

ITEM 3—RATIFICATION OF SELECTION OF AUDITORS

The Board of Directors has selected the firm of KPMG LLP, independent public accountants, to serve as auditors for the fiscal year ending December 31, 2003, subject to ratification by the shareholders. This firm (and its predecessors) has served as the Company’s auditors since 1980.

Audit Fees

The aggregate fees billed by KPMG LLP for professional services rendered for the audit of the consolidated financial statements of the Company for 2002 and the reviews of the Company’s quarterly financial statements during 2002 were $111,600.

Financial Information Systems Design and Implementation Fees

There were no fees billed by KPMG LLP for information technology services relating to financial information systems design and implementation rendered to the Company for 2002.

All Other Fees

The aggregate fees billed by KPMG LLP for other services rendered to the Company for 2002 were $336,641, primarily for tax compliance and tax advisory services.

The Company’s Audit Committee has considered whether the provision of the non-audit services provided by KPMG LLP to the Company is compatible with maintaining KPMG LLP’s independence.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF KPMG LLP.

If the appointment is not approved, the Board will select other independent accountants. Representatives of the firm of KPMG LLP will be present at the Annual Meeting, will have an opportunity to make a statement if so desired, and will be available to respond to appropriate questions.

Shareholder Proposals for the 2004 Annual Meeting

Proposals of shareholders intended for inclusion in the Proxy Statement for the Annual Meeting of Shareholders to be held in 2004, must be received at the Company’s executive offices not later than December 19, 2003. Proponents should submit their proposals to Robert William Jewett, Secretary, by Certified Mail—Return Receipt Requested.

A shareholder who wishes to make a proposal at the 2004 Annual Meeting of Shareholders without including the proposal in the Company’s proxy statement must notify the Company of such proposal by March 3, 2004. If a shareholder fails to give notice by this date, the proxy solicited by the Company for

20

use in connection with the 2004 Annual Meeting will confer discretionary authority on the persons named as proxies to vote in their discretion on such proposal without any discussion in the proxy statement of either the proposal or how the proxies intend to exercise their voting discretion.

Other Matters

The Company is not aware of any business which will be presented at the 2003 Annual Meeting of Shareholders other than those matters set forth in the accompanying Notice of Annual Meeting of Shareholders. If any other matters are properly presented at the 2003 Annual Meeting for action, it is intended that the persons named in the accompanying proxy and acting thereunder will vote in accordance with their best judgment on such matters.

Solicitation of Proxies

The solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally and by telephone or telegraph by regular employees of the Company, without any additional remuneration and at minimal cost. The cost of soliciting proxies will be borne by the Company.

| BY ORDER OF THE BOARD OF DIRECTORS

HOOPER HOLMES, INC. | |

| |

| | |

| | |

|

| |

|

| |

| Robert William Jewett

Secretary | |

April 17, 2003

21

Stock Purchase Plan (2004)

of

Hooper Holmes, Inc.

1. Purpose of the Plan:

The purpose of the Stock Purchase Plan (2004) (the “Plan”) is to provide employment incentive and to encourage stock ownership by employees of Hooper Holmes, Inc. (hereinafter called the “Corporation”) and employees of certain of its subsidiaries in order to increase their proprietary interest in the Corporation’s success. The Plan is intended to qualify under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”), and to comply with the requirements of 17 CFR 240.16b-3 (“Rule 16b-3”) for exemptive relief under Section 16(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

2. Administration of the Plan:

The Plan shall be administered by a committee of the Board of Directors appointed for such purpose (the “Committee”), provided that, no member of the Committee shall have (a) been granted or awarded equity securities pursuant to the Plan or any other plan of the Corporation or any of its affiliates (except as may be otherwise permitted under Rule 16b-3(c)(2)(i), or successor rule, to continue to be deemed as a disinterested person) during the one year period prior to appointment to the Committee or (b) failed to waive the right, if any, to participate in the Plan. The Committee shall have full power and authority to construe and interpret the Plan and may from time to time adopt such rules and regulations for carrying out the Plan as it may deem best. Decisions of the Committee shall be final, conclusive and binding upon all parties, including the Corporation, its shareholders and its employees.

The Committee may determine from time to time in its sole discretion, that the Corporation shall offer to enter into agreements hereunder (“Agreements”) with all the eligible employees, provided, however, that it shall be under no obligation to do so.

3. Participation in the Plan:

The individuals who shall be eligible to receive grants of purchase rights under the Plan shall be all the employees of the Corporation or of any subsidiary of the Corporation designated by the Committee as a Participating Subsidiary in the Plan, except employees who, on the date as of which purchase rights are granted under the Plan (the “Grant Date” in respect of each purchase right), have less than one year of continuous employment with the Corporation and/or a Participating Subsidiary immediately prior thereto; provided, however, that an Agreement will be entered into with an employee of a Participating Subsidiary only if such Agreement will, under the applicable provisions of the Code as then in effect, qualify for the same tax treatment as would be accorded if such employee was then an employee of the Corporation; and further provided, that no individual shall be eligible to enter into an Agreement under the Plan if immediately thereafter and after giving effect thereto, the aggregate value or voting power of all shares of stock of the Corporation and any Subsidiary (as defined below) then owned by such individual, either directly or indirectly, within the meaning of the applicable sections of the Code and including all shares of stock with respect to which such individual holds purchase rights, would equal or exceed in the aggregate 5% of the total value or combined voting power of all classes of stock of any corporation in an unbroken chain of corporations beginning with the Corporation (including the Corporation), in which each corporation other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of stock in one of the other corporations of such chain (all corporations other than the Corporation in such chain herein called “Subsidiaries” or individually a “Subsidiary”). Notwithstanding the foregoing, no individual shall be permitted or denied participation in the plan contrary to the requirements of Section 423 (or successor section) of the Code and the regulations thereunder.

For purposes of determining whether or not an employee of the Corporation or a Participating Subsidiary has met the one year employment requirement set forth above, employment by a corporation

22

all or substantially all of the assets of which have been acquired by the Corporation or a Participating Subsidiary or employment by a corporation which has been merged with or into the Corporation or a Participating Subsidiary shall be considered as employment by the Corporation or a Participating Subsidiary.

The subsidiaries of the Corporation which shall be Participating Subsidiaries will be designated by the Committee from time to time. The group of subsidiaries from which the Committee will designate Participating Subsidiaries shall include all subsidiaries of the Corporation as of the date of approval of this Plan by the shareholders of the Corporation, as well as corporations having become subsidiaries of the Corporation after the adoption and approval of the Plan.

4. Stock:

The stock subject to the Agreements shall be, in the discretion of the Committee, either authorized but unissued shares of the common stock of the Corporation (“Common Stock”) or shares of Common Stock held in the treasury of the Corporation or any Subsidiary, including shares purchased in the open market or otherwise. Subject to adjustment in accordance with the provisions of Section 6(i) hereof, the total number of shares of Common Stock which may be sold under the Plan shall not exceed in the aggregate 2,000,000 shares.

In the event that any Agreement for any reason expires or is terminated and the shares of Common Stock which are the subject thereof are not purchased, such unpurchased shares of Common Stock may again be subject to Agreements.

5. Number of Shares Which an Employee May Purchase:

From time to time, the Committee shall announce an offering of Common Stock pursuant to the Plan and the terms and conditions under which eligible employees may enter into Agreements for the purchase of the Common Stock so offered. Each Agreement shall provide that an employee may elect to purchase pursuant to the terms of the Agreement a number of shares of Common Stock determined by the Committee but in no event greater than the number of shares of Common Stock with a fair market value (determined as provided in Section 6(b)) on the Grant Date, equal to 10% of the employee’s aggregate compensation, as reported for such employee on form W-2 for the previous calendar year by the Corporation, the Participating Subsidiaries or any corporation, the employment by which pursuant to Section 3 hereof, will be considered to be employment by the Corporation or a Participating Subsidiary. In the event employees enter into Agreements to purchase more than the maximum number of shares to be offered, the number of shares subject to the Agreements shall be reduced proportionately.

Notwithstanding the foregoing provisions of the Plan no individual may elect to purchase under Agreements in any single calendar year, a number of shares of Common Stock which, together with all other shares in the Corporation and Subsidiaries which the employee may be entitled to purchase in such year pursuant to an Agreement and under any other employee stock purchase plan, as defined in Section 423 of the Code, has an aggregate fair market value (measured in each case on the Grant Date) in excess of $25,000.

6. Terms and Conditions of Agreements;

| (a) General: |

| |

| The Agreements shall be in such form as the Committee shall from time to time approve, and shall contain such terms and conditions as the Committee shall proscribe not inconsistent with the Plan. |

| |

| (b) Purchase Price: |

| |

| The purchase price per share shall be 95% of the fair market value of a share of Common Stock based on the closing price as reported on the American Stock Exchange on the Grant Date. |

23

| (c) Payment of Purchase Price: |

| |

| Each Agreement shall prescribe the method or methods pursuant to which the purchase price of shares shall be paid by the employee. Funds received or held by the Corporation or any Participating Subsidiary shall be deposited into a segregated custodial account controlled by the Corporation. Upon final payment of the purchase price, or upon termination of an employee’s Agreement, interest will be paid to the employee on his payments under the Plan. Interest so paid will be in an amount equal to the pro rata amount that the Corporation realizes by investing and reinvesting all of the deposits in the custodial account in short term interest bearing accounts, certificates of deposit, U.S. government securities, money market funds, or other similar investments; provided, however, that the Corporation shall not be liable for the failure to maximize the yield on any such investment. |

| |

| (d) Term of Agreements: |

| |

| Each Agreement shall be dated as of the Grant Date and shall have a stated term of 13 months from such date. |

| |

| (e) Date on which Shares Must be Purchased: |

| |

| Each Agreement shall provide that, subject to earlier termination pursuant to Section 6(g) hereof, any shares to be purchased thereunder must be purchased on the last day (hereinafter called the “Purchase Date”) of the stated term of the Agreement. |

| |

| (f) Employee’s Purchase Directions: |

| |

| Each Agreement shall provide that the employee on the Purchase Date shall purchase all of the shares covered by such Agreement unless the employee shall, to the extent and in the manner permitted by the Agreement, notify the Secretary of the Corporation, or such other persons specified in the Agreement, that the employee does not desire to purchase such shares. |

| |

| (g) Termination by Employee of his Agreement: |

| |

| An employee who has entered into an Agreement may, to the extent permitted by the Agreement, terminate the employee’s Agreement in its entirety by written notice of such termination delivered in the manner and within the time period set forth in the Agreement to the Secretary of the Corporation, or to such other person or persons as may be specified in the employee’s Agreement. If there are any funds, including interest (determined in accordance with Section 6(c) hereof), then on deposit pursuant to the Agreement, such funds shall be paid to the employee. |

| |

| (h) Termination of Employment and Change in Control: |

| |

| Each Agreement shall specify the applicable rules in respect of the effect of the death, retirement or other termination of employment of the employee and the effect, if any, of a change in control of the Corporation. |

| |

| (i) Adjustments: |

| |

| In the event that the Committee shall determine that any stock dividend, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, exchange of shares, warrants or rights offering to purchase Common Stock, or other similar corporate event affects the Common Stock such that an adjustment is required in order to preserve the benefits or potential benefits intended to be made available under the Plan, then the Committee shall, in its sole discretion, and in such manner as the Committee may deem equitable and consistent with the requirements of the New York Business Corporation Law, Section 423 of the Code and Rule 16b-3 (or any successor law, section or rule, thereof), adjust any or all of (1) the number and kind of shares which thereafter may be made the subject of Agreements under the Plan, (2) |

24

| the number and kind of shares subject to outstanding Agreements and (3) the purchase price with respect to any of the foregoing and/or, if deemed appropriate, make provision for a cash payment to a person who has an outstanding Agreement provided, however, that the number of shares subject to any Agreement shall always be a whole number. |

| |

| (j) Assignability: |

| |

| No rights hereunder shall be assignable or transferable except by will or by the laws of descent and distribution. During the lifetime of an employee who is a party to an Agreement, the shares which are covered by such Agreement may be purchased only by the employee. |

| |

| (k) Employee’s Agreement: |

| |

| If, at the time of the execution of an Agreement for the purchase of shares under the Plan, in the opinion of counsel for the Corporation, it is necessary or desirable, in order to comply with any applicable laws or regulations relating to the sale of securities, that the employee purchasing such shares shall agree that such employee will purchase such shares for investment and not with any present intention to resell the same, the employee will, upon the request of the Corporation, execute and deliver to the Corporation an agreement to such effect. The Corporation may also require that a legend setting forth such investment intention be stamped or otherwise written on the certificates for shares purchased pursuant to the Plan. |

| |

| (l) Rights as a Shareholder: |

| |

| An employee who is a party to an Agreement shall have no rights as a shareholder with respect to shares covered by such Agreement until the date of the issuance of the shares to the employee. No adjustment will be made for dividends or other rights for which the record date is prior to the date of such issuance. |

7. Term of Plan:

The plan shall be subject to approval by the shareholders in accordance with the New York Business Corporation Law, Section 423 of the Code, and any agreements entered into prior to such approval shall terminate immediately prior to the Purchase Date if such approval has not yet been attained. No Agreement shall be entered into after December 31, 2013.

8. Amendments:

The Board of Directors may from time to time alter, amend, suspend, or terminate the Plan or alter, amend, suspend or terminate any and all Agreements; provided however, that no such action of the Board of Directors may, without the approval of the shareholders, make any amendment for which shareholder approval is necessary to comply with any tax or regulatory requirement, including for this purpose any approval requirement which is a prerequisite for exemptive relief under Section 16(b) of the Securities Exchange Act.

9. Application of Funds: