UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Hooper Holmes Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of Hooper Holmes, Inc., to be held on Tuesday, May 25, 2004 at 11:00 a.m. local time, at the Company’s headquarters, 170 Mt. Airy Road, Basking Ridge, New Jersey.

The Notice of Annual Meeting and Proxy Statement which follow describe the business to be conducted at the meeting. There will also be a brief report on the current status of our business.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the Notice of Annual Meeting and Proxy Statement, please complete, sign, date and return your proxy in the envelope provided.

On behalf of the Officers and Directors of Hooper Holmes, Inc., I wish to thank you for your interest in the Company and I hope that you will be able to attend our Meeting.

|

For the Board of Directors, |

|

/s/ James M. McNamee |

|

James M. McNamee |

Chairman, President and Chief Executive Officer |

April 21, 2004

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held May 25, 2004

Hooper Holmes, Inc. (the “Company”) will hold its Annual Meeting of Shareholders on Tuesday, May 25, 2004 at 11:00 a.m. local time, at the Company’s headquarters, 170 Mt. Airy Road, Basking Ridge, New Jersey, for the following purposes:

| | 2. | To ratify the selection of the firm of KPMG LLP as auditors for the 2004 fiscal year. |

| | 3. | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

Holders of record of the Company’s common stock as of the close of business on April 9, 2004, are entitled to notice of, and to vote at, the Annual Meeting.

|

BY ORDER OF THE BOARD OF DIRECTORS, |

|

/s/ ROBERT WILLIAM JEWETT |

|

Robert William Jewett |

| Secretary |

April 21, 2004

Please sign the enclosed proxy and return it promptly in the envelope enclosed which requires no postage if mailed in the United States.

HOOPER HOLMES, INC.

170 Mt. Airy Road

Basking Ridge, New Jersey 07920

PROXY STATEMENT

INTRODUCTION

The enclosed proxy is solicited by the Board of Directors of Hooper Holmes, Inc., (the “Company”) for use at the Annual Meeting of Shareholders to be held on May 25, 2004.

An Annual Report to Shareholders containing the financial statements for the fiscal year ended December 31, 2003 is enclosed with this proxy statement. This proxy statement and form of proxy were first sent to shareholders on or about the date stated in the accompanying Notice of Annual Meeting of Shareholders.

Only shareholders of record as of the Record Date are entitled to vote at the meeting and any adjournments thereof. As of that date, 64,908,123 shares of Common Stock of the Company were issued and outstanding. Each share outstanding as of the Record Date will be entitled to one vote, and shareholders may vote in person or by proxy. Execution of a proxy will not in any way affect a shareholder’s right to attend the meeting and vote in person. Any shareholder giving a proxy has the right to revoke it at any time before it is voted by providing written notice to the Secretary of the Company or by submitting another proxy bearing a later date. In addition, shareholders attending the meeting may revoke their proxies at any time prior to the time such proxies are exercised.

The presence in person or by proxy of the holders of a majority of the votes entitled to be cast at the meeting will constitute a quorum. Abstentions and withhold-authority votes all count for the purpose of determining a quorum, but broker non-votes do not. Directors who receive a plurality of the votes cast at the meeting will be elected. The selection of auditors will be approved if a majority of the votes cast at the meeting are in favor. Votes cast for directors and auditors include votes for or against, but do not include broker non-votes, abstentions or withheld-authority votes.

All properly executed proxies returned in time to be cast at the meeting, if no contrary instruction is indicated, will be voted FOR the election of all directors nominated herein and FOR the ratification of the auditors.

The solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally and by telephone or telegraph by regular employees of the Company, without any additional remuneration and at minimal cost. The cost of soliciting the proxies will be borne by the Company.

1

ITEM 1—ELECTION OF DIRECTORS

The Board of Directors consists of seven members divided into three classes, one class with three members and two classes with two members each. At each Annual Meeting of Shareholders, one class of directors is elected to serve for a three-year term or until their successors are elected and have qualified. The class of directors to be elected at this Annual Meeting will serve until the 2007 Annual Meeting.

Any shareholder submitting a proxy has the right to withhold authority to vote for any individual nominee to the Board of Directors by writing that nominee’s name in the space provided on the proxy. Shares represented by all proxies received by the Company and not so marked as to withhold authority to vote for any individual director or for all directors nominated will be voted FOR the election of the nominees named below.

Nominees for Directors (Term expires 2007)

The nominees for directors and further information with respect to each nominee are set forth below. Each nominee has consented to serve as a director of the Company if elected. The Board has affirmatively determined that the Board of Directors’ proposed nominees, except James M. McNamee, Chairman, President and Chief Executive Officer, have no material relationship with the Company, directly or indirectly, that would interfere with the exercise of independent judgment, and are “independent” within the meaning of the American Stock Exchange’s (“AMEX”) new director independence standards. The Board of Directors of the Company does not contemplate that any of its proposed nominees listed below will become unavailable for any reason, but if any such unavailability should occur before the Annual Meeting, proxies may be voted for another nominee selected by the Board of Directors.

James M. McNamee

Mr. McNamee, age 59, has served as Chairman of the Board of Directors of the Company since 1996 and as President and Chief Executive Officer of the Company since 1984. He has been an employee of the Company since 1968 and a director since 1984. Mr. McNamee is a member of the Executive Committee.

Kenneth R. Rossano

Mr. Rossano, age 69, is a private investor. From 1992 to 1999, he was a Senior Vice President of Cassidy & Associates in Boston, Massachusetts. He has been a director of the Company since 1967, and is a member of the Executive Committee and the Corporate Governance and Nominating Committee. Mr. Rossano is also a director of Active International, Inc. and Chairman of the Katherine Gibbs School of Boston.

G. Earle Wight

Mr. Wight, age 70, was Senior Vice President of the Company from 1985 until his retirement in 2002. He has been a director of the Company since 1966. Mr. Wight is a member of the Executive Committee.

Directors Continuing in Office

The directors whose terms expire at the Annual Meetings in 2005 and 2006 and further information with respect to each continuing director are set forth below.

Benjamin A. Currier

Mr. Currier, age 70, was Senior Vice President of Operations for Security Life of Denver Insurance Company, a subsidiary of ING/Barings, in Denver, Colorado prior to his retirement in 1997. He has been

2

a director of the Company since 1996, and is a member of the Audit Committee, the Corporate Governance and Nominating Committee and the Executive Compensation Committee. (Term expires at the Annual Meeting in 2005.)

Elaine L. Rigolosi

Dr. Rigolosi, Ed.D, J.D., age 59, is Professor of Education and Chair, Department of Organization and Leadership, Teachers College, Columbia University. She has been associated with Columbia University since 1976, and has maintained a private consulting practice in management for health care organizations since 1974. Dr. Rigolosi has been a director of the Company since 1989, and is a member of the Audit Committee and the Executive Compensation Committee. (Term expires at the Annual Meeting in 2005.)

Quentin J. Kennedy

Mr. Kennedy, age 70, was Executive Vice President, Secretary, Treasurer and Director of Federal Paper Board Company in Montvale, New Jersey until his retirement in 1996. Mr. Kennedy has been a director of the Company since 1991. He is a member of the Audit Committee. (Term expires at the Annual Meeting in 2006.)

John E. Nolan

Mr. Nolan, age 76, is a partner in the law firm of Steptoe & Johnson LLP in Washington, D.C. and has been engaged in the practice of law since 1956. He has been a director of the Company since 1971, and is a member of the Corporate Governance and Nominating Committee and the Executive Compensation Committee. Mr. Nolan is also a director of Iomega Corporation. (Term expires at the Annual Meeting in 2006.)

The following sets forth certain pertinent information with respect to the current directors of the Company, including the nominees listed above.

| | | | |

Name

| | Age

| | Year First Elected or Appointed/ Term Expires

|

| | |

James M. McNamee(3*) | | 59 | | 1984/2004 |

| | |

Kenneth J. Rossano(3)(4) | | 69 | | 1967/2004 |

| | |

G. Earle Wight(3) | | 70 | | 1966/2004 |

| | |

Benjamin A. Currier(1)(2)(4) | | 70 | | 1996/2005 |

| | |

Elaine L. Rigolosi(1)(2) | | 59 | | 1989/2005 |

| | |

Quentin J. Kennedy(1) | | 70 | | 1991/2006 |

| | |

John E. Nolan(2)(4) | | 76 | | 1971/2006 |

| (1) | Member of Audit Committee |

| (2) | Member of Executive Compensation Committee |

| (3) | Member of Executive Committee |

| (4) | Member of Corporate Governance and Nominating Committee |

3

Corporate Governance Principles and Board Matters

The Company is committed to having sound corporate governance principles and practices. Having and acting on that commitment is essential to running the Company’s business efficiently and to maintaining the Company’s integrity in the marketplace. The Company’s primary corporate governance documents, including its Corporate Governance Guidelines, Code of Ethics and Board of Directors’ Committee Charters, are available to the public on Company’s internet website atwww.hooperholmes.com.

Board Independence

The Board has determined that all current directors of the Company, except James M. McNamee, Chairman, President and Chief Executive Officer have no material relationship with the Company, directly or indirectly, that would interfere with the exercise of independent judgment, and are “independent” within the meaning of the American Stock Exchange’s (“AMEX”) new director independence standards.

Meetings of the Board

As of the date of this proxy statement, the Company’s Board has seven directors and the following four committees: Audit, Executive Compensation, Executive, and Corporate Governance and Nominating.

The Board of Directors held four regular meetings and two special meetings during the fiscal year ended December 31, 2003. The Audit Committee met eight times, the Executive Committee met twice, the Executive Compensation Committee met twice, and the Corporate Governance and Nominating Committee met twice in 2003. The full Board of Directors nominated the nominees. All directors attended at least 75% of the total number of meetings of the Board of Directors and the committees to which they belong.

All of the Company’s directors attended the last annual meeting of shareholders. The Board of Directors’ policy is that all current Board members and all nominees for election to the Company’s Board of Directors put forth in the Company’s proxy statement by the Board attend the annual meeting of shareholders, provided, however, that attendance shall not be required if personal circumstances affecting such Board member or director nominee make such attendance impracticable or inappropriate. Beginning in 2004, the independent directors will meet at least annually in executive session without the presence of non-independent directors and management.

Certain Relationships and Related Transactions

Messrs. G. Earle Wight and Kenneth R. Rossano, directors of the Company, are brothers-in-law.

Mr. John E. Nolan, a director of the Company, is a partner in the law firm of Steptoe & Johnson LLP, which performs legal services for the Company.

Compensation of Directors

Each outside director of the Company will receive an annual retainer of $16,000 in 2004 plus a $2,000 fee for each regular or special meeting attended, a $1,000 fee for each telephone meeting attended, a $1,000 fee for each committee meeting attended and a $500 fee for each telephone committee meeting attended. Each outside director received 5,000 shares of the Company’s Common Stock on January 31, 2003, and each will also receive 5,000 shares of the Company’s Common Stock in 2004 and 2005. Additionally, each committee Chairperson will receive an annual retainer of $4,000. In accordance with the 1997 Director Option Plan, each outside director received stock options to purchase 200,000 shares of common stock pursuant to the Plan. Directors who are employees of the Company do not receive stock options pursuant to the Plan nor do they receive director fees. Directors are also reimbursed for out-of-pocket expenses incurred in attending Board and committee meetings.

4

The Company has entered into supplemental indemnity agreements with its executive officers and directors. The indemnity agreements require the Company to indemnify each such person for all expenses actually and reasonably incurred in defending or settling an action to which such person is a party or threatened to be made a party or is otherwise involved because of his or her status as an officer or director of the Company. If the action is brought by or in the right of the Company, the indemnification must be made only if such person acted in good faith, for a purpose reasonably believed to be in the best interest of the Company (or, in the case of service to another entity, not opposed to the interest of the Company).

Committees of the Board

The Board of Directors has an Audit Committee, an Executive Committee, a Corporate Governance and Nominating Committee and an Executive Compensation Committee.

Executive Committee

The Executive Committee exercises the authority of the Board of Directors in certain corporate matters between meetings, and exercises specific powers and authority as may from time to time be lawfully delegated to it by the Board of Directors.

Audit Committee

The Company’s separately-designated standing Audit Committee acts as principal liaison between the Board of Directors and the independent auditors employed by the Company. It reviews the annual financial statements and the Company’s internal accounting system and controls. The Audit Committee also appoints independent auditors to be employed by the Company, subject to ratification by the Company’s shareholders.

The Audit Committee is comprised of three members, each of whom satisfies the independence standards specified in Section 121A of the AMEX listing standards and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (“1934 Act”). All current members of the Audit Committee are financially literate and are able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement. The Board of Directors has determined that Quentin J. Kennedy qualifies as an audit committee financial expert as defined within Section 229-401(h) of the 1934 Act and is financially sophisticated as defined by AMEX rules.

The Audit Committee operates pursuant to a charter adopted by the Board of Directors that is included in this proxy statement asAppendix “A” and that is also available at www.hooperholmes.com. As enumerated in the Charter, the Audit Committee was established to assist the Board’s oversight of (1) the financial information provided to shareholders and the public, (2) the Company’s systems of internal controls, and (3) the audit process. Among other things, the Audit Committee prepares the Audit Committee report for inclusion in the Company’s proxy statement; annually reviews the Audit Committee Charter and the Audit Committee’s performance; appoints, evaluates and determines the compensation of the Company’s independent external auditors; and maintains written procedures for the receipt, retention and treatment of complaints on accounting, internal accounting controls or auditing matters, as well as for the confidential, anonymous submissions by the Company employees of concerns regarding questionable accounting or auditing matters. The Audit Committee has the authority and available funding to engage any independent legal counsel and any accounting or other expert advisors as the Audit Committee deems necessary to carry out its duties. The Report of the Audit Committee is contained in the proxy statement.

5

Corporate Governance and Nominating Committee

The functions of the Corporate Governance and Nominating Committee include identifying individuals qualified to become members of the Board of Directors, selecting, or recommending to the Board of Directors director nominees for each election of directors, developing and recommending to the Board of Directors criteria for selecting qualified director candidates, considering committee member qualifications, appointment and removal, and, if requested by the Board of Directors, providing oversight in the evaluation of the Board of Directors and each committee. The Corporate Governance and Nominating Committee met twice during the last fiscal year and operates pursuant to a charter adopted by the Board of Directors that is included in this proxy statement asAppendix “B” and is also available at www.hooperholmes.com.

When considering the nomination of directors for election at an annual meeting, the Corporate Governance and Nominating Committee will review annually the results of an evaluation performed by the Board of Directors and each committee, and the needs of the Board of Directors for various skills, background, experience and expected contributions and the qualification standards established from time to time by the Corporate Governance and Nominating Committee. When reviewing potential nominees for election as director, including incumbents whose term is expiring, the Corporate Governance and Nominating Committee will consider the perceived needs of the Board of Directors, the candidate’s relevant background, experience and skills and expected contribution to the Board of Directors and the following factors:

| | • | the appropriate size of the Company’s Board of Directors and its committees; |

| | • | the perceived needs of the Board of Directors for particular skills, background and business experience; |

| | • | the skills, background, reputation, and business experience of nominees compared to the skills, background, reputation, and business experience already possessed by other members of the Board of Directors; |

| | • | nominees’ independence from management; |

| | • | nominees’ experience with accounting rules and practices; |

| | • | nominees’ background with regard to executive compensation; |

| | • | applicable regulatory and listing requirements, including independence requirements and legal considerations, such as antitrust compliance; |

| | • | the benefits of a constructive working relationship among directors; and |

| | • | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

The Corporate Governance and Nominating Committee’s goal is to assemble a Board of Directors that brings to the Company a diversity of experience. Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our shareholders. They must have an inquisitive and objective perspective and mature judgment. Director candidates must have sufficient time available in the judgment of the Corporate Governance and Nominating Committee to perform all Board of Directors and committee responsibilities. They must also have experience in positions with a high degree of responsibility and be leaders in the companies or institutions with which they are affiliated. Members of the Board of Directors are expected to rigorously prepare for, attend, and participate in all Board of Directors and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although the Corporate Governance and Nominating Committee may also consider such other factors as it may deem, from time to time, are in the best interests of the Company and its shareholders. The Corporate Governance and

6

Nominating Committee believes that it is preferable that at least one member of the Board of Directors meet the criteria for an audit committee “financial expert” as defined by SEC rules. Under applicable AMEX listing requirements, at least a majority of the members of the Board of Directors must meet the definition of “independent director” set forth in such listing requirements. The Corporate Governance and Nominating Committee also believes it appropriate for one or more key members of the Company’s management to participate as members of the Board of Directors.

The Corporate Governance and Nominating Committee will consider candidates for directors proposed by directors or management, and will evaluate any such candidates against the criteria and pursuant to the policies and procedures set forth above. If the Corporate Governance and Nominating Committee believes that the Board of Directors requires additional candidates for nomination, the Corporate Governance and Nominating Committee will engage, as appropriate, a third party search firm to assist in identifying qualified candidates. All incumbent directors and nominees will be required to submit a completed form of directors’ and officers’ questionnaire as part of the nominating process. The process may also include interviews and additional background and reference checks for non-incumbent nominees, at the discretion of the Corporate Governance and Nominating Committee.

Shareholder Nominations

The Corporate Governance and Nominating Committee will also consider candidates for directors recommended by a shareholder, provided that any such recommendation is sent in writing to the Corporate Secretary at least 120 days prior to the anniversary of the date proxy statements were mailed to shareholders in connection with the prior year’s annual meeting of shareholders and contains the following information:

| | • | the candidate’s name, age, contact information and present principal occupation or employment; and |

| | • | a description of the candidate’s qualifications, skills, background, and business experience during, at a minimum, the last five years, including his or her principal occupation and employment and the name and principal business of any corporation or other organization in which the candidate was employed or served as a director. |

The Corporate Governance and Nominating Committee will evaluate any candidates recommended by shareholders pursuant to the above procedures against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

Executive Compensation Committee

The Company has an Executive Compensation Committee comprised of three members, each of whom satisfies the independence standards specified in Section 121A of the AMEX listing standards. The Board of Directors has adopted a Compensation Committee Charter pursuant to which the Compensation Committee operates. The Compensation Committee Charter is included in this proxy statement asAppendix “C” and is also available at www.hooperholmes.com.

The Executive Compensation Committee, among other matters, annually reviews and determines the compensation of the Chief Executive Officer of the Company and, based in part upon his recommendation, the compensation of the other elected officers and senior management of the Company and annually reviews and recommends to the Board of Directors the compensation and allowances for the Company’s outside directors. The Committee also prepares a report to shareholders (contained in this Proxy Statement) which discusses the Company’s compensation policies for the executive officers, the Committee’s basis for determining the compensation of the Chief Executive Officer for the past fiscal year, and the relationship between compensation and the Company’s performance for the past fiscal year. The Chief

7

Executive Officer of the Company may not be present during the voting or deliberations of his office. The compensation for all other officers must be determined, or recommended to the Board of Directors for determination, either by the Executive Compensation Committee or by the majority of the independent directors of the Company.

The Executive Compensation Committee also administers the 1992 Stock Option Plan, the 1994 Stock Option Plan, the 1997 Stock Option Plan, the 1997 Director Option Plan, the 1999 Stock Option Plan and the 2002 Stock Option Plan and determines the amount and terms of the options granted under the plans. The Committee also administers the 1993 Employee Stock Purchase Plan and the 2004 Employee Stock Purchase Plan.

THE FOLLOWING REPORT OF THE AUDIT COMMITTEE SHALL NOT BE DEEMED

TO BE “SOLICITING MATERIAL” OR TO BE “FILED” WITH THE SECURITIES AND

EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES

EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO

FILED.

Report of the Audit Committee

The Audit Committee of the Company consists of three independent directors, all of whom meet the independence requirements of the American Stock Exchange. Quentin J. Kennedy is Chairman of the Committee and the Board has determined that he meets the requirements as a Financial Expert under the Rules of the SEC and as financially sophisticated under the American Stock Exchange requirements. Mr. Kennedy was appointed to the Committee in October 2003 replacing Mr. John E. Nolan. The Committee operates under a written Charter (copy attached as Appendix A).

Pursuant to its Charter, the Committee has oversight responsibilities for

| | 1. | Overseeing management’s conduct of the Company’s financial reporting process and systems of internal accounting and financial controls; |

| | 2. | Monitoring the independence and performance of the Company’s outside auditors; and |

| | 3. | Providing an avenue of communication among the outside auditors, management and the Board. |

The Committee is also responsible for retaining the Company’s outside auditors and the fees to be charged for auditing and other approved services.

The Committee met eight times during the year 2003.

The Committee has reveiwed and discussed the consolidated financial statements of the Company for the year ended 2003 with management and KPMG LLP (KPMG), the Company’s independent auditors. It discussed with KPMG the matters to be discussed pursuant to Statement of Auditing Standards No. 61.

8

The Committee has received from KPMG the written disclosures and letter required by Independence Standards Board No. 1 and has discussed with KPMG its independence from the Company.

Based on the above, the Committee approved the inclusion of the audited financial statements for the year ended December 31, 2003 in the Company’s Annual Report on Form 10-K.

|

Submitted by, AUDIT COMMITTEE |

|

| |

|

Quentin J. Kennedy, Chair Benjamin A. Currier Elaine L. Rigolosi |

9

Compensation Committee Interlocks and Insider Participation

For 2003, Dr. Elaine L. Rigolosi and Messrs. John E. Nolan and Benjamin A. Currier served on the Executive Compensation Committee. Each executive officer has consented to serve as an officer of the Company.

Executive Officers

Set forth below are the executive officers of the Company who are not directors. Executive officers serve at the pleasure of the Board of Directors.

David J. Goldberg

Mr. Goldberg, age 47, has served as Senior Vice President and Chief Marketing Officer of the Company since January 2003. He was Senior Vice President of Sales and Marketing of the Company from 1997 until 2003. He has been an employee of the Company since 1979.

Robert William Jewett

Mr. Jewett, age 51, has served as Senior Vice President and General Counsel of the Company since 1991 and as Secretary since 1983. He has been an employee of the Company since 1981.

Steven A. Kariotis

Mr. Kariotis, age 47, has served as Senior Vice President and General Manager, Diversified Business Unit of the Company since September 2002. He was Senior Vice President and Regional Manager of the Company’s Northern Region from 2001 until September 2002. He was Vice President and Regional Manager from 2000 to 2001 and Vice President and Zone Manager of the Company’s Great Lakes Zone from 1988 to 2000. He has been an employee of the Company since 1982.

Fred Lash

Mr. Lash, age 58, has served as Senior Vice President of the Company since 1993, as Chief Financial Officer since 1989 and as Treasurer since 1987. He has been an employee of the Company since 1987.

Joseph A. Marone, Jr.

Mr. Marone, age 48, has served as Vice President of the Company since 1999 and as Controller since 1992. He has been an employee of the Company since 1990.

Raymond A. Sinclair

Mr. Sinclair, age 57, has served as Senior Vice President and Regional Manager of the Company’s Southern Region since 1990. He has been an employee of the Company since 1976.

Alexander Warren

Mr. Warren, age 58, has served as Senior Vice President and General Manager, Health Information Business Unit of the Company since January 2003. He was Senior Vice President and Regional Manager of the Company’s Western Region from 1991 until January 2003. He has been an employee of the Company since 1982.

10

Stock Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of February 13, 2004, the beneficial ownership of the Company’s issued and outstanding Common Stock (on the basis of 64,887,623 shares outstanding on that date), including the stock ownership of each person who, to the Company’s knowledge, owns over 5% of the Company’s outstanding Common Stock, each of the directors of the Company, each executive officer named in the Summary Compensation Table which follows, and the directors and officers of the Company as a group, and the percentage which the shares owned constitute of the total shares outstanding.

| | | | | | |

Name and Position of Beneficial Owners

| | Amount & Nature

of Beneficial

Ownership of

Common Stock (1)

| | | Percent of Class

| |

Kayne Anderson Rudnick Investment Management, LLC 1800 Avenue of the Stars, Second Floor Los Angeles, CA 90067 | | 4,465,709 | (2) | | 6.88 | % |

| | |

Merrill Lynch & Co., Inc. World Financial Center, North Tower 250 Vesey Street New York, NY 10381 | | 3,894,304 | (3) | | 6.00 | % |

| | |

Goldman Sachs Asset Management, L.P. 32 Old Slip New York, NY 10005 | | 3,801,394 | (4) | | 5.86 | % |

| | |

Putnam, LLC One Post Office Square Boston, MA 02109 | | 3,658,440 | (5) | | 5.64 | % |

| | |

State Street Research & Management Company One Financial Center, 31st Floor Boston, MA 02111 | | 3,294,600 | (6) | | 5.08 | % |

| | |

Directors | | | | | | |

| | |

G. Earle Wight | | 906,348 | (7) | | 1.40 | % |

| | |

Kenneth R. Rossano | | 1,492,752 | (8) | | 2.29 | % |

| | |

James M. McNamee | | 3,308,129 | (9) | | 4.95 | % |

| | |

Quentin J. Kennedy | | 238,000 | (10) | | * | |

| | |

Elaine L. Rigolosi | | 178,400 | (11) | | * | |

| | |

Benjamin A. Currier | | 131,520 | (12) | | * | |

| | |

John E. Nolan | | 250,000 | (10) | | * | |

11

| | | | | | |

| | |

| Other Most Highly Paid Executive Officers | | | | | | |

| | |

David J. Goldberg | | 193,916 | (13) | | * | |

| | |

Fred Lash | | 520,586 | (14) | | * | |

| | |

Alexander Warren | | 222,153 | (15) | | * | |

| | |

Steven A. Kariotis | | 157,950 | (16) | | * | |

| | |

All officers and directors as a group (14 total) | | 7,985,221 | (17) | | 11.82 | % |

| (1) | Includes shares, if any, held by or for a spouse or minor children or as a trustee. Unless otherwise indicated, the director or 5% stockholder possesses sole investment and voting power in respect of these shares. |

| (2) | Kayne Anderson Rudnick Investment Management, LLC (“Kayne Anderson”), a registered investment advisor, filed a statement on Schedule 13G dated January 1, 2004, disclosing that on December 31, 2003, it beneficially owned 4,465,709 shares of Common Stock of the Company, representing 6.89% of the Common Stock outstanding. On Schedule 13G, Kayne Anderson certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| (3) | Merrill Lynch & Co., Inc. (“Merrill”), a registered investment advisor and parent holding company, filed a statement on Schedule 13G dated January 27, 2004, disclosing that on December 31, 2003, it beneficially owned 3,894,304 shares of Common Stock of the Company, representing 6.01% of the Common Stock outstanding. On Schedule 13G, Merrill certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such purpose or effect. |

| (4) | Goldman Sachs Asset Management, L.P. (“Goldman Sachs”), a registered investment advisor, filed a statement on Schedule 13G dated February 12, 2004, disclosing that on December 31, 2003, it beneficially owned 3,801,394 shares of Common Stock of the Company, representing 5.90% of the Common Stock outstanding. On Schedule 13G, Goldman Sachs certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| (5) | Putnam, LLC (“Putnam”), a parent holding company on behalf of itself and Putnam Investment Management, LLC and the Putnam Advisory Company, LLC, registered investment advisors, filed a statement on Schedule 13G dated February 9, 2004, disclosing that on December 31, 2003, it beneficially owned 3,658,440 shares of Common Stock of the Company, representing 5.60% of the Common Stock outstanding. On Schedule 13G, Putnam certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| (6) | State Street Research & Management Company (“State Street”), a registered investment advisor, filed a statement on Schedule 13G dated February 13, 2004, disclosing that on December 31, 2003 |

12

| | it beneficially owned 3,294,600 shares of Common Stock of the Company, representing 5.08% of the Common Stock outstanding. On Schedule 13G, State Street certifies that the shares of Common Stock were acquired in the ordinary course of business and were not acquired for the purpose of, and do not have the effect of changing or influencing the control of the Company and were not acquired in connection with, or as a participant in, any transaction having such a purpose or effect. |

| (7) | Includes 513,344 shares held by the Lucile K. Wight Trust, of which Mr. Wight is trustee with sole voting and dispositive power, and 345,460 shares held by 874367 Ontario, Inc., a corporation of which Mr. Wight and his spouse Sonia are the controlling shareholders. |

| (8) | Includes 222,976 shares held by Mr. Rossano’s spouse, Cynthia, and 967,680 shares held by The Cynthia W. Rossano 1991 Trust, of which Mr. and Mrs. Rossano are trustees with sole voting and dispositive power. Also includes 200,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (9) | Includes 1,284,329 shares held by Mr. McNamee and his spouse Patricia as joint tenants, and 140,800 shares held by Mr. McNamee’s spouse, Patricia. Also includes 1,883,750 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (10) | Includes 200,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (11) | Includes 3,600 shares held by Ms. Rigolosi’s spouse, Robert. Also includes 160,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (12) | Includes 100,000 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (13) | Includes 166,950 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (14) | Includes 2,400 shares held by Mr. Lash and his spouse, Suzanne, as joint tenants. Also includes 491,650 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (15) | Includes 204,350 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (16) | Includes 156,850 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

| (17) | Includes shares owned individually by each officer and director in the group as well as shares indirectly owned by such persons as trustee of various trusts; however, where more than one officer or director is a trustee of the same trust, the total number of shares owned by such trust is counted only once in determining the amount owned by all officers and directors as a group. Also includes 4,311,700 shares underlying options that are currently exercisable or which will become exercisable within 60 days. |

13

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires executive officers and directors of the Company and persons who beneficially own more than ten percent of the Company’s Common Stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”) and the American Stock Exchange. Based solely on a review of reports and written representations furnished to the Company, the Company believes that all Section 16(a) filing requirements applicable to its executive officers, directors and ten percent shareholders were complied with on a timely basis.

Compensation of Executive Officers

The following table and footnotes provide certain summary information concerning compensation paid or accrued for the last three completed fiscal years to or on behalf of the Company’s Chief Executive Officer and the four other most highly compensated executive officers of the Company in 2003.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | |

| | | | | Annual compensation

| | Long term compensation

| | |

Name and principal position

| | Year

| | Salary ($)

| | Bonus ($)(1)

| | Awards

Securities underlying options (#)

| | Payouts LTIP

payouts ($)(2)

| | All other compensation ($)(3)

|

James M. McNamee Chairman, President and Chief Executive Officer | | 2003

2002

2001 | | 700,000

635,000

575,000 | | —

—

523,800 | | 350,000

100,000

325,000 | | 9,165

—

29,880 | | 204,801

113,480

117,931 |

Fred Lash Senior Vice President, Chief Financial Officer and Treasurer | | 2003

2002

2001 | | 230,000

223,000

212,000 | | 20,000

210,000

125,000 | | 60,000

30,000

75,000 | | —

— | | 37,083

36,833

36,708 |

Steven Kariotis Senior Vice President | | 2003

2002

2001 | | 197,000

132,500

118,500 | | —

50,000

60,000 | | 80,000

20,000

65,000 | | —

—

— | | 15,438

15,188

14,958 |

David J. Goldberg Senior Vice President | | 2003

2002

2001 | | 201,375

183,750

165,000 | | 100,000

70,000

62,500 | | 20,000

20,000

65,000 | | —

—

— | | 14,298

14,048

13,973 |

Alexander Warren Senior Vice President | | 2003

2002

2001 | | 218,750

145,000

135,080 | | —

50,000

72,500 | | 80,000

20,000

65,000 | | —

—

— | | 46,101

27,088

26,963 |

| (1) | For Mr. McNamee, includes stock award with a fair market value on the award date of $298,800 for 2001. Except for Mr. McNamee, perquisites fall below the thresholds required for disclosure and, accordingly, have been omitted. |

| (2) | Represents the fair market value of the stock bonus awarded to Mr. McNamee under the CEO Compensation Plan, which provides the potential for annual stock bonuses. |

| (3) | The amounts disclosed in this column include: |

| | (a) | Company contributions of the following amounts in 2003, 2002 and 2001 respectively, under the Company’s Salary Reduction Plan, a defined contribution plan, on behalf of Mr. McNamee ($3,000, $2,750 and $2,625), Mr. Goldberg ($3,000, $2,750 and $2,625), Mr. Kariotis ($3,000, $2,750 and $2,520), Mr. Lash ($3,000, $2,750 and $2,625) and Mr. Warren ($3,000, $2,750 and $2,625). |

14

| | (b) | Payment by the Company in 2003, 2002 and 2001 of premiums on whole-life insurance policies in the following annual amounts for Mr. McNamee ($106,155, $106,155 and $110,731), Mr. Goldberg ($11,298, $11,298 and $11,348), Mr. Kariotis ($12,348 each year), Mr. Lash ($34,083 each year) and Mr. Warren ($43,101, $24,338 and $24,338). |

| | (c) | Payment by the Company in 2003, 2002 and 2001 of premiums on a disability insurance policy for Mr. McNamee of $4,575 per year. |

| | (d) | For Mr. McNamee, includes perquisites of $91,071, which includes club membership costs of $65,650. The other named executive officers did not have perquisites in excess of the reporting thresholds. |

Option Grants in Last Fiscal Year

OPTION GRANTS IN LAST FISCAL YEAR

| | | | | | | | | | | | | |

Individual grants

| | | | |

Name

| | Number of securities underlying

options granted (#)(1)

| | | % of total options granted

to employees in

fiscal year

| | | Exercise

price ($/Sh)

| | Expiration

date

| | Grant date

present

value ($)(5)

|

James M. McNamee Chairman, President and Chief Executive Officer | | 50,000

300,000 | (2)

(3) | | 18.9

17.0 | %

% | | $

$ | 5.470

5.020 | | 1/28/13

3/20/13 | | 154,500

933,000 |

David J. Goldberg | | 20,000 | (3) | | 1.1 | % | | $ | 5.020 | | 3/20/13 | | 62,200 |

Senior Vice President | | | | | | | | | | | | | |

Steven Kariotis Senior Vice President | | 30,000

50,000 | (4)

(3) | | 11.3

2.8 | %

% | | $

$ | 5.470

5.020 | | 1/28/13

3/20/13 | | 92,700

155,500 |

Fred Lash | | 60,000 | (3) | | 3.4 | % | | $ | 5.020 | | 3/20/13 | | 186,600 |

Senior Vice President, Chief Financial Officer and Treasurer | | | | | | | | | | | | | |

Alexander Warren Senior Vice President | | 30,000

50,000 | (4)

(3) | | 11.3

2.8 | %

% | | $

$ | 5.470

5.020 | | 1/28/13

3/20/13 | | 92,700

155,500 |

| (1) | The 1997 and 2002 Stock Option Plan grants become exercisable commencing 24 months after the grant date and 25% become exercisable on each successive anniversary of that date, with full vesting occurring on the fourth anniversary date. The options terminate upon termination of employment for any reason other than death, disability or retirement. Further, to be eligible to exercise the options, an optionee must remain in the employment of the Company for a period of 24 months from the date of grant (or retirement or total disability, if earlier). Options that are not fully vested and exercisable as of the date the optionee terminates employment because of death, disability or retirement, or as of the date of an actual or threatened change in control of the Company, become vested and exercisable in full on such date. Similarly, the vesting of options may be accelerated in connection with certain mergers, consolidations, sales or transfers by the Company of substantially all of its assets. |

| (2) | These options were granted under the 2002 Stock Option Plan on January 28, 2003. |

15

| (3) | These options were granted under the 2002 Stock Option Plan on March 20, 2003. |

| (4) | These options were granted under the 1997 Stock Option Plan on January 28, 2003. |

| (5) | The valuation calculations are solely for purposes of compliance with the rules and regulations promulgated under the Exchange Act, and are not intended to forecast possible future appreciation, if any, of the Corporation’s stock price. The grant date present value for the options expiring on January 28, 2013 and March 20, 2013 is derived by using the Black-Scholes option pricing model with the following assumptions: the average dividend yield for the year ended December 31, 2003 of .71%; volatility of the Common Stock for the year ended December 31, 2002 of 47.79%; an annualized risk-free interest rate of 1.75% and an option term of 10 years. This valuation model was not adjusted for risk of forfeiture or the vesting restrictions for the options expiring on January 28, 2013 and March 20, 2013 which become 25% exercisable after two years and 25% in each of 3 successive years. This valuation model does not necessarily represent the fair market value of individual options. At the expiration date, the options will have no actual value unless, and only to the extent that, the price of the Common Stock appreciates from the grant date to the exercise date. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides certain information on options exercised in 2003 and the value of unexercised options at December 31, 2003.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FY-END OPTION VALUES

| | | | | | | | |

Name

| | Shares

acquired

on exercise(#)

| | Value

realized ($)(1)

| | Number of securities

underlying

unexercised options

at FY-end (#)

Exercisable/

Unexercisable

| | Value of unexercised in-the-money options at FY-end ($)(2)

Exercisable/

Unexercisable

|

James M. McNamee | | 0 | | 0 | | 1,833,750/731,250 | | 6,101,400/383,500 |

David J. Goldberg | | 0 | | 0 | | 156,950/96,250 | | 286,157/23,200 |

Steven Kariotis | | 0 | | 0 | | 146,850/153,750 | | 375,458/79,300 |

Fred Lash | | 0 | | 0 | | 479,150/156,250 | | 1,646,960/69,600 |

Alexander Warren | | 0 | | 0 | | 194,350/156,250 | | 431,908/79,300 |

| (1) | Amount represents the difference between the exercise price and the fair market value on the date of exercise, multiplied by the number of options exercised. |

| (2) | Amount represents the difference between the exercise price and the fair market value on December 31, 2003 ($6.18), multiplied by the number of options exercisable and unexercisable. |

16

Equity Compensation Plans

The following table provides information as of December 31, 2003 regarding equity compensation plans of the Company pursuant to which equity securities of the Company are authorized for issuance:

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | |

| | | Column A

| | Column B

| | Column C

|

Plan Category

| | Number of securities to be Issued upon

Exercise of outstanding

options warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights ($)

| | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in

Column (A))

|

Equity compensation plans approved by security holders(1) | | 10,930,125 | | 5.41 | | 478,575 |

Equity compensation plans not approved by security holders(2) | | 0 | | | | 0 |

Total | | 10,930,125 | | 5.41 | | 478,575 |

| (1) | Consists of the 1992,1994,1997,1999 and 2002 Employee Stock Option Plans, the 1997 CEO Option Plan and the 1997 Director Option Plan. |

| (2) | As of December 31, 2003, there were no equity compensation plans not approved by security holders. |

Report of the Executive Compensation Committee

The report of the Executive Compensation Committee below shall not be deemed to be filed under, or incorporated by reference into any other filing under, the Securities Act of 1933 or the Securities Act of 1934, except to the extent that the Company specifically incorporates this Report by reference.

The Hooper Holmes, Inc. Compensation Committee for 2003 was composed entirely of independent directors. The Committee establishes compensation policies for the Chief Executive Officer (CEO) and other executive officers and administers the Company’s programs for cash compensation and stock awards, bonuses and options.

For the CEO, the performance goals are both qualitative and quantitative. In addition to salary and cash bonus, the CEO may receive a Stock Award based on specific criteria reviewed annually by the Board. These criteria include corporate strategy and objectives, profitability, total return to shareholders and leadership development. When made in recent years, the Stock Award has been as much as 36,000 shares or their value in stock. No Stock Award was made for 2003.

The CEO may also receive a Stock Bonus measured by sustained increases in earnings per share. Over the past fourteen years, the Stock Bonus has ranged from zero to 46,000 shares and has contributed

17

significantly to aligning the interests of the CEO with the interests of all of the Company’s shareholders. For 2003, the CEO‘s Stock Bonus was 1,500 shares.

Each year the Committee also reviews and determines the compensation of the other executive officers. In furtherance of the Company’s policy to provide incentives and to reward performance, compensation is based on specific criteria developed through the Company’s experience, including attainment of revenue and expense objectives, planning and organizational development and personal leadership. The weight accorded each of these factors is within the Committee’s discretion and may depend on the Company’s performance during the year.

The Board believes that Management manages and the Board oversees the Company’s operations primarily in the interests of the shareholders. It believes, further, that the shareholders’ interests are best served by executives and directors who are themselves shareholders. To that end, Hooper Holmes has instituted stock option programs for executives and directors, a three-year restricted stock program for directors, and a broad stock option program for employees.

|

| EXECUTIVE COMPENSATION COMMITTEE |

|

| |

| John E. Nolan, Chair |

| Benjamin A. Currier |

| Elaine L. Rigolosi |

18

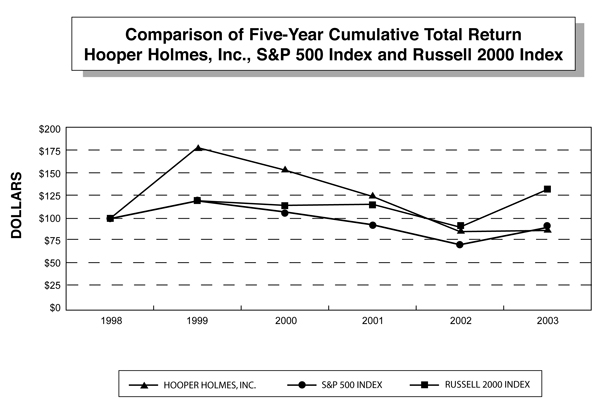

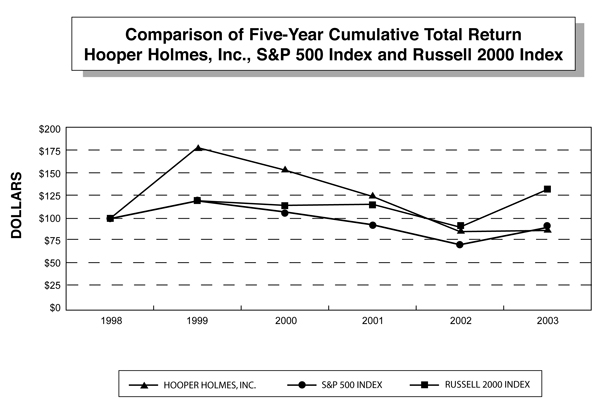

Stock Price Performance Graph

The Stock Price Performance Graph below shall not be deemed to be filed under, or incorporated by reference into any filing under, the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this graph by reference.

The following graph compares the cumulative total shareholder return (assuming dividends are reinvested) on the Company’s Common Stock for the last five years with the cumulative total return (assuming dividends are reinvested) of the Standard & Poor’s 500 Stock Index and the Russell 2000 Index. The Russell 2000 Index was selected because it represents companies with similar market capitalization to the Company. The shareholder return shown on this graph is not necessarily indicative of future performance.

ASSUMES $100 INVESTED ON DEC. 31, 1998

ASSUMES DIVIDENDS REINVESTED

FISCAL YEAR ENDING DEC. 31, 2003

19

Employment Contracts and Change-in-Control Arrangements

In May 2003, the Company entered into an employment agreement, (the “Agreement”) with Mr. McNamee under which Mr. McNamee will serve as the Company’s President and Chief Executive Officer and entitling him to certain compensation and benefits both during the term of his employment and following the termination thereof, whether or not due to a “change of control”, as defined in the Agreement. The Agreement is effective as of January 1, 2003 and continues until Mr. McNamee’s termination of employment, unless amended pursuant to a written agreement signed by both Mr. McNamee and the Company. The Agreement provides for a base salary of $700,000 per year or such higher rate as may be determined periodically by the Executive Compensation Committee (the “Committee”). Mr. McNamee’s current base salary is $700,000. The Agreement also provides for an annual cash bonus, an annual stock award for continued satisfactory performance in an amount determined by the Committee, and an annual stock bonus determined under a formula based on the annual growth rate in the Company’s earnings per share. The stock award and the stock bonus may be paid in cash at the discretion of the Committee. In 2003, Mr. McNamee received no cash bonus, no stock award, and a stock bonus of 1,500 shares. The Agreement also provides for Mr. McNamee’s participation in the Company’s benefit plans, the use of a company-provided automobile, and certain other fringe benefits (e.g., financial planning).

Upon his termination, Mr. McNamee will receive any accrued but unpaid base salary for services rendered to his termination date, and any bonus earned for the fiscal year ending coincident with or prior to his termination date, as well as previously accrued but unpaid reimbursable expenses, vacation, and deferred compensation. In addition, if his termination is due to death or total disability, Mr. McNamee will receive a prorated portion of his stock bonus for the fiscal year in which his employment is terminated. Unless he is terminated “for cause” as defined in the Agreement, Mr. McNamee will receive a retiree health benefit that allows him and his spouse to continue participation in those Company health benefit programs in which he is participating prior to his last day of employment, offset by any payments under Medicare. If Mr. McNamee’s termination is before age 65 and not due to death or for cause, the Company will pay the full premium of the life insurance policy in force under the Company’s Supplemental Retirement Plan until he reaches age 65.

If Mr. McNamee’s employment is terminated by the Company for reasons other than death, total disability, change of control, or cause, or if he terminates employment for “good reason” as defined in the Agreement, Mr. McNamee will receive a lump sum payment equal to twice the amount of the sum of (i) his base salary as of his termination date, (ii) his cash bonus and stock award for the immediately preceding fiscal year, and (iii) a pro-rated portion of his stock bonus for the fiscal year of his termination. In addition to the retiree health benefit described above, he will be entitled to continue in the Company’s welfare benefits in which he was participating for 24 months after his termination date.

If Mr. McNamee’s employment is terminated (other than for death, disability or cause) or if he terminates for good reason within 24 months after a change in control, or if Mr. McNamee is terminated before the change of control but in connection with or in anticipation of the change, the previous paragraph will not apply and the Company will pay Mr. McNamee a lump sum equal to three times the sum of (i) his base salary at the highest rate prior to his termination, (ii) the amount of his cash bonus and stock award for the immediately preceding fiscal year, and (iii) a pro-rated portion of his stock bonus for the fiscal year of termination. In addition to the retiree health benefit described above, Mr. McNamee will be entitled to continue in the Company’s welfare benefit programs in which he was participating for 36 months after his termination.

If any portion of the payment to Mr. McNamee under the Agreement plus other payments from the Company becomes subject to the excise tax under Section 4999 of the Internal Revenue Code (for excess payments made in connection with a change of control), his payment from the Company shall be adjusted as follows: (1) if total payments subject to the tax do not exceed 115% of the maximum amount that can be paid to Mr. McNamee without an excise tax, the total payments to Mr. McNamee will be reduced to $1

20

less than the maximum payable without the tax, or (2) if total payments exceed 115%, Mr. McNamee will receive a “gross-up” payment intended to cover his liability for the excise tax and any income and excise taxes on the gross-up payment.

Mr. McNamee is not subject to the noncompete clause or the prohibition against soliciting customers in the Agreement if his employment terminates on or after a change in control. He is subject to a confidentiality agreement and a limitation on soliciting services of the Company’s employees.

Under this Agreement, termination for cause generally means termination by the Company following a conviction of a felony or criminal act involving, in the judgment of the Board, fraud, dishonesty or moral turpitude; refusal to perform required duties; fraud or embezzlement, gross misconduct or gross negligence, or breach of any applicable confidentiality, noncompete or non-solicitation covenants in the Agreement. Termination by Mr. McNamee for good reason occurs if Mr. McNamee terminates employment due to a change in his responsibilities or status without his consent or the Company’s failure to meet its obligations under the Agreement.

The Company has entered into employee retention agreements (“Agreement”) with each of the other Executive Officers of the Company, entitling them to certain benefits if their employment is terminated within two years of a change in control, as defined in the Agreement. Following a change in control, each Executive Officer is entitled to retain the same position, duties and compensation as he had prior to the change of control for a period of one or two years after the date of the change in control. After a change in control has occurred, if the Executive Officer’s employment is terminated by the Company or by the Executive Officer within two years of the date of the change in control (other than as a result of his death, disability or for cause as defined in the Agreement), the Executive Officer is entitled to receive a lump sum payment in cash equal to the aggregate of (a) to the extent unpaid, his highest base salary through the date of termination (as defined in the Agreement), (b) a pro rata portion of his recent bonus (as defined in the Agreement, generally to be the highest guaranteed bonus to which he was entitled during the last three full fiscal years prior to the date of the change of control), (c) twice the sum of his highest base salary and recent bonus, and (d) all amounts of compensation previously deferred (with accrued interest thereon) and unpaid and any accrued vacation pay not yet paid by the Company. In addition, the Executive Officer will be entitled to receive during the two year period after the change in control, all benefits payable to him (or his family) under welfare benefit programs (such as medical, dental, disability and life insurance programs) equivalent to those most favorable immediately preceding the date of the change in control. In the event that the Executive Officer would be subject to an excise tax, then he is entitled to receive an additional payment such that after the Executive Officer pays such excise taxes, including any excise tax imposed on any portion of such additional payment, he will retain additional payments equal to the excise taxes imposed.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR”THE NOMINEES IDENTIFIED HEREIN.

ITEM 2—RATIFICATION OF APPOINTMENT OF AUDITORS

The Audit Committee has appointed the firm of KPMG LLP, independent public accountants, to serve as auditors for the fiscal year ending December 31, 2004, subject to ratification by the shareholders. This firm (and its predecessors) has served as the Company’s auditors since 1980. If the appointment is not approved, the Audit Committee will select other independent accountants. Representatives of the firm of KPMG LLP will be present at the Annual Meeting, will have an opportunity to make a statement if so desired, and will be available to respond to appropriate questions.

21

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING“FOR”RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS THE COMPANY’S INDEPENDENT AUDITORS FOR 2004.

DISCLOSURE OF FEES PAID OR ACCRUED FOR KPMG LLP DURING THE

YEARS ENDED DECEMBER 31:

| | | | | | |

| | | 2003

| | 2002

|

Audit(1) | | $ | 146,000 | | $ | 171,000 |

Audit-related(2) | | | 13,000 | | | 21,000 |

Tax(3) | | | 203,000 | | | 257,000 |

All other | | | — | | | — |

Total | | $ | 362,000 | | $ | 449,000 |

| (1) | Services relating to audit of the annual consolidated financial statements, review of quarterly financial statements, audits related to acquisitions (in 2002), and the review of documents filed with the SEC. |

| (2) | Services relating primarily to employee benefit plan audit and limited acquisition and due diligence related services (in 2002). |

| (3) | Services for tax compliance and advisory services. |

During 2003, and for 2003 only, the Audit Committee delegated to the Chairman of the Audit Committee (“Chairman”), the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) of the Company, together or separately, in the name and on behalf of the Company, the authority, subject to individual cost limits, to engage KPMG LLP to perform 1) Section 404 documentation assistance, 2) Accounting guidance and technical assistance for the implementation of newly issued accounting pronouncements and standards, 3) Accounting guidance and technical assistance related to the application of existing accounting pronouncements and standards to NVR transactions, 4) Assistance in the process of gathering documentation for tax audits and management of them prior to receipt of a potential assessment, 5) Assistance in the resolution of assessments from tax audits, 6) Assistance in the development and implementation of tax saving strategies and 7) SEC registration statement comfort letters and consents, together in an aggregate amount for all services not to exceed 50% of the annual audit fee, provided that the Chairman, the CEO and CFO reported any such audit-related or non-audit services to the full Audit Committee at its next regularly scheduled meeting. The Audit Committee will annually evaluate what types of audit and non-audit services (permitted by law), and subject to certain limits, can be entered into with pre-approval authority granted by the Audit Committee, and will grant that authority, if applicable pursuant to an Audit Committee resolution.

Shareholder Proposals for the 2005 Annual Meeting

Proposals of shareholders intended for inclusion in the Proxy Statement for the Annual Meeting of Shareholders to be held in 2005, must be received at the Company’s executive offices not later than December 22, 2004. Proponents should submit their proposals to Robert William Jewett, Secretary, by Certified Mail—Return Receipt Requested.

22

A shareholder who wishes to make a proposal at the 2005 Annual Meeting of Shareholders without including the proposal in the Company’s proxy statement must notify the Company of such proposal by March 7,2005. If a shareholder fails to give notice by this date, the proxy solicited by the Company for use in connection with the 2005 Annual Meeting will confer discretionary authority on the persons named as proxies to vote in their discretion on such proposal without any discussion in the proxy statement of either the proposal or how the proxies intend to exercise their voting discretion.

Other Matters

The Company is not aware of any business which will be presented at the 2004 Annual Meeting of Shareholders other than those matters set forth in the accompanying Notice of Annual Meeting of Shareholders. If any other matters are properly presented at the 2004 Annual Meeting for action, it is intended that the persons named in the accompanying proxy and acting thereunder will vote in accordance with their best judgment on such matters.

Solicitation of Proxies

The solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally and by telephone or telegraph by regular employees of the Company, without any additional remuneration and at minimal cost. The cost of soliciting proxies will be borne by the Company.

|

| BY ORDER OF THE BOARD OF DIRECTORS HOOPER HOLMES, INC. |

|

/s/ Robert William Jewett |

|

Robert William Jewett Secretary |

April 21, 2004

23

APPENDIX A

HOOPER HOLMES, INC.

Charter of the Audit Committee

of the Board of Directors

PURPOSE

The Audit Committee (Committee) is appointed by the Board of Directors (Board) of Hooper Holmes, Inc. (Company). The function of the Committee is to assist the Board in fulfilling its oversight responsibilities, primarily through:

| | • | overseeing management’s conduct of the Company’s financial reporting process and systems of internal accounting and financial controls; |

| | • | monitoring the independence and performance of the Company’s outside auditors; and |

| | • | providing an avenue of communication among the outside auditors, management and the Board. |

COMPOSITION

1. The Committee shall have at least three (3) members at all times, each of whom must be independent of management, as well the Company and each of its affiliates. A member of the Committee shall be considered independent if:

| | (a) | in the sole discretion of the Board, it is determined that he or she has no relationship that may interfere with the exercise of his or her independent judgment; and |

| | (b) | he or she meets the American Stock Exchange rules regarding independence of audit committee members. |

2. If any member of the Committee enters into or develops a “business relationship” with the Company, that member shall have an affirmative obligation to promptly disclose such relationship to the Board.

3. No member of the Committee shall accept any consulting, advisory or other compensatory fee from the Company other than in connection with serving on the Committee or as a member of the Board.

4. All members of the Committee shall have a practical knowledge of finance and accounting and be able to read and understand fundamental financial statements or be able to do so within a reasonable period of time after appointment to the Committee.

5. At least one member of the Committee shall have accounting or related financial management expertise, as the Board interprets such qualification in its business judgment. Upon the adoption of regulations by the Securities and Exchange Commission (SEC) in accordance with the Sarbanes-Oxley Act of 2002, at least one member of the Committee shall be a financial expert, as defined by such regulations.

6. Each member of the Committee shall be appointed by the Board and shall serve until the earlier to occur of the date on which he or she shall be replaced by the Board, resigns from the Committee, or resigns from the Board.

24

MEETINGS

1. The Committee shall meet as frequently as necessary, but no less than four times annually. The Board shall name a chair of the Committee, who shall prepare and/or approve an agenda in advance of each meeting. A majority of the members of the Committee shall constitute a quorum. The Committee shall maintain minutes or other records of meetings and activities of the Committee.

2. The Committee shall, through its chair, report regularly to the Board following the meetings of the Committee, addressing such matters as the quality of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the outside auditors, the performance of the internal audit function or other matters related to the Committee’s functions and responsibilities.

RESPONSIBILITIES AND DUTIES

The Committee’s principal responsibility is one of oversight. The Company’s management is responsible for preparing the Company’s financial statements and the outside auditors are responsible for auditing and reviewing those financial statements.

Although the Committee has the powers and responsibilities set forth in this charter, it is not the responsibility of the Committee to plan or conduct audits or to determine that the Company’s financial statements present fairly the financial position, the results of operations and the cash flows of the Company, in compliance with generally accepted accounting principles. This is the responsibility of management and the outside auditors. In carrying out these oversight responsibilities, the Committee is not providing any expert or special assurance as to the Company’s financial statements or any professional certification as to the outside auditors’ work.

The Committee’s specific responsibilities are:

General

| | 1. | The Committee shall have the power to conduct or authorize investigations into any matters within the Committee’s scope of responsibilities. The Committee shall have unrestricted access to members of management and other employees of the Company, as well as all information relevant to the carrying out of its responsibilities. |

| | 2. | The Committee shall, with the assistance of management, the outside auditors and legal counsel, as the Committee deems appropriate, review and evaluate, at least annually, the Committee’s: |

| | (b) | powers and responsibilities; and |

The Committee shall report and make recommendations to the Board with respect to the foregoing, as appropriate.

| | 3. | The Committee shall ensure inclusion of its then-current charter in the proxy statement for the Company’s annual meetings of shareholders, at least once every three years in accordance with regulations of the SEC. |

| | 4. | The Committee shall prepare annual Committee reports for inclusion in the proxy statements for the Company’s annual meetings, as required by rules promulgated by the SEC. |

| | 5. | The Committee shall, in addition to the performance of the duties described in this charter, undertake such additional duties as from time to time may be: |

| | (a) | delegated to it by the Board; |

25

| | (b) | required by law or under American Stock Exchange rules; or |

| | (c) | deemed desirable, in the Committee’s discretion, in connection with its functions described in this charter. |

| | 6. | The Committee shall be empowered to retain, at the Company’s expense, independent counsel, accountants or others for such purposes as the Committee, in its sole discretion, determines to be appropriate to carry out its responsibilities. |

Internal Controls and Risk Assessment

| | 1. | The Committee shall review annually, with management and the outside auditors, if deemed appropriate by the Committee: |

| | (a) | the internal audit budget, staffing and audit plan; |

| | (b) | material findings of internal audit reviews and management’s response, including any significant changes required in the internal auditor’s audit plan or scope and any material difficulties or disputes with management encountered during the course of the audit; and |

| | (c) | the effectiveness of or weaknesses in the Company’s internal controls, including computerized information system controls and security, the overall control environment and accounting and financial controls. |

| | 2. | The Committee shall obtain from the outside auditors their recommendations regarding internal controls and other matters relating to the accounting procedures and the books and records of the Company and its subsidiaries and review the correction of controls deemed to be deficient. |

| | 3. | The Committee shall review the appointment, performance and replacement of the senior internal auditor, and the activities, organizational structure and qualifications of the persons responsible for the internal audit function. |

| | 4. | The Committee shall, in accordance with SEC regulations to be adopted under the Sarbanes-Oxley Act, establish procedures for: |

| | (a) | the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters; and |

| | (b) | the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| | 5. | The Committee shall review major financial risk exposures and the guidelines and policies which management has put in place to govern the process of monitoring, controlling and reporting such exposures. |

Outside Auditors; Their Performance and Independence

| | 1. | The outside auditors are ultimately accountable to the Board and the Committee, as the representatives of the shareholders of the Company. The Committee shall evaluate and recommend to the Board the selection and, where appropriate, the replacement of the outside auditors. The Committee shall recommend to the Board the outside auditors to be proposed for shareholder approval in any proxy statement. |

26

| | (a) | confer with the outside auditors concerning the scope of their examinations of the books and records of the Company and its subsidiaries; |

| | (b) | review the scope, plan and procedures to be used on the annual audit, as recommended by the outside auditors; |

| | (c) | review the results of the annual audits and interim financial reviews performed by the outside auditors, including: |

| | (1) | the outside auditors’ audit of the Company’s annual financial statements, accompanying footnotes and its report thereon; |

| | (2) | any significant changes required in the outside auditors’ audit plans or scope; |

| | (3) | any material differences or disputes with management encountered during the course of the audit (the Committee to be responsible for overseeing the resolution of such differences and disputes); |

| | (4) | any material management letter comments and management’s responses to recommendations made by the outside auditors in connection with the audit; |

| | (5) | matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communications with Audit Committees), relating to the conduct of the audit; |